12 minute read

VIEWPOINT

The Business Pilot Barometer offers a monthly analysis of the key trends defining window and door retail. It draws on real industry data collated by Business Pilot, the cloud-based business management tool.To find out more see www.businesspilot.co.uk/barometer

The Business For example, in December 2021, sales were down by 40%, going forward to record a 47% bounce in January 2022. Pilot Barometer

Tougher times may, however, be ahead.

Leads were down 4% year-on-year, and 29% on December 2020. Sales last December were down 17% on the same time in 2021 and 32% on December 2020. The market has been creeping back towards ‘normal levels of demand’, for the last 12-months or more.

Seasonal adjustment?

By Neil Cooper-Smith, Senior Analyst, Business Pilot

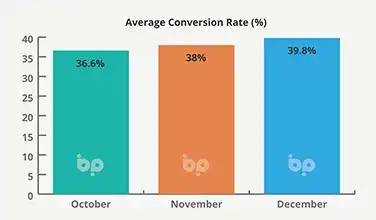

Despite massive political and economic upheaval, December was what December normally is – a slow month for window and door sales. Leads were down 40% on November and sales were down 43%. The flip side of that is that at £6,142, average order value was up 15%.

And while a month-on-month drop of 40% in leads and 43% in sales sounds – and is – significant, the fall is consistent with a ‘normal’ seasonal adjustment. We should still expect to see figures climb back in January this year after the Christmas-lull. The squeeze on household incomes and inflationary pressure, however, means that it is likely that this will be at a more modest level than in either 2021 or 2020.

The forecasts for the housing market and the wider UK economy are downbeat. The UK is widely predicted to already be in recession and the Bank of England is expected to increase the base rate further this year in the face of stubbornly high inflation.

Against this backdrop house prices are expected to suffer their biggest decline since the financial crisis with a drop of around 4%.

Even the double-digit falls predicted by the most pessimistic commentators would not wipe out the pandemic-driven increase of around 20% in house prices, since 2019.

Homeowners who purchased their properties before COVID and Stamp Duty holidays will retain equity, so will in this respect, still have cash to spend; but higher mortgage interest payments – predicted to rise on average by £3,000 this year – will lessen affordability.

Inflation will also continue to limit household discretionary spend.

If you don’t already, this may make it a prudent time to add finance to your offer. Homeowners are facing a squeeze on income but higher average order values suggest that they recognise the contribution windows and doors can make in lowering their heating costs and bills.

The other silver lining in amongst an otherwise gloomy outlook for the UK economy as a whole, is that unemployment remains at historically lowlevels, and while it may rise, it is forecast to do so more modestly than during past downturns.

The knowledge that their income stream is for most, protected, should give homeowners increased confidence to borrow to fund investments.

The bigger challenge may be company cash flow and bad debt. As always, those fabricators and installers that have continued to invest – and those who have close control on cash – will be better placed to ride out tougher times this year.

Business Pilot gives installers access to critical management information which supports them in maximising conversions, controlling costs and managing cash flow, through effective forecasting and planning.

This includes drag-and-drop scheduling, which allows you to plan and reschedule jobs to support your cashflow with a mouse-click.

Notifications, changes to diaries, all the things that you have to change with a job-move, are taken care of automatically behind the scenes, making your business more agile and more robust.

www.businesspilot.co.uk The decisions you make today will determine where your business goes in the next 12-months, so if you’re still running your business on unlinked spreadsheets and gut feeling, it’s time to get in touch.

‘2025 Document L – A Step Too Far?’

By Phil Slinger – CAB Chief Executive

To support members through the changes that took place to Approved Document L (AD L) of the Building Regulations in 2022, CAB produced a Guidance Note which details the changes in thermal insulation across the devolved Parliaments of the UK, this document has now been made available to nonmembers via the CAB website. Whilst our members and the wider industry have now got to grips with the 2022 changes to Approved Document L, we need to turn our focus on the next change to AD L where the Government is asking for an even greater leap in thermal efficiency which is planned to be introduced in 2025.

The Government is keen to ensure we begin to build carbon neutral homes from 2025, but new homes built now and in the future will only equate to a total of 20% of our building stock by the governments 2050 target. This means that refurbishment of existing building stock will be crucial to getting more of our buildings carbon neutral by 2050. But, when replacing just windows and doors, does it make sense to install high performance windows and doors into a structure which does not meet the same standards? Importantly, does the reveal for the installation offer good insulation as cold bridging at this junction with the structure can have a significant negative effect on a new products thermal performance? Whilst we applaud the speed of the move to ensure new buildings are constructed to good, overall carbon neutral standard, does it make sense to ‘piecemeal’ the refurbishment of our existing building stock? LETI emphasises that poor interfaces with the structure will compromise any potential thermal improvement if the building is not treated as a whole. Would it not be better to ensure that any replacement products, such as windows and doors, have a positive building thermal improvement overall, which in turn will reduce energy consumption? Should we be tackling the thermal improvement of window and door reveals as part of the ‘home improvement’ installation as this will certainly be needed when the building fabric is further insulated to meet carbon neutrality which may mean that the ‘new windows’ fitted into the existing structure will need to be removed, or even changed again?

Several CAB members already have cited examples of building refurbishment using thermally improved window systems, not necessarily of the highest performance, but when linked with structural thermal insulation taking a whole building approach, shows that payback of the improvements can be realised in a few years in energy savings. Could this be an alternative route to achieving carbon neutrality by 2050?

improving our existing building stock, ECO+, the scheme does not include grants to upgrading of old windows? Whilst a twenty year old boiler should be replaced for improved efficiency, so too must double glazing which is twenty years old. Again, should we not be looking at taking a whole building approach to thermal improvements in our building stock? Legislation recently announced in Scotland is that the Scottish Government is to push through legislation to ensure that all new homes built in two years time are built to a Passivhaus standard, or a Scottish thermal efficiency equivalent. LETI states that building to a Passivhaus standard increases costs for new build by only 5% to 10% over current regulation construction, which should prove affordable as energy savings will cover the increased costs.

Looking even further into the future, should we be satisfied with just building to carbon neutrality? There is much talk on social media at the moment that we should be aiming higher for our new build, where buildings should be ‘carbon positive’, that is to say to create an environment benefit and intentionally remove carbon dioxide from the atmosphere, which will help to reach the overall carbon neutrality for all our building stock.

Maximise Your Showroom Opportunities

Hardware that helps sell your doors and windows!

Premium look board designs, showcasing your style.

Enquire about adding a Coastal Display Board to your showroom today

Unlike some other materials, aluminium profiles are easily produced, as dies to extrude aluminium are relatively cheap and simple to design. Thermal break technology has also improved greatly in the last few years and high performance windows are already available to meet the most stringent thermal insulation requirements. A simple review of the UK’s Passivhaus Trust website shows that of the thirteen Passivhaus certified window systems available in the UK, five are aluminium systems, four are PVC systems, and four are timber based systems. As far as sustainability is concerned, aluminium can perform in use at least as twice as long as other fenestration materials, hence its preferred use in commercial projects and its growing use in residential new build and home improvement projects.

CAB Members are rising to the challenge of being ready for the thermal changes that will be implemented in 2025, but the debate continues. Why not join the debate by becoming members of CAB? the Association will act on what the membership decides, join and be heard. CAB membership is open to any business that is part of the aluminium fenestration and envelope supply chain. Based at the picturesque Bonds’ Mill development in Stonehouse, CAB staff are always on hand during normal working hours to answer any membership, training or technical aluminium fenestration related questions. www.c-a-b.org.uk

CLASSIC CONTEMPORARY ANTIQUE

y A range of sizes and designs y Bespoke options available y Spring cassettes on handles for realistic performance

Passivhaus

Principles Key To Commercial Business Pipeline, Says Supplier

As the ongoing energy crisis further underlines the need for energy-efficient structure design, fenestration professionals are being implored to highlight the importance of Passivhaus principles to futureproof new and existing building stock. at systems company Rehau, the Passivhaus performance criteria can provide installers and fabricators with a key tool for securing new business in the drive to more sustainable properties. Specifically, Steve Tonkiss, head of sales – South at the polymer supplier, is highlighting how educating commercial project stakeholders on Passivhaus principles and their impact on window design, can help fenestration professionals stand out in competitive markets.

“Passivhaus has long been regarded as a hard-to-reach goal in building design, but its focus on thermal efficiency has never been more topical,” explains Steve. “Consequently, the fabricator and installer have a major role to play in ensuring architects and specifiers stakeholders consider the principles when selecting frames for new and retrofit commercial projects, and the major impact window selection can have. This is

especially important considering recent updates to the Future Homes Standard and ongoing speculation that thermal performance requirements will soon begin to mirror this strict certification – something that is already being discussed in Scotland.

“Indeed, we have often found that while many across the supply chain for these projects are aware of the Passivhaus concept, it is only in more general terms. Being able to provide a technical steer on this fascinating topic will be key to a paradigm shift in building design, especially when it comes to window specification. It is for this reason that we have published a new guide to provide greater clarity on the topic, which can assist fenestration professionals in demonstrating how implementing the technical points rising from Passivhaus can improve property efficiency and sustainability”

Rehau’s new guide, In The Frame: Passivhaus Windows looks at key factors differentiating Passivhaus windows from traditional designs, including airtightness, insulation, ventilation and thermal bridging, and how these negate the need for additional air recirculation. Key to the guide is the message that frames do not need to be certified by the Passivhaus Institute – the organisation enforcing these higher standards – to work successfully in either new and retrofit builds.

“This guide has been developed to demonstrate that Passivhaus is not a binary concept, in which a structure achieves the certification or not,” concludes Steve. “Architects and specifiers, guided by fenestration experts, should instead see it as a set of influential design principles that can help foster greener building stock and greater thermal efficiency, which will only become a greater priority during window selection as we move closer to net zero.

“It is for this reason that we have detailed the specifications, requirements and key steps around Passivhaus, so installers and fabricators can further educate specifiers when choosing frames. By doing so, fenestration professionals will be able to strengthen relationships and business pipelines with new and existing customers, especially when further uplifts in building performance in line with the Future Homes Standard and any additional legislation comes into force.”

For more information on Passivhaus and its impact on window design, click here.

Reflections On 2022 And The Year Ahead

Bonnie Hodson, chief financial officer (CFO) at UAP, reflects on the trends that have shaped 2022 and what lies ahead.

In a year that has been dominated by economic and political upheaval, there have been inevitable challenges for all businesses. For manufacturers, supply chain disruption has also continued as have fluctuating material costs, creating further bumps in the road. But against this backdrop, there are also positive trends which are driving growth in our sector and creating new opportunities.

Smarter strategies

We operate in a fast-paced market, where customers’ needs and expectations are constantly changing. This is accelerating new product development with a focus on door hardware that improves security, durability, ease of use and installation. One of the biggest drivers of new innovation has been the shift towards smart technology. The pandemic, which caused people of all ages to more actively use online devices, has meant that smart technology is no longer a nice to have.

This trend has seen more electronic door locks come to market in 2022, including the Ionic, which is the first in a series of smart products to be launched under UAP’s Fullex-ai brand. Although the product launched at the end of 2022, it follows five years of extensive research, planning and testing.

This saw us investigate customers’ priorities and the factors needed to provide the best