7 minute read

Open integration from Wolters Kluwer powers

Open Integration from Wolters Kluwer powers new ways of working for advisors and their clients

@wolterskluweruk

Wendy Rowe is the UK Product Director at Wolters Kluwer, Tax & Accounting. Formerly a chartered tax adviser working at Ernst & Young, Wendy has also held senior roles at Data Sciences and Financial Data Systems. She has over 20 years’ experience within the tax and accountancy software industry.

Wendy’s focus is on how a business strategy and product vision can evolve through its customers and people. She translates customer needs into a software approach that solves pain points and provides new opportunities. She prides herself on her ability to anticipate the challenges that today’s accountants will face tomorrow. Wendy has an MBA in Strategy from Henley Management College, holds a Chartered Tax Adviser (CTA) qualification and is a member of the Association of Taxation Technicians (ATT).

U

nderstanding an industry in change

The world of bookkeeping is an area where technology has continued to evolve. From advisors simply promoting a single on-premise solution to their clients, to the introduction of collaborative cloud solutions such as those offered by Xero.

SME’s now have greater choice than ever before, and advisors are now in a strong position to offer more value-added services.

As usual, with opportunities, come challenges for the accounting practice. Employees are required to be more flexible. They need to adapt to changing solutions more quickly whilst simultaneously being able to swiftly move from one solution to another to deal with individual SME requirements.

Within the accounting practice, individuals will require advanced training on more than one solution to ensure they can continue to be seen as the ‘expert’ to their SME’s. Also, it’s possible that the flow of work from the SME to the advisor may call for some ‘work arounds’ to support multiple solutions. Accounting practices will have to manage relationships with multiple software suppliers, ensuring each solution meets with the needs of their practice and their clients.

At Wolters Kluwer, we understand that, as bookkeeping solutions become more intuitive and as more and more millennials start to use these solutions (both SME and practice users), roles and responsibilities are changing. Through collaborative bookkeeping, we are seeing scenarios where some SME’s are content to keep track of their income and expenditure, while continuing to rely on their advisor for review and accuracy checks. As a result, the advisor will have to learn and adapt to new solutions that are available.

With the introduction of Making Tax Digital, we will see even greater change as the advisor and SME relationship evolves. More touch points between the advisor and the SME will be required for the purposes of quarterly reporting, ensuring they have all the data they need to be able to submit accurate numbers to HMRC.

Although the changing industry landscape presents some challenges, it will also create many opportunities for advisors and SME’s.

SME’s now have real choice when deciding which bookkeeping solution best meets both their functional and cost requirements to run their businesses. Wendy Rowe said “Collaborative bookkeeping and changes in legislation, such as Making Tax Digital, will ensure that advisors and SME’s have much closer working relationships as they will interact more regularly using cloud technology.”

However, as practices will need to support multiple solutions and have more touch points with clients, there is the risk that advisors become less efficient. This could impact overall profitability of the practice, which could, in turn, affect the fees that they charge.

Introducing Open Integration

accountants often support 5, 10 or even 20 different bookkeeping solutions or versions of data and historically, there has not been an easy way to improve efficiencies without taking away choice. Wolters Kluwer is the first supplier that can offer the advisor a solution to support a strategy of choice for multi-bookkeeping solutions, by creating a unique Open Integration toolset in its cloud software - CCH OneClick.

Wendy Rowe added; “Open Integration, built around the principles of openness and collaboration, delivers a development framework that allows the advisor to integrate with any cloud bookkeeping solution they wish.” Wolters Kluwer is happy to incorporate the integration into their Open Integration Programme, providing the cloud supplier has an open API and is keen to collaborate with Wolters Kluwer.

So, how does Open Integration differ from what we have all previously been accustomed to? Open Integration provides:

Wolters Kluwer recognises that

A permanent connection

to bookkeeping data – the advisor will no longer be required to export data from the bookkeeping solution and manually import this into their compliance solutions. Data is automatically made available to the advisor, updated every 24 hours and can also be updated on an ad-hoc basis.

Availability of transactional

data– historically, only trial balance data could be exported from bookkeeping solutions for use in compliance systems. Open Integration gives access to transactional data allowing the advisor integrate the individual transactions

The ability to drill back down into the transactional data from the trial balance in their compliance solution and view

master data – this removes the need for the advisor to keep reverting to the bookkeeping solution to check the data that is making up a value in the trial balance.

The ability to make adjustments

in the compliance solution – this removes the need to revert into the bookkeeping solution to replicate any adjustments that have been made in the compliance solution.

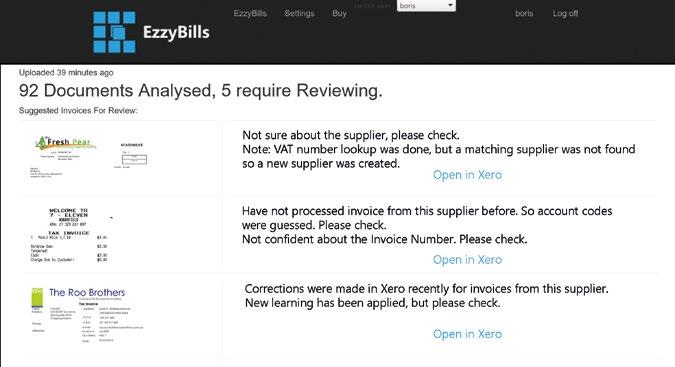

The benefits of machine learning

- the system automatically recognises where the mappings of data do not align and learns the changes for future data mapping, rather than setting up mappings each time data is imported.

The ability to work with

unlimited vendors – this is probably the most important aspect of the Wolters Kluwer Open Integration Programme and will be driven by the solutions the advisor is currently using and supporting. Wolters Kluwer is already connected with Xero, Exact, Twinfield, QuickBooks and Sage One and there is more collaboration lined up in the Wolters Kluwer roadmap. In addition, many advisors are using Accounts Production software to maintain digital records on behalf of their clients so Open Integration now integrates

seamlessly with Wolters Kluwer’s own CCH Accounts Production software.

Open Integration is part of the bigger move to digitalisation using CCH OneClick

CCH OneClick provides a set of cloud tools that are delivered through two new connected workspaces; the advisor workspace, which provides new features for advisors, and the client workspace, which delivers an area for secure document exchange, document approval and messaging. Wendy Rowe says, “Tax advisors now realise that the move to digitalisation is inevitable. As mentioned, they are now supporting multiple accounting packages as well as incoming data from HMRC and will be required to ensure GDPR compliance, meet Making Tax Digital requirements and, ideally, have access to information in a single place and on the move. In addition, to remain competitive, advisors will need to focus on value-add services such as business advisory. CCH OneClick has been created to become the single place from which tax advisors can obtain and process data while delivering services that are valued With the launch of CCH OneClick, Open Integration is a critical part of supporting a practice to become digital.

1. Advisors can now have all their client data in a consistent format no matter what cloud accounting system their client is using. 2. Instead of working with financial data and accounts payable from multiple different software programmes, the practice can use

Open Integration as a conduit to pull in and review financials from multiple sources. 3. It provides a consistent format for client bookkeeping data, in a single database, with reporting tools. This can be used to integrate seamlessly with CCH

OneClick and CCH Accounts

Production, interact with HMRC, provide dashboards and reports for the advisor and the client. As well as, create alerts and support proactive advice to clients, integrate with advisory tools and analyse and mine data. 4. Finally, it is a key part of connecting the practice to the ecosystem so that it cannot only produce accounts but will also use this to manage quarterly reporting for Making Tax Digital from a single place, irrespective of whether they use Wolters Kluwer or another provider for compliance.

Wolters Kluwer is the first supplier that can offer the advisor a solution to support a strategy of choice for multi-bookkeeping solutions, by creating a unique Open Integration toolset in their cloud software; CCH OneClick.

FIND OUT MORE...

To find out more about Open Integration and CCH OneClick, visit cchoneclick.co.uk

Subscribe to XU Magazine

FREE