14 minute read

Newmont Corporation First among equals

newmont corp

first among equals

Advertisement

Celebrating its centenary as a corporation, the world’s No 1 gold miner negotiated the obstacles of the global pandemic to deliver a remarkable performance in 2020

Newmont Corporation announced its full year and fourth quarter 2020 results in February this year. After a year of unprecedented challenges, including social distancing measures, government-imposed mine closures, travel restrictions, and all the rest, the company managed to meet its fullyear guidance, generate a record $4.9 billion of cash, and increase quarterly dividend to $0.55 per share. On the softer side of the measurement criteria, Newmont was recognized as the top-ranked gold miner for the sixth consecutive year in the DJSI Index, announced industry-leading climate targets for greenhouse gas emissions and achieved the best safety performance in the company’s history.

LIMIT YOUR DOWNTIME, NOT YOUR PROFITS.

In a mining operation, profits grow under tight tolerances.

Every minute spent switching a paste line adds up fast, so we designed valves to make it quick, safe and simple. The welding needed to place and remove lines used to take days, so we created threaded couplings to dramatically reduce the man hours needed, and our case hardened pipe saves time and money over the long haul. So we are engineered for safety, and speed and durability, but when you add it up, we’re also engineered for profits.

Induction Hardened Pipe

• Exceptional abrasion resistance provides durability • Reduces downtime for line switching

Threaded Coupling Line

• Faster assembly, installation and removal • Allows for smaller bore holes • Reduces man hours from days to hours • Uses Induction Hardened Pipe for exceptional abrasion resistance and durability

Diversion Valves

• Quickly and easily switch lines – even under pressure • Increases safety and productivity • Eliminates need for extra equipment

To learn more: UT-Sales@ultratechpipe.com 1-800-626-8243 UltraTechPipe.com

Threaded Coupling Line Ultra 600 Pipe Systems

Pneumatic Diversion Valve

Low-Profile Manual Diversion Valve

“In 2020, Newmont achieved record performance including $3.6 billion of free cash flow and ending the year with over $5.5 billion of consolidated cash. These results enable Newmont to lead the industry in shareholder returns, invest in organic growth and maintain financial flexibility,” said Tom Palmer, President and Chief Executive Officer. “While generating record value for shareholders, we also achieved record safety performance with the lowest injury rate in company history. As we complete our 100th year, we will remain focused on delivering superior operational performance whilst creating value and improving lives through sustainable, responsible mining.”

During the year, Newmont completed the divestment of the Red Lake Complex in Canada, and the company’s 50 per cent ownership interest in Kalgoorlie Consolidated Gold Mines in Australia, along with its investment holdings in Continental Gold.

From an operations point of view, attributable gold production for the fourth quarter decreased 11 per cent to 1,630 thousand ounces from the prior year quarter, primarily due to the sale of Red Lake and Kalgoorlie, as well as lower production at Cerro Negro in Argentina while it managed Covid-19 restrictions.

For the year, attributable gold production decreased 6 per cent to 5,905 thousand ounces from the prior year, primarily due to Yanacocha and Cerro Negro being placed into care and maintenance in response to the Covid pandemic, lower ore grade mined at Ahafo and the above-mentioned sales. These reductions in production were partially offset by a full year of operations from assets acquired in April 2019 with the Goldcorp merger.

Portfolio improvements

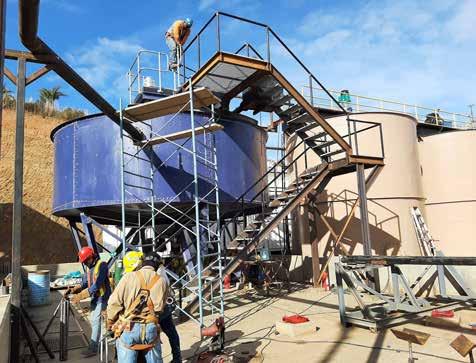

Portfolio improvements achieved during the year included the completion of materials handling projects at

first among equals

Musselwhite and Éléonore in Canada, the progression of the autonomous haulage system at Boddington and the Tanami Expansion 2 project in Australia.

Tanami Expansion 2 secures Tanami’s future as a long-life, low-cost producer with potential to extend mine life beyond 2040 through the addition of a 1,460 metre hoisting shaft and supporting infrastructure to achieve 3.5 million tonnes per year of production and provide a platform for future growth. The expansion is expected to increase average annual gold production by approximately 150,000 to 200,000 ounces per year for the first five years and is expected to reduce operating costs by approximately 10 per cent. Capital costs for the project are estimated to be between $850 million and $950 million with a commercial production date in the first half of 2024. 2020 also saw a mining method change at Subika Underground in Ghana, while advanced study work at Ahafo North (Ghana) and Yanacocha Sulfides (Peru) continued, with both projects expected to reach full funds approval in 2021.

Ahafo North expands Newmont’s existing footprint in Ghana, with four open pit mines and a stand-alone mill located approximately 30 kilometres from the company’s Ahafo South operations. The project is expected to add 300,000 ounces per year with all-in sustaining costs between $600 to $700 per ounce for the first five full years of production (2024-2028), with estimated capital costs of between $700 and $800 million. Ahafo North is the best unmined gold deposit in West Africa with approximately 3.5 million ounces of reserves. With over a million ounces of measured and indicated and inferred resources there is significant upside potential to extend beyond Ahafo North’s current 13-year mine life.

Yanacocha is South America’s largest gold mine, located between 3,500 and

first among equals

4,100 metres above sea level in the province and department of Cajamarca, approximately 800 kilometres northeast of Lima. The operation is a joint venture between Newmont (51.35%), Minas Buenaventura (43.65%) and Sumitomo Corporation (5%).

Yanacocha Sulfides will develop the first phase of sulfide deposits and an integrated processing circuit, including an autoclave to process gold, copper and silver feedstock. The project is expected to add 500,000 gold equivalent ounces per year with all-in sustaining costs between $700 to $800 per ounce for the first five full years of production (20262030).

The first phase focuses on developing the Yanacocha Verde and Chaquicocha deposits to extend Yanacocha’s operations beyond 2040 with second and third phases having the potential to extend life for multiple decades.

In the United States, Newmont’s operations in the state of Nevada have been combined with those of Barrick Gold since 1 January 2019. Identified synergies are expected to deliver up to $500 million per year over the first five years, then stepping down over time. These will come mainly from integrated mine planning, optimized mining and processing, cost reductions and the combination of Turquoise Ridge and Twin Creeks into a single mine. Production, CAS and AISC for the company’s 38.5 per cent ownership interest in Nevada Gold Mines is as provided by Barrick Gold Corporation.

In Canada, in December 2020, Newmont announced the successful completion of two key projects at its Musselwhite mine at Lake Opapimiskan, Ontario, with the full commissioning of the mine’s conveyor system and the material handling project.

“I am extremely proud of the work that has been completed by the team at Musselwhite to safely deliver these two critical projects, whilst managing through the unprecedented challenges

first among equals

caused by Covid-19,” said Tom Palmer. “Musselwhite is an important part of our North America region, and with the commissioning of these two projects is positioned to contribute to Newmont’s portfolio for many years to come.”

The conveyor system and the material handling systems work in association to efficiently move material from deeper mine levels to the surface. Haul distances are reduced as the ore crushed at depth will be hoisted from the underground crushers to the conveyor system and brought to the surface for processing.

Covid-19 response

The year’s achievements cannot obscure the effects of the pandemic, however. In addition to its normal operating costs, Newmont incurred incremental Covid specific costs of $92 million during 2020 for activities such as additional health and safety procedures, increased transportation and community fund contributions.

On 9 April 2020, Newmont announced the establishment of a US$20 million fund to help host communities, governments and employees combat the Covid-19 pandemic. The company continues to maintain wide-ranging protective measures for its workforce and neighbouring communities, including screening, physical distancing, deep cleaning and avoiding exposure for at-risk individuals.

Newmont has also been working closely with local governments, medical institutions, charities and non-governmental organizations to direct funds towards the greatest needs, targeting three key elements, employee and community health, food security and local economic resilience.

“Our purpose to create value and improve lives through sustainable and responsible mining is more relevant now than ever before,” said CEO Tom Palmer. “The strength of our portfolio

The worldwide leader in specialized drilling

Major Drilling is one of the world’s largest drilling services companies primarily serving the mining industry, and maintains field operations and offices in Canada, the United States, Mexico, South America, Asia and Australia.

SERVICES

Surface Underground

Core Drilling Heli-portable Reverse Circulation Directional Rotary Sonic Dewatering Energy Water Wells Drill & Blast

Core Drilling Percussive & Rotary Directional Reverse Circulation Dewatering Mining Services

of world-class assets across top tier jurisdictions underpins the financial flexibility to take care of our employees, communities and shareholders. I am proud of the way our employees have responded to these challenging times.”

The Peñasquito mine in Mexico is a good example of what he means. Newmont established infrastructure very early in the pandemic to keep employees and the surrounding communities safe, providing thousands of cleaning kits for health clinics and families, tens of thousands of reusable masks and thousands of books for distance learning.

Across the 18 testing sites the company established throughout Mexico, Newmont’s teams performed over 50,000 Covid-19 tests, testing people when they arrive at the site and also when they leave, so they can return to their families and communities safely.

In Ghana, elementary schools closed in March 2020, disrupting the education of many children. For some, due to limited access to digital devices and the internet, virtual learning has not been an option.

As part of Newmont’s Global Community Support Fund, and through the Gold-4-Gold Reading Program (a literacy initiative launched in 2019), Newmont Ghana rolled out a reading program in partnership with United Way Ghana and the Ghana Library Authority, designed to minimize the educational impacts of Covid-19 on children in the Ayawaso District of the capital city, Accra.

Another way of supporting communities is by local procurement. Plans have long been in place to optimize procurement and employment opportunities for key stakeholder groups by promoting local employability and skills development, diversity of the workforce, small business development for locals and sustainable business opportunities.

Developing and maintaining good relationships with suppliers is essential to Newmont’s overall success, so the company follows a sourcing strategy that utilizes only the highest performing suppliers for any type of good or service acquired. Its Supplier Code of Conduct sets out the minimum standards of conduct expected from all suppliers wishing to do business with, or on behalf of, Newmont, one of which is to embrace the company’s local procurement and employment philosophy, too.

Outlook

Newmont announced its 2021 outlook in February, with attributable gold production guidance of 6.5 million ounces and AISC (all-in sustainable costs) of $970 per ounce. Attributable gold production is expected to be between 6.2 and 6.7 million ounces per year in 2022 and 2023, increasing to between 6.5 to 7.0 million ounces in 2024 and 2025, with improving costs.

Newmont’s outlook reflects increasing gold production and ongoing investment in its operating assets and most promising growth prospects. The company has included Ahafo North and Yanacocha Sulfides in its outlook for the first time as the development projects are expected to reach execution stage in 2021.

“Newmont’s outlook remains strong and stable as we apply the rigour and discipline of our proven operating model across our world-class portfolio,” said Tom Palmer. “Our five-year outlook reflects improving production and costs as we continue to deliver value from superior operational and project execution. Our strong financial position allows us to continue investing in profitable, organic growth while simultaneously returning cash to shareholders through our industry leading dividend framework.”

The outlook for Africa shows production improving in 2021 with Subika Underground delivering higher tonnes at Ahafo, while Akyem benefits from higher grade. CAS (cost of sales) per ounce remains steady with higher grade at Akyem, offset by slightly higher costs at Ahafo due to stockpile processing and stripping from the Subika open pit.

Subika Underground should continue

first among equals

to deliver higher tonnes through 20222023 while Subika open pit reaches higher grade, partially offset by mine sequencing at Akyem. AISC increases in 2022 with sustaining capital spend for the tailings storage facility at Ahafo. Ahafo North then begins to ramp up in 2023, contributing to the higher production and improving unit costs.

In North America, Newmont foresees increased production in 2021 after a full year of operations at Peñasquito in Mexico, and Éléonore and Musselwhite (Canada). Peñasquito is expected to reach slightly higher grade and sustain ‘Full Potential’ improvements in the mill. Porcupine (Canada) will benefit from higher underground and open pit tonnes mined, partially offset by lower leach pad production at Cripple Creek and Victor (Colorado, US). Unit costs are also expected to improve with higher production from a full year of operations at Peñasquito, Éléonore and Musselwhite.

Through 2022 and 2023, Éléonore, Musselwhite and CC&V will deliver steady production while Porcupine benefits from higher grades in the Borden underground and the Hollinger open pit mines (in 2022) before Hollinger begins to ramp down in 2023. Peñasquito is, by then, mining lower grade, harder ore from the Chile Colorado pit while stripping the next phases of the Peñasco pit from 2022 to 2024.

Unit costs impacted by mine sequencing at Peñasquito, Éléonore, CC&V and Porcupine will be partially offset by improved productivity and efficiencies at Musselwhite, with the completion of the new conveyor system and lower mine material handling system.

In South America, a full year of production in 2021 from Cerro Negro is likely to be partially offset by Merian (Surinam) transitioning to harder rock and Yanacocha transitioning to a primarily leach operation while developing the first phase of the sulfide resources. Unit costs remain steady with higher production and improved productivity at Cerro Negro, offset by lower production at Yanacocha.

Production is forecast to improve through 2022-2023 with higher ore tonnes mined from Full Potential productivity improvements and mining from five to six ore sources at Cerro Negro. Yanacocha and Merian are expected to be impacted by slightly lower production due to mine sequencing.

In Australia, production will benefit in 2021 from Full Potential improvements at Boddington to sustain mill throughput at greater than 40 million tonnes per annum, while the site also benefits from higher grade in the South Pit. Tanami continues to deliver solid performance with 500,000 ounces of production while advancing the Tanami Expansion 2 project. AISC includes sustaining capital spend at Boddington to advance Autonomous Haulage, which is expected to reach commercial production in 2021.

Production at Boddington benefits from higher grade and improved efficiency from autonomous haulage beginning in 2022 before transitioning to stripping the next layback in 2023. Tanami will partially offset Boddington’s lower production in 2023 as Tanami Expansion 2 begins to ramp up.

Unit costs improve with higher grade and efficiency at Boddington and improved underground efficiencies at Tanami as the second expansion comes online.

Newmont has been careful to point out that its 2021 and longerterm outlook assumes operations continue without major Covid-related interruptions. The company continues to maintain wide-ranging protective measures for its workforce and neighbouring communities, including screening, physical distancing, deep cleaning and avoiding exposure for at-risk individuals. If continuing operations pose an increased risk to the workforce or host communities, Newmont says it will reduce operational activities up to, and including, care and maintenance and management of critical environmental systems. www.newmont.com