In this our April magazine edition, we've shifted our attention to Investment Opportunities in other Developing Countries.We've thoroughly explored their substantial influence on the global industry and various sectors, underscoring their vital roles.

The year 2024 is poised to bring transformation to developing nations worldwide, establishing them as significant players in the global landscape and presenting a wealth of investment opportunities. This article will delve into the sectors driving growth in these countries and illuminate how investors can leverage these prospects. Spanning infrastructure development, renewable energy, technology, agriculture, healthcare, real estate, sustainable practices, trade, financial inclusion, and tourism, emerging economies offer an enticing frontier for investors looking to expand and diversify their investments.

Emerging economies worldwide, particularly in developing nations, are poised for significant growth in 2024. Investors can explore diverse sectors in these regions, offering a promising landscape for profitable ventures. Here's an overview of the potential for investors to capitalize on the growth narrative in emerging economies globally.

Southeast Asia: E-commerce Revolution in Southeast Asia: Investing in the Next Big Market. Highlighting the rapid growth of e-commerce platforms like Shopee, Lazada, and Tokopedia in Southeast Asia, and discuss investment prospects in the region's digital economy.

Brazil: Agribusiness Opportunities in Brazil: Investing in the World's Agricultural Powerhouse. Explore Brazil's dominance in agribusiness, including soybeans, sugarcane, and meat production, and discuss investment prospects in the country's agricultural sector.

Saudi Arabia:The Neon Project in Saudi Arabia represents a groundbreaking development with immense investment potential. As a futuristic city focused on innovation and sustainability, it offers lucrative opportunities for investors looking to capitalize on cuttingedge technology and urban development in the region.

Vietnam: Explore the manufacturing boom in Vietnam, particularly in electronics, textiles, and automotive industries, and delve into investment prospects for companies aiming to diversify their supply chains amidst Asia's evolving industrial landscape.

Indonesia:Discover the immense tourism potential of Indonesia, highlighted by renowned destinations like Bali and Jakarta. Uncover emerging trends within the hospitality industry and lucrative investment prospects in hotels, resorts, and travel tech startups throughout the archipelago.

Bangladesh: Delve into the progressive innovations within Bangladesh's textile industry, focusing on sustainable practices, digital advancements, and ethical fashion initiatives. Explore investment avenues within the apparel manufacturing sector, showcasing the country's potential for sustainable fashion ventures.

Turkey: Turning the spotlight on Turkey's infrastructure expansion, this article uncovers key projects like airports, bridges, and railways, showcasing investment opportunities in the country's dynamic transportation and logistics sectors. These developments illuminate the vast potential and investment diversity within emerging economies.

Asian Countries: Analyzing Southeast Asia's booming edtech sector, this article examines the emergence of startups like Byju's, Ruangguru, and VIPKid in Singapore, Malaysia, and Indonesia. It delves into investment opportunities within the region's educational technology landscape, highlighting the growth potential of online learning platforms.

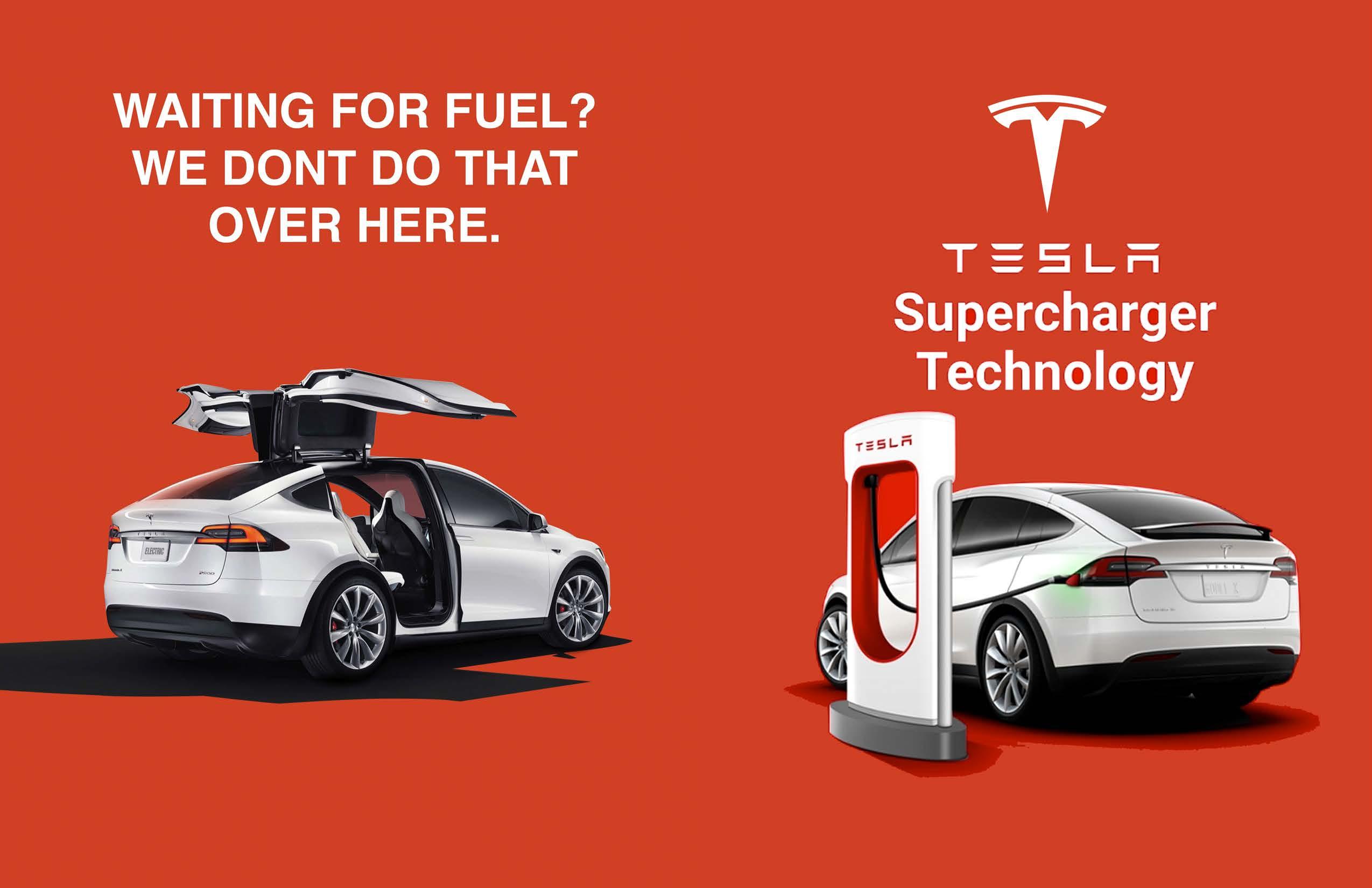

China:Highlighting the surge of Chinese electric vehicle manufacturers like NIO, Xpeng, and Li Auto, this article delves into the success stories within China's EV industry. It also analyzes the investment potential in the rapidly growing electric vehicle market in the country.

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

Influential Magazine

3010 LBJ Freeway, Suite 1200 Dallas , TX , 75234-7770

Tel: 1 469 9667050

4 unveiling china’s electric

8 India's

12 Unlocking the

22

30

36 Brazil's

40 Vietnam:

42

46

In the realm of electric vehicles (EVs), China has emerged as a formidable force, surging ahead of traditional automotive powerhouses like Germany and Japan. The country's EV market has witnessed unprecedented growth, with new EV sales skyrocketing by 82% in 2022, constituting nearly 60% of global EV purchases. This phenomenal ascent has outpaced early adopters such as the United States and various Scandinavian nations.

As China solidifies its position as a leader in the EV sector, investors worldwide are taking note of the immense opportunities this burgeoning market presents. With over half of the world's electric cars traversing Chinese roads and a substantial 35% share in global electric car exports in 2022, China's EV landscape is ripe with success stories. Notably, Chinese EV behemoth BYD surpassed Tesla in sales during the fourth quarter of 2023, reporting a staggering 62% increase in EV sales for the year. Similarly, Geely, another prominent Chinese automaker, experienced an 18% surge in EV sales, underscoring the sector's rapid growth and potential for investors.

The trajectory of China's EV dominance offers invaluable lessons for investors seeking to navigate this dynamic market. From identifying lucrative opportunities in adjacent industries to fostering operational efficiency and doubling down on core technology, China's EV journey serves as a blueprint for strategic investment in the global automotive sector.

One of the key strategies employed by Chinese automakers like BYD and Geely was to sidestep direct competition with established players and instead focus on adjacent industries within the EV ecosystem. This strategic approach allowed them to innovate and refine critical technologies, particularly in battery technology, which forms the backbone of EV development.

For instance, BYD strategically targeted the electric bus and motorcycle segments, leveraging these niche markets to push the boundaries of battery technology. By entering the electric bus market early on, BYD not only established a strong foothold in

sustainable public transport but also honed its expertise in high-capacity batteries, a pivotal component in EV manufacturing.

Similarly, Geely capitalized on opportunities in the electric motorcycle sector, which demanded lighter and more portable battery solutions than conventional cars. This strategic move enabled Geely to enhance its battery technology prowess and position itself as a frontrunner in the EV landscape.

Operational efficiency is a critical factor in driving EV adoption, and Chinese automakers have excelled in this aspect by collaborating with local groups and industry stakeholders. The seamless integration of EVs into existing infrastructure requires innovative solutions to address operational challenges such as charging infrastructure, range limitations, and grid compatibility.

Chinese EV brands worked closely with taxi companies to devise operational solutions that optimize battery performance and charging logistics. By

As European markets bolster their EV charging infrastructures, Chinese EV companies have a unique opportunity to participate actively in this process.

implementing smart charging schedules synchronized with power grid consumption patterns, Chinese EVs achieved optimal performance while alleviating strain on the power infrastructure.

Moreover, partnerships with technology companies facilitated the development of intelligent software and services for EVs, enhancing user experience and addressing operational complexities. This collaborative approach not only streamlined operational processes but also enhanced the overall appeal of EVs to consumers and businesses alike.

A key driver of China's EV success lies in its relentless focus on core technology, particularly in battery innovation. Recognizing the pivotal role of batteries in EV manufacturing, Chinese automakers embarked on a journey to strengthen their capabilities and forge strategic partnerships to bolster their competitive advantage.

BYD's strategic shift from manufacturing mobile phone batteries to automotive batteries marked a pivotal moment in its EV trajectory. Leveraging partnerships with industry giants like Daimler and Toyota, BYD gained invaluable insights into EV manufacturing processes while sharing its expertise in battery technology. This collaborative approach accelerated BYD's development of cutting-edge EVs and positioned it as a frontrunner in the global EV market.

Similarly, Geely's ecosystem-building strategy encompassed a wide range of technologies, from low-orbit satellites

to smart hardware, aimed at enhancing EV performance and functionality.

Strategic acquisitions of automotive and technology companies further fortified Geely's position and propelled its growth in the EV sector.

While China's EV market continues to thrive domestically, the next frontier for Chinese EV companies lies in global expansion. As they venture into international markets, Chinese automakers must navigate diverse regulatory landscapes, consumer preferences, and infrastructure challenges.

One of the critical aspects of global expansion is establishing local manufacturing or assembly plants to capitalize on regional incentives and streamline supply chain operations. By strategically investing in local production facilities, Chinese EV companies can mitigate logistical challenges and enhance their market presence in key regions.

Furthermore, building robust postsales service networks and collaborating with local stakeholders for infrastructure development are essential steps in driving EV adoption globally. Tesla's collaboration with local service providers in France for EV repairs serves as a testament to the importance of localized support networks in fostering consumer trust and satisfaction.

Moreover, as European markets bolster their EV charging infrastructures, Chinese EV companies have a unique opportunity to participate actively in this process. By leveraging their expertise in battery technology and charging solutions, Chinese automakers can contribute to the development of robust charging

networks, further incentivizing EV adoption and market growth.

For investors eyeing the lucrative opportunities in China's EV sector, a strategic and informed approach is paramount. Understanding the key drivers of China's EV success, such as technological innovation, operational efficiency, and strategic partnerships, is crucial in identifying investment opportunities with long-term growth potential.

Investments in battery technology, charging infrastructure, and EV manufacturing capabilities present promising avenues for investors looking to capitalize on China's EV boom. Moreover, partnerships with established Chinese EV players and technology companies can provide valuable insights and access to cuttingedge innovations in the EV space.

As China continues to drive the global transition to electric mobility, investors can play a pivotal role in shaping the future of sustainable transportation. By aligning investment strategies with China's EV priorities and leveraging emerging opportunities, investors can position themselves at the forefront of this transformative industry.

China's electric vehicle triumph represents more than just market dominance—it signifies a paradigm shift in the automotive landscape towards sustainability and innovation. For investors willing to embrace this transformative journey, China's EV sector offers a compelling and rewarding investment opportunity with the potential to reshape the future of mobility on a global scale.

India's tech startup ecosystem has witnessed a remarkable surge in recent years, propelled by a wave of innovation, entrepreneurial talent, and favorable market conditions. The country's vast consumer base, growing digital adoption, and supportive regulatory environment have created a fertile ground for startups across various sectors, attracting attention from investors seeking highgrowth opportunities. In this article, we delve into some of India's prominent tech startup companies and explore the potential benefits for investors looking to participate in this dynamic landscape.

CureFit: CureFit is a health and wellness startup that has gained traction for its holistic approach to fitness, nutrition, and mental wellness. With offerings ranging from fitness classes and personal training to healthy meal plans and mental wellness programs, CureFit has carved a niche in India's wellness industry. Investors interested in the health and wellness sector can benefit from CureFit's innovative solutions and potential for scalability as more consumers prioritize their wellbeing.

Razorpay: Razorpay is a fintech startup that has disrupted India's payment landscape with its

comprehensive payment solutions for businesses. From payment gateways and recurring payments to invoicing tools and financial analytics, Razorpay offers a suite of services that cater to the evolving needs of businesses in the digital era. Investors looking to tap into India's booming fintech sector can find opportunities for growth and innovation with Razorpay's technology-driven approach.

BYJU'S: BYJU'S is a household name in India's edtech sector, offering online learning programs for students across various age groups and educational levels. With interactive video lessons, personalized learning paths, and test preparation courses, BYJU'S has transformed the way students learn and prepare for exams. Investors keen on the education technology space can explore BYJU'S potential for expanding its reach and impact in India's vast education market.

Unacademy: Unacademy is another edtech startup that has gained popularity for its live classes, video lectures, and exam preparation courses. With a focus on democratizing education and empowering educators, Unacademy has built a communitydriven platform that facilitates learning and skill development. Investors interested in the intersection of technology and education can consider Unacademy's growth trajectory and innovative learning solutions.

Swiggy: Swiggy has emerged as a dominant player in India's food delivery and hyperlocal services sector. With a user-friendly app, diverse restaurant options, and efficient delivery network, Swiggy has revolutionized the way consumers order food online. Investors looking to invest in the food and logistics space can explore Swiggy's potential for market expansion and technological advancements in delivery services.

Zomato: Zomato, a leading food delivery and restaurant discovery platform, has a strong presence in India's food-tech industry. With features like online ordering, restaurant reviews, and loyalty programs, Zomato has become a go-to platform for food enthusiasts. Investors interested in the digital food ecosystem can analyze Zomato's market position and growth strategies for potential investment opportunities.

Nykaa: Nykaa is a beauty and wellness startup that has disrupted India's retail industry with its online platform for cosmetics, skincare, and wellness products. With a curated selection of brands, beauty tutorials, and customercentric services, Nykaa has captured a significant share of the beauty market. Investors looking to invest in the ecommerce and beauty sectors can explore Nykaa's growth potential and consumer-centric approach.

India's tech startup ecosystem is thriving, driven by a confluence of factors including innovation, entrepreneurship, and digital transformation. Startups across sectors like fintech, edtech, e-commerce, and logistics are reshaping industries, disrupting traditional models, and attracting investor interest.

Investing in Indian tech startups offers several potential benefits for investors:

Meesho: Meesho is a social commerce platform that empowers individuals, particularly women, to start their own online businesses by reselling products to their networks. With a focus on enabling entrepreneurship and creating economic opportunities, Meesho has gained popularity among microentrepreneurs. Investors interested in social commerce and inclusive economic growth can consider Meesho's innovative business model and market scalability.

UpGrad: UpGrad is an online learning platform that offers courses in data science, digital marketing, business management, and other domains. With a focus on upskilling professionals and providing industry-relevant education, UpGrad has positioned itself as a leader in India's online education space.

Investors looking to invest in the edtech sector and lifelong learning trends can explore UpGrad's potential for expanding its course offerings and global reach.

Cars24: Cars24 is a tech-enabled platform for buying and selling used cars, offering transparent pricing, inspection services, and hassle-free transactions. With a focus on digitizing the pre-owned car market and enhancing customer experience, Cars24 has become a preferred choice for car sellers and buyers. Investors interested in the automotive and e-commerce sectors can analyze Cars24's growth trajectory and technological innovations for investment opportunities.

Benefits for Investors in Indian Tech Startups

High-Growth Potential: Many Indian tech startups operate in sectors with significant growth potential, such as fintech, edtech, e-commerce, and health tech. These startups leverage technology and innovation to address market gaps and scale their businesses rapidly.

Diversification: Investing in Indian tech startups allows investors to diversify their portfolios and gain exposure to emerging markets and industries. India's startup ecosystem offers a wide range of investment opportunities across sectors and stages of growth.

Innovation and Disruption: Indian tech startups are known for their innovative business models, disruptive technologies, and agile approaches to solving complex problems. Investors can benefit from the creativity and dynamism of these startups in driving industry transformation.

Market Access: Investing in Indian tech startups provides investors with access to India's large and growing consumer market, which offers opportunities for market penetration, customer acquisition, and revenue generation.

Global Competitiveness: Some Indian tech startups have global ambitions and seek to expand beyond the domestic market. Investors can participate in supporting these startups' international growth strategies and positioning them as global competitors.

Economic Impact: Supporting Indian tech startups contributes to job creation, economic growth, and innovation ecosystems. Investors play a crucial role in fostering entrepreneurship, creating value, and driving positive social impact.

These startups represent a diverse range of industries and business models, offering investors opportunities for portfolio diversification, industry exposure, and potential returns on investment. However, it's essential for investors to conduct thorough due diligence, assess risk factors, and align investment decisions with their financial goals and strategies.

India's tech startup ecosystem is thriving, driven by a confluence of factors including innovation, entrepreneurship, and digital transformation. Startups across sectors like fintech, edtech, e-commerce, and logistics are reshaping industries, disrupting traditional models, and attracting investor interest. The potential benefits for investors in Indian tech startups include high-growth opportunities, diversification, innovation-driven returns, market access, and economic impact.

Investors interested in participating in India's tech startup revolution should conduct thorough research, evaluate investment risks and opportunities, and leverage insights from industry experts and market analysts. By identifying promising startups, understanding market dynamics, and aligning investment strategies with long-term goals, investors can navigate the Indian tech startup landscape effectively and capitalize on growth opportunities in one of the world's fastest-growing economies.

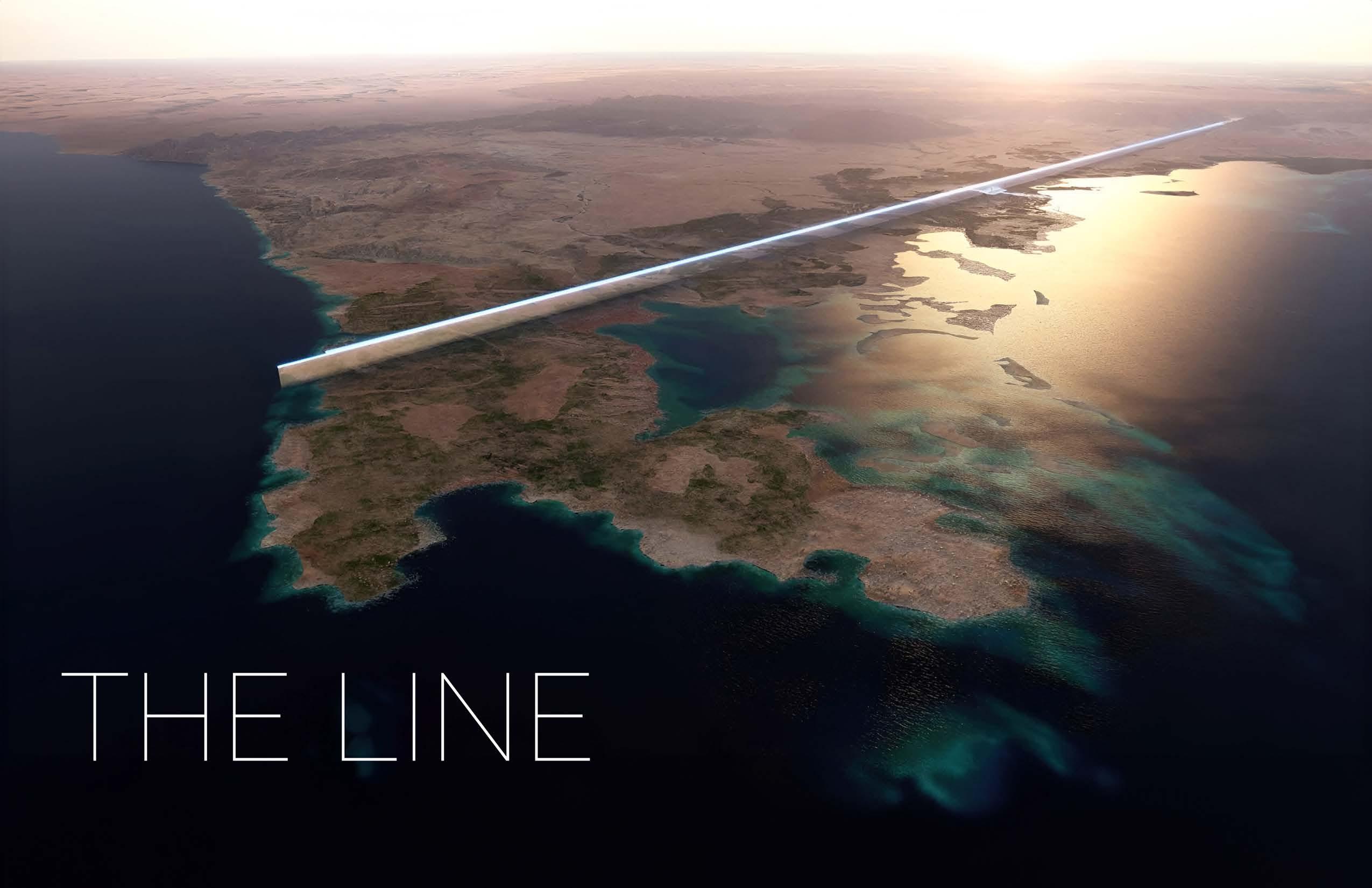

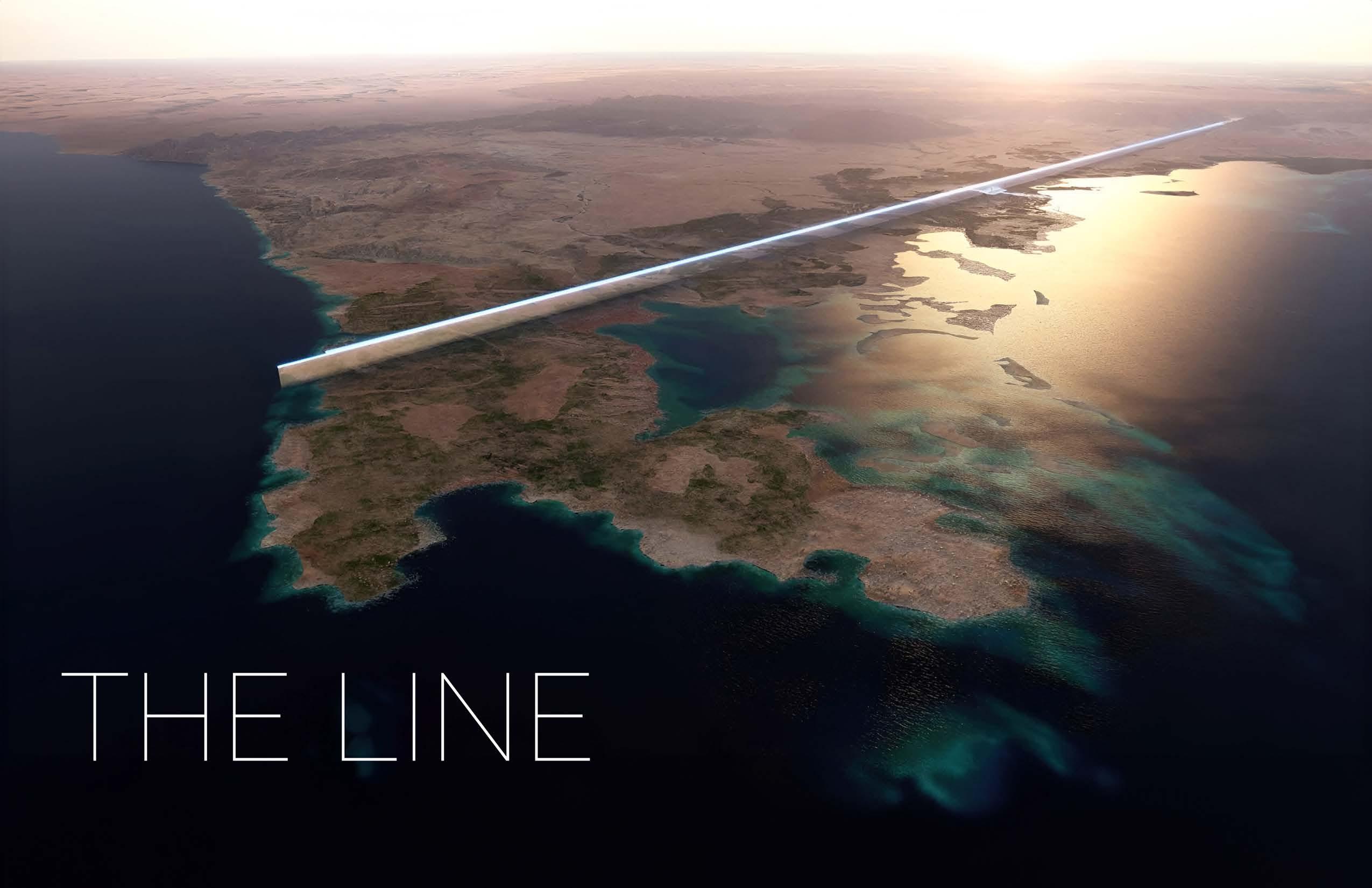

NEOM is a futuristic and ambitious project in Saudi Arabia that aims to create a cutting-edge city of the future. Spanning across the northwest region of the country and covering an area larger than Belgium, NEOM is envisioned as a hub for innovation, technology, sustainability, and economic diversification. This project represents Saudi Arabia's vision for the future and its efforts to transition from an oil-dependent economy to a knowledgebased society. Let's delve deeper into the NEOM project and explore its key aspects.

The vision of NEOM is to become a leading global hub for innovation, entrepreneurship, and sustainable development. It aims to attract top talent, businesses, and investors from around the world while fostering a culture of creativity, collaboration, and progress. NEOM's objectives include:

Economic Diversification: By focusing on non-oil sectors such as technology, tourism, entertainment, and renewable

NEOM represents a bold vision for the future of urban development

energy, NEOM aims to reduce Saudi Arabia's reliance on oil revenues and create new sources of economic growth.

Technological Innovation: NEOM seeks to be at the forefront of technological advancements, including AI, robotics, biotechnology, renewable energy, and smart infrastructure. The city will serve as a testbed for new technologies and solutions.

Sustainability: Environmental sustainability is a core pillar of NEOM's development. The city aims to be carbon-neutral, with a focus on renewable energy sources,

sustainable water management, waste reduction, and eco-friendly transportation.

Quality of Life: NEOM aspires to offer a high quality of life for residents and visitors, with worldclass amenities, healthcare facilities, education institutions, recreational options, and cultural experiences.

Smart Infrastructure: NEOM will be equipped with state-of-the-art infrastructure, including smart grids, high-speed internet connectivity, IoT devices, and autonomous transportation systems. This digital infrastructure will support innovation and connectivity throughout the city.

Green Energy: Renewable energy will play a crucial role in NEOM's development. The city aims to generate most of its energy from solar, wind, and other sustainable sources. Projects like the NEOM Solar Dome showcase the commitment to clean energy solutions.

Tourism and Entertainment: NEOM plans to become a premier destination for tourism and entertainment, with resorts, theme parks, cultural attractions, and recreational facilities. The Red Sea Project, located near NEOM, is part of the tourism development strategy.

Innovation and Research: NEOM will host research centers, innovation hubs, and technology clusters where companies, startups, and researchers can collaborate on cutting-edge projects. The NEOM Tech & Digital Academy aims to nurture talent in tech-related fields.

Healthcare and Education: World-class healthcare facilities and educational institutions will be established in NEOM to cater to the needs of residents and promote lifelong learning and wellness.

Free Zones and Investment: NEOM plans to create free zones and investment incentives to attract businesses, startups, and investors. The NEOM Industrial Complex and NEOM Bay are examples of strategic areas for economic activities.

Despite its ambitious vision and potential, the NEOM project faces several challenges and criticisms:

Environmental Impact: The massive scale of development in NEOM raises concerns about its environmental impact, including habitat destruction, water usage, and carbon emissions.

Social Impact: The influx of workers and residents into NEOM may lead to social and cultural challenges, including housing affordability, labor rights, and community integration.

Funding and Execution: Implementing the NEOM project requires significant financial investment and effective project management. Securing funding and ensuring timely completion of infrastructure and development projects are critical.

Geopolitical Factors: NEOM's success may be influenced by geopolitical dynamics, regional stability, and global economic trends. Factors such as diplomatic relations, trade policies, and market competition could impact NEOM's attractiveness to investors and businesses.

Despite the challenges, NEOM holds immense potential to transform Saudi Arabia's economy and contribute to global innovation and sustainability efforts. The project has already attracted interest from major technology companies, investors, and strategic partners. As NEOM continues to develop and evolve, its success will depend on effective governance, stakeholder collaboration,

sustainable practices, and adaptation to changing market dynamics.

NEOM represents a bold vision for the future of urban development, technology innovation, and economic diversification in Saudi Arabia. With its focus on sustainability, smart infrastructure, innovation clusters, and quality of life, NEOM aims to set new standards for modern cities. However, addressing challenges related to environmental impact, social dynamics, funding, and geopolitical factors will be crucial for NEOM's long-term success. As the project progresses, it will be fascinating to witness how NEOM shapes the future of urban living and contributes to global progress and innovation.

The NEOM project, spearheaded by Saudi Arabian Crown Prince Mohammed bin Salman, presents compelling opportunities for both companies and individuals alike. This visionary endeavor not only caters to the needs of Saudi Arabia but also beckons the finest talents and businesses from across the globe to partake in its transformative journey.

Announced as a groundbreaking initiative, the NEOM project encompasses a special zone spanning land within Egyptian and Jordanian borders. It is set to be the first area bridging three countries and boasts an

impressive investment of over 500 billion dollars, funded by the Public Investment Fund alongside contributions from local and global investors.

Situated in northwest Saudi Arabia, NEOM covers an expansive area of 26,500 km2, stretching along the Red Sea and Gulf of Aqaba for a total of 468 km. Surrounded by majestic 2,500-meter-high mountains to the east, NEOM's strategic location and forward-thinking approach make it an unparalleled investment destination.

Advantages for Companies in NEOM

NEOM presents an array of advantages for companies looking to invest:

Market Access: Companies in NEOM enjoy direct access to the Saudi market as well as global markets, positioning the region as a pivotal hub connecting three continents.

Innovation Ecosystem: The project offers a comprehensive system for innovation and supply, fostering collaboration and growth opportunities for businesses.

Financial Incentives: NEOM provides financial funding and incentives to attract and support businesses, ensuring a conducive environment for investment.

Regulatory Support: Companies benefit from a regulated environment with

targeted sectors and internationally supportive business laws, facilitating ease of operations and compliance.

Modern Infrastructure: NEOM boasts a forward-thinking infrastructure leveraging modern technologies to enhance efficiency, sustainability, and quality of life, making it an ideal setting for businesses to thrive.

Advantages for Individuals in NEOM

NEOM isn't just a haven for businesses; it also offers numerous advantages for individuals:

Quality of Life: NEOM promises a high quality of life with advanced civil services based on technology, including healthcare, education, transportation, entertainment, and more.

Growth Opportunities: The project provides ample opportunities for personal and professional growth, with a focus on international standards for living, culture, arts, and education.

Employment: NEOM's diverse sectors and rapid development create a wealth of employment opportunities across various industries, attracting talent from around the world. An unparalleled project that will undoubtedly enhance any resume remarkably.

For companies and individuals considering investment in NEOM, here are some encouraging tips:

Research and Due Diligence: Conduct thorough research and due diligence to understand NEOM's vision, sectors of focus, investment incentives, and regulatory framework.

Strategic Partnerships: Explore opportunities for strategic partnerships and collaborations within NEOM's innovation ecosystem, leveraging synergies and expertise for mutual growth.

Long-Term Vision: Keep a long-term investment perspective, considering NEOM's phased development timeline and its potential as a leading global hub for innovation and sustainability.

Diversification: Consider NEOM as part of a diversified investment portfolio, complementing existing investments and exploring new growth avenues in emerging sectors.

The NEOM project represents a groundbreaking opportunity for companies and individuals to be part of a transformative journey towards innovation, sustainability, and economic prosperity.

rtificial Intelligence (AI) has become a defining force in the modern era, reshaping industries, societies, and economies worldwide. Among the vanguards of this transformative wave stands China, a nation that has swiftly risen to prominence in the global AI landscape. Behind this meteoric ascent lies a confluence of strategic government initiatives, groundbreaking technological innovations, and a thriving ecosystem of AI companies and research institutions.

China's journey into AI supremacy didn't happen overnight; it was meticulously planned and executed through strategic policies and initiatives. The "New Generation Artificial Intelligence Development Plan," unveiled in 2017, serves as the blueprint for China's ambition to lead the world in AI by 2030. This comprehensive plan encompasses targeted investments in research, talent acquisition, and infrastructure development, laying the groundwork for a robust AI ecosystem.

At the forefront of China's AI revolution are powerhouse companies like Baidu, Tencent, Alibaba, and SenseTime. These tech giants have become synonymous with AI innovation, driving advancements across various domains such as natural language processing, image recognition, and autonomous systems. For instance, Baidu's Apollo project is pioneering autonomous vehicles, while Tencent's AI-driven platforms are transforming industries like finance and gaming.

The impact of AI in China is palpable across sectors, with healthcare, transportation, education, and manufacturing undergoing significant transformations. In healthcare, AIpowered diagnostic tools are enabling early disease detection and personalized treatment plans, revolutionizing patient care. Transportation is witnessing a revolution with companies like DiDi optimizing ride-sharing routes and Baidu's Apollo project leading the way in autonomous driving technology.

In education, AI-driven platforms are customizing learning experiences for students, offering personalized tutoring and adaptive curriculum design. The manufacturing sector is embracing AIdriven automation, leading to increased efficiency, reduced costs, and enhanced product quality. These real-world applications underscore the breadth and depth of AI's impact on China's socioeconomic landscape.

As China asserts its leadership in AI, it grapples with critical ethical and governance challenges. The nation's data-driven approach to AI raises concerns about privacy, surveillance, and data security. Striking a balance between leveraging data for innovation and safeguarding individual rights remains a pressing challenge for Chinese policymakers and tech leaders. Ensuring AI systems are unbiased, transparent, and accountable is paramount to building trust and fostering responsible AI adoption. This requires collaboration not only within China but also on an international scale, involving diverse stakeholdersfrom multiple sectors.

AI ethics guidelines, and government policies can impact investment strategies and risk profiles. Engaging with regulatory experts and staying abreast of industry developments is essential for navigating regulatory challenges.

For investors, Chinese AI companies present compelling opportunities for growth and diversification. Investing in established players like Baidu, Tencent, and Alibaba provides exposure to diverse AI-driven business models spanning e-commerce, cloud computing, fintech, and more. These companies' strong market positions, robust R&D capabilities, and strategic partnerships make them attractive investment prospects in the burgeoning AI sector.

Moreover, emerging AI startups in China offer investors access to cuttingedge technologies and disruptive innovations. From AI-powered healthcare solutions to smart city initiatives and autonomous systems, the Chinese startup ecosystem is teeming with entrepreneurial talent poised to drive the next wave of AIdriven disruption.

While investing in Chinese AI companies holds immense potential, it's crucial for investors to consider several strategic factors:

Industry Focus: Evaluate companies based on their AI applications and industry focus. Diversifying investments across sectors like healthcare, finance, education, and autonomous technologies can mitigate

risks and capitalize on sector-specific growth opportunities.

Technology Leadership: Prioritize investments in companies with a track record of technological leadership and innovation. Assessing factors such as AI patents, research publications, and technological partnerships can provide insights into a company's competitive advantage and long-term prospects.

Regulatory Landscape: Stay informed about evolving regulatory frameworks governing AI in China. Changes in data privacy laws, AI ethics guidelines, and government policies can impact investment strategies and risk profiles. Engaging with regulatory experts and staying abreast of industry developments is key.

Partnerships and Collaborations: Consider companies that actively engage in strategic partnerships and collaborations. Alliances with leading research institutions, industry peers, and government entities can enhance innovation capabilities, market reach, and resilience against competitive pressures.

Long-Term Vision: Adopt a longterm investment horizon when investing in Chinese AI companies. AI is a rapidly evolving field, and companies with a clear long-term vision, sustainable growth strategies, and adaptability to market dynamics are well-positioned for success.

Key Players in Chinese AI Landscape

Baidu: Known for its AI-driven search engine, autonomous driving

technology (Apollo project), and natural language processing capabilities.

Tencent: Leverages AI in areas like gaming, social media, fintech (WeChat Pay), and cloud computing (Tencent Cloud AI).

Alibaba: Utilizes AI for e-commerce (Alibaba Cloud), logistics (Cainiao), finance (Ant Group), and smart city initiatives.

SenseTime: Specializes in computer vision, facial recognition, and AIpowered surveillance systems.

iFlytek: A leader in AI-driven speech recognition, language translation, and intelligent customer service solutions.

Conclusion: The Future of AI in China and Global Implications

As China continues its relentless pursuit of AI excellence, the future of AI in the country appears dynamic and transformative. With strategic investments, technological prowess, and a burgeoning ecosystem of AI innovators, China is poised to redefine global AI standards and shape the future of technology.

For investors, Chinese AI companies offer a gateway to cutting-edge innovation, market growth, and diversification. By understanding the unique dynamics of the Chinese AI landscape, assessing investment opportunities strategically, and staying attuned to regulatory and technological developments, investors can position themselves to capitalize on the immense potential of AI-driven growth in China and beyond.

AI robots represent a fusion of robotics and artificial intelligence, reshaping industries by automating tasks traditionally requiring human intervention. With advanced algorithms, machine learning capabilities, and sensory perception, these robots navigate complexities, learn from experiences, and interact intelligently with humans.

China envisions AI robots as transformative forces, not just for automation but for revolutionizing key sectors like manufacturing, healthcare, logistics, and services. In manufacturing, they boost productivity, precision, and adaptability by streamlining workflows and responding dynamically to production needs.

Healthcare stands to gain significantly from AI robots, aiding in diagnosis, surgery, and patient care while promising better outcomes and enhanced efficiency. They also address societal challenges like aging populations, environmental sustainability, and disaster response, serving as companions, automating monitoring, and assisting in rescue operations.

China's Strategic Focus:

China's investment in AI robotics is bolstered by several key factors:

Technological Leadership: With substantial investments in AI research and infrastructure, China leads globally with top talent and cuttingedge institutions in AI and robotics.

Market Opportunities: China's vast market, growing middle class, and tech demand create extensive opportunities

across consumer robotics, industrial automation, and smart cities.

Government Support: Clear policies like the "New Generation Artificial Intelligence Development Plan" provide strategic guidance, funding, and regulatory frameworks supporting AI robotics.

Industry Collaboration: Collaborations among academia, industry, and government drive innovation, technological advancements, and market expansion in AI robotics.

Investment Advantages:

Early investors in China's AI robotics enjoy multiple benefits:

Growth Potential: Rapid market expansion driven by demand, tech advancements, and supportive policies offers substantial investment returns.

Innovation Ecosystem: Access to a vibrant innovation ecosystem with startups, labs, accelerators, and venture firms enables collaborations and market access.

Strategic Partnerships: Establishing alliances with AI robotics companies and stakeholders enhances knowledge sharing, codevelopment, and market penetration.

Risk Management: Diversification across segments, regions, and tech domains mitigates sector-specific risks, ensuring investment stability.

Impact and Sustainability: Aligning with innovation and societal impact themes, AI robots

contribute to productivity gains, resource efficiency, and improved quality of life.

Key Considerations for Investors:

Before investing, consider:

Market Analysis: Understand demand, competition, regulations, and growth potential in China's AI robotics market.

Technology Assessment: Evaluate capabilities, scalability, and differentiation of AI robotics companies, including tech infrastructure and AI models.

Risk Management: Assess tech, regulatory, cybersecurity, supply chain, competition, and geopolitical risks affecting investments.

Due Diligence: Conduct comprehensive analysis on financials, business models, teams, IP rights, traction, and growth projections.

Long-Term Vision: Adopt a strategic, long-term perspective considering market evolution, trends, disruptions, and emerging use cases.

Early investment in China's AI robotics presents strategic opportunities for growth, innovation, partnerships, diversification, and impact-oriented returns. By evaluating market dynamics, tech trends, risks, and opportunities, investors can capitalize on AI robotics' transformative potential in China's economy and contribute to a smarter, efficient, and sustainable future.

In the era of digital transformation, e-commerce has not only revolutionized traditional shopping but has also become a cornerstone of global market dynamics. Nowhere is this shift more pronounced than in Southeast Asia, a region teeming with diversity and economic vibrancy. Spanning approximately 4.5 million square kilometers and encompassing 11 countries, Southeast Asia has emerged as a powerhouse in the global ecommerce landscape. This article delves deep into the burgeoning e-commerce sector of Southeast Asia, examining its unique demographic advantages, evolving market trends, prominent players, and the multifaceted challenges that define this dynamic arena.

Demographic Dividends: A Thriving Consumer Base

Southeast Asia's demographic profile presents a fertile ground for e-commerce expansion. With a population exceeding 650 million people, the region boasts a substantial consumer market characterized by a burgeoning middle class and a youthful demographic. Two key demographic factors contribute significantly to the region's e-commerce potential:

Large and Growing Working-Age Population: Southeast Asia's workingage population, comprising individuals between 15 to 64 years, surpasses 60%, outpacing regions like Europe.

Countries such as Vietnam, Indonesia, Philippines, and Malaysia lead this demographic trend. Projections indicate an addition of 23 million individuals to the working-age populace by 2030, a stark contrast to declining workforces in many developed regions.

Middle-Class Expansion and Urbanization: The rapid expansion of the middle class, nearly doubling since 2012 and expected to reach 350 million by 2022, coupled with increasing urbanization rates (projected to rise from 49% to 56% by 2030), signifies a notable shift in consumption patterns. This upwardly mobile middle class, characterized by rising affluence and a penchant for quality products and sustainable solutions, represents a substantial driver of e-commerce growth.

The COVID-19 Acceleration: Transforming E-commerce into a Necessity

The onset of the COVID-19 pandemic acted as a catalytic force for Southeast Asia's e-commerce sector. Pandemicinduced lockdowns and social distancing measures propelled online shopping from a convenience to a necessity, leading to a surge in digital transactions. The digital economy witnessed an unprecedented doubling from 2019 to 2022, with e-commerce claiming a dominant 63% market share across various industries.

While the e-commerce boom in Southeast Asia has been remarkable, market variations exist across the region. According to Meta & Bain & Company, the Southeast Asian e-commerce market soared to a staggering $129 billion in Gross Merchandise Value (GMV) in 2022, with projections indicating sustained double-digit growth until 2027. Indonesia emerges as the frontrunner, constituting nearly half of the region's total e-commerce market, followed closely by Thailand and Vietnam, each poised for significant growth trajectories.

In Southeast Asia's vibrant e-commerce ecosystem, local players wield substantial influence, reshaping the online retail paradigm. Platforms such as Shopee, Lazada, and Tokopedia have emerged as frontrunners, offering diversified product portfolios and capturing significant market shares.

Shopee stands as the unrivaled giant in Southeast Asia's e-commerce arena, witnessing a staggering 342 million monthly visits. Key factors driving

Shopee's success include:

• Leveraging synergies from sister companies in gaming (Garena) and online payments (Seamoney).

• Adopting a localized approach with dedicated apps catering to specific Southeast Asian markets.

• Implementing a mobile-first strategy, with a whopping 95% of orders originating from mobile devices.

• Employing robust branding strategies involving celebrities and social media influencers for user acquisition.

Lazada: The Alibaba-backed Powerhouse

Backed by China's e-commerce behemoth Alibaba, Lazada mirrors the comprehensive Tmall experience in Southeast Asia. With a 12-year history in the region and a presence in six countries, Lazada focuses on Businessto-Consumer (B2C) transactions, offering an extensive array of brands and leveraging Alibaba's logistics and payment infrastructure.

Tokopedia: Empowering Indonesian Commerce

Tokopedia, Indonesia's premier ecommerce platform, has ascended to prominence by prioritizing local entrepreneurs and fostering a robust logistics network. Following its merger with Gojek, Tokopedia has diversified into a digital conglomerate encompassing e-commerce, ride-hailing, and financial services.

Social commerce is witnessing a meteoric rise in Southeast Asia, particularly in countries like Thailand, Vietnam, and Indonesia. By harnessing the power of social media platforms, businesses are seamlessly integrating online shopping with social engagement, leading to enhanced customer experiences and increased sales.

Despite the overarching trends, nuances exist within Southeast Asia's ecommerce landscape. Variations in consumer preferences, regulatory environments, logistical challenges, and technological infrastructures necessitate tailored strategies for e-commerce players to thrive across different markets.

Addressing Challenges: Navigating the E-commerce Terrain

Southeast Asia's e-commerce revolution is not devoid of challenges. Key hurdles include:

• Logistical Complexities: The region's geographical diversity poses logistical challenges, especially in last-mile delivery and infrastructure development.

• Regulatory Frameworks: Varying regulatory landscapes across countries necessitate compliance strategies and regulatory adaptability.

• Payment and Trust Issues: Building trust among online consumers and enhancing digital payment ecosystems remain critical for sustained e-commerce growth.

• Competition and Market Saturation: Intensifying competition and market saturation demand continuous innovation and differentiation strategies.

• Cybersecurity Concerns: With the digital realm expanding, cybersecurity threats require robust mitigation measures to safeguard consumer data and transactions.

Despite challenges, Southeast Asia's ecommerce sector brims with opportunities. Key growth areas include:

• Rural Market Penetration: Tapping into rural and underserved markets presents immense growth potential for e-commerce expansion.

• Tech Innovation: Embracing technological innovations such as Artificial Intelligence (AI), Augmented Reality (AR), and data analytics can enhance customer experiences and operational efficiencies.

• Sustainable E-commerce: Addressing sustainability concerns and offering ecofriendly products can resonate with the region's environmentally conscious consumers.

• Cross-Border Trade: Strengthening cross-border e-commerce initiatives can foster regional integration and expand market reach.

• Digital Payments: Furthering digital payment infrastructures and enhancing trust in online transactions can spur ecommerce adoption.

Conclusion: Charting the Path Forward

The e-commerce revolution in

Southeast Asia heralds a new era of digital commerce, characterized by innovation, dynamism, and transformative potential. As local and global players navigate the region's diverse markets, leveraging demographic dividends, technological advancements, and strategic partnerships will be key to unlocking growth opportunities. By addressing challenges, fostering regulatory harmonization, and embracing digital transformation, Southeast Asia is poised to solidify its position as a global e-commerce powerhouse, reshaping consumer behaviors and market landscapes in the digital age.

Brazil has long been recognized as a global powerhouse in agriculture, with its vast arable lands and strategic positioning in international markets. However, this agricultural success story comes with a complex set of challenges, including environmental degradation, land consolidation, and income inequality. As Brazil charts its path towards sustainable development, it faces the crucial task of harmonizing its highly productive agricultural sector with environmental preservation, social equity, and rural-urban poverty alleviation. This article delves into the intricacies of Brazil's agricultural landscape, exploring its achievements, ongoing challenges, and the potential benefits for investors in this evolving sector.

Brazil stands at a critical juncture where agricultural prosperity intersects with sustainability imperatives. Despite concerns about environmental impact

and social disparities, Brazil has made significant strides in agricultural productivity and global market integration. Over the past two decades, the country has emerged as a leading producer and exporter of agricultural commodities, driving economic growth and employment in rural areas.

Brazil's agricultural sector has witnessed remarkable growth, expanding its production capacity and diversifying its export portfolio. The value of agricultural output has doubled over the last two decades, with livestock production experiencing a threefold increase. Notably, Brazil now ranks among the top producers of 34 agricultural commodities globally, commanding a significant share of the international market.

Several factors have contributed to Brazil's agricultural transformation.

Technological Advancements:

Agricultural research and innovation have played a pivotal role in increasing yields and efficiency, enabling Brazil to harvest multiple crops annually in the same land area.

Global Demand: Rising demand for food, animal feed, and biofuels has fueled Brazil's export-oriented agricultural strategy, driving production expansion and market diversification.

Macroeconomic Reforms: Policy reforms, including currency stabilization and trade liberalization, have created an enabling environment for agricultural growth and investment.

Infrastructure Development: Investments in transportation, storage facilities, and logistics have facilitated the efficient movement of agricultural products, both domestically and internationally.

While Brazil's agricultural success is

commendable, it is not without challenges and trade-offs. Key areas of concern include:

Environmental Impact: The expansion of agriculture has led to deforestation, particularly in the Amazon and Cerrado regions, raising concerns about biodiversity loss and carbon emissions.

Land Consolidation and Inequality: Agricultural growth has contributed to land consolidation, exacerbating historical inequalities in land ownership and income distribution.

Resource Constraints: Rising costs of inputs such as fuel, fertilizer, and credit, coupled with infrastructure bottlenecks, pose challenges to longterm agricultural sustainability.

Pathways to Sustainable Agriculture

Achieving sustainable agriculture in Brazil requires a multi-faceted approach:

Environmental Stewardship: Strengthening conservation efforts, promoting agroforestry practices, and adopting sustainable land use policies are essential to mitigate environmental impacts.

Social Inclusion: Addressing land tenure issues, supporting smallholder farmers, and enhancing rural livelihoods are critical for fostering social equity and poverty alleviation.

Technology Adoption: Embracing precision farming, agtech innovations, and sustainable intensification can enhance productivity while minimizing resource use and environmental footprint.

Policy and Governance: Enforcing regulations, incentivizing sustainable practices, and promoting transparent governance frameworks are vital for guiding agricultural development towards sustainability.

Investors stand to benefit from Brazil's dynamic agriculture sector in several ways:

Diversified Investment Portfolios: Agriculture offers diversification opportunities for investors, with various subsectors such as crops, livestock, agribusiness, and technology.

Growth Potential: Brazil's agricultural sector is poised for continued growth, driven by expanding global demand, technological advancements, and market integration.

Innovation and Technology: Investments in agtech, precision farming, and sustainable practices can yield high returns while contributing to environmental sustainability.

Economic Resilience: Agriculture has historically demonstrated resilience to economic downturns, making it an attractive investment option during market uncertainties.

Impact Investing: Supporting sustainable agriculture initiatives can generate positive social and environmental impacts, aligning with ESG (Environmental, Social, and Governance) goals.

Investors should consider the following factors when exploring opportunities in Brazil's agriculture sector:

Risk Management: Assessing environmental, regulatory, and market risks is crucial for informed investment decisions and long-term sustainability.

Due Diligence: Conducting thorough due diligence on investment opportunities, including market trends, technological readiness, and operational risks, is essential.

Partnerships and Collaboration: Collaborating with local stakeholders, industry experts, and government agencies can enhance investment success and sustainability outcomes.

Sustainable Practices: Prioritizing investments in companies and projects that embrace sustainable farming practices, resource efficiency, and social responsibility can yield positive returns and impact.

Brazil's agricultural sector represents a compelling blend of economic potential and sustainability imperatives. By balancing productivity with environmental stewardship, promoting social inclusion, and embracing innovation, Brazil can chart a path towards sustainable agriculture that benefits investors, communities, and the planet.

Over the past two decades, the country has emerged as a leading producer and exporter of agricultural commodities, driving economic growth and employment in rural areas.

ietnam's rise as a manufacturing powerhouse has been nothing short of remarkable. The country has witnessed a doubling of foreign investment in October, with substantial contributions from China and Hong Kong leading this surge. This influx of investment underscores Vietnam's growing importance as a global manufacturing hub and highlights the strategic advantages it offers to investors.

In October alone, Vietnam received foreign investment commitments worth a staggering $5.3 billion, more than double its monthly average for the rest of the year. The majority of these investments, around 90%, were directed towards building new factories, reflecting the country's appeal as a manufacturing destination.

Since the beginning of the year, Vietnam has attracted foreign investment commitments totaling $25.76 billion, marking a 14.7% increase compared to the same period last year. A significant portion of these commitments, threequarters to be precise, went into the manufacturing and processing industry, signaling the sector's robust growth trajectory.

China and Hong Kong emerged as the leading contributors to foreign investment in Vietnam, followed closely by Singapore and South Korea. These investments have been instrumental in boosting Vietnam's manufacturing capabilities and expanding its exportoriented industries.

The surge in foreign investment can be

attributed to several factors. Firstly, Vietnam's strategic location between China and Singapore, coupled with its extensive coastline and access to major shipping routes, makes it an attractive destination for logistics and exportoriented industries. Approximately 40% of cargo transported from the Indian Ocean to the Pacific crosses Vietnam's East Sea, highlighting its crucial role in global trade.

Secondly, geopolitical developments, including trade tensions between major economies like the United States and China, have prompted companies to diversify their manufacturing bases. Vietnam's stability, favorable investment policies, and skilled labor force make it a preferred choice for companies looking to reduce their dependence on traditional manufacturing hubs.

Vietnam's manufacturing sector has experienced significant growth in recent years, fueled by investments in high-tech industries and a focus on value-added production. Major multinational companies, including Apple, Samsung, and LEGO, have expanded their operations in Vietnam, citing access to skilled labor, shipping facilities, and a conducive business environment as key factors.

For instance, LEGO's decision to build a $1 billion carbon-neutral factory in Vietnam reflects the country's commitment to sustainability and its potential to attract high-value investments. Similarly, Samsung's plans to increase its investment to $20 billion and establish a research and development center in Hanoi underscore Vietnam's growing importance in the global tech and electronics supply chain.

While Vietnam's manufacturing boom presents immense opportunities, it also faces challenges, particularly in terms of sustainable development and labor practices. The country's reliance on thermal power for electricity and delays in implementing renewable energy policies are areas that require attention to ensure long-term environmental sustainability.

Moreover, ensuring fair labor practices, upskilling the workforce, and addressing social and economic inequalities will be crucial for Vietnam's continued growth as a manufacturing powerhouse. Collaborative efforts between government, industry, and civil society are essential to address these challenges and build a sustainable and inclusive manufacturing ecosystem.

Conclusion: Vietnam's Ascendancy in Global Manufacturing

Vietnam's rapid ascent as Asia's new factory floor is a testament to its strategic advantages, investor-friendly policies, and skilled workforce. With ongoing investments in high-tech manufacturing, sustainable practices, and infrastructure development, Vietnam is poised to play a pivotal role in shaping the future of global manufacturing.

Investors stand to benefit significantly from Vietnam's growth story, gaining access to a dynamic market, competitive production costs, and a strategic gateway to regional and global markets. As Vietnam continues to attract foreign investment and expand its manufacturing capabilities, it reinforces its position as a key player in Asia's evolving economic landscape.

Indonesia is currently witnessing an unprecedented surge in domestic tourism, spurred by the conclusion of the Covid-19 pandemic. This resurgence in tourism is not only revitalizing the sector but also catalyzing growth in related industries, particularly the hospitality sector, thereby presenting lucrative investment opportunities in Indonesia.

The revival of the tourism sector has profoundly impacted Indonesia’s hospitality landscape. Ross Woods, CEO of Hotel Strategic Investments, highlighted this pivotal transformation, noting that domestic tourists have become the stalwarts of Indonesia’s hospitality sphere.

In 2022, a staggering 96 percent of hotel guests were domestic tourists, underscoring the pivotal role of the local market. This growth trajectory is remarkable, transitioning from 256 million journeys in 2015 to 735 million trips in 2022, driven by a Compound Annual Growth Rate (CAGR) of 16 percent.

The escalation of domestic tourism has been the driving force behind the renaissance of Indonesia’s hospitality sector. Even in the fivestar hotel category, 84 percent of patrons are now domestic tourists, with similar trends seen across lower-star accommodations.

In Jakarta, business hotels saw an upsurge in MICE activities (Meeting, Incentives, Convention, and Exhibition) in the first half of 2023, leading to increased demand for accommodations. Family-centric staycations during elongated weekends also contributed to rising occupancy rates.

By May 2023, occupancy rates for three-star, four-star, five-star, and luxury hotels had soared, reflecting an annual increase of 2.7 percent from 2022. Jakarta’s average hotel occupancy rate stood at an impressive 65 percent, surpassing pre-pandemic levels.

This improved occupancy matrix directly influenced the escalation of the average daily rate (ADR) across market segments, indicating a promising trend for investors.

Bali witnessed remarkable progression, especially during the G20 Summit hosted by Indonesia. The event catalyzed positive changes in Bali’s hospitality landscape, leading to increased international visibility and tourist confidence.

Komang Astawa, Managing Director of Astadala Hospitality, highlighted

the impact of the G20 Summit on Bali's international reputation, instilling newfound confidence among tourists to experience Bali’s charms.

Indonesia’s resurgence as an upper middle-income nation has propelled economic growth, contributing to increased gross national income (GNI) per capita. The expanding upper middle-class demographic has become instrumental in propelling growth across sectors, including hospitality.

Paradise Indonesia’s property sales segment reflects this advancement, showcasing a tenfold growth within the first semester of 2023.

The resurgence of the tourism sector and hospitality industry in Indonesia presents promising investment opportunities for both local and foreign investors. Government regulations further facilitate foreign investment, making Indonesia an attractive destination for hospitality ventures.

Investors stand to benefit from Indonesia’s vibrant tourism market, growing domestic tourism, and the nation's economic resurgence, making it a strategic investment destination in the hospitality sector.

Bangladesh's garment industry has risen to prominence as the world's second-largest garment exporter, showcasing its resilience and adaptability in the global textile and apparel sector. This journey from economic challenges to global recognition highlights the immense investment potential that Bangladesh's

garment industry offers in the midst of a changing world.

The inception of Bangladesh's garment industry in the 1970s marked a pivotal moment in the country's economic

trajectory, emerging from the aftermath of the Liberation War. Early stages primarily catered to domestic demand, but strategic policy initiatives in the 1980s paved the way for global market entry. Tax breaks, duty-free import of machinery, and streamlined export procedures were instrumental in creating a conducive environment for

industry growth, attracting foreign investment and fostering a thriving business ecosystem.

Central to Bangladesh's garment industry success is its abundant and cost-effective labour force. With dense population and competitive wage rates, Bangladesh attracted international apparel brands seeking cost optimization in production. This competitive advantage enabled Bangladesh to offer affordable clothing globally, sustaining

demand and reinforcing its position as a preferred manufacturing hub.

Participation in international trade agreements like the Generalized System of Preferences (GSP) provided Bangladesh with tariff advantages in key markets, facilitating increased export volumes. Geographical proximity to major consumer markets further enhanced accessibility to global supply chains, bolstering

Bangladesh's standing in the industry.

While growth has been impressive, challenges such as labour rights, workplace safety, and environmental sustainability persist. Incidents like the Rana Plaza collapse underscored the need for improved standards.

Bangladesh is actively embracing sustainable practices, investing in ecofriendly technologies, reducing environmental impact, and addressing ethical manufacturing concerns.

Central to Bangladesh's garment industry success is its abundant and cost-effective labour force.

The adoption of Industry 4.0 technologies is revolutionizing Bangladesh's garment manufacturing process. Automation, artificial intelligence, and data analytics are enhancing efficiency, reducing costs, and improving quality. Embracing these advancements positions Bangladesh as a competitive player in smart manufacturing, attracting tech-savvy investors seeking innovation-driven opportunities.

Sustainable practices and ethical manufacturing not only meet consumer expectations but also ensure compliance with international standards. By prioritizing sustainability, Bangladesh's garment industry gains market trust, mitigates risks, and fosters a responsible business environment conducive to long-term investments.

Diversifying product offerings beyond mass production to include high-value segments and niche markets is a strategic move. Customized, ecofriendly, and specialized garments cater to diverse consumer demands, reducing dependence on a single market and enhancing industry resilience against economic fluctuations.

The rise of e-commerce presents new avenues for growth in Bangladesh's garment industry. Embracing digital platforms enables direct access to global consumers, reduces dependence on traditional retail channels, and facilitates real-time communication and collaboration across the supply chain. Leveraging e-commerce enhances visibility, branding, and market reach, creating opportunities for investors in the digital realm.

Despite strides in sustainability, climate change concerns, competition from emerging markets, and potential nearshoring trends pose challenges. Addressing these challenges requires coordinated efforts, innovation, and strategic planning. Opportunities abound in technological advancements, sustainable practices, market diversification, and digital transformation, making Bangladesh's garment industry an attractive investment destination.

Investing in Bangladesh's garment industry offers a compelling opportunity to capitalize on a resilient, adaptable, and evolving sector. Embracing sustainability, innovation, digitalization, and market diversification can unlock growth potential and position Bangladesh as a global leader in the garment industry. Balancing economic growth with social and environmental responsibility is key to sustained success in an ever-changing world.