5 minute read

Are they right for the cloud?

You have a meeting with a prospective client wanting to move to a cloud based accountancy package. What do you need to ask them and does one size fit all?

@MHUpdates

Caroline Harridence joined MHA MacIntyre Hudson Peterborough office in February 2017 having originally trained with PWC. Caroline is a Business Services Manager running the outsourcing team. Her team provides the full spectrum of services from general bookkeeping and payroll functions, through to the preparation of management accounts for presentation to clients at their monthly board meetings. Caroline has a keen interest in Cloud Accounting and is the Eastern Regional Cloud champion.

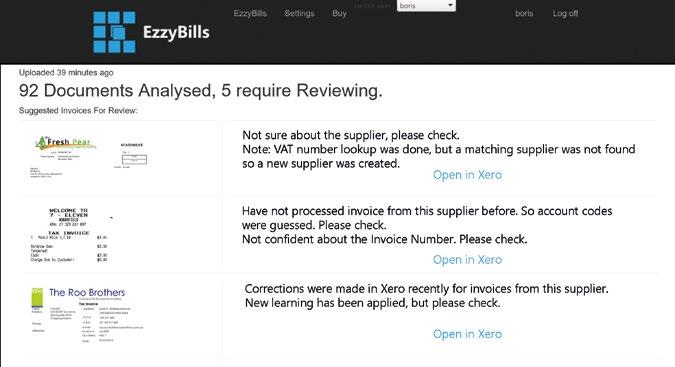

Get the basics right accounting history and also establish if they operate with First and foremost you need to multiple currencies as this will understand the client and establish dictate the version of Xero that they what the issues are with their should use. present accounting package. Systems and Procedures They may currently use a manual system, want to be ready for It is essential before you plan their Making Tax Digital, require better new accounting package that you reporting or they work in understand the multiple locations so processes and need easy access to their financial “I often find that systems that they currently data. The list is clients have an idea have. Discuss this endless! Whatever what they want but with the client the reasons, many are not aware and confirm the this information will allow you to establish the of the apps that work alongside Xero” document flow and approval processes as this requirements and the will all feed into the deliverables needed. development of their new accounting package. Next, you need to find out about the client – this includes what do Start Simple they do, where they operate and if they are VAT registered. Ask I often find that clients have an them about the shortfalls of the idea what they want but many are system they use at the moment as not aware of the apps that work this will help you find out exactly alongside Xero. what they want to achieve. This is essential as you need to address Start by informing them about the their needs at the outset. By getting benefits of bank and credit card to know them and letting them feeds, apps to reduce processing tell you their current problems, times (such as Receipt Bank and you can customise the solution Autoentry) and apps to assist them to their needs and suggest some with reporting and forecasting such ideas which they may not have as Futrli and Fathom. considered. Not all apps need to go live on day Another decision to be made one. By implementing the system is if they want to migrate their in multiple stages, the client can become familiar with it and gain confidence and experience before adding further apps at a later date.

Migration Date

Suggest migration at the end of the financial year or at the end of the VAT quarter if the client is VAT registered. Where they are not registered for VAT, there is no need to be as specific on the migration date as it is less critical.

The target date to go live on the new accounting package will require forward planning because there will be preparation time needed. This is the perfect time to clean up the accounts, including tidying up customer and supplier information and reviewing and modifying the chart of accounts.

Transaction volume

Remember, some businesses are too big for Xero. This is not based on their turnover or profit but on the number of monthly transactions. Therefore always ask the client transaction volumes when deciding on a cloud package.

Authorisations and Approvals

Establish who is required to approve and authorise documentation at each step during the process. It may be that apps outside of Xero (such

Staff Expenses

Find out if they have staff expenses and how this is currently managed. In many cases these will be very manual and time consuming.

Often moving to a cloud package is an ideal opportunity to improve how they manage expenses. Discuss expenses in Xero and also the use of apps such as Expensify.

Other Key Requirements

At the initial meeting find out what the client wants both now and in the future. There is no need to add everything on day one, but it can impact on the system you implement. Examples include –

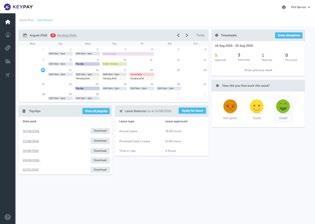

Xero Projects Inventory management Xero Payroll Consolidated reporting and Tracking Ask the client who will be using the accounting package and establish if they need training and when this will be needed. Some clients may want training ahead of going live so they can become familiar with it through adding contacts, revising their chart of accounts and reviewing their product lists. Others may prefer to be trained just after their migration date so they learn the system with “live” data. Therefore discuss their training needs at the outset so you can factor it in.

Be realistic

I have had clients come in and see me with the expectation to be up and running on Xero and the apps ready in a matter of a week or two. In the majority of cases, these are very short time frames which are totally unrealistic.

It is better to take your time and do it right than try and rush it and end up with issues. Explain the steps involved, the training needed and planning required. Bank feeds usually also take time to go live so time is needed to have these set up in good time.

It may seem like you have a lot to cover but, use the initial meeting as a fact finding exercise and this will be the basis of the work to do in the future. After the first meeting you can prepare a project plan for implementation which will ensure everything runs smoothly and all requirements are fulfilled.