AT HOMEONTHE GREATERWESTSIDE

ABy DELANEY NELSON Special Projects Reporter

ustin, West Garfield Park and North Lawndale residential property values were reassessed earlier this year, meaning some homeowners will pay more on their 2025 property tax bills than they did in 2024. They’ll be in good company. Cook County property taxes rose an average of 4% this year, marking the 30th consecutive year of hikes, a Cook County Treasurer’s Office analysis showed.

As property taxes rise, some policymakers and county officials are advocating for a new way to ease their financial burden: A circuit breaker program that serves low-income homeowners.

Economists classify property taxes as regressive because lower-income households pay a higher share of their income toward the tax compared with wealthier counterparts. In Illinois, the property tax system is based on assessed home value, meaning the 1.3 million homeowners who will pay more next year won’t all see the same percent increase on their bill. It also means property tax amounts are disconnected from homeowners’ ability to pay

The result? Lower-income homeowners struggle to keep up with property tax payments. The 19 highest tax rates in Cook County are in Chicago’s south suburbs, where the population is primarily lower-income Black

“The sticker

is too late:”

Here’s what you need to know about your

West Chicago homeowners have until Sept. 24 to file an appeal with the Board of Review

By DELANEY NELSON Special Projects Reporter

Overwhelmed by your property taxes? Got your tax bill in the mail and don’t know what to do?

Property taxes are used to fund state and local government programs, including public education. Illinois is known for its high property taxes, ranking eighth in the nation for heaviest reliance on the tax, according to the Institute on Taxation and Economic Policy

In Cook County, properties are reassessed every three years. The assessor’s office splits the city of Chicago into several townships. The area of the West Side of Chicago, which includes Austin, West Garfield Park and North Lawndale, was reassessed earlier this year.

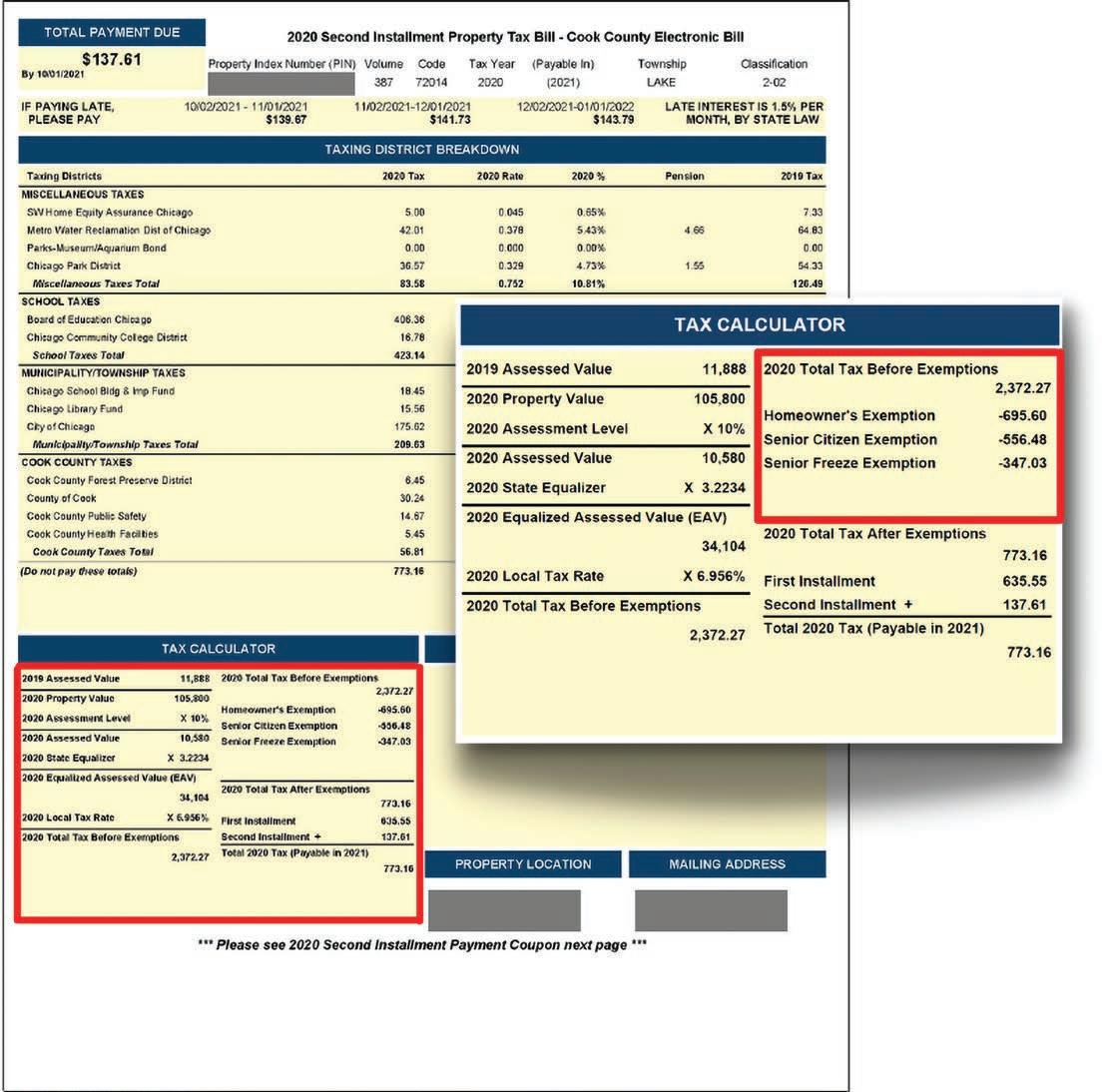

Your reassessment comes from the Cook County Assessor’s Office, while your annual tax bill — which comes in two installments, one due in March and another in August — comes from the Cook County Treasurer’s Office. In Illinois, property taxes are paid in arrears, meaning if your property is reassessed in 2024, you won’t see the new value reflected until the second installment of your tax bill in 2025.

Salvador J. Lopez, a practicing consumer rights attorney at Robson & Lopez LLC, advises homeowners to be aware of any notices they receive in the mail and to familiarize themselves with their township’s tax timeline.

A

“People say, ‘I’m going to appeal my tax bill.’ That’s incorrect. You can’t appeal your taxes. Your tax bill is what it is. It’s calculated based on the numbers that are provided from the state, the county, and municipalities, as far as how much they need,” Lopez said. “The sticker shock is too late. You can no longer appeal that bill. You can only appeal in 2024, which is paid in 2025.”

What you can appeal is the state-assessed value of your home. Once you receive your reassessment notice, you typically have 30 days to file an appeal with the Cook County

“There’s a lot of avenues for reducing and managing your taxes. You can’t make them go away, but chipping away 10% over time can make a big difference in a family’s budget.”

— Greg Hilton

Assessor. You may want to appeal if the property’s assessment appears too high or your reassessment notice includes incorrect property characteristics, among other reasons. This year, the deadline to appeal with the assessor’s office was June 20.

The second level of appeal is with the Cook County Board of Review. Homeowners on the West Side have until September 24, 2024 to file a complaint with the Board. Those in other townships should check the county’s website for deadlines. You can then appeal a Board of Review decision in circuit court or file with the Illinois Property Tax Appeal Board, though that process can take several years before a decision is made.

In between each triennial reassessment, homeowners can re-appeal if any of their property’s characteristics have changed drastically “There’s a lot of avenues for reducing and

managing your taxes,” said Greg Hilton, attorney and founder of Property Tax Solutions. “You can’t make them go away, but chipping away 10% over time can make a big difference in a family’s budget.”

While the first level of appeal is generally a manageable process for a homeowner, Lopez and Hilton recommend turning to a professional for help with a Board of Review complaint.

The property tax experts also have a key piece of advice for prospective homeowners: Ask about the tax bill before purchasing a property While a real estate agent cannot guarantee how much your tax bill will be, you can inquire about the property’s history, and tax records from previous years can typically be found online.

“There shouldn’t be any surprises,” Hilton said. Lopez stresses that the assessed value of your home does not impact your actual property value. An appeal will not decrease your property’s market value.

Because the reassessed value of a home is impacted by the assessed value of nearby properties, Lopez encourages homeowners to communicate with their neighbors about the assessment and appeals processes. If your neighbor’s assessed value is going up, yours is likely to go up as well, he said.

If you live in an area where surrounding property values have increased significantly since the last reassessment, Lopez recommends you be “uber-aware.”

“A lot of this is planning. If the tax is going to be unaffordable, maybe it’s time to put the property up for sale. I want to be clear, it is horrible that that’s a lot of the only option for a lot of people. But, you know, I say, ‘Look, I’d rather you sell it than lose it to foreclosure or lose it in a tax sale,’” Lopez said. “The more information you have, the better.”

Continued from page B1

residents, according to the treasurer’s office. This year, the area’s median bill grew nearly 20%. Fewer than a quarter of reassessed homes across the county saw their bills go down.

On average, middle-class Illinois homeowners spend 6% of their income on property taxes. Millionaires spend just 1%.

“Simply put, disparities of this magnitude are not fair or equitable, and we need to ensure we’re supporting the people who make our state run: the firefighters, teachers, social workers, and other working-class people who would benefit from desperately needed property tax relief,” Cook County Board of Review Commissioner George Cardenas told Austin Weekly News in an email. “By easing property tax burdens on working-class and lower-income households, people are better able to invest in their futures.”

A circuit breaker program could relieve this disparity by providing an income tax credit for property taxes that exceed a certain percentage of the homeowner’s income. Depending on the program, renters may also be eligible to earn credit.

Right now, many Americans are struggling with the cost of housing and

property taxes contribute to that, said Brakeyshia Samms, a policy analyst at the Institute on Taxation and Economic Policy

“A lot of families are overloaded, and circuit breakers can kick in and help mitigate that problem by rebating a share of income for the property taxes,” she said. “These credits really are one of the most effective tools that promote property tax affordability.”

In 2012, Illinois implemented a circuit breaker program that provided credits to qualifying seniors and people with disabilities. The state legislature did not approve funds for the program for the 2013 fiscal year, ending the program.

More than half of U.S. states administer circuit breakers of some kind, although they vary widely in size and scope. Thirteen states make this type of credit available to working-age homeowners.

County officials are working with legislators and community groups to draft a program proposal for next year’s legislative session, said Cook County Assessor Fritz Kaegi. The state will have to decide on income criteria, home value cutoffs, timing and structure of the program.

“We want to be a leader in making sure that property taxes are fair to everyone,” Kaegi said. “It’s a good idea for the state to incorporate a circuit breaker program that provides relief for when bills increase, for the people who need it most.”

By DELANEY NELSON Special Projects Reporter

In the 2021 tax year, homeowners in Cook County saved $16.7 billion in exemptions, according to research from the Chicago Metropolitan Agency for Planning and the University of Illinois Chicago Government Finance Research Center. Property taxes are a major expense for homeowners, and exemptions

are one way to ease that burden.

In the same year, total homestead exemptions equaled $16.7 billion. But, property taxes fund infrastructure and other needed services, so local governments try to make up the difference by raising tax rates for everyone.

The result is an asymmetrical tax burden distribution. Some residents — particularly in suburbs south of Chicago — have seen greater increases in their tax rate as a result of homestead

exemptions than others, research from CMAP and UIC shows. Take Park Forest, a south suburb that’s over two-thirds Black: The tax rate increase due to exemptions in 2021 was ten times higher than the county average.

Austen Edwards, a senior policy analyst with CMAP, says the practice of raising overall rates can erode the apparent savings homeowners get when claiming exemptions and raise costs for businesses.

“What we found was that there’s sort of a mixed picture when it comes to exemptions, that we are providing tax relief to each homeowner who claims the exemptions, but they’re paying a higher rate on the lower taxable value. And how that math works out for each homeowner depends on where they live in Cook County,” he said.

Edwards said tax policies try to be as neutral as possible. That is, they are supposed to treat similar taxpayers in the same way. But policies play out in different ways in different locations, based on the size, characteristics, property values, land use mix and share of homeowners who claim exemptions in each municipality.

“So the actual effects of an apparent uniform, neutral tax policy like homestead exemptions can vary widely across all towns and villages,” he said.

To address these disparities, the county established last year the Property Tax Reform Group, a working group researching solutions to these inequities.

Cook County offers eight exemptions for homeowners to reduce their property tax bill. The most common is the homeowner exemption, which saves homeowners an average of $950 annually.

You can apply for an exemption through the Cook County Assessor’s Office, which will review your application. If you think you missed out on an exemption in a previous tax year, you can file a certificate of error with the Assessor’s Office. Aside from the homeowner exemption, many Cook County residents may be eligible for other property tax breaks. Exemptions are available for seniors, low-income seniors, people with disabilities and veterans. Home renovations that improve the home’s property value are also eligible for a tax break.