Turn the Page COMPREHENSIVE LOW COST E&O INSURANCE Working RE 6353 El Cajon Blvd, Suite 124-605 San Diego, CA 92115-2600

Summer 2024, Volume 25 Working RE Now Reaching Over 30,000 Inspectors in Print and Online—Get the latest news at workingre.com NAR Settlement: Where Do Inspectors Go From Here? Why Customer Reviews Matter Stories From the Trenches: Interview With Attorney Geoff Binney

Home Inspector

Inspectors are more likely to face a claim than any other trade or real estate professional. You Need a Team with Experience In Your Corner

Specializing in Home Inspector insurance for over 22 years, OREP Members enjoy pre-claims defense from trial attorney Geoff Binney who delivers decisive response letters and shuts down frivolous claims.

Home

CALIF. LIC. #0K99465 OREP.org/inspectors (888) 347-5273 GET A QUOTE IN 4 MINUTES Includes E&O and General Liability

years OREP

Home Inspector

Summer 2024, Vol. 25

Mission

From the Editor

4

Readers Respond

NAR Settlement: Where Do Inspectors Go From Here? by Isaac Peck, Publisher

Why Customer Reviews Matter by Kendra Budd, Editor

Stories From the Trenches: Interview With Attorney Geoff Binney by Isaac Peck, Publisher

Essential Car Supplies for Home Inspectors by Kristine Gerber, Inspector Toolbelt

Is It Time to Be Your Own Boss? by Kendra Budd, Editor

The Backstory to Agent Disclosures: The Lawsuit That Started It All by Isaac Peck, Publisher

Should Home Inspectors Write ‘Monitor’ in Their Reports? by Greg Nelms, Nelms Inspections

30

32

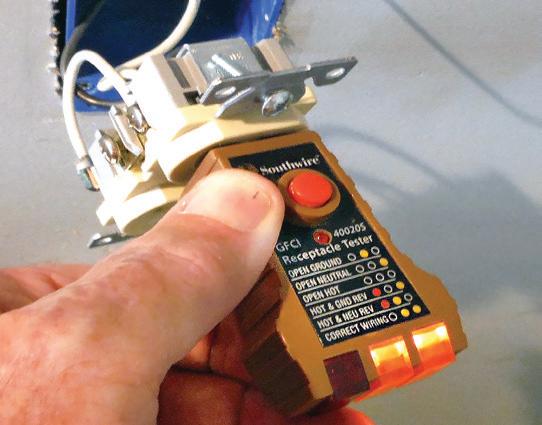

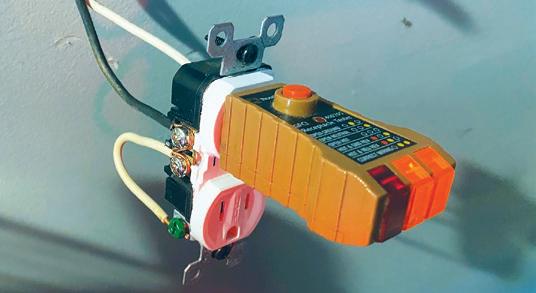

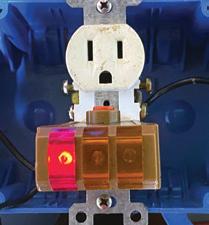

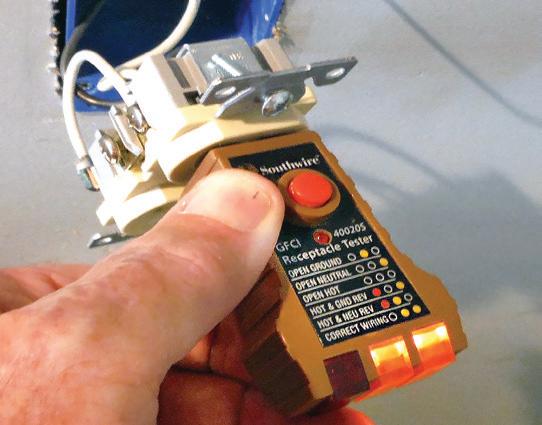

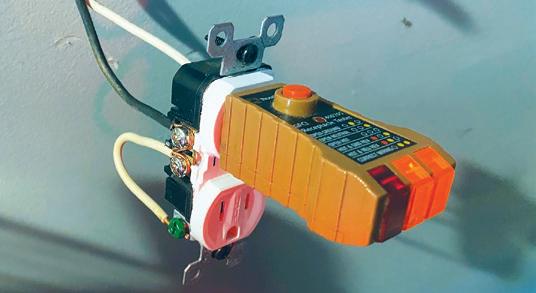

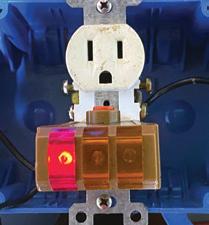

The Inconvenient Truth About Three-Light Receptacle Testers by Mike Twitty

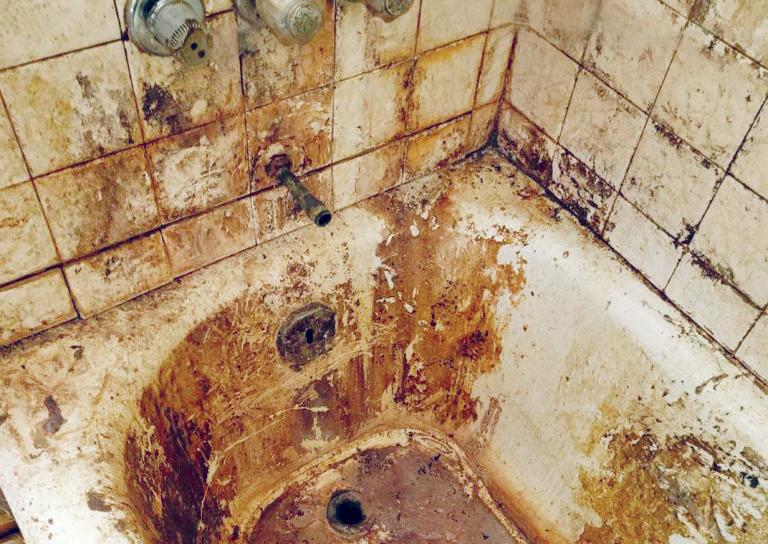

Animals, Skeletons and Creepy Home Inspection Stuff by Reuben Saltzman, StrutureTech

Professional Marketplace

40 26 Advertise! Now Reaching 30,000+ Inspectors Nationwide!

Working RE Home Inspector magazine is published tri-annually to help home inspectors build their businesses, reduce their liability and risk, and stay informed on important technology and industry issues.

Published by OREP

Working RE Home Inspector is published by OREP Insurance Services, LLC, a leading provider of home inspector insurance nationwide. OREP has a low cost, broad coverage E&O and General Liability policy that includes coverage for radon, infrared, termite, pest/rodent, lead paint, mold, drone, and more. Visit OREP.org/inspectors for more information or to get a quote in only four minutes!

OREP Insurance Services, LLC. Calif. Lic. #0K99465

Publisher Isaac Peck: isaac@orep.org

Senior Editor

Tony Jones: tony@orep.org

Editor

Kendra Budd: kendra@orep.org

Marketing & Design Manager

Ariane Herwig: ariane@orep.org

Working RE 6353 El Cajon Blvd Suite 124-605 San Diego, CA 92115 (888) 347–5273 www.workingre.com

Working RE Home Inspector is published tri-annually and mailed to home inspectors nationwide. The ads and specific mentions of any proprietary products contained within are a service to readers and do not imply endorsement by Working RE. No claims, representations or guarantees are made or implied by their publication. The contents of this publication may not be reproduced either whole or in part without written consent.

2 2 Working RE Inspector Summer 2024

Working RE

12

4

24

16 36 6 22

From the Editor

by Tony Jones, Senior Editor

Greetings! I’m the new guy. I’ve been on the job for less than a week, and I can already tell I’ve got a lot to learn from you folks. My name is Tony, and I’m excited to join our talented editorial team as senior editor. As a way of introduction, I thought it would be helpful to step in front of the curtain and give you a brief overview of how my professional experience and content philosophies align with the guiding mission of Working RE Home Inspector

As a career trade journalist and editor, I’ve spent nearly three decades learning, absorbing and covering a wide range of industries with the overarching goal to help small business operators succeed. That is best achieved by producing quality content that’s informative, educational and insightful.

Within that context, we strive to understand and alleviate your business pain points on myriad fronts. In this Summer 2024 issue, for example, Editor Kendra Budd underscores Why Customer Reviews Matter (pg. 12) and also sits down with a veteran home inspector to wrestle with the existential question of whether it’s best to join a home inspection company or go it alone (See Is It Time to Be Your Own Boss?, pg. 24).

Another component is to stay on top of and report on important trends, particularly if they help improve efficiencies, increase revenue and—critically—protect your business. For insight to what’s happening with respect to legal claims against home inspectors, be sure to check out our in-depth Q&A with attorney Geoff Binney on pg. 16.

These principles all fall under the big-picture umbrella of what’s occurring in the larger market. It’s our job to convey how ripples at the highest levels may affect you and impact your business. The collective nuances and driving market factors comprise the special sauce that makes the home inspector space distinct and worthy of dedicated, insightful coverage.

As such, Publisher Isaac Peck breaks down the landmark National Association of Realtors (NAR) class-action settlement for this issue’s cover story. At a time when home inspectors are dealing with a prolonged slow market that’s likely to persist through 2024, they’ll also be touched by the ramifications of this case. For a deep dive into the settlement, its fallout and how it’ll likely affect home inspectors, turn to pg. 6.

My goal is to be a worthy steward in upholding the high standards that have already been set for the magazine, while adding value to our coverage. Your input is crucial. If you have story ideas, big-picture thoughts about the home inspector market and profession, or otherwise just wish to reach out and connect, please don’t hesitate to email me at tony@orep.org. WRE

The Rise of Multi-Million Dollar Inspection Firms

Similar to Ian Robertson, I don’t know where to start in reaction to your article on the future of home inspections, especially regarding large firms. I talked to one guy who worked for such a firm and said he didn’t even get minimum wage and was given a time limit for each job. He didn’t seem to know much about homes either and was required to pay for his company-sponsored training.

Another fellow told me I could get $75 per inspection in which one inspector did the outside and another did the inside: did they share their information? I just had an inspection today where the crawlspace was damp. The interior, main level, and flooring had half-inch gaps at the end of each board. Without the exterior knowledge, someone would have just replaced the flooring and gotten the same gaps down the road. I’m not sure where the clients and Realtors fit into these inspections.

Launch Pad will be recommending contractors too? Isn’t that against the code? Conflict of interest? Here in Virginia, even the appraisers are chosen randomly to avoid collusion with Realtors.

There is nothing so personal as the home you choose to live in. One-person inspectors have years of experience and can provide a personal touch to a thorough inspection customized to each house. True, not all Realtors want a thorough inspector, but those who do are mainly interested in their clients, not any particular sale, and are also faithful to the best of us. —Paul Cummins

Clothes Dryer Vents: The Proper and the Improper

From my experience, when builders place the laundry area near the home’s center, they run the dryer vent straight outwards below the floor structure to the exterior which in most cases, allows the vent length to still be as short as possible. —Matthew Steger

44 Working RE Inspector Summer 2024

Home Inspector Get the latest home inspection news and information twice a month. Working RE OPT in Readers Respond www.workingre.com

NAR Settlement: Where Do Inspectors Go From Here?

by Isaac Peck, Publisher

The news about the National Association of Realtors’ (NAR) settlement has spread like wildfire. Everyone’s talking about it—even President Joe Biden—who (erroneously) stated that consumers could, for the first time, negotiate lower real estate broker commission rates as a result.

Many real estate experts say the settlement will fundamentally shift the way homes are sold in the United States.

The class-action lawsuit, Burnett et al. v. National Association of Realtors et al., was filed in 2019 against NAR and nearly two dozen of the largest real estate brokerages, including RE/Max, Keller Williams, Compass and almost every “big name” brokerage you can think of.

In October 2023, a jury in the Western District Court of Missouri issued a $1.8 billion verdict against NAR and the brokerages, finding that they had conspired to artificially inflate real estate agent commissions and misrepresent the way buyers’ agents were compensated.

As a matter of law, damages from an antitrust verdict are tripled, putting NAR and the brokerages on the hook for more than $5 billion in damages—a sum that likely would have bankrupted NAR and many of the brokerages. (NAR openly contemplated Chapter 11 bankruptcy after the verdict.)

However, some of the largest players in the case quickly began settling with the plaintiffs for lesser amounts. For example, RE/Max announced a $55 million settlement within 30 days of the verdict, Keller Williams settled for $70 million in February, and NAR announced a $418 million settlement in March. All settlements still need court approval to be finalized.

While this landmark legal case has far-reaching implications for real estate agents and brokers, one question largely unaddressed by the hundreds of journalists covering this issue is how the fallout will affect home inspectors.

Here are the details of the settlement and what it means for home inspectors.

Isaac Peck is the Publisher of Working RE magazine and the Senior Broker and President of OREP.org, a leading provider of E&O insurance for savvy professionals in 49 states and DC. Over 13,000 professionals trust OREP for their E&O. Isaac received his master’s degree in accounting at San Diego State University. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

Settlement Fallout

In addition to agreeing to pay the princely sum of $418 million (over four years), NAR has made a series of commitments to drastically change how it and its members operate.

The NAR agreement is more than 100 pages and full of procedural changes and concessions, but some of the most notable updates to NAR’s business model include:

• NAR will no longer require listing agents to offer compensation to buyers’ brokers, and listing brokers will now be prohibited from offering buyer broker compensation through multiple listing services (MLSs).

• NAR’s buyer brokers must now enter into an agreement with a buyer before providing any services and specify the amount or rate the buyer broker will be compensated as well as how it’ll be calculated. This amount cannot be open-ended (Example: “buyer broker compensation will be whatever amount the seller will offer to the buyer”).

• NAR buyer brokers are prohibited from receiving compensation from any source that exceeds the amount specified in the buyer broker agreement.

• NAR members are prohibited from screening or filtering listings presented to their buyer clients based on the compensation offered by the seller or seller’s agent. (Unless the buyer specifically requests this screening.)

• NAR has agreed to make other changes to ensure that sellers and buyers always receive full, complete disclosures about broker compensation.

NAR’s settlement doesn’t include a release of liability for brokerages who averaged more than $2 billion in annual transaction volume, which means the other large brokerages that haven’t yet settled with the plaintiffs are still on the hook for their own damages. It also doesn’t include potential liability relief for MLSs that aren’t wholly owned by NAR.

What Changes for Brokers?

To understand how home inspectors will be affected, it’s necessary to first analyze what exactly is changing for real

66 Working RE Inspector Summer 2024

estate brokers. There’s a strong sentiment among real estate professionals as well as the general public that the NAR settlement is going to reshape the real estate market. However, there appears to be little agreement on what exactly is going to change and when.

Pundits point to the fact that RE/Max, one of the largest broker franchises with more than 140,000 real estate agents, settled its case for $55 million over seven months ago. RE/Max agreed to the same process changes as NAR, but little has changed with respect to how its agents operate in the market—at least so far.

The most impactful change might be that listing brokers are now prohibited from making an offer of compensation to the buyer’s broker via the MLS. This is significant because many brokers routinely filter the houses they present to their buyer clients based on the commission being offered. Without any compensation being offered via the MLS, buyer brokers will no longer have certainty around what compensation they’ll receive from guiding their buyers to particular homes. Instead, they’ll need to call or communicate with the listing broker to determine what commission, if any, is being offered.

This, combined with the fact that buyers’ brokers (at least those who are members of NAR) will be required to enter into a written compensation agreement with the buyer that specifies the

amount or rate they’ll be compensated and how it’ll be calculated, creates a problem for buyers as well as their brokers.

With the increased uncertainty about whether the seller or listing agent will be paying the buyer’s broker, buyers’ agents will want their Buyer Representation Agreement to include a clause stipulating that the buyer will pay their commission if necessary. The prospect of paying their own broker’s commission may be enough to scare many buyers away, especially if they’re short on cash.

Consider that the median U.S. home price is more than $420,000, and a 3 percent commission on such a house would be $12,600. Many buyers simply won’t be able to afford this. In certain low-income communities, brokers argue that most buyers struggle to come up with a 1 or 2 percent down payment, which makes the prospect of paying their own broker over $10,000 at closing a non-starter.

Of course, the most significant aspect of this situation isn’t codified in any settlement. After all, if listing brokers can continue to convince sellers to pay a 5 or 6 percent commission in their listing agreements, the entire real estate market will continue to hum along as it has been. But the fact is these very public lawsuits against NAR and the largest brokerages have sparked a

Why Choose the Affordable Inspection Software Option?

7 Working RE Inspector Summer 2024 page 8 8

nationwide conversation about broker commissions, and some percentage of sellers are likely to begin balking at the concept of including an extra 2 or 3 percent for the buyer’s broker.

Just like everything else in real estate, the impact of these changes will vary by location. In some smaller localities, where all real estate brokers “hold the line” and take only listings in which sellers agree to include an offer of compensation to buyers’ brokers, very little will change in the market.

However, in larger, dynamic markets where some sellers balk at the 5 or 6 percent commission that listing agents typically request (and then split with the buyer’s broker), uncertainty in the marketplace will increase substantially. Some sellers will include compensation for the buyer’s broker, while some will not. Buyers who don’t want to pay their broker’s commission themselves will know that if they do sign a buyer’s broker agreement, they might be unable to purchase their dream home because they can’t come up with the extra $10,000 to $20,000 in cash to pay their own broker.

Will the buyer be able to increase their offer price on condition that the seller or listing agent pay a commission to the buyer’s broker? Potentially.

Here are five scenarios looking at how the market might change for real estate brokers and consumers:

• More Dual-Agency Transactions: With buyers concerned about being on the hook to pay their broker themselves, more may turn to the listing agent directly. Buyers could be less likely to sign a buyer broker agreement that locks up their options for three to six months (or longer) and instead choose to attend open houses, speak with different listing agents and potentially work directly with the listing agent to write the offer.

It’s important to note that dual-agency transactions are currently illegal in eight states because many believe agents can’t represent the best interests of both sides of a transaction at the same time. These states include Alaska, Colorado, Florida, Kansas, Maryland, Texas, Vermont and Wyoming. However, even in these states, many brokers try to skirt the rules by having one sales agent represent the seller and another broker from the same office represent the buyer.

• Alternative Buyer Services: There has been considerable discussion about the prospect of buyers using real estate attorneys to prepare their purchase documentation. In such a scenario, a buyer may go “unrepresented” in the traditional sense and simply hire an attorney to prepare a purchase agreement, help answer questions about disclosures, and so on.

• Rise of Tech Solutions: Large technology firms in the real estate space are actively working to “fill the gap” that might be created among buyers who want to purchase a

property without engaging a buyer’s broker. These solutions will likely include forms that enable buyers to write their own purchase agreements and repair requests as well as educate on the purchase process, etc.

• Flat-Fee and À La Carte Models: Tech firms, lawyers, paralegals and real estate brokers will likely begin offering more flat-fee or à la carte services to buyers. Leigh Brown, the 2023 president of the North Carolina Association of Realtors, suggested in a recent video posted to her YouTube channel that real estate brokers might consider charging by the hour just like attorneys!

Some new business models will likely allow buyers to pick and choose services à la carte. Imagine a world in which a showing costs $150, preparing a purchase agreement costs $600, a repair request costs $400, and so on. Tech firms, lawyers and certain brokerages may seek to serve this category and make up for the lower pricing with higher volume.

• Offer and Loan Workarounds: There has been lively discussion about how buyers might secure compensation for their broker by adjusting how they write their purchase offers. For example, when dealing with a seller who doesn’t offer any compensation to the buyer’s broker, the buyer could increase the purchase price offered by $10,000 to $20,000 (or not) and then include a demand for a seller concession or a demand that the listing agent pay the buyer’s broker as a contingency of the offer.

This would allow the buyer to work their broker’s compensation into the loan and pay it off over time. These potential solutions are still being explored and face a number of challenges. For instance, how will a real estate appraiser evaluate such concessions? Rolling the buyer broker’s commission into the loan would work only if the appraisal comes in at the (potentially inflated) purchase contract price. For example, if a home is listed at $420,000 and the buyer offers $430,000 to include a $10,000 concession for their broker, they’d still need to come up with the $10,000 difference in cash to close if the home appraises for only $420,000.

What Changes for Inspectors?

The degree that home inspectors’ business models are affected depends largely on how sellers and buyers respond to this new reality. Significant changes in the real estate market aren’t likely to happen overnight and will vary by location.

Harmony Brown, Chief Executive Officer of GreenWorks Inspections & Engineering, one of the largest home inspection firms in the United States, reminds inspectors that change always brings opportunity. “iBuyers are going to gain some traction. Low cost, low commission tech companies are going to take some market share, and some buyers might start using attorneys to write up their offers. Our industry’s innovators are going to become part of that shift. Anytime there’s a shift in any industry, there’s opportunity. Buyers are going to need

88 Working RE Inspector Summer 2024 7page 7

home inspectors more than ever. This is an opportunity for home inspectors to speak up, build their brands, and be more boldly known as the authority on the home,” says Brown.

Ian Robertson, owner of three home inspection companies, co-founder of Inspector Toolbelt Home Inspection software and host of Inspector Toolbelt Talk, has had numerous guests on his podcast to discuss this topic. Robertson is quick to acknowledge that he doesn’t have a crystal ball, but from what he’s seen in his own market, real estate brokers are expecting the worst.

“There are going to be a lot fewer real estate agents once all of this settles down,” notes Robertson. “We are already seeing agents get out of the business even though not much has changed yet. A friend of mine who owns a large brokerage is retiring. He told me he’s too old for this kind of change in the market. His team alone does a few hundred transactions a year minimum. If they were referring all that business to a few home inspection firms, that’s a lot of work lost for those home inspectors.”

The result will be a disruption in the market. While many brokers and agents will get out of the business (which isn’t terribly unusual), that volume will switch to other brokers, and/or some buyers will go it alone or through dual-agency.

Given the challenges that buyers face and how dual-agency, flatfee models and technology stand to alter the buyer experience, Robertson believes it’s fair to draw a simple conclusion: Some percentage of buyers/consumers will stop relying on a home inspector referral from their broker and choose to hire the home inspector themselves.

This would result in an increase in a home inspector’s directto-consumer business. “Whether we see an increase of 5 or 30 percent of consumers deciding to select their own home inspector, it’s reasonable to expect some type of increase in consumers researching, evaluating and hiring their own home inspectors,” Robertson says. “This is a shift away from the inspector’s traditional agent referral marketing model. We don’t quite know how big of a shift it will be, but it will be something. Even if it’s only 5 or 10 percent, that’s still substantial in most markets.”

Opportunity for Inspectors

The opportunity for home inspectors then is to adjust their marketing to capture this shift. “With less agents in general, there will be less agents to market to. A certain percentage of buyers are going to be working directly with the listing agent (dual-agency), or they might have a different relationship with their buyer agent, or they might be using flat-fee or à la carte services,” opines Robertson. “Some of the agents that are getting page 10 8

9 Working RE Inspector Summer 2024

7page 9

out of the business are the ones that wanted things to be easy and pressured their clients to use cheap, low-quality inspections, whereas buyers working without an agent may have an even stronger desire for a high-quality home inspection—to have someone look out for their interests.”

Robertson says his own firm started preparing for a more direct-to-consumer marketing approach last year. “When we started talking about the NAR case last year, we knew there was a chance something big would happen. We already had a strong online presence, but we started ramping up our direct-to-consumer marketing. Marketing to real estate brokers can happen quickly. If you build a relationship today, in a very short period of time that broker might start referring a lot of business to you.

Direct-to-consumer doesn’t happen quickly. Building a social media presence, search engine optimization (SEO), building up your Google reviews—that can take six months, a year or longer. If you’re starting today, you’re already behind a lot of your competition. If you started a year ago when we first mentioned it on the Inspector Toolbelt podcast, then you’re probably ahead of the majority.”

Most home inspection firms have built their businesses around agent referrals. Robertson points out that many home inspectors run successful single-man operations doing 400-plus inspections with very little or no online presence. “I got a call a few weeks ago from a solo-operator inspector who has been doing 500 inspections a year and has a great group of agents that refer him. He doesn’t have much of a website and has very little in terms of marketing. The reason he was calling me is because some of his agent-referral partners had left the industry and his work had started to decline,” reports Robertson.

Leading

“I have been an OREP customer for over five years, and these guys are fantastic. They have always gone ‘above and beyond’ with their service and are quick to respond to any concerns or needs I may have.”

Danny B

“I switched my E&O insurance to OREP last month and saved $349 bucks.”

—Dave

As the market shifts, home inspectors will have to learn new skill sets. “If the market shifts towards a more direct-to-consumer model, then branding becomes much more important. SEO, Google Reviews, Google Ads and Google Local Services Ads will play a bigger role. Home inspectors who are not spending time or money on their online presence are just going to fall to the wayside. Building an amazing website, having a strong brand in your community, having strong conversion rates, great scripts for your team when they answer the phone, and a great social media presence—is all going to matter more,” advises Robertson.

The importance of social media is also going to increase. “A home inspector’s social media presence is going to matter a lot,” notes Robertson. “If you’re a 25-year-old buyer and you need to find a home inspector, are you going to randomly hire one, or are you going to go with the guy you’ve been following on TikTok? The people we follow on social media or tv—that’s called a parasocial relationship. For example, we don’t know the person we see on TV personally, but we like them. They give us a warm-fuzzy feeling. They don’t know us, but we feel like we know them. Home inspectors who are running podcasts, posting videos to social media and building their personal brand are going to be the ones that people hire because people trust them.”

Just how much the buyer broker model will erode over the next five or 10 years is difficult to predict, but Robertson suggests that building relationships and a marketing framework around other parties in the transaction should prove fruitful. “Many people touch homebuyers at different parts of the transaction— mortgage loan officers, insurance agents, attorneys and more,” he says. “As home inspectors, we can make sure they have our business cards. We can take them out to lunch and work to make them part of our marketing campaign.”

WRE

“Competitive pricing and superior coverage. Although I do not envision needing OREP’s claim support services, I sleep well knowing OREP has my home inspection company well-covered.” —Kevin

10 10 Working RE Inspector Summer 2024

Provider of

E&O AND GENERAL LIABILITY INSURANCE or

(888) 347-5273 Get a quote in 4 minutes at OREP.org/inspectors Calif. Lic. #0K99465

Home Inspector

Call

Why Customer Reviews Matter

by Kendra Budd, Editor

The reviews are in—and they matter immensely! Believe it or not, clients look at the reviews that are posted about your business and they may greatly affect the future of your work.

Great reviews can propel your business into financial prosperity, while bad reviews can plummet its success altogether. (Especially with the rise in power of social media!) Instead of just letting negative reviews sit though, you can use them to better your business practices. In fact, criticism can help a business look at the parts in which your business could improve.

The truth is, both good and bad, reviews are good for business when you know how to use them to your advantage.

Why Reviews Matter

So how do reviews actually affect the standing of your business? Well, the truth of the matter is that clients read them and are inclined to trust them. In fact, clients actively research reviews. According to the Harvard Business Review, 98 percent of customers look at reviews before making a purchase.

Customers trust reviews to the point that it can affect your revenue. “[In] 2021, online reviews were predicted to affect $3.8 trillion revenues worldwide,” the Harvard Business Review found. This isn’t just simply because people get bad reviews per se, but it can also be affected by a lack of reviews. This means that if you don’t have online review site listings or a minimal amount, then you will not be getting a client’s business. If you can’t be found online, then you won’t be found at all.

When you look up a service on a search engine, odds are you are going to be recommended businesses with a plethora of positive reviews at the top of your search, while businesses with few reviews (positive or negative) will fall toward the bottom. Customers will be more likely to pick a business that comes up on the first page of a search, especially if it has an abundance of positive reviews. So, if your business doesn’t have reviews, then odds are clients aren’t even seeing it come up in a search.

Don’t Ignore Reviews

So, with this information, why do business owners choose to

Kendra Budd is the Editor of Working RE Magazine and Marketing Coordinator for OREP Insurance. She graduated with a BA in Theatre and English from Western Washington University, and with an MFA in Creative Writing from Full Sail University. She is currently based in Seattle, WA.

ignore or not utilize reviews more? Well, some feel like they don’t matter or that they are too busy to take the time to look at them. So, oftentimes, business owners will just reply to reviews with a generic response or not reply at all. This is turning future clients away!

When you ignore a review, you are telling clients you don’t care about them, that you’re not interested in improving your services, and worst of all that you are not listening to them. You are showing that you only care about making money, and not client interaction. Markets are saturated and you never want to fool yourself into believing that your services are good enough to stand on their own. Treating your clients as a means to make money is a surefire way to shoot yourself in the foot with even more negative reviews.

It is also imperative that you respond to reviews quickly and efficiently. If you’re not able to set aside time to respond to reviews daily, then you at the very least need to be doing it weekly. The longer you leave a review, especially a negative one, unchecked, then you’re inviting more time for other clients to see that review. This can even frustrate the customer to the point of them leaving more negative reviews due to your lack of response. Sometimes, your clients just need to know that they’ve been heard.

How to Respond to Reviews

As mentioned before, you never want to respond to reviews with a generic message. You want to take the time to analyze every single review and respond accordingly. People will start to notice if you’re using the same script in your responses, and it will turn them off to your business. However, if you’re responding differently every time while still holding respect, then clients will be more drawn to your business because they’ll know their concerns will be heard. This isn’t to say you can’t have automated responses in certain circumstances of course, but more on that later.

So, once you have taken your hour to sit down and respond to reviews, you’ll want to remember these tips:

12 12 Working RE Inspector Summer 2024

1. Tame Your Ego

It can be easy to just want to defend yourself and your business when receiving a negative—but don’t. Even if the review isn’t justified, your response is what clients will remember when considering your business in the future. Remember, at the end of the day that this person doesn’t actually know you or your work ethic, and it’s best not to take things personally. Always read reviews from a business standpoint.

2. Analyze

Take the time to really read the review. What is the client actually trying to say? In fact, it’s best to read the review twice. Sometimes what could come off as a negative review, could actually be a positive one—sometimes that second glance at it will clear up any confusion. Ask yourself what the best approach will be with this particular client, and if the review is justified or fixable.

3. Be Personable

Clients love it when you remember them and your interaction together. Always greet them by name when responding, and thank them for the feedback. Restate their review in new words so they can feel as if you’re really hearing them— especially if it’s negative. Let them know that you take their feedback seriously and that you understand them and are actually glad if they raised an issue.

4. Answer Questions

This is the only time you should use an automated response to reviews. Sometimes, clients or prospective customers will use your review tool to ask questions about your business. If you notice you keep getting the same questions, then having a pre-written response is a great way to get that “review” out of the way by answering the question efficiently and properly.

5. Stick to the Point

Finally, when you’re responding to a review, it is best to keep the message short and simple. Including too many details can be overwhelming to the client and make you seem desperate. This can be true when responding to both negative and positive reviews. You don’t want to ask follow-up questions in your response, either. If you need additional information about a review, offer the client an opportunity to call your office to discuss the matter further and in more detail.

6. Learn from the Negative

Remember, negative reviews can actually uncover insights that can help you improve your business. Ask yourself how you can improve future interactions with clients. It’s important to act when receiving consistent feedback about where improvements can be made, rather than just brushing them

page 14 8

13 Working RE Inspector Summer 2024

under the rug. Always let the reviewer know that you appreciate the feedback so that you may improve.

The more you take the time to respond to reviews, the less scary they become. Plus, you’ll come off as more professional and personable to future clients. It will show your clients that you do care about their feedback and take it to heart. You’ll soon learn that you need reviews to thrive as a business—both the positive and negative ones.

How to Get More Reviews

Despite reviews being a great way for you to build your reputation, many business owners find themselves too afraid to ask for them. Too many fear negative reviews, but the truth is that you are more likely to get a positive review if you ask for a review at all. People who leave negative reviews are going to leave them no matter what, but oftentimes, people who had a positive experience will only leave one if they are prompted to.

There is an art to review-solicitation that can bring a more positive light. First, you want to ensure you’re asking for reviews at the right time. The best time to send the email is around one hour after the service is complete. This gives time for the client to think more on their experience. Asking any later could give too much time for the positive experience or memories to wear off.

Next, you want to ensure you’re getting the wording right before sending the email. Don’t say something along the lines, “If you’re satisfied, please leave us a review online.” This wording

may make the client feel like they can only give positive feedback, making them feel like their opinion doesn’t truly matter to you. Instead, say something along the lines of, “You’ll receive an email shortly asking about your experience today. We’d really appreciate it if you took a couple of minutes to let us know how we did!” This invites the client directly and doesn’t pressure them to give feedback that they think you are expecting.

Keep everything simple. The more steps it takes to leave a review, the less likely customers will do it. Offer direct links in the email to where they can review your business. If they have to search for it or answer too many questions in a survey, they’ll abandon the venture halfway through. The simpler, the better.

Final Thoughts

Reviews are a great tool to help improve and build your business’s success. There is no need to fear a negative review as long as you are taking the proper steps to mitigate and solve them. In fact, you should be welcoming all reviews. The more reviews you have, the more business you are bound to get because you are more likely to show up on search optimization websites such as Google. Remember, clients actively search for and trust other reviews, so it is not something to ignore or brush under the rug if you get a negative one.

Instead of fearing customer reviews, start viewing them as opportunities for improving your business and to connect with your clients more. You just need to know how to wield them to your advantage. Stay safe out there! WRE

14 14 Working RE Inspector Summer 2024

7page 13

Stories From the Trenches: Interview With Attorney Geoff Binney

by Isaac Peck, Publisher

I spend a good part of my workdays at OREP speaking with home inspectors, pouring over claim documents and sharing risk management advice and information with our inspector insureds.

There are only a handful of attorneys who truly specialize in home inspector litigation and defense, so it was especially rewarding to sit down recently with someone who’s been in the trenches defending home inspectors day in and day out for 15 years.

Geoff Binney, managing partner at Woodlands, Texas-based Gauntt, Koen, Binney & Kidd LLP is an experienced trial attorney who’s built his practice around construction-defect litigation, first-party insurance defense work and home inspector claim defense cases.

His career path is an interesting one. After graduating from the U.S. Military Academy and serving in the Army, Binney became an FBI special agent in Houston, attending law school at night. Though he originally had no intention to practice law, once Binney began to litigate cases, he was drawn to those in which he could help people, similar to the work he did for the FBI. “I was investigating folks who had been injured or damaged in some way and trying to help,” Binney says.

As a practicing attorney, Binney got his first home inspector case around 2010. “I remember feeling like I really helped someone who needed help. They were good folks just trying to do the right thing and trying to make a business go,” he says. “I was able to help them continue doing that by defending them. It was a positive outcome, and I felt really good about myself working on that case.”

Since then, his home inspector case docket has increased substantially. “Today, I work for a number of different insurance companies who write coverage for home inspectors, and I also work directly for some home inspectors who need somebody who they can call,” notes Binney. “I’ve also gotten very involved in helping home inspectors in a pre-claims capacity, helping shut down claims before they turn into lawsuits.”

All told, Binney has been involved with more than 250 home inspection cases including pre-claims and litigation. In the following Q&A, he shares some valuable advice about inspector claims and risk management.

Question: Have you noticed an increase in claims against home inspectors now that the market has slowed down?

Geoff Binney: I feel like there has been an increase in claims against home inspectors, at least proportionally. Fewer transactions are occurring, but the level of claims has remained about the same. If you take into account that the market has slowed down and there are less transactions occurring, the percentage of claims occurring from those transactions has increased. If there are less transactions, then the net percentage is increasing.

Question: What are the most common home inspection claims you see?

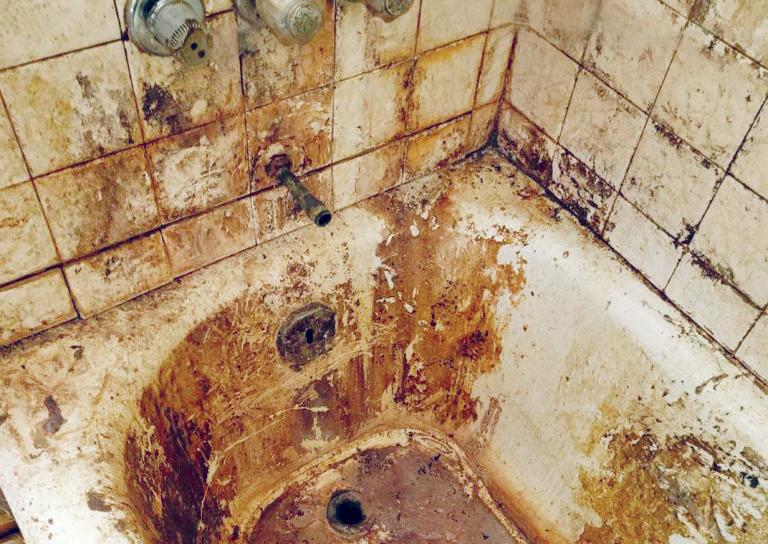

Geoff Binney: By far, the most common claim I see is water-intrusion related, which includes roof leaks, stucco or window leaks or water penetration, as well as plumbing leaks. Oftentimes, a homebuyer moves in and, whether it’s immediately or sometimes years later, they notice something like a damp spot in a ceiling, some sort of rot or other indication that there’s a water issue going on. They often get a contractor or a roofer to come out and look at it, and that individual will often take the position that “of course” the home inspector should’ve reported the problem.

I’d say foundation issues take second place. After that, I see a smattering of claims related to HVAC, flooring, electrical, plumbing, drainage, pests and so on.

Question: Are most demand letters and claims against home inspectors legitimate mistakes by the inspector or more on the frivolous side?

Geoff Binney: The vast majority of claims or lawsuits involving a home inspection are frivolous—with a caveat. I think the majority of these claims are more of a misunderstanding between the client/homeowner and the home inspector regarding what the home inspector’s duties are. While the claims seem frivolous to you, me, and the home inspector because we know what the duties and rules are of the inspection profession, they aren’t frivolous to the homeowner. Most of them believe that

16 16 Working RE Inspector Summer 2024

something is wrong with their house and that the home inspector should’ve found it.

I spend a great deal of time in litigation educating the claimant and/or the plaintiff lawyer about what an inspector’s duties are. The vast majority of claims that I see do not involve a mistake made by a home inspector. It’s usually more along the lines of there’s something wrong with the house, but the issue wasn’t within the scope of the duties to inspect for or wasn’t present or visible on the date of the inspection.

The buyer/homeowner and to some extent the attorneys who represent them often don’t understand at the outset what the home inspector’s role really was. At many depositions, I’ve asked what they thought the home inspector’s job was, and the most common answer I get is: “I thought they were going to tell me everything that was wrong with the house.” That’s an impossible and unrealistic expectation of an engineer or a specialist, let alone a home inspector generalist.

My job then becomes to educate that person. Whereas I am a home inspector defense lawyer and deal with these types of cases all the time, the vast majority of plaintiff attorneys aren’t very familiar with these types of cases. Typically, they don’t sue home inspectors as part of their career, so I need to educate them on what the industry standards are.

The challenge is that even after I explain to them that what they’re complaining about falls outside the scope of the home inspection or that the issue wasn’t visible at the time of the inspection, it’s often really difficult to get the inspector out of litigation once they’re in it. That’s why the pre-claims process is so important because we can shut down the claims before they make it to litigation.

Question: As the lead attorney managing pre-claims defense for OREP members, you’ve responded to more than 50 demand letters in the last two years. Is there anything that sticks out to you or that you’ve learned from that work so far?

Geoff Binney: The thing that sticks out the most is the success rate that we’ve had. I don’t think I anticipated that somewhere in the 95 to 97 percent range of claimants, including those in which the claimants were already represented by an attorney, would just go away after we respond to them.

Other than that, I’d say the experience has just reinforced what we just discussed. So many people have a misperception of what a home inspector does and what they’re responsible for. And because of that misunderstanding, having pre-claims support is really important. If a home inspector isn’t with an

17 Working RE Inspector Summer 2024

page 18 8

insurance carrier that has a pre-claims process, the carrier will sometimes move right into settlement discussions, or the inspector might try to handle the problem on their own.

The problem with an inspector trying to resolve the situation on their own is that it’s personal to them. If there’s a phone call between a client and a home inspector and the client is accusing the inspector of doing a poor job, that is going to make the inspector defensive, raise their voice and get emotional. Once that happens, the conversation is not productive. So, it’s important to have somebody step in that is not involved in the transaction that can objectively review the report, the evidence, the claim that’s being made, the alleged damages, and so on.

I would recommend to any home inspector who doesn’t have a pre-claims process ready to go right now to contact their carrier and find out what happens if a claim is made. If no plan is in place, they need an attorney they can call when a situation arises. Without a pre-claims process, that claim is going to turn into litigation very quickly. That happens most of the time. It’s critical for a home inspector to have a preclaims process already laid out for them that they can take advantage of.

Question: Are home inspectors more likely to face claims than other real estate professionals or folks in the trades?

Geoff Binney: Yes, especially as it relates to a real estate transaction. If a homeowner perceives something is wrong with the house, the first person they’re going to look at is the home inspector. They’re thinking: “That’s why I hired you. You were supposed to tell me everything that is wrong with the house.”

The next most likely target would be the sellers. If something is wrong with the house, surely they knew about it. They might’ve concealed it in some way or painted over it. Lower on the list are Realtors and appraisers. Anybody who stepped foot in the house becomes a potential target.

Another consideration is that the buyers/new homeowners likely had a positive relationship with their Realtor. They know that person, spent a lot of time with them and looked at a lot of houses together. The Realtor might’ve sat with them at closing. So, buyers have a real reluctance to sue their own Realtor, whereas they might not even know the home inspector. If they met them, it was for a very brief period. Thus, there’s more inclination to sue that person than someone they were friends with.

Question: What are the two or three top ways a home inspector can avoid claims and defend themselves?

Geoff Binney: The No. 1 way to protect yourself as a home inspector is to know your trade, be diligent and have good customer service. Be communicative with the client, listen to their concerns, do a good job and be open-minded.

In cases where the home inspector does potentially have liability, typically they are in a hurry. They almost always do a good job, but they didn’t in this case. I’ve also seen cases where they did a great job, but they’re just not great at customer service with the homeowner. In some cases, the home inspector doesn’t handle it right, is rude to the client when they raise an issue, and chooses to ignore the complaint.

Secondly, in terms of avoiding litigation, it’s absolutely essential to have a good, written and signed inspection agreement for every single inspection that you do. Your inspection agreement needs to have the proper clauses, be defensible, written and signed. A strong, signed pre-inspection agreement is almost as good as a get-out-of-jail free card. Even in the unlikely event the home inspector does make an error, it can be very helpful in removing the inspector from the litigation process.

No matter how good of a job you did, if you don’t have a signed pre-inspection agreement, it’s very difficult to get you out of the litigation process. Most inspectors today get signed agreements, but I occasionally encounter an inspector who tells me: “I’ve been doing this for 30 years. I’ve never had a written contract, and I’m not about to start now.” I have cases on my docket now in which there is no signed agreement.

The reason this matters is to get the home inspector out of the lawsuit as quickly as possible. If the agreement is a good one, there are clauses that will give me an opportunity to ask the judge to enforce them, which would lead to an automatic dismissal for the client. If you don’t have them, the judge is not going to let you out.

Most litigation can drag on for two years or more. It might need to go to a jury, there will be discovery and depositions, and it costs a lot of time and money and frustration. If there is no written inspection agreement, there are very few mechanisms I can employ to get the home inspector dismissed—unless the case against them is obviously frivolous.

The third thing is having a pre-claims process—access to some mechanism to help an inspector resolve issues when they pop up. Upset clients and demands are going to pop up for home inspectors. It’s inevitable.

Question: What would you say to home inspectors who don’t believe getting a signed pre-inspection agreement is necessary?

Geoff Binney: My question to that person: Wouldn’t you agree with me that today’s society is more litigious than it was five, 10 or 20 years ago? Because everything is becoming more litigious and people have access to lawyers more than they ever have, it’s truly just a matter of time before a home inspector faces a claim.

Just because you do a great job as a home inspector doesn’t mean you’re never going to face a claim. You don’t have to screw up to get sued. You could do a perfect inspection and page 20 8

Working RE Inspector Summer 2024 18 18 7

page 16

write a perfect report, but if you get the wrong claimant, it’s going to be expensive just to defend that litigation—especially if you don’t have a signed agreement. There are a lot of litigious people out there.

Question: Do you have specific clauses you recommend home inspectors use?

Geoff Binney: The most important clause to have in your agreement is the Limitation of Liability clause. There are a few states where it’s not allowed, and it has to be conspicuous—meaning in bold, underlined or stand out in some way—for it to be enforceable. However, the Limitation of Liability clause allows me to turn to the plaintiff or the plaintiff’s attorney and say, “We’re not liable here. We’ll fight this all day long, but even if we’re wrong, the most you can ever get is $500 to $1,000, or whatever the amount the inspection fee is.” It takes a lot of the wind out of the sails for the claimant and their attorney.

The second clause is the attorney’s fees provision. In litigation, most defendants do not have a mechanism to recover their attorney’s fees, even if they win. That means the plaintiff has no skin in the game. If they have a lawyer working on a contingency basis, or a family friend, or maybe they are an attorney themselves, it helps tremendously to have an attorney’s fees provision in the contract. This clause should just say that the prevailing party in any dispute can recover their attorney’s fees.

So, instead of losing and getting zero dollars being the worstcase scenario, the worst case is having to pay $25,000 in attorney fees to the home inspector. In most states, if not all, if a plaintiff sues for breach of contract or negligence, attorney’s fees are recoverable for the plaintiff. Really, the only person who needs protection is the home inspector, so that’s why we make it a dual attorney’s fees clause. It’s more enforceable that way.

Another important clause is the indemnification provision. What that means is you would think the person who signed the contract is the person who ends up suing the home inspector. For example, a wife or spouse may set up the inspection and

sign the agreement, but when litigation comes, the husband might be the plaintiff. When I point out there is a contract with an attorney’s fees provision, sometimes the plaintiff attorney will try to get around that by saying, “Well, the husband didn’t sign that.” An indemnification clause allows me to go after the wife for all the attorney’s fees that could’ve occurred.

Lastly, I like to see a notice provision. This basically mandates a timeline that a claimant would have to follow if there’s an issue that arises in the house. If the homeowner finds something wrong, they have to let us know about it within a reasonable amount of time. This alleviates two problems. One, if something happens 18 months after the inspection, this gives you the opportunity to inspect. Two, often there’s no communication between the plaintiff and inspector. The homeowner fixes the issue, and the defect is gone. There’s no opportunity for us to say that was there or wasn’t there at the time of inspection. It makes it difficult to defend. We’ve used this a lot in our preclaim response letters as well as in litigation to try to put some pressure on them that they failed to meet those timelines.

Conclusion

While state law differs with respect to what is and is not enforceable in a home inspector’s pre-inspection agreement (see Sharpening Your Pre-Inspection Agreement on WorkingRE.com), many of the tips that Binney shares above can be used in some form by home inspectors nationwide.

When faced with a claim or potential claim, inspectors are advised to seek legal counsel with experience defending home inspectors. If you currently carry insurance, ensure your carrier selects counsel familiar with home inspectors. That will be the case if you’re using a program written exclusively for inspectors, like OREP’s. The difference between the defense you receive can be substantial. With his extensive inspector claim experience, Binney is on the roster of experienced lawyers representing those insured with OREP’s primary carrier in Texas. OREP has served inspectors with comprehensive E&O insurance, risk management and pre-claims assistance for over

• Certified & Pre-Licensing Advanced Home Inspection Training

• Average from $56,030 to over $175,000 a Year

• 80 Hours of Hands-On Training in the classroom and out in the field.

• 100% Successful Student Passing Rate

• No Prior Experience Needed

• Approved for Veteran Training - Post 9/11 G.I. Bill

• Entrepreneur Magazine Call Home Inspections, “One of the Best Opportunities”

• Money Magazine has rated Home Inspection as one of “The 15 Highest-Paying Jobs That Don’t Require a College Degree”

• Free yourself from a Desk Job, Be Your Own Boss, Set Your Own Hours and Put Your Career in your Hands

• We Exceed all ASHI and NACHI national Standards

• Additional Courses in Radon Testing, Radon Mitigation and Mold Testing

20 20 7

page 18

WE DEFEND INSPECTORS FOR A LIVING

This isn’t our first rodeo. When the market slows (and even when it doesn’t!), somebody always wants to blame the home inspector.

That’s why you need a team with deep expertise who have been defending inspectors for decades.

OREP now offers its insureds PROFESSIONAL pre-claims assistance with trial attorney Geoff Binney, one of the nation’s most experienced home inspector attorneys. Geoff Binney writes decisive response letters to shut down frivolous claims.

When you’re facing a claim or complaint, you don’t have to go it alone or put your future in the hands of insurance adjusters who roll over and pay meritless claims.

Trusted by over 13,000 Professionals.

years

(888) 347-5273 OREP.org/inspectors

CALIF. LIC. #0K99465

OREP E&O INSURANCE

business is defending you

livelihood. OREP

Our

and your

Essential Car Supplies for Home Inspectors

by Kristine Gerber, Inspector Toolbelt

B

eing a home inspector often means spending long hours on the road, visiting various properties, and conducting thorough inspections. You may find yourself sometimes rushing to get in your car and off to your next appointment. But do you really have everything you need?

To ensure a smooth and efficient inspection process, it’s essential to have a well-equipped car. In this article, we will explore a variety of items that every home inspector should carry in their vehicle to stay prepared for any situation that may arise. Perhaps you may find some you didn’t think of!

Toilet Paper

This is a vitally important item. The reality is that home inspectors find themselves doing inspections out in the boonies or at abandoned houses without proper plumbing. Don’t find yourself in an emergency situation without toilet paper!

Water and Snacks

Home inspections can be physically demanding, especially during hot or busy days. Staying hydrated and energized is crucial for maintaining focus and providing quality service to clients. Always keep a supply of bottled water and non-perishable snacks like granola bars, nuts, or fruit in your car. These items will help you stay refreshed and prevent energy dips during inspections.

Emergency Kit

Safety should be a top priority for any home inspector. An emergency kit is essential for handling unexpected situations. The kit should include items such as first aid supplies, a flashlight, a multi-tool with a knife and pliers, extra batteries, a whistle, and a reflective vest. Additionally, consider including basic over-the-counter medications for headaches or minor pains.

Spare Tire and Tools

A flat tire can happen at any time, and being stuck on the side of the road can disrupt your schedule and inspection appointments. Ensure your car is equipped with a spare tire, jack, and lug wrench. Regularly check the tire pressure to avoid any surprises on the road.

Kristine Gerber is part of the Customer Success team at Inspector Toolbelt Home Inspection Software. She helps home inspectors across the US and Canada become more proficient with Inspector Toolbelt and in their business. You can reach Kristine via email at info@inspectortoolbelt.com.

Full Tank of Gas

Before starting your inspection rounds, make it a habit to fill your car’s gas tank. Having a full tank will prevent any unnecessary delays during inspections and keep you on track with your busy schedule.

Extra Clothing

Accidents happen, and being prepared for them is essential. Keep an extra set of clothes in your car, including a clean shirt, in case of any spills or stains. Not only will this help maintain a professional appearance during your inspections, but it will also keep you comfortable throughout the day.

Technology Essentials

As a home inspector, you rely on technology to document your findings and communicate with clients. Always carry fully charged devices, such as your smartphone, laptop, or tablet, along with charging cables and a portable power bank. This way, you can ensure you have access to your inspection reports, scheduling, and communication tools at all times.

Personal Protective Equipment (PPE)

In certain situations, you may encounter hazardous conditions or materials during inspections. It’s essential to prioritize your safety by carrying personal protective equipment like gloves, safety goggles, and a dust mask. These items will protect you from potential health risks and ensure you can confidently handle any inspection scenario.

Business Cards and Marketing Materials

Opportunities for networking and expanding your client base can present themselves unexpectedly. Always keep a stack of professional business cards and marketing materials in your car, making it easy to provide your contact information to potential clients or real estate agents you meet on the job.

Get Equipped and Be a Success

A well-prepared home inspector is a successful home inspector. By having these essential items in your car, you can tackle your daily inspections efficiently and be ready to handle unexpected and possibly embarrassing situations. Remember that being equipped with the right supplies enhances your professional image and contributes to your overall safety and well-being while on the road. Stay organized and ensure your car is stocked with these must-have items before embarking on your next inspection journey. WRE

22 22 Working RE Inspector Summer 2024

Is It Time to Be Your Own Boss?

by Kendra Budd, Editor

To join a home inspection company, or to not join a home inspection company? That is the question that many newer inspectors find themselves juggling with.

After the COVID-19 pandemic, there seemed to be a surge in independence that extended to the workplace. Many find themselves wanting to be more in control of their time, especially when it comes to the coveted work-life balance, which is why many new home inspectors are considering becoming independent business owners instead of joining up with an inspection company.

What exactly are the benefits of becoming a self-employed home inspector? Well, Working RE Home Inspector sat down with Dan Cullen—an inspector who has been his own boss for the past 27 years to answer that question.

A Change of Pace

Dan Cullen wasn’t always a home inspector; in fact, he was a firefighter for over 30 years. Cullen had never even considered home inspecting as a job prospect, until another one of the firefighters he worked with took it up as a side job.

Cullen’s friend began working under another home inspector in the area, “and he told me that the inspector was still looking for help. I applied and started doing my training,” Cullen explains. What started as a job to earn some extra cash, soon became Cullen’s new passion—working for the inspector for nearly three years before starting his own solo venture.

The Benefits of Solo Inspection

Once Cullen transitioned from trainee to full-time freelance solo inspector, he immediately started seeing the benefits that he wouldn’t otherwise working under a company. The first of which is financial freedom. “You’ve got an opening to be responsible for only yourself, which can give you an immense amount of financial freedom,” Cullen states. Some examples include: lower carrying costs, exemption from workman’s comp, and even slightly lower insurance coverage.

You’ll also have a higher earning potential overall because there is no cap on how much you’ll make. “The more home inspections I do, the more money I make,” Cullen enlightens. In fact, there is a potential to earn a higher wage per week while working less hours than a typical 40-hour work week if you were to work under a company.

Besides the financial benefits, there are also a couple of personal ones you’ll get as well. As a solo home inspector, you’ll have the option to choose your hours—meaning your work-life balance can actually be just that…balanced!

Cullen says another benefit often overlooked is making a name for yourself in your community. “I’ve been in the business for over 25 years and I have thousands of clients. I’ve got a low-level pipeline that continually feeds me work. I don’t have to go out there and grind for work—the phone just rings a few times a week and I do inspections quite often,” Cullen details. Once you have a positive reputation, the work will find its way to you.

So, how did Cullen build his reputation exactly when the work came to him? Well, that is due to another benefit of solo home inspection—setting your own prices. “Client’s know that I am going to set a reasonable fee, and that’s why they want to work with me,” Cullen shares.

All of these benefits tie into the fact that you get to be your own boss. Every choice you make is your own, and you don’t have to constantly be looking over your shoulder. If you’re looking to have a more cost-effective approach to your inspection work, set your own hours, and be your own boss, then solo inspection can open up those opportunities.

The Downsides

Unfortunately, solo home inspection doesn’t come without its challenges. When it comes to the lucrativeness of solo inspection, Cullen says it all depends on your local market. “You have to ask yourself, what kind of inspection fees can your local market sustain? Are you optimizing your fee schedule, doing ancillary inspection work? It all depends on a lot of factors,” emphasizes Cullen.

Cullen credits his business success to the area he lives in. “I was fortunate enough to start working in a metropolitan area with a significant ongoing demand for home inspections,” he says. If you’re working in an area that doesn’t have a lot of demand for home inspections, especially in the slower seasons, then you really need to ask yourself if freelancing is the right choice.

Working RE Inspector Summer 2024 24 24

Cullen also warns that even though you can lower your inspection costs as a solo inspector, you’ll still need to make sure you’re not short-changing yourself for a variety of reasons. “I still have to pay for software, recurring monthly fees, licensing fees, my InterNACHI and local ASHI chapter membership fees, etc. You’re not going to be able to absorb those ongoing costs the same as if you had other inspectors working for you. So, you have to price your work according to those additional fees,” Cullen elaborates.

You’ll have to do some serious accounting work to make sure that your services are both fair and going to cover your fees to keep your business running. It all goes back to making sure you’re doing enough home inspections throughout the year, which means you may even have to raise your prices during slower months. Otherwise, what starts as a way to make more money, could just end up sinking your business. Solo inspection is a risk, one you must dutifully weigh the pros and cons of before diving in head first.

How to Get Started

Most freelance solo inspectors don’t start off as such, Cullen included! When Cullen mentors prospective solo home inspectors, he actually insists that they start in a multi-inspector firm. “They need to get their feet wet, and learn the ropes because they’re bound to make some initial mistakes. It’s nice to have someone else responsible for you during that learning process,” Cullen explains. However, that isn’t to say that it doesn’t work to start off solo either. In fact, Cullen says he’s had many mentees that “hit the ground running.”

Education is also extremely important to the process. Knowledge is power in the home inspection industry, and if you don’t

know the laws and regulations surrounding your work then you’ll have a harder time succeeding. Unfortunately, education is also not a guarantee you’ll be successful. What it really all comes down to though, in Cullen’s opinion, is tenacity. “I used to have my own home inspection education firm for several years, and it just got really hard to predict who would actually be able to take that education and make something out of it,” Cullen reflects. Still, that education will give you a leg up against other inspectors who don’t obtain it.

According to Cullen, success in this business all comes down to drive. “You need to be a serious self-starter who’s willing to do that extra legwork of marketing and assembling all the technical information necessary to become a really proficient home inspector,” he tells us. You might not be able to get started right out of the gate and see immediate success, but it is the inspectors with the high-performance ethic that get to see the results.

Final Thoughts

So, is it time to finally be your own boss? Well, that comes down to your work ethic, marketability, and location. If those all seem easily obtainable, then it might be time to consider freelancing.

Cullen leaves us with a few words of advice to those who are considering it, “Get insurance, learn how to market yourself, and consider taking advantage of the resources organizations, such as InterNACHI, provide.” Freelancing may not be for every home inspector, but it can be invaluable to those who really feel they can benefit from it. Take Cullen, for example, who has been solo for over 25 years. Just make sure you take the proper time to consider whether it it’s the best option for you personally.

Stay safe out there! WRE

25 Working RE Inspector Summer 2024

SAVE OVER $500 A YEAR! Enjoy Corporate Savings as an OREP Member. OREP Members enjoy discounts on Office Supplies, Wireless, Airfare, Rental Cars, Gifts, Entertainment and More OREP is a Leading Provider of Home Inspector E&O and General Liability. Calif. Lic. #0K99465 Start Saving Today! Get a Quote, Bind, and Save at OREP.org/inspectors or call (888) 347-5273. SAVE on everyday expenses

The Backstory to Agent Disclosures: The Lawsuit That Started It All

by Isaac Peck, Publisher

As a home inspector, you’re probably familiar with the variety of disclosure paperwork that is shuffled back and forth between the buyer and seller during a property sales transaction.

And it’s not just the seller who’s expected to disclose information about the property.

Though state law varies widely on the specifics, generally real estate agents have a duty to disclose known defects about a property to potential buyers (and face significant civil liability if they don’t!) AND they are often held liable for failure to disclose “reasonably discoverable defects.” In California, for example, a Realtor typically fills out the Agent Visual Inspection Disclosure (AVID) form which is designed so the agent can disclose the “material facts affecting the value or desirability” of the subject property.

While such disclosures are now commonplace—with many states having passed laws that require agents to disclose obvious material defects and hold them accountable for defects they should have known about through “reasonable diligence”—it wasn’t always like this.

Which begs the question: Where did our modern day disclosure and investigation requirements come from?

One of the most defining cases on this issue is Easton v. Strassberger, a lawsuit decided by the California Court of Appeals back in 1984.

Here’s a look at the history of the case and how it shaped the regulatory and legal environment that agents operate in today.

Massive Soil Movement

In 1976, the Strassburgers solicited the services of a real estate brokerage, Valley Realty, to help sell their home to Leticia Easton, the buyer in the transaction, for $170,000.

However, shortly after moving into the home in the summer of 1976, the parcel of land that Easton’s new home was built on experienced massive slides, with parts of the driveway being destroyed and the foundation being so damaged that the walls of the home cracked and the doorways were warped. This occurred, according to the experts, because a portion of the property was “fill” that had not been properly engineered and compacted.

The result was that although the home had appraised for $170,000 just a few months prior, new estimates placed the property’s value at just $20,000 and the cost to repair the damage caused and avoid recurrence were as high as $213,000.

Not surprisingly, in December 1976, less than six months after moving in, Easton sued the Strassburgers and the real estate agents involved in the transaction for fraudulent concealment, intentional misrepresentation, and negligent misrepresentation.

Prior Knowledge

Unbeknownst to both Easton and the seller’s agents, the Strassburgers knew that there were serious soil issues affecting the property. There had been a minor slide in 1973 involving about ten to 12 feet of the filled slope, and another major slide in 1975 where the fill dropped eight to ten feet in a circular shape 50 to 60 feet across. However, the Strassburgers did not tell this to their agents (or the buyer!) or disclose the corrective action they had taken.

Judgment Passed then Appealed

Easton’s original case was tried in front of a jury that awarded her $197,000 in damages, to be paid from the parties as follows: five percent from seller’s brokerage, 65 percent from the sellers, and the remainder to be paid by the builders.

However, unwilling to accept liability in the matter (and perhaps worried about the precedent that would be set), the seller’s brokerage, Valley Realty, appealed the matter to the California Court of Appeals. Valley Realty made a variety of arguments, but perhaps most important was their contention that as a broker, they were “only obliged to disclose known facts and [had] no duty to disclose facts which ‘should’ be known to [them] ‘through reasonable diligence.’”

In other words, Valley Realty agreed that they were bound to disclose known facts, but objected to the idea that they were responsible for “conducting due diligence on the property,” which may or may not have identified the soil issues that caused the massive earth movements which nearly destroyed the home.

As the California Court of Appeals wrote, the court then had to decide whether “the broker’s duty of due care in a residential page 28 8

26 26 Working RE Inspector Summer 2024

CALIF. LIC. #0K99465 Call (888) 347-5273 | OREP.org If you are struggling to reach your insurance agent with a simple question or just to renew your policy, wait until you have a claim! In business for over 22 years, we still know the meaning of customer service. Over 13,000 professionals trust OREP with their insurance. It’s time to shop OREP. We Answer the Phone! We Don’t Make You Press “3” for Customer Service…

real estate transaction includes a duty to conduct a reasonably competent and diligent inspection of the property he has listed for sale to discover defects for the benefit of the buyer.”

Broker Due Diligence Established

Ultimately, the court found that the brokers’ duty to disclose material facts includes “the affirmative duty to conduct a reasonably competent and diligent inspection of the residential property listed for sale and to disclose to prospective purchasers all facts materially affecting the value or desirability of the property that such an investigation would reveal.”

In its decision, the court noted that the National Association of Realtors (NAR) Code of Ethics (at the time), indicated that its members had “an affirmative obligation to discover adverse factors that a reasonably competent and diligent investigation would disclose.”

NAR’s modern day Code of Ethics has been changed since then. The current requirement now reads:

Standards of Practice 2-1 : REALTORS® shall only be obligated to discover and disclose adverse factors reasonably apparent to someone with expertise in those areas re quired by their real estate licensing authority. Article 2 does not impose upon the REALTOR® the obligation of expertise in other professional or technical disciplines.

However, the court reasoned that failure to hold a real estate broker responsible for “reasonably discoverable defects” would set a bad precedent and reward brokers for their ignorance.

The court made a passionate argument for its position:

If a broker were required to disclose only known defects, but not also those that are reasonably discoverable, he would be shielded by his ignorance of that which he holds himself out to know. Such a construction would not only reward the unskilled broker for his own incompetence...If given legal force, the theory that a seller’s broker cannot be held accountable for what he does not know but could discover without great difficulty would inevitably produce a disincentive for a seller’s broker to make a diligent inspection.

The court also made clear that it expects more than a casual viewing of the property by an agent or broker, writing that because agents are held out to the public as professionals with “superior knowledge, skills and experience” in the field of real estate, they are expected the exercise their expertise and “should have been alert to the signs of soils problems.” As such, the court agreed with the original jury’s conclusion that a “reasonably diligent and competent inspection of the property would have included something more than a casual visual inspection and a general inquiry of the owners.”

Consequently, Valley Realtors was held liable for its failure to disclose a “reasonably discoverable defect” and the liability of the real estate agent/broker shifted substantially.

Liability and Birth of a Profession

Prior to this case, real estate had long operated on a doctrine of “caveat emptor,” which means buyer beware, and there was little recourse for buyers who purchased a home and later discovered major defects.

While state laws and legal precedents vary by state, the far-reaching effects of the Easton v. Strassberger decision in California should not be underestimated. The questions raised and the precedent established in California had a sweeping effect on agent practices, liability, and case law across the country.

Additionally, many cite Easton v. Strassberger as the catalyst that propelled the home inspection profession into existence (For more on this topic, visit WorkingRE.com; search History of Home Inspection). There were some home inspectors in operation throughout the 1960s and 1970s, but it was not commonplace to order a home inspection prior to purchasing a property.