anced! In other words, you don’t spend more than you make. A really good budget also saves a little each month, getting you to financial independence more quickly.

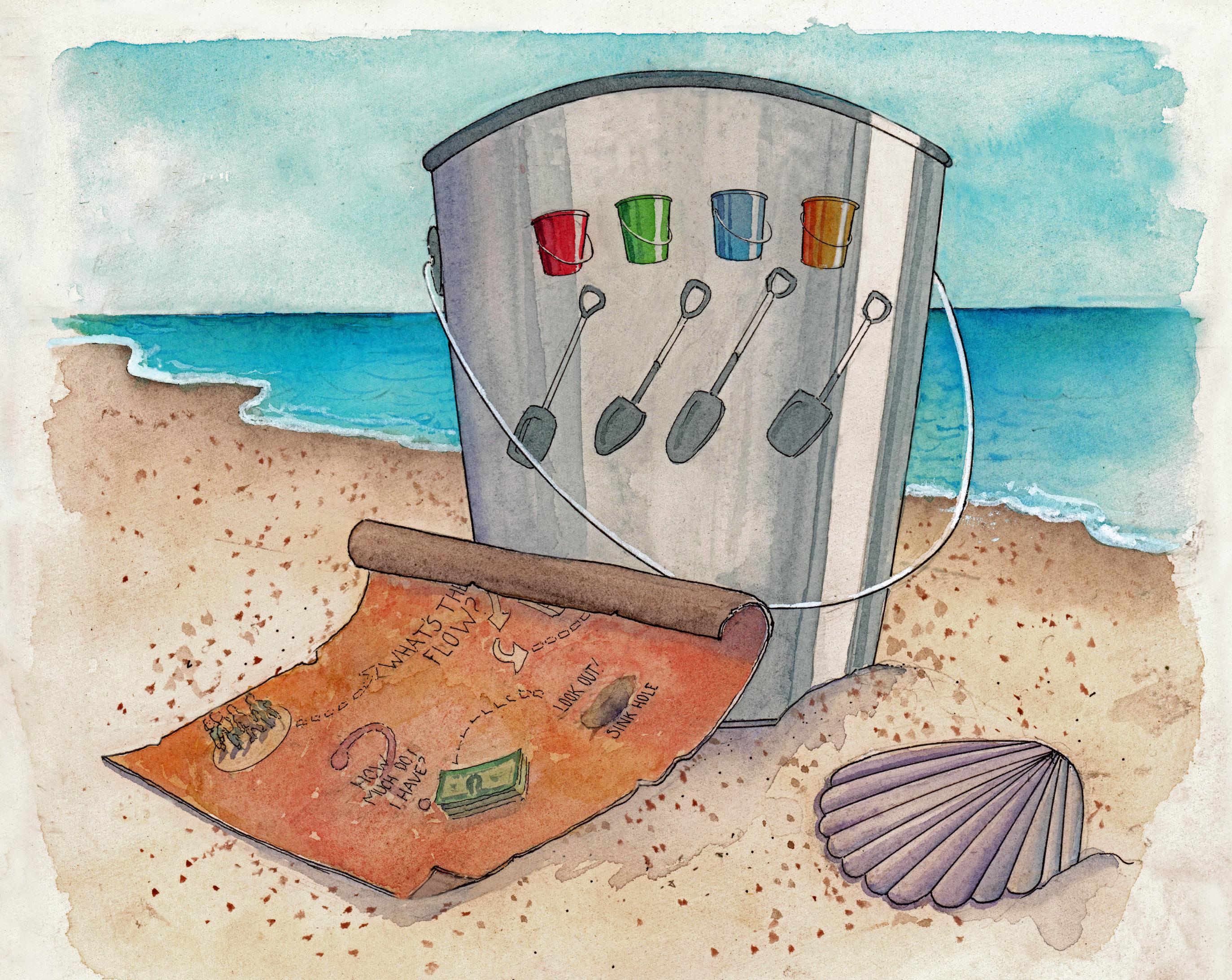

You can keep track of your budget in a notebook, on your computer, or through an app. Using online banking tools is especially helpful because they can be linked

to your bank account, which will help you track and categorize all your spending. They’ll also tell you when you’re spending too much. Look online for “budgeting tools,” and decide which one is the right tool for you.

Personal Finance Stories Katie loves to shop...a lot. Champagne taste on a beer budget is what it’s called. She makes about $500 per week working at a local clothing store, but about $100 per paycheck goes straight back to taxes. Her parents gave her their old car when she went off to college, but she has to pay for gas, which costs about $40 per week. Her clothing addiction costs her about $200-300 per month, and she likes to show off her new outfits by going out with friends. Her entertainment and dining costs are about $300 per month. She has a credit card, which is costing her about $100 per month. Miscellaneous expenses are about $150 per month. If you do the math, you’ll quickly see that Katie is overspending. Her parents were helping Katie by sending her money each month for school expenses, but have recently they told her that she needs to cut back on her spending. She downloaded an app on her phone that allows her to enter all of her bank accounts and credit cards, and then tracks her spending by category. The app automatically updates her balances and sends her texts when she’s near her limit. Using the app, Katie has learned to skip a few non-essential lattes, cut out a couple of new outfits, eat “in” more often, and still enjoy life! The hardest part was just getting everything set up; now she can’t live without it.

Adulting 101: A Guide to Personal Finance | 25