APXIUM, A LEADER IN INNOVATIVE ACCOUNTS RECEIVABLE AND PAYMENT SOLUTIONS FOR ACCOUNTING FIRMS, IS EXCITED TO ANNOUNCE A NEW INTEGRATION WITH FYI, A DOCUMENT MANAGEMENT SOFTWARE WIDELY USED BY ACCOUNTING AND BOOKKEEPING PRACTICES.

This powerful integration is set to enhance efficiency and convenience for practices worldwide by automating the filing of engagements and audit prepaid compliance service agreements.

Revolutionizing Document Management

With the integration of Apxium Collect and Apxium Audit Safe with FYI, accounting firms can now automatically file documents directly into FYI, against a selected cabinet. This seamless process ensures that all documents are organised and easily accessible, streamlining workflows and reducing the time spent on administrative tasks.

"We are thrilled to introduce this integration with FYI," said Gabor Szekernyes, the Chief Commercial Of-

ficer at Apxium. "Our goal has always been to provide accounting firms with the tools they need to operate more efficiently and focus on their clients. This integration is a significant step forward in achieving that goal."

Key Benefits of the Integration

1. Streamlined Processes: Eliminate manual data entry and document filing, saving time and reducing errors.

2. Enhanced Efficiency

Find out more

Stripe

SINCE XERO ANNOUNCED THE RETIREMENT OF CLASSIC INVOICING IN JANUARY, THEY’VE RECEIVED FEEDBACK FROM THE XERO COMMUNITY ABOUT THE NEW INVOICING EXPERIENCE WHICH HAS HELPED SHAPE FURTHER FEATURES AND ENHANCEMENTS.

To help ensure a smooth transition, you now have

more time to make the switch.

Changes to the retirement of classic invoicing

• On 1 September at 10pm BST, all invoicing users will automatically default to the new version each time they log into Xero. Some users will be notified at the time and introduced to the new version of invoicing prior to 1 Septem-

ber when they create an invoice to gradually get familiar with the new experience.

• We’ve extended the availability of classic invoicing, so users can choose to switch back to it until 19 November at 8pm GMT.

Features and enhancements now available in new invoicing

Keep reading

AIRWALLEX, A LEADING GLOBAL PAYMENTS AND FINANCIAL PLATFORM FOR MODERN BUSINESSES, CONTINUES TO SCALE RAPIDLY IN THE REGION, WITH A 152 PERCENT INCREASE IN REVENUE YEAR-ON-YEAR (YOY*) ACROSS EUROPE, MIDDLE EAST AND AFRICA (EMEA).

It also grew its transaction volume YoY by 125 percent, amid a challenging macroeconomic environment for the fintech sector.

Airwallex’s regional growth demonstrates its

commitment to supporting businesses of all sizes to grow without borders.

Globally, Airwallex’s customer base has swelled to over 100,000 businesses, signaling an increased need for more global payments and financial solutions to better serve small and medium-sized businesses (SMBs) and enterprise customers. Over 50 percent of EMEA customers use more than one of Airwallex’s products - ranging from business accounts, expense management, treasury management as well as virtual and physical cards. By partnering

with Airwallex, businesses can scale into new markets to reach new customers and achieve greater supply chain efficiency by transacting like a local as they resource their company globally. Airwallex has also recorded strong growth in revenue and transaction volume in the UK specifically, at 157 percent and 136 percent respectively. This follows a number of new customer and partner wins including Moss and Plum Guide, as Airwallex continues to meet the demands of UK businesses looking to expand internationally.

Find out more

WE'RE EXCITED TO INTRODUCE

PAIDNICE'S LATEST FEATURE: SEND AUTOMATED QUOTE REMINDERS FOR XERO AND QUICKBOOKS ONLINE.

This powerful addition is designed to help you keep track of quotes and ensure they are accepted before they expire.

Key Features of Automated Quote Reminders

1. Quote Expiry Reminders: Set up reminders based on quote expiry dates to automatically notify your prospects to accept or decline quotes.

XU BIWEEKLY - No. 85

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

2. Customizable Emails: Tailor the look, timing, and sending domain of your reminders to match your branding.

3. Seamless Integration: Easily integrates with Xero and QuickBooks, updating your accounting system upon quote acceptance or decline.

4. User-Friendly Setup: Configure your reminders in just four simple steps, allowing you to focus on more important tasks.

Why use automated quote reminders

1. Increased Efficiency: Save time by automating the follow-up process, reduc-

ing the manual workload for your team.

2. Improved Conversion Rates: Ensure no quote gets forgotten, improving your chances of converting quotes into sales.

3. Enhanced Professionalism: Customize reminders to come from your domain, giving your communications a polished, professional look.

Real User Experiences:

Geoff Smith, Managing Director of Marine Services Ltd, shares, “I've never had a way to remind prospects about quotes expiring in Xero until now."

Keep reading

HAT A MONTH!

WE’VE RELEASED MORE THAN 40 AMAZING UPDATES ACROSS XERO, MADE SOME PRETTY COOL PRODUCT ANNOUNCEMENTS AT XEROCON LONDON, AND GOT READY FOR THE NEW AUSTRALIAN TAX YEAR.

It’s been a busy month with lots of highlights, so read on to discover what’s new in Xero.

Global: Void or delete invoices on the mobile app [Product Idea]

Do you use the Xero Accounting app?

Well, we have some great news for you! You can now

void invoices that are awaiting payment (overdue or due) while on the go using the Xero Accounting app.

This requested functionality will help you manage your sales more efficiently when you’re on your mobile device.

Global: Improved control and customisation of how you get paid [Product Idea]

To make it easier to manage online payment methods and help you customise how you get paid, we’re rolling out the ability to toggle payment methods on and off in your payment settings without leaving Xero.

Find out more

AT SUITEFILES, WE BELIEVE IN THE POWER OF FEEDBACK, AND YOUR INSIGHTS HAVE BEEN INSTRUMENTAL IN SHAPING OUR PRODUCT IMPROVEMENTS. BASED ON YOUR VALUABLE INPUT, WE’VE MADE SIGNIFICANT ENHANCEMENTS TO OUR KARBON INTEGRATION TO MAKE YOUR DAILY WORKFLOWS SMOOTHER AND MORE EFFICIENT. HERE’S WHAT’S NEW AND WHAT YOU CAN LOOK FORWARD TO.

Improved Contact Selection

We understand that easy access to the right contacts at the right time is crucial

TODAY'S USERS ARE BOMBARDED WITH INFORMATION, AND THEIR ATTENTION SPANS ARE SHORTER THAN EVER. FORMS ARE OFTEN PERCEIVED AS MONOTONOUS WALLS OF TEXT AND A CHORE TO COMPLETE, AND THIS CAN BE A MAJOR BARRIER TO EFFECTIVE DATA COLLECTION.

At Zoho Forms, we are always looking for ways to help you create more effective and interactive forms, so we're excited to introduce our latest addition: the Embed Field.

This powerful new field allows you to embed video and audio directly within your forms, which opens up a world of possibilities for better communication, rich-

er interactions, and more dynamic user experiences— and you don't even have to write a line of code.

Why embed audio and video in your forms?

Increased engagement

Your forms are not just walls of text, but interactive experiences. Embedding a short, captivating video at the beginning of your form can instantly grab respondents' attention and draw them in.

Think of it like a movie trailer: a quick, enticing glimpse into what the form is all about. This initial spark of interest can significantly increase the likelihood of them completing the entire form.

Clarity through sight and sound

Complex instructions or product features can be a turn-off for respondents. However, with a well-crafted video or audio clip, you can break down those complexities and enhance understanding.

A personal touch makes all the difference

Nobody enjoys filling out forms for a faceless company.

By adding a human element through audio or video, you can personalize the interaction and make respondents feel more comfortable.

Keep reading

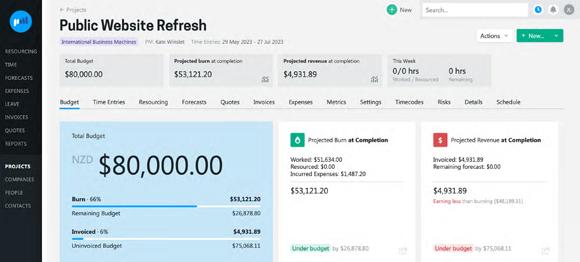

Experience further control and accuracy with an updated integration setup that lets you define precisely how QuickBooks works with Katana.

WE’VE IMPROVED THE SETUP AND CONFIGURATION OF YOUR QUICKBOOKS ONLINE INTEGRATION WITH KATANA SO THAT IT’S EASIER THAN EVER.

Doing away with a stepby-step configuration, the setup flow now lets you connect and activate the integration separately from its configuration, offering expanded visibility and control.

Simplified connect and config

Connecting QuickBooks Online to Katana is easier than ever!

Connect and activate: It

will only take you a few moments to link Katana with QuickBooks Online and activate the integration.

Customized setup and mapping:

• Connect different QuickBooks Online accounts to specific types of Katana orders

• Associate revenue between Katana categories and QuickBooks Online income accounts

• Tie Katana tax rates to QuickBooks Online tax types

• Import customer and supplier data from QuickBooks Online to Katana

Enhanced account mapping

The updated mapping ensures a more robust and accurate handling of data, reducing the chances of duplicate entries. You can also tailor the integration to fit your particular business processes.

The newly created configuration page provides a detailed overview of the connection settings, making it easier to manage what data is shared between Katana and QuickBooks Online:

• Purchase orders > QuickBooks bills (as inventory assets) Find out more

for effective document management. That’s why we’ve upgraded our Karbon integration to allow you to select from all Karbon contacts, whether your contacts are associated with an organization in Karbon or listed as individuals, when sending files for signature or sharing documents to clients. This means less time searching and more time doing.

Seamless Document Sharing and Signing

Sharing documents through our Connect Portal or sending them out for signing has never been easier.

Find out more

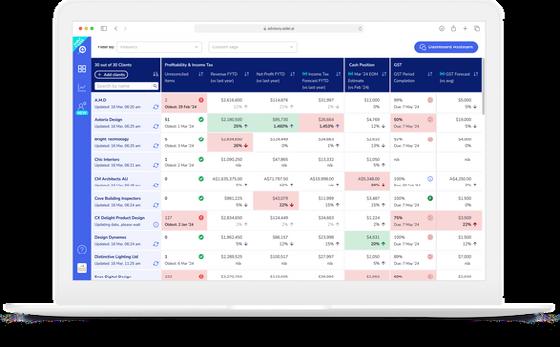

You asked and we listened: You can now customise what accounts are used to calculate the profitability insights.

Instead of the Revenue, Direct Costs, and Operating Expenses as defined in the Profit and Loss Report, you can now track exactly what your client needs to know via Aider - e.g. how net profit compares with last year when discretionary shareholder takings or non-performance expenses are excluded.

Don’t worry, the changes you make in Aider won’t affect the P&L report on your accounting platform.

Aider just gives you an extra tool to hyper-focus on KPIs that affect your client’s operational and financial decisions.

What benefits does it have for advisors?

1. Turn standard reporting into powerful actionable insights: Get a more accurate picture of how your client’s business is doing, and what needs

to improve. Filter out the distortions of discretionary spending, non-performance expenses, and one-off income - e.g. government subsidies - to understand if the business is fundamentally sound.

2. Deliver accurate advice that reflect each client’s unique circumstances: Every client’s profit and loss accounts are different. Ensure your profitability reporting accurately reflects each client’s real business circumstances and performance.

Find out more

At SuiteFiles, we’re committed to continually improving our platform to meet the dynamic needs of our users. Over the past few months, we’ve rolled out significant updates that not only refine user experience but also significantly boost the performance of our services. Here’s a snapshot of our latest developments and how they’re transforming the SuiteFiles experience for better.

Recent updates and their impact

February 12th – We’ve made it easier to share your Connect portal right from the start. Now, you can add multiple people when sharing your portal and set up message templates to streamline your communications.

March 12th – To simplify the process further, we relocated custom branding for signing and connect into the Admin settings. This strategic move allows SuiteFiles Admins to manage this fea-

ture more efficiently.

March 18th – The Connect portal received a major update with multiple UI & UX enhancements! This update introduced a cleaner, more user-friendly interface that enhances your workflow and improves interactions with your clients.

March 26th – Custom branding for Connect emails is now possible, allowing SuiteFiles Admins to update their existing branding and ensure communications reflect their brand identity accurately. This ensures your clients will recognize and trust all emails sent from your client portal.

April 15th – We extended custom branding to your Connect Client Portals, enabling every aspect of client interaction to fully align with your corporate style. This brings you a white label experience to build more trust with your client interactions and build brand equity.

May 1st – We enhanced the SuiteFiles experience with our new Client Folder Matching Tool. This tool puts

you in control, allowing for manual matching of SuiteFiles folders to specific clients, ensuring precise data management. Key features include:

• Manual Matching: Manually link folders with clients for tailored organization.

• Unique Client IDs: Automatically generated IDs ensure accurate folder-client matching, ideal for firms with clients who have similar names or multiple accounts. E.g. if you have two clients with the same name documents can be shared via client ID to ensure your files go to the right place.

• Enhanced Flexibility: Retains automatic matching capabilities while providing the option for manual customization.

These updates are part of our ongoing commitment to enhance the functionality and usability of SuiteFiles, ensuring our platform not only meets but exceeds your business needs.

Find out more

BUSINESS SHOW MEDIA ENDS THE YEAR EXCITED TO LAUNCH INTO THEIR NEXT CHAPTER; A GOLDEN 50TH EDITION OF THE EXPO THAT STARTED IT ALL, THE LONGEST-STANDING BUSINESS EVENT; THE BUSINESS SHOW LONDON.

On the 13th & 14th of November 2024, the UK will see the biggest business event staged to date. Celebrating 50 editions of entrepreneurialism, small businesses, and innovation, the team is going to deliver a spectacular show and will be pulling out all the stops.

In looking back at the history of The Business Show and its incorporation in 2000, the organisation started as a magazine which was then competing with the

introduction and increasing popularity of the internet. The team then switched industries and moved into the events sector hoping to support UK businesses and entrepreneurs, allowing them to tap into a resource to help them create a startup and flourish. Since then, the show has been unstoppable, holding events year after year with each edition being bigger and better than the last. This culminated in Business Show Media’s global expansion in 2023, launching in LA in September, hosting the biggest and most spectacular show to date this November just passed, and having The Business Show Miami on the horizon in March 2024. The event boasts a portfolio of editions now in London, LA, Miami, and Asia, with plans to expand further in the years to come.

CHARGEBEE HAS ONCE AGAIN BEEN RANKED #1 IN FOUR KEY CATEGORIES IN THE G2 SUMMER 2024 REPORTS: SUBSCRIPTION MANAGEMENT, SUBSCRIPTION BILLING, SUBSCRIPTION REVENUE MANAGEMENT, AND SUBSCRIPTION ANALYTICS.

This recognition is a proud milestone for us, but more importantly, it reflects the trust, support, and feedback we receive from our customers. We are so grateful to be a part of your growth journey.

Leading the way in Revenue Growth Management

Chargebee has been recognized in 120 reports and earned 53 badges across six categories in the Summer 2024 Reports. With over 790 reviews, 95% of which are rated 4 or 5 stars, we continue to stand apart from others in the industry in revenue growth management. These rankings underscore our commitment to enabling subscription businesses to acquire customers, grow and retain revenue, scale their financial operations,

and unlock new growth opportunities.

Here’s what some of our customers have to say about their experiences with Chargebee:

You asked, we listened. Very soon, timesheets will enable your crew to input the exact time of their break, and upload photos to jobs via the timesheet interface.

“Chargebee makes subscription management simple.”

Find out more

Airwallex becomes first payments company to obtain AFSL for expansion into retail investment products

AIn celebration of the incredible milestone, the golden 50th edition will include past keynote speakers through the years returning to deliver some exceptional insights into their journey to success. The show will have the biggest brands returning to offer their products and services to skyrocket your business to success, as well as suppliers who have been a part of the event for consecutive years. There will be an incredible awards ceremony hosted on the evening of the 13th of November to replace the usual exhibitor’s party. This will be a black-tie event where suppliers and speakers will have an opportunity to win prestigious business awards highlighting excellence in the industry.

Find out more

IRWALLEX, THE AUSTRALIA-FOUNDED LEADING FINANCIAL PLATFORM FOR MODERN BUSINESSES, HAS BECOME THE FIRST MAJOR PAYMENTS COMPANY TO BE GRANTED AN AUSTRALIAN FINANCIAL SERVICES LICENCE (AFSL) BY THE AUSTRALIAN SECURITIES AND INVESTMENT COMMISSION (ASIC) TO OFFER BUSINESSES ACCESS TO RETAIL INVESTMENT PRODUCTS.

This is an additional licence from the AFSL that Airwallex has held for its existing payments and foreign exchange business since 2016.

The authorisation from the regulator formalises Airwallex’s move into investment products and signals the company’s evolution toward becoming an end-toend financial services platform.

The announcement comes just eight months after Airwallex launched Airwallex Yield to wholesale customers, allowing them to earn attractive returns on their AUD and USD balances without having to open a

foreign bank account – a first in Australia.

With this expansion, Airwallex Yield will be offered to the broader retail market – with a lower minimum investment requirement of AUD$10K (or USD equivalent) – from today onwards.

The expanded Airwallex Yield offering will allow customers to:

• Invest with a minimum investment amount of AUD$10K (or USD equivalent);

• Invest in funds that have historically returned more than triple the interest rates of saver accounts of the big four banks; currently a return of 3.67 percent for AUD balances and 3.95 percent on USD balances (compared to a 1.06 percent p.a. and 0.50 percent p.a. respectively*) and;

• Avoid lock-up periods and easily move funds between their cash wallet balances and their Yield account, unlike term deposits.

• With Airwallex Yield,

customers can invest in a product that invests through a fund managed by J.P. Morgan Asset Management (J.P. Morgan), one of the world’s most trusted asset management firms. The J.P. Morgan underlying funds hold the highest rating from Standard & Poor’s at ‘AAAm’ grade, and equally high ratings from all leading rating agencies.

• Since launching, Airwallex Yield has been available to businesses with a minimum investment of AUD $500k or USD equivalent. To date, Airwallex Capital Pty Ltd has attracted over AUD$100M in funds under management from customers.

Airwallex Yield has been designed to be a competitive alternative for businesses because its returns more closely track the RBA cash rate than the rates on offer from traditional providers –a priority in this current high inflation environment. Businesses could earn more than triple the amount of a saver account with a big four bank by investing with Yield.

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE ITS INTEGRATION WITH DIGITAL RAPPORT, AN AI-DRIVEN REPORTING PLATFORM REVOLUTIONISING SMSF FINANCIAL REPORTING.

“We are excited to welcome Digital Rapport to the BGL Ecosystem,” said BGL’s Chief Executive Officer, Daniel Tramontana. “This integration will help accountants communicate more efficiently and effectively with their SMSF clients. Likewise, it will help trustees better understand their financial data and engage in a meaningful way.”

Digital Rapport revolu-

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA’S LEADING PROVIDER OF COMPANY COMPLIANCE, SMSF, INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, PROUDLY ANNOUNCES RECORD-BREAKING REGISTRATIONS FOR THE UPCOMING BGL REGTECH 2024 ROADSHOW.

With over 1,300 attendees and 34 sponsors already confirmed, the event promises to be a landmark gathering for the accounting, SMSF and compliance industries. Launched in 2017, BGL REGTECH is BGL’s annual accounting technology roadshow event.

“We are deeply grateful for the overwhelming support we have received from the community leading up to BGL REGTECH 2024” said BGL’s CEO, Daniel Tramontana.

“This year’s event will truly be a celebration of the industry and its incredible community and we’re honoured to be part of it.”

“BGL REGTECH events in Adelaide, Brisbane and Sydney are sold out,” added Tramontana. “The record number of registrations has necessitated venue upgrades in Adelaide and Brisbane to accommodate the growing number of attendees.”

Find out more

Xero partners: Refer your clients to the Xero Beautiful Business Fund and get rewarded

ON 9 JULY, WE ANNOUNCED THAT THE XERO BEAUTIFUL BUSINESS FUND IS BACK FOR 2024.

tionises client-accountant communication by creating AI-powered, data-driven videos. This automation enhances engagement with easy to understand visual reporting.

The integration connects Digital Rapport with BGL’s award-winning SMSF administration software, Simple Fund 360, via BGL’s free open API. David Cowling, CEO and Founder at Digital Rapport said:

“The integration of Digital Rapport with Simple Fund 360 is a game changer for how trustees consume and engage with their financial information. Being an agile and engaging tool, video enhances how accountants report financials to trustees. With seamless data integration, accountants can create a 2-3 minute AI-driven video, narrated in their AI voice, to deliver key highlights of SMSF fund performance."

Find out more

Just as we did last year, we’re giving away more than NZ$750,000 to eligible Xero small business customers across Australia, Canada (excluding Quebec), New Zealand, Singapore, South Africa, the UK, and the US.

We want to recognise the role of our accounting and bookkeeping partners in driving small business success and we’d love your help to encourage your clients to enter the Xero Beautiful Business Fund. By referring your clients, you could win a range of prizes. Read on to find out how, and what you can win.

Find out more

FOUNDED BY FORMER XERO EXEC NICK HOULDSWORTH, WITH INVESTMENT FROM ENTREPRENEURS LIKE MICHAEL WOOD (DEXT, TRANSLUCENT) JAMIE MCDONALD (HUBDOC, A2X) AND OTHERS.

Prosaic is an innovative new product that combines a streamlined personal finance experience with an automated business expenses app - leveraging AI and open banking to identify common tax deductions from personal bank, card and loan accounts.

With their just released Xero integration, small business users and their accountants can now sign up, subscribe and instantly post expenses into Xero as a draft bill or journal, all via

the Prosaic app store listing at https://apps.xero.com/nz/ app/prosaic

Background:

• Founded by Nick Houldsworth (former EGM Xero App Store, CMO Vend) and Rowan Oulton (Senior Engineer, Slack), Prosaic leverages AI to enable sole traders and small businesses to automatically find and share business expenses from personal financial data.

• The product has been in beta in NZ through late 2023 and since early 2024 has been rolling out to pilot accounting firm customers, including Rightway, Connected Accountants, Fantail Finances and more.

Find out more

Signals Australian and New

ADVANCETRACK, THE LEADING PROVIDER OF OUTSOURCED ACCOUNTING SOLUTIONS IN THE UNITED KINGDOM FOR MORE THAN 20 YEARS, HAS RELEASED A GROUND-BREAKING PIECE OF MARKET RESEARCH HIGHLIGHTING CAUSES AND IMPACTS OF THE ACUTE SHORTAGE OF ACCOUNTANTS AFFLICTING MOST OF THE WESTERN WORLD.

This research comes at a pivotal moment for governments and businesses worldwide grappling with

an increasingly complex political, commercial and financial landscape. The insights will be unveiled at an exclusive breakfast workshop, where industry experts from professional practice, academia and industry bodies will discuss the increasingly urgent talent gap and potential strategies to mitigate its impact.

In conjunction with this pivotal event, AdvanceTrack is excited to formally announce the launch of its business in Australia.

Find out more

AIRWALLEX, A LEADING GLOBAL PAYMENTS AND FINANCIAL PLATFORM FOR MODERN BUSINESSES, CONTINUES TO SCALE RAPIDLY IN THE REGION, WITH A 152 PERCENT INCREASE IN REVENUE YEAR-ON-YEAR (YOY*) ACROSS EUROPE, MIDDLE EAST AND AFRICA (EMEA).

It also grew its transaction volume YoY by 125 percent, amid a challenging macroeconomic environment for the fintech sector.

Airwallex’s regional

growth demonstrates its commitment to supporting businesses of all sizes to grow without borders.

Globally, Airwallex’s customer base has swelled to over 100,000 businesses, signaling an increased need for more global payments and financial solutions to better serve small and medium-sized businesses (SMBs) and enterprise customers. Over 50 percent of EMEA customers use more than one of Airwallex’s products - ranging from business accounts, expense management, treasury management

as well as virtual and physical cards.

By partnering with Airwallex, businesses can scale into new markets to reach new customers and achieve greater supply chain efficiency by transacting like a local as they resource their company globally.

Airwallex has also recorded strong growth in revenue and transaction volume in the UK specifically, at 157 percent and 136 percent respectively. This follows a number of new customer and partner wins including

Moss and Plum Guide, as Airwallex continues to meet the demands of UK businesses looking to expand internationally.

The company’s EMEA team has grown to more than 150 employees, with offices in London, Amsterdam, Vilnius and Tel Aviv. As part of its EMEA growth strategy, Airwallex recently hired its first UAE-based employee, will soon add several employees in France and also plans to further expand its team in the Netherlands.

Find out more

UPCOMING EVENTS

UPCOMING WEBINARS

Real-world, genuine AI is coming to accounting this year. But to work effectively, it requires a secret sauce of which accountants and their clients have plenty

By Stephen Hall, Product Owner, AutoEntry by Sage

BASED ON HEADLINE-GRABBING GENERATIVE AI BREAKTHROUGHS SUCH AS OPENAI’S CHATGPT, THIS NEW AI HANDLES ADMINISTRATIVE AND REPETITIVE TASKS IN ‘REAL TIME’, WHILST RECOMMENDING WAYS TO MAKE SAVINGS AND DRIVE BUSINESS IMPROVEMENTS. IT HELPS WITH FORECASTING, CASHFLOW MANAGEMENT AND GENERATING AND SENDING INVOICES, ALL VIA SIMPLE, NATURAL LANGUAGE COMMANDS.

In short, it really is like having a human assistant. You talk to it. It talks back. It spots things you need to know, and it tells you. It really is a game changer.

Sage got the march on Xero with Copilot, its AI assistant that’s already available for early access.

The Power of Data

Regardless of the ledger you use, what powers the new AI revolution is accounting data.

This is the secret sauce. After all, the AI can’t make helpful suggestions about your cash flow if there’s still

a stash of paper receipts in a folder, waiting to be entered.

Just as with any human, the AI simply won’t be able to get the insight it needs without the right information.

And this new AI really does dig down deep into the data, and also understands what it is. That’s why it’s so powerful.

What’s required to prepare now for AI assistant tools like Copilot are two things.

First, the accounting data flow needs to be always-on, so that it’s effectively 24/7.

Second, the data needs to be of a high quality. The general rule of thumb is that, if you feed bad and inaccurate data into a system, then you’ll get bad and inaccurate information out of it.

Luckily, there’s been a lot of work over recent years to try and ensure there’s a fast flow of high-quality accounting data.

For example, here in the UK we’ve seen open banking introduced, that makes it easy for accounting ledgers

to hook into bank feeds so that they can get live data about transactions.

This takes care of accounting data that’s already in the digital realm. But what about all that paperwork businesses receive on a daily basis, like invoices, bills, receipts and statements?

Okay, so some suppliers have tried to make life easier by emailing PDF versions of these documents. But there still needs to be a way of getting the data out of the PDF and into the accounting ledger.

This is where AutoEntry comes in. You use your phone to take a snapshot of paperwork when it arrives, and we extract the data. You can then categorise it, and click to publish it straight through to the accounting software.

AutoEntry will even try to autocomplete the categorisation, based on what you used previously. You can then create rules so that the entire process is automated. Just take a snapshot of the paperwork and we’ll do the rest.

Many people use their phones to take a snapshot of the paperwork—and if you can take a selfie then you can use our app. But you can also use a desktop scanner. This is useful if there’s a lot of paperwork to get through, such as if a client drops off their entire year’s accounting on your desk on 31 January.

It’s the same with those PDFs you receive by email. Just forward them to your special AutoEntry email address and we’ll extract the data in the exact same way. You can even provide the supplier with your special AutoEntry email, so the PDFs are emailed straight into AutoEntry.

The new AI breakthroughs are powered by something called machine learning. We know all about this at AutoEntry, because we’ve been perfecting it within our data automation extraction tool for years.

It powers the automation that makes AutoEntry so invaluable. And it’s automation that you’ll need to focus on to prepare yourself and your clients ahead of when

the AI assistants go mainstream.

What can be automated in your working processes? You need to think hard about it.

For example, did you know that there are apps for your phone that can measure car mileage? Examples include MileIQ and TripLog. They not only automatically track your mileage, but they do so in a way that’s compatible with the government’s requirements.

Ultimately, it means no more manually jotting down mileage figures, or working out the calculations. The data is right there, ready and waiting for you. TripLog sends the data through as an invoice, for example.

It’s yet another data flow that you can automate. And that’s what we need more of, moving forward.

Even if you’ve no plans to adopt AI assistants (which would be a mistake—you should at least take a look at them), there’s another reason why you should be focussing on 24/7 fast flows of

high-quality data: the government-mandated digitisation of taxes.

Here in the UK, we have the Making Tax Digital initiative, which already applies to VAT. Next year we’ll all need to start preparing for the introduction of Making Tax Digital for Income Tax (MTD IT), too.

Accountants and their clients need to get into a whole different frame of mind when thinking about their accounting data.

Yearly check-ins just for compliance are no longer an option. Data needs to be 24/7, and accurate.

It’s no mistake that the big accounting software companies like Sage are aiming to have their AI assistants ready for the introduction of MTD IT. AI assistants are going to make complying with MTD IT’s demands significantly easier for everybody.

Why AutoEntry?

When it comes to adopting the new AI, we need to focus on getting that flow of high-quality data.

Keep reading

Choose to save your clients $1000 off their implementation costs for every client that you successfully refer to Fishbowl. Become a Referral Champion with over 5 successful referrals in a year, and get your clients a $2000 discount for each subsequent referral!

Opt to claim the rewards yourself as commissions. Earn $1000 for every successful referral and unlock a $2000 per referral once you’ve surpassed the 5-mark per annum.

IBy Sidd Nigam, Director, Expense On Demand

T’S NO SECRET THAT COMPANIES THE WORLD OVER ARE INCREASINGLY TURNING TO AI AND MACHINE LEARNING TECHNOLOGIES TO STREAMLINE THEIR PROCESSES - FROM RECRUITMENT AND COMMUNICATIONS TO GENERAL TASK MANAGEMENT AND NOTETAKING.

These operational adaptations, no matter how small, can of course have transformative, positive impacts, but innovations in expense tracking are truly taking business efficiencies to another level.

Today’s tech offers unprecedented capabilities for not only automating mundane tasks, but improving accuracy, and providing valuable insights into spending patterns.

Namely, ExpenseOnDemand’s leading expense management solutions and innovative, user-friendly platform enables organisations to harness the power of AI to optimise their entire expense tracking processbut what exactly does this mean for your businesses, day to day?

Can better expense tracking change my business?

AI in expense tracking is more than an automation of manual processes. Of course, tasks like data entry and expense categorisation are no longer cumbersome and time-consuming, but did you know you can also enhance compliance, drive cost savings and essentially see a range of improvements across your entire business model?

Powerful expense tracking tools can allow you to accurately parse through receipts, invoices, and transaction data, automatically categorising expenses based on predefined rules and historical patterns.

From this, you can quickly identify patterns, anomalies, and trends in spending behaviour, helping you to take proactive measures to mitigate risks and optimise financial resources.

This leads to further benefits from a risk and compliance perspective, with tools easily detecting irregularities, such as potential fraud-

By Riley Malins, Content Writer, SuiteFiles

FOR MODERN FIRMS, THE ABILITY TO SHARE, REVIEW, AND COLLABORATE ON DOCUMENTS SECURELY IS MORE CRITICAL THAN EVER FOR BUSINESSES.

SuiteFiles’ Connect client portals redefine how professionals and their clients interact, ensuring that the most sensitive files are guarded with the utmost care while maintaining seamless collaboration.

Here’s why SuiteFiles Connect is an invaluable tool for any business seeking to enhance their document management and client interaction processes.

Personalized professional client portals

With Connect Portal Branding, gone are the days of one-size-fits-all client portals. Now, you can infuse your Connect client portal with the essence of your brand. From your proud logo to your signature brand colors, make every interaction within your portal a testament to your unique identity.

ulent activities or instances of overspending.

As Sunita Nigam, part of the ExpenseOnDemand team, summarises, “AI and machine learning technologies are transforming expense tracking from a manual, labour-intensive process into a more efficient, accurate, and insightful operation.”

Notable functionalities of ExpenseOnDemand for smarter spending

ExpenseOnDemand offers a suite of innovative features and functionalities that leverage AI and machine learning to streamline expense tracking.

One such feature is the receipt scanning capability, which allows users to effortlessly capture receipts using their mobile devices.

AI-powered algorithms automatically extract relevant information from the receipts, such as the vendor name, date, and amount, eliminating the need for manual data entry.

Keep reading

Personalizing your tech stack, specifically through customizing your client portal, significantly enhances brand recognition, professionalism, and trust with your clients, while also being easy to set up. This transformation not only reinforces your brand during every client interaction but also elevates the overall client experience with a coherent and professional touch.

Safeguard your most sensitive files

Scalable client portals offer a secure platform to send out files for review and collaborate with clients on their documents. Requesting files becomes a breeze within your own client collaboration portal, as any needed file is uploaded directly into your chosen SuiteFiles location. This direct upload feature ensures that your files are not only received in a timely manner but are also stored securely, exactly where you need them.

Share and request files securely with SuiteFiles Connect

SuiteFiles Connect com-

bines the security of a client document portal with the convenience of not needing to access an external application. This means you can exchange sensitive documents with the peace of mind that both you and your clients’ data are protected. Furthermore, SuiteFiles Connect notifies you as files are uploaded, keeping you up-to-date without constantly checking for new documents.

Effortless access with single sign-on

Understanding that ease of access is paramount, SuiteFiles Connect enables clients to use logins from Xero or Google for straightforward entry to the portal, or they can create their own SuiteFiles Connect account. This flexibility ensures that clients have no trouble accessing their documents, making the process as smooth as possible for everyone involved.

Keep up-to-date with clients

The capability to co-edit files directly within the portal allows for unparalleled collaboration. Customize permissions so you can work together on documents, create comments, and exchange ideas without ever leaving your file. This feature ensures that feedback loops are closed faster, and projects move forward without unnecessary delays.

One of the greatest challenges in modern workspaces is ensuring that the lates versions of documents are readily available and easy to distinguish from outdated versions. With SuiteFiles’ client collaboration portal, live documents are saved directly to your client folders, eliminating the confusion and risk associated with sorting through multiple copies of files. This means you always have the most current information at your fingertips, allowing you to make informed decisions and provide the best service to your clients.

Incorporating SuiteFiles Connect into your daily operations brings a transformational shift not only in how you manage documents but

also in how you engage with your clients. This platform isn’t just about security and efficiency; it’s about providing a branded, personalized experience that stands out. By customizing your client emails with your company’s logo and brand colors, you’re not just sharing documents; you’re extending your brand’s presence and creating a more cohesive and professional experience for your clients.

The value to your business

Enhanced brand perception: Customizing the client portal with your branding reinforces your professional image. Each interaction through the portal becomes a reminder of your firm’s attention to detail and commitment to excellence.

Streamlined signing: The portal’s intuitive design and powerful features, like direct uploads, mobile signing, and real-time notifications, streamline your digital signing process. This efficiency means you can spend less time on administrative tasks and more on activities that grow your business and serve your clients better.

Heightened security: With the increasing need for data protection, providing a secure platform for document exchange is crucial. SuiteFiles’ Client Portal ensures your sensitive information is guarded, building trust with your clients and giving you peace of mind.

The value to your clients

Ease of use: With options for single sign-on using Xero credentials, accessing documents becomes hassle-free. This ease of use improves client satisfaction and can reduce the time it takes for you to receive important documents and approvals.

Collaborative engagement: Clients can feel more involved in the process, leading to better outcomes and deeper client relationships.

Confidence in security: Knowing their sensitive documents are exchanged through a secure, branded portal reassures clients about the safety of their information.

Keep reading

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED THAT IT HAS BEEN SELECTED BY ADASTRIA GROUP TO POWER THE JAPANESE APPAREL COMPANY’S NEW SECONDHAND CLOTHING MARKETPLACE, DOT-C.

Adastria, which recently celebrated its 70th anniversary, operates a chain of clothing stores in Japan, China, Taiwan, Hong Kong, and the United States. The dot-C app is the first of its kind in Japan, and will allow Adastria customers to purchase secondhand clothing directly from their favorite staff member.

Adastria Group previously produced an online Staff Board which showed popular clothing store employees wearing outfits from across its fashion brands. This encouraged customers to buy the same “look” as the staff, who in turn became fashion influencers for the company. Over time, employees noticed demand from fans to buy their pre-worn clothing.

Find out more

BANK PAYMENT COMPANY GOCARDLESS HAS ANNOUNCED A PARTNERSHIP WITH OMS, THE SEAMLESS SINGLE-INPUT ENQUIRY TO COMPLETION PROCESSING PLATFORM FOR BROKERS, TO SIMPLIFY AND ACCELERATE THE PAYMENT PROCESS FOR ITS EVER-GROWING USER BASE.

OMS will integrate Instant Bank Pay, GoCardless’ open banking payments feature, directly into its platform, enabling brokers to efficiently request payments from their clients for a variety of services rendered, such as broker fees.

This will enable intermediary firms to better manage, collect and reconcile their payments to help improve cash flow and streamline a host of financial transactions, all without having to leave the OMS CRM system. In addition, they can sidestep expensive card fees by collecting instant, one-off payments through open banking.

Find out more

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED A RANGE OF NEW PRODUCTS IN JAPAN THAT PROVIDE MORE TOOLS FOR REACHING CONSUMERS AND GROWING REVENUE, DOMESTICALLY AND ABROAD.

In response to strong local growth, with payment volume on Stripe in Japan increasing 55% in 2023, Stripe is further investing in products tailored to Japanese companies and enterprises selling to Japan. The new products and features include the ability to work with multiple payment processors through the Vault and Forward API, installments for consumer payment flexibility, and enhanced verification through Stripe Identity.

Find out more

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED THAT ENRIQUE LORES HAS BEEN APPOINTED THE NEW INDEPENDENT CHAIR OF ITS BOARD OF DIRECTORS.

He succeeds John Donahoe, who is retiring from the PayPal Board after serving as Board Chair since 2015. Lores, President and CEO of HP Inc., has served on the Board since June 2021.

"Enrique's deep expertise in consumer and enterprise technology has been invaluable to PayPal, and I know that his experience leading and transforming HP into an industry disruptor will continue to serve the Board and the company well in his new role as Board Chair," said Alex Chriss, President and CEO, PayPal. "I also want to thank John for his incredible contributions to PayPal as Board Chair. John's strategic direction and steady leadership over the last nine years strengthened our company's foundation as a leader in digital commerce."

"It's a privilege to take on the role of Board Chair at such an exciting time for PayPal," said Lores.

Find out more

THE VENMO SMALL BUSINESS GRANT PROGRAM IS A PART OF VENMO’S ONGOING COMMITMENT TO THE SMALL BUSINESS COMMUNITY, PROVIDING SELECTED RECIPIENTS WITH FINANCIAL CAPITAL AND MENTORSHIP RESOURCES TO HELP THEM OVERCOME CHALLENGES AND ACHIEVE SUCCESS.

Venmo today announced the 10 recipients of the 2024 Venmo Small Business Grant program. These 10 small business visionaries have not only harnessed the power of Venmo business profiles to manage and help grow their business but have also turned their unique business concepts, as well as their unwavering passion and excitement, into tangible successes. These recipients will receive a $20,000 financial grant, pro bono technical expertise, and mentorship on topics such as legal services, financial analysis, digital marketing, and more as a part of the program. This year, nearly 50,000 entrepreneurs applied for the Venmo Small Business Grant program.

Find out more

Introducing our brand new name and fresh new look. Now we’re NatWest Cushon, we can bring you the best of both our worlds. Pink fizz with purple power!

NOTICE ANYTHING DIFFERENT?

SINCE OUR DEAL WITH NATWEST IN JUNE 2023, WHEN THE BANK BOUGHT AN 85% STAKE IN OUR BUSINESS, WE’VE BEEN TURBOCHARGING!

For starters, we’ve been plugging NatWest Group’s experience and clients into Cushon’s unique workplace savings and financial wellbeing offering. And to show that customers now get the best of both our worlds, we’ve got a fresh new look as well.

Introducing… NatWest Cushon!

Our new identity combines NatWest’s financial strength, knowledge and heritage with Cushon’s uniqueness, agility and innovation. From now on, it’s all about pink fizz with purple power!

Find out more

IT’S BEEN A HUGE FIVE YEARS FOR CASHPLUS. WE OFFICIALLY BECAME A BANK, DEVELOPED LOTS OF GREAT NEW FEATURES FOR OUR PRODUCTS AND HAVE PROVED OURSELVES AS A BUSINESS THAT’S HERE TO STAY.

It’s time for a new name and a new look to reflect what we’ve become and what we’ll build in the future.

Cashplus Bank is now Zempler Bank

Whether you’ve been banking with us for days or decades, we wouldn’t be here without you. You made Cashplus Bank what it was. And if you're yet to join Zempler Bank, we hope to welcome you soon.

Find out more

REVOLUT, THE GLOBAL FINTECH WITH OVER NINE MILLION UK CUSTOMERS AND 45 MILLION GLOBALLY, HAS ANNOUNCED TODAY THAT IT HAS RECEIVED ITS UK BANKING LICENCE WITH RESTRICTIONS FROM THE PRUDENTIAL REGULATION AUTHORITY (PRA), THE REGULATOR RESPONSIBLE FOR OVERSEEING THE UK BANKING SECTOR.

Revolut now enters the ‘mobilisation’ stage, sometimes referred to as ‘Authorisation with Restrictions’, a common step for many new banks in the UK.

Nothing changes for UK customers during this restricted period, which is to allow new banks like Revolut to complete the build out of their UK banking operations ahead of launching in the market.

Until then, UK customers can continue to use their Revolut e-money account as they always have.

Nik Storonsky, CEO of Revolut, commented: “We are incredibly proud to reach this important milestone in the journey of the company and we will ensure we deliver on making Revolut the bank of choice for UK customers.”

Find out more