EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Greg Sanders gsanders@wtwhmedia.com

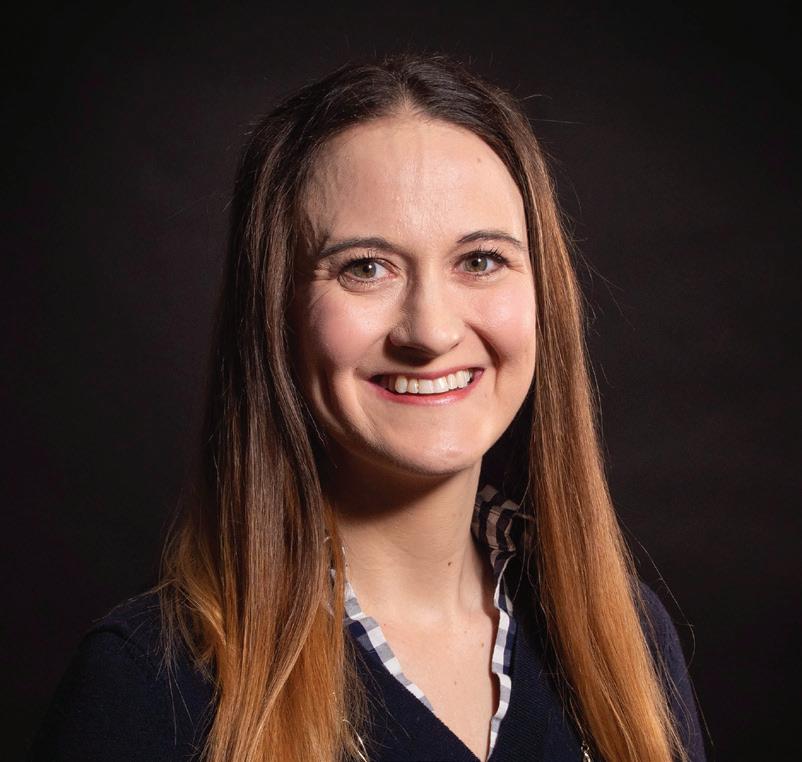

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Kevin McIntyre kmcintyre@wtwhmedia.com

COLUMNIST

Matt Sargent

EDITOR EMERITUS

John Lofstock

SALES TEAM

VP SALES — FOOD, RETAIL & HOSPITALITY

Lindsay Buck lbuck@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER

John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Tony Bolla tbolla@wtwhmedia.com (773) 859-1107

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES MANAGER Simran Toor stoor@wtwhmedia.com (770) 317-4640

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Jane Cooper jcooper@wtwhmedia.com

LEADERSHIP TEAM

CEO Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CFO Ken Gradman kgradman@wtwhmedia.com

HR EXECUTIVE Edith Tartar etartar@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

VIDEOGRAPHER Cole Kistler ckistler@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave.

Suite 2600 Cleveland, OH 44114

Ph: 888-543-2447

SUBSCRIPTION INQUIRIES

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Lindsey Harvey lharvey@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Carnett ncarnett@wtwhmedia.com

BRANDED CONTENT STUDIO

DIRECTOR OF BRANDED CONTENT Peggy Carouthers pcarouthers@wtwhmedia.com

ASSISTANT EDITOR Ya’el McLoud ymcloud@wtwhmedia.com

ASSISTANT EDITOR Olivia Schuster oschuster@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Olivia Beck • Operations Beck Suppliers Inc. • Fremont, Ohio

Nate Brazier • President and CEO Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer Sprint Mart • Ridgeland, Miss.

Bill Kent, President and CEO The Kent Cos. Inc. • Midland, Texas

Dyson Williams, Vice President Dandy Mini Marts. • Sayre, Pa.

Bill Weigel, CEO Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Real Estate/Government Relations Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO Hit-N-Run Food Stores • Lafayette, La.

Robin Hunt, Sales Hunt Brothers Pizza • Nashville, Tenn.

Kyle May, Director External Relations Reynolds Marketing Services Co. • Winston-Salem, N.C.

Steve Yawn, Director of Sales McLane Company Inc. • Temple, Texas

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

Copyright 2024, WTWH Media, LLC

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Director of Merchandising Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing The Kent Cos. Inc. • Midland, Texas

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

This month, CStore Decisions is recognizing up-and-coming Chains to Watch that are differentiating themselves in a competitive industry and poised for future growth, both via the physical expansion of their chain’s footprint as well as through foodservice or technology evolution.

C-stores today must innovate to remain relevant amid a shifting landscape, and this is especially true for small, mid-sized and familyowned companies that are looking to survive the soaring inflation, changing market dynamics and consolidation impacting the c-store industry.

New this year, we put out a call for nominations for our Chains to Watch segment, and while we received many impressive nominees, Gas N Wash, Roadtrac and Clark’s Pump-N-Shop stood out from the crowd, and we’re pleased to highlight how these rising chains are making a splash in their markets in the pages ahead.

Gas N Wash is rapidly growing its footprint in Chicagoland through state-of-the-art, new-toindustry locations and an investment in technology, including a new mobile app, a loyalty program, self-checkout kiosks and automated license plate readers at its car washes.

Roadtrac arrived on the scene in 2020 and in just four years has grown to 19 sites in Texas with five more stores currently under construction. It’s also focused on food through its Booma Boom Tex Mex foodservice brand and looking ahead to future app and loyalty program development, as well as electric vehicle (EV) charging options.

Clark’s Pump-N-Shop debuted six new upscale stores in the past year, complete with full-service kitchens, drive-throughs and self-checkout

kiosks. Currently, the chain is focused on launching a new loyalty program via its mobile app, adding an employee rewards program and testing EV charging.

As you read about these chains and their forward-thinking mindset, I hope it inspires ideas for charting future growth for your business in the year ahead.

For family-owned chains, part of developing a road map for the future includes preparing the leadership of tomorrow. CStore Decisions and NAG invite you to mark your calendars for CStore Momentum (formerly the Young Executives Organization Conference) set for Sept. 18-20 at the Texas Motor Speedway in Fort Worth, Texas, hosted by Yesway.

This exclusive event gives young executives and next-generation leaders a chance to engage in educational sessions on key industry topics, as well as interactive workshops and networking opportunities with peers in the industry.

CStore Momentum is a NAG member-only event. Attendees must be employed by a NAG member company or have been inducted into the 2023 class of the 40 Under 40. To see the agenda, register or learn more about NAG membership, visit cstoremomentum.com. I look forward to seeing you soon in Fort Worth, Texas, this September!

The future’s looking up for adult tobacco and nicotine consumers looking for spit-free, smoke-free nicotine satisfaction. ZYN makes 23 of the nation’s top 25 selling nicotine pouches which makes your top shelf the most logical place to find it.

With the introduction of so many new and innovative snacks, consumers are prioritizing their snacking habits and expanding their palates.

Based on 84.51°’s May Consumer Digest, the top five snacks consumers are purchasing are:

Cheeses Fruits Potato Chips Crackers Chocolate

Source: 84.51°, May Consumer Digest, May 2024

Consumers enjoy indulging in their favorite snacks whenever they can. In fact, according to Mondelez International’s “2024 State of Snacking” report, which surveyed nearly 3,700 consumers over the age of 18:

• Most consumers (88%) participate in snacking at least once a day.

• 60% of consumers claim that they eat snacks twice a day.

• Younger shoppers (Gen Z and millennials) are on average snacking more, with 94% saying they have one or more snacks a day, and 68% said they have at least two snacks a day.

• 3 in 4 snackers have ritualized snack time, dedicating specific times during the day to snack.

Source: Mondelez International, “2024 State of Snacking” report, March 2024

Consumers are considering eating more healthy foods and snacks now and in the years to come. Datassential’s Healthy Keynote Preview noted that consumers will eat the following foods more often:

Source: Datassential’s Healthy Keynote Preview, May 2024 38% 37% 25% 22% 20% Vegetables Fruits Superfoods Whole Nuts/Seeds Functional Foods Grains

84.51°’s May Consumer Digest also mentioned that the reasons consumers are buying snacks include:

73% Snacks are on sale.

44% Consumers see a new or unusual snack.

44% The flavor is appealing.

43% Consumers want to treat themselves/ their family/their children.

35% Consumers see snacks while shopping.

Source: 84.51°, May Consumer Digest, May 2024

Now that summer is here, consumers are outside and traveling more. While traveling, they are snacking more on sweet treats. According to the National Confectioners Association:

• Gummy candy, chocolate, taffy, lollipops and hard candy top the list of consumers’ favorite summer treats.

• 86% of people going on a road trip will bring along chocolate and candy, 82% will share treats on a family visit, and 68% will hit the beach with their favorites in tow.

• 78% of campers in the U.S. will treat themselves to chocolate and candy.

• To dress up their ice cream cones, consumers say chocolate pieces, chocolate sauce, peanut butter candy and gummy candy are their preferred toppings.

Source: National Confectioners Association, June 2024

CStore Decisions highlights three rising chains poised for continued growth.

Gas N Wash is fast expanding in the Chicagoland market with state-of-the-art stores, car washes and

an eye on technology.

Erin Del Conte • Editor-in-Chief

Headquartered in Mokena, Ill., and serving the Chicagoland area, Gas N Wash is standing out with upscale locations that provide a onestop shopping experience complete with fuel, a car wash, food and beverages, gaming, and even a pet wash. The chain is rapidly growing its footprint through state-ofthe-art, new-to-industry (NTI) locations and an investment in technology, including a new mobile app, a loyalty program, self-checkout kiosks and automated license plate readers at its car washes.

For all this and more, CStore Decisions is recognizing Gas N Wash as a Chain to Watch.

Owner Len McEnery founded Gas N Wash in 2011 and opened the first Gas N Wash in Mokena, Ill., in February 2012. A year later he built a second and third location and has continued growing ever since. Today, Gas N Wash operates 31 stores in Illinois. All but one of the locations are NTI stores, which has allowed Gas N Wash to offer sites with an upscale, modern appearance.

McEnery decided early on that Gas N Wash would be a fitting moniker for the chain.

“I was told years ago that places should be titled to what they do. When Gas N Wash was getting started, I thought, ‘We have a gas station and we have a car wash,

so we should maybe call it Gas N Wash,’” McEnery said.

A short time later, he visited a friend with a car wash business, who confided that he had to buy a sign that said “gas” and a sign that said “wash” and display them out front so drivers could identify what the business offered. “And I said, ‘That’s what I’m going to call it: Gas N Wash,’” McEnery said.

McEnery had the advantage of decades of experience in the petroleum business before launching Gas N Wash. He began his career at 14 years old working for his brother’s Gas City business where he managed stores. In 2011 that business closed, and McEnery started out on his own.

“It was a little easier to get started because it wasn’t new to me. … I knew a lot of vendors and players in the game, and so I was able to put it together,” he said. “Without

that it would be pretty difficult.”

Today, the family-owned company has second-generation family members woven throughout the business, including a son, daughter and two sons-in-law. The chain is focused on serving communities around the Chicagoland area and is concentrated on expanding its footprint in typically suburban locations.

Over the last six months alone, Gas N Wash has debuted four NTI sites.

“We opened a Crest Hill site at the end of December. We opened Caton Farm, Merrionette Park and Lemont, respectively, in February, March and April,” noted Gas N Wash VP of Finance Alex Kugar. At press time, Gas N Wash was preparing to debut another NTI site in Lockport in June. It’s also in the process of adding an addition onto its original location to accommodate a remodeled Dunkin’ and additional c-store space.

The convenience stores are

branded “The Market” and range from 4,000 to 12,000 square feet and offer one to three quick-service restaurants (QSRs) inside, depending on the location. The stores feature a red brick interior and exterior, with eye-catching graphics to call out the fountain area, beer cave, cashier area and gaming area. Black chalkboard-style signs with white writing call out the various segments of the store, such as Frozen Foods, Ice Cubes and Ice Cold Drinks.

In the forecourt, Gas N Wash features unbranded gas.

“Some of the stores are fitted to bring electric vehicle (EV) charging in when we see that the timing is right for EVs, but we really haven’t seen the equipment that’s needed for quick charging yet,” McEnery said.

On the food front, Gas N Wash partners with a number of QSRs, including Dunkin’, which it offers

at 29 locations; Ta Canijo (11 sites); Do-rite Donuts & Chicken (two sites) — an artisanal doughnut shop featuring an ever-changing variety of doughnuts; Pop’s Italian Beef (two sites); Duke’s Drive-In (two sites); Mickey’s Gyros (two sites); Dickey’s BBQ (one site); and Great American Bagel (one site). Coming soon will be Taco Pros (two sites), Jimmy John’s (one site) and a Subway.

“All the stores have grab-and-go items. We also have a local pizza company in Chicago (Beggars Pizza) that brings pizza in several times daily. All the stores have cases that we sell the pizza slices out of,” McEnery said.

At Gas N Wash, black chalkboard-style signs with white writing call out the various segments of the store, such as Frozen Foods, Ice Cubes and Ice Cold Drinks.

In addition, the stores offer a roller grill program and bake fresh cookies on-site daily. Several sites offer handmade sub sandwiches, but Gas N Wash largely avoids proprietary offerings to avoid competing with its QSR partners. Most of the coffee is sold through Dunkin’ or another QSR. Several of the QSRs offer delivery through Uber Eats and other third-party delivery services.

Gas N Wash operates 28 car washes all co-located with its convenience stores. They feature 140-foot tunnels and are equipped with free vacuums, pay stations and license plate readers. Car wash customers can purchase a wash while buying gas at the pump, at the pay station or in-store and enter a code to access the car wash.

“Then you drive around, and the attendant will guide you on the track, on the conveyor and wash your car in 90 seconds for you,” McEnery said.

Customers belonging to Gas N Wash’s Wash Club program only have to purchase once, and then the chain’s automatic license plate readers recognize the plate and open the gate. Customers can purchase and manage car wash memberships online or in-app. Most of the car washes also feature a pet wash, so people can give their dog a bath on-site.

The stores also offer propane filling for barbecue tanks, etc., and feature a gaming section.

“We’re allowed six to 10 gaming machines, according to the Illinois video gaming ordinance,” elaborated McEnery.

Gas N Wash also has its eye on technology. The chain launched its enhanced Gas N Wash Rewards app and loyalty program in 2024, working with Rovertown and Paytronix. The app has more than 40,000 users and now ranks amongst the top 5% on Rovertown’s platform, based on average monthly active users per store, which is particularly impressive considering the size of the chain.

While the Car Wash Club subscription and loyalty program are separate, Gas N Wash is now connecting those data points to provide an enhanced customer experience.

“We’re definitely listening to our customers, and that’s something they’ve been asking for. We’ve started to do that in the past few months, and we’ll continue to look for ways to join those two (programs) together,” said Laura Krawisz, VP marketing for Gas N Wash.

Gas N Wash has also rolled out self-checkout. Each store features two cashless self-checkout kiosks for those who prefer them.

“As far as technology, we’ve really just focused on what makes things easier and better for our customers,” McEnery added. “It goes back to serving that community. We want people to be able to use coupons, get deals and find things relevant to them in the app. Outside of the app, we want to extend that technology to other parts of the business too. We’re working on digital signage options; in our car wash we have the license plate reader technology. Anything that makes the customer

experience better and makes things easier for them is where our focus is in the technology realm.”

Gas N Wash has continued growth plans on the horizon.

Currently it has two stores under construction with plans to break ground on a third location soon. It has two additional new builds slated to begin construction in late summer that would be set to open in 2025.

“In 2025, we’d be looking to start construction on four additional stores,” McEnery continued. “We’re always looking for property and good locations, and that’s not going to change.”

As the chain looks ahead, it plans to continue differentiating itself with high-quality stores and services.

“A lot of people stop at convenience stores because they have to — they have to get gas, or they have to get something. But we’re building a brand where people will stop because they want to,” Kugar said.

“Having started at 14, Len had a long time to think about what the best setup would be for his concept if he had the opportunity, and he had the opportunity in 2011,” continued Kugar.

“His entire career has been in this industry, and he’s been focused on running convenience stores and car washes since he started his own business. I think it’s a great story of perseverance. Everyone here feels very fortunate to tap into the knowledge that he has and learn from what he’s been able to accumulate over the years and what he’s built.” CSD

Roadtrac is expanding beyond its Houston origins, solidifying its brand with a food focus and planning for near-future tech investments.

Emily Boes • Senior Editor

Houston-based Roadtrac is looking ahead to the future. With 19 sites located in Texas and five currently under construction, all within just four years, the chain is poised for acceleration and geared to make a name for itself in 2024 and beyond.

To facilitate this goal, Roadtrac has implemented grab-and-go options along with its Booma Boom Tex Mex foodservice brand. Additionally, Roadtrac is looking to integrate more technology into its stores, such as an app and electric vehicle (EV) charging.

For its dedicated focus on creating foodservice opportunity and active work bringing new technology

into its space, along with its growthdriven mindset, CStore Decisions has dubbed Roadtrac a 2024 Chain to Watch.

“Our brand really started in 2020, during COVID,” noted Zain Sunesara, managing partner for Roadtrac.

Sunesara’s father, Nick, teamed up with Sunesara’s uncle, Frank, to create the Roadtrac brand at this time. However, the pair had originally begun working together at a c-store in 1998 after immigrating from India, starting as cashiers working 12-hour shifts and working their way up.

A few years later, they had the chance to buy their own stores.

They ran their own existing stores separately before they noticed the strength of the c-store industry

Zain Sunesara, managing partner for Roadtrac, which has 19 sites in Texas and five currently under construction, handles the construction and finance parts of the business.

during the pandemic, and together, they launched Roadtrac.

“While other asset classes struggled, the c-store industry was the backbone of America during the pandemic,” Sunesara continued.

When he joined the business after graduating from the University of Texas at Austin with a finance degree, Sunesara brought a younger mindset to the team. He noted that their different generations allow the trio to view the business from a larger perspective.

“I always express my gratitude and support for my dad and uncle

for their invaluable guidance and encouragement in teaching me the business. Their wisdom has influenced my understanding and passion for the industry,” said Sunesara.

Currently, Nick handles store operations; Frank oversees real estate and acquisitions, while Sunesara covers construction and finance.

“One of our short-term goals is to excel in our food business,” said Sunesara. “We know that the food business is really critical to survive in today’s competitive market, especially in the Houston and Texas area with so many stores coming up.”

As a result, the Booma Boom deli brand was born.

Roadtrac wanted to capitalize on the large Hispanic population in its market area by offering Hispanic

foods to its customer base.

Options for customers include items such as tacos, quesadillas, gorditas and more.

Booma Boom offers made-toorder cuisine. Customers can begin their order by choosing either a corn or flour tortilla and a bowl or a taco. And then they choose their meat.

“Every day we try switching out our meats and food offerings because we understand that a lot of our stores are more neighborhoodbased stores. At these neighborhood stores we oftentimes see the same customers every day,” said Sunesara. “And these same customers, they don’t want to eat the same repetitive food every day. So we try switching it up with chicken, beef steak, pork — sometimes we also change our chicken a little bit too.”

For instance, chicken options

might be grilled or spicy Cajun.

Customers continue to customize their meals with toppings and sauces.

In addition to Booma Boom, Roadtrac’s grab-and-go options include cold sandwiches and readymade tacos, among other items.

Should customers want options other than these, Roadtrac cobrands some locations with Jack in the Box, Church’s Chicken and a few other companies, as well.

For coffee offerings, the chain added iced and frozen coffee to its beverage lineup.

“And we’ve really seen our coffee sales increase by around 20-30% year over year by implementing that,” Sunesara said.

Roadtrac prioritizes organic growth — opening new-to-industry

Roadtrac prioritizes organic growth to expand the chain — opening new-to-industry sites around 4,500-5,000 square feet versus acquisitions — although the chain doesn’t discount an acquisition with the right deal.

sites around 4,500-5,000 square feet versus acquisitions — although it doesn’t discount an acquisition with the right deal.

That said, Roadtrac is actively seeking expansion opportunities within and outside of the Houston market.

“We started growing slowly into the San Antonio and Austin markets. And that’s something that we’ve looked forward to for our long-term goals — expanding to more truck stops along with expanding to different markets for Dallas, Austin and San Antonio,” said Sunesara.

Attached to these locations are up to 2,500-squarefoot spaces the chain leases to mom-and-pop shops, such as liquor stores, smoke shops or doughnut shops, with the goal of finding businesses that will increase Roadtrac’s foot traffic.

Along with an escalating footprint, Roadtrac has new tech offerings on the horizon.

For instance, in the next two to three years, Roadtrac hopes to implement EV charging stations at its stores.

Presently, the chain sells its own branded fuel with 1216 fueling stations per store.

Roadtrac also has plans for a loyalty program and a mobile app, targeting launch in one to two years.

“And in that app, something that we’re looking at is adding a place for the menu so customers can see what food we’re serving for what day, because our food specials are always constantly changing. … Customers (will also be able to) scan their barcode for their loyalty program,” said Sunesara.

Roadtrac recognizes that customers can’t always go to the stores, so it’s also looking into delivery options.

With its new developments, Roadtrac’s mission is to make a customer’s experience as quick and convenient as possible. CSD

Chains to Watch / Clark’s Pump-N-Shop

With an eye on growth, a foodservice focus and a technology-driven mindset, Clark’s is modernizing for the future while building stores and refining its operations.

Erin Del Conte • Editor-in-Chief

Clark’s Pump-N-Shop has introduced six new upscale stores in the past year, complete with full-service kitchens, drive-throughs and selfcheckout kiosks.

Now, the Ashland, Ky.-based chain is focused on launching a new loyalty program via its mobile app, adding an employee rewards program and testing electric vehicle (EV) charging, all while emphasizing efficient operations, clean stores, friendly service and community engagement.

For all this and more, CStore Decisions is recognizing Clark’s Pump-N-Shop as a 2024 Chain to Watch.

Clark’s Pump-N-Shop can trace its roots to 1976 when oil jobber John Clark founded John W. Clark Oil Co.

In 1980, he opened his first convenience store in Westwood, Ky., and grew the business to about 12 stores over the next 15 years.

In the late 90s, John’s three sons, Rick, Rodney and Brent, purchased the c-store end of the business from their father and began growing the chain’s fleet of stores through acquisitions in Kentucky and new store construction in the Tri-State area and Florida, while John Clark continued to helm the oil business.

“Back in the day, they were pretty small stores,” noted Rick Clark, who, along with Brent Clark, is the co-owner of John W. Clark Oil Co. and Clark’s Pump-N-Shop. “But then, as we got going, we started building bigger stores, which meant (space for) kitchens and drive-throughs.”

Today, Clark’s Pump-N-Shop operates 67 stores in Kentucky, Ohio and West Virginia.

Now, the third generation has joined the family business. Brent’s oldest daughter Carlyle Clark is a district manager, while Brent’s younger daughter, Annabelle Clark, and Rodney’s son, Zack Clark, recently graduated from college and are in training as district managers. Rodney Clark passed away in 2016. John Clark, now 83, sold the oil business to his sons three years ago.

With a third generation ready to carry on the family legacy, Clark’s is focused on strategic growth while refining its operations to help support continued expansion.

Since June 2023, Clark’s has opened six ground-up locations, which included one raze and rebuild and five new-to-industry stores.

“They’re all in really, really good locations,” Clark said.

The new stores measure 4,000 to 4,200 square feet and include full kitchens, walk-in beer caves, big coolers and drive-throughs.

John came up with the concept for the drive-through, Clark said. “We get a lot of business through the drivethroughs. They’re pretty strong,” he added, noting that about 50-60% of the chain’s 67 locations offer the service. Customers can order anything they want through the drive-through from beer to food to groceries to lottery tickets.

In the forecourt, customers can find state-of-the-art gas pumps with video screens. Most of the sites fly the Marathon flag, while a few offer BP-branded gas. The chain is currently piloting EV charging at a few interstate locations and plans to add EV chargers to additional sites with assistance from a government program. Clark estimated the chain will have about six or seven EV chargers up and running this year to start, with a goal to add more as demand requires.

Clark’s offloaded its Florida stores last year before building in Kentucky, with the goal of keeping its footprint closer to its headquarters, which will make it easier to operate effectively as it expands.

Now Clark’s is pausing its construction momentum to dial in on perfecting its operations in 2024 to ensure it is operating as efficiently as possible. The chain prides itself on great customer service, loyal employees, wellstocked stores and clean restrooms.

Clark’s features an ample foodservice program through its Clark’s Café offering.

Clark’s works with its food distribution partner to fuel its menu, which includes a strong breakfast program.

“We sell sausage; biscuits; hashbrowns; sausage, egg and cheese (breakfast sandwiches). … We have a breakfast burrito that’s a big seller,” Clark said. Other popular items include Biscuits-N-Gravy and a BLT on Toast.

It also features Hangar 54 Pizza, Krispy Krunchy Chicken

and Champs Chicken in various locations. The stores feature a robust roller grill program, a strong fountain program and bean-to-cup coffee machines.

Next up, Clark’s is looking into potentially offering third-party delivery services.

Customers can already order ahead by calling the store with their food order. The stores also provide catering to offices, reunions, etc.

When it comes to foodservice, Clark noted quality is key to growing a program. The chain has an employee regularly inspect the food to ensure it’s meeting standards.

Between Thanksgiving and Christmas, Clark’s features a pie display with pumpkin, apple and other popular pies. “That’s a big mover for us,” Clark said.

The chain also features a monthly special salsa and its own private-label bottled water, which is sold by the case and individually. Clark’s advertises its specials heavily on TV, radio, social media, with window signage and via the Clark’s Pump-N-Shop app, which has a strong following.

Clark’s also provides about six car washes that are colocated with its c-stores. They feature automatic washes with dryers. Customers can get a discount on a car wash when they purchase fuel. The chain also has its own maintenance department and prioritizes keeping the stores in top shape.

With a popular mobile app under its belt, Clark’s is now rolling out an in-app loyalty program set to debut in August that allows customers to earn points on purchases and redeem them on merchandise in-store as well as cents off gas. The chain is simultaneously launching an employee rewards program, which will give team members discounts on products.

Clark’s six newest locations feature self-checkout kiosks, and Clark expects to launch kiosks at additional stores, particularly at its busiest locations.

“It’s going very well,” Clark said. “It’s something new for us, but a lot of customers like self-checkout.”

Clark’s is also rolling out new back-office software that at press time was set to go live on July 1, which Clark said will help position the chain for future growth.

Clark’s prides itself on its strong community ties. It regularly sponsors local high schools, universities, NIL (Name, Image and Likeness) collectives and non-profit organizations, and it’s the Official Fuel Sponsor of the Kentucky High School Athletic Association.

That community involvement pays off, Clark noted. “My dad taught us that when you give, you receive more in return. And guess what? That’s exactly what’s happened to us,” he said.

The Clark family holds an annual Clark Memorial golf event in memory of their late brother Rodney, through which it raises funds to provide scholarships to trade schools in the Kentucky area.

“We funded that endowment with $875,000 from that event that we’ve had every year, and last year we gave 17 scholarships away,” Clark said.

After seeing a need in central Kentucky, they began a second annual tournament in Lexington, Ky., which held its inaugural event at the end of May. “Our vendors, our

customers and our friends really supported that and we raised $120,000,” he said. “We have our Clark Family Charity, and next year, we’ll give two four-year scholarships worth $8,000 to two high school seniors in central Kentucky. We will also give to two high school seniors in the Tri-State area of northeastern Kentucky, southern Ohio and West Virginia.”

Looking ahead, Rick and Brent Clark don’t have any plans to slow down. They’re focused on mentoring the next generation and helping them learn the business while maintaining steady growth.

Clark said he plans to continue to eye opportunities for expansion, with a goal of adding another 10-15 stores to the chain’s footprint over the next five years, but with a focus on high-quality sites that will be competitive in the industry. The locations need to be “winners,” Clark noted, especially as inflation has nearly doubled the cost of a new store in the past few years.

As he looked back on how far the chain has come since the early 1980s, Clark credited his father’s vision and mentorship.

“My dad’s been the most influential person in my career. He taught us the business, and I think he’s very proud of me and Brent. … I think we’ve done better than he thought we would,” he said.

Clark added that the success of Clark’s Pump-N-Shop is only possible “because we have customers and communities that support us, and we’re really thankful for that.” CSD

WARNING: Cigar smoking can cause cancers of the mouth and throat, even if you do not inhale.

With summer here, packaged beverages are in the spotlight, and retailers are taking stock of the hot segments as well as recurring and new trends as inflation still makes its mark.

Zhane Isom • Associate Editor

The packaged beverage category is getting a lot more attention now that summer is here. Consumers are looking for beverages to cool them down and keep them hydrated in the heat, and they’re especially reaching for new flavors.

Meanwhile, c-store retailers are watching emerging and continuing trends and growth in dollar sales across the cold vault, even if unit sales are flatter overall.

Terry Messmer, category and sales manager for Tri Star Energy, which has 160 Twice Daily convenience stores across Tennessee, Alabama and Kentucky, mentioned that he has seen an uptick in beverage dollar growth.

“(However), we continue to monitor unit sales as retailers continue to increase the unit purchases. We are starting to see a decline, and we need to make sure that we keep a close eye to ensure that we don’t lose too much in unit sales,” he said.

In fact, carbonated beverages reached $10.7 billion in dollar sales, which is a 5% increase, while its unit sales held steady at 4.31 billion, a 0.3% increase for the 52 weeks ending April 21, according to Chicago-based market research firm Circana.

“I see the packaged beverage category continuing to rise if speaking of dollar sales. Inflation will cause an increase in dollar sales,” said Brian Young, vice president of Young Oil, which operates 11 Grub Mart stores in Alabama. “I see the category staying flat if speaking of volume. Having to choose between a Pepsi or Coke contract causes several products to be at a big price disadvantage versus the dollar, grocery or wholesale stores, which appear to have a different set of contract offerings.”

Bottled water, as well, has seen a rise in dollar sales. This segment rang in at $5.78 billion, a 4.5% increase for the 52 weeks ending April 21, per Circana. However, unit sales fell 2.5% to 2.35 billion.

“Even in uncertain economic times, bottled water remains consumers’ preferred option for a relatively inexpensive, convenient, portable beverage,” said Michael Bellas, chairman and CEO, Beverage Marketing Corp., in a recent statement. “Functional benefits that drove bottled water to the No. 1 position, such as caloriefree refreshment and healthy hydration, will drive its future performance.”

Along with craving new beverage flavors and brands, consumers are prioritizing their health and searching for better-for-you and functional beverage options.

For the 52 weeks ending April 21, energy drinks totaled $14.3 billion in dollar sales, a 12.1% increase, while unit sales for the segment increased 2.3%, according to Circana.

Young noted that energy drinks are doing great in his stores, with Ghost Hydration standing out as a popular seller with customers.

“Health and wellness continue to

be the greatest driver of beverage selection by today’s consumers,” said Gary Hemphill, managing director of research for Beverage Marketing Corp. “Drinks with health and wellness attributes and/ or functional benefits are likely to be where the greatest growth and innovation is.”

Following energy drinks are sports drinks with $4.88 billion in dollar sales, a 6% increase for the 52 weeks ending April 21, noted Circana. “2024 is the year of rapid hydration, and only items that contain electrolytes are what consumers are looking for,” said Messmer. “I am also seeing continued growth in the energy category, especially within the functional subcategory of energy with items with a little more caffeine and zero sugar.”

The beverage category is one area that is constantly seeing new flavors, brands and innovative ideas. With

the constant overflow of new beverages on the market, c-store retailers are left with the challenge of ensuring they have the right drinks in their coolers while keeping tabs on the next big thing.

“There is a continued influx of new items. There are a lot of new items, but many don’t seem to have a good strategy for how they are going to be the next big brand that consumers will be talking about,” said Messmer.

Hemphill agreed, noting that marketers must also continue developing meaningful innovation that can cut through the clutter.

“The beverage marketplace is very competitive with more products and categories than ever vying for the attention of today’s consumers,” explained Hemphill.

Nonetheless, packaged beverages will continue to see growth as long as brands keep introducing new beverages to consumers and giving retailers more options to add in their stores. CSD

Energy drinks persist in performing well in the beverage category, bringing in $14.3 billion in dollar sales, a 12.1% increase, and 4.74 billion in unit sales, a 8.3% increase, for the 52 weeks ending April 21, 2024.

Source: Circana Total U.S. Convenience data for the 52 weeks ending April 21, 2024

Sweet, salty and healthy snacks are thriving in c-stores as consumers continue to purchase them, and retailers are adjusting their snack sections based on growing trends.

Zhane Isom • Associate Editor

The snack category at convenience stores is expected to see continued dollar sales growth as inflation pushes prices higher and customers seek out new flavor experiences across sweet, salty, meat and healthy snacks.

Flavor and taste reign supreme in the snacking universe, with 83% of consumers reporting they choose snacks with a flavor they prefer, according to Circana’s recent comprehensive analysis of the snack market. The analysis also stated that 46% of

Americans eat three or more snacks each day, helping the snack category continue to grow exponentially.

Retailers reported seeing an increase in consumers’ salty, sweet and healthy snack purchases.

However, sweet snacks have received the most attention, resulting in a significant dollar sales increase. Cookies garnered $1.23 billion in dollars, a 13% increase for the 52 weeks ending April 21, per Circana.

Farmers Union Oil Co., with one store in Montana, vouches for sweet snacks’ continued growth.

“For our sweet snacks, most of our customers come in for our Peanut Butter Crispy Bars, Maple Bars, Cinna Babies and Hostess snacks,” said Diane Meeks, c-store manager, Farmers Union Oil. “Our Cinna Babies come in a pack of five small cinnamon rolls, and we typically sell between 150 to 200 packages a month.”

At Farmers Union Oil, Hostess doughnuts are a huge hit. The company sells about 30 bags of Hostess Donettes Crunch a month.

Following sweet snacks in terms of trends and dollar sales are healthy products. In particular, healthy snacks and granola bars have seen

In the snack category, cookies saw the most growth of $1.23 billion in dollar sales, a 13% increase for the 52 weeks ending April 21, 2024.

Source: Circana Total U.S. Convenience data for the 52 weeks ending April 21, 2024

the most traction from consumers.

For the 52 weeks ending April 21, snack bars, granola bars and granola clusters saw a 9.6% increase in dollar sales and stayed relatively flat at -0.2% in unit sales for the same period, noted Circana.

“There has been a notable increase in the popularity of highprotein granola and energy bars,” said Meeks. “We are also noticing a growing demand for fruit and veggie grab-and-go cups.”

Randy Adams, category manager/ buyer for Huck’s, with over 125 locations in five states, has noticed an uptick in healthy snack demands. He mentioned that Hippeas and some salty, better-for-you snacks have been doing well in his stores.

Other healthy snacks seeing dollar sales gains in c-stores are snack nuts, seeds and corn nuts. Seeds reached $999 million in dollar sales, which is a 4.3% increase for the 52 weeks ending April 21, per Circana.

“Additionally, we have always seen a high demand for products like sunflower seeds, especially being in a farm and ranch community with baseball season in full swing,” said

Meeks. “Sunflower seeds are currently our No. 32 top seller.”

For salty snacks, consumers still demand their favorites, including potato chips, pretzels and more.

Potato chips increased 9.4% in dollar sales and 2% in unit sales for the 52 weeks ending April 21. Pretzels increased 8.2% in dollar sales for the same time frame, per Circana.

The salty snack segment has been heating up at Huck’s as customers demand more snacks with heat.

“Anything with heat, whether it’s the Frito Flamin’ Hot line or items with Tajin, are trending,” said Adams.

Since spicy snacks are doing exceptionally well at Huck’s, the chain has decided to add a section in its stores called BIGG HEAT that displays a variety of hot, salty snacks.

2024 has been a rocky year for meat snacks, with inflation playing a massive role in sales at c-stores.

Meat snack dollar sales stayed steady at -0.5%, but unit sales dropped by 5.5% for the 52 weeks ending April 21, noted Circana.

“The pricing on jerky is starting to

have a little bit of a negative impact on unit sales,” said Adams. “I am seeing a shift from consumers from the bagged jerky to sticks because they can still get them for under $2.”

Farmers Union Oil, nonetheless, has seen growth. Meeks explained that jerky products have taken the top two spots in its grocery and snack categories this year. Craig’s Jerky is the c-store’s best-selling brand in terms of quantity and revenue.

“We expect an increase in our healthy and meat snacks ... due to the products we are starting to bring in from local vendors,” she said.

“With jerky taking the No. 1 spot and being a high-priced item, I believe we will increase the category by 5%.”

Snacks will continue to make great strides in c-stores. It is up to retailers to offer and know what their customers want and when they want it.

For instance, Farmers Union Oil is adding fruit, veggie and protein cups to its open-air selections and including more local vendors in the category. And Huck’s is keeping salty products in its loyalty program since the segment is popular in Huck’s stores. CSD

Retailers are brainstorming new and innovative ways to enhance their pizza, chicken and roller grill offerings as foodservice continues to be a heavy hitter in c-stores.

Implementing a foodservice program has become a must-have for most convenience store retailers as customer demand for food and beverage items increases.

But building out a food menu doesn’t have to be complicated. Many retailers are finding success with triedand-true foodservice staples, including pizza, chicken and roller grill items. These food offerings in particular allow retailers to get creative while providing customers with convenient and familiar foodservice items they can eat on the go.

Cenex Zip Trip, operator of 40 stores across seven states, co-brands with Hunt Brothers Pizza at 11 of its locations to offer its customers high-quality pizza.

“The Hunt Brothers program provides a great product, a well-known name, great partners who support us 100%, and better food margins with labor cost savings since their product comes pre-sauced and pre-cheesed,” said Jon Fleck, merchandising manager for Zip Trip.

“From the owners to the people delivering product to our stores, Hunt Brothers employees are helpful and wonderful to work with.”

Cenex Zip Trip, operator of 40 stores across seven states, co-brands with Hunt Brothers Pizza at 11 of its locations to offer its customers high-quality pizza.

Cubby’s, too, has co-branded with Godfather’s Express in most of its c-stores to bring pizza to its customers. In locations where Cubby’s can’t offer Godfather’s Express due to territory restrictions, the c-store offers the Godfather To-Go Program. The company also owns and operates five traditional Godfather’s restaurants.

With both Zip Trip and Cubby’s offering popular pizza brands, they have been able to watch customers’ pizza demands evolve.

“We are seeing more demand for limited-time offers (LTOs) that are of the hot/spicy variety and jalapeño, hot honey varieties,” said De Lone Wilson, president of Cubby’s. “Customers are also always demanding a highquality, great-tasting pizza.”

Fleck pointed out that Zip Trip customers are also looking for great-tasting pizza at a price they can afford. “Hunt Brothers provides all of that,” he said.

Mobile ordering and delivery continue to play a huge role in the success of pizza offerings.

“Today, they want an easy-to-use app to order it and have it delivered to their home or place of business without speaking to anyone,” said Wilson.

Cubby’s has begun to install grab-and-go warmers in its Godfather’s Express locations specifically to hold large pizzas for grab-and-go during the lunch and dinner dayparts, along with using DoorDash to deliver pizza from those same locations.

Chicken is another c-store foodservice staple for most retailers. Chicken can be offered in many different ways, from boneless wings to chicken tacos, which allows retailers to make it their own and prepare it the way their customers like.

Kwik Stop, which has 27 locations in Nebraska and Colorado, partners with Krispy Krunchy Chicken at six, soon to be eight, locations.

Through this program, Kwik Stop can offer its customers a variety of chicken, including bone-in wings, chicken tenders and a spicy chicken sandwich. For the morning daypart, the c-store offers a chicken tender biscuit.

At the remaining Kwik Stop locations that don’t have Krispy Krunchy Chicken, customers can purchase chicken gizzards, spicy chicken sandwiches and mesquite grilled chicken sandwiches.

Kwik Stop also offers Chicken Crispitos through another company at all 12 of its deli stores.

“The Chicken Crispitos are a big breakfast seller,” noted M. David May, food service director at Kwik Stop. “It’s a nice grab-and-go item that customers can eat on the go.”

Almost 50% of the revenue in stores featuring Krispy Krunchy Chicken comes from chicken sales, said May.

Out of the many chicken products Kwik Stop offers, customers are gravitating toward tenders.

Customers can choose from a three-piece all the way to a 25-piece tender meal with a biscuit, along with a Krunch Box through Krispy Krunchy Chicken. They can also choose a family meal with 12 pieces of chicken, six tenders, six biscuits and a side, or a 12-piece tender family meal.

Aside from offering affordable family meals, May keeps his chicken offerings new and exciting with LTOs. In June, Kwik Stop introduced an eight-piece bone-in chicken meal with three thighs, three legs and three wings with a large potato wedge, four biscuits and a side for $22.99.

“I wanted to take advantage of the summer market, so I wanted to have a viable option for customers while they are outside more during the summer months,” said May.

Roller grill items have always been a great addition to c-stores because they are one of the easiest grab-andgo products for consumers. Retailers that offer these items continue to see excellent outcomes from sales to customer feedback.

Rutter’s, operator of 85 c-stores in three states, offers a wide range of roller grill items like all-beef hot dogs, sausages and chicken rollers.

“We expect the roller grill category to see a positive growth of around 3-5% in 2024,” said Philip Santini, senior director of advertising and food service at Rutter’s. “This growth is driven by the rising demand for convenient, high-quality and diverse food options.”

Regarding roller grill trends, consumers are no longer looking for an ordinary hot dog or sausage; they have broadened their taste buds.

“Bold and unique flavors are increasingly popular as customers seek new and exciting taste experiences,” said Santini.

To capitalize on the new flavor trends, Rutter’s is including more diverse flavors and international options for its roller grill.

“Additionally, we are creating new classic options with items currently on our menu,” Santini explained.

As long as retailers that offer roller grill items keep bringing in innovative flavors and ideas, there will continue to be great success in the roller grill category.

“The rest of 2024 looks very promising for roller grill items. The roller grill category is and will continue to be a go-to choice for quick, delicious and varied meal options,” said Santini. CSD

• Chicken tenders tend to be a hit in the chicken category.

• Consumers want more flavor from roller grill items while demanding high-quality pizza offerings.

wednesday, september 18

1:00 - 4:00 PM

4:00 - 5:30 PM

Charity / Team Building Outing (optional)

Welcome Reception Evening Dinner on Your Own

thursday, september 19

8:00 - 8:30 AM

8:30 - 9:30 AM

Breakfast

Retail Case Study: Yesway Overview and Outlook

Derek Gaskins | Yesway

9:30 - 12:45 PM Yesway & Allsups Store Tours

1:00 - 2:00 PM

2:00 - 2:30 PM

2:30 - 4:30 PM

Burning Issues Session: Yesway Private-Label Deep Dive

Lisa Ham | Yesway, Darrin Samaha | Yesway, Alan Adato | Yesway

Networking Break

Burning Issues Exchanges: Round Table Discussions

4:30 - 5:00 PM Wrap Up / Closing Session

5:00 - 6:30 PM

Networking Reception at the Texas Motor Speedway Evening Dinner on Your Own

friday, september 20

8:00 - 8:30 AM Breakfast

8:30 - 9:30 AM

9:30 - 10:00 AM

10:00 - 11:00 AM

11:00 - 11:30 AM

11:30 - 12:30 PM

Burning Issues Workshop: Leadership & Culture

John Matthews | Gray Cat Enterprises, Inc.

Networking Break

Burning Issues Session: Grab QSR by the Horns: What Foodservice Competition Looks Like in Texas Becka Friessen | Corner Store, Scott Stanfield | Yesway

Networking Break

Burning Issues Session: Loyalty Driving Customer Engagement

Tiffany Sims | Pak-A-Sak, Mike Caldwell | Yesway

12:30 - 1:00 PM Wrap Up and Event Close

CStore Momentum is exclusively available to the rising leaders within NAG member companies and the 2023 40 Under 40 Leaders to Watch inductees. To learn more or to check your membership status, please contact NAG Executive Director Allison Dean | adean@wtwhmedia.com.

Hatco Corp. has launched the Dry Soup Well, which provides gentle, even heating without needing water to rethermalize and hold hot soups and other liquid foods at optimum serving temperatures. The wells feature an intuitive user interface and are preprogrammed with four customizable presets and six preset temperatures. The well will automatically transfer from rethermalization mode to hold mode, and an adjustable stir timer will alert operators when it’s time to stir the food. Models are available in 120 volts and as countertop or builtin options; the countertop models are available in a clear anodized or bold black gloss finish.

Hatco Corp. www.hatcocorp.com

Summer calls for sunshine, sweet treats and big bursts of flavors — exactly what the new Otis Spunkmeyer Lemon Burst Cookies have to offer. Otis Spunkmeyer’s Lemon Burst Cookie is now available in a three-ounce version for in-store bakeries under the Gourmet portfolio. There’s no need for the cookies to be decorated or fussed over by store employees — they have an appealing freshly baked flavor and aroma. These bright, summery Lemon Burst Cookies, made with real lemon essence, are positioned for a summer impulse buy.

Aspire Bakeries

www.aspirebakeries.com

Kretek International’s Cuban Rounds’ value starts with premium wrapper and filler tobacco blends that deliver a consistently smooth, medium-mild taste. They’re a fit in the tobacco shelf set with eight fresh packs per tray. Cuban Rounds are handmade in Nicaragua in natural, Maduro and Connecticut shade wrappers. They are also offered in four popular sizes for any cigar occasion, from weddings or golf to just watching the sunset.

Kretek International Inc. www.kretek.com

Placon has launched its new Crystal Seal Delectables line of tamper-evident square dry snack containers. The product line’s crystal-clear packaging is fully recyclable, and the line’s square design maximizes shelf space, making it perfect for displaying candies, nuts, trail mixes and dried fruit. In addition, the line’s tamper-evident lid design features labeled grip tabs and non-scrape indication, allowing consumers to easily identify whether a package has been opened or tampered with. Delectables square containers are available now in five popular sizes: eight ounces, 12 ounces, 16 ounces, 24 ounces and 32 ounces.

Placon www.placon.com

There are many use cases where artificial intelligence (AI) implementation is strategic, and c-store operators should grab these opportunities as they’re able.

Matt Sargent • NexChapter

If you’ve spent any time toying with ChatGPT or Meta prompts in the past, you may find yourself wondering about artificial intelligence’s (AI’s) potential for real marketing work. Ninety-one percent of marketing professionals are “already using AI in their jobs,” according to Ad Age/Wakefield. It’s clear that AI is here to stay, and its impact will only expand in terms of how brands engage with their customers.

The high frequency of customer visits puts c-stores in the driver’s seat for AI as frequent engagement provides more data to train AI models effectively. A c-store that sees a customer three times a week can leverage AI far more effectively than a quick-service restaurant that sees a customer only once a week. Additionally, c-stores, like other retailers, own a valuable flow of customer data, an often-overlooked advantage compared to consumer packaged goods brands, which typically lack direct data ownership. Most importantly, AI-driven messaging within loyalty programs and mobile apps allows c-stores to enhance customer engagement by connecting directly with their customers.

When unpacking the effort to run complex, multivariate marketing campaigns, retailers will quickly find it takes an army of resources to

tackle the task. Conversely, AI-driven marketing ties directly to your own customer data, removing much of the manual effort. Additionally, AI yields more effective messaging. This is accomplished by sorting through your customers’ behavioral data to determine which type of message will resonate. Paytronix cites a 50% increase in spend and frequency from messages optimized with AI. NexChapter engagements in the cstore space align with this magnitude of impact.

Before becoming overwhelmed by the applications for AI, consider these three marketing use cases to get started.

1. Craft personalized messaging tailored to specific segments or individual customers.

This is an obvious starting point for convenience stores. This type of deployment for AI typically provides the strongest and most immediate return on investment by positively impacting open rates, click-through rates and conversions.

2. Use customer data to optimize the time and channel for sending messages.

This is another way to maximize the impact of AI in your marketing systems. AI excels at this type of task given its ability to process massive amounts of data and turn it into individualized guidance.

3. Create product or offer recommendations based on an individual’s purchase behavior.

This approach is similar to Amazon’s product recommendations, enabling you to boost customer engagement in a significant way.

Utilizing personalized trigger promotions is a real-world example of how to combine all three use cases into one. These AI-enabled promotions, using time optimization and product recommendations, engage a customer that has carried out a specific purchase that is missing a natural-fit product for that type of behavior (i.e., buying a slice of pizza plus a dispensed beverage). The customer who purchases one item is presented with savings on a slice and a beverage for their next visit. The key concept in the trigger promotion is to engage the customer in the moment with a relevant solution, thus dramatically increasing the chances the customer will carry out the desired behavior on their next visit.

While marketing’s potential for AI is nearly endless, what’s clear is that AI represents an amazing opportunity to bring more efficiency and efficacy to marketing practices. In an environment where marketers often find themselves asked to get more out of their limited resources, AI is especially well positioned to deliver.

Matt Sargent, VP of loyalty analytics at NexChapter, has a 20-year history working at the intersection of consumers and brands at retail. Sargent has led consumer-focused strategy at retailers, including Target, Best Buy and, most recently, Casey’s, where he initiated a loyalty analytics practice resulting in a doubling of program enrollments.