6 minute read

CASE STUDY The real impact of advisory

The Real Impact of Advisory Services: An interview with ProfitSee and Navigate Virtual CFOs

Recently I sat down with our partners, Aaron Lane and Kyle Jenkins, from Navigate Virtual CFOs in Sydney to talk about the real impact of providing advisory services to their clients and how ProfitSee has helped them improve their processes and grow the value they provide. Navigate Virtual CFOs was a finalist nominated as the New Firm of the Year for the 2018 Accountants Daily Australian Accounting Awards. They believe, and have proven, that by helping businesses tackle their unique challenges they will be able to grow in a sustainable way...

@MyProfitSee

James Tobin, Director of Australian Operations, ProfitSee

James has traveled and worked in the US, the UK and Australia. He has designed and run training programs for service teams to ensure they are meeting the needs of their clients. After working at Macquarie Bank for almost 10 years dealing with Superannuation and Platform Operations, James has taken the opportunity to lead the Australian business. In his spare time James enjoys bike riding, photography, and visiting new places.

Throughout my time working

with Aaron and Kyle, and during this conversation, what really impacted me was how they are future driven. They are always looking forwards and forecasting the future for their clients with the goal of reducing risk and improving profitability. Our conversation kept coming back to a few main topics: using real-time data, making smarter decisions, needing scalable solutions, and providing real value.

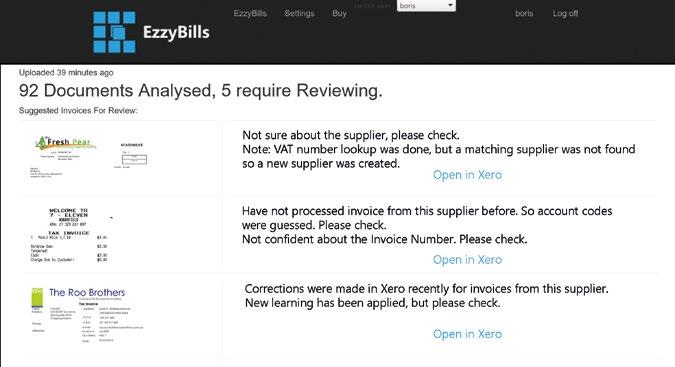

The value of using cloud based accounting software is the ability to be real-time. Having access to up-to-date information allows accountants and bookkeepers to help their clients make informed decisions based on the insights they gain from looking at the financials. This means they can partner with their clients and be an integral part of the team while monitoring the business’ progress every day.

There is no point in telling your clients at the end of the month that they have gone over their budget. By monitoring their progress on a regular basis, you can work towards achieving their targets before it’s too late. Being proactive means you can be working towards meeting their goals, rather than having to reactively fix problems.

One of the clients Navigate Virtual CFOs (Nav CFO) recently started working with had been through a period of growth and had acquired other companies, but it was not easy to understand their financial status. Once the Nav CFO team came on board, they realised that they could solve some of these business problems by using real-time data and consolidated reporting functions. This allowed them to have up-to-date performance reports on divisions and staff and understand where the company was standing as a whole at any point in time. After researching their options, the Nav CFO team decided to partner with ProfitSee to make this work.

Thanks to the evolution of cloudbased technology, accounting professionals can access up-todate information to help their clients make better decisions. As Aaron Lane says, the changes in the accounting industry are “really challenging the accounting profession to become more realtime.” This information is critical to SMEs and can be the difference between success or failure. If a business is going to achieve stability, profitability, and growth then they need to be looking forwards with quality insights.

“What ProfitSee brings is real-time reporting that can look backward and forward. A lot of the software solutions we looked at previously basically just looked backward, and if they look forward it’s in a really rudimentary way,” explained Aaron Lane. “You can’t keep looking backwards to see how you’re going to grow. You need to understand where you are and be in the moment. Once you see what’s really in front of you, you can make the right decisions and see the true power of real-time data” says Kyle Jenkins.

As an advisor, providing your clients better quality insights allows them to make better quality decisions.

“It can take our real-time position and aid decision making by adding scenarios, looking at the

Navigate Virtual CFO (navcfo.com) Kyle Jenkins (left) and Aaron Lane (right)

Navigate was founded with a very clear purpose to bring world class Chief Financial Officer services, financial management and reporting to SME’s, fast growing businesses and progressive companies who want to take their businesses to the next level.

forecasting, and seeing the impact of decisions… So much focus is on what’s happened, but to make a decision we really need real-time data to look forward. That’s where ProfitSee has been a real value to us, and also this client, in converting them from a historic, desktop, trying-to-catch-up business. They now know where they stand at any given point and they can actually look at real-time scenarios to make a decision and look back at the impact that decision had on the business.”

One of the most important things for the Nav CFO team is to be scalable, and they use technology to be an enabler. Today there are so many apps available that can do so many things, but it comes down to having the right tools for the job. They found that using cloud accounting, real-time data, and ProfitSee helps them run efficiently requests; they don’t have backlogs of outstanding work they are trying to catch up on.

“We don’t get phone calls at the end of the quarter saying, ‘Where’s our BAS?’ We get calls every day saying ‘What’s happening in my business today?’ So these tools, like ProfitSee, are of value because we’re not chasing our tails,” said Kyle.

Navigate Virtual CFOs pride themselves on being the dedicated financial expert for their customers that give their business a competitive edge. As Aaron explains, “since we are CFOs of multiple companies, we need a scalable solution. The ability to use a software like ProfitSee, we can white-label it, so the client really feels like it’s theirs. They can log in and modify things. It’s an easy way for us to show value. It’s given us the ability to talk to larger companies.”

Business owners are looking for real value and want to see the so they are on top of their clients’

benefits of working with an advisor. It is important to know what you are good at, play to your strengths, and deliver on your promises. If you do this you will build lifelong relationships with your clients. Having a strong relationship with clients means you are aware of what is important to them and will become a part of their team.

“I think that the role we play is all about getting transparency in everything; so not just necessarily the numbers, but the business processes in the back end and communication between teams,” explains Kyle. “It’s about the reality of the situation. It’s not all about a glossy picture; it’s about knowing exactly what’s in front of them. Seeing the reality really aids in the decision making.”

It’s important to not only sell services but provide true value that impacts your clients’ businesses. “We are absolutely ruthless on value; that is what we sell,” said Kyle. “What we need to do is partner with people who contribute to that value. We want to be in a position where our clients work with us and they know they’re going to get the best of the best – not just from the things that we do, but we’re going to partner with people who are the best in their fields. They’re going to get the best products, they’re going to get the best services, and they’re going to get the best advice. And I think that’s the value that we can add. We’re not just bookkeepers, we’re not just tax agents, we’re not just a run-of-the-mill CFO. We can bring that future-looking reporting, realtime, through ProfitSee, and then sell to our clients.”

We understand that advisory services can provide value to businesses, but as an advisor how can you measure the value you provide to know that you’re being successful? Kyle answered, “we genuinely feel valued, and it’s a massive compliment, when you’re not seen as a cost.”

Using real-time data and smart tools, you can scale your services, help your clients make better decisions, and provide insights that make a difference to your clients and provide value.