magazine The independent magazine for Xero users, by Xero users ISSUE 33 Creating a long-term practice survival plan Scaling up, scaling back, specialising and more–how to jump off the treadmill and create an amazing future Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES COVER STORY

2 / Issue 33 XU Magazine - the independent magazine for Xero users, by Xero users.Trial Wo r k flo w M ax f ree f o r 1 4 d ays w o r k flo wm a x .c o m /s t a r t S u p e rc h a rge y ou r clients’ profitability with WorkflowMax Tr y th e e n d -to - e nd j ob m an a ge m e nt s o f t w a re that ove r 1 0,000 b usin e s s e s love .

Issue 33 / 3Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Juliet Hyatt-Brown from Lautrec Consulting Engineers work with WorkflowMax implementation partner Josh Licence from BlueRock Digital Juliet Hyatt-Brown Lautrec Consulting Engineers J os h Licenc e BlueRock D ig i t a l Boost the va lue of you r a dv iso r y bu s ines s an d ge t c e rt ifie d wo rkflo wma x .c o m/a dv is o r We emp ower our c lien ts wi th technol ogy tha t drives tangib le impac t in their b usiness pe rf ormance and rea l-time un ders tanding f or ou r adviso rs. So fo r us , W orkfl ow Max was an ob vi ous choice when it came to smal l business job and prac tice managemen t.

Main Contacts -

CEO: David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Director of Strategic Partnerships: Alex Newson

Design & Communications: Bethany Fulks Creative Assistant: Hebe Vermeulen

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2022. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales.

Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or

contributors.

4 / Issue 33 XU Magazine

- the independent magazine for Xero users, by Xero users.

magazine Issue 33

its

The independent magazine for Xero users, by Xero users 8 COVER STORY AutoEntry by Sage Creating a long-term practice survival plan 14 ApprovalMax How Sharesies automated their approvals process & EOFY audits 18 CASE STUDY Tidy International Stocked, Sealed and Delivered 22 Libeo Putting payment safety at the forefront 24 NextMinute Why getting your construction business in order can boost your wellbeing 28 Zahara Get ahead of the game with Xero friendly tech 30 Satago Our experience of Satago - Pink Pig 32 Practice Protect The 2022 Accounting Cloud Apps Report is out! 34 AccountancyManager MTD for ITSA: How practice management software will help 38 INTERVIEW Xero Q&A with Chris O’Neill, Chief Growth Officer of Xero 46 HR Partner Explore the Benefits of Linking Xero with HR Partner 50 AdvanceTrack What, why, how? AdvanceTrack explains our service Welcome to issue 33... 54 INTERVIEW infoodle Q&A with Richard Smith, Owner & developer of infoodle 58 Chaser Why debt collections and receivables management is one of the hardest jobs in the world 60 Annature Annature enters a partnership with a new big brand McDonald’s, operated by the Munro Group Join our newsletter for regular updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! 8 14

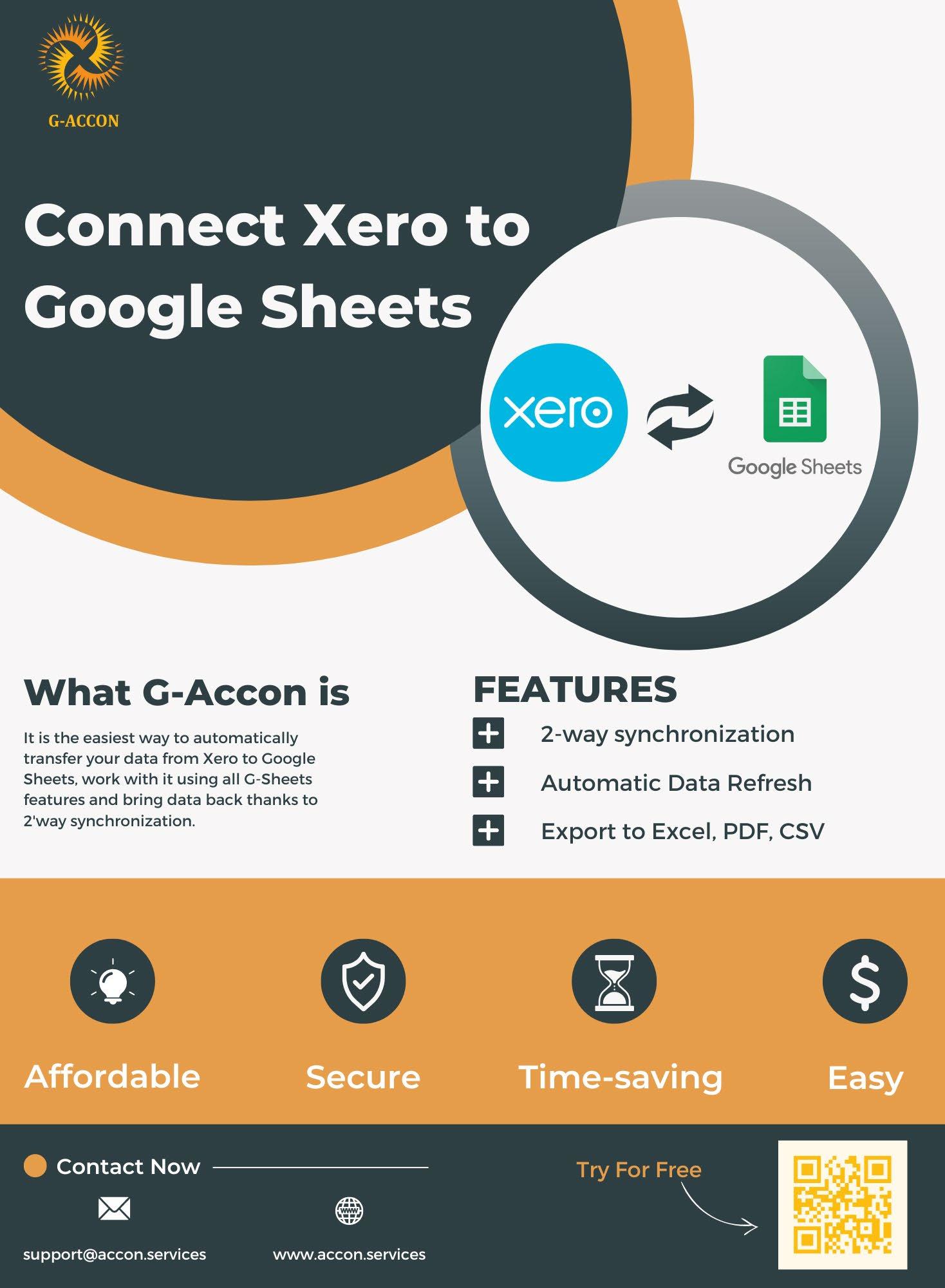

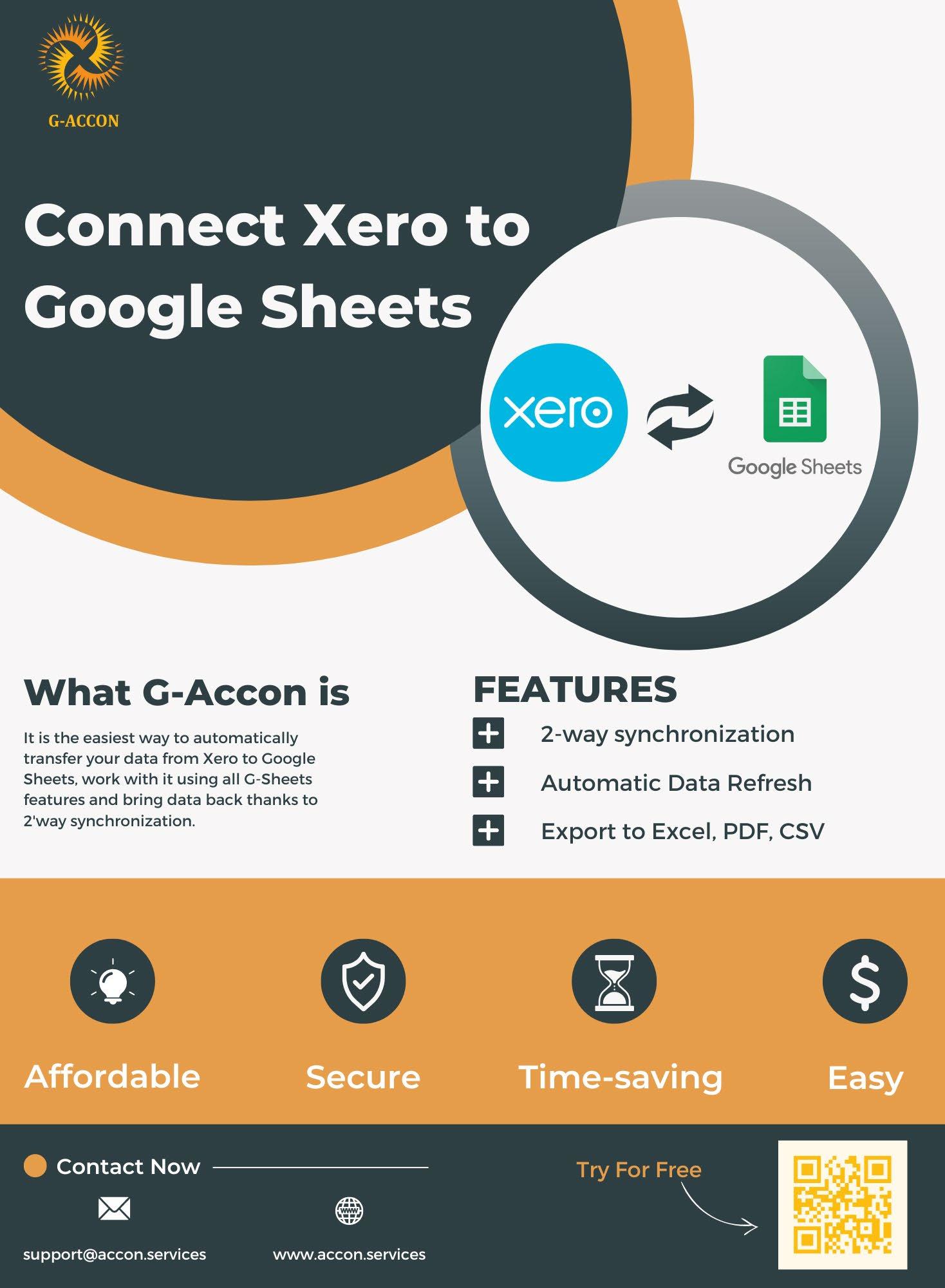

Issue 33 / 5Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine INTERVIEWS... 64 Spotlight Reporting The future of accounting: The untapped value of advisory services 70 MarketFinance Forecasting, flexing and funding: how to plan for uncertainty 74 G-Accon Game-changing add-on for those who make the world a better place 78 Pin Payments Why online payments should be an option on your Xero invoices 82 WorldFirst UK International accounting insights: how to send money to China from the UK with WorldFirst 84 FOCUS: MENTAL HEALTH How to really listen 90 Wolters Kluwer AsiaPacific The quest for work life balance – an accounting industry evolution 94 Dext There’s no more hiding from Digital Commerce 96 Updates and new releases from Xero connected apps DID YOU KNOW? Look out for any article that shows the CPD Certified logo. It has been approved to count towards your CPD points! XU are now a CPD Corporate Member We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register. 98 XERO APP PARTNERS OF THE MONTH Xerocon New Orleans Special 104 UPDATES FROM XERO 108 AutoEntry by Sage MTD for Corporation Tax: 9 things to tell clients 112 New to the Xero App Marketplace 114 Crezco Faster payments, for free, that reconcile instantly Upcoming... Chris O’Neill Xero, Chief Growth Officer 38 Richard Smith CEO & developer, infoodle 54 60 30 From The Trenches140 is proud to launch the first ever Australian Accounting Industry Awards for 2022

6 / Issue 33 XU Magazine - the independent magazine for Xero users, by Xero users. 118 EVENTS Accountex Australia Accountex Australia presents Balancing the Books 120 Wolters Kluwer Tax & Accounting UK Getting ready for MTD for ITSA 122 ExpenseOnDemand Economic Turmoil vs Christmas Parties 126 EVENTS Institute for Certified Bookkeepers “A Festival of Bookkeeping”: Reasons to attend ICB’s Bookkeepers Summit 128 XERO APP PARTNERS OF THE MONTH Xerocon Sydney Special 132 simPRO Software Help trade clients down tools and dig into data 134 EVENTS Accounting & Finance Show Asia Accounting & Finance Show Singapore 2022 was a huge success! 136 CLASSIFIEDS 140 ...and finally Event: From The Trenches 118 126

Issue 33 / 7Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Start your 14-day FREE trial today! tidyinternational.com/trial POWERFUL SOFTWARE. DELIGHTFULLY SIMPLE. I needed a stock system to run with Xero, as I wanted to be able to track and view transactions in real-time. We all use it to check stock and see what seals are proving the most popular, what we need to restock, and what seals we don’t currently stock but would be an area of opportunity for us. " " Helen Haslam, Managing Director Tekhniseal Users of

Creating a

practice

plan

8 / Issue 33 XU Magazine - the independent magazine for Xero users, by Xero users. Cover Story This article is

long-term

survival

How to jump off the treadmill and create an amazing future

Scaling up, scaling back, specialising and more

Since 2017, Sean has been one of the guiding forces behind AutoEntry.

As AutoEntry’s operations director, he continues to push to find ways that AutoEntry can be even better at being the marketleading data entry automation tool, servicing the needs of 100,000s of people every day.

The pandemic showed how accountants are the true superheroes of the business world.

Yes, there was significant extra work. But a door was opened. As accountants performed tasks like helping clients prepare reporting to access government assistance, clients were educated about a closer relationship with an advisor they could trust.

Similarly, Making Tax Digital in the UK has indicated that client relationships can evolve as accountants focus more on additional service offerings, such as periodic financial check-ups, and less on basic compliance now that the government demands technology do much of that work.

All of this is becoming the norm, rather than the exception.

In the very near future, more and more taxes will be digitalised— everything from income tax to corporation tax. Simultaneously, governments worldwide are increasing business regulation.

You need to choose how you and your practice will fit into this new world.

The issues are the same as they ever have been: ensuring you’re relevant to clients, pricing services optimally, remaining profitable, and so forth, all while being guided by your values.

There isn’t a single path that’s right for everybody. But it’s wise to jump off the treadmill for just a few minutes and plan your route. The focus should be less about the specific and unique challenges. Instead, look at the ways you can navigate through the challenges in a way that will create a future perfect for you.

Scaling up, scaling down, specialising or more radical options—all must be explored, and a destination selected.

And that’s perhaps the most important point. All journeys start with a single step. But less often mentioned is that all successful journeys start by choosing the best destination for you.

Scaling up

As the philosopher Alan Watts

said, the only way to make sense out of change is to plunge into it, move with it, and join the dance.

For accountants, this means scaling their practice to exploit challenges in the coming years. But while basic growth is simple— do more of what you’re already doing—accountancy practices have opportunities to instead evolve what they do, driven by aforementioned increasing government requirements and changing client demands.

After all, basic accounting services have become commoditised over the last decade, resulting in an inevitable fight to the bottom when it comes to pricing and profit. Nowadays a high street accountant competes with online services.

Providing more of the same is unlikely to be effective. Instead, fresh service offerings and increasing your practice’s understanding of client needs must be central to any plans to scale.

Issue 33 / 9Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

@AutoEntry

Sean Woods, Operations Director, AutoEntry by Sage

Cover Story

The world of accounting is pivoting with increasing government requirements and evolving client needs.

If you don’t manage change in the coming years, change could manage you—leading to a career forever on the treadmill. Take control now and ensure the coming years are everything you want them to be.

Cont...

“Accountancy practices have opportunities to evolve what they do.”

For example, Making Tax Digital for Income Tax Self Assessment (MTD ITSA) arrives in the 2024/25 tax year, with the expectation that many businesses will sign-up to the pilot programme ahead of time as of the 2023/24 tax year.

There remains industry-wide incredulity about clients being able to cope with the increased demands of at least quarterly reports for each trade and landlord income, plus discrete end of period statements (EOPS).

And that’s before we discuss the requirements for digital record keeping and digital linking.

Clients that scribble down income and expenses as they occur, then hand this over to their accountant each January along with a bag full of receipts, are in for a huge shock.

But some accountancy practices are seizing the chance to manage this change and in doing so, they illustrate perfectly the mindset needed for practices looking to scale.

Client accounting services

MTD ITSA’s quarterly reporting requirement in particular means some business owners and

managers will need to have much more contact with their accounting.

Because of the obvious reluctance of those clients to do so, some accountancy practices are pondering offering in-house bookkeeping services of some kind.

One recent survey suggested over half of UK practices are either doing this already, or planning to do so.

This is a classic thin end of the wedge that accountants can exploit. It’s driving discussion of a concept popular in the US, known as the Client Accounting Services (CAS) model.

With CAS, the accountancy practice takes on any number of accounting and advisory tasks agreed with the client, such as handling accounts receivable and payable, and other daily accounting needs. This is made easy by the use of cloud accounting software, along with data entry automation software such as AutoEntry.

In other words, the vast majority of the work can be carried out virtually.

Understanding the value of CAS is to switch to a forwardlooking mindset, compared to the normally reactive approach of accountants. With CAS, you’re responsible for creating the books moving forward. With traditional accounting, you simply review the previous years’ books retrospectively.

As such, further services are easily tacked on to any CAS offering, such as running the payroll, growth forecasting and more. Auditing services are also possible, if there isn’t an existing conflict of interest, of course.

A virtual finance director (VFD) is a logical end point, in which an accountant effectively becomes part of a business’ leadership team, advising on routes to growth and key financial decisions.

With CAS, existing clients are your marketing channel. You’ve already developed relationships and have the opportunity to sell additional services to them and ask for referrals. Successful clients tend to have successful friends and business acquaintances.

CAS as a growth model

Here are four tips when it comes to applying CAS when looking to scale-up:

for Xero users, by Xero users.

10 / Issue 33 XU Magazine - the independent magazine

Cover Story

“Accountancy practices are pondering offering in-house bookkeeping services offerings of some kind”

1. Free up time: CAS is going to require work and commitment to do properly, and shouldn’t be attempted as a sideline alongside your standard workload. You’re going to need to free up some time in your schedule to make the transition, so in the weeks following the end of the hectic tax season, get to work identifying who can benefit from your financial and business acumen.

2. Create a shortlist: Make a list of clients who you only provide traditional services to, but could benefit from CAS. Keep the list small enough to manage at first, ensuring that you provide the best service possible to your client base.

3. Analyse your clients’ industry: Once you’ve selected suitable clients, you’ll need to develop a sound strategy. Even if theirs is an industry with which you’re familiar, start by leveraging industry data reports to see where the possibilities lie in providing services to your clients.

4. Commit: You must carry this process through to completion, and be prepared for any stones in the road as well as the time it will take. There can surely be nothing worse than offering CAS to a favoured client, and then not following through with what was promised.

It should be noted that clients won’t have much interest should you talk about CAS. To them, you’re simply solving problems and providing solutions to their needs. You should couch your additional service offerings in those terms.

When it comes to pricing, CAS is typically a subscription model (monthly or yearly), but one that’s bespoke to each client’s needs. Effectively, you provide a menu

of services, and clients say what they want. The client is ultimately determining the value and this should feed into what you charge.

One thing is for sure: Thinking in terms of charge out rates and fixed fees is becoming increasingly irrelevant. You charge for an overall package, rather than for each hour worked.

Specialising

While adopting a broader and more diverse range of service offerings is one response to the changing world of accounting, it isn’t the only way forward.

Some accounting professionals are responding by simply turning their back on the demanding requirements of general practice.

Referred to sometimes as niching, becoming a specialist practitioner is a terrific route to scale a practice and can provide much more job satisfaction, to boot.

There are typically several types of specialist, as follows:

• Industry verticals: Retail, taxi drivers, construction, landlords, hospitality, charities/NPOs, medical and legal professionals… Most industry sectors benefit from inside knowledge when it comes to taxation and government regulations. Can a magician claim carrots as expenses, in order to feed the rabbit he pulls from his hat? A specialist practitioner working in the entertainments industry is sure to know!

• Taxation: Most common are VAT specialists, of course, but customs and excise specialists are in extremely high demand

since Brexit, as one other example. For another kind of client, a true specialist in capital gains tax might be worth their weight in gold (if the gold is inherited!).

• Business type or size: You might specialise in IT contractors and freelancers, or entrepreneurial businesses, or SMBs aiming for growth. As mentioned earlier, the virtual finance director (VFD) accountant can provide a unique service for businesses large enough to benefit from such a role, but that can’t yet support a full-time position.

• Technology: Combining accountancy services with a technological-driven approach creates a useful hybrid for many clients, especially in our world of Making Tax Digital. Business for such accountants is about selling and supporting an app stack, as well as providing services. Remember that many of those starting businesses today are from the Gen-Z and Gen-Y generations, who have never known a world without advanced technology. These kind of specialists meet that need.

• Lifestyle and culture: Less common but perhaps still worth investigating are specialisms built around specific client connections. This might be a similar cultural background, or belief system, such as Christianity or Islam. There’s even a vegan accountant!

Often your choice of niche will grow from a passion or understanding that you may already have, or perhaps from experience of a role within an organisation.

This is because specialism benefits from a laser-like focus

Issue 33 / 11Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Cover Story Cont...

“Thinking in terms of charge out rates and fixed fees is increasingly irrelevant”

“Specialist practitioners have a true interest in deep diving into specific knowledge”

and true interest in deep diving into specific knowledge. This provides the insights needed to be a successful specialist practitioner.

The key benefit of a niche specialism is ease of new client acquisition and marketing. Provide a good service as a taxi specialist, for example, and you’ll be recommended to other taxi drivers. Furthermore, advertising online is much easier than for a general practitioner, because you can target specific advertising keywords—or simply post for free in relevant groups on social media.

Specialist accounting also got a boost from the pandemic, when the world quickly learned that Zoom teleconferencing was a viable way to carry on doing business. Above all, clients are much happier to accept their accountant may not be local, creating the potential for onlineonly specialist practices with a national or even global client base.

Scaling back

Some practitioners have looked at the developments required in the coming years—and taken the decision to scale back, or at most maintain equilibrium with their existing setup. For sole

practitioners in particular this is a viable way forward.

Ensuring profitability from existing clients is key. The Pareto Principle, known as the 80/20 rule, can provide a path forward, in that it’s likely a minority of a practice’s clients are providing the majority of its income. Identifying them becomes key, as does potentially cutting any dead wood.

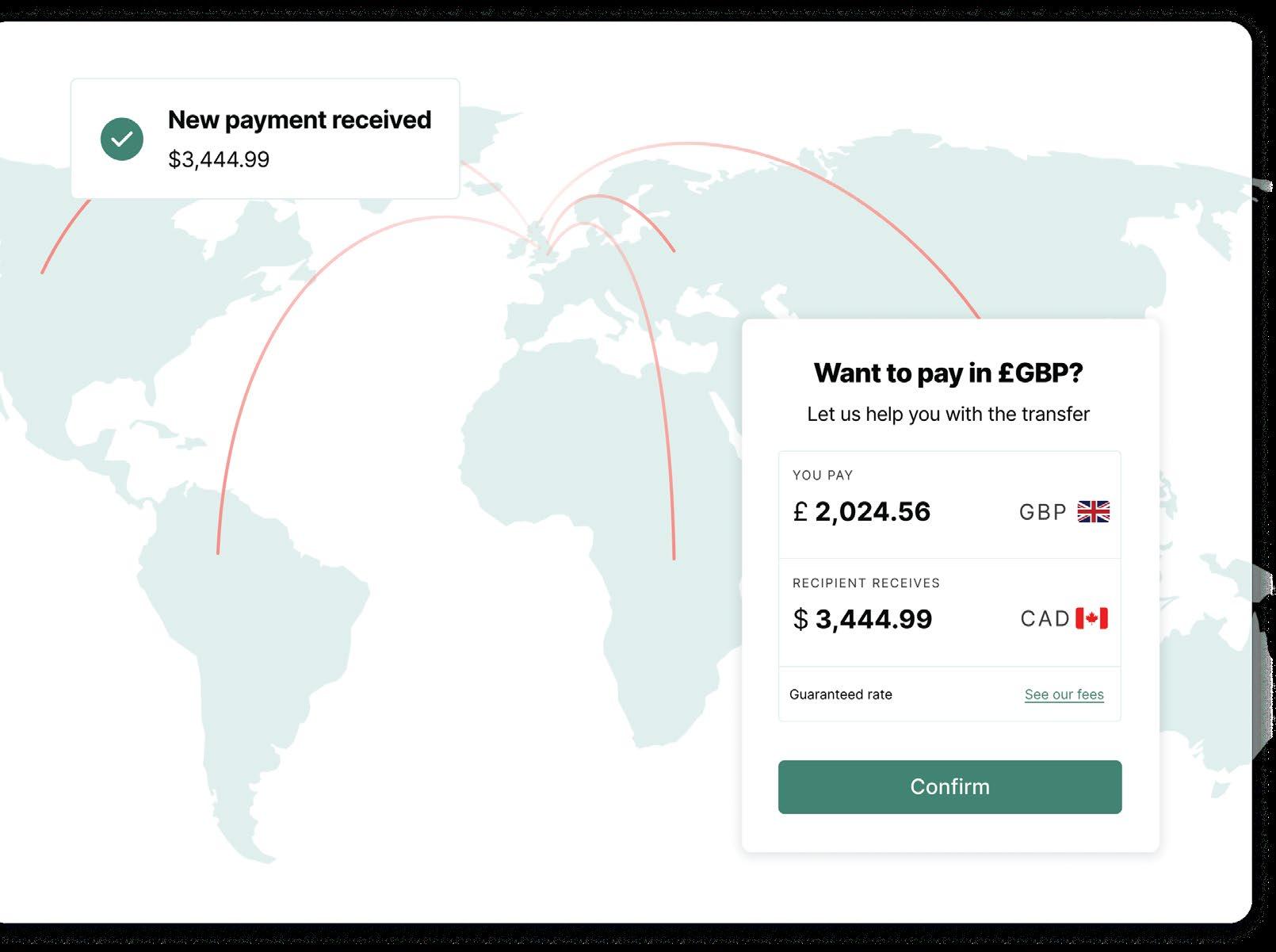

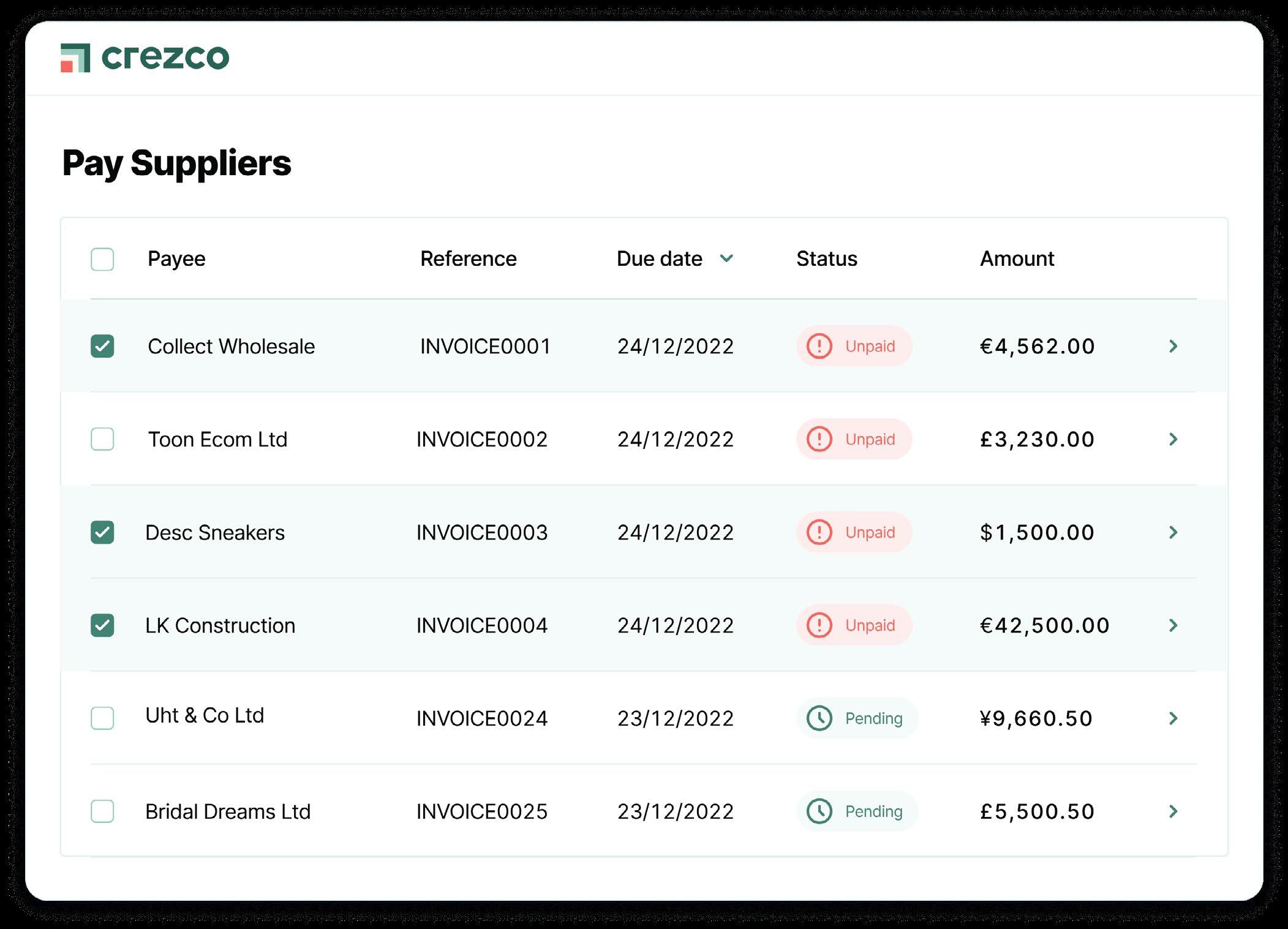

Putting it another way, scaling back is less about aiming for a larger client list, as it is returning value per client.

Timekeeping software can be used to measure the amount of work individual clients require. Using this data, client fees can be renegotiated on a periodic basis. Client contracts shouldn’t be set to automatically rollover each year, but should be reviewed and renegotiated if required.

When it comes to the requirements of MTD ITSA and subsequently MTD for Corporation Tax, client continuation with your practice can be based on how willing they are to do the work of tasks like

periodic reporting. Bookkeeping services via a third-party provider can be recommended to those that will struggle.

Technology can be used to automate wherever possible so that MTD is feasible for the client and accountant. AutoEntry can be used by the client to quickly extract the data from receipts, invoices and bank statements, for example. All clients need do is take a snapshot with their phone.

Selling up

As an alternative to scaling back in the face of a changing world of accounting, what might seem the most extreme possibility might be deployed: selling up. That might be selling your practice as an ongoing business concern, or selling your client list to another practice if the Gross Recurring Fees (GRF) are attractive enough.

While there are plenty of agents and brokers who specialise in selling practices, good advice for those intending to sell is to make the plans a reality sooner rather than later. With new client acquisition often ceasing to be a focus when a practice owner

for Xero users, by Xero users.

12 / Issue 33 XU Magazine - the independent magazine

Cover Story

“Good advice for those intending to sell is to make the plans a reality sooner rather than later”

decides to sell, churn rates can rise, making the practice appear to be in decline. Any sale should be orderly and planned well in advance, with business as usual maintained until that point.

Technology at its heart

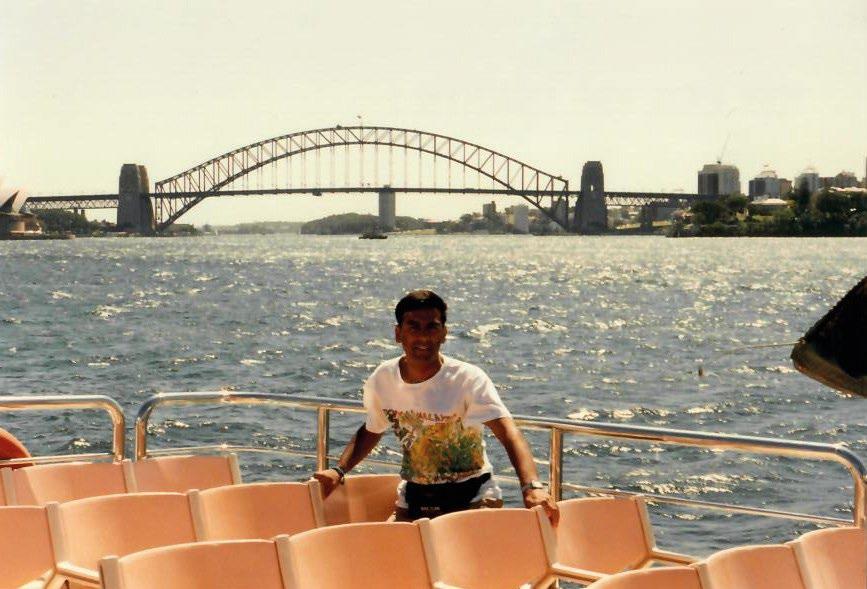

Whether you’re scaling up or scaling down, all the destinations we’ve discussed above have technology at their heart.

Cloud accounting and practice management software is the basic requirement for a modern practice aiming for growth, while to free-up time for services like CAS or practice specialisms, automation tools such as AutoEntry are a fundamental necessity.

Why devote hours or days of work to drudge tasks like data entry when you or your staff could be using that time to grow the

business—while demonstrating their expertise and passion? Client engagement tools like GoProposal should be used to price consistently and end scope creep, allowing you to focus on maximising profits while supplying a dependable client service.

If you’re scaling back or aiming for higher value from clients, tools like Futrli are vital in being able to provide budgeting, prediction and reporting so that you and your clients know their position— and are able to act on that information.

Most of all, if you’re planning to sell-up in the future, a practice that has robust digital systems in place is a far more attractive proposition because it enables easier transfer, as well as the auditing of any necessary information.

Issue 33 / 13Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Learn more about AutoEntry by Sage, including a limitedtime special offer for 3 months free: autoentry.com/offers FIND OUT MORE... Cover Story Powerful Management Software for Charities & Churches Centralise Your Contacts Communicate Better Organise Information Collect Data via Forms NZ +64 (0) 7 579 3085 UK +44 (0) 161 7318 437 sales@infoodle.com www.infoodle.com

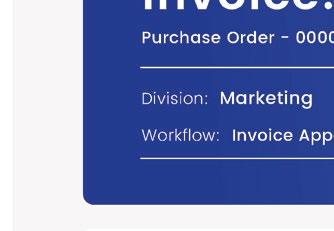

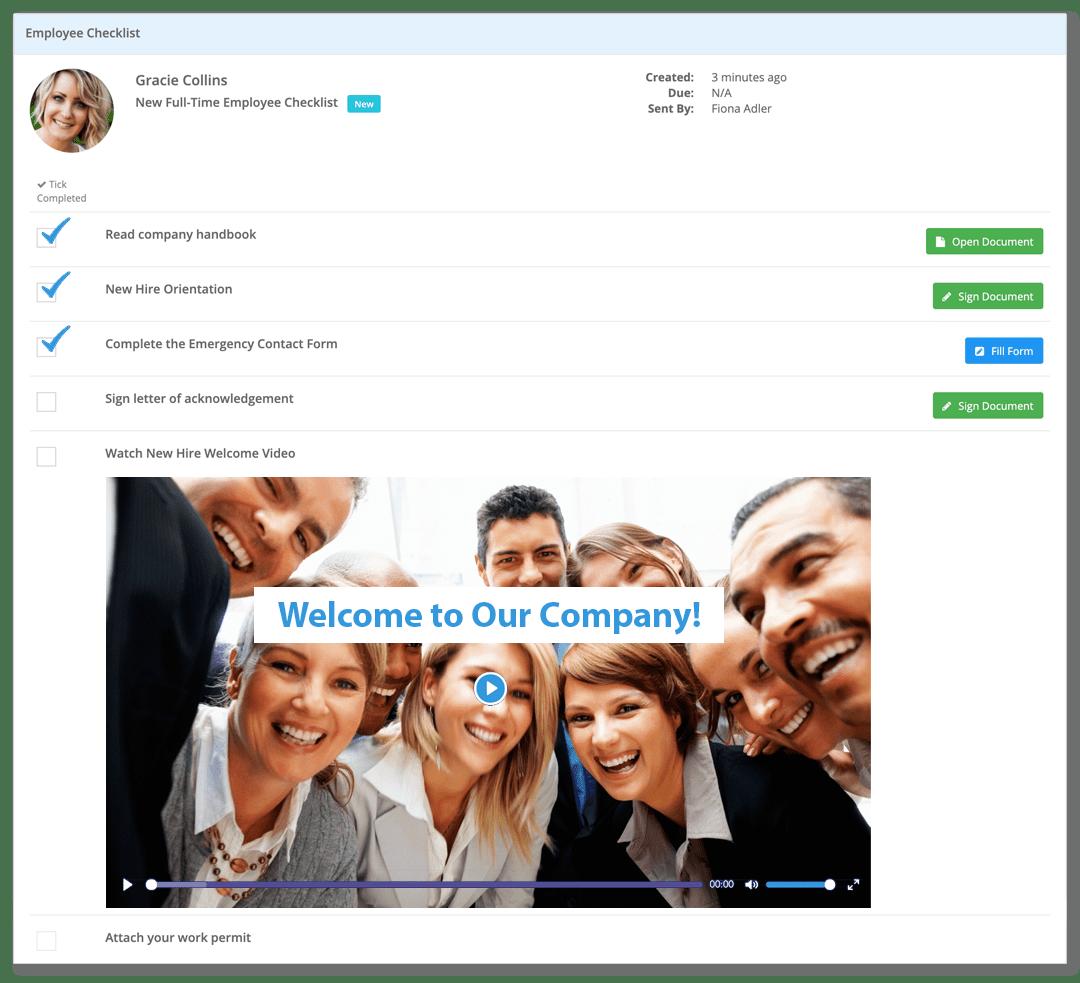

How Sharesies automated their approvals process & EOFY audits

Who are Sharesies and what do they do?

This

If you live in Australasia, there’s a good chance that you’ve heard of New Zealand investment platform, Sharesies. Their fintech innovation makes it easy for New Zealand and Australian investors to buy and sell shares in companies and funds across New Zealand, Australia, and the US.

Their vision:

To give someone with $5 and someone with $5 million the same investment opportunities.

Their inspiration: “We want to nurture and grow people’s finance and investing knowledge. And not just around investing – all things money.”

Sharesies are paving the way for accessible investment across New Zealand and Australia. Users also have access to a wealth of podcasts, webinars, and written content, which helps create an engaged user community that is in control of their own learning. Through their platform and product offering, Sharesies have developed a stand-out business

With roots in business process management and optimisation software development, Konstantin has undertaken hundreds of product implementations for ApprovalMax clients worldwide.

Konstantin has been advising numerous organisations on implementing automation, financial controls, and client collaboration capabilities using Xero-based trusted app stacks, with business profiles ranging from SMEs to large accounting and advisory practices.

strategy that’s set to see them grow from strength to strength.

Where does approval automation come into it?

Business growth is an important part of Sharesies’ story and they needed to have airtight finance management systems in place that would scale with them as they grew. Any solution they adopted into their tech stack needed to allow them to “Chase Remarkable” – one of their company values. Hannah Korner, Corporate Accountant at Sharesies, is big on using approval automation to support their finance function and shares how ApprovalMax helps them focus on their business goals.

Why Sharesies adopted

Before

14 / Issue 33 XU Magazine

- the independent magazine for Xero users, by Xero users.

@ApprovalMax

Konstantin Bredyuk, Director of Product, ApprovalMax

approval automation

automating their process, email-based approvals had

article is Learn how investment platform Sharesies uses automation to streamline their approval process and augment their cloud accounting tech stack.

Sharesies’

senior

leadership team

and co-founders,

from

left

to right: Leighton Roberts, Sonya Williams & Brooke Roberts

Hannah Korner; Corporate accountant at Sharesies

worked fairly well for Sharesies. At that stage, they were still small – processing around 300-400 invoices per year. It was manageable, although not without inherent inefficiencies.

To keep up with their growth, the team knew they needed a solution that would scale with them no matter how big they got.

“Within the finance team, we’re focused on being agile and delivering a self-service support function that brings value to the business. The tools and solutions that we use need to help us bring that value to the company efficiently and effectively.” says Hannah.

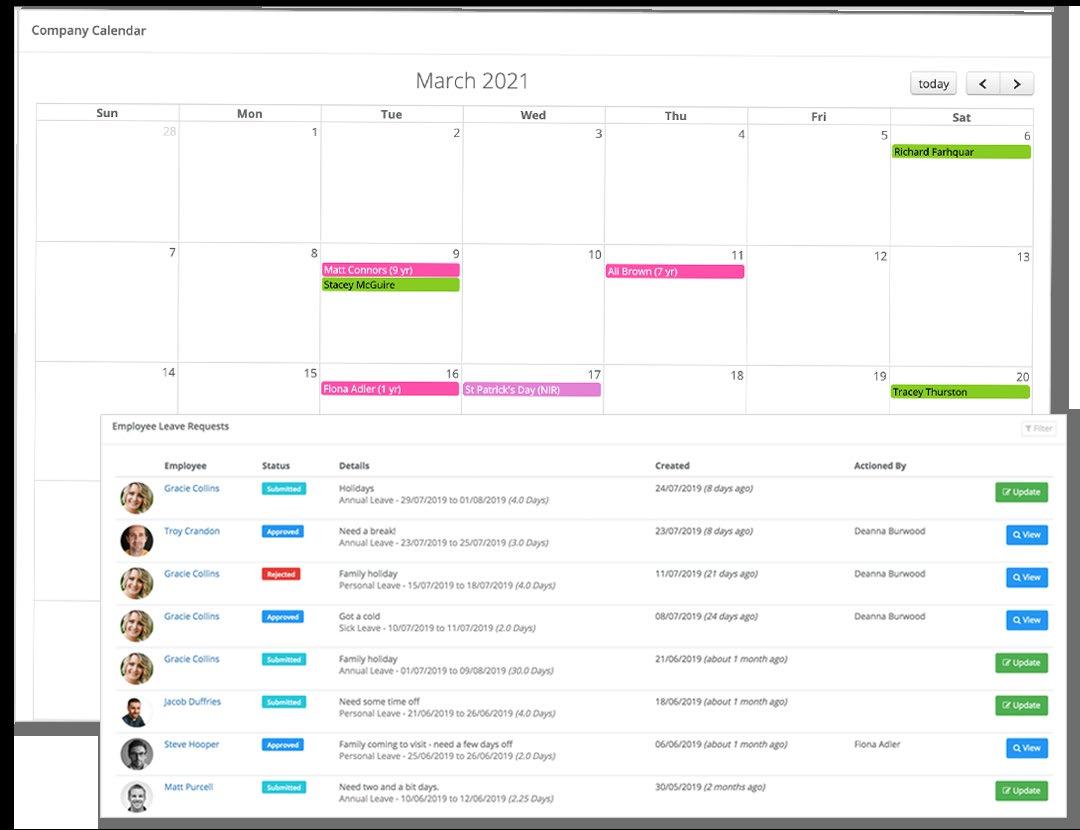

When the Sharesies team adopted ApprovalMax, they saw the value right away. With user experience and efficiencies at the top of their requirements list, Hannah was thrilled to find that ApprovalMax was easy to implement and that their approval matrix would easily grow and adapt with the business. With automated approvals, Sharesies can quickly and easily process everything from their software subscriptions, and daily business expenses, to office supplies and fixed-asset invoices.

• Streamline and automate the audit reporting process to be more efficient and accurate

• Save time and manual effort throughout the entire financial year

• Be scalable and able to handle the huge increase in invoices that comes with significant growth.

When it comes to the end of the financial year and preparing for the year ahead, it’s understandable that many finance professionals and business owners alike feel a sense of trepidation. EOFY could be a mammoth task. But not with their automated approval matrix in place.

“ApprovalMax is really easy to set up and use. That user friendliness was a huge part of the appeal. We could see the value right away and haven’t looked back.” says Hannah.

When it came to adopting automation, Sharesies were looking for a tool that answered all their AP processing needs, while also bringing sleek design and a native Xero integration.

They needed a tool that would: • Give decision-makers access to all the relevant documents and details

Not only has the Sharesies team grown since 2017, they also process many more financial documents each month. In fact, in any given month they process over 300 invoices just within the New Zealand arm of their company –that’s around 12 times more invoices processed per month since they adopted automation!

How invoice management and audits have changed for Sharesies since adopting automation Processing time and total documents processed aren’t the only numbers that Sharesies have been able to improve.

“We use Xero and have fully audited accounts so at the end of the year, approval audit trails help to make that process really easy for the auditors and for us.” says Hannah.

At the end of the day, emailbased approvals wouldn’t help the company grow and scale, and that meant change was essential. But financial services within the investment space are so heavily regulated that any new tools needed to simplify the audit process, ensure compliance, and make the process low-impact for everyone. Without automated approvals and features like audit trail reports or approval history, Sharesies would need an entire team to manage the AP process. Instead, approvals and audits are efficient and effective, and they all tick over in the background.

Issue 33 / 15Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

How Sharesies’ approval processes have changed thanks to ApprovalMax

“ApprovalMax is really easy to set up and use. We could see the value right away and haven’t looked back.”

Cont...

Automated approvals and tracking the movement of their financial documents helps Hannah and her team to stick to their goals. When it comes to the end of the financial year, automated audit trails make the process so simple that Hannah is able to focus on high-value tasks like budgeting and forecasting for the year ahead, and finding efficiencies elsewhere in the company.

How Sharesies use ApprovalMax and their appstack to scale their business

To get their finance function in a position to achieve their goals, Hannah and the rest of the team carefully selected just a handful of cloud-based accounting tools.

1. ApprovalMax – When it comes to approval automation software, there are no local options that could meet all of Sharesies’ needs. However, they quickly found ApprovalMax and were blown away by the value the tool was able to bring to the finance team and wider business. ApprovalMax’s native and seamless integrations with Xero mean that Sharesies’ tech stack works as one complete

tool, helping them save time and money while focusing on the big-ticket items.

2. Xero – It’s important to Sharesies to support local businesses, so to have one of the best cloud-accounting platforms meant it was an easy decision for them to adopt the tool. Beyond that, user experience and functionality are critical elements in enabling Sharesies to grow – Xero’s outstanding product and service help Sharesies to keep striving for their goals.

3. Spotlight Reporting –Sharesies consolidation and reporting tool of choice is another New Zealand-born accounting tool, Spotlight Reporting. With detailed reports, Hannah and the finance team can double down on their learnings and bring added value to the company by delivering insights, efficiencies, and forecasting – all important elements in preparing for the new financial year.

The wrap-up

It’s important to Hannah and the rest of the team at Sharesies that

the tools they use help them to bring added value to the company and scale as a business.

“It’s within our values to chase remarkable and to be a bit different – to not follow the status quo like a typical finance function. To build on that, we want to use tools that automate boring processes and make those processes much easier and more efficient. By automating invoice approvals, it frees us up to be valuable to the business through analysis and improvements.” says Hannah.

Watch our webinar to learn how Sharesies’ tech stack enables them to scale.

Featuring Hannah Korner from Sharsies, Kylie Wing from ApprovalMax, and Danelle Whaanga from Spotlight Reporting.

16 / Issue 33 XU Magazine - the independent

magazine for Xero users, by Xero users.

To find out more, please visit approvalmax.com FIND OUT MORE...

The

Sharesies Team

#ACCOUNTEXAUS Thanks to our Founding Partners The accounting and finance landscape is changing with the global adoption of fintech. Accountex Australia will provide an independent, year-round platform where you can source new technologies, share ideas and gain the practical tools to better serve your clients. Join us as we navigate the future of accounting. ACCOUNTEX PRESENTS Balancing the Books Join the industry for an afternoon of panel discussions and networking at this new CPD-accredited forum. Coming to Melbourne on 10 November 2022 at The Edge, Fed Square. BOOK TICKETS ACCOUNTEXAUSTRALIA.COM.AU

Stocked, Sealed and Delivered

The year is 1987 and in Greater Manchester, England, a small manufacturing shop has just opened its doors for the first time. With deft skills and a passion for seal refurbishment, they begin a journey of giving mechanical seals a second life.

35 years later, Tekhniseal have established themselves as an exceptional player in the local industrial seal industry. Providing swift solutions across a multitude of mechanical seal needs, they specialise in refurbishing,

redesigning, and manufacturing. Alongside this, Tekhniseal also supply new mechanical seals and cartridges from stock.

Introduction to Seals

Almost everyone is dependent daily on the work done by mechanical seals, even if they have no idea what they are! Any machine in industry or vehicle, including cars and aircraft, require seals to contain lubricants, like oil and grease, to stop moving parts from overheating, seizing up, and failing.

Mechanical seals prevent the leakage of lubricants from often fast-moving parts in machines under high load and friction, and are vital to the safe, reliable operation of these machines. They are also used in plant, engines and machinery across a vast array of essential industries including transport, food & beverage, dairy, chemical, wastewater, and refrigeration.

Helen Haslam, Managing Director of Tekhniseal, said, “The most interesting place our mechanical seals are currently used is in the production of food like chocolate, and other confectionery.”

Her company plays a principal role in keeping the machines in these industries churning. Whether mildly eroded or catastrophically damaged, Tekhniseal enjoy the challenge of restoring the seals for these machines back to prime condition.

The process of restoration and refurbishment can be a complex process. From ultrasonic cleaning and pressure testing, to lapping and seal assembly, it takes a lot of equipment and materials to get the job done.

18 / Issue 33 XU Magazine

- the independent magazine for Xero users, by Xero users.

@tidyint

Doria Kao, Education Lead & Marketing Strategist, Tidy International

After completing her internship with Tidy, Doria joined full-time this year with a degree in Strategic Management from the University of Waikato. An avid wordsmith, she brings her passion for storytelling to both product education and marketing at Tidy.

Case Study

Restoring seals?

That’s an exciting

prospect

for Tekhniseal.

Restocking inventory?

Not so much.

This article is Fortunately,

stock management is no longer a grievance for them. With Tidy, Tekhniseal’s time and focus have been brought back to their original purpose.

Assorted Items

Emblematic of their expertise in mechanical seals, Tekhniseal’s stock room is a treasure trove of parts. From wave springs to O-rings, and thousands of other items, their materials are sold to customers as parts or used in refurbishment projects. Consequently, there are a lot of items circulating in and out all the time.

Keeping track of it all can be tricky, especially as Tekhniseal advances towards their goal of becoming a ‘one-stop seal shop.’

While the stock control and management side of things can feel like a burden, it’s pernicious if left abandoned. In order to draw their time and focus back to their core expertise, Tekhniseal turned to TidyStock to take care of their inventory management.

“I needed a stock system to run with Xero, as I wanted to be able to track and view transactions in real-time” says Haslam.

With Tidy’s seamless Xero integration, Tekhniseal can automatically send information between the two platforms as transactions occur.

Her decision behind choosing TidyStock, Haslam explained she found its interface easier to use and more effective than alternatives. This was important for Tekhniseal because they needed a software solution that was powerful enough to put time back into their hands without being so complex it disrupted day-to-day operations.

A Tidy Stockroom

Rather than causing disruption, the software has settled easily into Tekhniseal’s everyday routine. Since 2019, using TidyStock has become a mainstay in everyone’s work, from seal

technicians to support staff.

“We all use it to check stock and see what seals are proving the most popular, what we need to restock, and what seals we don’t currently stock but would be an area of opportunity for us.”

TidyStock’s low level warning feature further aids this by summarising stock levels based on active transactions and set reorder levels. It does the repetitive math too, providing recommendations of how much of each item should be reordered ahead of time. With longer lead times in today’s unpredictable supply chains, this takes the headache out of the what, when, and how much, side of inventory management.

Putting It All Together

With the refurbishment projects they undertake, and their in-

house manufacturing of new seals, Tekhniseal produce a lot of finished goods from raw materials. This involves bringing together a medley of materials from suppliers to build a ‘top-level’ item that is sold to customers.

Tracking the consumables and cost of this might be a daunting process for some businesses, but not for Tekhniseal. They simply set up an ‘assembly’ in TidyStock. This is a bill of materials, or a ‘recipe’ of items required to build a finished product. Once it has been put together, the assembled product can be sold as a sales item.

This means that rather than billing for each individual component used in the production or refurbishment of a seal, Tekhniseal can just charge customers for the final product.

They can also send purchase orders for a complete assembly at the click of a button. TidyStock then takes care of breaking the assembly down into component

Issue 33 / 19Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Case Study Cont...

“I needed a stock system to run with Xero, as I wanted to be able to track and view transactions in real-time”

items and creates separate orders to send to different suppliers.

Supporting Sustainability

On how they envision the future, Tekhniseal sees their refurbishment service becoming increasingly utilised as more companies begin to consider the environmental impact of their decisions.

“By repairing a damaged or leaking seal, a new seal will not have to be purchased, and the old seal would not have to be discarded, preventing overall wastage” explains Haslam.

Choosing refurbishment is beneficial to multiple dimensions of a company’s bottom line. Not only is it more environmentally

sustainable, but it is also cost effective. By searching for alternate solutions to the cycle of discarding and repurchasing, businesses can undergo significant cost savings. In turn, expenses decrease, widening profit margins, and enabling businesses to reallocate resources towards areas that provide further economic benefit.

An Industry Shift

Tekhniseal’s adoption of Tidy’s cloud software demonstrates an industry-wide shift towards technology that manufacturing companies have traditionally been hesitant to embrace.

The benefits of technology go

beyond just relieving humans of monotonous or mechanical tasks. They also provide highly valuable data insights that can help “sealthe-deal” on important business decisions.

With TidyStock in their toolkit, Tekhniseal are well-equipped to become the ultimate one-stop seal shop.

Learn more about the work Tekhniseal do here

FIND OUT MORE...

To find out more about how you can make your business Tidy, visit: tekhniseal.com

20 / Issue 33 XU Magazine - the independent magazine for Xero users,

by Xero

users.

Case Study Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! Powerful Management Software for Charities & Churches Centralise Your Contacts Communicate Better Organise Information Collect Data via Forms NZ +64 (0) 7 579 3085 UK +44 (0) 161 7318 437 sales@infoodle.com www.infoodle.com

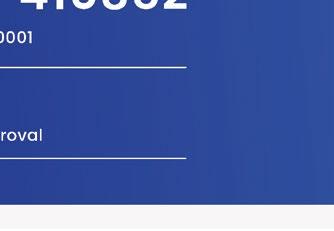

Issue 33 / 21Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Zahara is the all-In-one AP automation solution that helps Control Costs and Automate supplier payments It ’stimeto process your invoices on Auto-Pilot Approve Reject Invoice Approval Request Or Sign up From £39 Per Month • Fast Accurate Invoice Reading • Purchase Orders • Reciepts and Deliveries • Advanced Multi-Step Approvals • Connect and Sync to Xero Take a Free Trial Today www.zaharasoftware.com Zahara

Putting payment safety at the forefront

Time saving is great but payment security is critical

This article is

he role of Accountants & bookkeepers in derisking transactions is crucial for SMEs in the current context.

Fraud is one of the biggest risks businesses face and this is on the rise. It is becoming more cyber-enabled, giving fraudsters more opportunities to infiltrate companies through different methods. Small businesses aren’t getting the help and support that the wider consumer public gets. This is why this is one of our major areas of development at Libeo.

What are the different types of payments fraud?

There are two main types of

payment fraud, which can broadly be categorised as those that produce a direct victim and those that produce an indirect victim. For instance, payment frauds that fall into the former camp include things such as identity fraud and hacking, and attacks are commonly made via things such as supplier fraud, invoice fraud, and company director fraud.

Indirect fraud tends to focus more and more on”faceless” crimes, with the victims being banks, states or systems. Money laundering is the most common form of this kind of payment fraud. There is sometimes a combination of these two types of fraud, with AC Scams prompting victims to be misled about how

Glen has an extensive history of working with accounting software firms. His focus is on driving world-class customer experiences powered by cutting-edge technology, while stimulating quality revenue and growth in SaaS companies. Glen is passionate about providing SME business owners with financial clarity, and giving them the tools needed to make their business succeed. He is equally passionate about Libeo’s mission to allow SME business owners to focus on the things that matter.

their accounts will be used to cypher money from them.

Who is most likely to be targeted by payments fraud?

Businesses are a common target for payment fraud, with smaller businesses a particularly popular target for criminals. Financial institutions can also be targeted in so-called “multi-vector attacks” that target a range of financial actions.

Which stage of the payment process carries the most risk?

The attacks will often target processes like the onboarding of new customers, request-topay, invoicing, and initiation or execution of the payment.

If you think about it, there are commonly three steps customers will go through when making any kind of payment:

• Validation of the source when requesting the payment

• Validation of the payment requisition

• Validation of the transaction

Each of these steps in the process has vulnerabilities that criminals can exploit, although the greatest risk comes in the second and third steps of the payment process.

22 / Issue 33 XU Magazine

- the independent magazine for Xero users, by Xero users.

T

Tech companies often talk about time saving or the value they bring but in payments, security is the number one focus.

@Libeo_uk

Glen Foster, CMO & Managing Director, UK & Northern Europe, Libeo

For instance, fraud conducted at the invoicing stage often results in a so-called Authorised Push Payment (APP), as fraudulent invoicing can prompt the payer to initiate payments in good faith to criminals.

How does Libeo help reduce payment fraud?

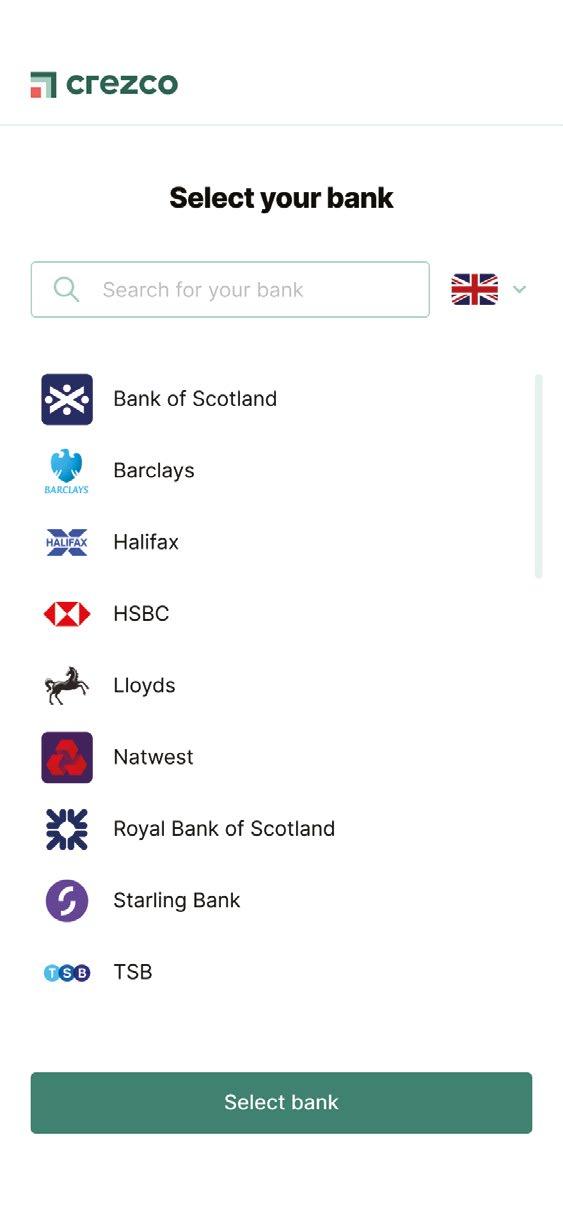

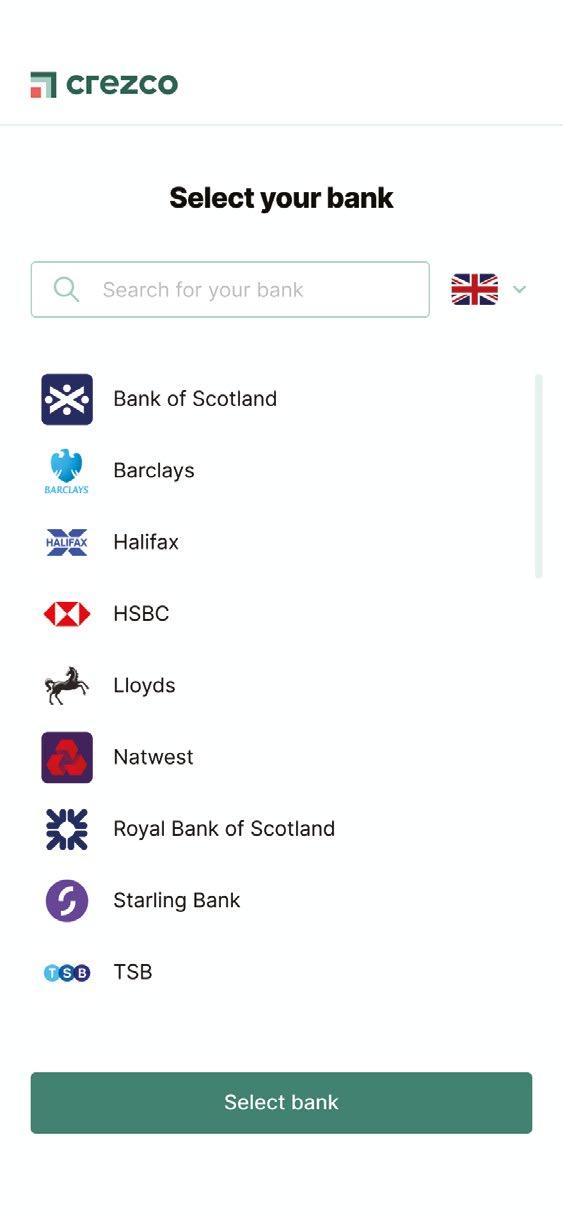

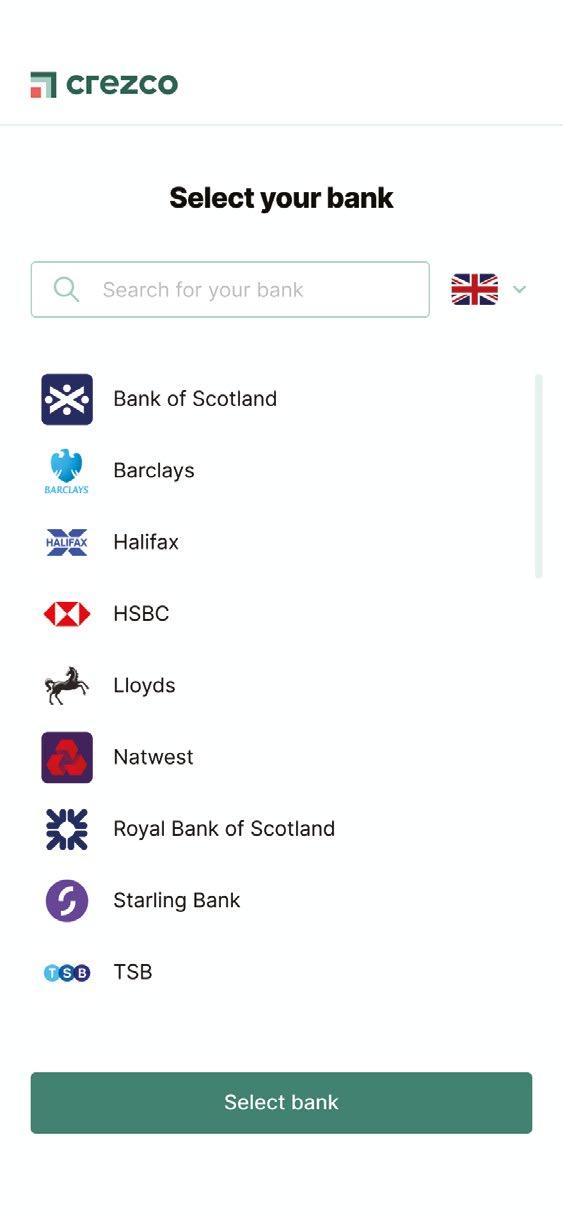

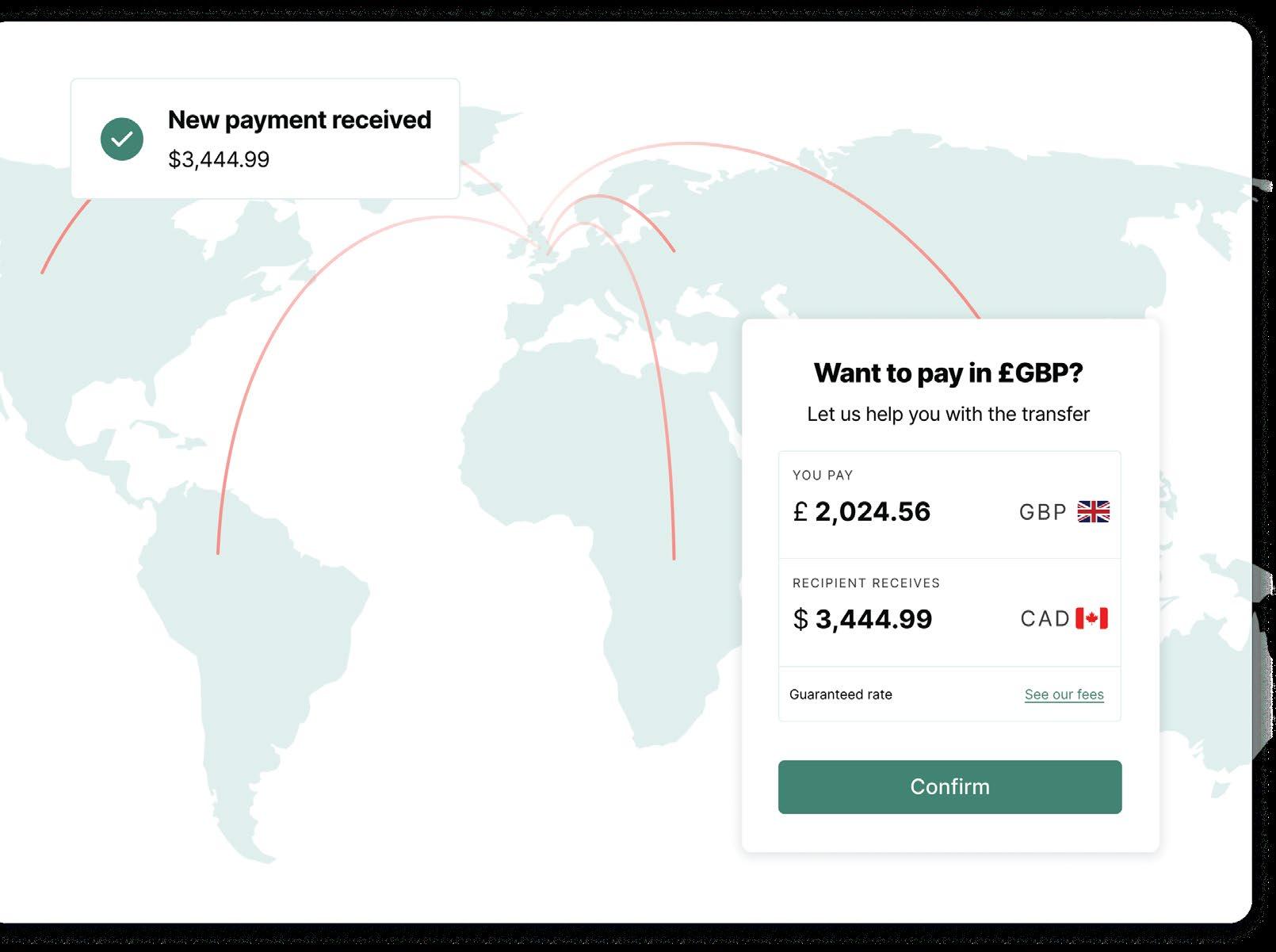

Firstly, we give our customers the choice of payment method, either Open Banking or a Libeo Wallet. We feel it’s important to offer a choice so customers can choose the right method for them.

We use artificial intelligence to flag erroneous transactions. These transactions are either just flagged or blocked if the activity looks suspicious. All payments are run through a fraud analysis based on multiple criteria to detect risky/unusual activity, such as IP addresses (different country or IP address compared to usual), the volume of payments, previous activity and destination. Every day, our Customer Success

Managers check high-risk of fraud transactions to ensure the validity of the payment. If the risk is identified as high, payment is blocked and the Customer Success Manager will make a call to check.

Modifying and validating the bank details can only be done by authorised people and these are then flagged if changed, meaning you have control over who can amend the most important of details.

User roles control who can see and do certain things. For example, we work with many accounting firms that don’t want to make the physical payment but do prepare the pay run for clients to log into Libeo and approve themselves.

The future of payment technology and Accountants & Bookkeepers

With the increased demand for businesses to outsource their full

accounting, we’ll only see more demand for pay-run support from accountants and bookkeepers, whether that be payroll or supplier payments. Having a solution in your corner that allows a secure and simple way to process payments or prepare payments for client approval gives you a great opportunity to deliver a new service but also one that adds real value to your clients.

FIND OUT MORE...

Find out more at: libeo.io/

Issue 33 / 23Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

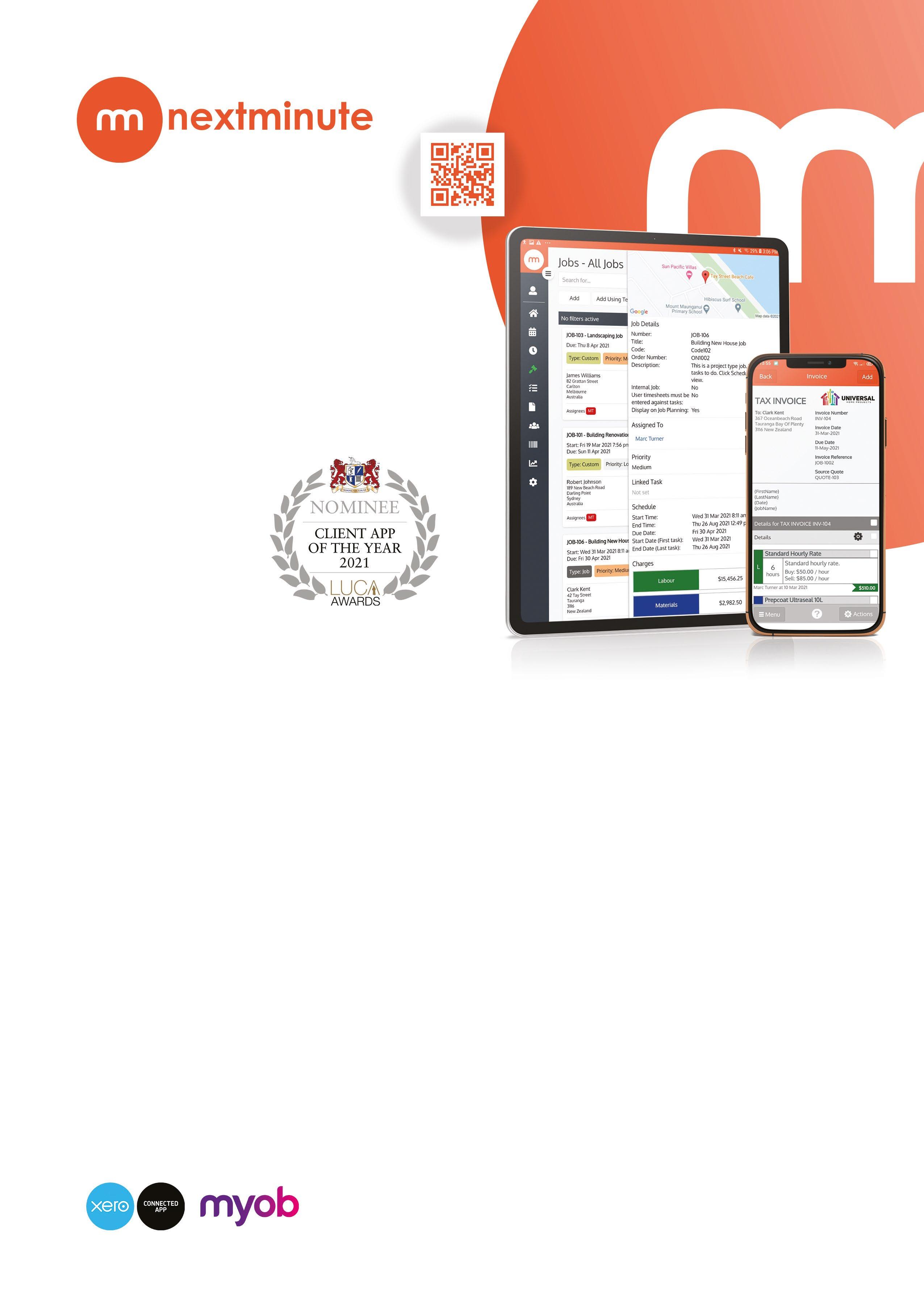

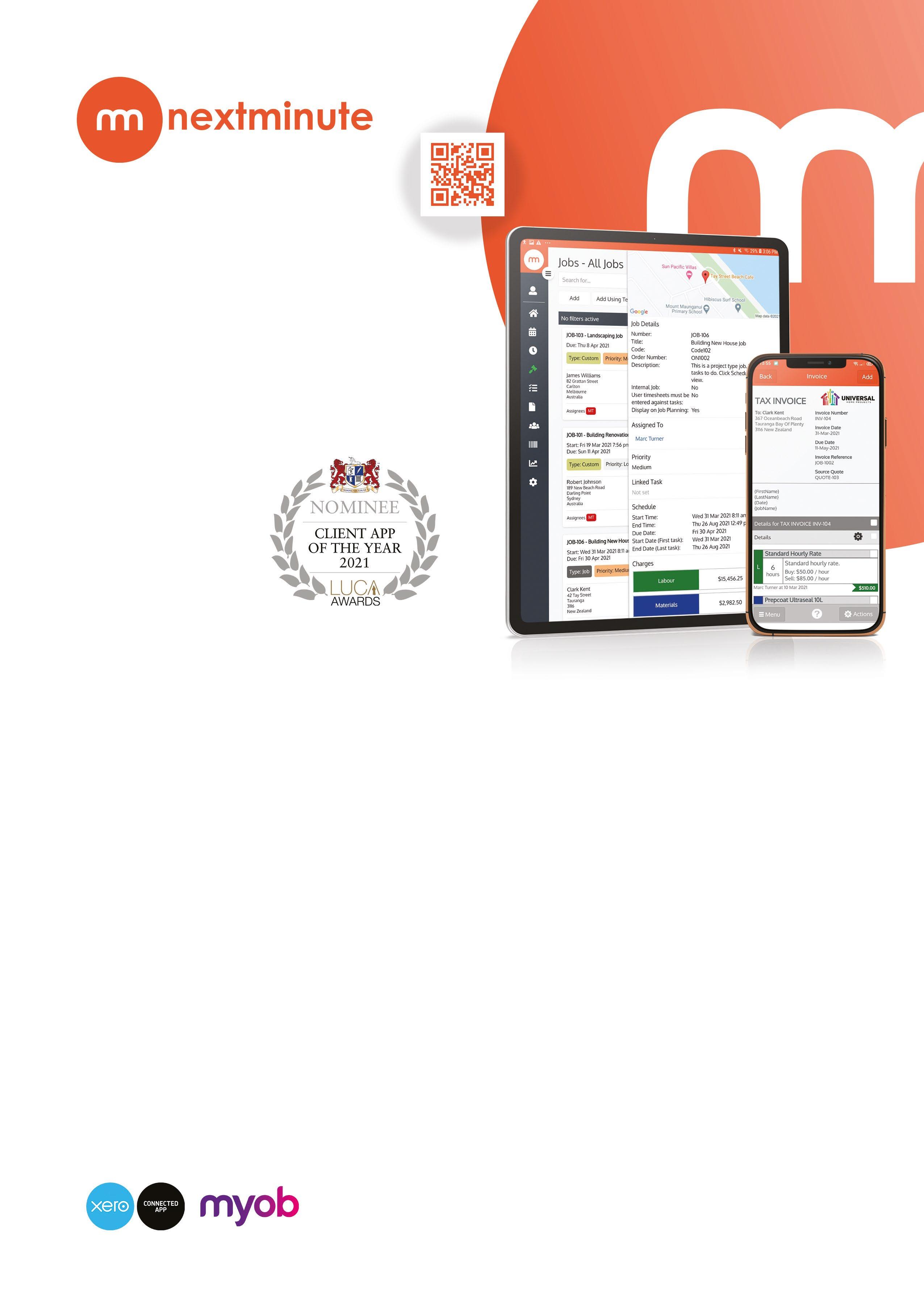

Why getting your construction business in order can boost your wellbeing

Helping to reduce stress for the construction industry by organising their work lives.

@NextMinuteApp

Michael Savanis, Chief Revenue Officer, NextMinute

Michael Savanis was appointed Chief Revenue Officer of NextMinute in 2022 and is responsible for leading the company’s global revenue operations functions along with Marketing, Customer Success and Support to accelerate market momentum. Michael has more than 25 year’s experience in executive B2B sales and leadership roles.

Knowing how your jobs are tracking, operationally and financially, means greater certainty about the state of your business.

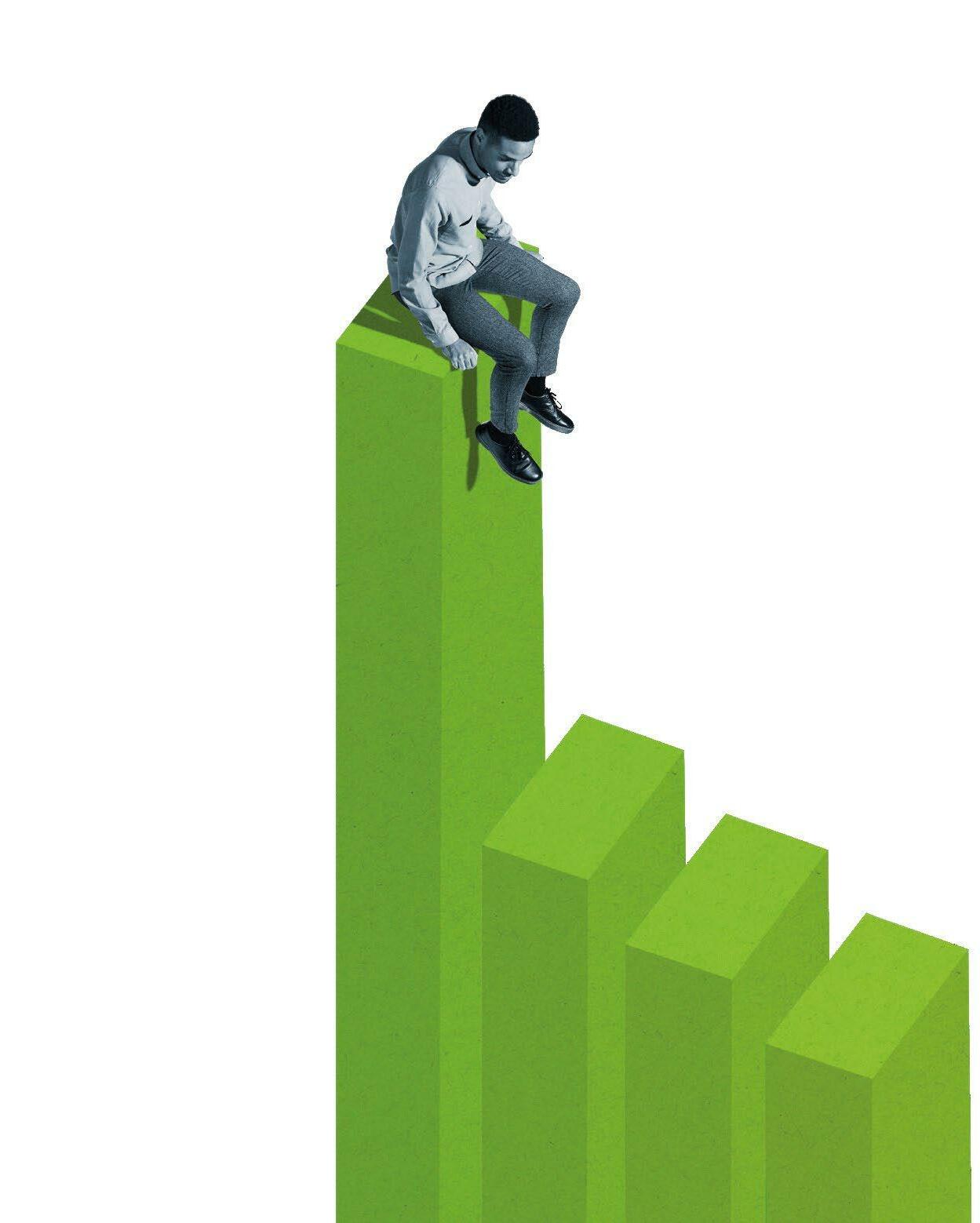

Since the COVID crisis struck, the construction sector has experienced the best and the worst of times.

Specifically in Australia, the federal government’s 2020 Home Builder subsidy scheme triggered a residential renovation boom which saw builders and trade businesses booked up months in advance.

The Housing Industry Association’s November 2021 Trade Report indicated the industry was experiencing its most significant skills shortage since the inception of the Report in 2003.

Widespread flooding across the east coast in early 2022 compounded the demand for services, such that it’s now a case of “good luck with that” for

anyone looking to have building work done in anything resembling a hurry.

That’s the upside.

And bust

The downside? Having a full order book is no longer the blessing that once it was. Keeping good workers on staff and on side has been a real challenge for many business owners.

So has sourcing materials. Australia is in the grip of its worst materials shortage in 40 years, with everything from timber and tiles to kitchen and bathroom fittings in short supply. In an industry where time is money, that’s no minor hiccup.

Prices have skyrocketed accordingly but passing on those increases to customers has been problematic for trade businesses that haven’t allowed for them in their quotes.

This confluence of factors has sent a string of builders, both large and mid-sized, to the

24 / Issue 33 XU Magazine - the independent magazine

for Xero users, by Xero users.

This article is

wall this year. Subcontractors inevitably share in the misery, when work has been carried out but the bills can’t be paid.

Take the pressure down

Against that backdrop, it’s no surprise many trade business owners are feeling like they’re up against it. More than 60 per cent say work pressures are their biggest stressor, according to OzHelp’s National Tradie Wellbeing Survey Results in January 2022. Family and relationship, and financial pressures come a close second and third.

But while there’s nothing you can do about supply chain disruption, national labour shortages and the other macro-economic factors making your business life trickier than you’d like it to be, there are steps you can take to dial down your stress levels.

Getting more organised on the operational front and achieving greater visibility of your financial position are two of them. Indeed, back-of-the-envelope quoting and seat-of-thepants accounting and cashflow management are still standard modi operandi for many. The net result? Unnecessary hours spent catching up on paper work over the weekend and lack of insight into how they’re tracking until jobs are done and dusted.

Tools to make the task easy

Fortunately, there are tools to help you get a handle on all these things, improve your cashflow and reduce the amount of overtime

you’ve been putting in.

Construction job management software that automates your quotes, timesheets, job scheduling, invoicing and back costing, and integrates seamlessly with your accounting package, can take the hard work and hassle out of running your business.

It makes it easy to price for profit, control your costs, and keep on top of compliance and financial management.

Once the exclusive province of commercial construction companies with sizeable ICT budgets and support teams, this technology is now affordable and easy to use, for every trade business owner with a smartphone.

Taking back your time

Knowing how your jobs are tracking, operationally and

financially, means fewer cost blow-outs and greater certainty about the state of your business.

And the hours you save each week can be spent doing more of the things that matter – whether that’s working on or in your business or taking some welldeserved time out with family and friends.

At a time when surviving and thriving in the construction sector is no easy matter, it’s an investment in your health, and the health of your business, you can ill afford not to make.

FIND OUT MORE...

Learn how to organise your residential construction business life with NextMinute: nextminute.com

Issue 33 / 25Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

“Knowing how your jobs are tracking means greater certainty about the state of your business”

26 / Issue 33 XU Magazine - the independent magazine for Xero users, by Xero users. Save time producing reports for your clients’ portfolios. CGT Reporter gives you all historical dividends, corporate actions and share price data for every listed company and trust in Australia since 1985. CCH iFirm CGT Reporter Comprehensive historical capital gains data dating back to 1985

Issue 33 / 27Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine It’s the “must-have” tool for any accountant dealing with investments. Unrivalled historical tax data Powerful portfolio worksheets Calculate and research on the run Well-connected in the cloud Request a Demo

Get ahead of the game with Xero friendly tech

Accountants should be no strangers to tech, in 2020 McKinsey reported that 66% of UK companies were piloting solutions to automate at least one business process. With such a huge opportunity, it’s no surprise that the number of finance automation options made available since then has grown significantly. This begs the question; how do you go about recommending the right technology to your clients and what’s in it for you?

Review the market regularly

There are so many more systems on offer to Xero users than ever before. The big names in bookkeeping technology from just 5 years ago are already being superseded when you compare what they offer to the feature rich systems available from newer and fast-growing SaaS providers. You only need to see some of the social media coverage of Accountex and similar events to see the rainbow of options revolutionising the lives of Finance Teams across the globe – or so they say. With free trials, online demos, and very little obligation required, it’s easy to explore what’s on offer.

Be less client led to boost client retention

It’s easy to be reactive when it comes to tech, a client is growing and those invoices are still being manually entered, time is tight, so they ask if there is a better way.

If you resort to recommending the same system you’re used to, your contingency based methods can see you left behind. The truth is, the different systems on offer all have slightly different features, even if they are trying to automate the same tasks. Being in the know about several options will not just allow you to recommend a more suitable system at a better price for your client, but it will empower you to be proactive, making you able to offer systems ahead of time, giving you a more credible reputation and in turn, better client retention.

Look for the option to reconcile their current systems

SaaS billing models, and direct Xero integrations make it easier than ever to change a system. Plus, getting multiple features (such as approval workflows and OCR invoice extraction) in one system means you don’t need a variety of tools any more.

Reconciling software for your clients can save money, drive efficiency and allow you to gain access to some of the newest features on offer, all for a single subscription. For example, with Zahara AP software (available via the Xero app store) you get an advanced, easy to use approval tool, OCR enabled invoice capture facility, plus a variety of enterprise class tools for budgeting, all in one place. Wouldn’t you rather have one system to manage your client’s documents instead of three?

Track the USPs of the systems you champion

All systems have key features that their competition may not offer, it’s important to explore and understand these. For example, a mobile app for approval on the go could be vital to clients with a remote workforce, or a PO facility with budget caps built in can help your clients tightly control spend. Aligning what a system offers with specific client needs can offer huge efficiencies and savings.

Help is for the little ones too

With the typical subscription models offered by many cloudbased systems, the amount you

28 / Issue 33 XU Magazine - the independent magazine

for Xero users, by Xero users.

How do you go about recommending the right technology to your clients, and what’s in it for you?

@zaharasoftware

Drew Murray, Head of Sales, Zahara

Drew is Head of Sales at Zahara and has spent almost a decade helping Finance Teams automate their expense and accounts payable processes.

This article is

Automation is a huge opportunity for accountants, are you making the most of it?

pay is often reflected by the volume of usage, so even the smallest of clients can get a fully functional solution at an entry level price.

Leverage a partner deal

As an accountant you have a lot more power than you may realise. The relationship you have built with your clients is highly sort after by the software providers referred to above. Explore partner programs, understand discounts for referrals and ask for more in exchange for multiple

recommendations. As many of the more widely used software options out there are slow to wake up to the increasingly competitive market, a great deal may be there to be had.

Conclusion

With millennials taking up more

never been easier

The battle for talent continues, and automation

an alternative to adding resource, is proving a bigger win than ever for many. This could be

a huge opportunity for you, and you need to be asking, are your clients expecting more already?

Zahara is a fully automated AP solution.

Issue 33 / 29Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

decision-making positions, technology has

to implement.

as

Search Zahara in the Xero app store or visit out website at: zaharasoftware.com/ Find out more... Dedicated Invoice Inbox OCR Invoice Capture Tailored Approval Workflows Easy to Use PO System Approve PO’s & Invoice Via Mobile App Auto Match Invoice to PO’s Coding to Line Item Level Auto Detect Duplicate Invoices Zahara Features You Wish Your Finance System Had OCR Capture Tool Approval workflow tool

Our Experience of SatagoPink Pig

Leigh has been in, around and serving the accountancy profession for over 20 years. From working in practice, to talking about marketing strategies over dining tables, to leading organisational change over boardroom tables and everything in between.

Leigh is Head of Accounting Partnerships at Satago - where the team helps firms to support their clients whilst finding new opportunities to grow fees.

hat made Pink Pig look again at Satago?

Although Satago was on my radar, because we’d been using Chaser it wasn’t something that was on my immediate radar.

Then I saw a post from a friend recommending you. I knew he was with Chaser before as well, so I was like, “Oh, what’s going on there, then?”

I spoke to him and asked him his reasons and what he thought. He just absolutely raved about you. So I was like, “Right, let’s have a chat”.

What goals did Pink Pig have?

I wanted to understand what we could get out the platform, how it could help us. And I do think credit control is quite a big and important service to our firm, but we’d never been able to get it off the ground before.

So I thought it’s worth trying a different tact. And the pricing was better, as well, so that helped!

I just wanted to give it a go. See

how it worked for us first, then see how we could potentially roll it out to clients and start making some money out of it, which is something we never managed to do before.

What have you done in your first two months as a Satago partner?

I’ve got my own practice connected. I’ve rejigged the templates to our tone of voice. We’ve got that going and it’s working.

We’ve also connected all of our clients, so we can see how much they’ve got outstanding as well.

We can easily pinpoint which clients have potentially got an issue, especially in line with some of the things they’ve been saying to us as well.

We’ve started reaching out to a couple of clients - the ones we feel would really benefit. So that’s going well.

I think one of the things I struggled with before was how to price [Credit control services] and how to set it up as a service. So we’ve spent some time with Seni [Cheryl’s Account Manager] to look at that. The Credit Control as a Service Handbook has really helped to pinpoint our service levels and the options we’ve got available.

Did the tools in Satago tell you there were clients with that need, or did you know that already?

We kind of knew it anyway because we talk to our clients and review them, obviously.

But I guess clients don’t necessarily see it as an issue - they just see it as part of business.

With clients not moaning about it - and when we’ve spoken to them they’ve just batted it away, it’s not something then that we would really prioritise.

- the independent magazine for Xero users, by Xero users.

30 / Issue 33 XU Magazine

More and more firms are looking again at what Satago can do for them and for their clients.

@SatagoHQ

Leigh Stallard, Head of Accounting Partnerships, Satago

W

Here’s what Cheryl Sharp – CEO of Pink Pig Financials – had to say about her experience as a new Satago partner:

This article is

“It’s really helped us to not just ‘throw spaghetti’ and send stuff to all our clients.”

But seeing it there more in black and white and seeing risk structure and everythingactually, we need to be a bit more authoritative here.

We need to say, “No, you have got an issue. You don’t think is a problem, but it is a problem”.

What advice would you give to people that are thinking about getting started with Satago?

I think the first thing is not to panic, not to stress. It’s something new, but it is going to be worth it.

Reach out to your account manager and really make the most of them because they’ve been brilliant with being proactive, putting calls in the diary to check on our progress and making sure that we’re using the platform, which I think is really good.

How many times do you sign up for software and then you are like, “I’ll get round to it another day” and never do it?

The Risk Insights and the Portfolio Overview have been brilliant because it’s really helped us to not just ‘throw spaghetti’ and send stuff out to all of our clients. It’s enabled us to pinpoint which ones to start with.

So we’ll start small, build our confidence. And then we’re going to do a big launch and a big campaign. We’ll tell all of our clients, but it’s been nice to be able to start small and pinpoint those that we really think will benefit the most.

What’s next?

I feel like we’ve got a really viable service that we can offer clients,

which they never really thought of before.

We’ve put our service blog together and our service page on our website, so we’ve got that ready to send out to clients.

We’re also putting together a webinar for clients and prospects to talk about getting paid. Something that’s going to be really valuable for clients and potential clients.

I think having a paid webinar will make it more valuable because we’re going to put in more things to make it more valuable, but it’ll also get commitment from people to actually watch it.

And then afterwards you’ve got that passive income - we’re going to put it on a gated page.

I know it’s not going to make us millions or anything, but it’s “Every little helps”.

And that is the goal, isn’t it? To have your business making money while you sleep.

Accountants can struggle with the idea of selling, but you can’t just keep adding free stuff, can you?

No, you can’t. I’m also a real big believer that you don’t have apps for apps sake. It’s got to solve a problem and it’s got to make your life easier because otherwise, what’s the point?

It’s all about taking the processes and services you’ve already got and making them better. Not just adding something for the sake of adding something.

It’s making your service better or making your clients’ lives easier or your life easier. And that’s what you’re using it for.

And I really do believe that this is something that can help make our clients lives better by not being so stressed about people owing them money.

Thank you to Cheryl for sharing her experience.

Issue 33 / 31Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Watch the full interview with Cheryl - AND our latest interview with Stephen Paul from Valued Accounting at: satago.com/XU33 FIND OUT MORE... Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX!

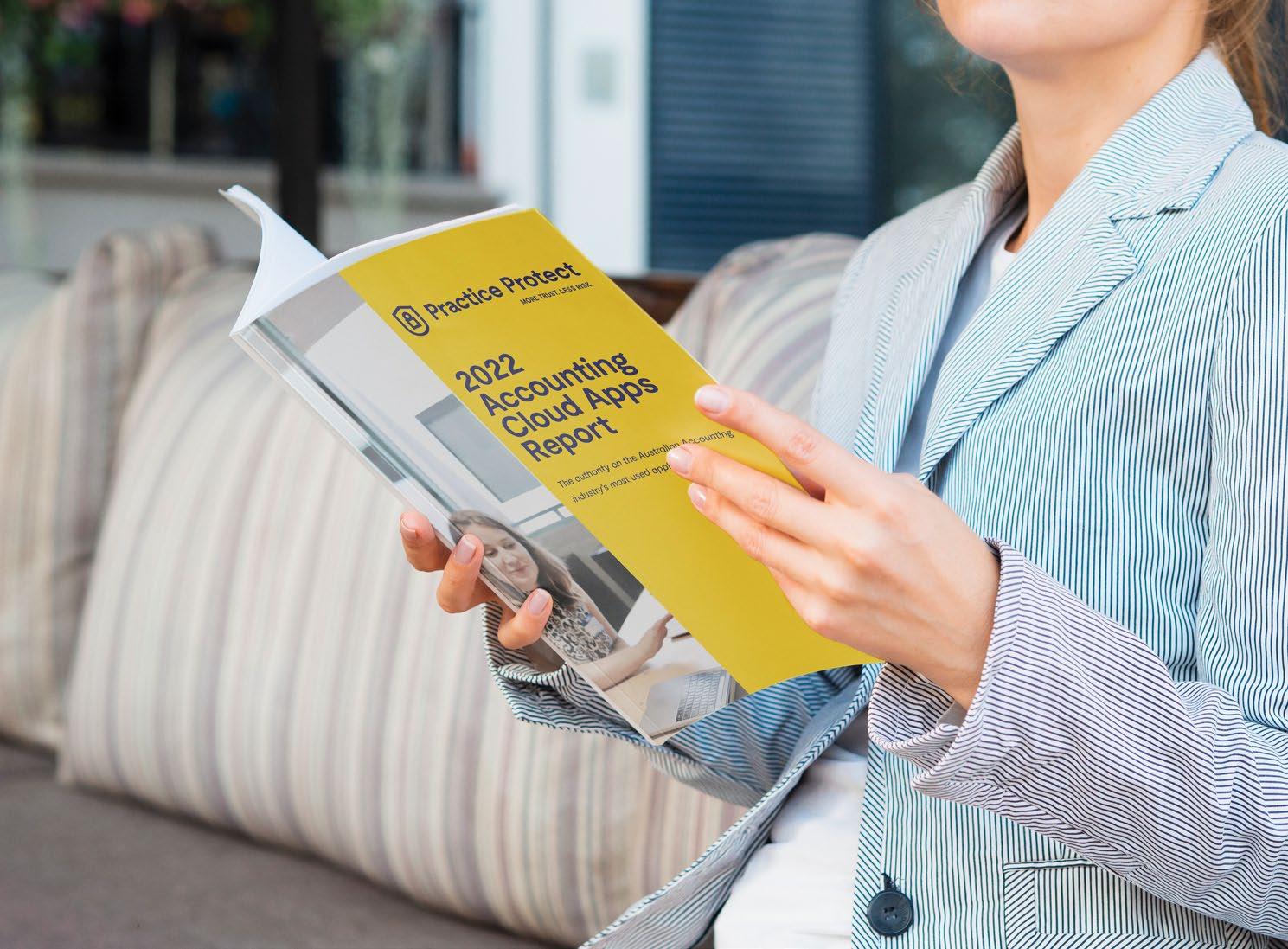

The 2022 Accounting Cloud Apps Report is out!

Providing the definitive answer to the most popular accounting apps

Jon Melloy, Head of Growth, Practice Protect

Jon Melloy serves as the Head of Growth for Practice Protect, the leading cybersecurity platform for accountants worldwide. With an extensive background in data security and the accounting industry, Jon works with accountants daily to ensure that their people, process, and software are positioned for security. Jon brings the war stories and mountain top wins from helping thousands of accounting firms in almost every geography upgrade their digital security.

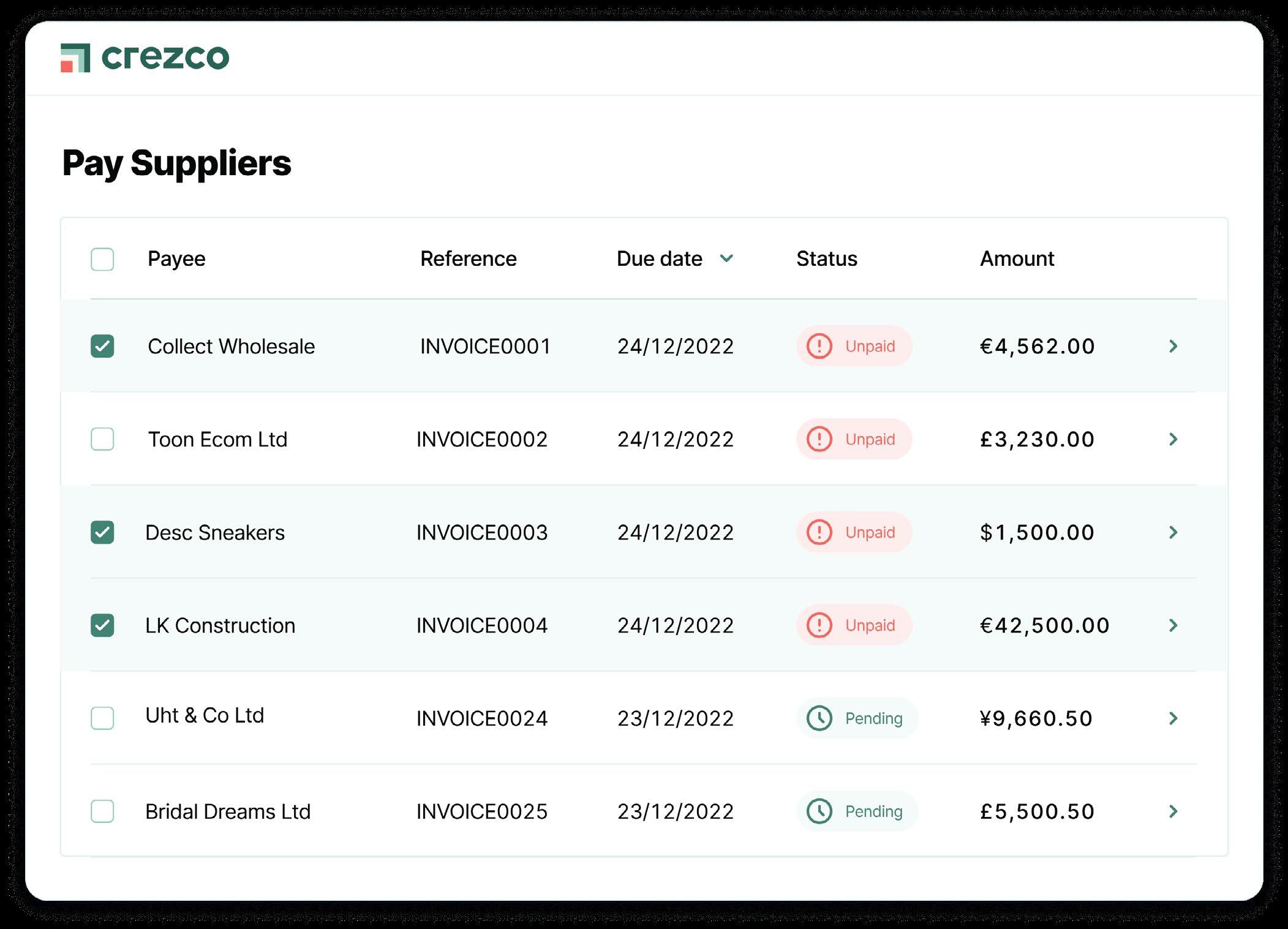

The 2022 Accounting Cloud Apps Report presented by Practice Protect is back for its second year.

We are excited to be launching the Practice Protect 2022 Accounting Cloud Apps Report. This report is back for its second edition after we received a lot of positive feedback from the accounting community around the 2021 edition.

The goal of this report is to provide a definitive answer to the most popular apps among Australian accounting and bookkeeping firms. Readers can then use the report as a shortlist of battle-tested

software that they can trial to improve processes at their firms.

The backbone of the report is the quality of the source data which is aggregated and anonymised data from 1,300 Australian accounting and bookkeeping firms on the Practice Protect platform.

In order to turn the raw data into value insights, we broke accounting technology down into practical categories and then ranked apps in those categories and provided commentary on app development and category trends. Categories vary from expense management to proposal software, practice apps, reporting, practice management, electronic signing and many more.

The benefit of publishing this report year on year is that we can track trend data between years, seeing where category

32 / Issue 33 XU Magazine - the independent magazine

for Xero users, by Xero users.

This article is

@PracProtect

“Readers can use the report as a shortlist of battletested software that they can trial to improve processes at their firms.”

growth and decline exists, and what innovations are having the fastest rate of adoption among accountants and bookkeepers.

One big takeaway from this report is that in the past 12 months, Australian accounting and bookkeeping firms have increased their investment in technology to improve productivity. They have done the calculations and recognised that software can reduce time to complete jobs and increase throughput.

This increase in technology investment is clearly seen with several categories experiencing

innovation and significant growth. Some of the fastest growing areas include proposal software, which increases the speed of onboarding and automates cash collection; electronic signature software, which has become far more widely accepted since the pandemic forced everyone to work remotely; and SMSF and corporate compliance, essential software if you’re trying to scale this service.

The two most interesting areas to watch in the next 12 months are practice management and practice tools. Both categories have a number of challengers bringing new ideas and

innovations, and in the former there’s also a lot of M&A.

With accountants and bookkeepers presented with more cloud-based software choices than ever before, our hope is that firms can use the data driven insights from this report to drive change and process efficiencies in their firms.

Download the report for free: practiceprotect.

Issue 33 / 33Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

com/2022report FIND OUT MORE...

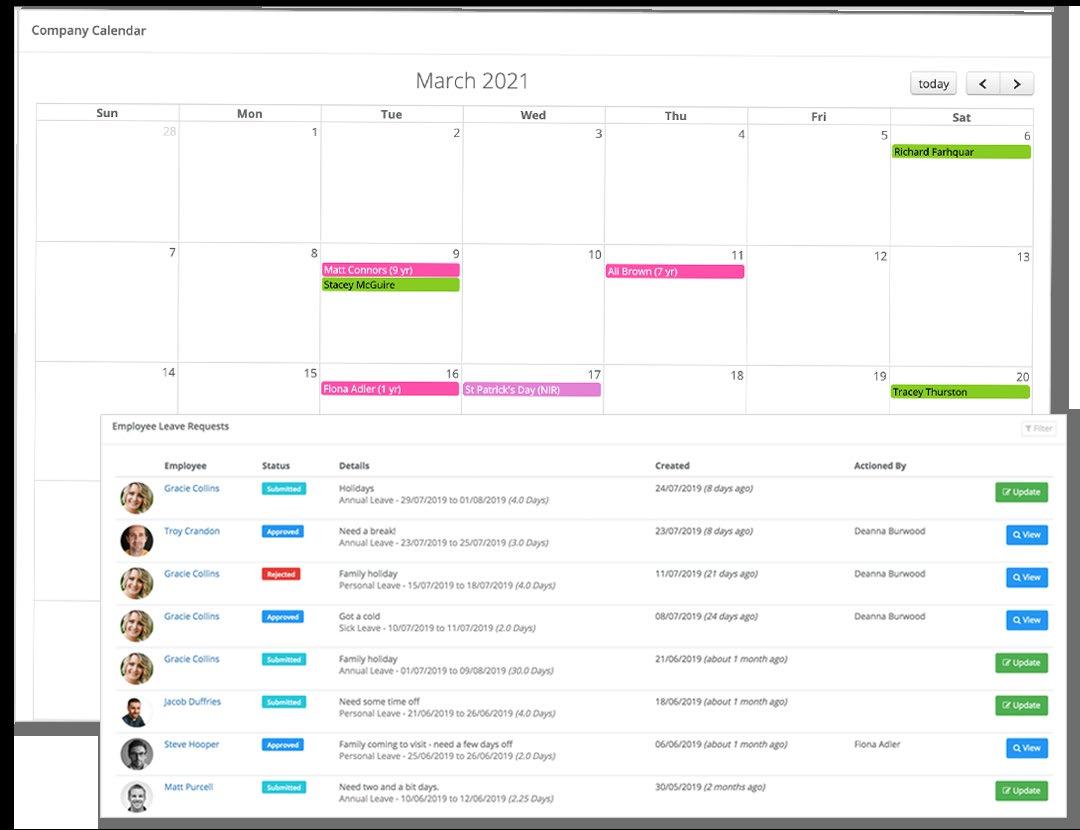

MTD for ITSA: How practice management software will help

Despite delays and speculation, the impending industry overhaul is absolutely on its way. In this guide, we take a look at how practice management software will help you handle MTD for ITSA.

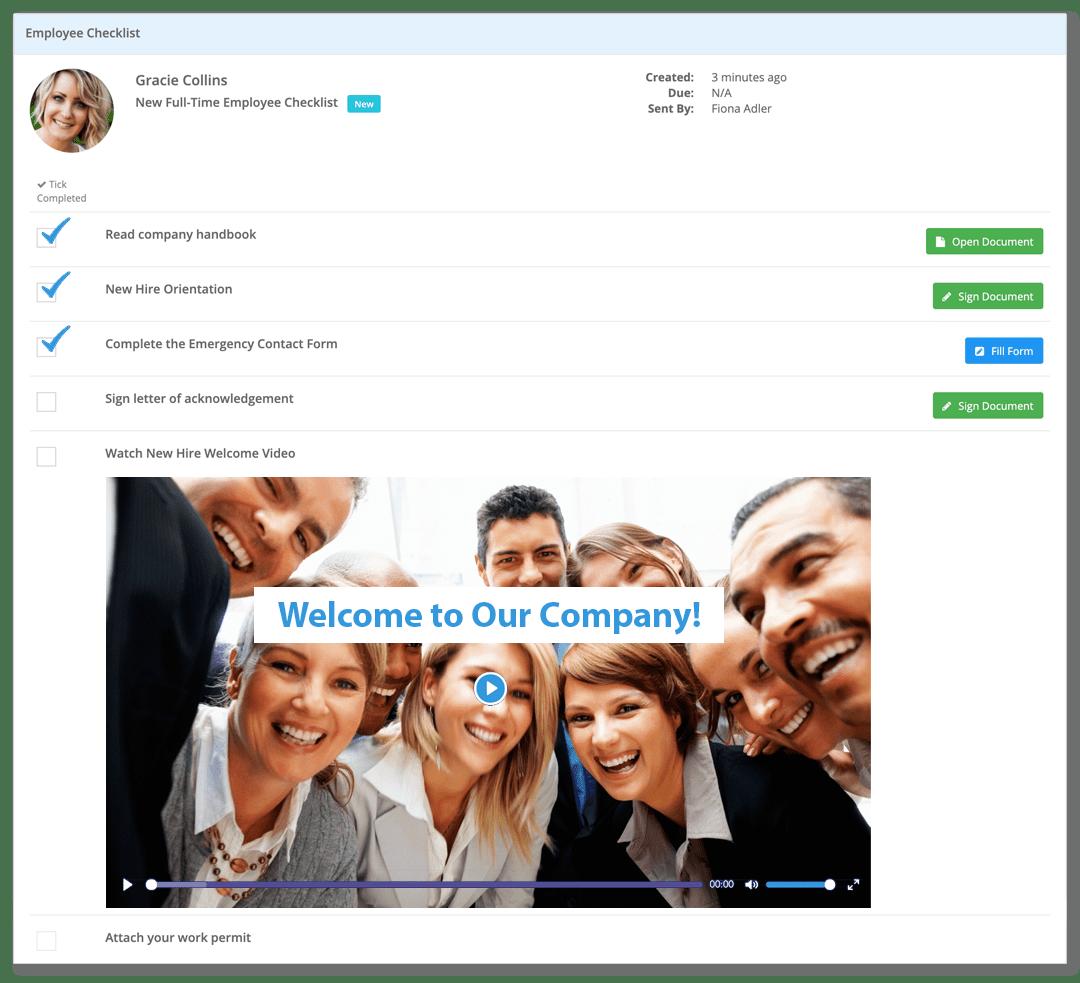

Task management and workflow

The increased workload of MTD for ITSA necessitates organisation across your whole team. Practice management software provides comprehensive task management

that means you can forget endless to-do lists and reshuffling your day. Using your clients’ period end dates and deadlines, AM automatically generates task lists for each person on your team. You can set internal target dates and create your own tasks for any non-compliance work. Break tasks down into subtasks and assign them to individual team members.

Technology adoption: Old dogs, new tricks

MTD for ITSA is also going to

@accountancymgr

Kevin has over 20 years of experience in the accounting software industry, spending 11 of those at FreeAgent. He first joined the company in 2021 as a non-executive director of AccountancyManager. Since the acquisition, Kevin was made COO of Bright and has now taken over as CEO.

increase the workload of your clients. They’ll need to get into the habit of submitting information regularly - just like your team will need to. It will take time for your clients (and your team) to adapt. The upheaval requires you to take a step back and look at the big picture. This isn’t just about specific MTD work; it’s about reviewing your entire process to make the changes feasible. A solid digital set up for you and your clients will bring simplicity. It’ll ease your workload, but also make technology the norm.

34 / Issue 33 XU Magazine - the independent

magazine for Xero users, by Xero users.

Kevin McCallum, CEO, Bright

This article is

MTD for ITSA is the biggest shake up to the administrative foundation of the UK tax system since self assessment.

Communication: keeping everyone on the same (paperless) page

With the shift from one submission to four, clients are going to have to engage with you, the accountant, more. Many accountants don’t communicate with their clients on a regular basis, because they simply don’t need to. This won’t be the case anymore. Make sure that as well as clarifying new procedures and introducing technology, you also outline the benefits of the new system.

Practice management software makes it easy to communicate with your clients regularly. Automatic communication features plus time-stamped records of all correspondence keep everyone in the loop. It means any member of your team can pick up the client work and provide a seamless experience. It’ll also protect your liability - when emails that have been opened by clients are tagged, you can guarantee that your

practice has followed the correct procedures if any disputes arise.

Pricing your services: making data-based decisions

There’s no denying it: if you’re doing more work for your clients, it’s going to cost more. Many practices will need to review fee structures to ensure that additional work and additional software licences are reflected in service prices. Don’t be afraid to charge more if you need to. But how do you decide price points?

Practice management software includes time tracking tools so that you can analyse staff costs against specific client work. Keep an eye on productivity, track profitability and see where profits are coming from.

Many firms recognise MTD for ITSA as an opportunity to move clients to regular billing. Historically, annual billing on completing a job has been the industry standard, but this hasn’t always been to the benefit of an

accountant’s cash flow. In the future you’ll be providing services on a more regular basis and you’ll be communicating on a more regular basis. This gives you an opportunity to bill on a more regular basis.

Discover AccountancyManager

The quickest way to find out how practice management software can help your firm tackle MTD for ITSA is with a free AM demo. Discover how our fullycustomisable system works in a way that’s best suited to the needs of your firm.

FIND OUT MORE...

Book a demo: bright.com/

Issue 33 / 35Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Goodbye manual data entry. Hello AutoEntry.

36 / Issue 33 XU Magazine - the independent magazine for Xero users, by Xero users.

Issue 33 / 37Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine www.autoentry.com | +44 0203 3933058 As easy as 1, 2, 3 Simply snap, scan, or email invoices, receipts, and/or bank statements. Let AutoEntry by Sage do the rest by automatically categorising data. Publish directly to the accounting software or export the data. 1. 2. 3. Discover the fastest way to capture, categorise, and publish data to accounting software. Get started in minutes with a free account. There's no hidden fees and you can cancel whenever you want. Get 3 months free Integrates with Xero Based on 1,300+ reviews Limited time offer:

XU Magazine - the independent magazine for Xero users, by Xero users.

Chris O’Neill CGO, Xero

XU Magazine - the independent magazine for Xero users, by Xero users.

Chris O’Neill CGO, Xero

This article is

XU: So, five months in the job. How have you found it at Xero so far?

Obviously, you’ve got lots of experience at different types of corporations, so was it what you expected? How do you find it compared to the other places you’ve worked?

CO: It’s a short answer: it’s been great. I’ve been traveling all over the place. I’ve been down under twice, London two times, Canada, all across the United States. My initial focus is to get to know the teams, get to know our partners, get to know our customers and really listen and learn. What I’ve heard is that the potential is vast, probably bigger than I could have imagined. There’s genuine love and trust amongst the community. You can feel it here at Xerocon, so that’s really cool and special. We can talk about how hard that is to create relative to other places.

I’ve been fortunate to be part of great companies, great brands, but the unique bond we have in our community is very, very special and rare. We have incredible talent in all pockets of the world that have been on their journey, some for a long time. Many are actually newer to Xero, so it’s been really interesting to watch our growth. I have a lot more to learn for sure, but I’ve enjoyed spending time with the team and partners and customers. It’s starting to give me insight into what sorts of things are working well, and how we adjust our strategies going forward.

a good vibe across the two. When

I was considering joining, Steve Vamos mentioned Xerocon. I was aware I’d never been to one, but he said just show up at one and you’ll get it. Part of it is the fact that we’re together again in real life, which is special in its own right, but it goes way beyond that. You can just feel it. You talk to people, they relay their stories, they talk about the impact that Xero has had on them, or more generally, the impact the cloud has had on their life.

Xero is a catalyst to do that, and you hear stories like yesterday with small business customer Rashida Gayle and her accountant, Miguel Octre-Marshall, which was just a special kind of combination and really a microcosm of the community right there on stage. Xerocons are a great opportunity for us to hear feedback.

It’s amazing to me that people travel from all over the world. They come and they’re really open. They trust us, they share feedback: Big, small, what’s working, what’s not, and we take it in. That doesn’t mean we can act on everything of course, but that people take the time and energy to be so thoughtful in their feedback is amazing. It’s just a wonderful event.

XU: One of the things that you’re spearheading is the applications and services division. Could you unpack what that actually is and what it means?

and APIs that allow data to flow in and flow out of Xero. Now think about, how do you stay organized and compliant? That’s the job that needs to be done. There’s everchanging laws, regulations and all sorts of things. Staying ahead of that has a degree of energy and investments required. It’s quite significant actually.