9 minute read

The clone wars

AutoCAD’s popularity and high cost spawned a copycat DWG clone industry. Now mature, the clone developers are not content with mirroring its functionality but are aiming for verticalised BIM and manufacturing capability, writes Martyn Day.

Along time ago in a galaxy far, an in-house competitor to kill them off, so far away, the Empire devel- Softdesk created a team to make a clone oped this CAD software called AutoCAD, code named IntelliCAD. AutoCAD, which swept all With complications of the sale, professional 2D CAD systems before it, Autodesk was horrified to see what until it ruled the Galaxy with its proprie- Softdesk had been doing in the shadows tary DWG file format. Slowly but surely a but, as Softdesk had previously been in rebellion rose up with the purpose of negotiations to sell IntelliCAD to the inundermining the Empire and all the ene- house team, the US Federal Trade mies of the Empire chipped in to create Commission got involved and IntelliCAD the Open Design Alliance and IntelliCAD had to be sold separately due to competiTechnical Consortium to reverse engineer tion rules. Autodesk had unwittingly and clone the file format and enable low- unleashed a highly-developed AutoCAD er-cost, yet compatible drawing tools. DWG clone onto the market and Visio

Unlike Luke Skywalker and the Jedi snapped it up for $6.7 million and then Knights, the DWG rebels also acquired the Marcomp never really managed to make any decisive blows to ‘‘ For very large Autodirect DWG toolkit to beef up development. In the Empire and have really just nibbled at the edges. While I have been writing Autodesk customers now retaliation Autodesk developed Actrix, a Visio clone to hit back. about CAD for almost 30 facing significant Eventually Autodesk years, the DWG clone market rarely caused Autodesk to lose sleep but price hikes, the budgetActrix and IntelliCAD under Visio flopped, selling a lot less than expected, but instead ensured all of constraints will the clone DWG developAutodesk’s competitors lead some to ment was kept alive by the had some level of DWG in and out capability to ease collaboration. However evaluate AutoCAD clones, IntelliCAD Technical Consortium created by Visio and funded by eager they must be doing some- their capabilities, Autodesk competitors. thing right as firms such as cost of ownership Earlier, Visio created the the Open Design Alliance and many independent and compatibility OpenDWG Alliance to get help in decoding the DWG AutoCAD clone developers such as Bricsys (formerly ’’ format, which eventually became the Open Design Bricsnet) and Graebert are all still in Alliance. This Alliance, with 1,250 memexistence and continuing to invest in bers, now not only reverse engineers developing AutoCAD clone functionality. DWG, ARX and many aspects of

Autodesk’s clone problem originated Autodesk’s proprietary CAD toolkits but though acquisition. In a period when also Bentley’s DGN and now Revit’s BIM Autodesk was acquiring some of its most formats. (It is now a whole ecosystem in successful third-party developers, it itself. CAD journalist Ralph Grabowski is acquired Softdesk, developer of AEC ver- the industry expert in this area and we tical applications, for about $90 million. recommend following upfrontezine.com).

The company’s owner, Dave Arnold, had The reaction from Autodesk ranged been secretly investing in developing his from trying to copyright DWG and rollown CAD tool, so as not to have to rely on ing out a ‘100% pure DWG’ advertising Autodesk’s underlying AutoCAD engine. campaign, to introducing a RealDWG Autodesk had established a practice of toolkit of chosen developers. However, either buying its developers or developing once in 2006 Autodesk sued the Open Design Alliance for copyright infringement, as Autodesk had added a copyrighted term into the file format to allow AutoCAD to recognise when a DWG of non-Autodesk origin was being loaded to warn AutoCAD customers that the data may be not a ‘TrueDWG’. The Alliance had to stop cloning that part of DWG.

The AutoCAD clone, or ‘workalike’ market has tended to stay off our radar at AEC Magazine, mainly because we have focussed on BIM, as opposed to document production. However, with increased capability and mature products there now seems to be an appetite from clone developers to get into BIM and high end solid modelling (MCAD). This, in is addition to the added twist that Autodesk’s move to Subscription, which increases the cost of ownership over three years and additionally puts perpetual licensing at risk, is driving some very large and previously non-clone-friendly Autodesk customers to re-evaluate the cost of subscription to AutoCAD and AutoCAD LT.

Over the past six months I have visited two of the key DWG European clone developers to see how they are adapting to the world of BIM and to attempt to estimate their opportunities in the face of Autodesk customers’ unhappiness at Subscription costs and their changing attitude to AutoCAD and DWG.

Bricsys Based in Ghent, Belgium, Bricsys is a long-established DWG-based developer with its product BricsCAD (the company was formerly called Bricsnet) which is run by CEO Erik de Keyser. With 135 employees, 90% of them programmers, Bricsys is very much focused on software development and uses an innovative online sales and support system for distribution. With such a mature product, BricsCAD is far from being a straight clone and has diversified to offer more capabilities, while staying true to the AutoCAD ribbon interface. An AutoCAD user would feel very comfortable finding tools and navigating the user-interface.

The classic variety of BricsCAD 1 costs €450 for a perpetual licence, €630 with maintenance. BricsCAD Pro with direct 3D modelling, rendering, cloud connectivity and third party apps costs €580 / 760. BricsCAD Platinum offers constraints, design intent, assembly, deformable modelling, 3D compare and some BIM capability / Sheet metal for €910 / 1,090. By comparison vanilla AutoCAD is £1,506 for one year access on subscription or £186 per month. 2 BricsCAD also runs on Linux, Mac, and Windows and the software replicates most of AutoCAD’s APIs so has access to thousands of third-party applications.

A case in point and an amazing coup for Bricsys is that Intergraph has ported its CloudWorx Plant 2017 to BricsCAD as a low-cost alternative to AutoCAD, while offering the same level of functionality. GT STRUDL CAD is also being ported to enable structural model analysis. With major developers choosing to support an AutoCAD clone as a low-cost without compromise alternative, it’s clear the market is starting to think differently about AutoCAD’s place within vertical markets.

BIM One of the key reasons for visiting Bricsys was because I had heard that the company was developing a BIM tool. It is not new at this game either as it created TriForma in the 1990s, which sat on top of MicroStation.

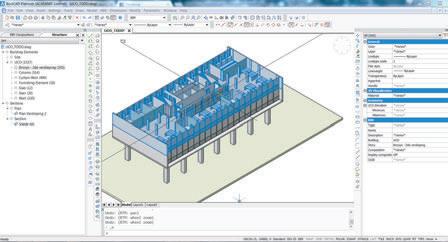

Bricsys gave me a demo of a new BIM modelling tool, which uses ACIS solids as a base. Instead of libraries of parts, the system works very much like TriForma, with a ‘model, then add intelligence’ approach.

Our demo model was very rectilinear but was amazingly fast, given that everything was modelled in solids. To prove a point the team imported a detailed reinforced concrete model which expanded to over thirty gigabytes. While the graphics struggled, the system stood up and enabled some navigation. From what I saw, it seems very early days with no library and no COBie or standards work. However, should development continue and with promised RVT (Revit) model access in the pipeline, Bricsys could play a part in Revit workflows.

My only reservation lies with the company’s decision to run everything in the traditional AutoCAD 2D interface and ribbon menu. While offering the benefits of familiarity to AutoCAD users it doesn’t

1 Bricsys Bricscad 2 Graebert Ares Commander

lend itself to 3D modelling particularly well compared to all new modelling tools.

I can understand why the company feels that customers who have been left behind in BIM may prefer to model in the familiar AutoCAD environment, but even Autodesk gave up on this concept as new interfaces for 3D work were required. For the record, Bricsys’ CEO vehemently disagrees with my analysis and considers the AutoCAD interface a benefit.

For now, Bricsys is already getting many enquiries from large Autodesk customers concerned about subscription pricing for the tools and looking to save money on their AutoCAD exposure. Appealing to major third-party developers is also a feather in its cap. It will be interesting to see who else other than Intergraph chooses to support its applications.

■ bricsys.com

Graebert GmbH Based in Berlin, Germany, Graebert also has its own AutoCAD clone which it calls Ares. Last year the firm announced that its drafting tool would work on desktop, on mobile and in the cloud on a web browser. This would mean that you’d have access to your drawings and the ability to draw whatever you want on whatever device.

Graebert is headed up by Wilfred Gräbert, who was the first German distributor of AutoCAD. That relationship soured and it went to court, where the matter was settled. Graebert has spent a considerable amount of time developing and competing against AutoCAD ever since. However, the company’s most remarkable success has been in providing DWG tools to Autodesk competitors. Both Onshape and Dassault Systèmes (DS) use Graebert DWG platforms within their mechanical CADfocused portfolios. DS might be best known for Catia and SolidWorks but its biggest product by volume is Draftsight, a free / pro 2D drafting tool that was developed for SolidWorks to muddy Autodesk’s AutoCAD income by reducing the need for SolidWorks’ customers to maintain AutoCAD licences when migrating to SolidWorks. What actually happened was that DS managed to get over 1 million users, many of which were architects. DS is still trying to figure out how to increase the income from Draftsight but it’s a nice problem to have. As far as I could tell Graebert has no obvious plans to go into BIM and compete against Revit but as its program supports LISP and ARX, the company is creating vertical apps to solve issues such as bathroom and kitchen layouts in 3D, similar to Autodesk Architectural Desktop.

Ares Trinity CAD is €250 per year for mobile, web and desktop. A perpetual licence is €795 for mobile, web and desktop. There is also is a network Flex licence option.

■ graebert.com

Perpetual vs subscription Autodesk is going through a business transition. The removal of huge joining fees is great when acquiring the software through subscription, but long-term it means that AutoCAD products are now more expensive over 3-4 years than when users could elect to upgrade when it made sense on their own unique business terms.

For very large Autodesk customers now facing significant Enterprise License Agreement price hikes, the budget-constraints will lead some to evaluate AutoCAD clones, their capabilities, cost of ownership and compatibility. According to Ralph Grabowski, “A common tactic is to replace most AutoCAD licences with a clone, keeping just a few AutoCAD to ensure compatibility and for some of the functions the clones don’t have.” Forget the cloud as a change agent; subscription is actually changing the way we think about our products, what we buy and for how long.