EDITORIAL

VICE PRESIDENT, EDITOR-IN-CHIEF

John Lofstock jlofstock@wtwhmedia.com

EXECUTIVE EDITOR

Erin Del Conte edelconte@wtwhmedia.com

ASSOCIATE EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

CONTRIBUTING EDITORS

Anne Baye Ericksen

Carol Brzozowski

Brad Perkins

Howard Riell

COLUMNIST

John Matthews

SALES TEAM

PUBLISHER

John Petersen jpetersen@wtwhmedia.com (216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com

(773) 859-1107

REGIONAL SALES MANAGER

Ashley Burk aburk@wtwhmedia.com

(737) 615-8452

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

REGIONAL SALES MANAGER

Jake Bechtel jbechtel@wtwhmedia.com (216) 299-2281

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE

Jane Cooper jcooper@wtwhmedia.com

WTWH MEDIA, LLC

LEADERSHIP TEAM

MANAGING DIRECTOR Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE SERVICES Mark Rook mrook@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

ART DIRECTOR Matthew Claney mclaney@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

EVENTS MANAGER Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Johnson njohnson@wtwhmedia.com

VICE PRESIDENT, STRATEGIC INITIATIVES Jay Hopper jhopper@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Patrick Lewis, Managing Partner

Oasis Stop ‘N Go • Twin Falls, Idaho

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations

Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Vice President/General Manager

Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement

Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Food Service Director Warrenton Oil Inc. • Warrenton, Mo.

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666 Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher.Circulation audited by Business Publications Audit of Circulation, Inc.

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Caroline Filchak, Director, Wholesale Operations

Clipper Petroleum • Flowery Branch, Ga.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

CStore

For any questions about this issue or suggestions for future issues, please contact me at jlofstock@wtwhmedia.com.

The young employees of today are the future business leaders of tomorrow. As leaders, we have an obligation to help our future by training and mentoring tomorrow’s leaders today. This is the goal of the Young Executives Organization (YEO).

YEO’s mission is to cultivate young talent in the convenience store and petroleum industry through implementation of education and networking. YEO accomplishes this mission by leveraging the experience of National Advisory Group (NAG) members to foster superior leadership skills among next-generation leaders. Companies that utilize the experience of senior executives can develop and maintain the talent they have to ensure the organization has a robust pipeline of talented leaders.

YEO pushes forward this month with a leadership track for young executives looking to develop political connections. These relationships can be complicated and challenging to maintain, but they are extremely vital in the c-store industry. Emerging leaders need to build these relationships, but they need advice that’s realistic, granular and nuanced when it comes to making political allies.

At NAG’s exclusive YEO workshop, conference attendees will hear what they can do to build political partnerships and mentor young leaders who are beginning their journey into the cutthroat world of politics. Learn more about the 2023 NAG Conference in Austin, Texas, March 26-29, by visiting NAGConvenience.com.

I am especially proud of the growth of YEO and the level of participation we are seeing from young leaders across the industry. What I am learning from this up-and-coming generation is that high achievers have an insatiable thirst for knowledge and will seek out learning opportunities throughout their careers that help hone their skills and add to their arsenal of leadership tools.

Alex Malley, a leadership expert and author of “The Naked CEO,” said the best way for young executives to become effective leaders is to focus on a learning journey that combines formal experiences in the workplace with selective experiences of their own making. In other words, choose their own paths. The business climate today is much different than the ones faced by leaders a generation ago,

so it stands to reason that their path in the business world will also be different.

Naturally, some things will never change. Treating people the right way and having a solid foundation ethically and morally will help you in times of crises, but other than that, forging your own leadership identity is vital to success.

Malley listed five priorities essential for young leaders:

1.) Pursue Your Passions. When you combine passionate pursuit with your work you have an energy that others notice. It’s in your body language. People are naturally attracted whether they like you or not. Great leaders mobilize others with their authentic energy.

2.) Listen and Observe. Great communication comes from a genuine human interest in others. If you want to be a leader, learn about the personalities of the people around you. Understand their strengths, weaknesses and motivations. Invest in them through conversation. Learn about their life experiences and marry your approach to different people in a manner consistent with their character.

3.) Empathy. Always take the opportunity to exhibit your understanding when a colleague faces difficult times, whether that be as a result of their own actions or not. A moment of kindness when a person is vulnerable can present a profound opportunity to recast a relationship and allow confidence to be built.

4.) Personal Identity. The most effective leaders are not defined by their own success or the title they hold. Always ensure that you do not align your identity to your title. Not only will it make you more tentative in conducting your activities, it could impact you if the title is taken away.

5.) Self-Awareness. Do everything you can to understand the impact you have on others around you and appreciate how your actions and behaviors impact others. Only when self-awareness becomes a strength will you be on your leadership journey.

The chain has grown from a single-service station to a c-store and petroleum distribution powerhouse in its 61 years of business.

Kevin McIntyre • Editorial AssistantAs a family-owned, second-generation company, Key Oil has expanded from a single-service gas station in Park City, Ky., to a multi-divisional company that services a dealer network of over 200 branded stores and a diverse network of unbranded stores.

“Key Oil started with Lester Key and his single-service station in 1962,” said Keelye Gaither, brand and marketing coordinator at Key Oil. “Three years later, he would go on to establish Keystops LLC and purchase the truck stop here in Franklin, Ky., now known as Keystop Travel Center.”

Today, Key Oil operates that Keystop Travel Center with Marathon-branded gas and a Keystop Express c-store with bp-branded gas — both located in Franklin, Ky. — as well as a Marathonbranded station in Corydon, Ky. The company also owns and operates 16 bulk plant locations

Today, Key Oil operates the Keystop Travel Center with Marathon-branded gas and a Keystop Express c-store with bp-branded gas, as well as a Marathon-branded station in Corydon, Ky.

throughout Kentucky, Tennessee and Indiana. These wholesale locations are open to the public with unattended card readers and serve the company’s dealer network.

Keystops LLC is a diverse company that services all facets of the industry. These services range

from fuel hauling with Service Transport to the construction and installation of petroleum equipment at future fueling stations with Southern Kentucky Maintenance. Alongside its maintenance and construction division, Keystops LLC also owns Southern Environmental Services, which handles the company’s environmental work.

Thanks to our unique triple-tank technology, DJEEP lighters deliver up to 3,500 lights. Paired with striking designs, textures and finishes, they offer a premium option like no other.

LONG-LASTING QUALITY & LONG-LASTING STYLE

ZIP

Key Oil is also one of the 53 Mobil One distributors in the U.S. for lubricants. This is where South Central Equipment, the company’s lubricant equipment distributor, comes into play.

What once started as a little fueling station has grown to be a provider of fuel services for clients in all facets of the industry that is now celebrating

The fact that Key Oil has business on both the retailer and supplier side gives the company an

Why“We’re all of these things wrapped up into one,” said Gaither. “And then we operate our own stores too. It’s really fun. We’re able to answer the questions that some of our dealers have because they’re the same questions that we’re having to

Customers visiting Keystop locations can find everything they might need on the road from food to fuel, plus additional services that set Keystop apart from the competition, including specialty products like VP Racing Fuel.

In terms of service to the customer and the community, Key Oil makes an immense impact on

The chain participates in the Spirit Pump program, where a percentage of sales from a dispenser provides funding for organizations in the community, whether it be for a school, sports team or charity nearby.

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

“When customers come in, they’re able to take a (portion) of that purchase and give it back to the school,” said Gaither. “We do that at several of our locations. That’s something we really, really like to do.”

The chain not only fundraises to support the community, but also to provide hands-on support at the stores. Each store is staffed with attendants who are available to pump gas for customers and help with anything they may need.

“We’re never going to get rid of that. We’re always going to have that,” said Gaither. “Before I started with this company, that’s something that I had not seen since I was a really, really young kid, was someone who would come out and pump your gas for you. I think that’s a unique feature. … If

someone needs help with something, they’ll be out there to help them.”

While still maintaining the oldschool values and charm of a c-store of the past, the technology at each location is anything but antiquated.

At the Keystop Travel Center and Keystop Express location, technology is likely what many customers notice first. Each pump at these sites features Dover Fueling Solutions’ Anthem UX User Experience Platform, which displays commercials and interactive features on a 27-inch touchscreen.

“They’re very cool,” said Gaither. “They offer a lot of really cool things that we’re starting to get into.”

The chain is also currently updating its point-of-sale (POS) system to feature brand-new Verifone C18 touchscreens. These 18.5-inch screens will help drive sales in a more intuitive and efficient way, offering customers a self-checkout option in the stores.

Key Oil is also working on giving customers the option to check out

at the pump and purchase in-store items without having to enter the store via the Anthem touchscreens.

While the forecourt is getting some major upgrades, the stores themselves are not being forgotten. Gaither noted that the travel center was just remodeled, with the bath-

rooms as the point of emphasis in the reconstruction.

“I don’t think a lot of people think about the bathrooms when they walk into a store, but that is one area you really want to spend some extra time in when you’re thinking of your customers,” said Gaither. “We did it for our truck drivers and of course our regular consumers who are coming in from the gas side as well.”

In addition to the restroom renovation at the travel center, small cosmetic changes to improve the stores’ appearance have been added at all locations.

“We’ve been focusing on some more modern finishes, including stainless steel and some metal finishes to keep things a little bit cleaner and nicer,” said Gaither.

Keystop customers can choose from a variety of foodservice options.

The company offers a proprietary quick-service restaurant (QSR) in the travel center site, which Gaither noted contributes heavily to the food sales in that location. The store also features a convenient drive-through.

The Keystop Express location offers a Hunt Brothers Pizza program, which now features a new online ordering and pickup service.

“It’s been really nice for our customers to be able to have that experience,” Gaither said, rather than having to wait in line for food.

The sites also offer some of the latest cold and frozen beverages, such as Fresh Blends dispensers, in addition to bean-to-cup coffee. The company purchased its own bean-to-cup coffee brand that is used throughout its travel center and c-store locations.

While the company excels in instore products and features, the main

The forecast is a cold cooler front when you use Trion’s Air Flow Baffle in coolers. Product temperature can be difficult to maintain at the front of a cooler. This Air Flow Baffle ensures that cold air is forced forward to keep items at their ideal temperature. Use as part of your cooler outfitting strategy, along with WonderBar ® Bar Merchandisers and hooks, EWTTM Expandable Wire Tray System, and cooler capable Clear Scan® label holders.

Call 800-444-4665 | TrionOnline.com

Merchandise all size drinks from mini Red Bull® cans to oversized Gatorade® bottles. ZIP Track® is the most versatile and cost-effective Grab-and-Go system available on the market. Use actual product to set lane width from 2" to 3 3/4 " Reset lane width on set-up in less than 30 seconds. Shelf-based and coolerready, this anchored system billboards product for easy selection and fast sale. forwards and faces product at

offers a wide range of adjustability for this ever-evolving beverage category

Neatly and effectively display cooler and freezer items, including yogurt, dips, puddings, ice cream, single-serve foods, and more. Our small Adjustable Merchandising Tray (AMT) fits a range of 4- to 6-ounce cups; the medium AMT organizes mid-range offerings; and the large AMT gives ice cream lovers pause to browse and choose a pint of their favorite flavor (hmmm why not get both Cherry Vanilla and Rocky Road?). This manual-feed tray ensures that products remain faced and accessible. Time to re-stock? Just lift out and refill. Add Clear Scan® Label Holder, and you’re finished! Call 800-444-4665 | TrionOnline.com

It’s not just for coolers or beverages. Use ZIP Track® in multiple categories to showcase many different types of product. This is the most versatile system, of its kind available on the market. Manufactured from durable, modern plastics, it provides extended merchandising life. ZIP Track® offers a wide range of adjustability. Custom spring tensions and lane depths are available to fit any and all shelf and product needs.

ZIP Track ® components clip on the front rail allowing easy adjustment. Lanes can slide on the rail even when full or to add additional facings.

If you think the WonderBar EWT is great, wait till you meet its big brother! Oversized just like some of your products, this weightlifter stays strong on both metal and open wire shelves and bar. One-piece installation means you can drop this bad boy right into place, adjust as needed, and watch the revenue increase. The EWT takes over from there, automatically feeding product to the front and billboarding merchandise for maximum visibility. Call 800-444-4665 | TrionOnline.com

WonderBar® Displays are the versatile heroes of the Trion product family, coming to the rescue when you need muscle and good looks to merchandise items of all sizes. These Bar Hooks can lift heavy loads in their capable arms. Display or Scan, Saddle Mount or Plug in, there are Trion WonderBar Hooks for every need.

Fill it with product. ZIP Track® maintains its width accurately for the entire depth of facing without the need for a rear anchor system.

faced. Feature items of different widths via asymmetric lane configurations. Cross merchandise a variety of products with ease. Trays install without tools and lift out for quick restocking or product rotation. Full line includes standard and oversize trays, and display, scan and pusher hooks. Call 800-444-4665 | TrionOnline.com

1 ⁄4 . Each lane features a separate pusher paddle to keep products forwarded and faced. Feature items of different widths via asymmetric lane configurations. Cross merchandise a variety of products with ease. Trays install without tools and lift out for quick restocking or product rotation. Full line includes standard and oversize trays, and display, scan and pusher hooks. Call 800-444-4665 | TrionOnline.com

®

This cross-selling approach makes shopping easier for the customer and more profitable for you. Select from a range of other Trion outfitting to maximize selling space from the base deck to the top shelf and beyond. Call 800-444-4665 | TrionOnline.com

the display space and create unique presentations of similar or related items. This cross-selling approach makes shopping easier for the customer and more profitable for you. Select from a range of other Trion outfitting to maximize selling space from the base deck to the top shelf and beyond.

The forecast is a cold cooler front when you use Trion’s Air Flow Baffle in coolers. Product temperature can be difficult to maintain at the front of a cooler. This Air Flow Baffle ensures that cold air is forced forward to keep items at their ideal temperature. Use as part of your cooler outfitting strategy, along with WonderBar ® Bar Merchandisers and hooks, EWTTM Expandable Wire Tray System, and cooler capable Clear Scan® label holders.

This mini tray leads to maximum revenue, because it allows complimentary items to be featured together. Dual lanes adjust to fit narrow merchandise sizes as small as 1 3⁄4 ". Each lane features a separate pusher paddle to keep products forwarded and faced. Feature items of different widths via asymmetric lane configurations. Cross merchandise a variety of products with ease. Trays install without tools and lift out for quick restocking or product rotation. Full line includes standard and oversize trays, and display, scan and pusher hooks.

Storewide solutions for any labeling need. Available in a variety of profiles (shapes), these bright, clear label holders are easily positioned in all standard C-channel configurations, as well as displays incorporating metal, glass, wood, wire baskets, wire shelving, wire fencing, and scanning hooks. Plain paper labels drop in behind a clear flexible PVC front, allowing labels to be changed quickly and inexpensively without messy adhesive backing. Adhesive label holders and strips also available if that is your need. Save time, increase visibility, and boost sales with this storewide labeling system.

Storewide solutions for any labeling need. Available in a variety of profiles (shapes), these bright, clear label holders are easily positioned in all standard C-channel configurations, as well as displays incorporating metal, glass, wood, wire baskets, wire shelving, wire fencing, and scanning hooks. Plain paper labels drop in behind a clear flexible PVC front, allowing labels to be changed quickly and inexpensively without messy adhesive backing. Adhesive label holders and strips also available if that is your need. Save time, increase visibility, and boost sales with this storewide labeling system. Cooler capable, color, and built-in promo

Use ZIP Track® in multiple categories to showcase many different types of product. It’s not just for coolers or beverages. This is the most versatile system of its kind on the market. Easy to install, ZIP Track® components clip on a front rail allowing lanes to adjust quickly, even when full or to add additional facings. Use actual product to set lane width from 2" up to 3 3/4 " Slide product front-to-back to “ZIP” each track together. Custom spring tensions and lane depths are available to fit any and all shelf and product needs. The sturdy plastic is durable, with an extended merchandising life.

Call 800-444-4665 | TrionOnline.com

Neatly and effectively display cooler and freezer items, including yogurt, dips, puddings, ice cream, single-serve foods, and more. Our small Adjustable Merchandising Tray (AMT) fits a range of 4- to 6-ounce cups; the medium AMT organizes mid-range offerings; and the large AMT gives ice cream lovers pause to browse and choose a pint of their favorite flavor (hmmm why not get both Cherry Vanilla and Rocky Road?). This manual-feed tray ensures that products remain faced and accessible. Time to re-stock? Just lift out and refill. Add Clear Scan® Label Holder, and you’re finished! Call 800-444-4665 | TrionOnline.com

Storewide solutions for any labeling need. Available in a variety of profiles (shapes), these bright, clear label holders are easily positioned in all standard C-channel configurations, as well as displays incorporating metal, glass, wood, wire baskets, wire shelving, wire fencing, and scanning hooks. Plain paper labels drop in behind a clear flexible PVC front, allowing labels to be changed quickly and inexpensively without messy adhesive backing. Adhesive label holders and strips also available if that is your need. Save time, increase visibility, and boost sales with this storewide labeling system. Cooler capable, color, and built-in promo Clip label holders and strips available. Call 800-444-4665 | TrionOnline.com

If you think the WonderBar EWT is great, wait till you meet its big brother! Oversized just like some of your products, this weightlifter stays strong on both metal and open wire shelves and bar. One-piece installation means you can drop this bad boy right into place, adjust as needed, and watch the revenue increase. The EWT takes over from there, automatically feeding product to the front and billboarding merchandise for maximum visibility. Call 800-444-4665 | TrionOnline.com

Flip-Scan® hooks are an open and shut case for ease of use. The articulated label holder lifts up and out of the way for easy product access, then falls back to vertical for viewing product and price info. Our unique label holder flexes open so plain paper labels can be inserted effortlessly. Available with short label holders or full length label strips and constructed of long-life materials, these durable, attractive scan hooks can outfit all display surfaces, including pegboard, slatwall, grid, crossbar, and corrugated. Fully compatible with the Clear Scan® Label Holder System for C-channel, shelf edge, wire basket, and refrigerated areas storewide.

This bottom is tops for displaying heavy, bulky, or hard-to-fit items. Display them attractively and neatly using front fencing and dividers to customize the display space and create unique presentations of similar or related items. This cross-selling approach makes shopping easier for the customer and more profitable for you. Select from a range of other Trion outfitting to maximize selling space from the base deck to the top shelf and beyond. Call 800-444-4665 | TrionOnline.com

Flip-Scan® hooks are an open and shut case for ease of use. The articulated label holder lifts up and out of the way for easy product access, then falls back to vertical for viewing product and price info. Our unique label holder flexes open so plain paper labels can be inserted effortlessly. Available with short label holders or full length label strips and constructed of long-life materials, these durable, attractive scan hooks can outfit all display surfaces, including pegboard, slatwall, grid, crossbar, and corrugated. Fully compatible with the Clear Scan® Label Holder System for C-channel, shelf edge, wire basket, and refrigerated areas storewide.

WonderBar® Displays are the versatile heroes of the Trion product family, coming to the rescue when you need muscle and good looks to merchandise items of all sizes. These Bar Hooks can lift heavy loads in their capable arms. Display or Scan, Saddle Mount or Plug in, there are Trion WonderBar Hooks for every need.

This mini tray leads to maximum revenue, because it allows complimentary items to be featured together. Dual lanes adjust to fit narrow merchandise sizes as small as 1 3⁄4 ". Each lane features a separate pusher paddle to keep products forwarded and faced. Feature items of different widths via asymmetric lane configurations. Cross merchandise a variety of products with ease. Trays install without tools and lift out for quick restocking or product rotation. Full line includes standard and oversize trays, and display, scan and pusher hooks. Call 800-444-4665 | TrionOnline.com

Flip-Scan® hooks are an open and shut case for ease of use. The articulated label holder lifts up and out of the way for easy product access, then falls back to vertical for viewing product and price info. Our unique label holder flexes open so plain paper labels can be inserted effortlessly. Available with short label holders or full length label strips and constructed of long-life materials, these durable, attractive scan hooks can outfit all display surfaces, including pegboard, slatwall, grid, crossbar, and corrugated. Fully compatible with the Clear Scan® Label Holder System for C-channel,

®

T he ART

Unlimited Configuration Expandable Wire Tray™

Call 800-444-4665 | TrionOnline.com

Oversize? No Problem!

That’s why Trion created the WonderBar® Expandable Wire Tray System, aka EWT. We included every feature you would want if you created it yourself: powdercoated galvanized wire that stands up to harsh environments; adjustable width; easy custom configuration; rail mount and freestanding units; wire or clear acrylic product stops. EWT mounts on pegboard, slatwall, gondola shelf, table top and cooler.

Product offerings come in different sizes, so it makes sense that displays should come in different sizes, too. That’s why Trion created the WonderBar ® Expandable Wire Tray System. We included every feature you would want if you created it yourself: powder-coated galvanized wire that stands up to harsh environments; adjustable width; easy custom configuration; rail mount and freestanding units; wire or clear acrylic product stops. EWT mounts on pegboard, slatwall, gondola shelf, table top and cooler.

TrionOnline.com

Announce

Extruded Sign Holders

Containers Well Contained Cooler Capable AMT®

Call 800-444-4665 | TrionOnline.com

Think of these extruded signs as a GPS for your retail setting. Quickly guide customers to the products they want and need with these versatile sign holders. Plan your customer’s routes, then slide in signs when you’re ready. Creative merchandisers might also use these sign holders for monthly or weekly specials, buy-one-get-one offers, specialized category definition (think gluten free, organic, fair trade, etc.), or promotion of in-store loyalty cards. A variety of mounting options are available including hooks, push pin, and foam tape. The opportunities for use are endless. Call 800-444-4665 | TrionOnline.com

Z ip Track ® Merchandiser

Bin there, organized that! Trion’s deck fencing helps you bin small, large, bulk or packaged items while keeping them accessible to customers. Customize your display to create closed-front or open-front compartments using straight or offset front fence, then add our convenient labeling systems to finish the job right.

Call 800-444-4665 | TrionOnline.com

Super Hooks! WonderBar® Hooks

® Create Your Own Merchandising Masterpiece with Trion Fixtures HOOKS | lAbElING | SHElF & COOlER MERCHANDISING 800-444-4665 | info@triononline.com triononline.com/Art © 2023 Trion Industries, Inc. Make an Appearance Gold AwArd winner

Let’s review your wish list of slatwall hook features: flat back plate base? Trion’s got it. Even load distribution?

Let’s review your wish list of slatwall hook features: flat back plate base?

Trion’s got it. Even load distribution?

Check. Customizable with Clear Scan Labels? Yep. Flip-front or metal plate

Label Holder, gotcha. Like your varied products, Trion’s Slatwall Hooks are offered in a range of standard, medium, heavy, and extra heavy gauges. Our hooks fit all industry standard slatwall slots, and many work with slot inserts. Call for a sample to check the fit with your design.

The forecast is a cold cooler front when you use Trion’s Air Flow Baffle in coolers. Product temperature can be difficult to maintain at the front of a cooler. This Air Flow Baffle ensures that cold air is forced forward to keep items at their ideal temperature. Use as part of your cooler outfitting strategy, along with WonderBar ® Bar Merchandisers and hooks, EWTTM Expandable Wire Tray System, and cooler capable Clear Scan® label holders.

Don’t judge a literature holder by its cover these coated-wire multi-taskers can be used to accommodate anything that is best displayed upright. Rather than stacking that merchandise flat on shelves, show off features and benefits where customers can fully view the entire item. Creatively deploy these to sell almost anything, including games, mirrors, frames, clocks, puzzles, life vests, baking sheets, and — for traditionalists —even product literature. Call 800-444-4665 | TrionOnline.com

Don’t judge a literature holder by its cover these coated-wire multi-taskers can be used to accommodate anything that is best displayed upright. Rather than stacking that merchandise flat on shelves, show off features and benefits where customers can fully view the entire item. Creatively deploy these to sell almost anything, including games, mirrors, frames, clocks, puzzles, life vests, baking sheets, and — for traditionalists —even product literature.

Call 800-444-4665 | TrionOnline.com

Don’t judge a literature holder by its cover these coated-wire multi-taskers can be used to accommodate anything that is best displayed upright. Rather than stacking that merchandise flat on shelves, show off features and benefits where customers can fully view the entire item. Creatively deploy these to sell almost anything, including games, mirrors, frames, clocks, puzzles, life vests, baking sheets, and — for

Call 800-444-4665 | TrionOnline.com

Use ZIP Track ® storewide for a wellorganized display of spray paint cans, and other craft items. Works well with caulking tubes in hardware too. This is the most versatile system of its kind on the market. Easy to install, ZIP Track® components clip on a front rail allowing lanes to adjust quickly, even when full or to add additional facings. Use actual product to set . Slide product front-to-back to “ZIP” each offers a wide range of adjustability for changing

Don’t judge a literature holder by its cover these coated-wire multi-taskers can be used to accommodate anything that is best displayed upright. Rather than stacking that merchandise flat on shelves, show off features and benefits where customers can fully view the entire item. Creatively deploy these to sell almost anything, including games, mirrors, frames, clocks, puzzles, life vests, baking sheets, and — for traditionalists —even product literature.

You’ll be hooked on these Clear Scan Label Holders when you see how easily they accommodate drop-in plain paper labels. Promote product and price or features and benefits so customers can choose easily .. . and so can you! Make your selection of Clear Scan Label Holders from a variety of profiles, colors and lengths, then add them to hooks with flip-front or FISH-TipTM mounts. Skip the mess of sticky adhesive labels and trade up to easy-to-use plain paper label holder systems.

You’ll be hooked on these Clear Scan® Label Holders when you see how easily they accommodate drop-in plain paper labels. Promote product and price or features and benefits so customers can choose easily and so can you! Make your selection of Clear Scan Label Holders from a variety of profiles, colors and lengths, then add them to hooks with flip-front or FISH-TipTM mounts. Skip the mess of sticky adhesive labels and trade up to easy-to-use plain paper label holder systems.

Neatly and effectively display cooler and freezer items, including yogurt, dips, puddings, ice cream, single-serve foods, and more. Our small Adjustable Merchandising Tray (AMT) fits a range of 4- to 6-ounce cups; the medium AMT organizes mid-range offerings; and the large AMT gives ice cream lovers pause to browse and choose a pint of their favorite flavor (hmmm why not get both Cherry Vanilla and Rocky Road?). This manual-feed tray ensures that products remain faced and accessible. Time to re-stock? Just lift out and refill. Add Clear Scan® Label Holder, and you’re finished! Call 800-444-4665 | TrionOnline.com

You’ll be hooked on these Clear Scan® Label Holders when you see how easily they accommodate drop-in plain paper labels. Promote product and price or features and benefits so customers can choose easily and so can you! Make your selection of Clear Scan Label Holders from a variety of profiles, colors and lengths, then add them to hooks with flip-front or FISH-TipTM mounts. Skip the mess of sticky adhesive labels and trade up to easy-to-use plain paper label holder systems.

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

You’ll be hooked on these Clear Scan® Label Holders when you see how easily they accommodate drop-in plain paper labels. Promote product and price or features and benefits so customers can choose easily and so can you! Make your selection of Clear Scan Label Holders from a variety of profiles, colors and lengths, then add them to hooks with flip-front or FISH-TipTM mounts. Skip the mess of sticky adhesive labels and trade up to easy-to-use plain paper label holder systems.

Call 800-444-4665 | TrionOnline.com

Truth or dare? The truth is that Trion’s ShelfWorks® Clear Dividers and Product Stops are up to any dare. Choose straight, reversible, or interlocking-front clear dividers to align, stack, divide, and organize almost any product you want to sell. Another truth is Trion’s products are durable, high-quality items that will work as hard as you do. Try to find better merchandising solutions. We double-dog dare you.

If you think the WonderBar EWT is great, wait till you meet its big brother! Oversized just like some of your products, this weightlifter stays strong on both metal and open wire shelves and bar. One-piece installation means you can drop this bad boy right into place, adjust as needed, and watch the revenue increase. The EWT takes over from there, automatically feeding product to the front and billboarding merchandise for maximum visibility.

Truth or dare? The truth is that Trion’s ShelfWorks® Clear Dividers and Product Stops are up to any dare. Choose straight, reversible, or interlocking-front clear dividers to align, stack, divide, and organize almost any product you want to sell. Another truth is Trion’s products are durable, high-quality items that will work as hard as you do. Try to find better merchandising solutions. We double-dog dare you.

Don’t judge a literature holder by its cover these coated-wire multi-taskers can be used to accommodate anything that is best displayed upright. Rather than stacking that merchandise flat on shelves, show off features and benefits where customers can fully view the entire item. Creatively deploy these to sell almost anything, including games, mirrors, frames, clocks, puzzles, life vests, baking sheets, and — for traditionalists —even product literature. Call 800-444-4665 | TrionOnline.com

Truth or dare? The truth is that Trion’s ShelfWorks® Clear Dividers and Product Stops are up to any dare. Choose straight, reversible, or interlocking-front clear dividers to align, stack, divide, and organize almost any product you want to sell. Another truth is Trion’s products are durable, high-quality items that will work as hard as you do. Try to find better merchandising solutions. We double-dog dare you.

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Truth or dare? The truth is that Trion’s ShelfWorks® Clear Dividers and Product Stops are up to any dare. Choose straight, reversible, or interlocking-front clear dividers to align, stack, divide, and organize almost any product you want to sell. Another truth is Trion’s products are durable, high-quality items that will work as hard as you do. Try to find better merchandising solutions. We double-dog dare you.

Call 800-444-4665 | TrionOnline.com

WonderBar® Displays are the versatile heroes of the Trion product family, coming to the rescue when you need muscle and good looks to merchandise items of all sizes. These Bar Hooks can lift heavy loads in their capable arms. Display or Scan, Saddle Mount or Plug in, there are Trion WonderBar Hooks for every need.

Keep those carded products tidy and easy to see when you add inventory control clips (ICCs) to your standard, medium, heavy or extra heavy wire hook displays. These handy clips keep merchandise faced and double as a marker to let you know when it’s time to reorder or re-stock products. Available in Rabbit Ear ICC and circular Sham configurations. Or order with half-moon ATICC Inventory control clips already pre-mounted on the hook for you.

Keep those carded products tidy and easy to see when you add inventory control clips (ICCs) to your standard, medium, heavy or extra heavy wire hook displays. These handy clips keep merchandise faced and double as a marker to let you know when it’s time to reorder or re-stock products. Available in Rabbit Ear ICC and circular Sham configurations. Or order with half-moon ATICC Inventory control clips already pre-mounted on the hook for you.

Keep those carded products tidy and easy to see when you add inventory control clips (ICCs) to your standard, medium, heavy or extra heavy wire hook displays. These handy clips keep merchandise faced and double as a marker to let you know when it’s time to reorder or re-stock products. Available in Rabbit Ear ICC and circular Sham configurations. Or order with half-moon ATICC Inventory control clips already pre-mounted on the hook for you.

You’ll be hooked on these Clear Scan® Label Holders when you see how easily they accommodate drop-in plain paper labels. Promote product and price or features and benefits so customers can choose easily .. . and so can you! Make your selection of Clear Scan Label Holders from a variety of profiles, colors and lengths, then add them to hooks with flip-front or FISH-TipTM mounts. Skip the mess of sticky adhesive labels and trade up to easy-to-use plain paper label holder systems.

Call 800-444-4665 | TrionOnline.com

Keep those carded products tidy and easy to see when you add inventory control clips (ICCs) to your standard, medium, heavy or extra heavy wire hook displays. These handy clips keep merchandise faced and double as a marker to let you know when it’s time to reorder or re-stock products. Available in Rabbit Ear ICC and circular Sham configurations. Or order with half-moon ATICC Inventory control clips already pre-mounted on the hook for you.

The forecast is a cold cooler front when you use Trion’s Air Flow Baffle in coolers. Product temperature can be difficult to maintain at the front of a cooler. This Air Flow Baffle ensures that cold air is forced forward to keep items at their ideal temperature. Use as part of your cooler outfitting strategy, along with WonderBar ® Bar Merchandisers and hooks, EWTTM Expandable Wire Tray System, and cooler capable Clear Scan® label holders.

This mini tray leads to maximum revenue, because it allows complimentary items to be featured together. Dual lanes adjust to fit narrow merchandise sizes as small as 1 3⁄4 ". Each lane features a separate pusher paddle to keep products forwarded and faced. Feature items of different widths via asymmetric lane configurations. Cross merchandise a variety of products with ease. Trays install without tools and lift out for quick restocking or product rotation. Full line includes standard and oversize trays, and display, scan and pusher hooks. Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

These strong, downward-canted waterfall hooks lift more weights than a personal trainer. Ready for a workout, Trion Industries’ hooks display heavy products, like free weights in multiple sizes, with both sales and safety in mind. Your customers can easily browse the merchandise, which is held in place by built-in pins to keep product from shifting or falling. Exercise your opportunity to cross-sell related products and keep your bottom line in shape! Of course these waterfall utility

Merchandise all size drinks from mini Red Bull® cans to oversized Gatorade® bottles. ZIP Track® is the most versatile and cost-effective Grab-and-Go system available on the market. Use actual product to set lane width from 2" to 3 3/4 " Reset lane width on set-up in less than 30 seconds. Shelf-based and coolerready, this anchored system billboards product for easy selection and fast sale. ZIP Track® forwards and faces product at all times. Quickly add lanes with this easy to install and adjust system. ZIP Track® offers a wide range of adjustability for this ever-evolving beverage category and changing package designs.

If you think the WonderBar EWT is great, wait till you meet its big brother! Oversized just like some of your products, this weightlifter stays strong on both metal and open wire shelves and bar. One-piece installation means you can drop this bad boy right into place, adjust as needed, and watch the revenue increase. The EWT takes over from there, automatically feeding product to the front and billboarding merchandise for maximum visibility.

Mirror, mirror on the wall. You can be the most difficult item to display of all. Clever merchandisers use large literature holders for three-dimensional, awkwardly sized items like mirrors, framed art, clocks, and more. Available in a range of sizes, gauges, and weights, Trion’s large literature holders can be spaced horizontally to accommodate all manner of product sizes.

Call 800-444-4665 | TrionOnline.com

This bottom is tops for displaying heavy, bulky, or hard-to-fit items. Display them attractively and neatly using front fencing and dividers to customize the display space and create unique presentations of similar or related items. This cross-selling approach makes shopping easier for the customer and more profitable for you. Select from a range of other Trion outfitting to maximize selling space from the base deck to the top shelf and beyond. Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Flip-Scan

Neatly and effectively display cooler and freezer items, including yogurt, dips, puddings, ice cream, single-serve foods, and more. Our small Adjustable Merchandising Tray (AMT) fits a range of 4- to 6-ounce cups; the medium AMT organizes mid-range offerings; and the large AMT gives ice cream lovers pause to browse and choose a pint of their favorite flavor (hmmm why not get both Cherry Vanilla and Rocky Road?). This manual-feed tray ensures that products remain faced and accessible. Time to re-stock? Just lift out and refill. Add Clear Scan® Label Holder, and you’re finished!

These strong, downward-canted waterfall hooks lift more weights than a personal trainer. Ready for a workout, Trion Industries’ hooks display heavy products, like free weights in multiple sizes, with both sales and safety in mind. Your customers can easily browse the merchandise, which is held in place by built-in pins to keep product from shifting or falling. Exercise your opportunity to cross-sell related products and keep your bottom line in shape! Of course these waterfall utility hooks are perfect for more than hand weights. Give them a try.

What do you want your customers to know? Want to promote great prices or unique product features? Add wall tags to your displays faster than you can say “sign up!” Wall tags allow you to mount your product and price separately on vertical display surfaces, for cleaner overall presentation.

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Call 800-444-4665 | TrionOnline.com

Storewide solutions for any labeling need. Available in a variety of profiles (shapes), these bright, clear label holders are easily positioned in all standard C-channel configurations, as well as displays incorporating metal, glass, wood, wire baskets, wire shelving, wire fencing, and scanning hooks. Plain paper labels drop in behind a clear flexible PVC front, allowing labels to be changed quickly and inexpensively without messy adhesive backing. Adhesive label holders and strips also available if that is your need. Save time, increase visibility, and boost sales with this storewide labeling system. Cooler capable, color, and built-in promo Clip label holders and strips available. Call 800-444-4665 | TrionOnline.com

These strong, downward-canted waterfall hooks lift more weights than a personal trainer. Ready for a workout, Trion Industries’ hooks display heavy products, like free weights in multiple sizes, with both sales and safety in mind. Your customers can easily browse the merchandise, which is held in place by built-in pins to keep product from shifting or falling. Exercise your opportunity to cross-sell related products and keep your bottom line in shape! Of course these waterfall utility hooks are perfect for more than hand weights. Give them a try.

Call 800-444-4665 | TrionOnline.com

Mirror, mirror on the wall. You can be the most difficult item to display of all. Clever merchandisers use large literature holders for

case for ease of use. The articulated label holder lifts up and out of the way for easy product access, then falls back to vertical for viewing product and price info. Our unique label holder flexes open so plain paper labels can be inserted effortlessly. Available with short label holders or full length label strips and constructed of long-life materials, these durable, attractive scan hooks can outfit all display surfaces, including pegboard, slatwall, grid, crossbar, and corrugated.

coming to the rescue when you need muscle and good looks to merchandise items of all sizes. These Bar Hooks can lift heavy loads in their capable arms. Display or Scan, Saddle Mount or Plug in, there are Trion WonderBar Hooks for every need.

make it easy to label and price products, regardless of plan-o-gram fixture layout, unusual product shape, or tightly spaced displays. When you need a flexible aid to label and price items quickly and conveniently, turn to this Swiss Army knife of outfitting. Scan-ItTM is available in a range of back plate sizes and label holder configurations.

Mirror, mirror on the wall. You can be the most difficult item to display of all. Clever merchandisers use large literature holders for three-dimensional, awkwardly sized items like mirrors, framed art, clocks, and more. Available in a range of sizes, gauges, and weights, Trion’s large literature holders can be spaced horizontally to accommodate all manner of product sizes.

Fully compatible with the Clear Scan® Label Holder System for C-channel, shelf edge, wire basket, and refrigerated areas storewide.

Call 800-444-4665 | TrionOnline.com

Merchandising is more than fitout and fixtures. It’s the art of creating an attractive, well-organized retail presentation. as with any artistic composition, a wide variety of tools may be used to create your masterpiece. In retail Visual Merchandising, a gondola, pegboard, slatwall or shelf is your blank canvas. When combined with tools such as display hooks, label and sign holders, bar merchandisers, tray systems, and merchandising accessories, there are endless ways to effectively display all kinds of products and inspire your target audience to make a purchase. As one of the world’s top retail fixture manufacturers, Trion offers a generous palette of over 25,000 components with 55 years of experience using them to execute precise planogram solutions, store designs and retail displays. call us to turn your vision into an inspired retail masterpiece.

focus is on the customer and how to best serve each individual that enters the store.

“We take a lot of pride in our spirit and our service to the customers,” said Gaither.

When customers were asked why they chose to visit Keystop over another store, Gaither pointed out that time and again shoppers responded, “They care about us.”

With customers as the focus of

its business, Key Oil has grown and prospered for over 60 years.

“We want to make sure that every person who walks into one of our locations, whether it is our travel center, or a c-store or one of our bulk plants, that they’re welcomed and that they’re accommodated, whether that be through a service or a food item,” said Gaither.

Gaither also noted that this service to the customer would not be possible without the help from employees. Therefore, the company makes it a point to show its appreciation for everyone that works at any of its company-operated stores or dealer locations.

“A lot of times, we’ll go out to our locations even if they’re our branded dealer network; we’ll go out and have a customer appreciation day,” said Gaither.

From its humble beginnings as a single-service gas station, Key Oil has come to be a pivotal force in many communities throughout its operating states.

KeyStop Travel Center was recently remodeled, with the bathrooms as the point of emphasis in the reconstruction. Stores have also received small cosmetic changes to enhance appearance, including modern finishes.

KeyStop Travel Center was recently remodeled, with the bathrooms as the point of emphasis in the reconstruction. Stores have also received small cosmetic changes to enhance appearance, including modern finishes.

Even though it's a new year, inflation is still causing problems for retailers. However, operators continue to find new ways to meet customers' needs.

Based on a series of interviews with 50 senior retail leaders, 70% of which are from companies with an annual revenue of $10 billion or more, Deloitte found:

• All surveyed executives expect inflation to pressure their profit margins.

• 6-in-10 executives expect inflation to raise operating costs.

• 8-in-10 retailers anticipate diminished consumption as a result of financial instability.

• 7-in-10 executives note that supply chain disruption will impact growth.

• 3-in-10 executives feel confident in navigating domestic supply chain disruptions.

Source: Deloitte, “2023 Retail Outlook," January 2023

Global consulting firm Protiviti surveyed 1,065 chief financial officers (CFOs), who shared concerns about inflationary trends.

For example:

• 35% of CFOs are assessing the need for new skills and talent inside and outside their organizations.

• 33% are balancing the risk of higher staff attrition against potential compensation increases.

• 32% are refining and/or increasing scenario planning.

Part one of SML RFID's “State of Retail Insight Report 2023” surveyed retailers to determine the challenges they perceive to be impacting the industry going forward in 2023. The survey found that when it comes to fulfilling customers’ orders:

• Almost half (48%) of retailers said that frequently out-of-stock items caused the biggest challenge to serving customers.

• 32% of retailers also said a dim view of inventory was an obstacle.

• 25% said it takes too long to find items.

Advantage Sales’ “Outlook

The main challenges retailers face when providing a good customer experience include:

• Not enough staff on the shop floor

• Poor visibility of inventory available to customers

• A lack of staff training

• Not enough in-store promotions, sales and discounts

October 2022,” found retailers are thinking of new ways to help with customers' price concerns over the next six months, including:

• 75% of retailers are increasing the availability of private-brand products.

• 60% of retailers are increasing promotions.

• 50% of retailers are increasing the use of long-term temporary price reductions.

• 48% of retailers have more displays of lower price point products.

Marilyn Odesser-Torpey • Associate Editor

Marilyn Odesser-Torpey • Associate Editor

Over 15 years ago, Fleet Morris Petroleum’s Fleetway Market locations added Hunt Brothers Pizza to its foodservice mix. And, according to Casey Comfort, the company’s food and beverage director, in just over the past three years sales have increased by 20%.

“We chose Hunt Brothers for our pizza program because it is simple to execute, the products are consistently the highest quality, and the level of interaction, support and service are so high, (which is) a rarity in foodservice vendors today,” Comfort explained. “It also takes minimal labor to run it.”

Fleetway Market has 23 stores in Mississippi. All but a few offer pizza, and this year two additional stores are set to open with the Hunt Brothers Pizza program, he said.

“The cool thing is we operate in many rural areas that don’t have typical pizza chains, so we become the go-to take-home pizza restaurant,” Comfort noted. “Some of our stores do upwards of 100 pizzas a day in orders to pick up on the way home for dinner.”

Comfort also pointed out the profit margins

are “higher than is typical on the store side.”

“While people might not think of pizza as a breakfast option, morning is our busiest time for pizza at our stores,” he said. “The breakfast pizza is already sauced and cheesed and ready to roll, so it’s easy for us to deliver a consistently fresh and delicious product.”

Throughout the year, limited-time offers (LTOs) also do well in the stores, he stated. To promote them, Hunt Brothers Pizza provides a full range of collateral marketing materials at no charge.

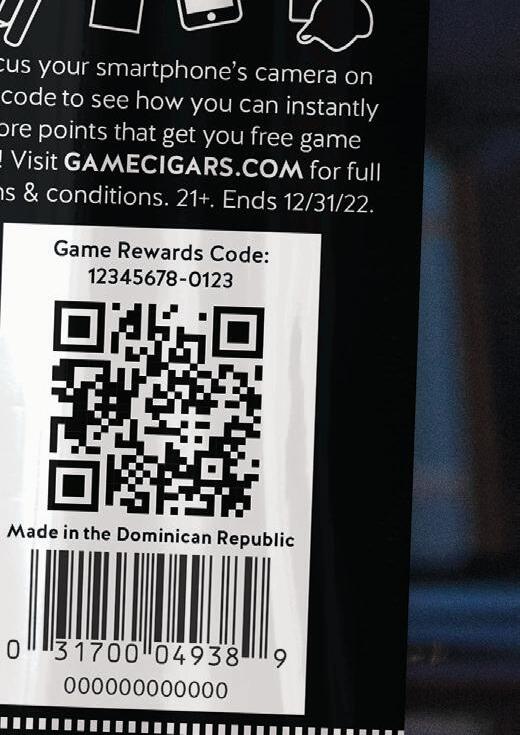

Hunt Brothers Pizza’s training processes are extensive and “are ironed out to a T,” Comfort noted. Employees use QR codes to access training videos as needed on a wide range of topics from making pepperoni pizzas to breaking down and cleaning the kitchen.

Reps from Hunt Brothers Pizza visit the stores once a week, and the company provides a single point of contact for Fleetway Market’s entire portfolio of locations. If there is an issue or slump in sales at any particular store, that contact person will immediately go there to give support and lead any necessary trainings.

For Andy Williams, director of retail sales for Santmyer Oil’s three Red Rover c-stores in Ohio, format flexibility is one of the most important attributes that Hunt Brothers Pizza brings to the table.

“They have a model that can fit into a lot of different formats based on the size of the store,” he said. “We’ll be putting the program in the two new stores we’ll be opening this year as well.”

The Hunt Brothers Pizza program was already in place when Williams joined the Red Rover team two years ago. Since that time high-volume locations have increased sales by 10-11% and other locations with lesser volume between 15-18%, he explained. Hunt Brothers Pizza is the largest portion of the stores’ food sales.

Williams noted that customers like the versatility of being able to come in and get one or two “hunks” (one-quarter of a 12-inch pizza) or call in an order for 10 whole pizzas. They also like the diversity of the toppings and that they can choose from over a thousand combinations at no additional charge.

“The LTOs bump orders up as customers try them and like them,” Williams pointed out. “We see them increasing, even doubling their orders.”

Overall, Williams said, his company is very satisfied with the quality of the Hunt Brothers Pizza products, and customers agree that they are consistently excellent. Hunt Brothers Pizza’s product delivery system also saves time, and the products have a good shelf life.

Training is key to making the program work to its fullest potential, and Hunt Brothers Pizza makes sure that the convenience stores’ staff is trained on every aspect, he continued. Hunt Brothers Pizza provides both live trainings and materials that staff can refer to as needed.

“Anytime a question or need arises, Hunt Brothers is right there with answers and solutions,” he said. “That consistent service is another reason why we choose to work with Hunt Brothers.”

SUNDAY, MARCH 26

9:00 AM

1:00 PM – 7:30 PM

Golf Outing at Hyatt Regency Lost Pines Resort and Spa

Registration

NAG/YEO Board Meeting

NAG Networking Reception

NAG Opening Night Dinner

Registration/Info Desk Open

Breakfast

Welcome/Conference Overview

President | Young Oil Co.

Executive Director | NAG

GENERAL SESSION: BURNING ISSUE #1: Developing and Refining Your Corporate Culture Strategy and culture are among the most important responsibilities for leaders in the workplace as they focus on the never-ending quest to maintain e ectiveness. Strategy o ers a formal logic for the company’s goals, and culture expresses these goals through values and beliefs. A strong company culture instantly reflects the values of a company, its leaders and its employees. What values define your company? What matters most to you and your employees? In this session, retailers will discuss the intense amount of work it takes to develop and maintain an outstanding culture in the convenience store industry and the communities they serve.

March 26 -29, 2023

For additional information, contact NAG Executive Director John Lofstock at jlofstock@wtwhmedia.com

John Lofstock, Executive Director | NAG

Speakers:

• Stephanie Stuckey, CEO | Stuckey’s

• Kevin Smartt, CEO | TXB Stores

• Greg Ehrlich, President | Beck Suppliers Inc.

9:15 AM – 9:45 AM Networking Break

9:45 AM – 10:45 AM

GENERAL SESSION: BURNING ISSUE #2: Understanding Foodservice Customers: Forecasting Future Demand Sta scheduling, inventory management, menu analysis, guest satisfaction, profitability and so much more rest on the shoulders of accurate foodservice forecasting. Understanding the foodservice market is more important than ever as store trips are forecasted to drop and third-party delivery services are gaining more traction. This session will examine how customers currently purchase food, what they are looking for and what the convenience store industry can expect over the next three years.

Moderator: Jessica Williams, CEO | Food Forward Thinking

Speakers:

• Derek Thurston, Director of Food Service Operations | Cli ’s Local Market

• Ernie Harker, Brand Therapist | Ernburn Brands

• Brian Scantland, Vice President Fresh Food Operations and Business Planning & Analytics | Thorntons

10:45 AM – 11:00 AM Networking Break

11:00 AM – 12:30 AM Information Exchanges Part 1

12:30 PM – 1:30 PM Lunch

1:00 PM – 5:00 PM Free Time/YEO Networking

1:30 PM – 6:30 PM NAG Retail Store Tours

Exploring the Best Retail Concepts in Austin

6:30 PM – 9:00 PM Dinner on Your Own to Explore Austin

TUESDAY, MARCH 28

7:00 AM – 4:00 PM Registration/Info Desk Open

7:00 AM – 8:00 AM Breakfast

2:45 PM – 4:00 PM YEO BREAKOUT SESSION:

Getting Involved: Why Young Executives Need Political Relationships

All politics are local, and for convenience store operators, that means having a personal relationship with the legislators who can enact laws that a ect your businesses. These relationships can be complicated and di cult to develop, but they are vital for the c-store industry. Young leaders should be working on these relationships, but they need advice that’s realistic, granular and nuanced when it comes to making political connections. In this exclusive Young Executives Organization (YEO) workshop, hear what you can do to build political relationships and mentor young leaders who are beginning to journey into the cut-throat world of politics.

8:00 AM – 9:00 AM

GENERAL SESSION: BURNING ISSUE #3: Exclusive NAG Research: The Convenience Experience Report

The National Advisory Group (NAG) has partnered with Bluedot to learn exactly what Americans think about convenience stores and quick-service restaurants (QSRs) today, and what drives their behavior, sentiment and loyalty. These findings will be presented for the first time at NAG and o er a glimpse into the current customer experience, how digital and mobile solutions influence customers, as well as expectations for the convenience stores of the future across key categories, such as foodservice, fuel, snacking and tobacco.

John Lofstock, Executive Director | NAG

Speakers:

• Nate Brazier, President and COO | Stinker Stores

• Judy Chan, Vice President | Bluedot

9:00 AM – 9:30 AM Networking Break

5:30 PM – 6:30 PM NAG Networking Reception

6:30 PM – 9:00 PM Dinner & Awards Ceremony

WEDNESDAY, MARCH 29

8:00 AM – 9:00 AM WORKING BREAKFAST: NAG Custom Research. The Impact of Digital Programs on Convenience Store Foodservice Sales and Consumer Loyalty

Digital has transformed foodservice, reframing customer expectations at convenience stores, restaurants and beyond. How are c-store retailers maintaining their food base and standing out with digital tools and promotions? Based on custom research fielded for the NAG audience, we will explore how consumers are utilizing digital platforms to engage with c-stores. We’ll uncover ordering and delivery trends as well as the impact on basket size and customer loyalty. Our retailer panel will explore various data points and share insights on how they plan to adapt to customer expectations.

9:30 AM – 10:30 AM

GENERAL SESSION: BURNING ISSUE #4: Developing Your Long-Term Fuel Strategy

The future of convenience stores is being reshaped by the increasing integration of electric vehicles and other alternative fuels. How long it takes for these fueling methods to a ect your business depends on where you live. In this session, hear from leading authorities on how your forecourt will evolve over the next five years and what steps you can take now when building new stores to be ready for future changes.

Speakers:

• Sridhar Sudarsan, Chief Technology O cer | SparkCognition

• Daillard Paris, Director of Petroleum Supply and Trading | Sheetz Inc.

• Peter Rasmussen, Founder and CEO | Convenience and Energy Advisors (CEA)

10:30 AM – 11:00 AM Networking Break 11:00 AM – 12:15 AM Information Exchanges Part 2

1. Micro Stores, Food Trucks and Non-Traditional Locations

2. Human Resources: Attracting Top Talent

3. Tobacco, CBD and Cannabis in C-Stores

4. Foodservice: Diversifying the Menu

5. Leadership for Young Executives

6. Foodservice: What Retail Leaders Are Doing From Apps to Delivery

7. Growing Loyalty and AI Programs

8. Buying, Selling and Financing Options

12:15 PM – 1:15 PM Lunch

Speakers:

• Abbey Karel, Vice President of Business Development, Convenience Retailing | Bounteous

• John Lofstock, Executive Director | NAG

9:15 AM – 10:15 AM GENERAL SESSION: BURNING ISSUE #6: Private-Label Product Branding

The convenience store industry is seeing a rapid rise in private-label branding across all categories. Private labels are often cheaper than national brands, which is a solid selling point as financially strained consumers tighten their purse strings. Two advantages — high availability and low price — have also made private-label products considerably more appealing to consumers during the COVID-19 pandemic. The shift toward private labels also benefits retailers, since these products are typically more profitable for them. Furthermore, high-quality private labels can gain a devoted following and become a powerful driver of customer loyalty. In this session hear from three leading retailers on why they are continuing to develop and expand private-label products.

Erin Del Conte, Executive Editor | CStore Decisions

Speakers:

• Nick Triantafellou, Director of Marketing & Merchandising | Weigel’s Inc.

• Kristine Modugno, Director of Category Management | Nouria Energy Corp.

• Alan Adato, Senior Merchandising and Procurement Manager | Yesway/Allsup’s Convenience Stores

10:15 AM – 10:45 AM Networking Break

GENERAL SESSION: BURNING ISSUE #5: Connecting Next-Generation Loyalty, Payments and POS Systems

1:15 PM – 2:15 PM

A number of next-generation technologies are converging, including loyalty, payments and point-of-sale (POS) systems. At the intersection, retailers expect a better, di erentiated customer experience and returns to the bottom line. These technologies are enabling hyperpersonalized customer experiences, seamless payments, mobile ordering, self-checkout and other benefi ts. How are c-stores combining these technologies? What are the expectations for increased store operating profi t? Our panel of distinguished retailers will answer these questions and more.

2:15 PM – 2:45 PM Networking Break

10:45 AM – 11:30 AM IDEAS BOOT CAMP

Best practices and a conference wrap up

Speakers:

• Brian Unrue, Director of Operations | Clark’s Pump-n-Shop

• John Lofstock, Executive Director | NAG

11:30 AM Conference Wrap-Up and Takeaways

12:00 PM Departures

Ben Brooks keeps Nouria on trend as category manager of cigarettes, other tobacco products and more, remaining agile with planning through a landscape of constant regulations.

Emily Boes • Associate EditorWhat started as a part-time position at a gas station in high school turned into a successful and vital role as a category manager at Worcester, Mass.based Nouria Energy for Ben Brooks, whose convenience store/petroleum industry career spans roughly 25 years.

As Nouria’s category manager of cigarettes, other tobacco products (OTP), automotive, lottery and store services, Brooks is responsible for keeping Nouria, which operates 151 stores in New England, up to date on the continuously changing landscape of some of the c-store industry’s staple sellers.

For his dedication to his categories, drive to work with the frequent shifts in the marketplace and more, CStore Decisions is recognizing Ben Brooks as a Category Management Leader.

“I am excited to continue implementing our 2023 plans that are innovative and will differ-

entiate us in the industry. I am proud to be a part of many exciting changes as well as part of the incredible growth journey happening at Nouria,” said Brooks.

Presently, Brooks is responsible for the overall strategic planning, execution, evaluation and success of his categories. This includes pricing, product assortment, planogramming, program negotiations and compliance. He also represents Nouria in government affairs related to tobacco regulations.

At the start of his career, however, Brooks worked odd jobs at gas stations in Maine.

“A part-time high school job turned into a management role, which I held for several years before moving over to convenience store wholesale distribution sales,” said Brooks. “Three years as an account manager for Nouria was how I initially built a relationship with this organization, so it was a natural fit when a new opportunity presented itself on their team.”

One of Brooks’ joys from this position is being challenged with the complexity of the tobacco category. His duties require him to be current on his industry knowledge and the newest trends. Additionally, he must stay incredibly agile when planning for possible regulatory changes.

“For example, I am currently planning multiple product assortment scenarios, each dependent on how local, state and federal governments rule on pending regulations. There is never a dull moment for sure,” Brooks said.

Brooks attributes Nouria’s culture and values as one of the primary reasons he enjoys his role.

“Our company is all about people, and it reflects in the people I work with. The level of professionalism and collaboration that is ingrained throughout the organization is phenomenal,” he said.

He included spending time at the stores collaborating with the front-line teams to ensure the chain is creating programs that can be successfully executed as an example of the effort the team puts into working well with each other.

“We are a passionate team, and we have fun while making sure that we give our guests the best possible retail experience,” Brooks added.

One of the projects Brooks has been involved with during his tenure at Nouria is Tobacco Computer Assisted Ordering. He had noticed Nouria was carrying large amounts of inventory unnecessarily, the assortments were not as accurate as they should be, and the stores had longer weeks of inventory on hand than needed.

As a response, he led the Computer Assisted Ordering Project from start to finish along with Nouria’s information technology and operations teams. The project enabled Nouria to use analytics to suggest item-level quantities, resulting in a reduction of labor tasks, out-of-stocks and average days of supply on hand.

Technology still has room to improve, however, as Brooks noted data analytics can be a challenge to category managers.

“It could be too much data or not enough data or not having the correct tools to analyze the information. One thing I love about Nouria is our leadership team’s vision to always look for new and improved technology to help us run the day-to-day business,” he said.

To combat this, Nouria is always researching new ways to leverage technology to better analyze the business and bring modern solutions to improve the guest experience. Brooks noted examples include using a relatively simple pricing/space optimization tool or a more cutting-edge artificial intelligence tool.

“I have no doubt that 2023 will be another banner year for the company,” Brooks said.

As restrictions and regulations continue to pour in for tobacco, Victoria Sheppard continues to enhance sales behind the front counter.

Zhane Isom • Associate Editor

From flavored tobacco bans to the Food and Drug Administration (FDA) trying to find a new way to regulate the use of CBD in food and supplements, these two categories can’t seem to catch a break.

However, Victoria Sheppard, category manager for tobacco and CBD at Love’s Travel Stops & Country Stores, which operates 608 locations in 41 states, is taking on these challenges while boosting sales.

CStore Decisions is recognizing Sheppard as a Category Management Leader for her expertise and ability to enhance the area behind the counter, her commitment to teamwork and motivation to attract more customers to the tobacco backbar.

Sheppard has been with Love’s Travel Stops

2022 and the beginning of 2023 have been challenging for the tobacco and cannabidiol (CBD) categories.

for over 19 years. She got her big break in the industry as a sandwich artist at Subway. Sheppard made her way through every Love’s Travel Stops position before becoming general manager at a Love’s location. Eventually, she was offered a position in merchandising, where she found her niche in the tobacco category.

Sheppard was the first category manager for tobacco at Love’s and helped develop the role into what it is today.

Now as category manager of CBD and tobacco, Sheppard is responsible for overseeing tobacco items with a main focus on Love’s smaller community stores. While Love’s doesn’t currently offer CBD products, if and when the time comes, Sheppard will be responsible for spearheading the category.

“Some of my current responsibilities are setting and exceeding our budgets, finding new products, operational efficiencies and finding ways to get the best value for customers,” said Sheppard.

When it comes to managing the tobacco backbar at Love’s Travel Stops, Sheppard must grapple with frequent changes due to ongoing regulatory mandates.

“Legal issues and restrictions within the categories have always been a challenge,” said Sheppard. “We see flavor bans monthly down to the county levels and must have the plans in place in case they pass.”

Still, she is constantly making sure she puts her company values and culture first while making customers happy at the same time.

“One of the additional challenges with my categories and Love’s is making sure we align with our company values and culture and making sure we put the right image in front of our customers,” said Sheppard.

While Love’s isn’t offering CBD due to legal concerns, Sheppard said she believes CBD could have a small role to play in convenience stores in the future.

“It must be the right product that the demographic of the area is looking for,” said Sheppard. “Follow the three Rs of marketing with the products, and they will do well.”

Sheppard has accomplished a lot to make the category at Love’s what it is today, and she also enjoys seeing her coworkers and the company grow and succeed.

“People are the key to success for any company. To be able to watch everyone evolve personally and professionally is a wonderful experience,” said Sheppard.

Overall, Sheppard is looking forward to continuing to elevate the tobacco backbar.

“I want to make this space pop,” said Sheppard. “This will help the overall appearance of the store and create a safe, well-maintained and lit experience to the counter for the customer.”

Some are coining 2023 a year of revival and reset.