20 minute read

Rio Tinto: Global operations for the modern world

Rio Tinto

www.riotinto.com

Advertisement

Global operations for the modern world

Rio Tinto is a global mining and metals group with operations on six continents, focused on finding, mining, processing and marketing the earth’s mineral resources to provide consumers and industry with what they need. Here we summarize the company’s most recent projects and achievements around the world.

Rio Tinto’s mining operations produce raw materials including copper, iron ore, bauxite, diamonds, and industrial minerals including titanium dioxide, salt, gypsum and borates. The company also processes some of these materials, with plants dedicated to processing bauxite into alumina and aluminium, and smelting iron ore into iron. Other metals and minerals are produced as by-products, including gold, silver, molybdenum, sulphuric acid, nickel, potash, lead and zinc.

Copper

Rio Tinto’s very first mine was a copper mine on the banks of the Rio Tinto river, in Andalusia, Spain – purchased by auction from the Spanish government in 1873 by a British-European investor group. Following this purchase, the Rio Tinto Company was launched in March 1873. The Spanish assets have long since been divested, but Rio Tinto has become a world leader in copper, with operations in the United States, Chile, Mongolia and most recently, Australia.

Today, its copper operations around the world are at various stages in the mining lifecycle, from exploration to rehabilitation. In Arizona in the United States, exploration is under way at the Resolution Copper Project, a joint venture with BHP, which reached a significant milestone in 2019 with the release of a draft environmental impact statement (DEIS), paving the way for the development of one of the world’s most significant copper deposits.

By contrast, the Kennecott mine in Utah is a long-standing world-class, integrated copper mining operation which also produces gold and silver as bi-products. In 2019, after 75 years of operation, Kennecott retired its coal-fired power plant in Magna, Utah, replacing it with power from renewable energy certificates purchased from Rocky Mountain Power – primarily from wind and solar resources.

Rio Tinto also has a 30% interest in the Escondida mine in the northern Atacama Desert in Chile, although the mine is managed by BHP which owns 57.5%. From mid-2021, the power supply at Escondida will also be largely sourced from renewable energy.

Still being developed is Oyu Tolgoi, in the South Gobi region of Mongolia, home to one of the largest known copper and gold deposits in the world. When the underground mine is complete, it will be one of the world’s largest copper mines.

Oyu Tolgoi is jointly owned by the government of Mongolia (34%) and Turquoise Hill Resources, which owns 66%. Although not a direct shareholder in the mine, Rio Tinto owns 50.8% of Turquoise Hill Resources and manages the operation on behalf of the owners.

Open pit mining began at Oyu Tolgoi in 2011 and the copper concentrator, the largest industrial complex ever built in Mongolia, began processing mined ore into copper concentrate in 2013. Current infrastructure at Oyu Tolgoi will allow the mine to operate for decades to come.

The vast majority of resources lie underground, and Rio Tinto achieved a significant milestone at Oyu Tolgoi in late 2019 with the completion of Shaft 2, enabling the acceleration of work on the Oyu Tolgoi Underground Project, but subsequent development has been affected by the Covid-19 pandemic, and other difficulties, including arrangements for a permanent power supply. In the summer of 2020, agreement was reached between Rio Tinto, Turquoise Hill and the Government of Mongolia on the preferred domestic power solution for Oyu Tolgoi, paving the way for the Government to fund and construct a state-owned power plant at Tavan Tolgoi.

More recently, Rio Tinto and Turquoise Hill Resources entered into a memorandum of understanding to provide a clear pathway for completion of the underground project, but delays and cost-overruns continue to cause difficulties in the relationship between the partners. In December 2020 the Government of Mongolia and representatives of Canada’s Turquoise Hill called for a special board committee to be set up to conduct an independent review of the project.

In late 2017, Rio Tinto discovered

copper-gold mineralisation at its 100% owned Winu project in the Yeneena Basin in the Paterson Province of Western Australia. A significant programme of work has continued since, including reverse circulation and diamond drilling to define the mineralisation extent and continuity.

In July 2020 the company announced the maiden resource at Winu.

Global operations for the modern world

www.riotinto.com

Study work suggests the copper mineralisation supports the development of a relatively shallow open-pit mine, combined with the industry-standard processing technology used at other Rio Tinto sites. The project team is working with regulators and local Nyangumarta and Martu traditional owners to progress the agreements and approvals required for any future development. First production is targeted for 2023, subject to all necessary approvals.

The discovery of a new zone of gold dominant mineralisation approximately 2km east of the Winu deposit, as well as a number of other encouraging drilling results in close proximity to the maiden Winu Resource, indicates the potential for the development of multiple ore bodies within one system.

Other activity at Winu includes cultural heritage surveys and the commencement of construction of a gravel airstrip for emergency response purposes, given the exploration camp is located approximately 200 kilometres by gravel and sand track from the Great Northern Highway and a seven hour drive from Port Hedland.

Iron ore

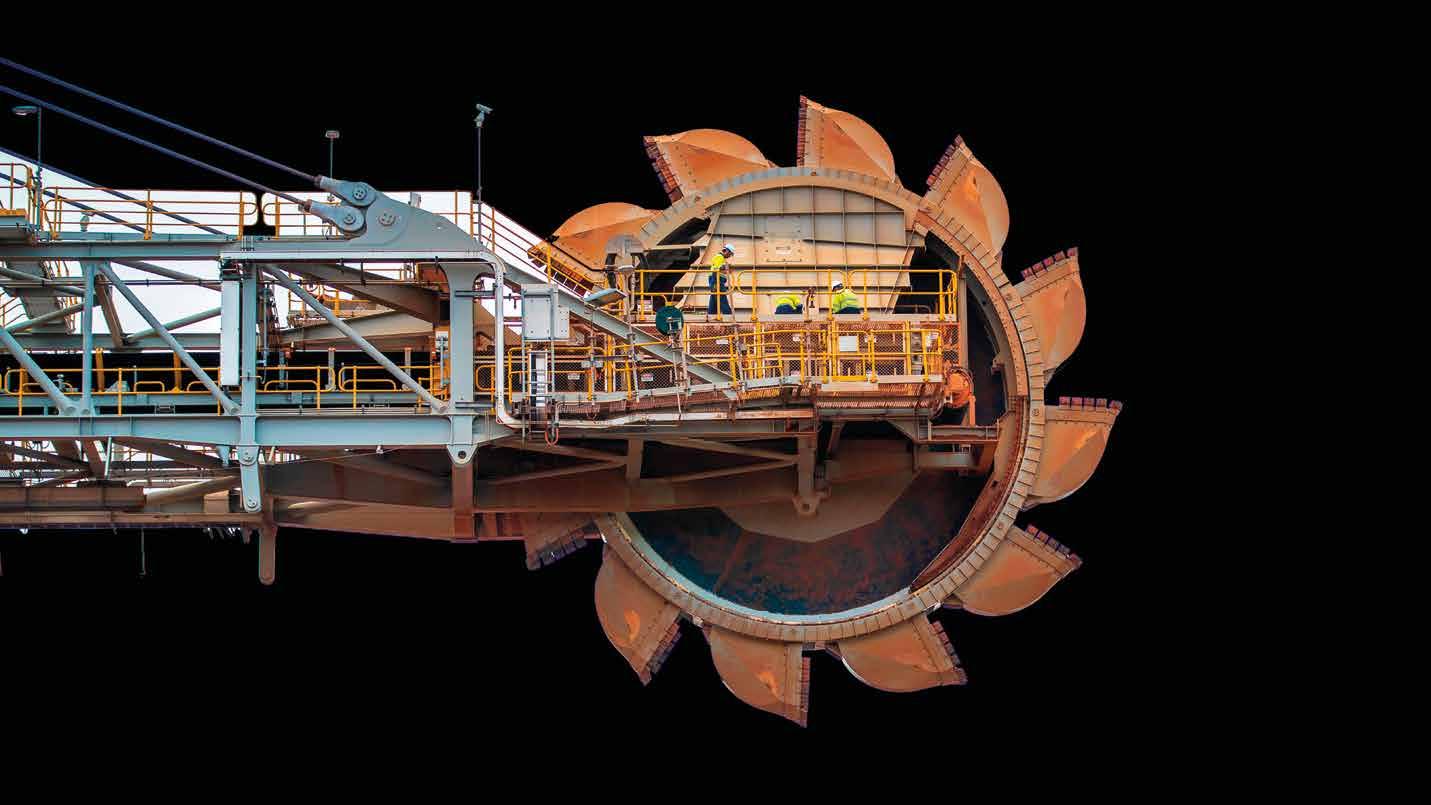

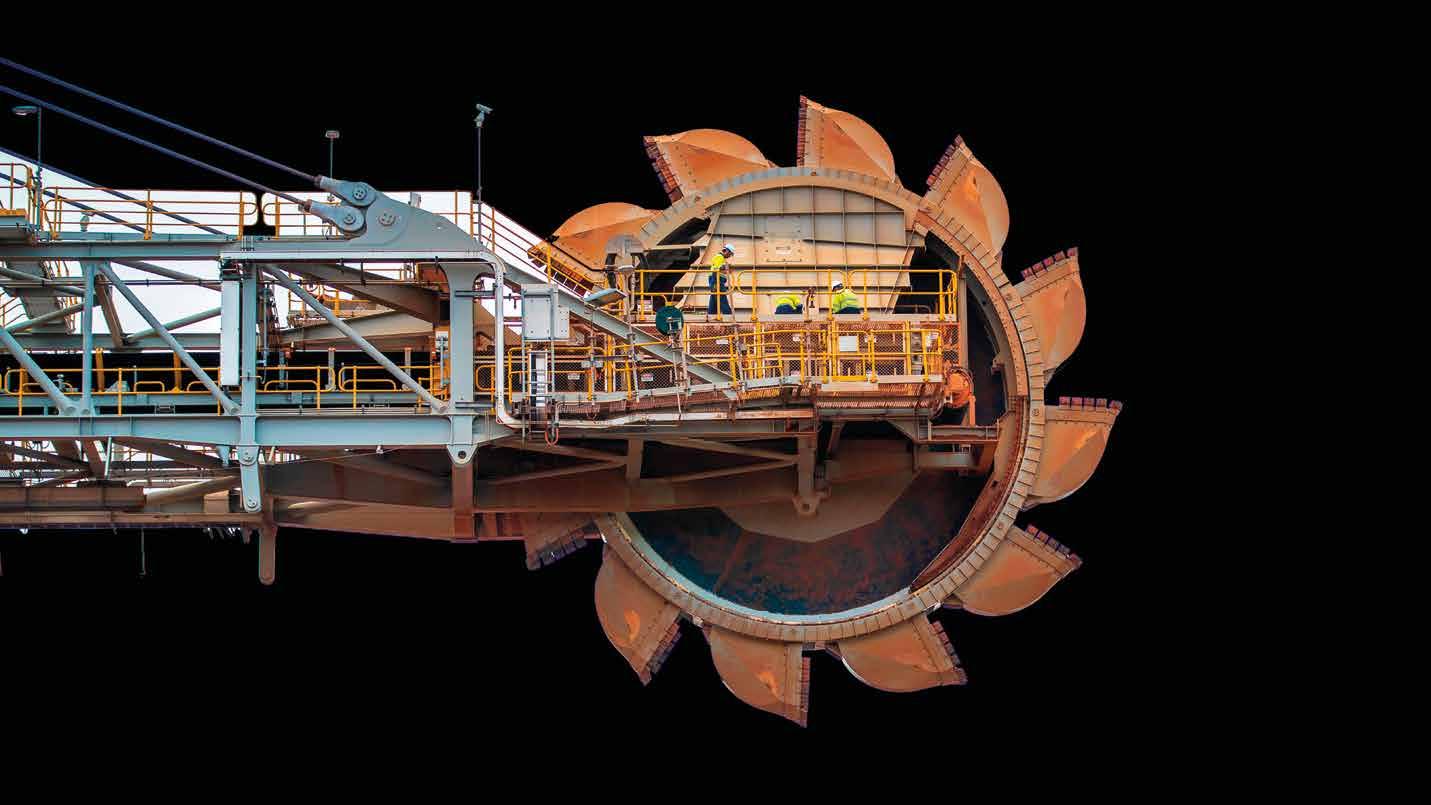

Rio Tinto is also one of the world’s leading producers and exporters of iron ore, operating a world-class, integrated network of 16 iron ore mines, four port facilities, and a 1,700-kilometre rail network and related infrastructure in the Pilbara region of Western Australia.

On the other side of the world, the Iron Ore Company of Canada – a joint venture between Rio Tinto (58.7%), Mitsubishi (26.2%) and the Labrador Iron Ore Royalty Income Corporation (15.1%), operates a mine with five pits, a concentrator and a pelletising plant near Labrador City, Newfoundland and Labrador; a port and stockpile in Sept-Iles, Quebec; and a 418 kilometre railway that joins these two parts of the operation.

Rio Tinto is currently expanding its operations in the Pilbara to epic proportions, while at the same time introducing next generation technologies to deliver greater efficiency, lower production costs and improve health, safety and environmental performance, including artificial intelligence, automation and robotics. The company’s AutoHaul™ train system is the world’s first fully autonomous, long-distance, heavy-haul rail network – one of the world’s largest robots.

In July 2019, the company approved

Global operations for the modern world

www.riotinto.com

a A$1 billion investment in its existing Greater Tom Price operations (100% owned) to help sustain the production capacity of its world-class iron ore business in the Pilbara of Western Australia. The investment in the Western Turner Syncline Phase 2 (WTS2) mine will facilitate mining of existing and new deposits and includes construction of a new crusher as well as a 13-kilometre conveyor. The new conveyor system will help lower greenhouse gas emissions from the mine by 3.5 per cent compared to road haulage. First ore from the crusher is expected in 2021.

As part of the investment, the haul truck fleet at the mine will be fitted with autonomous haulage system (AHS) technology, which has been proved to deliver significant safety benefits as well as enhancing productivity and reducing costs at the company’s existing Pilbara operations.

In August 2019 Rio Tinto awarded contracts worth more than A$250 million to leading Western Australian suppliers BGC Contracting and Monadelphous Group, for work on the Robe River Joint Venture’s West Angelas iron ore mine in the Pilbara. Rio Tinto owns a 53 per cent interest in the Robe River Joint Venture, Mitsui 33 per cent and Nippon Steel 14 per cent.

The epic investment, however, is the $2.6 billion earmarked to create Rio Tinto’s first ‘intelligent mine’, GudaiDarri, approximately 35 kilometres northwest of its Yandicoogina mine site, and about 110 kilometres from the town of Newman.

After working closely with the traditional custodians of the land, the project, formerly known as Koodaideri, will now be pronounced and spelt in the Banjima language as Gudai-Darri, following a request from Banjima Elders.

All set to be the company’s most technologically advanced mine, the 100% owned Gudai-Darri has more than 70 design innovations, in addition to technology already in use across Rio Tinto, such as autonomous trucks, trains and drills. The project will incorporate a processing plant, associated infrastructure and a 166-kilometre rail line. Significant innovations include a digital replica of the processing plant, accessible in real time by workers in the field and at the remote operations centre, fully integrated mine automation and simulation systems, and an automated workshop.

In February 2020, Rio Tinto approved a $98 million investment in a new solar plant at Gudai-Darri, as well as a lithium-ion battery energy storage system to help power its entire Pilbara power network.

The 34-megawatt solar photovoltaic plant is expected to supply all of the mine’s electricity demand during peak solar power generation times and approximately 65 per cent of its average electricity demand. The plant will comprise an estimated 100,000 panels, covering an area of 105 hectares. Construction is due to be completed in 2021. Complementing it will be a new 12MWh battery energy storage system in Tom Price that will provide spinning reserve generating capacity to support a stable and reliable network.

In November 2020 Rio Tinto opened Australia’s newest airport at GudaiDarri. The facility can accept a range of different aircraft including Boeing 737s, A320s, F100s and King Airs. The airport is expected to handle more than 600 workers in a day at peak operating times.

Rio Tinto is also a global leader in aluminium, with largescale, high-quality bauxite mines and alumina refineries producing some of the highest quality, lowest-carbon footprint aluminium in the world. The Saguenay-Lac-Saint-Jean region in Canada is an important hub for Rio Tinto’s aluminium business, responsible for close to half of its global production. Its operations in the area include an alumina refinery, four wholly owned smelters, six hydropower plants, the Arvida Research and Development Centre (ARDC), the Aluminium Operational Centre, a rail network and one port.

In 2018 Rio Tinto launched ELYSIS, a joint venture with Alcoa, and supported by Apple and the governments of Canada and Quebec, dedicated to developing a breakthrough aluminium smelting technology with no direct greenhouse gas emissions.

Also in Canada, Rio Tinto’s BC Works operation in Kitimat, British Columbia, comprises a newly modernised aluminium smelter and the Kemano Powerhouse, a hydropower facility supplied by the Nechako reservoir. From Canada’s west coast, products are transported by ship and rail, primarily to customers in Japan, South Korea and the United States.

In 2019, BC Works was certified by the Aluminium Stewardship Initiative (ASI) for producing aluminium to

the highest internationally recognised standard for responsible environmental, social and governance practices.

Back across the world to Australia again, Rio Tinto’s Weipa operations in north Queensland include three bauxite mines, processing facilities, ship loaders, an export wharf, two ports, power stations, a rail network and ferry terminals. Here the company’s newest mine, Amrun, will extend the life of the company’s Weipa bauxite operations by decades, building on its 55-year history on the Western Cape.

The $A2.6 billion Amrun bauxite mine, plant and export facility were approved in 2015, with a targeted start date of 2019. Rio Tinto made Amrun’s first shipment to its Yarwun alumina refinery in December 2018, six weeks ahead of schedule. At full production, Amrun will have capacity of 22.8 million tonnes a year, with options to expand. The mine and associated processing and port facilities will replace production from Rio Tinto’s depleting East Weipa mine and increase annual bauxite export capacity by around 10 million tonnes, at a time when higher-grade bauxite is becoming scarcer globally.

www.riotinto.comwww.riotinto.com

Diamonds

Until the closure of its Argyle diamond mine in November 2020, Rio Tinto was one of the world’s major producers of diamonds, with a diamond mine in Canada as well as Australia.

The Argyle ore body in Western Australia was discovered in October 1979. Alluvial operations began in 1983, open pit mining began in 1985 and the mine became a fully underground operation in 2013. Over this period of time the mine has produced more than 865 million carats of rough diamonds, becoming the world’s largest producer of coloured diamonds and virtually the sole source of a very small but consistent supply of rare pink diamonds.

The technologically sophisticated underground operation at Argyle was the first block cave mine in Western Australia, a method involving undercutting the ore body and allowing it to break up or ‘cave’ under its own weight. The closure process is expected to take some five years to decommission and dismantle the mine and undertake rehabilitation, followed by a further period of monitoring.

Rio Tinto’s Diavik diamond mine is in the Northwest Territories of Canada, half a world away in geographical terms, and vastly different in conditions. Around 200 kilometres south of the Arctic Circle, Diavik operates in an icy tundra, where Argyle enjoys the savannah-like conditions in remote Western Australia. While Argyle operated underground, Diavik comprises four diamond-bearing pipes that are mined using a combination of open pit and underground mining, although underground, in this instance, also means under water.

Rio Tinto has developed world class engineering technology and techniques to hold back the waters of Lac de Gras to

reach the diamond-bearing pipes at the bottom of the lake, building an embankment to create a pool of water within the lake, then pumping millions of litres from this pool back into the lake, monitoring water quality and fish stocks.

The Diavik Diamond Mine is managed by Rio Tinto but owned by a joint venture between Diavik Diamond Mines (2012) Inc., a wholly owned subsidiary of Rio Tinto (60% ownership) and Dominion Diamond Diavik Limited Partnership, a wholly owned subsidiary of Dominion Diamond Mines (40% ownership).

All mines have a finite life cycle and Diavik has planned for its closure from the outset. The buildings on site have been designed to be removed without a trace. When mining ends, the embankments will be reclaimed and lake water will flow back into the open pit.

Minerals

Rio Tinto has thriving operations in the minerals sector, too, where it produces salt, borates, titanium dioxide and one of the most highly demanded minerals of the modern age, lithium.

The company’s Dampier Salt operation in Western Australia is the world’s largest exporter of seaborne salt – salt produced from evaporating seawater, as opposed to being mined as a solid mineral. The shallow evaporation flats at Dampier have the potential to produce salt almost indefinitely. The operation relies on evaporation over an area equivalent to 27,900 soccer fields to transform seawater into salt, predominantly used for industrial purposes. Rio Tinto exports more than five million tonnes of salt every year, most of it to customers in Asia and the Middle East.

Deposited millions of years ago, borates are crystallised salts that contain boron, a mineral used in fertilisers, but also in high tech applications such as the heat-resistant glass for smartphones and materials for renewable energy – for both wind and solar projects, in wood protection and fiberglass insulation.

Commercially viable quantities of this rare and versatile mineral have been found in a very few places in the world. One is in California’s Mojave Desert, where Rio Tinto started mining over 100 years ago, first in Death Valley and then moving, in 1927, to Boron, California, from where the company supplies approximately 30% of global demand for refined borates.

Titanium dioxide is a brilliant white, opaque compound, used as a pigment in paints, plastics and paper, and also to produce toothpaste, sunscreen and cosmetics. The 70-year-old Rio Tinto Fer et Titane (RTFT) operation in Quebec, Canada, pioneered the process of removing iron and titanium from

ilmenite. The RTFT Havre-Saint-Pierre mine in eastern Quebec is home to the largest ilmenite deposit in the world. The ore is transported from there to the Sorel-Tracy metallurgic complex, just over an hour from Montreal, for processing into iron and titanium.

When it is smelted and processed into metallic form, titanium is light, resilient and corrosion-resistant. Most of Rio Tinto’s production is used in the automotive industry, to manufacture complex mechanical parts.

In South Africa, Rio Tinto holds a majority interest in Richards Bay Minerals, launched in 1976 and now the country’s largest mineral sands producer and a world leader in heavy mineral sands extraction and refining. RBM’s principal product is titanium dioxide in the form of an 85% pure titanium dioxide slag; the company also produces the higherpurity 95% titanium dioxide product rutile as well as pig iron and zircon, from the vast mineral rich sands of the northern KwaZulu-Natal province.

On the island of Madagascar, QIT Madagascar Minerals – a joint venture between Rio Tinto (80%) and the government of Madagascar (20%), also produces ilmenite, rutile and zircon. The raw material is shipped to the Rio Tinto Fer et Titane operation in Canada and processed into titanium dioxide.

Global operations for the modern world

www.riotinto.com

From Concept To Closure

Environmental Engineering and Consulting for the Mining Industry

u Strategic Consulting u Feasibility & Permitting u Development u Construction

Management u Operations u Closure For more information on how Foth can support the success of your project, contact Steve Donohue at (920) 4966806 or Steve.Donohue@Foth.com.

www.foth.com

Lithium

Few minerals have the economic potential of lithium, an important component in batteries for electric vehicles, energy storage facilities and consumer electronics. The Jadar Project in western Serbia is a worldclass lithium-borate deposit discovered by Rio Tinto in 2004. This is a unique deposit containing jadarite - a new lithium sodium borosilicate mineral found nowhere else in the world.

Jadar has been ranked as one of the most significant, high-grade lithium deposits in the world, with the potential to supply a significant amount of lithium and boric acid. Rio Tinto completed the detailed exploration of the Jadarite deposit in February 2020. At the end of July 2020, the project moved into feasibility study, with an investment of almost

Global operations for the modern world

$200 million on a scope that includes detailed engineering, land acquisition, workforce and supply preparation for construction, permitting and the early infrastructure development. The feasibility study is expected to be complete at the end of 2021 and, if approved, construction could take up to four years.

As recently as 10 December 2020, Rio Tinto disclosed to the Australian Securities Exchange (ASX) a maiden ore reserve and updated mineral resource at Jadar. Pre-feasibility studies showed that the project has the potential to produce both battery grade lithium carbonate and boric acid. The deposit is located on the doorstep of the European Union, one of the fastest growing electric vehicle markets in the world, and has the potential to provide lithium products into the EV value chain for decades.

In parallel, Rio Tinto has also started work on the commissioning of its lithium demonstration plant in the United States, which is extracting lithium from waste rock at its Boron mine in California. This plant could potentially produce 10 tonnes per year of lithium-carbonate.

As a pioneer in mining and metals, Rio Tinto maintains a portfolio of materials in demand around the world. Having disposed of its coal interests, the company now concentrates on iron ore for steel, aluminium for cars and smartphones, copper for wind turbines, electric cars and the pipes that bring water to our homes, not to mention borates for agriculture, titanium for paint, diamonds for glamour, and the resource of the future, lithium. With a history approaching 150 years, Rio Tinto looks set for the next century and beyond.