GUIDE 2 024/2 025

GUIDE 2 024/2 025

Publisher

Ricardo Seguin Guise

Editor-in-Chief

Mansha Daswani

Editor-at-Large

Anna Carugati

Executive Editor

Kristin Brzoznowski

Senior Associate Editor

Jamie Stalcup

Associate Editor

Alexa Alfano

Production & Design Director

David Diehl

Online Director Simon Weaver

Sales & Marketing Director

Dana Mattison

Sales & Marketing Manager

Genovick Acevedo

Bookkeeper

Ute Schwemmer

Ricardo Seguin Guise President

Anna Carugati Executive VP

Mansha Daswani Associate Publisher

Kristin Brzoznowski VP, Content Strategy ©2024 WSN INC. 401 Park Avenue South, Suite 1041, New York, NY 10016, U.S.A. Phone: (212) 924-7620

Website: www.tvkids.com

No part of this publication can be used, reprinted, copied or stored in any medium without the publisher’s authorization.

For a free subscription to our newsletters, please visit www.subscriptions.ws

more information, please contact Ricardo Guise at rguise@worldscreen.com, Dana Mattison at dmattison@worldscreen.com or Genovick Acevedo at gacevedo@worldscreen.com.

Mansha Daswani

Find opportunities within the chaos. That was the overarching theme at the TV Kids Summer Festival in June, where we explored the major challenges in the business today, including risk aversion, reduced content spend and the struggle to get kids to discover new shows.

The tips for coming out the other end of an unprecedented reset in the children’s content business include dusting off your co-production skills, having a well-thoughtthrough monetization plan and being strategic about how you seed and build a brand. And in this landscape, having a brand that has some awareness already is paramount.

Whether you’re financing a show based on an existing property or a brand-new idea, innovative solutions are crucial, but many producers are returning to the tried-and-true co-pro model.

As one of the world’s leading makers and distributors of children’s content, France serves as a good barometer for assessing the state of the market. Recent data from the CNC and Unifrance is a stark illustration of the challenges the sector is facing and the opportunities still ahead.

It was a difficult year for French animation exports, with revenues falling 11.2 percent in 2023 to €51.2 million ($58 million), led by a 70 percent plunge in the U.S. and a 6.6 percent drop in worldwide rights. Presales fared slightly better, falling 5.4 percent. The bright spot, however, was co-pro investment, which rose by 54 percent to €36.3 million ($40.4 million). Indeed, while the SVOD streamers have scaled back their kids’ commitments, the public and commercial channels that have long been the backbone of the industry are still collaborating to get projects off the ground.

While concerns remain about a market in the midst of transition, kids’ media executives are relying on ingenuity, creativity and some tried-and-true models to navigate this great reset. And there’s some fantastic IP available on the market, including the properties you’ll see highlighted in this edition of the TV Kids Guide

Director, Kids’ Content, U.K. & Ireland Sky

TV KIDS: What have you learned about what works best in a linear versus an on-demand environment?

MURPHY: In this age of a very crowded environment and “discoverability” being a buzzword, a linear channel gives you an opportunity to introduce a new show and create an appetite and a love for it that can then get translated into the ondemand environment. Linear also gives us an opportunity to create mood and energy, which you can’t really do on-demand in quite the same way. We can follow the rhythm of a young child’s day. Early in the morning, when kids are waking up, you want something that is going to get them into the day quietly. Then you bring all your big brands in before school. We have children of different ages available at different times of the day. We assume the bigger kids have gone off to school, so we can put on much younger-skewing programming during the middle of the day and think about what parents need at that moment.

TV KIDS: How much acquired fare is being programmed across the platforms?

MURPHY: We try to complement what we get from our pay partners. We look at where the gaps are so that we’re filling them in. We look for huge global brands—all the brands that you would expect from a premium entertainment service. When acquiring or commissioning, you really hope you’re going to find those little gems that are not known IP and are not big brands and have blossomed and flourished.

TV KIDS: How are the Sky brands positioned to be competitive in the U.K. kids’ entertainment landscape?

MURPHY: We’re looking all the time at what’s going to add value for our customers—what’s going to make them feel good about paying for their subscription. A part of staying competitive is about that value, and part of it is about keeping one step ahead so that you stay current, relevant and, most importantly, loved.

TV KIDS: What is on your wish list in terms of genres, age demographics and formats?

DEBERTIN: At KiKA, we have a big [appetite]. We started 27 years ago as a linear channel. We have the KiKAPlayer app that we have to feed. There’s a need for fiction, nonfiction, preschool, everything. For preschool, we’re cherry-picking. We’re looking at everything because you never know. Perhaps this one thing that you missed out on becomes the next big thing. I always say, Please go on our web offerings. That will tell you whether your show, your concept or your program could fit into this big picture of the KiKA world.

TV KIDS: Are you eyeing any content that taps into the creator economy?

DEBERTIN: All of us need and want to be close to our audiences. We have a show about gaming called Ansage! Kids from the preteen audience challenge the most beloved Twitch and YouTube stars. TickTack Zeitreise is hosted by twins Lisa and Lena, [German-speaking TikTok and Instagram stars]. They are covering history, and they are not doing it in the usual way. It’s helping to bond [with our audience]. They see that we take them seriously, that we are where they are, and we recognize that they have these new stars.

TV KIDS: What is your stance on exclusivity?

DEBERTIN: At a certain point, we need exclusivity and shows that set us apart from the others. Rights are very often a project-by -project decision. There is a third season of The Smurfs. We wouldn’t have become one of the three lead coproducers if we wouldn’t have gotten exclusivity. For free TV and BVOD, you need to have that. If you find The Smurfs everywhere, that’s a problem. So, I think it’s important. It’s also important nowadays to work on the right accompanying materials. We have to create touchpoints.

TV KIDS: Tell us about the role of acquired content on the M6 Group kids’ channels and platforms.

BOITRELLE-LAIGLE: For us, content is key. We do acquisitions, and we do prebuys. It’s essential to keep proposing new, high-quality content to maintain our leading position among kids and families. We have a free channel called Gulli, targeting children and families, and we operate two pay-TV channels in France. We’ve launched a platform called M6+, so we are looking for AVOD rights.

TV KIDS: How has your acquisition strategy shifted in the last year or two?

BOITRELLE-LAIGLE: In France, the market is really crowded and the media industry has to go through an intensive shift, so we have to keep communicating with children and the digitalnative generation to give them new content and [get] closer to these new consumer habits. We have to be agile to keep proposing new content and keep the financial balance.

TV KIDS: What is currently on your wish list?

BOITRELLE-LAIGLE: Gulli is targeting children and families, and it’s always a good start with Gulli to propose comedy shows that include our positive values. Comedy must be grounded in the daily lives of children, so they can recognize themselves in the show. TiJi is a preschool channel that [leans] slightly toward girls’ shows. And for Canal J, we are looking for an action-adventure for children from 8 to 12. We are looking for volume because we program big blocks on the grid.

TV KIDS: What is your stance on exclusivity?

BOITRELLE-LAIGLE: We work on a case-by-case basis. We have different approaches depending on the franchise. We need exclusivity. We need to offer this content and this experience only on our platforms and channels. We are taking exclusive rights wherever we can, but it always depends on the IP.

Head, Content & Programming Strategy

BBC Children’s

TV KIDS: What is the general breakdown between commissions, coproductions and third-party acquisitions for BBC Children’s?

TAGANOV: The BBC started acquiring way more in the last two years. But with our commissioning slate, the lion’s share of the budget is still going toward co-productions and fully funded commissions. We’re doing fewer fully funded commissions, and they’re mostly with public-service, traditional genres such as documentary, factual and factual entertainment. We’re looking for co-productions more and different levels of funding for animation and high-level liveaction entertainment, drama or comedy.

TV KIDS: What’s your stance on exclusivity and rights?

TAGANOV: For straightforward commissions or co-productions when we have significant investment, we’ll have a very clear outline in terms of what we expect for rights and holdbacks in the U.K. For acquisitions, we have become more open-minded lately. We’re open to sharing rights. We’re open to second windows. We are after uncoupled iPlayer rights, which wouldn’t be connected to linear broadcast. There are several titles that would benefit from exclusivity. It’s always a bespoke decision.

TV KIDS: What are the best ways to engage kids in “TV” content?

TAGANOV: Having a USP is very important. As a public-service broadcaster, our USP is local relevance. Our big competitors in this market are foreign companies; so, that’s something we can offer. Then, obviously, it depends on the audience. Commercial broadcasters and streamers very rarely cater to babies and toddlers. That’s what we can offer, and that’s where curation still matters. Parents rely on that.

It’s obvious that for each platform, the majority of views are driven by a handful of shows. So, the main thing to have is that big kahuna. Fewer, bigger, better. It’s embedded in our strategy.

Senior VP & General Manager PBS KIDS

TV KIDS: What’s your view on the state of public broadcasting?

DEWITT: Our support is steady. We have been able to stay the course. The things we feel that we need to be doing for kids are still there and are maybe even more critical, given learning loss during Covid and mental health challenges. It’s more important than ever that the U.S. has an accessible, engaging media option for kids that’s also noncommercial and isn’t feeling the same pressures in the same way. We are trying to think about how we are having an impact on kids and making sure that we reach as many kids as possible throughout the country. We aren’t having to watch that bottom line in the same way that a lot of others in the industry are.

TV KIDS: What’s guiding the commissioning strategy for linear?

DEWITT: For a couple of decades, our commissioning strategy has been looking beyond just linear and thinking about multiplatform options from the beginning. We have to be flexible and think about how IP can operate in all of these different spaces. We’re very much a creator-driven network. We also think about how we can fill gaps. What kinds of things are kids missing right now? We’re thinking a lot about early literacy skills, early math skills, the things that families seem to be struggling with right now, and how we can make sure that we are putting content in front of them that can support them as they are trying to get their kids back up to speed or excited about school and school-ready.

TV KIDS: How do acquisitions complement this slate?

DEWITT: Our primary focus is original content and content that we’ve had a hand in developing. Acquisitions are pretty limited. When we do think about them, we’re looking for opportunities to diversify our slate. We’re looking for content that fits nicely with the PBS KIDS mission, values and goals. Acquisitions are a good opportunity for us to experiment with different ways of engaging with the audience. But we don’t do them often; we’re more focused on commissioned projects.

TV KIDS: What is the role of acquired fare in RTÉ’s kids’ content?

KELLY: We have two main channels for children’s content. We have a preschool channel, RTÉjr, which runs from 7 a.m. to 7 p.m., and we also are on the parent channel from 7 a.m. to 5 p.m. We have loads of real estate to fill. We commission quite a lot of con tent—we have a vibrant animation sector in Ireland—but we’re always looking for [more]. We’ve got quite a lot of preschool options, but we’re always looking to enhance our drama offering for 8 to 12.

TV KIDS: How has your acquisition strategy shifted?

KELLY: An absolute prerequisite now is strong box-set rights for our VOD player. We used to operate on the basis that we would sometimes get a 30-day catch-up, but that just doesn’t suffice anymore. Children are moving away from linear content. Everything is on demand. If we can’t get those rights, then we’re just not buying that particular type of content. We’re also trying to build our brand significantly on YouTube, so we also argue quite strongly for content so we can create some kind of experience on that platform, [with a view to] pushing toward our player. There’s so much content coming in from the U.S. and the U.K. It’s very difficult to get kids to come to a public-service broadcaster. We are always looking at the various touchpoints we can create using the content in a clever way to try to engage them back to our service.

TV KIDS: What is your approach to exclusivity?

KELLY: We’re pretty happy with things like simultaneous broadcasts. We’re happy to geo-block for our territory. We’re not really that demanding. If we can just have strong box-set rights for our player and the ability to exploit a little bit on YouTube, we’re open to negotiation. The protectionist outlook on content is slightly old hat at this stage. You can deliver to your territory and to your audience [without] demanding that you own everything.

President, Animation

Paramount Animation & Nickelodeon Animation

TV KIDS: What have been the benefits of combining the Paramount and Nickelodeon animation divisions?

NAITO: With these two divisions being combined, we can be strategic with our talent, and we can provide opportunities for them to work across so many different kinds of content, which broadens their skills and allows them to work with us for many years.

TV KIDS: What is the strategy for animated TV series?

NAITO: Our lineup is comprised of known IP, but we are actively developing and looking to greenlight an original. The originals are so important. They speak to today. They add tremendous value to us because they’re adding to our library of great legacy titles.

TV KIDS: Have advances in technology sped up animation processes or made them more efficient?

NAITO: Making an animated movie or series takes a very long time. Technology is helping us quicken that process. Technology supports our ability to get visions on-screen. Artists can put their fingerprints on every aspect and make it feel irregular and handmade. At the end of the day, one thing will always remain: You need a great visionary and great artist behind the keys executing great work. Animation is a people process. It’s like workshopping a play over the course of many years. You get to iterate, change and make things better and rerecord, rewrite and reanimate.

TV KIDS: What are some of the ways you connect with young viewers today?

NAITO: You have to be focused on marketing campaigns that reach audiences, know where kids are and speak to kids. You have to tell stories that are relevant with characters that feel authentic and fresh and that kids can identify with and see themselves in. And then, how are you going to make everyone know you have these great characters and great stories? You’ve got to go to TikTok, Instagram and YouTube.

Senior VP, Development, Series & Strategy Disney Jr.

TV KIDS: What does Disney Jr. want to offer young viewers?

SAPIRE: Disney Jr. is the preschool brand for The Walt Disney Company and the first touchpoint for that lifelong relationship with Disney. We are careful about making sure that our stories are filled with signature qualities: magic, wonder, adventure and heart. We ensure that our characters are relatable and funny. We want young viewers to connect to our stories, to see themselves in our characters—who have a range of real emotions and experiences that kids can relate to—and also get a window into how others navigate relationships and emotions. Our characters are largely curious, optimistic and joyful; that’s a very real reflection of where preschoolers are at.

TV KIDS: How are you adapting major franchises such as Star Wars and titles from Marvel for young viewers?

SAPIRE: Disney Jr. is the only brand within The Walt Disney Company that brings together all of the company’s most iconic characters under one umbrella. We get to adapt iconic IP from Marvel to Lucasfilm to Disney Princess and Pixar, reimagining the stories and characters for a preschool audience. We make the characters younger and more relatable to our audience. When kids see characters as kids themselves, like a young Spidey or a young Ariel, they relate that much more, and they think they were made just for them. This is precisely what kids tell us themselves, and parents confirm all the time.

TV KIDS: Do Disney’s linear, streaming and digital platforms support one another?

SAPIRE: We meet our audiences where they are; whether it’s streaming globally on Disney+, our linear networks Disney Jr. and Disney Channel or our Disney Jr. YouTube channel, we have a treasure trove of content. Beyond the screen, we have pretty unrivaled products, parks and cruises that extend our storytelling in meaningful and memorable ways.

President & CEO WildBrain

TV KIDS: What considerations drove the restructure for WildBrain around content creation, audience engagement and global licensing?

SCHERBA: When we refer to our 360 strategy, it is about our full suite of inhouse capabilities, which allows us to go from initial concept through to screen and retail. Having those capabilities all inhouse makes us quite unique as an independent. It was a lot of work over the past number of years building out these in-house capabilities. To get to this next stage of growth for our own and partner IP, we needed a simplification and a focused approach. We started by taking a look at all of our inhouse capabilities and distilling them down into their core objectives. That’s how we landed on the three pillars of content creation, audience engagement and global licensing.

TV KIDS: What tools can you use to increase engagement with young viewers?

SCHERBA: One of the things that’s most fascinating about this generation of kids is their ability and desire to go seamlessly between different platforms to consume the content and brands that they love. Kids are doing their own curation; they go from screening something on an SVOD service to YouTube to nonYouTube AVOD and then over to gaming platforms. For brand owners to understand this and have a holistic strategy is a huge advantage. It was in that context that we set out to build this audience engagement pillar. Within this pillar are our worldleading YouTube network and our global distribution business, which includes licensing to streaming services, linear networks [and] non-YouTube AVOD and FAST. With our Canadian broadcast business, we’re able to leverage some of our programming expertise on YouTube AVOD channels. Also in this group is our digital marketing team, which is able to amplify fandom across these different platforms. Then, we’re providing advertising solutions to brands utilizing our inventory across these different platforms.

Chairman & CEO Cyber Group Studios

TV KIDS: Cyber Group Studios has studios in France, the U.S., the U.K., Italy and Singapore. What has been the strategy for expansion?

BOURSE: The strategy has been to identify top talents in key markets for animation. It was natural to look to these markets, particularly the U.K. and Italy, to find top creative talents in genres that are important for us. We also have a base in Los Angeles for North America. Then, it was logical to look at Asia. Asia is expected to be one of the fastest-growing regions for animation in the next five to seven years. And we already had a co-production with a great company in Singapore, Scrawl Studios. So, it was also logical to partner with them and have them be our development force for the Asia-Pacific region.

TV KIDS: Are new technologies making the process of animation any faster or more efficient?

BOURSE: Definitely. We are at the forefront of trends coming from the video game industry to the production of linear content with real-time rendering technologies. We are also heavily investing in research and development. We’ve been doing that in three main areas: real-time production, AI and machine learning. We do not see AI creating in lieu of artists. We see AI as enabling artists to go further and demonstrate their talent and creativity more.

TV KIDS: What opportunities do you see for further expansion?

BOURSE: We’ve been able to penetrate the regions we were not present in, and they have now become business opportunities. We are also looking at future expansion with new series genres, such as preschool comedies, anime and spooky comedies. We see this as a way to grow. We are also looking at expansion by reaching new age groups. The young adult group is an important target for us. You have to be able to offer the visual and cultural codes that this older age group is looking for. Technology helps you get that. For new technology, our motto is to use AI, machine learning and all these new trends as creativity enablers for artists.

Iginio Straffi Founder & CEO Rainbow Group

TV KIDS: What is driving gains for Rainbow Group?

STRAFFI: We have had quite a lot of success in the live-action division. Our service division is also doing very well. Last but not least, our animation series are doing great. We are working very carefully on the reboot of the Winx Club animated series, with a lot of attention to the storytelling, animation and graphics. We want to bring the show to a new audience, with all the DNA of Winx but with today’s quality ani mation and pace.

TV KIDS: How is the 20th anniversary of Winx Club being celebrated?

STRAFFI: We launched many activities and content on social media. We joined the main Comic Con events around the world. The biggest event was the official Winx Club 20th birthday party in Rimini on August 31.

In the new version of Winx , the graphics have changed. From the traditional 2D, we have created CGI models, and everything has been redesigned. The story will tell how Bloom joined the other Winx to form the Winx Club. In a coming-of-age story, she and the other fairies find out how to become more powerful and, most importantly, how to save the magic dimension from the dark forces who want to take control of it. We have put a new twist, and some new secrets will be revealed.

TV KIDS: What are the challenges in producing live action versus animation?

STRAFFI: We use storyboards and animatics usually used for animation to better develop some particular scenes for live-action series or TV movies. This gives us many advantages. It’s helpful with complicated scenes that may require more attention during shooting. We work on them and study all possibilities very carefully in advance to avoid difficulties on set.

Creator

Bob the Builder, PAW Patrol

TV KIDS: Is it harder to create a global IP success today than when you first started in this business?

CHAPMAN: When I first started, there hadn’t been that many big global breakout hits. Bob the Builder first started on TV on the BBC in 1999. Deep down, I was hoping for a big global show like The Muppets because I’d worked with Jim Henson and learned the business working there and seen how big a brand could go. Bob started off as a 13-episode show. By Christmas 2000, a year and a half later, it was the biggest preschool show on the planet. I had incredible luck with everything connecting. You do need the stars to align.

TV KIDS: Does the nature of creation for kids’ content need to change?

CHAPMAN: The way that we used to create shows—and the way I still do—[they have] a true story arc; we’re talking about the 52x11 traditional model or maybe 26 episodes. The more episodes you can get, the more chance you have of building a brand. But it’s been fragmented with all these new platforms, short-form on YouTube and TikTok, and Roblox. It’s a different way of doing things with these new, young creators. I still believe that in that classic preschool age group, from 2 to 5 especially, kids have not been corrupted. They will still sit down and watch those more traditional types of shows. Beyond 5 and 6, they’re watching stuff [that has] quick editing, quicker imagery, the storyline is less important. It’s more visuals, style and music.

TV KIDS: What are the keys to creating an IP that not only has staying power but also the potential for L&M and spin-offs?

CHAPMAN: I’m more commercial-minded, having come through an advertising background, working on brands where I had to find the USP, trying to find the big idea. What would capture the audience’s imagination and make it compelling to buy that product? I still use those skills in the way that I approach creating shows.

CEO CAKE

TV KIDS: How do you view the kids’ business today?

GALTON: The landscape has been challenging for the entire entertainment industry—but the kids’ industry is feeling it more so than other genres. A lot of that has to do with the market constricting. The wars between the big streamers seem to have come to an end. [The global platforms are] understanding better what their audience is looking for and are becoming more narrowly focused. They’re zeroing in on fewer, bigger brands. That’s a challenge for all of us independents trying to get new shows away. The advertising market has become difficult. Also, the nature of how kids are consuming content has shifted quite dramatically. Kids are not necessarily watching linear television anymore. They’re not necessarily watching any sort of content anymore, or at least not in the same way that they used to. They’re playing and living on game platforms a lot more than they had in the past. They’re snacking on content and not necessarily sitting down and watching a whole bunch of content on their own. When kids do that, it’s probably more in the family space with their parents. So, a lot of the broadcast partners are saying, We need content that’s going to work for co-viewing. Those are some of the challenges that we’re experiencing.

TV KIDS: What opportunities are there in the market for CAKE?

GALTON: We’ve been around for a long time. We’ve experienced down markets in the past. We’re small enough and nimble enough that we can withstand the down cycle because we’re not laden with debt and we’re not employing hundreds of animators. We still have a strong distribution business. When content is not getting produced, there’s still a need to fill platforms. That’s where the distribution business becomes handy. Finished content becomes more important. We use that as an opportunity to wait until the market gets a little bit better, and then we can bring content that’s new. We choose our projects pretty well. We do see opportunities in small pockets.

Albie Hecht Chief Content Officer pocket.watch

TV KIDS: What have you learned about the ways that kids want to be involved in their content today?

HECHT: We’ve had the privilege of working with the biggest kids and family creators in the world. On YouTube alone, we have over a billion subscribers and 660 billion lifetime views. We trust their instincts and work closely with them because they know their brand better than anyone else. One of the core attributes of those kid creators is how authentic they are. We don’t want to mess with what’s successful.

TV KIDS: What are some of the attributes that pocket.watch looks for to determine if a creator-led brand is ripe for franchise expansion?

HECHT: We look for an incredibly diverse portfolio. Not just diverse in nationality and origins from around the world, but also, importantly, in types of content. When you look at our portfolio, you’ll see everything from farming to gaming to mindfulness to art for kids. And that gives us the chance to look deeply into where the white spaces might be as opportunities for these creators and for content. And then we see how they perform in content syndication, ad sales and monetization.

TV KIDS: Looking ahead, what other areas will pocket.watch be investing energy into, as this whole business adjusts to shifts in the landscape?

HECHT: We’re definitely going to be expanding our content to our own services, like Ryan and Friends Plus and our FAST channels, and third-party platforms where we’re putting our content. We want to make our partners more money. We’re improving our monetization of creator content. Our ad-sales team is growing. Our mission is to be everywhere kids are. We’ll continue with consumer products, games and other franchise areas.

CEO

Gruppo Alcuni

TV KIDS: What is driving Gruppo Alcuni’s business today?

MANFIO: The entertainment market, specifically animation, is going through a rapid transformation with regard to new production trends and distribution strategies. I strongly believe innovation should be a guiding principle for every company seeking to increase its business. In this sense, Gruppo Alcuni is actively investing in research and development, along with executive training for the various sectors of our company. One key element to our strategy is scouting new talent, and in order to do so, we have established a school (with support from the autonomous province of Trento) for advancing young artists. Our objective is to provide them with the necessary skills to excel in the field of animation while giving them an opportunity to apply what they’ve learned by working with our creative and production teams. Along with this, I believe it is essential to keep diversifying our investments. From the outset, we specialized in preschool series. However, in recent years, we have successfully expanded into the kids’ market. Now, we are producing tween content. In addition, we have opened a theme park dedicated to our animated characters, the Talking Tree Park, while also investing in developing the video game market to further enhance our presence in the entertainment industry.

TV KIDS: How are you serving the needs of your broadcast and streaming clients around the world?

MANFIO: We are working to diversify and expand our content library so as to meet the various demands of broadcasters and streamers. However, it isn’t just a matter of increasing the quantity of our content; it is also essential that we strive toward quality. We do this by telling compelling stories that captivate an audience’s interest, wherever they may be in the world. I firmly believe it is possible to produce content that can spark a global interest, even if it is rooted in the culture and tradition of a singular geographic area.

President, Global Distribution & Consumer Products

Atomic Cartoons & Thunderbird Entertainment

TV KIDS: What types of shows are generating interest in sales?

GOLDSMITH: The global platforms want big IP. At our animation company, Atomic Cartoons, we’ve largely refocused our development on that. And they want bigger audiences. They want co-viewing and niche series. For example, we have a series that helps kids wind down their day that originally was targeted for autistic kids.

TV KIDS: Have there been changes in attitudes toward exclusivity?

GOLDSMITH: The good thing about the downturn in the last year is that almost every platform in the world is open to different funding strategies. A platform that has traditionally said, “We need global rights,” has now said, “It’s OK if you bring in a partner in a couple of territories and we can give them a first window.” That allows us to bring in co-production partners and do a couple of presales. It helps everybody because it gets these shows made.

TV KIDS: On how many platforms do you have to place a show in order to reach kids and gain exposure for your property?

GOLDSMITH: Most of the series that we invest in and distribute have very high consumer products value. When we take something out that has toy value, we sit with the toy companies and ask what they want us to do. Traditionally in the U.S., you had to be on Disney, Nickelodeon or Cartoon Network, and that is still the main priority for some toy companies and retailers, but it’s changing dramatically. We took out a series called Mittens & Pants. We showed it to the toy companies and the publishers, and they all had the same opinion, which was that this has to go everywhere. It will be on ten AVOD platforms in the U.S., on YouTube and on social media channels. Ultimately, one thing we can’t ignore is how important YouTube is to building any brand. No matter what platform you’re on, you need to have a very significant YouTube plan as well.

Joe Barrett VP, Global Sales PBS Distribution

TV KIDS: Have there been changes in attitudes to exclusivity?

BARRETT: [Buyers] always want exclusivity where they can get it. But there are two factors that are weighing in on this exclusivity piece. One is tightening budgets. The second is accessibility. The release approach needs to be multiplatform, and having your content on multiple platforms with tightening budgets tends to lean toward non-exclusivity. So, the attitudes are changing based on the complexity of the platform strategy.

TV KIDS: On how many platforms do you have to place a show in order to reach kids and gain exposure for your property in an ideal world?

BARRETT: All of them. PBS is a U.S.-based public broadcaster, and part of its mission is accessibility, making sure that it is on linear broadcasting, regardless of a child’s ability to access broadband. But, of course, we’re on streaming platforms and YouTube in short-form and long-form. We’re everywhere kids can be. A one-size-fits-all [rollout strategy] doesn’t work. Every market is different, but the one common denominator globally seems to be YouTube.

TV KIDS: What are some strategies to best monetize a show?

BARRETT: Have a windowing strategy that makes sense. Particularly with new series, you don’t want to be cutting and structuring deals on AVOD and FAST before the broadcast and SVOD deals just for the revenue they are generating. Secondly, be in as many territories as possible.

TV KIDS: What demand are you seeing for library product?

BARRETT: We have evergreen types of franchises in our portfolio. Having that evergreen characteristic of a program is critical for our catalog. Buyers do want that catalog title to squash risk aversion. By the same token, they want new, they want fresh. It’s a balancing act.

O (33-1) 8508-7022

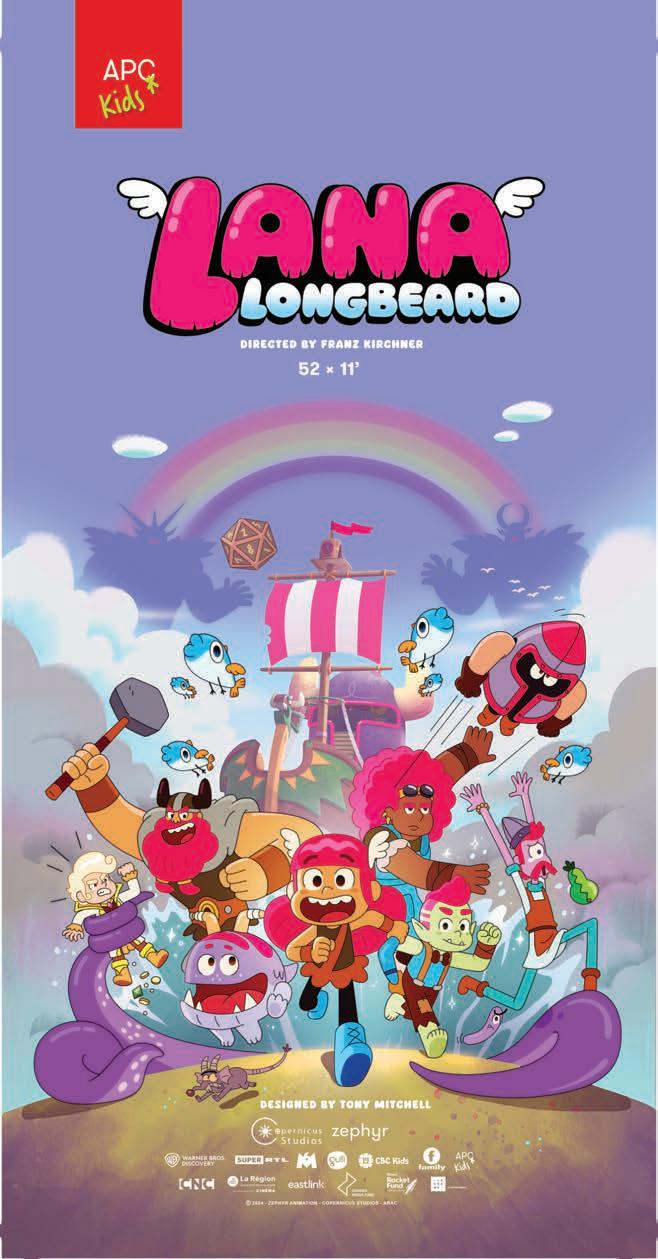

w www.aboutpremiumcontent.com

m lionel.marty@apckids.com

KEY CONTACTS:

Lionel Marty, Managing Director

Julie Mateille, Head, International Sales

Albertine Lacarrière, Sales Executive

PROGRAMS:

Lana Longbeard: 52x11 min., 2D, comedy/adventure/fantasy, kids; High Hoops : 10x30 min., live action, comedy, tweens; Ewilan’s Quest: 8x26 min., 2D, adventure, tweens; Nitso and the Very Hairy Alphabet: 26x7 min., 2D, educational, preschool; Hawa & Adam: 13x24 min., live action, sci-fi/drama, tweens/teens; Walter’s Christmas: 24x26 min., live action, fantasy/ adventure, kids/tweens; Isadora Moon: 48x11 min. & 2x22 min., 2D, comedy, kids; Jade Armor : 52x22 min., 3D, action/ adventure/comedy, kids; Tinka: 72x26 min., live action, fantasy/ adventure, teens/family; Angelo Rules: 78x7 min., 156x13 min., 46x11 min. & 1x60 min., 3D, comedy, kids.

“APC Kids, the children’s entertainment arm of leading independent distribution and production company APC Studios, has opted for a boutique approach to kids’ and family content, focused on a limited number of carefully chosen productions.

From animation to live action, across every genre and from TV exposure to brand building, we work with some of the most creative independent producers worldwide, with tailor-made services and long-term partnerships being key to our identity.

This MIPJunior and MIPCOM, we are excited to launch the 2D animated comedy-adventure-fantasy series Lana Longbeard , co-produced by our own production arm Zephyr Animation and Copernicus Studios for Warner Bros. Discovery (EMEA), Super RTL (Germany), M6’s Gulli (France) and CBC and Family Channel, a WildBrain company (Canada); the liveaction comedy High Hoops, produced by Can Can Productions for CBBC (U.K.); and Ewilan’s Quest, produced by Andarta Pictures and Vivi Film for France Télévisions.”

—Lionel Marty, Managing Director

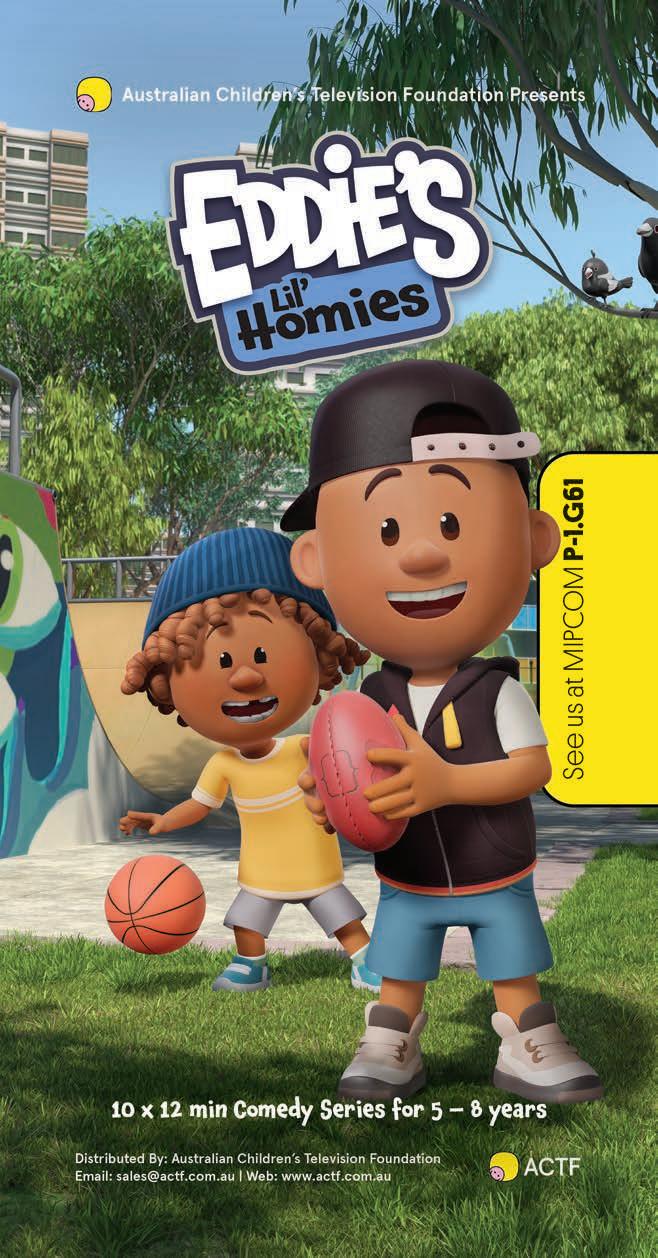

O (61) 9200-5500

w www.actf.com.au

m info@actf.com.au

KEY CONTACTS: Jenny Buckland, CEO

Bernadette O’Mahony, Head, Content

PROGRAMS:

Windcatcher: 1x80 min., live action, comedy/drama, family; Eddie’s Lil’ Homies : 10x12 min., 3D, comedy, 5-8; MaveriX : 10x30 min., live action, drama, teens; Kangaroo Beach: 52x12 min. & 2x30 min. specials, 3D, comedy, preschool; Crazy Fun Park: 10x30 min., live action, comedy/horror, tweens/teens; Hardball: 23x24 min., live action, comedy, 7-12; Built to Survive: 10x30 min., live action, wildlife/adventure, 7-12/family; Barrumbi Kids : 10x30 min., adventure/comedy, 7-12; Little J & Big Cuz: 50x12 min., 2D, adventure/comedy, 4-6.

Children from all over the globe enjoy watching Australian shows. The Australian Children’s Television Foundation (ACTF) distributes over 450 hours of Australia’s best children’s programming to more than 100 countries—including liveaction and animated series, preschool programs, short-form content, films and documentaries—to a global audience of preschoolers through to teenagers.

Our programs are very successful, attracting large audiences for broadcasters and winning a slew of international awards, including an International Emmy Award, the Prix Jeunesse, a Banff Rockie Award, the Japan Prize and many Australian Academy of Cinema and Television Arts Awards.

Kids love to watch quality shows that engage, inspire and make them laugh. It doesn’t matter where they’re from or what device they’re watching on—they just want to see good shows. And that’s universal! Buyers from around the globe will find content from the ACTF that offers kids a fabulous and engaging viewing experience.

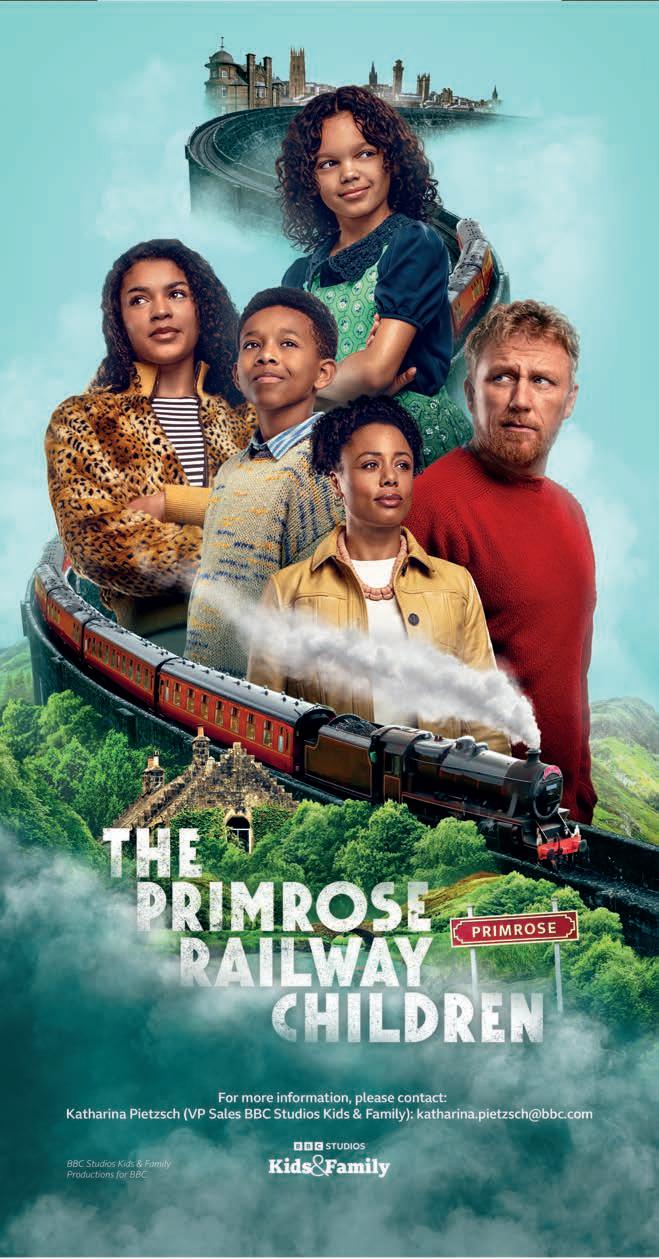

O (49-151) 1819-2581

w productions.bbcstudios.com/our-production-brands/kids-family

m katharina.pietzsch@bbc.com

KEY CONTACTS:

Katharina Pietzsch, VP, Content Sales

Stephanie Germann, Account Manager

Jacqueline Hall, Manager, Content Sales

PROGRAMS:

The Primrose Railway Children: 1x90 min./3x28 min., live action, family drama, 7+/family; Hey Duggee: S1-5 216x7 min., 2D, preschool; Hey Duggee’s Squirrel Club: 26x7 min., 2D, preschool; Supertato: 52x7 min., 2D, preschool; Bluey Minisodes: 20x1-3 min., 2D, preschool; Obki: S1-3 46x2 min. & 5x6 min., 2D, preschool/6+; Deadly 60: S1-5 81x30 min., live action, natural history, 6+; Pickle Storm: 10x22 min., live action, comedy, 6+; Stan Can: 52x11 min., 2D, preschool.

“We’re taking an incredible slate to Cannes with something for everyone, including a vibrant mix of live action and animation with strong international appeal. Our offering covers scripted with the cinematic, feature-length family drama

The Primrose Railway Children , starring Hollywood actor Kevin McKidd. Based on Jacqueline Wilson’s novel of the same name and adapted by Tom Bidwell ( The Velveteen Rabbit , The Irregulars ), it’s a modern retelling of the classic The Railway Children. In the preschool animation space, we’re especially excited about our brand-new season of Supertato , with its slapstick silliness, superhero antics and some new veggie characters. We also have Hey Duggee’s Squirrel Club , an interactive spin-off show, and Bluey Minisodes , created to dive deeper into the wonderful world and characters of Bluey. There’s also natural history with a new season of Deadly 60, as explorer Steve Backshall continues his mission to meet more of the planet’s deadliest creatures.”

—Katharina Pietzsch, VP, Content Sales

O (1-416) 591-0065

w www.boatrocker.com

m sales@boatrocker.com

KEY

Jon Rutherford, President, Global Rights, Franchise & Content Strategy, Boat Rocker Studios

Gia DeLaney, Senior VP, Global Sales, Kids & Family

Henry Or, Senior VP, Strategic Partnerships, Asia

Jessica Watson, VP, Global Sales & Strategic Partnerships

Kelsey Griffin, Director, Global Sales & Creative Partnerships

PROGRAMS:

Dino Ranch: S1-3 52x11 min. each, 3D, comedy/adventure, 2-5; Olga Da Polga: S1 13x11 min./S2 15x11 min., mixed media, family, 4-7; Daniel Spellbound : S1-2 10x30 min. each, 3D, action/adventure, 6-11; The Strange Chores: S1-3 26x11 min. each, 2D, adventure/comedy, 6-11; Lex & Plu: S1-2 26x11 min., 2D, adventure, 6-11; Kingdom Force : 52x11 min., 3D, action/adventure, 3-6; Trulli Tales: S1 52x11 min. & 23x1 min. specials/S2 52x11 min., 2D, comedy/adventure, 3-6; Remy & Boo : 52x11 min., 3D, comedy/adventure, 2-5; The Bigfoots : 26x11 min., 3D, family sitcom/adventure, 4-7; Love Monster: S1 54x7min./S2 25x7 min. & 1x14 min. special, 2D, comedy/adventure, 2-5.

“Boat Rocker develops, produces and monetizes a catalog of premium live-action and animated entertainment for audiences around the world. The Kids & Family division collaborates with Rights & Brands on multiple franchise properties. With leading in-house animation capabilities and artful storytelling through Jam Filled Entertainment (2D and 3D animation) and an investment in Industrial Brothers (kids’ and family animation), Boat Rocker is an award-winning global provider of truly original kids’ and family content.”

—Gia DeLaney, Senior VP, Global Sales, Kids & Family

w cakeentertainment.com

m info@cakeentertainment.com

KEY CONTACTS:

Ed Galton, CEO

Dominic Gardiner, Managing Director, Distribution

Daniel Bays, Senior VP, Development

PROGRAMS:

Talking Tom Heroes Suddenly Super: 52x11 min., 3D, action/adventure, 4-7; Nikhil & Jay: 52x11 min., 2D, comedy/ adventure, preschool; Mechamato: 104x11 min. & 1x120 min. movie, 3D, action, 6-12; Moley: 104x11 min. & 1x120 min. movie, 3D, adventure, preschool; Tish Tash: 104x5 min., 2D, adventure, preschool; Cracké Family Scramble: 52x7 min., 3D, nondialogue/comedy, 4+; Angry Birds Summer Madness: 32x11 min. & 4x22 min., 2D, comedy, 6-11; Total Drama Island: 26x22 min., 2D, comedy/reality/adventure, 6-12; Lucas the Spider: 78x7 min., 3D, comedy, preschool; Mush-Mush & the Mushables : 96x11 min. & 4x22 min., 3D, comedy/adventure, 4-8.

CAKE is a leading independent entertainment company specializing in the production, distribution, development, financing and brand development of kids’ and family properties. CAKE Distribution works with renowned producers, including Rovio Entertainment, Fresh TV, Kickstart Entertainment, Coolabi and Ragdoll Productions. Following the recent acquisition of the Jetpack brand, CAKE’s catalog now comprises over 3,200 half-hours from IPs such as Dennis & Gnasher: Unleashed!, Talking Tom and Friends, Clangers and more.

CAKE Productions drives CAKE’s development and production activities on shared and originated projects. With over 13 properties in development, productions include Angry Birds Summer Madness for Netflix, Mama K’s Team 4 with Triggerfish Animation for Netflix, Pablo with Paper Owl Films for CBeebies, Mush-Mush & the Mushables with La Cabane and Thuristar and the forthcoming Nikhil & Jay with King Banana TV and Paper Owl Films, set to premiere on CBeebies in 2024.

An award-winning company, CAKE is based in London, with offices in Berlin, Los Angeles and Toronto.

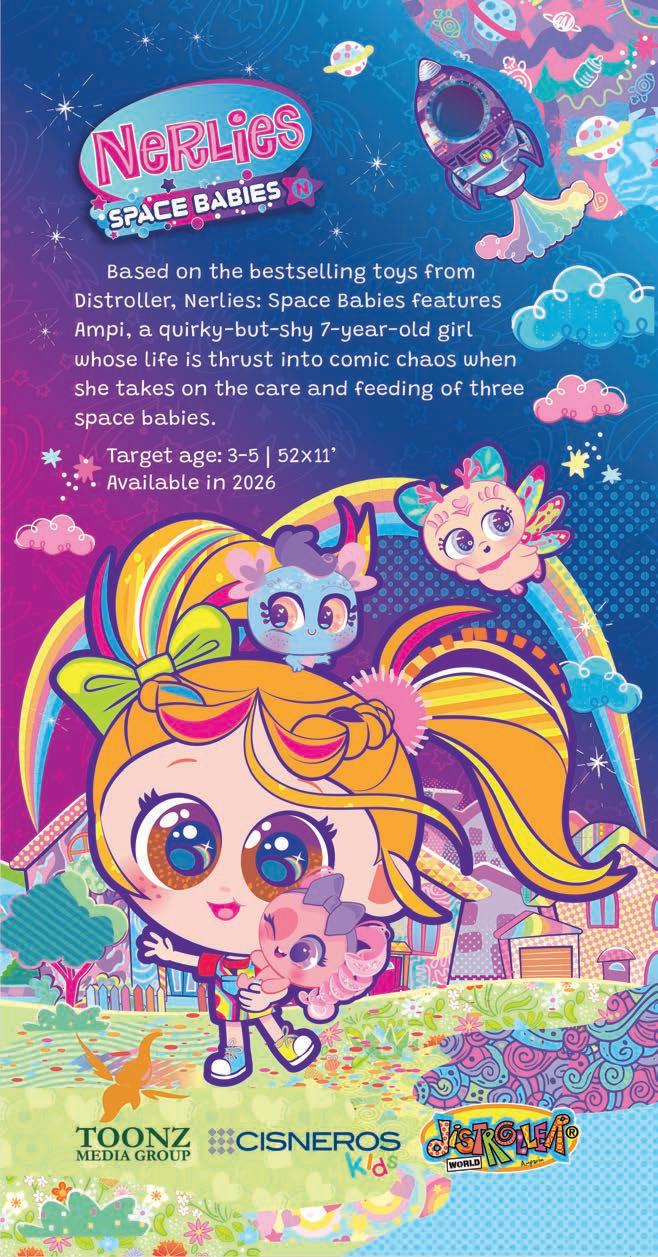

O (1-305) 442-3400

w cisneros.com

m ccabrera@cisneros.com

KEY CONTACTS:

Ailing Zubizarreta, VP, Content Development & Creative Services

Carlos Cabrera, VP, Sales

PROGRAMS:

Nerlies: Space Babies : 52x11 min., animation, 3-5; Zumbar : 26x5 min., live action/mixed media, 6-11; AnimalFanPedia: 26x11 min., edutainment, kids/family; Super Genius: 104x30 min., live action/VFX, edutainment, kids/family; Deva Dives In : 52x11 min., 3D, preschool; Pat Patagonia: 26x11 min., 3D, 6-11.

Cisneros Kids is Cisneros Media’s children’s and family division. Driven by passion and purpose and rooted in diversity, curiosity, inclusion and family values. We strive to give all children a voice and space in the world.

O (33-1) 5556-3213

w www.cybergroupstudios.com

m sales@cybergroupstudios.com

KEY CONTACTS:

Raphaëlle Mathieu, Chief Operating Officer

Pierre Belaïsch, Chief Creative Officer

Michèle Massonnat, Head, Sales & Acquisitions

PROGRAMS:

Alex Player: 26x22 min., 2D/CGI, adventure/esports, kids; Press Start!: S1 52x11 min., CGI, comedy/adventure, bridge; Droners: S2 52x22 min., 2D/CGI, adventure/comedy, kids; Gigantosaurus: S1-3 156x11 min./78x26 min., 2D/CGI, comedy/adventure, upper preschool; The McFire Family: 52x11 min., CGI, family/adventure, bridge; 50/50 Heroes: 52x11 min., 2D, comedy/adventure, kids; Taffy : S1-2 156x7 min., 2D, cartoon/comedy, kids/family; Nefertine on the Nile: 52x13 min., 2D/CGI, comedy, bridge; Zak Jinks : S1-2 104x13 min., 2D, comedy, kids; Squared Zebra : 78x7 min., 2D, comedy/edutainment, preschool.

“Cyber Group Studios is thrilled to showcase our latest productions at MIPCOM. This includes the fully delivered kids’ series Alex Player, commissioned by France Télévisions and Rai Kids, centered on the exciting world of esports. We will also present the first episodes of Press Start!, an original Peacock show based on the best-selling children’s novel, launching this fall in the U.S. and already presold to Discovery Italy. Additionally, we are excited to unveil the first images of The McFire Family, commissioned by M6’s Gulli and Rai Kids and presold to Radio-Canada and Super RTL. Finally, Gigantosaurus returns for a fourth season, commissioned by France Télévisions and NHK, with the first episodes available in fall 2025.”

—Michèle Massonnat, Head, Sales & Acquisitions

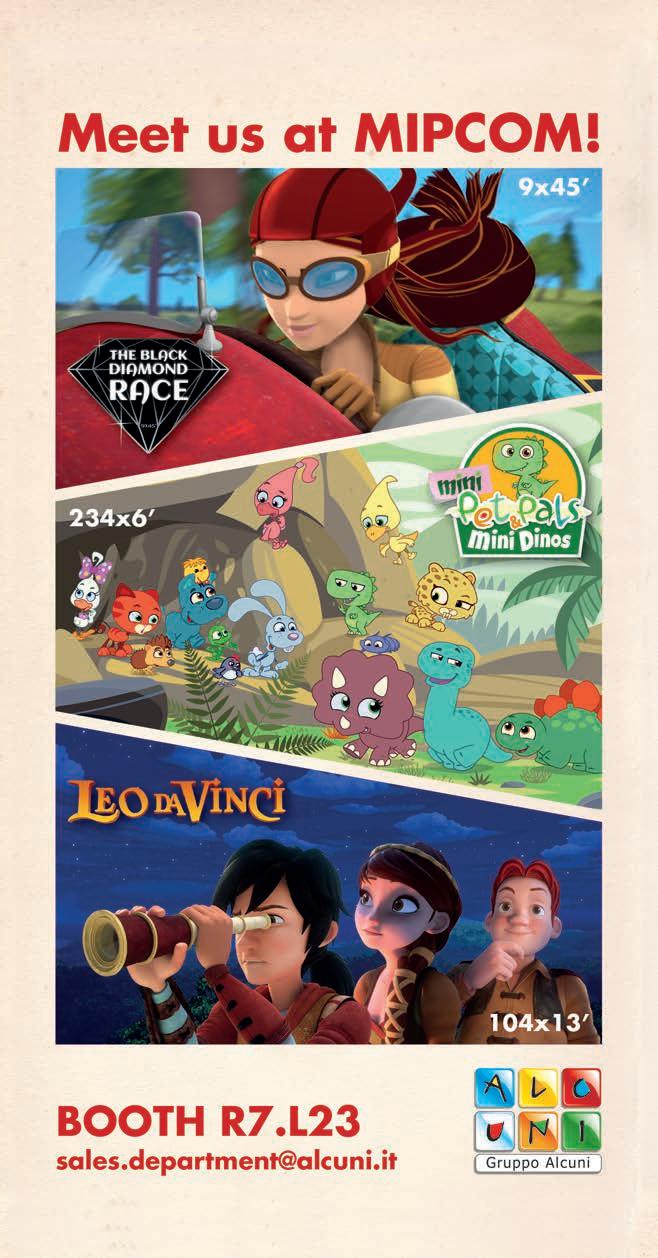

O (39-0422) 301060

w studios.alcuni.it/en

m sales.department@alcuni.it

KEY CONTACTS:

Francesco Manfio, CEO

Kristina B. Simon, Head, Global Distribution

PROGRAMS:

The Black Diamond Race: S1 9x45 min., CGI, adventure, 8-12; Leo da Vinci: S1-2 104x13 min., CGI, adventure, 5-10; Mini Pet Pals: S1-3 156x6 min., 2D, comedy/adventure, preschool/2-5; Mini Pet Pals Start School: S1 52x6 min., 2D, comedy/adventure, preschool/3-6; Mini Pet Pals & Mini Dinos: S1 52x6 min., 2D, comedy/adventure, preschool/2-5; Gateway 66: S1 52x6 min., 2D/live action, adventure/science, 5-8; Vlady & Mirò : S1 26x5 min., 2D, slapstick, family.

“Gruppo Alcuni produces and distributes high-quality entertainment, including CGI 3D/2D television series and animated feature films for global audiences. The animated content is completely original and non-violent, promotes positive values and helps youngsters develop many diverse skills. To date, our productions have been distributed in more than 150 countries worldwide.

This MIPJunior and MIPCOM, we are launching The Black Diamond Race, an original upper kids series taking place in 1929. The plot revolves around our young heroine Rani’s adventures with her friends and their death-defying showdown with wicked Mister K. Needless to say, we’re thrilled to have great, enthusiastic partners on board. The show is expected to launch early next year on Rai and RTVE.

Our company is all about kids. In 2008, we also established the Talking Tree theme park, where youngsters and their families can experience extraordinary adventures with their favorite Gruppo Alcuni animated characters.”

—Kristina B. Simon, Head, Global Distribution

O (1-416) 599-4878

w gurustudio.com

m sales@gurustudio.com

KEY CONTACTS:

Frank Falcone, President & Executive Creative Director

Dave Padbury, Development Executive

PROGRAMS:

123 Number Squad! : 104x11 min., 3D, preschool; Big Blue : 52x11 min., 2D, comedy, 5-9; Pikwik Pack: 52x11 min., 2D, preschool; True and the Rainbow Kingdom: 30x22 min., 5x22 min. seasonal specials & 1x44 min. holiday special & bonus content, 3D, preschool; Justin Time : 74x11 min. & 2x22 min., 2D, preschool.

“Guru has a long track record of building iconic brands that resonate around the world. On the production front, we’re always seeking worldclass broadcast and co-production partners to join us on our exciting, new projects.

Based on the best-selling children’s book Where’s Spot? , we’re developing a new TV series, Spot & Friends , which follows the beloved, rambunctious and curious puppy Spot as he explores the big, wide world around him. Our focus is finding partners who are looking to participate in the reboot of this 40-year, best-selling heritage property. Where’s Spot? is currently a top ten-selling book on Amazon.

True and the Rainbow Kingdom , our Emmy-nominated, Netflix-commissioned series, now has over 2 billion views on YouTube and millions of subscribers. With increasing demand, we are looking to find additional broadcast and brand partners.”

—Frank Falcone, President & Executive Creative Director

w www.kidoodle.tv m content@kidoodle.tv

Brenda Bisner, Chief Content Officer

ABOUT:

Kidoodle.TV, the Safe Streaming service for kids and families globally, is celebrating its tenth anniversary in 2024. Once again showing up for MIPCOM and MIPJunior, Kidoodle.TV is a leading AVOD and FAST channel. Available in over 160 countries and territories and hundreds of millions of homes and clocking in with over 45,000 episodes, families choose Kidoodle.TV for the important moments in the home. Owned by A Parent Media Co. (APMC), with a vision to develop technical solutions that better match what audiences expect in their streaming, Kidoodle.TV has been the catalyst for APMC’s expansion in offerings. APMC offers streaming and monetization solutions to some of the biggest brands, including VIDAA/Hisense’s Kids and Family offering. In 2023, APMC launched the official Dude Perfect streaming service. Lastly, APMC has recently launched the first free direct-to-consumer sports streaming service, Victory+.

“ Over the last decade, we have grown Kidoodle.TV to be a destination trusted not just within the industry but within the homes of children globally. Today, our footprint has expanded, and APMC has aligned with the biggest brands in the world across multiple genres, including, most recently, sports. As the landscape continues to evolve, we are proud to be at the forefront of the change.”

—Brenda Bisner, Chief Content Officer

w www.lionforgeentertainment.com

m sales@lionforge.com

KEY CONTACTS:

Stephanie Sperber, President & Chief Content Officer

Kirsten Newlands, Executive VP, Production & Partnerships

Jonathan Abraham, Director, Global Media Sales

PROGRAMS:

Iyanu: 26x22 min., animation, action/adventure, 6-11; Bugtron: 52x11 min., animation, action/adventure, 4-8; Best Wishes : series of films, live action, YA comedy, girls 10-16; Jubilee! : 52x11 min., animation, socio-emotional/comedy, girls preschool; The Secret Society of Rebel Girls : 20x22 min., live action, single-camera comedy, girls 6-11; Chicka Chicka Boom Boom: 52x11 min., animation, adventure/comedy, preschool.

Lion Forge Entertainment (LFE) is an Academy Award-winning, Black-owned animation and live-action studio focusing on diverse stories, authentically told.

Founded in 2019, LFE focuses primarily on the kids’ and family and YA demographics. We showcase and celebrate talent from underrepresented communities through TV, film, publishing and consumer products. LFE is dedicated to ensuring that all kids and families see themselves represented on-screen and to developing career opportunities for women and minorities.

We focus on building global transmedia franchises around Lion Forge IP; expanding partnerships through distribution, financing and co-production; spearheading licensing and merchandising initiatives; and live-action film and TV development.

Lion Forge Entertainment is based in Los Angeles, California, with a preproduction studio based in Atlanta, Georgia, and is part of the Polarity group of companies, which includes Oni Lion Forge Comics (domestic publishing) and Magnetic Press (international publishing).

O (44-207) 631-1800

w www.magiclightpictures.com

m distribution@magiclightpictures.com

KEY CONTACTS:

Michael Rose, Managing Director

Martin Pope, Managing Director

Muriel Thomas, International Distribution Director

PROGRAMS:

Pip and Posy: 104x7 min., 3D, comedy, 3-5; The Gruffalo & The Gruffalo’s Child: 2x27 min., 3D, 3-7; Zog & Zog and the Flying Doctors: 2x27 min., 3D, comedy/adventure, 3-7; Tiddler: 1x25 min., 3D, comedy/adventure, 3-7; The Smeds and The Smoos: 1x27 min., 3D, comedy/adventure, 3-7; Superworm: 1x26 min., 3D, comedy/ adventure, 3-7; The Snail and the Whale: 1x27 min., 3D, adventure, 3-7; Stick Man: 1x27 min., 3D, comedy/adventure; Room on the Broom: 1x26 min., 3D, comedy/adventure, 3-7.

“Magic Light Pictures is renowned for its captivating CG-animated half-hour specials, which are adored by millions of viewers in the U.K. and worldwide. They have won a multitude of awards, including four International Emmys and four BAFTAs, and been nominated for three Oscars. We work consistently with the finest acting and creator talent to ensure that our productions have the Magic Light vein of quality running through them.

Our in-house distribution team sells and distributes our productions internationally, working with over 300 partners all over the world. Endeavoring to build long-term relations and always expanding our worldwide network of contacts, we work with carefully chosen partners in each territory to connect our shows with the widest audiences locally and globally through television, home entertainment, platforms, cinema and festivals.”

—Muriel Thomas, International Distribution Director

O (1-310) 252-2000

w www.mattel.com

m content_sales@mattel.com

KEY CONTACTS:

Ynon Kreiz, Chairman & CEO

Josh Silverman, Chief Franchise Officer

Alex Godfrey, VP, Content Distribution

PROGRAMS:

Hot Wheels Let’s Race: 10x24 min., 3D, adventure/comedy, 4-6; Barney’s World: 52x11 min., 3D, friendship/educational, preschool/ 2-6; Masters of the Universe: Revolution : 5x25 min., 2D, action/adventure/fantasy, 6-11; Polly Pocket: 13x11 min., 2D, adventure/friendship, 6-11; Thomas & Friends: All Engines Go: 26x11 min., 2D, adventure/friendship/educational, preschool/ 2-6; Barbie Mysteries: The Great Horse Chase: 8x25 min., 3D, adventure/fantasy, 6-11; Barbie: A Touch of Magic: 13x22 min., 3D, adventure/fantasy/friendship, 6-11; Monster High : 20x22 min., 3D, fantasy/comedy, 6-14; Barbie and Stacie to the Rescue: 1x60 min., 2D, adventure, 6-11.

“In 2024, Mattel Television Studios saw remarkable growth for IP-driven programming. Highlights include a new season of Thomas & Friends: All Engines Go, featuring its first-ever 60-minute holiday special; the debut of an allnew animated series, Barbie Mysteries: The Great Horse Chase; and the second season of Hot Wheels Let’s Race , which premiered in September, following the successful first season, which spent four weeks in the global top ten TV (English) and reached top ten TV in 69 countries. Additionally, the all-new animated series Barney’s World launched globally this fall. We reintroduced the beloved purple dinosaur to audiences with fresh takes on classic songs, familiar faces and new characters, inspiring a new generation around the world to love each other and themselves. Looking ahead to 2025 and beyond, Mattel is excited to celebrate its 80th anniversary and continue creating content for a wider family audience across live action and animation.”

—Alex Godfrey, VP, Content

Distribution

w www.mediawankidsandfamily.com m contact.mkf@mediawan.eu

KEY CONTACTS:

Julien Borde, President

Katell France, General Manager & Chief Content Officer, Method Animation

Erick Rouillé, Senior VP, Global Distribution & Consumer Products

PROGRAMS:

Pirate Academy : 52x13 min., 3D, comedy, 5-8; Robin Hood, Mischief in Sherwood: S4 52x13 min., 3D, comedy, 5-8; The Enchanted Village of Pinocchio: 52x11 min., 3D, comedy, 5-8; Barnkidz: 52x13 min., 3D, comedy, 5-8; Miraculous, Tales of Ladybug & Cat Noir: S5 26x16 min., 3D, action, 6-10; Maddie + Triggs: 52x7 min., 2D, comedy, 4-6; The Specials: 10x13 min., live action, comedy, 8+; Dogmatix and the Indomitables : S2 52x13 min. , 3D, comedy, 5-8; The Little Prince & Friends: 52x13 min., 2D, adventure, 4-6; Sonic Boom: S2 52x13 min., 3D, 6-10.

Discover the Three Musketeers as you’ve never seen them before! Freshly reimagined for a new generation of children ( 6- to 10year-olds) and co-produced by Mediawan Kids & Family’s label Method Animation and Palomar Animation (Mediawan Group), in association with Germany’s ZDF and ZDF Studios and with the pa rticipation of France Télévisions and Rai Ragazzi, The 3 Musketeers is a CGanimated 52x11-minute series that updates Alexandre Dumas’ masterpiece with the introduction of the iconic swashbucklers as strong girls adventuring through France defending a young King Louis XIII.

“We are excited to present for the very first time this brandnew adaptation of the iconic French IP at MIPJunior. The twist we have imagined is refreshing and in complete alignment with the values of diversity and modernity that we uphold in our production choices. We are convinced that children all over the world will be immediately transported.”

—Katell France, General Manager & Chief Content Officer, Method Animation

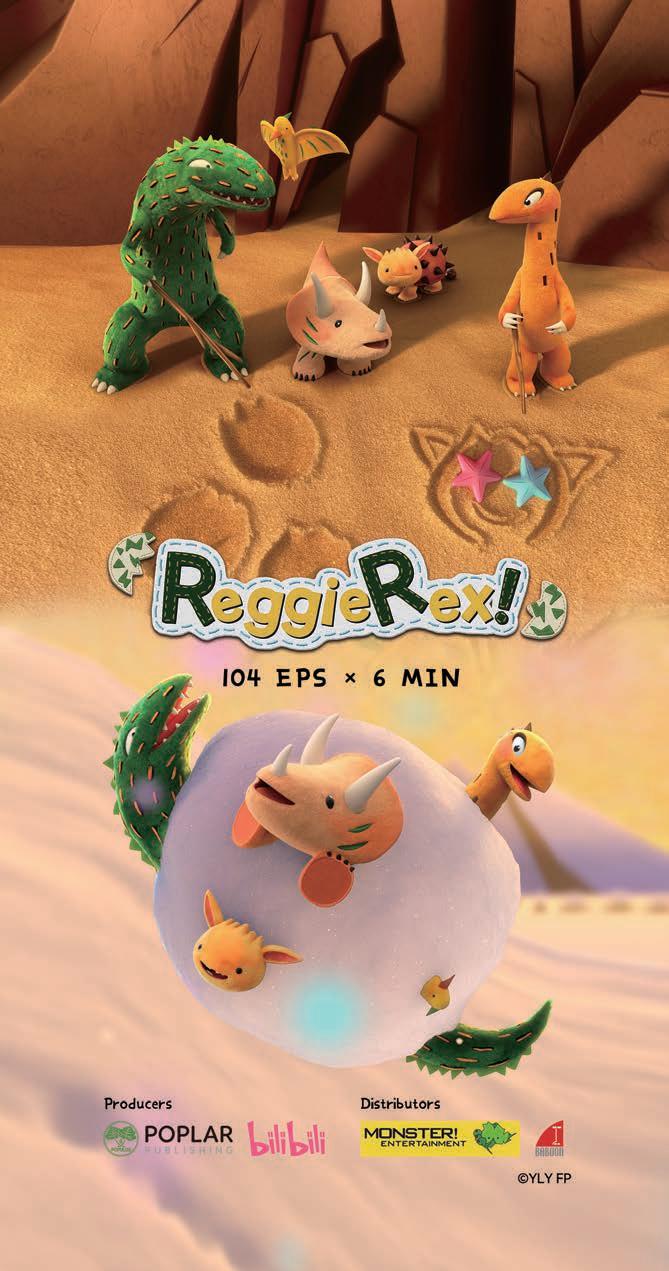

w www.monsterentertainment.tv

m andrew@monsterentertainment.tv

KEY CONTACTS:

Andrew Fitzpatrick, Chairman

Ania Rozenszprung-Clinton, Head, Sales & Acquisitions

PROGRAM:

Reggie Rex! : S1-2 104x6 min., 3D, comedy/adventure, preschool/bridge.

Based on the 24 million-selling preschool book series You Look Yummy!, translated in seven languages and published by Japan’s POPLAR Publishing and worldwide sub-publishers, Reggie and his plush dino pals are now stampeding toward global TV stardom.

Currently viewed by over 1.1 billion people in China on over 160 TV stations, including BRTV Kaku Children’s Channel and Bilibili’s own platform. Now, Monster Entertainment brings Reggie Rex! to the Western world. We are quickly locking in broadcasters, including RTÉ and Česká televize, as well as beIN throughout the MENA region. Monster welcomes you to join the success!

Reggie Rex! was developed and written by Baboon Animation, the DreamWorks alum-founded development, writing and voicedirecting studio with 31 Emmys among its teammates collectively. Keep an eye out for the forthcoming Reggie franchise.

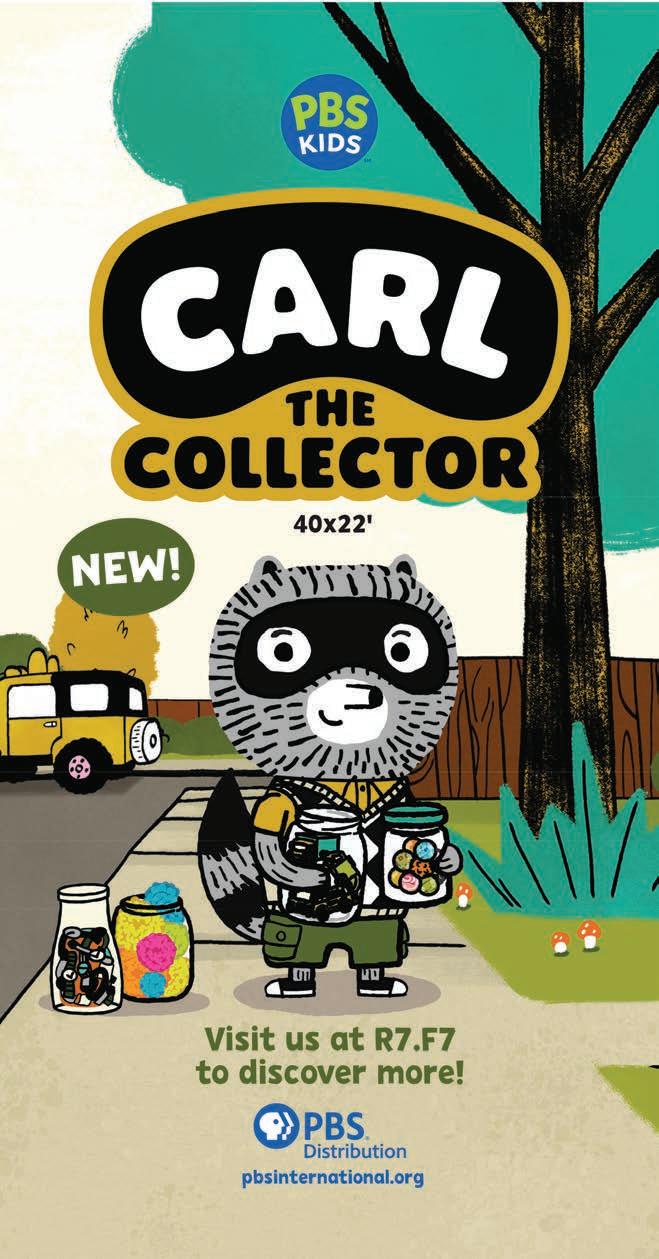

w pbsinternational.org

m aburton@pbs.org; jshata@pbs.org; saguirre@pbs.org

KEY CONTACTS:

Andrea Burton, Senior Director, Business Development, Europe

Jamie Shata, Senior Account Manager, Canada, MENA, Africa & AsiaPac

Sabrina Hall Aguirre, Sales Manager, LatAm

PROGRAMS:

Carl the Collector: 40x22 min., 4-8; Lyla in the Loop: 80x11 min./ 40x24 min., 4-8; Work It Out Wombats!: 80x11 min./40x24 min., 3-6; Elinor Wonders Why: 134x11 min./67x25 min. & 1x55 min. special, 3-5.

“As a leader in the children’s content market, PBS Distribution is committed to delivering high-quality kids’ programming that resonates with families and young audiences. PBS KIDS is committed to making a positive impact on the lives of children through curriculum-based entertainment. Our portfolio includes beloved PBS KIDS shows such as Arthur , Elinor Wonders Why and Work It Out Wombats!, which continue to engage, inspire and entertain children. We remain dedicated to expanding our reach through innovative digital platforms, ensuring that our content is accessible to audiences worldwide. We’re also excited to launch a brand-new series at MIPJunior, Carl the Collector, which is PBS KIDS’ first series featuring a lead character on the autism spectrum. This series is a significant step forward in our commitment to inclusion and empathy, wrapped up in humor, heartfelt relationshipbuilding and social-skills development.”

—Joe Barrett, VP, Global Sales

O (39-071) 7506-7500

w www.rbw.it/en

m info@rbw.it

KEY CONTACTS:

Thomas Ciampa, COO

Andrea Graciotti, Head, Sales, TV & VOD Rights

Lorena Vaccari, Marketing Director

PROGRAMS:

Mermaid Magic : 10x24 min., 3D, adventure/action, 9-12; Gormiti—The New Era : 20x22 min., live action/3D, action/ adventure/drama/comedy, 7-12; Winx Club Reboot: 26x24 min., 3D, adventure/action/comedy, 5-10; Pinocchio and Friends: S1-2 52x11 min., 3D, comedy/adventure, 4-7; Summer & Todd—Happy Farmers: 52x7 min., 3D, comedy/edutainment, 2-6; 44 Cats : 106x12 min., 3D, comedy, 3-6; Winx Club : S1-8 208x24 min., 2D/3D, adventure/action/comedy, 5-10; Regal Academy: S1-2 52x23 min., 3D, comedy, 4-8; Maggie & Bianca Fashion Friends: S1-3 78x23 min., live action, comedy, 8-12; World of Winx: 26x23 min., 2D/3D, adventure/action/comedy, 5-10.

Established in 1995 by multi-award-winning creator Iginio Straffi, Rainbow Group produces and distributes animated and live-action content for a variety of audience age groups that is available in more than 130 countries. The group consists of Rainbow CGI, Emmy Award-winning Bardel Entertainment and Colorado Film. Rainbow’s ability to create global franchises from its content portfolio has secured the business’s position among the top global licensors.

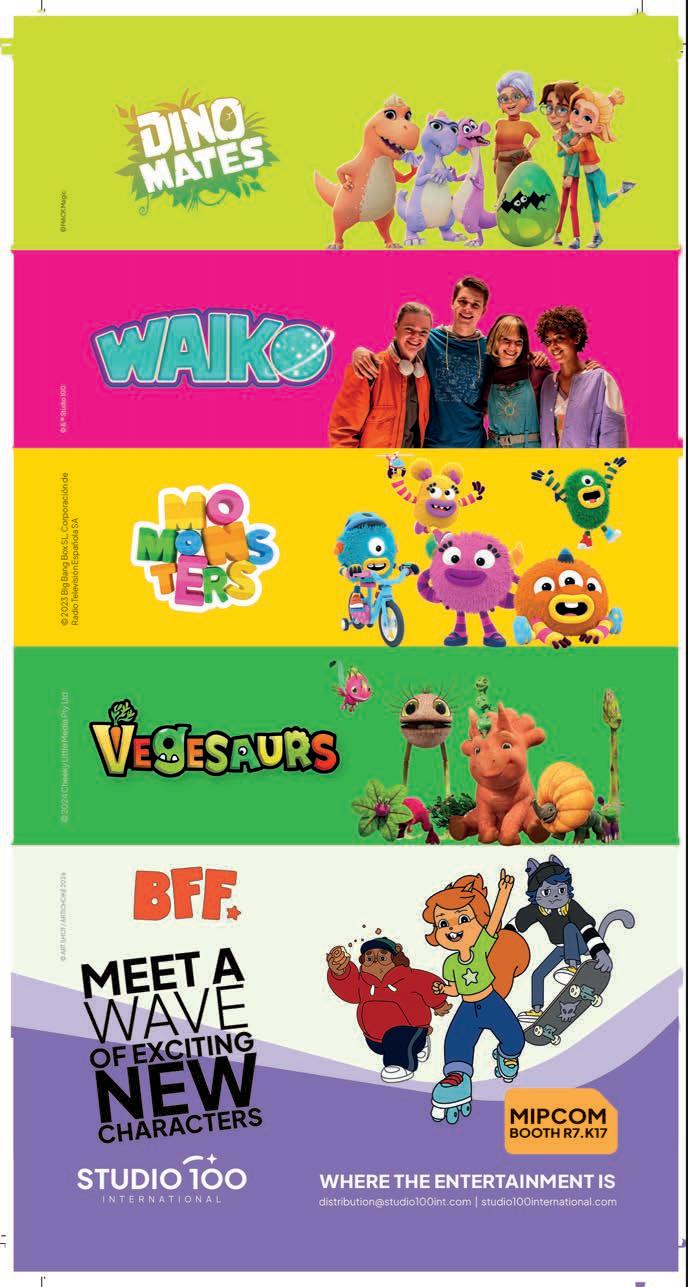

O (49-89) 960855-0

w www.studio100international.com

m distribution@studio100int.com

KEY CONTACTS:

Martin Krieger, CEO

Dorian Bühr, Head, Global Distribution

PROGRAMS:

DINO MATES: 26x11 min., 2D/CGI, comedy/adventure/action, 6-10; Waiko: 10x25 min., live action, adventure/sci-fi, tweens/teens; BFF: 26x11 min., 2D, comedy, 5-8; Momonsters: S1 52x7 min./ S2 26x7 min., CGI/2D/live action, comedy/adventure, preschool; Vegesaurs: S1-2 40x5 min./S3 20x5 min., CGI, comedy/ adventure, preschool/4-7; 100% Wolf—The Book of Hath : S1-2 52x22 min., CGI, comedy/adventure, 6-10; FriendZSpace: 52x11 min., CGI, comedy/adventure, 5-9; Mia and me : S1-4 104x23 min., live action/CGI, fantasy/adventure, girls 6-12; Game Keepers: S1-4 40x25 min., live action, action/adventure, tweens/teens; Heidi: S1-2 65x22 min., CGI, adventure, 5-8.

“Studio 100 International is a leading production and distribution company specializing in high-quality children’s and family movies and series. Based in Munich, it represents a portfolio of well-known brands such as Maya the Bee, Mia and me, Heidi, Vic the Viking and 100% Wolf. Studio 100 International further engages in global brand-rights licensing and manages its own state-of-the-art production studio, Studio Isar Animation. The company is part of the Belgian Studio 100 Group, with a strong presence in the theme park industry across Belgium, Germany, the Netherlands, Poland and the Czech Republic.”

—Dorian Bühr, Head, Global Distribution

w thunderbird.tv

m sales@thunderbird.tv

KEY CONTACT:

Richard Goldsmith, President, Global Distribution & Consumer Products

PROGRAMS:

Mermicorno: Starfall : 26x22 min., 2D, adventure/comedy, 5-9; Mittens & Pants : 81x7 min., live action, preschool/2-5; BooSnoo!: 41x7 min., mixed media, 2-12; Beddybyes: 52x11 min., 3D, preschool/1-4; Rocket Saves the Day : 1x45 min., 2D, preschool/3-5; The Last Kids on Earth: 21x24 min. & 1x68 min., 3D, action/comedy, 6-11.

“Sales for original series created by Thunderbird’s Kids & Family division, Atomic Cartoons, continue apace. Mermicorno: Starfall , our epic 26x22-minute animated action-comedy for ages 5 to 9 inspired by tokidoki’s hit collectibles and fashion brand, will debut on Max in the U.S. in early 2025 and has also been picked up by POP (U.K.), Corus (Canada), Max and Cartoon Network (LatAm) and Cartoon Network (Southeast Asia). The TV special Rocket Saves the Day, which debuted on PBS KIDS in late 2023, has been sold to Knowledge Network in Canada, along with PCCW Media (Hong Kong) and UYoung/Ukids (China).

Thunderbird Distribution & Brands has also recently acquired global media (excluding the U.K., Ireland, Denmark and Finland) and consumer products rights to Beddybyes , which was greenlit by BBC Children’s and is produced by Ireland’s JAM Media. This beautiful CG series mirrors a typical toddler/ preschooler’s day, following main characters MeMo and BaBa from playtime to bedtime, and focuses on helping young children wind down and get ready to head to dreamland. Beddybyes joins Mittens & Pants, the adorable live-action preschool animal series from Canadian producer Windy Isle, and BooSnoo!, commissioned by Sky Kids (U.K.) and co-produced by Visionality and Mackinnon & Saunders, in Thunderbird’s growing roster of third-party acquisitions.”

—Richard Goldsmith, President, Global Distribution & Consumer Products