GUIDE 2023

Publisher Ricardo Seguin Guise

Editor-in-Chief

Mansha Daswani

Editor-at-Large

Anna Carugati

Executive Editor and Editor, English-Language Guides

Kristin Brzoznowski

Associate Editor

Jamie Stalcup

Production & Design Director

David Diehl

Online Director

Simon Weaver

Sales & Marketing Director

Dana Mattison

Sales & Marketing Manager

Genovick Acevedo

Business Affairs Manager

Andrea Moreno

Anna Carugati Executive VP

Mansha Daswani Associate Publisher & VP of Strategic Development ©2023 WSN INC.

A Note from the Editor . . . . . . . . . . . . .8 Interviews . . . . . . . . . . . . . . . . . . . . . . . . .9 Distributors . . . . . . . . . . . . . . . . . . . . . . .21 Contents

Ricardo Seguin Guise President

Phone: (212) 924-7620 Fax: (212)

Website: www.worldscreen.com No part of this publication can be used, reprinted, copied or stored in any medium without the publisher’s authorization. For a free subscription to our newsletters, please visit www.subscriptions.ws

1123 Broadway, #1207 New York, NY 10010

924-6940

6

Book your Exclusive Showcase in WORLDSCREENINGS For a full list of benefits and examples of previous Exclusive Showcases, please visit WorldScreenings.ws. For more information, please contact Ricardo Guise (rguise@worldscreen.com) or Dana Mattison (dmattison@worldscreen.com) World Screen has totally redesigned its flagship video portal, WorldScreenings.com, offering a slew of improvements and a sleek new look. In addition, we have unveiled four new targeted screenings destinations: • TVKidsScreenings.com • TVDramaScreenings.com • TVRealScreenings.com • TVFormatsScreenings.com

A Note from the Editor

Mansha Daswani

Mansha Daswani

The streaming wars shifted into overdrive last year as Disney+, Paramount+, Viaplay and others expanded their footprints and new players arrived on the scene, leading to record investments in content across the globe.

But with war ongoing in Europe and fears of a global recession, peak TV finally appears to have peaked. Indeed, Ampere Analysis is forecasting that global content expenditure will increase by just 2 percent this year, the lowest growth in more than a decade, other than the Covid-19-induced contraction in 2020.

“SVOD services will still see an increase in total content investment in 2023 but a lesser 8 percent year-on-year growth compared to 25 percent in 2022,” Hannah Walsh, research manager at Ampere Analysis, said. “Services will continue to focus on original content to compete in a crowded, cost-sensitive market, but we are already seeing a shift in content commissioning to incorporate a greater volume of cheaper, unscripted formats.”

This year is also expected to see further gains in AVOD. Price-conscious audiences are becoming more willing to watch ads on their streaming services, Deloitte observed in its 2023 Technology, Media & Telecommunications (TMT) Predictions. All major SVOD platforms in developed markets will have added an ad-supported tier by the end of this year, Deloitte predicts.

“AVOD’s resurgence is healthy for the wider television industry,” Deloitte says. “For SVOD providers, it unlocks an additional revenue stream and could reduce churn; for broadcasters, it raises the profile of a service they’ve been offering for years; for consumers, it enables continued, lower-cost access to their favorite content, albeit with the (minor) wrinkle of having to watch ads. While AVOD is not for every viewer, it’s likely to appeal to the majority, even in the wealthiest of markets.”

This edition of the World Screen Guide is packed with new and returning titles, ready to be consumed on a myriad of platforms.

8

INTERVIEWS

Robert Bakish President & CEO

Robert Bakish President & CEO

Paramount Global

Paramount Global

WS: Paramount maintains scaled theatrical, broadcast and cable busi nesses in addition to growing Paramount+ and Pluto TV. Why has this strategy been important?

BAKISH: The combination of our content, multiple platforms and the strategy we’re using to execute against them does provide an advantage. It gets us to the largest TAM—total addressable market. It helps us get an ROI on content investment. Content moves sequentially across platforms, and it’s really important for creating consumer excitement. We are using these platforms to get that return on our investment to unlock multiple revenue streams. We love our diversified portfolio. And in a macroeconomic environment with challenges, it also helps create stability.

WS: Will your teams continue to license content to third parties?

BAKISH: We have a massive library of films and television—one of the largest in the world. We feel licensing portions of that library, including early seasons of a series on a non-exclusive basis so we can use it for ourselves, is additive financially, and it’s also additive from a franchise-development standpoint. We’re also selectively in the originals business for third parties. It’s good incremental money, and it’s good for helping manage our talent ecosystem to provide some optionality.

WS: What led you to believe in AVOD before others did?

BAKISH: We think this notion that the whole video business would go strictly SVOD was fundamentally wrong. There’s always been a free segment in media—broadcast television is free media. We thought that would be the case in streaming. We acquired the best asset in the industry in Pluto TV. Then we added fuel to it. We have massive libraries that we’ve deployed on Pluto TV. We have one of the leading advertising businesses in the U.S. Advertisers have found that it’s a great source of high-quality inventory. It may be library content on the entertainment side, but it’s high-quality. If you look at some of the demographics, it skews younger; some of those audiences are pretty hard to reach in general. Pluto TV has turned out to be a great consumer product and a great product for advertisers. We still think it has a lot of runway ahead of it.

10

Gerhard Zeiler President, International Warner Bros. Discovery

WS: How do you see the health of your global channels business?

ZEILER: Linear TV is not dead. We believe in linear. Yes, all the statistics show that the number of minutes watched on streaming is increasing. But still, the majority of minutes watched is on linear, in the U.S. and even more so outside the U.S. We are required to give the consumer both options, streaming and linear. I strongly believe that linear networks will continue to be a factor in the future of video consumption. And they are also a strong provider of revenues and cash flow. And let’s not forget that we own strong free-to-air networks. That helps us a lot in promoting our streaming services.

WS: How has the company’s streaming strategy evolved?

ZEILER: Streaming is an essential part of our strategy going forward, but it’s not our only strategy. Our combined [HBO Max and discovery+] streaming service will be launched sequentially, starting in the U.S., then Latin America, followed by the European markets and some key Asia-Pacific markets in 2024. David Zaslav [CEO and president] made it very clear that subscriber numbers are not the only factor in how success is measured. It’s important, but not the only important [metric].

WS: Is it still part of Warner Bros. Discovery’s strategy to sell content to third parties?

ZEILER: We are the owners of probably the largest global library of content. This requires us to maximize the value through a broad distribution and monetization strategy. It makes sense to monetize across all windows, from theatrical to home entertainment, streaming and linear. It’s also clear that when we want to be the home of the best and greatest storytellers, we can’t create and use content only for our networks. Yes, a lot of the content we create we make for and use on our platforms. But there are also shows that are created for and air on third-party platforms that are very successful. We will not give up this third-party business. It wouldn’t make sense financially, and I also don’t believe that we could hold on to the best storytellers in the world if we tell them they could work only for our networks.

11

Norbert Himmler Director-General ZDF

WS: What programming strategies have placed ZDF in a market-leading position?

HIMMLER: We have been consistently optimizing our schedule on the main channel for many years. The stable success of our daytime programming, early evening offerings and prime-time lineup is an essential cornerstone of our linear success. In addition, we have further increased the quality standards in all relevant genres. The recipe for success includes highlights, fiction events, major sports events and unique formats, for example, comedy, factual and information.

WS: How is ZDF collaborating with other public broadcasters in Europe?

HIMMLER: Some years ago, ZDF initiated The Alliance, together with Rai and France TV, which can now proudly look back on rave reviews regarding high-end drama series. Additionally, there is a close co-production cooperation with the BBC and Nordvision, the content grouping of the Scandinavian public broadcasters. A vast majority of the crime-based fiction series coming from that initiative have been co-produced and co-financed by ZDF. And then, we support the co-production initiatives by the EBU, especially when it comes to children’s programming and high-end doc projects. There is no better deal than when several partners with similar sets of values and production strategies come together and co-produce: you pay for one or two episodes and receive eight to ten for your program in return! And it is the only way for us to match financially the streamers’ deep pockets in production.

WS: What opportunities and challenges do you see looking ahead to the next 12 to 24 months?

HIMMLER: We are all facing major challenges. The East-West conflict that has flared up again, the climate and energy crises, inflation, the pandemic, divisions in society—these buzzwords describe the extent of the changes. The media industry is responsible for accompanying and supporting the debates taking place in society with accurate information and journalistic products. As an influential media platform, we can make an important contribution—with meticulously checked facts and a wideranging, independent information product. That’s why we invest in good journalism, training and quality.

12

Tom Fussell CEO

BBC Studios

WS: Tell us about BBC Studios’ new global ambition.

FUSSELL: When Tim [Davie] became BBC’s director-general, he set a strategy, supported by all of us on his executive committee, called “Value for All.” For the first time, one of the four key tenets of the BBC’s overall strategy was to grow commercial income. For us, it starts with the BBC and begins with the content. We’re a fully-fledged global content studio across all three genres [kids, scripted and non-scripted]. We’re all driven by the mission and the purpose of the BBC. The joy is that we’re seen as an ideal partner to work with. In a world where many people aren’t taking risks anymore—and I understand the economic challenges—we are, making us an attractive place for creatives to come and do their best work.

WS: What opportunities are you exploring in terms of M&A or first-look deals?

FUSSELL: We’ll do both and things in the middle as well. The key thing is that we’re open for business on investment. That includes acquiring and investing in the gaming side of the business, linear channels in some parts of the world and production labels in genres that are in our portfolio. The key thing is ensuring our partners share our values; they’re driven by the BBC’s mission and purpose. They want to take creative risks in the ways we want to, and we can work well with them.

WS: What’s the roadmap for doubling commercial revenues in five years?

FUSSELL: We have the support of a new BBC commercial board chaired by the well-respected U.K. businessman Damon Buffini. We’re in it for the long term and making longterm investments. We’re investing in UKTV, our linear business. We’re investing in the BBC’s website outside of the U.K. We’ll buy labels. We will do first looks. We are continuing our investment in distribution rights and building for the future. We’ve had good successes in the short term, but we’re also set up for long-term success. The path doesn’t need course correcting because it is the right pace and the right level of risktaking. That creative risk-taking, driven by the BBC’s mission and purpose, makes us unique.

13

Jane Turton CEO All3Media

WS: Have broadcasters and platforms become more risk-averse than they used to be?

TURTON: There’s a theory that in times of economic challenge, buyers tend to favor the familiar and wellestablished, hence the conversation around the number of spin-offs, reboots and adaptations with popular, proven IP considered a safer bet. Meanwhile, at the same time, and in the same market, innovation is incredibly strong, with new shows in both scripted and non-scripted launching every week. Buyers are taking risks across all platforms, and audiences are excited by both established favorites and new series launches. I think the common feature in success is quality as opposed to the age of the show.

WS: Are you looking to expand the company’s footprint and make other investments?

TURTON: It’s all about talent and IP. To deliver a long-term and sustainable business, the quality of the team and the programs that are developed and produced are fundamental. Are we still looking? Yes. We are always keen to look at an opportunity to add exceptional talent to the business. And, of course, IP is, in itself, an interesting potential area for investment, either as rights catalogs for All3Media International to exploit or as IP that can be adapted into TV shows. We are also interested in the potential of adding new geographies to the business as, today, we do not have a particularly broad production footprint. There aren’t many opportunities, and we’re very selective. But we are keen to continue to grow the business inorganically and organically.

WS: And scale still makes a difference, doesn’t it?

TURTON: It makes a difference more now than ever for a number of reasons. One, it gives you extra insight and greater optionality when you’re deal-making, whether it’s in attracting talent, buying rights or exploiting rights on a global basis. It also gives you more resilience. When the market is as dynamic as it is currently, it’s helpful to have a well-established, scaled business with supportive shareholders where you can move fast to respond to opportunities and invest.

14

Henrik Pabst

Chief Content Officer, Seven.One Entertainment Group CEO, Seven.One Studios

WS: How and why did Seven.One Studios come about?

PABST: We established Seven.One Studios as our new production umbrella last November, bringing together all our production subsidiaries in Germany, the U.K., Denmark and Israel, and our worldwide distribution arm. With the growing demand for local programming, Seven.One Studios is producing across all our platforms and for the external market.

WS: As ProSiebenSat.1 has transitioned from being a traditional linear television business to operating multiple linear and nonlinear platforms, what is the strategy for offering content and reaching viewers?

PABST: Our strategy is best illustrated by a triangle: We have our linear platforms, a strong AVOD offering and an exclusive SVOD offering. Within this triangle, we play our programs always with the goal of maximum reach and the best monetization. Having flexibility here is key to us.

WS: Is advertising a key way you are monetizing content?

PABST: We strongly believe in advertising. Our in-house media marketer, Seven.One Media, is the largest, strongest and most innovative sales organization in the German market. Adsupported content is here to stay, and with Joyn, we have a wellestablished streaming platform with a clear focus on AVOD. We also have the right ad-tech solution tools across the ecosystem to meet the needs of our advertisers. And let’s not forget that people are used to watching ad breaks. The strategy shift from some global players toward AVOD is a clear sign that the strategic approach we started with the setup of Joyn was the right way.

WS: Is Seven.One Entertainment still emphasizing local programming in its schedules?

PABST: It’s been a journey, but we have steadily increased our local share on our main channels in prime time and will continue with that. We have also invested in our own news offering that we have been producing in-house since the beginning of this year, and we have steadily increased our volume in relevant programming. But licensed [programming] still plays a role for us and [makes up] a big volume in the grids.

15

Cathy

CEO Banijay

Payne

Rights

WS: Is there more aversion to risk among broadcasters and platforms?

PAYNE: All large platforms are reviewing the economics of their operations, and the cost of original content is right at the center of those discussions: What is affordable and sustainable? Reversals of season pickups or cancellations of development [projects] have been widely reported. Does this mean broadcasters are more risk-averse? No doubt, with more focused spend. Having initial feedback on their SVOD launches, tough decisions have had to be made. Putting that aside, all platforms and broadcasters need content that delivers; it is a question of how they run their commissioning process and what is handled globally or commissioned locally. The days of commissioning shows just to have volume are gone—it was never sustainable. While we will always see the high-end, premium and expensive original signature pieces, the rest of the slate needs to reflect a more affordable price point. How we produce at these price points will require innovation.

WS: Do you see a continued need for co-productions?

PAYNE: Co-productions are here to stay, and we are seeing an everincreasing need for collaboration. Indeed, none of the platforms or broadcasters can afford to have every original fully funded. At the premium price point, some domestic commissions cannot proceed without an international partner being secured up front. As a distributor, the increased pressure on providing deficit finance is obvious, and what they can risk is a reflection of where they believe the program will be licensed.

WS: Where do AVOD and FAST fit into your distribution sequence?

PAYNE: Both provide new avenues for exploiting libraries and catalog, which makes up most of these channels. Banijay runs 21 unique FAST feeds that are syndicated more than 80 times globally, and all of these operate on a revenue-share basis—so AVOD and FAST are part of the distribution life cycle of all content. Our best-performing titles across AVOD and FAST are those that had an initial strong performance and, therefore, already have audience recognition. As AVOD and FAST develop and more is learned, there will be a greater focus on editorial and less on volume for the sake of volume.

16

Dr. Markus Schäfer President & CEO ZDF Studios

WS: What have been the benefits of the rebrand to ZDF Studios?

SCHÄFER: Our value proposition to the market has become much clearer. ZDF Studios is a fully integrated media group from creation to production and exploitation. In this regard, we see ourselves in the same bracket as other stu dios—branded businesses like, for example, BBC Studios or ITV Studios. The new brand was very helpful in conveying to the market that we are not just a distribution business, which is our heritage, but we cover the full value chain. As such, we appeal to a much broader range of partners in the international market. Also, within our group, the new name has an impact as it supports our ambition to become a more integrated company.

WS: What have been your priorities since you took over?

SCHÄFER: The ZDF Studios group comprises many companies spread across three business areas: production, distribution and services. We cover all major genres, from documentary to entertainment and scripted. We are a multi-site group with premises all across Germany, and we also have footprints in the Netherlands and the U.K. Last but not least, our shareholder, ZDF, is one of Europe’s largest broadcasters. The key is to drive our internal integration in three dimensions: across our various production businesses, between production and distribution, and, of course, between ourselves and our shareholder, ZDF. Such integration will service our key objectives and serve both the overall market and ZDF.

WS: How is ZDF Studios working with producers or production partners?

SCHÄFER: In principle, we say we are model-agnostic, so collaborations vary from project to project. First and foremost, we make sure the interests and needs of the partners around the table are aligned and clearly defined, so everybody knows what they are contributing and what they cannot contribute. Any kind of collaboration or structure model should be designed following such a setup of needs and interests. Our general approach is to be a complementary partner who brings skills and assets to the table that our partners don’t have and vice versa.

17

Fredrik af Malmborg CEO

Eccho Rights

WS: What factors do you have to consider when determining if you should do a global deal on a show versus selling territory-by-territory?

AF MALMBORG: At some point, I thought that all projects would go to global deals with the platforms, but I see a very strong trend in the other direction. We are investing much more in development financing with producers. Instead of going the commissioning route, we are going the acquisition route. So we sell it as an acquisition to the platforms regionally and manage the rights from the start.

If we see something we like at the development stage, we make a deal with the producer. We invest in development and go out and find presale or co-production partners, instead of the producer going to one platform and asking for development money. You retain your rights longer, and you invest more. Doing that will give you a stronger development slate and a much better negotiation position with the different buyers. Selling windows to broadcasters and streamers at perhaps shorter terms [can be more lucrative]. If it’s a success, you retain the rights and make much more money. But, of course, it’s more cash-intensive in the development stage. That’s where we come in. We are investing more and supporting producers. We still think that the IP should be majority owned by the producers. As a producer, it’s important not to go with one platform too early because you have no room for negotiations later.

WS: What new opportunities are you finding with Turkish drama internationally?

AF MALMBORG: MENA is coming back strongly. Latin America is strong. Spain is increasing. Eastern Europe is still strong. We want to make more deals in Africa. Many of our clients are traditional linear broadcasters, but there are more platforms, and we have a big direct-to-consumer team doing YouTube, Facebook and Dailymotion. We have the full episodes, and we’re investing in more dubs and language assets. We make a lot of short clips together with the long form. We have a big team doing that in Istanbul. Also, [there are opportunities with] regional AVODs and FAST channels. Turkish dramas are long-running and made for advertising exposure.

18

Can Okan

Founder & CEO Inter Medya

WS: How did Inter Medya begin?

OKAN: In my youth, I worked in our family company Fono Film at various levels for a long time, and I was actively involved in almost every level of film distribution and postproduction. In this way, I grew up in our industry. Inter Medya started out as a film distribution company serving the Turkish film industry solely within the domestic market. In its first ten years, its basic market structure remained more or less the same, but soon found itself operating both inbound and outbound. Starting from 1999, we expanded to Central and Eastern Europe, Russia, Ukraine and Asian countries, extending our field of distribution to include these markets and enriching the product range. In addition to the geography above, Inter Medya has started distributing Turkish TV series and movies across the globe and has become an important content provider and distribution company worldwide.

WS: What have been the company’s major milestones?

OKAN: From 2007, Turkish TV series and feature films started to draw broad interest from all these markets, as well as the Middle East and North Africa. With solid market demands, both local and international, and accompanied by strong governmental support, the Turkish film industry and TV content production business developed more and gained further stature. In 2016, Inter Medya started to develop and produce entertainment, reality and gameshow formats by bringing together a creative team. In 2019, Inter Medya launched its own production department. In 2021, Inter Medya took a bigger step and invested in Inter Yapım, a sister company dedicated to producing scripted and non-scripted content. Within this frame, Inter Medya became an international company distributing content in over 150 countries and pursued its journey as a producer as well as an international distributor.

WS: How are you positioning the company in the crowded landscape today?

OKAN: Inter Medya is a company that has a multinational team and a global vision due to doing business worldwide, which is growing day by day. We have very strong business relationships that we have been developing for years. We believe that our difference is to be solution-oriented, provide transparent service and a mutually beneficial business.

19

Paul

Heaney

CEO BossaNova Media

WS: What’s been your approach to building the BossaNova slate?

HEANEY: We’re not obsessed with growing the number of new titles. We want enough volume, noise and quality of the right shows. We’re also not looking at padding out a catalog with potential channel fodder. Others may have that business model, and maybe we will in the future, but this is our plan right now. We see it as more of a slate than a catalog—and maybe that’s a key difference with BossaNova.

WS: What does the team look for in acquisitions?

HEANEY: In the producer, a track record of delivering and executing on time. A well-researched idea. If it’s a commercial specialist factual series, you need good archive and an original take on something. Even if it’s the same story, you need an original way in. If it’s simplistic and doesn’t have enough layers, we won’t do it. We’re not going to do anything that looks too cynical or simplistic. Everything needs a certain layer of sophistication with respect to the audience. All producers realize you have to have something clever now. It doesn’t have to be intellectual or cerebral. If you look at our Development Day, the projects that stood out were sometimes outrageously original in the topic, but some ideas were only more original in their angle and execution rather than the story. That’s what we’re looking for.

WS: What trends are you seeing in the market?

HEANEY: You hear that the market has hit saturation for many returning true-crime franchises. At the same time, there is a demand for new strands. If it were four years ago, we’d have more returnable true-crime series than we do now. We have some singles, some two-parters, some potential four- and sixparters, all in the “stranger-than-fiction, you can’t make up” areas. It’s a complete mixed offering.

The big elephant in the room is about the distribution business itself. How can smaller businesses survive when projects they are offered need financing almost every time? It looks like it’s sustainable if you’re a big business. At TCB Media Rights, in the beginning, most of the shows we got were funded. In this world, the opposite is the case. [Shows comes funded] 10, 15 percent of the time.

20

DISTRIBUTORS

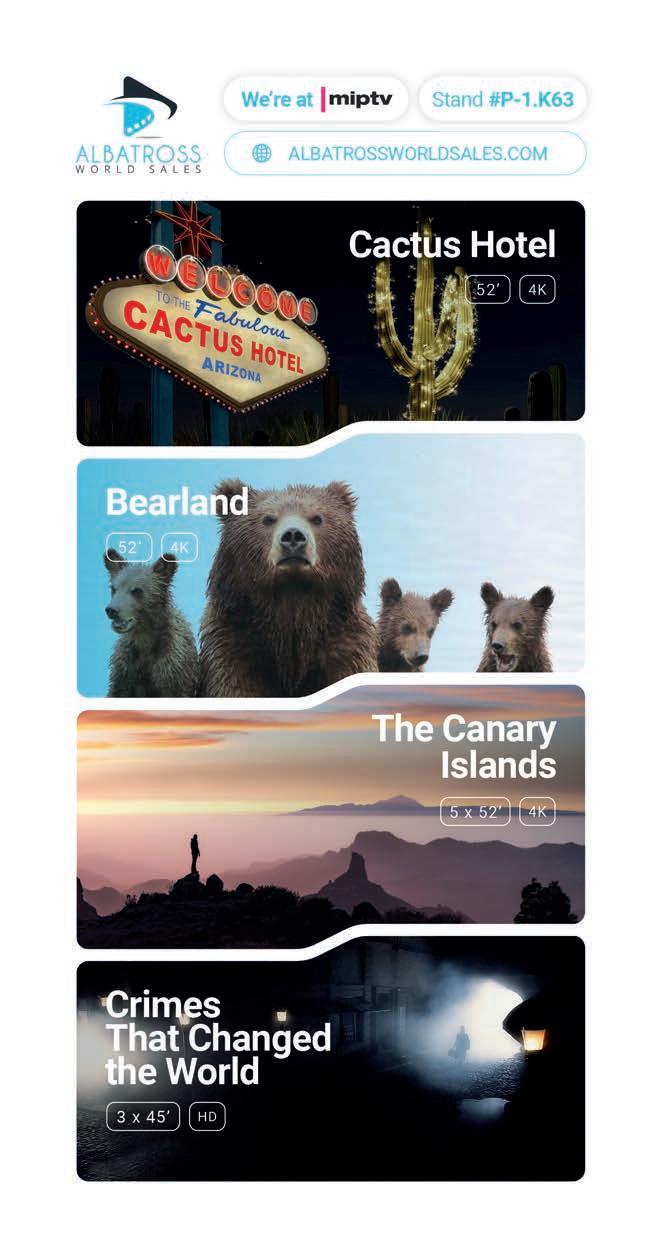

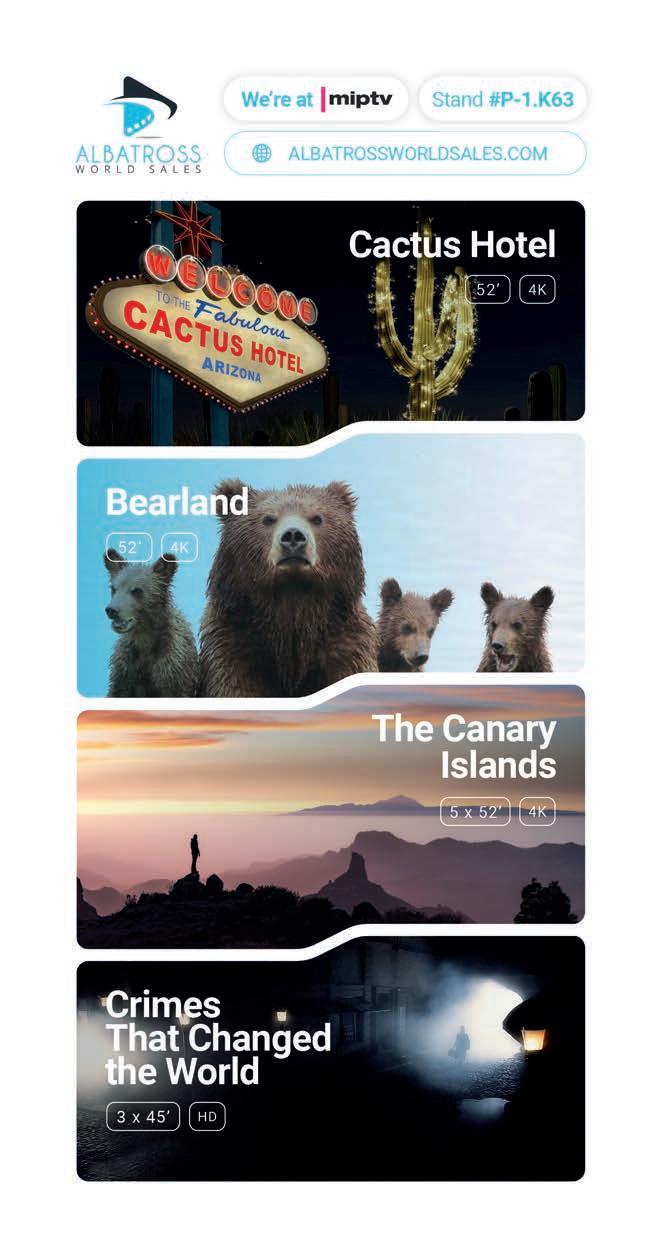

Albatross World Sales

O (49-341) 44282450

w www.albatrossworldsales.com

m info@albatrossworldsales.com

KEY CONTACTS:

Anne Olzmann, Managing Director

Lisa Anna Schelhas, Sales Director

Lisa Anna Schelhas, Sales Director

PROGRAMS:

Cactus Hotel: 1x52 min., nature/wildlife; Crimes That Changed the World: 3x45 min., history; Bearland: 1x52 min., nature/wildlife; The Canary Islands: 5x52 min., destinations/ travel/nature/wildlife; Sudden Silence—How Animals

Reclaim a World in Lockdown: 1x52 min., science/wildlife; The Wadden Sea—Living on the Edge: 4x52 min./1x90 min., nature/wildlife; The Kennedys : 1x52 min., history; Europe’s Highlands : 4x52 min., destinations/travel/nature/wildlife; The Dark Side of the Bright Nights: 1x52 min., science; Lethal Leaks— On the Track of Escaping Methane: 1x43 min., science.

“Albatross World Sales is a leading documentary and factual program distributor offering high-quality and award-winning titles in the genres of nature and wildlife, science, history and destinations. We work with many international production companies and can offer a wide variety of programming with different visual approaches and storytelling.

We are returning to MIPTV with a bigger slate than ever before and are especially eager to talk about our flagship bluechip title Cactus Hotel, featuring the saguaro cactus from the Wild West. Bearland, on the other hand, travels to the bears of Asia to explore their wild lands. We’re also really excited to present our history true-crime series Crimes That Changed the World, about famous felonies that changed our perception of right and wrong and our justice systems forever.

We bring a diverse and strong factual slate to MIPTV 2023 and are looking forward to talking about our brand-new and highly relevant programs with our clients and friends in Cannes.”

—Lisa Anna Schelhas, Sales Director

22

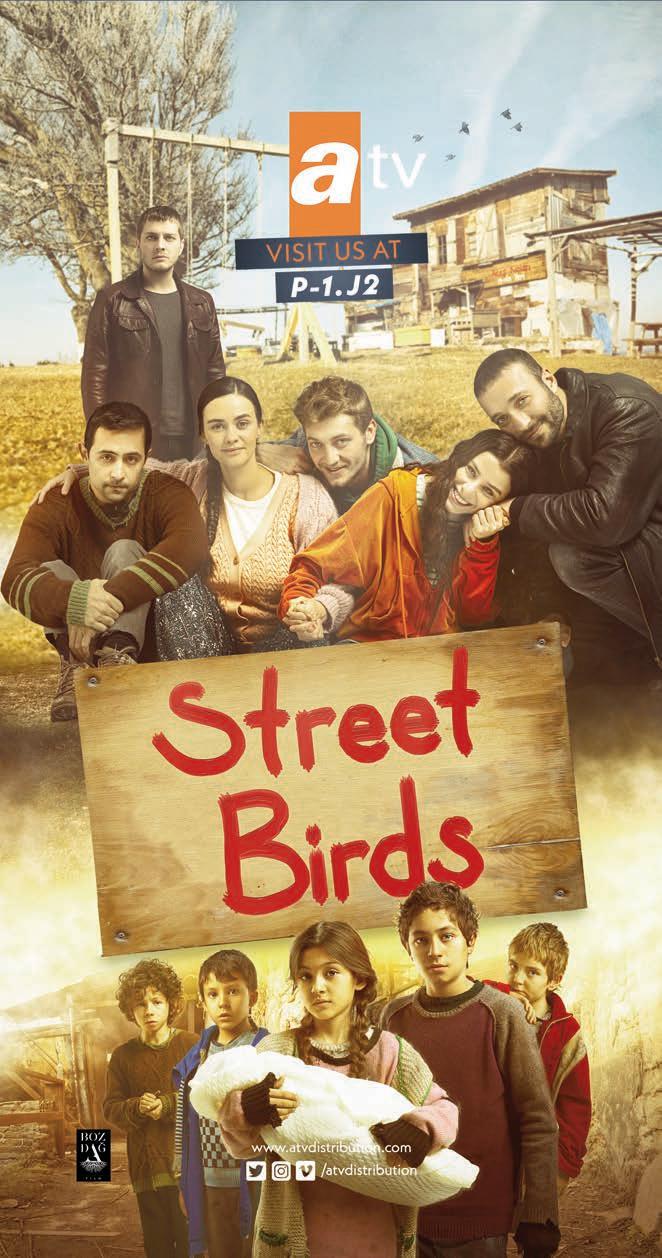

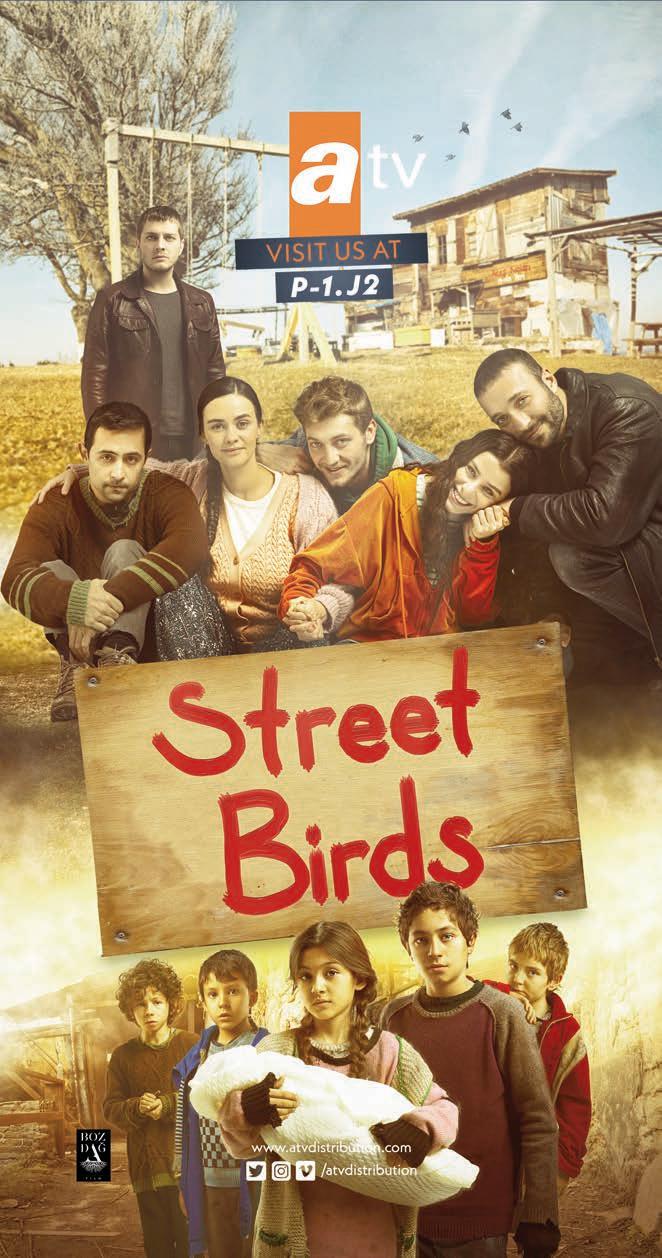

O (90-212) 354-37-01

w www.atvdistribution.com

m info@atvdistribution.com

KEY CONTACTS:

Müge Akar, Head, Sales, Europe, Asia & Africa

Emre Görentaş, Head, Sales, Americas & MENA

PROGRAMS:

Street Birds: 45 min. eps., drama; A Little Sunshine: 45 min. eps., drama; The Father : 45 min. eps., drama; For My Family : 200+x45 min., drama; The Ottoman : 321+x45 min., drama; Destan: 91x45 min., drama; Wounded Heart: 107x45 min., drama.

“Founded in 1993, atv’s reputation is built on creating unique dramas and exploring what is not explored before. With years of experience and being the pioneer in various fields of Turkish dizis, atv plays a major role in Turkish drama being acknowledged universally. Moreover, atv continues to be more than just a channel but a trademark in its field of production with the same passion, excitement and quality. Throughout the years, atv Distribution has provided high-quality dramas that lead the industry by the key factors of authentic yet global, unique but common.”

—Corporate Communications

24

atv

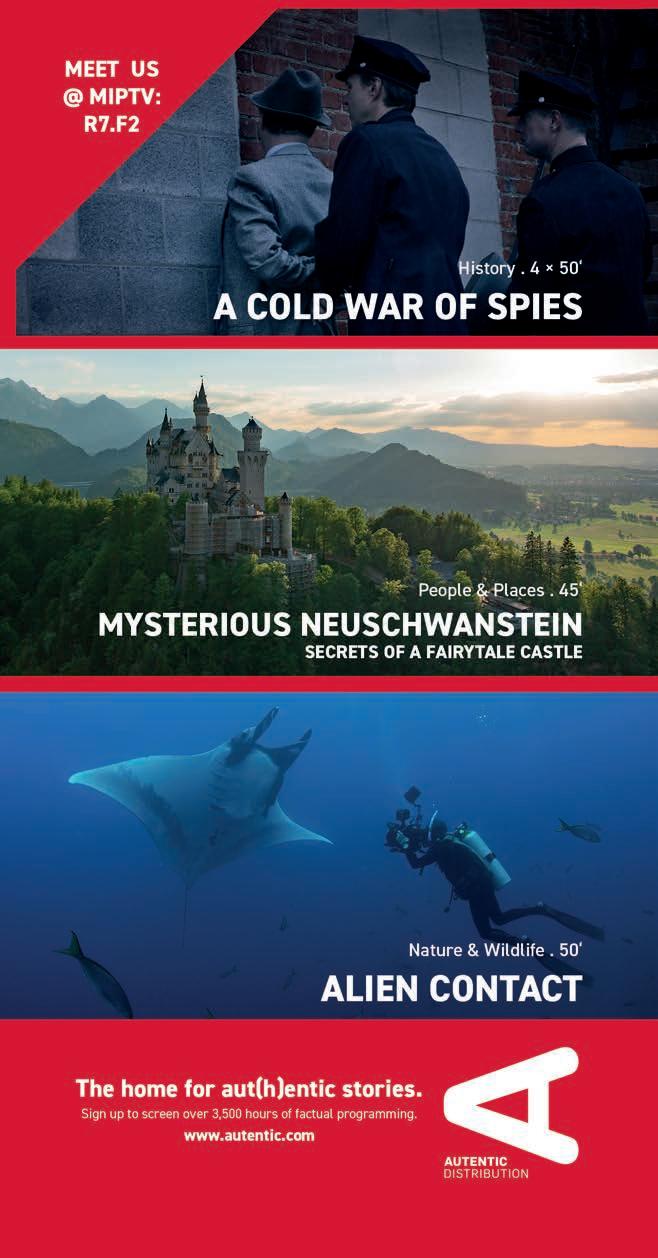

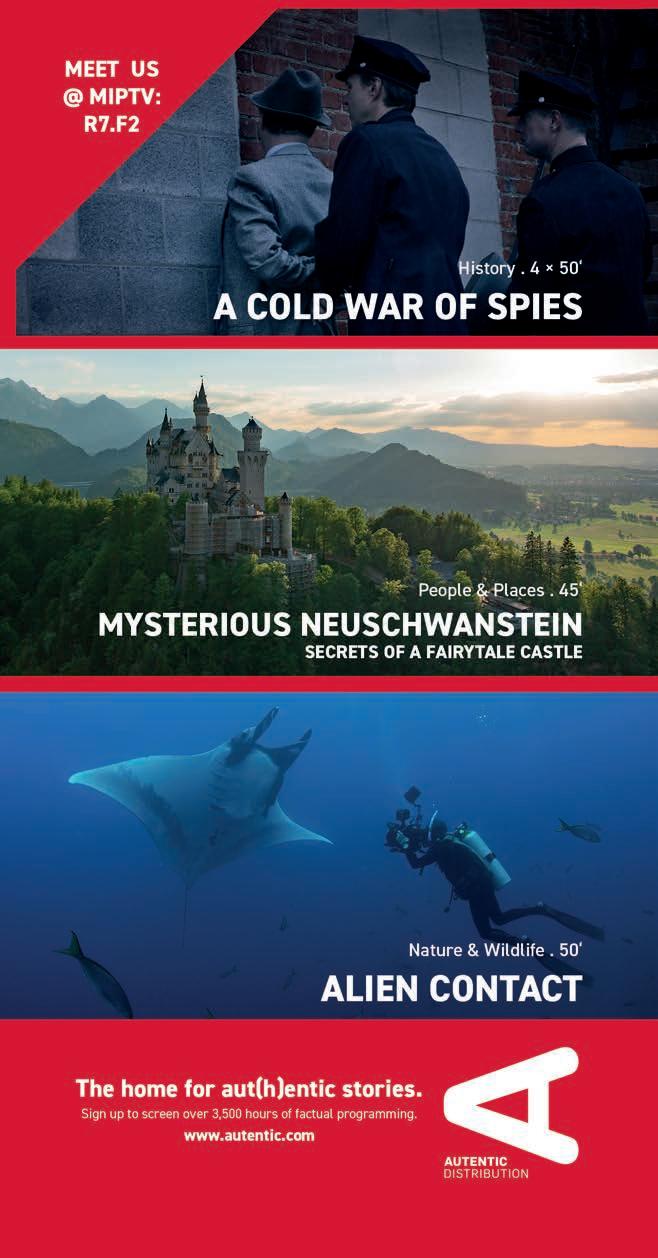

Autentic Distribution

O (49-89) 673-469-797

w www.autentic.com

m sales@autentic.com

KEY CONTACTS:

Dr. Patrick Hörl, Managing Director

Mirjam Strasser, Head, Sales & Acquisitions

PROGRAMS:

Against All Odds : 1x55 min., current affairs; Life After Coal :

1x52 min. & 4x45 min., current affairs; That Crazy Italian Farm: 6x45 min., factual entertainment; A Cold War of Spies: 4x50 min., history; Michael Caine—The Becoming of a Hollywood Star: 1x90 min., lifestyle/arts; Alien Contact: 1x50 min., nature/wildlife; The Hummingbird Effect : 1x50 min., nature/wildlife; Mysterious Neuschwanstein—Secrets of a Fairytale Castle: 1x45 min., people/places; Mapping Disasters: 6x52 min., science/technology; Engineering Extreme—

Rehauling a High Speed Train: 1x55 min., science/technology.

“Autentic Distribution focuses on high-quality documentaries and factual series for the global market. Our catalog includes documentaries of all factual genres, from gripping current-affairs titles like the Ukrainian film Against All Odds to history, science, lifestyle and factual-entertainment programs.

Our highlight of the year certainly is our cooperation with Terra Mater Studios, which brings hundreds of hours of stunning wildlife films to our portfolio, and we are thrilled to present Terra Mater Studios’ latest blue-chip productions as part of our spring lineup, including the breathtaking film Alien Contact, which decodes the secrets of some of the sea’s most graceful giants: manta rays.

Our catalog also includes the latest documentaries by Autenic’s own production division as well as our next coproductions with Go Button Media in Canada, for example, A Cold War of Spies and Mapping Disasters. The latter science series replays Earth’s worst disasters to understand how they could have happened and find out what can be learned in their aftermath. There are many more compelling and inspiring documentaries to discover in our catalog.”

Mirjam Strasser, Head, Sales & Acquisitions

26

BEC World

O (66) 262-3249

w www.becworld.com

m inter-sales@becworld.com

KEY CONTACTS:

Surin Krittayaphongphun, President, TV Business

Ziraviss Vindhanapisuth, VP, International Business

Ratsarin Phaisantanamol, International Business Account Manager

Kawalin Chantawatkul, International Business Account Manager

PROGRAMS:

Royal Doctor: 22x70 min., romance/drama/comedy; Because of Love: 18x70 min., romance/comedy/drama/action; Eclipse of the Heart : 20x70 min., romance/drama; Devil in Law : 17x70 min., romance/comedy; Doctor Detective: 18x70 min., drama; The Betrayal: 16x70 min., thriller/drama; Never Enough: 22x70 min., romance/drama; Love at First Night: 20x70 min., romance/comedy; You’re My Universe : 28x42 min., romance/drama; The Legend of Nang Nak : 28x42 min., romance/thriller.

“BEC World is a content company. We continue to challenge ourselves to be the best storyteller and compete with content from the region for the rest of the world. We produce a wide range of content for different target markets, including tentpoles like Love Destiny , which showcases Thailand’s rich history and culture that is widely received internationally, as well as rom-coms with BEC’s A-listers, drama and horror. We are cognizant of the post-pandemic economics of platforms and are exploring creative innovations in new program formats and workflows. In 2023, BEC aims to meet the rising demand with engaging and quality Thai content.”

—Surin Krittayaphongphun, President, TV Business

28

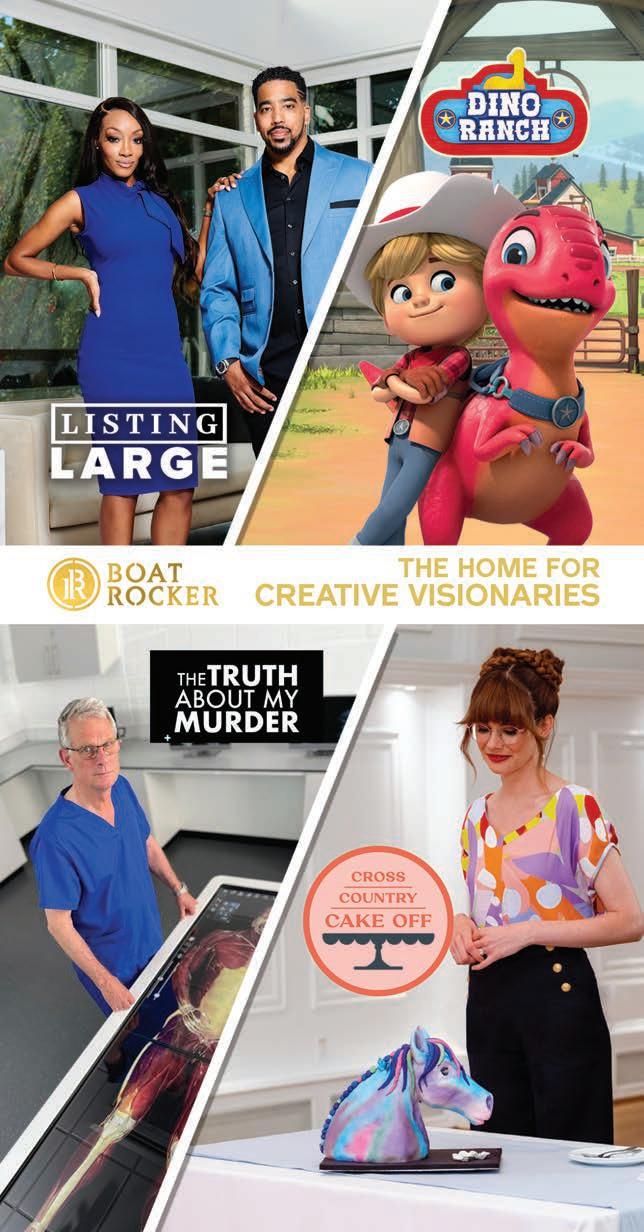

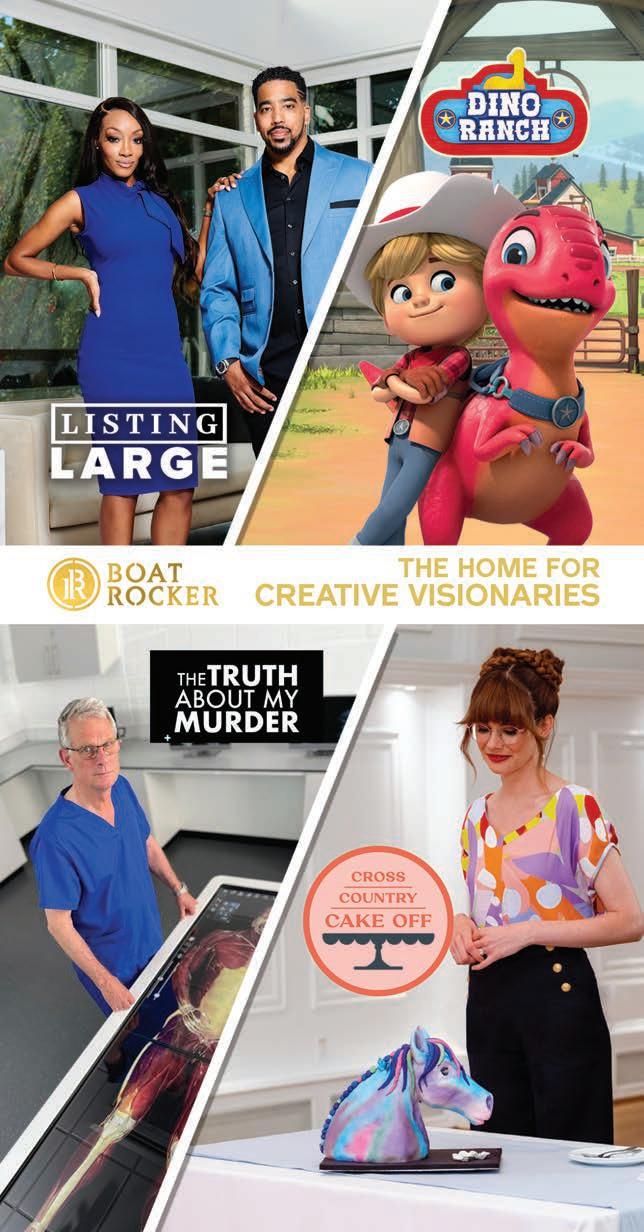

Boat Rocker Studios

O (1-416) 591-0065

w www.boatrocker.com

m sales@boatrocker.com

KEY CONTACTS:

Jon Rutherford, President, Boat Rocker Studios, Kids & Family & Rights

Gia DeLaney, Senior VP, Global Sales, Kids & Family

Natalie Vinet, Senior VP, Global Distribution

Erik Pack, Senior VP, Global Sales & Co-Production

PROGRAMS:

Slip : 7x30 min., comedy/scripted; Robyn Hood : 8x60 min., action/drama/scripted; Beacon 23 : 16x60 min., sci-fi/ thriller/scripted; Orphan Black: Echoes : 10x60 min., sci-fi/ thriller/scripted; Dino Ranch : 156x11 min., preschool/ action/adventure; The Next Step : 223x30 min., tweens/ teens/scripted/live action; The Strange Chores : 78x11 min., kids/comedy/adventure; Mary Makes It Easy : 50x30 min., cooking/unscripted; Cross Country Cake Off : 10x60 min., cooking/unscripted; Listing Large : 10x30 min., real estate/unscripted.

“Boat Rocker Studios is an independent, creative-driven studio that specializes in the development, production and distribution of premium, award-winning global content, building franchises across all major genres via its scripted, unscripted and kids and family divisions. The studio distributes and licenses thousands of hours of its own and third-party content around the world through its Rights & Brands division. Boat Rocker has won a variety of prestigious industry accolades, including Emmy, Peabody, Golden Globe, BAFTA and Canadian Screen Awards. Recent projects include Dino Ranch for Disney Junior, Invasion for Apple TV+ and The Kids Tonight Show for Peacock. With over 800 employees across its Toronto, New York, Los Angeles, London, Ottawa and Hong Kong offices; 400 hours of content produced annually; and a distribution library now totaling over 9,000 half-hours, our sales team maintains a boutique style of distribution with the reach of a global media company. In the past year, Boat Rocker has sold content in over 300 countries worldwide across free TV, pay TV, pan-regional channels, OTT and streaming platforms.”

—Corporate

Communications

30

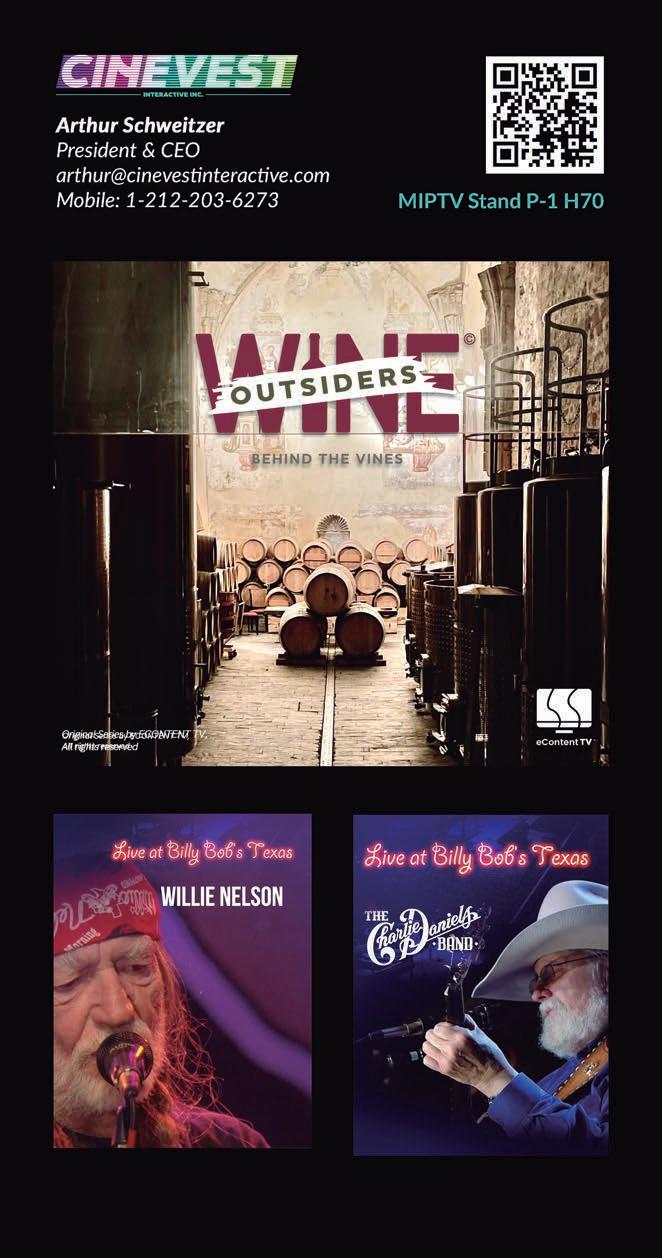

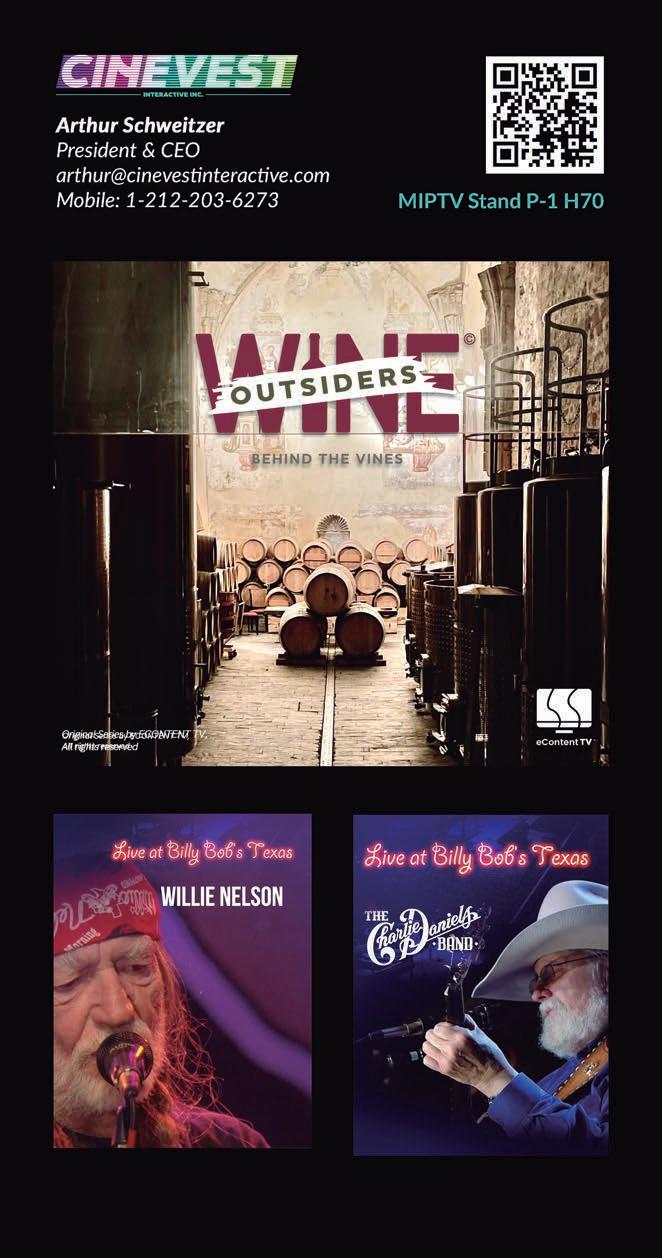

Cinevest Interactive

O (1-212) 203-6273

w www.cinevestinteractive.com

m arthur@cinevestinteractive.com

KEY CONTACTS:

Arthur Schweitzer, CEO & President

Susan Schweitzer, CFO

Tunde Aina, Producer & Advisor

PROGRAMS:

Wine Outsiders: 5x60 min., travel doc.; Willie Nelson at Billy

Bob’s Texas : 1x60 min., concert; Charlie Daniels at Billy

Bob’s Texas : 1x60 min., concert; RVD Headstrong: 1x60 min., autobiographical doc.; Underbelly: drama/historical/adventure;

Takers: drama/historical/adventure; Herdsmen: drama/ historical/adventure; The Deli : comedy; Daniella’s Court : 11x30 min., kids/live action/dramedy.

“Cinevest Interactive is a worldwide distributor of original movies, TV series, documentaries, concerts and live-action children’s TV series that have universal appeal. Cinevest continues its acquisition of high-quality individual and film libraries to provide the best content to the growing number of video platforms. We are adding a boutique theatrical distribution division later this year for a selection of our arthouse feature films.”

—Arthur Schweitzer, CEO & President

32

Cisneros Media

O (1-305) 442-3400

w www.cisneros.com

m contentsales@cisneros.com

KEY CONTACTS:

Jonathan Blum, President

Ailing Zubizarreta, VP, Content Development & Creative Services

Carlos Cabrera, VP, Sales

PROGRAMS:

Zumbar : 26x5 min., kids; AnimalFanPedia : 26x11 min., edutainment/kids; My Birthday Bash : 13x22 min., kids; #GOAT : 26x5 min., tweens; WERK! : 26x5 min., tweens; Mysterious Earth : 13x30 min., docuseries; Killer Instincts : 13x30 min., docuseries; Food Pop : 13x30 min., docuseries; Fashion Insta: 60 min. eps., variety show.

“We are committed to creating, producing, programming and distributing the best content for our audience. We create shows with global appeal, driving viewership for our affiliates, clients and advertisers. We operate channels and platforms to increase the reach of our content and develop partnerships to amplify our footprint in the market.”

—Jonathan Blum, President

34

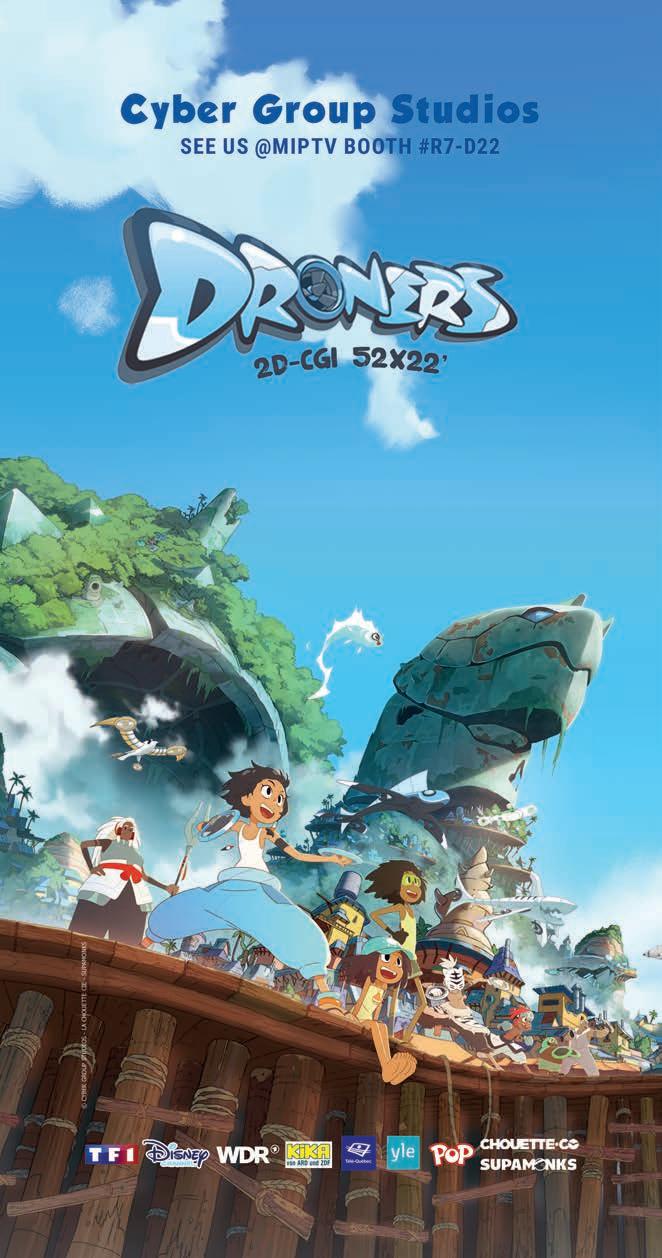

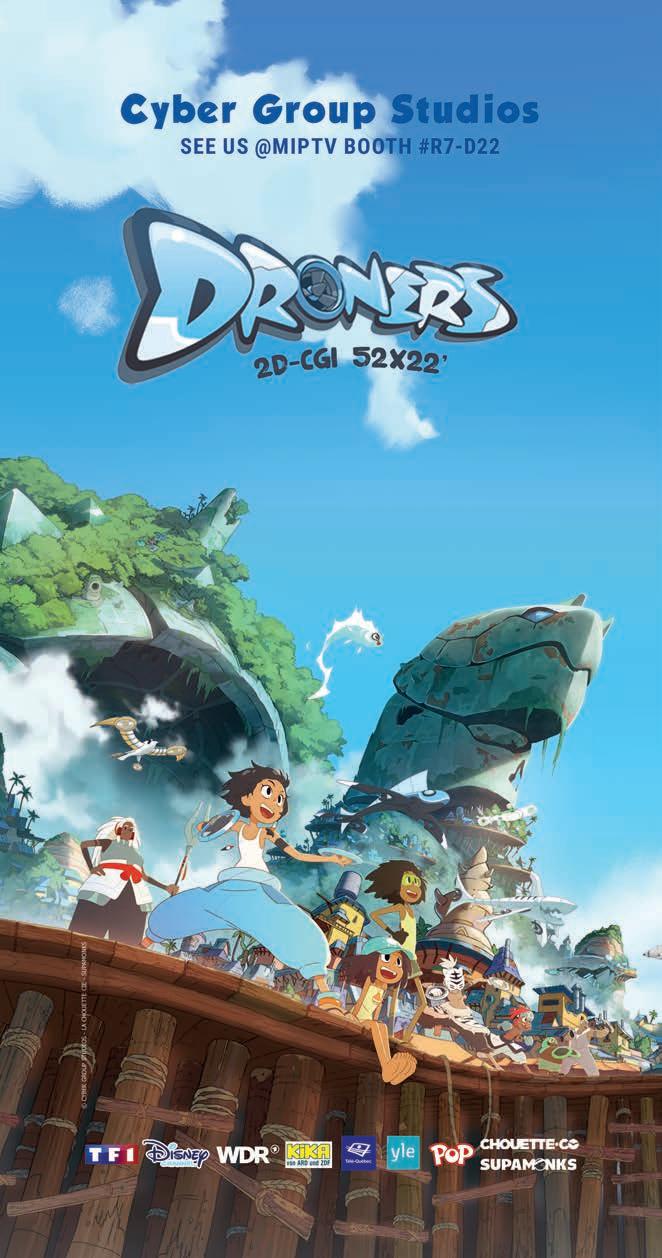

Cyber Group Studios

O (33-1) 5556-3232; (1-818) 844-1660

w www.cybergroupstudios.com

m sales@cybergroupstudios.com

KEY CONTACTS:

Dominique Bourse, Chairman & CEO

Raphaëlle Mathieu, Executive VP

Karen K. Miller, President & CEO, Cyber Group Studios USA

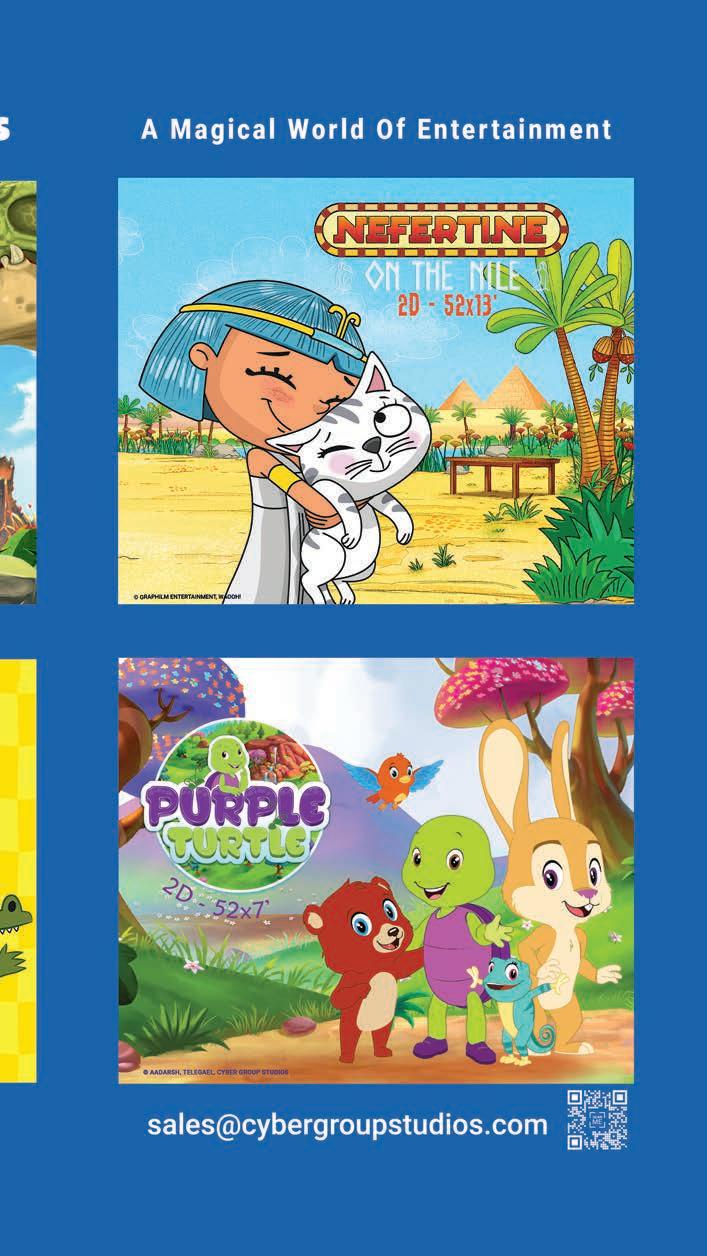

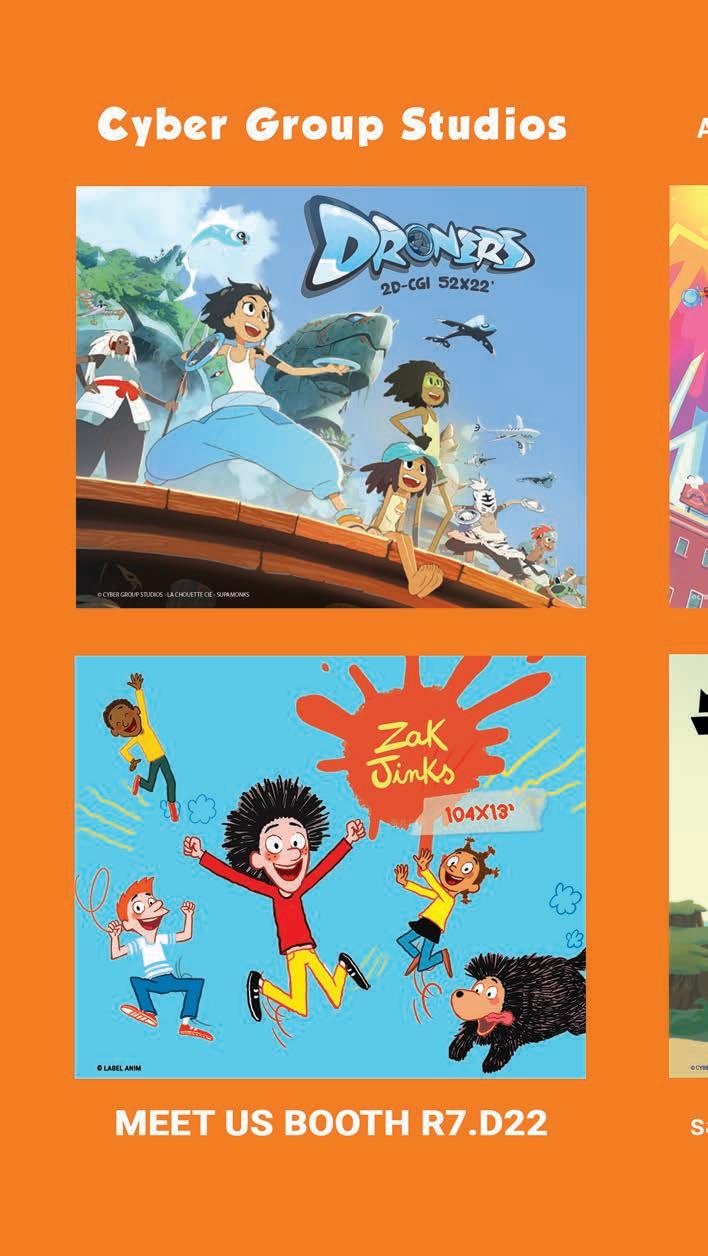

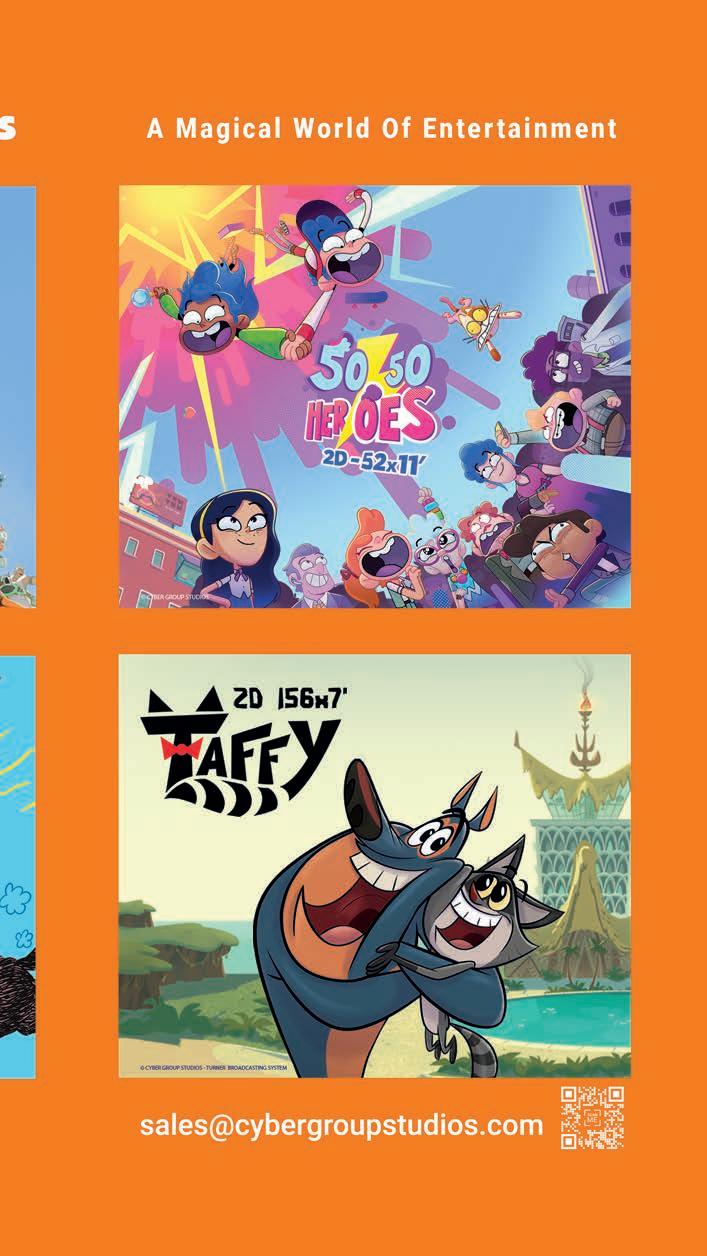

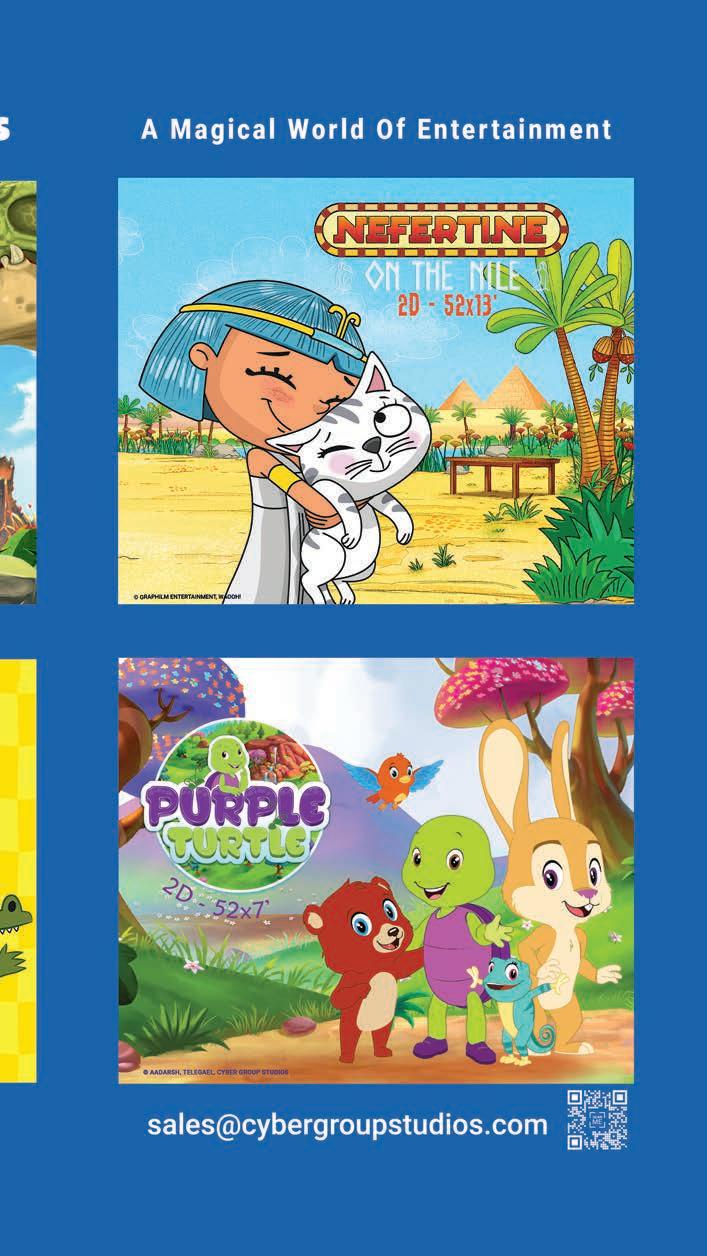

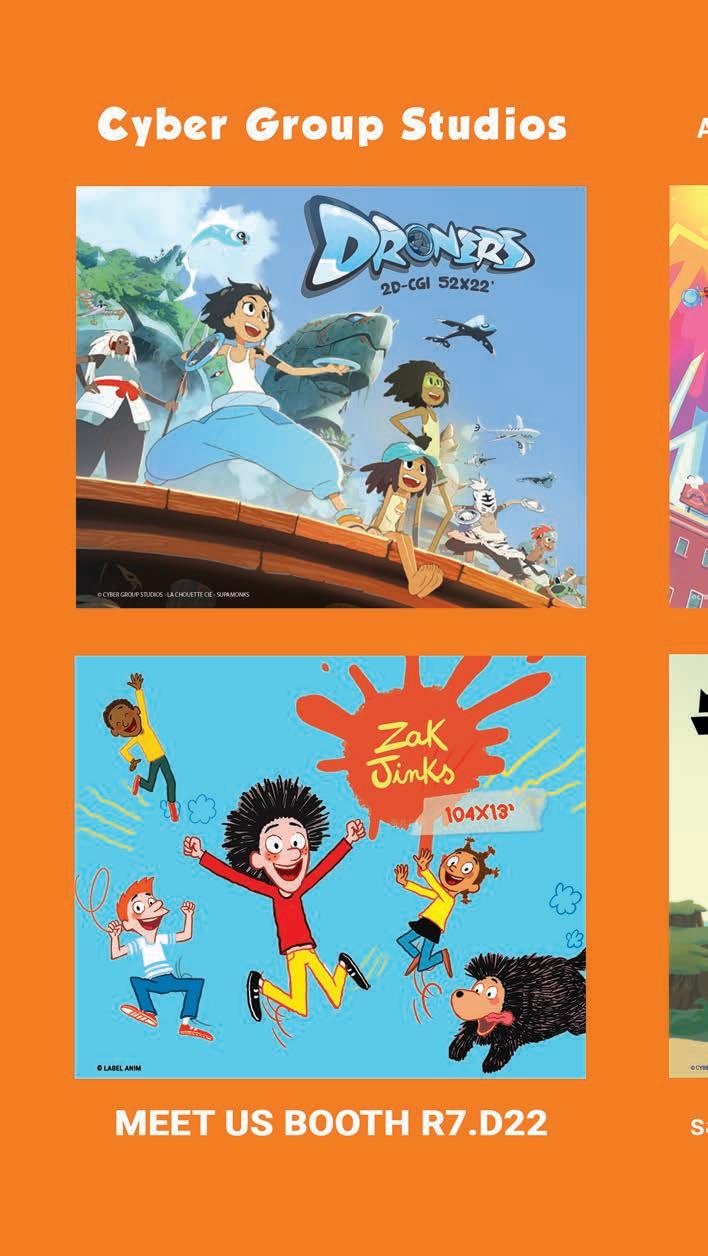

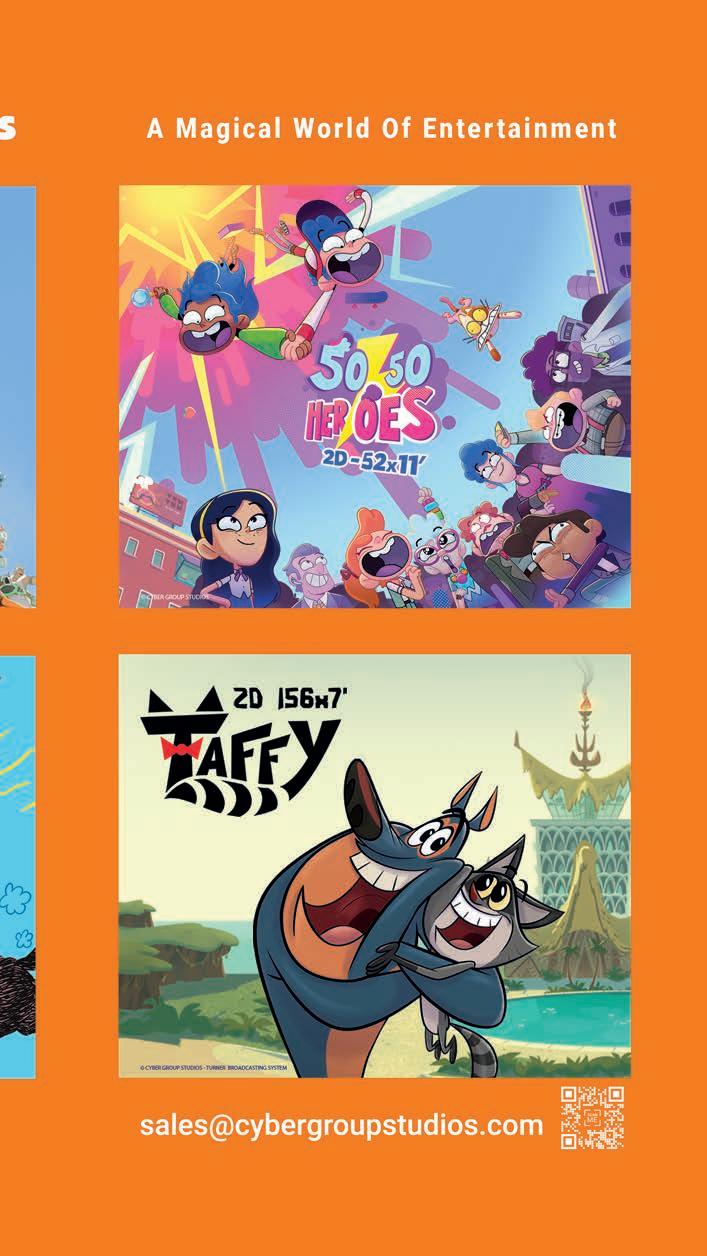

PROGRAMS:

50/50 Heroes: 52x11 min., kids/comedy/adventure; Droners: S1-2 52x22 min., kids/adventure/comedy; Taffy : S1-2 156x7 min., kids/family/cartoon/comedy; Gigantosaurus: S1-3 156x11 min./78x26 min., preschool/comedy/adventure; Zak Jinks: S1-2 104x13 min., kids/adventure/comedy; Nefertine on the Nile : 52x11 min., preschool/animation/comedy; Squared Zebra: 78×7 min., preschool/comedy/edutainment; Chloe’s Closet: 104x13 min., preschool/edutainment; The Case (La Custodia): 1x40 min., family/animation; Alpha & Omega: 3x45 min. specials, kids/comedy/adventure.

“Founded in 2005, Cyber Group Studios is a leading multi-award-winning international producer and distributor of animated programs for an audience ranging from kids to young adults. The company is based in France, the U.S., the U.K., Italy and Singapore. Its team is driven by a passion for creating great and inspiring stories targeted at a global audience on all continents. Its five development and production studios share a strong culture of innovation, offering audiences the best storytelling, animation and music experiences. Cyber Group Studios produces its own content as well as third-party programs that are distributed worldwide on all digital and linear platforms. It also engages in large-scale marketing and consumer-products licensing programs of its series’ characters.”

Raphaëlle Mathieu, Executive VP

36

Escapade Media

O (61-4) 1103-5317

w www.escapademedia.com.au

m natalie@escapademedia.com.au

KEY CONTACTS:

Natalie Lawley, Managing Director

James Braham, Consultant, Development & Completed Content, U.K., Ireland, German-Speaking Europe & Select U.S. Clients

Charo Penedo, Consultant, Development & Completed Content, France & French-Speaking Territories

PROGRAMS:

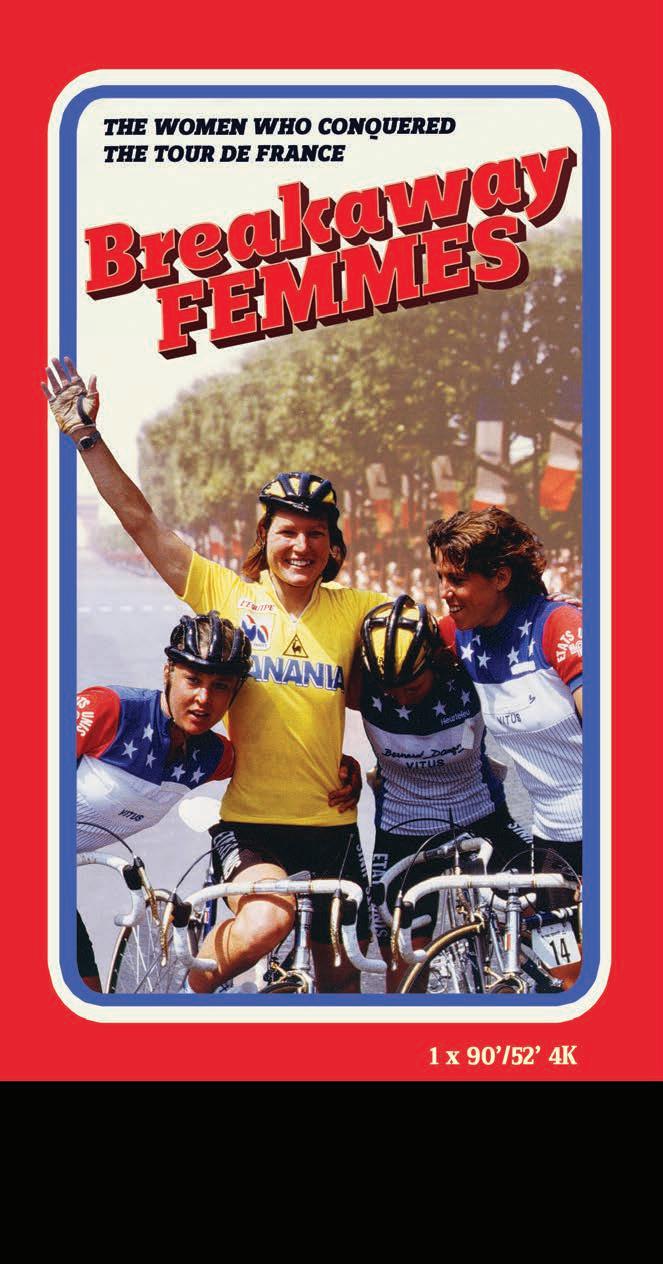

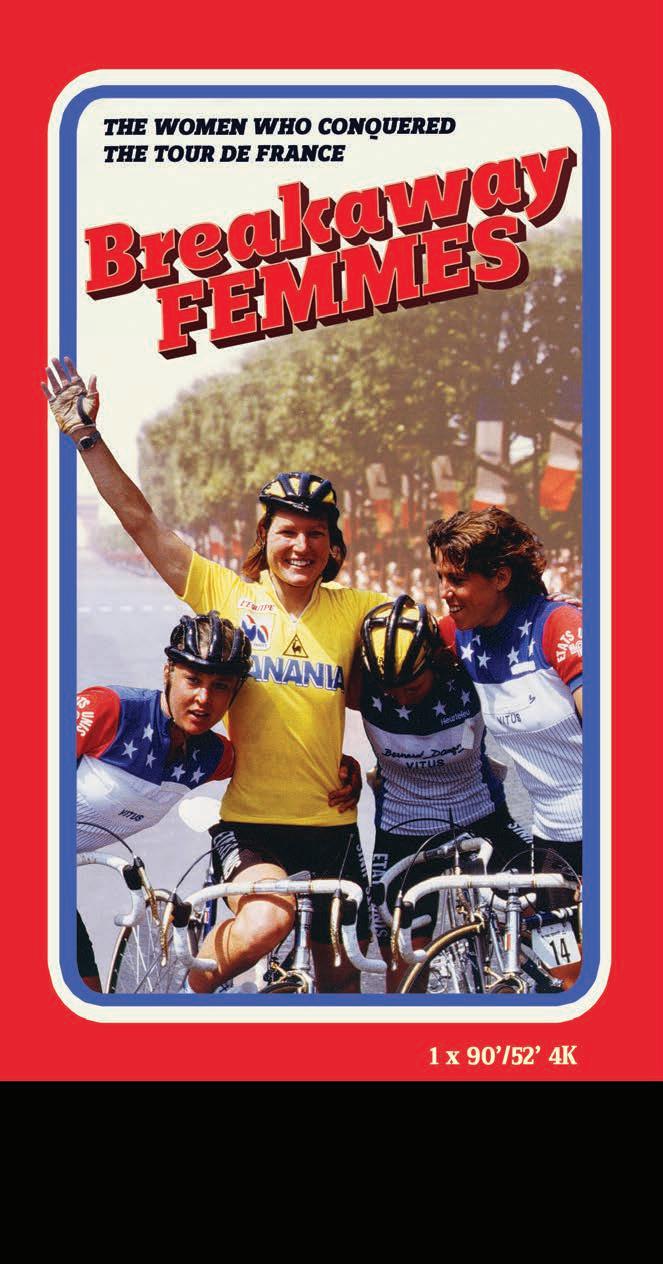

Grassroots: 6x60 min., drama; Whisky Trails: 10x30 min., lifestyle; Bluenoses: 26x5 min., kids; Breakaway Femmes: 1x90 min. & 1x56 min., factual; Hacking Evolution: Lionfish: 1x56 min., natural history; For the Love of Pets narrated by Jai Courtney: 8x60 min., factual entertainment; The Healing: 1x60 min., factual; Gold Digger: The Search for Australian Rugby: 1x90 min., factual; The Best Kind of Beautiful: 6x60 min., drama; Reel Destinations: 12x30 min., lifestyle.

“Escapade Media is a content distributor and content developer. The company works with producers and production houses from all over the world, collaborating on projects to ensure maximum international appeal and revenue generation. Escapade specializes in premium dramas, children’s, lifestyle and factual programming with a point of difference. Our projects are represented by a team with over 40 years of experience across the industry, with consultants on the ground across major territories.

The development side of the business has attracted projects from across the globe, across all genres, providing targeted strategies for each project through the development phase into production and across into distribution. This also includes ensuring the project is in line with any technical developments, noting that all our new content is delivered in 4K with an HD option.”

—Natalie Lawley, Managing Director

38

www.escapademedia.com.au

For more information: Natalie Lawley natalie@escapademedia.com.au

GoQuest Media

O (91-22) 495-591-00

w www.goquestmedia.com

m contact@goquestmedia.com

KEY CONTACTS:

Vivek Lath, Founder & CEO

Jimmy George, VP, Sales & Acquisitions

PROGRAMS:

Erinyes: 12x45 min., crime drama; Crusade: 13x45 min., crime drama; Sacrificiul : 98x45 min., drama; Crazy in Love : 260x22 min., drama; Secrets of the Grapevine: S1-2 72x50 min., romantic drama; Traitor: S1-2 12x58 min., espionage/spy thriller; Civil Servant: S1-2 36x50 min., spy thriller; Debt to the Sea: S1-2 24x50 min., mystery thriller; Divorce in Peace : S1-2 20x28 min., dramedy; Northern Rescue: 10x45 min., drama.

“GoQuest Media is a leading independent global distributor of entertainment content specializing in bringing the best of international drama and scripted formats to new audiences worldwide. Our carefully curated catalog is the culmination of sifting through and choosing high-quality stories with international appeal from nontraditional geographies. We have successfully placed our titles on global platforms like Disney+ Hotstar, Globoplay, SBS, VOYO and Telemundo, among others. Headquartered in Mumbai, with additional offices in the U.K. and Vietnam and local sales presences in Istanbul and the CEE, GoQuest continues to strongly expand its catalog and distribution footprint around the globe.”

Jimmy George, VP, Sales & Acquisitions

40

Inter Medya

O (90-212) 231-0102

w intermedya.tv

m info@intermedya.tv

KEY CONTACTS:

Can Okan, Founder & CEO

Ahmet Ziyalar, President & COO

Beatriz Cea Okan, VP & Head, Sales & Acquisitions

Hasret Özcan, VP & Head, Legal & Business Affairs

PROGRAMS:

Deception: drama; Tuzak: drama; Another Chance: drama; Poison Ivy: drama; The Girl of the Green Valley: drama/family; Dreams and Realities: S1-2 13x60 min. each, drama/romantic comedy; Aziz: 91x45 min., drama; The Trusted: 74x45 min., drama; Scorpion: 91x45 min., drama; Hicran: 126x45 min., drama.

“Inter Medya is a leading independent development, cofinancing and distribution company based in Turkey, which aims to deliver premium content to viewers across the world. Globally, the company distributes scripted and unscripted formats in over 155 territories and has a powerful portfolio of unique Turkish stories. Encouraged by the increasing global interest in Turkish films and TV series, Inter Medya is always looking forward to achieving success in international markets by co-producing and distributing high-quality Turkish content.”

—Corporate Communications

42

Kanal D International

O (90-212) 413-5111

w www.kanald.international

m hello@kanald.international

KEY CONTACTS:

Selim Türkmen, Director, Sales

Çağla Menderes, Sales Manager

Canan Koca, Sales Executive, CEE, CIS & Europe

Özen Yenice Çetinaslan, Marketing & Operations Manager

PROGRAMS:

Farewell Letter : drama; That Girl : drama; Three Sisters : 101x44 min., drama; Love and Hope: drama; Love and Hate: 61x44 min., romantic comedy; Hekimoğlu: S1-2 157x44 min., medical drama; Price of Passion: 96x48 min., drama; Ruthless City: S1-2 136x46 min., drama.

“Kanal D International is the global business arm of Kanal D, the leading TV channel of the Turkish broadcasting world. Operating under Europe’s leading media organization, Demirören Media Group, Kanal D has been creating quality content for the past 28 years. Accompanied by Kanal D International Networks brand, Kanal D International has grown within the content world to reach the end user since 2018. The distribution arm of the company continues its activities under Kanal D International, and Kanal D International Networks is the business line that holds all linear assets.

Kanal D Drama is the first Turkish drama channel that was established in LatAm and Europe and the first that entered the U.S. market. Today, it continues to present a never-beforeseen experience of premium Turkish content.”

Selim Türkmen, Director, Sales

44

MISTCO

O (90-216) 695-1300

w www.mistco.tv

m info@mistco.tv

KEY CONTACTS:

Aysegul Tuzun, Managing Director

Zeynep Kayrak, Head, Marketing

Maria Fernanda Espino Noguez, Sales Manager, LatAm & Iberia

PROGRAMS:

The Patriots : action/drama; Bahar : 100x45 min., drama; Secrets of an Angel : drama; Barbaros: Sultan’s Order : historical drama; The Town Doctor: 107x45 min., drama; The Blackboard: 64x45 min., drama; The Great Seljuks: Alparslan: S1 91x45 min./S2, historical drama; An Anatolian Tale : S1 110x45 min/S2 126x45 min./S3, drama; The Shadow Team: S1 44x45 min./S2 114x45 min./S3, crime/drama; Balkan Lullaby: 85x45 min., drama.

“A leading global distributor and international brand-management company, MISTCO represents a multi-genre portfolio consisting of dramas, movies, animations and documentaries and serves top titles, brands and channels.”

—Corporate

Communications

46

Nicely Entertainment

O (1-323) 682-8029

w www.nicelytv.com

m info@nicelytv.com

KEY CONTACTS:

Vanessa Shapiro, CEO

Scott Kirkpatrick, Executive VP, Distribution & Co-Production

Rachel Siegenthaler, VP, International Sales

Dave Hickey, Head, Production

PROGRAMS:

When Love Springs: 1x90 min., romance; Dance of the Heart: 1x90 min., romance; Romance at the Vineyard : 1x90 min., romance; The Christmas Checklist : 4x60 min./2x90 min., holiday romance; A Perfect Christmas Pairing: 1x90 min., holiday romance; The Art of Christmas: 1x90 min., holiday romance; Love by Design: 1x90 min., romance; Bad Connection: 1x90 min., thriller/horror; Beyond the Reef : 1x90 min., doc.; A Tiny Home Christmas: 1x90 min., holiday romance.

“In 2023, Nicely Entertainment will bring over 20 brand-new ‘feel-good’ movies to the global market, and since its creation, we have built a library of over 60 films. Nicely’s main focus has been producing original projects for worldwide broadcasters and global platforms, including romance films (like Dance of the Heart, our latest movie shot in Hawaii), cozy Christmas movies, as well as scripted TV series like Dive Club and Gymnastics Academy . Nicely is continuing to expand with narrative TV series, including its holiday limited series The Christmas Checklist, produced for Canada’s CBC.”

Vanessa Shapiro, CEO

48

ZDF Studios

O (49) 6131-9910

w www.zdf-studios.com

m info@zdf-studios.com

KEY CONTACTS:

Dr. Markus Schäfer, President & CEO

Robert Franke, VP Drama

Peter Lang, VP Junior

Ralf Rückauer, VP Unscripted

Christine Denilauler, VP Marketing & Corporate Communications

PROGRAMS:

The Swarm: 8x45 min., drama/thriller; Dear Vivi: 7x45 min., drama/crime/suspense; Clean Sweep : 6x52 min., drama/crime/suspense; Spellbound : 26x26 min., kids/live action; Maari—Adventures at the Reef : 20x7 min., kids/animation; Superhero Academy : 13x15 min., kids/live action; The Six Continents Revealed : 6x50 min. , unscripted/history/biography; Bison—An American Icon : 1x50 min., unscripted/wildlife/nature; Naked—Sex and Gender: 6x50 min./1x90 min., unscripted/science/knowledge; Cash or Trash: 1,700 eps. aired, unscripted/docutainment.

“ZDF Studios was founded in 1993 as a commercial subsidiary of ZDF, one of the largest TV broadcasters in Europe. The group is responsible for global program distribution and acquisition, international co-productions and merchandising of successful program brands under its own name, for ZDF and third parties. In a strong alliance of 30 direct and indirect subsidiary and associated companies in production, distribution and services, ZDF Studios has the largest German-speaking program inventory in the world and an ever-growing offering of international productions, comprising series and miniseries, TV films, documentaries and children’s programs.

The ZDF Studios Group offers a comprehensive full service in B2B, B2C and B2B2C, where it covers every step in the process of creation and exploitation of successful productions, from content development through production to the marketing of TV licenses, merchandising, online rights and much more. The integrative power of ZDF Studios allows for the development of innovative, outstanding, high-quality programs and makes the alliance an attractive workplace for both German and international talent, providing an inspiring and creative environment and ample freedom for new and fresh ideas.”

—Dr. Markus Schäfer, President & CEO

50

WorldScreenPremieres.com TVDramaPremieres.com TVRealPremieres.com TVKidsPremieres.com If you wish to reserve a World Screen Premiere, please contact Ricardo Guise (rguise@worldscreen.com) or Dana Mattison (dmattison@worldscreen.com) Please visit WorldScreenPremieres.com to see examples of previous Premieres. Showcase Your New Series on

Mansha Daswani

Mansha Daswani

Robert Bakish President & CEO

Robert Bakish President & CEO

Paramount Global

Paramount Global

Lisa Anna Schelhas, Sales Director

Lisa Anna Schelhas, Sales Director