16 minute read

Subscription

Autodesk Subscription

As Autodesk accelerates towards a subscription-only model for its CAD tools and services, Martyn Day analyses what it all means.

Autodesk, the volume leader in customers on existing maintenance con- Subscription’s bedfellow of choice is ‘the the CAD market, is now well tracts will continue to receive updates and cloud’ and Autodesk is also in the midst on its way to transforming its new releases for as long as the mainte- of architecting a potential formidable business model from selling nance is kept. backbone with its ‘360’ product portfolio, boxes of software to supplying design which connects and merges desktop, tools to customers solely on subscription. Why subscription? mobile and cloud-services. Autodesk

Autodesk has decided to accelerate its In the 1980s and 1990s Autodesk used to Subscription plans include various levels phased plan to stop selling perpetual release updates to its only product, of cloud-based storage and extended fealicenses of software. It had announced AutoCAD, every two to three years and tures, such as fast rendering or analysis. that as of January 31, 2016, it would no went through extended periods of market- Autodesk has gone from offering a DOSlonger be possible to buy perpetual ing and selling upgrades to the next based 2D drafting tool to building 3D licenses of individual products (Revit, release. Customers tended to upgrade design ecosystems, spanning multiple AutoCAD, Inventor etc.). Now, from July their software every three to five years and platforms. 2016, Autodesk will no longer sell perpet- there was not a maintenance option. ual licenses of its bundled application For many businesses this was painful. A Pros and cons ‘Suites’ (Autodesk Design Suite, lot of energy and money was spent to get Subscription’s most noticeable benefit is AutoCAD Design Suite, Building Design the installed base to move along with new the lack of a ‘joiner’s fee’. To buy a perpetSuite, etc.). New customers will have to developments. Now that Autodesk has ually owned seat of AutoCAD costs sevsign up for a time-based subscription many products in its portfolio, covering eral thousand pounds and is something contact for the applications or that needs to be budgeted for. suites they require. This accelerated move will mean that by mid-2016, ‘‘ The key issue will be to ensure To get a seat of AutoCAD on subscription costs £185 a month, no up front fee. Seats Autodesk will have an almost entirely subscription-based customers believe the subs fees provide can be increased or dropped quickly, so should the market business model, following slow- value for money, instead of feeling they go into recession, overheads ly in the footsteps of Adobe, the industry’s poster child for sub- are merely renting the software can be cut. Subscribers will also have access to the latest scription transition, which went harder and faster than any other company and upset many cus’’ release with a global-use license and there are cloud benefits too. tomers in the process. multiple vertical markets, and is moving For accountants, subscription pay-

The reason given for the acceleration by from big yearly releases to streamed ments are operational expenditure, as Jeff Wright, vice-president, strategy and updates, serving a subscription-base. This opposed to buying the software which is marketing at Autodesk, was that the com- represents a major transformation and has capital expenditure with a depreciating pany realised that having a foot in both potential business benefits to Autodesk: asset over years. Subscription payments camps — perpetual licence sales and sub- are therefore tax deductible within the scription only — was a lot harder to tran- • Predictable recurring revenue vs burst same financial year. Although here, it is sition than originally envisaged. There is good for the markets, smoothing out arguable if Autodesk products are a was a recognition that the company needs quarter-to-quarter financial results. depreciating asset, given the efforts the to be “in one camp”. • By going increasingly direct there is company made historically to stop users

To smooth this transition, Autodesk will additional margin for Autodesk. reselling their perpetual licenses. offer a range of simplified subscription • Subscription management software Autodesk also highlights that subscripplans for individuals, teams and enter- makes piracy more difficult. tion comes with e-learning and telephone prises, Mr Wright said. Customers will be • Less monolithic development of apps, ‘technical support’, but with exceptionalable to purchase individual or shared sub- more dynamic updates. ly mature and complex products this is scriptions with the option of single user • Bigger potential to offer services for remote. It certainly will not be like having licensing or shared network licensing. higher subscription levels. local help from a reseller or hands-on Those customers that purchase or pur- • Lowers the barrier to entry for new cus- training. That kind of support will cost, chased a perpetual license of Autodesk tomers. probably a lot more than the product subDesign & Creation Suites to July 31, 2016, • Potentially means less income now but scription. will continue to own those licenses, and greater income per customer over time. While there are undoubted benefits,

some customers see a move to subscription as a loss of freedom. In the past the customer could evaluate upgrades to see if they offered value to their business and would pay to upgrade or opt to miss out. Autodesk’s move to predictable yearly releases increased the frequency of this evaluation but also the upgrade pricing was concocted to penalise those that fell behind, making subscription of perpetual seats the lowest cost of ownership.

Then there were the dreaded DWG format changes and the ‘obits’ — when a version of a product over three releases old (so, three years’ old) were retired and customers were given the option to upgrade or lose that capability. Now with the subscription-only model less than a year away, it is very much a take it or leave it, term-based access and for those not pushing the boundaries or using the cloud, mobile or collaboration, the added benefits seem, at the moment, completely hypothetical.

As Autodesk moved into subscription, it had noticeable teething problems getting the ‘portion size’ for annual fee. Suites on subscription compounded the issue further. Levels of user contentment with updates varies within each vertical market, but there have been many negative comments on the pace of development of Revit in return for the subscription monies paid. For example, firms may have the Building Design Suite, but most designers use Revit for over 90% of the time. The enhancements, however, are spread across the multiple products in the Suite.

The situation is much more clear cut when looking at new and quickly expanding products like Autodesk Fusion 360, a 3D CAD/CAM tool designed for multiple OS, mobile and cloud from the get-go. It has only ever been sold as a subscription product and is only $25 a month. Its aim is to torpedo the current Windows/desktop-based modelling tools and is priced to penetrate as a companion seat that eventually usurps the likes of SolidWorks, a popular product design and engineeringfocused CAD tool.

Customers of 3D mechanical design toolAutodesk Inventor get Fusion as part of the subscription and so Autodesk is playing the hunter, as opposed to the farmer, with its own mature desktop products, which have yet to become truly cloud applications. Channel model Autodesk’s move to subscription opens up questions about how, in the future,

To get a seat of AutoCAD on subscription costs £185 a month, no up front fee. Seats can be increased or dropped quickly, so should the market go into recession, overheads can be cut

the company envisages its relationship with its Value Added Distributors (VADs) and Value Added Resellers (VARs). The distribution layer is clearly being replaced with web fulfillment and for a long time, Autodesk has been weaning VARs off relying on revenue from box and upgrade sales. Changes to Autodesk’s engagement with its existing channel has always been a delicate issue, due to its symbiotic nature.

So far, the proportion of maintenance/ subscription revenue paid to VARs has helped resellers survive through some very tough economic times. But with Autodesk selling increasingly direct in enterprise accounts and now moving new business to subscription-only accounts, how will the VARs be rewarded?

Many have moved to offering training and consultancy, but that brings its own challenges. Autodesk’s products are a lot more complex than hours of e-learning will ever be able to convey.

Despite the low monthly price, products like Fusion include high-end CAM capabilities, which requires a lot of expertise and training. The cost of training and consultancy for this would be prohibitive.

I suspect that over time many small resellers will cease to exist and only those with large installed bases will get enough out of customer services to survive. Conclusion The move to the cloud and to subscription is commonly seen as extinction level event. Those who had a big presence on the Windows desktop are not necessarily going to be the winners on future mixed devices and mixed operating systems. Autodesk is ahead of its competitors in this regard and it is now compressing its timescales further.

Autodesk Fusion 360 serves as an indication of the cloud-architecture expected for all products in the vertical markets. Running over the Internet, on a cloud server, applications will be almost impossible to pirate.

With distribution and VAR margin removed or reduced considerably, Autodesk would also keep a bigger share of the subscription payments. It makes good business sense.

The key issue will be to ensure customers believe the subs fees provide value for money, instead of feeling they are merely renting the software. Autodesk needs to ensure customers use a range of the new tools and services to warrant the cost.

From up in the cloud, Autodesk will still have to nurture customer and partner relationships, as well as improve development and velocity of its core platform products.

© 2015 Workstation Specialists — Acecad Software Ltd. E & OE. © 2015 AMD Corporation. AMD, and the FIREPRO logo are trademarks and/ or registered trademarks of the AMD Corporation. All rights reserved. All company and product names are trademarks or registered trademarks of the respective owners with which they are associated.

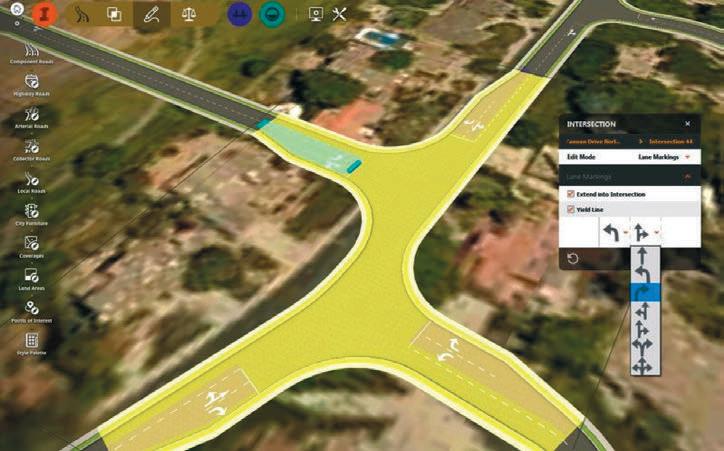

Infraworks: Looking at traffic flow, the new capabilities allow designers to identify problem areas, re-design and then re-analyse in a virtual environment giving visual results

Autodesk mid-year release

With Autodesk going 100% subscription from July 2016, the company continues to stretch out the development and delivery of new capabilities throughout the year, including traffic simulation for Infraworks 360 and a performance boost for Revit.

by Martyn Day

Subscription means enhancements come as part of the deal. You are always on the latest release and can benefit from new developments as they arrive. For Autodesk’s AEC team, moving from a single yearly release cycle, to in-cycle enhancements has taken the form of a mid-year update.

In the past Autodesk would compile a release with hundreds of new features and enhancements in the hope that customers would pay to upgrade to get the productivity benefit; then after three releases if all the advances had not enticed folks to upgrade then the threat of an ‘obit’ of a three year-old-release would assist (meaning it could not be upgraded at a reasonable cost).

The move to subscription makes that whole process go away. But it means to asses the value of the new features added, you have to take in what has been released throughout the year. For instance, the updates to Revit in March seemed underwhelming but they need to be combined with the mid-year updates for the subscription value to be appreciated. It is not only a different way of ‘owning’ but also a different value proposition. Infraworks 360 New with this update, Infraworks has advanced ‘Traffic simulation’. Some of this functionality was available in a ‘preview’, which Autodesk pushes out to customers but now the capability is deemed to be good enough for prime time. Autodesk does these technology trials frequently, like corridor optimisation capabilities in the last release and through Autodesk Labs projects.

Looking at traffic flow, the new capabilities allow designers to identify problem areas, re-design and then re-analyse in a virtual environment giving visual results. Compared to products like Civil 3D, Infraworks almost feels like a game, as it displays rich 3D worlds that can be spun and maniupulated in real-time while engineering designs are assessed and edited.

Designers input traffic flow and the mix of vehicle types, add signals, define turn lanes , then specify time of day. Obviously rush hour is going to be the most popular to check stressed situations.

Autodesk’s headquarters are in California, where roundabouts are a recent introduction, and while it took Autodesk a long time to implement them properly in its software, it is good to know that Infraworks Traffic simulation can handle those too. It is possible to watch the results in real time and edit and re-run the simulation to optimise the design prior to detailed design. The software simulates those annoying drivers who are in the right lane but want to turn left (no, no, never done that ever). Traffic simulation is a significant addition to the software and looks very impressive.

Infraworks’s ability to deal with railway design has also seen a considerable improvement with the ability to customgenerate detailed rail styles, allowing for various conditions and rail track types e.g. troughs at tunnel entrances, circular tunnels, viaducts, etc. It is possible to combine railtracks to apply bridges. In the previous release each track required its own bridge.

Road intersection modelling has been improved, enabling staggered intersections. Talking of roundabouts, Infraworks can now model left and right hand drive conditions, which is handy for us in the UK and probably one of the reasons that Infraworks has not been widely adopted yet. Yield signs and road markings are now displayed.

Bridge design has a new library of realistic foundation and pier types, which can be customised. Multiple components (piers,

girders) can be applied throughout a design style, using an ‘Apply To’ tool. Quantity and volume calculations have been moved to ‘on demand’. Previously Infraworks caused unnecessary performance-hitting calculations across the design, causing excessive model regenerations. Civil 3D When you see the leaps and bounds that InfraWorks has been doing in the last few releases, Civil 3D seems awfully pedestrian but it is a much more mature product and does not need huge new slices of capability.

In terms of Civil 3D updates Autodesk talks mostly about the continual improvement process that the company has taken to the ongoing development of Civil 3D and it is a reassuring story.

It seems the development team is taking a longer term view on Civil 3D and has planned to add content much more regularly than other Autodesk AEC products.

Through the release of Productivity Packs, Service packs and Extensions (such as the forthcoming Transport extension), Civil 3D customers can look forward to a number of regular bundles. Autodesk has delivered one Productivity pack this year, which featured Civil Engineering Data Translator, Rail Turnouts and Crossings, Coordinate Geometry Editor, improvements to Surfaces and to Pipe networks.

By Autodesk University (December), the company will aim to ship a second Civil 3D Productivity pack, which should include enhancements to: Reports, Alignment, Corridors, Points, Profiles, Projects and Surveys. Civil 3D and Revit will start to work better together with Revit supporting the import of corridor information.

To bring the community into the development of Civil 3D, Autodesk has launched an IdeaStation portal for Civil 3D and InfraWorks, on the Autodesk community site, where users can wishlist development area and post suggestions. In addition a Autodesk Civil 3D Futures portal enabled previews of new functionality being developed, where users can try out and feeback on new features in the pipeline. Revit Sunrise tech preview And so to the big one, the mid-year update to Revit for subscription customers, currently in beta with the codename ‘Sunrise’. As it is not yet released, Autodesk maintains that the functionality on show may or may not make the final version, expected mid October. Again, there is no file format change and it covers potential forthcoming features in Revit Architecture 2016, Revit MEP 2016, Revit Structure 2016 and Revit LT 2016. Autodesk has not confirmed exactly when the features in the tech preview will be available.

The most significant update lies at the very core of Revit and applies to every Revit-based product, and it is a major boost to speed of operation. Revit now supports ‘Occlusion Culling’, which means it only draws the visible elements and uses a Graphics Processor Unit (GPU) to work out what elements do not need to be drawn. Autodesk says this provides a 30%-40% performance gain on complex models with lots of geometry, improving model navigation, and model manipulation (orbiting/panning).

Export commands, such as export DWF or Autodsk 360, are now ‘parallelised’ and no longer significantly impact perfor mance. They also make more use of hardware power.

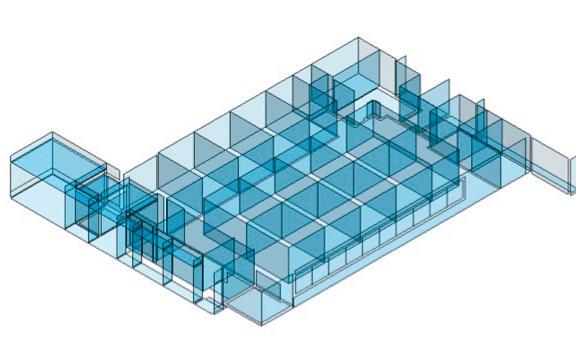

Revit Sunrise has automatic thermal zoning, creating an accurate model for analysis or export to gbXML

When the crop region moves, Revit no longer updates the view, leading to fewer refreshes. It is much faster to draw walls and ducts with Revit automatically replacing complex geometry with lines, when the view is far enough away.

Global parameters takes the intelligence from the family environment and applies it to the project. Parameters can be applied within projects. These can be turned into reporting parameters and applied to other objects, the user can add offsets and formulas. This can create very complex and useful relationships between objects as design changes are made. Reveal Constraints can also be used to find these user-defined parameters.

Family Element Visibility Preview shows what geometry will be visible when loaded into a project.

Revit Sunrise features automatic thermal zoning, creating an accurate model for analysis or export to gbXML.

There are a wide range of enhancements. IFC4 with support for ‘advanced BRep’, view filters, name reference planes in canvas, cancel multi-sheet print/export (as opposed to having to shut down Revit). Most have been requested by customers.

Sunrise offers custom rendering settings to the new Autodesk Raytracer engine; underlay has been improved; railings have previews; copy and paste is available in perspective views; and wall join type can be selected during wall creation.

Revit MEP Sunrise features background processing of colour fills, making them almost instantaneous when editing. The Fabrication Part Modelling tool released earlier this year gets enhancements: rotation controls, part options, show service (show related parts) and place tap (off an exiting component).

R2 includes default circuit rating and is customisable to allow for non-US circuits.

For a full list of what is new in Autodesk

Sunrise, visit tinyurl.com/RevitSunrise

Conclusion With each product at different stages of maturity, it seems the development teams are taking divergent approaches to developing and releasing enhancements throughout the year.

Infraworks is the hot product with major new functionality, Civil 3D has an experimental subscription model of its own and is seeking to bring customers in to influence future direction. Revit is chugging along. Autodesk has finally bitten the bullet to improve its operational speed by better utilising GPU acceleration and stopping Revit from wasting time tying up valuable processors calculating geometry that cannot be seen. It is my understanding that there will be more of this kind of performance work to come.

Looking ahead, as Autodesk goes from experimenting with subscription-only for individual products in January, to only offering new Solo or Suites on subscription come July 2016, the perceived value of the additional functionality becomes much more important. Autodesk has been experimenting with ‘portion size’ and has not always hit the mark. With Civil 3D it looks as if it will increase the regularity of additional features.

Autodesk should invest more time in gauging the value of the subscription service to get this new model right; from promptly providing access codes to time licensed software, better online support, more online training and ‘product velocity’.