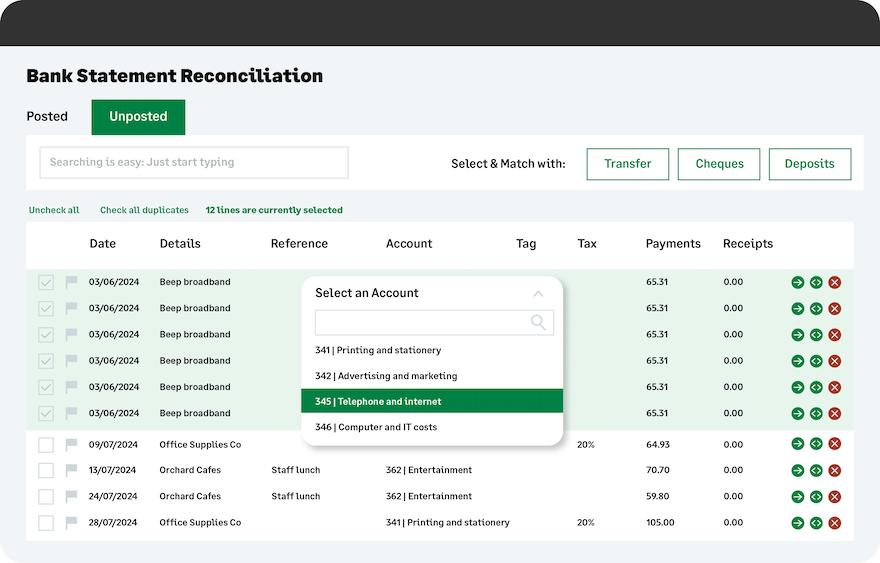

INTEGRATING SEAMLESSLY WITH DATA AUTOMATION TOOL AUTOENTRY, THE ACCOUNTSPREP ADDON MEANS ACCOUNTANTS AND BOOKKEEPERS CAN QUICKLY AND EASILY PREPARE, ADJUST AND OUTPUT A TRIAL BALANCE FOR AN UNLIMITED NUMBER OF CLIENTS WHO DON’T USE ACCOUNTING SOFTWARE.

This can then be imported into final tax software for compliance purposes.

Visual reports can also be created for clients, showing balance sheet, tax position, and more.

Rob Newman, Managing Partner, CCM | Carter Collins & Myer, says: “AccountsPrep can turn what was previously a full working day for us, per client, into just 60 or 90 minutes.”

AccountsPrep eliminates the need for accountants to manually input and reconcile data in Microsoft Excel

to create working papers, or input manually into accounting software.

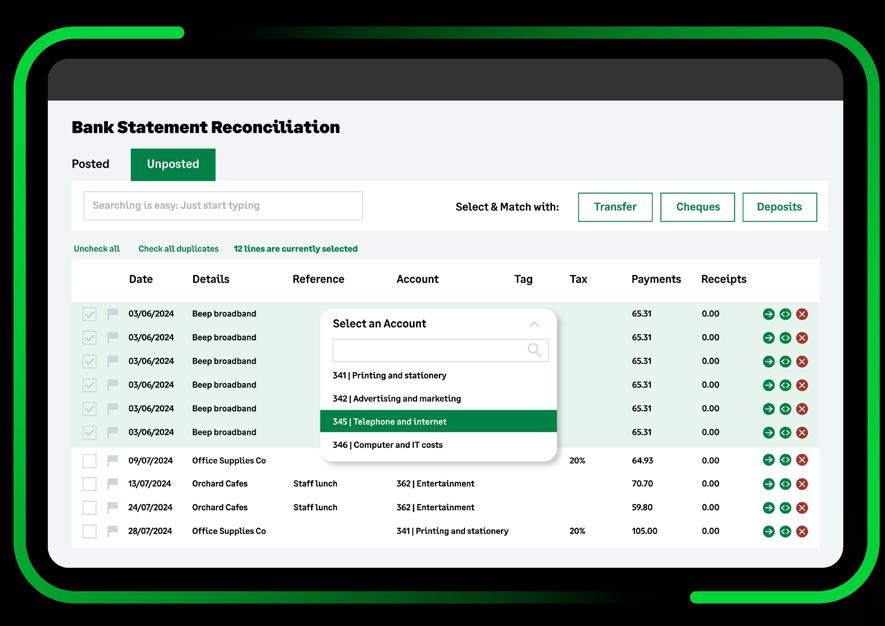

Using AccountsPrep is simple. AutoEntry extracts the data from bank statements, invoices, or receipts (paper or PDF).

The data then flows through seamlessly, ready to be reconciled and adjusted via AccountsPrep’s easy-touse interface.

Keep reading

SAGE, A LEADER IN ACCOUNTING, FINANCIAL, HR AND PAYROLL TECHNOLOGY FOR SMALL AND MID-SIZED BUSINESSES (SMBS), IS ENHANCING ITS SUPPLY CHAIN SOFTWARE CAPABILITIES BY ACQUIRING ANVYL, A NEW YORKBASED TECHNOLOGY FIRM FOCUSED ON THE HIGHGROWTH $20 BILLION SUPPLY CHAIN SOFTWARE SECTOR.

With this acquisition, Anvyl’s end-to-end supply chain software will allow Sage to deliver a cost-effec-

tive Supply Chain Execution (SCE) solution that provides SMBs with complete visibility across their entire supply chains, from purchase order creation to warehouse delivery. It combines intelligent purchase order management with a broad supplier network to be delivered through Sage Network, which is Sage’s platform of products and services that benefits customers by connecting business ecosystems.

Mark Hickman, Managing Director, North America, Sage said: "Our acquisition

of Anvyl reinforces Sage’s commitment to offering comprehensive back-office solutions for SMBs, particularly in supply chain management. This move aligns with our strategy to expand beyond financials, providing a broader range of tools to help businesses thrive. By integrating Anvyl's technology with Sage’s solutions, we’re enabling businesses to connect with multiple buyers and suppliers, optimise operations, reduce costs, and enhance customer service"

Find out more

THE ACCESS GROUP, A LEADING PROVIDER OF BUSINESS MANAGEMENT SOFTWARE TO MID-MARKET ORGANISATIONS IN THE UK, IRELAND, THE US AND ASIA PACIFIC, TODAY ANNOUNCED THAT IT HAS ENTERED INTO AN AGREEMENT TO ACQUIRE TRADIFY, EXTENDING ITS OFFERING IN ERP SOFTWARE GLOBALLY.

Access ERP serves small, growing and medium to large businesses with tailored solutions in a range of industry verticals, including

Construction, Supply Chain, Waste Management, Professional Services and Facilities Management.

The introduction of Tradify provides an end-to-end job management platform, built for trades and field-service businesses, enabling small businesses to be more efficient by automating key business processes.

Founded in 2013, Tradify has grown to a base of 20,000 customers from within the trade industry across the UK, New Zealand and Australia. With offices in the UK and New Zealand, Tradify offers a best-inclass platform that brings together customer enquiries, service reminders, estimates, quotes, scheduling, staffing, contractor management, job tracking, timesheets, invoices, certification and payments—all in one place.

Claire Carter, managing director of Access ERP, commented: “Tradify is a great fit for our business."

Find out more

FOR THE FIRST TIME IN QUOTER PRODUCT UPDATE HISTORY, WE’RE SHARING OUR WORK IN PROGRESS IN ADDITION TO ITEMS WE’VE DEPLOYED THIS MONTH. A FEW ITEMS ARE SO CLOSE TO BEING OVER THE LINE THAT I CAN’T WAIT TO SHARE!

We’ve also made progress on our major Quoter Editor enhancements project and a number of small improvements, which Partners can learn about in our Release Notes. You could say it’s been a busy month for our development squads, and I’d like to give a special shout-out to three of our senior developers — Gustavo, Diego, and

XU BIWEEKLY - No. 90

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

Edgar — who expertly pivoted to a significant project for both Quoter and ScalePad: our ScalePad Hub integration. More on this below!

Quoter Editor Enhancements for Nuanced Pricing Display

No two quoting processes are the same, which is why we’re obsessed with refining the Quote Editor to deliver on the unique nuances each of our Partners brings to their experience with Quoter. This month, as part of our larger Quote Editor enhancement project, we’ve released the ability to have bundles within single-select item groups.

Keep reading

ONE OF THE XERO DEVELOPER TEAM’S GOALS IS TO MATCH THE RIGHT APP WITH THE RIGHT CUSTOMER AT THE RIGHT TIME, AND A KEY CHANNEL ON HOW WE DO THIS IS VIA THE XERO APP STORE.

We’re constantly making improvements to the App Store and your app listings to help our team collect data that will help enhance the visibility of your app with the right customers, and help drive more quality traffic and leads.

Let’s take a look at the new fields:

• Free Trial: This field pro-

OLLENO 2.0 RELEASE IS DESIGNED TO HELP OUR CLIENTS FURTHER OPTIMIZE OPERATIONAL WORKFLOWS AND BUILD A STRONGER FOUNDATION FOR PAYMENT SUCCESS.

We are also introducing Kolleno’s AI Co-Pilot, your daily partner for reducing the burden of routine tasks and providing instant customer analysis support, which we’ll tell more about in the next product update. In this product update, we’ll talk in more detail about the updated view of the dashboard.

Granular Overview of the Aging Balance Breakdown

The dashboard allows you

to switch between actively chased customers or all customers and is aimed to help you with the following key objectives:

Easily identify and stay on top of promises to pay:

No more wasting time tracking down customers’ promises to pay! You can now easily view the portion of your overdue balance with a commitment to be paid by checking the respective bar within each aging group.

Click on the bar for a detailed breakdown of each group by invoice, including invoice number, customer name, total amount, due date, and more.

Keep reading

vides information about whether your app has a free trial and the duration of the trial.

• App Audience: This field enables you to select the primary customer your app is designed for so we can better match users with your app.

• App Features / Customer Tasks: This field allows you to select the tasks your app helps customers complete. You’ll be able to select up to 10 App features that match your customer’s primary tasks. While only the first 5 will show on your app listing, the rest will be used for internal categorization and SEO optimization.

Find out more

THE BIGGEST NEWS OF SEPTEMBER, FOR SURE, WAS THAT APRON RAISED A FURTHER $30 MILLION. BUT WE DIDN’T STOP TO CELEBRATE FOR TOO LONG. WE’VE BEEN HARD AT WORK UPDATING AND IMPROVING SOME OF YOUR FAVOURITE FEATURES. IT’S ALL PART OF OUR GOAL TO HELP MORE BUSINESSES MAKE IT.

Here’s a round-up of what’s new to Apron in September.

Enforce Two-Factor Authentication

Two-Factor Authentica-

tion or 2FA is already available in Apron as an option, but now, those with Admin rights can enforce 2FA across all team members.

This added layer of security greatly reduces the risk of unauthorised access.

With 2FA enforced, team members will only be able to access their accounts once they’ve verified with both a password and their authenticator app.

You can enable 2FA for all team members by clicking the toggle on the Team page.

Keep reading

AS A BUSY ACCOUNTANT OR BOOKKEEPER, WE KNOW YOU DON’T ALWAYS HAVE TIME TO GO THROUGH EACH CLIENT’S BOOKS TO PROACTIVELY IDENTIFY ISSUES OR OPPORTUNITIES.

That’s why we’re thrilled to share that we’ve been testing a new client insights dashboard for advisors, which gives you a snapshot of the financial health of all Xero business edition clients, in one place. Client insights makes it easy to run your eye down the page and quickly see how your clients are tracking overall, and which ones might need your attention. If you spot something that looks like it might need more analysis,

you can dive into the client’s individual organisation from the dashboard, and get to work. The dashboard will be available to all Xero partners globally, and rolled out over the next couple of weeks. We’re releasing it now so you can enjoy all the value it currently offers, but have big plans to enhance it with more functionality next year. We’d love to know what metrics you’d like to see in the future — let us know over at Xero Product Ideas.

Get a snapshot of your clients’ financial health

We’re releasing client insights with key financial metrics for the current month, and will continue to enhance the dashboard

WARD WINNING FINTECH AND SAAS SOLUTION PROVIDER APXIUM PROUDLY UNVEILS ITS LATEST INNOVATION: APX CAPITAL TAX PAY.

Designed to simplify tax payment management for Accounting Firms, Tax Agents, and Businesses across Australia, Tax Pay promises efficiency, flexibility, and peace of mind during tax season.

Built upon Apxium’s robust technology infrastruc-

ture and years of expertise in financial technology services, APX Capital Tax Pay offers a comprehensive suite of features to streamline the tax payment process for accounting firms, and their clients.

From hassle free setup, to user friendly facility flexibility managing tax liabilities. APX Capital Tax Pay empowers clients with never seen before tools to balance business needs and tax payments.

Keep reading

based on your feedback. Our next priority (based on our testing with Xero Insiders) is to add more financial metrics and date ranges, so you get even more value from the dashboard. Right now, you can:

• Identify concerns or opportunities: Quickly identify clients that need attention, by viewing key financial indicators for all Xero business edition clients in one place

• Easily view key financial metrics: See clients’ overall cash balance (in Xero), accounts receivable, accounts payable, current ratio, revenue, expenses, net profit and industry

Find out more

Quicker activation for Apple Pay, customisable monetisation with Application fees and improved deposit information

Quicker and easier activation for Apple Pay as a payment method

Enabling Apple Pay just got much easier for merchants using Airwallex payment plugins, as well as core API and embedded finance customers. Rather than using a manual activation process, customers can now activate and enable Apple Pay on their own via API.

This improvement will simplify introduction of Apple Pay in a few ways:

• Merchants using plugins like WooCommerce can now easily introduce Ap-

ple Pay whenever needed, similar to other payment methods and without the need for manual setup.

• Core API customers can efficiently manage their Apple Pay domain registrations by recycling retired domains and adding new domains to their existing registration, without needing to create separate merchant accounts.

• Platforms offering embedded finance to merchants can quickly integrate Apple Pay as a payment method for merchants, versus merchants needing to manually apply.

Coming Soon: Expand payment methods with Dis-

cover and Diners Club acceptance

Businesses in Asia-Pacific and Europe can soon increase their business in the US by accepting Discover and Diners Club cards as payment methods. Introducing Discover and Diners Club will allow merchants to improve authorisation rates, as these are popular payment methods especially for travel and entertainment in the US. Discover and Diners Card will soon be available as new card payment methods alongside Visa, Mastercard, AMEX, JCB and UnionPay.

HOW DO YOU THINK SMALL BUSINESSES IN YOUR AREA ARE DOING? NEW REGIONAL AND PROVINCIAL DATA FROM XERO SMALL BUSINESS INSIGHTS (XSBI) HELPS TRACK DIFFERENCES IN SMALL BUSINESS PERFORMANCE WITHIN CANADA AND WITHIN THE US. THIS DATA PROVIDES A MORE GRANULAR LOOK AT EACH COUNTRY BY SHARING A RICHER, MORE NUANCED PERSPECTIVE WHEN COMPARED TO NATIONAL LEVEL STATISTICS.

The new data covers:

• Canada: Alberta, British Columbia and Ontario

• United States: Northeast, Midwest, South and West (the major regions defined by the US Census Bureau)

To help set the scene for this new data, we’ve released two new research notes covering how sales and payment times have tracked in each region and province since 2017. This includes how they performed during the Covid-19 pandemic and how they’ve recovered since.

How can you use this data?

• How do your payment times compare to the average in your province? What payment services can you implement to improve them?

• How do sales in your local business compare to average sales in the broader region?

• What factors might be contributing to economic volatility in your area? How can you plan for these now and into the future?

What did we learn from these reports?

Canada:

• Alberta has experienced more volatility in sales performance compared to other provinces, probably due to a reliance on the energy sector and the flow-on impacts of global oil price fluctuations. Payment times rose during the pandemic – a trend not generally seen elsewhere in the XSBI data –but have since improved

Regional data can be especially helpful for small businesses and advisors who want to benchmark performance against similar businesses in the region. You can take the insights and make adjustments or set achievable goals for your business or clients. Some considerations could include:

Find out more

BGL

SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE CAS 360 NOW SUPPORTS OVER 3,700 FIRMS MAINTAINING OVER 1 MILLION COMPANIES ON ITS COMPANY, TRUST AND ID VERIFICATION MANAGEMENT SOLUTION.

This significant achievement solidifies CAS 360 as the software of choice for company secretarial compliance, providing unmatched support to businesses in Australia, Hong Kong, New Zealand, Singapore and the UK.

“We are incredibly proud of CAS 360’s journey,” said BGL’s Founder and Director, Ron Lesh. “Reaching 1 million companies is a testament to our team's hard work and our clients' trust in us. From day one, we had a goal to simplify compliance for businesses and this milestone highlights why CAS 360 is the global leader in company secretarial software.”

“Since its beginning, CAS 360 has been an invaluable resource for businesses, accounting firms and corporate service providers,” said Warren Renden, General Manager of CAS 360. “With continuous updates, including innovations like BGLiD and AI-powered automation, BGL remains dedicated to providing best-in-class compliance technology.”

Keep reading

APRON, THE BUSINESS PAYMENTS POWERHOUSE, HAS RAISED A $30 MILLION SERIES B FUNDING ROUND TO HELP MORE SMALL BUSINESS OWNERS MAKE IT BY DIGITISING AND SIMPLIFYING THE PAYMENTS PROCESS, AND BRING GREATER SECURITY TO THESE COMPANIES’ CASH FLOW.

The investment was led by Zinal Growth, a growthstage focused tech fund backed by the founder of Checkout.com.

Existing investors Index Ventures, who led Apron’s $15 million Series A in September 2023, and Bessemer Venture Partners participated in the round, alongside investor Tony Fadell, inventor of the iPod and Principal at Build Collective.

Receiving and making payments are pain points universally felt and endured by small and medium-sized businesses (SMBs). So much so that the average SMB owner spends up to 20% of their working week issuing, paying and managing invoices and the associated admin that exists around them. Taking time away from serving customers to grapple with these payments is no guarantee of company success. More than four in five small and medium-sized businesses in the UK fail due to cash flow issues, and two in five SME owners admit to dipping into personal funds to bankroll their businesses when they hit cash flow trouble.

Countering this status quo, Apron enables business owners and their accountants to receive, sort,

approve, pay and reconcile invoices in seconds. By taking a ‘town square’ approach in which suppliers, buyers and their accountants can manage payments between themselves smoothly and seamlessly, Apron helps SMBs reduce precious time and effort spent arranging and chasing payments, and get back to serving their customers and building their businesses. Through its proprietary payments platform, Apron enables customers to pay anyone, whether its employees or suppliers anywhere in the world. Apron also integrates easily with a business’s existing accounting tools (Xero or Quickbooks) for instant payment reconciliation.

Founded in late 2021 by Bogdan Uzbekov, a former product leader at Revolut, Apron’s customer base of

UK-based SMBs is fast-expanding, largely through word-of-mouth. Since securing a $15m Series A in September 2023, the number of SMB customers served by Apron has increased by over 20x. Today, thousands of invoices and millions in payments pass through Apron’s platform daily, helping more businesses save time and get back to doing what they love.

Guillaume Pousaz, Founder of Checkout.com and Chairman of Zinal Growth, comments: “We’ve been deeply impressed by the execution and vision of Bogdan and the Apron team. They have created a delightful product for both SMBs and accountants, and we are excited to continue supporting them on their journey.”

Find out more

T’S AN ABSOLUTE HONOUR TO SHARE THAT XERO HAS BEEN AWARDED CANSTAR’S MOST SATISFIED CUSTOMER AWARD IN THE SMALL BUSINESS ACCOUNTING SOFTWARE CATEGORY, FOR THE SIXTH CONSECUTIVE YEAR.

This recognition is a testament to the support and trust we’ve earned from small and medium enterprises (SMEs) across Aotearoa New Zealand.

We don’t take for granted the support we get from our small business customers, and I’d like to thank everyone who rated us number one. It’s a big endorsement for the mahi we do, and we’re hugely grateful.

Canstar Blue, a customer satisfaction research and ratings business, surveys hundreds of small business

owners annually to establish industry benchmarks. Business owners are asked to rate their accounting software providers across a variety of categories. It’s a delight to see we’ve exceeded expectations this year, illustrating the exceptional value our customers place in our software and services.

We also want to thank the team at Canstar Blue for their unwavering support and recognise the incredible work they do to shine a light on Kiwi business achievement. We’re a Kiwi-born company, here for Kiwi small businesses.

Our community of small business here in Aotearoa New Zealand is our greatest asset and we will continue to champion you all during these tough economic times.

Keep reading

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS EXPERT-LED TRAINING SERIES, BGL EDUCATION.

Starting 30 September 2024, BGL Education offers expert training to help clients unlock the full potential of their CAS 360, Simple Fund 360 and/or Simple Invest 360 investment.

"We’re thrilled to launch BGL Education as part of our ongoing commitment

to client education and support” says BGL’s Founder and Director, Ron Lesh.

"Our goal is to have every BGL client feel confident and equipped to make the most of our products."

"Our experts will lead a series of short webinar courses to ensure clients can learn directly from BGL professionals and unlock the value of the BGL Suite.”

Daniel Tramontana, Chief Executive Officer at BGL, added, “At BGL, we know that client success is based on knowledge and skills. Education is not simply a training program; it’s an opportunity to provide our clients with the tools they need to navigate confidently in an evolving industry.”

Find out more

AS A LEADER IN THE GLOBAL EXPOSITIONS AND CONFERENCE INDUSTRY, DIVERSIFIED COMMUNICATIONS CANADA ACKNOWLEDGES ITS RESPONSIBILITY TO FOSTER CONVERSATIONS AND ACTIVELY PROMOTE GENDER EQUALITY, SOCIAL JUSTICE, AND INCLUSION. WE STRIVE TO CULTIVATE A CULTURE WHERE DIVERSITY IS CELEBRATED, EQUITY IS THE STANDARD, AND ACTION IS A CORE COMMITMENT.

How Is Diversified Communications Doing It?

Diversified Communications Canada is proud to be the first professional business event organizer (PriMed Canada and Accountex Canada) nationally accredited as Rainbow Registered by Canada’s 2SLGBTQI+ Chamber of Commerce (CGLCC). This recognition reflects our dedication to diversity, inclusion, and support for the

WE ARE THRILLED TO ANNOUNCE THE APPOINTMENT OF BEN HUSSEY AS THE NEW CO-CEO OF KATANA CLOUD INVENTORY.

Ben will be taking on this vital new role to lead the execution of our company’s strategy and expansion especially in North America, while Kristjan Vilosius will continue to focus on shaping our strategic direction, leading the executive team meetings, and continue his work as the CEO and co-founder of Katana at the headquarters in Tallinn, Estonia.

A new chapter in Katana’s growth

As Katana continues to grow, especially in the North American market, the decision to appoint Ben as CoCEO is a strategic move to ensure we remain agile and innovative in a rapidly evolving SMB space. Ben’s extensive experience in eCommerce, order management and business operations, combined with his proven leadership skills, makes him the ideal choice to oversee the execution of our strategy.

“Ben has been an integral part of our team for a while now, and his leadership and commercial acumen has been pivotal in driving our

expansion in the SMB space in North America,” said Kristjan Vilosius. “His ability to translate our vision into actionable plans and deliver results has been remarkable. As we enter this new phase, I am confident that Ben will excel in his expanded role as Co-CEO.”

“I’m honored to partner with Kristjan in leading the Katana team on our journey to being the category leader for Inventory Management. I am extremely excited about the future ahead of us as we embark on this new chapter of growth,” Ben Hussey commented.

Focused leadership for a stronger future

With Ben focusing on the execution of our strategy close to our customers, leading Katana business operations and the ongoing evolution of Katana Cloud Inventory, Kristjan will now dedicate more time to leading the executive team meetings, and the key areas that will fuel Katana’s longterm growth:

• Refining our strategic vision

• Building and maintaining strong relationships with our investors

Keep reading

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE INTEGRATION WITH REGISTRY DIRECT TO STREAMLINE COMPLIANCE REQUIREMENTS FOR LISTED AND UNLISTED PUBLIC COMPANIES.

The integration seamlessly connects BGL's company, trust and ID verification management software, CAS 360 with Registry Direct— an advanced share and unit registry platform. This collaboration provides public companies with comprehensive tools to meet their

complex legal obligations, including shareholder management, TFN and AIIR reporting and withholding tax calculations.

"We are excited to welcome Registry Direct to the BGL Ecosystem" said BGL's CEO Daniel Tramontana.

"This integration will help our clients simplify and centralise their compliance tasks, ensuring listed and unlisted public companies can efficiently meet their regulatory requirements. By combining the power of CAS 360 with Registry Direct’s extensive registry services, clients will experience a more streamlined, automated solution that reduces manual workloads and mitigates compliance risks.”

Find out more

2SLGBTQI+ community.

Find out more At Diversified Communications Canada, We Walk the Talk

Our Commitment to Inclusivity

Achieving the Rainbow Registered accreditation signifies our commitment to creating an environment where our 2SLGBTQI+ customers, exhibitors, attendees, partners, suppliers, and staff feel valued and respected. This aligns with our core values of diversity, inclusion, and excellence. We are honored to contribute to this important national initiative.

What This Means for You

As a Rainbow Registered organization, we adhere to national standards of 2SLGBTQI+ inclusivity. Whether you are a customer, exhibitor, attendee, partner, or supplier, you can trust that you will experience a safe, welcoming environment that respects and celebrates everyone.

IAM THRILLED TO SHARE THAT CHASER HAS BEEN SHORTLISTED FOR THE AI IN FINTECH AWARD AT THE GLOBAL FINTECH AWARDS 2024. IN THEIR INAUGURAL CEREMONY, THE GLOBAL FINTECH AWARDS 2024 WILL BE RECOGNIZING AND CELEBRATING INNOVATIVE SOLUTIONS IN THE FINANCIAL SERVICES AND FINTECH INDUSTRIES, HONORING ORGANIZATIONS THAT DEMONSTRATE EXCEPTIONAL CREATIVITY, TECHNOLOGICALLY ADVANCEMENTS, AND INDUSTRY LEADERSHIP.

Being recognized as a finalist for the AI in FinTech Award is a testament to Chaser's use of artificial intelligence technology to improve the accounts receivable process, and financial outcomes for businesses worldwide. The shortlisting recognizes three key pieces of AI technology released

by Chaser: Recommended chasing times, Payer rating, and the Late payment predictor.

Finalist for the AI in FinTech Award

Research shows late payments are only getting worse for SMEs, and dealing with them is putting a significant time burden on their already-stretched finance teams.

Chaser conducted research with SME credit-controllers and found one of the biggest pain points for them today is struggling to prioritize their limited time and resources.

In response, Chaser looked at ways cutting-edge technology and advancements in artificial-intelligence could support them to reduce late payments and improve efficiency, at a low cost. Chaser released 3 AI-driven features

to improve efficiency and reduce late-payments:

• Recommended chasing times

• Payer rating

• Late payment predictor

For Chaser users who have adopted all AI functionality, there’s been a 55.7% reduction in time between payment reminders being sent and payment being received. These features are helping cash-strapped SMEs protect and bring revenue in faster, in our challenging economic environment.

Payer ratings

Payer ratings use data on customers’ previous payment behavior and compare trends seen across Chaser, assigning every payer an AI-generated ‘rating’.

Ratings are ‘Good’, ‘Average’, and ‘Bad'; they predict how likely a customer is to

pay their future invoices on time.

This lets SMEs who are often strapped-for-time see at a glance how their customers are paying.

Payer ratings let SMEs prioritize effectively and instantly see who problem payers are, assess at-aglance who to extend credit to, and optimise their follow up approach for different payer groups, so they can protect and bring their revenue in faster.

Late payment predictor

The late payment predictor gives instant AI-generated predictions on how likely an invoice is to be paid late, assigning a percentage score out of 100. Giving visibility on whether to expect cash on time, and whether to pursue debt collections.

Keep reading

Prepare, adjust and output a trial balance for an unlimited number of clients with AccountsPrep, an add-on to your AutoEntry subscription.

Get started now

UPCOMING EVENTS

UPCOMING WEBINARS

WEBINARS

one’ easy for both your new employee and you!

By Debbie Gainsford, HR Partner

YOU’VE JUST HIRED THE PERFECT PERSON FOR YOUR OPEN ROLE, CONGRATULATIONS!! NOW COMES ALL THE ADMIN OF ONBOARDING THEM… AND IT CAN FEEL ENDLESS. IT’S ALSO THE MOMENT THAT YOUR NEW EMPLOYEE GETS A REAL UNDERSTANDING OF HOW YOUR ORGANISATION OPERATES. AND OFTEN, IT CAN BE A MAKE OR BREAK MOMENT.

What does day one look like for your new hires? How many different systems do you use to onboard a new employee? And how many of those systems are still manual or involve spreadsheets or word docs?

Are you making your new employees' onboarding experience seamless or do they have a few hoops to jump through?

Wouldn’t it be wonderful if there was one system that did almost everything for you?

Well there is.

And we’ll give you an insight into how an HRIS, like HR Partner, can be used to seamlessly onboard your new hires - no matter where in the world they work.

Press “Hire” and automatically create an employee record

Does your Applicant Tracking System integrate with your HRIS? Or do you have to manually enter new employee information into your system? Having one system ensures that there is no data loss, duplication of effort or basic mistakes being made.

If you are using HR Partner’s Applicant Tracking System, as soon as you press the “hire” button, all the information you’ve collected throughout the recruitment process will automatically generate the employee record.

This includes their name, contact information, CV/Resume and any other relevant information.

Data entry and/or data transfer to create a new employee record is a thing of the past.

Getting employment contracts signed is a breeze

The single most important document between you and your new employee is their employment contract.

Often contracts can be in Word or PDF and they are a pain to sign; or you might be paying for a standalone eSignature system. With HR Partner, you can upload the contract, add the fields to be completed and your new hire can electronically sign the contract. The best part? It’s automatically saved against their employee record.

You’ll no longer need to save important contracts in shared drives or across multiple systems.

Simplify the Day One admin

The first day of a new job can feel overwhelming for new employees. New names to learn, new ways of doing things, setting up new passwords. And there is a lot of HR admin that needs to happen. From collecting bank details to industry or educational certifications through to sharing company policies and documents, it all adds up. Which is why we created Checklists within HR Partner.

What can be included on your employee onboarding checklist? Anything you like, they are customisable to you. So you could include:

• A welcome video

• A form to capture their bank details (that’s automatically saved on their employee record)

• Your policies and documents to read, where they can acknowledge they’ve read them (and they’re saved against their employee record) or you can use the eSignatures for them to electronically sign them.

• A request for them to upload any certifications or other essential documents to their employee record

• Share with them the employee training on how to use HR Partner

The best part of using the checklist functionality is that you can set up a checklist once and use it for all your new hires. Or you can set up dedicated versions for spe-

cific locations, departments or job roles.

No more admin duplication required when setting up a new employee.

Vacation and Leave calculations at your fingertips

It’s one of the important numbers for any employee… how many days leave do I have? And it can be one of the most frustrating things to calculate. Wondering how to work out your employee’s starting leave balance? Or their leave balance on a future date? We’ve got you covered.

Use our FREE Calculator to work out the balances for Paid Time Off (PTO), Vacation Time, Annual Leave or any type of Leave.

And we’ve made the entire leave process easy. From setting up your policies to managing leave requests and showcasing when employees will be out of the office. It’s all part of our Leave and Absence Module.

It’s time to throw away the spreadsheet calculations and forget about the back-andforth questions about leave requests and leave balances via email.

Empower your employees with a self-service portal

Make your employees self-sufficient from day one. How great does that sound? Reduce the number of repetitive questions you’re constantly asked or having to provide the same information to multiple people.Those requests take time away from what you should be doing in your job, and we want you to really love what you do.

The HR Partner self-service portal empowers your employees to do everything from updating their personal information and managing their employee record to viewing their leave balances, preparing for performance reviews and discovering colleagues in the employee directory. And there is so much more.

Put the power in your employees hands, so you have more time on yours.

Keep reading

How accounting and bookkeeping professionals can use automation to unlock new service offerings

ACCOUNTS PAYABLE IS CRITICAL TO A HEALTHY FINANCE FUNCTION. BUT IT’S ONE AREA MANY ACCOUNTING AND BOOKKEEPING PROFESSIONALS AVOID TAKING ON, FOR A FEW REASONS. MANY CONSIDER IT RISKY, ESPECIALLY WITH RISING RATES OF FRAUD, OR JUST TOO TIME CONSUMING AND MANUAL TO BE WORTHWHILE.

Yet there are a growing number of those in the industry using it to expand their service offerings, grow revenue, and create an allround better experience for clients and teams.

Technology – in particular automation – is the key that opened this door. In the past, accounts payable was a highly manual process that lacked transparency. Bills would come in, be placed in someone’s desk tray for approval, then eventually go on to be paid. Even with newer technology, like email and cloud accounting, there’s still limited visibility that can be easily taken advantage of by nefarious players.

“Previously, we could have only done AP if we were in a client’s office and able to see everyone and guarantee all bills were approved,” says Brendan Lucas, Head of Accounting APAC at ApprovalMax and Founder of Next Dimension Accounting. “When working remotely, we

typically left AP to the client because it was too hard to manage without any real oversight.”

However, the right approach can unlock a whole new world of accounts payable.

Introducing AP as a service

More and more, accountants and bookkeepers are overcoming the roadblocks to offer accounts payable as a service, both standalone and as part of broader offerings.

This sees them taking on part or all of the AP process for clients, taking care of the input of bills, getting approval, batch preparation and, in some cases, making the payment.

Why are they taking on a once off-limits task? First, to boost revenue. Offering AP as a service expands their business and introduces a new, recurring income stream with different fee structures. More clients are also seeking this kind of service – many accountants and bookkeepers say they first started due to client requests.

Not only does this introduce a new revenue stream, it’s recurring revenue; usually on a monthly basis. This guarantees a consistent amount of work vs the vol-

atility of tax or consulting work. But the service adds to more than just the bottom line.

Lucas says offering AP as a service boosts the overall quality of accounting data, which has a big impact for those offering it as part of broader services. “At the end of the day, we can't do our management accounting unless we've got all the expenses in the system because otherwise it doesn't make sense.”

With up-to-date AP insights and accurate data, accountants and bookkeepers can save time and feel confident in the numbers they’re working with.

Finally, it pays off in client satisfaction and retention. “We’ve found where we offer that complete package we have a lower attrition rate, which is huge for us,” says Lucas. “It 100% offers a competitive advantage. Offering more value and reliability to a client through better processes and experiences builds a better relationship – and good relationships last longer.”

So, whether you already offer accounts payable or are new to it entirely, how can accountants and bookkeepers create and standardise this service for clients?

Keep reading

NEWTON PROPERTY MANAGEMENT HAS EXPANDED ITS EXISTING RELATIONSHIP WITH BANK PAYMENT COMPANY GOCARDLESS BY ADDING INSTANT BANK PAY, ITS OPEN BANKING-POWERED PAYMENT FEATURE, TO THE DIRECT DEBIT FUNCTIONALITY IT USES ALREADY.

Through GoCardless’ unique combination of Direct Debit and open banking payments, Newton can now collect both recurring and one-off payments within the same platform. This will help to reduce manual admin, save time and cut costs by avoiding the high fees associated with cards. Customers will benefit from a more seamless experience, with a single self-service portal to make regular and ad hoc payments for property management. They will also gain greater control over their finances through a new functionality to choose their Direct Debit payment dates.

Vincent Goldie, CEO at Newton Property Management, said: “Newton is committed to modern property management. We want our partners to be as innovative as we are, and when it comes to payments, GoCardless is miles ahead of the competition."

Keep reading

PAYPAL UNVEILED PAYPAL COMPLETE PAYMENTS, A SAFE AND EFFICIENT ALL-IN-ONE PLATFORM THAT INTEGRATES A RANGE OF CUSTOMIZED PRODUCTS AND SOLUTIONS TO SUPPORT CHINESE MERCHANTS IN SELLING GLOBALLY.

This platform streamlines payment and receivables processes for businesses of all sizes in China, empowering them to thrive in cross-border trade and the digital economy.

Today, PayPal’s global and China management teams engaged with over 700 merchants from across the country along with partners.

They provided insights into PayPal’s global and local business strategies, cross-border payment solutions, industry trends, and specific initiatives designed to drive business growth for Chinese merchants.

Keep reading

Company also provides the ability for business accounts to externally transfer cryptocurrency.

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) ANNOUNCED IT IS ENABLING ITS U.S. MERCHANTS TO BUY, HOLD AND SELL CRYPTOCURRENCY DIRECTLY FROM THEIR PAYPAL BUSINESS ACCOUNT. AT LAUNCH, THIS FUNCTIONALITY FOR BUSINESS ACCOUNTS WILL NOT BE AVAILABLE IN NEW YORK STATE. TODAY'S ANNOUNCEMENT IS PAYPAL'S LATEST STEP TO INCREASE CRYPTOCURRENCY'S UTILITY BY MAKING INCREASED FUNCTIONALITY AVAILABLE TO MILLIONS OF MERCHANTS IN THE U.S.

"Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency," said Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal. "Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers."

Keep reading

STARLING BANK (“STARLING” OR THE “BANK”) CONFIRMS THAT IT FULLY ACCEPTS THE FINDINGS SET OUT IN THE FINAL NOTICE PUBLISHED TODAY BY THE FINANCIAL CONDUCT AUTHORITY (“FCA”). THIS RESOLVES THE INVESTIGATION REFERRED TO IN THE BANK’S ANNUAL REPORT IN JUNE 2024. STARLING REGRETS AND APOLOGISES FOR THE EVENTS AND SHORTCOMINGS THAT LED TO THE FCA’S FINAL NOTICE.

The Final Notice details failings that occurred at Starling between December 2019 and November 2023 in relation to the onboarding of certain high-risk customers and sanctions screening processes.

These failings resulted in breaches of existing Voluntary Requirements (“VREQ”) and a breach of Principle 3 of the FCA’s Principles for Businesses.

Keep reading

REVOLUT, THE GLOBAL FINANCIAL TECHNOLOGY COMPANY HAS TODAY ANNOUNCED IT HAS REACHED TEN MILLION CUSTOMERS IN THE UK. REVOLUT’S LARGEST MARKET, AND WHERE THE COMPANY WAS FOUNDED IN 2015 HAS ADDED NEARLY TWO MILLION UK CUSTOMERS SO FAR IN 2024 AND CONTINUES TO GROW. REVOLUT HAS OVER 45 MILLION CUSTOMERS GLOBALLY.

Francesca Carlesi, CEO of Revolut UK, commented: “Today’s announcement is a tremendous achievement for Revolut. Ten million customers across the UK makes us one of the largest payments businesses in the market, and we are incredibly grateful to our growing customer base, who continue to use Revolut more and more. The UK is our home market, and is the base for the company’s wider global expansion plans. As

we work towards launching the bank in the UK in the coming months, we will continue to offer products and services that improve the financial lives of everyone who uses Revolut.”

Key company highlights in 2024:

In August, Revolut signed agreements with a group of leading technology investors to provide liquidity to employees through a secondary share sale at a $45 billion valuation.

• In July, Revolut received its UK banking licence with restrictions from the Prudential Regulation Authority (PRA).

• In July, Revolut announced the appointment of Fiona Davies as Head of Growth for UK, Ireland, and Nordics.

Keep reading

TODAY, PAYPAL VENTURES, THE GLOBAL VENTURE CAPITAL ARM OF PAYPAL, ANNOUNCED AN ADDITIONAL INVESTMENT IN CHAOS LABS, AN INDUSTRY LEADER IN ONCHAIN RISK MANAGEMENT. THIS INVESTMENT UNDERSCORES PAYPAL VENTURES' CONFIDENCE IN CHAOS LABS' POTENTIAL AND THEIR BLOCKCHAIN PRODUCTS.

Chaos Labs' recent launch of Edge, a new decentralized oracle protocol, has garnered significant attention within the industry.

Edge has already secured a remarkable $30B over the last 2 months and has been adopted by leading exchanges such as Jupiter, the top perpetuals exchange on Solana, and GMX, the leading exchange on Arbitrum.

Edge offers a comprehensive, low-latency oracle solution, combining accurate price data with actionable market intelligence. Its advanced architecture ensures the security and efficiency of DeFi applications while providing insights into market dynamics and security risks. Edge monitors the market for specific risk signals, performs the offchain data parsing and computation, and outputs one actionable data point.

Omer Goldberg, CEO and Founder of Chaos Labs, said, "We're excited to receive the strong confidence and additional support from the PayPal Ventures team. Edge by Chaos is the culmination of our entire company's work and expertise."

Keep reading