5 minute read

Cloud software and property: How is it

Cloud software and property: How is it helping?

@ArthurProperty

Dan Allan was Arthur Online’s first ever graduate recruit. Now, he’s a seasoned PropTech enthusiast and author. In his time at Arthur, he was been involved in nearly every aspect of the business.

In recent times, there have been several changes to the law surrounding the financials of those that own multiple properties. This includes everyone from those that may have a holiday home to those that run their own property business. One of these was scheduled to be digital tax returns, coming in April 2018. Luckily, digital tax returns have now been delayed until 2020 for most businesses and this means that lots of people have once again put off moving to a cloud-based accounting system like Xero. However, there is no time like the present to ensure your business is ready for the future...

When you rent out property,

be it one or be it many, your tax situation becomes a lot more complicated than if you were to just have a day job. What level of tax relief do I get? What do I get it on? How much is my wear and tear allowance? There are hundreds of different questions to be answered and, if you get even one wrong, you could be inspected by the taxman. Those that have rented out property for years may think they have it down to a tee but add in the change in Stamp Duty Land Tax (SDLT) as well as what charges the tenant is liable for and their system is about to become more complicated.

By moving to a cloud accounting system like Xero, property owners are ensuring that if there is one small mistake and they are unlucky enough to be inspected, they have easy access to all their bank records for previous years and can supply the information the taxman has the right to review with ease – don’t forget, they may try and ask for things that they do not have the right to view! If you are reviewed by the taxman, make sure you talk to your accountant before handing anything over. Furthermore, if a property owner is inspected and seeks support from an accountant, the information is readily available. This means no time wasted scrambling around trying to find a bank statement from two years ago.

Due to the changes to SDLT, more property owners are considering transferring their property assets into the name of a company. Whilst on the face of it, it seems simple – move the property to a company and reap the rewards – there is a lot of nuance to it. In fact, for most people that let out a few different properties the moving of assets to a company could see the owners worse off, if accepted, or rejected at the point of application. This is due to variables such as when tax relief is applied and how long a property owner spends on running their rentable properties.

Productivity is key in any business. But, for landlords and property managers it has now become paramount. As SDLT has increased and tenants are no longer liable for charges such as reference checks or contract fees, the bottom line for property owners and managers has dropped quite dramatically. This means that less time can be spent on tasks that do not count directly to revenue, purely to ensure profitability is maintained or even increased. One of the areas where timing is imperative and where productivity can directly affect revenue is arrears chasing. Xero’s live bank feed means you can easily see who has or has not paid their rent.

Whether or not an owner chooses to move their assets into a company or not, using a cloud accounting system such as Xero has several benefits. One of them is the professionalisation of your accounts: using the reporting and forecasting sections you can see real life cashflow based on individual properties. The separation of business accounts and personal accounts becomes very easy, using a variety of different apps to enter different expenses into different accounts and make sure an invoice is paid by the correct account too. Whilst this may spell the sad end of the spreadsheets that hours and hours were spent on, it is also a happy day as it spells the end of spreadsheets!

Using software that is based on the cloud means that you are subject to far fewer limitations compared to the stuff that you had to download on a CD. Instead, you can select from a wide variety of different software and then you can decide to

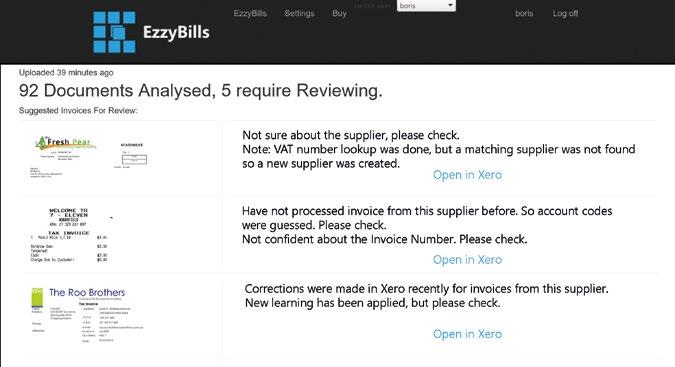

integrate them all together to give yourself a little property-accounting ecosystem. These ecosystems allow you to move data from one software to the next without having to enter any data yourself, saving you time and money. Take the link between Xero and Arthur Online, for example. Arthur feeds rent charges to Xero, at which point Xero matches the charge against its corresponding receipt from the live bank feed. That way, when you go to log in, the information is already there for you.

However, it doesn’t stop there! A cloud software that has something

called an open API (don’t ask me what it stands for), means you can integrate to anything! Why not integrate with a credit check company so that if rent is late, the information is automatically passed on to them? Using these sorts of systems is suitable for anyone and everyone. As a small portfolio owner, it is easy to manage around another job. For the larger owner, take advantage of the system’s full potential and streamline your business.

Arthur Online is one of the only Check out approvalmax.com open API property management software on the market, integrating with thousands of different apps. The software encompasses the tenant’s journey to ensure that the property managers and owners are able to conduct their business from one platform. By integrating Arthur Online and Xero together, users create a complete management and accounting solution.

FIND OUT MORE...

To find out more visit: