NEC 2023 PACKS

NEC 2020 PACKS

NEC 2017 PACKS

NEC 2014 PACKS

NEC 2011 PACKS IN STOCK - NOW

THIS IS BUILDING IS SUPPLIED BY MULTIPLE SOURCES OF POWER WITH DISCONNECTS LOCATED AS SHOWN:

NEC 2023 PACKS

NEC 2020 PACKS

NEC 2017 PACKS

NEC 2014 PACKS

NEC 2011 PACKS IN STOCK - NOW

THIS IS BUILDING IS SUPPLIED BY MULTIPLE SOURCES OF POWER WITH DISCONNECTS LOCATED AS SHOWN:

As North America’s most diversified steel and steel products company, Nucor is committed to delivering quality, on-time reliability, and sustainability to the renewable energy market. Our Energy Solutions team is your partner in optimizing the design and installation of your next solar and wind projects. Let’s work together to make your next project a success.

Photovoltaic solar power, like other renewable energies, faces undue scrutiny when compared to fossil fuel sources like natural gas and coal. The latter garner reverence for job creation and sustaining communities, while the former is often politicized and brushed off due to intermittency concerns.

I grew up in the fossil fuel community of North Lima, Ohio. It’s a town you drive through without noticing, because it’s intersected by state routes and is just over seven square miles in size. Despite its small tract, North Lima was home to coal and strip mines. I spent many summer days in former strip mines just across the street from my house, hiking land that was shaped by the unnatural process of pulling precious metals from the ground.

After high school, I moved with my family to East Palestine. Even before the quiet agricultural community made global news, I witnessed hydraulic fracturing rigs being erected just down the road. Then, three months ago, I watched a toxic plume of flames erupt from a train that derailed mere miles from where I once lived, and where my family still resides.

The consequences of sourcing fuel with extractive practices that leaves the land hollow and unfit for many other developments are clear. Yet, a field of solar panels can still receive greater ire from a community than fossil fuels that have legitimately harmed the environment and its people. That experience is deeply frustrating — watching the solar industry strive to decarbonize our electrical grid contrasted against some of the

greatest environmental disasters of our generation.

But recent solar legislation aims to right some of those wrongs. One of the many provisions in the Inflation Reduction Act incentivizes development of renewable projects in “energy communities,” or places like my hometown that have been impacted by fossil fuel plant closures. These tax incentives are meant to encourage developers to build solar arrays on former mine lands (one of the few construction projects still possible in these settings) that will benefit communities with tax revenue and job creation like they formerly sought from coal and fracking. For more on energy communities, read our in-depth story on page 15.

This issue of Solar Power World also covers topics related to large-scale solar development and the longtime maintenance and operations of those projects. The solar industry will be responsible for the exponential deployment of renewable energy in the coming years, and for keeping those assets running for decades to come. The case for solar is made stronger when companies consider the long-term effects the construction has on land and build management plans that integrate agricultural and regenerative practices to keep the ground underneath solar panels healthy

Billy Ludt Senior Editor

Senior Editor

and productive — contrasting even further against the harms of the fossil fuel industry.

To meet the country’s renewable energy goals, fields, rooftops and parking lots will be covered in solar panels, and they will provide careers and tax dollars for communities in an actual sustainable manner. My hope is a place like my hometown can be remediated by these efforts, both environmentally and economically. North Lima might be just another no-name town you pass by on the turnpike, but there is a path forward for communities like these through solar development. SPW

PUBLISHER

Courtney Nagle cseel@wtwhmedia.com 440.523.1685

EDITORIAL

Editor in Chief Kelly Pickerel kpickerel@wtwhmedia.com @SolarKellyP

Managing Editor Kelsey Misbrener kmisbrener@wtwhmedia.com @SolarKelseyM

Senior Editor Billy Ludt bludt@wtwhmedia.com @SolarBillyL

CREATIVE SERVICES & PRINT PRODUCTION

VP of Creative Services

Mark Rook mrook@wtwhmedia.com

Senior Art Director Matthew Claney mclaney@wtwhmedia.com

Art Director Allison Washko awashko@wtwhmedia.com

Senior Graphic Designer Mariel Evans mevans@wtwhmedia.com

Director, Audience Development Bruce Sprague bsprague@wtwhmedia.com

WTWH Media, LLC : 1111 Superior Avenue, Suite 2600, Cleveland, OH 44114

Ph: 888.543.2447 | Fax: 888.543.2447

MARKETING

VP of Digital Marketing

Virginia Goulding vgoulding@wtwhmedia.com

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com

Digital Marketing Coordinator Emily Gillespie egillespie@wtwhmedia.com

Digital Production/ Marketing Designer Samantha King sking@wtwhmedia.com

Marketing Graphic Designer Hannah Bragg hbragg@wtwhmedia.com

Webinar Manager Matt Boblett mboblett@wtwhmedia.com

Webinar Coordinator Halle Sibly hkirsh@wtwhmedia.com

ONLINE DEVELOPMENT & PRODUCTION

Web Development Manager B. David Miyares dmiyares@wtwhmedia.com

Digital Media Manager Patrick Curran pcurran@wtwhmedia.com

Digital Production Manager Reggie Hall rhall@wtwhmedia.com

Front End Developer

Melissa Annand mannand@wtwhmedia.com

Digital Production Specialist

Nicole Lender nlender@wtwhmedia.com

Digital Production Specialist

Elise Ondak eondak@wtwhmedia.com

IN-PERSON EVENTS

Events Manager

Jennifer Kolasky jkolasky@wtwhmedia.com

Event Marketing Specialist Olivia Zemanek ozemanek@wtwhmedia.com

Events Manager Brittany Belko bbelko@wtwhmedia.com

CUSTOMER SERVICE

Customer Service Manager

Stephanie Hulett shulett@wtwhmedia.com

Customer Service Representative

JoAnn Martin jmartin@wtwhmedia.com

Customer Service Representative Tracy Powers tpowers@wtwhmedia.com

SOLAR POWER WORLD does not pass judgment on subjects of controversy nor enter into disputes with or between any individuals or organizations.

SOLAR POWER WORLD is also an independent forum for the expression of opinions relevant to industry issues. Letters to the editor and by-lined articles express the views of the author and not necessarily of the publisher or publication. Every e ort is made to provide accurate information. However, the publisher assumes no responsibility for accuracy of submitted advertising and editorial information. Non-commissioned articles and news releases cannot be acknowledged. Unsolicited materials cannot be returned nor will this organization assume responsibility for their care.

SOLAR POWER WORLD does not endorse any products, programs, or services of advertisers or editorial contributors. Copyright©2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval systems, without written permission from the publisher.

Customer Service

Representative

Renee Massey-Linston renee@wtwhmedia.com

Customer Service

Representative Trinidy Longgood tlonggood@wtwhmedia.com

FINANCE

Controller Brian Korsberg bkorsberg@wtwhmedia.com

Accounts Receivable Specialist

Jamila Milton jmilton@wtwhmedia.com

VIDEO SERVICES

Videographer Garrett McCafferty gmcca erty@wtwhmedia.com

Videographer Kara Singleton ksingleton@wtwhmedia.com

SUBSCRIPTION RATES: Free and controlled circulation to qualified subscribers. Non-qualified persons may subscribe at the following rates: U.S. and possessions, 1 year: $125; 2 years: $200; 3 years $275; Canadian and foreign, 1 year: $195; only U.S. funds are accepted. Single copies $15. Subscriptions are prepaid by check or money orders only.

SUBSCRIBER SERVICES: To order a subscription or change your address, please visit our web site at www.solarpowerworldonline.com

SOLAR POWER WORLD - VOLUME 13 ISSUE 3 - (ISSN2164-7135) is published 7 times per year: January, March, May, July, September, November and December by WTWH Media, LLC, 1111 Superior Avenue, 26th Floor, Cleveland, Ohio 44114. Periodicals postage paid at Cleveland, OH and additional mailing o ces.

POSTMASTER: Send address changes to Solar Power World; 1111 Superior Avenue, 26th Floor, Cleveland, Ohio 44114.

CONTENTS

STORAGE

Emerging lithium alternatives for large storage installs give developers more options

Keeping

Credit: NovaSource Power Services

A ground-mount project brings new energy to a contaminated paper mill site in New Jersey

PANELS

The status of AD/CV duties on solar modules imported from some South Asian countries

INVERTERS

Improving inverter maintenance starts with more transparency from manufacturers

MOUNTING

SPECIAL SECTION: O&M Staying on top of solar O&M ensures projects are performing as promised for as long as possible. Learn about the latest O&M innovations in this section. | PAGE 42 ENERGY COMMUNITIES Everything developers should know about the IRA’s energy community tax credits 10 20 38 30 24 34 14 FIRST WORD SOLAR POLICY SCOOP CONTRACTOR’S CORNER AD INDEX 2 8 54 56

solar arrays running at full power requires dedicated O&M efforts by skilled technicians using the latest technology.

• Maximum power up to 590W

• Up to 21.8% efficiency

• N-type i-TOPCon technology

• Streamlined Procurement

• Faster Install Times

• Optimized System Performance

• Improved Power Gains

• Lower LCOE

Designed

for

DENVER, COLORADO

Gov. Jared Polis signed a bill into law that updates Colorado’s community solar garden program to ensure subscribers receive stable bill credits from utilities. Subscribers can now choose between locking in their credit rate at the beginning or opting for a variable rate determined annually by the Colorado PUC.

WASHINGTON, D.C.

The Dept. of the Treasury has issued eligibility requirements for “energy communities” seeking a 10% ITC or PTC adder via the Inflation Reduction Act. The three types of energy communities include brownfields, retired coal plants and statistical areas impacted by those coal plant closures.

WASHINGTON, D.C.

The U.S. House of Representatives passed the Limit, Save, Grow Act of 2023, a Republican bill that would repeal the majority of the clean energy incentives enacted by the Inflation Reduction Act. While it’s unlikely to pass the Senate, it’s a sign Republicans in the House may keep working to curb IRA incentives.

Conservation and community groups sued the Federal Emergency Management Agency (FEMA) and U.S. Dept. of Homeland Security over their plans to rebuild the fossil fuel-based electric grid in Puerto Rico instead of investing in renewable energy sources after Hurricane Maria. The groups say FEMA wants to invest at least $12 billion in projects that lock Puerto Ricans into decades of fossil-fuel dependence.

WASHINGTON, D.C.

The U.S. Dept. of Energy announced a new round of $82 million in funding to support solar PV recycling innovations, development of domestic cadmium telluride and perovskite solar cell manufacturing and more. Some of the funds will go toward efforts to design modules for easy recycling, and others toward advancements to the end-of-life recycling process.

Colorado rural electric cooperative Holy Cross Energy proposed a new rate structure that would cut netmetering rates for solar customers and add a per-kilowatt-hour delivery charge to maintain the grid. Industry advocates say if the proposal is approved, it will discourage consumer investment in solar power.

The NCUC issued final orders in its solar net-metering docket, which will shift Duke Energy solar incentives from 1:1 credits to a time-of-use program with “critical peak” pricing on July 1, 2023. The order includes a minimum monthly bill amount, grid access fees for larger projects and other requirements that will lengthen the solar payback period.

A law that will replace Maryland’s legacy community solar pilot program with a permanent, less restrictive and more equitable community solar program has been signed by Gov. Wes Moore. The new law will eliminate the 580-MW community solar cap and require a dedicated percentage of capacity to benefit low- and moderateincome customers.

AUSTIN, TEXAS

Texas senators passed a bill that would end the subsidies paid for renewable energy produced in the state, saying the renewables market has grown so much that they’re no longer necessary, according to the Herald Banner. SB 2014 is part of a portfolio of bills to prop up gas-fueled generation that has now moved on to the state’s House of Representatives.

The N.C. Clean Energy Technology Center’s latest edition of “The 50 States of Solar” report found 41 states took some type of distributed solar policy action in the first quarter of 2023, with most related to net-metering, community solar or fixed charges. Net-metering program changes in Arkansas, North Carolina and Indiana underscored these findings.

Recently introduced bipartisan legislation would enable community solar development in the state of Michigan. The bills would allow anyone with space — homeowners, small businesses, government buildings, schools and churches — to install and share a community solar project with their members or neighbors.

SACRAMENTO, CALIFORNIA

encourage solar canopies over parking lots and direct the state to plan for solar power along its highways. More than 60 environmental organizations signed a letter of support for this legislation, saying existing developed areas like parking lots and highways should be used to their fullest extent to capture solar energy.

The recent Silicon Valley Bank (SVB) banking crisis offers a cautionary tale for solar companies and other enterprises that rely on a complex financial system to originate, develop and deliver renewable energy projects. SVB was a $200 billion bank that failed in a matter of days, cutting off scores of companies — many in the renewable energy industry — from their deposits, lines of credit and other supplies of capital.

Several companies anxiously wondered whether their businesses built over many years would collapse. Fortunately, a plan orchestrated by the U.S. Dept. of the Treasury, the Federal Reserve and the FDIC, in coordination with state regulatory authorities, quelled the immediate risks, guaranteed deposits and restored banking order.

Still, there are lessons for solar companies to heed in the wake of the SVB crisis. The industry is capital- and labor-intensive. Bringing projects together requires considerable lead times before the first panels are even installed, from prospecting and designing projects to site control and permitting efforts.

These activities and the followon project development require an array of capital, including developer equity, supplier credit, working capital facilities, bridge/construction funding, tax equity and long-term debt financing. Sourcing these requirements from various capital providers further complicates financing efforts.

To successfully build a capital program, solar companies need to align themselves with financing

partners that understand the delicate relationships that must exist among these capital facilities. Financing partners also need to understand the lifecycle of project development, the interplay between sources of capital and the "chain of custody" of available collateral to comfort the multiple capital providers as projects evolve along their development paths.

Solar companies often fall into the trap of promising funding facilities, only to have their businesses mired in terms and conditions that prove unworkable with on-the-ground operational realities. This leads to broken covenants, events of default and funding that gets frozen in its tracks — imperiling projects in development and the overall business.

Performing due diligence on potential financing partners, particularly

depository institutions, is necessary. Companies should ask:

What is the lender or investor’s experience in the solar industry?

What companies and projects have they financed? Is this industry of particular importance to the institution? How so? Get client references and put in the time to reach out to companies with an active and ongoing funding relationship with these capital sources.

What is the lender or investor’s experience with troubled credits in the industry? What went wrong and what was their approach to resolving the matter?

Not everyone can be a bank analyst, but an inspection of filings with the Securities and Exchange Commission, such as 10-K forms (annual financial statements and accompanying commentary), can often help explain a bank's risk exposure and how it is managed. Review filings each quarter on an ongoing basis, not just when commencing a relationship, and look for changes.

Additionally, companies should search for articles in the financial press and reports produced by rating agencies. Speak to individuals at the banks you partner with — not just the relationship manager, but those in risk-management functions.

These next steps could be seen as excessive concerns with risk, particularly for a bank's customers, but the questions must be asked:

If the financial institution suffers an impairment to its capital base from its investment portfolio, a shock rise in charge-offs from its loan portfolio or a surprise flight of cheap deposits (which, with today's technology, can be executed in seconds with a smartphone) that need to be replaced with more expensive funds, what impact might these events have on the lender's lending profile? What industries might get pared back from a lending perspective?

Suppose the lender is new to the solar industry and lacks a deep record. Might these clients be the first to suffer from credit facilities that will be trimmed?

Due to their investment mandate and mission, green banks may offer solar companies tailored financing

products or services. Green banks are more focused on a particular sector or sectors than regular commercial banks, so they are more likely to be comfortable underwriting solar companies. They understand the current trends affecting the solar industry, the policy environment and how it affects the feasibility of solar projects and the intricacies of solar projects — from cash flows to transaction structuring.

Green banks are likely more comfortable than commercial banks in transaction structures involving tax equity investors. Tax equity partnerships where an entity with a tax liability forms a partnership with an entity without a tax liability to monetize a solar investment tax credit and thereby make the ownership of a solar project financially viable have been around for over a decade. However, they are complex and nuanced structures, often requiring significant transaction costs and a steep learning curve, which may be unenticing to commercial lenders.

Depending on the cost and source of their capital, some green banks may be willing to offer deal terms that commercial banks cannot. For example, green banks may offer debt with 15- to 20-year terms with fixed interest rates rather than over a floating benchmark with the requirement to enter into interest rate swaps to result in more fixed debt service arrangements.

Green banks such as Connecticut Green Bank — the first state green bank in the nation — aim to leverage private sector capital, which may mean taking a subordinated position in the capital stack for a transaction and allowing the private sector partner(s) to participate in a role suited to their risk profile. It could also mean the green bank makes equity investments or provides debt guarantees to help a project prove its viability so private sector finance providers can feel comfortable contributing capital. However, green banks are not depository institutions and are not "fullservice" financial partners. Consequently, working capital facilities, for instance, are the mainstay of community and commercial banks nationwide — often benefiting from well-established federal Small Business Administration loan guarantee programs.

To maximize options and access the best partners, solar companies should position themselves to be as attractive as possible for lenders and investors. Demonstrate to existing and prospective capital providers that the enterprise is well-managed and of moderate-to-low risk, and position the company as a "model borrower" in total compliance with terms and conditions under existing arrangements across the board and on top of performance metrics (operating and financial).

The difficult recent market conditions present additional challenges for solar companies that make sourcing capital more daunting. Higher interest rates and material costs for projects may make some projects financially unattractive or translate into lower returns for solar companies to the extent these costs can't be recovered from customers, such as higher rates charged under power purchase agreements. Potential benefits that could offset some of these cost impacts are the expanded tax credits under the Inflation Reduction Act.

Solar companies should prioritize relationships with capital providers and equipment suppliers. Attaining some level of priority status from lenders and suppliers will be critical for solar companies to retain access to the funds and materials needed to complete projects and sustain ongoing business operations. The solar companies that are wellmanaged, have a solid view of their pipeline and understand the capital and equipment requirements over time will be in the best position to explain their anticipated demands to suppliers and line up funds from lenders and investors to ensure projects continue to be developed without interruption and on time. SPW

A coal mining and processing plant. Nici Gottstein

A coal mining and processing plant. Nici Gottstein

The "energy community" tax credit adder in the Inflation Reduction Act presents a potential renewable windfall to developers and could bring much-needed tax revenue to communities affected by the dissipating fossil fuel industry.

Solar projects are eligible for an additional 10% tax credit on top of the potential 30% investment tax credit (ITC) or production tax credit (PTC) if project sites meet the criteria for energy communities laid out by the IRS. Last fall, tax equity investors did not have enough clarity to feel confident investing in these projects, but that changed after new guidance was released in April 2023.

"As somebody who's down in the trenches doing deals, the guidance did a nice job of bringing up a lot of difficult questions," said Keith Martin, partner at Norton Rose Fulbright.

Energy community projects can fall into one of three categories:

This category includes any project site that may be difficult to develop due to the presence of pollution or mine-scarred land.

"It's basically to help promote development in areas that have been industrialized, and where redevelopment can be economically important," said Gregory Wetstone, president and CEO of the American Council on Renewable Energy.

If a site is already on a Superfund or other government cleanup list, it must be analyzed further to ensure compliance. Developers will have to bring in environmental lawyers for that certainty.

The second category is any census tract or directly adjoining tract where a surface or underground coal mine closed after 1999, or a coal-fired generating unit was retired after 2009. Some mines may not

appear in federal records or on Google Earth due to different access points or shifting locations of surface mines, so the IRS said it will allow developers to request additions of tracts.

"They left the window open to let developers try to persuade the government that other coal census tracts should be on the list," Martin said.

The final category is any location with a 0.17% or greater employment rate or 25% or greater tax revenues related to fossil fuel extraction, processing, transport or storage; and an unemployment rate at or above the national average unemployment rate for the previous year.

The IRS published a table that shows which statistical area each county in the United States falls into, along with a table showing which statistical areas meet the fossil fuel employment

statistic. The IRS also published a map reflecting the current data on former mine land and statistical areas and will update the employment information after the Bureau of Labor Statistics publishes 2022 unemployment information. The government plans to publish an update every year in May with the latest statistics.

Solar projects qualify for the adder if at least half the nameplate capacity is located in an energy community; and storage projects qualify if at least half the storage capacity in megawatt hours is located in an EC.

Additional government funding and assistance is available for some of these projects, including $450 million from the Bipartisan Infrastructure Law to advance clean energy demonstration projects on current and former mine lands and Rapid Response Teams to provide targeted, on-the-ground assistance to communities

and regions facing “acute and unique challenges.”

PTC vs. ITC considerations for EC projects

Choosing between the ITC and PTC is especially crucial when it comes to energy community projects. The most important factor in this decision is the year the project would classify as an energy community. Due to the elastic nature of the criteria — for example, a county could have a higher unemployment rate than the national average one year but lower the next; or a retired coal-fired power plant could resume production — companies will need to "test" for EC status on the year the project would qualify to receive the credit.

For projects placed in service in 2023 or later, developers have different choices to test a project's energy community

status. If they select the ITC, they can choose either the year construction started or the year a project is placed in service. If they select the PTC, they can choose a single eligibility test the year construction started or a test every year during the 10-year PTC period.

For projects that started construction before 2023, developers can only select the placed-in-service year for the ITC, or every year of the 10-year period for the PTC.

That caveat proves to be particularly difficult for PTC projects that started construction before this year. Testing every year is clearly a nonstarter for financiers, who require the certainty that the 10% bonus credit is guaranteed for the lifetime of their investment.

"A lot of the projects in the market currently seeking financing started [construction] before 2023. If they opt for PTC, they will not be able to assure a tax

We offer fabricated piles (black and galvanized) to optimize your solar project, reducing costs, time and labor.

A wide range of beam dimensions are available.

Custom lengths, punching and galvanizing according to your specifications.

Complete engineering and support during whole project life cycle.

AT: WWW.MCSWUSA.COM

Our operations are strategically located to supply to the US market in an efficient and cost-effective way. We provide our products by truck or rail.

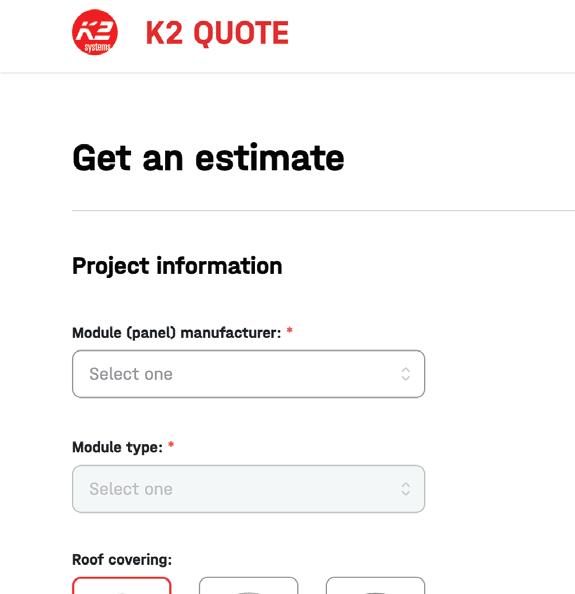

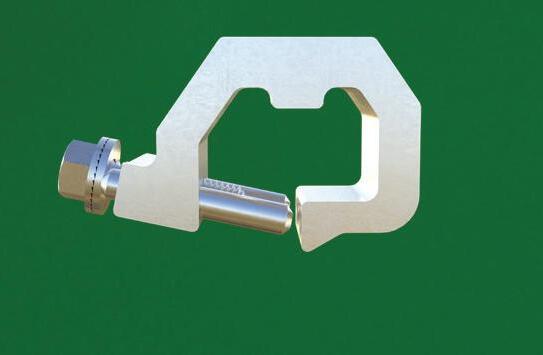

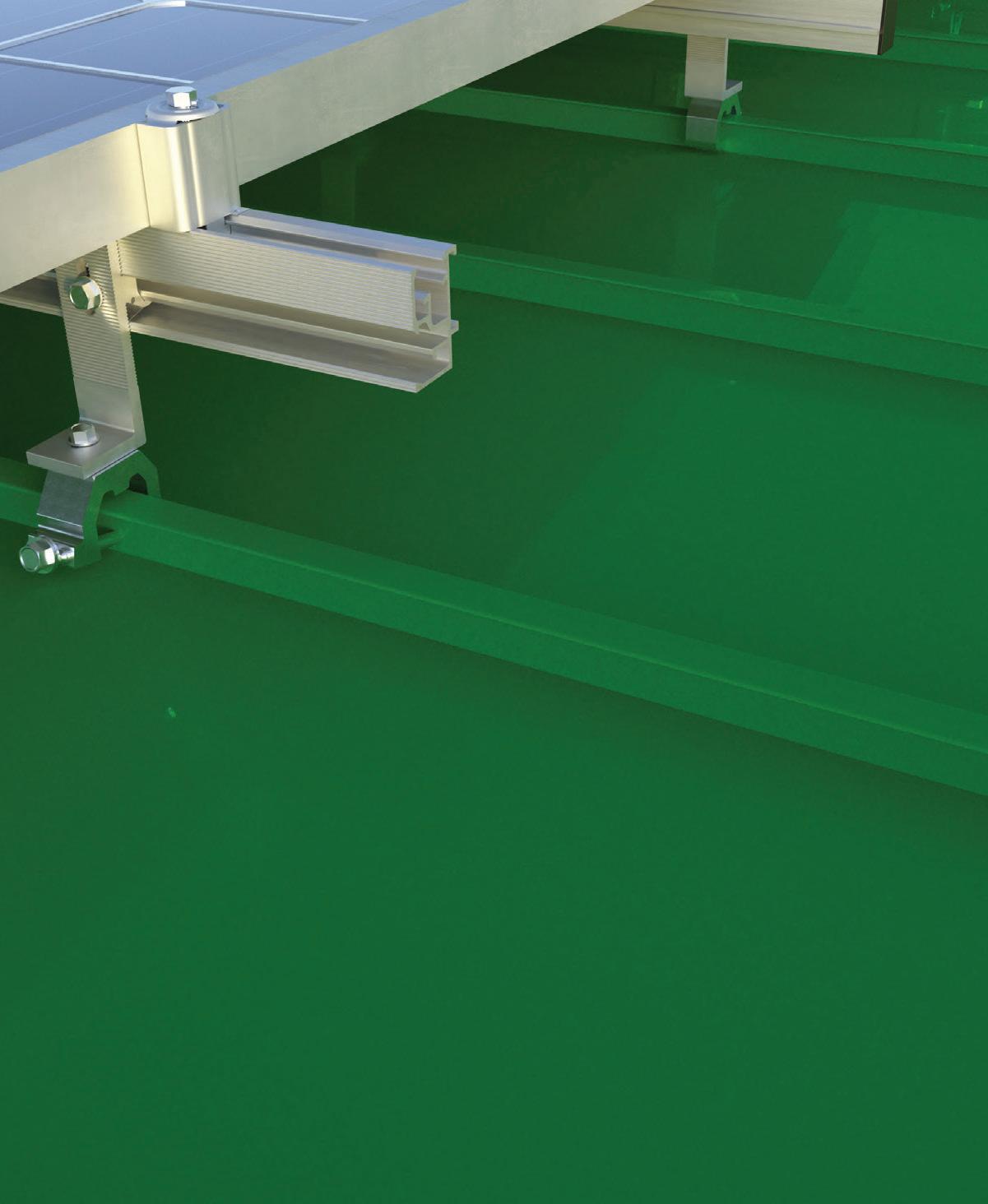

K2 SYSTEMS IS a racking company that manufactures installation-friendly solar mounting systems tailored to the needs of customers. Recent investments in more robust software solutions add to that mission of helping installers do their jobs quicker and easier. Andy Neshat, CEO of K2 Systems US & MX, joins Solar Power World in this podcast to talk about the new K2 Quote solution and the company’s plans to further cut soft costs.

Below is an excerpt of K2’s Solar Spotlight podcast, but be sure to listen to the full episode on your favorite podcast app.

Can you start o by giving us an overview of what K2 is doing globally this year?

Andy Neshat: K2 has been doing the same thing for the last 20 years and we continue to expand in the existing markets we serve. We've been providing primarily rooftop racking systems throughout the world, and some ground-mount systems since 2020.

We're working throughout Europe, some parts of Asia, South Africa, England, Australia and throughout North America, which is the market that I cover. We continue to grow and we continue to open up new spaces or new areas or regions of the world where we see a need for our products and services.

How does K2 stay up to date with software services in the solar industry?

We’ve been providing digital tools for our customers primarily so that they can design and engineer our systems. So we've invested in two primary platforms — K2 Base, which is a global tool, and more recently, K2 Quote, which is a

more generic tool for the U.S. and Mexico to generate the Bill of Materials.

We've also started to invest heavily into integration with the entire solar ecosystem — design tools, sales tools, permitting tools and things like that, so that our customers, both our partners and solar contractors, can easily design, configure and create Bills of Materials and get the engineering data they need to do their job. That's the fundamental goal — to make it as easy as possible for people to design and use our systems throughout the world.

What di erentiates K2 systems from other racking manufacturers?

I think primarily it's our people and our culture that we have. We've been an international company for a very long time. We have a very market-driven approach. Instead of being one company doing the same thing throughout the

world, every market we go to, we adapt. And I think the most important thing that we do really well is that we're laser-focused and attentive to our customers and our partners. We actually listen really well, then we take that back and we act and then we deliver on it, be it products, services, logistics or whatever the need is for those customers. We embed that into our culture throughout the world. And we've been successful in many, many countries, not by being centralized but being more distributed and closer to the customer. I think that helps us di erentiate ourselves both with products and services. SPW

WWW.K2-SYSTEMS.COM

equity investor will get the bonus for the full 10-year period," Martin said.

Competitive projects

There is no gigawatt limit on this bonus credit like there is with the Low-Income Communities Bonus Credit Program. The only limit is the availability of sites that meet the criteria. The industry expects competition to be high.

"I know from being out on the road talking to developers that they're all keenly focused on these bonus credits. They are worth a lot of money," Martin said.

Community solar developer New Energy Equity is vying for as many of these credits as possible, starting with projects already in its development pipeline.

"We're mostly verifying projects in the coal plant region or coal mine region zones, just because all that data and guidance has been released. We're still keeping tabs on the potential employment statistical area zones," said Josh Anderson, market and policy analyst at New Energy.

New Energy and other developers are working with lawyers like Martin to prove to investors they will qualify for the intended credits.

"From the financiers' perspective, we'll all need legal opinions and … legal support to be able to monetize the credits, because ultimately, if they don't have a sign-off, we can't represent those credits within our transactions," said Eric Pasi, SVP of new market development and marketing at New Energy.

Martin and his team at Norton Rose Fulbright have seen an influx of requests for memos that can be shown to lenders, tax equity investors or tax insurers ever since the guidance was released. The memos can be difficult to write if the developer is unsure when construction will begin.

"I've been telling them, 'Look, if you want certainty, you better start

construction this year.' That's the way to lock in qualification," Martin said.

Community benefits

Installing renewable energy in place of old fossil fuel plants is good for developers and the climate, but also for the communities impacted by coal plant closures. Former fossil fuel workers won't necessarily be employed at scale to build new solar projects, since many are likely retired or moved on to other professions, but job opportunities could attract younger workers living in ECs.

"Hiring the very same workers is a huge challenge. We're going to see that happen, but maybe not as much as we would dream," said Thom Kay, program manager for energy transition at the labor and environmental group BlueGreen Alliance.

Still, solar projects can bring some property tax revenue back and breathe new life into these communities. When coal plants shutter, the tax revenue that once funded a town’s basic needs disappears with them.

"The entire town suffers. They start laying off teachers, they have trouble with maintaining clean water supply, roads go to hell. Everything is reliant on getting some tax revenue," Kay said.

The NC Sustainable Energy Association found North Carolina properties with solar developed on them paid nearly 2,000% more in property taxes than the land prior to installation. Solar increases the real property taxes paid on a parcel of land by classifying the land as having a “commercial” use, which increases the assessed real property taxes, according to NCSEA.

Large solar projects in energy communities can also serve as reliable energy sources after coal plant closures, especially when paired with batteries.

"Bringing in some new industry or some new utility-scale clean energy is also really important just for maintaining electricity throughout the area," Kay said.

Brownfield and coal plant solar projects present some logistical and design hurdles that greenfield projects do not — including mounting considerations on contaminated land and excavation health and safety requirements — so the IRA bonus adder is important in drawing developers to these types of installations.

"There's a need for an added incentive to make sure that those communities aren't left behind," Kay said. "We've been fighting for that sort of focus on energy communities for a long time, and it's really clear that this administration takes that very seriously." SPW

• No megawatt-cap on this 10% bonus credit

• Energy communities can fall into three categories:

• Brownfields

• Former mine land with date limits

• Statistical areas affected by coal plant closures

• Developers that select the ITC for these projects can choose either testing a project for eligibility in the year construction started or the year a project is placed in service

• Developers that choose the PTC for these projects can choose either a single eligibility test the year construction started or a test every year during the 10-year PTC period

• For projects that started construction before 2023, developers can only select the year the project is placed in service for the ITC or every year of the 10-year period for the PTC

PV technicians working across a range of O&M activities can rely on the Megger tools when performing extremely critical jobs like ground-fault testing.

DLRO2X

Digital Low Resistance Ohmmeter

Provides technician with a way to test to IEC62446 standard for the continuity of bonded conductors.

MIT2500 Insulation Resistance Tester

Perfect for segmenting out different sections of the array to identify ground fault locations.

DCM1500S

Digital Clamp Meter

Your go-to instrument for ground-fault locating. Check three points from line to line and use those points to locate the fault.

TDR2050

Time Domain Reflectometer

This two-channel fault locating instrument can be used on the ac side of a PV system. Its step function is used to improve detection of near-end faults.

DET2/3

Digital Earth (Ground) Tester

This instrument helps the technician accomplish the tests required on large or more complex ground systems. It’s designed to measure earth electrode resistance and soil resistivity.

Learn more about ground Fault testing in PV systems - scan the QR code to download our informative application note or visit: https://us.megger.com/groundpv

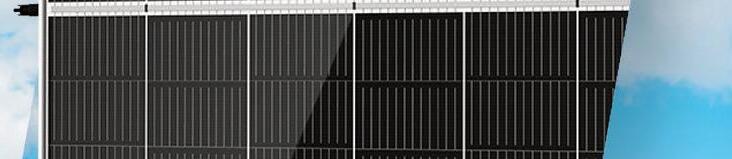

in 1907, a paper mill was built in the borough of Milford, New Jersey, to take lumber, turn it into pulp and process that into food-grade paper. This mill operated until the 1990s, changing names and ownership several times before being abandoned and shuttered entirely in 2003.

Fifteen years after the Milford paper mill officially closed shop, the site was developed for a solar project by New Jersey-based CEP Renewables, taking a post-industrial site and making it a power plant for the nearby community and greater Hunterdon County.

Recent clarifications on energy community tax adders in

Backthe Inflation Reduction Act could incentivize more projects to be built on sites like the paper mill in Milford. Land that is designated as a landfill, brownfield, Superfund site or retired fossil fuel plant is potentially eligible for solar project subsidies and the job creation and tax benefits that accompany these developments.

Although it was built prior to energy community credits, the Milford paper mill array highlights the economic and environmental potential these types of solar projects pose for communities.

“One of the biggest impacts is the property getting back on the tax roll,” said Chris Ichter, executive VP of CEP Renewables. “A property

that’s sitting there as a liability then turns into an income-producing asset. That’s a huge thing for the community, having power being made locally.”

But turning an abandoned paper mill into a two-phase, 17MW solar project was no small feat. The property was designated a brownfield by the New Jersey Dept. of Environmental Protection (NJDEP), due to “unpermitted discharges” of environmentally harmful substances. The Environmental Protection Agency determined that much of the site was contaminated by polychlorinated biphenyls, a carcinogenic chemical capable of lingering in soil, air and water

The land at the Milford paper mill is considered a brownfield, and underwent several steps of remediation before solar construction could begin. CS Energy

without breaking down. Some of the groundwater on the property was found to be contaminated by other cancer-causing and toxic chemicals, as well.

When the paper mill was in operation, irrigation pipes buried beneath the buildings and surrounding fields sprayed effluent byproduct generated from paper processing onto the land, rendering the area unsuitable for most types of construction.

“Who wants to live on a property that’s deed-noticed because it used to be basically a spray field for contaminants?” Ichter said.

CEP Renewables hired CS Energy of New Jersey to build the array because the solar contractor had worked with the developer on previous projects and had prior experience installing on brownfield and landfill sites.

“I don’t know what’s out of the ordinary [for brownfields], because every one of these projects is so extraordinary to try to get done,” Ichter said. “It’s almost like nothing surprises us at this point.”

In the years preceding solar development, the paper mill facilities were demolished, leaving only concrete

slabs to indicate where several buildings once stood. The EPA conducted site evaluations resulting in soil remediation, proper facility closures and water treatments.

CS Energy had to cover the contaminated fields with a 6-in. cap of EPA-approved topsoil so equipment and solar installers could safely work on the land. This solar project was built in two phases, and during construction of the second, truckloads of soil were coming to the site daily to cover the 23 acres that would host the array.

Unlike a capped landfill project where non-penetrative ballasts are typically used for the system’s foundations, CS Energy was able to drive piles into the ground to build this solar array, with the caveat that installers could only scrape 6 in. deep into that cap of topsoil. The NJDEP required that construction “does not exacerbate the contamination at the property” or affect any of the prior remediation conducted on the site, including the ground beneath that soil-cap.

The ground itself was rife with rocks that caused many post refusals and even

damaged some machinery used for installation. Operating heavy machinery on the site made ruts in the ground, and installers had to carefully break and remove rocks to drive the posts. With all these delicate site conditions to maintain, CEP and CS had to coordinate with environmental agencies weekly to ensure contaminants remained contained.

“In terms of contractors, because we’ve been through this process so many times, the stuff that would probably scare the crap out of other people is par for the course for us,” Ichter said. “None of this is easy, it’s just that these folks are good at what they do.”

The first phase of the Milford paper mill solar project was completed in 2019. Shortly after, CEP submitted another application to expand the solar farm on a separate section of the paper mill property. Construction on the second phase began in 2020 and was completed in summer 2022.

Since it was a two-phase solar project, the contractors had the advantage of tying into an existing regional interconnection point

maintained by Jersey Central Power & Light that was established on the first phase of the project. During construction, the first array had to be powered down, so it was not producing power for the system owner, but CEP avoided much of the usual tedious interconnection process.

“The reason why phase two was able to be constructed essentially within two years of the completion of phase one is that phase two was treated as an upgrade … which basically means that you’re not asking for a new interconnection. You’re just adding additional capacity to an existing interconnection,” Ichter said.

The array itself is composed of about 20,000 solar modules from Boviet Solar. About 14,000 are 370-W monofacial modules and the remainder are 450-W bifacial modules. They’re attached to Terrasmart fixed-fixed tilt racking and use 37 DC combiner boxes from its power electronics subsidiary, SolarBOS. The system uses two central inverters from TMEIC, the first rated at 2,520 kW and the second at 4,200 kW.

NJR Clean Energy Ventures, a subsidiary of natural gas utility New Jersey Resources, acquired this solar project in 2021 and oversaw the second phase of construction. The array is now serving its regional customer base.

"Not only do projects like this help support clean energy and emission reduction public policy goals, it also helps revitalize constrained space by turning it into clean energy," said Garrett Lerner, managing director of development and finance at NJR Clean Energy Ventures. "Any time we can transform and repurpose underutilized space to produce clean, renewable energy to benefit customers and communities, it is win-win."

Plenty of unique opportunities remain for solar to be installed on contaminated land like the Milford paper mill, where other types of construction wouldn’t work. Residents that live near the former paper mill no longer see the remnants of an industry that left its community. Instead, they see the results of a new one entering.

“The impact is tangible in the sense that there’s a real impact happening in the community,” said Marc Chernin, project manager at CS Energy. “Not only for CS Energy, but the community, the township, the municipality, has something to operate and maintain for the next 20 years.” SPW

Not only do projects like this help support clean energy and emission reduction public policy goals, it also helps revitalize constrained space by turning it into clean energy.A two-phase, 17-MW solar project took the place of a long-abandoned paper mill in New Jersey. CS Energy

share will still be lithium-ion, due to its early

infancy, the U.S. utilityscale battery storage market has existed in earnest since 2011 led by one dominant battery chemistry choice: lithium. According to data through 2021 from the U.S. EIA, 97.95% of utility-scale batteries installed in the United States were lithium-based. While there are significant battery projects in the works (the country currently has 9 GW of utility-scale batteries under operation and a 26.4-GW construction pipeline), the lion’s acceptance and established installation codes.

But lithium is by no means the only available option. Other battery technologies — whether metal-, sodiumor flow-based — are elbowing their way into the conversation. For large-scale developers concerned about both the climate-threatened world and increasingly stretched supply chains, domestically produced lithium alternatives are becoming more attractive.

“There were many years where folks wouldn’t give us the time of day. They had lead-acid and it was working or were investing in lithium,” said Ann Marie Augustus, COO and co-founder of zincalkaline battery maker Urban Electric Power (UEP), which began its manufacturing path in 2014. “The one thing that came out of this whole post-COVID supply chain chaos is that folks took a different look at what was available, specifically a second look at alternatives to lithium-based technology.”

Interrupted supply chains and labor concerns have caused the U.S. solar and storage industries to look inward for product options. Installation and manufacturing tax credits included in the Inflation Reduction Act have also encouraged more battery factories to set up shop stateside. Most new factory announcements have been lithium-based, with much of that lithium capacity going toward electric vehicle batteries, something solar and storage developer Pine Gate Renewables is aware of — and therefore seeking lithium-alternatives.

“We’re not transitioning away from lithium. We’re more thinking about it as having a toolbox of different options, different technologies to understand what’s out there and what’s the best fit for our projects,” said Emily Leonard, Pine Gate market strategy associate. “Lithium has been deployed [already] at the utility scale, so it’s well understood. But there are competing industries for those pouch cells. Alternative chemistries could have advantages there and less competition overall.”

Non-lithium battery makers are taking advantage of this new acceptance. Increased interest in EnerVenue’s nickel-hydrogen battery is allowing the company to expand out of its 100MWh pilot line in Fremont, California, to a 1-GWh new-build facility outside Louisville, Kentucky.

“We’re sold out for a long time. We got firm orders and are now approaching

nearly 1 GWh total [in sales], which is the first phase of our gigafactory,” said Jorg Heinemann, EnerVenue CEO. “All of this makes it very clear that customers value the differentiation. There’s very little operating expense on our battery. That’s worth a huge amount to a customer, more than we thought. And that’s reflected in the demand we have.”

The benefits of lithium-alternatives — lack of thermal runaway, longer cyclelife and durability — are major selling points for these battery makers, even though the companies and batteries themselves are largely unproven. While not demonstrated on a large-scale,

EnerVenue’s battery technology has history — nickel-hydrogen batteries have been used for years in satellite and space applications.

“While technically our battery is new, we’re drafting off a 40-year-old technology at 30 years of track record in aerospace applications. Our burden of proof is lower, and we have an enormous amount of test data to back it up,” Heinemann said. “The discussions we tend to have are more about how quickly we can supply the product.”

UEP is in the same situation. While not as widely adopted as lithium, Augustus said UEP’s zinc-alkaline battery is already well understood due to its similarity to consumer alkaline batteries. Because of that familiarity, more largescale developers are willing to trust the technology.

“We have a lot more customer interest than we can fulfill,” she said. “We use the same raw materials [as consumer alkaline batteries] of zinc and electrolytic manganese dioxide (EMD). The supply chain already exists and we’re leaning into it.”

Augustus said UEP is slowly scalingup production, currently operating a 200-MWh factory in Pearl River, New York, even though more developers are signing on for product. In 2022, Pine Gate publicized two memorandums of understanding for non-lithium battery supply — a 4.5-GWh deal with UEP and a 2.4-GWh deal with EnerVenue. Leonard said the two partnerships were established early to give the company time to learn about these new technologies and apply them

We’re not transitioning away from lithium. We’re more thinking about it as having a toolbox of different options.EnerVenue leadership with the company’s Energy Storage Vessel at its Fremont, California, pilot line.

successfully — and support an increasing domestic manufacturing chain.

“We are aware that there isn't a one-sizefits-all for storage,” she said. “There are a lot of exciting technologies that are emerging, and Pine Gate is a developer that's excited to look into those and see if we can apply them to help evolve the grid. [With UEP and EnerVenue], we also saw the benefit of working with folks that are domestically manufacturing their products or have a path to domestic manufacturing for the American manufacturing supply chain efficiencies that come along with that.”

Project developer Ameresco is also looking into emerging non-lithium manufacturers, publicizing one strategic relationship with zincbromine flow battery maker Redflow Limited. Ameresco will first incorporate Redflow’s 40-kWh four-battery enclosure on an existing customer site before using more flow batteries in longduration storage setups. Doran Hole, CFO and EVP at Ameresco, said this type of pilot system is something the developer has been doing for years as it gets more comfortable with newer technologies.

“We have been deploying early-stage clean technologies for 23 years at Ameresco,” he said. “Once we are satisfied with a technology’s readiness for commercial deployment, we will typically look to pilot the product in a smaller installation prior to moving into large-scale deployment. This is usually well-suited for the vendor, as we’ll look to synchronize the expansion of our deployments with the expansion of manufacturing capacity.”

Solar and storage developers are open to exploring all battery options instead of defaulting to tried-and-true lithium, an effort that is a win for supply chains and clean energy deployment overall.

“I’m thrilled to have gone through the last decade and COVID and still be standing and getting this attention back from these larger utilities and large integrators,” UEP’s Augustus said. “We can make something domestically using a largely domestic supply chain that’s nontoxic, low cost. There will be more than one chemistry in the market that takes the space.” SPW

As long as the sun is shining, it seems Solar Power World will be talking about tariffs on solar panels. The U.S. industry hoped to be planning for the second half of 2023 and beyond with some certainty when it came to antidumping/countervailing duties (AD/CVD) possibly being placed on silicon solar cell and panel imports from Southeast Asia, but the Dept. of Commerce threw another curveball — a final decision will now come on August 17, 2023.

Commerce was supposed to release its final decision in May, after preliminarily deciding in December

2022 that Chinese solar cell and panel producers were working in Cambodia, Malaysia, Thailand and Vietnam as a way to avoid paying duties on Chinesemade solar goods that have been in place since 2012. Commerce suggested tariffs be extended to all exports out of the Southeast Asian countries, except from four individual companies that were investigated and found to not be circumventing the tariffs: New East Solar (Cambodia), Hanwha Qcells (Malaysia), JinkoSolar (Malaysia) and Boviet Solar (Vietnam).

After the preliminary decision to extend AD/CVD to silicon cells using Chinese wafers and final panels made

with Chinese wafers that also use additional Chinese components, the DOC spent months combing through case briefs and rebuttals from solar manufacturers and installers. Since about 20 interested parties submitted documents, Commerce decided it needed even more time to consider all statements.

One of the crucial clarifications requested in those documents is an explanation of the department’s new “wafer-forward” ruling, placing tariffs on an earlier step in solar module manufacturing. The AD/CVD parameters of 2012 placed tariffs at silicon cell production and through to the final module assembly. The country point of

JULY 26-27, 2023

PHILADELPHIA, PA

Join conversations with industry buyers, suppliers, distributors, consultants, and more to explore solutions, exchange ideas, and discover new technologies.

REGISTER TODAY | RE-PLUS.EVENTS

FEATURING:

PRESENTED BY:

origin was determined to be where the p-n junction is activated, which happens at solar cell development. The December 2022 preliminary decision shifted the tariff rules back one step to the silicon wafer.

Companies found circumventing the tariffs in December 2022 were circumventing based on the new wafer-forward rules. They were under compliance based on the previous cellforward requirements, but now the rules have potentially changed.

While the wafer-forward stepback is likely a small win for petitioner Auxin Solar, who appears to be asking Commerce for no Chinese inputs in any imported solar products, the California panel company expressed displeasure with Commerce’s decision that wafers produced outside of China with Chinese polysilicon were not under investigation. Auxin stated in documents that this provides a “Get Out of Jail Free” card to silicon solar producers who rely exclusively on Chinese inputs but “merely slice Chinese-origin polysilicon ingots into wafers outside of China.” Nearly 80%

of the world’s polysilicon comes from China.

North American panel manufacturer Silfab called Auxin’s Monopoly-game reference ironic because “Auxin is the only producer of [crystalline silicon] products that has requested circumvention remedies at all — effectively seeking to monopolize this process in direct contravention to Silfab USA’s interests, and the interests of the domestic solar industry as a whole.”

No other crystalline silicon solar panel manufacturer has come out in support of Auxin. The AD/CVD extension’s only other supporter is CdTe thin-film manufacturer First Solar, whose solar panel products are not included in the circumvention investigation.

Once a final tariff decision is announced in August by Commerce, any extensions would not go into effect until after June 6, 2024, on account of President Joe Biden’s 2022 executive action that paused additional tariffs for two years. The Biden Administration stepped in to prevent retroactive duties on imported panels “in order to ensure

the U.S. has access to a sufficient supply of solar modules to meet electricity generation needs while domestic manufacturing scales up.”

Congress has attempted to reverse Biden’s two-year pause, passing a Congressional Review Act (CRA) in both chambers. Biden pledged to veto the CRA, and both the Senate and House appear unable to reach twothirds majority votes to finalize the congressional action.

In the meantime, domestic manufacturing has continued to scale up, although not as quickly as the country needs. Silicon cell manufacturing is not yet established in the United States (and only three companies have suggested they will start by the end of 2024), which means all American solar panel assemblers will have to import solar cells that would likely come with these extended tariffs.

Until Commerce’s final decision is announced, U.S. developers and installers won’t be sure of the cost for solar panels imported after June 2024. Future plans will have to be delayed just a bit longer.

Some inverter-makers have embraced technology to simplify O&M, but others are lagging.

Troubleshooting faulty inverters is a post-install task that isn't going away. These power electronics are the components most likely to fail in a solar project, according to a 2020 Solar Risk Analysis report by kWh Analytics that found inverters were responsible for around 80% of non-weather production loss across a 3-GW utility-scale portfolio. Simplifying that problem-solving process is crucial to maintaining power plant production.

"Considering that inverters are the most revenue-tied piece of equipment and the piece of equipment with the most downtime and tickets related to performance issues, this is something that inverter manufacturers really need to buy in on as we continue to just try and lower the cost of operational expense and risk and yield," said Eric Toff Bergman, director of channel sales at SMA America.

Manufacturers like SMA are identifying inevitable inverter failures using technology and knowledge-sharing. SMA offloads some of the monitoring and maintenance work from project owners using its Smart Connected app, a free service for utility-scale string inverters.

In Smart Connected, data is gathered and updated from individual inverters every 15 minutes, detailing an inverter’s location, weather, project design and other necessary information to keep the power electronics running. When an issue is detected, Smart Connected sends an alert to SMA’s service team and the client.

In the background, SMA's service team pulls log files from the inverter experiencing an issue and uploads new parameters or a new firmware file to fix the problem.

"In the best case, we would respond back to that customer and say, 'Hey, Smart Connected event closed. We fixed

it remotely. You do not need to go and roll a truck to the site,’" Bergman said.

When Smart Connected does identify a failure that can't be resolved remotely, it creates a return merchandise authorization (RMA) if the inverter is under warranty. The service team ships a new unit to the client in two to three business days to replace the failed inverter.

Tim O'Malley, VP of O&M at renewable developer Green Development, said Smart Connected sets SMA apart from other original equipment manufacturers (OEMs).

"I'd say out of all [the support] I've seen and I've worked with, I really like SMA's," he said. "They obviously put a lot of time and money and effort into their user interfaces, their back end and their data collection."

Although some hardware failures could technically be fixed by swapping

parts, SMA favors full replacement for string inverters, since opening the inverter could result in other unintentional damage if a technician is not properly trained. The used inverter is then sent back to SMA and typically refurbished.

Smart Connected has the potential to save significant time and money on fault diagnosis and truck rolls, but it's a relatively new service that is taking some time to catch on.

"It's a good way to dictate future product development, but also have us be a little bit on the frontlines of identifying potentially systemic issues that may exist in our hardware that can be fixed with things like firmware," Bergman said.

Central and string inverter maker Sungrow hasn’t implemented remote troubleshooting software like SMA, mostly to avoid cybersecurity concerns as a

China-based company. Instead, customers email or call customer service and enter their issue into a ticketing system.

"We're still operating on a structure where the ticketing and metrics of issues are the heartbeat of everything," said Ryan Chen, senior corporate strategy manager at Sungrow.

Sungrow keeps its diagnostic info under wraps. If there's a problem with a Sungrow inverter, the technician must download encrypted log files and send them to the manufacturer to troubleshoot the issue. But O'Malley has found Sungrow is quick to send Green Development replacement string inverters and will reimburse the cost of a technician’s time and labor.

Once an issue is entered, Sungrow workers add the problem to a database and look for solutions based on past problems. Like SMA, Sungrow most often

leans toward RMAs for string inverters and swapping parts for centrals.

For central inverters, Sungrow uses its ticket database to assess the most commonly failing parts, then forecasts the number of spares to keep in stock according to those stats.

"Ticketing software gives you so much data from the past that helps you order the correct quantities, build knowledge spheres, things like that," Chen said.

Chen said Sungrow plans to continue building out a robust knowledge base to help project owners solve problems quickly themselves, without the need for much back and forth with the support team. The company is also working on a customer-facing electronic parts request form to expedite replacements.

Although manufacturers are using new technology to limit truck rolls, the biggest time-saver, according to O&M provider Pearce Renewables, is increased transparency. Pearce technicians have performed O&M on more than 6,500 solar sites and made repairs on a wide range of inverter brands. The company has found inverter OEMs that see independent service providers (ISPs) like Pearce as complimentary businesses keeping inverters online will share their fault codes with technicians.

"The real key to solving a system fast is access to the diagnostic or fault codes," said Kyle Williams, SVP of EV, ESS and solar O&M at Pearce. "In relationships where they train or collaborate with Pearce on certification training, they readily publish or share fault codes.

"That's the dream state, because, at the end of the day, we share the same customer and we're able to increase our rate of speed and satisfaction of uptime or availability," he continued.

National contractor Standard Solar partners with other developers on projects, so the company’s in-house and subcontracted O&M techs also deal with many inverter manufacturers across its portfolio, like Pearce.

"It just gets to be a real puzzle of just logistics and technical phone support, troubleshooting, coordination and project management. Every day is such a challenge," said Jay Smith, director of asset management at Standard Solar.

Smith said that process could be simplified if inverter manufacturers used universal fault codes instead of different naming conventions for each brand.

"It's hard to find really good, experienced technicians and then it's even harder to retain some of that technical knowledge. So having a standardized approach to how you

troubleshoot inverters would be beneficial," he said.

Pearce's Williams understands why not all manufacturers are collaborating like this — it makes business sense for them to keep their fault codes unique and dispatch their own service teams for a fee. Companies are also eager to guard anything that could be perceived as intellectual property, including information like fault codes.

Most solar inverter manufacturers offer training and certification courses at a cost to teach technicians to fix their products. After technicians are certified, they can perform maintenance on those inverters while keeping the warranty intact. Larger O&M providers like Pearce can set aside a budget to train technicians on all the inverters they'll be working on, but smaller in-house O&M teams might struggle to find the time and money for training.

"If you can't rely on the manufacturers to send you help quickly, then you've got to start looking at hiring your own people," O’Malley said. "They're happy to charge you to send the person to do training to fix parts under their warranty. That kind of seems counterintuitive. Like, what are we paying for a warranty for?"

Even though a developer might love a product, it's difficult to continue working with a brand if they aren't investing in the necessary O&M support.

"The operation side of these inverter manufacturers really need to step their game up of getting support to their customers," O'Malley said. "Selling products is great, but if you can't support them after sales, how long are we going to last?"

As the country's solar footprint continues to grow, more collaboration between inverter manufacturers and O&M teams will help keep those gigawatts flowing to the grid without interruption. SPW

MICROINVERTERS ARE A common component in residential solar projects that are built to handle the wattage of smallerscale PV arrays. But like solar modules, microinverters are increasing in capacity and can handle larger electrical loads. For example, inverter manufacturer APsystems’ new QT2 microinverter can invert energy from four solar panels at a time, unlike previous models that were installed on single modules. Jason Higginson, head of marketing for APsystems USA, is here to discuss this new breakthrough and the subsequent trend of microinverters entering the commercial and industrial solar market.

Below is an excerpt of APsystems’ Solar Spotlight podcast with Solar Power World, but be sure to listen to the full episode on your favorite podcast app.

Why are we seeing this trend of microinverters shifting into C&I with what has traditionally been primarily a residential solar product?

We see the shift happening because many of the hang ups with microinverters in C&I applications, especially three-phase

applications, no longer exist. So even though our new line of three-phase microinverters, QT2, is ideal for C&I projects, there are a lot of myths or preconceptions that still exist around using microinverters outside of residential solar.

What can you tell me about the new QT2 microinverter?

The QT2 is a native three-phase microinverter that serves four PV modules simultaneously. It can be paired with four PV modules up to 550 W to 575 W — that is probably the sweet spot — but it can accommodate even higher wattage modules without negatively impacting the inverter. So, it comes in 208- and 480-V models that can be used for Y delta and even 240 delta high-leg configurations. So, really, any new or existing commercial and industrial buildings can use this microinverter.

What sort of myths exist around the use of microinverters in the commercial and industrial solar space?

Microinverters go back a ways in this industry, and traditionally they have had a lot of success in residential solar. Unfortunately, if you do something well, long enough, it can sometimes

be perceived that that's all you do. It would kind of be like me telling people they can use their barbecue to cook a pizza — which I've done by the way, it actually wasn't too bad. We specifically designed the QT2 for C&I applications, and we were immediately met with resistance from the industry. Without looking at specs or pricing, customers would say microinverters are too expensive, they're not powerful enough. None of these are true with the QT2.

How are microinverters suddenly more competitive in C&I?

So, historically, microinverters compared with popular C&I inverter, the string inverter, microinverters were twice the price, sometimes more, and microinverters have significantly cut down on cost over the years, APsystems microinverters in particular. When you look at the cost-per-watt of output, it's a dramatic change in pricing over the years, especially considering we've designed it to serve four PV modules, and it does not cost the same as four individual microinverters. Now compare that to string inverters which now must have a rapid shutdown system for rooftop applications, but it now adds an additional 50 to 70% of the inverter cost to the system pricing.

Is there anything else we should know about the QT2?

Yes, I also want to say that another one of those big myths is shading and I just tell everybody that shading can come in many forms. So, we see quite often dust, dirt, bird droppings, snow, in addition to clouds and rain that happens all the time. Microinverters performed better under all these conditions compared with standalone string inverters. SPW

Single-axis solar trackers are the structure of choice for utility-scale solar development since these systems generate more energy by keeping PV modules pointed toward the sun throughout the day. Company names like Array Technologies, Nextracker and PV Hardware are synonymous with large-scale solar projects, because they manufacture the tracker systems that produce gigawatts of renewable energy across the planet.

These competing manufacturers have one component in common that’s used in many of their trackers — the hardware that makes them move in first place.

“Kinematics may be the most important company no one’s ever heard of when it comes to trackers,” said Adam Plesniak, CTO of Kinematics. “Often, you have various value [propositions] with trackers, like Nevados has got a very different type of system than OMCO, than Nextracker, than Array, but they all literally revolve around our gearbox.”

Kinematics manufactures and assembles slew drives or actuators deployed on single-axis tracker systems, many for the companies that hold a majority of the global solar tracker market share. There are more than 2 million Kinematics actuators in the field, responsible for driving 53 GW of power on single-axis solar trackers.

“We’re in the early stages of a journey to sort of put ourselves out there a bit more,” said John Payne, CEO of Kinematics.

For a company that started assembling actuators for the industrial mobile market almost 30 years ago, Kinematics has grown alongside the solar industry. From

its headquarters in Phoenix, Arizona, Kinematics still serves the industrial mobile and satellite ground station industries, but 90% of the business is now focused on supplying actuators to solar tracker manufacturers.

“We get the benefit of working across all of those industries and being able to take the knowledge from, say, the precision repeatability that we have to deliver for satellites, pushing that into utility solar — taking the ability to manufacture huge volumes for utility solar for the likes of Nextracker and PV Hardware, and pushing that learning back into the other industries,” Payne said.

An actuator is a self-contained gearbox composed of one or more gears that rotate loads on an axis. In solar applications, an actuator is attached to a torque tube — the rotating portion of a single-axis solar tracker — to create the torsion that moves it.

One Kinematics actuator can rotate a single-axis tracker row hosting between 90 and 100 solar panels. On average, it takes about 30 Kinematics actuators to power rotation for 1 MW of solar power.

Kinematics doesn’t manufacture a single model of driver, because no two solar trackers are the same. For example, Nextracker produces solar trackers with independent panel rows that use individual drives; and Array Technologies’ trackers use drive lines that connect between panel rows and rotate groups in unison. So, Kinematics works with tracker manufacturers to design an actuator that fits their systems’ torque demands and rotational layout.

“They truly appreciate that they’re not just buying an off-the-shelf product. We’re innovating for them and we’re helping the tracker companies reach their goals,” said Jen Cangelosi, VP of global sales and business development at Kinematics.

Actuators manufactured by Kinematics make rotation possible for many solar trackers.

Kinematics

Kinematics has also helped fixed-tilt racking companies transition into tracking systems.

“We’ve had multiple fixed-tilt companies come to us and say, ‘Our customers are asking for trackers. Can you help us?’” Cangelosi said. “We’ve made the path super easy for them. You provide the steel and the panels, and we’ll provide the guts and the heart of the motion control system for those trackers. We’re a really frictionless way to come from a fixed-tilt side of the business and easily morph into a tracker company.”

Kinematics designs and manufactures actuators that are self-locking, meaning a solar tracker can change angles to face the sun and lock into place for however long is needed without risk of an outside force like wind applying opposing torque and rotating it out of position.

The actuator is just one component in the company’s portfolio of motor control hardware for solar trackers. Kinematics also makes encoders and sensors that monitor the system and produce data for operators

and the manufacturer to optimize tracker performance.

“There’s this move to what we characterize as ‘digital solar,’” Payne said. “So, making more use of connectivity, sensors, data management, intelligence, actually developing actionable intelligence that ultimately should improve the total lifecycle cost of installing a solar plant.”

To further cut down on operations and maintenance costs, Kinematics has ambitions to produce a “maintenancefree” actuator. In previous models, Kinematics drives required routine grease replenishment. The latest update to the company’s line of actuators is a sealed gearbox where the lubricant is self-contained and doesn’t need to be replenished, while the drive is also protected from outside matter like dust. Kinematics is calling this the ST series.

“[Solar trackers] are inspected at least once every 10 years, because there are elements in the controller’s electronic components — in the batteries, namely — that must be inspected, and in many cases, replaced every 10 years,” Plesniak said. “So, to have a maintenance-free product, in one sense, means that it basically has the opportunity to be touched every 10 years. The ST has been purposefully engineered so that you can put eyes on it every 10 years, make sure we have a couple of things to inspect, but ultimately there’s nothing to maintain.”

China, and ships them to its other plant in Nogales, Mexico, for final assembly.

The company was recently approved to export its actuators into the United States from its Mexican factory. Shipping the final product from Mexico allows the company to avoid tariffs that would apply if importing directly from China.

“It’s our unique technology that enables us to get that tariff shift, so we can effectively get tariff-free products into the U.S. from our Mexico facility, which is a big, big advantage for our customers,” Payne said.

Kinematics plans to expand its manufacturing lines and possibly open a factory in the United States using incentives from the Inflation Reduction Act.

“We are waiting, I think along with a lot of other companies, on getting more clarity from the IRA,” Payne said. “But we have developed a blueprint for what we’re calling ‘future factory,’ which, if we can make it work … we’ll be able to produce drives at a fraction of the time that we currently are producing them out of our facility in Jiangsu.”

Those improvements could be achieved through factory automation and robotics. Kinematics plans to eventually make those updates to its existing facilities as well.

Until then, Kinematics will continue producing its actuators in China and Mexico to keep much of the solar tracker market in motion, pushing toward another 2 million deployed.

Kinematics

While headquartered in Phoenix, Kinematics manufactures components at its factory in Jiangsu,

“We build these relationships with customers, they last for a long time, and we just quietly work behind the scenes,” Payne said. “We do need to be a little bit more forthright in some of the, quite frankly, amazing things we’re doing, because we are the world leader in the space. I don’t think we’re ever going to be the sort of team that is doing a massive amount of self-promotion and selfaggrandizement. We’re just not wired that way.” SPW

the project’s performance meets expectations.

In this special section, O&M experts explore the latest advancements in technology, tools, land

life of the system and ensure that it continues to generate clean energy for many years to come. By implementing a proactive maintenance plan, solar project owners can identify and address issues before they become major problems and guarantee management and more.

The operations and maintenance of all sizes of solar projects is constantly evolving. Solar panels and inverters grow more powerful every day with new parameters that change how systems are serviced. Robotic technology innovations could transform labor requirements. O&M providers follow these trends and adapt their services to an industry that reinvents itself every day.

Solar Power World talked about the state of the O&M industry with Troy Lauterbach, CEO of NovaSource,

likely the world’s largest solar services company. NovaSource formed in 2020 as a merger of some of the largest O&M portfolios, including from SunPower, First Solar and SunSystem Technology. Today, the company provides O&M solutions for both solar and storage in the residential, commercial and utility-scale markets in nine countries. Lauterbach explains how NovaSource views solar construction and maintenance as the industry launches into a new era. This interview has been edited for clarity.

Solar Power World: How has the industry evolved in the last decade and how does that affect O&M?