MODULR, THE EMBEDDED PAYMENTS PLATFORM, TODAY ANNOUNCES ITS ACQUISITION OF NOOK, AN INNOVATIVE DISRUPTOR IN ACCOUNTS PAYABLE (AP) AUTOMATION.

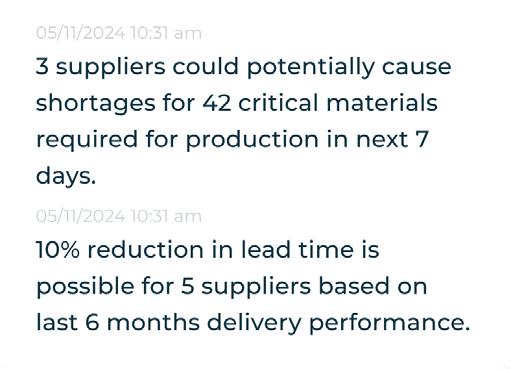

Both companies share a mission to address inefficiencies, remove manual steps and enhance the security of business payments These are significant concerns, as highlighted by Modulr’s survey of 250 ac-

Airwallex

counting practices which revealed that nearly half (45%) of respondents spend over three hours per week on manual data entry.

Today’s businesses often have no choice but to use multiple platforms to manage their financial operations, from paying supplier invoices to processing payroll, managing treasury, and accessing finance. For instance, 60% of large companies use at least five separate systems just for accounts payable.

Modulr is bringing Nook’s comprehensive functionality to its established network of thousands of accountants and businesses already using its innovative and award-winning payment products. Security and efficiency remain central to both platforms, with features such as Confirmation of Payee (CoP) to validate account details in real-time, helping prevent fraud across payment processes.

Find out more

Revolutionising business spend management, with ai-powered automations at every step

REDUCING THE AMOUNT OF TIME SPENT MANAGING SPEND AND EXPENSES IS CRITICAL IN FAST-PACED BUSINESS ENVIRONMENTS. THIS IS ESPECIALLY IMPORTANT FOR BUSINESSES WITH INTERNATIONALLY BASED VENDORS OR EMPLOYEES.

We understand the challenges that come with juggling multiple financial processes across your global business, which is why we are thrilled to in-

troduce Airwallex Spend. It’s our integrated suite of spend management tools, that includes Borderless Cards, Expense Management and Bill Pay applications.

These are designed to reduce the time and number of tools businesses need to manage their finances with an all-in-one global platform. Airwallex Spend is powered by AI-automations, and has fast and efficient financial rails to pay global suppliers built-in.

Addressing the pain points in managing business spend

Managing business spend is often fraught with challenges that can hinder efficiency and financial control. We recently commissioned NewtonX to survey 500 UK-based companies about their business spend management, and found that across these businesses, they face several common pain points.

Find out more

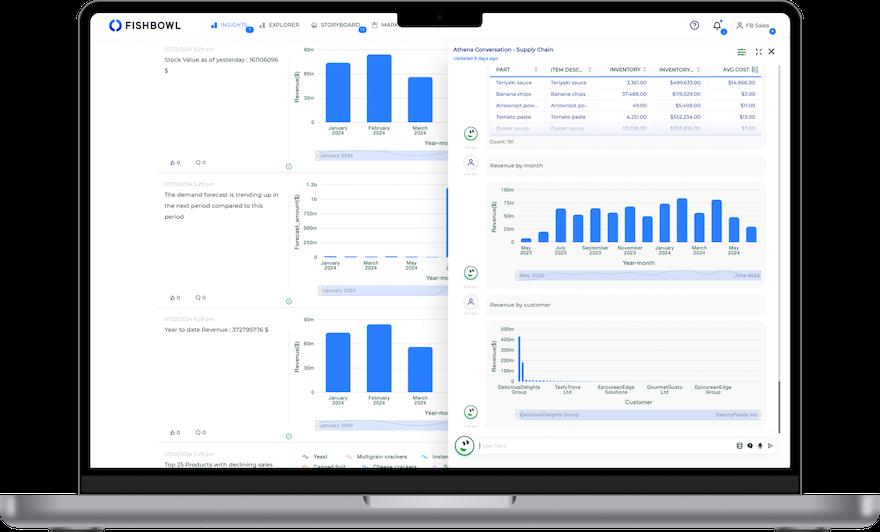

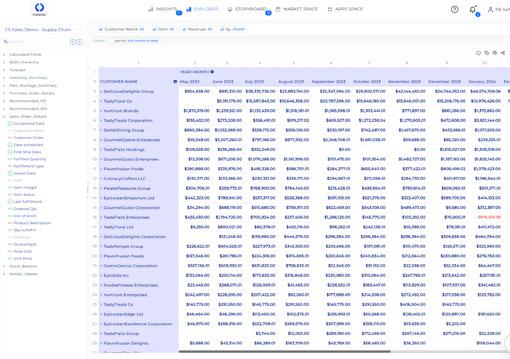

FISHBOWL INVENTORY, THE PREMIER INVENTORY MANAGEMENT AND MANUFACTURING SOFTWARE PROVIDER, IS PROUD TO ANNOUNCE THE LAUNCH OF FISHBOWL AI INSIGHTS.

Powered by ConverSight, this cutting-edge reporting solution is designed to empower small and medium-sized businesses (SMBs) using Xero and QuickBooks with a new level of actionable analysis across their entire business.

Fishbowl AI Insights introduces an embedded AI capability offering instant access to crucial business data and insights directly at a users’ fingertips. With this new proprietary tool, businesses can make informed decisions with the ability to access and analyze their sales, purchasing, forecasting, MRP, inventory, costing, manufacturing, BOM and operations data like never before.

This new use of data means cost savings, optimiz-

ing inventory and improving profitability—all without the technical know-how typically required for advanced data analysis.

“We are excited to deliver Fishbowl AI Insights to provide tangible and measurable value to business operators who can make better business decisions that drive cost savings and improved profitability,” said Kendrick Hair, the company’s chief evangelist.

Keep reading

ABIG HELLO AND WELCOME BACK TO THE NOVEMBER EDITION OF THE EMPLOYMENT HERO PRODUCT UPDATE. WE’RE GETTING CLOSER TO THE END OF THE YEAR, BUT WE’RE NOT SLOWING DOWN.

Our team has been working hard behind the scenes and we’ve got a tonne of new and exciting updates to share with you. So, what’s new in November? We’ve added enhanced security settings with two-factor authentication (2FA) and single-sign on (SSO), enhanced our Performance Reviews module, added extra functionality to Rostering, made

XU BIWEEKLY - No. 94

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

our Workflows feature more powerful and that’s just the beginning. It’s all here and ready for you to use in-platform – let’s get to it.

Enhanced Single-Sign On (SSO) login experience

Available for the following HR plan: Platinum

We’re excited to share that we’ve enhanced security when logging into Employment Hero to give you an even safer experience. Organisations with SSO enabled can login to Employment Hero with one-click via the ‘My Apps’ Dashboard on Okta, Microsoft Office Apps

and Google Workspace Apps. This login option can be enabled via the IDP setup.

You can now add backup approver options in Employment Hero

Available on the following plans: Classic: Platinum, Next Gen

Admins now have flexible backup approver choices, including options like Admin, Team Leader, Primary/ Secondary Manager and specific teams, across Leave, Expense and Employee File Change modules.

Find out more

NEW IN CALXA THIS WEEK IS THE ADDITION OF DYNAMIC COLUMN REPORTING. AT LAST, THIS NEW WAY OF BUILDING YOUR TEMPLATES WILL ADD MORE FLEXIBILITY TO YOUR REPORTING OPTIONS.

It is the start of an ongoing project. We are adding the option to choose any number of columns to our multi-column reports. First up this week are the P&L with Projected Total reports with more to come over the next weeks.

New in Calxa Next Week: Dynamic Columns

TReports like the P&L with Projected Total, P&L Comparison, Cashflow Forecast, have long had preset report templates. They have variations with options for 12 months, 24 month, 4 quarters, 5 years, 10 years and more. Ultimately, with the dynamic configuration, you can specify how many columns you want to show. Whether that’s 3, 7 or 123, the choice is yours.

The pre-existing templates will continue to be available for some time. We will progressively add this option to all the multi-period reports.

Keep reading

ACCRUAL REPORTS HELP BUSINESSES KEEP ACCURATE FINANCIAL RECORDS BY TRACKING INCOME AND EXPENSES AS THEY’RE EARNED OR INCURRED, EVEN IF THE CASH HASN’T CHANGED HANDS YET.

We’re excited to announce that ApprovalMax now lets you create and approve accrual reports directly within the platform, making it easy for customers using Xero to manage accruals and related journal entries. The report provides valuable insights and guarantees account balance accuracy to accountants, bookkeepers, and businesses. By tracking income and expenses in real-time, you gain a clear, up to date understanding of your financial position.

With ApprovalMax, creating and managing accrual reports becomes simple, especially for businesses needing to accurately reflect expenses incurred in a given period but not yet posted to the general ledger. This is invaluable for accountants and auditors who manage manual journal workflows, as it provides them with comprehensive access to accrual reporting.

Creating a workflow for accrual reports helps to make sure every journal entry is accurate and approved before pushing it to Xero. This provides consistent and reliable data across both systems to help make more informed decisions.

Keep reading

HE INSTITUTE OF CHARTERED ACCOUNTANTS IN ENGLAND AND WALES (ICAEW) HAS ANNOUNCED A NEW CATEGORY WITHIN ITS TECHNOLOGY ACCREDITATION SCHEME; “CLIENT COMMUNICATIONS” AND CLIENTWINDOW IS THE FIRST SOLUTION TO BE ACCREDITED IN THIS NEW CATEGORY.

Launched in the Channel Islands, ClientWindow is an innovative communications platform that seamlessly integrates WhatsApp and WeChat with email for compliant client communications.

The ICAEW Technology Accreditation scheme assures firms that accredited products meet high standards in quality, security, and functionality. Through a rigorous evaluation process, ICAEW assesses solutions for regulatory compliance, data security, user experience, and industry adaptability, enabling firms to confidently adopt innovations that enhance client service and operational efficiency.

The launch of this new category underscores the growing importance of chatbased client communications for businesses – not just as a necessary ingredient for success but also as a critical requirement for secure and compliant communications. Especially significant for accountants, ClientWindow is also able to integrate WhatsApp conversations with industry software including Hubdoc, Dext, Apron and AutoEntry. ClientWindow’s achievement as the first platform to meet ICAEW’s rigorous standards for client communication is a noteworthy accomplishment, setting a new benchmark in innovation for the industry.

Craig McLellan, manager of the ICAEW Technology Accreditation Scheme, commented, “We are delighted that ClientWindow has been accredited by the ICAEW. It is important that we continue to give members the ability to review independently evaluated software that embraces the rapid changes in technology which is reshaping the finance and accountancy markets.’

Developed by

Chartered Accountants David Moehle

and Tim Zeale, ClientWindow was created to bridge the gap between client expectations for instant messaging and the regulatory demands for data retention in financial services. The platform uniquely allows clients to communicate seamlessly via WhatsApp or WeChat, while professional teams manage responses through their normal email platforms, thereby maintaining compliance and operational efficiency.

Tim Zeale, co-founder of ClientWindow, commented, “Receiving ICAEW’s Technology Accreditation in this new category is a proud moment for our team and a testament to the value ClientWindow brings to professional service firms. This accreditation assures our users that they can communicate effectively with their clients through a platform that not only facilitates real-time messaging but also upholds the highest standards of client communications and regulatory compliance.”

Find out more

T MIGHT BE HALLOWEEN, BUT GETTING PAID DOESN'T HAVE TO BE SCARY! HERE ARE THE LATEST NEW FEATURES FROM ADFIN TO HELP YOU GET PAID.

Personalise emails

Showcase your brand by adding your own touch to customer communications sent by Adfin. You can add your logo, icon and colour scheme to the payment request, reminder and direct debit mandate emails.

Head to Settings > Branding to configure this. Here

you can also preview exactly what your customer will see.

Specify precisely which invoices are imported from Xero to Adfin

Set up Xero branding theme templates to select which Xero invoices are imported and sent by Adfin. You can also use branding theme templates to either send the invoice to your customer as a one-time payment request, or schedule a payment for collection by direct debit.

Configure this by navigating to Settings > Integrations

> Xero > Manage Connection. Once enabled, Adfin will only import invoices that are created using an Adfin branding theme template.

Creating an invoice with a "one-time payment" template will route the invoice for a one-time request to be paid via card or pay by bank. Using a "direct debit" template schedules the invoice for collection by direct debit - if your customer hasn't yet been sent a direct debit mandate, we'll send a mandate first before scheduling payment.

WE’RE EXCITED TO ANNOUNCE THAT PARTNERSHIP TAX HAS ARRIVED IN XERO TAX. YOU CAN NOW MANAGE MOST OF YOUR CLIENTS’ TAX NEEDS – CORPORATE, PERSONAL, AND ORDINARY PARTNERSHIPS – IN ONE SIMPLE, SECURE PLATFORM.

No more juggling multiple tools or battling complicated software.

By managing partnership tax in Xero, you can remove some of the stress around tax time for your practice and your clients.

Unlocking the benefits of Xero Tax

Partnership tax can be quite complex, with various rules and regulations regarding profit-sharing, individual partner tax liabilities, and filing requirements. This can be a headache for businesses, and a very manual process for you as their advisor.

For example, partnership tax often involves manual data entry, calculations, and reconciliation across different platforms.

This takes valuable time

away from core business activities and using multiple tools or relying on spreadsheets creates inefficiencies and potential for data discrepancies.

Your practice can now gain all the benefits of Xero Tax across your ordinary partnership clients. The benefits of this addition include:

• Saving time: reduces manual data entry by pulling directly from your client’s bookkeeping data in Xero.

• Simple and efficient: Xero streamlines partnership tax management by

bringing everything into one platform, making it easy for the whole team to use and collaborate on tax returns together.

• Use Xero Tax for more of your clients: Xero Tax is designed to make it easy to prepare accounts and tax where your clients are using Xero. However, if a client is not using Xero, you can still prepare company accounts and tax and partnership tax by adding their data to a Xero ledger and connecting to Xero Tax.

Keep reading

RACKING CATEGO-

MANAGING MULTIPLE ENTITIES CAN BE TIME-CONSUMING FOR ACCOUNTANTS AND ADVISORS, ESPECIALLY WHEN IT INVOLVES UPDATING COMPANY DATA ONE BY ONE.

We understand how cumbersome this can be, which is why we’re excited to introduce our new Bulk Update feature. This highly requested functionality allows you to update multiple entities simultaneously with just a click, streamlining the process and saving valuable time. The Bulk Update feature not only speeds up the process but also provides real-time visibility into the status of updates via the top navigation bar, making it easier than ever to keep your data current and accurate.

What’s new with Bulk Update?

The Bulk Update feature brings several key enhance-

ments to Fathom’s platform, focused on efficiency and improving our user experience. Here’s what you can expect:

Bulk Update & Queue Manager

Fathom’s Bulk Update feature allows users to update financial data across multiple entities at once, rather than individually. Updates are triggered from the My Companies page or the Consolidated Group landing page, ensuring that both standalone companies and subsidiaries in a group are covered. Once an update is initiated, the status is displayed in the top navbar, which can be expanded to see detailed progress.

This feature applies to cloud-based systems such as Xero, QuickBooks Online, Sage, and MYOB, but excludes Excel and QuickBooks Desktop data.

RIES ARE A KEY FEATURE OF XERO AND VERY POWERFUL. THEY ENABLE THE ACCOUNTING DATA TO BE SEGMENTED INTO BRANCHES, PRODUCTS, COSTS CENTRES, GEOGRAPHIES OR ANY OTHER SEGMENTATION REQUIRED. THEY ARE A KEY PART OF A GOOD DATA MODEL.

Using Tracking Categories in Multi-Entity Businesses

For groups and multi-enti-

ty businesses Tracking Categories are both an opportunity and a problem:

If the Tracking Categories are well aligned then the power they bring to a single entity can be applied across a group but, if they are misaligned, they will create errors in reporting.

The issue is that - until now - there has been no easy way to monitor if the Tracking Categories are aligned.

Find out more

TRACKING CATEGO-

RIES ARE A KEY FEATURE OF XERO AND VERY POWERFUL. THEY ENABLE THE ACCOUNTING DATA TO BE SEGMENTED INTO BRANCHES, PRODUCTS, COSTS CENTRES, GEOGRAPHIES OR ANY OTHER SEGMENTATION REQUIRED. THEY ARE A KEY PART OF A GOOD DATA MODEL.

Xero enables 4 Tracking Categories but only 2 can be active at any one time. This

means that a business effectively has 2 Tracking Categories with each limited to 100 Options. For some businesses this isn’t enough…

How many Tracking Categories or Data Dimensions do you need?

The limited number of Tracking Categories is the #1 reason for leaving Xero cited by businesses that have migrated to an ERP.

Keep reading

Business

insights your clients need,

when they need them, in the format they need them in.

All in one place.

Fishbowl AI Insights gives your clients full report customization and storyboards with the data and insights they need with the ability for any user to access any piece of data, at any time – just Ask Athena, Fishbowl’s AI Assistant.

Create Custom Reports

Drag and Drop Report Creation

On Demand Insights and Recommendations

Meet Athena

Create custom reports with the exact data and columns needed

Get instant access to data and insights. In Lite, access 100+ preconfigured questions. In Freeflow, access any data, at any time using our powerful LLM

Proactive Insights

Data Newsfeed + Alerts

Get tailored newsfeeds and alerts with relevant insights that provide an eagle eye view of business operations

Predictive Insights

Data-Driven

Recommendations

Identify historical trends to appropriately time orders, predict future demand and avoid stock-outs

Collaboration accelerates audit process enhancements and boosts efficiency for firms

CASEWARE, A GLOBAL LEADER IN CLOUD AND AI-ENABLED AUDIT, FINANCIAL REPORTING, AND DATA ANALYTICS SOLUTIONS, HAS ANNOUNCED A STRATEGIC PARTNERSHIP WITH VALIDIS, A LEADING ACCOUNTING DATA EXTRACTION AND STANDARDIZATION TOOL.

This collaboration will provide audit firms with powerful data ingestion tools that deliver audit-ready data from diverse sources; clean and readily available for analysis.

Validis is already a trusted partner for numerous large audit firms, providing them with instant access to business data from major accounting systems. Now, through the integration with Caseware, this capability will be extended to customers of Caseware’s cloud-based platform in the US and, ul-

timately, across the globe in markets including Canada, UK, Australia and New Zealand.

Automated data collection, cleansing, and standardization offers several compelling benefits for organizations looking to harness the full potential of their data, not least the reduction in time and effort required to gather, clean, and standardize data. This allows firms to focus on analysis and decision-making rather than data preparation. The standardized data makes it easier to identify anomalies, assess bookkeeping quality, and analyze trends across client portfolios. In addition to being more accurate, consistent and delivering data of a higher quality, automated systems can handle large volumes of data efficiently, scaling up as volumes grow – particularly important for organizations dealing with big data.

Automation helps ensure that data processing adheres to regulatory requirements and industry standards, reducing the risk of non-compliance. Simultaneously, audit professionals are empowered to focus on deriving quality insights and creating value instead of being overwhelmed by routine data management tasks.

Davis Jackson, chief commercial officer at Caseware stated, “Quality data is the cornerstone of our vision at Caseware. It fuels our commitment to deliver precise, insightful, and transformative solutions for audit and accounting professionals."

"By ensuring the highest standards of data integrity and accuracy, we enable them to make informed decisions, drive innovation, and achieve unparalleled results."

Keep reading

THIS WEEKEND, ON NOVEMBER 24, DEPUTY INVITES THE WORLD TO CELEBRATE SHIFT WORKER SUNDAY, A DAY DEDICATED TO HONOURING THE SHIFT WORKERS WHO FUEL ESSENTIAL SERVICES ACROSS AUSTRALIA, THE UNITED KINGDOM, AND THE UNITED STATES.

Observed annually on the final Sunday of November, Shift Worker Sunday recognises the hourly workers who keep our communities thriving through every life moment — big or small, exciting or challenging — shift after shift.

To mark this occasion, Deputy is rolling out 'Clock Out 2024' for its second year. This in-app experience allows shift workers to share their 2024

shifts and showcase the impact of their work on social media. Each participant will receive a personalised message of gratitude, acknowledging their dedication to the communities they serve.

Deputy’s recent State of Hourly Work Survey highlights the need for showing shift workers greater appreciation: Only 33% of U.S. shift workers, 31% in the U.K., and 35% in Australia feel that the public often acknowledges their work. Employer recognition is slightly higher, with 46% in the U.K. and U.S. and 45% in Australia reporting that their employers frequently show appreciation.

Shift Worker Sunday and the 2024 Clock Out app experience aim to bridge this gap by showing gratitude to those who work tirelessly to keep society moving.

“Shift Worker Sunday is a chance to highlight the crucial contributions of shift workers,” said Silvija Martincevic, CEO of Deputy. “These workers keep our communities moving forward every day, often with little public recognition. With our in-app experience - Clock Out 2024, we’re providing shift workers with the opportunity to showcase their impact while also creating a moment of reflection for all of us to appreciate the dedication and sacrifices that go unseen. Our goal is to foster a broader culture of gratitude and respect for those who work tirelessly behind the scenes, and we invite everyone to join us in celebrating these essential contributors.”

Access Evo is the biggest technology investment in Access history. It is a technology platform that will become a part of every Access product, producing a unique AI driven software experience for all of our customers.

What does this mean for Accountants?

The Access Evo platform will be added to all products in our Accountants portfolio, starting early 2025. This means that our APS, HandiSoft, Elite and Access Accountants customers will all benefit from new, AI driven capabilities made available by the Evo platform.

Key functionality

to ask questions of tax legislation and provides a summary with links back to the specific content on the ATO website saving you and your team time.

• Feed - intelligent alerts and notifications personalised to what is important for you (this is based on the products that have been activated to do this for example Applause, Collaborate, Engage, LMS and Financials Access Accountants will not provide feed data at this time).

• Mobile - the power of Access Evo in your pocket providing freedom to do more, on the move.

Find out more BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE COMMERCIAL RELEASE OF BGL SMARTDOCS 360.

BGL SmartDocs 360, already a multi-award-winning AI-powered paper-to-data solution, effortlessly transforms unstructured data, such as paper or PDF financial documents, into smart digital data with actionable insights— eliminating manual data entry. Unveiled at BGL's Live Product Premier on 20 November 2024, BGL SmartDocs 360 is set to revolutionise document management for accounting and financial professionals as

well as the extended community. Designed to streamline workflows, reduce human error and optimise data management, this launch marks a powerful step forward for the industry.

"I am proud of our team and truly excited about the launch of this incredible product," said BGL's CEO, Daniel Tramontana.

• Copilot - an intuitive chatbased interface that is available in-product and on your mobile phone, powered by Microsoft OpenAI and privately hosted by Access to keep your data safe and secure. It’s your digital assistant delivering what you need while you work. Copilot is connected to your underlying practice and tax data enabling you to ask questions of your data. E.g. “Provide a list of clients who have rental properties with deductions over $5,000” or “Provide a list of companies with ultimate holding company located overseas”. In addition, our ATO website vectorisation allows users

Access Evo gives customersthe confidence to use AI software safely and securely. We are doing business AI the right way. That’s why we built Access Evo with our 3-Tier Security Model.

1. Company secure. Access use of AI remains within a secure private environment. This means no customer data leaves this controlled infrastructure. No

2. User profile permissions. Access use of AI remains within a secure private environment. This means no customer data leaves this controlled infrastructure. No user prompts or uploaded information will leave this secure environment or be used to train open AI models.

3. Individual confidentiality. We want everyone to enjoy the benefits of generative AI with confidence. Users of Access Copilot will use this feature to assist with things of a confidential or sensitive nature. Consequently, it is important that users feel free to use the system with complete confidence. The Access policy keeps an individual’s use of the feature completely confidential. No one else in the organisation can access what you have used the feature to generate, and your own use will be deleted after 30 days.

Keep reading user prompts or uploaded information will leave this secure environment or be used to train open AI models.

Keep reading

Prepare, adjust and output a trial balance for an unlimited number of clients with AccountsPrep, an add-on to your AutoEntry subscription.

Get started now

PYUSD Stablecoin Will Help Build Foundational Pathways to Upgrade Global Payment Rails

TODAY PAYPAL ANNOUNCED IT WILL BE ENABLING DISBURSEMENT PARTNERS TO USE PAYPAL USD (PYUSD) TO SETTLE CROSS-BORDER MONEY TRANSFERS MADE WITH XOOM. CEBUANA LHUILLIER AND YELLOW CARD WILL BE THE FIRST XOOM DISBURSEMENT PARTNERS TO USE PYUSD TO SETTLE CROSS-BORDER MONEY TRANSFERS, ALLOWING THEM TO LEVERAGE THE COST AND SPEED ADVANTAGES OF BLOCKCHAIN TECHNOLOGY.

These forthcoming integrations will help drive financial inclusion by providing more widespread access to digital financial solutions across Asia-Pacific and Africa. In addition, PayPal will be able to conduct cross-border settlement transactions without being restricted by traditional banking hours.

"Cross-border transactions are an important driver for economic growth and prosperity in developing countries," said Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal. "With this step, Xoom and its partners, like Cebuana Lhuillier and Yellow Card, will be able to leverage PayPal's payment technologies and the blockchain to further enable seamless money transfers across borders."

Cebuana Lhuillier, the largest micro-financial services provider in the Philippines, boasts a robust network that enables Filipinos worldwide to send money back home to its 3,500 branches and 25,000 partner agent locations across the country.

Find out more

Starling launches ‘Easy Saver’ with 4% AER* and unlimited, immediate withdrawals

STARLING BANK IS AIMING TO SIMPLIFY SAVING WITH THE LAUNCH OF EASY SAVER, A SAVINGS ACCOUNT LINKED TO A STARLING PERSONAL CURRENT ACCOUNT. THIS ACCOUNT OFFERS PENALTY-FREE, IMMEDIATE WITHDRAWALS, AND AN INTEREST RATE OF 4% AER / 3.92% GROSS* VARIABLE ON BALANCES UP TO £1 MILLION.

The new account is open to eligible Starling personal current account holders and will be rolled out at the end of November. Easy Saver customers will earn daily interest, paid monthly, on their balances and can make immediate, fee-free unlimited deposits and withdrawals to and from a Starling personal current account.

Customers will be able to apply for Easy Saver in a matter of minutes through the Starling app. It will sit under the Spaces section of their current account, bring-

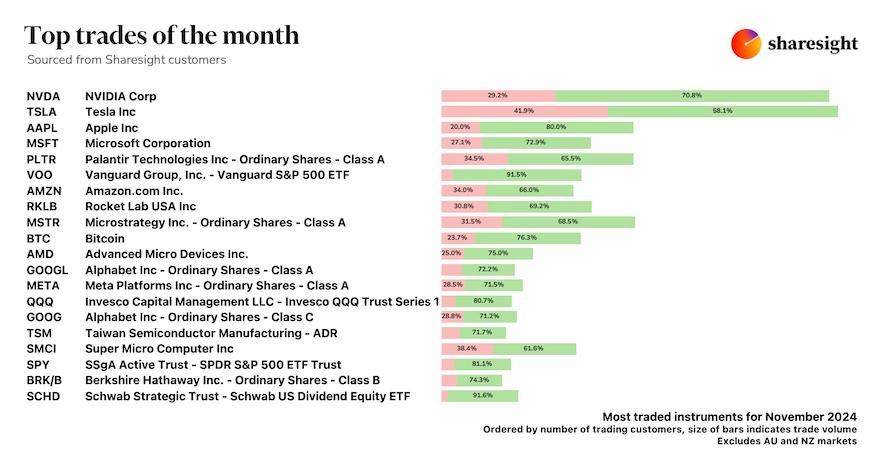

WELCOME TO THE NOVEMBER 2024 EDITION OF SHARESIGHT’S MONTHLY TRADING SNAPSHOT FOR GLOBAL INVESTORS, WHERE WE LOOK AT THE TOP 20 TRADES MADE BY SHARESIGHT USERS AROUND THE WORLD, EXCLUDING AUSTRALIA AND NEW ZEALAND (WHICH WE COVER SEPARATELY).

Below we will reveal the top trades by our global userbase, highlighting some of the most popular stocks and the market-moving news behind them.

Top trades in November 2024: This month’s top trades

were led by NVIDIA (NASDAQ: NVDA), which saw its share price fluctuate throughout November, essentially ending the month at the same price it started at (as at the time of publishing). The top trades were followed by Tesla (NASDAQ: TSLA), with Sharesight users split between buy and sell trades amid surging share prices. Bitcoin also made it into the top 10, hitting all-time highs in the wake of the US election. It should be noted that the assets in our trading snapshots are ordered by the number of Sharesight users trading that asset, while the size of the bars indicate the actual trade volume.

Keep reading

TIDE, THE LEADING BUSINESS FINANCIAL PLATFORM IN THE UK, HAS LAUNCHED AN AUTOMATED CARBON CALCULATOR DEVELOPED IN PARTNERSHIP WITH CARBON MEASUREMENT PIONEER CONNECT EARTH. THE NEW TOOL WILL ALLOW TIDE’S 650,000 UK MEMBERS (CUSTOMERS) TO VIEW AN ESTIMATED AND CATEGORISED UNDERSTANDING OF THEIR CARBON EMISSIONS.

The insights mark the first phase in Tide’s longer-term aim to support its UK members eventually get to net zero. Members will be able to see estimated emissions in real-time and measure any changes over time via Connect Earth’s carbon dashboard, Connect Insights. Members will be able to understand the potential im-

pact of their spend on carbon emissions. The dashboard provides estimates of carbon-related data for overall carbon emissions, via category split, using Connect Earth’s models and databases.

In 2023, Tide made a pledge to make it simpler for its members to get to net zero, by developing support for them to reach carbon neutrality.

The partnership means that Tide and Connect Earth will also introduce tools such as automated carbon accounting for bank transactions, invoices, and accounting data. The goal is to offer further insights, recommendations, and strategies that help businesses reduce emissions while saving time and money.

Find out more

ing all their Starling products together. Spaces are already used extensively for money management, with Starling’s personal account customers having on average at least two Spaces attached to their account, used for everything from putting aside money for Christmas to holiday spending overseas using a Starling virtual card with no fees.

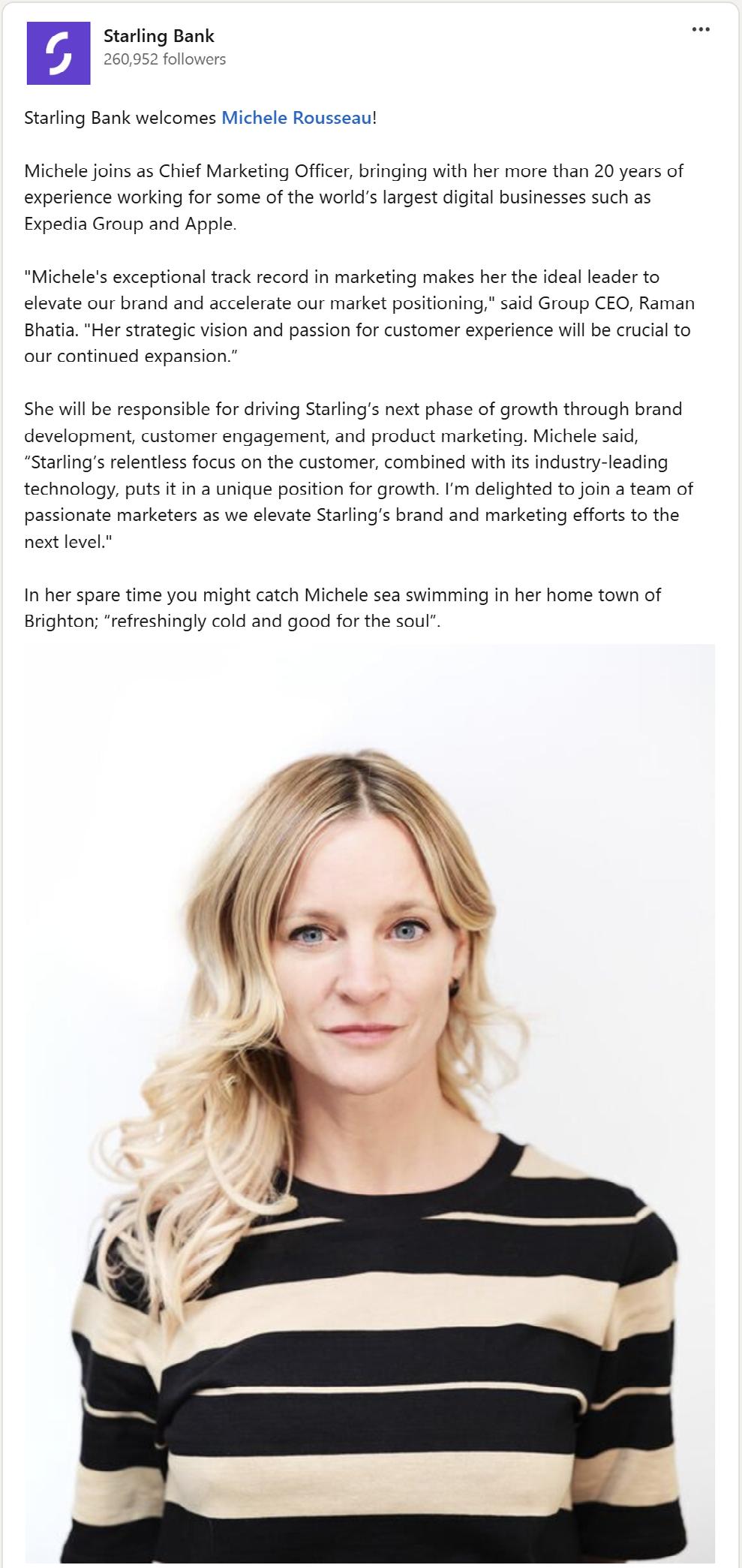

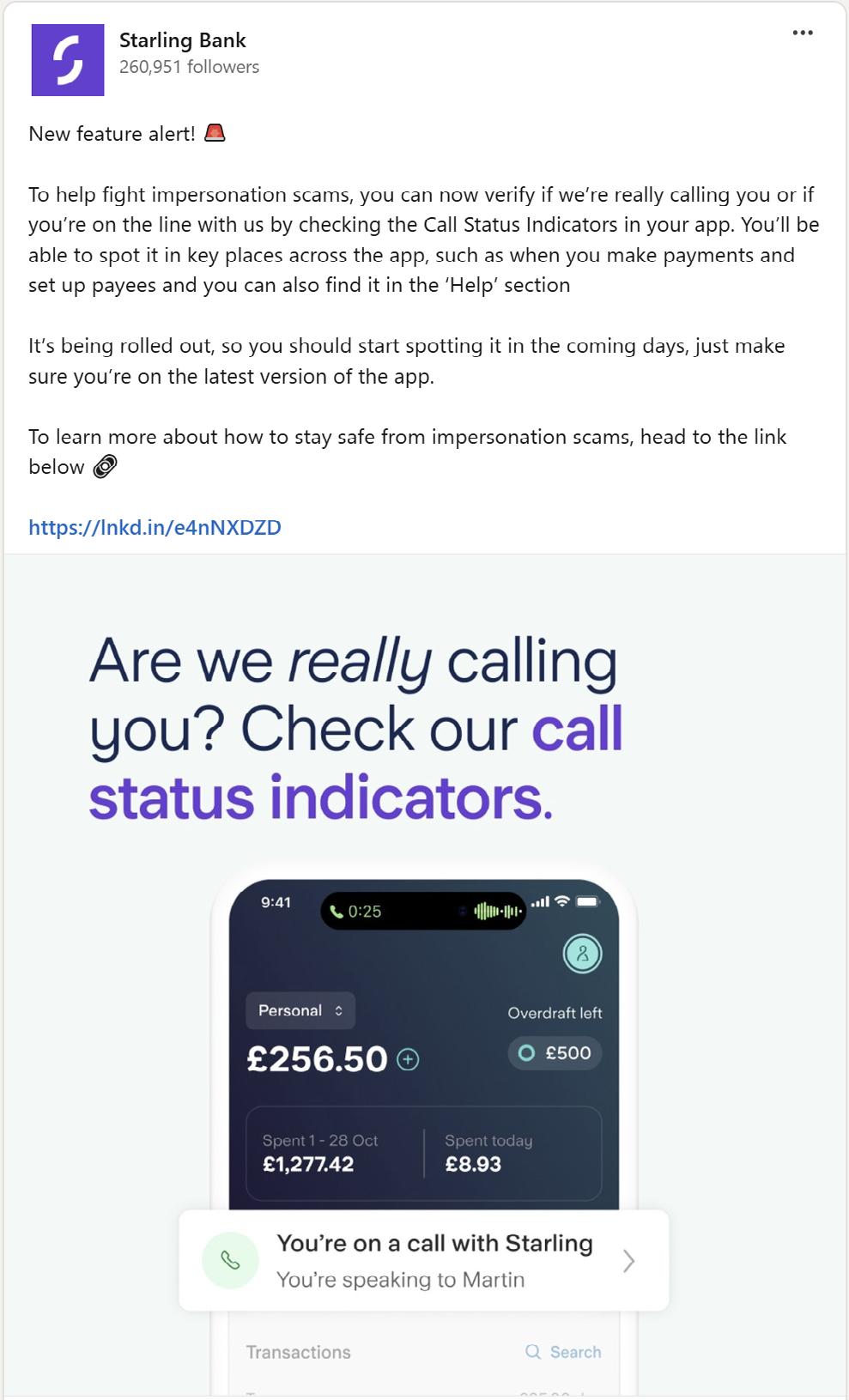

Maria Vidler, Chief Customer Officer of Starling Group said: ‘Easy Saver helps our customers with a highly competitive interest rate, penalty-free access and full integration into their Starling app so they can see everything in one place.’ She added: ‘Easy Saver is the latest in a suite of new products and services at Starling, following the recent launch of Call Status Indicators, an in-app service helping to protect customers from bank impersonation fraud, with more to follow in 2025.’

Keep reading

ARYZA GROUP, A LEADING PROVIDER OF FINANCIAL SOFTWARE SOLUTIONS, ANNOUNCES THE EXPANSION OF ITS PARTNERSHIP WITH GOCARDLESS, A GLOBAL BANK PAYMENT COMPANY. THE CONTRACT BUILDS ON A TWO-YEAR RELATIONSHIP AND WILL SEE ADDITIONAL GOCARDLESS SOLUTIONS BUILT DIRECTLY INTO ARYZA’S PLATFORM.

As part of the new agreement, Aryza will integrate GoCardless' open banking-powered payment feature, Instant Bank Pay (IBP), into its loan and lease management software, Aryza Lend, in 2025 with plans for broader integration across other product lines. This initiative gives Aryza customers even more choice, providing merchants with an effective alternative for instant, oneoff payments while reducing the costs associated with traditional card transactions.

Additionally, Aryza's mer-

chants will benefit from Success+ to recover failed payments, elevating the customer experience. Success+, which recovers two-thirds of failed payments on average, applies machine learning to data from the millions of transactions GoCardless processes each year to intelligently identify the best time for payment retries.

These enhancements are further examples of Aryza's commitment to innovation and responsiveness to market demands. From a market perspective, Aryza will extend GoCardless' capabilities beyond the UK and Ireland, rolling out the fintech’s Direct Debit and IBP solutions across Europe, Australia, New Zealand, and North America.

Tom Metcalfe, Director, UK&I Partnerships at GoCardless, said: “We’re excited to scale our reach in the banking and lending space through this expanded relationship with Aryza."

Keep reading

SPENDESK, THE COMPLETE SPEND MANAGEMENT PLATFORM FOR MID-SIZED BUSINESSES, HAS OFFICIALLY LAUNCHED SPENDESK FINANCIAL SERVICES, ITS PAYMENT INSTITUTION.

Regulated by the ACPR (Autorité de contrôle prudentiel et de résolution), and including a strategic collaboration with VISA, Spendesk Financial Services enables the company to deliver innovative and secure payment solutions to its clients across

France and the European Union.

With Spendesk Financial Services, Spendesk now has end-to-end control over its payment services infrastructure. This strategic initiative represents a significant milestone in the evolution of its platform. The company offers its 5,000 client businesses, representing more than 200,000 users across Europe, a fully integrated spend management solution.

Innovation at the heart of the user experience

This launch strengthens Spendesk’s commitment to its customers by providing a more secure and optimized environment for managing company spend.

Beyond payment management, Spendesk Financial Services enables the platform to centralize operational processes and introduce new features faster.

Keep reading

WITH THIS COLLABORATION, PAYHAWK, WHICH HOLDS EMI LICENCE STATUS IN THE UK, IS SET TO HAVE GREATER CONTROL OF ITS PAYMENT STACK AND BETTER ACCESS TO PAYMENT NETWORKS, GIVING THE COMPANY THE ABILITY TO ENHANCE ITS PAYMENT OFFERING FOR CUSTOMERS.

J.P. Morgan Payments will provide Payhawk with several banking services through its API, including access to bank accounts in multiple currencies and for the safe-

The Payhawk Mastercard integration enables U.S. and Canadian businesses to gain realtime visibility and control into their bank card transactions within the Payhawk platform.

PAYHAWK, A GLOBAL LEADER IN SPEND MANAGEMENT

SOLUTIONS, TODAY ANNOUNCED A NEW INTEGRATION WITH MASTERCARD TO OFFER BUSINESSES IN THE U.S. AND CANADA REAL-TIME VISIBILITY INTO THEIR CARD TRANSACTIONS WITHIN THE PAYHAWK PLATFORM.

These businesses will also be able to take advantage of enhanced spend controls on their eligible Mastercard corporate and business cards, all while staying with their existing issuing bank and benefiting from a next-generation spend management platform.

Hristo Borisov, CEO of Payhawk, commented: "With this new integration, any U.S. or Canadian business using eligible Mastercard corporate

and business cards can gain real-time visibility into their finances within Payhawk’s unified spend management platform. Combining expense, budget, and payments tools with enhanced controls and security, and native integrations, Payhawk simplifies and automates finance operations and offers an unparalleled user experience so our customers can fully automate their expenses and reconciliation without having to change their core banking cards."

Key benefits for Payhawk customers

With this integration, U.S. and Canadian businesses using eligible Mastercard corporate and business cards can gain real-time visibility and control over their spending directly within Payhawk's platform. Find out more

guarding of funds, and domestic payment rails. These services were previously provided through intermediary BaaS providers with a heavy reliance on third parties.

Hristo Borisov, CEO and Co-founder of Payhawk, says: "Our strategic focus on mid-size and enterprise customers across traditional industries requires the highest standards and trust in our banking partners. Working with J.P. Morgan, one of the most highly regarded and trustworthy banking institutions in the world, repre-

sents everything we need in a banking partner. Its global footprint and depth of currencies enables us to deliver more features that make payments even more convenient for our multinational enterprise customers."

Jason Clinton, Head of Europe Financial Institutions Group and Global Head of Non-Bank Financial Institutions at J.P. Morgan Payments, says: "We have a strong track record of powering innovation for institutional clients at a global level."

Find out more

Spendesk partners with Adyen

Adyen’s UK banking licence and international footprint will strengthen Spendesk’s offer in core markets and support global growth

ADYEN, THE FINANCIAL TECHNOLOGY PLATFORM OF CHOICE FOR LEADING BUSINESSES, HAS TODAY ANNOUNCED ITS LONGTERM STRATEGIC PARTNERSHIP WITH SPENDESK, THE COMPLETE SPEND MANAGEMENT PLATFORM FOR MEDIUM-SIZED BUSINESSES.

The partnership will support innovation in embedded financial services, as Spendesk continues to accelerate bringing products to market in 2025, and Adyen continues to build its suite of embedded financial products, including business bank accounts and card issuing.

Spendesk offers a comprehensive spend management solution that enables finance teams to automate workflows and gain full visibility and control over

company spending. Providing essential tools like virtual and physical cards, expense management, and a new procurement solution, Spendesk also allows businesses to work with their existing accounting and financial software via its APIs and native integrations.

Scaling rapidly, Spendesk chose Adyen for its full stack Banking-as-a-Service (BaaS) coverage across multiple key markets, which eliminates complex multi-provider set-ups. With Adyen’s UK banking licence, this partnership empowers Spendesk to maintain full control over the payment experience, provide its UK customers with the card customisation they need, and embed financial products beyond payments going forward.

Keep reading