Xero lead the way with announcements in America and globally

RUNNING A SMALL BUSINESS IN THE US OR CANADA COMES WITH ITS FAIR SHARE OF UNIQUE CHALLENGES. THAT’S WHY XERO HAS BEEN DOUBLING DOWN ON BUILDING OUT OUR PRODUCT CAPABILITIES FOR THE UNIQUE NEEDS OF THIS REGION.

Today, on stage at Xero-

con Nashville, I was very excited to unveil the huge number of improvements Xero has made to make things easier for small businesses and their advisors. These improvements support more streamlined accounting, enabling small businesses to save time and have greater control over their cash flow. Here’s a look at what we announced.

Our accounting solution just got better

We’ve been listening closely to your feedback and have put a significant amount of resources into adapting our software and improving the areas small businesses and accountants and bookkeepers use the most.

Keep reading

ON WEDNESDAY, AUGUST 14, ATTENDEES OF THE XEROCON CONFERENCE IN NASHVILLE WILL BE INTRODUCED TO BILL360, THE END-TO-END ACCOUNTS RECEIVABLE (AR) AUTOMATION SOLUTION THAT ACCELERATES GROWTH FOR ACCOUNTANTS AND THEIR CUSTOMERS.

FinTech News

Revolut announces secondary share sale to provide employee liquidity

THE JUDGES HAVE BEEN ANNOUNCED FOR THE ICB LUCA AWARDS 2024.

• Alex Newson XU Magazine

• Richard Sergeant MD Principle Point

ICB CEO Ami Copeland is passionate about having a high-calibre judging committee.

• Jo Wood C.FICB PM.Dip The 6 Figure Bookkeeper

• Penelope Allard FICB PM.Dip Director, Wild Bookkeeping

The company, based in Tampa, Florida, launched its SaaS-based, AI-enhanced platform in August 2023 and has quickly built a roster of 7,000 users within targeted small to medium-sized B2B companies.

to elevate their advisory services for their clients and frees up capacity to expand their practice.

Bill360’s state-of-the-art AR technology digitizes the invoice-to-cash process, generates financial insights, and produces workflow efficiencies. This unlocks opportunities for accountants

The solution syncs with existing accounting software (Xero and QuickBooks), typically within an hour, and seamlessly provides:

• Automated invoicing with customizable reminders

Keep reading

Experts on tax, software, accountancy and bookkeeping have been announced as judges in the bookkeeping industry’s leading awards –the ICB LUCAs.

The list of judges in full:

• Graham Hambly PQ Magazine (Lead judge)

• Paul Aplin OBE Tax & Technology Writer

• Kasim Choudry Enterprise Ambassador for Pathway Group

• Dayle Rodriguez Systems Advisory Manager, Kreston Reeves

• Della Hudson FCA, C.ICB Accountant, Author, Speaker

• Bev Flanagan Speaker and Business Coach

Bookkeepers and vendors serving the bookkeeping community can enter the awards here before Weds 11 September.

The awards – held every year as part of the ICB Bookkeepers Summit – recognise bookkeepers of all shapes and sizes in addition to training providers and software vendors that support the industry.

“The ICB LUCA Awards are highly respected in the industry, and a big part of that comes from our exceptional judges—experienced professionals who really understand our members and the challenges they face. We also believe it’s important to have a diverse group of judges, including those from education, journalism, consultancy, and, of course, practice. We’re especially excited to welcome Bev Flanagan to the judging team, 12 years after she won a LUCA award herself!"

Find out more

MANAGING ACCOUNTS PAYABLE IS A CRUCIAL PART OF DOING BUSINESS, BUT PAYING THE BILLS CAN BE TIME-CONSUMING AND INEFFICIENT. SO WE’RE ON A MISSION TO MAKE IT EASIER.

We’re excited to announce that, over the next few months, we’re making some enhancements to the way you manage bills in Xero. These updates will help small businesses to streamline their end-to-end accounts payable process, saving time and gaining efficiencies.

These updates to bills are

XU BIWEEKLY - No. 87

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

being rolled out gradually, so if you’re an accountant or bookkeeper, or a small business owner using Xero for more than one organisation, you may notice that one of your clients or organisations has access to one or all of these updates while another may not.

By the end of the year, the following enhancements will be available on all business edition Xero plans.

Bill upload

Soon, you’ll be able to easily add bills to Xero by uploading a file, or by dragging and dropping a file from your desktop. Xero

will create draft bills with key details entered and the source document attached for you to approve.

This is a great time saver for creating multiple bills at once; however, if you prefer our existing options (Hubdoc or email to bills) these options will still be available as well.

Duplicate detection

A new duplicate detection feature means you’ll receive alerts when duplicate bills are detected, regardless of how the bill was created in Xero.

Keep reading

HAPPY AUGUST! WE ARE BACK WITH ANOTHER EDITION OF THE BIGIN BULLETIN, JAM PACKED WITH BRAND NEW FEATURES, INTERESTING INTEGRATIONS, AN AMAZING CUSTOMER JOURNEY, AND MORE!

Bring your favorite CRM to Zoho Mail

Up until now, the Zoho Mail integration enabled you to send, receive, and track all your emails from Bigin. With this brand new widget, you can add new contacts, view details about existing ones, create tasks, schedule calls, and perform a wide variety of other actions in Bigin—all without leaving Zoho Mail.

Build forms that are truly unique to your company

Our forms are now more customizable than ever! Add your company's logo, include custom images in the background, control the shape and position of the "Submit" button, and divide the forms into sections based on the data you're collecting.

Clearly define the role of every user in each customer-facing pipeline

Define the level of access every user has to a particular Team Pipeline.

Find out more

What’s new in Xero – August 2024

WELCOME TO THE AUGUST EDITION OF WHAT’S NEW IN XERO.

This month, we’ll introduce you to some of the updates we’ve made to some favourite features, including Xero HQ, invoicing, bank reconciliation and more. These updates will help make managing your finances a breeze. Read on to find out more.

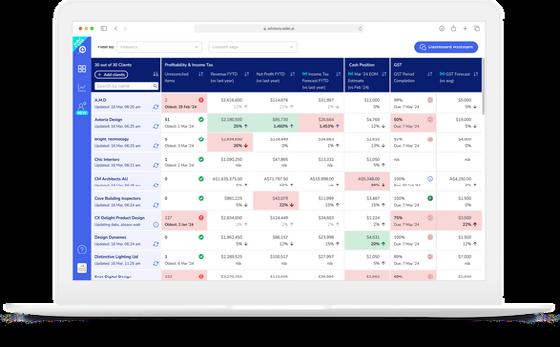

Global: Improvements to managing clients in practice tools

In Xero HQ you can now filter your client list in more ways, including on blank data to find gaps. To get the most relevant view of clients, you can combine multiple filters. For example,

Find out what you need to know about our latest product updates and feature releases. You can also explore what’s on the way for you and your clients in the near future.

Accurate and current business data has always been essential. In today’s fast-paced world, businesses expect more from their tools and services. Compliance is also becoming increasingly digitised, which means your processes need to be connected more than ever and your data up to date and relevant.

To meet these evolving

demands, we are pleased to have recently announced significant upgrades that integrate our core Dext Prepare product with features from Dext Precision and Dext Commerce, creating one seamless platform.

These updates, along with our recent and upcoming feature releases, are designed to make it even easier to manage your business bookkeeping and employee expenses in one place.

The updates will make

it easier for you to capture data in real time, ensure accurate recording, and benefit from enhanced automation that saves time and reduces manual work.

Above all, your data will be more actionable, supporting the health of your business. Here we round up our recently released features and take a look at what’s coming soon, including more on the enhanced Dext platform.

Keep reading

Cyou can filter your list by the plans your clients are on, or even by clients that have no Xero organisation.

We’ve also extended the single client record to include notes, so that notes from Xero Practice Manager are reflected in Xero HQ (and vice versa).

Global: Invoicing layout improvements

Further enhancements to the layout of new invoicing include improved field placement and sizing to make better use of the screen real estate. This change makes it easier to navigate and tab through the fields.

Find out more

HASER, THE LEADING GLOBAL ACCOUNTS RECEIVABLE SAAS PROVIDER, HAS LAUNCHED THE REVENUE FORECAST. THIS NEW TOOL ENABLES BUSINESSES TO AUTOMATICALLY PREDICT FUTURE REVENUE, IMPROVING THEIR FINANCIAL PLANNING AND DECISION-MAKING.

Accurate revenue forecasting is essential for effective financial planning and business growth. Organizations with precise forecasts are 10% more likely to grow their revenue year-over-year and are twice as likely to be industry leaders (Argano). However, collating various data points across multiple systems to build a revenue forecast can take time and can often be inaccurate (CFO Magazine). Factoring in crucial elements like customer payment speeds, bad debt write-offs, and refunds can be painstaking to calculate and can make accurately predicting future revenue impossible.

Chaser has developed a Revenue forecast to address these challenges, providing businesses with a reliable and automated way to predict their future income. The Revenue forecast feature leverages advanced machine learning to provide the most accurate predictions possible and analyzes over 65 data points, including geo-specific economic conditions, seasonality, past financial trends, and customer payment behaviors.

By automating the revenue forecasting process, Chaser saves businesses considerable time. This allows finance teams to focus on strategic planning and decision-making instead of manual calculations and data entry. This enhanced accuracy supports better financial planning and resource allocation, giving businesses the confidence to make informed investment decisions.

Sonia Dorais, CEO of

Chaser, highlights, "Chaser

customers can streamline their financial planning by anticipating cash inflow to manage their spending better using the Revenue forecast. This tool automates revenue predictions and provides actionable insights, helping businesses reduce financial risks and collect revenue faster."

By having access to automated vital metrics such as Year-to-Date actuals, Cash at Risk, and Monthly and Annual forecasts every month, businesses can stay informed about their financial health without manual calculations. This capability supports better decision-making and allows companies to manage their financial strategy confidently.

As Chaser continues to innovate and expand its offerings, businesses worldwide can access a comprehensive tool to help them forecast, protect, and collect their revenue automatically.

Find out more

Choose to save your clients $1000 off their implementation costs for every client that you successfully refer to Fishbowl. Become a Referral Champion with over 5 successful referrals in a year, and get your clients a $2000 discount for each subsequent referral!

Opt to claim the rewards yourself as commissions. Earn $1000 for every successful referral and unlock a $2000 per referral once you’ve surpassed the 5-mark per annum.

MANAGING YOUR ACCOUNTING

FIRM’S LICENSES SHOULDN’T BE A HEADACHE.

Yet, as your team grows and you take on more clients, juggling user access, billing, and connected organizations can become overwhelming. But what if you could handle all of this from one simple dashboard? That’s exactly what our new G-Accon Customer Portal offers.

Everything you need to manage your G-Accon licenses is now at your fingertips. Whether you’re adding users, updating billing information, or managing multiple organizations, our Customer Portal makes it easy and efficient.

Why the Customer Portal Matters for Accountants

Accountants like you deal with sensitive financial data, multiple clients, and a growing team. Keeping

everything organized and secure is crucial. But managing licenses—especially as your firm expands—can become a time-consuming chore. That’s why we developed the G-Accon Customer Portal: to give you more control and simplify the process of managing your licenses.

What You Can Do with the G-Accon Customer Portal

The new Customer Portal centralizes all your license management tasks, making it easy to handle everything in one place. Here’s how it helps:

1. Add or Remove Users with Ease

Growing your team? The Customer Portal lets you add new users quickly. You can assign roles, set permissions, and ensure everyone has the right level of access. And if someone leaves, removing them is just as straightforward.

Find out more

IN MAY, WE ANNOUNCED CHANGES TO XERO’S PLANS IN THE UK AS PART OF OUR EFFORTS TO SIMPLIFY XERO’S OFFERING.

The new plans, which will launch on 12 September 2024, bundle key features such as Xero Payroll, Xero Expenses, multicurrency, Xero Analytics Plus and bill payments into some plans, making it easier to choose the best option for your business or clients.

We’re now able to share an update on our migration approach and the timing for moving customers to these new subscription plans.

Key things to note:

• For the majority of customers whose subscription plan will include the same or more features for either the same or lower price*, we’ll move you in February 2025.

• For customers that will see a price increase* as a result of the new subscription plan that we’re migrating you to, we’ll delay

moving you until September 2025.

• We recognise for some customers this may be a significant price increase when moved by Xero to a new plan, and in some scenarios we’ll offer discounted pricing. We’ll share more on this with eligible customers and partners in the email we’ll send you in late September.

This means Xero won’t migrate some customers to the new plans by March 2025 as originally communicated.

Our migration approach and revised timing

We’ll email you in late September 2024, with the details of which plan Xero will move you to and when.

For accounting and bookkeeping partners this email will include a link to a list of subscriptions that your practice holds (note this will only include those subscriptions that will be moved).

To determine which plan you’ll be moved to, we’ll look at your current plan – in-

CHARGEBEE, A LEADING AND INNOVATIVE PROVIDER OF SOLUTIONS IN THE SUBSCRIPTION AND REVENUE GROWTH MANAGEMENT INDUSTRY, TODAY ANNOUNCED THAT IT HAS BEEN POSITIONED BY GARTNER AS A LEADER IN THE FIRST-EVER MAGIC QUADRANT FOR RECURRING BILLING APPLICATIONS.

The evaluation was based on specific criteria that analyzed the company’s overall Completeness of Vision and Ability to Execute. “We are delighted to be named as a Leader in the Gartner inaugural report of recurring billing applications. We believe this recognition underscores the primary role of our finance and growth automation platform in addressing the complex invoicing, compliance, integration, and revenue acceleration needs of modern, global B2B and B2C businesses.” — Krish Subramanian, CEO and Co-Founder, Chargebee

Your partner in enabling agile growth

The subscription and recurring revenue industry is

at a transformative stage, as companies seek out efficient growth strategies to build predictable, sustainable businesses amidst rapidly changing market conditions.

Enabling agile growth for our customers takes more than just great technology — it requires a deep understanding of business strategy along with the ability to experiment, learn, and implement quickly for competitive advantage. Core to our founding principles, we bring a spirit of partnership to every customer engagement at Chargebee.

“Through collaboration and partnership, we’ve unlocked many benefits, including new options, facilities, and capabilities for our customers. By working closely with Chargebee, we’ve also discovered innovative ways to automate workflows, enabling continued growth without additional investment.” — Joaquim Lechà, CEO at Typeform

Recurring Billing Applications, defined

The August 2024 Gartner Magic Quadrant for Recurring Billing Applications

is the first of its kind. In it, Gartner defines a recurring billing application as one that “enables organizations to bill customers for onetime, subscription-based and usage-based fees for goods and services.”

The report lists a number of mandatory and common features, including the ability to ingest orders and service contracts, ingest usage data, rate it and generate usage charges, integrate received revenue with a general ledger system, and predict and prevent customer churn.

We at Chargebee embrace Gartner’s definition of the Recurring Billing Applications space.

In our work serving thousands of recurring revenue businesses around the world, we see that companies across industries and business models — from AI startups to B2B SaaS and services pioneers to consumer behemoths — are all revolutionizing their offerings to meet the changing expectations of today’s buyers: flexibility, choice, simplicity, and value.

The new demands we

cluding any add-ons you’ve purchased – and your recent feature usage (that is, Xero Expenses and/or Xero Payroll).

You can stay on your current plan until Xero moves you, or you can choose to move yourself once the new plans launch on 12 September 2024. If you choose to move, you won’t be included in Xero’s migration. As we’ll offer discounted pricing in some scenarios of significant pricing impact, we recommend waiting until you’ve received email confirmation from us in September on how the migration applies to you or your clients before making your own decision about moving plans.

Throughout this process, you’ll always have the choice to choose a different plan to what Xero selects for you. You’ll also be able to change plans after Xero moves you if you decide another plan better meets your needs.

Summary of what to expect and timings

12 September 2024 New

plans available in the UK. You can choose to move to a new plan at any time if you don’t want to wait for Xero to move you/your clients. However, we recommend waiting until you’ve received your email from Xero in September before making a decision

Late September 2024 Full details on what plan/s you and you/your clients will be moved to and when will be sent via email. For accounting and bookkeeping partners a list will be available in Xero Central of your impacted clients you hold the subscriptions for, including where Xero intends to move them to

February 2025 Xero will move customers to the new plans where there is no increase to the price*, based on the migration approach outlined above

September 2025 Xero will move customers to new plans where it would mean paying more*, based on the migration approach outlined above

Find out more

see from customers underscore the ongoing transformation of our market — from enabling flexible, automated billing operations to empowering revenue growth innovation through the full customer lifecycle, across B2B and B2C industries.

To achieve predictable, sustainable growth, companies are innovating efficient subscriber acquisition and retention strategies that span sales, growth, usage-based pricing, and hybrid models.

Our merchants are embracing AI to improve performance and reduce costs, building predictive models to improve the customer experience and grow lifetime value, and leveraging automation to scale financial operations around GTM complexity.

Today’s B2B and B2C trend setters are seeking a partner with the technology and experience to enable their growth — and Chargebee is on a mission to unlock the potential in every recurring revenue business.

Find out more

SYFT ANALYTICS, A LEADING PROVIDER OF FINANCIAL REPORTING AND DATA ANALYTICS SOFTWARE, IS EXCITED TO ANNOUNCE THE LAUNCH OF FREE PLANS FOR NONPROFIT ORGANIZATIONS. THIS INITIATIVE IS DESIGNED TO SUPPORT NONPROFITS IN THEIR MISSION TO MAKE A POSITIVE IMPACT IN THEIR COMMUNITIES.

Empowering nonprofits with essential tools

We recognize the crucial role charitable nonprofits play in addressing social, environmental, and cultural issues. With our new free plans for nonprofits, these organizations can now access our reporting tools, visualizations, transaction-level drill-down, and KPI and ratio analysis at no cost.

The aim is to enable nonprofits to streamline operations, make their reporting more efficient, and achieve

their goals by leveraging a greater understanding of their data.

Key features of the nonprofit plan

Nonprofit, charitable organizations that sign up for Syft Analytics will benefit from free access to the Standard plan, which includes:

• Reporting: Financial reports, interactive and collaborative Live View reports that update in real-time, AI commentary, actuals vs. forecasts or budgets, and exports to PDF, Excel, and Word

• Budgeting and forecasting: Cash flow forecasting, budgets, P&L forecasting, importing budgets/forecasts from Excel or Google Sheets, 10-year planning window

• Visualizations: Interactive dashboards, KPIs, scorecards, cash

LESSN, A LEADING TECHNOLOGY INNOVATOR IN THE BILL PAYMENTS INDUSTRY, IS PLEASED TO ANNOUNCE A SIGNIFICANT STRATEGIC PARTNERSHIP WITH APRIL, A PAYMENT GATEWAY PROVIDER TO BE ACQUIRED BY ASX-LISTED COMPANY SPENDA.

This collaboration marks a pivotal step in Lessn’s journey, enabling the company to expand its capabilities and reach new markets, including Singapore.

Key Highlights of the Partnership:

• Integration with April: This partnership allows Lessn to process a wide range of transactions including taxes, wages, and superannuation, while

maintaining the lowest headline fees in the market. The integration is set to go live on October 15, 2024.

• Expansion to Singapore: With the support of April, Lessn will now be able to extend its services to the Singapore market in early 2025, providing its customers with enhanced payments automation solutions that are both efficient and cost-effective.

• Projected Growth: This partnership is expected to significantly boost Lessn’s growth, with projections indicating the company is on track to deliver $200 million a month in payment volume, translating to an annualised volume of $2.4 billion inside of 24 months since launch.

Find out more

EAKFLO IS EXCITED TO SHARE THAT WE HAVE RENEWED ITS SOC 2 TYPE 2 COMPLIANCE.

We received our first SOC 2 Type 2 Compliance achievement in 2023. And we’ve just earned it again in 2024. This validates our unwavering commitment to enterprise-level security for our customers’ data.

Why SOC 2 Matters?

SOC 2 is an external audit created by the American Institute of CPAs (AICPA)

LONDON-BASED INVOICE CAPTURE AND PAYMENTS APP, APRON, HAS BEEN NAMED AS A CLOUD 100 RISING STAR BY FORBES.

Founded in 2021 by former Revolut employee, Bogdan Uzbekov, Apron gained momentum among accountants and bookkeepers in the UK, with its all-in-one solution for paying suppliers, contractors and staff from a single platform.

In 2024, Apron launched

Capture, its own invoice capture solution, aimed to help business owners upload receipts, bills and other documents on the go. It launched the feature with its ongoing #PitchTheSwitch campaign, in which Apron offers users a free Capture account until their current software agreement ends.

About the Cloud 100 Rising Star list

Each year, Forbes publishes a list of companies it believes to be among the best

to ensure that software platforms properly manage customer data. The AICPA has established strict Trust Services Criteria based on five key principles: security, availability, processing integrity, confidentiality, and privacy. A SOC 2 Type II certification is given to organizations that show top-notch security practices in these areas during a specific audit period. Achieving this certification is an industry standard that helps build trust in Peakflo’s security and compliance efforts.

Find out more

YWORKPAPERS IS EXCITED TO ANNOUNCE THE UPCOMING INTEGRATION OF TOLLEY’S VAST LIBRARY OF PERSONAL TAX CONTENT INTO OUR PERSONAL TAX FILES.

This strategic partnership will soon provide firms with direct access to some of the industry’s leading tax content within MyWorkpapers, streamlining the preparation of personal tax work.

With this integration, users will benefit from the comprehensive and authoritative resources that Tolley is renowned for, allowing for more efficient, accurate, and

informed tax preparation.

This enhancement will empower firms to deliver superior tax services by leveraging Tolley’s expert content directly within their MyWorkpapers workflow.

This feature is coming soon, and we encourage firms to request a demo to learn more about how this integration can revolutionise their personal tax work.

Don’t miss the opportunity to see firsthand how this powerful combination can enhance your practice’s efficiency and accuracy.

Find out more

private cloud companies of the future. The 2023 list included in its top 10: OpenAI, Stripe, Canva, Klaviyo, and Grammarly.

Apron Founder and CEO, Bogdan Uzbekov said: “Our instinct from day one was that accountants, bookkeepers and business owners, were being underserved by payments apps. They were being overcharged by banks for foreign transfers, and the whole disconnected process was fraught with risk.

“Being named as a Rising Star by Forbes reinforces our belief that we’re on the right track, and that we’re providing a service that is as much useful and necessary, as it is innovative.”

Apron publishes its product roadmap on its blog regularly, giving users and potential users an opportunity to make an informed decision about the payments software they choose.

Find out more

Two-thirds (68%) of Singapore’s Generation Z prefer to pay with PayNow and close to 3 out of 10 use GrabPay (29%)

NEW RESEARCH BY GLOBAL SMALL BUSINESS PLATFORM XERO REVEALS THAT SINGAPORE’S YOUNGER GENERATIONS OF CONSUMERS ARE LEADING THE SHIFT TO DIGITAL PAYMENTS WHILE MORE THAN HALF OF SMALL BUSINESSES IN THE COUNTRY DO NOT CURRENTLY PROVIDE CASH PAYMENT OPTIONS.

Launched today, Xero’s new report 'I want to pay that way', delved into changing payment habits among consumers and how small businesses are adapting.

Digital payment technology rapidly growing in Singapore

The survey findings reveal a growing trend to-

wards digital payments in Singapore, driven by strong government support and initiatives aimed at building a digitally connected society.

Currently, over three-quarters of Singapore consumers (76%) use credit or debit cards for payments. More than half of the population utilises funds transfer service PayNow (55%) or bank transfers (55%).

About a fifth are also using e-wallet service GrabPay (22%) and buy now, pay later platforms (21%). Reflecting changing perspectives, the research showed that 30% of Singapore consumers only carry their mobile phones to pay when shopping, notably higher than the global average of 21%.

Find out more

UPCOMING EVENTS

UPCOMING UK WEBINARS

UNDERSTANDING THE FINER POINTS OF YOUR FINANCIAL SITUATION IS CRUCIAL IN TIMES OF ECONOMIC UNCERTAINTY.

Entrepreneurs and business owners don’t always fully engage with all of their financial data. This is completely understandable—not all business owners come from a financial or accounting background, and can feel at sea in the world of cash flow, budgets, and spreadsheets.

Enter Spotlight Reporting: a powerful suite of tools designed by accountants to help businesses track the metrics that matter.

When utilised to its full potential, Spotlight Reports, Forecasts, and Dashboards can empower business owners to understand their data, make better business decisions, and take control of their economic future.

1. Data Visualisation and the Cashflow Waterfall

The most obvious imme-

diate benefit of a Spotlight Report is the visualisation of important data in bright, easy-to-understand graphs and charts. Forget sprawling Excel spreadsheets, hefty stacks of paper, and lines and lines of seemingly disconnected numbers—Spotlight shows you exactly what you need to know, in a fraction of the time.

One example is our Cashflow Waterfall. While many business owners zero in on their profit and loss, a better indicator of business health is the state of their cash flow.

Negative cash flow might be caused by one of many problems: environment restrictions, overspending, poor product demand, a stagnant business model etc—but whatever the reason, poor cash flow is eventually insurmountable.

“Businesses don’t often live or die on profit alone. The old saying, ‘profit is an opinion, cash flow’s a fact’, is very true in a crisis. There’s all sorts of accounting jiggery-pokery you can do to get the numbers to look the

way you want, but if the cash isn’t coming in, it can all be over really quickly.”

Richard Francis,

Spotlight Reporting CEO

By using our Cashflow Waterfall chart, business owners can pinpoint what is pushing them into the red, and use this knowledge to balance their inflows and outflows.

ing

For those of you who are part of a multi-entity group, consolidation is going to save you a lot of time. Instead of preparing a set of reports per entity, consolidated reporting surfaces and compares key metrics across your group in a single report, so stakeholders can evaluate performance efficiently and effectively.

Being able to identify over and underperformers in difficult periods can mean the difference between sink or swim for your company.

Having the data on hand means you can spend more

time and energy on those who are struggling, to help them stay buoyant.

You could also survey the tactics of better performers, and implement them across the board to boost business performance.

But if you don’t have holistic monthly performance insights, you might not even recognise which of your group are under performing.

For franchises, Spotlight Multi takes consolidated reporting one step further with our Rankings Page, which lets you rank entities based on the metrics you choose.

You can quickly surface each entity's strengths and weaknesses, and review top, bottom, median, and average results too.

Best of all, you can bring it all together—quickly and accurately—in a beautifully presented report, and give your network the visibility they require to unlock growth opportunities.

3. Forecasting and Scenarios

Usage of Spotlight Forecasting across our customer base has grown exponentially.

Creating a forecast is the first step towards understanding how to keep your business running.

To get the most out of the process, create three different scenarios for the next few months—what our CEO Richard Francis calls “the good, the bad, and the ugly”:

1. A best-case scenario. What does the future look like if everything goes according to plan?

2. A second scenario that factors in the reality of the situation. What is most likely to happen if things continue to take a dive?

Our Comparison Pages allow you to compare actuals to forecasts, and track your progress. The goal of this exercise is to prepare for various scenarios. Knowing the plan before the yoghurt hits the fan is going to save you precious time and energy if it happens. The last thing you need right now is to be worrying about the future, when you’re needed in the present.

If you need help with forecasting, our Forecasting Power Hour webinars have you covered.

By leveraging data visualisation, consolidated reporting, and robust forecasting capabilities, businesses can gain critical insights, streamline operations, and make informed decisions. Adopting Spotlight Reporting's solutions can empower business owners to better navigate economic uncertainties and drive sustainable growth.

3. Get to grips with the worst-case scenario. If you’re forced to close up shop, for whatever reason, can you pivot to online sales? Do you have enough in reserve to get your business through this period?

Keep reading

and embrace a smarter way to manage leave.

MANAGING TIME OFF - WHETHER IT’S ANNUAL LEAVE, SICK LEAVE, PARENTAL LEAVE - CAN BE A TIME AND RESOURCE HEAVY PROCESS FOR BOTH YOU AND YOUR EMPLOYEES.

Mega-events, like the Olympics, or key periods during the year often lead to an influx of leave requests - both planned and unplanned.

For those of you with email inboxes overflowing with requests or manually keeping track in spreadsheets, it’s time to ditch those outdated methods and embrace a smarter way to manage leave.

Why a Leave Management System is a Game Changer

Imagine a world where employees request leave with a few clicks, managers approve instantly, and leave balances are automatically updated. That's the power of an online and automated Leave Management System.

What does a leave management system offer you:

• Effortless Request Process: Employees submit leave requests electronically, specifying dates and leave types. No more digging through email threads or chasing down approvals.

• Customisable Approval Rules: Set up the approval process that suits your company, including having multiple or joint approvers.

• Flexible Leave Types: Want to track Time Off In Lieu (TOIL) a custom type of leave or different leave for employees in different locations? It’s easy.

• Real-Time Visibility: Managers see a clear picture of team leave schedules, preventing conflicts and ensuring adequate staffing day-to-day and throughout key events.

• Goodbye Spreadsheets: Ditch error-prone spreadsheets! Leave balances and accruals are automatically tracked within a leave management system, saving HR from tedious manual calculations.

• Transparency and Fairness: A centralised system ensures everyone plays by the same rules. Transparent leave policies are readily accessible for all employees.

HR Partner has leave management at its core. We know how important it is for both the employer and employee, and that’s why we built a fully flexible platform, where customers can manage their leave the way that best suits their business needs. Including:

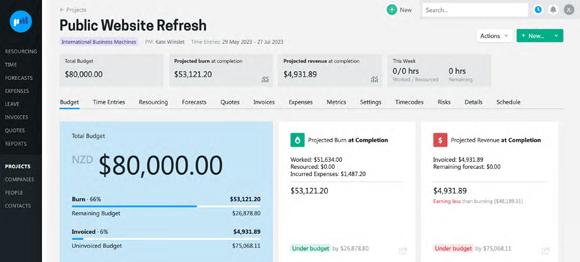

By Nicola Stewart, Content Marketing Manager, Projectworks

EXPLORING HOW CONSULTANTS CAN TRANSFORM CLIENT OPERATIONS AND DEVELOP NEW REVENUE STREAMS BY ADOPTING JOB MANAGEMENT SOFTWARE INTEGRATED WITH XERO.

2024 is the year to elevate your practice with revolutionary software advice

Your consulting clients' most tedious tasks are a ripe opportunity for mutual growth. Consulting clients are time-poor and need help keeping their business organized, their projects on track, and their profit margins healthy.

• Policies and documents in one central and accessible place

• Automated leave requests, approvals and accruals

• A customisable calendar for both managers and employees

• Intuitive reporting that allows easy identification of trends across the business, within teams or individuals

Moving from a manual to automated leave management system

There are a few things key in mind when you are setting up your new leave management system.

Find the system that suits your business: Spend time doing your research, there are lots of different systems available on the market. Take the opportunity for a demo or free trial, like HR Partner offers, to really understand how the system will work for you.

Communication is Key: Clearly communicate the benefits of the new leave management system to your team. Highlight the ease of use, improved transparency, and the elimination of email clutter. HR Partner even provides tutorials for you to use with your employees.

Keep reading

A job management platform that automates tedious tasks and seamlessly syncs with Xero is the key to solving your client's problems and expanding your own practice. By helping your clients implement software that will revolutionize their business operations, you'll become an indispensable, trusted business advisor.

Keep reading to discover why 2024 is the year to elevate your accounting practice and deliver even more value to your consulting clients with a job management platform.

The key to your consulting client's heart

Your consultancy clients offer their expertise to the world and work on our most challenging projects; because of this, their time is precious. Anything you can provide to save time will make your services an asset to their operations. Consulting and professional services clients, such as engineering services, architecture firms, and management consultants, didn’t become experts in their craft to spend time juggling spreadsheets. They want to get on with their work and deliver exceptional projects.

This struggle is where you can step in as an advisor to get them using an automated platform that saves them

time and keeps their business thriving.

Expanding your advisory practice

Tracking billable hours on a spreadsheet or resourcing with MS Projects wastes a considerable amount of your client's time on maintenance and data entry. Not to mention how risky it is for their business. Minor errors in logging hours can make the difference between a profitable or costly project.

You and your clients need a better system. You can help them find one by implementing leading job management software. Job management software can transform your clients' operations by streamlining project management, reducing errors, and providing real-time insights into their business performance. This allows them to allocate resources more effectively, track progress accurately, and make informed decisions that drive profitability.

What should you be looking for in a Xero integration?

All integrations aren't created equally. Some software platforms claim to integrate with Xero but only integrate with one part of their software—for example, you might find you can export your invoices, but there isn't a function to connect expenses. This inefficiency puts you and your client back where they started, copying data between two systems.

Plus, with a comprehensive Xero integration, you'll have full transparency of your clients' invoices, reimbursable and planned expenses, and purchase orders, making managing their books seamless and easy.

Your client's success is your success

When your clients succeed, so do you. Connecting Xero to your clients' job management tools will foster trust and drive mutual growth.

Once you start implementing software and providing advice to your clients, you'll also benefit from offering additional services that generate:

• Advisory services fees

• Implementation fees

• Ongoing support fees

• Referral bonuses

Then, as your clients find success using a better job management platform, you'll experience growth in the following ways:

Enhanced reputation and credibility

When your clients thrive using job management software and Xero, it reflects positively on you as a trusted advisor.

Increased demand for advisory services

Successful clients are more likely to seek ongoing advice and services. As their business grows, so does the complexity of their financial and operational needs. This creates more opportunities for you to offer higher-value services, from advanced financial planning to strategic growth consulting.

Stronger client relationships

You build trust and loyalty by helping your clients achieve their goals. Clients who view you as critical to their success will likely retain your services and recommend you to others.

2024 is the year to add software advisory services to your practice

In 2024, almost all of your clients will be using some software to manage their books and run their business.

To continue supporting your clients in the coming years, becoming aware and skilled at using the best tools available will be an advantage for your practice.

Keep reading

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED THE STRENGTHENING OF ITS GLOBAL STRATEGIC PARTNERSHIP WITH ADYEN, THE GLOBAL FINANCIAL TECHNOLOGY PLATFORM OF CHOICE FOR LEADING BUSINESSES.

Within the expanded partnership, Adyen will offer Fastlane by PayPal to accelerate guest checkout flows for its enterprise and marketplace customers in the U.S., with plans to extend this offering globally in the future.

Together, the companies expect Fastlane by PayPal to improve consumer shopping experiences and enhance conversion for businesses leveraging Adyen's platform.

STARLING BANK CAN TODAY REVEAL ITS NEW EDITORIAL PLATFORM, BREATHING LIFE INTO MONEY STORYTELLING. NOTEWORTHY, HOSTED ON STARLING BANK’S WEBSITE, EXPLORES THE ORDINARY, EXTRAORDINARY WORLD OF MONEY.

Noteworthy, which has been built inhouse, will be run by Starling Bank’s creative team, including editors, writers, photographers and graphic designers, as well as commissioning illustrators, videographers and freelance contributors.

Part of the content strategy includes exploring ‘Money Truths,’ shining a light on relatable moments, milestones and conversations related to money. The new editorial platform complements the launch of Starling Bank’s latest brand platform, ‘The Bank Built For You’, which launched at the start of this year.

New series that will appear on the platform:

• For What It’s Worth

• Joined at the Chip

Find out more

GOCARDLESS, THE BANK PAYMENT COMPANY, HAS ANNOUNCED A PARTNERSHIP WITH FUTURE TICKETING, AN API-FIRST TICKETING SOLUTION FOR SPORTS, VISITOR ATTRACTIONS, VENUES AND EVENT ORGANISERS, TO MAKE THE PURCHASE OF TICKETS AND MEMBERSHIPS EASIER AND MORE AFFORDABLE FOR CONSUMERS IN THE UK AND IRELAND.

By integrating GoCardless directly into its platform, Future Ticketing can now offer customers -- which include clubs in the English Football League, Scottish Premier League,Super League and Elite Ice Hockey League -- the ability to collect payments via Direct Debit. This means that season ticket holders, festival-goers and other event attendees will be able to split the cost of their ticket.

Keep reading

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED A PARTNERSHIP TO POWER ONLINE PAYMENTS AND SUBSCRIPTION BILLING FOR STAN, AUSTRALIA’S LEADING LOCAL STREAMING SERVICE.

The company, launched in 2015, is known for providing Australians with unlimited access to thousands of hours of entertainment including first-run exclusive shows, original productions, movies, kids programming, and sport, all ad-free. With the partnership, Stan is using Stripe to complement its initiatives to increase its subscriber base further, by increasing authorization rates and reducing involuntary churn.

“We are continuing to build outstanding user experiences our customers value,” said John Hogan, chief technology officer at Stan.

FInd out more

U.S. employees whose pay is processed through UKG Pro can now sign up for a PayPal Balance account and set up PayPal Direct Deposit through their employer’s payroll portal, and payroll funds may be available up to two days ahead of time.

PAYPAL IS COMMITTED TO ADVANCING PRODUCTS AND EXPERIENCES THAT HELP CUSTOMERS MANAGE THEIR FINANCIAL LIVES. PAYPAL HAS TEAMED UP WITH UKG, A LEADING PROVIDER OF HR, PAYROLL, WORKFORCE MANAGEMENT, AND CULTURE SOLUTIONS, TO GIVE U.S. EMPLOYEES WHOSE PAY IS PROCESSED THROUGH UKG PRO THE ABILITY TO EASILY SET UP PAYPAL DIRECT DEPOSIT THROUGH THEIR EMPLOYER’S PAYROLL PORTAL.

How to Set Up PayPal Direct Deposit on the UKG Pro HCM Suite

U.S. employees whose pay is processed through UKG Pro can sign up for or link to an existing PayPal Balance account and set up PayPal Direct Deposit on their employer’s payroll portal by following a few easy steps:

1. Tap the PayPal button on your employer’s payroll portal.

2. You will be prompted to log into your existing PayPal account or sign up for a new one.

3. The PayPal experience will walk you through set up.

4. Once completed, you will be automatically redirected back to the payroll portal to fi-

nalize your Direct Deposit setup.

Customers who set up PayPal Direct Deposit on their employer’s payroll portal can also take advantage of PayPal’s suite of financial products and services, including the PayPal Debit Mastercard® which they can use in any store or online where Mastercard is accepted and earn cash back on eligible purchases. Customers can also send money to friends and family, earn cashback and rewards in the PayPal app and transfer funds into PayPal Savings, a high-yield account provided by Synchrony Bank with a current 4.30% APY, 9x the national average.

Consumers continue to gravitate toward the use of digital wallets as they seek out quick and secure payment options, and a recent survey found that 64% of U.S. consumers who responded use a digital wallet. With over 200 million active PayPal accounts in the U.S., the collaboration allows people whose pay is processed through UKG Pro to set up PayPal Direct Deposit via the UKG HCM suite – a payroll industry first – while also enabling them to access their pay up to two days ahead of time. Keep reading

REVOLUT, THE GLOBAL FINANCIAL TECHNOLOGY COMPANY WITH OVER 45 MILLION CUSTOMERS WORLDWIDE, HAS SIGNED AGREEMENTS WITH A GROUP OF LEADING TECHNOLOGY INVESTORS TO PROVIDE LIQUIDITY TO EMPLOYEES THROUGH A SECONDARY SHARE SALE AT A $45 BILLION VALUATION.

This secondary share sale allows current employees to capitalise on their contribution to Revolut’s growth, while attracting a diverse mix of both new and existing investors. The round was led by Coatue, D1 Capital Partners, and existing investor Tiger Global. This valuation reflects the strong financial performance recorded by the company in recent quarters as well as the progress made in executing its strategic objectives.

Keep reading

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED THAT STRIPE HAS BEEN NAMED A LEADER IN THE GARTNER® MAGIC QUADRANT™ FOR RECURRING BILLING APPLICATIONS. BILLING IS NOW STRIPE'S SECOND PRODUCT, ALONGSIDE ITS PAYMENTS SUITE, TO BE RANKED AS A LEADER BY INDUSTRY ANALYSTS.

Launched in 2018, Stripe Billing is software that helps more than 300,000 companies manage how they charge their customers. For most companies a billing system is as crucial as, but distinct from, their ability to accept payments: their billing system manages the intricacies of how much to charge, whom to charge, and when.

Stripe Billing allows businesses to orchestrate their overall financial logic, making it easy to set up billing plans, customize pricing logic, calculate amounts owed, preview upcoming invoices, apply discounts, send payment reminders, track payments, and much more. Stripe Billing supports a wide range of billing models including sales-based contracts, tiered pricing, and usage-based billing. It’s the easiest way to run a modern, global billing system. Find out more