AIRWALLEX, THE AUSTRALIA-FOUNDED LEADING FINANCIAL PLATFORM FOR MODERN BUSINESSES, HAS RANKED IN THE TOP 10 MOST INNOVATIVE COMPANIES IN AUSTRALIA IN THE BANKING, SUPERANNUATION AND FINANCIAL SERVICES CATEGORY OF THE AUSTRALIAN FINANCIAL REVIEW (AFR) AWARDS.

Announced at a gala ceremony in Sydney last night,

Airwallex was commended for category-disrupting innovation, including the launch of Airwallex Yield.

An Australian-first product, Airwallex Yield enables customers to earn an attractive return on multi-currency funds with no minimum lock-up period. Launched in November 2023 to wholesale customers, Airwallex Yield was expanded to all Australian businesses in July this year after becoming the first payments company to

be granted an Australian Financial Services Licence for retail investment products by the Australian Securities and Investment Commission (ASIC).

Also this year, the company launched Airwallex for Startups, which has fast become Australia’s most comprehensive initiative for local startups seeking to accelerate their growth.

Find out more

PENFOLD, THE MODERN DIGITAL PENSION PROVIDER, IS THRILLED TO ANNOUNCE THE LAUNCH OF ITS NEW PULL INTEGRATION WITH XERO – AUTOMATING PENSION CONTRIBUTION PROCESSING ENTIRELY.

Streamline your business operations with the new Pinch Payments and Annature integration, enabling seamless payment collections and e-signatures without subscription fees.

Ations are processed, users receive an email confirmation detailing the pension contributions for the pay period.

For businesses connected to both Xero and Penfold, their contributions are processed automatically every time payroll is run or re-run in Xero. There’s no need for users to log into Penfold to upload contribution files – they can just use Xero as usual and Penfold takes care of the rest. Once contribu-

It eliminates the need for manual uploads or button presses, enabling employers and accountants to set and forget their pension processing. Penfold’s the first pension scheme to offer this kind of powerful integration to a mainstream payroll software. And soon to be the first pension in the Xero App Store!

This integration significantly reduces the administrative burden on accountants, payroll professionals and employers – allowing businesses to save valuable time and resources, and enabling them to focus on more strategic tasks.

Find out more

T PINCH PAYMENTS, THEY'RE ALWAYS LOOKING FOR WAYS TO SIMPLIFY AND ENHANCE THE PAYMENT PROCESS FOR CUSTOMERS.

That’s why we’re excited to announce a powerful new integration with Annature, the #1 rated e-signature and identity verification platform on the Xero App Store.

Together, Pinch Payments and Annature are making it easier than ever for businesses to capture both customer payment methods and e-signatures in a single, seamless step.

With this integration, you can set up pre-approvals for future payments while ensuring that your contracts and agreements are signed and stored securely—all without any ongoing subscription fees. Both platforms operate on a pay-asyou-go basis, which means you only pay when your customers actually use the services.

Businesses, especially service-based ones, often struggle with managing both payment collection and contract signing. Manag-

ing two separate processes can result in administrative headaches, inefficiencies, and errors. By combining these tasks into one streamlined solution, businesses can improve their customer experience, reduce friction, and ultimately save time.

Let’s break down exactly how this integration works and why it’s so valuable.

A Seamless Experience for You and Your Customers:

The Pinch and Annature integration allows you to capture your customer's e-signature and payment details.

Keep reading

Explore our latest feature updates and product announcements.

WELCOME TO DEXT’S RELEASE ROUND-UP.

WE’LL BE DETAILING THE LATEST FEATURES AND GIVING YOU A SNEAK PEEK AT WHAT’S ON THE WAY FOR ACCOUNTANTS AND BOOKKEEPERS.

You can also find out more about our recently-announced product enhancement, and our plans to combine our three products into one integrated Dext experience.

What’s new?

Approvals: With Dext’s new Approvals feature for

XU BIWEEKLY - No. 91

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

cost items, you can streamline your client’s approvals workflows, ensuring all transactions are verified and approved by the right people for greater accuracy and control.

• Compliance and reporting

• Reduce the time spent on manual checks, and minimise errors that could lead to incorrect tax figures

• Minimises risk of fraud and errors

• Assign different levels of approval permissions for both your clients' and your own practice's records.

Find out more

WE RELEASED SOME AMAZING NEW FEATURES THIS MONTH, INCLUDING THE MUCH-ANTICIPATED ROLLOUT OF UNIVERSAL MERGE FIELDS, REFERRED TO AS MERGE FIELDS. WE ALSO INTRODUCED A NEW LOOK UP JOB AUTOMATION STEP AVAILABLE WHEN BUILDING OUT PROCESSES IN FYI, ALONG WITH MANY MORE ENHANCEMENTS TO THE PLATFORM.

Merge Fields

This month, we were excited to release Universal Merge Fields, referred to as Merge Fields. The new and improved Merge Fields feature offers

THIS MONTH’S XERO PRODUCT UPDATES INCLUDE EXCITING NEW FEATURES AND ENHANCEMENTS TO STREAMLINE YOUR WORKFLOWS AND BOOST PRODUCTIVITY.

From rolling out new tools for our accountants and bookkeepers, to improvements to the Xero Accounting app, and tools for managing inventory, Xero’s October updates offer valuable enhancements for both small businesses and advisors alike.

Read on to discover how these updates can benefit you.

Global: Get a snapshot of your client’s financial

health in Xero Practice Manager and Xero HQ

Client insights is now available for all Xero partners. The insights screen in Xero HQ (and coming soon in XPM) shows you the latest financial data across all your business edition clients, to help you identify which clients would benefit from your support or advice and a timely conversation.

Global: Manage finances from anywhere with Xero Accounting app enhancements

We’ve also made it easier to share invoices from the Xero Accounting app on iPhone.

Keep reading

Form design matters more than ever

Imagine a user landing on your website, ready to engage with your brand. The first thing they see is a form. Whether it is for signing up, making a purchase, or submitting a question, this form is their gateway to your business. Forms often serve as the first point of interaction between your business and potential customers, setting the tone for their entire experience with your brand.

With this in mind, Zoho Forms has revamped the theme builder and the look of the live standard forms to take your forms to the next level. This tool offers a wide

practices greater flexibility and means a practice can gain far more efficiency when streamlining processes and personalising jobs, emails, tasks, documents and more.

Using Merge Fields allows a practice to update Job information by inserting details from the Client, such as assigning a Job with the same Accountant, Administration or Bookkeeper User Role as the Client. Merge Fields can also be used when creating templates, with the feature now making it more efficient to insert custom fields and data from integrated platforms such as Companies House, BGL or NowInfinity.

Find out more

OVER THE LAST FEW WEEKS WE’VE BEGUN ROLLING OUT AN EXCITING NEW LOOK FOR PROJECTWORKS, AND WE’RE INCREDIBLY PROUD TO SHARE IT WITH YOU. IT’S A BOLDER, SHARPER AND STRONGER REFLECTION OF OUR UNWAVERING COMMITMENT TO THE SUCCESS OF THE CONSULTING, ENGINEERING, ARCHITECTURE AND SOFTWARE SERVICES INDUSTRIES.

Why the change?

As much as we were due a facelift, our brand refresh is about more than just aesthetics. It’s about doubling

down on who we are and why we exist – to power the world's experts.

From day one at Projectworks we’ve always been all-in on services – it's in our DNA, with our platform being born out of a professional services firm.

We’re deeply passionate and proud of all that our customers achieve, creating lasting impact across society. Therefore, it's only right that our new identity reflects the passion, energy, insight and expertise we see so much of in our customers throughout the globe.

Keep reading

WAU WAS OUR DEFAULT DOMAIN. SINCE THEN, WE’VE MIGRATED TO PINPAYMENTS.COM BUT MAINTAINED PIN.NET.AU AS PART OF OUR LEGACY INFRASTRUCTURE.

To streamline our operations, we’ve decided to retire the pin.net.au domain and migrate all our processes to pinpayments.com from 1st of December 2024.

How does this change impact existing customers?

For customers who are already on the pinpayments. com domain, this change will have no impact on their account.

Who is impacted by this change?

This change may affect you if you have been one of our early customers or are using Pin Payments through a plugin or a third-party platform. Our team will notify you or your platform provider of this change.

What happens after the 1st of December 2024?

If you attempt to log in to your Pin Payments account at dashboard.pin.net.au, you will be automatically redirected to dashboard.pinpayments.com.

If you are using our API or Hosted Fields features with api.pin.net.au, the requested API request will fail, and in

the response there will be an error message advising you to update to use api.pinpayments.com.

After the 1st of December, the request api.pin.net.au will not resolve and will not provide any response.

What do I need to do?

Update all pin.net.au references to pinpayments.com anywhere in your system or workflows, including your integration code, API calls, saved bookmarks or internal documentation.

If you’re unsure of what to do and if this impacts your business, please contact our support team for help.

Find out more

range of customization options, allowing you to create forms that are not only visually appealing but also aligned with your brand's identity.

Key features of the new theme builder

Simplified interface

The redesigned theme builder has a cleaner, more user-friendly interface to make it accessible to users of all skill levels. Whether you are a seasoned designer or a beginner, you can easily navigate through the theme builder and create stunning forms in no time.

Keep reading

FIRMCHECK, THE COMPREHENSIVE ANTI-MONEY LAUNDERING (AML) SOFTWARE FOR ACCOUNTING FIRMS, ANNOUNCED A SIGNIFICANT UPGRADE TO ITS SOLUTION. THE UPGRADE DELIVERS ENHANCED CAPABILITIES THAT UNITE ALL COMPLIANCE PILLARS IN ONE INTUITIVE PLATFORM WHILE STREAMLINING PROCESSES AND ACCOUNTING PRACTICES.

The platform upgrade,

driven by extensive customer feedback and market insights over the past year since launching into the UK market, transforms how accounting firms manage their AML obligations.

It brings clarity, control, and comprehensive documentation into a single, user-friendly solution.

No more scattered spreadsheets, missing documents, or out-of-control compliance.

Firmcheck has found early success in the UK market, supporting hundreds of firms in organising their AML compliance to date.

One happy customer recently shared, “Firmcheck is a fantastic product. We recently had a compliance visit, and implementing Firmcheck helped us through the process and demonstrated our commitment to doing things correctly.”

Find out more

THIS MONTH HAS SEEN US HEAVILY FOCUSED ON SEVERAL INITIATIVES INCLUDING NEW REPORTING FUNCTIONALITY, EXPANDED CYBERSECURITY TOOLING AND OTHER FEATURE WORK WHICH

I HOPE TO BE IN A POSITION TO DISCUSS IN MORE DETAIL IN NEXT MONTH'S UPDATE.

In addition to these key projects, we have continued our focus on the onboarding flow and expanding trade confirmation support to multiple languages, rolling out trade confirmation support to an additional 12 languages with Degiro alone.

New functionality / enhancements

• Introduced a ‘Quick Start’ guide for new retail users

• Revamped our help page

• Introduced a new modal for adding your investments, setting the scene for an expansion in sup-

port across additional asset classes.

Broker import functionality

• Added support for the seamless import of historical and future Coinbase trades using Snaptrade

• Added trade confirmation support for Midsec Financial Advisors (AU)

• Expanded support for the following brokers to include additional trade file imports;

• Westpac – Support for Holdings, ConfirmationDetails and EOFYTransaction files

• Fidelity – Support for domestic versions of Accounts_History and History_for_Account files

• Directa – Support for Movimenti file

• CMC, ANZ, BOQ, ebroking, Bendigo, St. George – Support for Holdings file

Keep reading

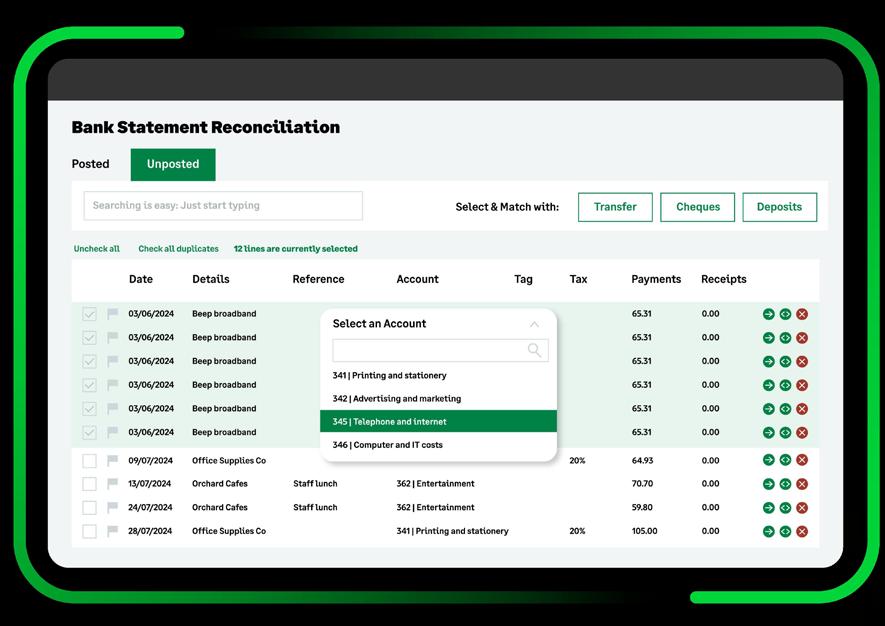

Better support for fixing your client’s reconciliation issues

What’s new?

We listened to your feedback, and have improved the Period Close Checklists’ reconciliation alerts. They now:

• Better reflect how reconciliation works on Xero and QuickBooks

• Offer more guidance and tips on fixing reconciliation problems

What benefits does it have for your team?

• Easier to diagnose reconciliation issues for both Xero and QuickBooks clients

• With Xero and QuickBooks specific reconciliation alerts, we’ve taken the guesswork out of figuring out where the problem may lie.

• Less time wasted figuring out what actions are needed

• Clearer task instruction and reminders help your

team stay focused and complete tasks quicker with less hassle.

• Improve real time data availability for advisory

• Making your bookkeeping jobs easier means data will more likely get processed quickly and promptly.

How does it work?

The reconciliation alerts now guide you step by step in ensuring your client’s bank / credit card account recordkeeping accurately reflects activities in those bank / credit card accounts.

For both Xero and QuickBooks clients, the Period Close Checklists’ Bank Reconciliation section now show platform specific alerts and guidance for:

1. Unreconciled bank feed data

Keep reading

MANAGE MY RENEWALS, A FAST-GROWING TECH COMPANY FOCUSED ON HELPING BUSINESSES MANAGE VEHICLE RENEWALS, INSURANCE EXPIRY, INSPECTION DATES AND OTHER KEY DEADLINES, HAS JOINED FORCES WITH JOURNEY, A LEADING SAAS AGENCY FOR ACCOUNTING TECH COMPANIES, TO SCALE THEIR CUSTOMER SUCCESS AND MARKETING EFFORTS.

This partnership will focus on optimising Manage My Renewals' brand presence and customer outreach, ensuring businesses continue to benefit from their innovative solutions for managing time-sensitive renewals efficiently.

and other critical deadlines,” said Deb Thomas, Founder and CEO of Manage My Renewals.

"We’re excited to collaborate with the team at Journey. Their expertise in growing tech companies and aligning marketing strategies will allow us to focus on what we do best— helping businesses stay on top of their vehicle renewals

Journey will provide comprehensive marketing, content creation, and customer engagement strategies aimed at expanding Manage My Renewals’ reach in the Australian market.

"Manage My Renewals has developed a truly impactful solution for businesses, and we're thrilled to be working alongside them

to elevate their brand. We’ll be focusing on creating tailored content, enhancing customer journeys, and delivering a targeted marketing strategy to help them grow faster,” said Trent McLaren, CEO of Journey. This partnership represents a strong step forward in expanding the impact of both companies, helping more businesses streamline their operations and avoid missed deadlines or costly lapses.

Keep reading

IRIS SOFTWARE GROUP (IRIS), A LEADING GLOBAL SOFTWARE PROVIDER OF ACCOUNTING, EDTECH, PAYROLL AND HR SOLUTIONS, HAS LAUNCHED PRACTICE IN A BOX: A NEW, ALL-IN-ONE SOLUTION DESIGNED TO SIMPLIFY ACCOUNTANCY FIRMS’ WORKFLOWS AND ALLOW THEM TO GROW MORE PROFITABLY.

Built on the powerful IRIS Elements cloud-based accountancy platform, Practice in a Box combines essential accountancy services into one seamless and easy-touse bundle. For newly established firms, it simplifies essential tasks like compliance, tax filing, and practice management. For existing firms, Practice in a Box streamlines the transition from desktop to cloud, eliminating inefficiencies and freeing up valuable time for accountants to focus on delivering high-value services to their clients.

IRIS’ Practice in a Box helps accounting practices and firms maximise their potential and improve client

satisfaction through five distinct features—all managed from one user-friendly dashboard:

• Comprehensive onboarding and compliance tools ensure all aspects of client and practice onboarding are handled efficiently, including Anti Money Laundering compliance.

• Integrated practice management helps streamline practice operations, from tax and income management to record-keeping and client communication.

• Tailored outsourcing services allow practices to delegate tasks and focus on core activities.

• Integrated Microsoft 365 suite enables seamless collaboration and productivity with the latest Microsoft 365 tools.

• Modern website creation with built-in encryption capabilities and SEO optimisation helps practices build an online presence, while ensuring security and accessibility.

Keep reading

EXPEND, THE BUSINESS EXPENSE MANAGEMENT DIGITAL PLATFORM, HAVE ANNOUNCED RECORD TAKE-UP OF THEIR INDUSTRY-FIRST PRODUCT ‘CARDCONNECT™’. THEY ARE THE FIRST UK PLATFORM TO PROCESS BUSINESS EXPENSE DATA INSTANTLY, FROM MASTERCARD AND VISA TRANSACTION FEEDS, DIRECTLY INTO AN EXPENSE CAPABILITY.

Expend clients can now benefit from real-time expense settlement, streamlining financial management and improved efficiency.

SAGE, A GLOBAL LEADER IN ACCOUNTING, FINANCIAL, HR, AND PAYROLL TECHNOLOGY FOR SMALL AND MID-SIZED BUSINESSES (SMBS), IS PROUD TO ANNOUNCE THE LAUNCH OF SAGE FOR ACCOUNTANTS (SFA) IN FRANCE.

This scalable, AI-powered suite of applications is designed to accompany the transformation of accountancy practices and help firms grow their business through innovative solutions tailored for evolving needs.

Empowering accountants with advanced tools

As the accountancy profession continues to shift in response to increasing client diversity, changing professional roles, and regulatory requirements such as e-invoicing, Sage for Accountants offers a solution that keeps pace with these transformations. The suite brings together the essential tools accountants need to streamline everything from client proposals to advisory services, ensuring a seamless

practice experience. “This suite represents our unwavering dedication to helping accountants thrive in the face of continuous change,” said Arnaud Petit, Managing Director, Sage Southern Europe. “Sage for Accountants is a scalable solution that enables smooth data and workflow integration across our products, helping accountants do more with less effort while reducing administrative burdens.”

Introducing Sage for Accountants

Designed to enhance the functionality and productivity of accounting practices, Sage for Accountants integrates client management, simplifies operations, boosts efficiency, and enhances collaboration with clients. Even for firms not using Sage ledger tools, the suite enables continuous accounting, allowing users to tap into the power of integrated tools across their client base—freeing up time for more valuable client engagement.

Keep reading

SISS DATA SERVICES IS EXCITED TO ANNOUNCE THE LAUNCH OF ‘CDR READY’, A FREE, EASY-TO-USE TOOL DESIGNED TO EMPOWER AUSTRALIANS TO HARNESS THE FULL POTENTIAL OF THE CONSUMER DATA RIGHT (CDR).

In just two minutes, users can verify their authority to access and share their bank accounts under the CDR framework and Open Banking.

Streamlining Access to CDR and Open Banking

“CDR Ready simplifies the process of checking account access, ensuring that

consumers are prepared to engage with the CDR effectively,” said Grant Augustin, CEO and Founder of SISS Data Services. “We've successfully guided thousands of consumers in navigating the CDR landscape, revealing that many users—especially those with business or jointly-held accounts—often lack the necessary authorisations on file. With CDR Ready, users can swiftly confirm their authorisations before starting the CDR process, eliminating unexpected hurdles along the way. Plus, if updates are needed, we provide clear, easy steps to get everything in order.”

Keep reading

Expend CEO, Johnny Vowles says: '’Card Connect has two important attributes. It enables companies to connect all of their business cards to our single platform, which has multi-card acceptance. This means that users can view and submit all of their expense claims in one app, whether, for exam-

ple, they paid on their corporate Barclaycard or business HSBC card.

“The second is that these card payments can be viewed in the app instantly, as they happen. There is no wait time between making the payment and seeing it in the Expend app.”

Streamlining everything from proposals to advisory services for a seamless practice experience. Expense management fintech Expend reports surging demand for Card Connect, with UK-first real-time expense management

He explains: “Employees can charge business expenses to their Visa or Mastercard business card, and by connecting their preferred business cards to Expend, the transaction information can be processed quickly and seamlessly. Users can add receipts, categorise the expense and submit it for approval, via the app, in a few moments, and at the time they are making the purchase, which is very convenient. So, for example - the expense for team coffees can be completed and submitted by the time the coffee is ready.”

Find out more

Prepare, adjust and output a trial balance for an unlimited number of clients with AccountsPrep, an add-on to your AutoEntry subscription.

Get started now

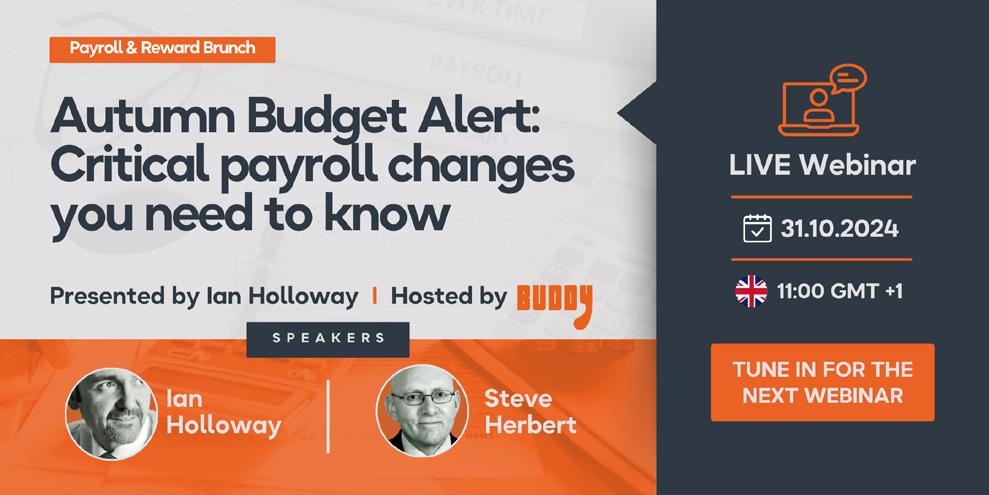

UPCOMING EVENTS

UPCOMING WEBINARS

WEBINARS

IBy Paul Lodder, VP of Accounting Product Strategy, Dext

N FINANCE, STAYING AHEAD MEANS EMBRACING THE LATEST IN TECHNOLOGY AND AUTOMATION. AT DEXT, WE ARE COMMITTED TO PROVIDING ACCOUNTANTS AND BOOKKEEPERS WITH CUTTING-EDGE SOLUTIONS TO SIMPLIFY PROCESSES, IMPROVE ACCURACY AND IMPROVE COLLABORATION. AS THE INDUSTRY EVOLVES, SO DO OUR OFFERINGS, ENSURING THAT OUR PARTNERS CAN FOCUS MORE ON STRATEGIC TASKS AND LESS ON REPETITIVE, MANUAL WORK.

By recognising the dynamic nature of the accounting industry, we continuously strive to develop and implement tools that not only address current challenges but also anticipate future needs. This proactive approach allows us to deliver innovative solutions that significantly reduce the administrative burden on accountants and bookkeepers, enabling them to allocate more time and resources to high-value activities.

That’s why, after careful thought, steered by invaluable feedback from our customers, we’ve decided to upgrade Dext Prepare –combining it with features from Dext Precision and Dext Commerce to create one integrated experience. For the first time, you’ll have access to Data Capture, Data Automation, Data Health & Insight and Practice Productivity all in one place.

And to continue supporting our mission, we are excited to introduce a range of new features designed to integrate seamlessly with your existing workflows. These updates will further streamline operations and foster better collaboration with clients, making your job easier and more efficient. By leveraging these enhancements, you can ensure that your practice remains at the forefront of technological advancement, providing superior service to your clients and driving greater business success.

Dextension: Seamless Integration with Chrome

One of our most exciting

new launches is Dextension, a free browser extension that’s already available for Chrome and Microsoft Edge. This tool allows you to view Dext data within Xero and QuickBooks interfaces, making it easier than ever to transition between Dext and your accounting software. The key benefit here is instant collaboration with clients to find missing documents, significantly reducing the time spent on administrative tasks. You can download Dextension for free on the Chrome Web Store.

We also have three new features coming soon:

iation with Supplier Statements

Our new Supplier Statement feature leverages AI to extract and understand supplier statements. This feature will help you reconcile invoice references and amounts quickly and accurately. By simplifying the process of requesting missing paperwork from suppliers, it’ll save you time and help manage cash flow more effectively.

With the Approvals feature, you’ll be able to control how expense reports and invoices flow, complete with audit history. This tool will allow you to define multi-step and stage approval workflows for users and groups, ensuring that the right processes are followed every time. You can also set conditions for when approvals are needed, such as by Value, Supplier Category or Project, and enable auto-publishing after approval. The simple mobile and web experience will also make it easy for clients to use. This feature will be available at no extra charge with an existing subscription.

Mileage claims for both personal and company-owned vehicles will soon be tracked and added to expense reports with ease.

Our new Mileage feature will allow users to create a mile-

By Gurpreet Lidder, Senior Account Manager, Spotlight Reporting

Lage claim by recording the trip automatically or adding it after on the web or mobile application. Dext will then automatically calculate the amount that should be reimbursed based on legislative requirements or custom information. The feature will integrate seamlessly with Dext automations, including auto publishing and auto categorisation. Like the Approvals feature, Mileage is available at no charge with an existing subscription.

In our commitment to continue enhancing the efficiency and integration of accounting workflows, our team at Dext is always working on new features to make your life easier.

Whether it’s through seamless data viewing with Dextension, AI-powered reconciliation with Supplier Statements, enhanced control with Approvals, or simplified Mileage claims, these updates are designed to provide real-time data and complete records – the cornerstones of effective accountancy.

As we continue to innovate, we remain focused on delivering tools that not only meet the current needs of our users but also anticipate and support the future of accounting and bookkeeping. We’re excited about these new features and the value they will bring to your practice.

Case Study: Why Scrutton Bland trusts Dext and Xero to always deliver

Originally founded in 1919 by Alfred Scrutton and Frank Bland as two independent firms, and then merged in 1990, Scrutton Bland has always prioritized client needs. Initially providing tax support for returning war veterans and insurance services, to this day the firm continues to offer high-quality services across various sectors.

Ryan Pearcy, Associate Partner at Scrutton Bland, joined the firm to lead their digital transformation team.

Keep reading

AST YEAR, SPOTLIGHT REPORTING SURVEYED OVER 1,100 ACCOUNTANTS FROM FIRMS AROUND THE WORLD, ASKING FOR THEIR INSIGHTS ON CURRENT AND UPCOMING TRENDS IN THE ACCOUNTING INDUSTRY.

The resulting Global Advisory Trends Report is well worth reading, but one of the biggest insights we uncovered was that just over 42% of accountants surveyed would like more than 50% of future revenue to come from advisory services.

Currently, only 20% of respondents are achieving that level of advisory revenue.

This movement towards greater advisory revenue is something I’m seeing on the ground as well: advisory services are on the rise, and offering more services to more clients is definitely something practices are looking at this year.

With that in mind, here are a few steps you can actively take to sell/upsell advisory services to your base.

1. Organise your client base

First, conduct a portfolio review and categorise your clients in a way that makes sense for your firm. Some questions you can ask yourself include:

• What industry do your clients belong to?

• How big is their business?

• What are their goals?

• What services do you already offer them?

• What services could you offer them?

By grouping businesses together and tracking services offered, you’ll start to identify service gaps where you could be adding more value. Don’t assume that if a particular client isn’t asking for a service, they don’t want it—they might not be aware of what you can really do for them. It’s up to you to be proactive!

At the end of the day, the best strategy here is to focus on what your clients need, and offer them the services that will help them reach their goals.

2. Package your services

The best and most practical way to organise your services is to build monthly packages, rather than offering one-off sessions—a bit like a subscription model.

Designing tiered packages according to client size and need is definitely advantageous. They’ll be a good baseline that will allow you to tweak and scale services efficiently and effectively. But while this approach works well—you’re charging for value, increasing the potential ROI per client, and the client understands exactly what they get each month—it’s still really important to be flexible.

Client needs can change as their businesses grow or contract, or when economic conditions throw a spanner in the works. If a client approaches you for a oneoff service, it’s far better to build it into the monthly subscription, instead of hitting the client with a lumpsum fee.

Furthermore, the tiers you design may also not be the perfect fit for every client on your books. If this is the case, the best approach is to discuss options with the client, get a real understanding of what they’re after, and then build a monthly service structure that works for them and for you. They’ll really appreciate you going above and beyond.

3. Sell the package

Once you know what you want to offer clients, the next step is to sell those services. Selling can feel more natural for some than others, but it’s all just a matter of keeping things simple and asking the right questions.

For example:

• What is the current situation of the business, and where is the client looking to go?

• What are their current roadblocks?

• And what future problems could they face?

Once you get that understanding, you’ll be able to demonstrate the value and pay-off of having an expert like you supporting them in achieving what they want. Be an extension of the client's company—you want to live and breathe it. This will build exponential rapport with your client but also enable you to offer your advisory skills in the best way possible.

Finally, when it comes to advisory, you need to emphasise the outcome.

Keep reading

SNew agreement includes GoCardless’ ‘Same Day Settlement’ feature to help savers reach their financial goals more quickly will shorten the time it takes for their customers to get funds onto the platform, helping them save, invest, and earn more quickly.

AVINGS AND INVESTING PLATFORM MONEYBOX HAS RENEWED ITS RELATIONSHIP WITH BANK PAYMENT COMPANY GOCARDLESS, BUILDING ON AN EIGHTYEAR PARTNERSHIP.

Moneybox launched in 2016 with GoCardless as its preferred payment method, enabling customers to transfer money into its wide range of savings and investment products. Today, more than 92% of Moneybox’s payment transaction volumes go through GoCardless.

The renewal will see Moneybox continue to rely on GoCardless for Direct Debit in addition to adding Same Day Settlement, a feature

Kaley Addo, Head of Investment Operations at Moneybox, said:

“Moneybox has experienced a period of exponential growth in recent years with Assets Under Administration rocketing to more than £7bn and GoCardless has been a valued partner throughout.

“Helping people build and embed positive saving and investing behaviours earlier in life has been at the heart of our business since day one."

Keep reading

VENMO TODAY ANNOUNCED A NEW, HIGHLY REQUESTED FEATURE THAT ALLOWS USERS TO SCHEDULE ONE-TIME OR RECURRING PAYMENTS OR REQUESTS WITH FRIENDS AND FAMILY ON VENMO. USERS CAN USE THE NEW FEATURE TO SET UP ONE-TIME OR RECURRING PAYMENTS MONTHLY, WEEKLY, OR BI-WEEKLY IN ADVANCE.

Research shows that more than 84% of consumers have used a peer-to-peer service1 with common payments including monthly rent, utilities, and other regular living expenses. Venmo’s new feature makes it easier to manage

one-time or recurring expenses by setting up automatic payments or payment requests to another Venmo user.

“We know many of our users make payments on Venmo on a regular basis for things like their share of rent or utilities,” said Alexis Sowa, Vice President and General Manager, Venmo. “We’re excited to introduce this highly requested feature which offers an easy way to set up and manage one-time and recurring payments in the Venmo app to continue our commitment to delivering the best possible P2P experiences for our users.”

Keep reading

BANK PAYMENT COMPANY GOCARDLESS HAS NAMED ALEXANDRA CHIARAMONTI THE MANAGING DIRECTOR OF ITS INTERNATIONAL BUSINESS. WITH THIS APPOINTMENT, CHIARAMONTI ALSO JOINS THE GOCARDLESS EXECUTIVE TEAM.

In her role, Chiaramonti is responsible for scaling the fintech’s growth outside of the UK and Ireland, with a

focus on Europe and Asia Pacific.

Chiaramonti joined GoCardless in 2021 as VP and General Manager, EMEA. Under her leadership, new business bookings tripled in the region in 2023 and revenues grew by 40%, contributing to a 49% increase overall in international revenue.

Her appointment comes as GoCardless doubles down

Stripe announces expanded interoperability, major upgrades to Stripe Billing, new partnerships with NVIDIA and Pepsi, and more

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED NEW FEATURES TO HELP BUSINESSES ACCELERATE THEIR GROWTH. THE UPDATES WERE PART OF STRIPE TOUR NEW YORK, THE COMPANY'S ANNUAL PRODUCT SHOWCASE IN NYC.

"Our mission is to grow the GDP of the internet, and we do that by helping our users grow faster. Increasingly, that means helping the world's most sophisticated companies not only optimize their payments, but also modernize their billing systems. Stripe Billing now powers

more than 300,000 businesses, and it's one of our top investment areas," said Will Gaybrick, Stripe's president, product and business.

The announcements at Stripe Tour New York highlighted three areas of progress for Stripe:

1. Expanding support for more payment providers

2. Upgrading Stripe Billing

3. Continuing to build traction with some of the largest and most sophisticated enterprises in the world, such as NVIDIA, with which Stripe announced a new partnership today

Keep reading

on its international business with ambitious goals to significantly increase revenue from regions outside of the UK & Ireland over the next three years.

Paul Stoddart, President at GoCardless, said: “We’ve made fantastic progress across our international business over the past few years, with each market exceeding targets across new customer acquisition and

new revenue generation. There remains a significant opportunity for GoCardless and the MD of International will be instrumental in driving further growth. With her outstanding achievements in Europe and extensive experience in scaling and expanding businesses globally, I’m confident that Alex is the right leader to help us reach our objectives.”

Keep reading

We’re thrilled to be shortlisted in the Moneyfactscompare.co.uk Awards 2025! By casting your vote, you could win £1K from Moneyfacts.

WE’RE BUZZING TO ANNOUNCE THAT TANDEM HAS BEEN SHORTLISTED IN THE MONEYFACTSCOMPARE.CO.UK AWARDS 2025, AND WE’RE UP FOR SOME SERIOUS HONOURS IN TWO CATEGORIES.

The Moneyfactscompare. co.uk Awards give you the power to recognise the best products and providers out there, helping people make smarter financial choices— so we’re chuffed to be in the running again.

Here's what we're nominated for

• App-only Savings Provid-

How to vote for us

Fancy casting your vote? It’s quick and easy! Just head to the link below, complete a short survey, and show Tandem some love.

Voting closes at midnight on Friday 22 November 2024. You could win £1,000 By voting, you’ll automatically be entered into a draw to win £1,000 from Moneyfacts*.

Keep reading