XERO KNOW HOW IMPORTANT IT IS FOR SMALL BUSINESSES

TO HAVE ACCESS TO POWERFUL INSIGHTS TO HELP THEM RUN THEIR BUSINESS BETTER, NO MATTER THE ECONOMIC ENVIRONMENT THEY’RE FACING.

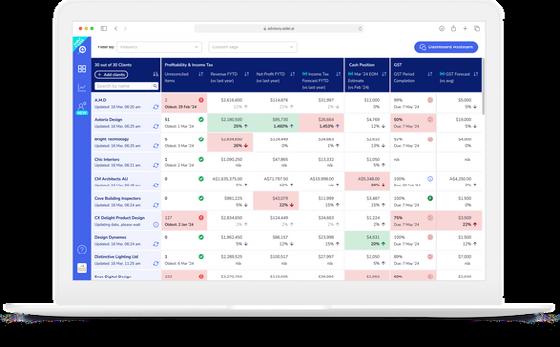

To accelerate our mission to provide powerful insights, we are thrilled to share that Xero is acquiring Syft, a leading global cloud-based reporting, insights and analytics platform for small

businesses, accountants and bookkeepers.

Today, Syft is available through the Xero App Store as an app partner. And we know that many Xero customers know and love Syft for its beautiful custom reporting and visualisation features. Syft is the most used reporting and insights app in the Xero App Store and has been awarded several accolades this year, picking up Xero Awards across multiple countries.

Following the acquisition, we plan that Syft will continue to be available as a standalone offering to small businesses and their accountants and bookkeepers – no matter who their accounting software provider is.

How does this benefit Xero customers in the future?

We’ve always been focused on reimagining how accounting software can

BANK PAYMENT COMPANY GOCARDLESS HAS COMPLETED THE ACQUISITION OF SENTENIAL LTD, OPERATING UNDER THE NUAPAY BRAND, FROM EML PAYMENTS LIMITED (ASX: EML).

The deal, which was announced in March, will significantly scale GoCardless’ indirect channel proposition and fast-track the rollout of new capabilities that will enable customers to send as well as collect money through GoCardless. Introducing these capabilities will

be the first product priority for GoCardless, allowing the fintech to unlock new vertical sectors and use cases in areas including payroll, financial services, utilities, insurance, gaming and gambling.

Paul Stoddart, President at GoCardless, said: “Nuapay adds breadth and depth to our offering, positioning GoCardless as a full-service bank payment provider."

"The ability to both send and collect money via our

platform, plus products that help merchants improve payment success and reduce fraud, will make GoCardless more competitive in our existing markets and help us enter new ones. This will ultimately accelerate the delivery of our strategy.”

Brian Hanrahan, CEO of Nuapay, said: “We’re excited to join GoCardless, a company with an amazing track record and great growth prospects."

Find out more

empower small businesses, as well as their accounting and bookkeeping partners, by providing insights to help them to run their business better. Syft supercharges our ability to serve customers in this way.

There is strong alignment between Xero and Syft, and we couldn’t be more excited to work together to accelerate our joint goals. Current customers love Syft for its custom reporting, visualisations, benchmarking,

live analysis views with drill down, ability to consolidate across financial data sources, budgeting and forecasting, reporting automation and data quality assurance.

Syft also provides insights by aggregating data from other software that small businesses and accountants and bookkeepers use – whether that’s accounting software, Excel, or partners such as Stripe, Square, Shopify and Gusto. These are all things we be-

lieve will bring greater value to the Xero experience and support small businesses and their advisors to have a deeper understanding of their business to make informed decisions.

We’ll also work to embed Syft’s functionality within Xero over time, to provide powerful visualisations, analytics and reporting capabilities for new and existing customers.

Keep reading

ROVEEL THE REPORTING SOFTWARE COMPANY BASED IN NORWICH (UK) ANNOUNCED A NEW PARTNERSHIP WITH COMPLEAT SOFTWARE, A PIONEER IN PURCHASETO-PAY AND ACCOUNTS PAYABLE AUTOMATION.

This collaboration aims to deliver comprehensive financial management solutions to businesses using Sage and Xero accounting platforms. The partnership combines Roveel’s powerful

reporting and dashboard tools with Compleat’s advanced purchasing and AP automation features, including their innovative Amazon Business Punch-In integration.

This collaboration will provide users with enhanced visibility into financial data and streamlined procurement processes.

"We are thrilled about this partnership with Roveel, as it represents a significant step

forward for both our companies and, more importantly, our customers. "

"Our unique offerings is an opportunity for our users to enhance their financial and accounting processes like never before. Compleat and Roveel customers will now have access to a broader range of tools that can streamline their operations and drive greater efficiency across their teams."

Keep reading

IT’S BEEN A HUGE THREE MONTHS: WE’VE HOSTED XEROCONS IN BOTH LONDON AND NASHVILLE, AND HAVE BEEN HARD AT WORK DELIVERING NUMEROUS PRODUCT UPDATES, MANY INSPIRED BY YOUR IDEAS, REQUESTS, AND FEEDBACK.

In last month’s edition we shared how we’re making it easier for you to navigate and tab through fields in invoicing, and in July we rolled out the ability to toggle payment methods on and off in your payment settings without leaving Xero. We heard your feedback about wanting faster, simplified content searches, so we rolled out

XU BIWEEKLY - No. 89

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

AI-generated search results in the help menu, and you’re now able to bulk void bills, credit notes and payslips on a single page. (Read more in the June edition). This month we’re excited to share more exciting enhancements with you. We’ve added more ways for customers to pay, including Tap to Pay on Android (initially in Australia), released Xero Inventory Plus in the US, and continued improving new invoicing.

Global: Offering small businesses more ways to get paid with Tap to Pay and Klarna

Keep reading

WHILE IT MAY SEEM LIKE JUST A WORD, DEPENDING ON YOUR BUSINESS OR INDUSTRY, IT MIGHT BE MORE APPROPRIATE TO OFFER YOUR CUSTOMERS A ‘PROPOSAL’ OR AN ‘ESTIMATE’, RATHER THAN A ‘QUOTE’, WHICH HAS BEEN THE ONLY OPTION IN QUOTIENT UP UNTIL NOW.

To make the switch, just

go to Layout, Contact Info, Acceptance, where you can change it from ‘Quote’ to ‘Proposal’ or ‘Estimate’. Changing this setting will update all past and future Quotes and all future customer emails. You may need to manually update some of the wording in your Email Templates if you’ve previously tweaked the defaults.

Keep reading

MYWORKPAPERS IS BRINGING THE BENEFITS OF ITS CLOUD-BASED WORKING PAPER PLATFORM TO THE PAYROLL PROFESSION WITH ITS LATEST CONTENT LAUNCH.

The award-winning, cloudfirst system’s latest update provides a standardised set of content that has been designed to simplify payroll processes for accountancy firms and payroll bureaus.

This enhancement brings the benefits of MyWorkpapers’ centralised and collaborative workspace to payroll functions for the first time, improving efficiency,

compliance, and teamwork amidst growing regulatory complexities.

The platform now offers built-in guidance, real-time updates, and intuitive workflows, enabling accountants to manage their payroll process in the cloud. This ensures accurate, timely payroll submissions and helps tackle the challenges of managing ever-changing compliance.

“MyWorkpapers is committed to addressing the challenges accountants face,” said Rich Neal, CEO of MyWorkpapers.

Keep reading

OVER THE LAST 15 YEARS, RECURLY HAS BEEN LUCKY TO PARTNER WITH SOME OF THE MOST INNOVATIVE BRANDS IN THE WORLD TO HELP THEM BUILD AND GROW THEIR SUBSCRIPTION BUSINESSES.

They are all united by their passion and drive to create unique experiences and products for their customers. Recently there has been a clear evolution in our industry - subscribers now have more options and higher expectations.

In addition to great products they expect frictionless and personalized brand ex-

periences. This year Forbes found that 81% of customers prefer companies that offer a personalized experience.

It wasn’t always this way, the first subscriptions were really just utilities. Your gas bill, your rent, maybe the newspaper or the milkman.

This utility model became the blueprint as more and more companies started to offer recurring purchases of their products and services. Those first subscriptions were really just products offered as “utilities” that billed monthly. It was purely transactional.

Keep reading

Prioritise the Entities that Matter in your Intercompany Matrix

Now, you can reorder entities within your loan and AP/AR matrices to better suit your needs. This new feature allows you to prioritise the entities you want to view first, based on any criteria you choose, without needing to filter out other entities.

• Personalise your matrix view: Easily rearrange entities to align with your priorities, helping you focus on the most important data first.

• Improve workflow efficiency: By prioritising loan account balances, you can work through your tasks more smoothly and effectively.

• Gain clearer insights: A

customised order provides a more organised and easy-to-read matrix, making it quicker to find and analyse the information you need.

Automatic mapping of your intercompany Loan Matrix

Today we launch v1 of our automatic mapping of IC loan accounts.

This means that when you add your data to Translucent we seek out, identify and map your IC loan accounts for you.

It’s not quite perfect, so we can’t (yet!) guarantee that we will always map 100% of accounts but we will get there!

• Instantly detect intercom-

pany discrepancies: Gain immediate insights without any complex setup, ensuring your accounts are always accurate.

• Eliminate tedious manual mapping: Automatically identify and map intercompany relationships, saving you time and reducing errors.

Exciting news for larger groups!

We have updated the Intercompany Settings page to make it easy to view, add, edit, and delete a large number of intercompany relationships in one place.

• Get a holistic view of your intercompany relationships, providing clarity and insight at a glance.

Keep reading

WE ARE SUPER EXCITED TO ANNOUNCE THE GENERAL AVAILABILITY OF THE LATEST NEW VERSION OF ZOHO ANALYTICS TODAY!

The release brings in 100+ updates that you will find quite powerful and useful. Whether you are a business user, a data analyst, a data engineer, a data scientist, a BI developer, or a data expert, there's something for everyone.

Let's go through the release in detail.

Data Management Hub

To enable our users have a strong data management foundation, we have deepened the data integration and management functions in Zoho Analytics 6.0.

• To make complex data workflows easy, we now have a Visual Data Pipeline Builder, which will help you build the whole data pipeline, through a drag-anddrop interface.

• We now have added 25+ new Data Connectors in this release. Like

Databricks, Dremio, Yellowbrick, Neo4j, Oracle Netsuite, Qualtrics, Expensify, Monday.com, Pipedrive etc.

• We now support Streaming Data Analytics, for analyzing data from IoT sensors and applications that are funneled through Google Pub/Sub, Kafka, PubNub and other processors.

• We are now introducing a Live-sync option for Zoho CRM data with Zoho Analytics, providing real-time sales insights.

Find out more

BEING RECOGNIZED FOR ITS CLEAR COMMITMENT TO PROVIDING SUPERIOR TECHNOLOGY PRODUCTS AND SOLUTIONS TO SMALL AND MEDIUM-SIZED BUSINESSES, REACH REPORTING HAS JOINED THE INFORMATION TECHNOLOGY ALLIANCE (ITA).

ITA is the highly regarded international not-for-profit association of leading Consulting and VAR firms, CPA firms, and technology product/service providers.

The ITA invitation was extended because of the high level of support and service Reach Reporting has provided to their business partners

and clients and for their commitment to being a leader in the information technology (IT) industry. “The primary focus of ITA is to provide an independent forum for leading IT business owners to exchange information, share best practices, assess the current status and future direction of the profession, and thereby improve their overall business results,” said Geni Whitehouse, President of ITA. “In becoming a Gold Technology Partner member in ITA, Reach Reporting has shown that they are committed to being part of the long-term success of their business partners and end-user clients.”

Find out more

DELIGHTED TO SHARE THAT CHASER HAS BEEN SHORTLISTED FOR THE BEST USE OF TECHNOLOGY IN CREDIT & COLLECTIONS AWARD AT THE 2024 CREDIT & COLLECTIONS TECHNOLOGY AWARDS

This award recognizes the new technological developments available to organizations using Chaser including: Auto-call, Payer ratings, and Recommended chasing times. These three functionalities were designed to help businesses benefit from cutting-edge AI and automation solutions, at a cost-effective price. Chaser is delighted to be recognized by the Credit & Collections Technolo-

gy Awards for how these AI and automation tools have supported businesses worldwide in reducing late payments, bad debts, and improving cash flow in the most efficient way possible.

How AI and automation is supporting credit teams

Late-payments are only getting worse, with £7.4billion currently-owed to UKSMEs (Capital On Tap).

Dealing with this is putting a significant time-burden on already stretched credit management teams around the world.

Find out more

FOR ANY SMALL BUSINESS, ATTENDING AN EXHIBITION CAN BE A GAME-CHANGER. BUSINESS EVENTS OFFER A UNIQUE PLATFORM TO SHOWCASE YOUR PRODUCTS OR SERVICES, CONNECT WITH POTENTIAL CUSTOMERS, AND EXPAND YOUR NETWORK.

Exhibiting at The Business Show puts your business face-to-face with over 9,000 SME owners and senior decision-makers seeking innova-

AMY IS THE NEWEST RECRUIT AT MYWORKPAPERS, BUT AMY IS A BIT DIFFERENT. THIS DEDICATED AI ASSISTANT IS AVAILABLE 24/7 TO SUPPORT MYWORKPAPERS’ GROWING NUMBER OF USERS WORLDWIDE.

Developed using the latest large language model (LLM) technology, AMY has been designed to ensure that accountants, auditors and advisors receive the assistance they need, whenever they need it.

Her friendly demeanour and immediate response times aim to create a seamless interaction that feels personal and engaging.

AMY can generate accurate responses to common questions with MyWorkpapers’ award-winning platform, ensuring that users get the information they need without delay.

AMY is designed to be intuitive and easy to use, making it accessible to a wide range of users.

“AI is the talk of the town, and we have committed to delivering AI in a way that it assists our clients and virtually holds their hand if they have a query,”

- Rich Neal, CEO of MyWorkpapers.

Re-Leased is pleased to announce a the first property management integration with ERP Oracle NetSuite.Excellence Awards 2024 and the finalists.

RE-LEASED IS THRILLED TO ANNOUNCE A MAJOR MILESTONE: OUR INDUSTRY-FIRST INTEGRATION WITH ORACLE NETSUITE, THE GLOBALLY RECOGNIZED FINANCIAL MANAGEMENT PLATFORM.

This integration is set to transform the way businesses are run, delivering unparalleled efficiency and strategic insights for both property management and NetSuite accounting teams.

We’re equipping real es-

tate teams with cutting-edge tools to drive superior business outcomes while providing finance teams with a system that meets their high standards.

This partnership enables our customers to streamline operations, allowing them to focus on growing their businesses and delivering exceptional service. Partnering with NetSuite allows us to eliminate inefficiencies and ensure a seamless flow of information across all operations.

Find out more

Find out more about Chaser's 10 year anniversary, the Accounts Receivable Excellence Awards 2024 and the finalists.

Adfin launches from beta to help accountants, bookkeepers, and their clients get paid: faster, cheaper, easier

Ative products and services to maximize their revenue and elevate their businesses.

Our team is here to guide you through every step, ensuring a successful exhibiting experience for you and your company.

Your Business in the Spotlight: Exhibitions provide a spotlight of exposure that can significantly increase your visibility.

Find out more

Celebrating 10 years helping businesses reduce late payments

Chaser was founded by a small team in 2014 as an email follow-up tool for unpaid invoices.

Today, Chaser helps thousands of businesses around the world to handle their entire credit management process and protect, chase, and collect revenue using AI and automation. On the 23rd

of October 2024, Chaser will have supported businesses for 10 years.

To celebrate this milestone, Chaser is recognizing some of its very best users in the Accounts Receivable Excellence Awards.

A special video message from Chaser's CEO, CTO, and Founder will also be shared - stay tuned!

Find out more

DFIN, AN ACCOUNTS RECEIVABLE AND PAYMENTS PLATFORM, IS SET TO TRANSFORM HOW ADVISORS AND THEIR CLIENTS MANAGE AND PROCESS PAYMENTS. ADFIN'S NEW PLATFORM ADDRESSES THE CRITICAL CHALLENGES BUSINESSES FACE WITH LATE PAYMENTS, HIGH FEES, AND OUTDATED PAYMENT PROCESSES BY PROVIDING AN ALL-INONE SOLUTION TO MAKE GETTING PAID FASTER, CHEAPER, AND EASIER.

Tackling the payment problem head-on

Businesses today are grappling with significant challenges in managing payments. Late payments, fragmented systems, and high transaction fees often result in time-consuming and costly payment management processes. Adfin aims to solve these problems by

consolidating the entire accounts receivable process into a single, streamlined platform.

From automated invoice sending and payment chasing to seamless reconciliation, Adfin is designed to ensure that businesses can focus on their core activities rather than being bogged down by payment administration.

Adfin’s platform integrates state-of-the-art payment technologies with AI-powered insights to deliver a faster, more cost-effective payment experience.

It offers a comprehensive suite of features that make it easier for businesses to manage their cash flow, including direct debits, card payments, and open banking options, all within a single, user-friendly interface.

Find out more

HOMETOGO, THE WORLD’S LARGEST MARKETPLACE FOR VACATION RENTALS, FACED A SIGNIFICANT CHALLENGE WHEN ACQUIRING A NEW BUSINESS THAT REQUIRED QUICKLY ADDING SUBSCRIPTION SERVICE CAPABILITIES.

With a tight nine-month timeline for full integration, HomeToGo needed an agile partner to help it navigate this new territory.

“We had to add a completely new tech capability and revenue management capability, aka subscription services, which we just didn’t have before,” explains Inga Flicker, Director of Small Partner Solutions at HomeToGo. “The short timeframe made it necessary to find a

partner and platform that could raise the bar about how to do things in a very short time with a high level of agility and flexibility.”

After evaluating the Salesforce and SAP subscription modules, HomeToGo ultimately chose Chargebee as the best solution for their needs. Chargebee demonstrated the most expertise and had the most developed solution that fit HomeToGo’s needs.

"Chargebee was the solution that has the most expertise in the field and the most developed solution ultimately."

- Inga Flicker, Director of Small Partner Solutions

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE ITS INTEGRATION WITH AUDITCOVER, A LEADING PROVIDER OF HASSLE-FREE TAX AUDIT INSURANCE FOR SMSF CLIENTS.

The integration seamlessly connects BGL's market-leading SMSF administration software, Simple Fund 360, to AuditCover—an InsurTech solution that provides comprehensive tax audit insurance to protect SMSFs, businesses and individuals from unforeseen professional fees arising from tax audits.

"We are excited to welcome AuditCover to the BGL Ecosystem" said BGL's CEO Daniel Tramontana. "This integration empowers BGL clients to offer their SMSF clients reliable protection against unexpected accounting fees associated with tax audits. Accountants now have the ability to share insurance options with their clients effortlessly, helping them add value to their services."

The integration simplifies the quoting process for BGL clients. It automates campaign setup, policy renewals and client communications ensuring a hassle-free experience for accountants and their clients.

Find out more

ADFIN, THE BILLING ENGINE FOR ACCOUNTANTS & BOOKKEEPERS AND ENGAGER.APP, A LEADER IN PRACTICE MANAGEMENT SOFTWARE, ARE THRILLED TO ANNOUNCE A TRANSFORMATIVE PARTNERSHIP.

This groundbreaking integration, unveiled at Accountex North 2024, addresses one of the industry's most pressing issues—inefficient and costly payment collection processes.

Addressing the payment collection challenge

Accountants and bookkeepers have always faced persistent challenges when collecting payments, including late payments, fragmented systems, and high transaction fees–which is

XBERT, THE AI-POWERED DATA AND WORKFLOW AUTOMATION PLATFORM FOR ACCOUNTING PROFESSIONALS, IS EXCITED TO ANNOUNCE A NEW PRODUCT INTEGRATION WITH FREEAGENT, A LEADING CLOUD-BASED ACCOUNTING SOFTWARE.

This strategic partnership is designed to streamline and enhance the daily operations of accountants and bookkeepers by providing an integrated solution that optimises workflow, risk detection, and financial accuracy. The integration between XBert and FreeAgent allows accountants and bookkeepers to automatically sync client data across both platforms, improving collaboration and enabling proactive management of financial records.

Find out more

Our journey to new invoicing: an update

WANTED TO REACH OUT PERSONALLY, AS WE OFFICIALLY RETIRE CLASSIC INVOICING IN NOVEMBER AFTER MORE THAN A YEAR OF TRANSITIONING.

While we’re thrilled to introduce even more features on our new invoicing platform, I know this change has been difficult for some of our customers. I thought it might be helpful to share a bit of insight into our journey at Xero and explain how changes like this fit into our bigger plans.

Accelerating innovation

We know how important continuous innovation, product improvement and delivery is to you and your business.

Find out more

often costly and time-consuming.

Adfin and Engager.app’s integration is a unified solution that streamlines every aspect of the payment workflow. By combining Adfin’s accounts receivable technology with Engager.app’s comprehensive proposal and practice management tools, this partnership will make collecting payments faster, more affordable, and far easier.

Simplifying payment collection

The integration offers a robust suite of features to simplify payment collection:

• Seamless proposal to payment workflow

Keep reading

WE ARE THRILLED TO ANNOUNCE THE OPENING OF OUR NEW OFFICE IN DUBLIN, MARKING A SIGNIFICANT MILESTONE IN CHARGEBEE’S EUROPEAN EXPANSION.

As a leader in subscription billing and revenue growth management, we continue to enhance our presence across Europe, and Dublin’s vibrant tech scene makes it the perfect hub for this growth.

With an existing European HQ in Amsterdam, this expansion reinforces Chargebee’s commitment to our already well-established European customer base. Dublin offers access to a deep talent pool and proximity to leading SaaS and tech companies, positioning Chargebee to better serve brands like xSellco, Personio, and Typeform.

Find out more

Deputy

Partners with Sydney

Fringe: Powering the People Who Bring the Festival to Life

DEPUTY, THE GLOBAL PEOPLE PLATFORM FOR HOURLY WORK, HAS ANNOUNCED ITS OFFICIAL PARTNERSHIP WITH THE SYDNEY FRINGE FESTIVAL, THE LARGEST INDEPENDENT ARTS FESTIVAL IN NEW SOUTH WALES.

The collaboration supports the festival's backbone — the volunteers and staff — who work tirelessly behind the scenes to bring the event to life. The Sydney Fringe Festival will present over 450 events across 70 venues throughout Greater Sydney. With Deputy's platform, the festival can seamlessly manage the scheduling and rostering of its 160 volunteers and venue managers, ensuring smooth coordination across all locations.

Find out more

WE’RE EXCITED TO INTRODUCE THE XERO DEVELOPER GROWTH PILOT PROGRAM APPS, A PROGRAM AIMED AT HELPING APPS GROW WITHIN THE XERO APP STORE.

Through increased promotion, dedicated support and collaborative opportunities, these apps will receive the tools they need to enhance their visibility and scale their businesses. Let’s meet the first apps to take part in this exciting journey.

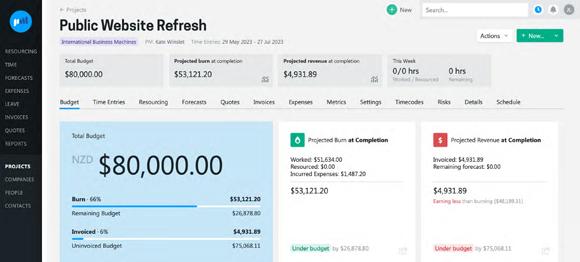

LiveCosts.com is an award-winning tool for transparent cost management in construction projects. It offers real-time tracking of material costs, labour hours and site deliveries, along with budget notifications and a user-friendly dashboard. Livecosts.com connects office and site operations seamlessly, providing detailed insights to keep projects on track and within budget.

MinuteDock simplifies time tracking and billing for professional services with its intuitive interface. Ideal for accountants, agencies, and freelancers, it allows users to log billable hours, generate customisable invoices, and track budgets in real time. MinuteDock’s integration with Xero ensures seamless operations and effective time management, enabling businesses to effortlessly turn time into money.

NiceJob is a reputation marketing app that helps businesses collect reviews, boost referrals, and increase sales through automated review requests and customer engagement. Perfect for service-based businesses, NiceJob is the easiest way to build your reputation, bank more reviews and boost your sales.

By

For small and medium-sized businesses (SMEs) in all sectors, late payments are more than just an inconvenience; they’re a threat to their very existence. Above all else, they hinder cash flow, which as anybody who works with small enterprises will know, is their most basic lifeline.

In this turbulent economic environment, where the lingering effects of the pandemic, rising costs, and the threat of a recession continue to weigh heavily on businesses, accountants are uniquely positioned to play a pivotal role in helping their SME clients navigate the challenges of late payments. By stepping in as strategic partners, accountants can assist SMEs in recovering billions of pounds in unpaid invoices, helping secure the

financial stability and future growth of their clients and potentially their own practices. The ability to effectively manage and mitigate the impact of late payments is not just an additional service offering – it’s a critical opportunity for accountants to add substantial value to their clients and establish themselves as indispensable allies.

In this article, we explore the late payments crisis: its impact on SMEs and the broader economy, new regulations that are being drawn up to solve it, and the key role accountants can play to help their clients regain control and build resilience when it comes to managing cash flow.

As some accountants may already be aware, the UK currently has some of the

longest invoice payment windows in Europe, with many SMEs already finding it difficult to negotiate payment terms that suit them and their customers. When you consider that a very large percentage of invoices are also paid late, it creates a hostile environment for small, cash flow conscious businesses.

The construction sector is among the worst impacted by late payments, not necessarily because of the amount of money owed, but because it has a direct effect on multiple stakeholders, suppliers, and project deadlines.

Is Regulation Tight Enough?

The ripple effects of late payments extend beyond individual businesses. Hiring is halted or slowed to a crawl, jobs are made redundant, local investments decline

and community resources become strained. That’s why the UK government is stepping up efforts to combat the late payment crisis, with an extension of the Reporting on Payment Practices and Performance Regulations 2017, which now requires businesses to report on the value of invoices paid late to foster some sense of accountability. Powers held by the Small Business Commissioner are also being enhanced, allowing them to undertake investigations and actively report on payment practices. But will this be enough to close the payment gap for small and medium-sized enterprises?

An Opportunity for Accountants

Accountants are uniquely positioned to be heroes in the battle against late payments. With a deep understanding of their clients' financial health

and operations, they can provide more than just traditional bookkeeping services – they can offer strategic advice that directly impacts on their client’s bottom line. This might include advising SMEs on best practices for setting clear payment terms, negotiating upfront payments, and regularly reviewing outstanding invoices to catch late payments before they snowball into bigger problems.

But this is only the beginning. Accountants can also leverage technology to streamline the invoicing and payment process for their clients. Digital tools and software such as Xero offer robust features for automating invoice tracking, sending payment reminders, and managing accounts receivable. These tools not only save time but also reduce the likelihood of payments slipping through the cracks. By in-

tegrating these solutions into their service offerings, accountants can help their clients stay on top of their invoicing, ensuring that payments are received promptly and that cash flow remains steady.

However, while traditional accounts receivable management can address some late payments, longstanding debts or unresponsive customers often require a more specialised approach.

Introducing Paycada

It’s one thing to streamline billing cycles and send payment reminders, but recovering payments from long-standing invoices can be gruelling work. The longer an invoice goes unpaid beyond the payment deadline, the less likely it is to get settled.

Keep reading

Can accountancy practices get to grips with automation, AI, a scarcity of accountants... and evolving their skills mix?

By Kevin Reed, Freelance Journalist & Editor

Accounting talent: an increasingly scarce resource

The Accounting Talent Index, a new global research study from Advancetrack, reveals almost half of firms are being ‘significantly’ affected by an ‘existential’ crisis

As practice leaders look to create a sustainable and profitable future, their talent resource strategy will need to be laser-focused.

The first-ever Accounting Talent Index, conducted and produced by Advancetrack, lays bare that firms across the globe are stricken by skills shortages.

The index reveals that of 280 senior practitioners interviewed, 74% said their firm is ‘significantly’ or ‘severely’ affected by a lack of skills.

The 28-page report finds reasons for this ranged from more competition for talent from commerce firms to fewer people attending and graduating from university, as well as the effects of the Covid pandemic and an ageing workforce.

Vipul Sheth, MD of Advancetrack, said:

“Our Accounting Talent Index, released today, shows how the acute lack of accountants has emerged as a critical bottleneck, and its impact has been nothing short of severe, impacting businesses, institutions and economies on a global scale. While the solutions are not exhaustive, or all yet identified, significant strides can be made by investing in the development of accounting talent, rethinking recruitment approaches, and promoting the essential role of accountants in supporting economic stability.”

Gain valuable industry insights, strategic recommendations and stay ahead of trends by downloading the Advancetrack Accounting Talent Index for free.

Getting to grips with resources management

Kevin Reed picks out talent and resource as critical areas for the future of both accountants and the practices in which they work.

When you’ve attended accountancy events (particularly tech-focused ones) over the course of 21 years, it can

be difficult to spot trends at the next gig on the list.

Many of the ‘new tech trends in town’ have been driven by some form of regulatory change; from Lord Carter’s ‘digitisation of tax’ plans in the mid-noughties that have led us to Making Tax Digital (MTD), through to pensions auto-enrolment and its impact on payroll services.

There are also technological leaps that translate from the consumer into B2B; such as 3G and smart mobiles (aka the iPhone), which drove the creation of a gazillion apps.

However, looking at events over most two/three-year periods, one can be forgiven for thinking: what’s changed?

Generative AI has been a part of public discourse for the last couple of years, while AI in the context of ‘robotics’ and automation has formed a central part of accountancy tech events since pre-pandemic.

All on show

I have a very unscientific way of gauging trends from the major accounting tech shows: look at the vendor list and try to gauge which ones are new or more prevalent. I might even just ask someone else who’s done the groundwork (journalists will cut to the quick wherever possible, particularly if it saves them legwork).

And, at Accountex 2024, it felt like there was a step change. Dozens of vendors offering a range of outsourcing and offshoring options. Of course, after a stellar few years, Advancetrack was literally front and centre.

It isn’t really for me to question the quality or capabilities of the vendors on show. But it seems that the market for outsourcing and offshoring is growing – and finally out of the shadows. Outsourcing and offshoring aren’t ‘new’ – for example, Advancetrack is now in its 21st year – but it feels like there is a broader acceptance that both models are now a viable and valuable option in a resourcing manager’s armoury.

The Accounting Talent Index

And what has driven that acceptance? Well, it’s com-

plicated. However, the launch of Advancetrack’s Accounting Talent Index, at its gbX conference, provides some pointers.

The Index highlighted that the number of people taking accountancy qualifications is (generally) falling; that accounting salaries for younger staffers is uncompetitive, and other professions are becoming more attractive.

What does it all mean?

There’s no doubt the pressures are, as Advancetrack’s new APAC general manager Craig McKell described it at gbX, a multi-headed “Hydra” of problems, including:

• You’re struggling to recruit;

• Fewer people are studying accountancy;

• Some of those you have may need to ‘re-skill’ in a world of AI and analysis;

• New recruits and existing staff salaries are rising; and

• Clients want more from you, but in a fragile economy where some are struggling.

It is no wonder then, that when resources are constrained and expensive, outsourcing and offshoring have come to the fore.

Ironically, those who outsource and offshore are also under similar resourcing pressures (though Advancetrack may well argue that their access to accounting talent is currently plentiful). However, AI and automation are also potential answers to the resources question and a threat to the outsourcing model.

There are many that are petrified about this existential threat to the accountancy profession. As a journalist covering the profession for nearly 25 years, and easy for me to say, but I have to admit that I am more excited than concerned.

The accountant in practice has evolved into the ‘adviser of choice’ for businesses and individuals. Broadly speaking this has become even more intense post-pandemic. Technological developments have eroded, and continuing to erode, some of the number-crunching work undertaken by the profession.

Keep reading

By Anna Jörnlid, Growth Manager, Mimo

BY ADOPTING MIMO, GREEN & PURPLE

ENHANCES CLIENT RELATIONSHIPS WHILE STREAMLINING ACCOUNTS PAYABLE PROCESSES.

Green & Purple, a finance firm offering flexible financial solutions for startups and scale-ups, has experienced a significant surge in demand over the past few years. Providing services ranging from basic bookkeeping to board-level advisory, Green & Purple is an inhouse finance team helping clients scale.

But how do you grow a finance firm without getting lost in tedious manual work? According to Jodine Williams, a management accountant at Green & Purple for the past seven years, one way is to improve your tech stack so that more time can be spent building strong client relationships.

According to Jodine, one of the key drivers of Green & Purple’s success to date has been its unique approach to working with clients and building relationships. Continuing to provide this value has been crucial as the firm has grown.

But for that to be feasible, it has meant ensuring that

Green & Purple’s internal processes are as efficient as possible. “Our clients trust us to manage their finance systems in a professional and secure way, and therefore we need to find systems that support us in that and can benefit both us and our clients.”

One area where Green & Purple identified inefficiencies was in manual accounts payable processes. Creating Excel reports for payment approval and entering payments individually was labour-intensive and prone to errors, especially for clients with hundreds of invoices.

The firm had been looking to improve its tech stack when it came across Mimo. For Jodine, Mimo stood out not only because of the platform’s ability to read and manage invoices effectively but also because of its willingness to listen to Green & Purple’s needs and tailor its roadmap accordingly.

“The kind of company you want to work with is one that’s going to listen to you and try and help you find solutions to the problems you come up against,” shares Jodine. Given how important client relationships are to Green & Purple, building strong relation-

ships with service providers proved equally important.

Mimo:

A few months since implementation, Mimo has proven to be a game-changer for Green & Purple. The platform’s layered approval workflow and automatic data capture have significantly reduced the time needed for payment runs. The seamless integration with accounting software like Xero and QuickBooks further streamlines reconciliation, ensuring accurate financial records and offering clients actionable insights.

This efficiency boost allows Green & Purple to focus more on delivering strategic value to clients. “Mimo has enabled us to process payments more efficiently, reduce the risk of payment errors with its ability to read invoices, raise alerts to any changes in details, and save us a significant amount of time.”

According to Jodine, this means they can spend more time doing the things that add value to their clients while also improving trust and ensuring that clients’ finances are managed securely.

Keep reading

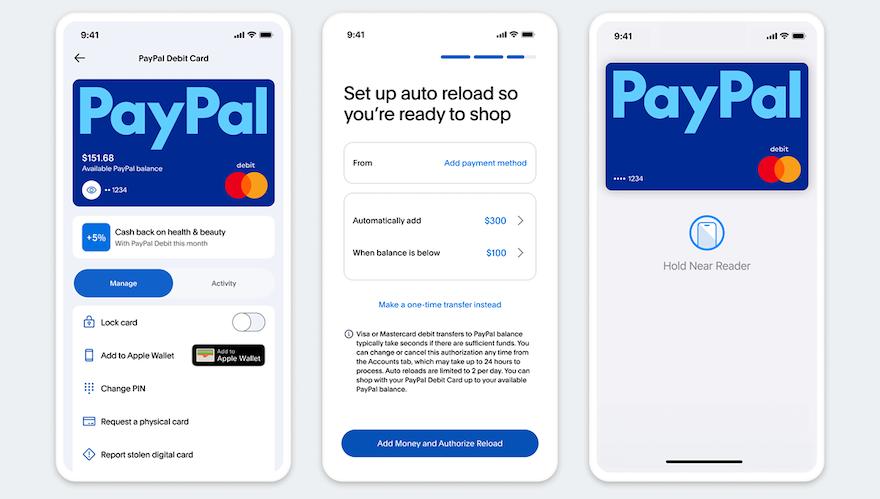

New rich rewards and in-store access transform PayPal into a single solution for every type of customer everywhere they shop

PAYPAL (NASDAQ: PYPL) TODAY USHERED IN A NEW ERA FOR CUSTOMERS, MAKING IT EASIER AND MORE REWARDING THAN EVER TO SHOP AND PAY WITH PAYPAL ANYWHERE, ANYTIME – BOTH IN STORES AND ONLINE.

Now, customers have access to rich rewards, stackable cash back offers in the PayPal app, and more personalized ways to manage their spending – all with the safety and security PayPal is known for and the peace of mind they’re getting more money back in their pockets.

PayPal has been the go-to solution for online purchases, with the majority of U.S. adults having used PayPal in the last 5 years1. Now, with consumers looking for more ways to save money on every purchase, PayPal is expanding its reward program and its availability to deliver an omnichannel solution to give consumers a smart choice for every purchase, every time. PayPal’s enhanced rewards include the ability to choose a monthly category of spending, such as groceries or clothing, to receive 5% cash back on up to $1,000 in selected category spend per month when using their PayPal Debit MasterCard ® 2. Customers can also stack rewards on top of their monthly category by discovering and saving offers in the PayPal app

from top brands including Sephora, Domino’s, DoorDash, Instacart, PetSmart, and hundreds more. For example, if a customer selects Restaurant as their monthly category, they’ll receive 5% cash back3 and another 10% cash back [for a total of 15%] if they save a deal from DoorDash in the PayPal app, which will be automatically applied when checking out with PayPal online.

Every customer has unique needs and individual spending patterns. PayPal’s new auto-reload option empowers them to shop confidently by setting a PayPal balance threshold that automatically tops up if it dips below their chosen amount. Knowing how much is in their balance and customizing it for their shopping needs removes the guesswork and makes PayPal simpler for millions of Americans.

“We know that consumers are looking for smart, simple and safe ways to make their everyday purchases while also getting more value out of every transaction. That's why millions of customers can now enjoy the trust and convenience they love about PayPal everywhere - both in-store and online, with access to rich rewards that put more money back in their pockets,” said Alex Chriss, President and CEO, PayPal.

Keep reading

PayPal will become an additional provider for processing online credit and debit card transactions for Shopify Payments in the U.S. PayPal wallet transactions will be integrated with Shopify Payments, providing a consolidated view for merchants.

PAYPAL HOLDINGS INC. (NASDAQ: PYPL) TODAY ANNOUNCED AN EXPANSION OF ITS GLOBAL STRATEGIC PARTNERSHIP WITH SHOPIFY INC. (NYSE, TSX: SHOP) IN THE U.S. PAYPAL WILL BECOME AN ADDITIONAL ONLINE CREDIT AND DEBIT CARD PROCESSOR FOR SHOPIFY PAYMENTS THROUGH PAYPAL COMPLETE PAYMENTS, A SOLUTION FOR MARKETPLACES AND PLATFORMS COMPRISED OF FLEXIBLE AND POWERFUL DEVELOPER TOOLS.

With a brand-new experience, PayPal wallet transactions will be integrated into Shopify Payments in the U.S., which will streamline the managing of orders, payouts, reporting, and chargeback flows.

This enhancement creates a single, unified experience for PayPal and Shopify merchants offering both innovative payment options and operational efficiency.

Keep reading

REVOLUT, THE GLOBAL FINTECH WITH MORE THAN 45 MILLION CUSTOMERS WORLDWIDE, TODAY ANNOUNCED IT IS DOUBLING DOWN ON BUSINESS ACCOUNTS AS GLOBAL ANNUALISED REVENUES OF ITS BUSINESS-TO-BUSINESS (B2B) OFFERING, REVOLUT BUSINESS, HAVE SURPASSED $500M. GLOBALLY, MONTHLY PROCESSED TRANSACTION VOLUME HAS REACHED £17B.

The news comes as Revolut continues to expand its footprint globally with the launch of Revolut Business in Singapore – benefitting global businesses with Sin-

gaporean operations and introducing a tech-first business account solution to a market underserved by legacy banks. This move brings the total number of markets where Revolut Business is live to 40. That accelerated growth is set to continue as Revolut Business onboards over 20,000 businesses each month, who are joining hundreds of thousands of monthly active businesses.

Building on this momentum, Revolut has launched Revolut BillPay today to further meet the growing demand for better business accounts.

Keep reading

IT’S TIME TO SAY GOODBYE TO FIDDLY TRANSACTIONS. TAKING PAYMENTS FROM CUSTOMERS IS NOW EASIER THAN EVER – WITH OUR MOST RECENT UPDATE, YOU’LL NO LONGER NEED TO USE YOUR PHONE TO INITIATE A PAYMENT. IT CAN BE DONE ENTIRELY USING YOUR TIDE CARD READER!

Carry out transactions within seconds and get paid directly to your Tide account in a couple of days, in two simple steps:

1. Select the Tide POS app on your Card Reader device

2. Enter the amount you wish to charge You’re all done!

How the Tide POS app can help you

1. Faster transactions Everything’s straight-forward, and happens on

one device. We know that when you’ve got customers queueing up on a busier day, time is of the essence

2. Streamlined process Less hassle and stress for everyone involved. There are fewer steps too, so it’s less likely there’ll be any hiccups

3. No more juggling devices Go back to using your phone as just your phone.

No more stressing about Wi-Fi or data issues – or worrying that your battery might run out from personal use throughout the day

4. Privacy first A secure and quick way to accept payments on the go.

There’s no need to open your Tide banking app and risk others seeing your private information

Keep reading

WE INTRODUCED A HUGE IMPROVEMENT TO OUR INVESTMENT SEARCH IN EARLY AUGUST, BENEFITING THOSE CUSTOMERS INCLINED TO ADD TRADES MANUALLY. YOU SHOULD FIND SEARCHING FOR AN INSTRUMENT ON OUR MANUAL TRADE FORM A MUCH SMOOTHER EXPERIENCE MOVING FORWARD. THIS WAS AN IMPORTANT IMPROVEMENT FOR THE PRODUCT NOW THAT WE SUPPORT MORE THAN 750,000 INSTRUMENTS GLOBALLY.

Some of you may have also noticed a couple of improvements to our new holdings page with the increase in the maximum number of file attachments per holding increasing from 5 to 20 for paying customers, and the introduction of a ‘target

price’ function where you can set a target price for an investment. This is our first step towards rolling out a series of goal-based features. We also rolled out the second step towards customisable reporting in the form of a report download options screen allowing you to configure the PDF or XLSX download, including the addition or removal of columns, column sorting and other settings for certain reports.

Finally, we continued our focus on expanding broker support and introduced support for trade confirmations in multiple languages.

New functionality / enhancements

• We streamlined our broker pages

Keep reading