Max Sets Sail in Asia / Inspector Ellis ’s Sharon D Clarke

CJ ENM’s Diane Min / GoQuest Showcase

WORLD VIEW By Mansha Daswani.

UPFRONTS Spotlighting new content on the market.

MAX AMBITIONS Warner Bros. Discovery’s JB Perrette and James Gibbons discuss Max’s Asian aspirations.

EXPLORING INSPECTOR ELLIS Three-time Olivier Award winner and Tony Award nominee Sharon D Clarke on her starring turn in All3Media International’s new detective drama Inspector Ellis .

CJ ENM’S DIANE MIN Watch an interview with the head of format sales at South Korea’s leading media and entertainment company.

AIMING FOR ASIA GoQuest Media’s Vivek Lath on the company’s strategy for expanding its business in the Asia Pacific.

TRENDING ON The most-viewed clips on our video portals for the last 30 days.

Publisher

Ricardo Seguin Guise

Editor-in-Chief

Mansha Daswani

Editor-at-Large

Anna Carugati

Executive Editor

Kristin Brzoznowski

Senior Associate Editor

Jamie Stalcup

Editor, Spanish-Language

Publications

Elizabeth Bowen-Tombari

Production & Design Director

David Diehl

SUITED TO ASIA Several leading distributors talk to Mansha Daswani about acquisition trends across the Asia Pacific in the run-up to Asia TV Forum.

BACK IN STYLE! TV Asahi Corporation is bringing back its beloved Obocchama-kun anime series with partners in India.

YOSHIMOTO KOGYO’S AKIHIKO OKAMOTO The president and representative director at the famed production house discusses the rising prominence of Japanese creativity across the globe.

THE PRADEEPS OF PITTSBURGH’S VIJAL PATEL The creator and showrunner showcases his new Prime Video comedy series.

REWIND NETWORKS’ AVI HIMATSINGHANI & SANDIE LEE The CEO and executive VP, respectively, at the pay-TV channels operator, showcase the distribution gains and content highlights at HITS, HITS MOVIES and HITS NOW.

Online Director

Simon Weaver

Sales & Marketing Director

Dana Mattison

Sales & Marketing Manager

Genovick Acevedo

Bookkeeper Ute Schwemmer

PROGRAM LISTINGS Highlights from several distributors.

WORLD SCREEN is a registered trademark of WSN INC., 401 Park Avenue South, Suite 1041, New York, NY 10016, U.S.A. Phone: (212) 924-7620 Website: www.worldscreen.com ©2024 WSN INC. No part of this publication can be used, reprinted, copied or stored in any medium without the publisher’s authorization. For a free subscription to our newsletters, please visit www.subscriptions.ws.

Ricardo Seguin Guise

President

Anna Carugati

Executive VP

Mansha Daswani

Associate Publisher

Kristin Brzoznowski

VP, Content Strategy

BY MANSHA DASWANI

European SVOD customers are spending less than their U.S. counterparts and using fewer services on average, but the perception that there is just way too much choice has no geographical constraints.

Per a study of 5,000 subscribers across the U.K., Germany, France, Italy and Spain by Bango, 65 percent say there are too many services to choose from, and 46 percent want all subs to be managed in one place. Bundling is key to solving this issue, the report notes; 58 percent of subs want a single app to manage all of their accounts. The report also found that 42 percent are canceling a service due to price increases, and 60 percent say they can’t afford all the services they want. “Services are responding to consumer cost concerns with flexible pricing,” the report notes. “Ad-tiering is one way to offer more affordability.”

Ad tiers are well established across the U.S. and increasingly available in Europe and LatAm, but it’s early days still in Asia, JB Perrette, CEO and president of streaming and games at Warner Bros. Discovery, told me as we discussed the Asian expansion of Max. “It’s going to be a build over time in a lot of these international markets because, in some cases, premium digital video as an inventory type is fairly new. We’re trying to create, along with others in the streaming space, a premium video inventory that is priced appropriately. We see that as a growth driver for us over the next two to three years, but it will take time.”

Bundling, however, is a key opportunity, as you’ll see in the piece on Max’s AsiaPac ambitions in this edition. “There’s still an oversupply and an overcomplexity for the consumer in the streaming era,” Perrette says. “There are opportunities in every market to simplify the experience, whether through structural—M&A and further consolidation— or commercial bundling. We are a big proponent of that.”

At ATF, All3Media International is showcasing the natural history series Parenthood from Silverback Films for BBC One. Also a highlight, the drama Joan stars Game of Thrones’ Sophie Turner as notorious U.K. jewel thief Joan Hannington. In the way of entertainment formats, the company has on offer The Anonymous. “This new strategic reality competition lets audiences experience what happens when the real world and online worlds collide, delivering an addictive game show filled with scheming, deception and questions of identity,” says Ziran (Tony) Tang, VP of sales for Asia.

Power Couple / Love at Third Sight / AMIA

The reality format Power Couple, on offer from Dori Media Group, tests how well partners know each other. The format Love at Third Sight features singles in their golden years. In the drama AMIA , a Mossad agent whose sister was killed in a terrorist attack in Argentina takes a leave of absence and hooks up with a local journalist to find those responsible. This type of action-driven political thriller “is very in demand in this part of the world,” says María Pérez Campi, director of sales for LatAm, U.S. Hispanic and Asia.

The Anonymous

“ATF is a key event for us every year.”

—Ziran (Tony) Tang

“Our aim is to expand our successful international catalog in Asia, connect with new partners and explore potential opportunities by showcasing our premium dramas and innovative formats at ATF.”

—María Pérez Campi

Max fi nally arrived in Asia in November with launches in Indonesia, Malaysia, the Philippines, Singapore, Thailand, Taiwan and Hong Kong. The regional rollout expanded Max’s global footprint to more than 72 markets. “I think back to August 2022 when we first made comments about the timeline of Max coming to market,” JB Perrette, CEO and president of global streaming and games at Warner Bros. Discovery, says. “We had the target of $1 billion in profitability and 130 million subscribers by 2025, and the ambition of being a top three service in the markets we’re in. It was always the view that it was going to take us

about 18 months to re-platform, restructure the organization and shift some strategies as it related to content and investment. Based on our latest earnings release, we are a little ahead of where we thought we’d be. The AsiaPac team has had to be the most patient. We rolled out in the U.S. [in May 2023] and [this year in] LatAm in February, Europe in May and June and now Asia.”

“We’ve got a lot of work ahead of us but a lot of opportunity from this incredibly dynamic and exciting region.” —JB Perrette

Perrette stresses that this regional expansion “is a big step forward for the company,” noting, “AsiaPac is a huge market. Max is available today in roughly half of the addressable market as measured by broadband households. A big chunk of the broadband households we are not available in are in Asia. We’ve got a lot of work ahead of us but a lot of opportunity from this incredibly dynamic and exciting region. We’re just getting started.”

Perrette concedes that launching a new service in a crowded market is no easy feat. “There are a lot of established players. The flip side is we’re not selling the same thing as everybody else. We have a unique portfolio of IPs. Max is the exclusive home of all the HBO originals; the best of Hollywood with all of the Warner, Universal and Paramount pay-one titles; classic franchises in the WB library; and local content in select markets.”

Perrette adds, “When we moved from HBO Max to Max in Europe and Latin America, the prod uct experience got a lot better, the content offering got better, but it’s not as dramatic as the change we’ve gone through in Southeast Asia, Taiwan and Hong Kong. We went from an HBO GO product; we were two generations behind in Southeast Asia. It’s a vastly improved content offering, a vastly improved product experience and much greater distribution partnerships.”

Existing HBO GO customers will be migrated to Max, which is also being offered through telco and pay-TV partnerships and directly to the consumer. “We’re upgrading the experience for all of the existing customers of HBO GO, but also extending that reach significantly within the universe of each of our partners,” says James Gibbons, the president for AsiaPac at Warner Bros. Discovery. “We will be much more widely available. We are working toward having a full app integration, so the experience that customers will have will be greatly superior. We are also working with partners— Singtel, Telekom Malaysia, AIS, Link Net—to make it easier for a wider customer base to access the product. The DTC pure retail space, via app stores and the web directly, will also be greatly enhanced. We’re taking down all the barriers so our fans can consume the content in one fantastic, high-tech destination.”

As Gibbons references, partnerships are key, and bundling will be an area of opportunity for Max in Asia. Partnerships will also

allow Max to access locally resonant content in key markets— without having to produce everything on its own. “We know the importance of local content,” Perrette says. “This is where there’s an advantage in coming in at this stage of the party as opposed to five or eight years ago. The mentality then was everybody had to do everybody else’s business, which led to the virtual bankruptcy of the industry. There’s not a massively greater demand for more content. We can go out and spend hundreds of millions of dollars producing more original content in Japan or Thailand or wherever, but we don’t think the consumer’s saying, ‘You know what’s missing? More content.’ They’re saying, ‘Bring it to me in a more seamless way. Don’t make me have to choose. Make it easier and more affordable.’ That’s where we go back to the bundle conversation. A lot of the industry has seen how hard it is to do everybody else’s business. We see that opportunity with local players who are fantastic at producing local content and who are going to struggle over the long term to stay independent and go it alone because of the cost of the technology, the platform and the marketing—it just gets to be too much. There’s a ripe opportunity for players to work together in a smart way.”

“We’re taking down all the barriers so our fans can consume the content in one fantastic, hightech destination.” —James Gibbons

The January print edition of TV LATINA will be extensively

The digital edition will be sent out before Content Americas

The print edition will also be mailed to our circulation in

SPACE RESERVATIONS: January 3

AD MATERIALS: January 7

By Kristin Brzoznowski

Three-time Olivier Award winner and Tony Award nominee Sharon D Clarke returns to the TV series space in the detective drama Inspector Ellis . From Company Pictures, in association with Northern Ireland Screen, for Acorn TV and the U.K.’s Channel 5, the three-parter sees Clarke take on the titular role as DCI Ellis, a tenacious Black female cop who is parachuted into failing investigations.

Ellis is used to being dismissed and overlooked despite being a first-class murder detective. As she arrives at a different police station in each episode, she has to win over the local teams and immerse herself in the cases she’s

come to solve. “I’ve never seen a Black, female, titular role on my television screen” in a police drama, Clarke says. “What sets Ellis apart is her empathy and tenderness. What I love about her is how she deals with people. She is tough. She can be stubborn. She’s all about the case… she’s got a job to do!”

“I’ve never seen a Black, female, titular role on my television screen.”

—Sharon D Clarke

Ellis is joined in each feature-length episode by her “righthand man” DS Harper, played by Andrew Gower. “They go on such a journey,” Clarke says. “When they first meet, she sees him come in, and she’s invisible to him; he goes over to the white woman and asks if she’s Inspector Ellis—even though Ellis is sat there with a visitor’s pass on. In that instance, she’s thinking, what kind of detective are you? She doesn’t trust him as a detective immediately. Then, you see them go on this journey of him seeing what kind of detective she is.”

The atmospheric police procedural is being taken out globally by All3Media International. It’s set in a different police station each week, with varying sets of local teams, victims and suspects. “I love the amount of different energy you can have on set through the turnover of people that come in and what they bring to the story with their own individual talents and experiences,” says Clarke.

By Kristin Brzoznowski

The Korean audience is a discerning one, and the TV market in the country is quite competitive. “Viewers don’t want to watch the same show again and again,” says Diane Min, head of format sales at CJ ENM. “So, even the top-rated shows don’t have that many seasons. Korean producers have one of the toughest jobs because even when they have success one season, they have to do something new. The producers and creators have to try fresh and unique things to capture the Korean audience.”

This creativity can be seen in the shows that CJ ENM is taking out to the world, and notably in its innovative format concepts traveling the globe. Among them are hybrid formats like the recently launched Artistock Game, which combines the appeal of music competition formats with stock and investment

strategies. “We tried to do something unique; there are hundreds of singing formats, so we have to stand out,” Min says.

Min acknowledges that there’s much talk about the unscripted entertainment business being risk-averse at present, but says she sees opportunities with buyers and commissioners for fresh entertainment concepts. “You need to take a risk to stand out from competitors,” she says.

“You need to take a risk to stand out from competitors. ”

Remarkable Entertainment and ITV, for example, are bringing CJ ENM’s The Genius Game to the U.K. next year, after a long road to land commissions though many option deals signed. “Every producer has loved it, but we didn’t get it commissioned for eight or nine years until Tin Can produced it for NPO in the Netherlands. Even though the market is difficult, if you have a strong format, you can sell it. I still believe that broadcasters are taking risks. You just need to meet the right person at the right time.”

For the year ahead, Min and the CJ ENM formats team are focusing on two different areas. “We are trying to keep I Can See Your Voice traveling,” she says. “We are exchanging ideas between all of the international local producers. We collect the new [information from the versions] and share it with them. Also, we will be focusing on The Genius Game. With the U.K. premiere and now that we have many options, we will try our best to develop it in each country.”

By Kristin Brzoznowski

From both sales and acquisition perspectives, Asia has been an important market for GoQuest Media. The company has secured deals for a range of Indian, Indonesian, Japanese and Korean titles and has been representing them at key markets. It has also optioned several titles from its catalog for remakes this year.

The Estonian drama Divorce in Peace and the Lithuanian series Troll Farm, for example, have been optioned in India.

GoQuest has also put a premium on partnerships in the region. The company signed a deal earlier this year with Amuz Distribution and is now representing a number of its titles in various territories,

including Asia. GoQuest has also partnered with Vidio, one of Indonesia’s largest VOD service providers, to distribute its titles globally. The catalog includes Ratu Adil.

“Over the past decade of doing business in the region, we have collaborated with nearly all major players,” says Vivek Lath, managing director. “Viewership demands here are highly diverse, with programming ranging from long-running melodramas to short, premium series. Our catalog for ATF has been curated with this variety in mind.” Titles for the market include the co-production Kuma ( The Other Wife ), as well as the mafia thriller Serigala Terakhir (The Last Wolf) and romantic drama The Perfect Strangers from Vidio. These are joined by Telekom Srbija’s Absolute 100 and TVP’s Crusade, alongside the latest season of Secrets of the Grapevine and new series Valmont and Happiness Guaranteed.

“We’re expanding our make-to-sell model from producing Turkish series to exploring Korean content.” —Vivek Lath

“We’re expanding our make-to-sell model from producing Turkish series to exploring Korean content as part of our commitment to backing stories that can appeal across multiple regions,” says Lath. “Although we’re still in the early stages, we want to announce our interest in connecting with local writers and production companies who would like to leverage our expertise to bring their stories to global audiences.”

Distribution Trends / Yoshimoto Kogyo’s Akihiko Okamoto / The Pradeeps of Pittsburgh’s Vijal Patel Behind the Scenes of Obocchama-kun / Rewind Networks’ Avi Himatsinghani & Sandie Lee

Shōgun, FX’s take on James Clavell’s 1975 novel, swept the Emmy Awards this year, landing 18 wins, including best drama and nods for lead actors Hiroyuki Sanada and Anna Sawai.

The awards haul for the buzzy series, much of which is in Japanese, came just two years after Netflix’s Korean original Squid Game achieved a similar feat, landing the win for outstanding drama.

Several leading distributors talk to Mansha Daswani about acquisition trends across the Asia Pacific in the run-up to A sia T V Forum.

Ricardo Seguin Guise

Publisher

Mansha Daswani

Editor-in-Chief

Anna Carugati

Editor-at-Large

Kristin Brzoznowski

Executive Editor

Jamie Stalcup

Senior Associate Editor

David Diehl

Production & Design Director

Simon Weaver

Online Director

Dana Mattison

Sales & Marketing Director

Genovick Acevedo

Sales & Marketing Manager

Ute Schwemmer

Bookkeeper

Ricardo Seguin Guise

President

Anna Carugati

Executive VP

Mansha Daswani

Associate Publisher

Kristin Brzoznowski

VP, Content Strategy

TV Asia

©2024 WSN INC.

401 Park Avenue South, Suite 1041, New York, NY 10016, U.S.A.

Phone: (212) 924-7620

Website: www.worldscreen.com

Content from Asia does seem to be having a bit of a moment on the global stage, finally highlighting markets beyond South Korea’s dominance as the region’s biggest exporter of culture and entertainment. Of note, MIPCOM celebrated China in 2023, and this year featured an abundance of showcases of Japanese creativity, from a Treasure Box Japan format showcase to a screening of the rebooted Obocchama-kun series—you can read more about that Japanese-Indian anime co-production in this edition—to a keynote featuring Yoshimoto Kogyo’s Akihiko Okamoto. The president of the famed Japanese production company shared the stage with Amazon MGM Studios’ James Farrell as they discussed the global rollout of LOL: Last One Laughing, based on Documental. “I was hired by Amazon in April 2015, and we wanted to get going fast in Japan,” Farrell, head of international originals at Amazon MGM Studios, said. “When we went to Yoshimoto, we were looking for a big comedy variety format because variety is so popular in Japan.” The format is “heavily” adapted for each market, Farrell explained. The French and Italian editions, for example, play to a four-quadrant audience, while the upcoming U.K. edition “is more potty humor. In Mexico and Colombia, it skews more edgy. But it’s the number one show in pretty much all those places because it does adapt itself to the local sense of humor.” For Yoshimoto Kogyo, the alliance with Prime Video has helped the company broaden its global ambitions, Okamoto told me in an interview that appears in this edition.

Adaptation and flexibility came up in almost all of my conversations in the run-up to Asia TV Forum as we all try to make sense of the market shifts and what they mean for the business overall in the year ahead. Distributors I spoke to discussed the rising demand for formats and the importance of having diverse slates when approaching cautious, cash-strapped buyers. Avi Himatsinghani and Sandie Lee spoke to me about evolutions in Rewind Networks’ strategy for its portfolio of networks, including HITS and HITS NOW. Vijal Patel, creator and showrunner of The Pradeeps of Pittsburgh, discussed how that Prime Video original is delivering universal humor while telling an authentic story about an Indian immigrant family making sense of life in America. —Mansha Daswani

TV Asahi Corporation is bringing back its beloved Obocchama-kun anime series with partners in India.

Yoshimoto Kogyo Akihiko Okamoto

The Pradeeps of Pittsburgh Vijal Patel

Rewind Networks

Avi Himatsinghani + Sandie Lee Talks Acquisitions

From Silverback Films, Parenthood is a large-scale natural history production created for BBC One that is a lead highlight on the All3Media International slate. “As familyfriendly content, the universal themes of parenting and childhood will resonate deeply across Asia,” says Ziran (Tony) Tang, VP of sales for Asia at All3Media International. “We’re confident this series will appeal to both commercial platforms and public broadcasters.” Also on the slate, Joan tells the true story of a notorious U.K. jewel thief. It stars Game of Thrones’ Sophie Turner and debuted on ITV and The CW earlier this year. Meanwhile, the entertainment format The Anonymous comes from Studio Lambert, behind hits such as The Circle, Squid Game: The Challenge and The Traitors’ U.K. and U.S. versions.

“ATF is a key event for us every year, and we’re thrilled to be here with our full Asia team, ready to connect with clients from across the region.”

—Ziran (Tony) Tang

The Swap Project / R4 Street Dance / Where Does the Sea Begin

Fuji Television Network is presenting the factual entertainment format The Swap Project, a cross-cultural comedic social experiment that features two participants from different countries with the same profession as they exchange lives for a week. “The Swap Project format has the potential to resonate not only in the Asia-Pacific region but globally,” says Ryuji Komiya, head of unscripted format sales. R4 Street Dance brings together leading artists and dancers to form dance crews, which are then judged across battles. Regarding scripted formats, Where Does the Sea Begin conveys the message of parental love, giving answers to how and when we become a family. “As we believe the theme of family resonates with many Asian audiences, the message the series brings should be very relatable,” says Yuri Akimoto, head of scripted format sales.

GMA Network is bringing to ATF the historical drama In the Arms of the Conqueror, a World War II story of four childhood friends whose dreams and loyalties are tested as war rages in their homeland. “Many Asian countries have histories of conflict, colonization and resistance, which makes this war drama relevant and relatable across the region,” says Rochella Ann Salvador, assistant VP of the Worldwide division. Widows’ War tells the tale of former best friends who become prime suspects in the sudden deaths of their husbands and must fight to prove their innocence. “These dramas add cultural depth by exploring loyalty, societal expectations and the consequences of breaking norms, making them both relatable locally and intriguing to international audiences,” Salvador adds. The GMA Network catalog also includes Voltes V.

“Fuji TV offers a diverse collection of unscripted formats and scripted formats in our archive, ranging from game shows, reality programs, love stories and legal dramas.”

—Ryuji Komiya

“By connecting with local buyers, we aim to bring these stories to a wider Asian audience and enhance our regional footprint.”

—Rochella Ann Salvador

Valley of Hearts / Sayara / Loveberry

The Inter Medya catalog features Valley of Hearts, which centers on a mother who abandoned newborn twins without ever holding them before going on to marry a wealthy figure. When the twins grow up, they go on a mission of retribution for being abandoned. In Sayara, the titular Turkmenian young woman works as a cleaning lady at a gym in Istanbul, where her sister is killed by the owner. Unbeknownst to everyone, Sayara’s father is a former special operations commander in Turkmenistan who trained her like a spy. When the court rules her sister’s death as a suicide, Sayara vows to use her skills to bring about justice. Loveberry follows a personal development expert whose seemingly perfect life takes a turn when she falls in love with someone against her father’s wishes.

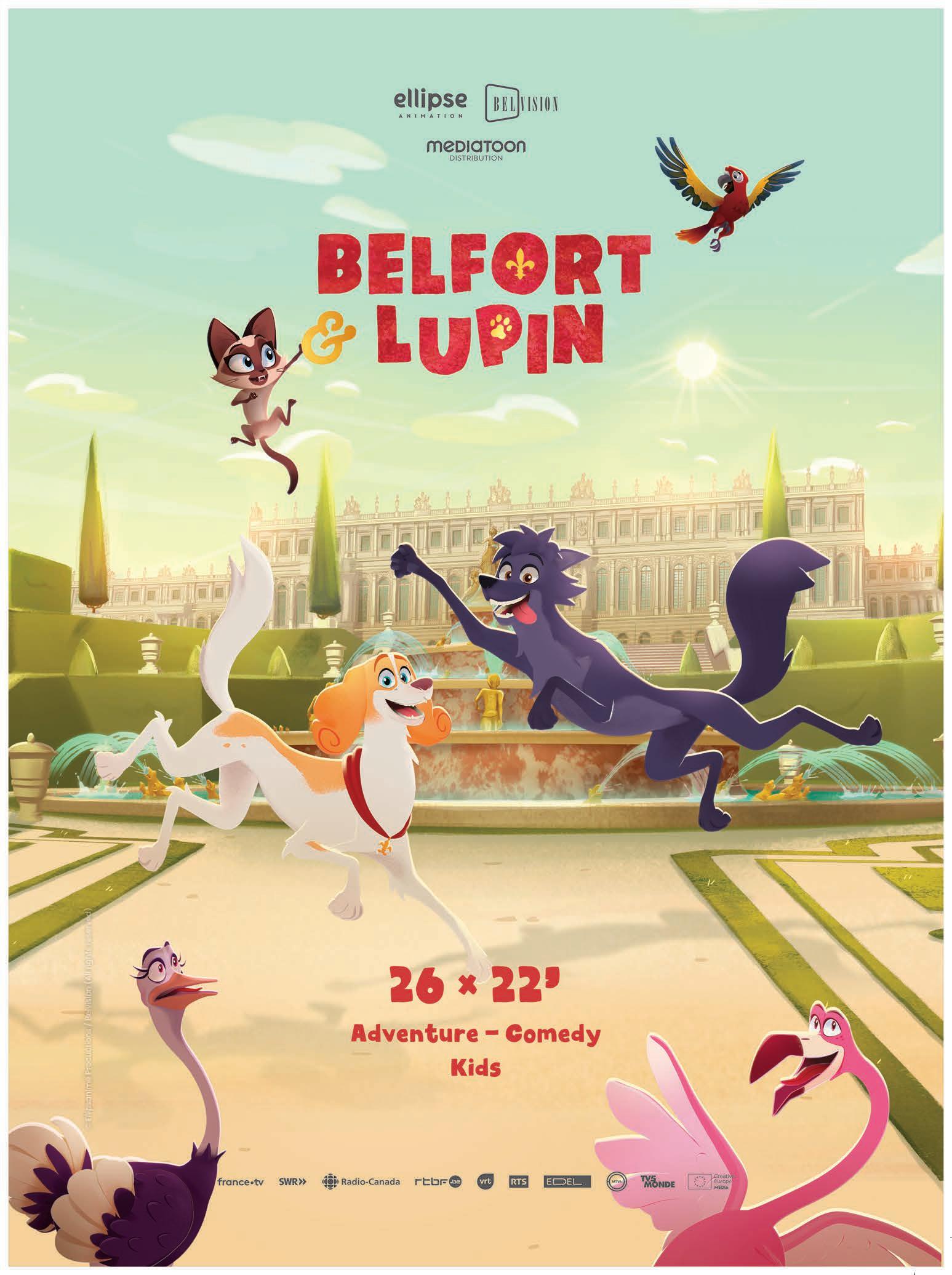

Belfort & Lupin

Belfort & Lupin, leading Mediatoon Distribution’s offering, follows the adventures of an aristocratic dog who has lost his sense of smell and a laidback instinctive wolf living at the 17thcentury royal court at Versailles, where they are surrounded by exotic animals. Produced in 3D, the series is aimed at kids ages 6 to 9. “Though the program is still in production, Mediatoon Distribution has already locked presales across multiple countries in Europe and beyond,” notes Frédéric Gentet, head of sales. The Mediatoon lineup also features SamSam: Cosmic Adventures, a new 3D adaptation for upper preschoolers featuring the superhero SamSam as he explores the galaxy with his friends. In addition, “we continue to promote our iconic animation shows featuring internationally wellestablished IPs such as Garfield and Trotro,” Gentet adds.

Nippon TV’s ATF slate features an array of formats, including Silent Library, Secret Makeover and Colors of Sisterhood Silent Library sees six players sit at a public library table and pick one card each, with the person who selects the skull mark card having to endure a bizarre punishment while staying silent. The scripted format Secret Makeover follows a top fashion coordinator who styles her clients and turns their lives around. It “blends style, mystery and suspense into an unforgettable success story,” says Tom Miyauchi, head of formats. Colors of Sisterhood, another scripted format, takes inspiration from Little Women and centers on four sisters with different personalities and views on romance. “The series explores the universal question of whether love is necessary for a happy life,” Miyauchi says.

“We are confident that the unique French touch of Belfort & Lupin will be valued by our partners in Asia.”

—Frédéric Gentet

“We

are eager to connect with potential co-production partners and new buyers at this year’s final major market.”

Rewind Networks currently operates three channels: HITS, a retrospective channel featuring Hollywood drama and comedy series; HITS MOVIES, showcasing blockbusters from the 1960s to the late 2000s; and HITS NOW, offering current programming from U.S. broadcasters. “On HITS, we are experiencing great success with procedurals that have a proven track record, such as Law & Order: SVU and the early seasons of CSI,” says Sandie Lee, executive VP. HITS MOVIES features films ranging from war epics like The Guns of Navarone to modern blockbusters such as War of the Worlds. “HITS NOW offers a distinctly different experience, bursting with current pop culture through talent shows, cooking competitions, game shows, hit dramas, comedies and entertainment news,” Lee adds.

Doctor-X the movie / THE TRAVELNURSE / Believe -A Bridge to you-

The medical drama Doctor-X , now in its seventh season, is one of Japan’s highest-rated drama series, and it concludes with a movie being released this December. TV Asahi Corporation is offering Doctor-X the movie to buyers at ATF. Also on the company’s ATF slate are THE TRAVELNURSE , starring Masaki Okada and Kiichi Nakai, and Believe -A Bridge to you- . “Not only does the leading cast member of Believe -A Bridge to you-, Takuya Kimura, remain one of the most well-known figures from Japan in Southeast Asia—thanks to the popularity of Japanese dramas in the ’90s and early 2000s—but the suspenseful plot and portrayal of Kimura’s character seeking justice will surely resonate with audiences in Southeast Asia,” says Taka Tagami, international sales.

There are three new action movies on the Vision Films slate, including the buddy heist title Agents . There’s also the creature feature DinoGator , starring Michael Madsen ( Kill Bill ) and directed by Jim Wynorski ( Chopping Mall ). “With great special effects and a throwback to classic creature features that came before, DinoGator is a lot of fun,” says Scott Kamins, executive director of international sales and strategic partnerships. The crime thriller Adrenaline, meanwhile, stars Louis Mandylor and his brother, Costas Mandylor. “Given that the AsiaPac region is home to a massive audience of action-movie fans across all ages and demographics, buyers at ATF are being presented with three titles (and many more!) that deliver the goods for a rabid fan base in their respective territories,” Kamins says.

“We are constantly on the lookout for successful library titles that will garner an audience for us for HITS and HITS MOVIES.”

—Sandie Lee

“Leveraging

our strength as an all-genre content powerhouse, we are actively pursuing co-productions and continuously seeking opportunities with promising overseas production companies.”

—Taka Tagami

“We believe we have one of the strongest content offerings in the marketplace across the strongest-performing genres in the region.”

—Scott Kamins

Content investments in seven Asia-Pacific markets rose by 4 percent to $15.5 billion last year, according to a recent study by Media Partners Asia (MPA). That rate marks a significant slowdown from 2021 and 2022 amid a global reset of streamer budgets. India led the content gains with a 12 percent boost, primarily driven by sports, with Indonesia at 5 percent. Korea, the Philippines and Thailand reported modest gains, while content spend fell in Malaysia and Vietnam. At a time of diminished content expenditures worldwide in the era of post-peak TV, we’re not on track to return to the boom years, but there is plenty to feel optimistic about in the run-up to Asia TV Forum, numerous distributors attending the market in Singapore told me for this piece.

MPA’s 2024 Asia Video Content Dynamics report, which tracks content investment, engagement and viewership across TV, VOD and theatrical in India, Korea, Indonesia, the Philippines, Singapore, Thailand and Vietnam, has good news for Asian IP owners. Demand for content from the region continues to boom across the continent.

At present, Asian content is dominated by Korea and India, which accounted for 80 percent of all local content investments in 2023. Going forward, Korean growth is expected to be flat as streaming and film gains will be offset by reductions in TV investments. India, however, still has significant growth potential, with its local content spend expected to top Korea’s by 2026.

Across the seven markets, MPA anticipates a 2.7 percent CAGR gain in content investments to reach $17.2 billion by 2028, driven by India, and Indonesia and the Philippines to a lesser extent. MPA projects “limited” gains in Korea and Thailand. Vietnamese content investments are expected to be challenged due to a weak ad market and piracy.

Free-to-air still leads in local content investments, accounting for 64 percent of spend in 2023, with streaming

at 26 percent and film at 10 percent. TV will still be at more than 50 percent in 2028, with streaming rising to 33 percent.

Stephen Laslocky, MPA VP, noted: “Korean content continues to lead the pack with world-class production values and compelling storytelling, though we’re seeing online original content costs inflate to as much as $7 million per episode. Its extraordinary appeal is evident, accounting for over 30 percent of content demand in Southeast Asia and Taiwan. The rise of streaming has significantly elevated storytelling and production quality, particularly in Thailand and Indonesia, where competition is intensifying. We’re seeing content from these countries, especially Thai titles, gaining traction across Asia.”

Laslocky continued, “It’s become clear that many traditional TV drama producers are struggling to compete with higher-end streamed video content. In contrast, quality film producers have embraced the flexibility of streaming and adapted with greater ease. Over the past year, as some ad revenues have permanently shifted to digital and streaming behavior has become entrenched, we’ve observed TV production margins contracting across most markets. For online originals, streamers have become much more disciplined in their approach to budgeting and content strategy.”

Formats—scripted and non-scripted—are proving to be welcome solutions for disciplined programmers in these challenging times.

“In India, formats have been exceptionally strong for us,” reports Sabrina Duguet, executive VP for the Asia Pacific at All3Media International. “We’ve seen high demand for both scripted and unscripted formats, with seven scripted format adaptations, five more in development, and several unscripted format adaptations, including the recent announcement of The Traitors for Prime Video” in India.

Duguet references a “noticeable rise in demand for unscripted formats,” thanks in large part to the global success of The Traitors , “alongside fresh launches like The Anonymous for NBCUniversal in the U.S. and Buy It Now, which has been a success for both Channel 4 in the U.K. and recently commissioned by Prime Video in the U.S.”

Unscripted formats are selling well for Nippon TV across the region and worldwide, according to Sayako Aoki, head of scripted formats at the Japanese media giant. “Our unscripted formats are acclaimed for their bold concepts and scalability for budgets big and small. Recently, the Mongolian version of Old Enough! was produced. Silent Library , produced by Nip pon TV in association with Yoshimoto Kogyo, also got licensed anew in Europe, adding to its list of adaptations in over 20 countries. Indeed, Nippon TV unscripted formats, both new and enduringly popular, are capturing attention.”

Nippon TV is similarly seeing strong traction for its slate of scripted formats, Aoki adds. “Scripted formats continue to propel our sales in Asia. This year, Mother , the most exported format in Asia, was adapted in Mongolia and the Philippines, with the latter slated to stream on Prime Video beginning in November. What’s more, Love’s In Sight! in Malaysia and Homeroom in Malaysia and Thailand were licensed and produced locally. Secret Makeover, our latest drama series, is a mystery-solving suspense with elements of revenge and suspicion reminiscent of telenovelas. Immediately after announcing it at MIPCOM, we received inquiries from European and Middle Eastern buyers. Viewers in Asia have an appetite for stories with thrilling twists that entice them to think like detectives, and we are confident that Secret Makeover satisfies their demand.”

All3Media International also has a compelling story to tell when it comes to scripted format adaptations, Duguet explains. “Scripted formats remain incredibly successful across much of the region for the Asia team, and we’re thrilled to have several new adaptations set to be

announced soon,” Duguet says. “While the first half of the year saw some delays in production and commissioning, we’re now witnessing strong momentum in Q3 and Q4 as many of our scripted formats in development are moving into production or are about to get released. Local versions of our formats have been well-received; for instance, Kafas, the Indian adaptation of Dark Money by The Forge for Sony LIV in India, won several awards this year.”

While formats are helping broadcasters and platforms mitigate risk when it comes to their original content expenditure, tape sales remain a vibrant opportunity for distributors of all kinds attending the market this December.

“This year, we have maintained a consistent presence across the islands in the Pacific, ensuring our content remains accessible and relevant in those markets,” says Rochella Ann Salvador, assistant VP of the Worldwide division at GMA Network in the Philippines. “Negotiations are underway with our long-standing partners in Malaysia and Indonesia, where we aim to reinforce and expand our collaboration. Additionally, we’re excited to be in talks with new partners in Vietnam and Mongolia, reflecting our commitment to broadening our reach across Asia and bringing GMA Worldwide’s content to new audiences.”

Pelin Koray, senior sales, acquisition and strategy manager at Inter Medya, is encouraged by the interest in Turkish drama series from key Asian markets, notably South Asia, she explains. “Besides the Turkish drama DNA that captures a wide audience, we believe that Turkey and South Asia’s cultural and social similarities are behind this demand. We have closed deals for Last Summer in India and Vietnam, and we are also in talks with Bangladesh. On the other hand, our best-selling title Bitter Lands has big potential; licensed in 80 countries worldwide, it is a strong love story, and I’m glad to share that it has become the most-watched content in more than seven countries. We are in talks with India and the Philippines for the broadcast

of the show. Recently, we also had effective meetings with Indonesia; even though Indonesia is mostly focused on local content, several parties are interested in our new drama series Valley of Hearts.”

The kids’ sector, while challenged globally, is also offering opportunities for content owners at ATF. “Like in other regions, we’ve observed a growing demand for wellestablished IPs with proven success,” says Frédéric Gentet, head of sales at Mediatoon Distribution. “Furthermore, there is a stronger interest in 3D-animated shows in Asia. Since Mediatoon has one of the largest animation catalogs in Europe, including a broad range of styles and techniques, we are confident with our lineup, including the new 3D adaptations of The Marsupilamis and SamSam.”

Tape sales have been strong for All3Media International in Japan, Hong Kong, China and Korea, Duguet explains, “particularly of our premium dramas and thrillers, such as Joan starring Sophie Turner, returning detective series such as Midsomer Murders and high-octane thrillers like The Tourist and Trigger Point, which has had a third season commissioned. Southeast Asia offers a balanced mix of premium factual and natural history programming, with titles such as Parenthood holding significant appeal, but also travel series like Travel Guides, science programming like Lion TV’s Irresistible: Why We Can’t Stop Eating, current-affairs factual titles like 72 Films’ Trump: The Criminal Conspiracy Case and HOYO Films’ Ukraine: Enemy in the Woods , alongside a range of scripted and unscripted formats.”

While not facing the same seismic shifts taking place in the U.S. and Europe when it comes to content expenditure and viewing habits, Asia is still dealing with many of the broader issues at play in the global media sector. Awareness of those concerns is critical for content owners working with their clients in the region.

“Many clients across the Asia-Pacific region are currently approaching their acquisition strategies with increased caution due to macroeconomic pressures,” says Salvador at GMA. “According to Ampere Analysis, budget tightening has led streaming platforms and broadcasters to prioritize a more strategic acquisition of content, focusing on local-

lan guage productions and proven genres that can maximize viewership on a budget. In addition, global economic shifts have led clients to pursue partnerships or bundled packages, which help them manage costs while maintaining a diverse content library.”

Mediatoon’s Gentet expresses a similar sentiment: “We’ve noticed increased caution in decision-making, even regarding acquisitions of completed shows. With shifts in demographics, evolving habits among young audiences and a decline in advertising investments, the animation market is undergoing a significant transformation. As a result, broadcasters are prioritizing established brands. However, there is still room and interest for original concepts with innovative art direction and captivating storytelling. Our upcoming production Belfort & Lupin, produced in 3D with a 2D aesthetic, responds to this demand.”

Gentet, addressing differing needs across broadcast and streaming, adds, “In Asia, local players are sometimes more open to new IPs than global streamers. Thanks to their support, we can launch new titles in the region. Besides that, we have noted a growing interest from traditional broadcasters in acquiring more comprehensive rights packages, particularly for AVOD and FVOD exploitation. The lines between linear broadcasting and streaming are becoming increasingly blurred, especially regarding children’s content.”

Asked about contending with shifts in the streaming economy, Nippon TV’s Aoki notes, “Given the many choices available, we are looking for the optimal way to coexist with the various streamers as we aim to maximize the value of our content. The methods to accomplish this continue to increase, such as simultaneous broadcast and streaming on a domestic platform, offering titles non-exclusively across multiple domestic streamers, and making available new dramas and a large archive of dramas to a global play er for worldwide streaming. We at Nippon TV took the strategy of streaming our dramas on a global platform immediately after they are broadcast in Japan, which has proven successful.”

GMA’s Salvador points out that strategy changes at the global streamers “have deeply impacted content sales and distribution businesses in the Asia-Pacific region. Key areas of influence include content selection, local production, exclusivity and content licensing.”

Salvador continues, “Global streaming strategies have reshaped the Asia Pacific’s content ecosystem by increasing local investment, intensifying competition and elevating content standards. These shifts create both opportunities and challenges. Local distributors now have greater chances to supply region-specific content that appeals to audience preferences. However, adapting to the growing competition for exclusives and high production values has become essential, especially as global platforms increasingly focus on market-specific strategies and exclusive licensing, pushing up costs and intensifying demand for quality content.”

Duguet at All3Media International has found that the region’s streaming platforms “prioritize localized content— either through local productions or acquisitions that resonate with their specific audiences. Following this, they seek regionally relevant stories, and finally, they look for international productions, especially those featuring wellknown talent or themes with broad appeal. There have also been fantastic formats opportunities with the streamers, at

a local and regional level. Several of our current productions for our formats are for streamers in the region on the scripted and unscripted sides.”

On what’s ahead for 2025, meanwhile, Duguet expects “an active year with multiple formats currently in development and production across scripted thrillers, comedy series and unscripted genres, including some exciting news about The Traitors in the region. We’re also excited about several high-profile international scripted series set to launch, including the new title from Two Brothers Pictures, The Assassin , led by Keeley Hawes and Freddie Highmore, which promises a compelling storyline and exceptional production values. Premium natural history programming like Parenthood is set to make a strong impact, along with the return of audience favorites such as Gordon Ramsay’s Kitchen Nightmares , returning for its ninth season in the U.S. ”

Nippon TV will likewise be looking to drive business across finished content and formats, Aoki explains. “For tape sales, we will continue to respond to the high demand for Japanese content with anime at the core while also addressing the growing appetite for live-action content with new dramas. As for formats, we will boost our sales efforts for our recently announced Man or Mannequin?, Unstoppable and Secret Makeover while preparing for announcements of several new formats. Of course, we continue to seek new partners for codevelopments. In this realm, we recently announced that our very own multiple Asian Academy Creative Award-winning director Itaru Mizuno, renowned for the massive hit Reboot ing, has joined forces with Anyway Content to create How to be a Sensei. It is still fresh from being launched, but our expectations are already high that it will soar across Asia in 2025 with local adaptations.”

GMA is keenly focused on continuing to drive business with new and established clients for Filipino fare, Salvador says. “GMA Worldwide is actively re-engaging with key markets such as Vietnam, Indonesia and Malaysia, where we see tremendous potential for content distribution and partnerships. Vietnam’s burgeoning economy and growing

media landscape present good collaborative opportunities. Meanwhile, Indonesia and Malaysia are also critical focus areas as we strengthen our ties through ongoing negotiations with existing partners and explore new collaborations. Additionally, we are in discussions with partners in Mongolia, further expanding our reach in emerging Asian markets. By leveraging these relationships, GMA Worldwide aims to enhance its presence and adapt our content offerings to meet the diverse needs of these dynamic regions.”

Inter Medya is also strengthening ties with existing customers while looking to penetrate new markets, Koray says. “India, Pakistan, the Philippines, Vietnam and Bangladesh are the biggest markets for Turkish content. We’ve closed deals for long-running dramas such as Endless Love and Last Summer Thanks to our extensive catalog, we have done deals in Thailand, Taiwan, Korea and Japan. We licensed our miniseries such as Naked and crime drama series Interrupted.”

Scripted formats are a new opportunity for the Inter Medya team in Asia, Koray adds, and expanding to more challenging markets for Turkish drama. “In 2024, we closed a deal with a major Korean production company for the adaptation rights of our romance/comedy series Love Undercover Since then, we have realized an increasing interest in remake rights for Korea. On the other hand, there are new requests from Japan and Korea for finished content. We believe that our modern crime drama series The Ivy and Dreams and Realities are the best fits for Korea and Japan since both titles have approximately 20 episodes in total.”

Gentet highlights the importance of Mediatoon’s presence in Shanghai with a local office, “which allows us to significantly expand the distribution and visibility of our content within China. By working closely with our team on th e ground, we can better understand and respond to regional market trends and audience preferences. Additionally, we continue exploring new opportunities in Southeast Asia, a region with diverse and changing markets, which has always welcomed our programs and enabled us to extend our impact throughout the AsiaPacific region.”

The global pandemic had a hand in Obocchamakun ’s resurrection; indeed, if it hadn’t been for surging demand from India, a new season of the show likely never would have happened.

“No one was thinking [the demand for new episodes would] come from India,” said Makiko Inaba, the director of the international business department at TV Asahi Corporation, at a screening for the new series at MIPCOM that I had the pleasure of moderating. “That was the magic of this project.”

Obocchama-kun is based on a Japanese manga from the 1980s, created by Yoshinori Kobayashi, that was turned into an animated series that aired on TV Asahi in prime time. “It created a huge sensation at the time,” said Inaba.

Following the success of the original on Sony YAY! in India, the channel opted to commission a new season. Inaba said it was a challenge to find a studio in Japan to make the series, so the company chose to partner with Green Gold Animation, which is handling production of the show at its studios in Hyderabad, India. “Once we decided to do the co-production, it took almost two years to work things out and get the project going. It’s deeply moving to see this series revived as a new production, not in Japan but in India, after three decades.”

Sony YAY! was previously almost solely reliant on local fare, but when the pandemic hit in 2020, the channel found itself in need of external acquisitions, leading to the licensing of the original Obocchama-kun

“We initially acquired the first season, which was just 52 episodes,” said Ronojoy Chakraborty, head of programming for Sony YAY! at Sony Pictures Networks India (SPNI). “It became such a raging success that we had to ask for more. Within a year, we acquired all three seasons— 156 episodes. We ran out of episodes. That’s when we approached TV Asahi. We went to Tokyo during the pandemic. We met with Shin-Ei Animation [producer of the original]. We wanted to produce it quickly. We met Mr. Kobayashi. When he said, Yes, I’m excited about this project, the deal was signed.”

Kobayashi has been deeply involved with the new season. “Some of the episodes are based on the plots he has written,” said Kanon Asami, development executive for animation at TV Asahi. “Some of the episodes are based on the original manga, which was published 30 years ago. We’re asking advice for every episode, in every production stage,

and he’s giving us ideas for how to enhance the humor and make the tone right for this show.”

Rajiv Chilaka, founder and CEO of Green Gold Animation, talked about the process of animating the show at its studios in India. “Although the show looks very simple, we knew it was going to be challenging. When we went through the scripts, we found the humor was phenomenal and the scripts were well-designed. We asked if it would be OK to take some creative freedoms, and they were open to that. It’s been a phenomenal experience working on this. We’ve learned a lot about new things. This is not the first Japanese show we worked on, but we learned more about the culture.”

Of course, cross-border collaboration can come with an abundance of challenges.

“We created the scripts in Japanese with Mr. Kobayashi and translated them into English for the team in India,” Inaba explained. “All the animation process went to India. In creating the new season, one of the first challenges was figuring out how much to consider the Indian audience. We knew that it would air first in India, not Japan, but we kept in mind that the Indian children enjoyed watching the previous seasons that were made and aired in Japan. Both the Japanese team and Indian team worked with that element in mind.”

The TV Asahi team visited the Green Gold studios in April of this year, Asami explained, together with representatives from Shin-Ei. “It was a meaningful trip,” she said. “The staff at Green Gold have a lot of respect for Japanese animation. We discussed leveling up the quality of the animation and the differences in how the production was done in Japan. We discussed things like how many times the characters are going to blink and the thickness of the eyelines. We discussed a lot!”

Chakraborty talked about the process of dubbing the new season into Hindi and noted, “It was smooth sailing for us in production because we had dubbed those previous episodes. We knew how to translate from the Japanese original scripts to our language. Most of the stories are adapted from the older works of Mr. Kobayashi, so we had visual references. That was very helpful. There were four stakeholders in the show: us, TV Asahi, Green Gold and Shin-Ei. We knew exactly what our roles were. The synergy made the show smooth sailing.”

Paying special attention to the facial expressions was key, Chilaka said. “The humor is just not about the dialogue. It’s also about his expressions. There was a learning curve. We got a lot of support from SPNI and TV Asahi.”

For more than 100 years, Yoshimoto Kogyo has been entertaining Japanese audiences, often with the kinds of madcap comedy-variety shows the Asian nation has become so well known for. The arrival of the major streamers in Japan provided a new opportunity for the famed production house to expand its audience base, with the company teaming with Amazon’s Prime Video on Documental. The series, featuring an array of comedians trying to make each other laugh, has been a huge hit in Japan since its 2016 launch and is now a global success as LOL: Last One Laughing, having been formatted by a range of markets worldwide, among them Mexico, France, Italy, Argentina, the Philippines and, in 2025, the U.K. Akihiko Okamoto, the president and representative director at Yoshimoto Kogyo, discusses the road ahead for the company and the rising prominence of Japanese creativity across the globe.

TV ASIA: How did your alliance with Prime Video come about?

OKAMOTO: Yoshimoto was established 112 years ago. We started in comedy clubs and managing talent. Over the 112 years of our company’s rich history, we’ve constantly evolved and adapted to industry and societal changes and predicated business practices around them to stay current and successful. Our dealings with Amazon’s Prime Video are representative of the latest iteration of our philosophy to embrace evolution, in this case, streaming and technology shifts in the entertainment industry. This is, for us, a chance to connect with the next generation of consumers.

TV ASIA: What was the origin of Documental, and why do you think it has translated so well to so many territories?

OKAMOTO: Documental was created by one of the leading talents in our roster, Hitoshi Matsumoto, a top comedian in Japan. When Amazon was launching in Japan, we were having discussions with them, and he thought of the idea for Documental . From inception, starting with the ask of Mat sumoto to come up with an idea for Amazon, we always thought that whatever this program or format would be, it should be translatable and understandable to the entire world. And that is what he came up with. This show came to be because it was Amazon asking us to come up with an idea. Amazon is a global platform, and because of its universality, we knew we had to come up with an idea that would be translatable worldwide.

TV ASIA: What new opportunities are you seeing for your company, given Japanese creativity’s newfound prominence on an international stage?

OKAMOTO: Historically, the Japanese entertainment industry has focused on creative thinking and solutions toward what

By Mansha Daswani

can be made successfully for Japanese terrestrial TV. When Amazon and Netflix launched in Japan, and all these digital tools and information technology developed, there was a way for Japanese creativity to be in touch with the rest of the world instantaneously. This is when Japanese creativity started to become unleashed around the world. It was inevitable that talented artists would have a newfound sense of what is cool and what will become trendy. When their work is exposed to the rest of the world, it is only natural for them to seize the opportunity and showcase their creativity around the world.

TV ASIA: How are you growing the company today?

OKAMOTO: LOL is an Amazon-Yoshimoto collaboration and everything relating to the expansion of the format is done in tandem between Yoshimoto and Amazon. We work with many different streamers, platforms and studios worldwide, including Netflix. We’re looking to work with companies like Disney, Warner Bros. Discovery and Max, among other platforms and streamers around the world. Our strategy is to establish audience reach beyond what we have now.

TV ASIA: Is there anything else you’d like to share with us about Yoshimoto’s international vision?

OKAMOTO: We value our strong relationship with Amazon and will continue to grow the LOL brand together. MIPCOM was a successful market for us, and we’re happy to have a high volume of attractive business opportunities to consider. We’re very much open to creating content from scratch and collaborating on international co-productions. We represent over 6,000 talents, and we’re ready to unleash them on the world! Our employees are working hard to create the next big thing that unleashes our talents’ creativity.

By Mansha Daswani

Vijal Patel has spent much of his television career working on classic network family-friendly sitcoms, including The Middle, black-ish and Schooled. For his debut show at Prime Video, The Pradeeps o f Pittsburgh , Patel took inspiration from his own family. The eight-part comedy, which dropped on Prime Video in October, follows the antics of a recent immigrant family from India as they settle into life in an American city, with a cast that includes Naveen Andrews (Lost, The Dropout) and Sindhu Vee (Roald Dahl’s Matilda the Musical) as parents trying to make sense of work life, unusual neighbors and parenting their three kids as they make their way in a foreign land. Patel talks to TV Asia about the inspiration for the show, the arc of the season and delivering a heartwarming, universally relatable comedy around a type of family that global audiences don’t often see.

TV ASIA: Take me back to the beginning. What sparked the idea for the show, and how did it land at Prime Video?

PATEL: The spark of the idea was the pain of my own life. My family moved from India to Pittsburgh in 1980. I always wanted to do that story. That experience was so seared into my brain. For me, it was wonderful. For other people in my family, it wasn’t wonderful. And with just that difference, literally, I said, Let’s put this story on TV. This isn’t new, but it’s just so interesting. There were little events that happened that I said, This is going on TV because this happened to my family, but other people would be like, What? That was the impetus. I developed it, and we pitched it around. Amazon was interested in it because it told a relatable story. I had worked on black-ish and The Middle and all these successful family comedies, and they wanted to do that genre, but for streaming—elevated, edgier and you can get away with more. I said, Do I have the show for you! And that’s how we’re here.

TV ASIA: What was the approach to crafting the arc of the season? And do you have more episodes plotted in your head to tell more stories about this family?

PATEL: I have only as many stories to tell as stories that happened to families. Every day, there is a new one. I usually worked on shows with 24 episodes, but when you get into the streaming world, it’s 8 or 10. At that point, it’s tempting to tell a more serialized story where there is a history, a past. Usually, when you do 24 episodes, the next episode has no memory of the previous one. But with this one, we tell an arced story. I came up with the storytelling device of them telling this to somebody in an interrogation setting. That helped create this idea of a mystery. Once we had that—a mystery and a family—it became: craft a little bit of an arc, but tell family stories in this arc. That was the fun of it. It was a new challenge, and I loved doing it.

TV ASIA: I don’t like getting too caught up in DEI conversations because I feel like that shouldn’t be something we have to talk about anymore. But, we haven’t seen much storytelling in the U.S. focused on Asian immigrants, especially those from India, and rarely in comedy. Is that added pressure for you, knowing this is a breakthrough for South Asians in American shows? Or did you opt to keep that element out of your head?

PATEL: It’s the second. I heard the characters, I saw the characters and I saw the stories. They were very Indian because I would draw from the responses of Indians that I know. Eventually, they just became the Pradeeps to me. It was this family. Other Indian writers would bring their experiences. So, yes, this is a bigger experience. But I always focused on this family. I was aware that they were from India, but I was also aware these dreamers had come to America. If you ask my dad, What are you? He’ll say, I’m an engineer. He would say that way above being Indian. That’s how I see Mahesh. Mahesh sees himself as an engineer more than he sees himself as an Indian. Which is very

Indian in and of itself, right? [Laughs] When there are 1.6 billion of you, you have to start differentiating yourself in other ways! [Laughs] That’s how we wrote the characters.

TV ASIA: We touched on this briefly earlier. You came up through a network television background. Did your approach to storytelling have to adjust for a streaming environment?

That was one of the great joys of writing this show and crafting these stories.

TV ASIA: Do you also consider the global nature of the Prime Video audience as you’re writing the show?

PATEL: I do. I keep it in the back of my mind. What I find comfort in is that family stories are so universal. The disappointment parents have in their children is

“So much of my work is done for me in terms of global appeal just because of the genre and the story I’m telling.”

PATEL: Very much. We can get away with serialized storytelling more. My favorite thing is that we didn’t have to end the episodes with everything wrapped up. That is such a delight to be able to do. It’s not like all my Wednesday business is done when my Wednesday ends. Something happens at night that carries over to the next day. When you get to write stories like that, they feel more organic. You have more space to breathe. And you could tell more complex stories that are, most of all, exciting to watch because they have twists and turns that you just don’t see coming.

universal. The bucking against the rules and the sibling rivalry are universal. So much of my work is done for me in terms of global appeal just because of the genre and the story I’m telling. Comedy has a higher bar to clear to become universal. I try to keep the comedy in the characters and the family versus many references and colloquialisms. I color it with local things, but I like to keep the comedy broad, universal and appealing to every market because I know those family stories are so appealing.

By Mansha Daswani

The r apid take-up of FAST channels in North America has proven that even though consumers are ditching their pay-TV packages, curated linear destinations delivering compelling lean-back entertainment are very much in demand. For Avi Himatsinghani and the team at Rewind Networks, in the pay-TV ecosystem in Asia, the demand for well-built channels has shown its resiliency despite the broader shifts in the market. On the heels of the success of HITS and HITS MOVIES, delivering classic library fare, Rewind Networks began rolling out its first-run service, HITS NOW, ear ly last year and has secured carriage in six markets, bringing it to 14 million homes. TV Asia catches up with Himatsinghani, founder and CEO, to talk about the overall landscape for the channels today, while Sandie Lee, executive VP, weighs in on her programming approach.

TV ASIA: Let’s talk about the flagship HITS channel, your first to launch. It’s already well penetrated. What gains are you seeing there?

HIMATSINGHANI: It’s 11 years in for HITS. We’re in nearly 22 million homes across 11 countries, deeply rooted as a basic-tier channel. Our thinking at the time of the launch versus where we are today has not deviated much. I keep going back to the idea of a playlist, a curated destination of the “best of.” It continues to attract audiences that love great storytelling, whether it’s tapping into nostalgia or just saying, I don’t know what to watch, but this is something I love. That truth remains clear, even in 2024. We have our strip-and-stack strategy, Monday to Friday; the same show at the same time, creating a habit at least for that season. We’ve made small, stunt-style tweaks, like miniseries. But at the core of it, our biggest driver is the fact that this stuff doesn’t work on-demand. It’s not like we are deep-pocketed and outbidding Netflix or Prime Video for content. It’s just that it doesn’t work in that environment. I would say Friends, The Big Bang Theory, Modern Family and Suits are outliers, but broadly, I don’t think the stuff we do works well in an on-demand environment.

TV ASIA: Where are you on HITS MOVIES?

HIMATSINGHANI: It’s six years old; we launched in October 2018. It was five years after the first launch of HITS. HITS MOVIES has taken off. It’s now in nine territories, 17 million homes. We doubled down on the concept of linear versus on-demand. We’re curating content that you wouldn’t easily find on Netflix, Prime Video, Disney+, Max or Apple TV+. Not because they can’t buy it. It’s because it won’t work there. It’s a super wide spectrum. Who else is focused on the golden era of Hollywood? It runs from the ’60s and ’70s to the early 2000s. Because of the way it’s positioned and its placement as mass basic-tier entertainment, sometimes you do need a newer show to bring in a new audience that will appreciate some of the older stuff.

It’s very difficult to emulate a Spotify-type playlist in a linear broadcast environment. But we are there. The proposition is so crystal clear. We can double down on what’s doing well and then experiment with requests we’re getting from viewers.

TV ASIA: It’s been less than two years since you ventured into first-run programming with HITS NOW. How has the marketplace responded?

HIMATSINGHANI: We launched in February 2023. We’re in 14 million homes across six countries in less than two years. That took us four or five years for HITS. This was an opportunity waiting to be tapped. It deviated from our previous networks that were curating from deep library, but again, it is a curated, branded destination with a very clear-cut proposition. It is the best of the newest U.S. broadcast TV, all in one place, express from the U.S. when it can be. Some is live. The name “HITS” has to be honored. We have Survivor , MasterChef , American Idol, America’s Got Talent, Shark Tank, Hell’s Kitchen and Top Chef, all in one place. In the two-anda-half decades that I’ve been in pan-Asian TV, I haven’t seen a single pan-regional network carry all of this in

one place, even in the good old days of Star World. And then, of course, we’ve doubled down on franchises, procedurals and comedies. We have the Chicago franchise. We’re betting on newer shows like Fire Country and Matlock

TV ASIA: Looking ahead, what growth opportunities are you pursuing for the portfolio?

HIMATSINGHANI: Getting our services into more markets and platforms remains a key growth driver. For example, Hong Kong and Thailand reentry strategies are important for us. We are trying to expand our footprint into other markets. We recently got HITS MOVIES into Papua New Guinea. Mongolia is showing interest in a couple of the channels, so we are exploring that. Maybe Kazakhstan and some of the smaller markets like Laos and Cambodia too.

TV ASIA: HITS, your first channel, was created to deliver classic American shows. How has your programming strategy evolved over the years?

LEE: When we started, we put more titles from the ’70s, ’80s, ’90s and some 2000s. We decided some years ago that we should look at the older classics, like I Dream of Jeannie and Bewitched from the ’60s. We also went to the new classics, like Law & Order. We just added CSI, and the first two seasons have proved to be popular. We haven’t given up on the middle eras—things like Quantum Leap—but we decided to broaden on both ends. That has worked well for us. And we delved into miniseries. At first, we were afraid of miniseries; it’s hard to market them. Because of the way I schedule, it’s hard to get people to be interested. It’s four episodes, six episodes, and then it’s gone. The longevity is not there. We decided to do some miniseries because it adds programs of very high production quality into the channel. And high entertainment value. At the time, those miniseries cost a lot of money. We did North and South, which worked very well for us. People in Taiwan were asking for season two! Our affiliates were asking when we’re bringing it back! We also aired V. For Halloween, we added the It miniseries. We also went a little bit outside of our original proposition with

TV ASIA: What about other markets outside of Asia where there is still a healthy pay-TV ecosystem?

HIMATSINGHANI: We are exploring that. Sandie and I spent some time in Dubai earlier this year; we’re exploring the Middle East and North Africa. It’s early days, but we think where there’s a pay-TV ecosystem and Hol lywood content carries value, we will explore it. Maybe we’ll need investment or JV partners.

We are also exploring a basic-tier sports network. We don’t do vanity projects. We have conceptualized a basictier network idea with a mix of live and archive. It celebrates sports. We will only do this if the affiliates see value in it. We want to super-serve our customers and their customers. We have a very clear strategy, but we need buy-in from our partners.

Christmas and Valentine’s Day movies. The softer rom-com shows work well in the Philippines, Indonesia, Malaysia and Sri Lanka. We respond to our audience. Whatever they tell us on Facebook and Instagram, we look at it seriously. Not everybody has a view on new titles, but everyone has a view on old titles. That’s why the channel garners a loyal audience.

TV ASIA: What have you been looking for at HITS MOVIES?

LEE: We listen to our viewers and our affiliates. They say genre-based thematics are more nebulous and less focused, while star-focused thematics are better. So, this year, we had Tom Cruise and Tom Hanks festivals. In January, we’re having a Tom Clancy stunt. This focuses the audience on things they can expect. That’s the good thing about our channel. We can play around with so many kinds of themes. For Chinese New Year, we have some Chinese movies. We don’t do Chinese movies any time of the year, except for Chinese New Year. We have Crouching Tiger, Hidden Dragon; Kung Fu Hustle and others.

And our audience lets us know what they want to watch. People love war-themed movies, so if I bring The Bridge on River Kwai back, the ratings will still be good. We’re thinking of creating a Throwback Thursday where we have some black-and-white movies so that when they appear on the channel, it’s not surprising to people. They know that Throwback Thursday is going to have this kind of movie. I’m trying to get things like Judgment at Nurem berg and 12 Angry Men. We can expand on both ends. I don’t have to stick to t he 1960s. We can go to the 1950s and I can go later in the 2000s. The purists are looking for certain types of movies on our channel, but some of these blockbusters will bring in an audience.

TV ASIA: What’s the scheduling approach for HITS NOW?

LEE: We are governed by what America does. If America’s Got Talent is on Tuesday, I’ll show it on Wednesday. Every day, I have Entertainment Tonight. I receive it in the daytime, we go through the process of censorship, and it goes out at 11 p.m.

On certain days, I have two back-to-back express from the U.S. titles, so I’ll have Hell’s Kitchen at 8 p.m. and Survivor at 9 p.m. It’s very tight. We try to do the best we can so people know when the shows are on. I try not to move them. It’s only when there’s a change in the U.S. schedule that we have to make the change over here as well.

All3Media International

Dori Media Group

Fuji Television Network

GMA Network

Inter Medya

Mediatoon Distribution

TV Asahi Corporation

Vision Films

ALL3MEDIA INTERNATIONAL O (65) 9858-6934 m international@all3media.com w www.all3mediainternational.com Stand: FB-08

The Gold (Crime drama, 6x60 min.) Featuring a star-studded cast, including Hugh Bonneville and Dominic Cooper, and with a second season coming soon, delves into the decades-long aftermath of the 1983 Brink’s-Mat robbery.

The Gold

Critical Incident (Drama/thriller, 6x60 min.) Based on creator Sarah Bassiuoni’s experiences working as a lawyer in Western Sydney’s juvenile justice system. The Traitors (Game show, 60 min. eps.) With the U.S. version awarded the Emmy for best reality competition, 30 versions commissioned worldwide and a successful merchandise program, the faith in this nail-biting psychological adventure continues. Parenthood (Doc., 5x60 min.) This new series, narrated by David Attenborough, focuses on the incredible stories of devotion, ingenuity and sacrifice of animals to ensure the survival of their young.

Jesus: Crown of Thorns (Doc., 4x60 min.) Brand-new from Nutopia, this series will reimagine

For

Jesus Christ’s story as a gripping political thriller set against the backdrop of the turbulent times in which he emerged as a revolutionary figure.

Joan (True-crime thriller) Starring Game of Thrones’ Sophie Turner, this story is inspired by the life of the U.K.’s most notorious jewel thief, Joan Hannington.

Trump: The Criminal Conspiracy Case (Doc., 1x90 min.) Follows the biggest criminal case against Donald Trump, accusing him of spearheading a wide-ranging conspiracy to overturn the 2020 election result.

The Anonymous (Game-show format, 60 min. eps.) From Studio Lambert, lets audiences experience what happens when the real world and online world collide, delivering a game show filled with scheming, deception and questions of identity.

Liar (Scripted format, 60 min. eps.) A tale of consent, modern-day gender politics, family life and deceit, with 12-plus local versions produced.

Gordon Ramsay’s Future Food Stars Australia (Fact-ent./food, S1-2: 9x60 min.) Gordon Ramsay competes with another industry titan to discover and mentor the best new food entrepreneurs across the country.

DORI MEDIA GROUP

O (972-3) 647-8185 m sales@dorimedia.com w www.dorimedia.com

Amia (Political/action drama, 8x45 min.) A Mossad agent hooks up with an Argentinean journalist to find those responsible for a terrorist attack, drawing them into a world of espionage and arms dealers.

Indal (Action drama, 8x45 min.) A group of EthiopianIsraeli youth decide to kidnap the police officer who peppered their adolescence with abuse and eventually murdered their closest friend.

Love at Third Sight

Lalola (Comedy, 20x30 min.) Lalo breaks Romina’s heart and she goes to a witch to teach him a lesson. He wakes up turned into Lola and must learn to be a woman in a macho world while seeking to reverse the spell.

Power Couple (Reality format) Eight couples face extreme challenges that will test how well they really know each other.

Yum Factor (Cooking competition) Flips the script on culinary competitions. This isn’t about the professionals; it’s about the everyday culinary maestros.

15 a la Hora (Minimum Wage) (Drama, 10x30 min.) Three Latina women in Los Angeles decide to take charge of their destiny and open their own cleaning service business.

Love at Third Sight (Docureality format) Vibrant men and women in their golden years spend 14 days at a luxurious resort seeking love through tailored activities, romantic outings and deep conversations.

Ciega a Citas (Date Blind) (Romantic comedy, 140x60 min.) The story of a woman unknowingly

trapped in a love triangle—the love that is not good for her blinds her, and the love that could make her happy is not even on her radar.

The Best of All (Game show) Is the average answer from a large group of people always closer to the right result than the answer of one?

Las Estrellas (5 Stars) (Romantic comedy, 120x60 min.) The death of Mario Star leaves his five daughters facing the challenge of successfully managing a boutique to claim their inheritance.

O (81-3) 6865-1988 m intlsales@fujicreative.co.jp w jet-pm.com

Stand: B12-15

Swap Project (Docureality, 1x60 min.) Two contestants with the same occupation from different countries swap lives for a week.

R4 Street Dance (Dance competition, 15x30 min.) Over three months, four crews of six dancers from various styles compete in seven themed showcase battles to determine the top crew.

The Versus (Game show, 487x60 min.) A guest team of six competes against the resident team, made up of eight to ten athletes and celebrities, in classic physical, agility and comedy games.

VS School—The Ultimate Hide and Seek (Game show, 23x30 min.) A large-scale game of hide-and-seek against an entire high school. Celebrities hide in realistic props, and students must find all of them in time to win the prize.

Iron Chef (Food competition, 295x35 min.) Chefs compete against Iron Chefs in a high-energy culinary challenge, creating innovative dishes with a themed ingredient in just one hour.

Run for Money (Game show, 80x60-114 min.) Players must evade professional hunters and complete missions within a set area to win prize money.

Where does the Sea Begin (Family drama, 12x54 min.) Natsu discovers he has a 6-year-old daughter, Umi, after his ex, Mizuki, passes away. He struggles to embrace fatherhood.

OKURA-Cold Case Investigation (Crime, 11x54 min.) A compassionate retro detective and a cool, modern partner solve cold cases.

My Precious (Romance, 11x54 min.) Miwa conceives a child with her childhood friend, raising it as her husband’s.

AARO-All-Domain Anomaly Resolution Office(Mystery, 10x54 min.) The All-Domain Anomaly Reso lution Office investigates paranormal cases, including disappearances linked to a god-like figure.

GMA NETWORK

O (632) 8333-7633/34

m GWI@gmanetwork.com w gmaworldwide.tv Stand: FB-03