ROVEEL, THE REPORTING SOFTWARE COMPANY BASED IN NORWICH (UK), HAS LAUNCHED ITS GLOBAL INTEGRATION FOR XERO, UNLEASHING THE POWER OF DATA HELD BY SMALL AND MEDIUM BUSINESSES (SMES).

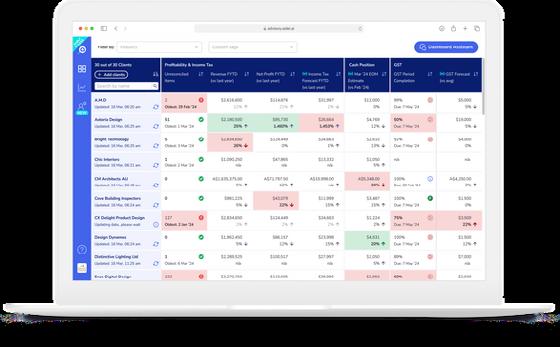

Now available for SMEs and accountancy firms via the Xero App Store, the reporting tool builds on the significant amount of data stored in a company’s accounting system and allows in-depth drill-down analysis to allow for smarter decision making.

Established in 2014, Roveel helps accountants and business owners, directors, management, and staff save time on day-to-day admin report-

ing tasks and the need for endless Excel reporting. The value of data which an SME has access to is powerful in driving growth, identifying opportunities in sales and increasing profits.

Diving deeper into data using Roveel’s drill-down functionality provides accountants and business owners with a powerful tool for quick analysis and reporting using the suite of pre-built business dashboards and reports. Roveel is supported by a comprehensive marketplace of additional insights, complemented by a bespoke service too, ensuring that the company motto of “ANY Report You Want” is fulfilled.

Xero data is valuable and Roveel boasts a vast library

of dashboards and reports covering areas from sales to finance, credit control, purchasing, stock and allows customers to manage their budgets, cash, and profitability with ease.

Mark Donaldson, founder of Roveel and former practice accountant, said: “The market has asked for more in-depth analysis and I am thrilled to launch our Xero integration and build upon our already strong market offering to SMEs. Roveel provides a secure and affordable way to generate the information required and empower teams. Being listed on the Xero app store and recognised as a connected app and certified by Xero is extremely exciting.”

Find out more

BGL CORPORATE SOLUTIONS (BGL), THE WORLD'S LEADING PROVIDER OF COMPLIANCE MANAGEMENT SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS COMPLETE COMPANY SECRETARIAL, TRUST AND AML MANAGEMENT SOFTWARE SOLUTION, CAS 360, IN THE UNITED KINGDOM.

"We are thrilled to bring CAS 360 to the UK market," said BGL's Chief Executive Officer, Daniel Tramontana. "It's been 2 decades since BGL first entered the UK market with its pioneering Corporate Affairs System (CAS) desktop software. The launch of CAS 360 in BETA is a testament to our team's dedication and hard work. CAS 360 is set to revolutionise how UK firms manage their compliance obligations

and we couldn't be prouder of this achievement."

To coincide with the launch of CAS 360 in the UK, BGL is excited to welcome Ashley Barker to the BGL team. Based in the UK, Ashley joins as the dedicated UK Business Development Manager.

With a focus on building strong relationships with prospective clients and partners, Ashley will drive growth in BGL cloud products and deliver remarkable experiences to our UK clients.

Warren Renden, General Manager – CAS 360, Ecosystem and UK at BGL, said: 'The launch of CAS 360 in the UK is a significant milestone for BGL. Our software is designed to streamline compliance processes and

we are confident it will be a game-changer for UK accountants and company administrators."

CAS 360 is the complete company secretarial, trust and AML management software solution designed to help accounting firms, corporate service providers and company groups efficiently manage compliance obligations in one innovative and user-friendly platform.

With automated alerts and integration with UK Companies House, CAS 360 provides streamlined workflows for managing companies (Annual Return confirmation statements, company registrations and common changes made by companies), trusts, AML compliance and more.

Find out more

ALLICA BANK – THE DIGITAL CHALLENGER BANK BUILT

ESPECIALLY FOR ESTABLISHED SMES – HAS ANNOUNCED THE LAUNCH OF A NEW PARTNERSHIPS TEAM, SPECIFICALLY FOCUSED ON GROWING ITS RELATIONSHIPS WITH ACCOUNTANCY FIRMS ACROSS THE UK.

Recently named by Deloitte as the UK’s fastest-growing business of 2023 in its Technology Fast 50 Awards, the business

bank sees accountants as a vital connection to its core segment of established SMEs. It defines ‘established SMEs’ as those businesses with 5 to 250 employees – a group that currently contribute a third of UK turnover and employment.

Allica, which offers a range of lending and savings products for established businesses, has defined itself by offering each of its business current account customers a dedicated relationship manager, built on modern tech-

nology – Allica has described it as ‘business banking like it used to be, just better’. The bank has won awards such as Best Business Finance Provider at the 2023 British Bank Awards and Best Commercial Mortgage Provider at the 2023 Business Moneyfacts Awards.

Initially a team of eight partnerships managers with coverage across the UK, this new team will be led by Sophie Hossack, previously the first employee at Dext (formerly Receipt Bank) and

Rich Williams, who previously led Australian asset finance intermediary, Stratton Finance.

The role of the new team will be to collaborate closely with accountancy firms to help them and their clients get more from their banking with personalised and dedicated support.

The team will run regional events, share knowledge, and help accountants add value to their client relationships.

Discussing the need for a bank that prioritises accountant relationships, Mitch Hahn, CEO of accountancy firm Nordens said:

"Over the years we’ve tried to work with all the high street banks, but frustratingly, we’ve found most have fallen short time and time again. They haven’t really understood our clients, their needs or their potential.

"Last year one of our clients introduced us to Al-

lica Bank because they’d started banking with them. It was refreshing to talk to the banking team there who were genuinely interested and passionate about working with us and our clients.

"It’s key for accountants and banks to work together to provide business owners with an excellent service. We’re pleased (and relieved!) to have finally found a bank willing to step up and deliver."

Find out more

DEPUTY, THE GLOBAL PEOPLE PLATFORM FOR HOURLY WORK, ANNOUNCED THE LAUNCH OF ITS FAIR WORKWEEK COMPLIANCE PRODUCT THIS WEEK.

The solution is tailored to meet the compliance needs of businesses as cities and states across the US expand their Fair Workweek (FWW) laws, strengthening its leading position as a compliance solution for hourly work.

Fair Workweek Laws are expected to facilitate higher labor market participation by providing more predictable and stable work schedules, especially among women, those with caregiving responsibilities and the growing number of poly-employed workers across the US. Deputy will quickly become a crucial tool in navigating the complexities and nuances of city, state, and industry-spe-

XU BIWEEKLY - No. 80

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

cific requirements attached to the legislation.

Deputy’s Fair Workweek solution will streamline businesses’ ability to comply with key Fair Workweek requirements, reducing their risk of costly penalties.

Key features include:

• Good Faith Estimate Creator: Provides new hires with clear expectations about their projected work schedules.

• Advance Notice of Work Schedules: Deputy’s AI-powered scheduling tools facilitate accurate work schedules that are published in advance to maximize productivity and minimize labor costs.

• Consent for Schedule Changes: Empowers employees with the ability to consent to last-minute schedule adjustments.

Find out more

Reports & Data Feeds

New column for ‘Job Card Stock Required’ added to the Part Stock Level Report

Addition of SO Customer Contact name and email to the Sales Order Index page Data Feed to enable email automation via third party tools.

Addition of ‘Part ID’ on the Data Feed CSV for the following reports to enable enhance filtering:

• BOM vs Part Cost

• Part Component Stock level report

• PO Cost Variance Report

• Purchase Order Line Item

Report

• Purchase Order vs Part Cost Price Report

• Sales Order Line item report

• Sales Order Profitability By Line Item Report

• Sales Summary By Part Report

• Items Dispatched Report

• Items Due

• Items Received Report

• Outstanding Purchase Orders

• Part Location Report

• Purchase Order Returns

• Purchase Orders and Associated Job cards Report

• Unmoved Valuation Report

Find out more

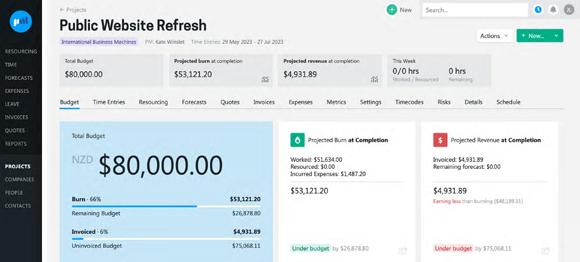

WWE’RE THRILLED TO ANNOUNCE QUOTE VERSIONS! NOW, EVERY QUOTE YOU CREATE WILL AUTOMATICALLY COME WITH VERSIONS BUILT RIGHT IN!

Why versions matter

You’ve always been able to edit a Quote after sending it to a customer, but previously, going back to an earlier version wasn’t possible if the customer changed their mind – awkward! The new Quote Versions feature fixes that by automatically saving different versions for easy recovery.

When are versions created?

A new version will get created whenever: • You edit a Quote and take it offline

Keep reading

IN OUR ONGOING EFFORTS TO PROVIDE TOOLS THAT STREAMLINE YOUR SALES PROCESSES AND ENHANCE USER EXPERIENCE, WE ARE EXCITED TO ANNOUNCE SIGNIFICANT ENHANCEMENTS TO OUR AUTOMATED QUOTE REMINDER FEATURE.

This update introduces customizable reminder intervals and account-level default settings, empowering you to tailor your follow-up strategy precisely to your business needs and customer behaviors.

Introducing Customizable Reminder Intervals

Until now, our Automated Quote Reminders allowed for reminders at fixed intervals. With the latest update, you can set customized intervals.

Keep reading

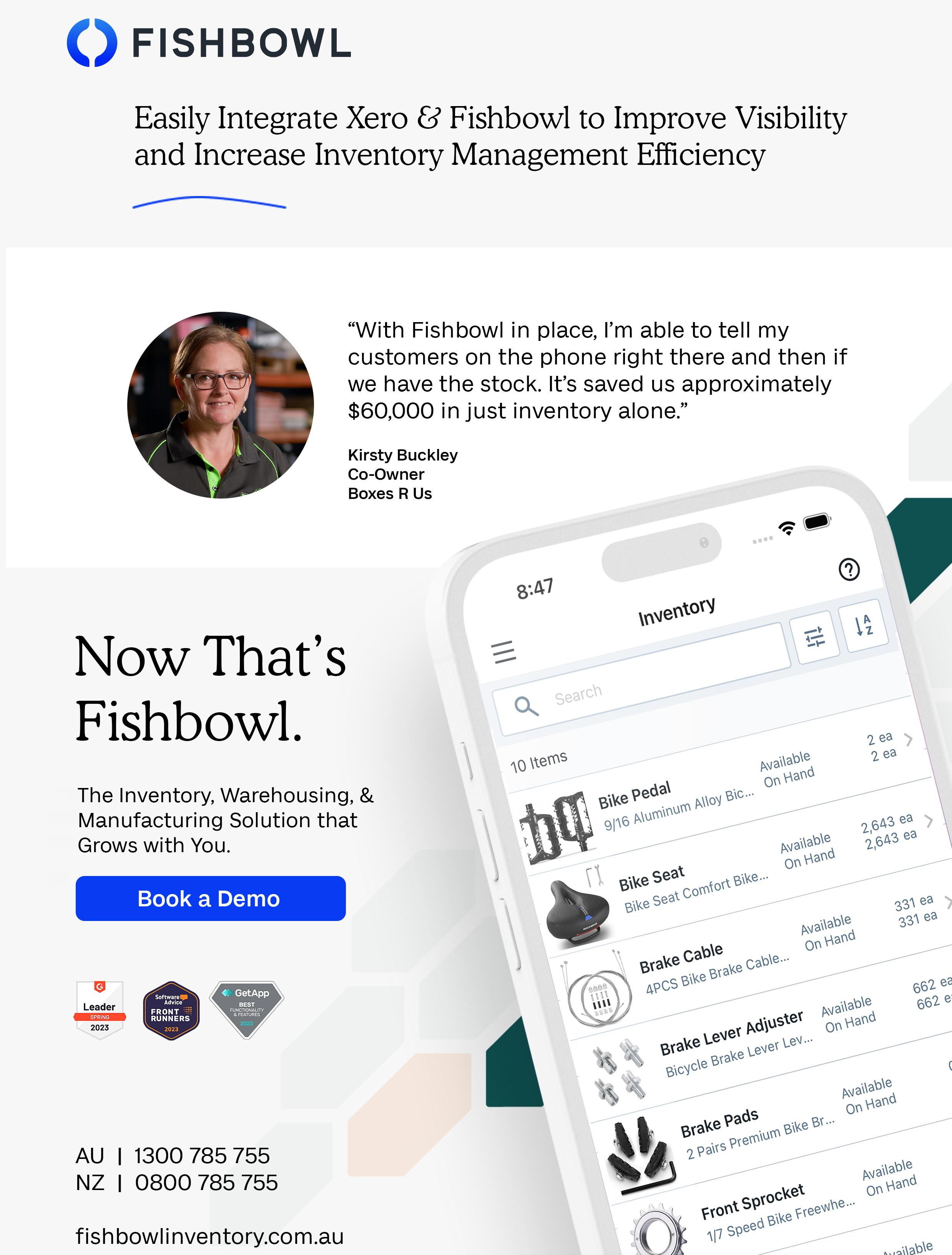

Global - Drill down reporting, analysis and dashboards to empower SMEs and accountants to improve decision making and drive business performance. Access ANY report you want.

MORE TIME TO FOCUS ON WHAT MATTERS. TODAY WE’RE EXCITED TO DELIVER ON THIS PROMISE WITH THE LAUNCH OF OUR ALL-NEW SALESFORCE FOR ARLO INTEGRATION.

Built from the ground up, Salesforce for Arlo 2.0 brings you instant two-way synchronization, a modern UI built on Lightning, advanced logging, duplication management, and a whole lot more — all designed to give you greater speed and accuracy.

After extensive internal and customer testing we’re excited to announce that the new all new Salesforce integration is robust, dependable and ready for your business.

Find out more

WE REPEAT, THIS IS NOT A DRILL. THIS IS NOT ANOTHER BETA TEST. CAPTURE, OUR INNOVATIVE INVOICE CAPTURE TOOL, IS OFFICIALLY LIVE AND READY FOR ACTION.

After much anticipation and hundreds of early access signups, accountants and bookkeepers can now harness the power of Capture to streamline their invoice management processes like never before. In case you missed our previous post introducing Capture, let us give you a quick recap.

(And by the way… keep reading because we’ve added some new features to Capture already, based on feedback from the accounting and bookkeeping communities).

Capture is the ultimate solution for simplifying invoice capture, designed specifically to enhance collaboration between finance

professionals and their clients. It gives you and your clients the ability to snap a photo of a bill, receipt, or invoice on the go and upload it directly to Apron. No complicated logins, no manually typing in details.

We trained Capture’s AI on thousands of financial documents so that it can recognise bank details, payment and VAT amounts, due dates, line items, and even whether something is a personal expense (you just have to add a small comment when uploading for this to happen).

Capture was built with two main goals in mind

1. To be simple and fast enough for busy business owners to use on the go.

2. To work on its own for invoice capture, and alongside Apron Payments for a complete end-to-end Accounts Payable solution.

Find out more

OVER THE LAST MONTH, WE’VE ROLLED OUT UPDATES TO KEY FEATURES IN XERO, INCLUDING BANK FEEDS, TAX, PAYROLL, INVOICING AND MORE. AND WE’VE ANSWERED SOME OF YOUR MOST REQUESTED XERO PRODUCT IDEAS — INCLUDING UPDATING OUR BANK RECONCILIATION SCREEN SO YOU CAN SEE UP TO 50 STATEMENT LINES AT ONCE.

Global: Sort, search and filter statement lines in bank reconciliation [Product Idea]

Over the last couple of weeks, we’ve been rolling out an update to our bank reconciliation screen, allowing you to see up to 50 statement lines at once. This update was built on community feedback, closing out with 966 votes on Xero Product Ideas — one of our most popular ideas.

We’ve also added the ability to search, sort, and filter statement lines, making it easier than ever to find the information you need. Thanks again to Xero partners who added 1536 votes and comments across both ideas, and to our XPAC for getting involved in a bit of beta testing.

Global: Drill down into profit and loss account transactions in the Xero Accounting app

We’ve added a breakdown of each transaction in the profit and loss report in the

Xero Accounting app. This helps you understand your profit and loss more intimately, by understanding the transactions behind the numbers while on the go.

Global: Attach files to invoices in new invoicing [Product Idea]

You can now attach files to invoices from the Xero file library to the new version of invoicing, without having to download them first.

We’ve also made it easier to view your attachments side by side next to your invoice.

AU, NZ and UK: New guided onboarding in Xero Payroll

We’ve made improvements to Xero Payroll setup to save you time, including the ability to set up payroll accounts and pay frequencies directly from the payroll overview. Pay calendars have also been renamed to pay frequencies.

NZ: 2024 annual changes to Xero Tax

If you’re a practice using Xero Tax, we’ve released a number of compliance changes for the new tax year. These include rates and threshold changes (ACC, student loan and working for families), IR6 trust return changes, and version numbers to replace CHECKSUM on returns.

Keep reading

THERE IS A FEATURE THAT IS NEW IN CALXA THIS MONTH. ADDING XERO ORGANISATIONS FOR A CONSOLIDATED GROUP USED TO BE A BIT OF A TEDIOUS PROCESS. NOW, THANKS TO UPDATED FUNCTIONALITY AT THE XERO END AND SOME CHANGES IN CALXA, WE CAN CONNECT MULTIPLE COMPANIES ALL IN ONE GO.

Who needs Xero Bulk Connections?

Bulk connections will be useful any time you are setting up a group of entities in the same workspace.

If you’re working in a business, it’s likely that you would have all your organisations in the same workspace. If you’re an accountant in practice, it makes sense to have one workspace per client.

Whether there are 2 entities in your group or 50, this feature will be a great time-saver. Rather than connect them one by one, you can just tick the ones you want and they will import simultaneously. Because we process them in parallel, the import time won’t be much more than that of a single organisation.

Once you have them all in, you can then start creating an Organisation Group and setting up your consolidated reporting.

From a technical perspective, the process is very similar to adding one company, so if you’ve done that before, this will be very familiar. The only difference in the choices you need to make are that instead of choosing one, there are checkboxes next to each of the companies you have access to. Choose as many as you need, allow access and the process will commence.

With a single organisation import, we give you options to select things like tracking categories and budgets and then ask some of the basic cashflow setup options. Naturally, we skip these for the bulk connections as they can be different for each company. We will provide some sensible default choices which you can then review and update afterwards.

Once the initial connection has completed, whether you have connected one organisation or many, you’ll be able to run most reports for the current and prior financial years. From here, Calxa imports this information first so you can be up and running quickly.

Find out more

IN MARCH, I HINTED AT A MAJOR ENHANCEMENT TO QUOTER, WHICH TWO DEVELOPMENT SQUADS WERE WORKING ON TOGETHER. IT WAS THE FIRST TIME SINCE ADOPTING THE SHAPE UP PLAYBOOK LAST YEAR THAT WE’D TRIED SQUAD COLLABORATION ON A PROJECT, AND I’M EXCITED TO SHARE THAT IT WAS A SUCCESS. THE RESULT? A NEW AND IMPROVED QUOTES LIST. MORE ON THAT BELOW!

This month, I want to give a special thanks to our Quality Assurance (QA) team. These folks are incredibly adaptable to our nonconventional software development approach, in which we don’t always know what we’re building in advance. Production is constantly evolving at Quoter to meet our Partners’ needs, and our QA team does a phenomenal job of moving tickets through our pipeline in a fast-paced environment — they’re collaborative, involved, and come to our meetings with great questions. Totally inspiring, QA.

Let’s look at Quoter’s product releases for May in more detail.

Refreshed Quotes List with Faster Quote Lookup

Our previous Quotes List interface was due for a rebuild, and early feedback suggests we’ve really hit the mark on this one.

The new Quotes List takes all the same functionality that we had before — filter-

ing and sorting and traditional UI elements — but takes it to the next level with an ultra-modern refreshed UI and the ability for Partners to save filtered views for quick ata-glance access to the Quotes that require higher visibility.

We’ve also broken down our core statuses into filters called Quote Stages for easier Quote-specific lookup. This has had a really positive early impact on Partners who are diving in and using this Stages feature on a regular basis to better manage their quote life cycle.

See the full list of enhancements in our Quotes List blog post. Additional functionality is coming soon, so stay tuned.

Quoter Partners who haven’t tried it out yet will be delighted to see that it’s entirely backward compatible with the previous Quotes List, so take it for a spin and let us know what you think!

Inventory Check for Autotask PSA

For our Partners who also use Autotask PSA, good news! Our latest Quoter + Autotask PSA integration enhancement gives you the ability to look up your stock or inventory when adding items to a Quote. This gives you faster product lookup from a single pane of glass. No more toggling between platforms to complete a Quote.

Keep reading

THIS LATEST ACQUISITION WILL EXTEND THE GROUP’S OFFERING IN ERP SOFTWARE GLOBALLY AND TRANSFORM THE PURCHASING AND AP CUSTOMER EXPERIENCE.

The Access ERP division serves small, growing and medium to large businesses, with tailored solutions in various industry verticals, including Construction, Supply Chain, Waste Management, Professional Services and Facilities Management.

Access ERP software enables customers to streamline their operations, allowing data to be shared seamlessly across different business operating systems.

The introduction of Lightyear will deliver an end-to-end integrated solution for customers that handles the spending needs of these businesses, with a focus on efficiency, control and visibility. Lightyear is the latest in the Access ERP growing portfolio.

Founded in 2017, Lightyear has grown rapidly across APAC, EMEA and North America. Lightyear’s all-in-one suite of finance automation solutions automates critical financial processes across accounts payable, purchasing and expenses for SMEs and mid-market businesses. By automating these manual, time-consuming and er-

Karbon has been Certified™ by Great Place To Work® in the United States, Australia, United Kingdom and New Zealand.

KARBON, THE GLOBAL LEADER IN ACCOUNTING PRACTICE MANAGEMENT SOFTWARE, TODAY ANNOUNCED IT HAS BEEN CERTIFIED™ BY GREAT PLACE TO WORK® IN THE UNITED STATES, AUSTRALIA, UNITED KINGDOM AND NEW ZEALAND.

The prestigious award is based entirely on what current employees say about their experience working at Karbon. 90% of employees said Karbon is a great place to work—33 points higher than the average US company.

Great Place To Work® is the global authority on workplace culture, employee experience, and the leadership behaviors proven to deliver market-leading revenue, employee retention, and increased innovation.

"Great Place To Work Certification is a highly coveted achievement that requires consistent and intentional dedication to the overall employee experience," says Sarah Lewis-Kulin, the Vice President of Global Recognition at Great Place To Work. She emphasizes that Certification is the sole official recognition earned by the real-time feedback of employees regarding their company culture.

“By successfully earning this recognition, it is evident that Karbon stands out as one of the top companies to work for, providing a great workplace environment for its employees."

Keep reading

ror-prone tasks, Lightyear helps customers focus on value-adding initiatives to accelerate their growth and reduce costs.

Claire Carter, managing director of Access ERP, commented: “Lightyear is a great fit for our business. The proven success and innovation of the Lightyear team excite us and show huge potential for the future of this world-class product in conjunction with the other solutions we provide today. Following completion of regulatory reviews, we will be delighted to welcome Lightyear into our Access ERP eco-system.”

Chris Gregg, Lightyear CEO commented: “Joining the Access Group is a tremendous milestone for our team and our customers. Together we can innovate faster and deliver more benefit to our mutual customers. I have been thoroughly impressed with their customer focus, ambition and culture. We are excited to be joining their mission”.

Claire Carter summarised, “This latest acquisition supports our growth strategy and focuses on delivering solutions that meet the needs of our expanding international customer base. We look forward to welcoming Lightyear customers, partners and employees into The Access Group.”

Find out more

iwoca secures £270m from Citi and

IWOCA ANNOUNCES A NEW £270M PACKAGE OF DEBT FUNDING, TAKING TOTAL GROSS INVESTMENT IN THE COMPANY TO OVER £1BN SINCE IT WAS FOUNDED IN 2012

iwoca has received £150m (175m EURO) in debt financing commitments from Citibank and Insight Investment to support the company’s growth in Germany, and a further £120m from Barclays and Värde for the UK business, as it responds to mounting demand for finance from small businesses.

The new investment follows £200m in funding from Barclays and Värde Partners in October last year, and £170m from Pollen Street Capital in January 2023.

New lending record and £3bn in loans to small businesses

Since its launch in 2012, iwoca has provided £3bn in loans to SMEs in need of working capital in the UK and Germany.

The company has already broken its record for the volume of loans issued in the first quarter of this year, with over £200m lent across 9,000 business loans in the UK and Germany from January to March 2024.

iwoca has been growing its share of the lending market through embedded finance technology and increasing its number of partners — allowing businesses to access loans directly through a range of platforms including Qonto and Countingup.

Keep reading

Leading inventory and order management software invests in growth, new AI capabilities on the heels of new CEO appointment.

CIN7, THE INDUSTRY-LEADING INVENTORY AND ORDER MANAGEMENT SOFTWARE PROVIDER, TODAY ANNOUNCED THE ACQUISITION OF INVENTORO, A LEADING PROVIDER OF AI-DRIVEN SALES FORECASTING AND REPLENISHMENT OPTIMIZATION SOLUTIONS.

The acquisition and integration of Inventoro’s capabilities with Cin7’s platform will extend product seller’s access to state-ofthe-art AI technology, enabling customers to enhance existing inventory and order management capabilities with intelligent prediction and optimization.

Overstocking and similar inefficiencies are estimated to drive $163B in losses each year for global product sellers. The combined power of Inventoro and Cin7 can change that.

Inventoro’s innovative AI-powered forecasting technology accurately predicts future product demand, providing daily updates on key optimization performance and insights on which products drive profits. Together with Cin7’s end-to-end inventory management software, sellers will gain invaluable visibility into their product availability

listing as one

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE ITS LISTING AS ONE OF AUSTRALIA’S BEST TECHNOLOGY WORKPLACES.

The ranking comes just a few months after BGL announced its Great Place to Work® recertification for the 2023-2024 year.

"To be recognised again is a moment worth celebrating,” said BGL's Chief Executive Officer, Daniel Tramontana. "It is a true testament to the hard work of our team. For us to be selected again speaks volumes about our passionate leaders throughout the business and the hard work of our People and Culture team to ensure our workplace culture is one where everyone feels supported and respected."

Nadine Freitag, People and Culture Manager at BGL said: “We’re honoured to receive this recognition again. It reaffirms the impact of our People and Culture team, the leaders at BGL and the collective effort of every team member”. Great Place To Work®, the leading global expert on workplace culture, unveiled the best-of-the-best organisations in the technology industry with a people-first, purpose-driven employee culture.

Keep reading

and inventory capital.

Powered by a proprietary AI engine, sellers can forecast demand with unmatched accuracy months in advance, maintaining optimal stock levels and eliminating overages. This allows sellers to make fast, impactful decisions – enabling both short and long term forecasting that translates insight into action.

Not only does this help achieve over 99% product availability, it also frees up to 20% of inventory capital and saves valuable time through automated, streamlined operations.

“Inventoro’s AI forecasting and optimization capabilities are a perfect complement to Cin7’s robust inventory management solutions,” said Ajoy Krishnamoorthy, Cin7’s CEO. “The actionable insights and increased visibility into performance provided by the combined capabilities help customers optimize performance across channels and minimize impacts from overstocking and stock outs. By combining Cin7’s inventory management platform and the power of Inventoro’s AI-powered forecasting, the future of inventory intelligence is here.”

Keep reading

Expensify Travel will begin rolling out to customers next week on the expense management company’s next-gen platform, New Expensify.

EXPENSIFY, INC. (NASDAQ: EXFY), THE FINANCIAL MANAGEMENT SUPER APP FOR EXPENSES AND CORPORATE CARDS, TODAY ANNOUNCED THE UPCOMING LAUNCH OF THEIR NEW TRAVEL PLATFORM: EXPENSIFY TRAVEL.

Expensify has partnered with Spotnana to create a new robust travel offering in Expensify, built on top of Spotnana’s cloud-based Travel-as-a-Service platform.

“Book your trip in minutes, we'll handle the rest. We've made it effortless for members to search and book flights, hotels, cars, and trains—all at the most competitive rates available," said David Barrett, Expensify's CEO. "Our early release will let business travelers manage it all in one place, with real-time support, customizable rules, and the option to assign virtual travel cards to employees. We couldn't be more excited for the future of Expensify Travel in partnership with Spotnana.”

The early release includes extensive booking and management capabilities in the Expensify web and mobile apps, with 24/7 Expensify support. Longer term, the offering will integrate Spotnana’s cloud-based infrastructure directly into New Expensify, Expensify’s new chat-based super app. Customers will then be able to book and manage trips, manage travel expenses, chat with colleagues, and more -- all in one place.

Expensify Travel provides access to global travel inventory, lower fares, and better servicing.

Keep reading

UPCOMING EVENTS

UPCOMING UK WEBINARS

UPCOMING US WEBINARS

The average UK employee works for 8 hours a day but is productive only for 2 hours and 53 minutes.

By Sidd Nigam, Director, Expense On DemandPRODUCTIVITY IS ONCE AGAIN TAKING CENTRE STAGE IN ECONOMIC DISCUSSIONS AS ANALYSTS LOOK BEYOND INFLATION TO WHAT REALLY DRIVES GROWTH – GETTING MORE OUTPUT FROM INPUTS.

“While productivity isn't the sole determinant of success, it remains one of the most crucial factors over the long term,” says ExpenseOnDemand director Siddharth Nigam.

In business, productivity is crucial even in the best of times. However, during challenging trading conditions, maximising the efficiency of limited resources can determine whether a company survives or shuts down.

This underscores the close relationship between productivity and resilience, as highly productive companies are better equipped to withstand unexpected shocks.

What is productivity and why is it important?

In simple terms, productivity is about how effectively resources like staff time, inventory, and capital

are transformed into revenue-generating products and services.

Lost productivity costs employers $1.8 trillion each year.

One of the most common measures is revenue per hour worked. When companies increase revenue without increasing working hours, they're considered productive.

For small businesses, productivity enables them to compete with larger counterparts and meet customer needs on a tight budget. It also creates flexibility to handle unexpected expenses or sales variations.

How to measure and manage productivity

Measuring productivity requires calculating ratios like revenue per full-time employee or profit divided by expenses over a consistent time period. While large corporations meticulously measure such metrics, smaller businesses often don’t have the tools or manpower.

Consequently, they miss out on insights that could help streamline operations.

Fortunately, ExpenseOnDemand offers easy-to-use expense management software that provides the visibility independent contractors and small businesses need to measure productivity.

By automatically capturing expense data and linking it to projects and clients, the solution makes it simple to see key ratios across your business.

You can effortlessly monitor individual employee spending or the company's overall expenditure on business expenses.

Alternatively, you can calculate expenses as a percentage of revenue to gauge profitability.

This level of visibility enables you to pinpoint successes and areas for enhancement effectively.

Redesign your workflow

Step through your list of inefficiencies and work out the kinks. You can often make big improvements simply by clarifying roles and responsibilities, optimising job sequencing and enhancing communication

between departments.

Make sure employees know where to access the details they need to complete tasks or assist customers.

Reducing the time wasted searching for information, waiting for approvals, or tracking people down to ask questions is a productivity game-changer.

ExpenseOnDemand provides authorised employees with immediate access to the financial information they need, precisely when they need it. This streamlining of workflows effectively reduces bottlenecks, resulting in a smoother, more efficient operation.

3 tips to boost small business productivity

While every small business faces unique challenges, these three universal tips can help you optimise productivity:

1. Adopt technology

Small businesses that leverage technology tools effectively can bridge the productivity gap with larger enterprises.

ExpenseOnDemand is tailor-made to assist small businesses in managing expenses and gaining valuable insights.

86% of UK workers agree that workflow automation software would boost productivity while making workers happier and improving morale.

2. Systematise processes

Standardising repetitive tasks saves employees time while reducing mistakes. Document procedures so staff can consistently follow best practices.

ExpenseOnDemand simplifies even the most complex expense-related tasks with straightforward workflows and processes.

3. Incentivise employees

Workers who feel invested in the company’s success are intrinsically motivated to be productive.

Offer bonuses or perks for meeting targets to ignite their competitive spirit. ExpenseOnDemand's user-friendly interface simplifies expense management, empowering your employ-

ees to focus on their best work with greater efficiency!

Reality check: worldwide study on small business productivity

Much remains unknown about small business productivity.

To develop smarter strategies, ExpenseOnDemand invites you to a free consultation to discover how automating your expense reporting can save your business money and time to reinvest in higher revenue generating tasks.

The insights will empower small businesses to match and even surpass their larger counterparts.

Now is the opportune moment for small businesses to prioritise productivity. By measuring, managing, and maximising it with solutions like ExpenseOnDemand, they can enhance performance and resilience regardless of economic conditions.

Thriving amidst uncertainty yields the ultimate productivity dividends.

Keep reading

Your People Data Should Not be stored in Spreadsheets - See Why…

By Christina Kryske, Customer Success Specialist, HR PartnerEXPLORE HOW AN HRIS ENSURES ACCURACY, PREVENTS ERRORS, AND ALLOWS CUSTOMISATION FOR ENHANCED PEOPLE DATA MANAGEMENT AND ANALYTICS.

Relying on manual spreadsheets for this important data is risky as your company grows. Spreadsheets are prone to human errors, visibility permission lapses, and data loss. In contrast, using an HRIS for people data and analytics prevents such mistakes and offers customisable permission settings.

One of the primary advantages of an HRIS over manual spreadsheets is enhanced data security. Using spreadsheets for employee data exposes you to risks like data loss and theft. Cloud-based HRIS software, like HR Partner, offers higher security levels for staff data. We prioritise transparency, adhere to industry best security practices, and host our servers with a leading GDPR-compliant cloud provider to safeguard your HR data.

LEARN MORE ABOUT OUR RECENT UPDATES, FRESH NEW LOOK, AND WHAT’S COMING SOON.

n 2023, we rolled out the most comprehensive feature updates for ApprovalMax to date. We’re proud to have brought all these new capabilities to businesses, accountants, bookkeepers, and anyone else using our product around the world.

With so many great updates, you might have missed a few. Don’t worry, though, we’ve got you covered with a thorough recap of the new features and functional enhancements unveiled throughout the year. Keep reading to learn more!

introduces an essential new tool that’s especially helpful for larger practices.

The feature is useful for detailed tracking of changes made to your workflows. Issues can arise when multiple administrators are updating a workflow at the same time so it’s critical to be able to see who made these changes, what they are, and when they happened.

Workflow version history addresses this concern by archiving every change made to the workflow. This comprehensive record lets users easily look into the history of the workflow to see past versions and changes, allowing them to to fix errors, better understand past workflows, and inform future updates.

keep your accounting system secure.

Creating sales invoices (in ApprovalMax)

Based on ongoing feedback from our customers, ApprovalMax has introduced a new feature to generate sales invoices within the platform. Previously, users could raise purchase orders and grant access to staff for bill creation but had limited capability to create the sales invoices as part of this process.

With this new function, you can submit the invoices for approval and once fully approved they’ll be automatically sent to the designated customers, offering more control and efficiency in the sales invoicing workflow.

When using an HRIS, keeping track of which employees are compliant under your local and federal regulations and employment laws is easier than when using a manual spreadsheet for this information. With an HRIS like HR Partner, businesses can effortlessly manage employee compliance, create custom categories, and receive reminders for document expirations – all beyond manual spreadsheet capabilities.

Spreadsheets tend to not be intuitive, relying on precise formulas, making them difficult to use for staff who may not be tech-savy. In the user experience battle, HRIS systems excel over spreadsheets, offering intuitive processes, streamlined management, and advanced features.

Look for an HRIS like HR Partner that prioritises user-friendly design for efficient employee data analytics and management. We made our HRIS easy to navigate and intuitive, especially

We also understand that each organisation has their own access preferences for employee information and capabilities. With this in mind, we built extremely configurable admin permissions options.

when it comes to people analytics and reporting.

As companies expand beyond 15 or so employees, manual spreadsheet updates may prove unsustainable for managing the growing volume and variety of HR data. Continuously creating multiple spreadsheets for specific functions becomes impractical. Scaling with an HRIS is the optimal solution, allowing centralised management of HR processes and personnel changes in one platform. Imagine overseeing the entire employee life cycle, from hiring to departure, with seamless data analysis and reporting – all in one place!

Although spreadsheets can be useful for some HR processes and data tracking, they come with concerning vulnerabilities. Ditch spreadsheet risks, and opt for a trusted HRIS. Enhance security, scalability, compliance, and user experience with HR Partner. If you’re ready to stop second-guessing your people analytics, enhance the security of your employee data, and streamline your HR processes - then you’re ready to upgrade from manual spreadsheets to an HRIS.

Keep reading

There were some big updates to ApprovalMax last year, including:

Goods received notes (GRN)

The long awaited goods received notes (GRN) feature provides the flexibility to update the status of received items – whether it’s fully received, partially received, or pending. With this, you can also add comments and attach relevant documents, improving the record-keeping process.

Picture a scenario where new stock is being delivered; by promptly updating the status, users get a big boost in efficiency and quickly see when goods are received. The updated status is prominently shown on the request page at the bottom of the screen and linked to the audit trail.

It’s also easy to navigate to the main menu where an additional tab shows the status of received parcels. This extra control even extends to reporting, allowing users to generate reports based on the current status of their goods. The GRN feature offers a smarter way to manage and monitor goods, providing better visibility and control for inventory.

Workflow version history

Workflow version history

Watchers is a feature highly anticipated by many ApprovalMax customers. It addresses a common need to involve individuals who are not designated as approvers for a request but still need to see how it’s progressing.

For instance, in a situation where a manager raised approvals some time ago and isn’t currently part of the approval workflow. With this new feature, this manager can be added to the request so they can receive updates without having the authority to approve, modify, or make changes. This functionality ensures relevant stakeholders, even if not directly involved in the approval process, can stay on top of crucial developments and outcomes.

Manual journal workflows allow junior staff members into ApprovalMax without providing direct access to Xero. They can create journal entries, submit them for approval, and then enable senior staff to review and approve the entries before final posting into their respective accounting system.

This not only streamlines the process but also minimises the risk of errors to improve efficiencies and

Workflow manager role

The new workflow manager role within ApprovalMax introduces a valuable layer of flexibility which is especially helpful for larger enterprises. This lets specific individuals modify workflows without giving them full administrative access. These designated workflow managers can make nuanced adjustments to the workflow.

Importantly, this role does not grant the authority to execute broader organisational changes, such as removing individuals from the organisation or altering the organisation’s name. Instead, it means users can make controlled changes solely within the context of the workflow, balancing customisation and administrative oversight.

New integrations

• ApprovalMax for Cin7 Core

• Payments with Airwallex

• ApprovalMax Notifications in Slack

What’s next this year?

There’s plenty more to come in 2024. Stay tuned for more features& integrations.

Keep reading

VENMO TODAY ANNOUNCED THE THIRD VENMO SMALL BUSINESS GRANT, A PROGRAM FOR SMALL BUSINESSES THAT WILL PROVIDE FINANCIAL GRANTS AND MENTORSHIP TO 10 VENMO BUSINESS PROFILE USERS.

In the program’s third year, selected businesses will each receive $20,000 for expenses, such as rent, supplies, marketing, or to help digitize and grow their businesses.

Access to financial capital remains a key challenge for small business owners, and a recent survey found that 77% of small business owners that responded are concerned about their ability to access the capital they need to run and grow their businesses. Venmo will provide

selected recipients with a financial grant and technical expertise and mentorship on topics such as legal services, financial analysis, digital marketing, and more. These resources will be provided in partnership with Global Entrepreneurship Network, Hello Alice, and with PayPal and Venmo employees who will provide coaching, and pro bono services.

“Since launching the Venmo Small Business Grant program in 2022, I’ve been inspired by the creativity and entrepreneurial spirit of our Venmo business profile users and the way they’ve used the access to capital and mentorship to help overcome barriers and grow their business,” said Erika Sanchez, Vice President and General Manager, Venmo. “We’re proud that small business owners turn

TIDE, THE UK’S LEADING BUSINESS FINANCIAL PLATFORM, HAS TODAY LAUNCHED ITS FIRST PRODUCT IN GERMANY, A FREE CURRENT ACCOUNT AIMED AT SMALL BUSINESSES.

In March, Tide announced it planned to make the Tide app available in Germany –Tide’s third market following the UK and India, where it successfully launched in December 2022.

Tide will gradually offer a full range of other services to members (customers) in Germany, including invoicing, accounting features, and eventually credit.

The deposits that customers hold in their account are protected by the statutory European deposit protection scheme, up to an amount of 100,000 euros.

The rollout of services in Germany will follow Tide in the UK, where it serves 590,000 small and medium enterprises (SMEs) or more than 10% of the market share. Across India, Tide has grown its member base to more than 225,000 micro and small and medium entrepreneurs, with a strong presence in Delhi and Mumbai and in regions beyond these two urban hubs.

Germany represents a major opportunity for Tide. Europe’s largest economy is home to nearly three million small businesses, of which the vast majority employ less than 10 people.

The German SME sector employs 5.9m people who are increasingly turning to digital solutions to manage their finances.

Keep reading

to Venmo to help take their businesses to the next level, so we’re excited to bring the program back for a third year on Small Business Day in the U.S.”

As a part of PayPal’s ongoing commitment to advancing racial equity and creating an inclusive economy, the selection for the Venmo Small Business Grant program will also give special consideration to small businesses in historically underrepresented communities. To submit for the Venmo Small Business Grant, entrants must have or set up a Venmo business profile and complete an application by May 31, 2024. Recipients will be announced in July 2024 based on an evaluation from Venmo’s judging committee.

Keep reading

AT PAYPAL, WE'RE FUELED BY A RELENTLESS AMBITION TO EMPOWER CONSUMERS AND MERCHANTS WORLDWIDE TO ENGAGE IN THE GLOBAL ECONOMY, ALL WHILE DOING GOOD IN THE WORLD.

We work with merchants like Yuki Matano, owner of Tsugu Tsugu. Yuki turned her curiosity and passion for kintsugi, the traditional Japanese art form of repairing broken ceramics, into a thriving business that helps keep broken ceramics out of landfills. The innovation, resilience, and entrepreneurial spirit of Yuki and millions of customers around the world inspire and drive our work.

Our 2023 Global Impact Report details how our progress on our corporate sustainability and impact priorities helps strengthen our foundation for sustainable, long-term growth while sup-

EXPENSIFY, INC. (NASDAQ: EXFY), THE FINANCIAL MANAGEMENT SUPER APP FOR EXPENSES AND CORPORATE CARDS, TODAY ANNOUNCED UNLIMITED VIRTUAL CARDS WITH THE EXPENSIFY VISA® COMMERCIAL CARD.

With this addition to the platform, Expensify empowers businesses to take control of their spending with unparalleled flexibility and precision.

Expensify members can now issue an unlimited number of virtual cards, providing unmatched flexibility in managing expenses across employees and merchants.

This precision empowers businesses to manage both one-time and recurring expenses on one platform.

The new feature offers even tighter controls, allowing customers to set fixed or monthly spend limits for each card.

Fixed-spend cards are ideal for one-time expenses, providing employees access to a card for a designated purchase.

Monthly spend cards, on the other hand, are perfect for managing recurring expenses such as subscriptions and memberships.

Keep reading

porting our customers, employees, and communities. Here’s a selection of highlights from this year’s report.

We’re financially empowering individuals, businesses, and nonprofits to achieve great things

In 2023, we provided access to $2.7 billion in much-needed capital to help small- and medium-sized businesses grow and thrive, bringing the total to more than $28 billion since 2013.

We also leveraged our capabilities to make a meaningful impact on groups around the world. We supported the economic empowerment of low-income women through our partnership with Women’s World Banking and harnessed the potential of blockchain technology to enable low-cost and nearly instant funds transfers with the PYUSD stablecoin. We

also enabled our customers to support worldwide causes and organizations they feel passionate about.

In 2023, PayPal users donated $20.9 billion to nonprofits and causes around the world.

We’re fostering a collaborative environment for employee growth

We continued to take tangible actions to cultivate belonging and foster workplace culture in alignment with our mission, vision, and values. Our eight distinct Employee Resource Groups, with more than 9,400 members, are open to all and built on a foundation of allyship and provide an essential channel for building community and a sense of belonging. We're also focused on expanding opportunities for underrepresented talent.

Keep reading

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED THAT STEVE WINOKER HAS BEEN NAMED CHIEF INVESTOR RELATIONS OFFICER, EFFECTIVE MAY 15, 2024. WINOKER WILL REPORT TO JAMIE MILLER, CHIEF FINANCIAL OFFICER, AND BE RESPONSIBLE FOR COMMUNICATING THE VISION AND PROGRESS OF PAYPAL'S TRANSFORMATION TO THE FINANCIAL COMMUNITY.

"Steve is a collaborative and trusted strategic advisor, who brings a wealth of experience working with companies during transitions," said Miller.

"His broad expertise not only as an equity analyst, but also as an operator, makes him the right leader

for

Winoker joins PayPal from GE, where he most recently served as Chief Investor Relations Officer and Group Vice President for GE Aerospace.

During his tenure at GE, he built trust and confidence across GE's investor base, simplified disclosures, and communicated the company's transformation with clarity and candor.

Winoker and his team at GE were consistently recognized by investors and analysts as having the top IR program and best professionals in the industrials sector and across all large-cap companies.

Keep reading