independent news source for users of accounting apps & their

Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Editorial Translator: Lyla Lezghad

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

8 COVER STORY Advancetrack The Human Touch

12 Avalara Automating tax management can drive efficiency and minimize risks for global businesses

16 Ignition 7 strategic steps to run a smart, profitable, and efficient accounting firm

20 CASE STUDY WorkflowMax by BlueRock Getting to the heart of things: Atria Designs levels up with WorkflowMax by BlueRock

26 CASE STUDY Fishbowl Fishbowl Helps Moto Armor Improve Operational Efficiency and Achieve YOY Growth

28 INTERVIEW Plooto Exclusive interview with Plooto Director of Customer Success Ryan Rego

We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register.

Three client problems I solved so you don’t have to

@Advancetrack

Kevin Reed

Kevin Reed is one of the UK's most senior accounting and finance journalists. He has written for, edited or managed various business and finance titles for VNU, Incisive Media, and Contentive since 2000 - and is now a freelance journalist and consultant. He is currently editor of Financial Accountant magazine.

Can accountancy practices get to grips with automation, AI, a scarcity of accountants... and evolving their skills mix?

Accounting talent: an increasingly scarce resource

The Accounting Talent Index, a new global research study from Advancetrack, reveals almost half of firms are being ‘significantly’ affected by an ‘existential’ crisis

As practice leaders look to create a sustainable and profitable future, their talent resource strategy will need to be laserfocused.

The first-ever Accounting Talent Index, conducted and produced by Advancetrack, lays bare that firms across the globe are stricken by skills shortages.

The index reveals that of 280 senior practitioners interviewed, 74% said their firm is ‘significantly’ or ‘severely’ affected by a lack of skills.

The 28-page report finds reasons for this ranged from more

competition for talent from commerce firms to fewer people attending and graduating from university, as well as the effects of the Covid pandemic and an ageing workforce.

Vipul Sheth, MD of Advancetrack, said:

“Our Accounting Talent Index, released today, shows how the acute lack of accountants has emerged as a critical bottleneck, and its impact has been nothing short of severe, impacting businesses, institutions and economies on a global scale. While the solutions are not exhaustive, or all yet identified, significant strides can be made by investing in the development of accounting talent, rethinking recruitment approaches, and promoting the essential role of accountants in supporting economic stability.”

Gain valuable industry insights, strategic recommendations and stay ahead of trends by downloading the Advancetrack Accounting Talent Index for free.

Getting to grips with resources management

Kevin Reed picks out talent and resource as critical areas for the future of both accountants and the practices in which they work.

When you’ve attended accountancy events (particularly tech-focused ones) over the course of 21 years, it can be difficult to spot trends at the next gig on the list.

Many of the ‘new tech trends in town’ have been driven by some form of regulatory change; from Lord Carter’s ‘digitisation of tax’ plans in the mid-noughties that have led us to Making Tax Digital (MTD), through to pensions auto-enrolment and its impact on payroll services.

There are also technological leaps that translate from the consumer into B2B; such as 3G and smart mobiles (aka the iPhone), which drove the creation of a gazillion apps.

However, looking at events over most two/three-year periods, one can be forgiven for thinking:

what’s changed?

Generative AI has been a part of public discourse for the last couple of years, while AI in the context of ‘robotics’ and automation has formed a central part of accountancy tech events since pre-pandemic.

All on show

I have a very unscientific way of gauging trends from the major accounting tech shows: look at the vendor list and try to gauge which ones are new or more prevalent. I might even just ask someone else who’s done the groundwork (journalists will cut to the quick wherever possible, particularly if it saves them legwork).

And, at Accountex 2024, it felt like there was a step change. Dozens of vendors offering a range of outsourcing and offshoring options. Of course, after a stellar few years, Advancetrack was literally front and centre.

It isn’t really for me to question the quality or capabilities of the vendors on show. But it seems that the market for outsourcing

and offshoring is growing – and finally out of the shadows. Outsourcing and offshoring aren’t ‘new’ – for example, Advancetrack is now in its 21st year – but it feels like there is a broader acceptance that both models are now a viable and valuable option in a resourcing manager’s armoury.

And what has driven that acceptance? Well, it’s complicated. However, the launch of Advancetrack’s Accounting Talent Index, at its gbX conference, provides some pointers.

The Index highlighted that the number of people taking accountancy qualifications is (generally) falling; that accounting salaries for younger staffers is uncompetitive, and other professions are becoming more attractive.

What does it all mean?

There’s no doubt the pressures are, as Advancetrack’s new APAC general manager Craig McKell described it at gbX, a multiheaded “Hydra” of problems, including:

• You’re struggling to recruit;

• Fewer people are studying accountancy;

• Some of those you have may need to ‘re-skill’ in a world of AI and analysis;

• New recruits and existing staff salaries are rising; and

• Clients want more from you, but in a fragile economy where some are struggling.

It is no wonder then, that when resources are constrained and expensive, outsourcing and offshoring have come to the fore.

Ironically, those who outsource and offshore are also under similar resourcing pressures (though Advancetrack may well argue that their access to accounting talent is currently plentiful). However, AI and automation are also potential

answers to the resources question and a threat to the outsourcing model.

Threat vs opportunity

There are many that are petrified about this existential threat to the accountancy profession. As a journalist covering the profession for nearly 25 years, and easy for me to say, but I have to admit that I am more excited than concerned.

The accountant in practice has evolved into the ‘adviser of choice’ for businesses and individuals. Broadly speaking this has become even more intense postpandemic.

Technological developments have eroded, and continuing

to erode, some of the numbercrunching work undertaken by the profession. Ultimately, I think we will need fewer qualified accountants – at least in their current guise – than we have in the past.

However, the world continues to become more complex, and areas such as tax, accounting and audit follow suit. We are always going to need experts in these fields. But for practices to be sustainable, they will need to be laserfocused on data management and verification, while becoming better at communicating more frequently – and in a more valuable – way to their clients.

Whether it’s outsourcing, offshoring, AI or automation, there are various solutions to

the current talent and resourcing issues that accountancy faces. But the successful and sustainable practices of the future will be the ones that truly get a handle on talent, skills, and roles – in other words, good old-fashioned humans.

Kevin Reed is a freelance journalist and editor. His views may not represent those of Advancetrack.

Advancetrack continues to evolve its offering! Podsourcing® combines the best of both offshoring and outsourcing. Find out more on the Advancetrack website, or read about Podsourcing® in the next issue of XU.

ith the OECD’s Business Confidence Index (BCI) dropping to below pre-COVID levels before the start of this year, the outlook for businesses across various industries has been driven by the possibility of recession, rising inflation, and volatile consumer confidence, among other economic factors. As a result, businesses across the globe have shifted their focus to meeting efficiency goals, rather than putting a bullseye on unrestrained growth.

A goal around efficiency includes many of the same practices businesses have been leveraging for years, now coupled with the benefits of digital modernization.

To meet new goals around efficiency, businesses are leveraging technology that automates operations and processes; many on the backend. To cut down on added costs, time, and resources spent on low value business requirements, businesses have turned to areas like tax compliance as a part of their operations where they could be more efficient.

Tax compliance is an area especially ripe for automation within global businesses because easy-to-use automation solutions drive both time and cost reduction, protects businesses from harsh fines and penalties from audits, and creates a better overall customer experience. This

Luke Yamnitz

Luke heads up the "Strategic Verticals" partnerships team at Avalara, a leading provider of tax compliance automation software for businesses of all sizes. The team of Strategic Partner Managers lead Avalara’s top Fintech, Point-of-Sale, and Private Equity & Venture Capital partners, in addition to the "FastTrack-Build" accelerator for emerging technology partners.

is especially true for small and midsize businesses, which have fewer resources at their disposal.

According to research from Avalara, small and midsize businesses spend a combined 163 hours and more than $17,000 per month on manual sales tax management. That’s 163 hours that tax professionals could spend on numerous other and more important tasks to support their business’s bottom line. After all, an hour spent on tax management is an hour lost on other parts of the business, which can lead to growth.

The cost of manual tax compliance goes beyond time and money. Like many human-centric tasks, manual tax management is an errorprone process. Using outdated methods, like spreadsheets, makes it increasingly difficult for tax professionals to keep up with constantly changing tax rates and rules. The uncertainty surrounding manually managed tax rates and rules that are used to make tax determinations for a business creates unnecessary risk.

Tax can also serve as a barrier to business growth and expansion. Entering new markets and adding sales channels, employees, products, and/or services can trigger new tax obligations to

register and file in more locations. When businesses are looking for areas to cut costs and resources, and drive overall efficiency, tax compliance can quickly become the poster child for automation because of the low value that managing it provides to a business. Adding in the risk of getting tax wrong and the impact it can have on a business, the decision to automate makes even greater sense.

Automation not only allows businesses to reduce the time and money currently spent on manually managing processes that can be handled more quickly and accurately with technology, but it also reduces barriers to growth and enhances the value of existing technology and systems.

Automation decreases the tax complexity that often comes with business growth. The effort required to remain compliant in a few states is vastly different when you do business in most of the USA. Selling into more countries adds a whole new level of complexity. With automation, it’s easier to scale.

The rise in the adoption of automation signals that more businesses are realizing that tax is simply too complex to manage on their own. However, it’s still important for businesses to understand that not all technology is created equal. For example, if a business is using a solution that only handles tax calculation, they still have an obligation to manage the rest of the compliance lifecycle.

Avalara and Xero have a wellestablished strategic partnership, which brings sales tax workflows and easier management to the Xero platform. Working together, the sales tax compliance capabilities help small businesses, accountants, and bookkeepers simplify sales tax obligations for small businesses, with more reliable sales tax calculations on invoices, more flexible sales tax reporting, and filing via Avalara.

Xero also recently launched its auto sales tax capability, which was developed in partnership with Avalara. The embedded solution brings advanced sales tax workflows and management

directly into the Xero platform, enabling advisors and business owners to automate sales tax calculations, reporting and filing.

This auto sales tax capability is best suited for companies who invoice for their goods and services in Xero, operate across multiple jurisdictions, and have a mix of taxable, non-taxable and exempt goods.

Avalara's expansive tax content database and sales tax calculation engine, coupled with Xero's invoice and reporting capabilities, make it easy for both small business customers and their advisors to benefit from a seamless delivery of tax determinations and calculations on every transaction.

@mckanas

Matt Kanas, Managing Director, Americas, Ignition

Matt Kanas is a seasoned professional who serves as the Managing Director, Americas at Ignition. With a proven track record of driving growth and innovation, Matt has earned a distinguished reputation within the technology industry. He brings over 18 years of experience in the accounting software industry, including working for leading companies such as Intuit.

If inefficient processes are holding your firm back from maximising revenue and profitability, it’s time to consider a smarter way to run your business.

Here are seven proven steps for fast-tracking your revenue, cash flow, and efficiency.

1. Clearly define your services, pricing, and packaging

Many firms are using outdated ways to price and package services. Yet strategic pricing and packaging can significantly enhance your firm’s profitability and operational efficiency. Effective pricing strategies

start by clearly defining and breaking down your services into detailed components. Once you’ve identified the services you’re offering, only then can you determine the value and put a price on each of those services.

This is where a three-option pricing system comes in, enabling your business to offer predefined service packages to clients. Clients understand exactly what they’re getting, when, and for how much, which improves communication

and sets clear expectations.

Using a platform such as Ignition allows you to easily build your service library and create predefined service packages using proposal options

2. Re-evaluate your billing model

Holding on to traditional billing models is another common culprit that can hinder efficiency and profitability for service-based businesses. Billing by the hour, manually tracking billable hours, billing after you’ve completed the work, chasing clients for payments – these are all entrenched habits that drain your resources and your profits.

Updating old billing models is key to managing your firm’s revenue. This includes rethinking how you bill and get paid – for example, shifting from billing upon completion to billing upfront or taking a deposit before the work begins.

When re-evaluating your billing practices, it’s important to have a billing and payments solution that can help you successfully navigate this transition. Ignition’s flexible billing options mean you can bill

hourly or use fixed fees, apply one-off or recurring fees, take upfront payments or deposits, and more.

3. Shift to upfront client payments

It’s no surprise that many firms suffer from cash flow issues if they’re stuck using outdated billing practices.

Even if your business isn’t ready to make the leap from hourly to fixed-fee billing, you can still implement billing processes that will guarantee you’ll get paid. Just like when signing up for a gym membership, firms can collect payment details upfront when clients sign a proposal using a tool such as Ignition. This puts you, rather than your clients, in control of the payment process and allows you to collect the payment automatically when the invoice is due. You can then transition to upfront payments, before the work even begins.

4. Transition to recurring revenue

If your business is stuck on a roller-coaster revenue recycle, it may be time to transition to recurring revenue or diversify your revenue streams to protect your cash flow year-round. For Marcus Dillon, CPA and President of Dillon Business Advisors (DBA), transitioning from a traditional accounting practice to offering more comprehensive client advisory services (CAS) has led to increased revenue. DBA now offers Essential, Premier, and

spend time on the phone giving advice you probably should be charging for. Ultimately, it all adds up and means you and your staff are working, at least in part, for free.

Effective pricing strategies start by clearly defining and breaking down your services into detailed components.

Elite core packages for CAS.

5. Engage clients with a clear scope of work

One of the fastest ways for firms to lose out on revenue and profits is by not having a clearly defined scope of work when engaging clients. You’re not only missing out on an opportunity to communicate your firm’s true value, but also introducing ambiguity to the client relationship. Clients don’t know exactly what they’re paying for, and your staff members are unclear on the services they should be delivering – exposing your business to scope creep.

When sending clients your proposal or engagement letter, it’s vital to include the scope, frequency, and pricing for the services you’re offering, alongside your payment terms, so everyone is on the same page.

Luckily, Ignition enables you to templatise proposals and engagement letters, meaning it takes only minutes to create proposals that provide clients with complete clarity on the scope of services.

6. Get paid when the scope changes

Even if your business is diligent in engaging clients with a clear scope of work, chances are that you’re not charging them for all the ad hoc services you’re providing. It’s all too easy to assist clients with a ‘quick favour’ or

The solution? Refer back to your original signed agreement to remind clients what is or isn’t in scope, and charge them for additional services appropriately.

Thankfully, Ignition makes it easy to bill for any ad hoc or out-ofscope work using the instant bill feature

7. Automate time-consuming processes

Once your firm has redefined its approach to pricing and packaging, engaging clients, billing, and payment collection, it’s time to tackle the biggest challenge holding many firms back – administrative burden. Automating manual client engagement, billing, and payment processes is the key to scaling your business, and your revenue, more efficiently.

Taking stock of your current processes is the first step to helping you identify the biggest efficiency gains for your business. You can then implement platforms, such as Ignition, to help automate the way you run your business and unlock more revenue.

Discover how Ignition can transform your firm.

Try for free

Ryan Kagan, Head of Growth and Partnerships, WorkflowMax by BlueRock

With 20+ years' experience scaling businesses through digital solutions, Ryan Kagan, Head of Growth and Partnerships at WorkflowMax by BlueRock, is a seasoned leader in account management, product, partnerships, and business growth. Formerly a Director at BlueRock Digital, he propelled the startup to success. Prior roles at Deloitte Digital involved driving digital enablement and transformation through strategic advisory. Now, Ryan strives to build a thriving platform community where all prosper.

Migrating software systems can be tough. Reinventing your business operations is even tougher. But with the right software, and the right consultants, you can get it right the first time.

Alot of midsize businesses have the same problem: it’s hard to see past what you’re used to. And this is the case even for firms, like Atria Design, who specialise in fresh visions and off-the-wall solutions.

Samuel Kassis, Founder & CEO, Atria

Atria Designs are a passionate, innovative, multi-award-winning business who design for some of Australia’s best builders and developers. But like many businesses that grow rapidly from small beginnings, Atria hit some speed bumps.

Founder & CEO Samuel Kassis started Atria nearly 10 years ago, and over time Samuel had grown well aware of many of the issues they faced. The aftermath of the Covid pandemic was the perfect time to explore new directions, after Atria had a “bit of a staff shift.” With a mix of new and old hands aboard, Samuel was ready to take the time to find out what would really work for the business.

To do this, he turned to James Hickey, of JHC Consulting Group.

Designing a relationship

Samuel had two main goals for Atria Designs’ engagement with JHC Consulting: he wanted better business data, and more actionable reporting. In the building and design service space, this is more easily said than done. Materials become unavailable or more expensive, builders have to juggle their own commitments and clients, and then there’s always the weather. A certain amount of flexibility has to be built into a building design firm’s business practices, and this can make time-tracking and reporting difficult to nail. But it has to be done, or a lot of money can slip through the cracks. JHC’s approach was making sure that the right people were using the right processes – and that Atria had the right software to power them. That’s why he suggested they use WorkflowMax by BlueRock.

“The new WorkflowMax by BlueRock shows significant promise,”

James says. “The improvements in the tech stack and integration capabilities have been particularly impressive. The ability to link with platforms like Power BI enhances the reporting and analytics functionalities, which is a big step forward for users. What’s more, BlueRock has improved WorkflowMax by enhancing its integration capabilities, providing more robust reporting options, and streamlining the user interface. These improvements make it easier for businesses to manage their workflows and access critical data in real time, which aids in better decision-making and efficiency.”

People, strategy, systems, software – in that order.

Migrating software isn’t always as easy as it should be. Problems often arise less from the actual migration process than from ingesting out-of-date or just plain wrong data. For the migration to work well, these errors need correcting – but at the same time, useful historical data needs to be preserved. For Samuel and Atria Designs, this was very much the case – but the situation was

complicated by the fact that the Xero edition of WorkflowMax had been set up wrong. “I’ve had consultants in the past that came alongside WorkflowMax, who didn’t understand our business and what we were trying to achieve –or even how we actually bill and invoice,” Samuel explains.

Luckily, JHC understands that every business is different, and they took the time to properly research and reinvent Atria’s business processes before encoding them in software. Their empathetic, people-and-systems-first approach not only worked – it paid instant dividends. JHC’s strength is in data management and presentation, and after understanding the people, systems and processes, data can be ingested, cleaned, and put to work.

our head against the wall,” Samuel says.

“It all makes sense. It all works smoothly.”

“WorkflowMax is a costeffective, all-in-one job management software that can transform your business operations” -

James Hickey, Founder, JHC Consulting

The results have been huge for the team at Atria Design. They now have clean, clear data with which to make business decisions. They’re getting precise measurements of time, jobs, and finances.

balance sheet. “The team is now really well-equipped to use the new systems effectively, and the ROI for Atria is substantial.”

“One of the benefits of having James on board through the migration from the old WorkflowMax by Xero to the new WorkflowMax by BlueRock is that he really understands data,” Samuel says. “James discovered we weren’t really using the old WorkflowMax to its full capability, but he was able to say ‘this is the best program for you guys, because we can see all the benefits of where it’s going to go.’ So we kept with it, and had him help us through the transition process, which was really beneficial."

Samuel and James agree: this careful approach meant that the pain of migration was minimised, and benefits were realised sooner than they’d otherwise have been.

“Overall, the integration project with Atria went quite smoothly,” James says. “We successfully migrated data from WorkflowMax (WFM) by Xero, to new WorkflowMax with integrated Power BI for advanced reporting, and streamlined several operational processes.”

“If we didn't have James, I could tell you now, we would be bashing

“They can now access comprehensive data insights through Power BI, which was not possible before,” James says. With new WorkflowMax, they have a unified workflow for managing quotes and invoices, linked with their sales processes, and they can generate real-time reports for better decision-making. The team, he says, will see significant time savings across job management and project delivery timelines, thanks to the streamlined workflows and automated processes.

There will be quantifiable savings where it’s most visible, James adds – the bottom line of the

“Financially, they can expect increased revenue from improved strategic decision making, while cost savings will come from optimised operations, as well as reduced need for additional software solutions,” James says. “They’ve quantifiably reduced the time spent on job management tasks, improved project delivery timelines, and they’re increasing sales and revenue from having better strategic alignment across the business."

Meanwhile, Samuel says that with WorkflowMax by BlueRock fully implemented in the business, it’s finally approaching its full potential.

“The thing I do love about WorkflowMax is the sync with Xero,” James says. “For the job financial management side of things, sending your invoices through to Xero, it all makes sense. It all works smoothly.” Cont...

“WorkflowMax helps you manage your projects efficiently and make data-driven decisions to drive growth” - James Hickey, Founder, JHC Consulting

If they didn’t have WorkflowMax, it’d be a different story, he notes. There’d be a huge amount of manual workarounds for job and performance tracking. “It’s great for our team to track their time, and input time data straightaway. For job tracking, it’s really great."

For both Samuel and JHC, a big positive of the migration from old WorkflowMax to WorkflowMax by BlueRock is that the user interface has, at long last, been polished to a bright shine.

“Migrating across to the BlueRock WFM has been a bit of a shift because things look a little bit different, but it’s a lot more user-friendly. It’s a lot prettier, let’s be honest. It looks really nice and efficient, and you can tell they’ve put a lot of effort into making it cleaner and better.”

Designs and JHC Consulting to down tools – but it’s not. In fact, it’s just the start.

Atria’s staff are thrilled with the change in operations: not only are they more efficient, but they’re happier in their jobs. The investment has paid off in spades. “After what I’ve been able to do now, I wish I’d engaged someone like James sooner. Being able to really understand your business, your output, and being able to track data well, I wish I’d had those tools earlier,” Samuel says. “I can tell you now, there would have been a lot less heartache with both staff members and clients.”

essential for staying competitive,” James adds. “WorkflowMax is a cost-effective, all-in-one job management software that can transform your business operations.”

You and your clients could win by using Atria’s software stack too

• WorkflowMax – WorkflowMax by BlueRock job management. Boost your productivity, profitability and performance. Do it all from anywhere –quotes, jobs, scheduling, time tracking, invoicing, reporting, and more.

“WorkflowMax is fantastic for our team to track their time, and input time data straightaway.” - Samuel Kassis, Founder & CEO, Atria Designs

Transform your business operations with WorkflowMax – and the right consultant

With the move to the new WorkflowMax complete, and the first phase of workflow and process transformation concluded, you’d be forgiven for thinking it was time for Atria

For his part, James and the team at JHC say they’re very happy with how the project went with Atria, and they’ll continue to recommend the new WorkflowMax to clients. WorkflowMax, James says, can help businesses like Atria by providing a comprehensive solution for job management, time tracking, and reporting. It streamlines operations, enhances data visibility, and integrates seamlessly with other tools like Xero and Power BI, leading to improved efficiency and better strategic decisions.

“And from meeting the WorkflowMax by BlueRock leaders, I can see a major commitment to continuous improvement, which is

• Xero – Xero is accounting software for thriving businesses. Xero’s online tools have all the financial insights to make better decisions and simplify business admin.

• Microsoft Power BI – Visualise any data and integrate the visuals into the apps you use every day with Power BI, a unified platform for self-service and business intelligence.

• Wordpress – One of the most popular, powerful, and customisable CMS systems in the world

• Response Database Integrations – Specialises in innovative data solutions to drive business performance, growth, and efficiency.

• Microsoft 365 – Atria Designs uses a market-leading Microsoft suite, including Microsoft Teams (for sharing PowerBI), Outlook Templates and SharePoint

A great design is everything, whether it's for a kitchen or a business

SuiteFiles combines document management, secure client communication, digital signing, and world-class integrations into one seamless experience.

Spend more time doing what you love, and watch your business thrive.

1. Better processes across the business, happier and more productive staff, and more proactive leadership

2. Correctly-implemented modern software stack that helps keep the business on track rather than hindering it

3. Accurate timekeeping and workflow management with WorkflowMax, and powerful, accurate reporting with Microsoft Power BI

Want to become a WorkflowMax partner?

From full implementation partners, to certified business advisors and ecosystem partners

– we encourage you to join our community.

Find out more about the new WorkflowMax by BlueRock partner program at :

workflowmax2.com/ become-a-partner

Coachbar is proud to work with WorkflowMax as a foundational customer of ChannelBoost, our flagship software that helps software providers grow their partner channels. ChannelBoost offers everything you need to increase your ROI from indirect sales channels: increased engagement, efficient channel management, and a unique, integrated partner directory.

Coachbar has three products that support the full software selection and implementation lifecycle. There’s software selection education for small businesses through StackPlan; our AppVentory software enables tech advisors to discover and optimise apps within their client base; and ChannelBoost is for businesses that make and sell software. Together, the Coachbar suite revolutionises the way tech advisors work with software providers, to achieve better outcomes for small businesses.

If you’re a software provider, who wants help to start or improve your partner channel with accountants, bookkeepers, or software consultants, get in touch with the team at Coachbar today. Visit coachbar.io to find out more.

Does sales tax give you a headache?

Sales tax as easy as 1

If you or your clients sell taxable g across jurisdictions, automate Xero’s sales tax, powered b

Take the guesswork out of wha what’s not, and at what rate with automat sales tax calculations on in

Stay on top of payment deadlines and amounts due with automaticall

Ready to file? Xero conn seamless e-filing options.

Learn how Avalara can help you grow your practice and expand your services.

Automated sales tax is included in Xero subscriptions. Visit avlr.co/xero to learn more.

Fishbowl software improved Moto Armor's inventory management by saving time and reducing manual labor, boosting their business growth.

oto Armor was founded in 2016 with a vision to bring high-quality, Americanmade parts for Offroad UTV platforms.

Since 2016, Moto Armor Has doubled in size almost every year.

For Moto Armor to achieve such impressive YOY growth, the company had to improve its

operational efficiency. For the past couple years, the team noticed how much harder it was to manage inventory, order raw materials, and track parts internally throughout the process from raw to finished products.

Challenge

In any company that begins to scale, an efficient inventory

management process can make all the difference and save precious time and money.

The Moto Armor team was wasting just that, manual labor and time tracking and managing their inventory manually via spreadsheets, constricting them from focusing on other things that could improve and drive the business forward. @Fishbowl

The team started looking for inventory management software and came down to a few companies, one of which was Fishbowl.

“After being able to demo multiple software options, Fishbowl was a no-brainer. Being a company from Utah appealed to us as well as how easy the software was to navigate through.” – Scott Kartchner, General Manager

Solution

After choosing Fishbowl and going through the implementation process, Scott admitted that the process wasn’t fun, due to the amount of work.

The team had to input thousands of part numbers while integrating their current software applications with Fishbowl.

But as soon as everything was implemented, they quickly noticed how much more efficiently they were handling inventory, orders, and work processes. The team was able to reduce manual labor, handle large quantities of orders, and improve scheduling all in one platform, utilizing Fishbowl’s powerful automation tools.

“Fishbowl has helped us manage inventory, sales, and productivity all in one place.” -

Scott Kartchner, General Manager

Ultimately, Fishbowl has enabled Moto Armor to work more efficiently, giving them time back to focus on what they do best, creating high-quality, American-made products for their customers.

XU: Can you provide an overview of Plooto and its primary functions in accounts payable and receivable?

This article is

RR: Plooto is an all-in-one payment automation solution that securely automates accounts payable and receivable for small-to-midsize businesses and their accounting firms, saving them time and helping them gain control of their cash.

Plooto makes it easy for more than 10,000 North American

businesses to customize and automate payment workflows, reduce time spent chasing approvals, and mitigate human error in accounting processes.

XU: How does Plooto differentiate itself from other accounts payable and receivable software in the market?

RR: Unlike other point solutions that manage either AP or AR – often requiring separate software to facilitate approval logic – Plooto is a true

end-to-end, automated solution. We’ve made Plooto approachable and user-friendly, from the pricing – which is per entity, rather than per user, so the savings grow as your business grows – to the interface, on which we get consistently positive feedback.

We also offer top-tier product support and hear from our users that our response times outpace other software.

XU: What are some common pain points businesses face in cash management that Plooto addresses effectively?

RR: Plooto allows businesses and accounting professionals to be hands-off with manual tasks, while keeping the hands-on security of your chosen approval settings. Rather than relying on bank feeds and CSVs, you can reconcile in a fraction of the time with Plooto. You stay informed throughout the payment process with consistent updates on the status, and can also set tailored approval controls to reduce the risk of fraud and allow only necessary team members to access payments.

XU: How does Plooto's technology simplify manual payment and accounting processes for businesses?

RR: A two-way sync with Xero, QuickBooks, or NetSuite alleviates the need to manually enter and reconcile payment data. Plooto offers multiple payment methods and supports payments to vendors across 20 currencies to 40+ countries, so you can manage all AP and AR from one platform. Say goodbye to tedious bank lines, cutting paper checks, and email thread approvals.

XU: Can you highlight any specific features of Plooto that enhance total control over cash management for businesses?

RR: If knowledge is power, then Plooto plays a part in powerful cash flow management.

Automating the payments portion of your cash flow process ensures you have control over when and how you pay and get paid – giving you clear insight into dollars in and out of your business. When you’re on top of your cash management, you’re able to make smarter, more timely business decisions.

XU: How does Plooto integrate with other accounting software platforms?

RR: Plooto integrates directly with Xero enabling powerful end-toend payment automation and reconciliation. Once the connection is established contacts, bills, and invoices are imported into Plooto.

After a user initiates the payment, approval rules that have been set up are activated, the payment is made, and Plooto reconciles your records in Xero. We offer similar two-way integrations with QuickBooks and NetSuite.

XU: What kind of businesses benefit the most from using Plooto?

RR: Businesses with finance teams still using manual accounting processes can see immediate time savings and error mitigation from using Plooto.

For accounting practices, Plooto is a single platform on which to manage their entire book of business – securely automating client payments so they can spend more time growing their firm.

What are the onboarding and support processes like for new Plooto users? How easy is it for new customers to get started?

RR: It takes less than 15 minutes to create an account and complete the verification submission. Once you pass security checks, you should be ready to start transacting within one business hour. The process is simple enough to complete yourself, but our customer success team is also available to help you get started with a demo, training, and the right resources.

XU: How does Plooto leverage automation to reduce the manual workload for finance teams?

RR: Teams can use our Plooto Capture feature to email or upload invoices and let Plooto do the work of automatically importing the data into accounting software like Xero.

Accounting teams can then send funds through Plooto to pay the invoice, which is automatically synced back into Xero and marked as paid. Approval processes based on roles, responsibilities and even dollar amounts ensure you can control spend and security without additional human effort.

XU: How does Plooto's reporting and analytics capabilities help businesses make better financial decisions?

RR: Plooto gives you visibility and control of funds going in and coming out of you (or your client’s) business, and auto-reconciliation with your accounting software means you can have confidence you’re getting complete data to forecast your cash flow. Automation enables speed to insight, so your finance decision makers are equipped with timely data.

XU: What role does customer feedback play in the development and improvement of Plooto's features?

RR: Two of our company values are innovating for our customers and championing their success. We love engaging with Plooto users at live events and through one-on-one interviews. These conversations keep us close to pain points and real-world needs that we strive to solve both through our platform development and customer support.

XU: Looking ahead, what are some future developments or features that Plooto plans to introduce to further enhance cash management for businesses?

RR: We’re excited to announce new capabilities that will provide businesses with even more ways to take control of their cash very soon! Stay tuned in the coming months.

November 5-6, 2024

The second annual Accountex Canada Conference & Trade Show, held in 2023, marked a significant milestone for the accounting and finance community, drawing over 700 accountants and finance professionals nationwide. This 2-day conference and trade show, with 60 industry vendors, provided an unparalleled platform for networking, learning, and growth, solidifying its place as a must-attend event in the industry calendar.

Accountex Canada 2023 was a hub of activity, with attendees eager to connect with peers, explore new products and

services, and gain insights from leading industry experts. The event featured an impressive lineup of top-tier speakers, including Jamie Golombek, Regan McGrath, and Tim Coakwell, who delivered engaging and informative sessions. Their expertise and passion resonated with the audience, leaving a lasting impact.

The success of the conference was reflected in the positive feedback from participants. One attendee commented, "Great energy! The trade show offered face-to-face networking opportunities with such a diverse range of accounting

Steve Dempsey, General Manager, Accountex Canada

Steve has been managing events across Canada for 30+ years, from trade shows and conferences to awards shows and galas. With a wealth of knowledge in several B2B industries, Steve leads a dedicated team that produces Accountex Canada (Nov 5 & 6, 2024), the fastest-growing accountancy & booking conference & trade show in Canada, and the recently launched Accountex Canada webinars.

and fintech providers.” This sentiment was echoed by many, highlighting the vibrant and dynamic atmosphere that characterized the event. Another participant noted, "The sessions were packed with valuable insights and practical tips that I can directly apply to my work," emphasizing the high-quality content and its relevance to their professional development.

"Accountex 2023 was a great show! We got amazing leads, and our booth location was top-tier. We loved participating in it and can't wait for next year!"

The conference also received praise for its organization and opportunities for exhibitors. A vendor shared, "Accountex 2023 was a great show! We got amazing leads, and our booth location was top-tier. We loved participating in it and can't wait for next year!" Such testimonials underscore the event's success in facilitating meaningful connections and driving business growth.

Building on last year's event momentum, Accountex Canada is gearing up for its third annual conference, scheduled for November 5-6, 2024, at the Metro Toronto Convention Centre.

"Great energy! The trade show offered face-to-face networking opportunities with such a diverse range of accounting and fintech providers.”

The upcoming event promises to be even more impactful, with an expanded program and new features designed to enhance the attendee experience.

One of the major highlights for Accountex Canada 2024 is the introduction of 25+ CPD-verified sessions, ensuring attendees can earn continuing professional development credits while gaining cutting-edge knowledge. The conference will feature three stages, each dedicated to addressing the industry's most relevant and requested topics. These include Succession Planning, AI, Ethics, Tax and Payroll Updates, Marketing, and Strategic Planning.

The "Main Stage" will host a series

of high-profile sessions, such as:

• How To Work Less and Get More Done by Joe O'Connor

• AI & The Future of Work by Swish Goswami

• Choose Your Own Adventure — Remedies Taxpayer Issues by Amanda Doucette

• Top 5 Biz Myths by Ron Baker

• Bridging the Generational Gap in the Workplace by Kim Tabac

• AI and the Alignment Problem: An Ethical Consideration by Garth Sheriff

These sessions are designed to provide attendees with actionable insights and strategies to navigate the rapidly evolving accounting and finance landscape.

New Features: Bookkeeper's Base Camp and Professional Lounge

Accountex Canada 2024 will also introduce some new features to enhance the attendee

experience. The Bookkeeper's Base Camp, offered by Jo Wood and Zoe Whitman, will offer a dedicated area for bookkeepers to network and relax with peers. This initiative aims to foster community and provide a supportive environment for sharing best practices and insights.

Another notable addition is the Professional Lounge, where attendees can learn how to optimize their LinkedIn profiles and maximize their professional exposure. Led by Ashley Leeds, this interactive space will provide valuable tips and hands-on assistance, helping participants enhance their online presence and leverage LinkedIn for career advancement. Participants will also have the opportunity to refresh their LinkedIn photo with a professional headshot photographer.

As Accountex Canada moves into its third year, it continues to build on its legacy of excellence. The conference's commitment to delivering high-quality content, fostering valuable connections, and addressing the evolving needs of the accounting and finance community remains unwavering. With an exciting lineup of speakers, innovative sessions and leading fintech providers, Accountex Canada 2024 is set to be an unmissable event for professionals looking to stay ahead in their field. Make sure to mark your calendars for November 5 – 6th, 2024, and join us at the Metro Toronto Convention Centre for an unforgettable experience!

@tidyint

Amelia Douglas, Content Creator, Tidy

Amelia began working as an apprentice in the Marketing team at Tidy at the beginning of this year. With a passion for creating engaging content with a positive impact, Amelia provides an exuberant flair in bringing Tidy’s vision to life.

When inefficiencies started leading to supply chain disruptions for Kendermar, they needed a solution. So who did they turn to?

FThis article is

ounded in 2010 by Ken and Mary McCabe, Kendermar Distributors Ltd is a family-owned enterprise with deep roots in Ashbourne, Co Meath. Spanning a 10,000 sqft facility, the company is a prominent supplier of an extensive range of products including crockery, cutlery, cooking utensils, glassware, and disposable items.

Catering primarily to the hospitality sector, including contract caterers, educational institutions, and various other entities, Kendermar stands out for its unwavering commitment to superior service and customer satisfaction. The company operates with a dedicated team of nine employees, who are pivotal in ensuring smooth operations and high-quality service.

Kendermar is defined by its close-knit, family-oriented culture. The company fosters a sense of community among its staff, promoting a supportive and collaborative work environment and the longevity and dedication of the staff are testaments to that.

Many employees have been with Kendermar for over 13 years, contributing to the company’s growth and stability. This continuity has been instrumental

in maintaining the high standards of service that Kendermar is known for.

Before choosing TidyStock, Kendermar Distributors had relied on an older solution for well over a decade. Despite its initial effectiveness, the old system struggled with maintaining precise stock levels, leading to inefficiencies and disruptions in the supply chain.

The challenges prompted the search for a more robust solution that could offer real-time inventory management and better integrate with the company’s existing tools.

TidyStock emerged as the ideal candidate. Its seamless integration with Xero and its real-time stock management capabilities promised to streamline Kendermar’s inventory processes and enhance overall supply chain efficiency. The transition to TidyStock was executed smoothly, with minimal disruptions, and Kendermar adapted quickly to the new system.

Benefits from Start to Finish

The implementation of TidyStock has yielded several significant benefits for Kendermar Distributors. One of the most notable advantages is the access to real-time stock information.

This has led to a remarkable boost in accuracy of inventory information, which is crucial for effective decision-making regarding stock ordering and replenishment.

Ken McCabe, Managing Director of Kendermar, noted ”having real-time stock information gives us great confidence in knowing we have everything we need to do business. TidyStock really does help keep our stock as accurate as possible which makes us much more efficient."

"Having real-time stock information gives us great confidence in knowing we have everything we need to do business"

The enhanced accuracy has also contributed to a reduction in overstocking and stockouts, optimising the supply chain and improving customer service.

In addition to real-time stock tracking, TidyStock’s user-friendly interface has been well-received by the team. The efficiency features of the platform, such

as automated stock alerts and streamlined order processing, have been particularly valued.

Since opening their doors, Kendermar has established itself as a preferred supplier for three of Ireland’s largest contract caterers—KSG, Gather & Gather, and Apleona—as well as the leading hospitality group, Press Up Entertainment Group.

The endorsement from such prestigious clients underscores Kendermar’s ability to meet and exceed the high standards expected in the competitive hospitality sector.

"TidyStock really does help keep our stock as accurate as possible which makes us much more efficient"

This status highlights the company’s reliability and solid reputation within the industry.

Looking towards the future, Kendermar is optimistic about its ongoing success and growth. Although there are no immediate plans for physical expansion, the company remains agile and ready to evolve in response to emerging market trends and customer demands. The team is continuously exploring opportunities to enhance their offerings and adapt to

the dynamic landscape of the hospitality industry.

As the company progresses, its focus on innovation, customer satisfaction, and sustainability will drive its future achievements and reinforce its reputation as a leading supplier in the hospitality industry.

To find out more about how you can make your business Tidy, visit:

https://tidyinternational. com/solutions FIND OUT MORE...

Embracing AI and Automation for MTD for ITSA: A Comprehensive Guide for

Introduction to MTD for ITSA

The UK government’s Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) aims to simplify tax processes for sole traders and landlords.

Starting in April 2026 for those with incomes over £50,000, and extending to incomes over £30,000 in April 2027, MTD for ITSA mandates digital recordkeeping and quarterly updates via HMRC-compatible software.

1. Digital Records: Maintain and store income and expense records digitally.

2. Quarterly Updates: Submit updates to HMRC every quarter.

3. Annual Summary: Complete an end-of-year process to finalize tax data.

Benefits

• Accuracy: Automation reduces human errors.

@app_myt

Oumesh Sauba, CEO, MYT

Oumesh Sauba is the visionary founder and CEO of MyT Limited, an innovative AIpowered accounting app and software tailored to meet the bookkeeping and recordkeeping needs of freelancers and micro businesses. He previously directed Sauba and Daughters Co, a wellestablished accounting firm based in Croydon. With over 15 years of experience as a Chartered Management Accountant, Oumesh specializes in financial accounts, management accounts, and taxation.

• Efficiency: Streamlined processes save time.

• Compliance: Regular updates ensure adherence to tax regulations.

AI and Automation in MTD for ITSA

AI and automation play a pivotal role in helping businesses and accountants adapt to MTD for ITSA. Here’s how:

1. Automated Data Entry: AI-

powered tools can automate the entry of financial data, minimizing manual input and reducing errors.

2. Real-time Reporting: Automation enables realtime updates and insights, making it easier to track financial performance and meet quarterly reporting requirements.

3. Error Detection and Correction: AI algorithms can identify discrepancies and suggest corrections, ensuring accurate record-keeping.

4. Predictive Analytics: AI can analyze historical data to predict future financial trends, aiding in better financial planning and decision-making.

MYT, an AI-powered bookkeeping software, is designed to streamline the MTD for ITSA process. Here’s how MYT can assist:

1. Seamless Integration: MYT integrates with HMRCcompatible software, ensuring

compliance with MTD for ITSA requirements.

2. Automated Record-Keeping: MYT automates the recording of income and expenses, reducing the need for manual data entry and minimizing errors.

3. Real-Time Insights: MYT provides real-time financial insights, helping businesses and accountants make informed decisions and stay on top of their financial health.

4. Quarterly Updates: With MYT, businesses can easily submit quarterly updates to HMRC, ensuring timely compliance.

5. AI-Powered Analytics: MYT's AI capabilities offer predictive analytics, helping businesses forecast future trends and optimize financial planning.

1. Choose Compatible Software: Select HMRC-approved software like MYT that integrates AI and automation features.

2. Training: Educate staff on using new digital tools effectively.

3. Stay Updated: Regularly check for HMRC updates and attend relevant training sessions.

HMRC provides extensive support through webinars, guides, and a variety of compatible software options to assist in the transition to MTD for ITSA.

MTD for ITSA is a significant step towards digitalizing tax processes, with AI and automation providing the tools needed for a smooth transition. These technologies enhance accuracy, efficiency, and compliance, ensuring businesses and accountants are wellprepared for the digital tax future. MYT's AI-powered bookkeeping software stands out as a valuable tool in this transition, offering seamless integration, automated record-keeping, real-time insights, and predictive analytics.

To find out more, visit our website:

Financial controls are vital policies and procedures put in place to keep financial records in check and protect company assets. Yet the vast majority of businesses don’t have strong controls in place, according to our latest research.

Head of Financial Controls North America, ApprovalMax

Three in four businesses don’t have the right financial controls in place to protect their business; only one-quarter (25%) of businesses report having strong financial controls in place, the research shows.

How can businesses of all sizes build better financial controls, especially with the help of their accountants and bookkeepers? We consulted our ApprovalMax experts to learn more:

Angela Bierman, Head of Financial Controls North America, ApprovalMax

Why is it so important for businesses of all sizes to have strong financial controls?

Strong financial controls are

the guardrails of good decisionmaking in any business. A lot of smaller companies may hear the term ‘financial controls’ and think ‘that’s not for me, my company isn’t big enough. But no matter the size, every business has something to protect and no one wants to lose money to fraud or carelessness.

How can accountants help their clients to build and maintain these strong controls?

As trusted advisors, accountants not only provide services but valuable education. Many small business accountants can help clients design, monitor, and adjust financial controls as circumstances change and their business evolves. It doesn’t have to be a huge project to deliver a full playbook of financial policies and procedures – simply asking questions like ‘How are you protecting your business from phishing emails?’ can highlight potential risks.

How can bookkeepers help their clients to build and maintain these strong controls?

By working closely with clients, bookkeepers can identify the types of controls clients may need to put in place and where they

@ApprovalMax

Konstantin Bredyuk, CEO & Co-Founder, ApprovalMax

With roots in business process management and optimisation software development, Konstantin has undertaken hundreds of product implementations for ApprovalMax clients worldwide.

Konstantin has advised numerous organisations on automation, financial controls, and client collaboration capabilities using Xero-based trusted app stacks, with business profiles ranging from SMEs to large accounting and advisory practices.

can help. We can also help them set up the workflows around these controls and monitor them as needed.

Are there any specific requirements or guidelines around financial controls in North America, where you’re based?

Across North America, guidelines around financial controls vary. Companies operating in the US capital markets are subject to the Sarbanes Oxley Act (SOX) and all companies listed in Canada are subject to Bill 198 (unofficially “C-SOX”).

Where do businesses –especially smaller ones – often misstep when it comes to controls?

Some small businesses misstep when it comes to financial controls by simply copying the financial controls of another company without assessing what will work for them, or where their own areas of risk are.

If you find your team is always processing exceptions to the guidelines, they weren’t customized enough for your unique ways of operating – or you’ve outgrown them!

Cassandra Scott, Head of Bookkeeping APAC, ApprovalMax

How do you define financial controls?

Financial controls are mechanisms that govern financial management within a business. They’re checks and balances put in place to ensure there is integrity around a businesses’ financial data, processes, and output.

When is the best time to set up financial controls?

Cassandra Scott, Head of Bookkeeping APAC, ApprovalMax

While the new financial year is always a good refresh, there’s nothing that stops people from fixing their financial controls immediately! If you wait and try to make everything perfect before starting, there’s always the risk that you’ll get distracted and never get it done.

Stuart Hurst, Head of Accounting EMEA, ApprovalMax

finances so can help develop processes around purchases and sales as a starting point.

Accountants can also play the enforcer role in a firm, making sure processes are followed, which some business owners may feel uncomfortable with.

Where do businesses –especially smaller ones – often misstep when it comes to controls?

They probably put too much trust in people over processes to be honest and they often move so quickly that controls get neglected. In the worst case, this puts you at risk financially.

Why is it important for businesses of all sizes to have strong financial controls?

Ensuring that you have Integrity around your financial information is critical, particularly if you're needing to provide that to other stakeholders or selling a business. For example, are you buying a business, seeking financing, or do you have Australian Taxation Office or other legal compliance obligations? It even extends further out to things like marriage breakdowns.

Financial controls are also vital for fraud mitigation. In businesses there can be a fine line between success and failure; you want to protect the financial resources of that business from any misappropriation or mishandling, whether intentional or not.

How can bookkeepers support their clients to build and maintain these controls?

As bookkeepers, we're very deeply embedded in the dayto-day mechanics of business operations and that gives us unique insights into workflows, processes, and procedures. Through this, we have the ability to spot where there are weaknesses or flaws in those processes, as well as the capacity to work with business owners to try and fix those gaps.

How do you define financial controls?

They are ultimately controls that safeguard cash, whether this is directly in terms of peoples bank access or more indirectly, such as approval processes for purchase orders.

Why is it so important for businesses of all sizes to have strong financial controls?

Financial controls serve several purposes. They help stop worst case scenarios, whether that be because of fraud or simply poor spending decisions.

It also means so much more time needs to be spent building controls down the line which can be messy the more people are involved. It’s much easier to build solid foundations from day one!

Are there any examples, like with your own clients, where you’ve seen first-hand the benefits of stronger controls?

Head of Accounting EMEA, ApprovalMax

Financial controls also help maximise the use of your money. You’d be amazed how much money can be wasted without the right controls in place. A prime example is on subscriptions set up that are never used but not cancelled.

How can accountants help their clients to build and maintain these strong controls?

Accountants are in a prime position to help build controls. They have a great grasp of

We saved a client over £10k over a six month period by bringing in a robust purchase order system. Previously he was paying for stuff that never arrived!

Whether your business is large or small, there are huge benefits to building robust financial controls and using automation to help keep them in place.

Want to know more? Download our latest guide to learn about tightening your financial controls for Xero users:

really adds up

more time & flexibility for you we match you with global talent

more value-added advisory enjoy expertise -driven growth

Release your staff from entry-level tax and compliance work Your dedicated team at The Back Room takes care of mandatory accounting and bookkeeping tasks – so you can do more higher-value work

Boost your marketing capability Our full and part-time talent covers all the bases – from lead generation, nurturing and general support to content creation and social media management

Grow your business – not your admin overhead Our skilled assistants handle a host of recurring tasks that eat up time and attention That means more time working on the business, less time down in the weeds

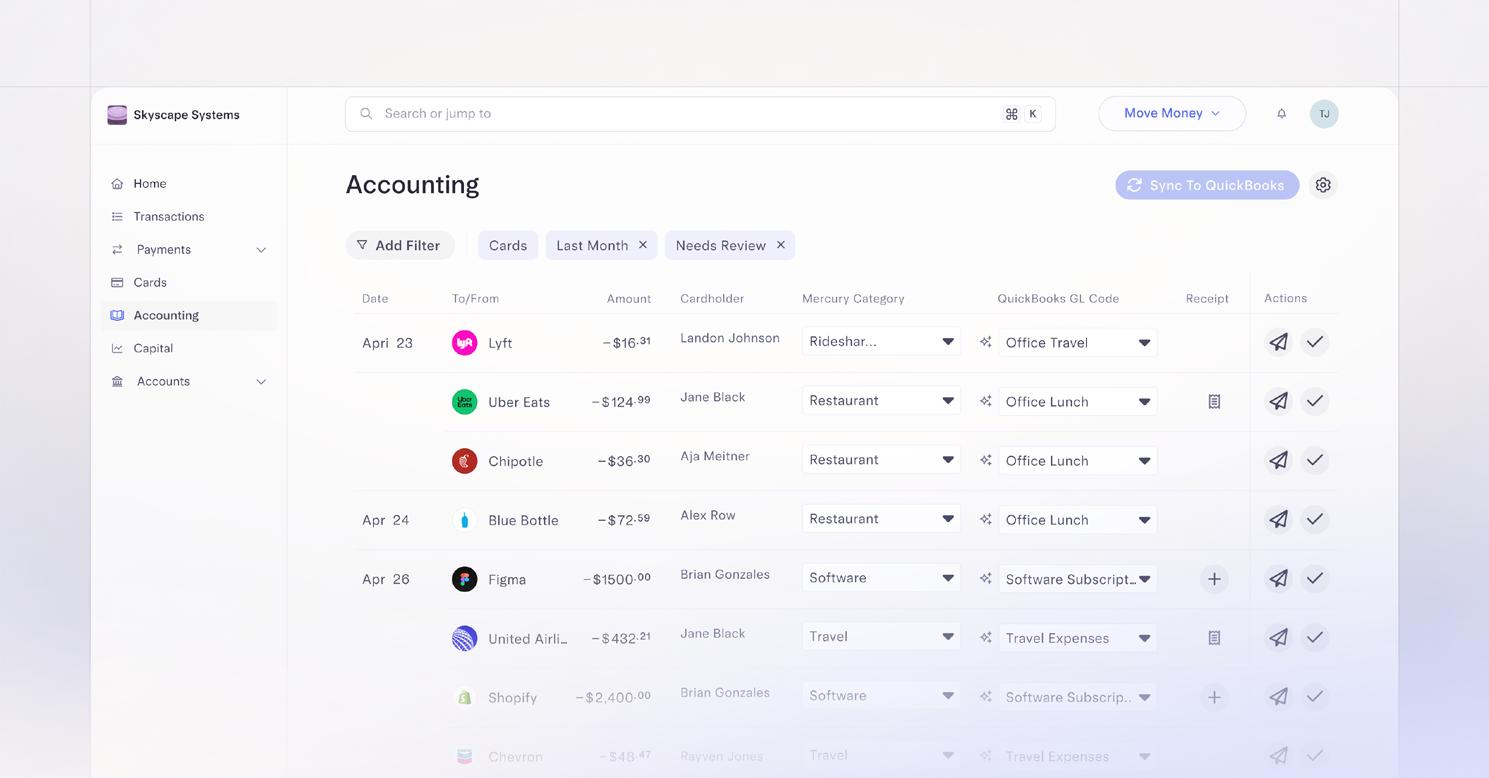

s an accountant or bookkeeper, navigating the financial intricacies of a startup can often feel overwhelming. Simplifying these processes not only alleviates your burden, but also sets a robust foundation for the company's future and positions you as a true partner and asset to the startup founder.

Key financial focus areas for accountants at early-stage startups

Most of the time, a startup founder won’t be a finance expert — and they shouldn’t be. They’ll understand what’s happening with the business on a fundamental level, but they’ll value freeing up their time so that they can stay focused on

customers and products. Here’s where you come in to help. If you are working with early-stage startups as an accountant, your scope will likely stretch beyond that of a typical accountant. These are six areas the founder will likely care about most and where you can be the biggest asset:

Core accounting & tax - This is typically what the founder will be looking for.

• Basic bookkeeping: Accurate record-keeping is foundational for understanding the startup’s financial position and making informed decisions. The startup’s investor will also expect some level of financial reporting from the founder as well. The startup doesn’t necessarily need GAAP-

Dan Kang, VP of Finance, Mercury

Daniel Kang is VP of Finance at Mercury working to reimagine a better banking experience for startups and businesses of all sizes. Before leading finance for Mercury, he was VP of Finance for Digit and has also worked in finance and strategy at Square, Vista Equity Partners, and Bank of America. He holds a BS in Finance and Philosophy from NYU Stern School of Business.

compliant, audited financial statements at this point, but as the accountant, you should have a basic grasp of their financial picture.

• Taxes: Understanding and meeting tax obligations helps the company avoid legal complications and costly financial penalties. In the beginning, this will mostly be for income tax filings but could also cover sales & use taxes, filing for R&D tax credits, and other tax incentives potentially available for a startup.

Operations - Founders often want help running their finance operations as well which can include activities below.

• Payroll: Ensuring the team is compensated accurately and on time is non-negotiable. This is a pretty direct reflection of the company's reliability and respect for its workforce.

• Customer payments: Streamlining the process of receiving payments affects the company’s cash flow and, by extension, the business's operational viability.

• Vendor payments: Timely payments to vendors preserves essential business relationships and prevents supply chain disruptions.

• Cap table management: If your customer is an investor-backed

startup, the founder might ask for help with keeping a precise record of equity ownership. This can be especially tough in the early years of a startup when there are dozens of shareholders that might include a handful of friends, family, and angel investors.

Depending on the specific industry, there might be an additional item or two on this list that you need to focus on as an accountant. But for the most part, this list of six basic finance functions will cover 90% of what the startup will need help with in its early days, and represent where you can lean in most.

While strategic financial planning isn’t necessarily an accountant's responsibility, it is important to understand your client’s business well enough that you can provide input and basic insights into the business model’s sustainability and scalability. The best outsourced finance professionals will be the ones that can also be business thought partners to founders. You should understand the basic financial aspects of the business, including how they are acquiring and retaining customers, what revenue growth looks like (just a basic understanding of this is okay), and how any hiring, marketing, or vendor spend is expected to impact its burn rate and cash runway in the future.

Focus on setting a solid financial foundation

When considering the right partner for their startup, a founder will look to an accountant or accounting firm that can understand its business model and industry. A founder will also look for a willingness to roll up

your sleeves to help establish core financial workflows, such as:

• Playing an active role in mapping what the workflows will look like so that it’s clear what the roles and responsibilities will be between you and the founder. For example, maybe a bookkeeper will handle all vendor payments and customer invoicing, but the founder will be more involved in approving major expenditures and will review monthly financial reporting. This could also involve things like aligning on your vendor payment terms or SLAs to ensure timely payments.

life a lot easier as the company grows and scales. Determine clear financial processes from the start, ensuring they're scalable and adaptable to the business's growth.

"One of your main financial responsibilities as a finance professional for an early-stage startup is ensuring that you’re taking the right small steps"

Remember that at this point, one of your main financial responsibilities as a finance professional for an early-stage startup is ensuring that you’re taking the right small steps to make the future state of the company’s growth a lot less painful. This foresight reduces the need for time-consuming overhauls or corrections down the line. Get things in as best shape as possible at the start.

• Partnering with the founder on what its chart of accounts and cost centers should look like. Having the right setup here can make a big difference in the ability to understand the business well. Think about this as the data structure for understanding the business.

• Encouraging the founder to keep clear records of every dollar that comes in and out of the business, and to save and organize all contracts and agreements in a centralized place for easy reference whenever needed. It’s much harder to remember why certain transactions occurred on what terms and to dig through your inbox to find old agreements. This’ll be crucial when preparing financials and during financial audits.

• Establishing a shared financial process to manage recordkeeping across the company will make everyone’s

For founders, simplifying financial operations is not just about reducing their workload; it's about creating a solid foundation for sustainable growth. By focusing on key financial areas and methods for streamlining operations, an accountant or accounting firm can help a startup ensure that its financial backbone is not only resilient and scalable, but relatively easy to manage.

@projectworksio

Mark Orttung, CEO, Projectworks

Mark Orttung, a top voice in professional services, shares his extensive experience growing a successful software service firm through a series of refreshingly human articles. He offers practical advice you can apply to your practice and your clients' businesses.

Mark Orttung leverages his expertise from growing a success service firm to solve your consulting clients' biggest problems.

Common Problems I Solved That You Can Solve for Your Clients Too

Fighting the trademark office, losing a major client, and striving to stay relevant in a crowded market. What if I told you this is just the tip of the iceberg of what your clients struggle with at their software service firm?

It's true, running a service firm isn't always rainbows and sunshine.

I know firsthand because I built Systems in Motion/Nexient from under $35 million to over $130 million in revenue and faced all these challenges and more. Now that it's all said and done, I've started to put pen to paper and share my experience of how I overcame some of these big challenges.

My hope is that by reading these articles, you'll gain expert insight into the experiences of your consulting clients and how to help them conquer these common challenges.

Below, I share three of these challenges and how I overcame them. Be sure to click through to read the full articles on our blog after each segment.

called Systems in Motion. I was in a weekly meeting that most of the company's leadership would join to go over our new projects and staffing assignments. As a newcomer, it was a chaotic meeting but was clearly central to how the company ran.

“I built Systems in Motion/Nexient from under $35 million to over $130 million in revenue and faced all these challenges and more”

Challenge #1: Balancing revenue and talent costs

"Cancel the engineering manager's offer letter." The statement came out so quickly and matter-of-factly that I almost didn't stop the meeting to ask what was happening.

In 2014, I was in my first few weeks as CEO of what was then

I had the curiosity/ presence to stop the meeting and ask what that statement meant. Had we offered someone full-time employment? Yes. Had they already quit their current job based on our offer? Yes. So I interjected, "Don't cancel the offer." There was a shocked silence in the room. I had clearly just done something that broke from the norms here.

It took me a while to really appreciate the two conflicting objectives that would challenge

me for the next seven years as I ran a product development consultancy… read more.

Challenge #2: Managing client relationships

"Our client just gave us notice that they will be rolling off more than 50 people immediately. Also, they believe we've mishandled the engagement so badly that we should pay them $700k."

This update from one of my client partners is the kind you feel in your stomach. It is pretty much the worst possible news you can hear when you're running a business.

At the time, Nexient had around 250 employees on billable work. For 50+ of them to roll off was catastrophic. They'd most likely move to our bench, which typically ran at around 5-7% of our revenue.

This development would increase it to

15-20% and finding new billable work for them all could take months. Our model was built to have 5-7% invested to support our bench, and a large increase would mean the firm would start to lose money. Also, this was our second-largest client at that time, and it was showing all the signs of going away for good.

We had a huge problem… read more.

Challenge #3: Standing out from the competition

At heart, I'm a product manager. I love taking ideas and trying to figure out how to package them up to be a complete product offering. One of the first things I always focus on is what differentiates the product or service offering.

Not long after I joined Nexient, I tried to figure out how we would differentiate ourselves. At the time, there were

more than 10,000 software development consultancies globally and I wanted us to have a unique place in the market.

So I started by looking at our home page (see the image below). We were a firm of just over 200 people, but our website claimed to do almost anything an enterprise could need. I failed to see how we could be great at all of these things, and when I looked at our competitors' websites, it seemed like they were also making these claims… read more.

If you enjoyed these snippets, click here to follow Mark on LinkedIn.

Check out the The Consulting Balance Blog:

projectworks.io/blog

XU: Can you tell us the story behind the inception of Buddy Payroll? What inspired the creation of a payroll company focused on people?

This article is

DS: Buddy Payroll was born out of a need for an integration between Xero and Deputy—two products we were offering through Sixteen Limited, my SAAS company in Malta. We noticed a significant gap in the market when it came to integrating these systems for seamless payroll processing. Despite reaching out to existing payroll providers in Malta, none

were willing or able to offer the necessary APIs to connect Deputy with Xero.