independent news source for users of accounting apps &

independent news source for users of accounting apps &

Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Editorial Translator: Lyla Lezghad

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

8 COVER STORY ApprovalMax A new age for accounts payable and receivable

14 BGL BGL Launches CAS 360 Software in the UK

16 Zoho Meet Bigin: Zoho's CRM solution for small businesses

18 Paycada Take Control of Late Payments with Paycada

22 Mimo How Arjay Consulting improved client relationships with AP automation & credit with Mimo

26 INTERVIEW Apron XU Magazine sits down with Apron Founder & CEO Bogdan Uzbekov

30 Tidy Streamlining Surgical Success: How Tauranga Oral and Maxillofacial Clinic keep their stock Tidy

We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register.

XU Magazine interviews Allica Bank's Head of Partnerships Sophie Hossack

WorkflowMax by BlueRock

Introducing the key WorkflowMax by BlueRock integrations to power up every step of your workflow 40 Ignition

Rethinking your pricing strategy to create greater value and profitability for your accounting firm

An Inventory Bulls Eye: How Fishbowl Helped Raider Targetry Hit the Mark

Creating capacity with cloud software and AI

& Business Show Asia

A new look: The same amazing event but with more opportunity than ever

58 Xenon Connect How your accounting firm can easily charge for bookkeeping corrections 60 ClientWindow Game changing communications platform launches WhatsApp to email technology 64 Buddy Transforming Payroll for Accountants, Bookkeepers & Payroll Bureaus 66 Projectworks Why 2024 is the year to elevate your practice with software advisory services 70 AdvanceTrack Outsourcing Change Manager 72 XBert The Smartest Way To Use AI Is To Create New Revenue

EVENTS Accountex Accountex Summit Manchester returns for its sixth year

Spotlight Reporting 3 Ways Spotlight Reporting Can Help Your Business Thrive

Leave Management 82 Dext

How Dext and Xero connect to simplify the bookkeeping workflow

86 XERO NEWS What’s new in Xero

90 XERO NEWS

Airwallex Bill Pay, now available with Xero

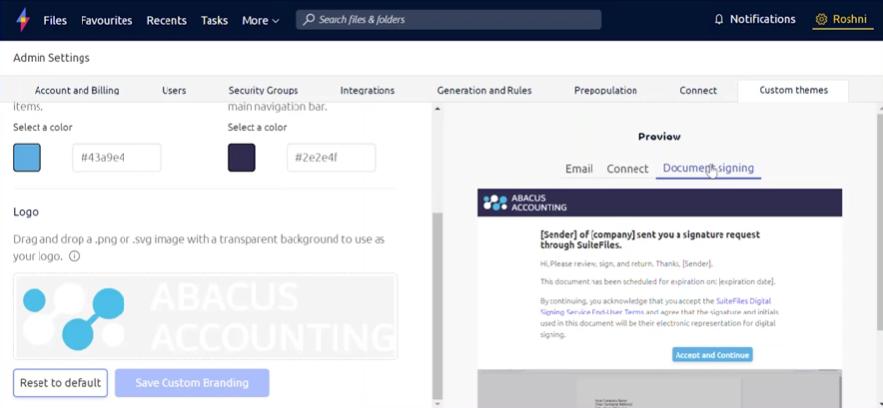

94 SuiteFiles Simplify sharing with SuiteFiles Connect

96 Expense On Demand Innovations in Expense Tracking: AI & Machine Learning for Smarter Spending

98 AutoEntry by Sage Prepare now for the AI revolution!

100 G-Accon The Power of Automated & Integrated Spreadsheets

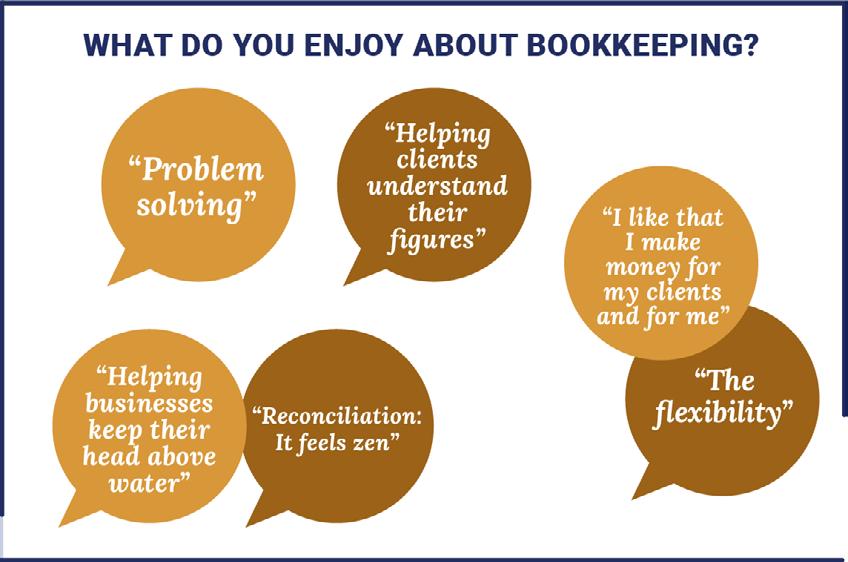

102 Institute of Certified Bookkeepers

The results are in – The Bookkeepers Survey 2024

106 Tim Hoopmann The Power of 'Appified' Spreadsheets

108 EVENTS The Business Show Asia

The Business Show Asia returns to Sands Expo & Convention Centre for 2024!

112 UPDATES AND NEW RELEASES

114 CLASSIFIEDS

118 AND FINALLY...

Dext announces the general availability of Dextension at Accountex London, 2024

The way we do things is constantly evolving, even if we don’t always realise it. As late as the 20th century, ice was big business.

It was manually harvested from rivers and ponds and delivered to houses and businesses, sometimes travelling all the way across oceans and seas. Now? Most people just go to their freezer. The international ice trade went the way of many other obsolete processes, into the past and out of our memories.

These days, technology has made the pace of change faster than ever before. But while no one would consider importing glacier ice from overseas, many other slow, manual processes still persevere. Consider accounts payable and receivable. The functions have historically been highly manual during all parts of the process, even after going online with the dawn of the internet and computing technology.

Now, we have the chance to fully reimagine accounts payable and receivable to happen seamlessly and with minimal intervention. Over the years, automation has made light work of single elements, like importing bills or

managing approval workflows, and it has the potential to help even more.

Here at ApprovalMax, we’re proud to be a part of this evolution – we want to make AP and AR just happen for businesses, their accountants, and bookkeepers, but still with the right checks and balances along the way.

Our latest product releases aim to do exactly that; offering a way to automate accounts payable and receivable from end-to-end, all in one platform. With this, we’re excited to enter a new era for how we approach AP and AR here at ApprovalMax. Introducing our two new products – ApprovalMax

Konstantin Bredyuk, CEO & Co-Founder, ApprovalMax

With roots in business process management and optimisation software development, Konstantin has undertaken hundreds of product implementations for ApprovalMax clients worldwide.

Konstantin has advised numerous organisations on automation, financial controls, and client collaboration capabilities using Xero-based trusted app stacks, with business profiles ranging from SMEs to large accounting and advisory practices.

Capture and ApprovalMax Pay (Beta)!

Automatically import bills into ApprovalMax

One of our most requested features is now here – an inbuilt automated data capture tool, ApprovalMax Capture. This kick-starts your accounts payable process by importing bills and receipts through photo or PDF upload, individually, in bulk, or via email.

These outstanding bills automatically funnel into you or your client’s pre-set approval workflows, so the right documents end up in the hands

“As a bookkeeper, we’ve moved from literally writing stuff up in Kalamazoo books and having really rigorous filing processes for paper-based systems, to everything going digital. These days, things happen much more quickly, with higher volume coming through, and that’s because we can handle accounts payable and receivable in a far more streamlined way. But with fewer people involved in the process, the question is ‘what we can do in software to make sure we're adding the financial controls we need?’ for things like catching duplicate invoices or checking that we haven’t paid one previously.”

Cassandra Scott, Head of Bookkeeping APAC at ApprovalMaxof the right people. With a little bit of set up, it all happens without lifting a finger!

Why use ApprovalMax Capture?

• All-in-one control. Take care of everything from ApprovalMax and simplify your tech stack –one less login for less hassle.

• Save time and reduce errors. Use automated data capture technology to import bill details faster and with more accuracy.

• Add extra layers of control. ApprovalMax Capture funnels incoming bills straight into your approval workflows before they enter your general ledger so they always go through your proper processes.

Manual data entry isn’t just time consuming but expensive too. The average cost of paying a PDF invoice is £13.93/AUD$27.67 and for paper invoices £16.13/ AUD$30.87 with most of this due to the manual work of inputting data from bills and processing for payment, including fixing errors.

With automated data capture, it’s easy to get things right from the start. Bills enter the system accurately and on time. Then, they automatically go through the right checks and balances so you and your team can focus on higher value tasks while feeling confident in your accounts payable data. With ApprovalMax Capture, this all happens via the one app to streamline the process even more.

ApprovalMax Capture is now available for Xero customers in all regions, with QuickBooks Online and Oracle NetSuite compatibility coming soon. To get started, simply add ApprovalMax Capture to your existing subscription, set up email preferences, and sync to approval processes.

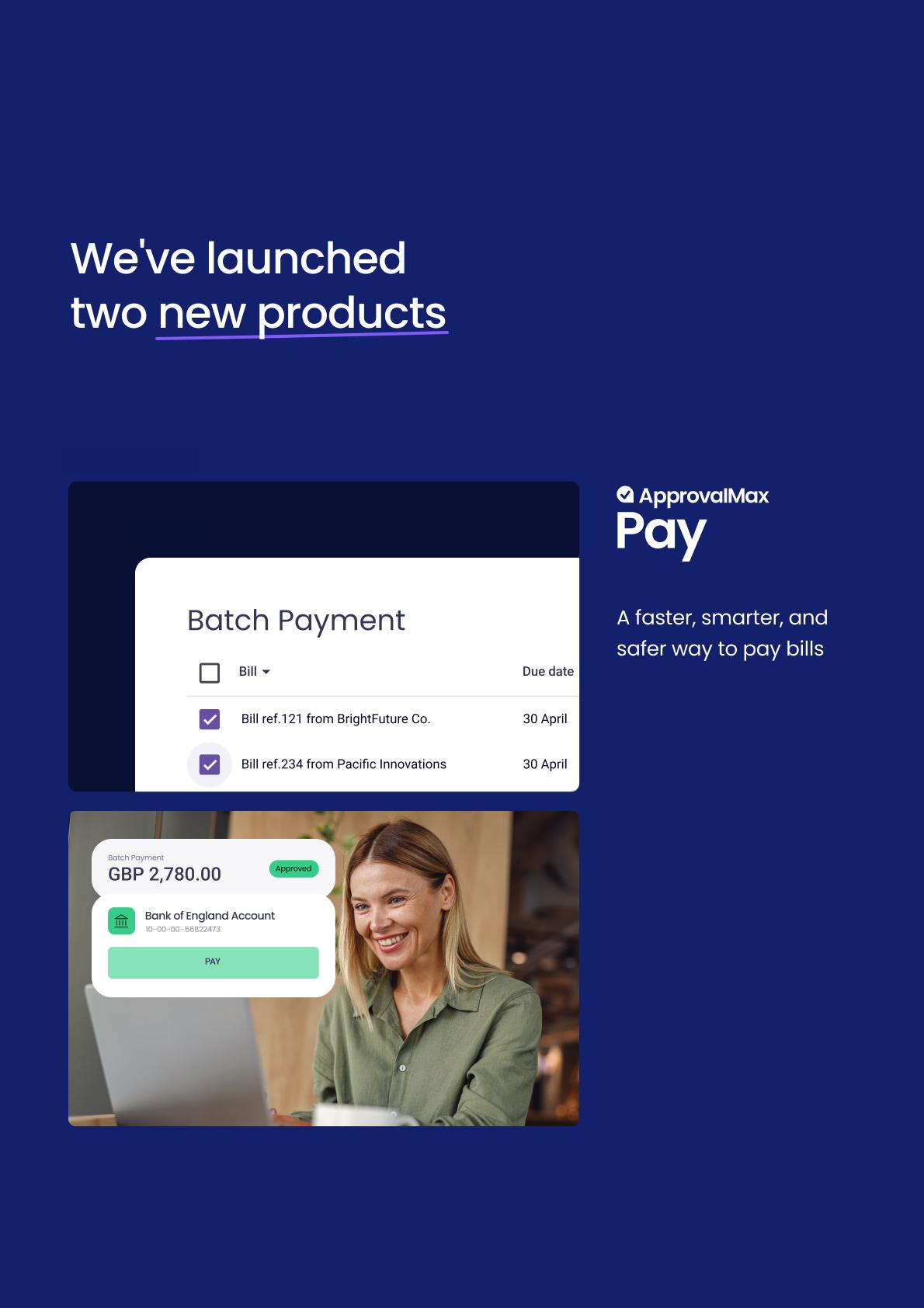

A secure and convenient way to pay bills

We’re excited to launch a new way to pay bills directly from ApprovalMax. Using open banking technology, ApprovalMax Pay (Beta) allows you to pay approved bills directly from the

platform and build stronger financial controls across your entire accounts payable process. Why make payments from ApprovalMax though? Just think – it’s easier to travel an entire journey via one express train than get out halfway and change.

Currently, ApprovalMax Pay is available in beta for UK businesses using Xero. In a few simple steps, securely sync your bank account to ApprovalMax via open banking and pay approved bills with ease. Payments can only be made for bills that have been through your preset approval workflow, so you know funds are going to the right place.

Why use ApprovalMax Pay?

• Strengthen your financial controls. Feel confident knowing you’re paying a bill that’s gone through the right approvals process and internal verification checks, every step of the way.

• Protect your banking data. With ApprovalMax Pay, there’s no need to share sensitive bank

data. Instead, employees create a request, pay approved bills in a few clicks, and have this added to the audit log for full visibility.

• Avoid payment errors. There’s minimal risk of paying the wrong amount (or even person!) with ApprovalMax since there’s no need to manually copy payment details and amounts.

ApprovalMax Pay allows businesses, their accountants, and bookkeepers to securely manage payments from one platform. Extra security controls mean you can authorise only certain people to make payments and update beneficiary payment details, mapping these to a predetermined delegation of authority.

While ApprovalMax Pay (Beta) is only available in the UK right now,

watch this space – we hope to bring it to other markets soon.

The next phase for ApprovalMax

Since our first day in business, we’ve helped more than 15,000 customers automate their approvals for accounts payable. Now, with the addition of accounts receivable features, like sales quotes and invoices, and our new features ApprovalMax Capture and ApprovalMax Pay, we’re adding on to that journey for our customers and partners to give them end-to-end accounts payable and receivable automation. And we’re excited about what this new path brings!

By managing everything from POs to payments in one platform, it’s not only faster, more convenient, and safer, but you’re less likely to make errors and mess up your

processes. It takes just a few easy steps to set up workflows that go all the way from preparation to payment.

In a world where change is constant, and it’s only getting faster, we want to make life easier for our customers. By bringing each step of accounts payable and receivable into one place, combined with automation and built-in financial controls, we hope to take you there.

To learn more about ApprovalMax and our new products, visit: approvalmax.com FIND OUT MORE...

Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released.

@BGLdot

BGL is the world leader in compliance management solutions, delivering innovative software to 12,700+ businesses maintaining 1.4 million+ entities worldwide.

BGL has launched CAS 360, the complete company secretarial, trust and AML management software in the UK.

AThis article is

s the accounting world converges at Xerocon London, BGL Corporate Solutions (BGL), the world's leading supplier of compliance management software solutions, is thrilled to announce the launch of CAS 360 in the UK.

This innovative software solution promises to transform the landscape for UK accountants, corporate service providers, and company administrators, heralding a new era of efficiency and innovation.

For 35 years, BGL has been at the forefront of developing cuttingedge compliance management solutions. With a global presence and trusted by more than 12,700 businesses, maintaining over 1.4 million entities worldwide, BGL’s multi-award-winning products provide cutting-edge innovation and are well-established in many markets.

CAS 360, now available in BETA in the UK, is the latest testament to this legacy. Designed to simplify and automate company compliance processes, CAS 360 integrates seamlessly with UK Companies House, providing automated alerts and workflows for managing companies (Annual Return confirmation statements, company registrations and common changes made by companies), trusts, AML compliance and much much more.

commitment to innovation and excellence. Our software will revolutionise how UK firms handle their compliance obligations and we couldn't be prouder of this achievement.”

“The launch of CAS 360 will revolutionise how UK firms manage their compliance obligations.”

“We are thrilled to bring CAS 360 to the UK market,” said BGL’s Chief Executive Officer, Daniel Tramontana.

"It's been two decades since we first introduced our Corporate Affairs System (CAS) desktop software here. The launch of CAS 360 in BETA reflects our unwavering

The introduction of CAS 360 is more than just a software launch; it represents a strategic move to empower UK firms with the tools they need to stay ahead in an increasingly complex regulatory environment. With features like automated document management, Xero integration, digital signing and robust data protection (ISO 27001 certification), CAS 360 offers a complete, user-friendly solution designed to meet the unique needs of UK businesses.

Welcoming Ashley Barker: Driving Growth and Building Relationships

BGL is excited to welcome Ashley Barker as the UK Business

Development Manager to coincide with the UK launch.

Ashley’s role is pivotal; he will be the cornerstone of BGL’s efforts to build solid and lasting relationships with prospective clients and partners. His mission is to ensure a smooth transition to CAS 360 and ensure clients receive unparalleled support and remarkable experiences.

“Ashley’s appointment underscores our commitment to the UK market,” says Warren Renden, General Manager – CAS 360, Ecosystem and UK at BGL.

"His expertise and dedication will drive the growth of our cloud products, ensuring that our UK clients are well-supported and able to fully leverage CAS 360's transformative capabilities.”

Since its inception in 1989, BGL has been synonymous with innovation and excellence. The company’s journey from its early days of developing the pioneering Corporate Affairs System to the sophisticated cloud-based solutions of today is marked by a consistent focus on client needs and technological advancement.

The launch of CAS 360 in the UK is not just a milestone for BGL; it's a significant development for the entire UK accounting and compliance industry.

CAS 360 is built on a foundation of 35 years of experience, combining the latest technology with deep industry insights. The platform was designed to help firms manage their compliance obligations more efficiently, reducing the time and effort required to stay compliant. By automating routine tasks and providing real-time notifications and alerts, CAS 360 enables firms to focus on what they do best –providing exceptional service to their clients.

The future of compliance management in the UK looks bright with the introduction of CAS 360. BGL’s commitment to delivering innovative, multiaward-winning solutions continues to drive the company forward, and the UK market is poised to benefit from this dedication. Integrating CAS 360 into everyday compliance practices will streamline operations and enhance

compliance management's accuracy and reliability.

Join the Revolution

Experience the future of compliance management with CAS 360. Whether you're an accounting firm, a corporate service provider or part of a company group, CAS 360 provides a complete, integrated solution that simplifies compliance and enhances your operational efficiency. Don’t miss the chance to be part of this exciting new chapter.

The launch of CAS 360 is a highlight for those attending Xerocon London. It’s an opportunity to see firsthand how this groundbreaking software can transform your compliance processes and improve your firm’s efficiency. We invite you to visit our stand to learn more about CAS 360 and to meet Ashley Barker and the rest of the BGL team.

www.bglcorp.co.uk FIND OUT MORE...

For more information, visit:

Trusted by 20,000+ businesses, rated 4.8/5 on Trustpilot

@bigin

Annet Mathews, Product Marketing, Zoho

Meet Annet, a product marketer with Zoho. She found her solace in writing during her high school and never looked back. Armed with a Master's degree in English Language and Literature, Annet has spent over half a decade with Zoho, leading social media, expert interviews, video marketing, and lead nurturing initiatives. She often tries to turn tech into tales everyone loves with her simple way of writing.

Have you heard of the simplest CRM? Say hello to Bigin—the CRM for small businesses and startups to manage sales.

hen it comes to maintaining strong relationships with customers, businesses nowadays face numerous challenges. From tracking leads and sales opportunities to maintaining communication with them, the complexities of customer relationship management can often overwhelm entrepreneurs.

This is where a CRM system comes into the picture. A CRM tool can provide businesses with the capability to streamline business operations, improve customer interactions, and drive growth.

A study by Gartner found that businesses using CRM platforms can increase customer satisfaction by up to 50%.

Do any of these sound familiar?

• The struggle to manage scattered customer data and communicate with them on multiple channels.

• The perpetual battle to allocate time and resources effectively in managing your customers.

• Delays in responding to

customer inquiries, missed opportunities for follow-up, and inconsistencies in messaging across different channels.

Zoho's answer for a simple and streamlined business solution

Zoho, the SaaS powerhouse behind some of the slickest business software, has developed a simple and cost-effective CRM software—Bigin by Zoho CRM—that handles sales,

contact management, pipeline management, automation, and insights to improve customer relationships. 20,000+ businesses across the globe including real estate, education, retail, legal, manufacturing, trading, etc., use Bigin.

How can Bigin help you?

• Bigin consolidates all your customer information in one place and eliminates

the scattered nature of data, ensuring that all relevant data is easily accessible, organized, and can be efficiently managed within Bigin. From calls to emails to WhatsApp conversations, all interactions can be seamlessly managed right from Bigin.

• Forget about lengthy installations and complex configurations. With Bigin, you can have your account up and running in less than 30 minutes, thanks to customizable templates tailored to your unique business needs.

Experience Bigin with a 15-day nocredit card free trial. Paid plan starts only at $7

• Free up valuable time by automating repetitive tasks such as follow-ups and reminders. With Bigin's intuitive workflows, you can focus on what truly matters—nurturing client relationships and driving growth.

Unlike other software solutions that come with a steep learning curve, Bigin prides itself on its simplicity and ease of use. With a hassle-free setup process and a user-friendly interface, you can start leveraging its benefits from day one.

And the best part? You can try Bigin for yourself with a 15-day free trial and then upgrade to paid plans starting from $7 based

on your business requirements.

So what are you waiting for? Visit bigin.com or email me at annet.m@zohocorp.com for more details.

Josh Skelding, Commercial Director, Paycada

With over a decade of experience in technology and financial services, Josh has excelled in various commercial and sales roles, focusing on CRM solutions for mortgage brokers and financial advisors. In the last 18 months, Josh served as Director of Sales at Twenty7Tec, following their acquisition of Bluecoat Software. As Commercial Director at Fignum, Josh is cultivating new business opportunities, building lasting relationships, and working closely with our product team to propel our solutions forward.

In today’s fast-paced business environment, managing accounts receivable efficiently is crucial for maintaining healthy cash flow.

n today’s fast-paced business environment, managing accounts receivable efficiently is crucial for maintaining healthy cash flow. Yet, many businesses struggle with late payments and the administrative burden of chasing invoices

This is where Paycada steps in, offering a seamless solution that integrates with Xero to streamline your accounts receivable process.

Late payments can cripple a business, leading to cash flow issues, a lack of working capital and wasted resources on chasing overdue invoices. Traditional methods of managing accounts receivable are often timeconsuming and prone to errors, leaving businesses frustrated and financially strained.

The Role of Technology

Paycada offers a smart solution to these challenges. By integrating seamlessly with Xero, Paycada automates the accounts

receivable process, ensuring timely payment reminders and real-time updates. This not only reduces manual processes but also improves cash flow management and working capital.

Key Features and Benefits:

• Automated Payment

Reminders: your clients will receive timely reminders, significantly reducing the occurrence of late payments.

• Real-Time Xero Data: Receive instant and accurate data from Xero, keeping your records up to date.

• Unlimited Invoices: Whether you’re managing a handful of invoices or thousands, Paycada handles it all with ease.

• Full Audit History: Maintain complete transparency and accuracy with a detailed audit trail for every transaction.

For those persistent invoices that won't clear despite repeated reminders, Paycada offers an Enhanced Collection Service. Powered by Bluestone Credit Management, a regulated FCA collections agency, this fully digital service takes debt recovery to the next level. You only pay for the results delivered based on a no-win, no-fee model. This service ensures that you can recover outstanding debts without incurring unnecessary costs.

Expand your service offering and enhance client satisfaction by joining the Paycada Partner Programme. As a technology partner, you can introduce Paycada's smart accounts receivable management to your clients, providing them with the tools they need to streamline their financial processes. The Partner Programme offers a

flexible commission structure, allowing your firm to benefit from an additional revenue stream. By partnering with Paycada, you not only help your clients manage their invoices more efficiently but you maximise your earning potential.

Incorporating Paycada into your accounts receivable management strategy can transform the way you handle payments, ensuring better cash flow and reducing administrative headaches. Don’t let late payments hold your business back. Visit us on stand E2 at Xerocon or to get in touch with us, visit our website at www. paycada.com to discover how Paycada can help you streamline your accounts receivable process and enhance your financial stability.

By adopting Paycada, you’re not just improving your accounts receivable process—you’re investing in the future stability and growth of your business.

Paycada is built by Fignum, a leading developer of cloud-

based software solutions for the financial sector. Specializing in digital payment processing as well as loan origination and servicing software, Fignum powers automated lending decisions with cutting-edge technology. Our extensive experience in creating software for the financial services industry allows us to tailor our platform to meet your specific needs.

Fignum is part of the Bluestone Group, a company with a longstanding history in financial services since its founding in 2000. This strong foundation ensures that Paycada is built on years of expertise and innovation, providing you with a reliable and efficient solution for managing your accounts receivable process.

Use our Xero integration to create powerful reports and forecasts. Import your data and transform numbers into insights in just a few clicks.

This article is

ob is a Chartered Accountant and runs Arjay Consulting, a Fractional FD practice serving growing FMCG brands.

How did you get started?

Rob embarked on his professional journey in the Big Four, building his expertise and experience at firms such as EY and KPMG, where he specialized in Audit and Mergers & Acquisitions.

Rob most enjoys spending his time with clients. In this case, non-alcoholic beer brand Day's Brewing.

The trajectory of his career took a pivotal turn when he began assisting friends who were building companies in the food and beverage sector. They required assistance in developing financial models and strategizing financially, areas where Rob's experience and insight proved valuable.

His ability to simplify complex financial concepts for growing

@joinmimo

Henrik Grim, CEO & Cofounder, Mimo

Henrik is the CEO & co-founder of Mimo. He spent the last 12 years building and investing in the financial technology ecosystem across UK & Europe. He started his career at iZettle (acquired by Paypal) in 2012, helping small businesses accept card payments. Most recently, Henrik spent 5 years as an investor with early stage technology investor Northzone, and the European leader of digital SME lender Capchase.

businesses led to an increasing demand for his services. Consequently, Rob assumed the role of a Fractional Finance Director, catering to companies poised on the brink of growth yet not in a position to employ a fulltime finance expert.

The fractional FD position has enabled him to significantly contribute to the trajectory of these companies.

"I build deeper relationships with my clients using Mimo."

However, when serving his clients, Rob kept spending time across tools to manage Accounts Payable, FX, credit and cash flow.

Mimo stood out as a relevant tool for Rob, providing a single interface to manage payments and cash flow on behalf of clients.

Mimo's capacity to manage supplier payments across multiple currencies in a single process simplified accounts payable processes, removing the need for managing various banking relationships and minimizing transaction costs.

The platform's feature of offering

credit on supplier invoices was a game-changer, providing growing businesses the ability to bridge the cash flow gaps. This capability provided additional ability to grow, and Rob to act as a strategic advisor.

Furthermore, the seamless integration with accounting software like Xero and QuickBooks streamlined the reconciliation process, enhancing financial record accuracy and efficiency.

This not only saved time but also offered Rob and his clients clear, actionable financial insights, facilitating better strategic decisions.

By adopting Mimo, Rob was able to build deeper relationships with his clients. Efficient Accounts Payable & Payroll is a great value

add at zero marginal cost, and cash flow management & credit allowed him to act as strategic advisor.

The impact

By implementing Mimo, Rob has been able to save five hours per week on pay runs across his portfolio, significantly streamlining his workflow.

This efficiency is achieved through the use of a single tool to manage payments, consolidating what previously required three separate tools.

“I build deeper relationships with my clients using Mimo. Efficient accounts payable & payroll is a great value add at zero marginal cost, and cash flow management & credit allows me to add strategic value.”

As a result, Rob now has more time to spend with client employees, which is his preferred activity, allowing him to foster stronger relationships and provide better support.

Now, he's hiring to grow his practice and build on its success to date.

This article is

XU: Tell us about Apron’s journey. What problem are you out to solve?

BU: Apron was born out of a simple yet significant realisation: small business owners don't set up shop to spend hours drowning in invoices and admin. Unfortunately, that’s the reality

for many. Our mission at Apron is to change that narrative entirely.

We've built a product to address the pain points of SMBs and their accountants, consolidating hours of tedious work into minutes. We view payments not just as transactions but as part of a connected network involving businesses, accountants, and suppliers. This holistic perspective

allows us to reimagine the entire invoice workflow for a seamless and satisfying experience for all involved.

XU: What sets Apron apart from other solutions out there?

BU: What sets us apart is our commitment to building right alongside the communities we serve, so accountants, bookkeepers and business owners. Drawing from my experience at Revolut, we've built a robust technical architecture backed by a usercentric design. In other words, we listen to our users and make sure it’s built properly!

This combination has enabled us to acquire customers solely through word of mouth, a testament to the need for some real change. We talk a lot about offering an all-in-one accounts payable solution, and that’s exactly what we’ve built.

XU: How has Apron evolved since its launch?

BU: Apron started a simple ‘bills only’ solution but steadily evolved into all things money out. Our goal right from the start was to create an end-to-end solution for finance professionals and their clients.

Over the past two years that’s

come to mean everything from invoice capture, to supplier payments, payroll payments, and reconciliation. The problem we saw was that accountants and bookkeepers were having to juggle too many apps and spend too much time handling client money. So it was important for us to keep things lean, to give them everything they needed in one place.

XU: The launch of the new invoice capture feature seems like a significant milestone for Apron. What was the inspiration behind this feature, and how do you see it benefiting your customers?

BU: Capture is indeed a significant milestone for Apron. The inspiration behind this feature comes from recognising the struggles faced by entrepreneurs in capturing and managing invoices efficiently. Traditionally, invoice capture tools have been tailored for finance professionals, overlooking the needs of multitasking entrepreneurs who are at the forefront of the payments process.

We understand that business owners like plumbers, caterers, and makeup artists are constantly on the move, juggling various tasks and responsibilities. Asking them to spend hours scanning receipts or grappling

are hard to miss when they rock up to an event.

with outdated software is simply unrealistic and counterproductive. This disconnect results in a strained relationship between accountants and their clients, usually leading to document chasing and unnecessary delays.

Apron Capture is our solution to this problem. Designed with a business-first mindset, it streamlines the entire invoice capture process, making it friction-free for both accountants and their busy clients. By eliminating unnecessary complexities, we empower business owners to focus on what truly matters: running their businesses effectively.

With Capture, there's no more

chasing after clients for missing documents or playing endless games of email tag. We've simplified the process to the point where even the busiest entrepreneurs will find it effortless to use. Also, Capture seamlessly integrates with our broader platform, completing the first part of that all-in-one solution I mentioned.

Ultimately, our goal with Capture is to not only alleviate the frustrations of invoice management but also to enable finance pros and business owners to think bigger and focus on driving growth and success.

XU: How does Apron prioritise customer feedback and incorporate it into the development process, particularly with regard to new features like invoice capture?

BU: Community has always been our North Star, and always will be. The mistake we see other apps and solutions making, is that they build without truly involving the people they’re building for. We’re constantly talking to the people who use our product, asking them what they need, and what frustrates them about the apps they have now.

We run regular webinars

where we encourage people to ask questions and suggest features. And we recently set up a Customer Advisory Board, to help get customer feedback into our priority workflows at board level faster. We’re also out on the road a lot, too, at events and conferences, giving demonstrations and getting inperson feedback from potential users.

One other priceless aspect of gathering feedback is our collaboration with design partners. These are real accountants, bookkeepers and business owners who use Apron day-to-day. We work extra closely with them to really pick out the specific problem areas that we need to solve for. I think that closeness sets us apart from other platforms.

How do you prioritise work when you’ve got so much feedback coming in?

BU:

That’s always a tough one, but generally we ask ourselves two questions: What are we building? And what are we not building? When answering the question of what we’re not building, we have to sometimes show some tough love on certain points of feedback. We have a clearly-defined central idea, or thread, if you like, of what we want to build. If a piece of feedback or a feature suggestion doesn’t fit with that goal, we have the confidence as a team to set it aside.

Prioritising, though, really comes down to leadership and communication. As a team, we’re constantly questioning our own ideas, and discussing what to do next. Our Product Managers are responsible for prioritising within their own areas. It’s then up to me to bite the bullet and make a decision about what gets done, and what can wait, in terms of Apron as a whole.

You mentioned Apron becoming the first ‘all-in-one AP’ solution for accounting and bookkeeping firms. What does this mean?

We recently ran a blog post on this, where we asked two of our users what they thought it meant. Again, this links to our ethos of working alongside our community, giving them what they need. For me, the answer is simple: All-in-one means endto-end. It means that you can upload an invoice or a bill, pull the information from it, set up an

approval workflow, get it paid and reconcile it in the books, all in one place.

One user in particular who echoes this sentiment is Lara Manton, Founder of LJM Bookkeeping Ltd. Lara is now on our Customer Advisory Board, but even before then, she had a clear idea.

“To me, an all-in-one solution entails having all aspects of the process consolidated in a single platform, facilitating easy tracking, complete visibility, and straightforward management. Ideally, the workflow should progress seamlessly from Apron Capture for document intake to recording bills in Xero, processing payments through Apron, and ultimately reconciling transactions back in Xero.” — Lara Manton, MICB

XU: Looking ahead, what future developments can we expect from Apron?

BU: There’s definitely a lot more to come, although pretty much all of it is under wraps at the minute. I know that’s a very secretive way to end this interview, so I’ll say instead that if you’re looking for a truly allin-one payments solution, please do consider Apron. Our website is www.getapron.com

FIND OUT MORE...

To find out more, visit our website:

SuiteFiles makes filing documents a breeze. With SuiteFiles’ integration with Xero and Outlook, our clients are finding document signing so easy and fast.

We love that signed documents automatically appear back in the right folders. The connected folders are much easier for clients than our previous Client portal.

Test it out for yourself with a free trial. suitefiles.com/trial

Benita Wright, Partner at Wright Doig

rom routine outpatient extractions, to more complex inpatient procedures, TOMS don’t have time to manually track stock. So how do they do it?

John Bridgman is an Oral and Maxillofacial, or “MaxFax”, surgeon at Tauranga Oral and Maxillofacial Surgery (TOMS). The clinic, staffed by three MaxFax surgeons, 15 nurses, and three receptionists, caters to an average of 50 patients daily.

They offer a comprehensive range of oral and maxillofacial surgical services, from routine outpatient extractions to more complex inpatient procedures. John performs 90% of his surgeries at TOMS. He also operates at the Tauranga Public Hospital and Grace Private Hospital for public-funded surgeries or those requiring general anaesthesia.

Change can be tricky. Originally, TOMS operated with just two surgeons out of a single surgery,

@tidyint

Amelia Douglas, Content Creator, Tidy

Amelia began working as an apprentice in the Marketing team at Tidy at the beginning of this year. With a passion for creating engaging content with a positive impact, Amelia provides an exuberant flair in bringing Tidy’s vision to life.

managing their clinical stock manually. However, when a new surgeon joined and TOMS expanded to two operatories, the clinic faced increasingly complex stock control challenges.

Stock management began to occupy valuable nursing time; particularly with stock items made up of hundreds of components with varying expiry dates. They decided to turn to technology and started looking for just the right inventory management system. After much searching and evaluation, they found Tidy.

Since implementing TidyStock, John reports that their workflow has significantly improved, becoming more efficient and precise while requiring less time from fewer staff members. Managing their stock has become more enjoyable, with less drudgery associated with manual checks.

“Although the system relies on human input, when executed properly, it provides a perfectly accurate measure of what’s in the drawer,” John says.

TOMS have also found that having up-to-date stock levels has streamlined the ordering process, making it easier, quicker, and more accurate, knowing they are not over or underordering. The integrated system has resulted in TOMS’ entire team of nurses becoming happier and more efficient.

Deb Buxton, a nurse at TOMS, had a big part in managing the

clinical supplies and general stock needs both before and after the implementation of TidyStock.

Before TidyStock, inventory control was a laborious task, involving physical counting of implants, checking expiry dates, staying up to date with ordering, and managing spreadsheets for end-of-month invoicing. With TidyStock, these tasks have been simplified significantly.

“It has completely streamlined my workflow,” Deb says.

“I can now order stock with just a few clicks. Tidy generates our supplier purchase orders automatically.”

Now TOMS never run out of stock.

Prior to TidyStock TOMS had so many spreadsheets, they were practically drowning in paperwork. Now, they are on their way to becoming completely paperless, with Tidy doing the work for them. John says that “TidyStock works for everyone at TOMS,” whose staff have adapted

quickly to the system.

Fast forward to the present day, John says that the journey is “definitely” going in the right direction. TOMS are impressed with the excellent quality technology which simplifies complexities and eliminates distractions.

Good software allows for quicker consultations, making everything “just rapid.” John described the system being like a “well ordered filing cabinet” with information now found at just the touch of a button.

To find out more about how you can make your business Tidy, visit: https://tidyinternational. com/solutions

This article is Current Business Bank Landscape and Frequent Concerns from Accountants about Big Banks

XU: What do you see as the biggest challenges currently facing the business banking sector in the UK?

SH: Having navigated through Covid, rising prices, higher borrowing costs and a challenging economic environment, many SMEs are finding it increasingly hard to access finance. With some banks tightening their credit appetite and reducing their exposure to particular sectors, they are also taking longer to give SMEs an answer as to whether they are prepared to provide financing for growth or working capital support.

Previously an SME might have had a dedicated Relationship Manager that understood their business and took an interest in their plans and ambitions, today many find themselves with an increasingly impersonal service,

unable to get speak to a human or spending a long time waiting on hold for a call center.

What’s more, despite the base rate currently sitting at 5.25%, SMEs are being let down when it comes to the interest they earn on their hard-earned cash. Whilst banks have gradually increased the rates they pay on fixed term and notice deposit accounts, most have been reluctant to increase much when it comes to interest earned on the current account. With many SMEs not having the luxury of being able to tie their cashflow up for longer periods, they are losing out on potential interest that could make a meaningful difference to their business.

XU: How have the needs of SMEs evolved in recent years, and how are big banks struggling to meet these needs?

SH: Staggeringly in 2023, over 140,000 SMEs had their bank accounts closed. With little warning these SMEs found themselves unable

to access their banking due to a change in their business, such a change in shareholding. Being de-banked and having their account frozen or closed is now a significant concern for business owners. As Relationship Managers have been withdrawn, banks can no longer effectively verify and validate a change in a business's circumstances or structure. Instead, it is quicker for a bank to freeze the bank account rather than understand what has changed.

XU: What are some of the most common complaints you hear from accountants regarding the services provided by big banks?

SH:

Over the last 10 to 15 years, accountants and their SME clients have been receiving such a low standard of service and support from the big banks. Unfortunately, their expectations have almost hit rock bottom, often having to wait on hold to speak to someone who doesn’t know them or their business about a time-sensitive query. This experience has

become normalised and they can’t see this changing.

Accountants enjoy solving problems for their clients, helping them to make sound business decisions and setting them up for success. This becomes really challenging when banks take months to make decisions on lending or setting up current accounts and if they don’t provide feedback on why an application has been unsuccessful. It’s hard for accountants to then help their clients on what their options and choices are.

XU: Can you share any insights on how Allica Bank is addressing these concerns differently from larger, more established banks?

SH: At Allica, we blend the very best of digital banking – quick processes, efficient decision-making and seamless account setup – with personalised relationship management. Each business customer has their own dedicated Relationship Manager. They’ll have their contact details; they’ll speak to them regularly and

will be able to build a good and supportive relationship with them.

In 2023, research conducted by our team of Allica Bank relationship managers, found that and a notable 82.3% of accountants responded that the ‘ability to talk to a person’ is a crucial factor when working with banks or lenders. At Allica we’re actively investing in our people and our technology to give accountants and SMEs the experience they deserve.

The Business Banking Service Gap for SMEs

What specific gaps in the business banking services for SMEs have you identified, and how does Allica Bank aim to fill these gaps?

SH: Allica is actively banking and supporting the UK’s established SMEs. These medium-sized businesses, typically with 5 to 250 employees, represent a tenth of the UK’s SME population. But they are disproportionately important

to our economy and our society, representing two-thirds of all SME turnover and employment and even more of the SME borrowing that drives productivity and jobs.

However, these businesses – the small warehouses, wholesalers and factories on the local industrial estate or the familyrun hotel, pub or restaurant – are at real risk of being left behind, notably by the big banks. Traditional banks have left our towns, closed their high street branches and removed the relationship managers who made lending decisions.

Established SMEs are complex and need greater levels of support, however the big banks have stopped catering for them, instead they’re focusing on microSMEs and large enterprises. This structural issue isn’t going away and it’s why Allica was built. We are focused on banking and supporting this underserved and vitally important segment.

XU: Can you discuss any recent innovations or services that Allica Bank has introduced to support SMEs?

SH: In 2023 Allica published ‘The Great British Savings Squeeze’. This report highlighted the stark difference between the traditional banks’ treatment of SMEs and corporate businesses when it comes to savings. With £150 billion of SME cash earning nothing and a further £125 billion earning 2% less than what is being offered to larger businesses, there is a clear need to raise awareness of the options available to these businesses.

Closing the gap on corporate savings rates and opening up the market to greater transparency provides an opportunity to give a well-needed – and well-deserved – £7.5 billion boost to the bottom line of SMEs.

Allica is proud to be championing this and we also have a leading

rate of interest (4.33% AER variable) on our instant access Savings Pot in our business current account. We are committed to helping SMEs make their cash work that little bit harder for them.

What role do accountants play in the relationship between SMEs and banks, and how can this relationship be improved?

Accountants play an integral role in helping their SME clients. They are the trusted advisors who support businesses to succeed. This is particularly true for established businesses, who rely on their accountant to have a deep understanding of their business, how they operate and their aspirations.

Historically, accountants and bank managers would work side by side, providing business owners with valuable, timely support and peace of mind. However, with the high street banks reducing their support and removing access to relationship managers, accountants have had to fill the

void and provide businesses with even more proactive support.

It’s important for accountants to know what banks are available and where to turn. A collaborative banking relationship can still exist, and it is key to have regular communication with the banks and to build your own banking network. This will ensure accountants are up to date with the right information that can help their clients.

Allica’s Partnership Team Launch and the Role of Supporting Accountants in the UK

Can you explain the purpose behind the launch of Allica’s partnership team?

SH: At Allica, we’re working on becoming the UK’s most recommended business bank. By delivering a relationship-focused service to the underserved established businesses, we have already become one of the UK’s most highly-rated banks and named the fastest-growing UK fintech in history, according to Deloitte’s UK Technology Fast 50. By continuing to grow and support businesses at this scale, we

believe the traditional banks will be encouraged to reassess and improve how they treat this community, whose success is critical to our economy and society. To achieve this, we can’t do it alone, we need to work hand in glove with accountants, helping them to support their clients.

We’ve recently partnered with Nordens Chartered Accountants, and they told us that high street banks haven’t really understood their clients, their needs or their potential. Plus, it was very rare that they have taken the time to understand them as a business either.

Our focus is on earning their trust, helping deepen their client relationships and positively contributing to the accounting industry.

XU: How does the partnership team plan to support accountants across the UK? And what specific benefits can accountants expect from working with Allica’s partnership team?

SH: Our Partnerships Team are focused on providing accountants with the help they and their established

business clients need. Practically, this means each accountancy firm will have their own dedicated Partnership Manager. A single point of contact for them to speak to at the bank. Someone who will know their firm and what’s important to them. The experienced team have deep industry knowledge and work with accountants all over the UK at different stages of growth. Accountants can confidently introduce their clients to their Partnerships Manager, knowing they will help to find solutions and support them through the current account application process.

Our team tends to have business current accounts set up in days (rather than weeks, or months!). They also act as a key conduit to other areas of the bank, for example the lending teams who provide commercial mortgages, asset finance and growth finance. Alongside our proactive relationship management, we provide firms with marketing collateral and support to help them confidently identify valueadd opportunities and discuss business banking as part of their conversations with clients. We are also launching our online ‘Accountants Directory’ this summer to help established

businesses find their local accountants and we’ll be hosting networking events for partners later in the year.

Allica’s Recent Launch of Accounting Software Integrations

Can you provide details on the recent launch of Allica’s accounting software integrations?

We know that good and reliable bank feeds are critical for SMEs and their advisors. Earlier this year we launched our direct integrations with Sage and Xero. This means that Allica Bank business current account customers can have their account transactions fed automatically to their accounting software. By sharing this data (including amount, date, time, direction, reference and merchant information) it can save business owners and their bookkeepers and accountants significant amounts of time, reducing manual work and the potential for error. Using these insights, business owners and their accountants can make the most of their finances, finding opportunities to grow and succeed. Our aim is to integrate

with the leading software packages, including QuickBooks, to help our customers run their businesses.

Alongside our accounting integrations we also integrate with Wise to help businesses with ambitions to expand and operate internationally. This allows them to use their current accounts to send international payments with transparent fees and no exchange rate markups. The Wise Platform integration means that our customers can complete the whole process of making an international payment quickly and conveniently within their own banking app. They will know upfront the total fees for making an international payment and be able to guarantee the exact amount is received by their recipient.

What’s next for Allica Bank? Are there any more integrations or features that you are looking to implement in the near future?

SH: We’re at a great point where we’re actively listening to our accounting partners, learning what they and their clients need most from Allica. We've had specific suggestions about creating an ‘accountants view’ and also dedicated client money accounts. We’re very open to hearing feedback from firms on how we can make the accounting-banking relationship even better.

s Head of Growth and Partnerships, I can confidently say that partnerships play a pivotal role in the development and success of new job management software like WorkflowMax by BlueRock.

“I’m thrilled to share more on our growing range of integrations that will really help small business customers.”

By collaborating with a diverse range of technology and service providers, we've been able to create a robust ecosystem that enhances functionality and extends our capabilities. These strategic alliances allow us to integrate complementary applications, such as accounting software, CRM systems, and various productivity tools, which streamline workflows and eliminate the need for multiple standalone solutions. Such integrations not only save time and reduce errors but also significantly boost operational efficiency and overall profitability for our users.

Moreover, partnerships are essential in fostering innovation and ensuring our software remains at the cutting edge of

technology. They provide us with access to broader expertise and specialised knowledge, which is crucial in addressing complex user needs and adapting to changing market conditions. I’m thrilled to share more on our growing range of integrations that will really help small business customers.

Manage your customers and sales pipelines

HubSpot

Launching end of June.

Integrate HubSpot with WorkflowMax by BlueRock to seamlessly manage your customer relationships and sales pipelines. HubSpot's powerful CRM capabilities allow you to track every interaction, automate follow-ups, and gain valuable insights into your sales process. This integration ensures that your customer data is always up-to-date and easily accessible, enabling your sales team to focus on closing deals and building strong customer relationships.

Ryan Kagan, Head of Growth and Partnerships, WorkflowMax by BlueRock

With 20+ years' experience scaling businesses through digital solutions, Ryan Kagan, Head of Growth and Partnerships at WorkflowMax by BlueRock, is a seasoned leader in account management, product, partnerships, and business growth. Formerly a Director at BlueRock Digital, he propelled the startup to success. Prior roles at Deloitte Digital involved driving digital enablement and transformation through strategic advisory. Now, Ryan strives to build a thriving platform community where all prosper.

Boost your ability to schedule and manage team capacity

PlanRight

Available now.

PlanRight enhances your scheduling capabilities by integrating with WorkflowMax by BlueRock to provide a visual overview of your team's availability and project timelines. Easily drag and drop tasks to reassign resources and adjust schedules as needed. This integration helps you maintain a balanced workload across your team, improving efficiency and ensuring that projects stay on track.

Runn.io

Launching in August.

With Runn.io integrated into WorkflowMax by BlueRock, you

can effortlessly plan and manage your team's workload. Runn.io provides real-time visibility into your team's capacity, allowing you to allocate resources effectively and avoid overloading your staff. This integration helps you optimise project schedules, ensuring that deadlines are met and your team remains productive.

Automate payments and expense tracking

Live now.

Integrating Xero with WorkflowMax by BlueRock streamlines your financial management by automating invoicing, payments, and expense tracking. Sync your job management data with Xero to ensure that all financial transactions are accurately recorded and up to date. This integration reduces the time spent on manual data entry and helps you maintain accurate financial records.

Live now.

EzzyBills simplifies expense management by automating the capture and processing of receipts and invoices. Integrate EzzyBills with WorkflowMax by BlueRock to automatically extract data from receipts and sync it with your job management system. This integration helps you keep track of expenses in real-time, reducing administrative overhead and improving financial accuracy.

Power up your reporting insights

Live now.

The Dashboard Insights integration provides WorkflowMax by BlueRock users with advanced reporting and analytics capabilities. Create custom dashboards and reports to gain deeper insights into your project performance, financial health, and team productivity. This integration helps you make data-driven decisions and identify areas for improvement.

SyncHub

Live now.

SyncHub connects WorkflowMax by BlueRock with your preferred business intelligence tools, enabling you to consolidate data from multiple sources and generate comprehensive reports. Easily visualise your job management data alongside other business metrics, providing a holistic view of your operations. This integration enhances your reporting capabilities and supports strategic decisionmaking.

Launching end of June.

Rally’s integration with WorkflowMax by BlueRock enhances your project management by providing powerful reporting and analytics tools. Track project progress,

measure team performance, and identify potential bottlenecks with ease. This integration helps you stay on top of your projects and ensures that you have the insights needed to deliver successful outcomes.

Etani

Launching end of June.

Etani enhances your administrative efficiency by integrating with WorkflowMax by BlueRock to automate data entry and reporting tasks. This integration helps you save time on routine administrative tasks, allowing you to focus on more strategic activities.

Get paid faster

AirWallex

Launching in July.

The AirWallex integration with WorkflowMax by BlueRock will simplify your global payments and reduce transaction costs. Automate invoicing and payment processes to ensure that you get paid faster and more efficiently. This integration supports multiple currencies and provides transparent exchange rates, helping you manage international transactions with ease.

Automate more of your admin tasks

Upsheets

Launching in June.

Upsheets integrates with WorkflowMax by BlueRock data to simplify data management and reporting. Automate the

transfer of data between your job management system and spreadsheets, and easily upload into Xero or other payroll apps. This integration reduces manual data entry and enhances your ability to generate accurate reports.

Launching in July.

The Notud integration allows you to digitise and streamline your administrative tasks. Capture notes, create to-do lists, and manage documents directly within WorkflowMax by BlueRock. This integration reduces the need for paper-based processes and improves your overall productivity.

Zapier

Launching later in 2024.

Zapier acts as a bridge between WorkflowMax by BlueRock and hundreds of other apps, enabling you to automate repetitive tasks without any coding. Create "Zaps" to connect WorkflowMax by BlueRock with your email marketing tools, CRM systems, and other business applications, ensuring that data flows smoothly across all your platforms. This automation not only saves time but also reduces the risk of manual errors.

WorkflowMax by BlueRock to easily store, access, and share project-related documents. This integration ensures that all your files are organised and readily available, improving collaboration and reducing the time spent searching for documents.

The Dropbox integration with WorkflowMax by BlueRock provides a secure and efficient way to manage your documents. Sync your files automatically and access them from any device, ensuring that your team has the information they need at their fingertips. This integration enhances document management and supports seamless collaboration.

management processes. Organise, share, and collaborate on files within a centralised platform, ensuring that your team has access to the information they need. This integration improves document accessibility and supports efficient project management.

Partner with implementation experts for optimal results

Working with an implementation partner or cloud integrator can significantly enhance the efficiency and speed of setting up your complete tech stack.

These experts ensure that all integrations are seamlessly configured, allowing you to fully leverage the capabilities of WorkflowMax by BlueRock and its partner applications.

This professional guidance not only helps achieve a smooth implementation but also makes sure that your business processes are optimised for maximum productivity and growth.

The Box integration offers advanced document management capabilities for WorkflowMax by BlueRockusers. Securely store, share, and collaborate on files with your team, ensuring that everyone has access to the latest documents. This integration helps you maintain control over your documents and enhances your workflow efficiency. SuiteFiles

Launching in August 2024.

SuiteFiles integration with WorkflowMax by BlueRock streamlines your document

For more information on finding the right partner, visit the WorkflowMax by BlueRock Partner Directory. Get in touch

What would happen if you increase your fees by 20% – remembering a price increase goes straight to the bottom line into your profits?

Last year, Ignition carried out research that led us to publish an open letter for change, calling on accounting and tax professionals to reclaim the profitability they deserve.

We did it because the research showed that accountants have a tendency to prioritise their clients’ needs over their own business health, which can put their business at risk and lead to burnout.

As a recovering accountant and previous firm owner, I know all too well the fears faced in the accounting industry like changing

prices (pushing them up), the fear of asking for payment upfront, and saying yes to all clients' needs without any concerns for yourself or your firm, when we don't have time. These are some of the main reasons Ignition exists today.

In a recent podcast with Ryan Lazanis from Future Firm, we looked at various pricing strategies and methodologies, as well as ‘how big an increase is too big?’

What determines the right amount of value exchange between a firm and their clients? Based on that interview, we

Guy Pearson, Co-Founder and CEO, Ignition

Guy Pearson is the CEO and Co-founder of Ignition, the leading revenue generation platform for professional services.

Before co-founding Ignition in 2013, Guy started a progressive accounting firm, Scendar (previously Interactive Accounting). Guy and his cofounder, Dane Thomas set out to create Ignition, a platform that combines proposals, billing, payments and other essential workflows in one place.

learned that price increases and the confidence to implement these are crucial elements of the program to correct the firm’s margins and create capacity to enhance the service and the bottom line.

From qualitative insights and firsthand experiences shared on the Future Firm's online platform, a pattern emerges suggesting the most immediate and impactful strategy for a firm's growth could be increasing pricing.

It’s important to note that this observation is based on anecdotal feedback and professional

discussions, rather than empirical data. While these qualitative insights provide valuable perspectives, approaching pricing adjustment with a comprehensive understanding of your firm’s value proposition is key.

It's not only about adjusting rates, but understanding your Ideal Customer Profile (ICP), for example, size, location or industry, and recognising and communicating upfront the value and quality of the services offered.

But the prevailing fear that raising prices significantly (ie, by greater than 50%) for standard services could spell disaster for a firm seems to be a myth.

The real challenge, and opportunity, lies in the firm’s confidence and mastery of the tactics involved in re-evaluating its worth.

The evidence from numerous success stories within the Ignition community suggests a

well-considered pricing strategy doesn’t lead to the ruin of a business.

Instead, it contributes to its significant growth and profitability, because a wellcalibrated pricing strategy reflects the true value of the services provided, attracts the right clients, and supports the firm’s financial stability.

In the firm I started, we increased prices by 25% during the same end-of-financial-year period that I stopped being an active member of the team.

I think we lost one client out of however many hundreds we were dealing with, and the revenue went up.

So here lies the controversial stance: Is the traditional caution against raising fees a byproduct of undervaluing our services?

And more importantly, are we – as a profession – ready to reevaluate our worth and take the leap?

From Ignition data, I can tell you that the average price increase rolled out with our price increase feature in December last year, was 9%.

This is a far cry from 50% or even 25%, but with 9% being the average, and inflation being a factor (the old standard way to boost a price), there’s a significant range for consideration.

Let's challenge the status quo together and redefine the value of our services in the eyes of our clients and our community.

Start your free 14-day trial today!

go.ignitionapp.com/sign-up

n the dynamic landscape of high-tech industries, where intricate high-mix, low-volume production intersects with complex products and rapid technological advancements, achieving precision in inventory management can pose a formidable challenge.

Recognizing the critical role of robust inventory management in overcoming these challenges, Raider Targetry, a pioneering force in military training solutions, proudly unveils a groundbreaking advancement in efficiency through the integration of Fishbowl Inventory, a market

leading software solution for inventory management.

CEO & CTO Mick Fielding, alongside Executive Director Cody Webster, envisioned Raider Targetry’s global potential since its inception. Mr. Fielding emphasized the strategic importance of establishing a solid foundation for products and services to support the company’s growth trajectory, stating, “When we were looking at building the business, we knew that we needed an inventory management system that would support us today, but also into the growth that we would expect in the future.”

@Fishbowl

Craig Scarr, Marketing Director, APAC, Fishbowl

Craig Scarr is a marketing professional and business leader with passion and focus to help organisations and leadership teams to generate outstanding results. Craig has extensive experience as a business professional spanning strategic marketing, brand management, partnership development, content, and digital media marketing across a diverse range of industries including FMCG, financial services, not for profit organisations and software solution providers.

According to Simon Jupe, Fishbowl APAC Managing Director, “Accurate and efficient tracking of inventory movement from inception to its final consumption point is crucial for effective control and decision-making processes within a business. Investing in a system that enables both signature tracking and inventory tracking facilitates swift resolution in cases where physical transactions diverge from the system records.”

Tim Kelly, Digital Systems Manager at Raider Targetry, expressed the transformative impact of Fishbowl, stating, “Fishbowl’s been gamechanging for us in terms of having that single source of truth that everybody can refer to, to understand the status of any particular work order at any point in time.”

Further affirming his endorsement of the solution, Mr. Kelly emphasized, “Fishbowl’s also been fantastic in terms of helping us to save costs, in particular the labour cost of trying to coordinate all of these different production and work orders. The main thing though, that

Fishbowl’s really helped us with in terms of productivity is the ease of integration into the engineering software that we’re using. Implementing a new inventory management system is often a big commitment for any organisation. Thankfully, the Fishbowl support team is fantastic, and they’ve made it really, really easy for us to configure Fishbowl in a way that’s suitable for our organisation.”

The software’s capabilities extend to meeting regulatory requirements and ensuring compliance by providing accurate records, traceability, and comprehensive reporting features. Mr. Kelly highlighted Fishbowl’s prowess in digital track and trace, serialization, and managing complete bills of materials, ensuring the delivery of clean and clear, real-time information to the Defence Force.

got additional integration through the full depth of our bills of materials, and we’re tracking a lot of custom fields like NATO stock numbers and those kinds of things too.”

Mr. Fielding reiterated the strategic alignment of Fishbowl with Raider Targetry’s objectives, stating, “Fishbowl in particular has a number of features which support what we do. Fishbowl gives us a single source of truth for everything we do within the business, especially when it comes to production, but also supporting our R&D activities.”

Looking ahead, Mr. Kelly emphasized forthcoming enhancements, stating, “In the future, we’ve got an extensive amount of automated purchase order and production order planning coming into play. We’ve

Simon Jupe, Fishbowl APAC Managing Director, underscored the scalability of Fishbowl software emphasizing, “As high complexity, low volume businesses grow or evolve, Fishbowl software can scale to help our clients meet their changing needs. This flexibility can be essential, especially for companies dealing with diverse and evolving product lines.”

Mr. Fielding concluded, “As a company developing high-tech solutions, we need high-tech business processes that support

what we do, and especially those that scale with the business as we expand globally. The technology we’re developing has fast iteration cycles, they’re technically complex systems, and we need products that support the business that work in the same manner. Fishbowl was a natural fit for us and very much complementary to the tech stack we’d already brought on board. Now that we’ve partnered with Fishbowl, we’re really excited to see where the future will take us and we have full confidence that we’ve got the right partners in place to get there.”

Raider Targetry’s strategic integration of Fishbowl Inventory represents a paradigm shift in inventory management, reinforcing their commitment to operational excellence, innovation, and global growth.

To find out more about Fishbowl, visit their website:

fishbowlinventory.com.au

XU Magazine spoke to Cameron Ford, Silverfin’s UK General Manager and Russell Frayne, Director of Transformation at Gravita a top 30 full service accounting firm.

Silverfin (www.silverfin.co.uk) is a cloud software firm started by an accountant for accountants ten years ago. It now supports over 800 accounting firms, including 30 of the UK's top 100, by connecting and standardising data and automating accounting processes.

XU: There’s a lot of hype in accountancy circles about the cloud and AI. Are accountants right to be cautious about adopting new technologies?

CF: I don’t think accountants, or any sector for that matter, can avoid the cloud or AI for much longer. Data is exponentially growing, compliance demands are becoming more onerous and there’s a new generation of worker who expects technology to make their job easy. It’s a context that can’t be ignored.

I’m still surprised by the number of firms not making use of the cloud to collect and share client data. We know there is a ‘capacity crunch’ in accounting that impedes company growth

as well as stifling professional development and adding to stress.

The cloud can play a significant role in helping ease this pain, streamlining processes, improving accuracy, and removing repetitive tasks that often lead to human errors. With live, standardised data accessible to your entire firm from anywhere in the cloud, it’s a footing for adopting AI and reaping the benefits.

XU: Can accountants really take advantage of AI?

CF: Any industry can use AI to become better at what it does and how it does it. Think of it as a tool to help automate tedious jobs, improve performance and be your best.

Also, it’s not a technology just reserved for largest firms or those that are synonymous with the tech sector.

There are examples all over the world that show how AI can be used to improve staff and client satisfaction. I’d recommend learning from them and ‘borrowing’ tried and tested models. Look for ways to use AI to prove the concept first and build from small gains towards bigger ones

XU: What’s the most important consideration for accountants when moving to this new world?

RF: Getting your data quality ready - thinking about where it sits, how it's stored

and accessed should be a priority for all firms that want to thrive.

The whole data story is the gateway to enabling AI and taking advantage of the productivity, efficiency, and profitability it brings to your firm.

XU: Is that why you chose Silverfin as one of your AI partners?

RF: Working with Silverfin puts us into a very different position, when compared to other partner technologies. One of the big reasons I’m an advocate for Silverfin is the way in which it becomes the unstructured data aggregator and can slot into our existing stack with open APIs. It’s a process and methodology that’s so vital for success as the platform pulls everything together into one space, where teams can easily collaborate and seamlessly do their day job.

XU: Can you explain how that aggregation pays off?

RF: Yes, take the example of when we're doing working papers and accounts. Silverfin is pulling data from different sources in different formats, and it's unifying it in one place. You can then pull so much more insight from that unified dataset.

XU: Can you highlight some key features of Silverfin that your customers find most valuable?

CF: If you asked any of our clients how Silverfin is transforming their business, they’d say it’s created speed, consistency, capacity and opportunities to thrive.

Silverfin game changers:

1. Accelerate account preparation with Silverfin. Clients quickly harness the power of live data connections, remove the ‘copy, paste, roll

forward’ data operations and benefit from the ease of consistent single entry efficiency.

2. Create capacity with Silverfin Assistant. Analysis of client files is automated, saving hours checking files and even helping to train junior staff as they work through the flagged anomalies.

3. Streamline manager and partner reviews. Enhanced control and consistency is highly valued by clients. With Silverfin, they can make efficient side-by-side comparisons and teams can collaborate in realtime.

4. Next-level staff-client communication. The information you need to do your job is all at your fingertips. Nothing is missing, teams have audit trails, and can interact and work together where the work happens.

XU: Can you give us a real-life example of the technology in action?

We have trained everyone on Silverfin Assistant. It’s fantastic for junior staff as they’re doing their day job with an Assistant on the side of the screen to prompt and guide them.

It will tell you what it's looked for, why it's identified something, and what the information is telling you, with full background information as well. Not only is this great for training, it’s freeing

up more experienced accountants to spend more time with clients.