Member Benefit Provider

Trusted by accounting industry professionals nationwide, CPACharge is a simple,

solution that allows you to securely accept client credit and eCheck payments from anywhere.

Member Benefit Provider

Trusted by accounting industry professionals nationwide, CPACharge is a simple,

solution that allows you to securely accept client credit and eCheck payments from anywhere.

6 WICPA joins AICPA to voice concerns with BOI rollout

A letter has been sent toTreasury and FinCEN voicing serious concerns regarding the enforcement of the Beneficial Ownership Information reporting requirements.

8 From Challenge to Passion Ryan Hanson, CPA, CGMA, enjoys a challenge — and when he succeeds, it becomes a passion. See how the CPA Exam compares to climbing mountains.

By Marcia Tillett-Zinzow14 The evolution of billing: subscriptionbased models

Does the subscription billing trend in other sectors of business suggest an opportunity for innovation within accounting practices?

By Victoria Thayer, CPA, MSA and Shayla Coombs

18 ChatGPT and the accounting profession

As the adoption of generative AI becomes more prevalent, some question its role in a profession that uses spreadsheets above all else.

By Christina M. Olear, CPA and John Peatross, CPA

24 Did Barbie teach us about maintaining independence?

Buried in the storyline of the box-office hit was the subplot of Ruth Handler, inventor of the Barbie doll and co-founder of Mattel, whose story didn’t end well.

By Kathy Enstrom, MBA, EA28 TECHNOLOGY

The cybersecurity framework gets a facelift

The National Institute of Standards and Technology’s Cybersecurity Framework 2.0 introduces new content and tools.

By Jeffrey Lemmermann, CPA, CISA, CITP, CEH

32 ACCOUNTING & AUDITING

Crypto attestation updates and trends

As the FTX trial got underway last October, one question returned to the conversation: How exactly did this happen?

By Dr. Sean Stein-Smith, CPA, DBA, CMA, CGMA, CFE

34 HUMAN RESOURCES

Financial wellness: a strategic approach to employee retention and productivity

Stress over personal finance issues can significantly impact employee productivity and job satisfaction.

By Manuel Rosado, MBA

38 PROFESSIONAL DEVELOPMENT

The art of listening

Gain an understanding of the importance of good listening skills, and learn some simple yet effective tools to help build them.

By Dave Molenda, TDC, TDFC, TEQC

40 MEMBER BENEFITS

Guide to WICPA committees and boards

& CEO’s

On Balance is published five times a year by the Wisconsin Institute of Certified Public Accountants (WICPA). Change of address should be sent to: Membership, W233N2080 Ridgeview Pkwy, Suite 201, Waukesha, WI 53188; Phone: 262-785-0445 or 800-772-6939; Fax: 262-785-0838; email: comments@wicpa.org. Statements and opinions expressed are those of the authors and not necessarily those of the WICPA. Publication of an advertisement does not constitute an endorsement of the product or service by On Balance or the WICPA. Articles may be reproduced with permission. © Copyright 2024 On Balance

Chair

Ryan J. Hanson, CPA, CGMA

Chair-elect

Stacy A. Stinson, CPA, MBA

Past Chair

Matthew J. Schaefer, CPA, CGMA

Secretary/Treasurer

Lucien A. Beaudry, CPA, JD

Directors

Christopher M. Cholka, CPA, CGMA

Michael Donahue, CPA

Jessica B. Gatzke, CPA, MST

Tori M. Morrow, CPA, CGMA, MBA

Donna R. Scaffidi, CPA

AICPA Council

Ruth A. Kallio-Mielke, CPA

Neil R. Keller, CPA/ABV

• Highly Rated Carrier: AXA XL is rated (A+) by A.M. Best—one of the highest you can earn.

• Stacking Deductible Waivers: Get up to $50,000 of your deductible waived through early resolution, settlement through arbitration/mediation, and/or the use of an engagement letter—that’s real savings!

• Integrated Team: Sales, underwriting, and retention are all under one roof for faster turnarounds to save you time.

“I encourage each of you to step into a volunteer role to share your knowledge, to network and to make contributions to ensure the WICPA continues to be this strong career partner for you and your fellow members.”

As I begin my role as chair of the WICPA board of directors, I reflect on what the WICPA has been for me throughout my career. Earlier in my career, I participated in the Business and Industry Conference Planning Committee, which provided an opportunity to gain speaking experience. As a member of the Public Policy Committee, I gained knowledge of the legislative process, networking and advocacy experience when meeting with Wisconsin and federal legislators. The opportunity to join the board of directors and Finance Committee provided yet another experience in organizational governance. As I reflect, I realize the WICPA has been my “career partner.” By taking the initiative to get involved and contribute my time and resources, the WICPA has offered some of the most valuable opportunities of my career. Without a doubt, this organization has been a constant, reliable and valuable career partner.

The WICPA’s role in the partnership is twofold. In part, the WICPA provides resources and opportunities to individuals to level up professionally. It provides opportunities to further develop skills that typically are not offered in the work environment but are valued in the work environment. Some of these skills come from participating in continuing education, presenting at conferences, writing articles for publications or leading committees — all of which help develop networking skills, among other things.

All these development opportunities are offered by the WICPA. In addition, the organization is a guardian and advocate for the accounting and CPA profession. The WICPA monitors the legislative landscape, works closely with the AICPA and promotes the profession to improve the CPA pipeline.

Like all successful partnerships, the relationship is a twoway street. The value one partner receives is equal to the effort and resources one puts into the partnership. As accounting professionals, we also have roles in this partnership. One of our contributions is our time and knowledge. As a career partner, we must participate in events held by the WICPA, get involved in

continuing education as a participant or a presenter, or join one of the many committees as a member or a leader.

Another important contribution is providing our resources. It is incumbent on us to contribute to the success of the partnership by renewing our memberships, contributing to the WICPA Educational Foundation and CPAC/LIF, and promoting involvement in the WICPA to others. As a participant or leader in conference planning committees, you can shape the content and participate in the success of the events. Contributing to CPAC/LIF supports the WICPA in its efforts to monitor and ensure legislative actions that support the profession. All of these are our responsibilities as partners and members of our professional society — to ensure that our career partnership is successful.

You will get out of this partnership significantly more than you put into it. A great aspect of it is that there is no cap on what you can contribute. The more each of us participates, the stronger and more dynamic the WICPA partnership will become. We, as the membership community, will collectively benefit from each of our individual contributions.

I encourage each of you to step into a volunteer role to share your knowledge, to network and to make contributions to ensure the WICPA continues to be this strong career partner for you and your fellow members.

As I continue my partnership with the WICPA, I am energized and excited to contribute my time and expertise over the coming year as the chair of the board of directors. And I urge all of you to further your role in the successful career partnership you have with the WICPA.

Ryan J. Hanson, CPA, CGMA, is senior vice president and chief financial officer for Pekin Insurance and the WICPA’s 2024-2025 board of directors chair. Contact him at 309-478-2746 or rjhanson@pekininsurance.com.

| PRESIDENT & CEO’s MESSAGE

“I encourage you to invest in yourself, your career and your firm or organization by making the most of

your

membership!”

Information is power. Knowledge is power. Understanding how to get the most out of an investment leads to higher satisfaction. You joined the WICPA to invest in yourself, your career and your profession. How do you get the most out of your membership for yourself and your firm or organization?

Register for a virtual member orientation.

• Ask questions and learn more about the benefits, tools and volunteer opportunities available to you as a WICPA member.

• Take a personal tour of the website to learn how to update your profile, view members-only discounts, use the CPE & Special Event Catalog, access WICPA Connect and more.

Use the MY WICPA personal dashboard to put membership at your fingertips.

• Manage your profile and contact information.

• Update your areas of interest and volunteer opportunities.

• Find member benefits, such as discounts on credit card processing, insurance, check printing and many others.

• Renew your membership and make WICPA Educational Foundation donations in one transaction.

Easily track registrations, upcoming courses, events and meetings in MY CPE.

• See your upcoming WICPA programs, events and meetings.

• Access and download your CPE materials and certificates.

• Use the CPE Tracker to monitor your formal and informal CPE credits for the reporting period.

• Add other formal and informal CPE to the tracker to keep all your records in one place.

Explore various volunteer opportunities.

• Sustain and advance your profession by joining a committee.

• Attend legislative fundraisers and golf outings.

• Write for our publications, On Balance and CPA2b

• Present at a conference or breakfast program.

Give back to strengthen the profession.

• Educate students about CPA careers by presenting at high schools with WICPA materials (and swag) we provide to make it easy for you.

• Host an accounting presentation and tour at your organization for high school students.

• Read a book on financial literacy with students grades K-4 and discuss with WICPA-provided materials.

• Make a charitable donation to the WICPA Educational Foundation to support accounting awareness initiatives and pipeline campaigns.

• Make a contribution to CPAC or LIF to support advocacy to protect the profession and support good business legislation.

Ask questions, give advice and share information in the WICPA Connect online community.

• Read and participate in current discussions — or start a new one.

• Personalize your profile by controlling notifications and adding interests, education, experience, signatures and your photo.

• Use the Member Directory to find and connect to members across the state.

• Connect with specialized groups by joining a committee, such as Wisconsin or Federal Taxation, Business and Industry, Not-for-Profit and many others.

Designate an organization administrator to manage membership and registrations for everyone at your organization.

• Pay membership dues for your organization in one transaction.

• Register multiple individuals for programs.

• Update your organization’s roster and manage employees at multiple office locations.

• Add your organization’s information to Find a CPA. (Reach out to membership@wicpa.org or call 800-772-6939 to become an administrator.)

• Stay up to date with Frequency, our monthly member e-newsletter; our bimonthly magazine, On Balance; and CPA2b, our biannual magazine for students.

• Post your résumé or a job opening in the Career Center. I encourage you to invest in yourself, your career and your firm or organization by making the most of your membership!

Tammy J. Hofstede is president & CEO of the WICPA. Contact her at 262-785-0445, ext. 4518, or tammy@wicpa.org.

If you have not yet renewed your 2024–2025 membership, visit wicpa.org/renew for quick and easy online payment to keep your valuable member benefits coming, including On Balance magazine.

Pay your dues in the “My WICPA” section on the WICPA website. For information regarding your membership, contact Grace Hein at 800-772-6939 ext. 4517 or membership@wicpa.org.

Associated Bank Retirement Plan Services

H NEW Affinity Partner H

Associated Bank provides outstanding retirement plan solutions with a tradition of service excellence. We offer comprehensive retirement plan consulting and investment advisory services as well as our full-service, discretionary trustee platform that bundles plan administration, recordkeeping, custody and ERISA 3(38) investment management.

Bank-A-Count Corp. is a leading national printer of business checks located in central Wisconsin with an unwavering focus on low prices and exceptional customer service. We offer a variety of complementary items, including deposit products, pre-inked stamps, and custom print and mailing services.

H

CTaccess is a technology performance company. We use technology to improve how people work. As a managed services provider, we deliver people-focused, secure and operationally efficient outsourced IT. We also specialize in automating business processes with advanced workflow, artificial intelligence and e-form solutions.

In a letter dated April 3 and addressed to the U.S. Department of the Treasury and the Financial Crimes Enforcement Network (FinCEN), the WICPA and the AICPA voiced serious concerns regarding the enforcement of the Beneficial Ownership Information (BOI) reporting requirements.

The letter raises an alarm because of a March 1 court ruling, which finds that the Corporate Transparency Act is unconstitutional. This ruling only applies to National Small Business Association (NSBA) members as of March 1, meaning those NSBA members currently do not need to file a BOI report, but the filing requirement stands for all other businesses.

Consider

The WICPA Board of Directors provides strategic governance in accordance with the WICPA strategic plan, mission and vision. The board ensures the WICPA serves the diverse needs of members, enhances professional competency, promotes the value of members and the profession, advocates on behalf of the profession and builds community among members. New members began serving after they were elected May 9, 2024, at the Member Recognition Banquet and Annual Business Meeting.

President, CFO & Treasurer, Pekin Insurance Wisconsin Dells

Accounting, Concordia University, Mequon

SECRETARY/TREASURER

Lucien A. Beaudry, CPA, JD, Equity Shareholder, Reinhart Boerner Van Deuren s.c., Milwaukee

yan J. Hanson, CPA, CGMA, chief financial officer (CFO) at Pekin Insurance and the WICPA’s incoming board of directors chair, likes a challenge. It’s what attracted him to the CPA profession, and it also drives his personal interests, such as reaching mountain peaks. One of his mantras is “One’s greatest achievements start with seeking challenges beyond their reach.”

Hanson was born in La Crosse and grew up in Holmen, graduating from Holmen High School in 1995. He then headed to the University of Wisconsin–Eau Claire, where he studied accounting and management information systems and earned his bachelor’s degree along with obtaining an internship with Clifton Gunderson (now CliftonLarsonAllen).

An accounting career was not something Hanson had even thought of when he was in high school until his accounting teacher left the class with a substitute for a few weeks.

“She knelt down for literally 10 seconds and asked me what I was going to do once I was out of high school,” Hanson said. “I told her I didn’t know yet, and she said, ‘Maybe you should consider accounting.’ That’s all she said. Then she got up and walked away.”

Obviously, this casual comment made an impact. It inspired Hanson to enroll in college with hopes of working in business. But it was another educator who sealed the deal for him where accounting was concerned.

Her name is Lucretia Mattson, CPA, and she was the first female chair of the WICPA board back in 1998–1999. She also was an educator at UW–Eau Claire who taught accounting and tax courses for many years. Mattson didn’t pull any punches where her classes were concerned, Hanson noted.

“She was easily one of the hardest teachers there,” he said. “She never made you feel comfortable in the class because she was always pushing for excellence. I took every tax course that she offered, fully knowing that I would never go into tax. I just figured if I could get through her classes, maybe there would be something I could do in this career. I respect her deeply. She was a huge influence on my life.”

So Hanson pushed through and stuck with the profession. Without the inspiration of those two educators, he may have ended up in another profession altogether. But in addition to the inspirational

experience of Mattson’s teaching, the profession also offered him the kind of challenge he enjoyed — especially when it came to the CPA Exam.

“Not everybody has the CPA credential, but it was something I could work toward just to test myself. I had just graduated from college; I got married a month later and then started studying right away. I was working as an auditor at the time and studying, and then in December 2001 I took the exam,” he said.

His first job was auditing insurance companies of various types across the country and analyzing their financial statements. The work gave him the experience and desire to launch a career in the insurance industry. So, upon leaving, he went to work for a publicly traded insurer that he had been auditing. Hanson spent more than 16 years there before moving on to Palomar, a publicly traded specialty insurance company headquartered in La Jolla, California. He was hired there as VP–finance and treasurer and, in part, tasked with building a finance team, structuring transactions, managing collateral, and financial compilation.

“I was living in Wisconsin, but I’d travel out to La Jolla quite often. I was hiring people across the country, so I ended up having a person in every time zone,” Hanson noted.

Peoria, Illinois. In his role as CFO, he leads the accounting, finance, enterprise risk management (ERM), and procurement teams of about 30–35 people, many of them located around Peoria but a number working remotely, as he does when not traveling. His responsibilities include collaborating on corporate strategy and reinsurance, overseeing the company’s investment portfolio, forecasting, and rating agency relationships as well as financial compilations.

Along with his involvement with the WICPA, he has also served on several boards, including the board of directors of the national Insurance Accounting & Systems Association Inc., an organization that specializes in the insurance industry.

As noted earlier, Hanson likes a challenge. He has a passion for the outdoors and mountains that reach elevations of 14,000 feet or higher (“fourteeners”). He has climbed several peaks in Colorado, including Mt. Elbert, which he said is the second highest mountain in the contiguous U.S. (after Mt. Whitney). “It was tough — but a great experience on top,” he said.

Another outdoor pursuit Hanson has gotten into with his son, Evan, is scuba diving. When the family is on vacation in a place where they can do that, Hanson said, they’ll get the tanks and go diving.

“We’ve gone diving in Belize, Hawaii, the Caribbean, Pensacola [Florida] and, yes, even Wisconsin. When I worked for Palomar and was in La Jolla, I would get up early and go scuba diving with the sea lions before work. They’re very interactive — they’ll nibble your fins and play around with you a little bit.”

In addition to these outdoor activities, Hanson and his wife, Amanda — an oncology social worker for Ascension Sherman Cancer Center in Brookfield — enjoy watching 18-year-old Evan competitively race go-karts and, more recently, participate in snowboard racing; he was invited to race nationally this year. They have also been taking their son on pre-college visits, as he will graduate from Brookfield East High School in June. Evan seeks to major in mechanical and agricultural engineering.

Daughter Haydan, 16, definitely has a mind for business, having already been through a couple of small business startups.

“She made charcuterie boards for a few years, cutting the boards, sanding and staining them,” Hanson said. “She does different things to them — she makes some you can write on;

“

At the end of the day, are you a person who wants a seat at the table, in front of the board, making decisions? It’s the accountant, the CPA — that’s the person who’s going to be in that seat.

she’s burned some to make them look a little different. She has an Instagram account and does business as Old School Boards. She is on hiatus from it right now to focus on school, but when she’s doing it, she sells them through friends, family and craft fairs. She’s pretty entrepreneurial for sure.”

Hanson is passionate about the CPA profession and believes if more people knew about all the opportunities the career has to offer, more would go into it. A speaker at a Beta Alpha Psi meeting left an impression on him as a student.

“One thing he said really stuck with me. It was this: ‘A lot of people are going into technology right now because of the Y2K [end of millennium] hysteria. But at the end of the day, are you a person who wants a seat at the table, in front of the board, making decisions? It’s the accountant, the CPA — that’s the person who’s going to be in that seat.’ It really resonated with me,” Hanson said.

The incoming board chair has been a WICPA member for 20 years and is a huge proponent of the organization, having been inspired to join by Lucretia Mattson. His involvement has included serving on the Business & Industry Conference Planning and Public Policy committees, the board of directors Finance Committee, and as a director on the board of directors. He also served on the AICPA Council for a few years, involved there in strategic planning and legislative visits.

“I’m impressed with the quality and professionalism of the WICPA, whether it’s the magazine, other written materials, the conferences or events,” he said. “I give a lot of credit to the WICPA staff and leadership. Things are put together very well, and it’s very impressive from an outside perspective — and now, to have this opportunity to serve as board chair is an honor, and I look forward to it.”

Marcia Tillett-Zinzow is a Wisconsin-based freelance writer and editor. Contact her at mtzinzow@icloud.com.

The WICPA Educational Foundation Board of Directors provides strategic governance in accordance with the Foundation’s mission to play a pivotal role in supporting programs to improve awareness and perceptions by educating Wisconsin students and educators about the exciting opportunities available in the accounting profession. New members begin serving in May 2024.

Partner, Baker Tilly LLP

Wisconsin Women’s Business Initiative Corp.

DIRECTOR

Gina Skibo, CPA, Partner, Wipfli LLP

SECRETARY/TREASURER

Jeff Dewane, CPA, CMA, CGMA, Controller, Vinton Construction Co. Principal,

Port Washington High School

Dwayne Johnson & Associates

Bret Priaulx, CPA, Managing Director, Deloitte & Touche LLP

DIRECTOR

Jidong Zhang, Assistant Professor of Accounting, UW–Eau Claire

Fiduciary

Retirement

Improving

Bank reconciliation

Accounts payable

Organize the nancial records

Auditing nancial statements

Invoicing

Customer receipts

Accounts receivable

Document nancial transactions

Tax preparation

Inventory reports

Budgeting

Data

Make nancial recommendations

In the accounting industry, hourly billing has long been the standard, prized for its simplicity and direct link to compensating for an accountant’s time. This standard, set forth to compensate an accountant for time spent on each client separately, provides both accountants and their clients transparency in hours worked. However, the adoption of monthly subscriptions across a variety of business sectors, from Netflix to Adobe to software as a service (SaaS) platforms, suggests an opportunity for innovation within accounting practices. Why not, then, consider integrating subscription models into the realm of accounting services?

Subscription-based billing sets up a recurring monthly payment schedule instead of billing separately for time spent on individual projects. Essentially, with this billing model, you are selling services as a product. Subscription billing emerges as an innovative solution for CPA firms, promising not just enhanced profitability but also improved client satisfaction. This article explores subscription-based billing within CPA firms, discussing both its advantages and potential challenges, and showcases industry trends alongside practical examples.

The transition to subscription-based billing comes with numerous benefits for CPA firms. Primarily, it ensures a steady revenue stream, anchoring greater financial stability. This model significantly reduces the administrative load of meticulously tracking billable hours, thereby allowing firms to pivot toward value-driven client relationships rather than purely transactional interactions. Subscription billing embodies the principle of value-based pricing, in which clients compensate CPA firms for the impact and outcome of services rather than the sheer amount of time expended. Moreover, it synchronizes the needs of clients with those of the CPA firm, moving away from the possible conflict of interest inherent in hourly billing — which can occur if “billable hours” are knowingly or unknowingly padded to provide a higher charge for services. Without the

“

Subscription billing emerges as an innovative solution for CPA firms, promising not just enhanced profitability but also improved client satisfaction.

transactional work, accountants are able to build stronger relationships with their clients and better understand their financial situations.

The journey from hourly to subscription-based billing comes with its own set of hurdles. The deep-rooted tradition of hourly billing can lead both CPA firms and their clients to exhibit resistance toward this change. For example, some clients are indifferent to building a relationship with their accountant, preferring the transactional feel of hourly billing. Another challenge can be establishing scalable and tiered pricing models, potentially leading to underpricing services.

When working with transitioning intangible services to products, it can be difficult to evade “scope creep,” which occurs when clients request additional services not covered under their selected package. Clearly defining the various service packages can prevent these misunderstandings. Underbilling and overservicing are real challenges of subscription-based billing, and with no way to truly evade them, they are risks you have to be willing to overcome.

Firms considering a shift to subscription-based billing can benefit from adopting the following strategies:

Onboard clients gradually: Start with introducing only new clients to the subscription model. This will give you the opportunity to refine your pricing and service offerings without disrupting existing relationships.

Employ billing software: Utilizing specialized billing software, such as Ignition, can streamline the transition by automating many of the administrative tasks required to manage subscriptions. These software applications can

also deliver proposals; giving your proposal as a deliverable already puts you one step closer to transitioning your services to products.

Consult with current clients: and incorporating client preferences into your transition strategy to ensure the new method aligns with your clients’ needs and expectations. The key to a smooth and efficient transition from hourly to subscription-based billing is communication with your clients.

Develop a flexible pricing structure: pricing tiers that accommodate a diverse range of client needs will help prevent the risk of scope creep. Being able to scale your pricing model is key. For example, Kruze Consulting, a national startup accounting and bookkeeping firm, bases its pricing tiers on services it provides in each package; while Xendoo, which provides outsourced accounting services, bases its pricing on each client’s revenue.

Conduct personalized client discovery: discovery sessions for new clients leads to deeper understanding of their unique requirements, allowing for tailored subscription offerings that maximize value. Getting to know your clients before they sign will ensure they are getting the most from their subscriptions.

Initially a software company, inDinero recognized the evolving needs of its clients two years after launch and expanded its offerings to include accounting and bookkeeping services. Embracing a subscription-based model, inDinero placed a strong emphasis on enhancing the client experience by leveraging technology to streamline services. This strategic shift allowed inDinero to focus more closely on customer needs without the constraints of hourly billing, facilitating a deeper understanding of client businesses and fostering more meaningful relationships. This approach not only optimized their services but also significantly contributed to their growth, with revenues soaring to $14.6 million over 11 years. inDinero’s success story serves as a testament to how subscription billing can drive client-centric growth and ensure sustainability in the competitive accounting industry.

The adoption of subscription models in the tech industry highlights their potential applicability in the CPA sector. Pioneers like Xendoo, inDinero and Kruze Consulting have embraced subscription billing, marking a significant trend toward innovation in billing practices within the accounting field. Such models highlight flexibility and emphasize the industry’s readiness to adapt to evolving business landscapes.

During the 2023 AICPA Leadership Academy, AICPA CEO Barry Melancon, CPA, CGMA, stated that this

1

Christina M. Olear, CPA, and JohnPeatross,

CPA

While often considered a traditional profession, accounting has really always evolved and embraced innovative technologies to remain competitive and enhance efficiencies. One such advancement that has garnered significant attention in the past year is the emergence of generative artificial intelligence (AI), with ChatGPT leading the way. The technology has the potential to transform many industries, including the accounting field.

As adoption of generative AI becomes more prevalent, so too have the questions surrounding its role in a profession that uses spreadsheets above all else. This article takes a step into the world of ChatGPT and generative AI and explains how ChatGPT and programs like it will impact the accounting profession.

ChatGPT vs. generative AI: Is there a difference?

AI tools have been around for decades, so why has there been a lot of hype around ChatGPT (a form of AI) this year? We will first review AI and consider specific AI examples before we dive into ChatGPT.

As described on Investopedia.com, artificial intelligence refers to machines that are programmed to simulate human intelligence and actions. Often, the term is applied to machines that exhibit learning and problem-solving traits.1 AI examples include the virtual assistants Alexa and Siri, chatbots and self-driving cars.

Essentially, AI uses logic and algorithms to identify patterns and efficiently solve problems. Its integration into mainstream consumer products and services (Alexa, Siri), along with advances in machine learning and algorithms, have led to explosive growth in this technology.

Generative AI is a subset of AI that focuses on generating content based on patterns it picks up from existing data. It involves large datasets and training a model through the process of machine learning to generate content that is both contextually relevant and coherent.

ChatGPT is one of many generative AI tools. What makes it different is its ability to generate humanlike text

“ While often considered a traditional profession, accounting has really always evolved and embraced innovative technologies to remain competitive and enhance efficiencies.

responses in a conversational manner. While many other AI applications have the ability to process text inputs, ChatGPT’s design allows it to do so in a way that is accessible to a wider population while maintaining its efficacy. Currently, there are two versions of ChatGPT available: ChatGPT-3.5 and ChatGPT Plus. Access to ChatGPT-3.5 is free when creating an account with OpenAI, the developer of ChatGPT. You will need to pay a monthly subscription for ChatGPT Plus, which includes ChatGPT-4. The latter version opens the door to many more uses and produces better results.

These tools facilitate efficiency and automation, and the possible uses are endless. Some general examples include the following:

• ChatGPT can generate letters and emails with only a sentence or two of input.

• ChatGPT can summarize a 20-page report into one page of main points in seconds.

• ChatGPT can dramatically reduce the time needed to produce PowerPoint slides.

We’ll discuss more accounting-related use cases later in the feature.

The humanlike, text-based platform mentioned above offers users an interaction that feels as if you are communicating with another person. Asking ChatGPT to perform a task is known as “prompting.” As society gets better at asking questions (prompt engineering), the technology will produce better results.

PerformanceAccuracy/Pattern Recognition

Ability to provide precise and relevant responses along with pattern recognition.

Accessibility

No or low cost and no coding skills required.

Mimics Human Interaction

Ability to engage in "human-like" interactions.

Automation

Automates repetitive or routine tasks.

Expansion Capability

Extends functionality, which allows for customization.

While the main focus of this article is ChatGPT, it is important to note that there are numerous generative AI tools available to explore. Google’s Gemini (formerly Bard) and Microsoft’s Bing function similarly to ChatGPT, and there are various other generative AIs that focus on image and audio generation, among other specializations. Specifically for CPAs, AICPA’s CPA.com recently released a suite of tools to help accounting professionals enhance their knowledge of generative AI.2

ChatGPT sure seems to have everyone excited (in both positive and negative ways). This is because of the huge value proposition ChatGPT has going for itself. The program in its latest version significantly increased its accuracy, performance and capabilities while still maintaining accessibility. The table below highlights five ChatGPT features and compares the performance of GPT-3.5 versus GPT-4.

2 www.cpa.com/Gen-AI

Good level of accuracy and pattern recognition, but may sometimes produce irrelevant or incorrect responses.

Highly accessible: free and no coding skills required.

Can mimic human interaction to a certain extent, but may lack in understanding nuanced or complex queries.

Can automate simple tasks; may struggle with more complex tasks.

Lacks strong expansion capabilities.

Significantly improved accuracy and pattern recognition, leading to more precise and relevant responses.

Highly accessible: $20 per month and no coding skills required.

Excels in mimicking human interaction, with a better understanding of nuanced and complex queries, providing a more natural conversational experience.

Enhanced automation capabilities; able to handle more complex tasks efficiently.

Lacks strong expansion capabilities.

ChatGPT is a powerful tool with impressive capabilities. ChatGPT-3.5 is free and is good at many tasks. ChatGPT-4 is $20 per month, and its improved quality is noticeable. ChatGPT-4 produces more accurate results, provides better interaction, and offers a higher degree of customization compared with ChatGPT-3.5. ChatGPT-4 allows the user access to real-time data via plug-ins and beta settings. The plug-ins that are available help you easily create charts and slides, summarize PDFs or websites, and even order groceries or book flights. The numerous plug-ins significantly expand how you can use ChatGPT-4.

The potential benefits that ChatGPT can bring to the accounting profession boggle the mind, so it is critical to understand the relevant risks of this controversial technology. Following are some of the more current and pragmatic risks accountants will encounter with the current iterations of ChatGPT and similar programs.

Misinformation/inaccuracy/quality control: ChatGPT can create fabulously flawed content because it has a remarkable ability to produce information that is incorrect but sounds accurate. The content product is based on the data it was trained on; and, as a machine, it lacks true understanding and context. It’s also not uncommon for the software to misunderstand prompts created by its users.

ChatGPT can impressively “make up” information that is wrong or misleading in the process of creating the coherent response that it has been designed to make. We have witnessed many examples of overgeneralizations and the creation of examples or quotes that make no sense. There have even been cases where it fabricated references and attributed facts to improper or nonexistent sources.

Because most users opt for the free version of the software, some of these drawbacks should be expected. However, a lack of quality control around content inaccuracies has gotten many users into trouble.

Bias and inappropriate content: ChatGPT is trained on enormous sets of data so that it can perform its conversational functions, but there are limitations to this method. For one, the data used for training only goes through September 2021. In addition to the historical time limitation, data has been pulled from a wide range of internet sources, which could lead to unintended biases in the software’s responses to prompts. If a user asks ChatGPT for information that is based on biased training data, they could end up with a biased, harmful or inappropriate response.

Privacy: To further develop the software, ChatGPT collects data about the prompts and conversations that users have within the software. As is the case for every social media platform, it is important to consider the content we want to

“

The potential benefits that ChatGPT can bring to the accounting profession boggle the mind, so it is critical to understand the relevant risks of this controversial technology.

disclose. Since working with ChatGPT feels like you are texting a friend, you could easily be lulled into a false sense of security or safety. Inadvertent inclusion of private or sensitive information about yourself, others or employers is a real risk as prompts are created and your focus is on the tasks ChatGPT is being used to complete.

Some organizations have been communicating to their employees to not put sensitive or proprietary information into ChatGPT for fear they will inadvertently leak information. Many others have remained silent on the issue. Ideally, more organizations would come out with guidelines for their employees on how to use the software in a professional environment to enlist the efficiencies of the tool without adding unnecessary levels of exposure.

Plagiarism: If writing reports that you purport to be your own work product, there is a chance that plagiarism or copyright issues could rear their ugly heads. Because generative AI is trained on massive amounts of accumulated data, there is a chance that the resulting text could be generated exactly the same as the input or too closely paraphrased that a notation would be required. To use

another’s thoughts, observations or conclusions without proper acknowledgement is plagiarism. In addition, data used to build the generative AI often come from sources that are copyrighted and used without permission. If this material surfaces in a recognizable form, it could be a potential copyright violation.3

Responsible use of this technology requires careful consideration of the risks. As the technology continues to evolve, it will be essential for users to understand how they can best leverage the software while mitigating risks.

Accountants are finding numerous practical and innovative use cases for integrating ChatGPT into their daily workflows. AI-driven conversational tools are becoming valuable at streamlining processes, enhancing efficiency and delivering more comprehensive service packages. For all accountants, ChatGPT can be a useful tool for creating content such as articles, reports, emails and internal process documents. The table below offers more specialized uses.

Tax

• Automated Tax Calculations

• Tax Law Interpretation

• Tax Planning Advice

Audit

• Automated Audit Procedures

• Audit Documentation

• Fraud Detection

Coding

• Code Generation

• Code Review

• Automated Testing

Technical Accounting

• Financial Reporting Automation

• Accounting Standards Interpretation

• Technical Research

3 Wes Cowley, “Why I Don’t Use LLMs in My Work,” Words by Wes (May 5, 2023).

“ For all accountants, ChatGPT can be a useful tool for creating content such as articles, reports, emails and internal process documents.

Much like Excel has been, ChatGPT will be a tool professionals use as they perform their work, but it has the power to revolutionize the way accountants perform certain tasks. Historically, new tools allow skilled accountants to spend less time on simple yet time-consuming tasks and more time on higher-level work. Is the current version of ChatGPT going to be as revolutionary for accountants as Excel? That is to be determined. We can certainly say, however, the technology is going to be transformative and has the potential to support accountants in areas that Excel cannot. Following are some of the high-level impacts that we believe ChatGPT will have on accounting professionals.

“

With the massive potential that ChatGPT brings to the table, CPAs need to update their skills to leverage the technology.

Skill sets will adapt to the new technology: A tool is only as good as the person using it. With the massive potential that ChatGPT brings to the table, CPAs need to update their skills to leverage the technology. In fact, a few surveys indicate a majority of business leaders are looking to hire candidates with some ChatGPT skills.4 One such skill is prompt engineering, which is the practice of carefully designing prompts to guide AI models. Better prompts equate to better results. Skilled users can create prompts that provide better content in less time. One day, entry-level employees may regard prompt-engineering to be just as essential as proficiency in Microsoft Excel. On top of the specific skills to use the software, continuous tech learning will be essential. Additionally, improvement in our emotional intelligence skills will be necessary as we become more involved in cross-department collaboration, since we will have more high-level responsibilities and AI will take on more of the task work. An increase in technology skills, along with growth in emotional intelligence, will enable effective collaboration with departments such as IT, operations, risk management, legal, etc.

The tools will evolve with AI: One remarkable thing about ChatGPT is its adaptability to new information and situations. In recent years, accountants have been using a variety of tools to help read documents and process information in an effort to make their lives easier. ChatGPT can identify key information and summarize documents in a matter of minutes. In addition to improving on existing tools, ChatGPT can act as a virtual collaborator, offering real-time assistance and guidance. Accountants will rely on

4 Aaron Mok, “ChatGPT Experience May Be Able to Get You That Job – More than 90% of Potential Employers Are Looking for Workers Who Use the Chatbot,” Insider (April 27, 2023).

AI systems to automate repetitive tasks, flag potential errors and provide instant access to relevant information.

Job responsibilities will change: With the increased capabilities of AI-powered tools and the efficiency they bring, the role of accounting professionals will change. Time that was previously spent crunching numbers or reading through extensive contracts will be used to perform higher-level tasks, such as strategic planning and company innovation. This shift in responsibility could have a cascading effect on all levels of accounting, and someday even entrylevel personnel may find themselves doing today’s managerlevel tasks. While there may be some roles in which AI tools act as more of a replacement, most accountants will adopt ChatGPT as a supplement to their current roles and see their day-to-day responsibilities change as a result.

In closing, this rapidly changing technology has the potential to be transformative for businesses. While some embrace it with excitement, others fear it will have a negative impact on the future of our society. One thing is for sure, we will continue to hear about this technology — whether we like it or not.

Christina M. Olear, CPA, is an accounting professor in media at Pennsylvania State University–Brandywine. Contact her at cmo16@psu.edu. John Peatross, CPA, is a financial advisory services manager at Siegfried Advisory and an adjunct instructor in the Department of Economics at the University of Maryland. Contact him at jpeatross@siegfriedgroup.com.

Reprinted with permission from the Pennsylvania CPA Journal, a publication of the Pennsylvania Institute of Certified Public Accountants.

Christopher Cholka, CPA, has been promoted to controller at Cousins Submarines Inc., which is headquartered in Menomonee Falls.

Sam Dettmann, CPA, was elected by Whitefish Bay voters in the spring election to serve on the village’s board of trustees.

Jennifer Engroff, CPA, has joined Heartland Business Systems in Pewaukee as a senior ERP consultant. She was previously finance director for the city of Mequon.

Andrew Gutierrez, CFO of ProHealth Care Inc., has been named to the Waukesha State Bank’s board of directors.

Jay McKenna, CPA, president and CEO of North Shore Bank, has been appointed by Gov. Tony Evers to the Banking Review Board. He will advise the banking division of the Wisconsin Department of Financial Institutions.

Russ Plewa, CPA, senior vice president of commercial banking at Johnson Financial Group, was named to BizTimes Milwaukee’s list of 2024 Notable Commercial Banking Leaders.

Daniel J. Walsh, CPA, JD, has been selected by “The Best Lawyers in America” (Wisconsin) in the Elder Law category. Walsh is an attorney with One Law Group in Green Bay.

Want your new job, promotion or award mentioned in Kudos? H Email your announcement and photo in JPG format to mtzinzow@icloud.com. H

We are a Wisconsin-based company, focused on one thing: our customers

We take pride in boasting the lowest prices and the very best customer service, and have been doing so since 1956.

Corp.

variety of

manual, and

checks and accessories. Our business checks are guaranteed to be compatible with your accounting software. We also offer a full range of Pre-Inked Stamps, Deposit Products and Accessories.

By Kathy Enstrom, MBA, EA

By Kathy Enstrom, MBA, EA

The Barbie movie was the box office winner of 2023, grossing almost $1.5 billion worldwide. This movie demonstrated some wonderful life lessons for everyone. But (spoiler alert) buried in the storyline was the subplot of Ruth Handler, played by Rhea Perlman. Ruth Handler was the inventor of the Barbie doll, co-founder of Mattel and the company’s first president. Barbie meets Ruth while running away from executives at Mattel, but the audience knows her only as Ruth. Later in

the movie, she reappears, and Barbie says, “You’re Ruth from Mattel.” Perlman (as Handler) states, “Baby, I am Mattel — until the IRS got to me, but that’s another movie.”

What happened to Mattel?

The truth is in February 1978, Mattel’s vice president, its controller, a toy supervisor on the company’s toy division’s accounting team, and Handler were indicted by a federal grand jury on charges of conspiracy, mail fraud, and making false financial statements to the Securities and Exchange Commission (SEC). The indictment alleged that the group falsified internal business records concerning earnings and sales in 1971, 1972 and 1973 so they could influence the market price of Mattel stock. The indictment alleged that

Mattel also created fake documents that showed it was making over $10 million more in sales than it actually was and that Handler and a co-conspirator concealed false financial statements from its external auditors. Handler later pleaded no contest to the charges.

At some point in the conspiracy, the controller and accounting team made the unethical decision to step outside the lines of independence and objectivity by assisting Ruth Handler and her vice president to falsify financial statements. The AICPA Code of Professional Conduct states that “regardless of service or capacity, members should protect the integrity of their work, maintain objectivity and avoid any subordination of their judgment.”

While the government inferred the main purpose of altering the financial statements was to influence the stock market, we do not know exactly what caused the controller and the supervising accountant to participate in the scheme. Were they pressured by others to participate? Did they receive additional compensation for their actions? Or were they just so ingratiated with their superiors that they did it just to please them?

“

Accountants can get into trouble when they bend to the will of their employer or their client. CPAs are entrusted with a profound responsibility in ensuring the integrity of financial information. Central to their profession is the principle of independence, which serves as the bedrock of trust between clients, stakeholders and the broader public.

Independence for CPAs goes beyond a mere buzzword — it is the cornerstone of the profession. It encapsulates the idea that CPAs must remain free from any bias, conflict of interest, or undue influence that could compromise their objectivity and integrity in performing their duties. Whether a CPA is auditing financial statements, providing advisory services or preparing tax returns, independence is nonnegotiable.

Independence is the linchpin of financial transparency. By remaining impartial and free from external pressures, CPAs can objectively assess and report on the financial health and performance of organizations. This transparency is vital for investors, creditors, regulators and other stakeholders who rely on financial information to gauge the viability and sustainability of businesses. Any compromise in independence jeopardizes this transparency, casting doubt on the accuracy of financial disclosures and undermining market efficiency. CPAs must be constantly aware of the following seven threats to independence.

1

An audit firm provides accounting services to a client, including preparing financial statements. Later,

By remaining impartial and free from external pressures, CPAs can objectively assess and report on the financial health and performance of organizations.

the same audit firm is responsible for auditing those financial statements. The self-review threat arises because the audit firm is essentially reviewing its own work.

An auditor actively promotes the client’s interests during an audit. For instance, the auditor may overlook material misstatements or provide favorable interpretations of accounting standards to benefit the client.

Imagine a situation in which an auditor is investigating a company’s financial fraud. The company’s management, aware of the investigation, tries to influence the auditor to downplay the fraud’s severity. The adversarial relationship between the auditor and the client creates an adverse interest threat.

An auditor has been auditing the same company for many years and has developed close personal relationships with key executives. This familiarity can

“

In the ever-evolving landscape of accounting and finance, the importance of independence for CPAs cannot be overstated.

compromise objectivity, as the auditor may be hesitant to challenge management decisions.

5 Undue influence threat

Client management pressures the auditor to issue a favorable opinion on financial statements, even when there are significant issues. The undue influence threat occurs when the auditor succumbs to this pressure and compromises their independence.

6 Financial self-interest threat

An auditor owns shares in the client company or has a financial interest tied to the company’s success. This direct financial relationship creates a threat to independence, as the auditor may prioritize their own financial gain over objectivity.

7 Management participation threat

During an audit, the auditor takes on management responsibilities, such as making operational decisions or signing off on financial transactions. This blurring of roles undermines independence, as the auditor should remain an objective third party.

Independence is nonnegotiable

CPAs must be vigilant in identifying and mitigating potential threats. Implementing robust policies and procedures, maintaining professional skepticism, and adhering to ethical standards are essential steps in safeguarding against conflicts of interest and upholding independence.

The AICPA, as well as regulatory bodies such as the SEC and the Public Company Accounting Oversight Board imposes stringent requirements on CPAs to maintain independence, particularly in the context of auditing public companies. These

standards are designed to enhance the reliability and accuracy of financial reporting, protect investors and promote confidence in the capital markets. Noncompliance with independence regulations can lead to severe penalties, legal repercussions and reputational damage for both the CPA firm and its practitioners.

This article began with a story of Mattel executives who conspired to falsify financial records in the 1970s. Unfortunately, in October 2022 Mattel was in the news again for misstatements on its 2017 third- and fourth-quarter financial statements. Mattel agreed to pay $3.5 million to settle charges relating to the misstatements. At the same time, the SEC moved forward on litigation against a former external audit partner to determine whether they engaged in improper professional conduct and violated auditor independence rules.

In the ever-evolving landscape of accounting and finance, the importance of independence for CPAs cannot be overstated. It is the bedrock of trust, the cornerstone of ethical practice, and the foundation upon which the profession stands. By upholding independence, CPAs reaffirm their commitment to integrity, transparency and professionalism, thereby safeguarding the interests of clients, stakeholders and the public at large. In a world where financial information is paramount, independence remains nonnegotiable for CPAs striving to uphold the highest standards of excellence and trustworthiness.

Kathy Enstrom, MBA, EA, is director of investigations at Moore Tax Law Group, a boutique tax controversy law firm based in Chicago and New York. She has 27 years of federal law enforcement experience in tax and financial investigations. Contact her at 312-549-9990 or Kathy.Enstrom@mooretaxlawgroup.com.

Jeff Dewane

Jessica Gatzke

Heather Acker

Brian Anderson

Christine Anderson

Nicholas Ansley

Inga Arendt

Joseph Balus

Paul Barstad

Kelly Baumbach

Donald Bernards

Todd Bernhardt

Douglas Berry

Paul Bishop

Ann Blakely

Jeffrey Blattner

Brian Bohman

Marcie BombergMontoya

Marci Boyarski

Joshua Boyle

Cindy Bratel

Damon Busse

Gregory Butler

Daniel Buttke

Todd Carpenter

Stephanie Cavadeas

Lonny Charles

Kevin Cherney

Crystal Christenson

Brad Collard

Craig Cookle

Robert Cottingham

Lisa Cribben

Christine Dahlhauser

Jeffrey Danen

Brad DeNoyer

Chad Derenne

Jeff DeYoung

Emily Di Nardo

Andrew Dilling

Jodi Dobson

David DuVarney

Jeffrey Dvorachek

Karl Eck

Wayne Ehlert

Daniel Ehr

Thomas Eling

Brigid Elliott-Boger

Tania Erdmann

Robert Fabich

Valerie Fedie

Linda Feirn

Christine Fenske

Kayla Flint

Paul Frantz

Sandra Friess

Sara Funk

Robert Ganschow

Joshua Ganshert

Lynn Gardinier

Brian Gaumont

Matthew Gelb

Stephanie Gensler

Alyssa Geracie

Daniel Glomski

Carla Gogin

Kendra Goodman

Garrett Gosh

Brenda Graat

Nicole Gralapp

Kurt Gresens

Todd Hagedorn

Ryan Hanson

Monica Hauser

Sheanne Hediger

Kim Heller

John Hemming

Nathan Henrigillis

Michael Herman

Nicholas Hinz

Craig Hirt

Traci Hollister

John Honadel

Terry Hoover

Kirsten Houghton

Tina Huisman

Wade Huseth

Bruce Hutler

James Hyland

Chase Inda

Tyler Inda

Kevin Janke

Andrea Jansen

Tammy Jelinek

David Johnson

Robert Kane

Eric Kegler

Neil Keller

Terrence Kerscher

Anne Kirschling

Amanda Klein

Trenton Kleist

Brian Knoll

Andrew Koelbl

Holly Kohl

Kenneth Kortas

Keith Koszarek

Jeffrey Kowieski

John Krause

Casey Kretz

Thomas Krieg

Eric Kroll

Tony Kromanaker

Mark Kruncos

Ryan Lay

Abraham Leis

Brittany Leonard

Brian Lightfield

Bonnie Lilley

Robert Long

Allan Mader

Anita Mahamed

Randy Mahoney

Kyle Mair

Ryan Maniscalco

Zachary Mayer

Tami McCann

Andrew McCarty

Nancy Mehlberg

Joshua Meinen

Theresa Meiners

Deanna Merryfield

Randall Miller

Jeffrey Munger

Luis Murgas

Scott Nelson

Matthew Nitka

Chad O’Brien

Daniel O’Connor

Anthony Ollmann

Paul Ouweneel

Jason Page

Krista Pankop

Jacob Peters

Ashley Pharo

Maureen Pistone

Holly Pokrandt

Brett Polglaze

Andrew Potasek

Steven Pullara

Michael Pynch

Brian Rozek

Kelly Runge

John Runte

David Rupp

Bethany Ryers

John Salza

Donna Scaffidi

Kevin Schalk

Vincent Schamber

Craig Schessler

Thomas Schiesl

Christopher Schmidt

Corina Schoenke

Scott Schumacher

Jessica Schwantes

Kevin Scully

Thomas Sheahan

Gina Skibo

James Smolinski

Gregory Sofra

Mark Stevens

Daniel Szidon

Christopher Tait

Denes Tobie

Emily Tomlinson

Jay Totzke

Paul Traczek

Corey Tremaine

Eric Trost

Wendi Unger

Thomas Unke

Christopher Van Straten

Matthew Vanderloo

Nathanael Voss

Brent Wagner

Brian Walczak

Dan Walker

Colin Walsh

Robert Watson

Peter Wautlet

Michael Webber

Brooke Weitzer

Cory Wendt

Glen Weyenberg

Dustin Wiesner

Erin Witucki

Tom Wojcinski

William Wong

Aaron Worthman

Erika Young

Laura Zach

OTHER CONTRIBUTORS

Anthony Balistreri

Dana Brunstrom

David Fohr

Alan Giuffre

Wayne Huberty

Matthew Macdonald

Lucretia Mattson

Jean Mosher

Thomas Polacek

Daren Powers

James Rose

Kathleen Ruzicka

Katy Sommer

Richard Spencer

Roberta Ward

David Weber

Henry Wertheimer

PACESETTER LEVEL ORGANIZATIONS

Alliance Advisors, LLC

Baker Tilly

Hawkins Ash CPAs, LLP

Scribner, Cohen and Company, S.C. Vinton Construction Company

Wipfli LLP

OTHER ORGANIZATIONS WITH EMPLOYEE CONTRIBUTIONS

BDO USA LLP

Bert’s 1040 LLC

Dana E. Brunstrom, CPA LLC

Daren J. Powers, CPA Forvis

Hintz Giuffre CPAs, S.C. K&M Tax Service

Kempen & Company LLC

Pekin Insurance

RitzHolman CPAs

Sikich LLP

SVA Certified Public Accountants, S.C. Vrakas CPAs + Advisors

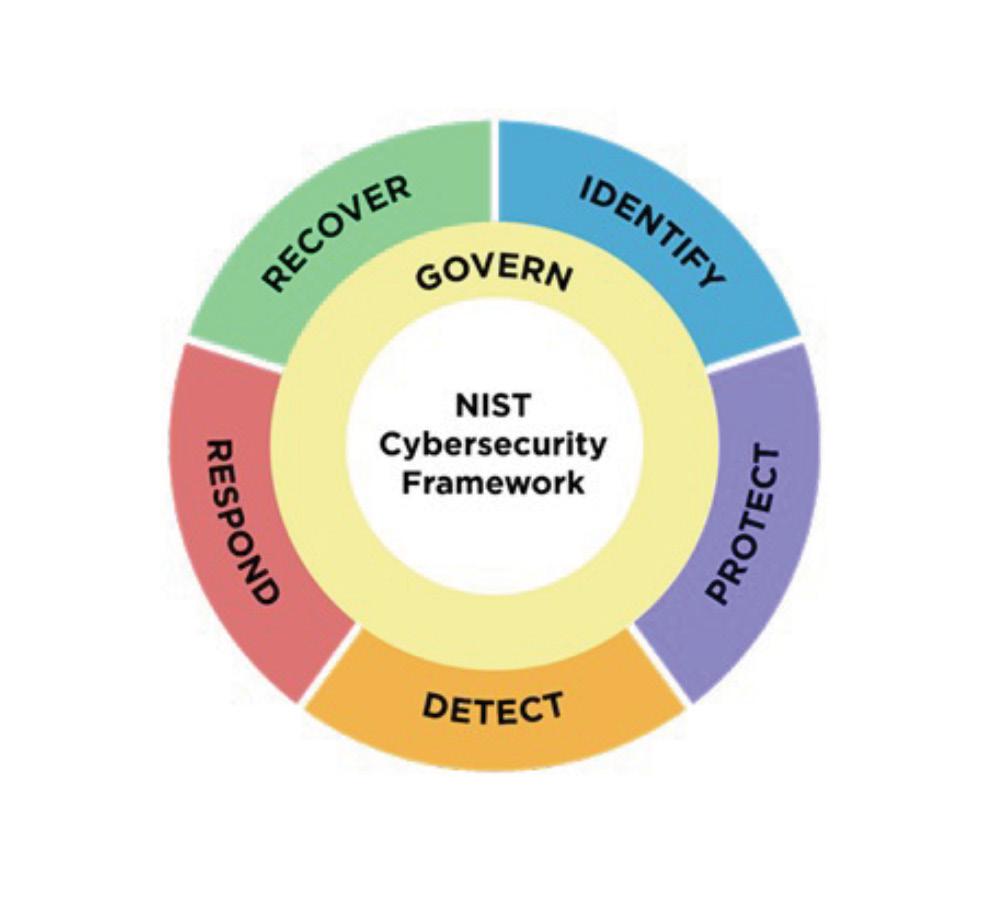

NIST CSF 2.0 brings new content to broaden its audience and new tools to help ease implementation.

By Jeffrey Lemmermann, CPA, CISA, CITP, CEH

By Jeffrey Lemmermann, CPA, CISA, CITP, CEH

In 2013, the National Institute of Standards and Technology (NIST) began development on a program to help private-sector businesses better understand, manage and reduce cybersecurity risk. That effort, geared for organizations that were part of the United States’ critical infrastructure, resulted in the NIST Cybersecurity Framework (CSF). In February of this year, version 2.0 of that framework was released.

The NIST CSF wasn’t the first framework targeting information systems, not even within the NIST itself. NIST SP 800-53 has been around far longer, and it’s designed to help organizations establish security controls for federal information systems. But for small and medium-sized organizations, 800-53 can be intimidating because of its complexity and sheer size. This is where the CSF fits in. The main focus of the CSF now is to help businesses of any size, any sector and any level of complexity manage and reduce risk.

Here is how version 2.0 has been changed to help put the CSF into practice — for all organizations:

The sixth function: Govern

There were five functions prior to the update, representing the key pillars that make up a complete cybersecurity program. All functions relate to each other, and each function has specific categories and subcategories that describe the specific controls or actions to implement.

The sixth function, Govern, addresses the need to establish and maintain processes that support the overall information security program’s development and enforce its requirements. Notice in the charts how NIST depicts this function as a ring inside the other five. This portrays how all other functions rely on governance for their continued support and development:

Govern (GV) looks at how an organization assesses cybersecurity risk, assigns roles, provides oversight and develops cybersecurity related policy. It is divided into the following six categories, each of which has a variety of subcategories:

1. Organizational Context (GV.OC): Five subcategories addressing risk management

“ All functions relate to each other, and each function has specific categories and subcategories that describe the specific controls or actions to implement.

2. Risk Management Strategy (GV.RM): Seven subcategories measuring how risk is measured and applied to decisions made by the organization

3. Roles, Responsibilities, and Authorities (GV.RR): Four subcategories addressing what positions are implementing and enforcing various controls

4. Policy (GV.PO): Two subcategories about how policy is established, communicated and enforced

5. Oversight (GV.OV): Three subcategories addressing how the risk management strategy is updated and adjusted

6. Cybersecurity Supply Chain Risk Management (GV.SC): Ten subcategories on risk management in the cybersecurity supply chain

Controls are identified under their functions and categories. For example, the subcategory “Cybersecurity is included in human resources practices” is the fourth item under Roles, Responsibilities and Authorities. It would have the designation GV.RR-04. In total, there are 31 new controls to consider as part of the Govern function.

tools

Reference tool

One very useful tool that doesn’t look like much at first glance is the NIST CSF 2.0 Reference Tool, located online at https://csrc.nist.gov/Projects/cybersecurity-framework/ Filters#/csf/filters.

In prior versions, NIST provided a spreadsheet version of the entire framework. With this new tool, you can modify the framework before exporting a spreadsheet version. For example, if you want to cross-reference the controls with the Center for Internet Security’s guidance or just want CSF items that apply to a specific NIST family, both can be accomplished with this tool.

“

One of the most useful for organizations that have not yet adopted a framework (or are just beginning the process) is the Small Business Quick-Start Guide.

Whether you are an auditor looking for an audit program or an implementor of the framework controls, this tool puts the framework at your fingertips.

There are a number of guides that can help organizations adopt or improve their adoption of the framework. One of

the most useful for organizations that have not yet adopted a framework (or are just beginning the process) is the Small Business Quick-Start Guide. This guide helps organizations move from having unorganized policies and procedures to developing cybersecurity efforts that will support the formal adoption of the NIST CSF 2.0. This guide can assist organizations of any size as an onramp to the NIST CSF. It can be accessed directly at https://doi.org/10.6028/NIST.SP.1300.

Community profiles and implementation examples

If you are looking for examples of how other organizations are utilizing the CSF, NIST provides two great resources:

Community profiles: These profiles detail how the CSF is utilized by multiple organizations in a community. The NIST National Cybersecurity Center of Excellence has worked with communities to develop community profiles for a variety of use cases. The goal is to help organizations understand how their peers are leveraging the framework. These profiles are available for versions 1.0, 1.1 and 2.0 of the CSF and can be viewed at https://www.nccoe.nist.gov/ examples-community-profiles.

“

Developing your own organizational profile will help define the current state and the ultimate target state of your cybersecurity posture. In a profile, you can define, tailor, assess, prioritize and communicate outcomes by considering an organization’s mission objectives, stakeholder expectations, threat landscape and requirements. This will allow you to prioritize actions and better utilize resources. Guidance for developing this profile is available at https://doi.org/10.6028/NIST.SP.1301.

Implementation examples: If you are looking for more detail than the profiles offer, these examples can give more of a step-by-step look at how other organizations have implemented the CSF. Many organizations with different needs, different sizes and different goals use the framework. These examples can help organizations find a similar use case, and they provide the early adoption steps that can help overcome the initial hurdle in adopting a framework.

This update to the CSF represents a major milestone in NIST’s support of the framework. After its initial publication in 2014, the CSF was updated in 2018 to version 1.1; version 2.0 makes the framework much more adoptable to

Ultimately, the CSF framework should be viewed as a flexible resource that can help organizations enhance their overall cybersecurity maturity.

organizations of many sizes and technical complexity. More importantly, it signals the importance of the framework to NIST and indicates that the tools developed to assist in implementing the CSF will continue to improve.

Ultimately, the CSF framework should be viewed as a flexible resource that can help organizations enhance their overall cybersecurity maturity. Version 2.0 adds depth and, more importantly, tools that can help organizations in their mission to better protect their information assets.

Jeffrey T. Lemmermann, CPA, CISA, CITP, CEH, is an information assurance auditor and consultant at SynerComm Inc. in Brookfield. Contact him at 262-373-7100 or jeffrey.lemmermann@synercomm.com.

As the FTX trial got underway in October 2023, with all of the headlines and stories that it pushed to the front page, one question also returned to the conversation: How exactly did this happen? And because FTX had audit engagements with two firms — Armanino and Prager Metis — as well as employed two of the Big 4 to perform various accounting and tax services, the question becomes even more pointed. The fallout for both audit firms has been severe, with Armanino having exited the blockchain audit business altogether and Prager Metis currently being sued by the Securities and Exchange Commission (SEC) due to

involvement with the FTX audit. In addition, the Office of the Chief Accountant at the SEC issued what has been construed by some practitioners as a warning against offering audit and attest services to crypto firms.

Coupled with the decline in market prices for cryptoassets at large, including recent opinions that 95% of the non-fungible token market is worthless, the outlook for crypto attestation might seem bleak. On the other hand, there are multiple stories and trends that offer a more optimistic outlook, both for the space at large and for more consistent and applicable auditing standards. Several of the largest financial institutions in the world, including Blackrock, JP Morgan and Citi, have all recently filed for certain crypto products to be approved, expanded existing blockchain and tokenization offerings, or launched tokenized payment options for clients. In addition to these developments, there has been beneficial news on the accounting front as well with the Financial Accounting

Standards Board preparing to pass the first crypto-specific accounting codification by the end of 2023.

With all of that in the marketplace, there are two specific things that practitioners seeking to provide audit and attestation services to clients in the crypto space, now or in the future, need to keep in mind as the conversation continues to progress.

As noted above, there are multiple large financial institutions investing heavily in developing and launching blockchain and cryptoassets, so this clearly means that the market expectation will be for more transparent and real-time accounting data. This is not to mention the developments at PayPal, namely the creation and issuance of a stablecoin (PYUSD on the stock exchange) that is available to more than 400 million customers worldwide. A stablecoin issued and backed by a payment processor that has household name recognition is almost guaranteed to increase the ubiquity of stablecoin transactions in the marketplace.

Additionally, stablecoin transaction volume exceeded that of Mastercard and PayPal in 2022, which also is a clear sign that crypto transactions are here to stay. Lastly, with the Gen Z cohort expressing substantial interest in receiving at least a portion of salary in crypto, the volume of crypto transactions (even if Bitcoin remains relatively subdued) looks set to continuously increase over the coming years.

With this increase in transactions, the need and expectation for real-time and accurate attestation will also grow; practitioners are well situated to take advantage of these trends.

Although the distinction between audits and attestation engagements are important to keep in mind, internal controls and the control environment are crucial to all work related to establishing the accuracy of accounting data. As cryptoasset transactions continue to increase in both volume and number of potential users, here are a few things that practitioners should keep in mind:

4 Wallet management: Hot wallets and cold wallets might seem like rudimentary areas to focus on for experienced users, but with new users, these are topics worth revisiting both in terms of client education as well as cybersecurity considerations.

4 Multi-signature access: One control that can help prevent misappropriation of assets is a multi-sig wallet, requiring multiple individuals within a firm to mutually authorize large crypto payments.

“ There are multiple large financial institutions investing heavily in developing and launching blockchain and cryptoassets, so this clearly means that the market expectation will be for more transparent and real-time accounting data.

4 Exchange to payment mapping: One common pain point in the crypto accounting space is the mapping of exchange balances and transactions into existing accounting ERP systems. This is often where errors, mislabeling and the potential for theft are highest.

Practitioners would be well advised to keep all of these factors in mind when either educating themselves about crypto attestation or seeking to engage with clients on these issues.

Dr. Sean Stein-Smith, CPA, DBA, CMA, CGMA, CFE, is a professor at the City University of New York – Lehman College. Contact him at sean.steinsmith@lehman.cuny.edu.

Reprinted from the Winter 2023–24 issue of New Jersey CPA magazine and used with permission.

As a retirement plan specialist, I have seen firsthand the impact of financial stress on employees. The anxiety and worry stemming from personal finance issues can significantly lower productivity and even cause workers to delay retirement. This issue creates a dual challenge: Not only can it negatively impact employees’ quality of life, but it also imposes higher costs on companies for salaries, health insurance premiums, and attracting top talent.

Nearly eight out of 10 (78%) employees say it’s important for their employers to offer financial wellness resources, and an overwhelming 82% believe that access to these resources helps reduce their financial stress. Furthermore, 78% would be more likely to stay with an employer who offers financial wellness programs, and 70% say access to financial wellness resources increases their productivity at work.

Given these statistics, it’s clear that providing financial wellness resources is not just an add-on employee benefit — it’s a strategic necessity for any organization looking to retain talent and boost productivity.

Financial stress can have far-reaching implications for both employees and employers. But with the right resources and support, it’s a challenge that can be effectively managed. To establish a comprehensive financial wellness program for employees, consider the following steps:

Define objectives: Identify the program’s goals, taking both organizational needs and employee preferences into consideration. This may involve addressing specific financial challenges, such as retirement planning for baby boomers, student loan relief for millennials and Gen Xers, or enhancing overall financial literacy. Conduct anonymous surveys to gather employee input and ensure their needs guide program development.

Understand demographics: Analyze workforce demographics to tailor the program effectively. Whether your employees consist predominantly of baby boomers or millennials will influence the selection of financial topics and strategies.

“

It’s clear that providing financial wellness resources is not just an add-on employee benefit — it’s a strategic necessity for any organization looking to retain talent and boost productivity.

Choose a provider: Engage a reputable vendor to deliver the program. Selecting an impartial vendor ensures employees receive unbiased financial education while maintaining confidentiality. Conduct thorough research to identify a vendor that aligns with your fiduciary responsibilities and organizational goals.

Develop a communication strategy: Implement a robust communication plan to promote the program. Inform employees about the initiative well in advance, emphasizing its benefits and purpose. Handle communication sensitively, acknowledging that financial matters can be delicate for many individuals.

1 John Hancock. “Financial Stress Survey.” 2023.

Additionally, monitor shifts in attitudes toward money and potential improvements in productivity, recognizing that these changes may take longer to manifest.

By following these steps, you can establish a comprehensive financial wellness program that addresses the diverse needs of your workforce and promotes overall financial well-being.

When comparing programs, it is important to look for a partner that can offer four key elements:

Fiduciary advice: Seek partners that offer impartial advice on financial matters. Whether it’s retirement planning or investment strategies, choose services that prioritize your employees’ best interests.

Personalized attention: Financial wellness is not a one-size-fits-all concept. Look for support services that can be personalized to suit individual needs and circumstances. Customized advice and ongoing support can make a significant difference when empowering employees to make their own informed financial decisions.

One-on-one experience: Emphasize the importance of personal interaction in any support program. Ensuring employees have access to one-on-one guidance fosters trust and engagement. This personalized approach can greatly enhance participation and overall program effectiveness.

“ Investing in your employees’ financial wellness is an investment in the health and success of your organization.

Comprehensive resources: Access to a diverse range of financial education and resources is key. From budgeting to estate planning, providing employees with a broad spectrum of tools and information empowers them to navigate various financial challenges confidently.

Investing in your employees’ financial wellness is an investment in the health and success of your organization. By prioritizing the principles outlined here, employers can effectively support their employees in managing financial stress and building a more secure financial future.