ATHOMEONTHE GREATERWESTSIDE For Cynthia Rodriguez, finding a forever home was a top priority

By DELANEY NELSON Special Projects Reporter

Whether growing up in Edgewater and Portage Park or renting in Belmont-Cragin — and now buying a house in Montclare — Cynthia Rodriguez has spent most of her life on the northwest side of Chicago.

Last January, Rodriguez and Abraham Roman, her husband of 20 years, attended an information session at YUB Realty. Roman was ready to start the home-buying process, but it took Rodriguez a bit longer to warm up to the idea.

“I was always the hesitant one,” she said. “[I was like], ‘We’re not going to be able to do it. How can we afford it?

How are we going to save for a down payment?’”

With two teenagers and an 18-month-old, Rodriguez was also worried about the prospect of balancing daily life with the ins and outs of buying a home, like submitting all of the necessary paperwork and visiting houses.

But by the end of the year, with some convincing on Roman’s end, the couple decided they were ready to dive into what they see as the “American Dream.” He told her, “I know it’s stressful to gather documents and have these financial conversations, but we can definitely do it.”

“It’s always a dream to buy a home for your kids and for yourself,” Rodriguez said. They wanted to give their kids a place to call their own, and it felt like time to transition away from renting, and instead invest in their own property.

They returned to YUB Realty in January, where they met with real estate broker Lorena Ramirez-Carrillo’s team. Within

A GCM GUIDE TO HOMEOWNERSHIP

a week, the couple received their preapproval letter, visited houses, submitted an offer, and closed on the house. Within the next month, they hope to move into their new home.

Rodriguez said she is excited that her kids will now have more room for themselves. Her 16-year-old daughter, for example, will stay in the finished basement, where she can chill without her two younger brothers “in her hair.” Her oldest son, 13, will

now have his own room, and her toddler will grow up in the family home.

“[I’m] looking forward to my little one growing up in his forever home,” she said. “With my older kids, we’ve moved a couple of times. I’m just looking forward to now, for my

GROWING COMMUNITY MEDIA March 13, 2024 B1

See FOREVER HOME on page B3

It took some convincing, but Cynthia Rodriguez said investing in her own home was worth it in the end.

PROVIDED

What you should know about buying a home, according to 3 real estate agents

By DELANEY NELSON Special Projects Reporter

For most prospective buyers, finding a real estate agent is a major step in the home-buying process. While it is possible to complete the process without a real estate agent, they can provide future homeowners with expert knowledge of the local real estate market, established connections to attorneys, loan officers and inspectors, and a wider variety of listings than you might find on Zillow.

Austin Weekly News spoke with three Chicago-based real estate agents about what buyers should look for in an agent and what to expect from the process.

Lorena Ramirez-Carrillo is a designated managing real estate broker and owner of YUB Realty. She has worked with attorneys in the real estate field, has worked as an underwriter and has run a title company. She works with first-time home buyers, people without a valid social security number and veterans, among others.

Eve Benton is a designated managing broker for EXIT Strategy Realty and an instructor with the Chicago Association of Realtors. Her specializations include first-time homebuyers, veterans, multi-unit sales and purchase/rehab.

Mario Greco is a real estate agent at Berkshire Hathaway’s HomeServices Chicago, where he founded the MG Group. He has been in the real estate business for over 20 years, serving the city and surrounding suburbs. Most recently, he has worked in West Town, Bucktown, Wicker Park, Lakeview, Lincoln Park, West Loop, Roscoe Village, North Center and Uptown.

Do I need a real estate agent?

Ramirez-Carrillo: You don’t need a real estate agent to buy a house, but it is always recommended if you want to make sure that there’s not going to be any room for mistakes, if you want to make sure that your purchase is going to go smoothly and that you’re going to be guided the right way. You also may not have access to all the resources that we have, and even to all the listings. If you don’t have a real estate agent, you might be limited to whatever you find on public sites.

Greco: If you wanted to go look for houses, you could find whatever you wanted to find online, you could call the listing agent and have an appointment and show the place and then if you want to buy it, you can have an attorney write up the contract. You really don’t need an agent for the looking process — although I think you do — but now I think that is less important. What I think you need an agent for more now is: One, their knowledge of existing buildings, as well as the reputation of a builder or developer for new buildings. Two, you want the agent’s contact list for trusted attorneys, trusted contractors, trusted inspectors, even. And in a very competitive market, you also want an agent because listing agents like to work with buyer’s agents because

they actually have counsel and guidance and the transactions tend to close much more often and in a much smoother way. And then finally, in this market where there are multiple offers galore, the buyer’s agent is going to advise the client in such a way that the potential for disappointment or anger is lessened. But all of that aside, a buyer’s agent is most important not to find the property, but to close the transaction. In other words, once you’ve found it, after you’ve negotiated — which an agent is very important for — keeping the deal together is just as hard if not harder than finding the property itself and a buyer’s agent is uniquely qualified to know of all the hurdles and bumps and potholes along the way.

How do I choose an agent?

Greco: The prospective buyer should interview at least three agents. They should always look at their website presence to see what it is they’re putting out to the public and they should also then go to any of the review sites like Zillow, Yelp, Google and see what’s out there. Obviously, most Realtors® only post their good reviews but Yelp doesn’t allow you to take down your bad reviews. Zillow does, but Google and Yelp do not.

Benton: I’m going to start by saying, don’t believe what you see on HGTV and those TV shows where they make it look easy. Even if they don’t have the experience, even if it’s a new agent, you want to look for someone who has a desire to advocate for you. It’s incredibly important for you to feel comfortable with the person, with their knowledge base, or even their desire to garner

Lorena Ramirez-Carrillo Managing real estate broker and owner of YUB Realty

“Don’t believe what you see on HGTV and those TV shows where they make it look easy. Even if they don’t have the experience, even if it’s a new agent, you want to look for someone who has a desire to advocate for you.”

Eve Benton Managing broker for EXIT Strategy Realty and an instructor with the Chicago Association of Realtors

the knowledge. So that’s why if it’s somebody who is new, that’s not a problem. In my opinion, it’s important to them to have a desire to learn and have other seasoned resources to go to. You also want somebody that’s tech savvy.

Ramirez-Carrillo: Whoever you choose as your real estate agent should be able to tell you right there at the first consultation whether or not you meet the basic requirements to buy a house. Make sure that that real estate agent is knowledgeable in the area [you’re looking to buy in]. Years of holding a license does not automatically mean that that agent has experience, experience is based on the number of transactions that you have closed because the more transactions that you are involved in, the more of a chance that you have gone through different situations and that you’re able to help your clients.

What should my relationship with my real estate agent look like?

Ramirez-Carrillo: For me, it’s one of trust, and making my clients understand that for me, the most important part is that they ask questions, that they understand the process, that they feel comfortable with making a decision. Since the very first conversation with my clients, I make it clear that I want them to ask me

B2 March 13, 2024 GROWING COMMUNITY MEDIA AT HOME ON THE GREATER WEST SIDE

questions — don’t ask the neighbor, don’t ask any relatives because they’re all going to have their own ideas based on their own experience. With me, it’s never about, “Oh, I’m the professional and you should respect me.” It’s more, you are my client and I want to make sure that you feel comfortable with whatever decision you’re making. If it takes us months to get you the house that you want, or if it takes us going to see 50 houses, that’s what it’s going to take and that’s what we’ll do. But I always make sure that they are comfortable with making decisions and understanding the whole process.

Benton: A lot of times, people will meet their Realtor® the first time at a property. That is not the most ideal way to do it. Ideally, we should be having a consultation with the buyer prior to even showing properties. It gives me an opportunity to go over the forms, explain the process, set up a search. Set expectations. You should be checking in with them weekly. Time is of the essence once you’re under contract and at the end of the day the buyer is going to be at work doing something else. So between your agent and the attorney, they’re gonna help you manage those deadlines. What I also explain to my clients is: I consider myself a professional but you are the boss. You’ve hired me to do something for you, so I’m not going to make the decision I make recommendations.

I don’t have a Social Security number. What’s your advice?

Ramirez-Carrillo: There are lenders out there that do the type of loan for people that don’t have a social security number but they actually meet the [homebuyer] guidelines. A lot of companies or agents don’t service Individual Taxpayer Identification Number clients and I’m very proud to say that I do help a lot of them and that’s when it becomes really rewarding, when somebody who has had so much trouble getting the help actually gets to buy their own house. Definitely reach out and inquire about different lenders. I’m not the only one who services them, but it’s just not one lender that does loans with ITIN. Be careful to not ever give

Mario Greco

Real estate agent at Berkshire Hathaway’s HomeServices Chicago

Mario Greco

Real estate agent at Berkshire Hathaway’s HomeServices Chicago

money upfront because there have been a lot of scams. You should never pay a real estate agent upfront, especially thousands and thousands of dollars.

What’s your advice for prospective home buyers?

Benton: Think of Pareto rule, the 80/20 rule. If it has 80% of the things you want, it might be worth considering. No home is perfect. Something is wrong with every house — that comes with home ownership. But the benefits outweigh the challenges. If it has 80% of the items on your wishlist, you’re winning.

Greco: One thing they shouldn’t be hung up on is square footage. They should be looking for layout and not number of square feet. Two: along with their agent, they should be looking for obvious signs of neglect or disrepair. The other thing buyers need to do is look at, whether or not they like natural light, they need to walk into a place and if all the lights are on, they need to turn the lights off, and see what it feels like. If it’s a super bright day, this is the best it’s ever gonna get. Finally — and this is critical — a buyer should come to the property, not necessarily having to go inside, to the neighborhood at different times and on different days. You might have seen that at two o’clock on a Saturday and there’s no one around, it feels really peaceful. Well, come there Friday at seven o’clock or come there in the morning on a Tuesday and see what’s going on.

Ramirez-Carrillo: If you’re paying rent somewhere else, you’re already spending your money on housing, why not apply it to your own house? Why not apply to something that is gonna generate you equity and wealth in the future as opposed to just paying for basically staying in somebody else’s house for that month?

What should people look for in a home?

Benton: I wouldn’t worry about the cosmetic issues. If you want 42-inch cabinets, you can get that later. Quartz counters, you can get that later. [Look at the things] you can’t change very readily: the floor plan and your neighbors. While the floor plan can be changed, it’s usually not practical or affordable. Think about your lifestyle also, some people don’t mind living on major thoroughfares and some people don’t want to. Where are you in terms of your family setup? Kids or no kids? Are you moving to an area because of the school district? How does that impact your taxes?

Ramirez-Carrillo: We all have priorities and we all have wants when it comes to a property. So what is a priority? You want to be close to your job, you want to be in a good school district, you want to have at least three bedrooms because you have four kids. Things that are very, very important. I want them to tell me at the very first consultation; I want to make sure that at least we focus on all the priorities, whatever it is, and if we can throw in some of their wants, that is wonderful. If I can find them a house that meets all their priorities and still has some of their wants, that would be excellent. But what I tell them is do not try to find everything in a house because it’s rare that you’re going to find everything in a house. You’re going to have to compromise on some things.

FOREVER HOME

Continued from page B1

toddler, this is his home and the one he’s going to remember growing up in. I’m excited for just making memories in our own home.”

Rodriguez credits her realty team with making the process smooth and easy. Their real estate agent was quick to respond to their messages and phone calls, and was sure to clarify information during each step of the process, she said.

“Our Realtor®, was so accessible,” Rodriguez said. “I’m fluent in English and Spanish, but when it comes to stuff like this, it’s like, I’d rather you explain it in Spanish to my husband so that we’re on the same page and I don’t miss or say something that maybe wasn’t translated correctly. So just having that accessibility of being able to speak with our Realtor® in both English and Spanish to where we all understand what we’re going through and understand what we’re reading and signing made it a lot easier.”

“That put us at ease that we had someone in our court that was able to provide us with that support in case we had any questions or didn’t thoroughly understand what was being asked,” she added.

The search

“One of the first questions Lorena asked us was, ‘What are you looking for? What does your ideal home have?’ It was at least two bathrooms and a dining room because with all the chaos, we do enjoy having family dinners together every day. That was one of the things that I must have had in my new home, was a large dining room. And honestly, all the properties that [Lorena] sent us had what we asked for, which made it really easy. It (was) like okay, they heard me, they are on our side, and want us to find what we consider an ideal home.”

The deciding factor

“At the end, we did have two [finalists]. The second house we saw, we really liked. There happened to be an open house that day, so of course there was other competition, there were going to be other offers.

With the last one we saw, the location and the size and it being move-in ready were those deciding factors. That second one we saw did not have a finished basement, where this one does.

[The situation was] having to go through that negotiation process with the one property that we liked, versus the last one where it was like, this has everything that we’ve been looking for, okay, let’s just do it and see what happens. We weren’t looking to do it so fast, it just happened this way. But again, because it was ready and had everything we were looking for, that is the reason why we decided to go with that last one we saw.”

Advice for prospective homebuyers:

“Don’t be afraid to ask questions. It’s one of those things where sometimes you’re like, ‘Oh, I should know this or I can Google this and I shouldn’t be asking so many questions.’ Or it’s like ‘Oh, I don’t want to bother you with this question.’ But I think [it’s important to] just be okay with asking for help or additional clarification. [Lorena’s team at YUB Realty] just made it seem like it’s not a bother, we’re here to support you and in a way educate you and make sure that you understand everything. So don’t be afraid to ask. [Real estate agents] are here to help you achieve your goal, your dream of owning a home.”

GROWING COMMUNITY MEDIA March 13, 2024 B3 AT HOME ON THE GREATER WEST SIDE

What is the housing market like on the West Side?

As demand for housing on the greater West Side grows, affordability for longterm residents hangs in the balance

By DELANEY NELSON Special Projects Reporter

Whether you’re a long-term Austin renter, homeowner, or prospective home buyer, the area’s housing market likely affects your dayto-day life. Familiarizing yourself with the housing market is one way to get realistic about the cost of becoming a homeowner.

The housing market describes the types, cost and amount of housing in an area.

The demand for and supply of housing are key drivers of the market and its prices. Typically, the economy, available mortgage credit, a neighborhood’s affordability and its amenities all contribute to the demand for housing in a particular area.

When there’s more demand than supply for a particular type of housing, like move-in ready single-family homes, for example, prices go up — especially if the demand is coming from higherincome home buyers.

Smith said. Some investors may just hold a property and rent it out.

On the other hand, if there are not enough move-in ready homes, for example, flippers may come into a neighborhood, purchase homes at a relatively low price, invest in home improvement, and then sell the home at a higher price to new owner-occupants. Flippers may bridge the gap between high demand and low supply for movein ready homes — but they also run the risk of pricing current residents out.

“One of the big challenges in a lot of neighborhoods is, if you do create a significant amenity in a neighborhood, how do you ensure that the housing in that neighborhood remains affordable for the long-term residents, or potential homebuyers from the community that want to stay in the community?” Smith said. “That is one of the key, I think, vulnerabilities of the way that housing markets work, unfortunately.”

West Side resident Eve Benton, who is the designated managing broker at EXIT Strategy Realty, has seen this influx firsthand.

But in some neighborhoods on the South and West Sides, historic disinvestment also puts a “bit of a wrinkle” in the story of the housing market, said Geoff Smith, executive director and principal investigator of the Institute for Housing Studies at DePaul University.

Communities with lower costs and a lessmaintained, disinvested housing stock can attract investors that play myriad roles in the market,

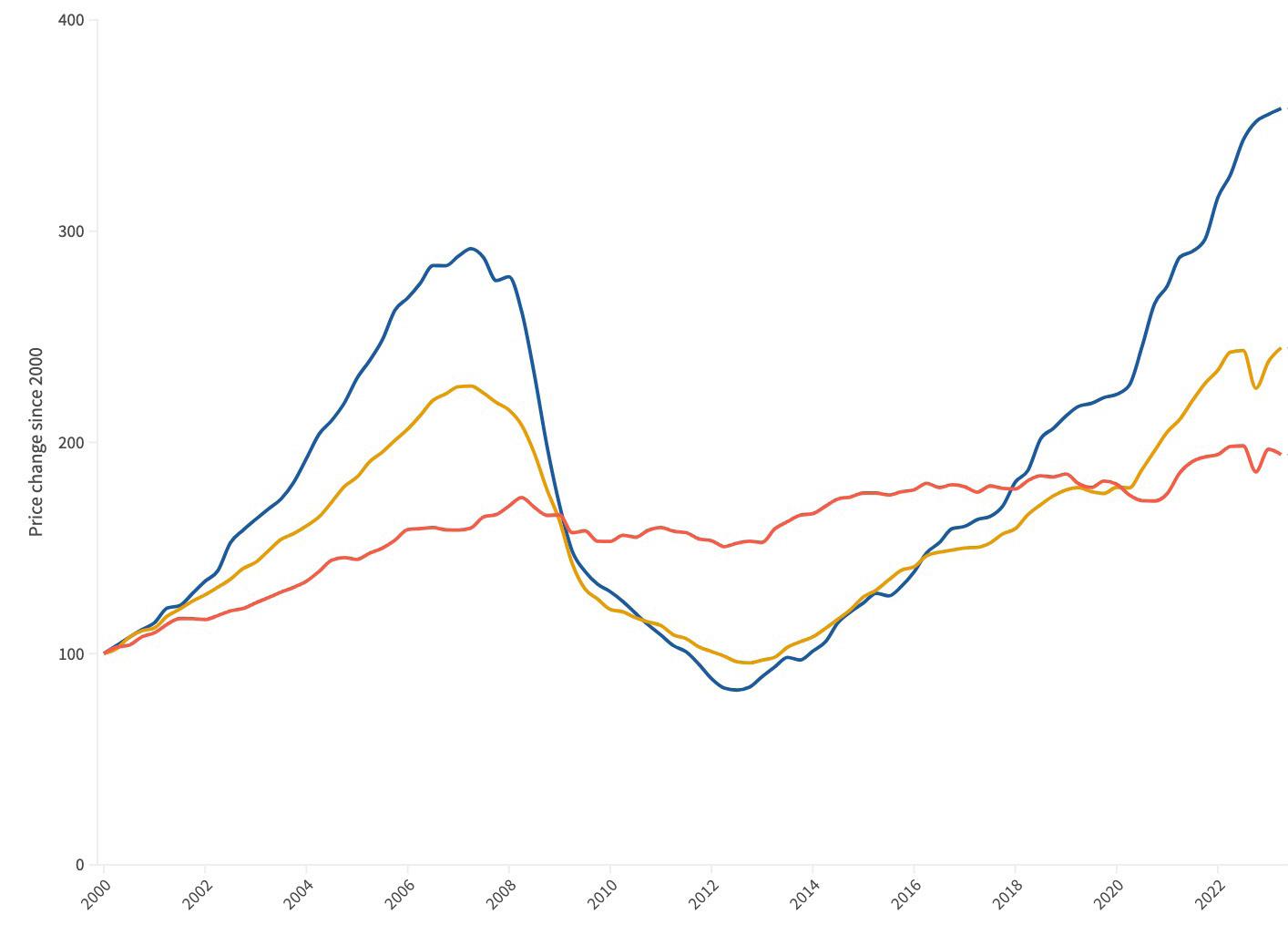

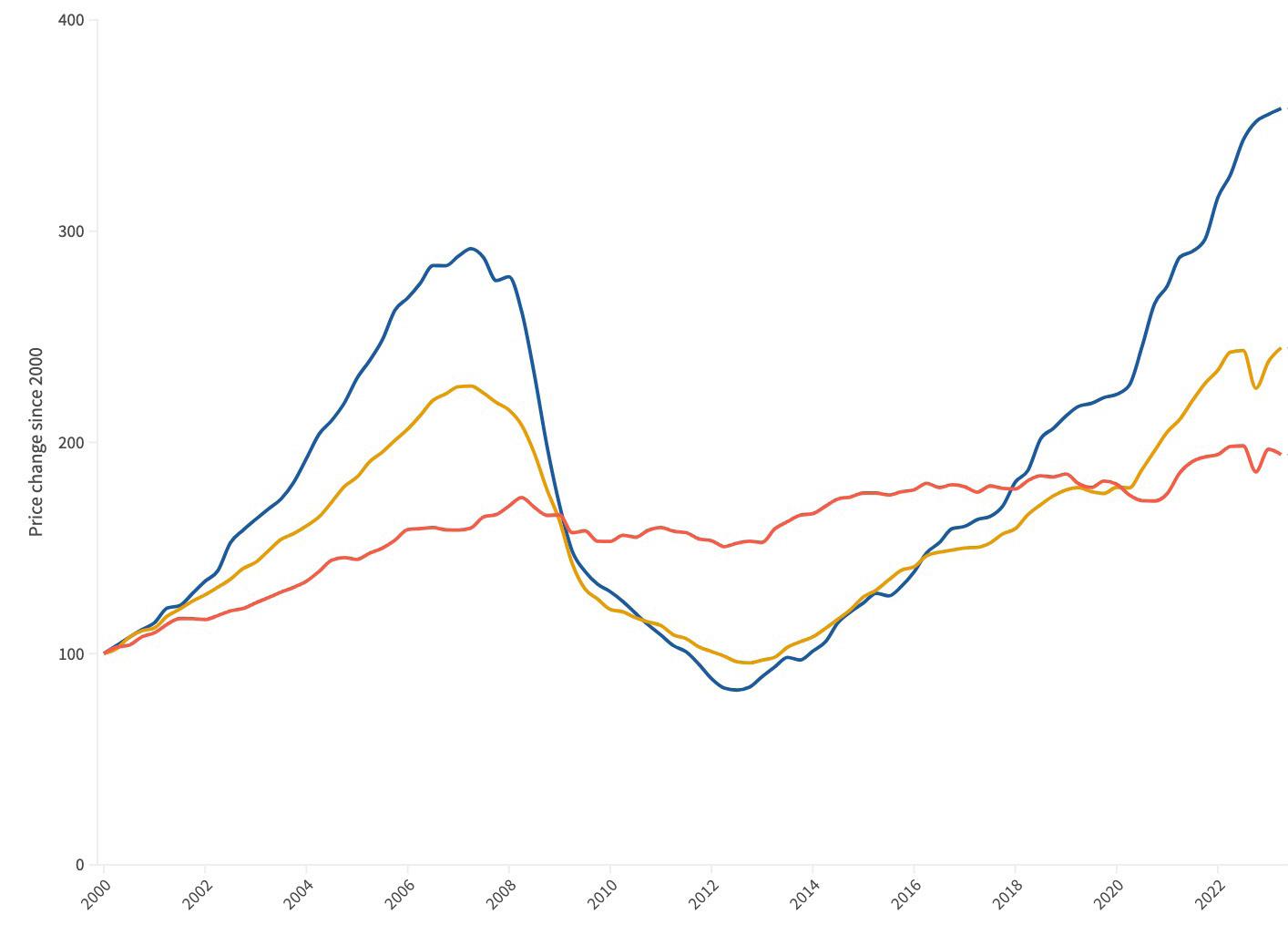

Sale price changes for single family homes

Price trends from the first quarter of 2000 to second quarter of 2023

Values indexed in each submarket to the first quarter of 2000. Data: Institute for Housing Studies at DePaul University

As mortgage rates rose, people who already owned homes weren’t too interested in selling, which would mean trading in a 3% or 4% interest rate mortgage for one at 7% or 8%. Supply started to drop. Then, when the Federal Reserve raised interest rates to cool inflation, mortgage rates rose too.

Humboldt Park/Garfield Park

Austin/Belmont Cragin

Lake View/Lincoln Park

Benton said her own neighborhood’s defining features, including central location and beautiful architecture, have attracted outside interest that can impact pricing in the area. As more people find neighborhoods on the West Side attractive, the more development it will likely see, she said.

“I have seen people are becoming aware of the benefits of living on the West Side,” Benton said. “There are some areas that may have been considered maybe not as desirable, and you’re seeing activity in those areas too, because those are probably the only areas where someone can do a renovation, turn it over to a first-time homebuyer, and make it profitable for everybody.”

Increasing demand

In 2021 and 2022, interest rates were low and the national housing market saw a boom. But then things changed.

Today, there’s more demand than supply in the nationwide housing market, or a “sellers market,” said Mario Greco, a real estate agent and founder of Berkshire Hathaway’s MG Group, a Chicago real estate firm.

“Right now, the market is a contradiction: Interest rates are high and inventory is very low, but buyers have gotten used to interest rates being higher and they are looking for things to buy and there isn’t enough for them to buy,” he said.

This means for people looking to buy, there might be lots of competition for a few available homes, and many prospective homeowners may encounter multiple-offer situations, according to Greco. Higher prices in the market means buyers will spend more on a downpayment and are therefore looking for a turnkey property — one that is move-in ready and doesn’t need expensive renovations.

On a regional level, there’s a fairly flat population in Chicago, so the city overall is not seeing a ton of price growth, compared with other markets. But as areas away from downtown and the Loop are becoming more coveted, the market for some neighborhoods on the West Side is more volatile.

From January 2000 to June 2023, the Institute for Housing Studies at DePaul tracked quarterly

price trends for single-family homes in more than 30 submarkets in the city and suburban Cook County. The team’s research indicates prices have increased more, and faster, in some neighborhoods on the West Side.

In the Humboldt Park/Garfield Park market, prices have gone up by 330% since the bottom of the market in 2013. Since the pandemic began in 2020, its prices have increased by 61%. These are some of the highest rates in the city, Smith said, which indicates a flow of demand into the neighborhoods. While prices in this area are still considered relatively affordable, with the median sale price below the city average at $215,000, concerns about affordability for long-term residents still loom.

The Austin/Belmont Cragin market, where the median sale price sits at $275,000, has seen a price increase of more than 150% since 2013. Before the second half of 2023, this submarket was previously the only submarket with single-family home prices lower than its bubble-era peak before the recession.

By contrast, the Lakeview/Lincoln Park submarket saw just a 29% price increase since 2013. Its median sale price is a hefty $1.28 million.

“I would say in the past three or four years, I’ve seen the prices increase in Austin,” said Lorena Ramirez-Carrillo, a designated managing real estate broker and owner of YUB Realty. “We all know that gentrification happens all the time, right?”

She said she believes in a couple of years, Austin is going to be “kind of like Logan Square” in terms of an influx of new residents.

B4 March 13, 2024 GROWING COMMUNITY MEDIA AT HOME ON THE GREATER WEST SIDE

Price change since 2000

Geoff Smith Executive director and principal investigator of the Institute for Housing Studies at DePaul University

400 300 200 100 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 0 LINE, BAR AND PIE CHARTS BY FLOURISH TEAM

Mario Greco

Real estate agent at Berkshire Hathaway’s HomeServices Chicago

Mario Greco

Real estate agent at Berkshire Hathaway’s HomeServices Chicago