Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors. The independent news source for users of accounting apps & their ecosystems

8 COVER STORY AutoEntry

AccountsPrep: The fast way to prepare accounts for simple clients

14 INTERVIEW Mimo

Exclusive interview with Mimo CoFounder & CEO Henrik Grim

18 CASE STUDY Intuit Quickbooks From 4 Hours to 4 Minutes: How Spire Accounting Uses QuickBooks Tax to Streamline Year-End Compliance

22 Ignition 7 strategic steps to run a smart, profitable, and efficient accounting firm

24 CASE STUDY WorkflowMax by Bluerock From Paper to Precision: How Katalyst Cloud & Business Services and WorkflowMax Help Roof Improvements Make DataLed Decisions

We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register.

Bookkeepers Assemble for the ICB Bookkeepers Summit 32

Fishbowl Scooping Up Success: Sajani Cups and Cones Freezes Out Stock Issues with Fishbowl

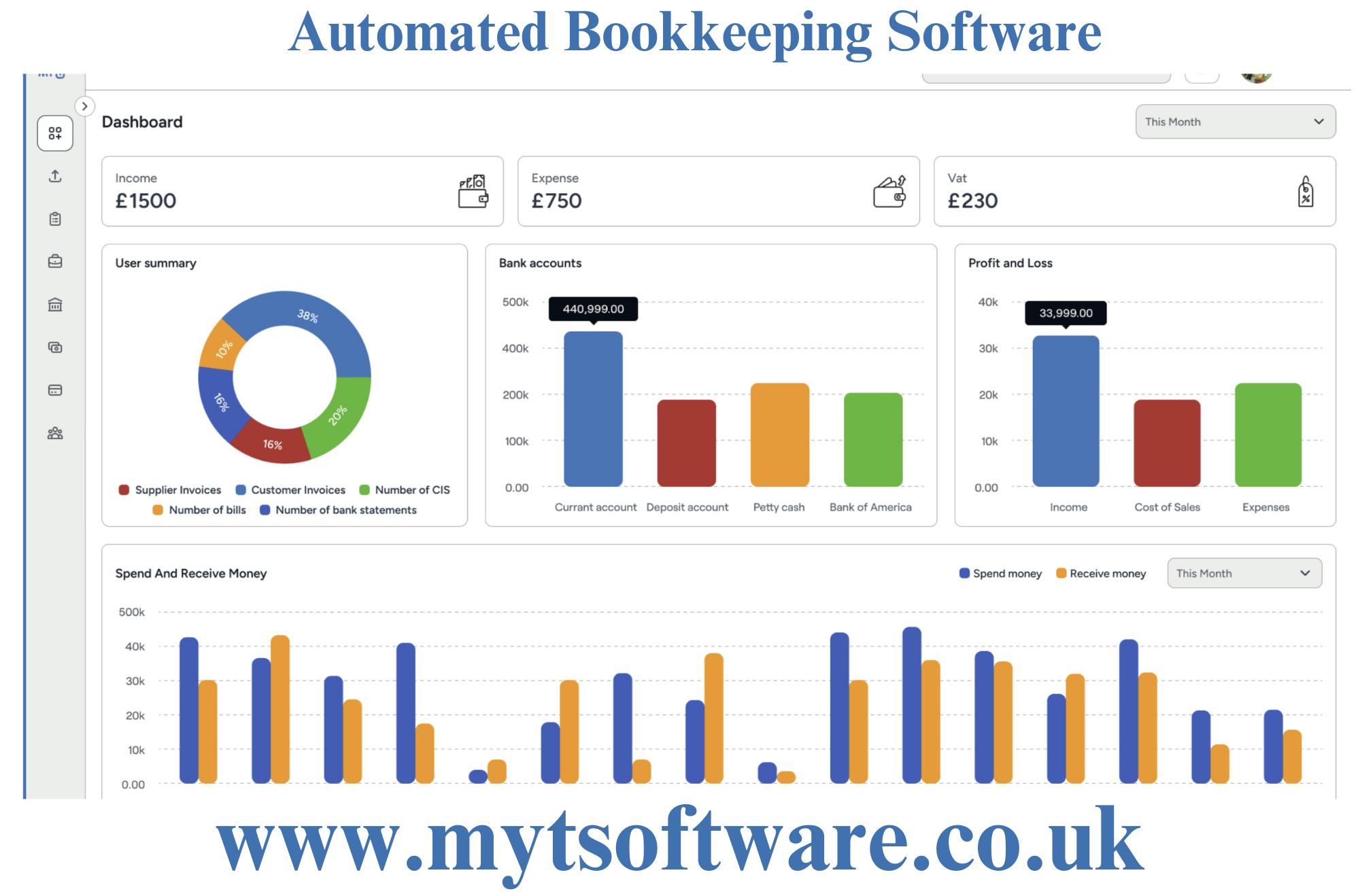

34 MYT

Accounting Ignorami: The Reluctance to Embrace AI for Making Tax Digital

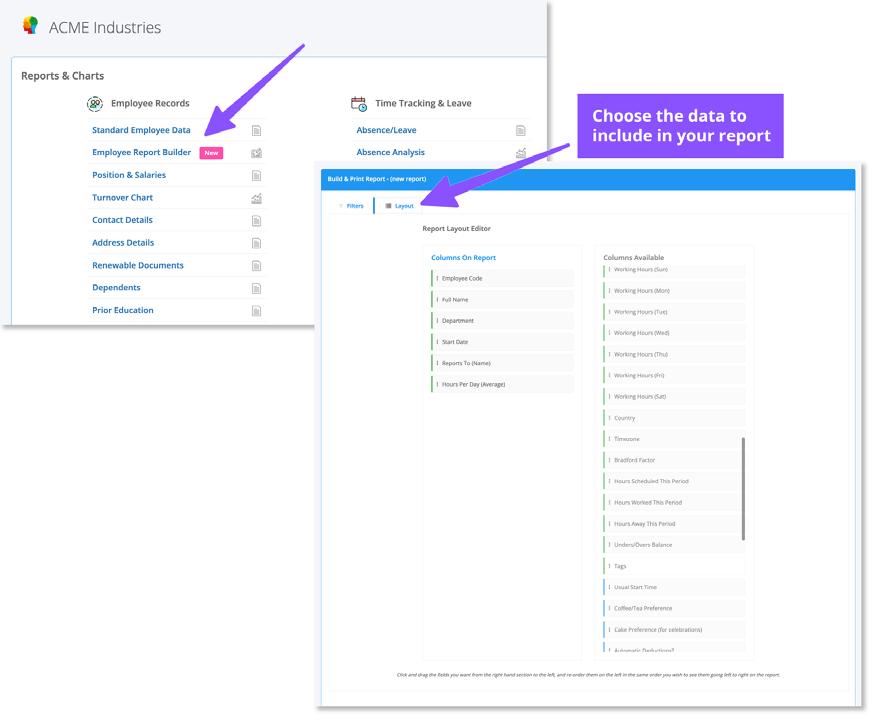

36 RecHound What’s one software tool that your business is missing? Making it yourself may actually be an option!

38 ApprovalMax Debunking the 'Too Small' myth

fumopay The New Way to Get Paid 42 CASE STUDY Frontline Accounting Expanding Capacity: How DTA Solved Their Staffing Crisis with Frontline Accounting

46 Tidy Hunting for Success: How Bene Footwear found their perfect solution

48 QX Accounting Services Tax Season: You’ve Been Doing It Wrong All Along!

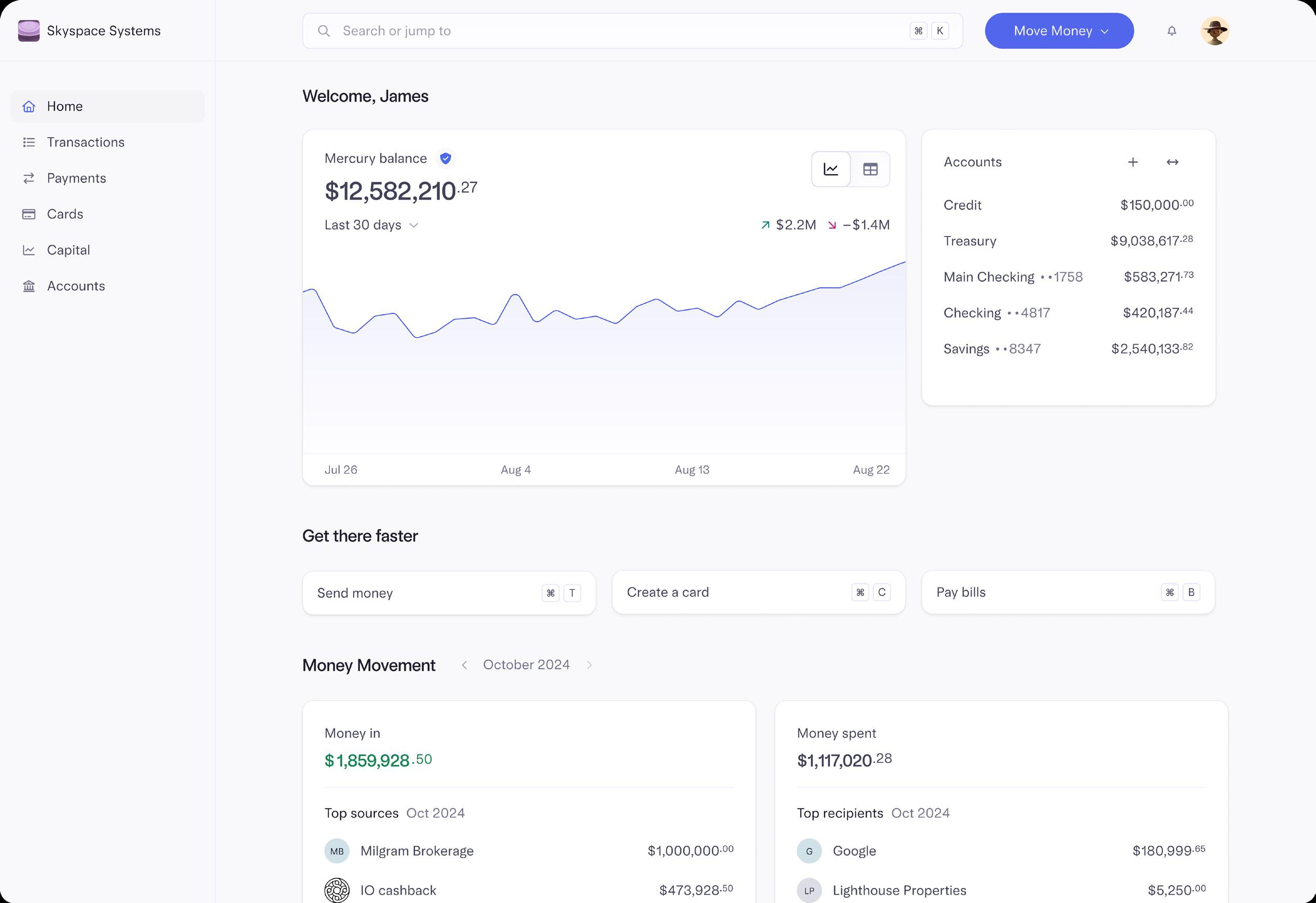

52 The Back Room From Tuatapere to Global Talent: How The Back Room Redefines Offshoring 54 Mercury Is cash basis or accrual accounting better for my startup client? 56 Projectworks The new Projectworks Academy

58 Buddy Empower your skills in Payroll

62 AdvanceTrack Outsourcing

Advancetrack® launches Podsourcing® for accountancy practices

Henrik Grim Co-Founder & CEO Mimo

64 G-Accon #1 Google Sheets Integration for QuickBooks and Xero

66 Expense on Demand From Paper to Pixels: The Journey to a Paperless Accounting Future

68 Spotlight 5 powerful features of Spotlight Forecasting you aren't using (but should)

72 EVENTS

The Business Show UK

The World’s Biggest Business Show | Golden 50th Edition

74 EVENTS

The Accounting & Business Show Asia

The Accounting & Business Show Asia made its successful debut on 16 - 17 October in Singapore

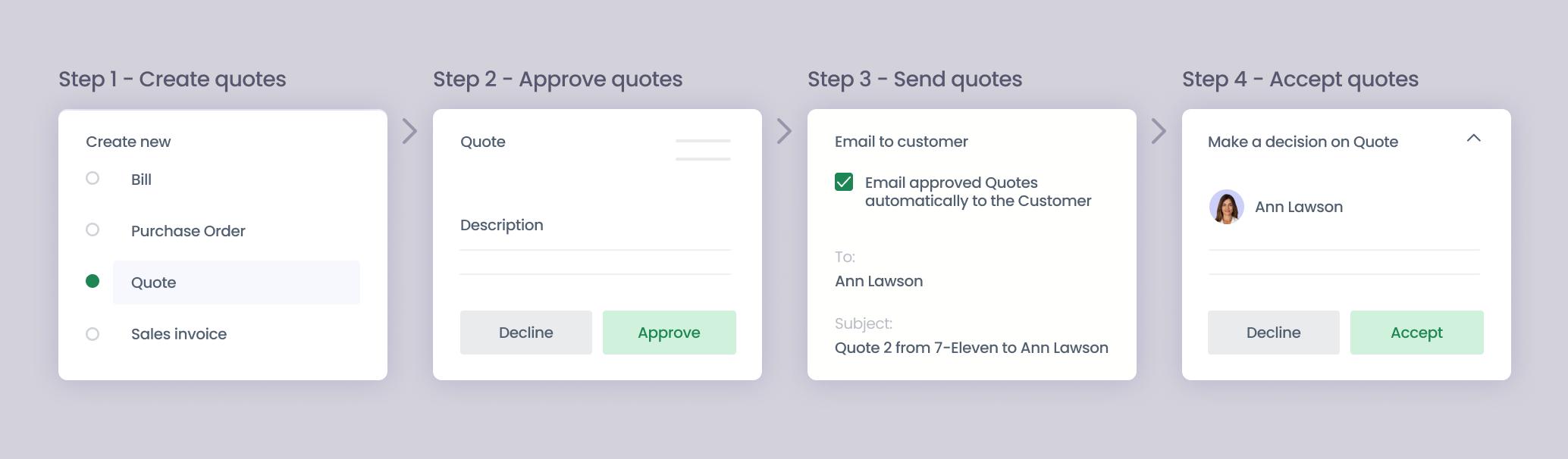

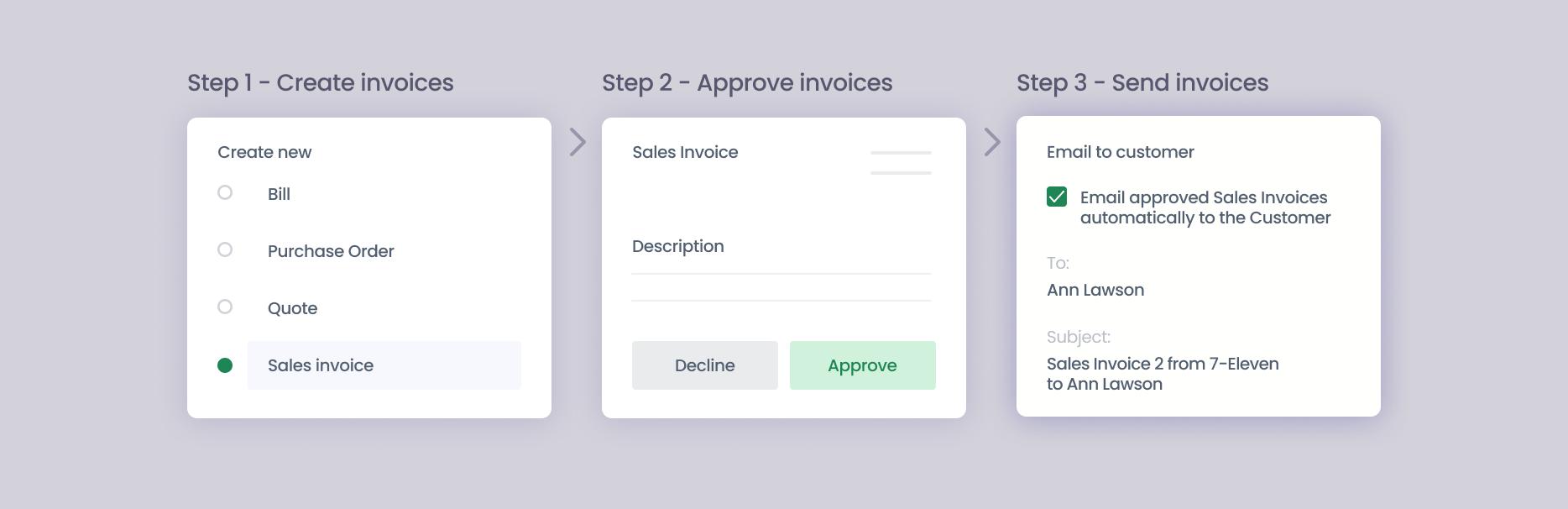

78 ApprovalMax Accounts receivable automation for end-to-end control

80 HR Partner

The Return-to-Office Debate: Choosing the Right Path for Your Company in 2025

82 Tim Hoopmann

How Small Business Owners can take Care of their Mental Health

84 Chaser

Celebrating 10 years of innovation

86 Revolut

Revolut reaches 10 million customers in the UK

88 XERO NEWS

What’s new in Xero –October 2024

90 UPDATES AND NEW RELEASES

92 CLASSIFIEDS

96 XERO NEWS

Hello, Xerocon Brisbane 2025

@autoentry

Keir Thomas-Bryant, Product Specialist, AutoEntry by Sage

Keir’s background is in journalism, where he spent two decades doing things like editing newsstand magazines and writing award-winning textbooks. For the last eight years he’s worked for Sage, where he’s written blogs, guides and more about core issues for accountants and bookkeepers, such as Making Tax Digital and practice management.

Accountants are struggling with their workload. The recent Practice of Now global trends update from Sage reported that 66% of accounting professionals say their current workload gets in the way of serving client needs.

The cause is often manual processes, such as clients providing 12 months’ worth of paperwork at tax time, and expecting their accountant or bookkeeper to make sense of it.

Even if manual entry is automated via a tool like AutoEntry, there’s still a need to

reconcile and adjust the data to get to an accurate trial balance.

However, here at AutoEntry we have found the perfect solution.

Cloud accounting

Cloud accounting like Xero provides one solution, of course. Yet as all accountants and

bookkeepers know, a stubborn subset of their client base won’t use any kind of accounting software.

This might be because they arguably have no need to do so. Small-scale landlords are a good example, where identical income arrives monthly and expenses are minimal. Other clients with simple accounting needs might be side hustlers, who earn a taxable income in addition to their day job.

But as you know, many clients simply can’t, or won’t, make use of technology no matter how powerful a case their accounting and bookkeeper makes.

We could call these do-it-forme clients. They want you to do everything for them. That can be a lot of work, with little financial reward.

AutoEntry has a perfect solution: AccountsPrep. Its users tell us it can turn hours of work into mere minutes. It forms an efficient workflow to use as a foundation in your practice.

Accountant Lee Coombes has been using AccountsPrep for several months and had this to say about how it has transformed the way he works with simpler clients.

How do you use AccountsPrep?

It’s brilliant for end-of-year work. I did a job this morning for a client who gave us 12 months’ worth of bank statements. With AccountsPrep I can literally just bash out a job with 500 transactions in about 30 minutes. And that’s not even rushing! Previously that would’ve taken me up to four hours.

You can also do things like VAT Returns because you can set AccountsPrep for quarterly filing, too. I used AccountsPrep this morning to prepare a VAT Return for a carpenter. There were 157 transactions and with AccountsPrep, it took me about three or four minutes to process.

I even use it daily. We have restaurant clients where we use AccountsPrep daily to pull the transactions off the bank account. I use software that turns the bank account into a CSV file and then I import this into AccountsPrep.

What clients do you use AccountsPrep with?

It’s for clients don’t have accounting of any kind. They don’t use or they don’t need accounting software. They use cash accounting, rather than accrual.

And there are a lot of clients out there like this, believe it or not. In my practice, I’d say there’s a 70/30 split in favour of clients who don’t use accounting software. We’re moving them all over now to AutoEntry and AccountsPrep. Often these are clients like construction industry workers, or within the hospitality

industry, like pubs and restaurants.

AccountsPrep is open to so many different types of clients, even up to medium-sized businesses as well as smaller.

Typically with these clients, they’re paid through the bank, and everything they buy is through the bank (or cash, or on account with a supplier). Effectively, the bank account is their general ledger. Everything I need as an accountant is there. And AccountsPrep lets me turn that into accounts incredibly easy.

You can use it for limited companies, too. You can input the opening balances from the previous year, then pull through the new data from the bank accounts and so forth. You can then produce journals for end of year, produce a trial balance, and then import that into accounting software.

Is AccountsPrep useful now governments require the digitisation of tax?

Here in the UK we have Making Tax Digital (MTD) for Income Tax coming in 2026. I’m building my MTD proposition around AccountsPrep. The fact is that clients who don’t want accounting software now are not going to want it when MTD comes in, either.

We can pull regular bank transactions in and we know what they are, obviously. But we can also manually input to AccountsPrep, as well.

So even if a client’s using their personal account they can give us a list of their debits and we can pull them in manually from their bank account. Even more than this, we can use AutoEntry to extract the data for clients with cash

paperwork receipts, or invoices for things out of the ordinary, and put it straight into AccountsPrep.

We can just ask them for access to the bank account. It’s faster and cheaper for them, too, compared to a cloud accounting subscription.

MTD requires client data to be sent to HMRC every 90 days. But with AccountsPrep we can be updating their accounts once a week or once a month. We’re not chasing clients for data. We’re just going to do it live, all the time.

What are the strengths of AccountsPrep?

The coding, reconciling and adjusting is so simple. Just click the income button so all the income transactions at the top, select them all, and code them as sales straight away. Then just list all the outgoings by alphabetical order so all the identical ones are next to each other, and it’s just a process of tick-tick-tick to code them. From a cost point of view, it’s perfect.

If you can use a spreadsheet, you can use AccountsPrep. I can use my own chart of accounts, like I do for corporation tax with limited companies, or use the ones that are already there for sole trader clients.

We use the reporting feature to output a profit & loss for some clients, too.

The price is perfect. We use a fixed pricing model, so if we can save time, it’s a no-brainer for us. Clients don’t care how we do it. They don’t care if it takes you one hour, or ten hours.

AccountsPrep is the biggest cost and time saving tool you’re ever going to use for fast coding bank transactions.

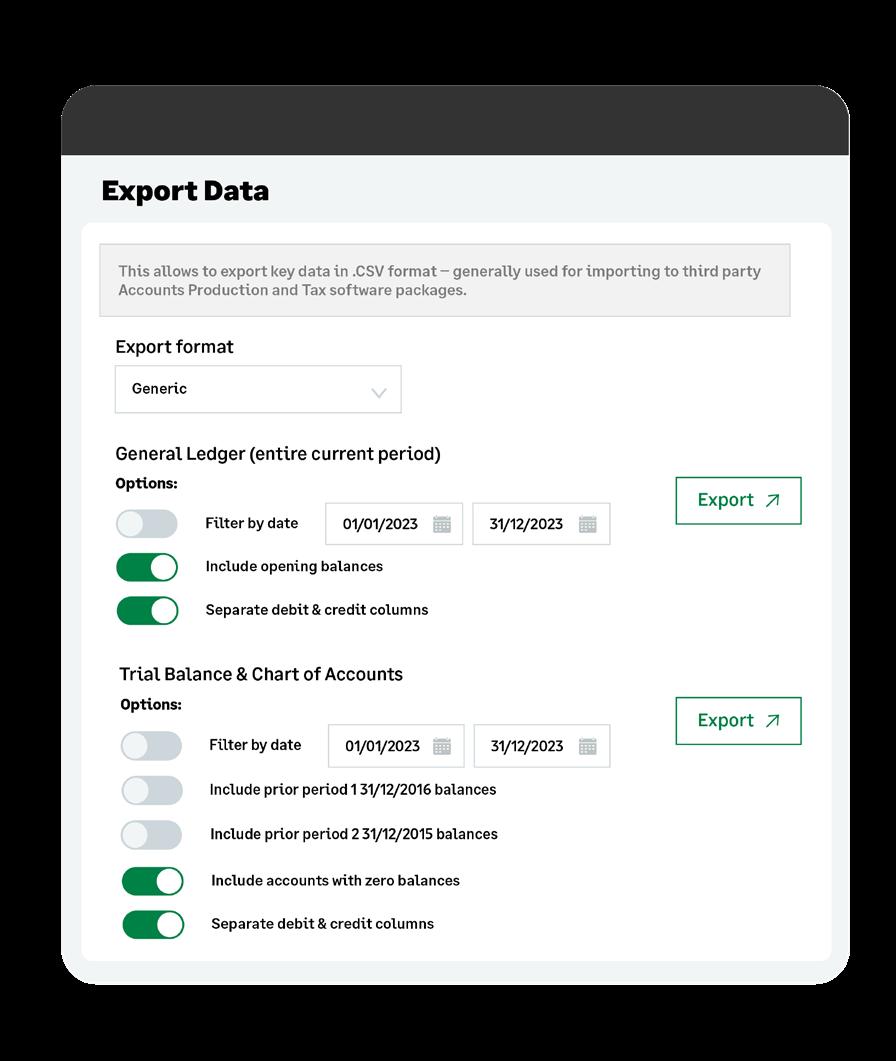

AccountsPrep means you can prepare, adjust and output a trial balance for an unlimited number of clients as an add-on to an AutoEntry subscription.

You can then output to a final accounts solution for compliance purposes.

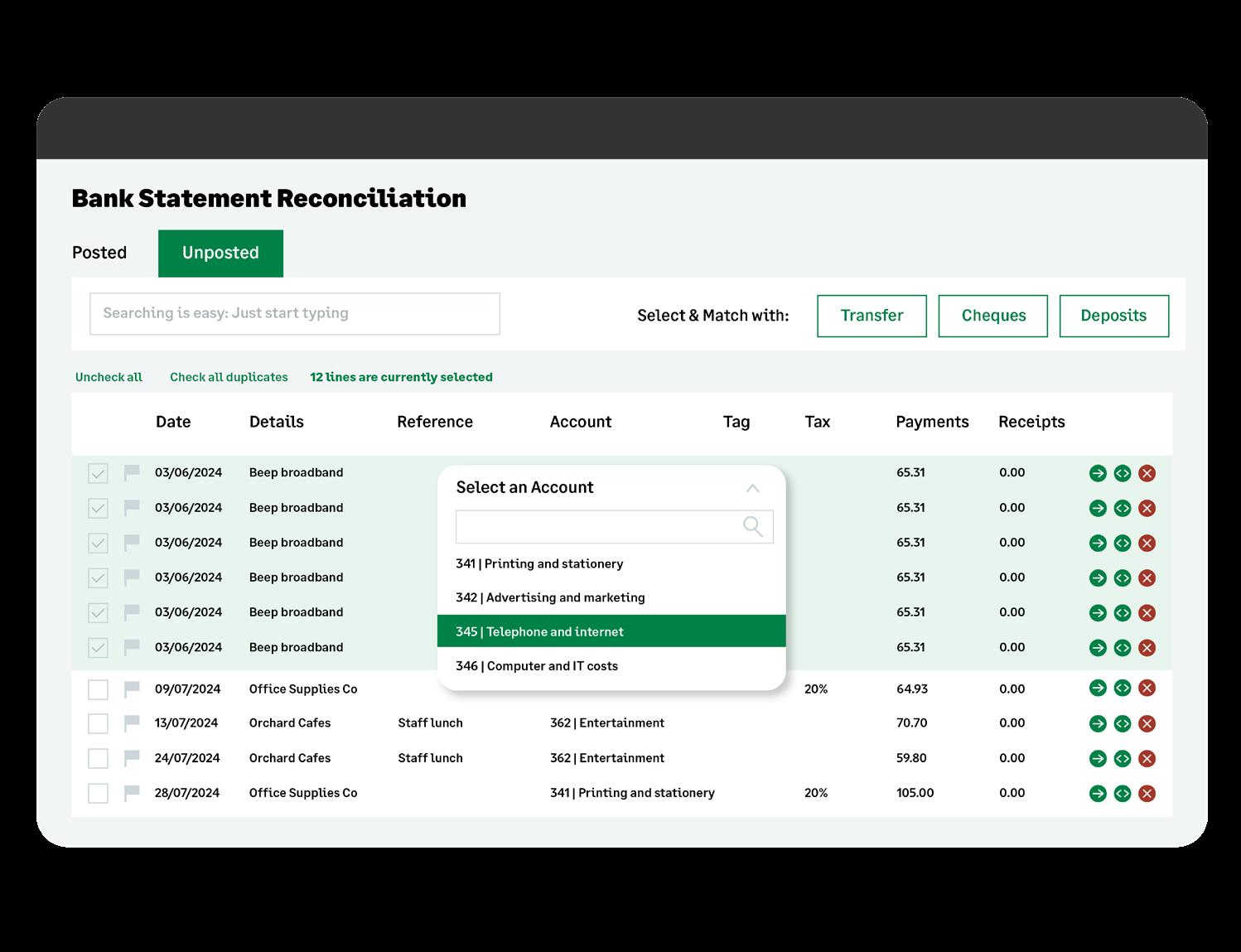

It’s tax season in the UK right now. Accountands and bookkeepers can upload PDF or print bank statements into AutoEntry in the usual way for

extraction. The data is then imported into AccountsPrep where it can be reviewed, updated and fast-coded to a chart of accounts (for which templates are provided, or you can use your own).

Cheques and deposits can be created and matched, too, and off-statement journal adjustments posted via three methods— standard journal, double journal, and manual quick edits direct in the journal.

Single transactions can be split

Phil Thornton is Senior Director of Product Management at Sage, and responsible for development of AutoEntry and AccountsPrep. Here he explains why accountants and bookkeepers need to use both.

How would you describe AccountsPrep?

How are you working today with those clients who turn up periodically with bags or boxes of paperwork? Or who email you all their paperwork once a year?

You can try and digitalise them to avoid this happening. Not all clients are interested or willing to use accounting software, however.

AccountsPrep expands AutoEntry’s data entry automation into full digitalisation of their accounting through to trial balance, profit and loss and balance sheet. For tax submission, as an example, you can use it maybe every quarter or 12 months to get to trial balance. With Making Tax Digital for Income Tax here in the UK, AccountsPrep in conjunction with AutoEntry will speed up the process of digitalising records and producing reports for the quarterly reviews and check points with clients.

More than this, though, AccountsPrep is about servicing these clients as efficiently as possible. You go from getting their bank data through to accounts in the fastest possible time, while retaining or even improving accuracy.

Where did the idea for AccountsPrep come from?

We are lucky enough to have a panel of accounting professionals who advise us on the best way forward for our products.

Those firms seeing the benefits of AccountsPrep already regularly tell us how important this tool is to their practice and supporting their clients. When we show AccountsPrep to new firms, they are blown away by the simplicity and efficiency.

AccountsPrep is unique. We feel there is nothing else like it on the market. And we’re very proud of it.

What kind of people should use AccountsPrep?

It’s for accountants and bookkeepers, in any size of practice. AccountsPrep solves a problem for sole practitioners all the way up to firms who are managing the affairs of thousands of clients.

into several lines for multiple nominal/tax codes, and you can make transfers between multiple bank and credit card accounts.

Once reconciliation has finished, you can instantly output reports such as a P&L, balance sheet, trial balance or tax report. Crucially, you can also export to your accounts production software of choice for tax compliance.

Easy-to-understand visuals demonstrating cash flow and yearly results can be created to provide clients with insight.

We feel it’s very much a tool for the practice who are doing work on behalf of their clients in a way that collects the data and produces the required reporting as efficiently as possible. If clients are looking for a way to manage their own finances in conjunction with their accountant, then a cloud accounting solution would likely be best placed.

What are the benefits of AccountsPrep?

There are so many.

At its core, it’s the simplicity. It’s just so easy to use, and that’s a strength: Get the data such as invoices, receipts and bank statements from the client, feed them into AutoEntry, then use AccountsPrep to instantly reconcile, adjust and prepare the reports.

Add to that speed and efficiency I’ve already talked about. We can’t think of a better or faster way to do this job. Accountants and bookkeepers are able to use AccountsPrep to reduce the time it takes to service those shoebox clients, while maintaining fee structures which ultimately leads to stronger margins. We love that!

AccountsPrep

AccountsPrep is available now as an addition to any AutoEntry subscription at £50 per month, for use with an unlimited number of clients (€55 in Ireland, with other countries following soon).

This continues our “unlimited” approach, where with each subscription to AutoEntry, our customers pay only for the data extraction they use. All AutoEntry customers get unlimited client companies, user accounts and cloud storage for scanned docs.

If you’re an existing AutoEntry user, all you need do is open your dashboard, click Settings, and then select to add AccountsPrep.

If you’re a new customer, you can sign-up for a free trial of AutoEntry (and get 25 free credits!) Then after you’ve selected any subscription package, you can add AccountsPrep.

FIND OUT MORE...

Get a free trial of AutoEntry and learn more about AccountsPrep: autoentry.com

Quickly prepare accounts in arrears for clients who don’t use accounting software. Prepare, adjust and output a trial balance for an unlimited number of clients with just one flat monthly subscription as an add on for any AutoEntry subscription. It’s ideal for tax submissions of any kind.

• Import a chart of accounts, or use one of the readymade templates.

• Split large transactions into individual

lines for separate coding.

• Make adjustments via standard, double or manual quick journal edit.

• Cheque and deposit creation and matching.

• Transfer between multiple bank and credit card accounts.

• Help future-proof clients for government tax digitisation demands (e.g. Making Tax Digital in the UK) by moving their existing accounting into the digital realm.

Trusted by 40,000 entities globally, Joiin delivers features for one great price, including global sear transaction drill downs, customisable dashboards and multi-client. This means multi-entity financial consolidated reporting from only £16/month.

Global search integrates with your Xero transactions, letting you seamlessly search and drill down into multientity transactional data.

Dashboard reporting automatically pulls together critical metrics in one place and lets you customise your dashboard easily with drag and drop.

Fine-grained user controls let you better restrict individual company data to selected people, meaning more control over who sees what financials.

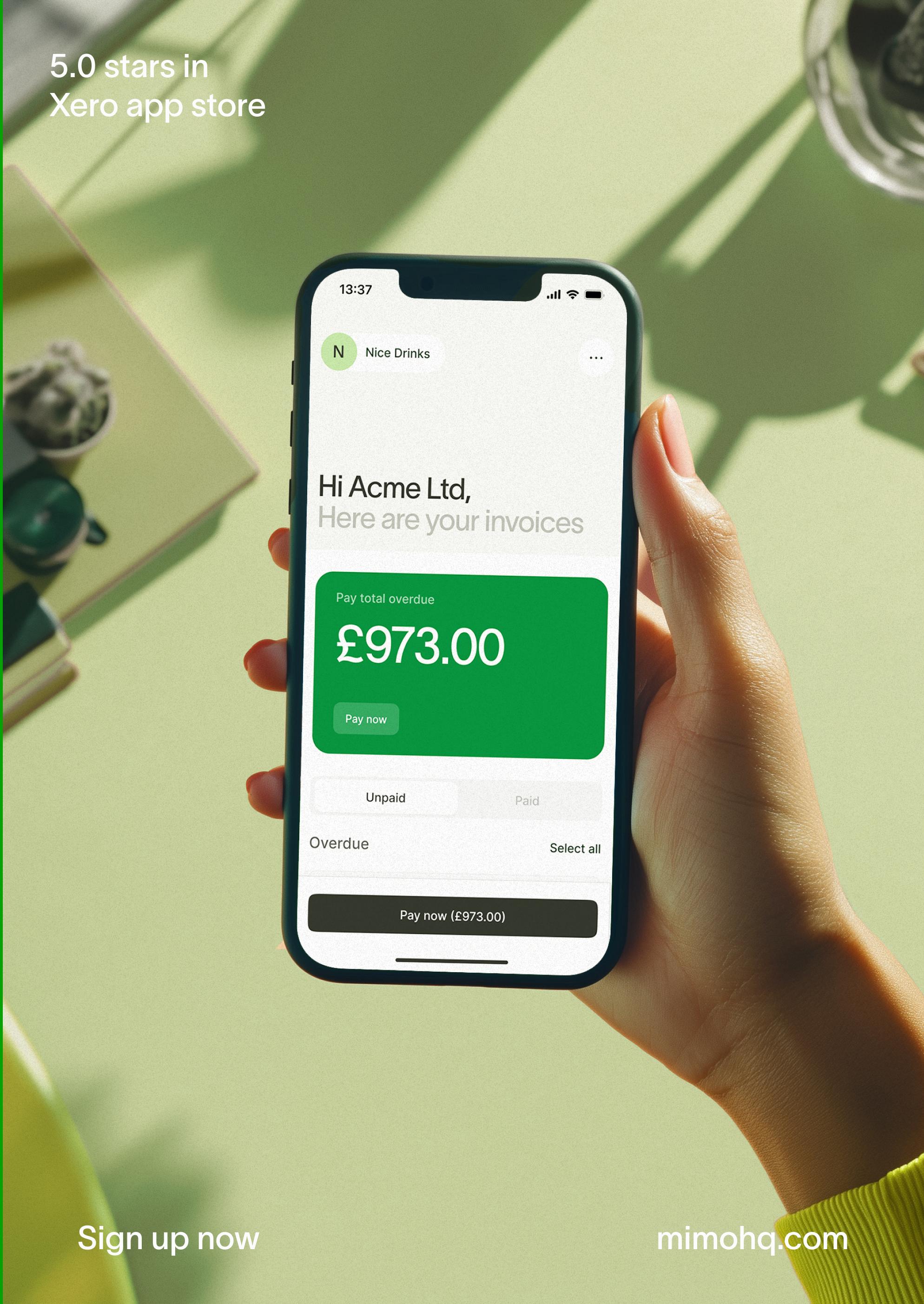

Henrik Grim

Mimo Co-Founder & CEO

XU: Can you briefly introduce Mimo and the vision behind its creation? What problem were you and your co-founders aiming to solve in the accounting and finance space?

HG: Mimo was founded with the mission to simplify financial management for SMEs, accountants, and bookkeepers by streamlining the way they handle business payments. We saw that many businesses and their accountants & bookkeepers struggle with managing payments—both incoming and outgoing—leading to cash flow problems and inefficiencies in reconciliation processes. So we created Mimo to provide a platform that automates these critical financial operations and helps businesses take control of their cash flow without the headache of manual effort.

XU: Can you tell us about the founding team behind Mimo? How did you all come together, and what unique skills and experiences does each cofounder bring to the table?

HG: My co-founders and I first met over a decade ago while working at iZettle (now Zettle since its

acquisition by PayPal) where we worked on solving payment problems for small businesses. Since then, we’ve gone on to work in different fast-growing tech companies, where we gained deeper expertise in finance, software development, payments, and SME products. What brought us back together was a shared realisation that, despite the advances in fintech, small business owners are still grappling with many inefficient financial processes. And that’s the very problem we set out to solve with Mimo.

XU: Since launching Mimo, how has the company evolved, and how do you see your platform fitting into the broader financial and accounting ecosystem?

HG: We just launched publicly 6 months ago, but we’ve already evolved significantly since then. We initially started with our accounts payable product, Mimo Pay, as well as our built-in credit line, Mimo Flex. But we have always known that granting accountants and SMEs with the ability to handle both sides of the cash flow

equation was essential. By having everything in one place, it’s easier for businesses to stay on top of their finances, which we think is going to be crucial as we continue to integrate more deeply into the broader financial ecosystem.

XU: What kind of company culture are you building at Mimo, and how do you ensure that the team remains aligned with your mission, especially as the company scales?

“Automation is at the core of what we do”

HG: At Mimo, innovation and putting our users first are at the core of everything we do, so we foster an environment where thinking outside the box and maintaining a customer-centric mindset are key. What that means in practice, is an emphasis on a flat organizational structure, where we hire a few, highly experienced people who act as individual contributors. It also means that we work in smaller, dedicated teams that align on weekly execution against short-term targets, while we within the larger company do quarterly planning sessions to maintain focus on the

longer-term mission. It’s a fastpaced environment, but this way of working ensures we’re all pulling in the same direction, which is crucial as we scale.

XU:

Let’s talk about your new Mimo Get Paid product. Could you explain what it is and how it fits into Mimo’s broader suite of offerings?

“Get Paid provides the tools to give accountants time to have high-value engagements with clients”

HG: Mimo Get Paid is designed to help businesses get paid faster by streamlining their accounts receivable. It automates the process of getting paid, from sending out payment requests and reminders, to reconciling bank transactions.

Together with our existing Pay product, which handles accounts payable, Mimo forms a complete cash flow management system, allowing businesses to manage both incoming and outgoing payments from one platform. This not only optimizes the

payment cycle but also ensures that businesses have better control over their financial health.

XU: What specific pain points in accounting and bookkeeping does Get Paid aim to solve for businesses and accountants?

HG:

One of the biggest pain points we’ve identified is the time-consuming nature of reconciling payments and chasing down late invoices, which can be particularly frustrating for SMEs with limited resources. Additionally, it helps accountants by providing realtime visibility into cash flow, making financial reporting and planning more accurate and less labor-intensive.

XU: Could you walk us through the key features of Get Paid and how it helps streamline cash inflows for businesses?

HG: There are several key features in Get Paid designed to get paid faster. First, it allows you to set up automation workflows to send reminders, reducing the need for manual chasing. Second, it

allows businesses to offer flexible payment options, including bank transfers, direct debits, and credit cards, which makes it easier for customers to pay on time. Finally, it provides automatic reconciliation of payments across any payment method, so businesses can see at a glance which invoices have been paid and which are still outstanding. These features work together to help businesses get paid faster and manage their cash flow more effectively.

XU: Automation is a growing trend in accounting. To what extent does Get Paid leverage automation, and how does it reduce manual processes for users?

HG: Automation is at the core of what we do. The platform automates many of the traditionally manual processes, such as sending out invoices, following up with reminders, and reconciling payments with bank transactions. This not only saves time but also reduces human error, ensuring that businesses have accurate, up-to-date information about their cash flow. For accountants and bookkeepers, it means less time spent on tedious tasks and more time focusing on strategic financial management.

XU: With Get Paid offering more automation and control over cash inflows, do you see the role of accountants changing? How do you think they will adapt to this new technology?

HG: I think accountants and bookkeepers will continue to play a crucial role, but their focus will shift more toward advisory services and helping clients manage financial planning, as automation takes over many of the manual tasks. Get Paid provides the tools to give accountants more time to have more frequent, high-value engagements with clients, and I believe they’ll embrace this shift

as it allows them to provide even greater value.

XU: How can small and medium-sized enterprises (SMEs) benefit from Get Paid? Are there specific features tailored to address the challenges these businesses face with cash management?

HG: With Get Paid, SMEs can benefit from automated payment reminders, flexible payment options, and instant reconciliation, greatly minimizing the time and effort required to receive payments. Additionally, through the Mimo platform, they can also access flexible working capital, further supporting healthier cash flow. Given the current economic environment, we know this to be more important than ever.

XU: The accounting tech space is competitive, with many tools aiming to simplify financial processes. How does Get Paid differentiate itself from similar offerings in the market?

HG: What sets Get Paid apart is that it’s part of a fully integrated platform that handles both accounts payable and accounts receivable. Many

tools focus on one side of the equation, but we believe that managing cash flow effectively requires both AP and AR to work seamlessly together. By offering a single platform for all paymentrelated processes, we provide businesses with a holistic view of their cash flow, making it easier to optimize both sides of the ledger. Further, by offering flexible finance natively embedded, we provide more options for both SMEs and their customers to make payments on terms that suit them and reduce potential negative cash flow impact.

XU: Looking ahead, what do you think the broader implications of Get Paid and similar tools will be for the accounting profession as a whole?

HG:

From what we’re hearing from our users, the continued advancement of automation is enabling accountants to broaden their offering and take on more clients, while becoming more focused on providing services like financial analysis, strategy, and planning. It’s an exciting time for the profession, and I think automation is only going to elevate the role of accountants in the future.

XU: Are there any future developments or features in the pipeline for Mimo?

HG: We’re constantly improving and expanding our platform in terms of functionality. In particular, we are working on a set of features around helping Accountants, Bookkeepers and business owners understand and control short-term cash flow in their payments workflow, with new data and finance products embedded into the Mimo platform. We are also working with increasingly large accounting firms, where we are building out broader support for their specific needs. Stay tuned—there’s a lot more to come!

@quickbooksau

Damien Greathead

Accounting and Advisor Group

Lead at Intuit QuickBooks

Spire Accounting: How QuickBooks Tax Powered by LodgeiT Transformed the Firm's Client Work - a Case Study

erang, Queenslandbased Spire Accounting was first established in 2016, when then-sports marketer Ken Bensley and his accountant Joel Gurciullo decided to go into business together.

Fast-forward eight years, and they’ve built a thriving six-person firm known for its personable, laid-back approach. Spire specialises in small and mediumsized construction businesses and

their owners, helping them stay compliant, grow the business, or manage their SMSFs so they can save for retirement.

However, Spire’s journey wasn't always easy. The firm originally used MYOB Accounting Office (AO) to handle its clients’ tax work—but this caused endless headaches.

Spire needed a new solution.

That’s when it came across QuickBooks Tax, powered by LodgeiT.

Despite their fast-moving ethos, Spire’s tax software and subsequent processes were anything but.

“The software was too complex for our clients’ needs, and the team wasted countless hours on manual data entry and other administrative tasks like chasing signatures.”

-

Ken Bensley

According to Joel, “The MYOB portal was slow, complex, and unintuitive”. Worse still, it caused the team and its clients to waste countless hours each month on admin.

One specific pain point was MYOB AO required clients to log in with a password to provide digital signatures. Unfortunately, clients kept on forgetting their passwords or thinking they needed to create a MYOB account themselves to access their files. There was constant confusion.

What’s more, there was no way to automate approval reminders

within the MYOB AO platform— meaning the team had to spend a significant portion of each week manually chasing client approvals. As Joel describes, "We were constantly hounding clients for signatures. It was a nightmare"

The team often waited weeks to get all-important sign-offs to complete reports. Spire quickly realised it couldn’t continue working this way and needed to think differently. So, it decided to look for another alternative solution—one that could help it save precious time.

“The Best In The Market”: Embracing QuickBooks Tax

Ken and Joel decided to give QuickBooks Tax a trial run after hearing about its evolution over the years. Ken was immediately impressed. “It was absolutely remarkable”

Eager to see if others felt the same, he asked the rest of his team to test it out themselves. They were just as enthusiastic as he was. “MYOB AO was archaic compared to QuickBooks Tax”, says Kieran Dingley, one of Spire’s accountants. “It was generations behind”

associated with generating financial statements. “It’s an absolute game-changer” explains Ken.

“Once people see the integration of Prep for Taxes into QuickBooks, I think it’ll blow their minds. It’s seriously the best in the market.”

and its clients. What’s more, it integrates directly with QuickBooks’ Prep for Taxes tool, saving hours on creating financial statements.

Spire has reduced its return approval wait times, improved the client experience, and lightened the administrative burden on their team thanks to QuickBooks Tax’s automated reminders.

- Ken Bensley

Bearing these features and the team’s feedback in mind, Spire decided to pivot to QuickBooks Tax.

Unlike other reporting systems, QuickBooks Tax uses a single import and classification exercise to automatically populate Working Papers, Tax Forms, and Financial Statements.

With features like automated reminders, instant data-sharing, and a userfriendly interface, QuickBooks Tax eliminates the headaches

“Getting client approvals used to take weeks. Now, we often get signatures back overnight. It’s worlds apart.”

- Joel Gurciullo

QuickBooks Tax, powered by LodgeiT, uses two-factor authentication (2FA). This means increased security, no more lost passwords, and enhanced security for both Spire

What’s more, QuickBooks Tax automatically populates followup emails—all the team needs to do is send them off. Then, clients can approve with one click. No more pesky passwords they need to remember. “It’s made life just so much easier on our end”, says Joel.

QuickBooks Tax users receive unlimited e-signatures included, as one of the benefits in the ProAdvisor Program. Helping accelerate client approvals, you can see at a glance which clients have approved returns, and who you’re waiting on. You can even automate or send reminders to sign in bulk.

Having switched over to QuickBooks Tax, Spire only has to follow up manually with 5% of its clients. This is a far cry from the 30 - 40% that was the norm when the firm used MYOB AO.

QuickBooks Tax automatically prefills tax forms and creates corresponding financial statements using data imported directly from QuickBooks’ Prep for Taxes tool. This virtually eliminates the need for the team to rekey data, meaning financial statements that used to take half a day to prepare now only take a couple of minutes.

“You can build a set of financial statements in three or four minutes, as opposed to three or four hours” explains Ken.

And while QuickBooks Tax streamlines the process for importing client data from QuickBooks Online, it also lets you import client-side financials from clients using Xero, MYOB, Reckon and many other platforms—even Microsoft Excel.

The Spire team find QuickBooks Tax’s dashboard feature particularly useful when it comes to maintaining an up-to-date view of all live tasks. The dashboard view means the team can see immediately if any clients have paperwork outstanding, or need an automated reminder to submit their data.

QuickBooks Tax, powered by LodgeiT, has transformed Spire’s operations. Thanks to its automated reminders, easy authentication, and effortless integrations, the firm now spends significantly less time on admin and data entry—all while providing a smoother client experience.

Now, Spire can focus on what it does best: building great

relationships with its clients. Less time chasing signatures, more time catching up with clients for a coffee or beer out on the firm’s veranda.

Access to QuickBooks Tax is free for members of the QuickBooks ProAdvisor Program. This Program is free to join*. Simply add more QuickBooks Online subscriptions for your clients to access additional tax and BAS lodgments.

@mckanas

Matt Kanas, VP, Partnerships & Ecosystem, Ignition

Matt Kanas is a seasoned professional who serves as the VP, Partnerships & Ecosystem at Ignition. With a proven track record of driving growth and innovation, Matt has earned a distinguished reputation within the technology industry. He brings over 18 years of experience in the accounting software industry, including working for leading companies such as Intuit.

If inefficient processes are holding your firm back from maximising revenue and profitability, it’s time to consider a smarter way to run your business.

Here are seven proven steps for fast-tracking your revenue, cash flow, and efficiency.

1. Clearly define your services, pricing, and packaging

Many firms are using outdated ways to price and package services. Yet strategic pricing and packaging can significantly enhance your firm’s profitability and operational efficiency. Effective pricing strategies start

by clearly defining and breaking down your services into detailed components. Once you’ve identified the services you’re offering, only then can you determine the value and put a price on each of those services.

This is where a three-option pricing system comes in, enabling your business to offer predefined service packages to clients. Clients understand exactly what they’re getting, when, and for how much, which improves

communication and sets clear expectations.

Using a platform such as Ignition allows you to easily build your service library and create predefined service packages using proposal options.

2. Re-evaluate your billing model

Holding on to traditional billing models is another common culprit that can hinder efficiency and profitability for service-based businesses. Billing by the hour, manually tracking billable hours, billing after you’ve completed the work, chasing clients for payments – these are all entrenched habits that drain your resources and your profits.

Updating old billing models is key to managing your firm’s revenue. This includes rethinking how you bill and get paid – for example, shifting from billing upon completion to billing upfront or taking a deposit before the work begins.

When re-evaluating your billing practices, it’s important to have a billing and payments solution that can help you successfully navigate this transition. Ignition’s flexible

billing options mean you can bill hourly or use fixed fees, apply one-off or recurring fees, take upfront payments or deposits, and more.

3. Shift to upfront client payments

It’s no surprise that many firms suffer from cash flow issues if they’re stuck using outdated billing practices.

Even if your business isn’t ready to make the leap from hourly to fixed-fee billing, you can still implement billing processes that will guarantee you’ll get paid. Just like when signing up for a gym membership, firms can collect payment details upfront when clients sign a proposal using a tool such as Ignition. This puts you, rather than your clients, in control of the payment process and allows you to collect the payment automatically when the invoice is due. You can then transition to upfront payments, before the work even begins.

4. Transition to recurring revenue

If your business is stuck on a roller-coaster revenue recycle, it may be time to transition to recurring revenue or diversify your revenue streams to protect your cash flow year-round. For Marcus Dillon, CPA and President of Dillon Business Advisors (DBA), transitioning from a traditional accounting practice to offering more comprehensive client advisory services (CAS) has led to increased revenue. DBA now

clients with a ‘quick favour’ or spend time on the phone giving advice you probably should be charging for. Ultimately, it all adds up and means you and your staff are working, at least in part, for free.

Effective pricing strategies start by clearly defining and breaking down your services into detailed components.

offers Essential, Premier, and Elite core packages for CAS.

5. Engage clients with a clear scope of work

One of the fastest ways for firms to lose out on revenue and profits is by not having a clearly defined scope of work when engaging clients. You’re not only missing out on an opportunity to communicate your firm’s true value, but also introducing ambiguity to the client relationship. Clients don’t know exactly what they’re paying for, and your staff members are unclear on the services they should be delivering – exposing your business to scope creep.

When sending clients your proposal or engagement letter, it’s vital to include the scope, frequency, and pricing for the services you’re offering, alongside your payment terms, so everyone is on the same page.

Luckily, Ignition enables you to templatise proposals and engagement letters, meaning it takes only minutes to create proposals that provide clients with complete clarity on the scope of services.

6. Get paid when the scope changes

Even if your business is diligent in engaging clients with a clear scope of work, chances are that you’re not charging them for all the ad hoc services you’re providing. It’s all too easy to assist

The solution? Refer back to your original signed agreement to remind clients what is or isn’t in scope, and charge them for additional services appropriately.

Thankfully, Ignition makes it easy to bill for any ad hoc or out-ofscope work using the instant bill feature

7. Automate time-consuming processes

Once your firm has redefined its approach to pricing and packaging, engaging clients, billing, and payment collection, it’s time to tackle the biggest challenge holding many firms back – administrative burden. Automating manual client engagement, billing, and payment processes is the key to scaling your business, and your revenue, more efficiently.

Taking stock of your current processes is the first step to helping you identify the biggest efficiency gains for your business. You can then implement platforms, such as Ignition, to help automate the way you run your business and unlock more revenue.

Discover how Ignition can transform your firm.

Try for free

Ryan Kagan, Head of Growth and Partnerships, WorkflowMax by BlueRock

With 20+ years' experience scaling businesses through digital solutions, Ryan Kagan, Head of Growth and Partnerships at WorkflowMax by BlueRock, is a seasoned leader in account management, product, partnerships, and business growth. Formerly a Director at BlueRock Digital, he propelled the startup to success. Prior roles at Deloitte Digital involved driving digital enablement and transformation through strategic advisory. Now, Ryan strives to build a thriving platform community where all prosper.

This article is

Residential roofing specialists, Roof Improvements, have been in business for three decades, which meant dealing with legacy tools, outdated systems, and manual processes. Discover how Katalyst and WorkflowMax stepped in to provide the tools that transformed their decision-making and boosted their efficiency.

Residential roofing is a big and increasingly complex industry in Aotearoa New Zealand, and one that plays a vital role in protecting Kiwis and their infrastructure from the elements. And it’s not just the wild weather that’s testing the industry, either. Strict and changing regulations, skills shortages and strong competition all put roofing companies under pressure.

Roof Improvements, an Aucklandbased residential roofing company that specialises in long-run iron, has seen it all in its

three decades of operation. Over many years Roof Improvements has grown from a small operation to a multi-million-dollar business servicing private and state-funded homes.

Naturally, as the company has grown over the years, they’ve found the manual processes, handwritten documents and reams of paper invoices just don’t cut it when it comes to efficiency, data clarity, or scalability. So they reached out to Glennis Stuckey at Katalyst Cloud and Business Services to see how WorkflowMax could streamline the company’s operations and offer better insights into its financial performance.

A foundation of manual processes

Co-founder Dean Foster was on the tools, Dawson Chung managed quantity surveying and Clare Barrett took care of the administration.

“WorkflowMax has just been phenomenal.”Clare Barrett, Owner Operator, Roof Improvements

“We had a couple of contractors that worked with us, but we were very small scale. My husband’s a roofer, and has been since about 16,” explains Clare.

The opportunity for the business to expand came along when Dawson, who came from a quantity surveyor background, agreed to join as their business partner, and bring on the skillsets they lacked. That was 25 years ago, and Roof Improvements has evolved significantly since then.

Like so many businesses, Roof Improvements started out small.

For one, Dean is now off the tools, and the team has grown to around 30 including directors, shareholders, roofers and contractors. As Roof Improvements expanded its

operations, it became increasingly evident that its manual processes were hindering the business’ growth and profitability.

“In the early days, you had to be an idiot to not make money in the building industry – not to sound like a prat. But we knew we had to get better than just writing out an invoice in Microsoft Word, dictated from some handwritten notes. We saw a lot of time being wasted on not being able to get your hands on information when you needed it.”

“The way we were doing things meant that we needed something more powerful. I couldn’t drill down to where we made and lost money,” says Clare.

“Sometimes your perception of where you’re making money isn’t accurate. You might have a great relationship with a business or person, but you need to know what it’s taking to make a deal, and where in your workflow it’s actually costing you.”

Manual processes were timeconsuming and prone to errors and delays. “We’d spend half a day looking through a stack of paper for a purchase order. That just wouldn’t do.”

The Katalyst for change

By 2016, the challenges had become overwhelming. Clare began exploring accounting software solutions. While their accountant had set them up with Xero, the team quickly realised they needed more than just an accounting tool—they needed a comprehensive job management solution.

quickly to solve the problem,” Clare says.

After investigating a few options, they reached out to Glennis Stuckey at Katalyst, to see what tools would be right for them – and Glennis immediately recognised the challenges Clare and the team were facing.

“There was a lot of custom data they were trying to track,” explains Glennis. “Roof colour, gauge, and profile, all needed to be taken into account – not just for quoting, but for accessing that information down the track for additions or issues.”

different places,” she adds. “This was a highly complex business with custom needs.”

For Glennis, the solution was clear: WorkflowMax – a comprehensive job management software designed to help businesses streamline their operations and improve efficiency. It offers a wide range of features for contractors like Roof Improvements, and at the time WorkflowMax was a Xero offering, so the fit was natural.

Glennis and Clare discussed at length the other features Roof Improvements wanted or were already using, like GPS tracking and time tracking for the installation teams.

“When you’re pulling the timesheets together to make sure you’re billing correctly, it was super time consuming, the information was coming from three

“WorkflowMax saves you time and does it easily. Don’t complicate. Automate.” - Glennis Stuckey, Owner Director, Katalyst Cloud & Business Services

“We had all parts of the business on different platforms. And if there were issues down the road, finding an email or an invoice was hard. Everything was scattered. It worked to a point, but if there was an issue, it was mind-blowing how hard it was to find the exact information

After completing a thorough assessment of Roof Improvements’ existing processes and requirements, Glennis started configuring WorkflowMax for them.

“When implementing WorkflowMax, Clare and I ended up creating an impressive 130+ custom fields and templates to account for all the variations and features they wanted to track,” Glennis says.

“The Roof Improvements team are heavy users of the system. Clare knew that there was a need for

L-R: Brendon and Glennis from Katalyst Cloud & Business Services Ltd Foundational Implementation Partners of the new WorkflowMax by BlueRock

general process improvements to their systems, in particular accessing historical information quickly. Now they could easily go back to 2016 and review their jobs to find all the information they need.”

“As a bookkeeping company, we tend to look at things from the bottom up – efficiency, ease of use, and best reporting possible. We like to make it easy; we can always complicate it later! It’s often best to start with implementing basic features, to get it to stick. If we go in too hard and fast, people get overwhelmed. Start with a job, record time and costs and invoice it. Then roll on extra features.”

Clare adds that “implementing the original WorkflowMax came with some challenges. It’s a beast to feed, because of the level of stuff that I want out of it. But that’s what’s made it such a successful solution for us.”

“There’s a bit of pain at the start, because you’ve got to train people, you’ve got to investigate what the business is capable of. But Glennis was integral to taking us through those steps. Every now and then she’d point out new things that WorkflowMax was capable of, and we’d get excited again!”

How Katalyst kept WorkflowMax close at hand

A few years after implementation, a fresh challenge arose. Xero was retiring WorkflowMax from their suite of offerings, and BlueRock was to take over the brand and build a new version called WorkflowMax by BlueRock.

“We had this beautiful system that worked really well,” says Clare. “And then we were told that we’d have the pain of having to learn a new but similar system.”

Glennis and Clare saw the challenge. Clare describes herself as a visual person, so needed a solution that would have an effective user interface that would continue to make sense. And Glennis knew that whatever solution they chose for Roof Improvements, it would have to deliver similar or better results.

Glennis notes: “We did investigate a few options that were similar to WorkflowMax, but these all cost two or three times more. In the end, we knew that sticking with WorkflowMax was the right move – but that it would come with some more changes to keep it moving.”

the final migration was completed on schedule. It’s been very much a process of testing, reviewing, and refining along the way!”

For Clare, it was hands-off. So much so that she could continue with her planned three-month European holiday.

“You need someone key in the business to make implementing a tool like WorkflowMax quick and easy, and a partner who makes it easy and works with you to get the results and changes you want.” - Clare Barrett, Owner Operator, Roof Improvements

As Clare says, “The timing couldn’t have been worse! But I had confidence that our in-house team along with Glennis as an implementation partner were all over it. Any time you’re integrating a new piece of software, there are going to be issues. But you stick with it. And Glennis has been integral to that.”

Inspiring an award-winning business

“We completed 133 migrations for clients transitioning from Xero's WorkflowMax to the new WorkflowMax by BlueRock. For Roof Improvements, the extensive data in their system required multiple passes to ensure a thorough migration. I maintained close communication with the WorkflowMax by BlueRock team to guarantee everything ran smoothly, while also keeping in touch with one of Clare’s team members to ensure

The partnership between Roof Improvements and Katalyst, coupled with the implementation of WorkflowMax by BlueRock, has been transformative for the company. They can see the revenue and costs for individual teams and contractors, manage their data, and deliver better outcomes for their own clients too.

Clare now raves about the ability to determine which teams are profitable – something that would

have been impossible with paper records. “I prepare all the KPIs for our business, and that level of drilling down I found really exciting. We’ve already gained so much new stuff, like making sure that some options are checked before a quote is approved (which makes it clearer for billing and install).”

“Your ability to be successful in business comes down to your ability to identify issues quite quickly, and make changes –and we have that, thanks to WorkflowMax and Katalyst.”Clare Barrett, Owner Operator, Roof Improvements

The level of data has also helped protect their reputation by showing entire timelines of conversations, emails and engagements to prove accurate information has been shared. In fact, information is so accurate that they’ve been able to free up their clients from the difficulties of bureaucracy.

“Our industry has become quite bogged down with the detail we have to provide – and there was no way we could do it manually. When the licence for building practitioners came in for roofers, WorkflowMax made it quite easy. And it meant it

could be easy for our customers. We could prepare the record of work, notify council on their behalf, upload documents to council on their behalf. And I got really good feedback for that – they’d say how amazing our admin was. WorkflowMax and Katalyst have enabled us to take that pain away.”

“We sent in an application to the Roofing Association of NZ, and won Roofing Training Company of the Year because I could easily get references from our clients to say how amazing our admin is.”

“I can do stuff quickly now, identify issues with people or jobs, and stay on top of it. Your ability to be successful in business comes down to your ability to identify issues quite quickly, and make changes. And if you don’t have a mechanism in place to ID stuff that goes wrong, then you’re in for a nightmare.”

The partnership between Roof Improvements and Katalyst, coupled with the implementation of WorkflowMax, has been a resounding success. “I had an issue only a few days ago, and could have got one of my team members to look at it,” says Clare. “But the relationship with Glennis and Katalyst is really good, so it was nothing to pick up the phone. Glennis can deal with my quirks! Nothing fazes her,” she laughs.

FIND OUT MORE...

Want to become a WorkflowMax partner?

From full implementation partners, to certified business advisors and ecosystem partners – we encourage you to join our community.

Find out more about the new WorkflowMax by BlueRock partner program at

workflowmax2.com/ become-a-partner

@ICBUK

Elizabeth Carter, Head of Marketing, Institute of Certified Bookkeepers

Elizabeth has been working with accountants and bookkeepers for longer than is believable. Now fully immersed in the bookkeeper community, previous homes include PracticeWEB, Senta and IRIS Software Group.

If you're a bookkeeper, there’s no better place to be this November than the ICB Bookkeepers Summit! The event is packed with everything you need to thrive in an ever-evolving industry — plus, a chance to meet fellow bookkeepers who really get what it’s like to balance ledgers while balancing life.

Bookkeepers attending the 2024 Bookkeepers Summit have plenty to look forward to, as this year’s event promises to be packed with valuable insights, networking opportunities, and exciting new industry developments. Hosted on Monday 11November at the Park Plaza Hotel in Westminster, the summit is a full-day, in-person event, complemented by virtual sessions from November 13-14, designed to equip bookkeepers with future-ready tools and strategies.

Keynote Speakers and Industry Experts

from Craig Ogilvie of HMRC, and Paul Aplin OBE will be interpreting the impact of the government’s first budget.

REMEMBER:

The agenda includes several sessions aimed at helping bookkeepers succeed in their businesses. Bev Flanagan from BFF will lead a session on actionable steps for practice success, while Gem Malek from FreeAgent will discuss how to future-proof your practice for

You don’t need to be an ICB member to attend. All bookkeepers are welcome.

One of the major highlights is the roster of industry experts lined up to speak. Allister Frost, former Microsoft leader, will open the day with his keynote on “The Future Ready Mindset,” offering valuable perspectives on how bookkeepers can adapt to the rapid changes in the profession. Delegates will also hear about how to support clients through the introduction of MTD

long-term growth. Attendees can also look forward to tips from Kate Powell MICB of Kingston Bookkeeping on delivering goldstandard client services, ensuring bookkeepers are prepared to elevate their client relationships

The best bookkeepers stories

Be inspired by stories from fellow bookkeepers. Over the course of the summit, you’ll hear from experienced bookkeepers including Lara Manton MICB, Natasha Everard, Jo Wood &

LUCA Awards: The Oscars of the bookkeeping world

Everyone’s favourite part of the Bookkeepers Summit, the LUCA Awards Ceremony is the hotly contested awards ceremony for the bookkeeping world. The highlights include awards for new practices, ICB students, large practices and Bookkeepers Champion of the Year. The vendor space is also recognised, with awards for software, financial services and training providers voted for by the ICB membership.

Zoe Whitman, Libby Walklett, Helen Bower FICB PM Dip and Emma Fox. All with a great story to share, and real life, practice experience to share.

Keep up to date with the latest tech and innovation

Learn how the brightest software companies are innovating to meet the changing needs of bookkeepers. Throughout the day, partners including Xero, Dext, FreeAgent, Apron, IRIS Software Group, Intuit

QuickBooks, and Sage will share their latest advancements in bookkeeping tech. The summit will also feature an exhibition where attendees can meet new vendors, network with fellow bookkeepers, and explore the latest products and services that can help streamline their business operations

The virtual summit

If you opt for the in-person summit you also get access to two days of virtual content. Or

you can opt for just the virtual summit. This year, we’re proud to introduce the Student Selection track, which includes advice for students past, present and future from the ICB education team, Ideal Schools and Training Link.

The Bookkeepers Summit is a hybrid event, with both in-person and virtual events happening across Global Bookkeeping week. You can choose to join in as much or as little as suits you - but do join in!

Monday 11 November

In-person Summit

Park Plaza Hotel, London

Be in the room where it happens! Join your fellow bookkeepers for a day of talented speakers, actionable insights, and unparalleled possibility. Hot lunch included. Hotel bedroom discount codes are available.

Book here

Weds 13 November

Virtual Tech Day

Explore the best tech in the market to enhance your practice and streamline your work with demos from our software partners.

Book here

Thursday 14 November

Virtual Summit

Our virtual summit draws together key industry speakers for practical insight and advice. Offering three tracks GO BIG, STAY STRONG and STUDENT SELECTION you'll find the right information for your personal journey.

Book here

ith new trend data revealing that almost half (46%) of food distribution and manufacturing businesses will this year be investing in tighter inventory management systems, Sajani Cups and Cones turns to Fishbowl for the way forward.

The recent CommBank Manufacturing Food & Drink Insights Report found that producers and distributors have navigated an operating environment marked by higher costs, constrained skills, and fluctuating customer demands by prioritising productivity.

When over 1 in 3 (37%) of food distributors and manufacturers confirm their biggest challenge is ineffective operating systems, many are turning to technology for the fix.

For almost half, they’re investing in new technology and software (46%) alongside new operating systems (49%).

Sajani Cups and Cones choose new inventory technology to meet challenges

When experienced business owner, Sue Boor, General

Manager of Sajani Cups and Cones bought this family owned business she knew change was immediately needed.

“We knew this business had great potential but not a lot of structure. So we had utilised Fishbowl at another business that we have and it worked extremely well there, so we decided to utilise Fishbowl here in Sajani, which has proven to be amazing.”

There was an immediate focus on improving stock management, streamlining purchasing, and winning back customer respect lost from previous stockout issues.

“We have thousands of types of stock, and one of the major issues of having a business with a lot of parts, is that it’s extremely difficult to keep on top of all those parts and make sure that we've got enough stock to be able to supply our customers,” said Sue.

“The last year has saved us thousands of dollars because we don't have any issues with not having things in stock anymore. Our customers are confident that we're able to supply them with the goods that they need, when they actually need them.

@fishbowl

Craig Scarr, Fishbowl Marketing Director, APAC

Craig Scarr is a marketing professional and business leader with passion and focus to help organisations and leadership teams to generate outstanding results. Craig has extensive experience as a business professional spanning strategic marketing, brand management, partnership development, content, and digital media marketing across a diverse range of industries including FMCG, financial services, not for profit organisations and software solution providers.

“Any staff member at any time can see what's on order. Fishbowl gives me the flexibility and the knowledge to be able to answer questions at any time.

“Everything is more efficient. It has probably cut off probably two to three hours a day in staff hours because its streamlined our business incredibly.”

Significant growth and importing precision achieved

“Fishbowl is a very powerful tool. It gives me the information I need when I want it. It gives my staff members the information they need when they want it and that's the most powerful tool that you can have in a business,” continued Sue.

“Fishbowl has allowed us to actually get true costs of the products that we're selling. We import and now there’s no guesswork on exchange rates and pricing anymore.

“Fishbowl has also increased our sales because we have become a reliable supplier. When we purchased the business we probably had about 3,000 line items. We've expanded that to around about 5,500. Without Fishbowl, we wouldn't have been able to do that.”

Staff empowered with confidence to master their work

Head gelato chef at Sajani Cups and Cones, Jean Aveline, or Frenchie as he’s known, recounts the relief that Fishbowl has given him to do his job well.

“I use Fishbowl on a daily basis to update the system so we know how much stock we have,” said Frenchie.

“Fishbowl has just made everything so much more efficient. Your customers can see what stock you have, they can order from there. Your workers know what's in there. It helps with the visibility of stock and communication all across the board.”

“The support for Fishbowl was easy. It was nice and easy to use. Everyone just showed me what I needed to do. And yeah, it's pretty hassle free.”

New technology ever evolving and Fishbowl at the forefront of AI

As is the nature of any technology adoption, the landscape is ever changing and along with it businesses are seeing the opportunities to continually

improve. The food and drink industry is no exception, with the CommBank report citing emerging technologies set to make its biggest impact in the next five years.

These include supply chain integration platforms, track and trace technology for supply chain visibility and AI and machine learning.

With the launch of Fishbowl AI Insights, APAC Managing Director, Simon Jupe, acknowledges that food manufacturers and businesses are set to reap even greater benefits.

“It’s clear from Australia’s largest food and drink industry trends research report that inventory management is front and centre,” said Simon.

“The arrival of AI technology has enabled this. It’s a huge opportunity, but with it those who don’t adopt quickly may find themselves left behind.

“Community expectations are quickly changing and more than ever people expect to deal with an efficiently run business. So, businesses must rise to a new challenge.

“We’re excited to be at the forefront of that change and able to offer our customers this new technology.”

FIND OUT MORE...

GET YOUR FREE AI INSIGHTS E-BOOK GUIDE

Want to learn more about how AI is shaping the food and drink industry? Click here to download our free e-Book:

“Food Manufacturing 2025: AI Technology Drives Inventory Innovation”

s HMRC’s "Making Tax Digital" (MTD) initiative draws closer, mandating quarterly digital tax submissions for the selfemployed by 2026, accountants should be leading the charge in adopting technology that simplifies compliance

Instead, a culture of Accounting Ignorami (AI) has surfaced— accountants who remain resistant, even oblivious, to the benefits of AI-powered tools like MYT. This hesitancy is more than a quaint attachment to traditional methods; it’s a failure to modernize that could hold both accountants and their clients back.

MTD aims to streamline tax reporting, minimizing errors, ensuring up-to-date records, and ultimately easing compliance burdens for sole traders. AIpowered tools like MYT are perfectly positioned to facilitate this shift, automating data entry, categorizing expenses, and providing valuable insights for users. Yet, the Accounting Ignorami remain unmoved, clinging to manual methods

that leave little room for error reduction or efficiency.

This resistance often stems from a misconception that AI threatens traditional roles, or an outdated belief that tax practices don’t need “fancy” technology. But tools like MYT don’t seek to replace accountants; they’re designed to enhance their work, allowing professionals to automate time-consuming tasks and focus on advisory roles that add true value. These tools integrate seamlessly with existing systems, ensuring timely submissions and providing real-time compliance alerts. Ignoring them, however, leaves accountants ill-prepared to navigate MTD’s evolving demands.

By choosing to stay in their comfort zone, Accounting Ignorami risk not only regulatory non-compliance but also the erosion of client trust. As technology becomes increasingly essential for financial transparency and efficiency, clients will seek out accountants who embrace tools that prioritize accuracy and convenience.

@app_myt

Oumesh Sauba, CEO, MYT

Oumesh Sauba is the visionary founder and CEO of MyT Limited, an innovative AIpowered accounting app and software tailored to meet the bookkeeping and recordkeeping needs of freelancers and micro businesses. He previously directed Sauba and Daughters Co, a wellestablished accounting firm based in Croydon. With over 15 years of experience as a Chartered Management Accountant, Oumesh specializes in financial accounts, management accounts, and taxation.

Stubbornly resisting AI’s transformative benefits does a disservice to both clients and the accounting profession, risking irrelevance in a field that must keep pace with technological progress.

The MTD initiative presents accountants with an opportunity to modernize, streamline, and improve service. Embracing AI-powered tools like MYT isn’t a luxury—it’s a necessity to stay competitive. The future of accounting is digital, and those who break free from the Accounting Ignorami mindset will find themselves not only compliant but also better equipped to deliver exceptional value in a changing industry.

Making it yourself may actually be an option!

Alex Lacota, Co-Founder, RecHound

With over 10 years of experience as an accountant, Alex is all about finding smart, tech-savvy ways to streamline accounting tasks. Now, transitioning into app development, he combines his accounting experience with the latest technology to make balance sheet reconciliations as smooth and hassle-free as possible.

Turning a software idea into reality is not as far-fetched as you may think.

ot a great software idea but no technical experience? You may not believe it, but even without coding, development, or marketing skills, building an app is actually within reach.

I’ve been an accountant for nearly 10 years and developed a Xero application for the last 2 years with no entrepreneurial background. Here’s what I've learned:

1. Start with a Problem You Know Well

The best ideas come from personal experience. For me, it was Balance Sheet Reconciliations - I was pretty shocked when I discovered that there was no Xero app to tackle these. Think about challenges you face in your industry. If you’re familiar with the problem, you'll understand how much people could benefit from a solution.

2. Partner with the Right People

You don’t need to know how to code to create an app. I took my idea to my brother-in-law who had coding skills, and he quickly came around to my vision. The key is to find people who not only believe in your vision as

much as you do, but I would also recommend finding someone you can really open up to. Whether it’s a co-founder or a freelance team, they must align with your goals, and be able to support you through ups and downs. At RecHound, our supportive co-founder relationship has been the driving force behind our application.

3. Find a channel that supports your idea

it, gather feedback, and improve. It’s not about creating something flashy—it’s about solving a real problem practically.

If you’re familiar with the problem, you'll understand how much people could benefit from a solution.

Use friends, colleagues, in-person groups or online forums to bring in feedback for your idea. Check if others may be willing to use your idea if developed, and ask for their ideas too. You will start to see trends very early on from people within your industry.

4. Focus on Simplicity

It’s easy to get excited about new ideas and features, but try to resist the temptation to commit to everything. Focus on a minimum viable product (MVP) that addresses your core problem. Keep the interface clean and intuitive, so users see its value immediately. The simpler your app, the faster you can test

5. Tackle Big Challenges HeadOn

You might hit technical hurdles that seem overwhelming, but every challenge is an opportunity. At RecHound, we spent a lot of time on the transactional clearing feature, which seemed impossible initially but once built, it became a unique selling point. Embracing these challenges can set your app apart and lead to defining features.

Building an app is more about persistence, problem-solving, and creativity than technical expertise. If you have a clear vision, you can bring it to life by focusing on solving a real problem, building the right team, and staying committed.

Lara Manton, Head of Bookkeeping EMEA at ApprovalMax & Director of LJM Bookkeeping

Lara Manton has over 10 years in the industry, running LJM Bookkeeping Ltd. She helps clients of all sizes with their finance function, as well as consulting on software implementation and process efficiencies. She won ICB’s Small Practice of the Year 2021 and has been nominated for multiple Accounting Excellence awards, including Highly Commended in Bookkeeping Team of the Year 2023.

Her love of software and tech led her to winning the inaugural Xero Innovative Partner of the Year in 2023, and she gives software providers a bookkeepers perspective.

Time and time again, I hear from bookkeepers that their clients ‘aren’t big enough’ to need approvals. This type of thinking holds so many businesses – of all sizes – back from experiencing the benefits of strong approvals and tools, like ApprovalMax, that support it.

With my clients, I focus on process efficiency and setting up the structures and systems that work best for their unique business, including building the right cloud-based tech stack. Sometimes, they put this off for far too long; many think they have to get to a certain size before they can use certain software but actually using the software might help them grow.

Here are three recent clients I’ve suggested ApprovalMax to, how I suggest they use it, and why:

This local sports club moved to Xero and Dext a few years ago but struggles with controlling spend. The club only has one full time employee and is otherwise supported by a team of volunteers, so it’s important to do more with less.

Although they’re using budgets in Xero, unnecessary costs slip through the cracks and lead to budgets spiralling out of control. Currently, it takes the volunteer treasurer two days per week to manage the finances.

Suggested approach:

• Start issuing POs via ApprovalMax, which will need to be signed off by the treasurer before issuing and checked against budgets to avoid surprises when final invoices come in.

• Reduce subscriptions by using ApprovalMax Capture to replace Dext when the purchases come in, including bill-to-PO matching, and push bills through approval before payment.

What will ApprovalMax solve?

• With ApprovalMax, the treasurer

can add a layer of security and limit access to Xero, while adding a more stringent approval process.

• The team can monitor budgets better and all spending will be signed off by the treasurer in advance before purchases are made.

• The audit trail will automatically save time by tracking each and every transaction for better continuity, especially when the volunteers switch over.

The media agency

At this fast-moving media agency, the team regularly shares quotes with clients on short notice. Sometimes, this means the quotes don’t go through the right approval process before sending to clients, or get lost in emails. With an average 200 jobs a year, things get confusing – fast.

The agency also bills for extra

time each month. Currently, one team member emails each and every client for confirmation before invoicing, then each invoice has to go through the right internal approvals.

Suggested approach:

• Roll out sales quotes using ApprovalMax and Xero to ensure all quotes are correct and checked internally before sending onto each client.

• Swap the POs to go through ApprovalMax so final invoices can be matched with the POs to tie every job up.

• Save time and use ApprovalMax Capture to extract data from ~200 jobs per year, instead of entering invoice details manually.

• Use additional reporting in ApprovalMax to track everything is linked together.

• The team can make sure quotes are internally approved first so the business is not under or over charging each job, then signed off by clients every time using the sales quote function.

• This gives the clients visibility and means there will be no queries around VAT or prices.

• Adding ApprovalMax will ensure costs are linked to POs, along with clear quote sign off, which ensures the team has full visibility across all processes.

• At the moment there’s no way

to connect POs and purchases in Xero if they come in via a separate system – this will make sure they’re billed correctly and in the system.

This client already uses an approval automation tool. However, its limitations are seeing the team spend hundreds of pounds in excess fees each month. The firm processes 300 invoices each month with a huge amount of manual workarounds; for example, the tool’s OCR tool takes 24 hours to upload so can’t be used for tight deadlines, meaning they need to be manually input or circulated via email.

All of this results in wasted time and resources, for both approvers and accounting staff.

Suggested approach:

• For continuity around controls, replace the current system with ApprovalMax and get all approvers to download the app.

• Build workflows for regular suppliers so they filter automatically and encourage the internal team to make comments directly in ApprovalMax.

• Build email rules on the accounts inbox and supplier rules in Dext to import bills faster.

• It will speed up the processing time for incoming invoices, through Dext connected to ApprovalMax since they use QuickBooks Online.

• Currently, there are no supplier rules, which means each item needs to be coded manually. It’s easy to build workflows in ApprovalMax for different suppliers and amounts.

• The app will make it simple for approvers to see urgent items and the team can message directly in the system, rather than having to email.

So, where’s the best place to start if you have a client that’s a good fit for approval automation? Start with a product demo, then think about your approval workflows. That’s when you can get the ball rolling with a free trial to see the difference it makes in automating approvals and building strong financial controls.

To learn more about ApprovalMax or start your free trial now, visit:

approvalmax.com

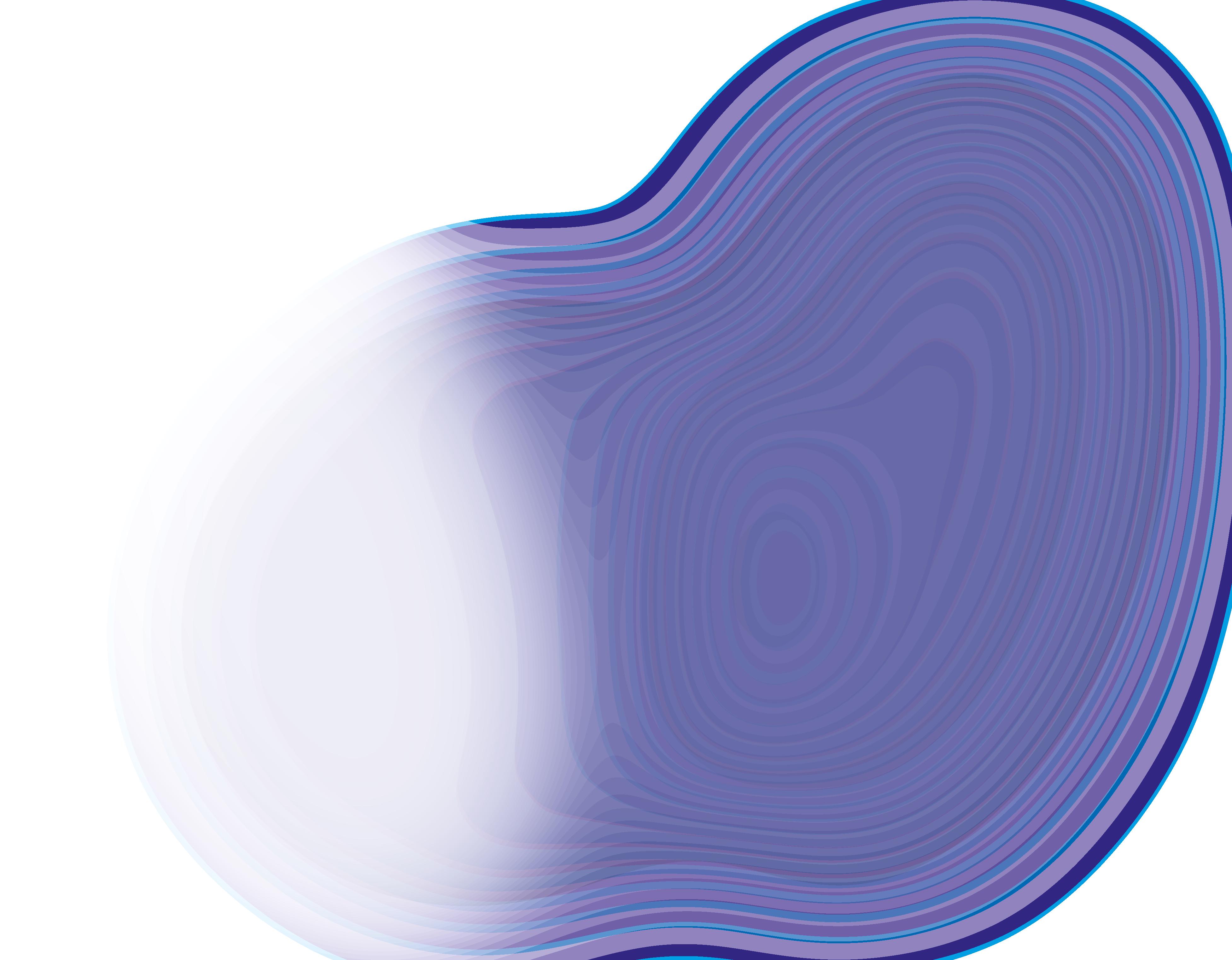

Kevin Ludford, Founder, fumopay

Kevin founded fumopay in 2020, to champion innovative payment solutions, specifically to help small businesses with their cash management. Kevin has a wealth of experience in the digital payments and the eCommerce industry, having founded a development agency back in 2011 and later being acquired by a PLC.

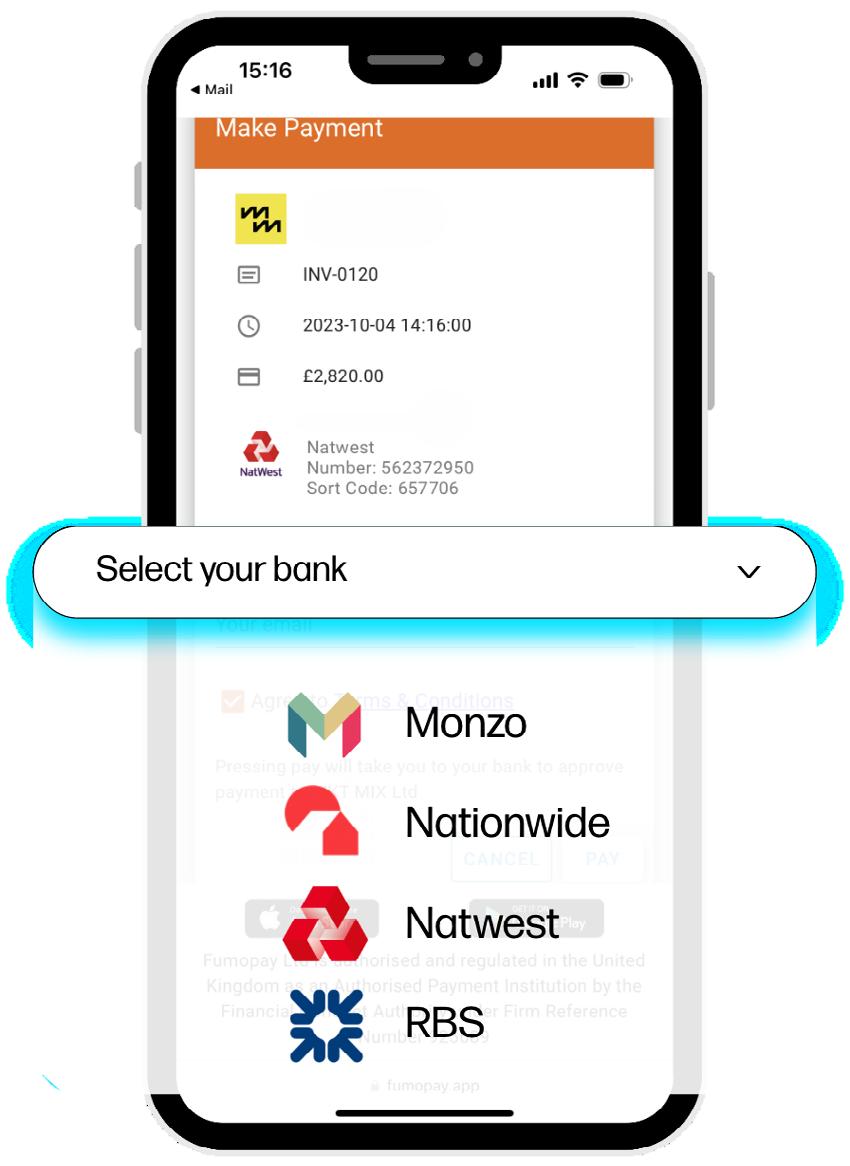

Discover how small businesses can adopt Open Banking to improve their liquidity, by collecting payments online and in-person.

Challenging the traditional ways to get paid

This article is

For many years small businesses have been neglected when it comes to payment technology, often having to choose between

the slow process of bank transfers or paying high fees to accept card payments.

However, the rise of Open Banking has sparked a wave of innovation in the payments industry, particularly benefiting SMEs. In this article we explore the advantages of small businesses embracing Open Banking solutions like fumopay, as a new way to get paid.

payer friction

High debtor days are a common challenge for small businesses across the UK, often leading to liquidity issues.

details, and process invoices in their banking app. Although it seems like a minor inconvenience, in today's fast-paced world— where purchases on platforms like Amazon can be made with just a few clicks—such tasks are easily postponed, often leading to payment delays.

“Our credit card transaction fees have significantly dropped, thanks to our clients paying via fumopay”

fumopay solves this issue by leveraging Open Banking technology, enabling direct bank-to-bank transfers with just a few clicks. No manual data entry is needed, making the process quick and seamless for customers. The result? Less hassle and faster payments.

While several factors contribute to this widespread problem, one frequent cause of delayed payments is as simple as customers having to manually set up new payees, enter account

Transaction fees & instant settlement of funds

Businesses that accept payments by credit card often face two main

challenges: losing a portion of their invoice value to transaction fees and waiting for funds to clear before they reach their account.

With fumopay, these issues are resolved. Transactions are processed through Open Banking, resulting in instant, bank-to-bank payments, with funds deposited immediately.