GREATERWESTSIDE

NACA is a solution for people with low credit scores or low but stable income

By DELANEY NELSON Special Projects ReporterFounded in 1988, the Neighborhood Assistance Corporation of America provides more than 30% of housing counseling throughout the country. The HUD-certified nonprofit serves homebuyers and homeowners in nearly 30 states, including Illinois. NACA provides mortgages to low-to-moderate income

people looking to buy homes in low-to-moderate income communities. Bank of America has committed $15 billion to NACA’s Best in America Mortgage program, which boasts no down payment, no closing costs, no private mortgage insurance and a below-market fixed rate to eligible individuals.

Amarilis Wise, who directs NACA’s Chicago office, spoke with Austin Weekly News about the work the organization is doing to promote economic justice and make homeownership accessible to historically marginalized groups.

Why is the NACA mortgage program unique?

Wise: Why do we say NACA is the best mortgage in America? NACA is the first housing counseling company in the United States to counsel people to buy a home in the right way. We’re a housing counseling company. The actual lender is the Bank of America — we have an agreement with them until 2026, which says whoever buys a home through NACA, they

See NACA on page B2

The Spanish Coalition for Housing will host its 23rd annual “Camino a Su Casa” housing exposition this month to connect prospective homebuyers with the resour need to start their home-buying journey

The organization will host 30 exhibitors, including HUD-approved housing counselors, lenders, real estate attorneys, home inspectors and government officials. To Joseph Lopez, CEO and executive director, the event is an opportunity for community members to start building their home-buying team.

“We’ll have those lender partners who have affordable lending products that are safe and affordable for first-time homebuyers, our realtor partners who understand the mission of not only getting folks in their homes, but ensuring that it’s affordable and sustainable for the long term,” Lopez said. “There’s all mission alignment with our partners in the work that we do. The community values that, to say, ‘Spanish Coalition for Housing is hosting this event. We know that the resources at this event are valuable resources, have been vetted and are within that trust ecosystem.’”

The event, which will be held on the West Side on June 22, will include information sessions about grants for down payment and closing cost assistance. The first 60 attendees will receive free credit checks.

For folks who are not yet ready to start the home buying process, the expo is still a helpful opportunity to learn more about the steps to homeownership, meet counselors who can pr epare them for their journey and connect with credit and financial coaching if needed, Lopez said.

“(It’s an opportunity) to share critical information to community members around the basics of homeownership, and make it accessible and meet the community where they’re at — bringing our lending partners, our realtor partners, our government partners,

and all the programs under one roof,” Lopez said. “It’s bringing all those resources in one location and dedicating the time and resources to connect prospective homebuyers.”

The expo will take place from 10 a.m. to 2 p.m. at Plumber’s Union Hall on West Washington Boulevard. The event is free and open to the public.

Are you a new homeowner? Are you currently going through the home-buying process? We want to hear from you! Contact Delaney Nelson at delaney@austinweeklynews.com.

Continued from page B1

will not be required to pay any down payment. If you want to put down a down payment, that’s fine — but it’s voluntary. The other important stuff is the closing costs: title insurance, appraisal, all those expenses that a buyer must go through when they buy a house, NACA pays for all of that, so they’re saving all that money that sometimes people are not able to even have the capacity to save for to become a homeowner

The regular median or lower-income people, it’s very hard for them to save for a down payment or save for their closing costs. Here, NACA gives you the opportunity to buy a house. We have people that have a credit score (as low as) 500. Why? Because what we evaluate is the behavior. You have to be paying on time at least the last 12 months of your liabilities, right? Some people have hardships in the past. Maybe they lost a job, they have charges they couldn’t pay two, three, four years ago. They do not need to pay it [back]. They just need to explain it. Any medical bills, even if it happened just two months ago — you don’t need to pay, you need to explain it. So those things open the door for much more low- and moderate-income people that normally will be rejected, or be treated with a much higher interest rate at any regular mortgage company or bank. So that’s why NACA is the best mortgage in America. No down payment, no closing costs, no interest in the credit score, no PMI.

Can you talk about NACA’s work in the Chicago area?

Wise: A lot of the members go for multifamily units. Others just want the house, right? We have communication with certain areas where they are building houses — not much in Chicago — but there are new construction houses, right? We do a lot in the suburbs. We also have our own in-house realtors that members can use if they want. They can bring their own realtor, or they can use one of NACA’s. They know the market, they know how to deal with NACA. They negotiate with the seller, know what to ask for, and can help the member with the transaction. The market in Chicago is growing exponentially, especially over the suburbs.

What can NACA members expect?

Wise: My counselors really go through, “did you upload your pay stub? Do you have a bank statement?” They are not just loan officers, they’re counselors. And I’ll tell you: the percentage of foreclosure with NACA loans is 0.00012. So almost nobody that buys a home through NACA goes into foreclosure, and this is because we do it in the right way. What does “the right way” mean? Very simply: You go to the bank. You get approved for $300,000 based on your

income. You go look for a home where you can make the monthly mortgage payment. You need to check with your counselor, what is your budget? How much can you afford, at most, for a house? That amount is the amount we’re going to approve you for. We’ll give you an estimate for what that mortgage amount can buy

We do multifamily, which is awesome in Chicago. They do it a lot. A lot of members have become investors, because they buy a unit where they live, but they rent the other unit, and technically, they pay off the mortgage with the rent that they receive for the other unit, or units. So that’s awesome.

The other mortgage companies don’t have anything close to this. They may say, “NACA takes a lot of time with the process.” That might be true, but it really depends.

What advice would you give prospective buyers?

Wise: The first thing I will say is, have a stable income — whatever it is, a fixed income, a selfemployment income, or a W-2 income, you have to be stable for at least two years of employment history. [It does] not necessarily [have to be] in the

same company, but at least two years working and producing money, because your income is going to determine how much you can afford.

Also, budget. Where am I spending my money? How much money do I have? Most people don’t know where their money goes. They start to budget, and they didn’t realize how much money they were spending every day at Starbucks. People don’t realize that until they don’t put it on paper and do their budget. So for us at NACA, the budget is a must. Do your own budget to see how you’re doing and what you need to adjust. Or maybe you’re saving well. We don’t know. It depends on different people. But becoming a homeowner is a financial situation that you need to have in order, and make sure that the monthly payment you are going to sign for is affordable for you.

Also, people that pay their rent on time can pay their mortgage on time. However, sometimes people want to be approved for a higher amount than the rent, so they need to save more money to prove that they can.

It doesn’t just matter how much money you make — it’s about how much money you make and how much you spend.

How does a prospective homebuyer get involved with NACA?

Wise: If you want to use NACA, the first thing you go is to the website: www.naca.com. Then, we have two options: We have, every two weeks, a face-to-face homebuyer workshop in Chicago, which I love to do. Or, you can do a webinar by yourself in two, three hours. Then, you get your NACA ID, and you are able to have your own online portal where you can upload your own documents, you can call us, and you can make an appointment in the system. Now, I would love for people to call directly to the office and we take care of them, because I still love the face-to-face. Nothing compares to talking to people. Every counselor here has their own office. But they also take care of a lot of people virtually. Members can come to the office, which is at 4425 West 63rd Street.

Follow us each month in print and at https://www.austinweeklynews.com/ at-home/, where you’ll find additional resources and useful information.

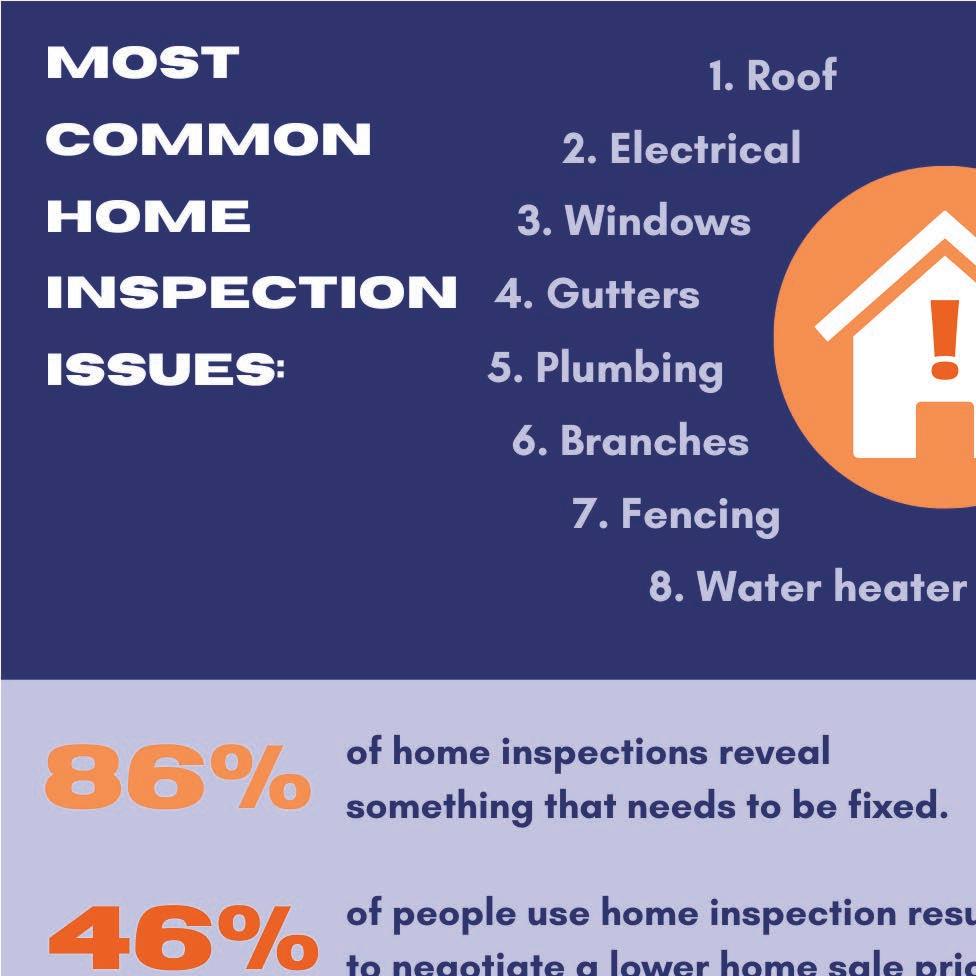

Picture it: You found a home you love, and your offer has been approved. Often, the next step is a home inspection. An inspection is not a test to pass, but rather an evaluation of what is and is not working properly, giving the buyer a clear picture of the property’s condition. An inspector will examine the heating system, central air conditioning, interior plumbing, electrical systems, roof, walls, ceilings, floors, windows, doors and foundation, among other things. Inspections typically occur after the contract or purchase agreement is signed, but before a buyer and seller close the deal on a property. Depending on the results of the inspection, the buyer can rescind their offer on the home or renegotiate the terms of the purchase. When faced with bidding wars for limited housing stock, some prospective buyers skip inspections to be a more competitive applicant. But homeowners — who end up responsible for expensive property surprises — often regret doing so. Plus, the benefits outweigh the cost: Inspectors generally charge somewhere between $200 and $500 for their services.

defects in their electrical system, defects in their plumbing, or just the overall condition of the home that they’re purchasing, giving them peace of mind of any defects or potential things that could come up later

What should a homebuyer expect from a home inspection?

Rodriguez: The inspection takes maybe about two hours, sometimes three, and they get a thorough report of my findings of the property.

What do you check during the inspection?

Carmelo Rodriguez became a licensed home inspector in 2016, with the goal of making the homebuying process a little easier for buyers in Chicagoland. He works as the master property inspector at Hometec Property Inspections.

Austin Weekly News spoke with Rodriguez about what homebuyers can expect going into an inspection — and what red flags to keep an eye out for

What exactly is a home inspection, and what is its purpose?

Rodriguez: A home inspection’s goal is to give clarity to the client, which is usually the home buyer, the purchaser. (That could be)

Rodriguez: I’ll check the roof. If it’s a shingled roof, I check for any missing shingles, any deterioration, any clogged gutters. I check windows, doors and siding. I check all the mechanicals, the heating system, the air conditioning system, the electrical system. I’ll check for proper drainage in the plumbing system. I also make a note of the age and model number of all the mechanicals, so (the buyer) can get an idea of the age of all the mechanicals. I basically test all the water and I test for water pressure. I’ll check the foundation. If there’s a crawl space, I look for any moisture accumulation in the crawl space, and I’ll check for any cracks in the foundation.

What are some of the red flags that you look out for during an inspection?

Rodriguez: Major electrical issues, like maybe an old electrical panel that could potentially lead to a fire hazard. I also look for foundation issues that can lead to flooding or settling, where it could cost them a lot of money in the long run to repair

What might an inspection look like for a unit within a building?

Rodriguez: That depends. If it’s a big complex that maybe has 30 or more units, [the inspection] is mostly focused just on their

unit. The common areas are not included in those inspections because those are homeowner-association issues. So, it’s mostly the dwelling unit within the walls when it’s a condo. Now, if it’s a building that’s maybe only three units or three condos, sometimes they would want me to check the roof, just because those could be added special assessments later, or things that could affect them later. So then I’ll go ahead and check the exterior, the roof.

What is your advice to prospective homebuyers?

Rodriguez: I would advise them to definitely get a home inspection. There’s instances where they might not want one, or think that they know somebody that can go and walk through with them, but there’s been instances

where they have done that and they regretted it. So I always encourage homebuyers to get into home inspection.

What should buyers look for in a home inspector?

Rodriguez: They have to be comfortable with who they speak with. There’s questions they can ask, like how long (the inspector) has been in business, what they’re going to be looking for, what’s included in the report, turnaround time, just basic questions.

Follow us each month in print and at https://www.austinweeklynews.com/ at-home/, where you’ll find additional resources and useful information.