Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor:

Wesley Cornell (Co-Founder)

Chief Revenue Officer:

Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Editorial Translator: Lyla Lezghad

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales.

Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU

30

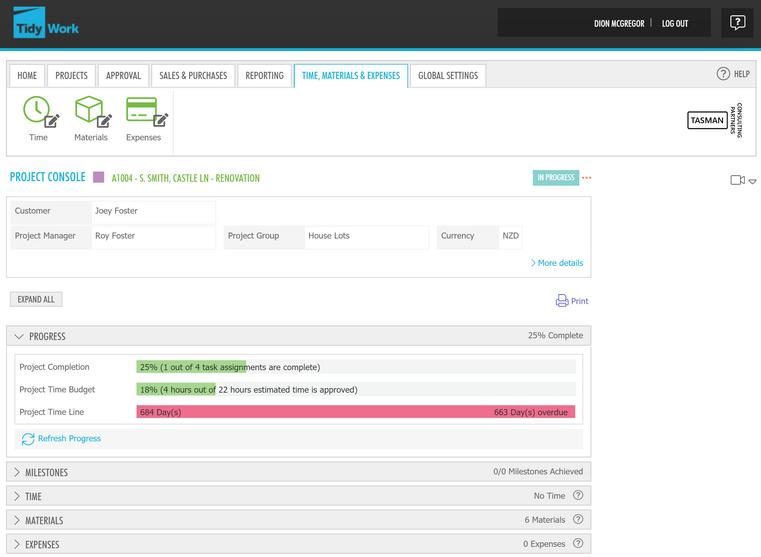

Create and manage project schedules to always stay on top of deadlines. Calendar view makes it easy to see what/when tasks are due, facilitating delivery of projects on time.

Track project progress, identify bottlenecks and manage resources. Customisable reports provide project performance insights, enabling data-driven decision-making.

" "

I've done half a dozen quotes using TidyWork and we have won all of them I can't believe how long it used to take before. We get a better breakdown on our projects - nothing is hidden.

Matthew Garvey FNE EngineeringProduce detailed quotes with custom templates.

Include branding, pricing with multiple currencies, and terms to ensure quotes are professional, accurate and consistent.

XU: What inspired the development of Castaway Cloud?

MF: Castaway Desktop has been a popular product in the market since 2010. We knew we had to develop a cloud version of our software and our company has transformed into a SaaS business now. Technology is heading that way and customers around the world were keen for a cloud version of Castaway.

XU: What did it take to build Castaway Cloud?

MF: Castaway, as a powerful forecasting and business modeling tool, is not an easy or quick application to build. This is the same for Desktop as well as Cloud. The calculation engine, enormous and complicated, had to be written from scratch. We spent a lot of time honing the user experience and interface, working on speed and response times, as well as perfecting the outputs (reports, dashboards and storyboards). We took four years to build this first-release version and on three occasions, we took valuable feedback from a select group of Desktop customers and brought that back into the product. We’d learned so much

from building and re-building Castaway Desktop which was also useful for our cloud project. It took a lot to design and engineer and, one day, I might talk about the cost and impact, but right now, I’m extremely proud of the Product, Engineering and Customer Success teams for their commitment and professionalism to get this done.

XU: What target market or industries do you believe will benefit most from Castaway Cloud, and why?

MF: Approximately half of our customers are accountants and advisors in

practice, and the other half are commercial accountants and SMEs. Most of the modeling in Castaway will be prepared by an accountant or advisor, and our products reduce errors, are safely collaborative and save accountants many, many hours compared to using Excel, for instance. SMEs are the ultimate beneficiaries of Castaway modeling and output. We truly believe SMEs have the power to move the world forward and this is the reason we do what we do.

With Castaway, our customers can ask better questions to get better answers and understand, in great detail, what their future possibilities might look like.

Cosette & Michael Ford, CEO

This gives them the clarity to make bold business decisions. Executives and Boards are more aligned to design business roadmaps that drive high performance, delivering more profit, cashflow and business value.

XU: I’ve heard you speak about his before, but can you talk about your vision for those involved in the planning process in businesses? Where do you see this headed in 5 years’ time?

MF: Planning and FP&A more broadly is

entering a golden age. The world is only becoming more uncertain. We can’t predict the future, but the businesses who prepare better for uncertainty will achieve the greatest success. It sounds counterintuitive, but planning as a process is much more valuable in uncertain times

The shift to digital means we have more information than ever at our fingertips. The challenge is turning that data into insight. The last 5 years have seen some fantastic planning tools come onto the market. My hope is these tools encourage many more businesses to engage deeply in planning,

forecasting and business modelling.

XU: Where will we see you out and about this year, Michael?

MF:

As far as the first half of the year goes, we’re preparing to exhibit at Accountex in London in May. We’ll have representatives at ABE in Sydney in March and Xerocon London in June.

I’ll also be leading roadshows in Australia, New Zealand and the UK this year, including special private Roadmap meetings for

our larger customers. We will also soon be announcing a series of webinars for northern and southern hemispheres.

We sponsor the Australian Small Business Champion Awards, the Australian Women’s Small Business Champion Awards and the Australian Trades Awards. So you’ll hear from us during awards season.

I also continue to ride in order to raise money and awareness for our chosen charity, Tour de Cure. In 2023, I rode more than 14,000 km, most of those in service of training other riders. This year, I expect to do a similar amount or more and have 3 upcoming

Australian Tour de Cure tours to prepare for in March, April and May.

There will be one or two surprise collaboration announcements soon, but the ink’s not dry yet, so I can’t talk too much about those.

XU: How can readers evaluate Castaway Cloud?

MF: We released Castaway Cloud evaluations to our existing Desktop customers in 2023 and we’re thrilled with all of the excitement around the new product. We welcome anyone who is interested to evaluate

Castaway Cloud. You can do so by going to our website or following this link [Castaway Cloud (cloudcastaway.com)]. We don’t take credit card details. In fact, we don’t take many details at all. My Customer Success team will help you evaluate and can answer any questions you have.

oxes R Us, a prominent provider of gift and promotional packaging solutions for small businesses, has recently demonstrated an outstanding leap in efficiency and operational excellence through the adoption of inventory management software solution Fishbowl Inventory.

Their exceptional transformation from completely manual processes to automation, made possible by the innovative capabilities of Fishbowl, serves as a beacon of inspiration for emerging businesses within the manufacturing sector.

According to industry experts, the absence of a robust inventory management system can pose serious challenges for developing businesses, leading to financial losses and operational setbacks. Amidst a multitude of outdated practices handed down from the previous owner of Boxes R Us, one particularly antiquated process involved the manual

recording of stocktakes on a whiteboard within the factory.

When husband and wife team, Kirsty & Scott Buckley took the reins of Boxes R Us, they quickly recognized the imperative to modernize their inventory processes. Acknowledging the critical need for streamlined operations and heightened accuracy, the entrepreneurial duo decisively shifted away from outdated, manual methods to embrace the innovative capabilities offered by Fishbowl Inventory.

Craig Scarr, Marketing Director, APAC, Fishbowl

Craig Scarr is a marketing professional and business leader with passion and focus to help organisations and leadership teams to generate outstanding results. Craig has extensive experience as a business professional spanning strategic marketing, brand management, partnership development, content, and digital media marketing across a diverse range of industries including FMCG, financial services, not for profit organisations and software solution providers.

Mrs. Buckley echoed the sentiment, noting, “Fishbowl has undoubtedly made our daily life incredibly easier. A thousand fold. From the day that we launched with Fishbowl, our life has been easier. Even with the little mix ups and learning the program and all that stuff, that was all easier than the way we ran prior to it.”

Mr. Buckley emphasized the simplicity of their choice, stating, “We undertook a comprehensive search, but implementing Fishbowl was an easy choice for us. The software did all of the things we needed it to do, and the service was exceptional right from the very beginning.”

According to Simon Jupe, Fishbowl APAC Managing Director, “Fishbowl enables you to monitor inventory levels in real time, manage inventory in multiple warehouses and drive operational efficiency by training team members in best practice inventory management. For most businesses, inventory is the largest asset they carry. All of these software features combine to help businesses carry the most efficient stock levels, ensure they are managing cashflow and meeting customer expectations of providing “In Full, On Time order fulfillment.”

“By using Fishbowl, it has saved us a lot of downtime and has basically paid for itself in the first 12 months, as with keeping everything

streamlined and making things a whole lot more efficient,” Mr. Buckley emphasized, highlighting the tangible benefits reaped from their successful integration with Fishbowl.

The transformative journey continued as Mr. Buckley highlighted, “We started using Fishbowl and doing complete stock takes and entering everything into the system and actually then started seeing how much stock we had sitting on the shelf. We had like $100,000 worth that wasn’t even moving. Now with Fishbowl we avoid these costly kind of mistakes!”

Fishbowl’s seamless integration with accounting solutions like Xero and QuickBooks provided Boxes R Us with a comprehensive view of their inventory levels, purchase orders, and sales activities. This enhanced visibility empowered the business to make informed decisions, optimize cash flow, and drive sustainable growth.

“Fishbowl integrates with accounting solutions, like Xero and QuickBooks, as well as other core business platforms, which allow you to get a 360-degree view of how your inventory levels, purchase

orders, and sales activities impact your cashflow. When inventory is ordered, received, sold, and shipped, Fishbowl automatically updates the relevant portions of your tech stack, which gives you a real-time view of quantities enroute, on hand, in production, and more. This level of visibility is a real game changer for businesses that may have previously done everything manually,” affirmed Mr. Jupe.

Management software can assist significantly with inventory prediction accuracy. By examining trends from highperforming products, inventory management systems can assist businesses with enhancing demand predictions. In addition, inventory management software reduces storing and handling expenses, increases sales, and can improve cash flow. Records from the past and peak seasons may also be used to determine significant sales trends that need stock modifications throughout the year.

Mrs. Buckley shared the impact on her daily routine, stating, “Before Fishbowl, I had to constantly leave my desk, keep someone on hold on the phone, and physically go to the factory to check our stock

levels. Now I can access all the information I need with the click of a button. It obviously saves me a huge amount of time and effort.”

She added, “Previously, I would find myself rushing from my desk to the factory floor probably 50-60 times a day just to check stock. With Fishbowl in place, I’m able to tell my customers on the phone right there and then if we have the stock. It’s saved us approximately $60,000 in just inventory alone.”

The resounding success of Boxes R Us’s transformative journey stands as a testament to the paramount significance of leveraging advanced inventory management solutions. By embracing the power of technology, Boxes R Us has achieved operational efficiencies which have enabled them to reaffirm their commitment to delivering unparalleled customer service and tailored solutions for small and medium businesses. Their remarkable achievement underscores the pivotal role of innovation in driving sustainable growth and operational excellence.

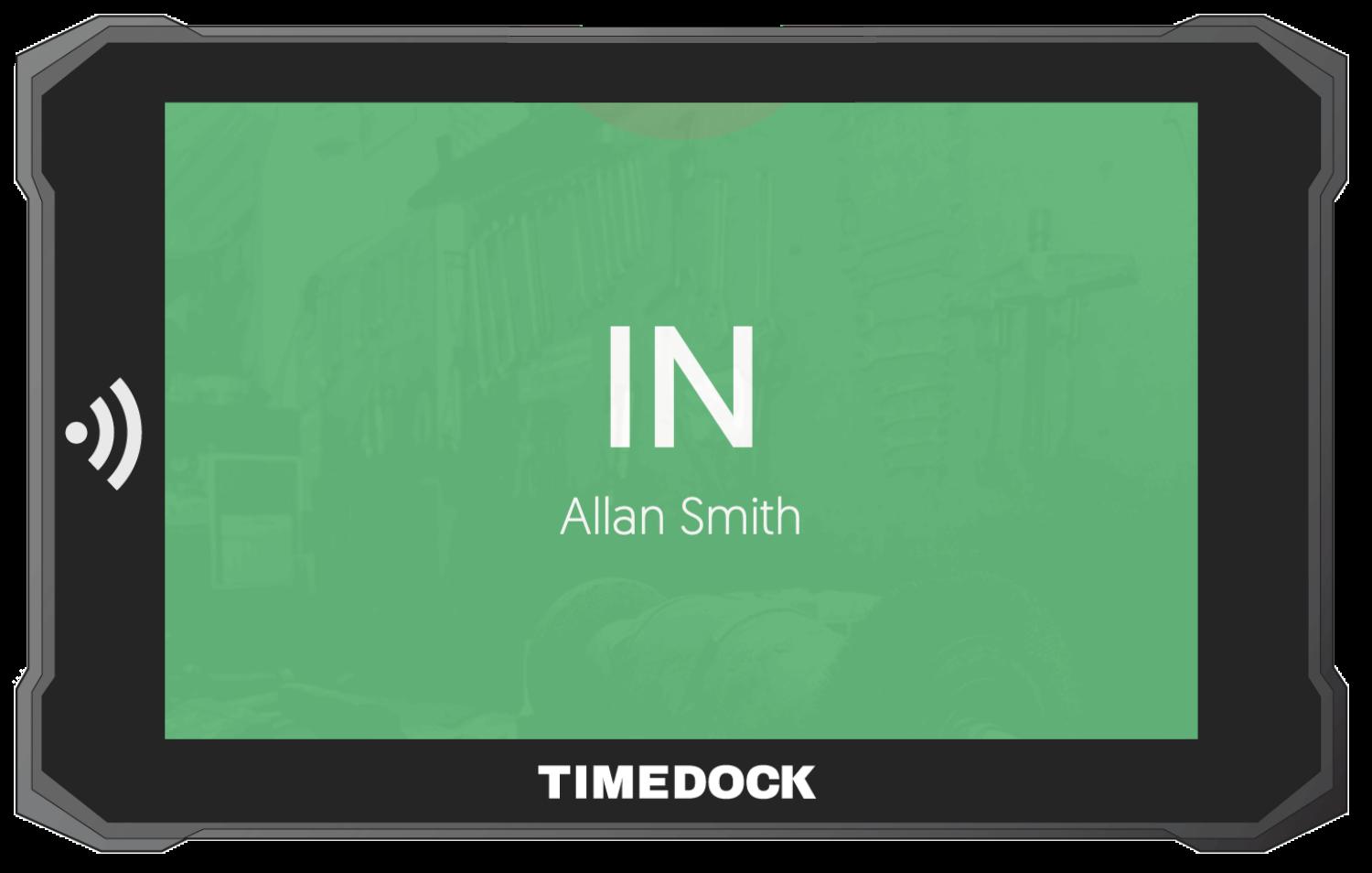

As Xero’s countdown to their June “switch off” (forever) of WorkflowMax, Tidy continues to work with WFM users who have decided that TidyWork is the proven, trusted, replacement.

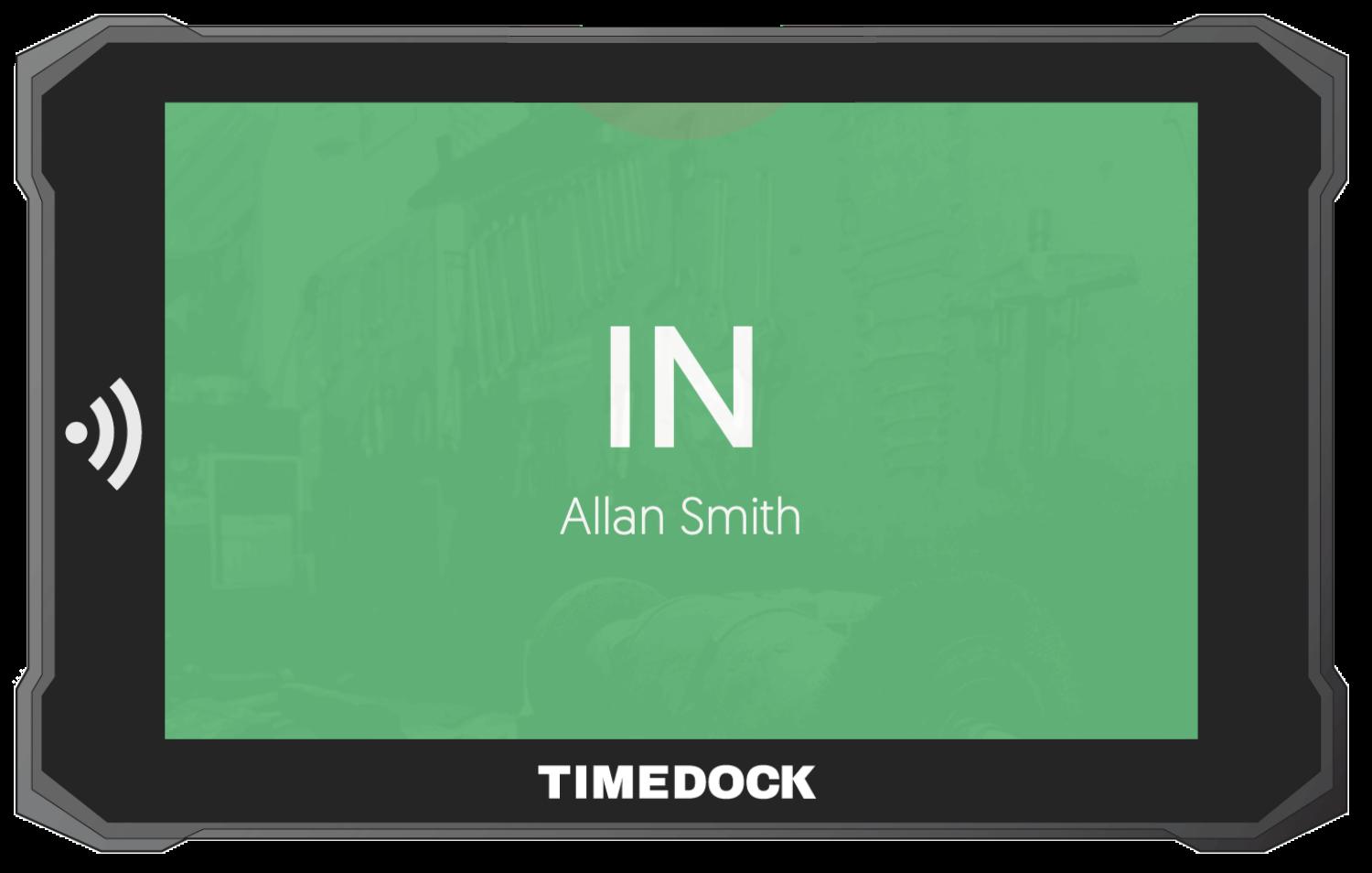

To create even more capability for those WFM converts, Tidy has teamed up with TimeDock to offer even more streamlined workflow capability. This dynamic duo is helping redefine efficiency in project and time management. Tidy, with its 14-year track record in job and project management decided late last year to team up with TimeDock- also a longstanding trailblazer in cloud with their real-time employee time tracking hardware-software

solution. Together, these solid companies and official Xero marketplace partners, form a powerhouse partnership that redefines efficiency and productivity in the modern workplace.

TimeDock's story is one of ingenuity and foresight, led by its founder, Le-roy Staines. Drawing from his experience in the construction industry, Le-roy identified a need for simplified time tracking solutions and set out to fill the gap. What started as a modest QR-code check-in app blossomed into a sophisticatedyet simple time tracking system, driven by a passion for a better user experience and global impact.

@tidyint

Amelia Douglas, Content Creator, Tidy

Amelia began working as an apprentice in the Marketing team at Tidy at the beginning of this year. With a passion for creating engaging content with a positive impact, Amelia provides an exuberant flair in bringing Tidy’s vision to life.

According to recent studies by Deloitte and EY, businesses that prioritise data efficiency are 67% more likely to experience significant revenue growth compared to their less efficient counterparts. Moreover, companies that invest in innovative solutions, such as integrated project and time management platforms, report an average increase in productivity of up to 20%

The collaboration between Tidy and TimeDock represents more than just a business venture - it's a meeting of minds dedicated

to unlocking the full potential of modern technology. Le-roy emphasises the benefits of this integration, stating, "The key benefit for organizations using Tidy and TimeDock is enhanced efficiency and productivity, through systems compatibility". This sentiment is echoed by Tidy's team, who see the partnership as an opportunity to empower businesses with the tools they need to thrive in today's competition.

So an alternative to Workflowmax huh?

Nope, much more than that!

The benefits of the Tidy and TimeDock partnership extend far beyond mere convenience. With real-time data at their fingertips, businesses can make informed decisions, optimize workflows, and stay ahead. Integrated time tracking adds another level of efficiency, providing leaders with quality insights into how employees spend their time without

By seamlessly integrating time tracking with Tidy’s project and job management application, end-user companies get a comprehensive suite of features that streamline operations and drive growth. This not only enhances transparency and accountability but also enables businesses to rapidly identify and resolve issues, optimize productivity, and motivate employees effectively, ultimately leading to improved project outcomes and sustained business success.

Recent case studies have shown that businesses using such innovative platforms experience an average reduction in administrative overhead of up to 30%. Moreover, employees report higher job satisfaction and morale, leading to increased productivity and retention rates.

The partnership between Tidy and TimeDock heralds a new era

of efficiency and empowerment. As Le-roy Staines aptly puts it, "Together we can help organizations more finely tune their systems and operations for greater long-term success.". Kevin Mann, Founder and CEO of Tidy adds, “Adaptability and innovation in our products and partnerships are essential for us delivering competitive solutions to our customers. This close partnership with TimeDoc helps customers get more from their cloud investments built around Xero and helps the Xero community of accountants and trusted advisors to recommend proven, risk-free, Xero marketplace certified, solutions to their clients”

To find out more about how you can make your business Tidy, visit:

https://tidyinternational. com/solutions

@DigitalAccShow

Dan Cockerton, Founder, Digital Accountancy ShowFounder

Digital Accountancy Show expands to two days in 2024 at Evolution London, featuring AI expert Jason Staats and main sponsor Xero.

After achieving an impressive trifecta of sellout shows, the Digital Accountancy Show have proudly announced their expansion to a two-day event in April, driven by overwhelming demand from accounting and finance professionals.

“The experience at DAS this year has been so upbeat, there’s so many likeminded people here to chat with”

– Katy Priestly, Duncan & Toplis

They will return to their new home at Evolution London on April 16th & 17th for a two-day experience consisting of over 100 speakers and 160 exhibitors.

“It is the one accountancy show I would highly recommend”

– Stephen Paul

“In true Digital Accountancy Show

fashion, we’re not content with resting on our laurels. While last year was exceptional, 2024 promises to be even more extraordinary” said Dan Cockerton, Founder

of the Digital Accountancy Show.

“I’ve really enjoyed the perspectives that I’ve been able to get that I can’t get anywhere else”

– Andrew Van De Beek

“Our team is working tirelessly to bring you the most groundbreaking speakers and exhibitors, including exclusive sessions focused on the topics that matter most to your career and firm: AI, recruitment, and automation“

This year’s sessions are being considered the most transformative talks in the industry, with titles including “My Name's Jason And I just Got Replaced By AI” and “Seizing the Upper Hand: Mastering AI Before It Masters You”.

It has been revealed that the show will be exclusively flying in YouTube and AI in Accountancy sensation, Jason Staats. Jason is confirmed to be hosting a unique session on each day, delving into the future of artificial intelligence in accountancy.

“DAS is different to all the other events in the calendar because…

Well, just look at it, right?”

A constant source of support and innovation, Xero, the main sponsor of the show, will once again play a pivotal role, featuring prominently with dedicated

FIND OUT MORE...

Secure your spot:

https://digitalaccountancy. com/ticket-options/

Xero

About

Digital

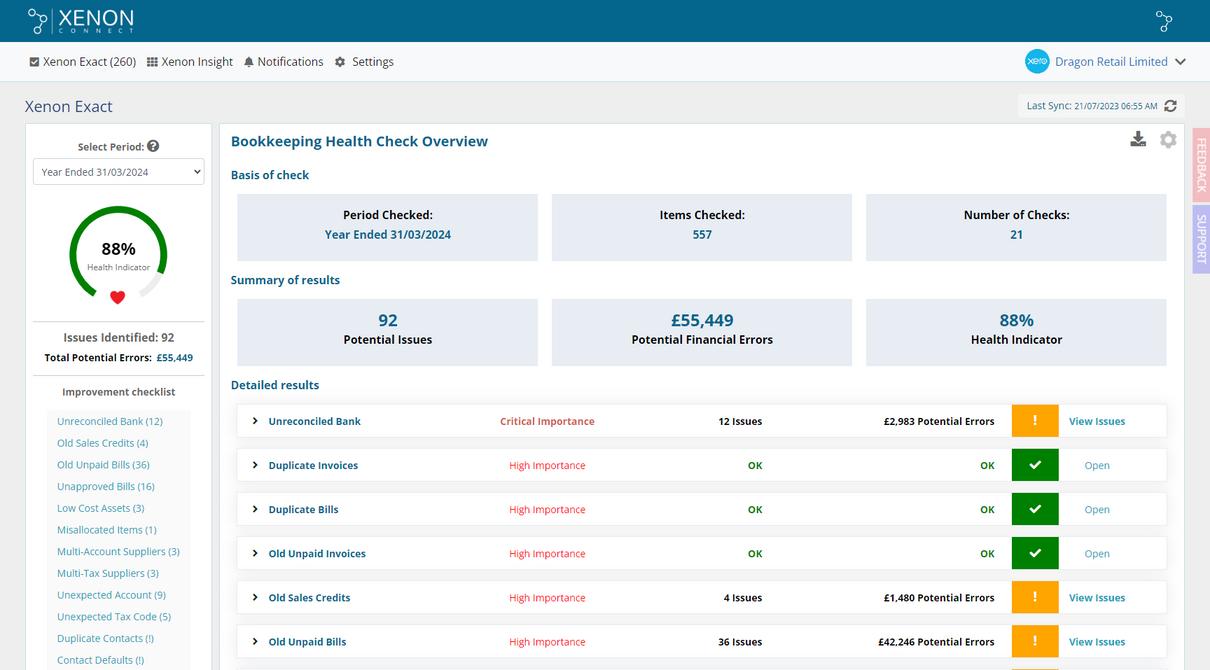

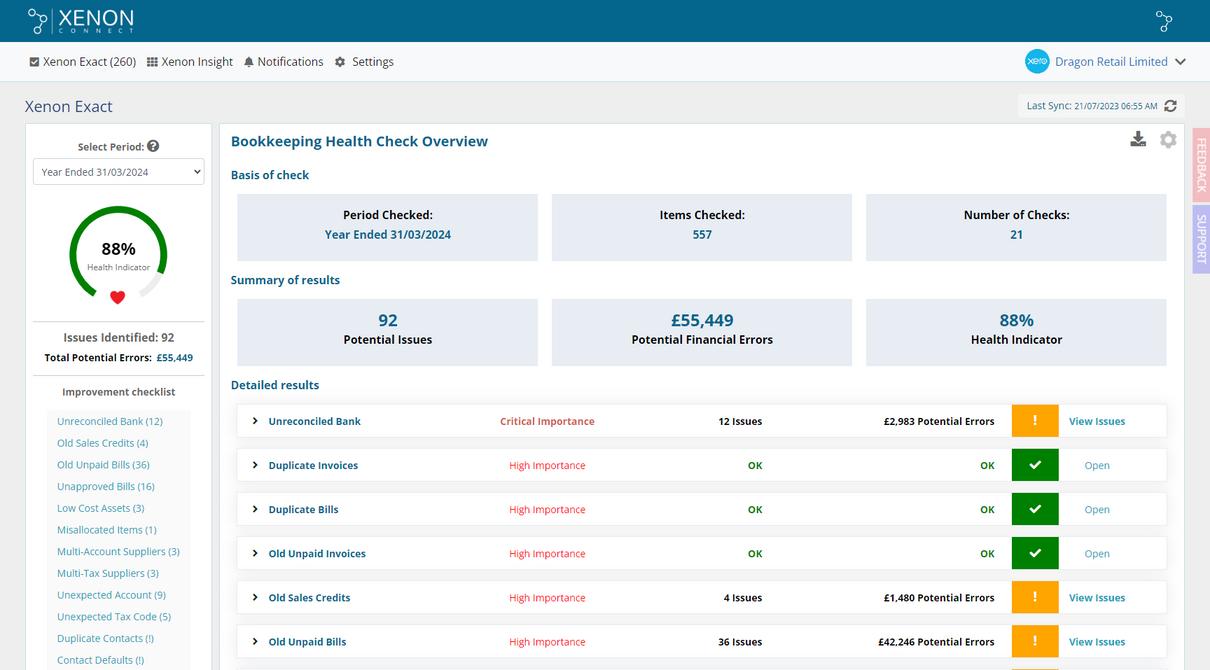

Events Automatically Detect Bookkeeping Errors in Xero www.xenonconnect.com Trusted by more than 400 accounting & bookkeeping firms

SuiteFiles makes filing documents a breeze. With SuiteFiles’ integration with Xero and Outlook, our clients are finding document signing so easy and fast.

We love that signed documents automatically appear back in the right folders. The connected folders are much easier for clients than our previous Client portal.

Test it out for yourself with a free trial. suitefiles.com/trial

Benita Wright, Partner at Wright Doig

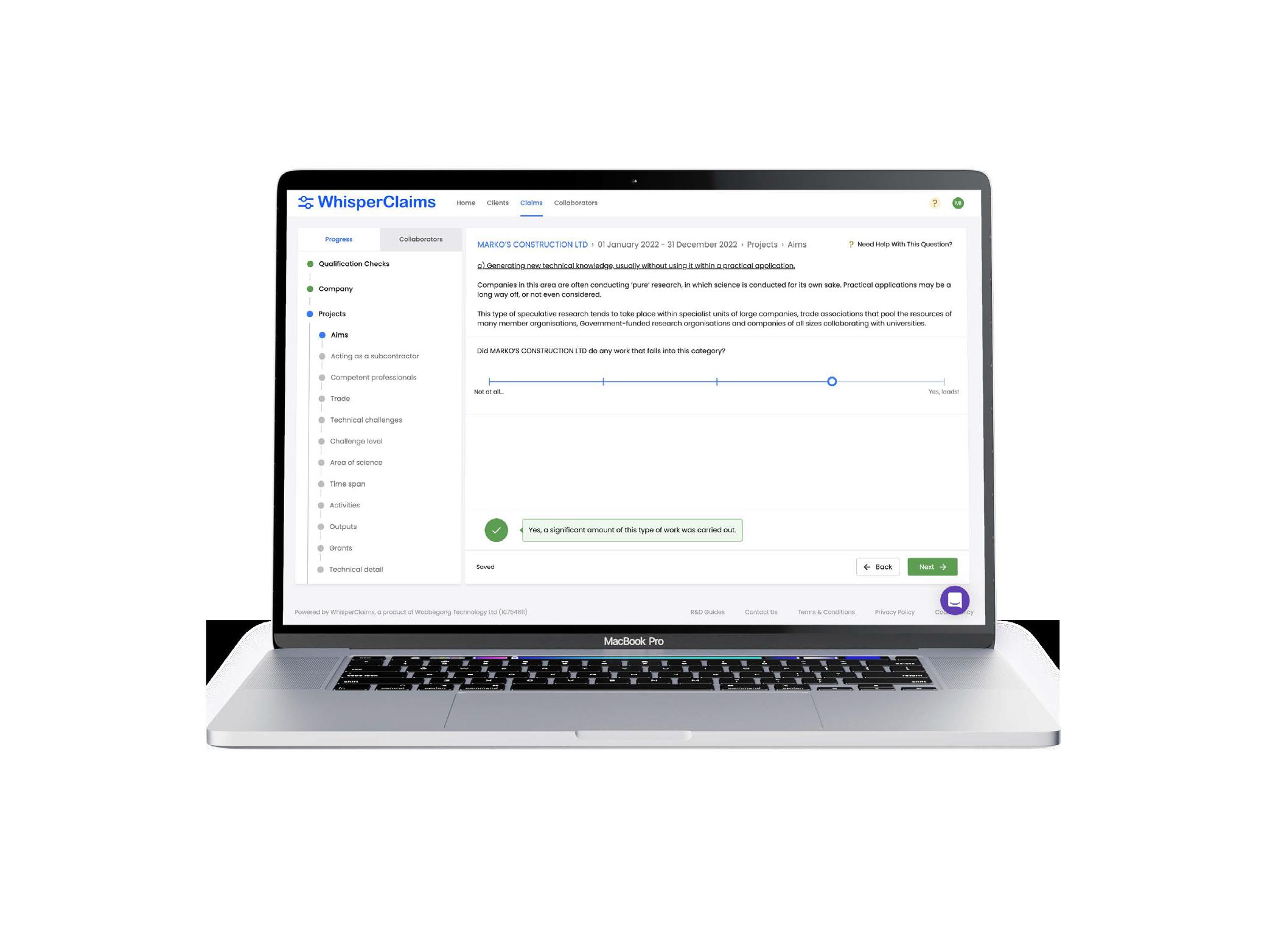

You might remember, back in March 2023, a pivotal moment unfolded in the world of project accounting and financial job management software. BlueRock, a techsavvy advisory firm known for its innovative approach, took a significant step by acquiring the well-loved WorkflowMax brand from Xero.

The brand acquisition marked the beginning of an ambitious journey to revitalise and re-envision WorkflowMax for the modern accounting professional and your clients. It’s now almost a year later and the fruits of this labour launched on 21 February 2024, when we introduced WorkflowMax by BlueRock to the world.

Helping

From the outset, our WorkflowMax by BlueRock team has been driven by a clear mission: to offer a seamless transition for existing WorkflowMax users and provide an improved alternative for businesses either using or looking for a new job management solution. The goal has been to build upon the solid foundation that made Xero’s WorkflowMax a favourite among accountants and bookkeepers – and their clients – while injecting new life and functionality into the platform.

WorkflowMax

by BlueRock‘s development has been characterised by rapid product evolution and underpinned by a growing team of passionate experts who want to exceed user expectations.

Our purpose is ingrained in everything we do: to help people drive productivity, performance and profitability every single day.

Design and development: a familiar yet enhanced experience

WorkflowMax by BlueRock has been meticulously crafted to offer a user experience that is both intuitive and powerful. Drawing on extensive feedback from more

Vince Giovanniello, CEO, WorkflowMax by BlueRock

Vince Giovanniello, CEO, WorkflowMax by BlueRock

With over 20 years of management experience in the field of operations, performance and continuous improvement, I thrive on crafting unique solutions for businesses, from startups to enterprise. At WorkflowMax by BlueRock, I aim to create an environment where innovation flourishes, challenges lead to growth, and success is shared.

than 3,000 small businesses, accountants and bookkeepers, the product and customer experience team enhanced the new platform's usability, streamlining navigation and integrating more robust features for managing workflows efficiently and effectively.

We’re also increasing the data and insights that modern accountants and bookkeepers need to advise more accurately. The result is a platform that feels familiar to WorkflowMax’s long-time users and has an improved level of refinement and functionality that will hopefully set a new standard in job management software.

Migration made easy

One of the key considerations for existing WorkflowMax users is the migration process. We've addressed this head-on by developing a simple-to-use, purpose-built migration tool that makes the transition to the new platform as smooth as possible. To showcase just how easy migration can be, watch a demo of the process. You’ll see a stepby-step walkthrough of how users can transfer their data and get up and running on WorkflowMax by BlueRock without skipping a beat.

The migration tool is designed to minimise disruption and make sure that users can switch without losing any valuable data or experiencing significant downtime. Because the platform

feels similar and familiar, businesses need not worry about completely re-training their teams or having to invest in a large-scale change management project to move software. This focus on a hassle-free transition reflects our commitment to supporting our customers every step of the way, from the initial decision to migrate through to full adoption of the new platform.

A free purposebuilt migration tool will take care of the heavy lifting.

Looking ahead: a commitment to continuous improvement

The launch of WorkflowMax by BlueRock is just the beginning. Our team is deeply committed to continuous improvement, growth and innovation driven by community feedback from our partners (accountants, bookkeepers, software experts) and end users.

This ongoing dialogue means that WorkflowMax by BlueRock will evolve in line with the needs of our users, offering new features, integrations and enhancements that make managing jobs simpler, more efficient, more profitable, and more enjoyable.

For professionals in the accounting and bookkeeping industry, WorkflowMax by BlueRock represents not just a tool, but a partner in your own business growth. Our launch is an invitation to join a community of forward-thinking professionals who value efficiency, innovation and the power of a well-managed workflow.

As we move forward, the promise of WorkflowMax by BlueRock is clear: to deliver a job management solution that users can be proud of, backed by a team full of pride and passion for what they have created.

The journey has only just begun, and we invite you to be a part of this exciting new chapter in job management software. Find out

what's new and what's next on the roadmap.

Supporting our partner community

Our Head of Growth and Partnerships, Ryan Kagan, has been instrumental in the development and strategy for our new partner program. One way we’re enhancing how we collaborate and support each other is through a strategic partnership with Coachbar. Coachbar, founded by the talented quartet of Doug LaBahn, Rob Stone, Josh Drummond and Owen Burley (ex Cin7, Xero, and

Sage to name a few) is set to advance our partner interactions by driving unparalleled value through the universal partner directory. This initiative will enhance our software ecosystem and create meaningful connections between businesses and professional software experts to foster better outcomes for all involved.

Furthermore, Coachbar. io is developing a partner relationship management (PRM) platform for WorkflowMax by BlueRock. The PRM is being co-

Join a community of forward-thinking professionals who value efficiency, innovation, and the power of a wellmanaged workflow.

designed with us, modelled to the needs of our WorkflowMax by BlueRock partners, and complimented by our collective and extensive experiences in partnership channels. This platform will serve as the centralised hub for all partner communications, new business opportunities, operations, education, and collaboration, ensuring that our partners have the tools and information they need at their fingertips.

With new partner agreements, commission structures, certification programs and a vibrant community, we're committed to supporting our partners every step of the way.

If you're interested in joining our partner community, we invite you to register here.

Empowering customers through the transition

At the heart of our customer success strategy is Kaia Kaldoja, our dedicated Head of Customer Success. For those of you who don’t know, Kaia was responsible for growing the BlueRock bookkeeping practice for 6 years, powered by WorkflowMax. She knows just what it takes to build an efficient, profitable and automated business. Under Kaia's leadership, we're rolling out a comprehensive and free support package designed to make the transition to WorkflowMax by BlueRock as smooth and stress-free as possible for customers.

50% off 3 months of subscription fees* – to ease the transition for WorkflowMax by Xero customers, we’re offering an exclusive discount for signups by 1 April 2024. It’s our way of supporting partners and customers through the change and making sure you all experience the full benefits of WorkflowMax by BlueRock without any hassle. *Terms and conditions apply.

New bite-sized training and education courses – get the knowledge and skills to make the most of WorkflowMax by BlueRock with our user-friendly learning management system (LMS).

1:1 migration planning sessions – offering a personal touch, these sessions give customers the opportunity to engage directly with our team, discuss their specific needs, and finalise their migration plan.

We’re making the transition to WorkflowMax by BlueRock as smooth and stress-free as possible for customers.

Weekly migration drop-in sessions – for those quick questions or when guidance is needed without delay, our weekly dropin sessions are the perfect opportunity to connect with our experts and get answers in real time.

Weekly product updates – led by our Head of Product, Chris Galt and Product Manager, Macaulay Hey, these sessions (some live and some recorded) are a fantastic way for customers and partners to stay informed about the latest updates, changes and future product developments.

the information they need, we've launched a new help centre that’s complemented by 24/7 support for all users. These are championed by our Product Experience Manager, Joanna Bellis and Head of Customer Support, Kuang Gan who have over 20 years of combined experience with the product.

Complimentary discovery sessions with our partner network – these are for customers with larger and more complex needs who’d like to engage with an expert. You can contact an implementation partner in our directory for a free conversation about your migration requirements, planning, staff training and account optimisation. Most partners have a range of support packages available to suit all budgets.

We hope you take advantage of all these resources and join us on this exciting journey towards improved productivity, performance and profitability.

If you have any feedback for me directly, you can contact me on LinkedIn

Tap into our free migration support package – here's what’s included for customers

Free access to the migration wizard – we’ve built a reliable tool to easily transfer your clients’ data. All important historical information comes across and businesses can continue as normal, with minimal disruption.

In-product educational journeys – new guided tours within the product will highlight improvements and changes, eliminating the need for teams to completely relearn the product from scratch.

Around-the-clock support and a new help centre – to make sure customers can quickly find

Get in touch with us: Website

Ignition helps accounting and bookkeeping firms reclaim time, profitability and cash flow. Automate proposals, billing, payments collection and workflows in a single platform.

Did you know 40% of people who are paid incorrectly, consider resigning. Yet, payroll services are still undervalued and seen by some smaller practices to be a ‘necessary evil’ to maintain a happy client and make a profit from other accounting services.

It’s time we stopped overlooking payroll, and truly understand the value that we can give to clients by ensuring that not only this service is done well, but also running a payroll division profitably.

Payroll should be a key strategic partner in driving

Over the past three years, I’ve spent countless hours attending accounting conferences around the world, with very little mention of payroll. Payroll, many of you would say is not within an accountant’s remit.

In fact, other professional bodies take care of payroll, such as the CIPP in the UK, and Payroll Org in the US. The Bookkeeping Institute also covers payroll for its members.

Yet, a client’s first point of contact for payroll will likely be their accountant. After all, our accountant deals with numbers

and taxes, payroll is also numbers and taxes hence it must be in their remit.

Faced with this challenge many accountants take on payroll, to maintain a client with their firm.

Payroll was once a simple process of paying employees. At one point it may have well been that, however, today this has very much changed.

Payroll teams can easily highlight numerous legislations that have made their job harder. Bringing some examples from the UK, the simple notion of paying time taken off, known as Holiday Pay, is nothing but simple.

Most accountants I know have been trying to shift this responsibility back to the business, simply because they do not have the necessary underlying data to be able to do this accurately.

For those of you not familiar with the legislation, it requires someone to collect 52 representative weeks where the employee was working, in which there were no days off, or sick. Someone may have to look back up to 2 years, to identify these, then work out an average weekly

@jonmifsud

Jonathan Mifsud, CoFounder, Buddy

Jonathan, Co-Founder & CTO of Buddy, has spent over 9 years working closely with accounting practices and payroll bureaus, helping them to scale and enhance their services.

He went into the depths of learning payroll, from calculations into leveraging his technology background to deliver a collaborative payroll solution, that doesn’t only allow peopleto collaborate but brings together various Apps integrated into payroll via APIs.

pay, based on which holiday is then calculated.

Based on conversations with leading influencers in the bureau space, what seems to have happened is that as these legislations came through, your payroll teams have kept providing their service, with added complexity, without raising prices, putting payroll under duress.

In the 5 years I’ve been involved in payroll, I’ve been noticing a shift. Payrollers are starting to talk about these challenges more frequently. As a result, we are seeing change, that is aligning with a technological shift within payroll. However, the biggest change that we can see is recognition.

Maria Mason, is a prime example, being made a Partner at BDO. Being one of the very few partners at accounting and audit firms, that are not an accountant or an auditor. Speaking at ACE23, the annual event organised by CIPP, she reiterated that her payroll division is one of the most profitable within BDO.

In a piece published by Alternative Insights, she shared how leveraging technology they were able to go from 500 to 1,000

payslips per person and shifted the extra resources towards advisory around payroll. One would say a key strategy in order to drive profitability

Cloud Payroll; round two.

Cloud accounting has over the past decade taken the industry by storm, and shifted plenty of firms from traditional accounting giants and ERP systems into the likes of Xero and other accounting players.

Payroll software, at least in the UK has somewhat lagged behind. The biggest players in the space have in so far been legacy desktop products. A few years ago the first wave of cloud payroll solutions hit the market.

Maybe the market wasn’t ripe; maybe they didn’t understand the customer base or simply ran out of cash. Most of these solutions, have, been acquired by larger businesses. Sometimes to augment a pre-existing HR solution that’s meant for larger businesses, and at times to simply knock out competition and add

to a collection of shelved payroll systems.

Hence a big question that comes up for any new payroll product in the UK, is what’s your exit strategy?

This caution and need for longevity from this second wave of cloud payroll products is understood. Choosing a sustainable business that doesn’t need to sell out, is critical given the risks, costs and efforts that come with a payroll migration.

With employers ever-keener to retain existing staff to avoid hiring and re-training costs payroll should be a key strategic partner in driving retention, especially when you consider that 79% of payroll errors are found by employees.

A key challenge many accounting firms encounter when looking at investing in cloud payroll is the sheer price jump.

Cloud Accounting solutions, come with a fixed per-entity cost, whereas payroll tends to be charged on a per-employee basis, easily ballooning costs for larger clients. With margins on payroll traditionally low; moving to the cloud means a re-pricing conversation. Something many are not yet attuned to.

Based on our previous experience in Malta we found that decoupling the payroll license, from people related per-employee services that employers value achieves the best balance to ensure that your relationship with the client and their employees prospers.

Embrace the future of payroll – where strategic insight and technology meet to elevate your practice and client satisfaction.

Discover the power of Cloud Payroll designed for Accounting Firms

www.buddy.hr/uk

Part of Xero’s preferred app stack

little bit of focus on financial controls can bring a whole lot of benefits.

In PwC’s Global Economic Crime and Fraud Survey, just under half (46%) of businesses surveyed experienced some form of fraud or economic crime in the last two years. This shows that a huge portion of businesses still don’t have enough checkpoints and guardrails to stay on top of financial processes – leaving them vulnerable. Financial controls are simple steps that can help with compliance, reduce risk, and even boost overall productivity by making many tasks easier.

Research commissioned by PwC found internal financial controls do indeed work – two-thirds of organisations that experienced fraud discovered their most disruptive incident through financial controls. No matter the size of a business though, now is the time to build good habits and put these essential steps in place.

What are financial controls?

Financial controls are policies and procedures that are put in place to keep financial records in check and protect company assets. Along with preventing or detecting accounting errors, they also help find and deter fraud, such as account skimming,

misappropriation of assets, or false expense claims.

Most larger organisations have fairly extensive financial controls due to the size of their teams. Smaller businesses, on the other hand, tend to have less rigor around these processes – it’s not uncommon for one person to handle most financial tasks. Adding controls not only makes their lives easier and the business safer in the long term, but also those of their accounting and bookkeeping partners.

Here are six essential financial controls businesses of all sizes should put in place for smoother and more secure operations:

1. Segregation of duties: Segregating duties means that no single employee has total control over a financial transaction – like processing invoices or approving expense claims. This improves the accuracy of financial data and minimises the risk of fraud.

When setting up a workflow, the more junior employee should book the journal or set up the payment and the more experienced team member authorise or book the transaction.

While these processes should involve a minimum of at least two

@ApprovalMax

Stuart Hurst,Head of Accounting, ApprovalMax EMEA

Stuart manages one of the fastest growing accounting firms in the UK, as well as mentors numerous accounting firms to help them grow while managing change.

Winner of the prestigious Xero's most valuable professional, he's well-versed in the app ecosystem and has completed over 2,000 cloud conversions and integrated hundreds of apps.

individuals, companies should plan for when staff are on annual leave with alternate workflows so time-sensitive transactions can still go ahead.

2. Reconciliations: Reconciliations aren’t a once-off – they should be done regularly. This process of matching accounting to source data keeps financial information up to date and can pin-point anomalies that can undermine the integrity of financial records.

Reconciling accounts weekly will make it easier to fix errors, helping to stay on top of banking, payroll records, and fixed asset registers. Retail businesses with a physical shop front should reconcile cash takings against transaction records, while those operating online should remember to reconcile digital transactions.

3. Authorisations and approvals: Financial controls include setting up who is responsible for what. Limits on who can authorise or approve transactions above a certain amount can keep tighter reins on spending, helping companies to stay on budget and make sure any spending policies are consistently applied throughout the business for both employee expenses and supplier invoices.

Tools like ApprovalMax can streamline these transactions through approval workflows related to managing purchase orders or employee expenses. By automating these, actions can progress easily without having to manually chase or nudge the next approver.

4. Control over budgets: While authorisation processes help, it’s still important to track and monitor company spend across all budgets so that expenses are within planned limits.

If you don’t check budgets before giving approval to pay bills and invoices, it can cause working capital issues.

This makes it harder to pay suppliers on time and increases the likelihood of needing shortterm funding, which isn’t always ideal.

Certain tools simplify, or even automate, this process. Where possible, seek out cloud-based options that compare company budgets to live accounting data, inspect and document variances.

5. Compliance checks: New legislation, like Making Tax Digital (MTD), and an increase in fraudulent activity make it more critical than ever for businesses to establish compliance checks in their finance departments.

Thankfully, there are ways to make sure your business is compliant. Businesses should use anti-money laundering (AML)

and Know Your Customer (KYC) procedures to check suppliers are legitimate and manage any associated risks.

These usually include obtaining original documentation, such as company registration details and, where relevant, VAT numbers.

It’s worthwhile also finding information on company directors to see if they’ve recently managed companies which have gone insolvent.

If offering customers payment terms, run credit checks during the onboarding process and regularly monitor them for adverse financial events, such as County Court Judgements (CCJs).

6. Audit trails: Maintaining details of who has created and approved transactions keeps finance team members accountable and makes it easier to interrogate large and unusual transactions during an audit.

The good news is many modern ledger software vendors automatically maintain an audit trail, including ApprovalMax. This can be run as a filtered report, listing initial transactions and any changes will be date stamped with specific user details, and is particularly useful at month-end when financial controllers may need to fix entries that weren’t input correctly. Third-party addons, such as ApprovalMax, can provide audit trails for processes not covered by ledger software, including accounts payable and accounts receivable workflows,

purchase order management, payments, invoicing, and quotations.

Putting financial controls into place

Setting up financial control processes doesn’t have to be complicated or painful. In fact, you often end up saving huge amounts of time in the long run, especially when adding automation to the mix.

Neglecting financial controls and postponing process development is a common tendency. Often, the significance of these measures isn’t fully recognised until a crisis occurs, resulting in substantial expenses and hardships. Many businesses fail to grasp the potential severity of the consequences. It’s crucial to address these controls proactively to safeguard against unforeseen challenges and mitigate potential losses.

Businesses with several layers of robust financial controls in their business will have better a financial health score, smoother operational efficiency, better legal compliance, and higher survival rates.

Want to try ApprovalMax? Start a trial, visit:

www.approvalmax.com

s we stand on the brink of a new era in the accounting sector, the winds of change are powered by automation and advanced technologies.

The future of accounting is not just an evolution; it's a revolution, spearheaded by innovations that promise to transform the traditional ledger into a dynamic, intelligent, and highly efficient system. At the forefront of this transformation is MYT, a visionary brand that has embraced the

potential of AI to redefine accounting for micro and small businesses.

The accounting industry is undergoing a seismic shift, with automation and artificial intelligence (AI) leading the charge. These technologies are not merely add-ons but are becoming integral to the accounting process, offering unprecedented accuracy,

@app_myt

Oumesh Sauba, CEO, MYT

Oumesh Sauba is the founder and CEO of MyT Limited, a revolutionary AI-driven accounting app and software designed to support freelancers and micro businesses with their bookkeeping and records. He is also director of his own Croydon-based accounting firm Sauba and Daughters Co, and has over 15 years of experience as a Chartered Management Accountant specialising in financial accounts, management accounts and taxes.

efficiency, and insights. Automation simplifies repetitive tasks, from data entry to complex calculations, freeing accountants to focus on strategic decisionmaking and advisory roles.

AI-Powered Data Extraction: A Game Changer

One of the most significant advancements in accounting automation is AI-powered data extraction. This technology streamlines the processing of invoices, receipts, and bank

statements by converting them into digital data. The result is a faster, more accurate, and highly scalable solution to bookkeeping that minimises human error and maximises productivity.

MYT stands as a beacon of innovation in the accounting landscape. Born from the desire to simplify bookkeeping, MYT has evolved into a comprehensive tool that embodies the future of accounting. With its AI-powered software, MYT automates VAT returns, prepares profit and loss statements, and generates balance sheets with unparalleled precision.

commitment to excellence and innovation. By leveraging optical character recognition (OCR) and machine learning, MYT has optimised data extraction, making bookkeeping a swift and hasslefree process.

Automation simplifies repetitive tasks, from data entry to complex calculations, freeing accountants to focus on strategic decision-making and advisory roles.

MYT is not just adapting to the future; it's actively shaping it. The brand's approach to automation and AI reflects a deep understanding of the industry's needs and the challenges faced by accountants and bookkeepers. By focusing on technology that enhances efficiency and accuracy, MYT is setting new standards for what accounting software can achieve.

Making Tax Digital initiative is a testament to its forward-thinking design and its ability to meet rigorous standards.

Conclusion: A New Chapter in Accounting

The future of accounting is bright, with automation and AI leading the way to a more efficient, accurate, and insightful industry. MYT is at the heart of this transformation, embodying the change that is reshaping the accounting landscape. As we look ahead, MYT's innovative solutions and visionary approach offer a glimpse into a future where accounting is not just about numbers but about empowering businesses to achieve their full potential.

Efficient, user-friendly, affordable, innovative, and simplified—these are the pillars upon which MYT is built. The brand's journey from an ambitious concept to a transformative tool highlights its

Moreover, MYT's adaptability and resilience, especially evident during the global lockdown, showcase its potential to lead in times of change. The software's compliance with the HMRC's

https://getmyt.com/ Accountants/

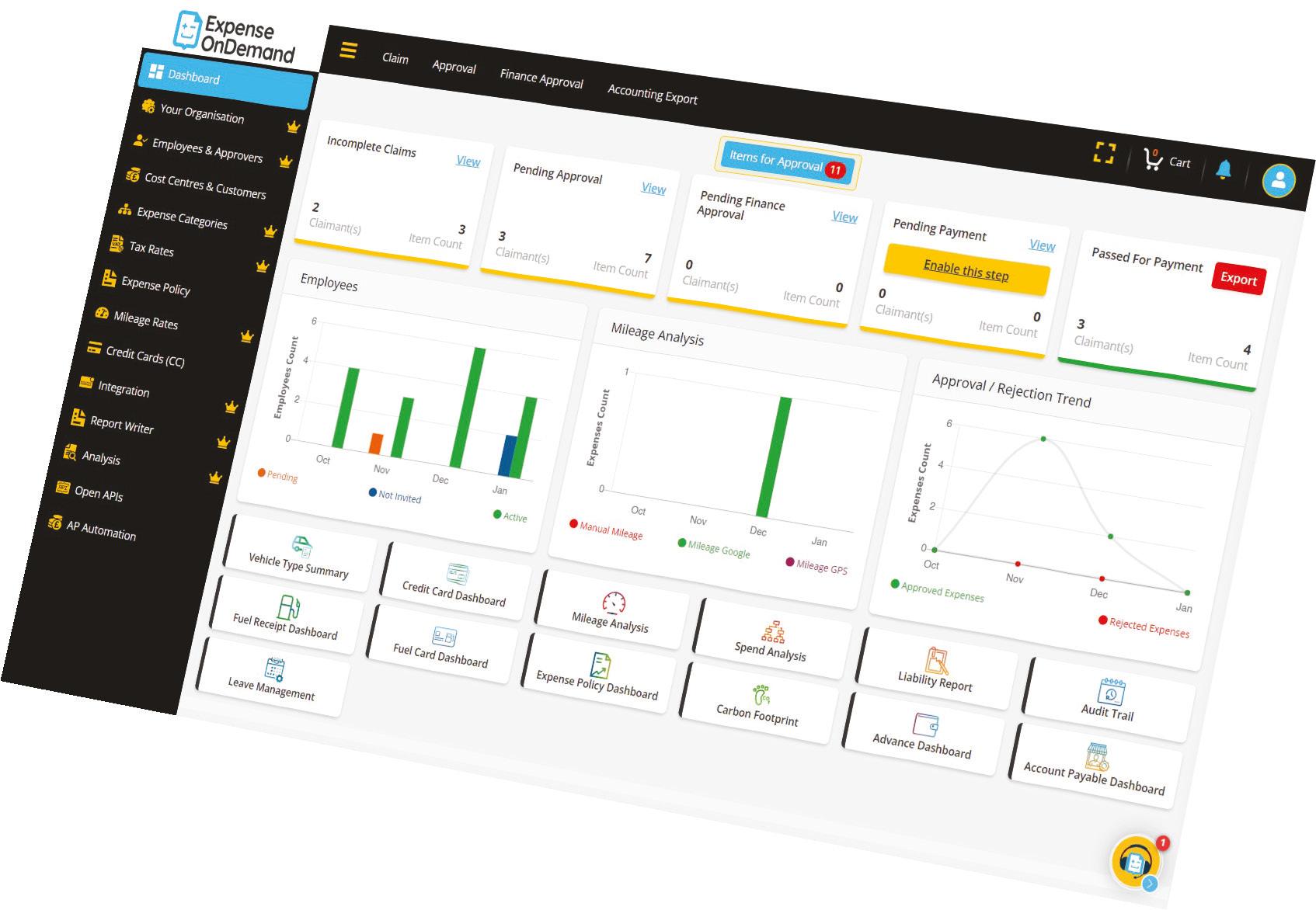

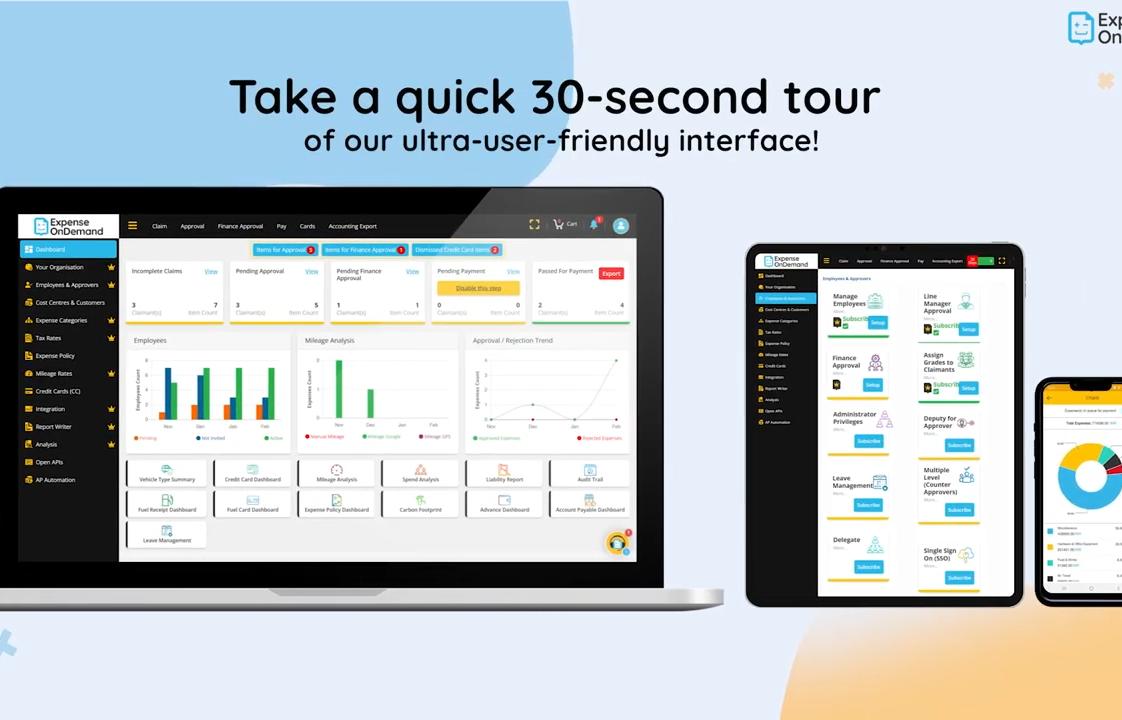

ExpenseOnDemand helps you say goodbye to spreadsheets, lost receipts & confused claimants. Say hello to on-the-go approvals, automated reports & simplified compliance.

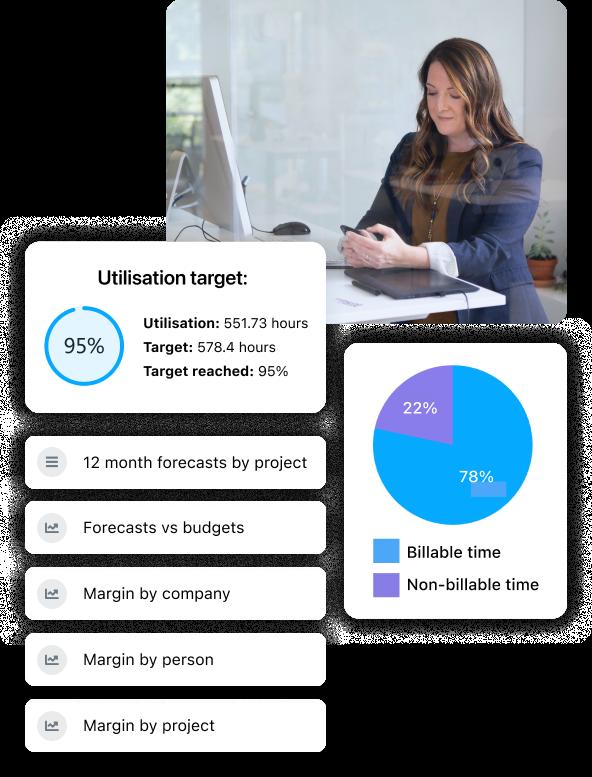

Nicola Stewart, Content Manager, Projectworks

Nicola Stewart, Content Manager at Projectworks, is a skilled writer specialising in Professional Services. Focused on industry news, expert advice, and software, Nicola brings a fresh perspective to the business world.

As technology continues to advance in the accounting space, accountants and bookkeepers are expanding their services to provide more value to their clients. By offering software advisory as an additional service, accountants can offer greater support and remain competitive in the market.

f you're an accountant or bookkeeper seeking to broaden your horizons and venture into advisory services, the professional services sector is an excellent starting point. This sector has long been overlooked, and therefore, offers lucrative opportunities for those willing to offer expert advisory support.

The professional services sector comprises businesses that specialise in different services but share a common business model. As a result, if you develop knowledge and skills in the professional services sector, you can advise multiple industries.

Some examples of professional services businesses include architects, software developers, engineers, advertising agencies, management consultants, creative studios, and many more, all of which operate on the same underlying model.

As of 2023, professional services have the 4th largest market size in Australia, attune to the sum of AU$263.2bn*. In addition, the sector is projected to bring in AU$2.44bn in 2024 alone**.

*IBISWorld: Professional Services in Australia Report

**Statistia: Professional ServicesAustralia

The opportunity is there, and clients are looking for people with your expertise to guide them.

One thing that we have observed over the years is that a lot of professional service firms are

not aware of what metrics they should be tracking, and frequently depend on past data without any forward-looking planning. Knowing the essential metrics used to gauge success within professional services is the first step in becoming a trusted advisor.

To help you get started, here are the 3 most important metrics for professional services to track:

Gross Margin

Professional services should be actively monitoring their gross margin to avoid potential revenue or cost concerns. Currently, many consulting businesses track their gross margin on a monthly basis, after invoicing, which is too late to make any improvements. By providing your clients with realtime gross margin information, they can be assured that their business is increasing its average

gross margin over time.

Gross margins should be between 10% and 30% on the lower end, all the way up to 50-85% for clients offering more unique services.

Projectworks allows clients to see all of the above, plus their projected margin. This gives them a glimpse into the future and an opportunity to make actionable changes in advance if needed.

Professional service firms must measure their utilisation rates to thrive. Utilisation rates are a critical metric that quantifies the amount of billable hours dedicated to revenue-generating activities by employees. Failing to measure utilisation rates means operating blindly, which can hinder a firm's growth and profitability.

In general, a company-wide utilisation rate of over 80% is considered acceptable, while over 90% is outstanding. This can however vary based on the services your clients provide.

While most firms have their utilisation targets tucked away in spreadsheets, few proactively manage them, and even fewer look at them in advance based on a resourcing plan. This is a lost opportunity as

professional service businesses can significantly increase their margins by measuring and improving their utilisation rates. Providing support in this area is a highly valuable skill that clients will appreciate.

Assisting your clients in balancing costs is likely something you're familiar with. You can utilise your expertise to help professional services increase their profit margins through appropriate leverage. In professional services, leverage refers to the ratio of senior professionals to less experienced employees within a firm. Finding the right balance is crucial, as a project staffed only with senior consultants can be costly, while a project with only junior employees may lack adequate quality control.

The average professional service firm should aim to maintain a balanced leverage ratio of around 6:1 - 8:1 (low experienced staff to experienced staff) on each project.

Professional services firms need advisers, could you be one?

The professional services sector is diverse and requires expert financial, and software advice. Through educating yourself on

one business model, you can serve a variety of clients as they share common KPIs, metrics, and advisory needs.

This is just a taster of the Professional Services sector, but if you’re curious to know more - consider joining our Partner Program. Within the Partner Program, we teach you how to advise professional services and offer information about Projectworks as an option for your clients.

The partnership is mutually beneficial as it helps us find new customers, and provides you with a highly rated software option for your clients, and commission, or the option to pass the savings on to your clients.

And that’s it! No contract is required, and you get all features from day #1, as well as unlimited clients, users and storage.

Try for free

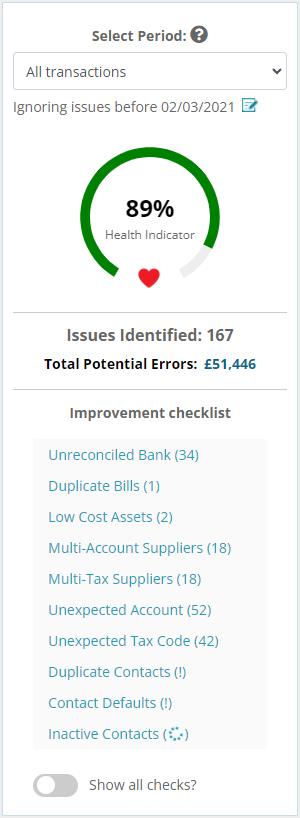

@xenonconnect

Gareth Salomon FCA, Founder, Xenon Connect

Gareth Salomon is a Chartered Accountant who has operated his own UK accountancy practice since 2010. He founded Xenon Connect in 2021, cloud software that connects to Xero and automatically detects more than 20 different types of bookkeeping error, saving accountants and bookkeepers time and money. He experiences the challenges facing bookkeepers and accountants in practice firsthand, daily, and enjoys addressing those challenges through Xenon Connect.

Gareth Salomon FCA discusses 5 ways that automatic bookkeeping data quality checks have become the secret sauce for practice growth.

As bookkeepers and accountants, we love data. A neatly reconciled bank account, a meaningfully accurate aged creditors report and a net pay control account whose balance neatly consists of the most recent submissions only. Pure bliss!

Let’s discuss how you can use bookkeeping data quality reviews

to harness that bookkeeping data and grow your firm…

Communicating your value – In all honesty, how do you currently evidence your knowledge and value to prospects during that first meeting? Imagine going into that first prospect meeting fully armed with

"Data quality and transactional activity reports give you the information you need"

an automatically generated bookkeeping health report and a couple of large transactions where purchase tax has been under-claimed by the previous advisor. If you were the client, would you be impressed? Is the prospect likely to choose you or one of the other two advisors that spent 30 minutes merely finding out what services are required?

Accurate Proposals – How many times have you had a quick glance at a prospect’s Xero data (probably just to get a rough idea of transaction levels and previous advisor’s fee in the P&L) before coming up with a proposal, only to realize later that there are thousands of unreconciled bank and credit card transactions, hundreds of unpaid invoices & bills dating back 5 years and far too many high value transactions in “429 – General Expenses”? How did the client feel when you doubled their fee? Or did you just suck it up yourself leaving money on the table? Data quality and

transactional activity reports give you the information you need to produce an accurate proposal, first time.

Gamifying and motivating

– A bookkeeping health score provides a tangible reading of the amount of work required to get the client’s records to an accurate trial balance. The race to get a client’s bookkeeping health score back up to 100% is addictive and extremely motivating – for you and your team members. The team member is motivated to work more efficiently, work gets pushed out of the door sooner and the firm increases profits. Pretty compelling!

Automatic Systemization – The problem with most systems in a firm is that they take a lot of time to develop, review and amend. Bookkeeping data quality checklists and reports are automatically generated, driven by the underlying bookkeeping data. They require very little setup and handholding. They systemize the bookkeeping process, allowing the team to focus on the fee-generating work.

Who needs help? – The ability to have a bird’s eye view of the bookkeeping health score for all of your clients is extremely useful. Which team members are struggling with technical issues? Not bringing bank reconciliations up to date in a timely manner? Are overworked? Bookkeeping health statistics give you the visibility required to nip such issues in the bud before they manifest.

A Final Thought – Every client is unique, with differing levels of complexity involved. Let’s use tools that harness the data we already have to identify exactly what our clients’ needs are, who is best suited to service each client and what fee is fair for the work involved.

Get started with Xenon Connect for free:

https://www. xenonconnect.com

nvironmental, social and governance (ESG) reporting is now becoming an increasingly necessary aspect of business activity. Not only are enterprises recognising the need to be involved in ‘measuring what matters’ beyond the bottom line, but they’re also seeking solutions to the problems that organisations and communities face in this modern world.

Spotlight Sustain offers crucial functionality across all key areas of ESG, with the ability for reports to drill down on what the business or client is most interested in.

“We believe that if ever there was a time to create a new and positive ripple, it’s now"

Recognising this need, Spotlight Reporting has launched its standalone ESG reporting solution, Spotlight Sustain. With over 12 years of expertise in delivering engaging and actionable reports and forecasts to accountants, CFOs and advisors, Spotlight Reporting’s new Sustain product aims to streamline the ESG reporting process, access data from leading specialist providers, while also being highly customisable and adaptable to specific business needs and initiatives.

Designed for advisors, accountants and CFOs alike,

Through customisable templates, extensive graphs, and the ability to add additional commentary and imagery, Spotlight Sustain provides the means to deliver actionable and engaging reports on the following areas:

• Environment: with a focus on improving impact, monitoring and reporting on environmental initiatives

• Social: to develop and evolve company culture and structure, analyse and track social performance indicators

• Governance: to report on governance while also taking into account specific measures relating to organisational oversight

To this day we remain a small

@spotlightrep

Richard

Francis FCA, CEO and Co-Founder, Spotlight ReportingRichard is the founder and CEO of Spotlight Reporting, a global business intelligence software company for accounting firms and CFO’s. Prior to Spotlight Reporting, Richard was in practice as a Chartered Accountant, starting his career at a large firm before moving to the UK for four years and has also worked as a General Manager for Xero (2012-14), having had a software business acquired in 2012.

but passionate team combining great software with the human touch. We continue to innovate and respond to customer needs, whilst also looking through a long lens at what our next disproportionate impact could be.

We believe that if ever there was a time to create a new and positive ripple, it’s now. By now, everyone realises that our planet’s inhabitants and organisations are grappling with unprecedented change and how to measure, reduce and mitigate the consequences of our human activity and choices. Transparency is lacking, the rules of engagement are unclear and we are still learning what it means to be good citizens and guardians of our world.

In a small way, we hope to use our decade-plus of reporting and forecasting experience to shine a light on ESG metrics and to encourage and educate the ‘sustainable-conscious’ organisations that want to ‘measure what matters’ beyond the dollar signs. This is us ‘leaning in’ alongside those in the front lines of carbon footprint mitigation, sustainability advisory,

progressive accounting, leading certification organisations, and those encouraging and guiding momentum on diversity, gender, community and other aspects of sound governance and corporate citizenry.

We believe that by allowing a coalition of the willing – and yes, there will be compulsion increasingly too as regulators move beyond strictly financial measures of success and impact – to more easily report holistically

across their spectrum of possible ESG measures and KPIs, we may just have a positive impact on actions and outcomes. If we can be a tiny part of the way forward on climate change, community endeavour, customer satisfaction and accessibility, sound and transparent governance and employee opportunity and diversity, then count us in!

By now you can tell that Spotlight Sustain has been a personal product journey for me and many

“By now, everyone realises that our planet’s inhabitants and organisations are grappling with unprecedented change and how to measure, reduce and mitigate the consequences of our human activity and choices.”

on the team, too. After all, don’t we all want our organisations, people, communities and planet to thrive?

https://www. spotlightsustain.com/

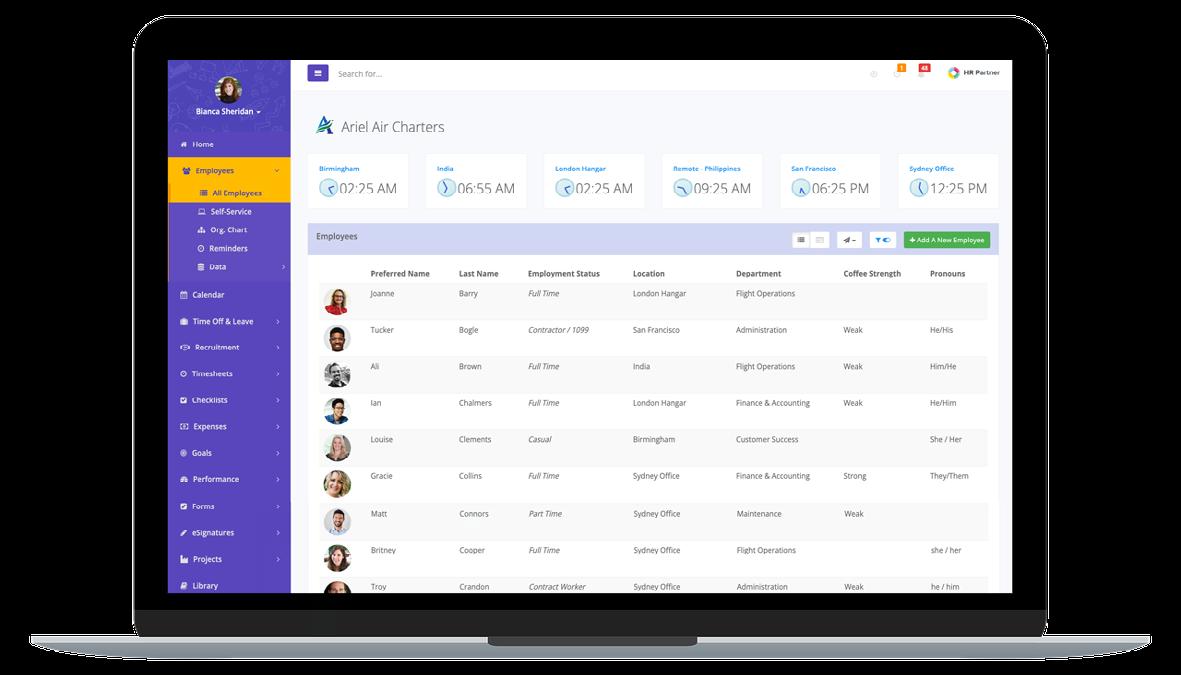

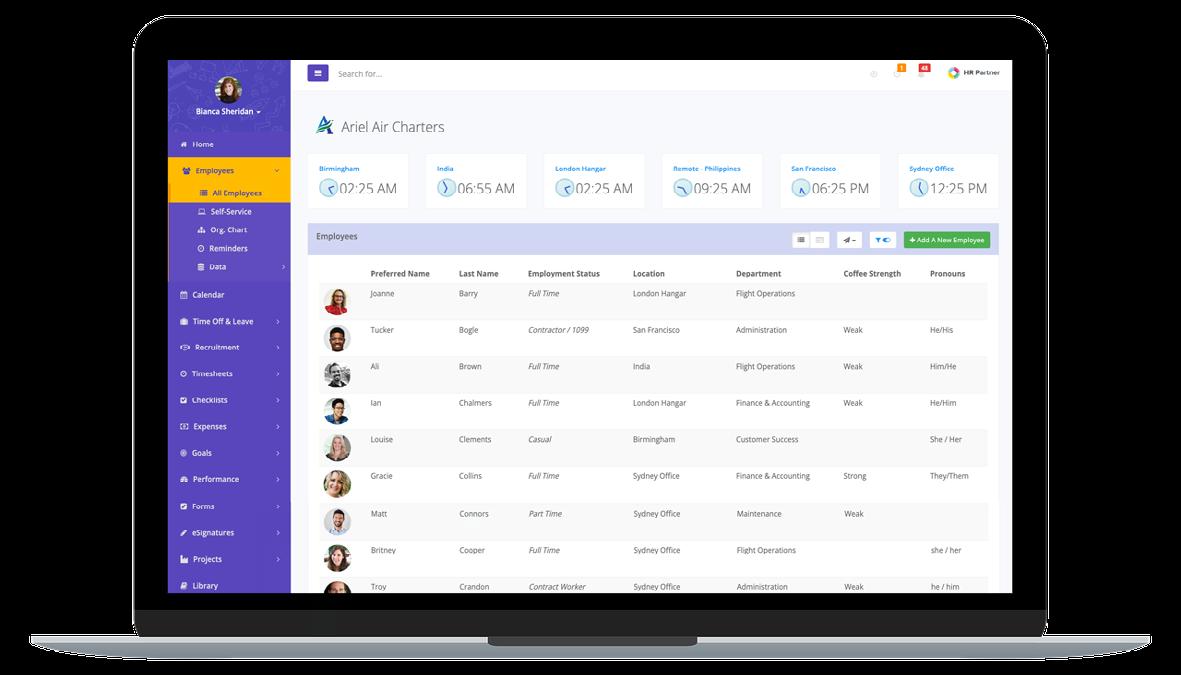

Christina Kryske, Customer Success Specialist, HR Partner

Christina is a support powerhouse based in California, USA. She loves meeting new clients and helping them identify how their businesses can improve their processes with HR Partner. She believes that HR operations should be simplified and streamlined, not cumbersome or complicated - and she loves sharing this knowledge with clients.

Explore how an HRIS ensures accuracy, prevents errors, and allows customisation for enhanced people data management and analytics.

Data analysis, including people analytics, is crucial for a company's success, enabling leaders to make strategic decisions and enhance workforce efficiency.

Relying on manual spreadsheets for this important data is risky as your company grows.

Spreadsheets are prone to human errors, visibility permission lapses, and data loss. In contrast, using an HRIS for people data and analytics prevents such mistakes and offers customisable permission settings.

“Imagine overseeing the entire employee life cycle, from hiring to departure, with seamless data analysis and reporting – all in one place”

One of the primary advantages of an HRIS over manual spreadsheets is enhanced data security. Using spreadsheets for employee data exposes you to risks like data loss and theft.

Cloud-based HRIS software, like HR Partner, offers higher security levels for staff data. We prioritise transparency, adhere to industry best security practices, and host our servers with a leading

GDPR-compliant cloud provider to safeguard your HR data.

We also understand that each organisation has their own access preferences for employee information and capabilities. With this in mind, we built extremely configurable admin permissions options.

When using an HRIS, keeping track of which employees are compliant under your local and federal regulations and employment laws is easier than when using a manual spreadsheet for this information. With an HRIS

like HR Partner, businesses can effortlessly manage employee compliance, create custom categories, and receive reminders for document expirations – all beyond manual spreadsheet capabilities.

Spreadsheets tend to not be intuitive, relying on precise formulas, making them difficult to use for staff who may not be tech-savy. In the user experience battle, HRIS systems excel over spreadsheets, offering intuitive processes, streamlined management, and advanced features.

Look for an HRIS like HR Partner that prioritises user-friendly design for efficient employee data analytics and management. We made our HRIS easy to navigate and intuitive, especially when it comes to people analytics and reporting.

Scalability

As companies expand beyond 15 or so employees, manual spreadsheet updates may prove unsustainable for managing the growing volume and variety of HR data. Continuously creating multiple spreadsheets for specific

functions becomes impractical. Scaling with an HRIS is the optimal solution, allowing centralised management of HR processes and personnel changes in one platform. Imagine overseeing the entire employee life cycle, from hiring to departure, with seamless data analysis and reporting – all in one place!

The Bottom Line

Although spreadsheets can be useful for some HR processes and data tracking, they come with concerning vulnerabilities. Ditch spreadsheet risks, and opt for a

trusted HRIS. Enhance security, scalability, compliance, and user experience with HR Partner.

If you’re ready to stop secondguessing your people analytics, enhance the security of your employee data, and streamline your HR processes - then you’re ready to upgrade from manual spreadsheets to an HRIS.

Does your company use an HR system you love? Are you running a team of 20-500 people? We’d love to show you everything HR Partner has to offer your people management and analytics!

Book a demo with us today:

www.hrpartner.io/demo

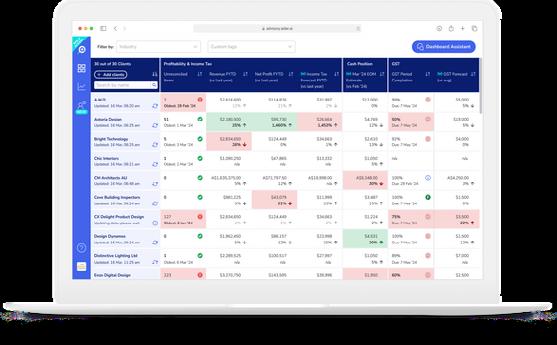

With its new customisable dashboard, group global search and transactional drill down, the Joiin platform will superpower your multientity reporting

Before exploring how our Joiin platform’s new group reporting features extend Xero’s capabilities and amplify your financial data (although you can take a quick look at the box below), there has been a boom in Xeroconnected apps. So, let’s first look at what is driving market demand.

There have never been so many awesome connected apps on the Xero App Marketplace, meaning there’s always an app to enhance your Xero and work, enabling you to build a sophisticated finance system around Xero itself easily.

Only last year, Joiin took part in a fantastic webinar series run by our app partner, Mayday, on how to build an enterprise-level system with Xero – aimed at helping CFOs and their teams. The webinar series highlighted a market demand right now –people like you are looking for ways to scale a Xero set-up to meet the needs of your growing business(es).

It’s widely believed that Xeroconnected apps are great (excellent news as Joiin is a connected app). But as an app vendor at Joiin, we’re ever mindful of how we must develop our

platform for the market and what our customers want, to deliver a powerful app that works your data hard to simplify the complex nature of group reporting.

Recently, three drivers have shaped how we’ve been developing our Joiin platform – all of which have come from market insights and feedback from customers, app partners, or business partners, helping us to move forward confidently:

• At the heart of it, there is a need amongst customers for seamlessness; not only how easily apps connect to Xero and maintain the integrity of data,

@joiinreporting

Paul Shipway, Chief Commercial Officer, Joiin

Paul Shipway is the CCO at Joiin – the Xero consolidated reporting app. Having grown businesses from start-up to exit and supported others in doing the same, Paul deeply understands the many challenges business owners and finance teams face. He recognises the true value that accurate and timely financial data plays in the success of any business, small or large. He works with the team at Joiin to help deliver this to an evergrowing number of multi-entity companies worldwide.

but also how they look and feel, providing familiarity with the Xero user experience and sticking to shared values such as simplicity and ease of use.

• There is a need for centralised control and a desire for apps that treat Xero as the hero and can support it wholeheartedly, enhancing the systems and processes already integral to a business’s Xero usage.

• People are mindful of costs and want to see app pricing models such as all-you-can-eat (you get everything for one fair price) and ones that scale sensibly (say, as more entities are

• Global Search: Within Joiin, search for and find any Xero transaction you need, meaning you can easily keep better tabs on complex, multi-entity finances.

• Transactional drill down: Drill down into specific transactions from a search, seamlessly opening any related documents in Xero via a hyperlink.

• Customisable dashboards: See data at a glance with a highly visual one-page overview and easily stay updated with the metrics that matter most to you.

added) to maintain cost control across multiple deployed apps.

Our new feature development approach at Joiin

At Joiin, we thoroughly acknowledge what’s currently driving the market: we’re mindful of the need for seamlessness between Xero and our Joiin platform, we understand people’s need for centralised control of their data, and that these people are rightly cost-conscious.

Alongside the above drivers, we’re also led by our customers, who had been asking us specific questions throughout 2023, and we’ve since worked with them to deliver against popular requests, such as:

• How can I get transactions into Joiin and drill down into these?

• Can you help me find Xero transactions amongst my masses of data easily?

• How can I quickly see my headline data on one Joiin screen?

Effectively, we were tasked with finding ways for our customers to achieve more control over

their data and get more from it. The challenge was accepted, and we set about delivering new features that let you move from real-time headlines to intricate drill-downs into your data, delivering a rounded experience that works your data harder and makes group financial reporting much easier.

“Once your transactional data is in Joiin, you can search for and find any transaction you need with our new, powerful Global Search feature and drill down into specific transactions from a search.”

add-ons – to repeat you get everything for one price – with our pricing based on the number of group entities you upload to Joiin. For example, it costs from just £16/ month for two entities and £50/ month for ten entities, with options from less than £1 per entity for 200 entities and beyond.

This led us to better integration with your Xero transactions – to make life easier when looking for the documents you need –alongside a Global Search feature that lets you find and drill down into these documents. At the same time, we’ve introduced customisable dashboards that enhance your data visually, bringing it to life in easily digestible golden nuggets of insight.

Before we look at our new features, I want to emphasise that, with Joiin, you get all features for one low-cost subscription price. We never charge for feature

Joiin’s new features – extending Xero’s capabilities and working your data harder

Feature #1: Global search:

With our Joiin platform, you’ve always been able to connect to Xero seamlessly and quickly –literally within minutes – and that hasn’t changed. With your say-so, when connecting to Joiin, you can now automatically upload your transactions from Xero to Joiin. Once your transactional data is in Joiin, you can search for and find any transaction you need with our new, powerful Global Search feature.

The look and feel of search results are similar to what you’d expect

in Xero. For example, you can see all your transactions in one place, presented as lists based on your account categories, which brings a welcome familiarity to the data being presented.

How does Global Search work your data harder?

Because our Joiin platform helps you manage group reporting, Global Search lets you see all your transactions in one place, meaning you can easily keep better tabs on complex, multientity finances.

Feature #2: Transactional drilldowns:

Moreover, you can drill down into specific transactions from a search, seamlessly opening any related documents in Xero via a hyperlink.

Drill-downs into transactional data can also be achieved from any report generated in Joiin. Our new drill-down feature is designed to work in the same way

as you would link to transactions in a Xero account transaction report, providing a more seamless user experience across the two platforms.

How do drill-downs work your data harder?

While group reporting you now have instant access to every transaction, across all your entities, within Joiin.

Feature #3: Customisable dashboards:

Our platform’s all-new Joiin dashboard automatically pulls together your critical metrics in one place. The dashboard is completely customisable, however. With our powerful interface, you can tweak and create your dashboard your way, precisely showing what you want to see, wherever you are.

Reporting widgets can be configured using a variety of KPIs, chart types and filters and can be moved and re-sized using drag

and drop.

How does a customisable dashboard work your data harder?

Our dashboard brings new life to your data and how you use it for group reporting. See your data at a glance, with a highly visual onepage financial overview, meaning you can easily stay updated with the metrics that matter most to you.

Reader offer: Claim your free 30-day trial

Like the sound of our new features? As an XU Magazine reader, you can claim a free 30day trial, letting you plug in and play with our new features for an extended period.

FIND OUT MORE...

Claim your free 30-day trial: app.joiin.co

The largest gathering of accountants and finance professionals is returning to ExCeL on May 15-16 2024.

@Accountex

Caroline Hobden, Portfolio Director, Accountex

Caroline is a dedicated event professional with over 20 years experience managing international business-tobusiness events.

With a wealth of knowledge and expertise in running technical events across a variety of industry sectors, Caroline is the Director for the hugely popular Accountex portfolio, which includes Accountex in London (15-16 May 2024), Accountex Summit Manchester (17 September 2024), a wide variety of virtual events, the bi-monthly e-newsletter Accounting Insight News and a host of global events including Accountex Canada and Accountex Spain.

Over ten thousand accountants, bookkeepers and finance professionals from across the UK are expected at Accountex this Spring.

he upcoming event aims to build on the success of the 2023 show, celebrated as the largest in Accountex history.

295 software and service suppliers will be exhibiting, alongside a comprehensive CPD accredited education programme, to help visitors stay up to date with the evolving landscape of the profession.

“This show keeps my business current and my mind fresh!”

“As always, we’re excited to welcome the accounting and

finance community through the Accountex doors. We understand more than ever that attendees are using their valuable time away from their desks to attend the show, so we have to continue making it worth it. We are prioritising fresh content, especially sessions that focus on practical application, so attendees can start using these insights as soon as they return to their desks. We also have our most diverse exhibitor list yet,

with a mix of established software providers and start-ups.” said Accountex Portfolio Director, Caroline Hobden.

“A 'must-attend' event for any accountant and bookkeeper in industry or practice”

Attendees will have the opportunity to reconnect with current suppliers, get updated on new products, and explore new exhibitors to enhance business efficiency and reduce costs. Notable industry giants such as FreeAgent, Intuit QuickBooks, IRIS, Sage,

TaxCalc, Wolters Kluwer, and Xero will be exhibiting, alongside emerging brands like NORI HR, Signature Group, and Sovos.

The education program offers up to 16 free CPD hours across 13 theatres and 250+ sessions. Seminars will be given by thought leaders, critical thinkers, and experts covering a range of topics from AI and AML to branding and Companies House Reform.

Creation Clinic, and after-show parties.

ongoing commitment to mental health and wellbeing.

After the success at Accountex

Summit Manchester, the Ask the Accountants Podcast team, Johann Goree and Aaron Patrick, will be hosting a Podcast Pitstop. Over the two days, they will be interviewing experts and leaders on their show takeaways and industry insights.

“Who thought so many accountants in one place could be so much fun!”

The event also promises plenty of networking opportunities, including the Bookkeepers Basecamp, Content

Familiar features from previous years, such as the Start-up zone will return, with the addition of a new Quiet Zone. Geared towards those needing a break from overstimulation, this area allows visitors to recharge in silence, supported by the Watch This Sp_ce team, Accountex's official D, E, and I partner.