younger people who aren’t making a lot of money. 401(k) accounts are employer retirement plan accounts. Everyone should participate in this option, especially if

your employer provides a match—meaning for every dollar you put in, your employer contributes a certain amount, too. That’s free money! Your goal should be to contribute at least the maximum amount your employer will match. The earlier you start saving for retirement, the better off you’ll be when you get there—we’re talking multi-millionaire status.

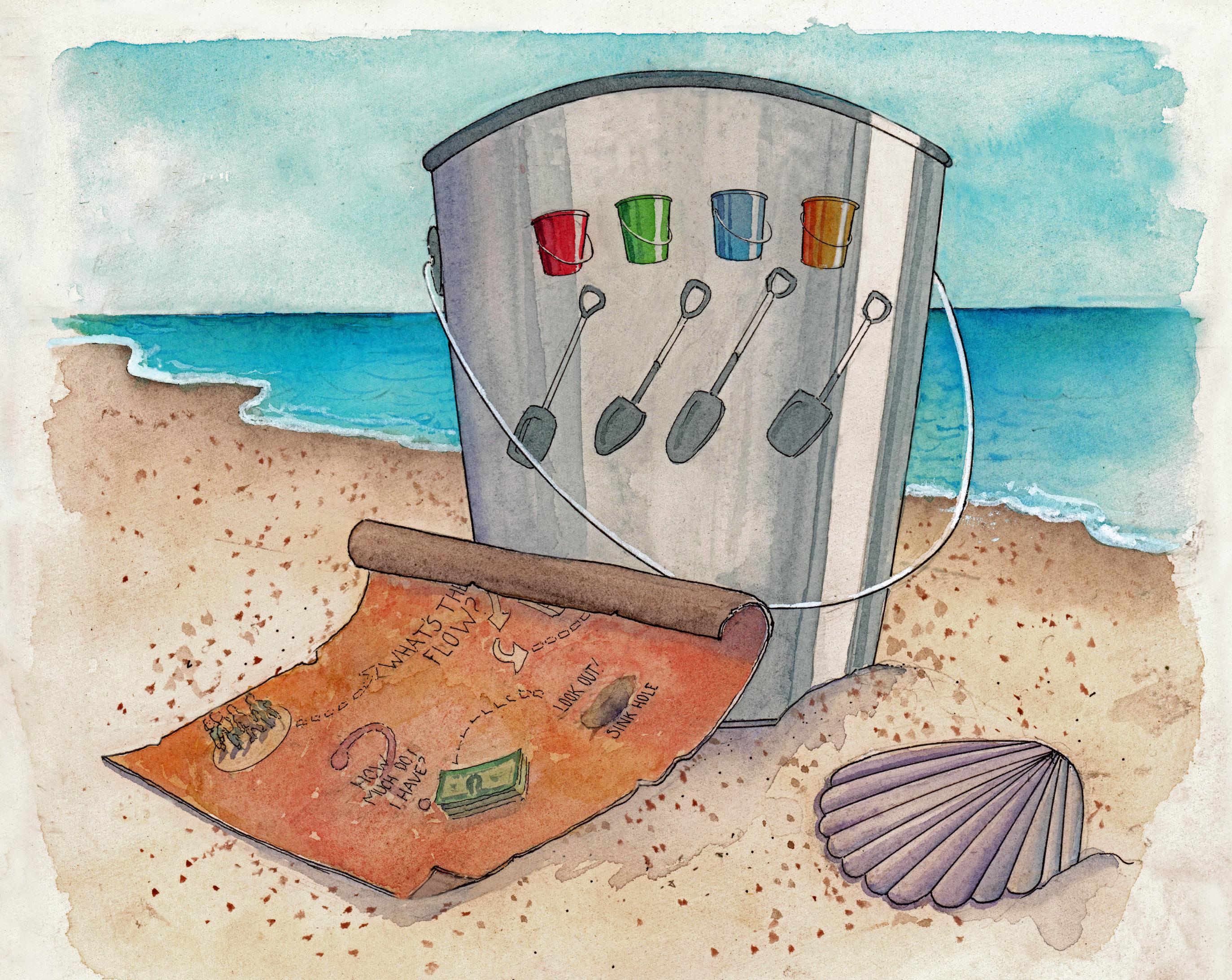

Personal Finance Stories Jake wants to save money but tends to live paycheck to paycheck and has a hard time finding a way to transfer money into his savings account every week or even each month. So, after doing some research online, he found an app that enables him to connect his bank accounts and credit cards to the app. Then, every time he makes a purchase using those linked cards or accounts, the purchase is rounded up to the nearest dollar, and the change is added to a savings account in the app. For example, if he buys a coffee drink for $2.45, the app rounds it up to $3 and the extra $0.55 is added to the app. It’s basically a “set it and forget it strategy” for saving. Jake has been using the app for over a year now and has been able to save more than $1,000, just with roundups of his “pocket change.” He barely misses the extra change is able to save, and is excited to see his savings growing. His new goal is to save more quickly, so he’s changed a setting in the app too add $10 per week on top of the roundups. Jake has discovered that saving money is actually fun!

Adulting 101: A Guide to Personal Finance | 37