AT

By DELANEY NELSON Special Projects Reporter

Chicago is known as the city of neighborhoods; it’s a place where each community has unique history, struggles, qualities, goals, residents and values. One distinct, but perhaps overlooked, part of each neighborhood’s identity is its existing housing stock.

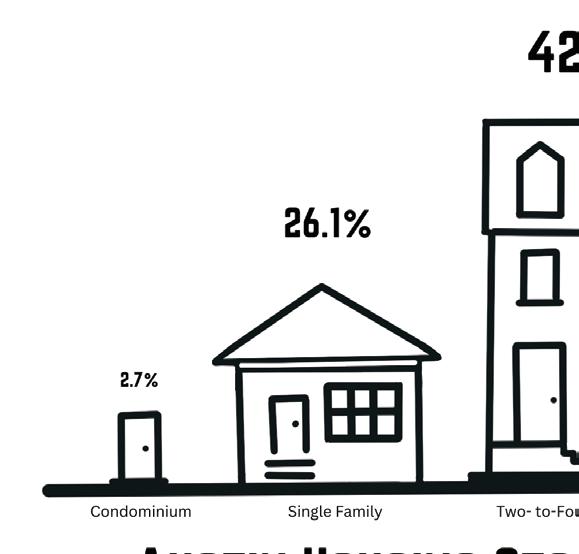

Housing stock refers to the total number of dwellings in a specific area, including single-

family homes, condominiums and multifamily units. An area’s housing makeup can be used to strategically address the community’s housing needs. Programs designed to increase homeownership in a neighborhood with a high number of owner-occupied units, for example, will look different from programs for a community with a large percentage of multiunit apartment buildings.

“If your neighborhood has a lot of two- tofour-unit buildings, and you have a lot of these small rental properties, there may be small-scale landlords who own and run those properties. That’s a different type of consideration than if the neighborhood has all single-family homes, which are more likely to be fully owneroccupied,” said Geoff Smith, executive director

See HOUSING STOCK on page B3

By DELANEY NELSON Special Projects Reporter

If you want to become a homeowner, but don’t think you can afford it, the Cook County Land Bank Authority wants to help.

The Homebuyer Direct program, launched by the CCLBA in 2017, connects prospective buyers with below market-rate houses in need of renovation. The program aims to remove barriers that come with fixer-upper properties through grants up to 6% of a home’s purchase price, capped at $20,000.

“[Program grants] allow them to buy, rehab and ultimately move into the home of their home of their dreams,” said Darlene Dugo, deputy director of the CCLBA.

In 2024, the program expanded to assist buyers in purchasing developer-owned renovated properties or newly built properties on former land bank plots. The grant is only available for property that will become the owner’s primary residence. Homebuyers may use grant funds to finance renovations, contribute to a down payment or closing costs or pay for things related to property transactions, like insurance or inspection fees. In addition, buyers must contribute at least $1,000 or 1% of the home purchase price, whichever is less.

There are two ways to participate:

For buyers interested in purchasing a fixer upper directly from the land bank, search the CCLBA’s interactive property viewer for available properties. Buyers may show their interest using the “apply” button on the property’s listing. From there, a representative from the agency will take potential buyers on a property tour and talk them through needed renovations.

The second option is to purchase from a developer. A list of qualifying properties can be found on the CCLBA’s website

under “equity fund program.” This includes both developer-renovated properties and previously vacant land bank lots on which developers have built new property. Application documents are also listed on the website.

In either case, buyers must be mortgage-ready to apply for the grant money. That may mean going to homebuyer counseling, meeting with a lender and getting pre-approved for a mortgage.

Darlene Dugo, deputy director at the CCLBA, said the homebuyer direct program intentionally has few limits, aside from mandating the property be owner-occupied for a minimum of three years.

“We don’t impose any income restrictions, we don’t impose any credit score requirements. Essentially, we’re letting the applicant know, ‘Follow your lender’s guidelines, because they’re going to direct you,’” Dugo said. The program’s purchase assistance can be layered with other purchase assistance or down payment assistance programs, she added, as long as the buyer’s lender allows it.

Cook County President Toni Preckwinkle, first elected in 2010, has led a charge to investigate and create solutions for historic disinvestment.

The CCLBA, which, aside from this grant program, acquires vacant, abandoned and foreclosed properties and develops them in a way that’s consistent with community stakeholder priorities, is a branch of Preckwinkle’s work.

In addition to making home buying more affordable and accessible, the land bank’s grant program “continues its mission of promoting redevelopment and reuse of vacant, abandoned, foreclosured, tax delinquent property,” Dugo said.

“Imagine having one delinquent property on your street and the havoc that that causes,” said Dugo. “That impacts everyone on that block’s property values. What we want to do is turn these properties into an asset for that neighborhood.”

In the past decade, the CCLBA’s partnerships with private developers have done just that: created jobs, built affordable housing and aided in the revitalization of disinvested communities across Cook County, according to the organization’s ten-year impact report. At a cost of just over $185 million since 2014, the CCLBA’s programs generated $9.77 for every dollar spent.

In Austin, CCLBA’s reach extends beyond homeownership. On Oct. 10, PCC Community Wellness will host a ribbon cutting ceremony for its Austin Primary Care Pavilion, which was built on former Land Bank plots. The center will of fer medical care, job opportunities, an urban farm and workforce development programming. And earlier this year, local developer Leodus Thomas Jr. unveiled a newly restored eight-flat residential building in Galewood. It includes five affordable residences and was also built on plots purchased from the Land Bank.

Continued from page B1

at the Institute for Housing Studies at DePaul University. He said two flats, for example, provide owner-occupied homeownership opportunities, as well as affordable rental units.

On the West Side, each community has a unique housing stock composition. Singlefamily homes make up 26% of the housing in Austin, which is on par with the city average. But it has a higher percentage of two- to-four-flats than Chicago overall.

West Garfield Park and North Lawndale look a little different. Both West Side neighborhoods have a lower percentage of single-family homes than Austin, and their rates of two- to four-flats are far above the city average. Here, a homeownership-boosting initiative may include classes to teach two-flat homeowners how to rent out a unit of their home, Smith said.

A neighborhood’s housing stock is closely tied to its location and when the neighborhood was developed, according to Smith. Austin, which was established in 1920, has many older, smaller multi-unit buildings.

As a result of decades of disinvestment by the government, banking institutions and developers, many of these properties need rehabilitation, narrowing the selection of movein ready homes for sale.

“Those buildings require substantial rehab,” Smith said. “So that would mean a flipper or

some type of developer would have to come and purchase those properties and improve them. That has been happening, for sure, but there’s just a need for increased investment.

Austin also has some vacant land, which can provide opportunities for new construction. But the financing of such projects isn’t always plain sailing.

“Because of the nature of the cost of new construction versus the value of real estate in some neighborhoods, the economics of those deals are tricky sometimes for market-rate developers to make work,” Smith said.

Today, there are an array of initiatives focused on increasing homeownership and stabilizing affordable housing on the West Side.

Both Austin and West Garfield Park are, for example, designated target areas for the city’s Micro Market Recovery Program, an initiative of the Department of Housing focused on “rebuilding distressed Chicago communities” by reducing the cost of homeownership and reinvesting in vacant buildings. The Oak Park Regional Housing Center hosts Austin Rising, a program designed to help existing homeowners and “improve housing stock without displacement.” The Preservation of Affordable Housing-Chicago, a nonprofit developer focused on building and rehabbing affordable housing, has undertaken two rehab projects in Austin. One of the organization’s acquisitions is the Austin Renaissance, a structure built in 1926 on W. Washington Boulevard.

Even day-to-day conversations with neighbors can be shaped by the way a neighborhood is built. On blocks filled with owner-occupied single-family homes, residents are likely to have more interactions with their neighbors, said Don Washington, director of the Chicago Housing Initiative Coalition.

In turn, these communities may become stronger, cohesive units that can better fight against destabilizing factors like gentrification. A community with more vacant lots and large, spread-out buildings may have a harder time creating the same degree of cohesion, Washington said.

“If the housing stock is mostly apartments and renters, if it’s mostly large buildings, then it’s easy to displace it. Neighbors don’t really know each other,” Washington said. “By displacement, I don’t just mean gentrification. I mean things like, ‘We want to put something in your neighborhood that you don’t like, like a chemical plant.’ But if the neighborhood has people who have investments in their homes, or has a bunch of two- and six-flats scattered among single-family homes, it becomes very hard to displace that neighborhood. You have to build around it, because you’re not going to be able to go through it.”

Follow us each month in print and at https://www.austinweeklynews.com/ at-home/, where you’ll find additional resources and useful information.

By DELANEY NELSON Special Projects Reporter

Last month brought good news for prospective homebuyers who are wary of high mortgage rates: The Federal Reserve — the U.S. central bank — cut its prime lending rate by 0.5% in midSeptember, in an effort to cool inflation and stabilize the U.S. economy. That rate cut and its ripple effects should make buying a home less expensive.

Why do lower mortgage rates matter?

The lower the interest rates, the more people who can afford to buy a home, explained Alex Bokich, a senior mortgage consultant at W intrust Mortgage in the wester n suburbs.

A buyer’s debt-to-income ratio can be a make-or-break factor in qualifying for a mortgage, Bokich said. Debt payments — combined mortgages, credit card debt, car loan payments and more — shouldn’t be more than half of the buyer’s income. Generally, buyers won’t qualify for a mortgage amount that would put them over

the 50% threshold.

“If (rates) drop about a half a percent, millions of new people have that opportunity to purchase a property,” Bokich said.

Why does the Fed control interest rates?

The Federal Reserve has two main responsibilities: promote maximum employment and stable prices.

Rate setting is one tool the Fed uses to stabilize the economy and meet its so-called “dual mandate.” Although it doesn’t have the power to set mortgage rates outright, cutting the short-term federal rate sends a signal to other lenders — and the country — about how the economy is doing. This filters down to mortgage lenders, which tend to respond by lowering rates, too.

The decision is a sign the Fed is shifting back to “normal dual-mandate mode, where we’re thinking about employment and inflation,” said Chicago Fed president Austan Goolsbee in a news conference. He compared that to the past year and a half, during which the Fed was “singularly prioritizing the fight against inflation — which we had to.”

How much does one rate cut help borrowers save?

The average 30-year fixed mortgage interest rate is around 6.2% right now, compared to a year ago, when the average was closer to 8%. A buyer who didn’t qualify to borrow enough cash for a home in their neighborhood last year may qualify today.

In other words: A theoretical household earning $60,000 per year with no debt could qualify for a 30-year fixed rate mortgage of $181,443 with 8% interest, according to Fannie Mae’s online mortgage affordability calculator. That same household would qualify for a $211,115 mortgage at 6.2% — a difference of nearly $30,000.

To be clear, mortgage rates had been falling for most of 2024, before the Fed cut its rate. That’s because other economic factors, like employment, can influence mortgage rates.

For example, when unemployment rose in August, some economists saw it as a final nail in the coffin, proving the economy was showing signs of struggle and that the Fed would have to cut rates. So lenders dropped mortgage rates in anticipation of a Fed cut, Bokich with Wintrust Mortgage said.

If the Federal Reserve continues to make cuts

— which many economists, and Bokich, predict will happen later this year — mortgage rates will likely fall even more.

I’m already a homeowner, but the interest rate on my mortgage is high. Is now a good time to refinance?

Typically, when rates have been up for a while and then they start coming down, it starts making sense for borrowers to refinance.

But refinancing comes with a fixed cost, so it only makes sense to do if the cost doesn’t outweigh potential savings, said Bokich.

“Let’s say closing costs are $2,000 for example. Would you spend $2,000 to save 20 bucks a month? No, that’s too little savings,” said Bokich. “Would you pay $2,000 to save $500 a month? The answer is yes, because you would break even in four months.”

Plus, the “right” time comes down to each homeowner’s circumstances, Bokich said. In some cases, waiting to see how low rates get is the right move. For others, it may make sense to refinance several times.

“You refinance now, guess what? In four or five months, if (rates) come down, you can refinance again. Why not?” he said.