Issue 35 / 1 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine magazine The independent news source for users of accounting apps & their ecosystems ISSUE 35 The next wave of global growth for ApprovalMax What can their evolution teach us about innovation? Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES 9 772054 722009 35 ISSN 2054-7226 COVER STORY

2 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems Same Same. Bun Difeeeent

Issue 35 / 3 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Same. Difeeeent

Issue 35

Main Contacts -

CEO: David Hassall (Co-Founder)

Managing Editor:

Wesley Cornell (Co-Founder)

Director of Strategic Partnerships: Alex Newson

Design & Communications

Manager:

Bethany Fulks

Creative Assistants:

Hebe Vermeulen, Robyn Consterdine

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

4 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems magazine

The independent news source for users of accounting apps & their ecosystems 8 COVER STORY ApprovalMax The next wave of global growth for ApprovalMax 14 WhisperClaims The accountant’s gamechanging guide to preparing R&D tax claims 16 INTERVIEW Dext Q&A with Sabby Gill, Chief Executive Officer of Dext 20 Pixie 5 biggest trends to come out of Accountex 2023 24 vWork Power up your deliveryintegrating vWork with Xero 28 HR Partner 3 HR Metrics You Need to Track 32 Datamolino AI: Enhancing Accountancy’s Human Touch 34 INTERVIEW BlueRock Q&A with Peter Lalor, Founder & Chief Executive Officer of BlueRock Welcome to issue 35... 40 AutoEntry The Well-Trained Client: The First Step for Real-Time Accounting 44 Wolters Kluwer AsiaPacific Working smarter during tax season 48 Spotlight Reporting Top 5 trends shaping accountancy in 2023 52 EVENTS Institute for Certified Bookkeepers Join the Inspire Tour 2023: FutureProof Your Bookkeeping Practice Join our newsletter for regular updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! 8 The next wave of global growth for 68

Issue 35 / 5 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine INTERVIEWS... 54 INTERVIEW Joiin Q&A with Paul Shipway, Chief Commercial Officer of Joiin 58 AdvanceTrack Conference kick-off 60 Bright Let your clients do the talking: tips for marketing success 64 CASE STUDY Tidy The Dull, Dirty, and Dangerous: How Autoline is Revolutionising it all 68 EVENTS The Business Show The Business Show: The World’s Biggest Business Event 72 ExpenseOnDemand Why the human touch is still an essential part of global business 76 INTERVIEW Capium Q&A with Tushir Patel, CoFounder of Capium 78 Dext Beyond the Basics DID YOU KNOW? Look out for any article that shows the CPD Certified logo. It has been approved to count towards your CPD points! XU are now a CPD Corporate Member We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register. 82 CloudPayroll STP and Payroll for Withholding Payer Number (WPN) 86 Wolters Kluwer Tax & Accounting UK The Future of Financial Reporting and Forecasting in Modern Accountancy 92 Institute for Certified Bookkeepers Australia Is not engaging in the latest tech holding you back? Sabby Gill Dext, Chief Executive Officer 16 Peter Lalor BlueRock, Founder & CEO Paul Shipway Joiin, Chief Commercial Officer 34 54 52 20

98 EVENTS Accounting & Finance Show Asia Asia’a largest technology-centric event for accountants and finance professionals returns 102 UPDATES FROM XERO 104 NEW TO THE XERO APP MARKETPLACE INTERVIEWS... Dermot Hamblin AdvanceTrack, Sales Director 58 Tushir Patel Capium, Co-Founder 76 98 64 106 EVENTS Accountex Accountex summit Manchester returns for its fifth year 108 FOCUS: MENTAL HEALTH What is mental health? 112 UPDATES & NEW RELEASES 114 CLASSIFIEDS 118 CASTAWAY Forecasting Process 120 AND FINALLY... Xero’s FY 2023 Financial Results 120

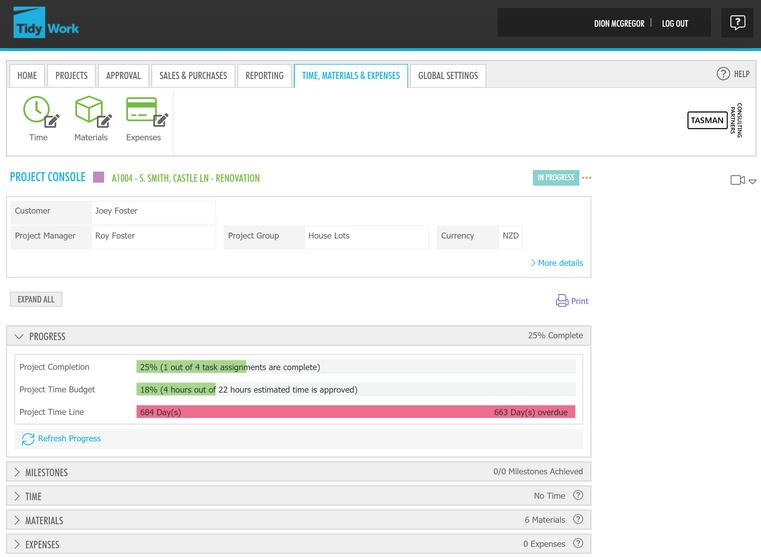

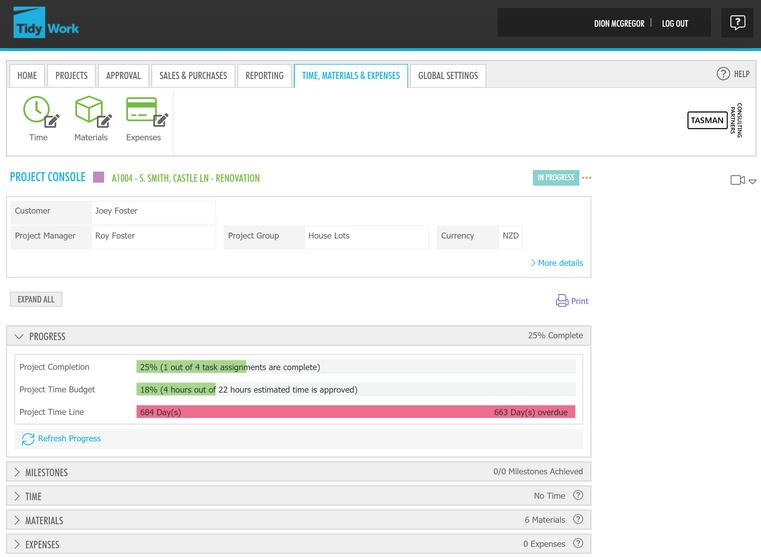

THE WORKFLOWMAX

ALTERNATIVE Project Scheduling

Create and manage project schedules to always stay on top of deadlines. Calendar view makes it easy to see what/when tasks are due, facilitating delivery of projects on time.

"

Real-Time Insights Custom Quoting

Track project progress, identify bottlenecks and manage resources. Customisable reports provide project performance insights, enabling data-driven decision-making.

I've done half a dozen quotes using TidyWork and we have won all of them I can't believe how long it used to take before. We get a better breakdown on our projects - nothing is hidden.

Produce detailed quotes with custom templates. Include branding, pricing with multiple currencies, and terms to ensure quotes are professional, accurate and consistent.

Issue 35 / 7 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Start your 21-day FREE trial today! tidyinternational.com/trial

"

Matthew Garvey FNE Engineering

The next wave of global growth for

8 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems Cover Story This article is

What can their evolution teach us about innovation?

ApprovalMax

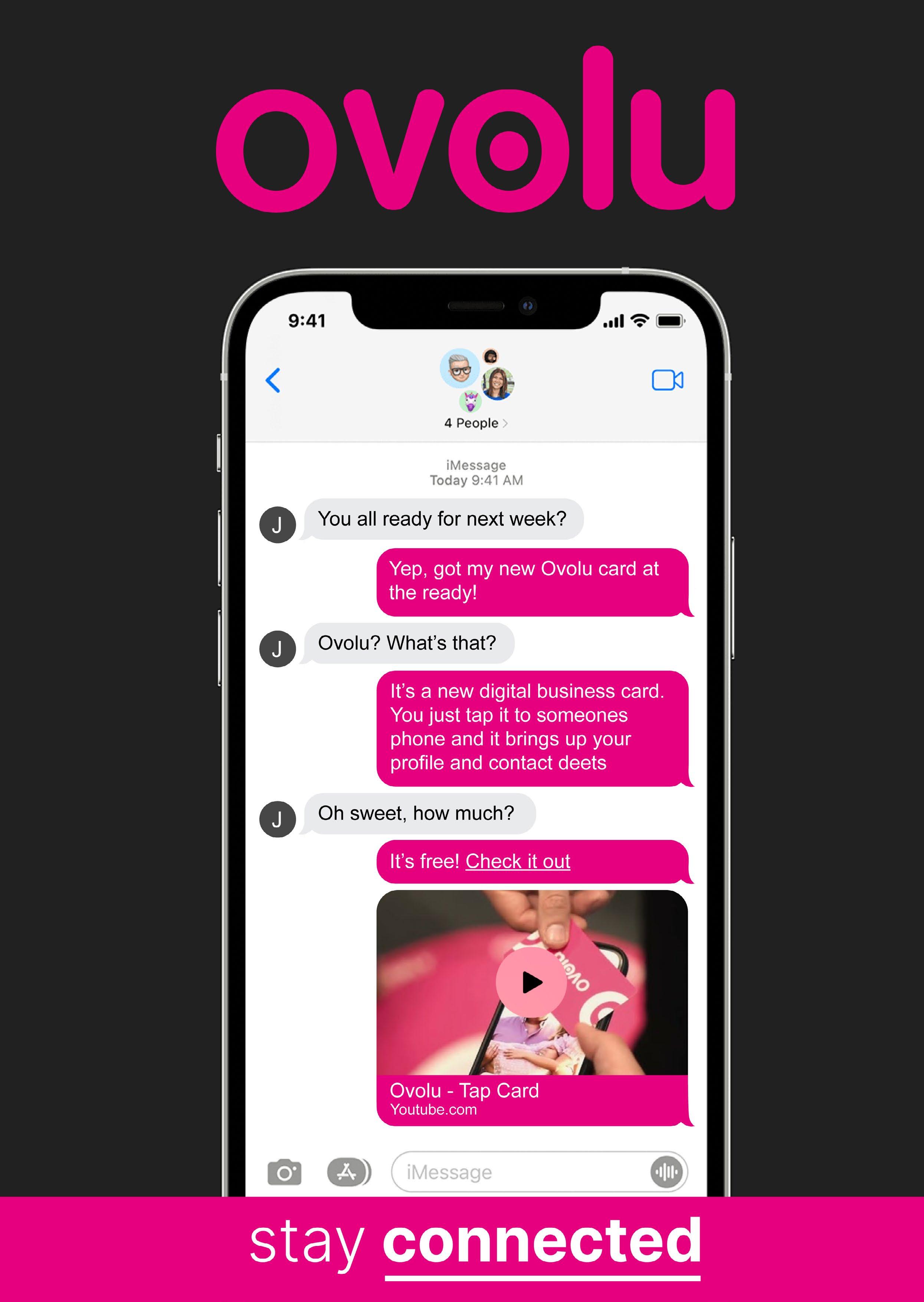

ApprovalMax is an awardwinning SaaS company that helps businesses and accounting firms implement robust financial controls. Their product automates the entire approval process to save time, money, and manual effort. Headquartered in the UK, they operate across global markets and employ staff in over 30 countries.

att leads the global sales and customer success teams. His role is pivotal to ensure ApprovalMax continues to grow in the Xero ecosystem and the company’s global customer base continues to get value from the product.

Kylie: Welcome to the team, Matt – we’re so pleased that you’ve joined ApprovalMax at such an exciting time of growth! We currently have just over 100 team members who are spread across 30 different countries. What inspired you to join ApprovalMax?

Matt: I’m really excited to be joining the team! The growth to-date speaks for itself, picking up several Xero awards and being shortlisted for others recently in several geographies is a testament to the great work the team is doing. Speaking with the Founders highlighted the exciting new product developments that are planned to continue this growth trajectory and I like that we are expanding into new markets with a goal of being an end-to-end accounts payable solution of choice.

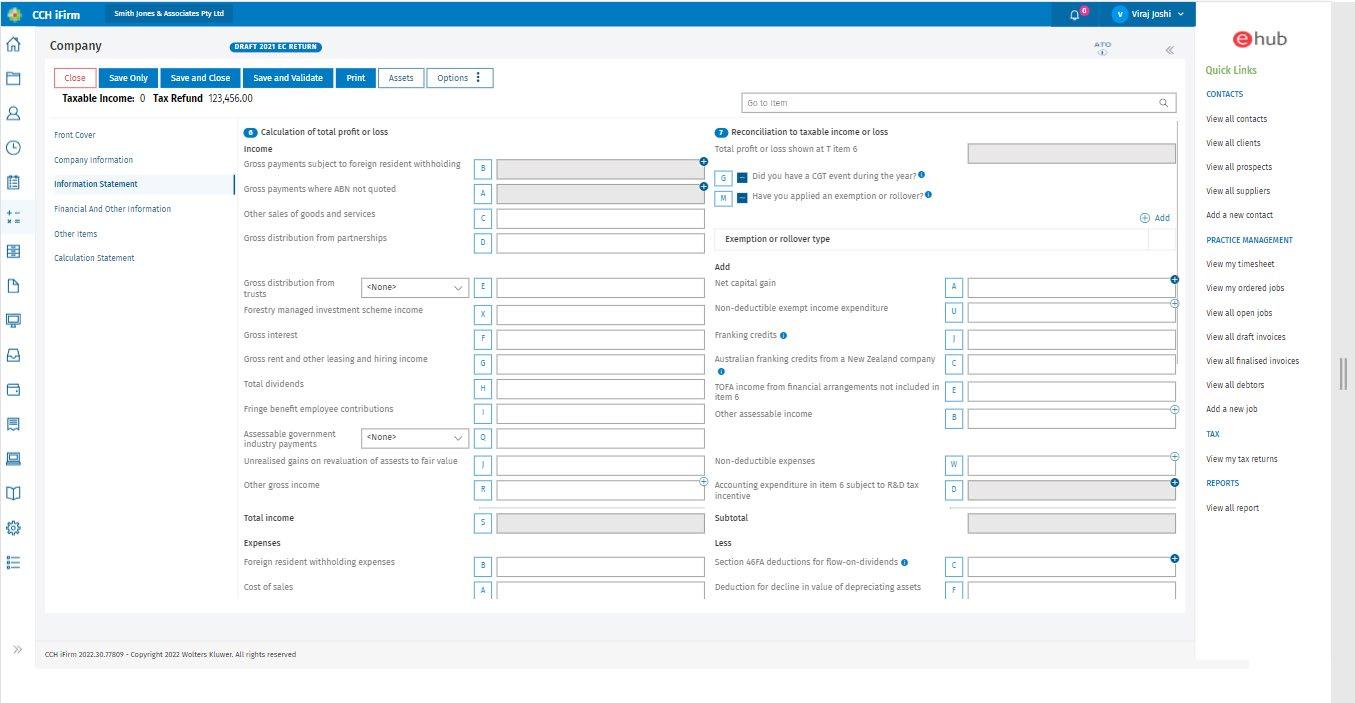

Having come from another company within the Xero ecosystem, I was already familiar with ApprovalMax’s great reputation and best-in-class product. I’m glad I get to keep working in the cloud accounting industry because it’s great to be part of a mission where we help accountants, bookkeepers, and SMEs worldwide have a tangible impact on society.

Kylie: We definitely have a ripple effect when it comes to our

impact and the communities we serve, so you’ve joined the right team. Tell me about your background and what I’d find out about you if I was to look on your LinkedIn profile.

Matt: I originally have a legal background, working in-house for a small-cap listed technology company in the UK. I transferred internally to head up their customer experience department after realising that I enjoy being in the driver’s seat and making

Issue 35 / 9 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine @ApprovalMax

Cover Story

M

Learn what’s new at ApprovalMax and how our team is building the product that helps businesses and accountants go strong.

Join Kylie Wing, Chief Marketing Officer at ApprovalMax, as she talks to the newest addition to the team: Matt Lowry, Chief Revenue Officer.

Cont...

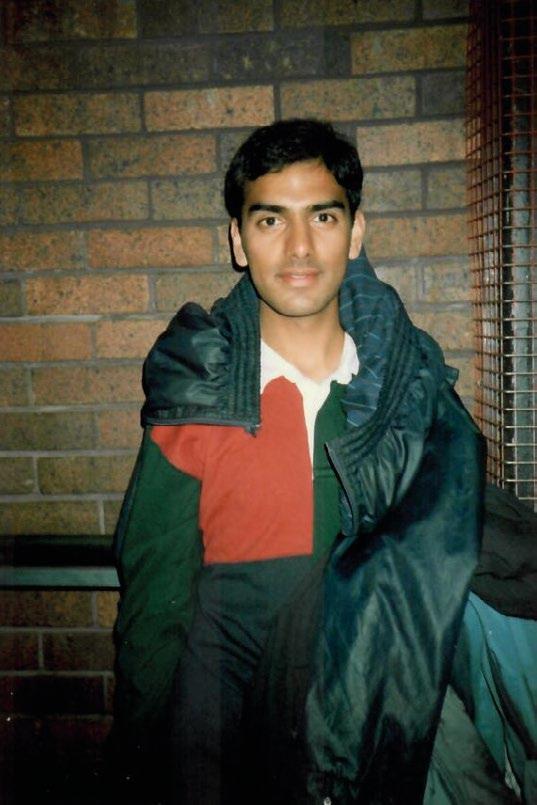

Image: Matt Lowry

decisions, rather than reactively acting on decisions in a purely legal sense! This experience gave me first-hand experience of board meetings and the impact that internal red tape can have on growth. If only we had ApprovalMax and some of the other leading ecosystem apps to help!

In late 2018, I joined the management reporting and forecasting app, Fathom, to launch their UK office. The role was to grow the revenue base significantly and I became their

MEET KYLIE

Kylie Wing is the Chief Marketing Officer at ApprovalMax, where she leads the marketing team to drive business strategy. As a member of the executive team, she collaborates closely with people in the Xero ecosystem to identify opportunities and enhance the company’s overall purpose. With her expertise, Kylie delivers impactful results for ApprovalMax and its customers, helping the company connect with the market and deliver value globally.

Head of Growth (EMEA), leading go-to-market activities in the EMEA region, primarily the UK and South Africa. Helping thousands of SMEs and advisors globally to change how they view forecasting and management reporting was a greatly rewarding experience and showed me first-hand the impact that great AccounTech can make to businesses globally.

Kylie: We have something in common. My previous role was also working for another company in the Xero ecosystem where management reporting and forecasting was a huge part of the value proposition. Helping SMEs and accounting firms understand the story behind the numbers was a big part of the inspiration. Now that you’re on a new adventure with us, what opportunities are you looking forward to diving into?

Matt: ApprovalMax is at such an exciting stage of growth, with all the recent and future product launches. I’m keen to work with the sales and marketing team to reach more of our target market to promote how ApprovalMax can really help lead the way forward! A really recent example is the ApprovalMax and Airwallex

integration for UK businesses, providing an end-to-end accounts payable solution, ensuring a seamless experience for our customers in preventing fraud and implementing in-house financial controls. It’s great that we’re using Airwallex’s financial technology inside ApprovalMax to help businesses not only with payments, but scale across borders.

Kylie: Absolutely. We’ve just given our UK accounting partners another way to add value with this service without requiring access to client bank accounts. It’s automating the steps from approving it, to processing it, to paying it. I think it’s fantastic that our team has created a faster and smoother workflow, and that it can be done without having to leave the ApprovalMax platform.

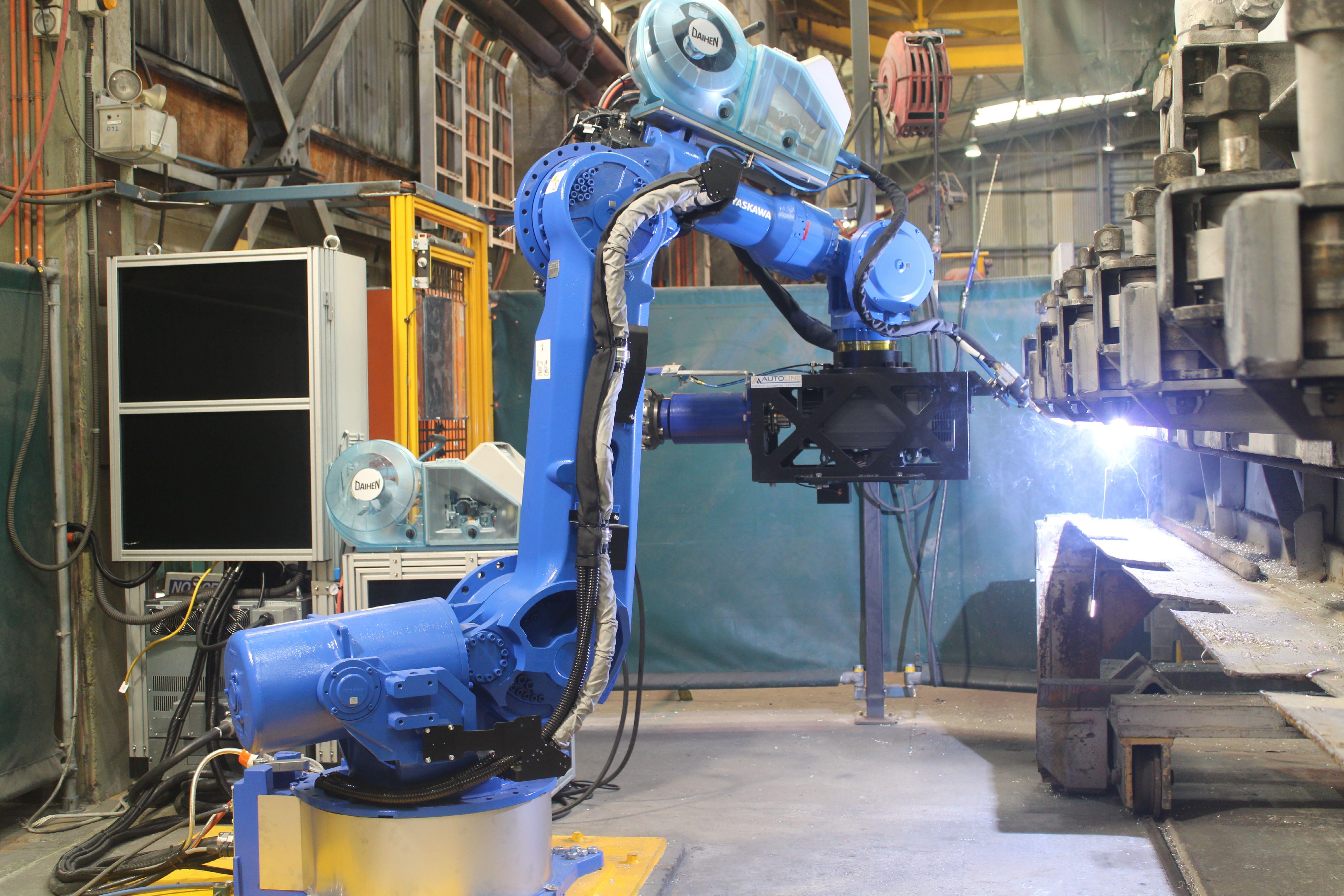

Matt: Outside of that, we also want to continue making our existing customers happy and provide them with world-class customer support – this is particularly important as we scale to new markets and geographies. Personally, I’m also looking forward to continuing to advance our relationship with Xero accountants and bookkeepers,

10 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems Cover Story

Kylie Wing, Chief Marketing Officer, ApprovalMax

Image: The ApprovalMax Team

and assisting them with implementing in-house financial controls and workflows to their clients. That’s important because it ultimately adds deeper value to their relationships. I want to also add to that list the new corporate identity and brand direction that your team has been heavily involved in – what was the story behind the new branding?

Kylie: The ApprovalMax story is interesting because it goes as far back as 2014. The brand has evolved over the years, but at the end of 2022, we decided it was time for a new look. We wanted something that was deliberate, more modern, and software relevant. We exchanged our darker colours for ones that were brighter, lighter, and more energetic. It’s happening during a phase when there are a number of exciting internal changes and new people joining our team, such as yourself, Justin Campbell from Xero, Brendan Lucas as our Head of Accounting, and Cassandra Scott as our Head of Bookkeeping, just to name a few. Can you relate to the evolution of the brand, and why branding in SaaS is important?

Matt: The new brand looks clean and concise, which for me is imperative to stand out in any market. The timing is perfect as we move into a new stage of growth with a more comprehensive product. The new brand reflects the new stage of the journey that we are now on. Branding is important in any business model but with SaaS it’s important to stay front of mind given the nature of the subscription model – people are reminded every month that they are paying for the service which means that every month you need to continue to prove the value. Having a strong brand plays a huge part in that, as does providing a top-tier customer experience of course.

Kylie: The brand, the people, the product – all working nicely as one to help our customers go to the next level with their financial controls and more. Our latest product developments such as batch payment approvals for Xero users, and payments with Airwallex for UK businesses, mean customers get even more value. And our team growth means we’re able to put more

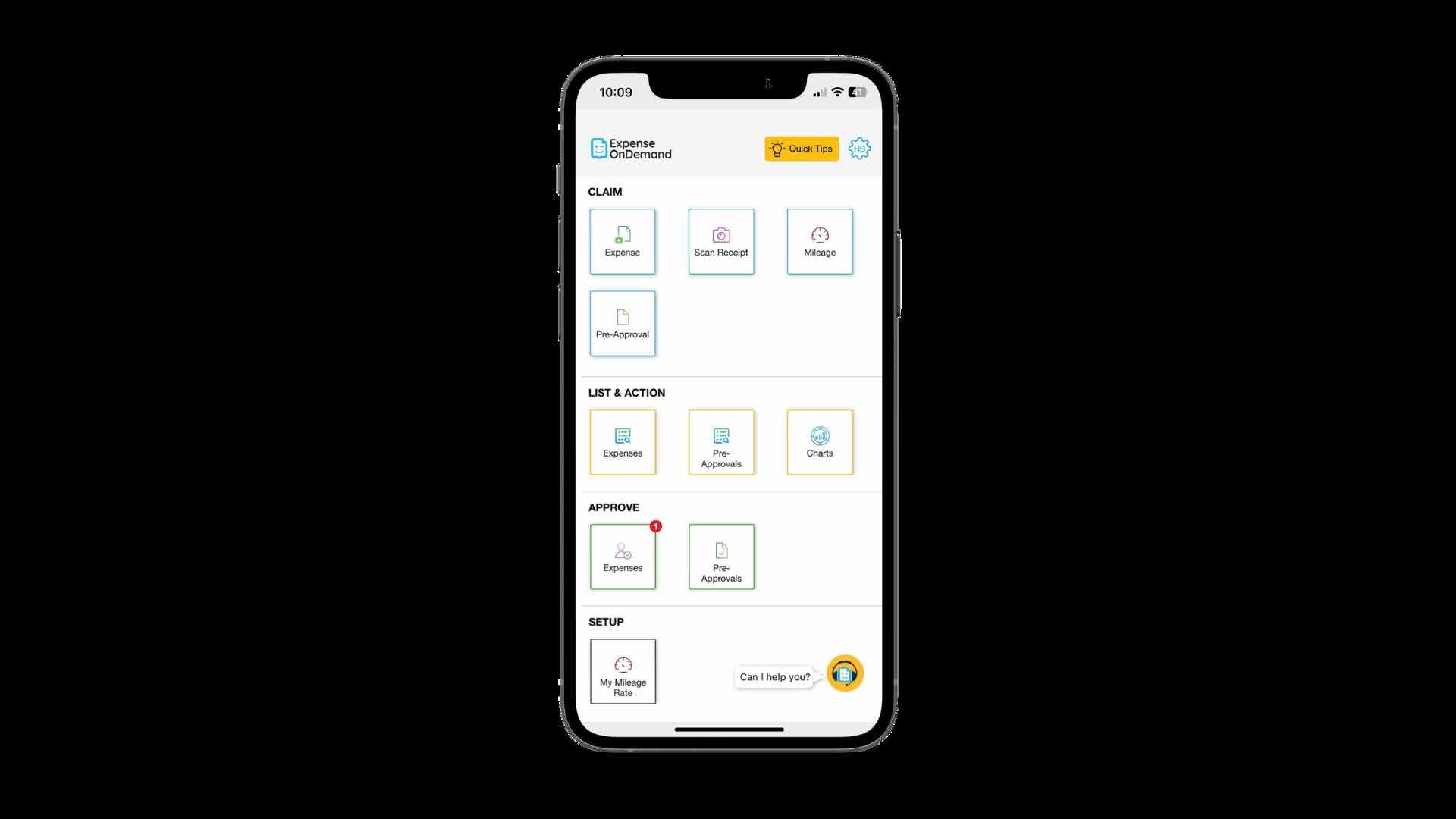

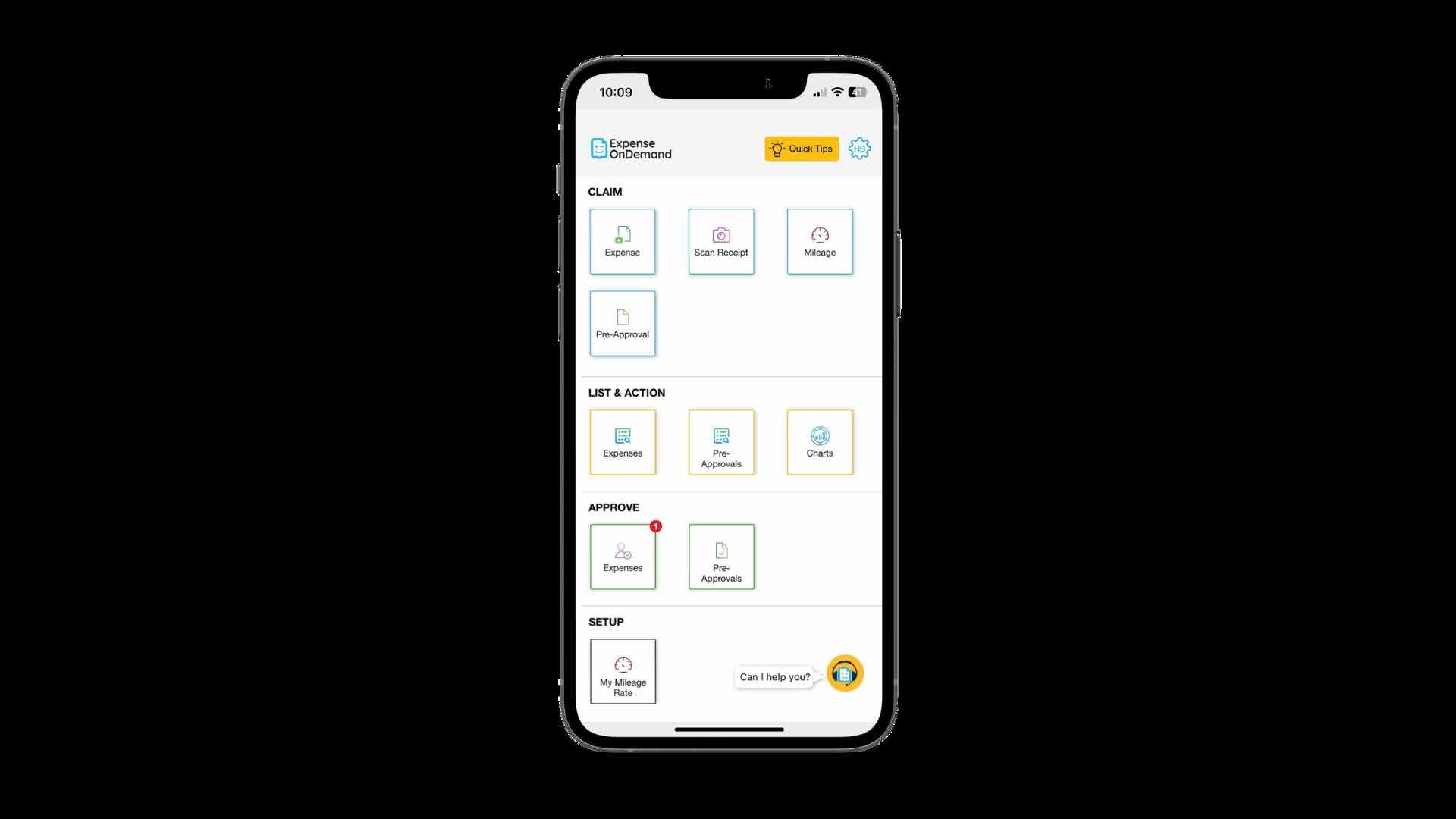

MEET MATT

Matt Lowry, Chief Revenue Officer, ApprovalMax

Matt is Chief Revenue Officer at ApprovalMax, where he leads global revenue initiatives and leads the Sales and Customer Success teams. Prior to joining ApprovalMax, Matt was Head of Growth (EMEA) for a scaling B2B AccounTech SaaS company and Head of Customer Experience at a B2B SaaS small cap publicly listed company. Outside of work Matt coaches, trains and competes in Brazilian JiuJitsu, holding the rank of brown belt.

into supporting customers around the world as we build out more features. We have plenty happening at ApprovalMax to keep readers of XU Magazine informed and engaged!

Cover Story To find out more about ApprovalMax and our new features, visit: approvalmax.com FIND OUT MORE...

12 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems Xero Marketplace

Issue 35 / 13 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

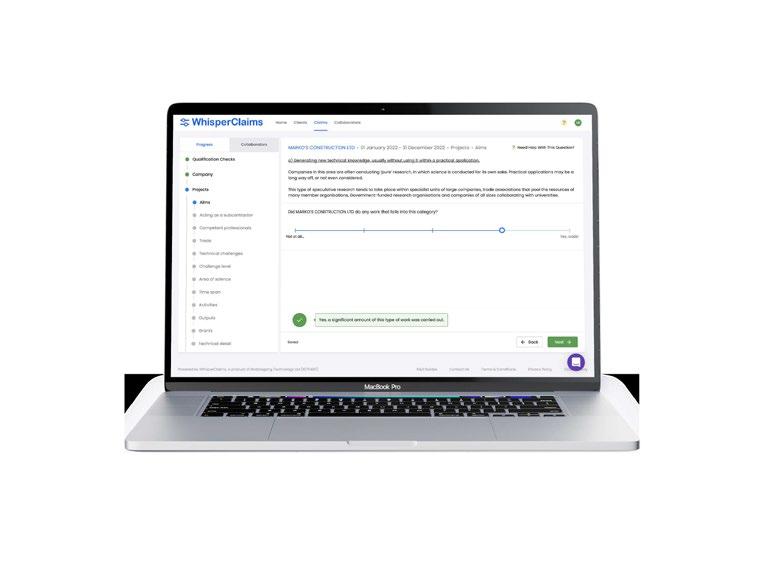

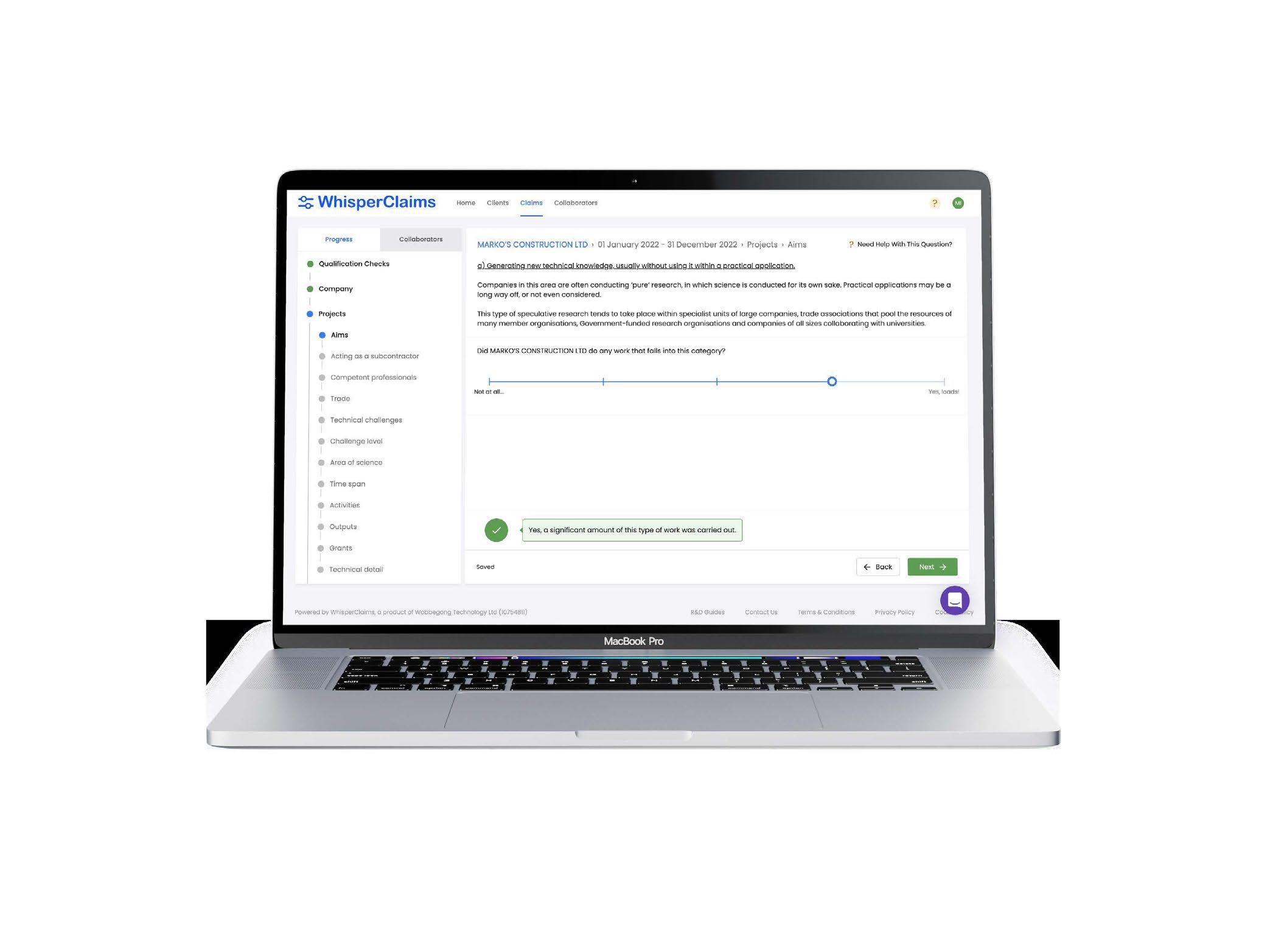

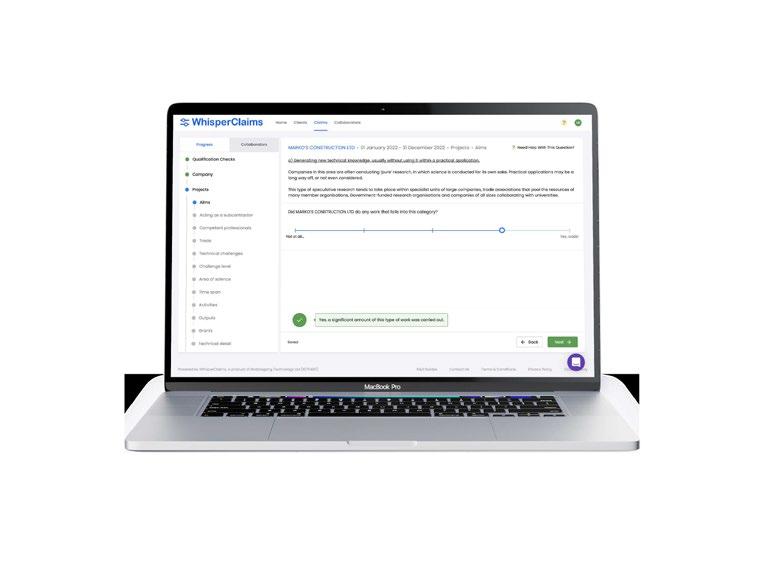

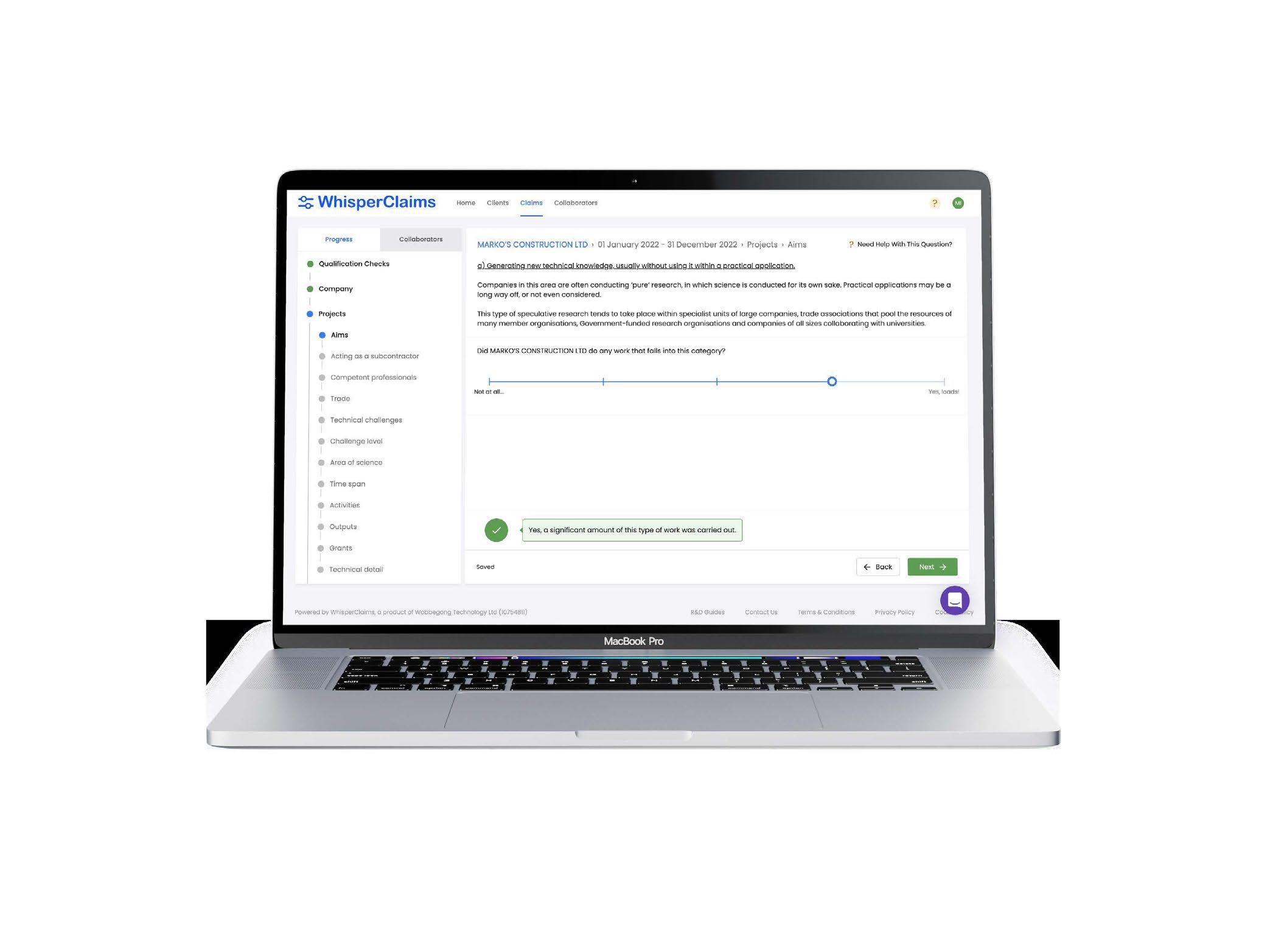

The accountant’s game-changing guide to preparing R&D tax claims

Mike Dean, Managing Director, WhisperClaims

Mike Dean is the Managing Director and Co-founder of WhisperClaims, an awardwinning Fintech company that empowers accountants to deliver an efficient R&D tax claims service with confidence, through intuitive software and expert support services.

Passionate about the digitisation of business processes, especially advisory services, Mike is your go-to for questions on the R&D tax relief scheme and how to get the most out of using WhisperClaims technology.

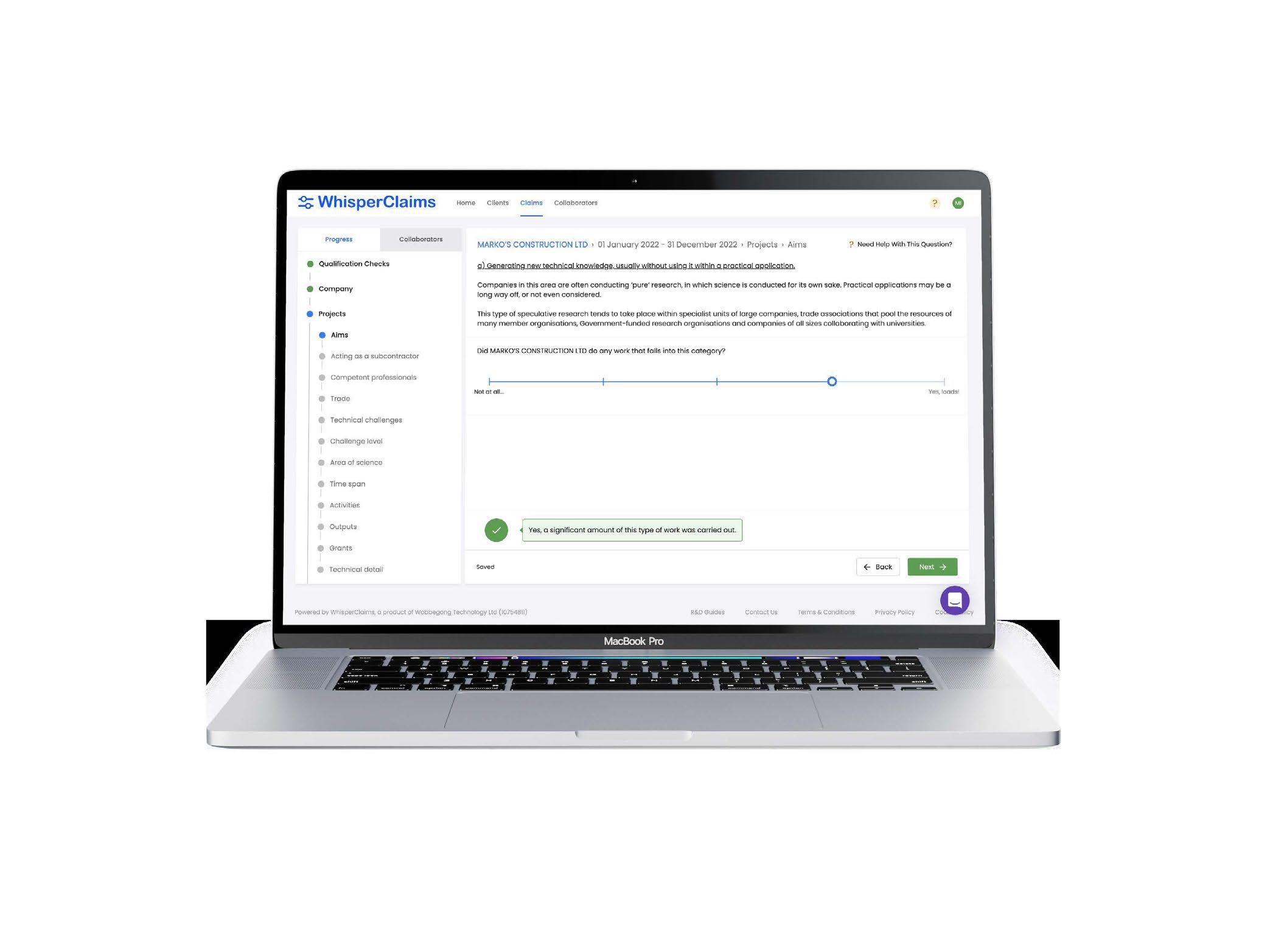

What are the essential tools and tactics that accountants need to confidently deliver an R&D tax service for their clients—and what role does R&D tax technology play?

n the last 12 months, HMRC have made changes to the R&D tax relief scheme in a bid to eradicate the malpractice that has developed within the R&D tax sector. While this extra scrutiny is welcome in a market that has, without any doubt, experienced problems due to a few bad apples, this shift in HMRC’s behaviour has caused some ripples to be felt across the R&D tax advisory sector. Some accountants are rightly seeing this as an opportunity to improve their operations, move their clients away from third party providers and implement a new R&D tax service offering under their own brand. They are realising that their clients are hungry for support, and there is a way to add more value to these client relationships.

Surely, this is what HRMC want to see as a result of legislation changes. A good accountant

who understands the claimant’s business and who can steer them effectively through the eligibility criteria is precisely the kind of advisor who should be preparing claims in the eyes of HMRC. A deep, existing relationship is the very best way for an advisor to identify legitimate R&D work, which in turn helps remove the risk of SMEs being exposed to bad practice.

So, what are the essential tools that accountants will need to deliver a dependable R&D tax service in-house, and what role can R&D tax technology play?

Guiding the client

First of all, it is critical to ensure that both the accountant and the client have a basic understanding of the R&D tax scheme. It is the client who should make the call as to whether science and technology is being advanced within a project, so preparing an R&D tax claim is something the

accountant needs to do with their client, rather than for them. A key factor in the claims process, therefore, is ensuring that the client has at least a passing understanding of the relevant parts of the guidance. But how?

To support the client through this process, the accountant needs to ask the right questions so that they understand what HMRC’s definition of R&D looks like and can assess if the eligibility criteria have been met.

This is where R&D tax software with wrap-around support can be useful. WhisperClaims guides the accountant through the conversation so that the right questions are asked. Questions flex around the data being input— none can be missed or skipped, ensuring all data is reliably gathered.

If reassurance is needed, live chat and 1-1 support channels give the accountant quick and easy access

14 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

I This article is

Delivering an R&D tax service that clients can trust.

to a team of R&D tax experts to lean on for scheme or eligibility advice. While built-in learning tools, explainer videos, and links to HMRC’s online guidance help to remove uncertainty as the accountant and client work through the claim.

Simple processes

Having a simple, intuitive process that is applied in the same way every time, for every claim, is also an essential element to preparing robust and compliant claims.

Fully automated R&D tax software provides structure, relieves friction and keeps the accountant up to date with legislation. Qualification checks help identify potential issues early to quickly screen out ineligible work, while dynamic feedback guides the accountant through the process.

In addition, the accountant has the option to invite the client to work collaboratively within the app, so that they can contribute directly to the process where appropriate.

HMRC friendly reports

Once a claim is prepared, an automated report is downloaded at the click of a button, reducing the time taken to prepare the technical narrative and costs breakdown for submission to HMRC. This saves hours, if not days, of report-writing.

When preparing supporting documents for an R&D tax claim, it pays to remember: ‘less is more’. All that’s really needed is to make sure that HMRC can see the claimant has considered all the relevant parts of the guidance and assessed the technical work and costs appropriately; padding the report with irrelevant details, commercial or otherwise, is simply counter-productive.

The value the accountant adds is in the robustness of the claim produced and the advice that they can give to the client—not the length of the technical narrative!

The value of WhisperClaims software and support

With WhisperClaims, the accountant gains access to intuitive software and expert support services to help guide them through the claims process. R&D tax specialists have their fingers on the pulse, feeding legislation changes back into the software. The software itself is constantly evolving to ensure that claims remain robust and compliant with current legislation—a great example being the introduction of the Additional Information Form, a new process for claim submission that will be compulsory from August 2023 for all claims.

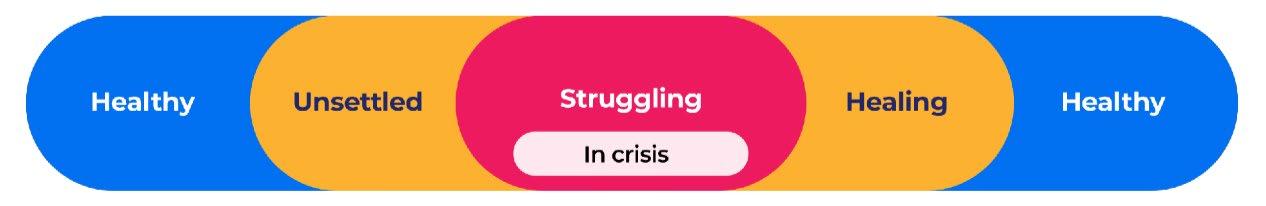

optional ‘Claim Review Service’

of reassurance that the claim has been thoroughly reviewed by an R&D tax expert prior to

All of this can be done without compromising on consistency or quality. Accountants can be sure that all claims are being prepared in the same way every time, and that their clients are receiving a robust and high-quality service.

“A good accountant is precisely the kind of advisor who should be preparing claims in the eyes of HMRC.”

WhisperClaims is already developing a solution to this that will ensure the submission process is as painfree as possible.

A common challenge faced by accountants is identifying eligibility within their current client base. If advice is needed, a ‘Portfolio Review Service’ helps them uncover low-hanging fruit and potentially overlooked companies, while also flagging clients who are unlikely to be eligible.

Once a claim has been prepared, built-in risk mitigation features will flag areas of weakness that should be reviewed, and an

Critically, accountants can be confident that they are minimising the likelihood of prompting an HMRC investigation. Even in the event of one being launched, the structured and consistent process of WhisperClaims software ensures an accountant can remain confident when responding to any additional questions HMRC may raise, with the added back-up of expert advice, guidance and support.

Issue 35 / 15 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Book a demo and start your 30-day subscription free trial:

credit-software/demo-trial FIND OUT MORE...

whisperclaims.co.uk/rd-tax-

XU Magazine - The independent news source for users of accounting apps & their ecosystems

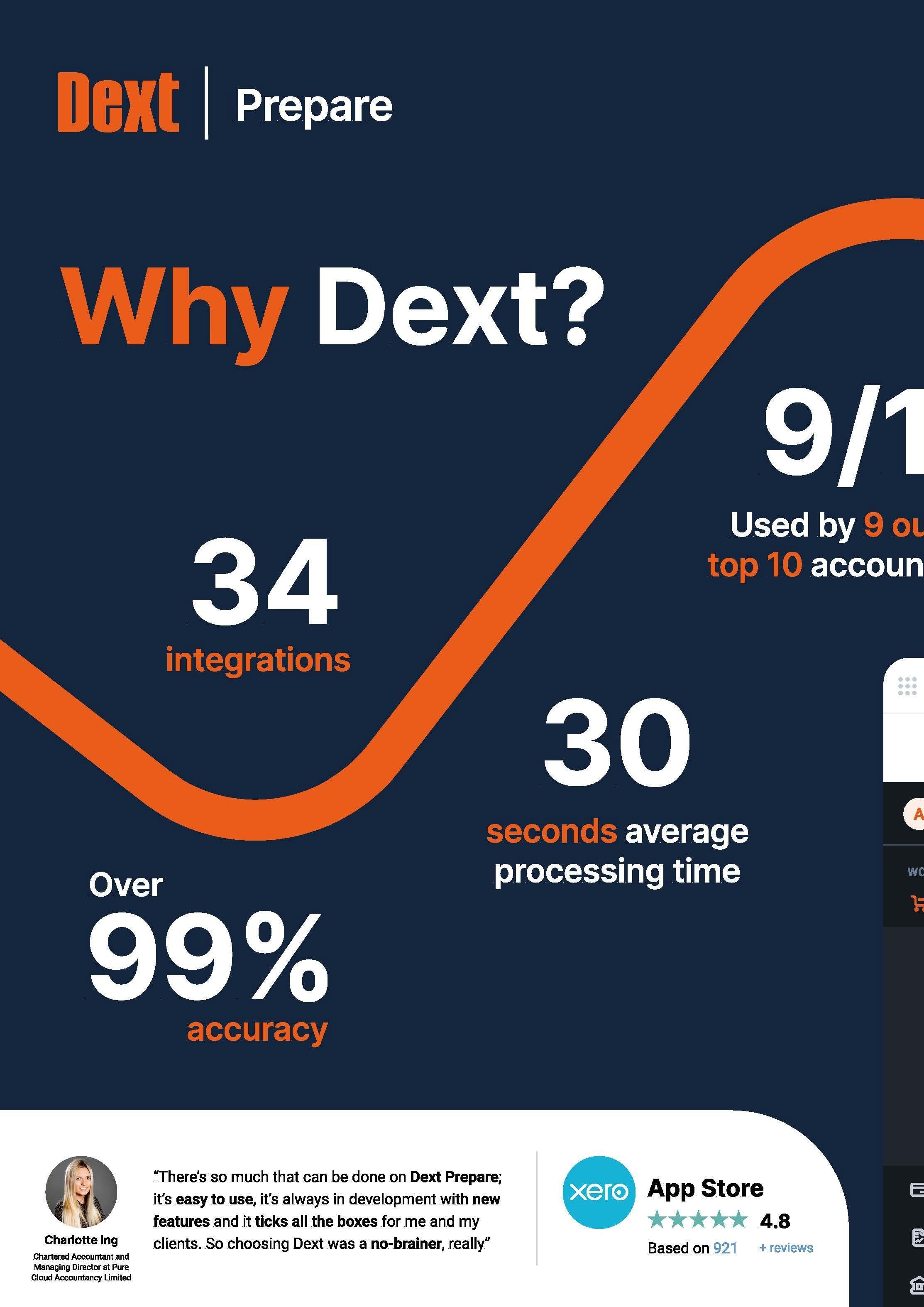

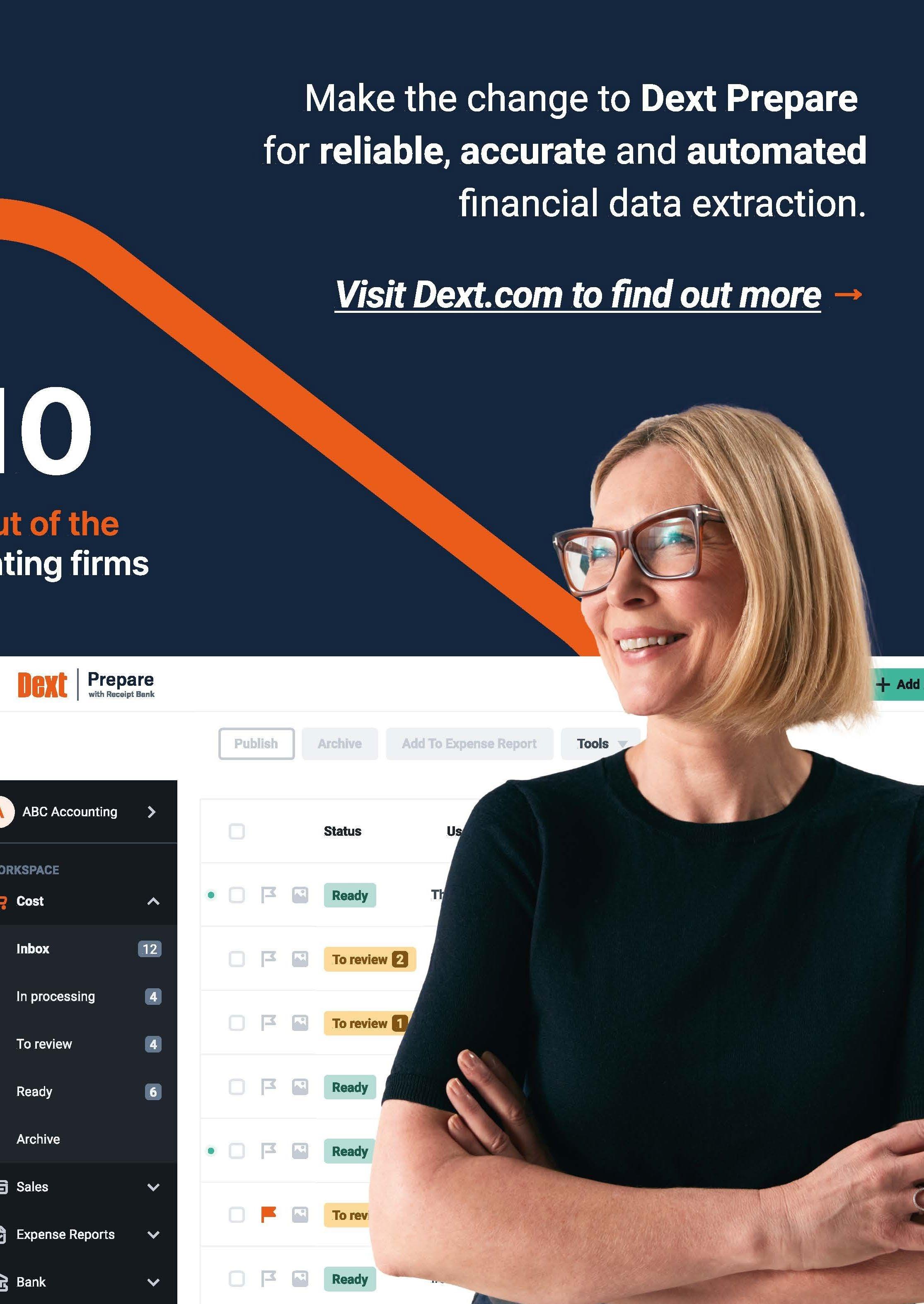

This article is Q&A

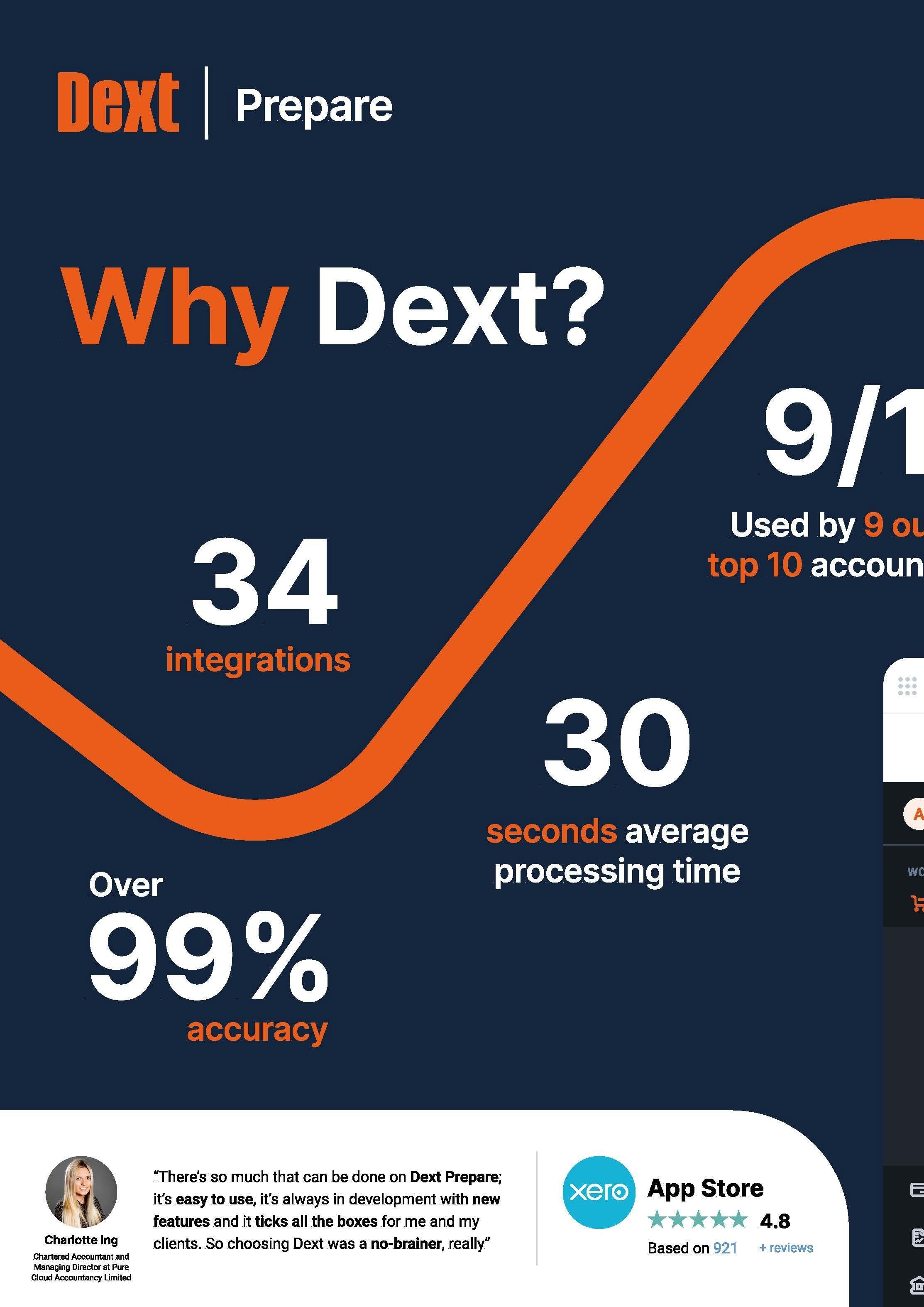

Sabby Gill CEO, Dext

XU: We’re joined at day two of Accountex by Sabby, the CEO of Dext. How are you finding it in your new role?

SG: I’m absolutely loving it, I’ve been here just over seven months now. The great thing about working for an organisation like Dext is being back in the accounting and bookkeeping space. I’ve previously worked for Sage for a number of years, so it’s great being able to come back into it and have that passion back again, for something that I absolutely love. I just love the thrill of working with accountants and bookkeepers, they’re so integral to growth around GDP economies.

When we’ve got five and a half million small businesses in the UK, they don’t necessarily have everything that they need, such as the expertise and experience of how to run a business properly, especially from an accounting, legislation, regulatory and compliance perspective. I’d like to think that Dext plays a major part in that, around the efficiency and effectiveness of their practice, giving them more time back, which is probably the number one thing I would say is the most critical thing that everybody craves for. Just the ability to get back time, whether that’s spending that time back in their own business or just taking time out for them personally.

Being back in fintech has been a real eye-opener in relation to technology and emerging technology. A lot’s changed in the two years that I’ve been away, which you can tell by just looking at the number of organisations that are here at Accountex. We have more people attending as I’m sure after Covid there was that sort of yearn for having social engagement and interaction. We could never have done this over Zoom in the same way that we can do this sort of conversation face to face.

Dext has been around for a while. I’d say it’s been one of the flagship companies for innovation within the fintech community. It was one of the main companies that was integrating with apps like Xero, Sage and QuickBooks and was really driving that change towards digitisation amongst the accountant and bookkeeping community, moving away from paper receipts and into a more digital world.

XU:

few months, looking at how we can expand the value and the stickiness of our applications, and how much more we can do to make organisations more effective and efficient in the way they go about processing and working on behalf of clients. I won’t let too much away, but there is some real exciting innovation, potentially some M&A activity that we are looking at. We are on a really powerful journey and over the next couple of years it’s going to be an exciting time.

How do you see Dext’s journey over the next three to five years, in terms of continuing to drive that innovation and being one of the companies at the forefront of that continued change and evolvement?

XU: Where’s your focus on a global perspective - have you got areas that you are going to be specifically looking at moving forward?

SG:

It’s a great point, we are probably the preeminent pre-accounting solution. We’re at the forefront of any flow that you could possibly imagine. We’ve got some other inroads into receivables, mainly because of legislation changes in places like France and Australia. But for us, it’s really about continuing the journey we’re on. We will be the best at extraction, whether it is paper, whether it is digital. We have an e-commerce solution that works with people like Amazon, eBay, Etsy, Shopify, all of those organisations.

If you are a small business and you operate on any one of those platforms, you still want the ability to extract invoice information and load it up. Today, we are on a great journey. We do 330 million transactions on an annual basis. The data quality is sitting at 99% of the information that we extract, 75% plus of all of those are using the latest, greatest technology such as applied AI.

Really, it’s about making sure that we continue that journey because so many organisations are dependent on that type of efficiency and effectiveness. There’s other things that we’re also thinking about, you’ll hear more about it over the next

Also, multilingual is always a big question that’s asked of everybody. What’s your thoughts on that at the moment?

SG: We’re in the major economies of the world that are more AngloSaxon, and also you have to think about accounting models. If you think about where our strengths play, we’re strong here in the UK, Canada and Australia, who all have similar accounting type models around VAT, GST, sales tax, whatever you want to call it. So, very strong presence in those geographies, which is also where the three general ledger integrators, Sage, Xero and QuickBooks, are all major players already. So, we’ll continue that journey in those particular jurisdictions. We’re also really strong in France, so that multilingual extraction engine, being able to do multi-language extraction and capability, we have that but it gives us an opportunity to go elsewhere.

It’s probably the one thing that I’m sure everybody thinks about, do I expand in more geographies and try and take on more, sometimes, complexity? It’s not easy setting up a new geography, jurisdiction, region or any of that stuff, but for us, the market’s big enough where

Issue 35 / 17 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Cont...

Q&A

we already operate, and I think more value that we can provide in those particular markets is important.

There’s huge opportunity in North America, it’s very close to the Canadian market. Intuit is very strong there and we have a great partnership. We have some great alliances over there that literally turn around, and when they set up their financial operations, they’ll say, unless you’ve got Dext and Intuit, we won’t actually take you on as a business. It’s very strong and powerful to have that sort of relationship.

We’ve got relationships like that globally with Sage and with Xero and other partners. We just want to continue on the journey that we’re already on, but provide more value in the geographies we’re already in, before we try and take on the rest of the world.

XU:

How does it feel to be back at Accountex?

There’s a lot of you here at the Dext stand, people in orange

absolutely everywhere doing tons of demos.

How has it been out in the wild, seeing the team interact with people, and what’s your view on the conference so far?

SG:

This Accountex has been brilliant for us over the last two days. Everybody is tired, but it’s been very powerful. I think people forget about how important relationships are. A relationship on Zoom is not a relationship. Looking at people, looking in the whites of their eyes, looking at clients and being able to have a proper strategic discussion is really key. That’s very much what we’ve been concentrating on. People always talk about, is it worth it, do you get the value, and everything else, but sometimes, the value is in the relationship and the partnership rather than how many leads or enquiries.

For me, it’s more about just having a presence, having a place that everybody knows that we’re

going to be there, being able to see all the 50 people that we have here in orange T-shirts and very visible. It’s been a great show, and I saw that the footfall is 20% up from last year, and there’s even more people in the community, and more apps being provided. It’s exciting times with new emerging technologies and new capabilities coming to market. It’s always keeping us on our toes, and that’s the reason why over the next couple of months, we’ll share more, but I think there’s a real opportunity for Dext just to continue on the journey that it’s already on, and Accountex is a great platform to do that.

18 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Learn more about Dext: dext.com FIND OUT MORE...

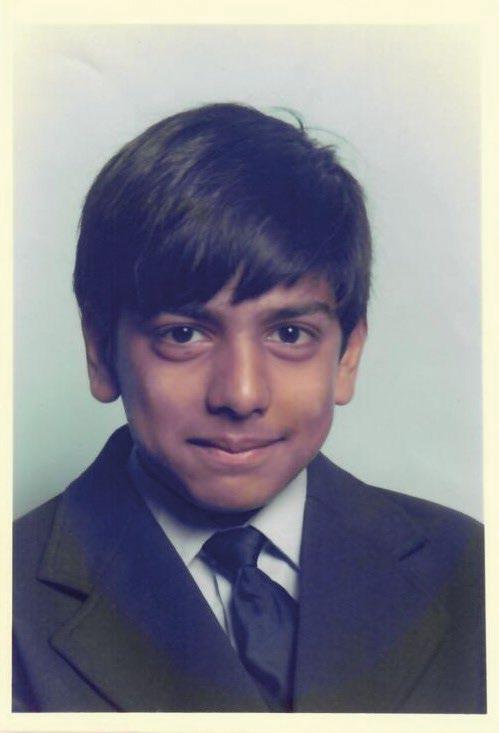

Image: David Hassall, CEO of XU Magazine, with Sabby Gill, CEO of Dext, at Accountex London 2023

Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! Q&A

Go to www.xumagazine.com Follow us on Twitter: @xumagazine What type of accountant do you want to be? #IWantToBeAnAccountant www.advancetrack.com Where Quality and Security comes as standard If you want to be an accountant that helps clients more then talk to the team at advancetrack Book a Zoom meeting with our team advancetrack.com/start-here/ #IWantToBeAnAccountant

5 biggest trends to come out of Accountex 2023

Made it to Accountex? Don’t worry. We have the inside word from the biggest accounting and bookkeeping industry show in the land.

ou may have missed the axe-throwing (yes, you read that right). Perhaps you even missed the whole thing. Just to recap though, Accountex London, May 2023 was its usual exciting self.

The biggest industry expo in the land didn’t fail to deliver. It was jam-packed full of insights and big innovations.

We were there. Proud to unveil the New Pixie platform and all our new features. Do have a read here. Don’t be surprised if you’re as excited as us.

We enjoyed the spotlight with queues of curious and long-time fans at our stand. It was a real validation of the pent up demand for an accounting practice management software that listens and delivers what small practice owners want.

There was plenty more on show too. All the biggest industry names and thought leaders were there. Accounting professionals from across the country shared their insights and experiences. It was our happy place!

To help you keep your finger on the pulse of the accounting

world, we’ve gathered the most compelling trends that are shaping the future of the profession.

Get ready to discover the gamechanging strategies, technological advancements, and client-centric approaches that are redefining accounting practices in the UK and beyond.

1. Eye on AI for the next big thing

UK accounting firms are rapidly adopting artificial intelligence, machine learning, and automation tools. These technologies can streamline routine tasks and allow accountants to shift their focus towards strategic and advisory roles.

We’re proud to sit at the heart of that discussion, unveiling Pixie Co-Pilot as part of our revamped Pixie launch. Hold on to your hats, folks, because it’s a gamechanger. When your clients send in requests, this incredible AI capability kicks into gear. CoPilot jumps right in and reads the email, strategising the best way to respond. It’s like having your own personal assistant in the background, doing the heavy lifting for you. It dives deep into

@usepixie

Will Rush, Head of Commercial, Pixie

With 6 years of experience in the accounting technology space and over a decade in sales will excels in helping accounting and bookkeeping firms optimize their processes through the adoption of innovative software solutions. With a consultative approach, he really understands the needs of accountants and bookkeepers today. Connect with Will for accounting technology expertise, sales strategies, or engaging discussions about rugby.

the Pixie system, hunting down the relevant documents you need.

Once it has all the information at hand, Pixie Co-Pilot creates a draft response. But hey, here’s the best part: you’re always in control. You have the final say on whether to send the response or make any changes.

It’s time to take your accountancy game to a whole new level. Check out Accounting Web’s story on this new feature. We’re thrilled to be part of that conversation.

2. Everyone is calling out for technology consolidation

At the end of the day, you just want all these apps to be in one place so you don’t have to go through all these different hoops to get your job done.

Pixie is picking up the pace on that score, choosing Accountex to launch our new version of Pixie. It was time to move to our next phase of capability, having listened to our 3000+ customers on what their top improvements were and delivering on those. More features in one place to run your practice accounting software. You asked, we delivered.

20 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Y This article is

The game changers this year for your accounting practice

It was helpful to hear from leaders at Accountex, like Frances Kay, Carl Reader, and Will Farnell, who agreed that automation and accounting software for accountants is becoming ever more critical.

3. Data analytics front and centre

The Fintech Innovation Showcase was a favourite stream of ours. We had to love the talks from leaders Mark Edmondson, CEO & Founder of Inflo, who had AI and analytics on the mind.

The demand for data-driven insights is on the rise in the UK. Accountants are increasingly expected to interpret and analyse financial data to provide strategic advice, alongside their traditional auditing and reporting responsibilities.

This is another space we’re pleased to spend time. So much of our new Pixie software for accountants is about empowering performance with data. One of the new Pixie features that our customers have been pushing for is about tracking profit potential in clients.

These features make it easier to stay across what clients are in the

red or the black and how much time staff are taking to deliver the services. That data goes a long way to decide what services to focus sales on and what kinds of clients to invest more time in.

4. Sustainability and ESG reporting

The UK has been a global leader in requiring businesses to disclose their environmental, social, and governance (ESG) performance. As these requirements become more stringent, UK accountants are likely to play an increasingly important role in auditing and assuring these disclosures.

At Pixie we’re keeping a close eye on this. We’re already seeing on our system and from chats with our customers that this kind of service is popping up more and more.

5. Remote work and digital collaboration

The pandemic has significantly changed work arrangements, and many UK firms have adapted to a hybrid or fully remote model. This is likely to continue to shape the accounting industry, affecting both workforce management and client services.

Sure, we gave up the nostalgic view that popping by a colleague’s desk to brainstorm ideas is the be all and end all. But let’s be honest. Keeping the lines of communication clear and maintaining good staff oversight can still be difficult.

The new version of Pixie help you do just that. It’s funny how things work. Just when you need it, the technology is launched to help it happen. It feels a little like we (you and me) were meant to be, right?

Join the Pixie Community

Accountex was great and I’m sorry to miss you. But there’s more good times to come.

You don’t need to do it all by yourself. Whether you have a team of 3 or 300, its worth giving Pixie a look into. When was the last time you turned around to look at your business to say, ‘yep, I’ve got this covered’?

Issue 35 / 21 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Book a demo today: usepixie.com/demo FIND OUT MORE...

22 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Power up your delivery - integrating vWork with Xero

Steve Taylor, Chief Technology Officer, vWork

Steve Taylor is the Chief Technology Officer for vWork. He is responsible for its technical roadmap including the API and integration strategy enabling the vWork app to be part of a highly connected, operational, eco-system. He has a deep appreciation for the issues companies face in delivering a great customer experience around last-mile delivery and is dedicated to creating an exceptional delivery experience through the vWork app.

It is no accident vWork is designed to fill a very specific part of the transport eco-system - that last-mile delivery between your door and your customers. It forms an important part of a connected ecosystem between your Customer Relationship Management (CRM) database,

any telematics tools your fleet may use and your accounting systems.

It natively integrates with a number of major brands in all these spaces - including Xero. This means customers can benefit from off-the-shelf

integrations with minimal time to implement and maximum value delivered - including keeping pace with any upgrades and new functionality that might be relevant.

“It means there is no double or triple handling of data between dispatch, the driver and accounts”

So what does vWork’s Xero integration let you do?

Xero was a very early integration partner. According to vWork CTO, Steve Taylor, it was in high demand by customers across both Australia and New Zealand and there was real synergy in the desire to add as much mutual customer value as possible.

“Any vWork customer can simply connect their Xero instance into vWork with confidence around maintaining data security and compliance,” says Steve. “We have looked to add as much value as we can natively, with the opportunity to extend this functionality out with further configuration to

24 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

How vWork’s native integration model creates an exceptional last-mile delivery ecosystem.

This article is

Designed as part of a connected ecosystem, vWork’s native integrations benefit those using its dispatch and scheduling software.

meet individual customer needs if necessary.”

Faster money through the door

One of the key things vWork’s Xero integration enables is the ability to instantly invoice on delivery. As a driver signs off on delivery completion in vWork, all the relevant information is immediately transferred into a Xero invoice. It takes seconds and can then be issued immediately or included in monthly billing. Either way it means billing for the delivery is immediately in Xero and more likely to be paid on time.

“It means there is no double or triple handling of data between dispatch, the driver and accounts - which is where so many errors or delays occur,” explains Steve. “The increased accuracy is a time saver in itself, as is the admin time in managing an otherwise largely paperbased system.”

vWork delivers a more efficient eco-system

This becomes even more powerful when vWork is integrated with a CRM - such as SalesForce - giving you a single

source of truth for reporting against a customer record. It creates further value again with vWork’s telemetry integrations with most of the major market players including EROAD, Linxio, Navman, and Webfleet.

“This dramatically reduces those ‘where are you’ calls and ensures dispatchers can give highly accurate delivery locations and track a truck’s progress in real time,” explains Steve. “It adds even greater value to vWork’s ability to enable three-way communication between driver, dispatcher and customer, creating the exceptional delivery experience every company is wanting to achieve.

Integrations with vWork not limited

Because vWork has been designed from the ground up to integrate with a wide range of other solutions, its ability to sit seamlessly in your tech stack isn’t limited by the integration partners it has.

“Billing for the delivery is immediately in Xero and more likely to be paid on time”

“Organisations with fleets of twenty through to five hundred or more vehicles can now seamlessly manage the delivery experience from accepting the order through to submitting the invoice. The dots in-between are connected by vWork with a light implementation footprint for your tech-team and high ROI from an operational perspective.”

“We have designed vWork’s API to be an extremely powerful tool. We have created integrations to meet a wide range of environments, including highly complex ERP operations,” says Steve Taylor. “The aim is for vWork to be as useful as possible, as quickly as possible. That means it needs to work the way you do - rather than forcing you into a different way of working - unless change is needed, of course. Your IT team being able to use our API to rapidly integrate vWork into your business is a key part of enabling this.”

FIND

To find out more visit: vworkapp.com/integrations

Issue 35 / 25 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

OUT MORE...

“Any vWork customer can simply connect their Xero instance into vWork with confidence”

26 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems Automated data entry. No fuss. No fee. Just 3 months free. www.autoentry.com | +44 0203 2933058 Terms and conditions apply

Leave the data entry to automation.

Spend less time chasing and entering data. Spend more time building meaningful relationships with clients, sharing your knowledge and insights.

No contract, no hidden fees, no need to pay more for additional functionality. Integrates seamlessly with Xero.

Offer ends 2 July 2023.

Issue 35 / 27 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

free.

HR Metrics You Need to Track

Unlock the Power of Your HR Data Today!

Christina Kryske, Customer Success Champion, HR Partner

Christina works with thousands of small and medium businesses to help them run their HR function more efficiently. She is passionate about HR that creates a environment where employees can thrive, while also meeting business goals.

Well run businesses need to incorporate HR data into their decision making. So what areas of HR should you be using data to track?

Employee Retention & Turnover

At the forefront of any successful company is its ability to retain its people. “Employee retention” is arguably the most important piece of HR data to be analysed by leaders. In fact, we often say that retention is the highest form of recruiting.

One method to assess your company’s employee retention strategy is to observe your employee turnover rates and the reasons employees leave. HR Partner has a reporting chart to track your company’s turnover rates and trends of termination reasons.

2. Time to Hire

Attracting and recruiting the right talent is a top priority for almost all organisations, and one key metric to analyse is “time to hire.” This important data point measures the number of days that pass

28 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

3

@HRPartner

1 This article is

3

“Retention is the highest form of recruiting.”

from the initial contact with a job candidate to the moment they accept your job offer.

By tracking this metric, you can gain insights into the effectiveness of your recruitment efforts and the efficiency of your hiring managers. For instance, a lengthy “time to hire” may indicate a need to streamline your hiring process or to improve communication with candidates. Importantly, it often means that the best candidates will be offered other positions and you’ll have to select from a reduced pool of applicants.

HR Partner has a built-in Applicant Tracking System that enables you to see this data as soon as you view your Recruiting Dashboard.

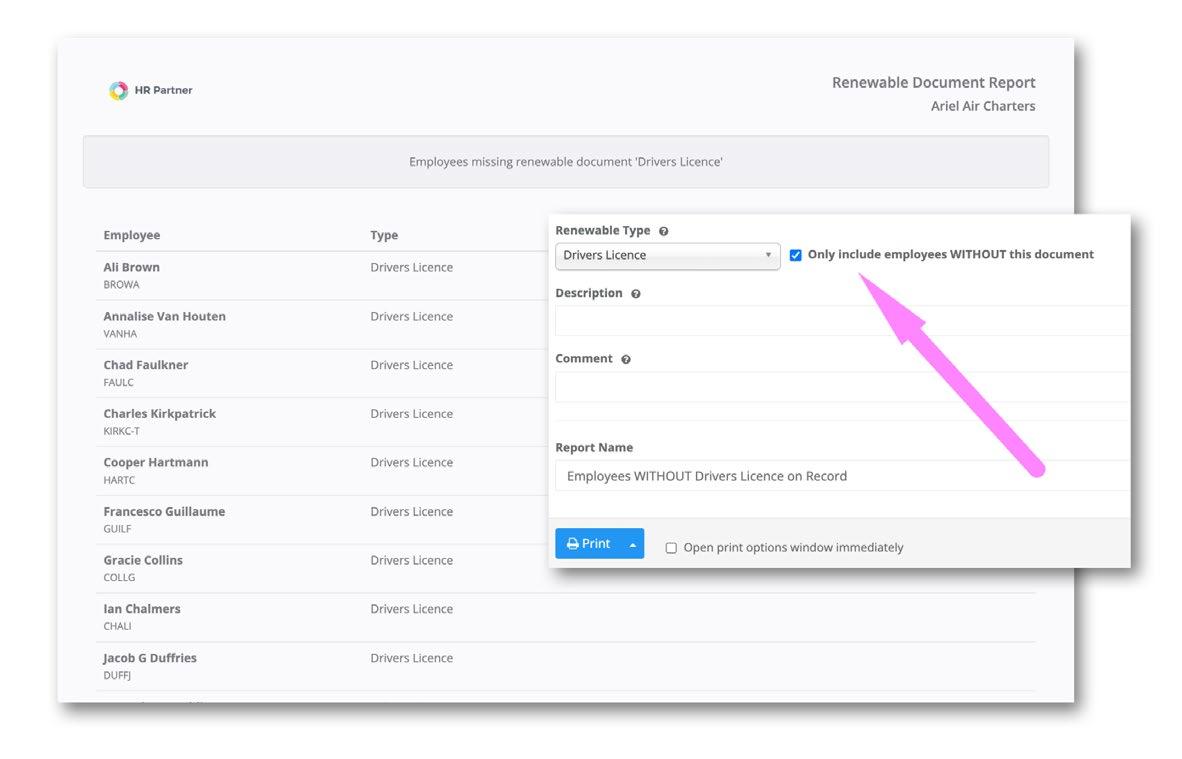

3. Compliance Reporting

One of the most critical functions of HR teams is compliance reporting, which ensures that your employees have the necessary training and documentation to comply with internal policies and industry

Cont...

regulations. With an ongoing “compliance reporting” process in place, HR teams can identify and address any potential gaps before they become issues.

This proactive approach is crucial for mitigating risks and protecting your organization from potential fines and lawsuits. By regularly monitoring compliance metrics, you can gain insights into areas where additional training or policy updates may be needed, and take corrective actions as necessary.

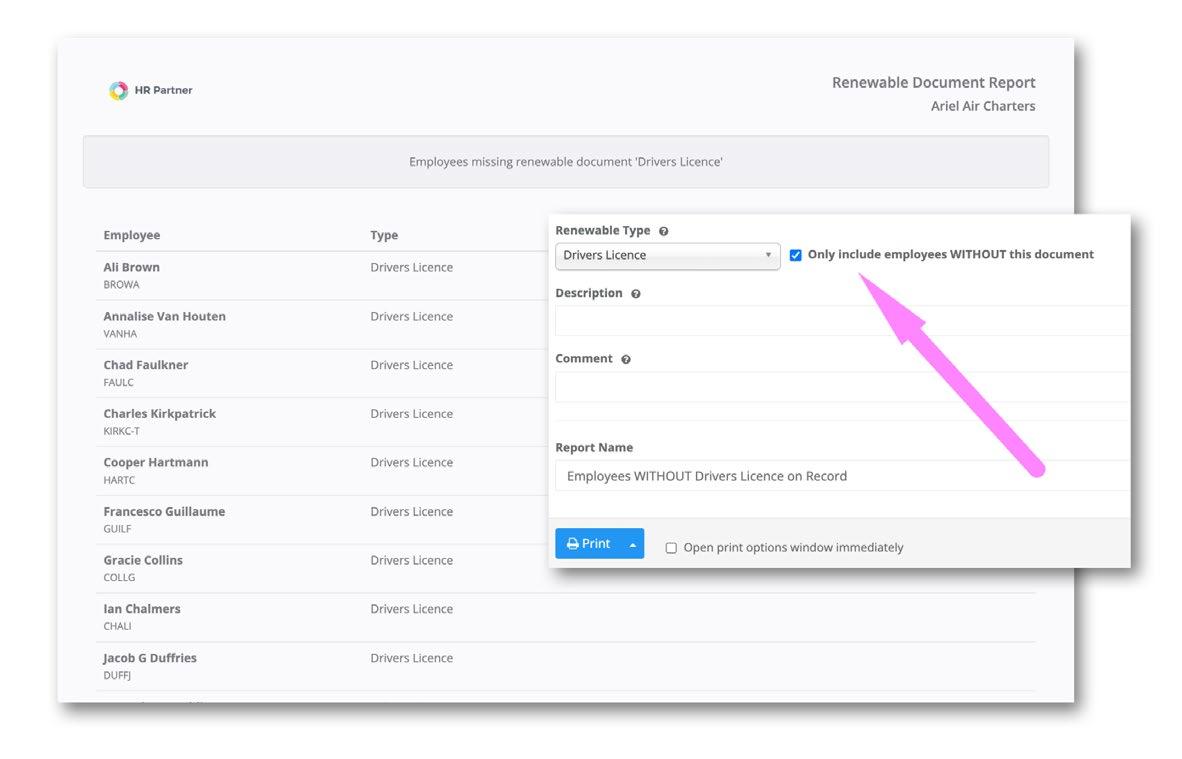

Within HR Partner, you can store your employees’ renewable documents – including certificates, forms of identification, work visas, and more. But importantly, you can also run a report to see

which employees are missing a specific type of document. This report gathers informational data to assess if any of your employees need to deliver updated documentation in order to stay compliant with your organisation, as well as remind you of any renewable documents which need to be renewed.

You can also use checklists to require that all new employees upload these important files at the beginning of their employment, and on an annual basis for all employees. HR Partner has flexible reports so that all of your HR data that can be exported for further analysis.

Data reporting can be intimidating, but it doesn’t have to

be and if you’re not measuring at least these 3 key metrics, you’re doing your business a disservice.

Cloud-based job scheduling and dispatch software that delivers

•Proof of delivery, time stamped and auditable

•Three-way SMS between dispatch, truck & customer

•Real-time invoicing

•Template driven software - works the way you do

•Integrates with existing business tools

5,000+ active users

Over 400,000 jobs per month dispatched Customers in 10 countries

www.vworkapp.com

Does your company use an HR system you love? Are you running a team of 20-500 people? HR Partner helps you streamline your HR Processes and get all your employee information in one place. It is everything small and medium businesses need to manage HR records and processes.

Book a demo today, to effectively manage your employee records and streamline your HR operations:

www.hrpartner.io/demo

FIND OUT MORE...

“HR teams can identify and address any potential gaps before they become issues”

If you are an Accountant or Bookkeeper looking to get your practice ready this EOFY, look no further! Our team of experts have created a free easy-to-follow checklist, with all you need to confidently engage your clients and grow your practice this EOFY and beyond.

Issue 35 / 31 Follow us on Twitter: @xumagazine

your free EOFY checklists today

more & get started

plan* Ignition's EOFY offer

sign up before June 30, 2023. Offer available for Professional or Scale Ignition monthly plans only. Not be used in conjunction with any other offer.

Your ultimate EOFY checklist Request

Learn

Receive 50% off your first 6 months of Ignition on any Professional or Scale

*Must

AI: Enhancing Accountancy’s Human Touch

Jan Korecky, Chief Executive Officer, Datamolino

While being passionate about processes automation, Jan is also a big advocate of the human element in business. Seeing real people behind each organization and focusing on their needs first and foremost helps him find ways to simplify their day to day jobs. This approach is also reflected in great customer support as one of the cornerstones of Datamolino, which Jan cofounded.

Welcome to the era of artificial intelligence (AI) in accounting. An industry largely based on data analysis and precise calculations, accounting is ready for AI integration. The adoption of AI can revolutionize traditional accounting practices, making them more efficient, accurate, and insightful.

n the future, successful accountants will be those who embrace these technologies and use them effectively, while maintaining their professional judgment and personal touch in client relationships. A “technologically adept human touch” will become the new gold standard in accountancy.

How did we get here?

AI models have been in use

for some time. However, a renaissance period of AI was ushered in November 2022, with the release of ChatGPT, a generative pre-trained transformer. This AI language model, thanks to its easy user interface and public access, allowed anyone to start interacting with AI.

ChatGPT proved to be a versatile tool, and interest in AI has skyrocketed. There are now many other publicly accessible AIs,

like Google’s Bard or Anthropic’s Claude, and various purpose-built apps based on these and other AI models.

So, how can this benefit your business? How can you start using AI? What should you consider? How can you and your firm adopt an AI-first approach? Let’s explore.

Automation: The First Step towards AI

Many firms still rely too heavily on manual work, where basic automation could streamline their processes. Automation reduces manual errors and saves time. Tools like Datamolino demonstrate this advantage, by automating data entry and categorization of bills and receipts, reducing manual work and margin for error.

If you’re reading this, you’re likely using (or considering) Xero. The Xero ecosystem is a great place to start with automation, with over 1000 apps enhancing Xero’s functionality. Start with automating repetitive, well-defined tasks. Apps that

32 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

I

This article is

automate data entry of invoices and receipts, help businesses with payments, cash flow management, and reporting, should be your first consideration.

Automation first, Artificial intelligence second

AI takes automation a step further by mimicking human intelligence and improving over time. Unlike traditional automation, AI can analyze large data volumes, identify trends, make predictions, and automate complex tasks. However, it’s crucial to understand that AI, like humans, isn’t infallible and its performance can be affected by biased or incomplete data.

Transitioning from traditional automation software to AI is a paradigm shift. Traditional software follows pre-programmed instructions, while AI learns, adapts, and improves over time. This learning capability is a game-changer, enabling AI to handle unexpected scenarios and produce more accurate results, enhancing accountancy practices.

How can your business become AI-first with Xero?

The good news is, you’re probably already using AI. Xero uses AI to streamline data entry and classification tasks. Automated data entry tools like Datamolino use AI to capture data from your invoices and receipts. Other apps in the Xero ecosystem leverage AI, bringing innovation to your doorstep. Exploring the Xero ecosystem and understanding how it can help you today is crucial. Likely, it will be one of these apps that brings the AI capabilities your firm needs.

So, what about ChatGPT?

AI models like ChatGPT go beyond simplifying tasks. They possess unique capabilities such as understanding context,

generating text, and making predictions based on the data fed to them.

If you haven’t yet explored what ChatGPT can do, now may be a good time to start. You can experiment with these models. They can create text summaries of lengthy documents, assist with writing tasks, and even interpret data to some extent, enhancing productivity and efficiency.

Should you be worried if you’re not a ChatGPT prompt professional?

The AI landscape is in its infancy and evolving rapidly. New tools are emerging every day. You can expect companies like Microsoft and Google to integrate the best capabilities directly into your email, word processor, or spreadsheet software in the near future.

The technology is rapidly improving, and skills acquired today, such as prompting, can become obsolete quickly. I advise positioning your business to benefit from AI-infused tools by eliminating your technical debt. Revise your technology stack and ensure you’re using the current apps to their fullest potential. Likely, these apps will provide all the AI capabilities you’ll need in the near future.

Striking the Right Balance of Technology and Human Touch

Embracing AI-infused tools is more than adopting new technologies; it’s about strategic transformation. We must understand where these tools can add value, where caution is necessary, and how they can redefine roles and relationships. By doing so, we can chart a future for accountancy that is efficient, accurate, and value-driven.

Accountants still play a crucial role in client relationships, interpreting data, and making strategic decisions. In the future, successful accountants will be those who embrace these technologies and use them effectively, while maintaining their professional judgment and personal touch in client relationships. A “technologically adept human touch” will become the new gold standard in accountancy.

Issue 35 / 33 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine Get started with automated data entry: datamolino.com FIND OUT MORE...

“A ‘technologically adept human touch’ will become the new gold standard in accountancy.”

Founder & Chief Executive Officer

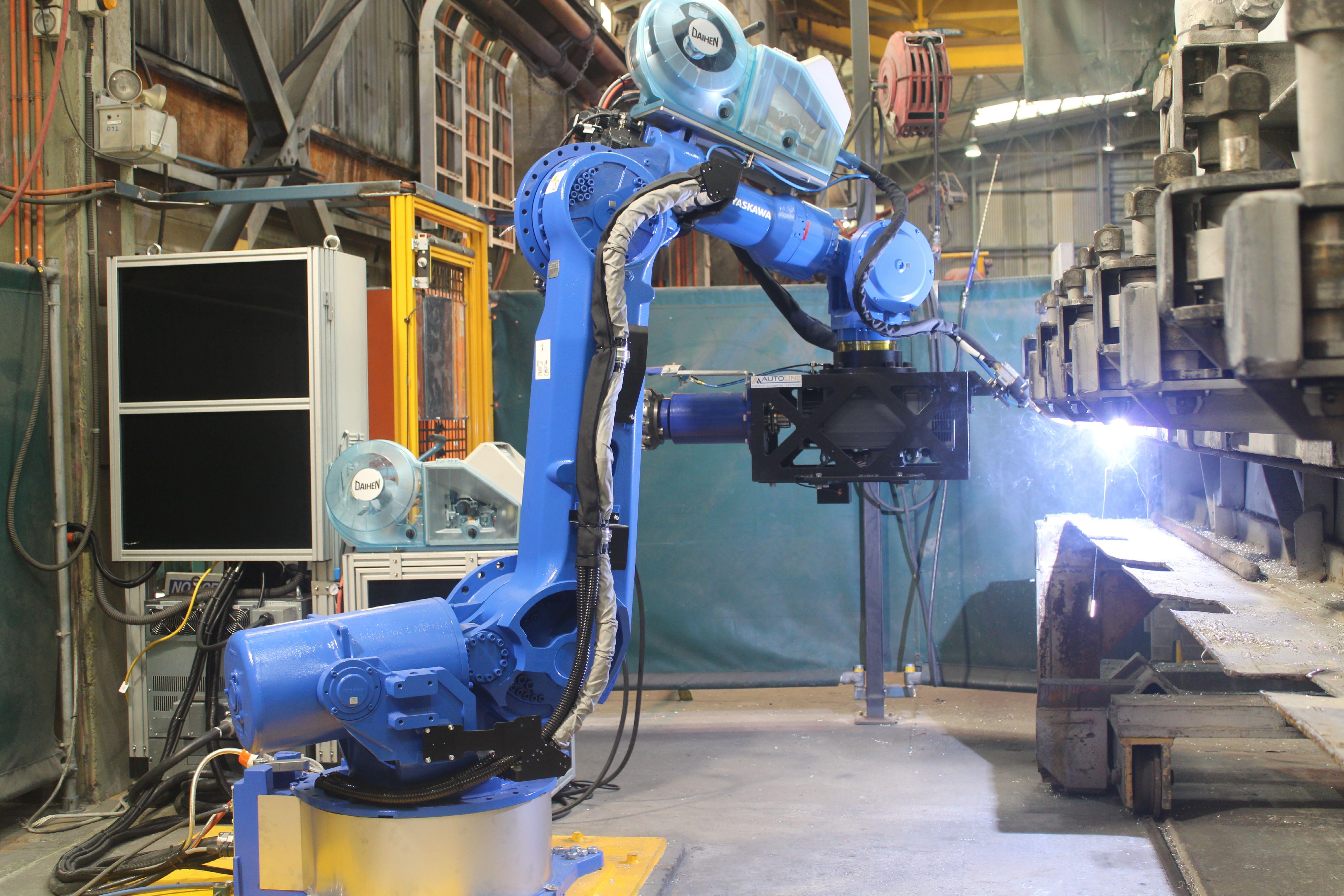

Tech-led Australian advisory business BlueRock acquires

the WorkflowMax brand from Xero

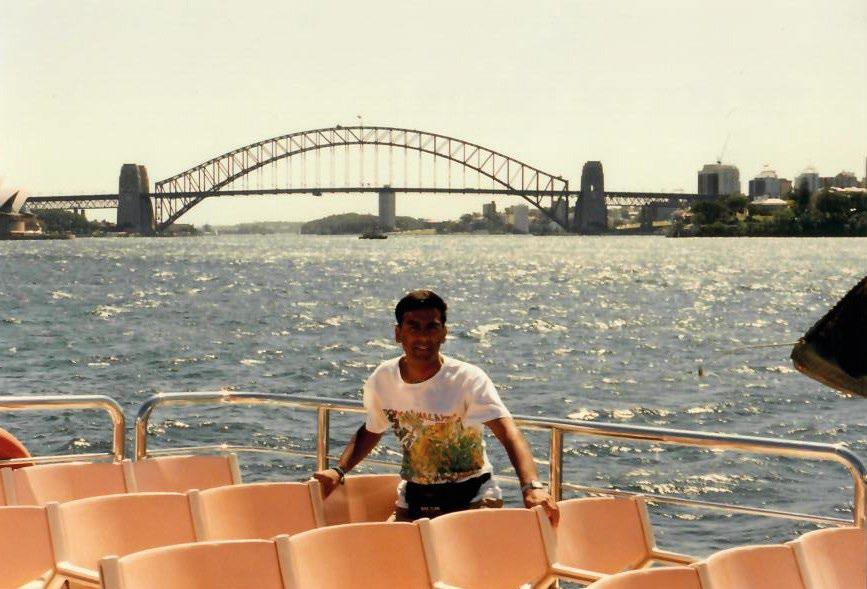

Melbourne is well-known for its famed laneways and arcades, splashed with vibrant graffiti art, lush botanical gardens and a thriving business district. The city is also renowned for its distinct blend of contemporary and Victorian architecture and buildings, and is the base for over five hundred thousand SMBs who drive the small business economy.

Now, Melbourne is the new home for the team at BlueRock who have acquired Xero’s WorkflowMax brand and kicked off grand plans to take their new software to new places and spaces. With investment to boot, they are building a new product to truly scale the solution globally and offer an even richer job management capability. Leveraging the best

in breed technology, with a top-notch customer service and same pricing promise - there’s lots of reasons for you to find out more…

and scaled multiple businesses himself and plans to take the new WorkflowMax by BlueRock to the world. Fast.

Can you tell us about BlueRock?

XU:

We recently caught up with BlueRock’s Founder and Chief Executive Officer, Peter Lalor for a candid interview to understand a bit more about why they love WorkflowMax so much that they want to build a similar product!

Peter is an experienced Director, CEO and Chairman with a demonstrated history of working with entrepreneurial businesses and helping SMBs run successful, profitable operations. With a huge passion for technology and thinking differently, he’s also started

PL:

With three thriving offices based in Melbourne, Australia, we were founded in 2008 and quickly became known as a disruptive startup. BlueRock is a business for entrepreneurs, by entrepreneurs. We’re a growing team of business and technology experts who all work together to get the best outcomes for business owners. We know that business is tough, which is why we act as tech savvy advisors, and bring together lawyers, finance brokers, digital specialists, insurance brokers, financial planners, business advisory, consultants and systems

34 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Peter Lalor

BlueRock

Q&A This article is

and software development experts...basically everyone a business needs on their team to make life easier.

BlueRock has grown quickly to become an international business, recognised on Top 100 lists and as a ‘Best Place to Work’ company for many years. We love what we do, and we understand how to attract and retain the best talent and clients. We also place great importance on giving back to the community and, through our Be BlueRock Foundation and certification as a B Corporation, we strive to have a positive impact on the world.

We live by this mantra: Do things you love with people you care about and good things happen.

XU:Why did BlueRock acquire the WorkflowMax brand?

affordable, cost effective job management solution.”

We’ve always been passionate about WorkflowMax and the benefits it brings SMB owners and we believe there is so much potential to build on the great foundations Xero has set with this product. We’re excited to build a new job management software solution, which we’re aiming to be familiar and similar (if not better), in terms of functionality, to meet evolving market and customer demands. And as a business ourselves, we’re focusing more and more on the development of tech and AI products that will support our SMB clients and advisors. The WorkflowMax by BlueRock product will be a fantastic addition to our offering and provide an even better experience for customers.

build a really comprehensive connection between the two systems

• Access to a brand new WorkflowMax by BlueRock open API with some exciting new app integrations

• We’re overhauling the reporting feature to provide better reporting and visualisation

• Refining the user interface and experience across the board

• …AND adding a pause on the timer! (that’s been one of the most “asked for improvements of all time”)

• A free migration service will be available for customers wanting to make the switch

XU:

As a tech-led advisory business, BlueRock is always looking for ways to improve the lives of SMB owners through technology and innovation. Xero’s WorkflowMax has been a solution that has ticked so many boxes for business owners including our own.

PL:

What is the roadmap for WorkflowMax by BlueRockwhat can customers expect?

When we heard the news about Xero’s plans to retire the current product, we were eager to jump in and take over the reins and build a new product from the ground up (to be known as WorkflowMax by BlueRock). BlueRock plans to keep all the great features, functionality and pricing that customers already know and love.

Ryan Kagan, Founder of BlueRock

Digital and his team have been implementing WorkflowMax, and designing/building custom integrations to the product for over 8 years.

“We’ve seen first-hand the value the product delivers and the popularity of this job management solution across many industries and business types. There’s still a real niche in the market for serving customers with a fully featured,

PL:

WorkflowMax by BlueRock is being designed with customer needs at the forefront. Since Xero’s announcement, we’ve talked to thousands of customers and taken on all the feedback to make sure what we are building will be even more efficient and easier to use than ever before. With the launch of WorkflowMax by BlueRock, we’ll be including the same features customers know and love, particularly when it comes to detailed quoting, managing jobs and costs, tracking time, and invoicing. We’re bringing our decades-long experience working with SMBs on how to efficiently run jobs for profit optimisation. The experience may be slightly different to what WorkflowMax was – but we know customers will feel right at home, saving time with an improved and more intuitive layout.

In the new product launching officially in February 2024 customers and partners will experience some new stuff too:

• Leveraging of Xero’s API to

The team is completely customer obsessed and committed to building a user-centric product with continuous investment in product development now and into the future. We look forward to sharing our further plans and roadmap for post launch which includes a number of new features, product optimisations and some AI surprises, just to name a few. If customers and partners have not yet had the chance to add their feature requests they can do so here in the new Product ideas/feature request forum.

For customers who want to make the move over to WorkflowMax by BlueRock by 1 April 2024, we are offering 50% off the subscription price for 3 months*. We understand that there may be some momentary disruption to their businesses and we want to make the move as painless as possible to help customers to onboard to their new home for job management. There will be a free migration tool/wizard for customers and partners to transfer data over to the new system.

XU: How will WorkflowMax by BlueRock integrate with Xero or other accounting platforms and apps moving forward?

PL: As I mentioned, the new integration with Cont...

Issue 35 / 35 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Q&A

Xero is core to what we are building and we have future aspirations to drive further integrations into other accounting systems to be truly customerled. The interest from the ecosystem community has been overwhelming, so customers can expect a number of new options when it comes to integrating their business operations/job financial management software with other products they love like CRMs, document management, BI reporting tools, task management and more. We’re working with Bryan Williams from Hockey Stick Advisory to make sure we design, build and create a platform community that really drives value for everyone who is part of it.

XU: Can you discuss the details of the brand acquisition and what it means for WorkflowMax’s existing customers?

PL: BlueRock has been one of the thousands of customers using WorkflowMax over the years, experiencing firsthand the value it offers to SMB owners. We want customers to feel right at home with us.

We also think this is the perfect time for customers to review their business processes and

look at their needs (for not just now) but into the future to make sure the solution they choose is the right one that can accelerate their growth and potential. Of course, we hope that choice is WorkflowMax by BlueRock!

As part of the brand acquisition, Xero will continue to use the WorkflowMax brand and manage existing customer subscriptions until the WorkflowMax product is retired in June 2024.

XU: What role will the accounting and bookkeeping community play in WorkflowMax by BlueRock’s future growth and success?

PL: We see the relationship with the accounting and bookkeeping community integral to our success. Advisors have a unique lens into the world of small business and they help drive the performance and potential in the daily operations of a business through their advisory work.

We plan to launch a new and improved certified advisor program to help advisors be even more successful through the use of data. One of the key improvements we are launching in the initial release is an overhaul

of the reporting feature, allowing for even more data insights with an easier interface, giving advisors the ability to visualise data to highlight the most important insights that count. With even greater API connectivity, there’ll be more capacity to integrate with a deeper connected tech stack.

Leveraging the data that sits inside the WorkflowMax by BlueRock operational data set provides a significant opportunity for advisors to better consult and help businesses understand their potential, where to invest their time, and be more productive and profitable.

XU: How will BlueRock’s own expertise and resources help WorkflowMax by BlueRock expand its reach and customer base?

PL: From a design and development standpoint, we are not only bringing a world class engineering experience to this product, but we’re bringing a more robust, scalable and user friendly solution to market by using our internal expertise. We know first hand what drives performance in job management and we’ll be injecting our smarts, the combined wealth of experience

36 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Cont... Q&A

UNLOCK YOUR POSSIBILITIES

POWERFUL INTEGRATED 3-WAY MODELLING

Numbers you can trust

Answer the questions that matter

Engaging reporting made easy

Model complex scenarios in minutes

Be ready for anything

Issue 35 / 37 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

castawayforecasting.com/xu

we have in business advisory and software development/ implementations to help every small business solve their business problems and get more leverage out of their operations.

XU: What kind of values and culture will the new WorkflowMax by BlueRock business instill in its people and customers?

PL: Brace yourself, because this is the incredibly thrilling part! We’re revolutionising the game by acquiring the trusted WorkflowMax brand and fusing it with the very best of BlueRock’s values. The result, we hope will be a new generation of passionate advocates propelling WorkflowMax by BlueRock as the leading job financial management solution. We’re dedicated to offering our customers more than just an app; we want them to experience peace of mind, regain control of their business operations, and empower their teams to achieve productivity, profitability, and excellence. We hope many customers and partners will join us on this

journey, one we plan to fill with meaning, injecting joy, excitement and fun at every turn.

XU: What are the key dates and what should customers and partners do now?

PL: For any WorkflowMax customers and partners wishing to move across to the new solution here are the key dates and next steps to take:

December - January 2024

Free beta access for select WorkflowMax customers.

February - June 2024 - Live launch of the new WorkflowMax by BlueRock product being fully operational and available for all customers directly through the website or via the Xero app store.

June 2024 - Xero retires WorkflowMax

All WorkflowMax customers wishing to join our WorkflowMax by BlueRock community will need to migrate by 26 June 2024.

Get in touch

Jump over to the new website and register your interest to keep updated with our progress. Customers won’t automatically be migrated, so it’s important you understand the steps you need to take.

Watch a WorkflowMax by BlueRock information webinar

Join the Facebook group just for Partners.

Many of the implementation partner community are happy to continue to provide advice and support for customers through the transition. Reach out to them if you’d like help with a system audit / health check or if you have unique implementation needs.

38 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

CALL... Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! Q&A

Book a call with the WorkflowMax by BlueRock team. workflowmax2.com BOOK A

The Well-Trained Client: The First Step for Real-Time Accounting

The last few years have been a busy period for the UK’s accountants. Making Tax Digital changed many fundamental processes, and the impact of Brexit took many by surprise, too.

ollowing the postponement of MTD for Income Tax, it might feel like we’re in a well-deserved period of calm. But this is the perfect opportunity to make key process changes that bring long-term benefits.

There’s never been a better time to get clients trained in the kind of digital skills that are vital if the ongoing digitisation of taxes isn’t to put a strain on them—or on you.

This is true no matter where clients reside, and it isn’t just a UK issue. Most western countries are on journeys towards the digitisation of taxes, which present very similar challenges.

Real-time

One vital digital skill is real-time accounting.

The goal is simple: clients address accounting and bookkeeping tasks when they arise, taking them in their stride as part of their working day.

For example, they will issue invoices and collect payment

when they’ve finished a task. If your client must be onsite to carry out their work, this can even be done immediately once the job has been completed.

They will take a snapshot of receipts or invoices when they’re received, so the data is instantly moved to their accounting. Regular bills can also be fetched from online locations, removing client intervention entirely.

Few accountants realise the scale of the accounting administrative problem facing their clients, or why a solution is so desperately required.

A National Federation of Self Employed & Small Businesses survey amongst its members revealed the following startling issues:

• More than half of small business owners say growth is held back by the time they dedicate to business administration.

• Over two-thirds say the admin

@AutoEntry

Brian Carolan, Product Owner, AutoEntry by Sage

Brian Carolan is Product Owner at AutoEntry. He has been working at the organisation since before its launch, helping guide the development and success of the world-class accounting automation product.

An expert on all matters relating to accounting, Brian has a deep understanding of not only AutoEntry but how customers use it.

Brian is dedicated to helping both the product grow and helping customers and users get the most from AutoEntry.

burden is preventing them from focusing on their business purpose.

• Three-quarters say they spend more time than they would like on issues like tax, accounting and more.

Clients “catch-up” at the weekend on tasks such as balancing the P&L, or inputting receipts, invoices and statement data into their ledgers, or preparing VAT, corporation tax or income tax returns.

As a result, their work/life balance is often awful. None of them started their own business to do admin, yet this is what eats much of their time.

Similarly, preparing for tax crunch times like quarterly VAT returns can be a recurring nightmare that just never goes away.

But real-time accounting means the data is already there. Quarterly VAT returns become a matter of tapping a few buttons, sense-checking a few columns,

40 / Issue 35 XU Magazine - The independent news source for users of accounting apps & their ecosystems

F

This article is

“Client work/life balance is awful. None of them started their own business to do admin”

clicking to submit—and then returning to work. This can even be done during a coffee break.

New processes

The solution is a fundamental rethink by your client about their accounting and bookkeeping processes.

They need to introduce new processes, and possibly even ditch others.

Yes, this can be scary.

But ultimately, it’s about building healthy new habits when it comes to their finances.

Spending time now doing this will save time in the long run—and prepare them for the relentless digitisation of taxes. As their trusted advisor, you can help them through it. It’s much more straightforward than you might think.

Clients that aim for real-time accounting and bookkeeping make their own lives easier, and also make your life easier. For them, they might gain back hours at the weekend. For you, it means significantly less chasing paperwork or data, and always being able to help instantly upon request.

Even better, if you assist in helping the client adapt to realtime accounting and bookkeeping, you’ll appear to be a superstar in their eyes. You’ll literally give them back hours of their lives to spend with their families.

This massively enhances attempts to move into a trusted advisor role, thereby putting you in the best position for the future.

Results

AutoEntry was created to automate data entry, and it’s something we know a lot about.

So, let’s use that as an example of how it empowers real-time accounting and bookkeeping— and what the results look like.

The goal is to help clients create a new habit of scanning receipts, invoices and paperwork such as credit card statements. Real-time accounting means this must be done as soon as they’re received.

For example, if a builder client buys supplies from a wholesaler, they should scan the receipt in their van before they drive away from the car park. When

the morning’s mail is opened, receipts and statements should be scanned or snapshotted. Bills arriving by email should be forwarded to AutoEntry for automated processing.

Once these tasks are done, their accountant or bookkeeper pick-up the data, categorise it as required (or create rules to automate in future), and then publish to the accounting software.

Now, you may have tried to encourage this behaviour in the past, and come up against resistance. Clients have other Cont...

Issue 35 / 41 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

“The solution is a fundamental rethink about accounting and bookkeeping processes”

things to think about, and even a task as quick and easy as taking a phone snapshot of a receipt can be forgotten.

Habit formation

That’s why I talked earlier about habit formation. Once a habit is formed, it doesn’t go away.

True, it requires effort. But there’s significant amounts of guidance out there about good habit formation— and millions of success stories.

The NHS has published clinical guidance about the topic. It did so to encourage healthy eating, but we can easily adapt the processes to encourage real-time accounting.

Here are its basic rules:

• Set a clear goal. For your client this could be, “I will scan all receipts using the AutoEntry app, freeing up several hours of data entry each week”. Goals are always about starting something new. Be careful

not to set a goal to stop doing something. This is unlikely to work.

• Create a cue for the new habit. In other words, when will the AutoEntry app be used? For the client, this might be, “I will scan the receipt in the car or van immediately following a purchase”, and, “I will snapshot paper receipts as soon as I open the envelope”.

• Research suggests habit formation takes 10 weeks! In other words, it’s long-term investment— but after this it really will become automatic. Not undertaking the habit will feel odd.

Incentivising

Your role is to educate, and also enforce. Check in often with the client, and provide paradigms from your own accounting, or other clients.

You must also focus on the output of the good habits the client builds. This is the secret sauce that incentivises clients to

continue their new habits.

For example, the real-time data from AutoEntry feeds into reports that show instantly the cash flow situation for the client – especially if open banking is connected to the accounting software.

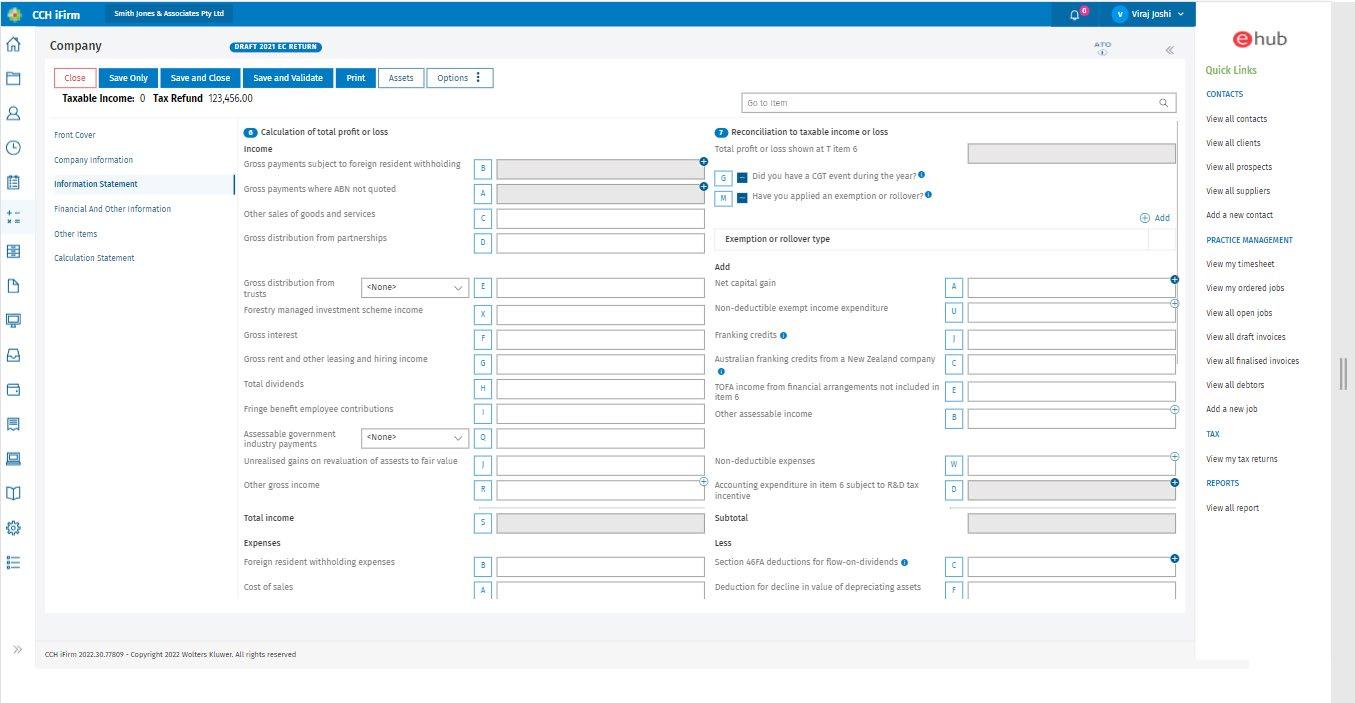

This empowers confident decision-making, such as making capital expenditure purchases or applying for financing. With realtime accounting, there’s no need for prep work, or hunting around for the data required to create reports.