FRIDAY, MARCH 3, 2023 8:00 AM - 5:00 PM | Conference 5:00 PM - 6:00 PM | Networking Happy Hour ANNUAL @ABQFOUNDATION WEA L T H M A N AGE M E N T

On behalf of the Board of Trustees of the Albuquerque Community Foundation (the "Foundation"), we are honored to welcome you to our 4th Annual New Mexico Estate Planning Conference. Thank you all for taking time to connect and learn with us. We are grateful to have you in our network.

As we look ahead to the future of the Foundation and our community, we are inspired by how far we have come and strive to be better partners as we become the community’s Foundation. Part of our work at the Foundation is being a community convener and collaborator. We know our impact is greater when we work in partnership with leaders and community members like yourself.

Another part of our work at the Foundation is being a storyteller for our community. We're honored to be able to learn about the needs, the successes, and the legacy of our community and those in it. Through our partnership with you all we are honored to play a part in telling not only your story, but also the stories of your clients and loved ones. Thank you for the work you do to support families and individuals as they plan their future. We're grateful to stand next to you all as you have those complex conversations and are honored to share their story and legacy through the work at the Foundation.

As a native of New Mexico, I feel honored to be a part of the collective story we are creating with this year’s Estate Planning Conference. We are intentionally including new voices and topics that are current and inclusive. We hope that as we do this work together, we can further align with the Foundation’s core values of trust, equity, integrity, and accountability.

Thank you for joining us today so we can continue to share our stories and learn how we can partner to continue building New Mexico’s rich, wonderful legacy.

Sincerely,

Juaquin Moya

Juaquin Moya

Vice President of Philanthropic Advising Albuquerque Community Foundation

Vice President of Philanthropic Advising Albuquerque Community Foundation

Annual

THANK YOU SPONSORS

WEA L T H M A N AGE M E N T

Plan on dying.

Plan your f uneral ahead of time and take t he burden of f your loved ones.

f renchf unerals.c om

THANK YOU VENUE SPONSORS

The American Heart Association’s Professional Advisor Network provides you with personal assistance from a nationwide team of estate and gift planning professionals, free planning tools and resources, and exciting networking opportunities.

And get your complimentary Impact Guide, a charitable planning road map for you and your clients!

The American Heart Association Professional Advisor Network is a proud sponsor of the 4th Annual New Mexico Estate Planning Conference

2023 Board of Trustees

Marcus Mims, Chair CliftonLarsonAllen LLP

José Viramontes, Chair-Elect MediaDesk

Arellana Cordero, Treasurer Community Member

Debbie Harms, Secretary NAI SunVista

Beverly R. Bendicksen, Past Chair Sandia Financial Consulting, LLC

Dr. Abinash Achrekar UNM Health Sciences Center

Emily Allen Dekker/Perich/Sabatini

Tom Antram French Funerals and Cremations

Bob Bowman Bob Bowmania Productions

Tom Daulton

Independent Venture Capital & Private Equity Professional

Michelle Dearholt Nusenda Credit Union

Sanjay Engineer FBT Architects

Monique Fragua Indian Pueblo Cultural Center

Rebecca Harrington Community Member

Pam Hurd-Knief Philanthropic Advisor

Paul Mondragón Bank of America New Mexico

Linda H. Parker Parker Center for Family Business

Anne Sapon Community Member

Charlotte Schoenmann Community Member

Walter E. Stern Modrall Sperling Law Firm

Becky Teague PNM Resources

Sara Traub PBWS

Esther Villas-Wingfield Junior League of Albuquerque

Lori Waldon KOAT TV

After

Let’s talk about your future, today.

Bank of Albuquerque® and BOK Financial® are trademarks of BOKF, NA. Member FDIC. Equal Housing Lender

When it comes to your future, who’s there to protect it?

all, it’s not just money at risk. It’s your future and legacy.

AGENDA

TOPIC

Opening Remarks

SPEAKER(S)

Marcus Mims CliftonLarsonAllen

Designing the Best Vehicles to Own and Ken Leach

Manage Real Estate

Kenneth C. Leach & Associates

Integrating Portfolio and Insurance Planning Brad Justice Justice Financial

Estate Planning for the LGBTQ+ Community Cristy Carbón-Gaul (virtual) The Law Office of Cristy J. Carbón-Gaul

Lunch

The Charitable Giving Conversation

Randy Royster, Juaquin Moya & Khia Griffis

Albuquerque Community Foundation

Ethical Issues Involved in Representing a Fiduciary

Nell Graham Sale

Pregenzer, Baysinger, Wideman & Sale, PC

SECURE 2.0: Applications for Advisors

Tales from the (Fiduciary) Crypt –

Madison Jones

Rodey, Dickason, Sloan, Akin, & Robb, P.A.

Daniel Montoya

True Stories of a Corporate Trustee Heritage Trust

Closing Remarks

Networking Happy Hour

Randy Royster

There will be a 10-minute break between each session TIME 8:10 AM 8:25 AM 9:35 AM 10:45 AM 11:40 AM 12:30 PM 1:15 PM 2:25 PM 3:35 PM 4:30 PM 5:00 PM

Albuquerque Community Foundation

Vara Winery and Distillery

315 Alameda Blvd NE 87113

FACULTY BIOGRAPHIES

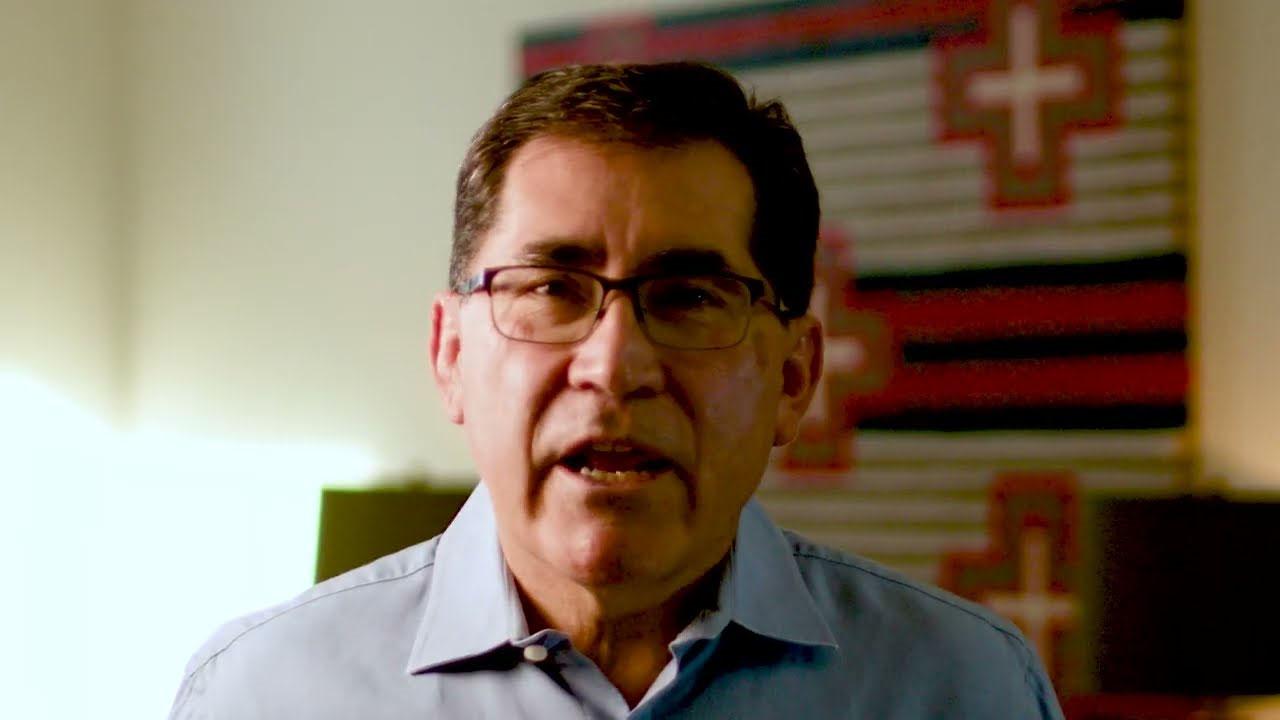

Randy Royster President & CEO Albuquerque Community Foundation

As President and CEO of the Albuquerque Community Foundation, Randy commenced his career in philanthropy in 2005. Under his leadership, average annual contributions and grantmaking have increased exponentially, resulting in the Foundation’s assets under management surpassing $100M in 2019 – a monumental achievement within the community foundation field.

Over the last seventeen years, Randy has been instrumental in several local and statewide collaborations including: the Center for Nonprofit Excellence; the New Mexico Collaboration to End Hunger; the Office of Philanthropic Outreach; the New Mexico Coalition of Community Foundations; Healthy Neighborhoods ABQ; NM Counts 2020; the New Mexico Census Funder Collaborative; the All Together New Mexico Fund; and dEi United.

Randy served 8 years as a member of the National Standards Board for Community Foundations, including as President for two years. He also served on the Board of Directors of the Council for 7 years. Randy is currently a member of the Board of Directors of CFLeads, a national organization headquartered in Boston, Massachusetts, assisting community foundations across the country.

Randy is a multi-generation native of Albuquerque, New Mexico. He is an attorney, with a Juris Doctor degree from the University of New Mexico and Bachelor of Business Administration degree from Eastern New Mexico University. He is married to María Griego-Raby owner and principal of Contract Associates, a father of four and grandfather of five.

Juaquin Moya

Vice President of Philanthropic Advising Albuquerque Community Foundation

Juaquin is the founding Executive Director of Horizons

Albuquerque, a nonprofit transformative, tuition-free educational program that serves students from low-income families on the campuses of Bosque School, Manzano Day School, and Sandia Prep School. He brings previous college admission, teaching, and directing experience as the creator of Bosque School’s College Counseling program.

A native of New Mexico who attended Corrales Elementary School, Taylor Middle School, and Sandia Prep School before leaving New Mexico to attend and graduate from Wesleyan University, CT, Juaquin is a respected leader in the community. He is on the Council of the Hispano Philanthropic Society and in recognition of his outstanding college counseling, he received the Yale Educator of the Year Award. Most recently, Juaquin was awarded the Albuquerque Business First Diversity Leader Award and selected as one of the 40 Under Forty honorees. He was also selected as a Líderes Fellow with Hispanics In Philanthropy and received the Horizons National Leader of the Year Award.

Khia Griffis Community Impact Director Albuquerque Community Foundation

Khia joined the Albuquerque Community Foundation team in June 2019 after completing her graduate internship at Con Alma Health Foundation, where she was drawn to the world of grantmaking. Khia earned her Bachelor of Arts in Psychology from UNM and her Master of Social Work from NMHU.

Philanthropy & strategic grantmaking at Albuquerque

Community Foundation have been a welcome application of her passion for improving the lives of others. Khia was born and raised in New Mexico and currently resides in Corrales, while also spending time in the East Mountains with family. In her free time, Khia enjoys playing soccer and running in the Bosque with her dog Buffy.

Kenneth C. Leach Attorney

Kenneth C. Leach & Associates

Kenneth C. Leach completed his education through the University of New Mexico with his B.A. in History in 1972, and his JD in Law in 1975. He was then admitted to the bar by the New Mexico and U.S. District Court in 1975. He is a Fellow of the American College of Trust and Estate Counsel (ACTEC), and has been listed on Martindale-Hubbell’s Bar Register of Preeminent Lawyers. He is a member of the University of New Mexico Law School Alumni Association, the Albuquerque Bar Association, the New Mexico Estate Planning Council and Southern New Mexico Estate Council, and a Trustee on the Board of Trustees of the Albuquerque Community Foundation.

Kenneth previously served on the New Mexico Board of Legal Specialization, An Agency of the Supreme Court of New Mexico Estate Planning, Trusts & Probate Law Specialty Committee, He is presently serving on the San Juan College Foundation Board and served as President from 2019-2022. Mr. Leach served on the University of New Mexico Foundation Board (from 1995-2003), and as the Chairman of the Gift Acceptance Committee for the UNM Foundation. Kenneth has been listed in the prestigious “The Best Lawyers in America” publication in the Trust & Estates section for 26 consecutive years (1996-2022). He was the Community Foundation of Southern New Mexico advisor for the year of 2013, and he received the Excellence in Charitable Gift Planning Award for 2006 by the Albuquerque Community Foundation.

Daniel Montoya President and CEO

Heritage Trust Company of New Mexico

Daniel T. Montoya is the current President and Chief Executive Officer of Heritage Trust Company of New Mexico, an independent trust company headquartered in Taos, New Mexico, with offices in Santa Fe and Albuquerque.

Daniel is an attorney licensed to practice law in New York, 1985, and New Mexico, 2008. He received a B.A. in Psychology in 1981 from Columbia College and a J.D. in 1984 from Columbia University School of Law.

Prior to moving to Northern New Mexico in 1997, Daniel practiced municipal and corporate finance, securities and venture capital, and banking law for 13 years in New York City. From 1993 to 1999, he worked for Citibank’s WorldWide Securities Services Legal department, including working for the trust and custody departments. He was responsible for creating the framework and the account opening process for Citibank’s branches and offices in over 50 countries. He also assisted the Global Relationship Bank in connection with the Citibank-Traveler’s merger.

From 1999 to 2001, Daniel served as the first executive director of Taos Community Foundation. In January of 2002, Daniel joined the Heritage Trust team as a consultant, focusing on compliance and administration, including helping HTrust develop a comprehensive Policy Manual and a detailed Procedures Manual, and satisfy its regulatory obligations with the New Mexico Financial Institutions Division. During that time, he also worked for a variety of for profit and non-profit businesses. From 2007 to 2018, Daniel served as Executive Vice President of Heritage Trust, and was promoted to President & CEO in 2020.

Daniel has been a member of the Board of Directors of Heritage Trust since 2002. In addition to serving on the Board of Directors, Daniel has also volunteered with a number of local non-profits over the years.

In his spare time, he loves hiking and backpacking in the mountains of northern New Mexico, skiing, gardening, photography, and writing. He has been practicing Qigong and Taiji Quan since 1989.

Nell Graham Sale Of Counsel and Attorney

Pregenzer, Baysinger, Wideman & Sale, P.C.

Ms. Sale is Of Counsel with the law firm of Pregenzer, Baysinger, Wideman & Sale, PC. While actively practicing law, she was licensed in New Mexico, Delaware, Pennsylvania, U. S. Tax Court and the U. S. Supreme Court. She is a Certified Elder Law Attorney, a member of the American College of Trust and Estate Counsel, and is an emerita member of the Special Needs Alliance. Nell is celebrating over 10 years of having her AV Preeminent® rating from LexisNexis Martindale-Hubbell.

She has been repeatedly selected for inclusion by her peers in Best Lawyer in America®, Super Lawyers and was included in the 26th Edition of Best Lawyers in America for her work in Elder Law and Trusts and Estates in 2020. In 2019 Nell was chosen for Who’s Who among American Lawyers. In 2017, Nell chaired a successful capital campaign for Paws and Stripes and she is also one of the founders of the New Mexico Planned Giving Roundtable.

Cristy Carbón-Gaul Attorney at Law

The Law Office of Cristy J. Carbón-Gaul

Cristy J. Carbόn-Gaul grew up primarily in Omaha, Nebraska but considers herself a New Mexican, living in Albuquerque most of her adult life. Her and her husband, Daniel Gaul, moved to New Mexico in 1997. They have two children, two dogs, three cats, and 23 chickens.

She is a lawyer licensed by the New Mexico State Bar since 1997, earning her law degree from Creighton University School of Law, graduating cum laude. Her undergraduate degree, a B.S. in Business Administration with a concentration in accounting is from Trinity University in San Antonio, Texas.

Cristy J. Carbόn-Gaul has practiced estate planning, guardianship and conservatorship and probate law in New Mexico for over 25 years. She is also the Probate Judge for Bernalillo County.

Brad Justice Wealth Management Advisor Justice Financial

Born and raised in Orange County, California, Brad graduated from Brigham Young University with a double major in Business Administration and Portuguese in 2004. Immediately after college Brad was recruited by GE Consumer Finance to move to Albuquerque, New Mexico.

In May 2006, Brad transitioned into financial services and joined Northwestern Mutual. He achieved prestigious company milestones and excelled in multiple leadership roles. The Justice Financial team was recognized in 2022 by Forbes Magazine as one of the best Wealth Advisors in the state of New Mexico.

Today Brad focuses primarily on working with clients in the retirement income space and professionals. He holds securities registrations in Series 6, 7, 26, and 63 in addition to the following designations: CERTIFIED FINANCIAL PLANNER™(CFP®), Masters of Finance Services (MSFS), Retirement Income Certified Professional (RICP), Certified Life Underwriter (CLU), Chartered Financial Consultant (ChFC), Certified Advisor of Senior Living (CASL) and Wealth Management Certified Professional (WMCP).

Brad is married to Lisa, and they have four wonderful children, one dog, and 18 box turtles that live in their backyard. They love playing lots of board games, swimming, traveling, regular visits to Disney, and anything that involves family. He loves a good hamburger, fries, and a Dr. Pepper.

Madison Jones

Rodey, Dickason, Sloan, Akin, & Robb, P.A.

Madison is an attorney in the business department of Rodey, Dickason, Sloan, Akin, & Robb, P.A. where she focuses her practice on estate planning, trust and estate administration, and business planning. Madison is honored to serve on the Board of the National Museum of Nuclear Science and History and on the Albuquerque Community Foundation – Future Fund Board. She speaks to financial advisors, attorneys, accountants, and others on estate planning, business planning, charitable giving, planning related to retirement benefits, and legal ethics.

Madison attended the University of New Mexico, where she earned a Bachelor of Arts (summa cum laude) in International Studies in May 2015 and a Masters in Business Administration in December, 2015. Madison then attended the Seattle University School of Law where she earned a Juris Doctor (cum laude) in 2019.

A Different Kind of Lawyer. A Different, Kinder Lawyer. 505-BRENDNN 505-2736366 thelawyersoreilly.com Brendan O'Reilly Licensed since 2007 Estate Planning Wills & Trusts Probate Real Estate Contracts Serious Personal Injury

SESSION TOPICS

1

Designing the Best Vehicles to Own and Manage Real Estate

Ken Leach

Kenneth C. Leach & Associates

This presentation will delve into the best entities to manage real estate from a business efficiency, liability and tax perspective and how holding title in a third party settled trust can result in increased asset protection.

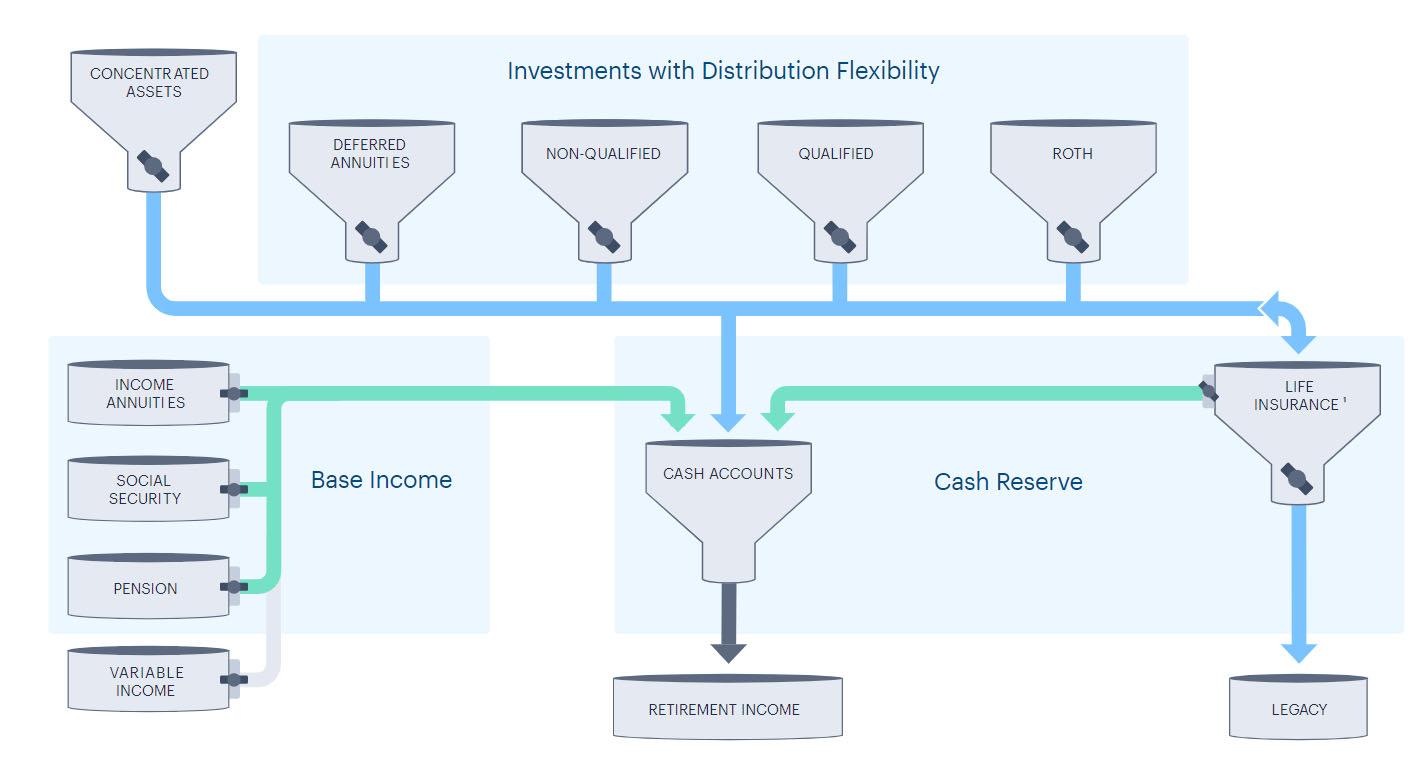

Integrating Portfolio and Insurance Planning Brad Justice

Justice Financial

A complete financial plan integrates both offensive and defensive strategies. How should a portfolio be designed for a retiree? What impact does life insurance have on an investment strategy? How do longevity and balance sheets impact the decision to start drawing from Social Security? This session explores the integration of portfolio investments and insurance planning through a variety of life stages.

3

Estate Planning for the LGBTQ+ Community (virtual) Cristy Carbón-Gaul

The Law Office of Cristy J. Carbón-Gaul

Cristy has represented the LGBTQ+ community for over 20 years. In this presentation, we will discuss issue spotting that is particular to the LGBTQ+ community, including addressing the children of these relationships, in order to provide the protections needed in their estate plans. We will also discuss legal terms and terms of art that are used in preparing estate plans for individuals, couples and throuples in the LGBTQ+ community.

2

The Charitable Giving Conversation

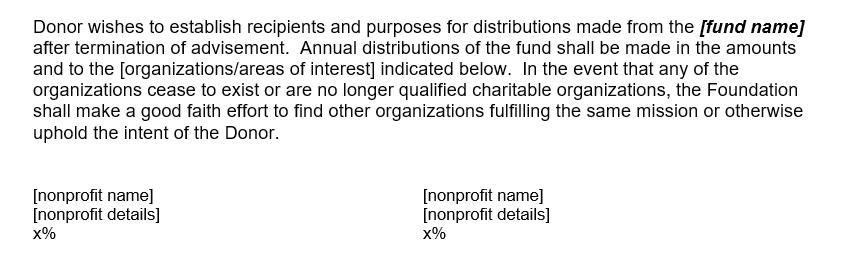

Juaquin Moya, Khia Griffis, Randy Royster Albuquerque Community Foundation

Albuquerque Community Foundation staff will share questions that can open a charitable giving conversation with clients thinking about estate planning. They will give an overview of the topics that philanthropy professionals use to help potential donors gain an understanding of their personal giving priorities. The Foundation will also discuss information about the current landscape of nonprofit organizations, philanthropy practices, and emergent work in the local New Mexico community.

Ethical Issues Involved in Representing a Fiduciary

Nell Graham Sale

Of Counsel, Pregenzer Baysinger Wideman & Sale

Does representing a fiduciary in New Mexico mean that you the attorney have ethical duties not only to your client but to those for whom your client is the fiduciary? Nell Graham Sale, an experienced presenter and attorney, will answer this question and speak about the ethical responsibilities and considerations when representing a fiduciary. The session will use a hypothetical case study to examine the nuances and requirements of the attorney's duty.

SECURE 2.0: Applications for Advisors

Madison Jones

Rodey, Dickason, Sloan, Akin, & Robb, P.A.

Estate planning attorneys and professional advisors alike will benefit from taking a deeper dive into the SECURE 2.0 which addresses questions regarding required minimum distributions, certain eligible designated beneficiaries, and trusts. There are many nuances to the SECURE 2.0 and this seminar will give estate planning attorneys and professional advisors an overview of what’s new and some strategies for how to best support our clients in light of the new legislation and guidance.

Tales from the (Fiduciary) Crypt –True Stories of a Corporate Trustee

Daniel Montoya Heritage Trust

With over 20 years of experience as a corporate Trustee, Daniel Montoya will speak about the nuances and best practices of stewarding trusts for New Mexico families. He will share "Tales from the (Fiduciary) Crypt - True Stories of a Corporate Trustee." His session will touch on lessons learned from situations including a family conflict over multiple trusts and properties, and mediation in a trust dispute that ended up including multiple parties across different cases to get to settlement.

4 5 6 7

Strategies to achieve what matters most.

At New Mexico Bank & Trust, our passion is creating smart, custom solutions that enrich lives. Our local wealth and fiduciary specialists work closely with you and your clients to align financial goals and fiduciary needs.

• Personal attention and customized solutions

• Local personal trust administration

• Special needs trust administration

• Investment management

• Work closely with beneficiary and family

• Consult with estate planning attorneys drafting the trust instrument

• Settlement trusts can work in conjunction with annuities

505.830.8177 PRODUCTS OFFERED THROUGH WEALTH ADVISORY SERVICES ARE NOT FDIC INSURED, ARE NOT BANK GUARANTEED AND MAY LOSE VALUE.

nmb-t.com/wealth Local Bank. Trusted Advice.

MEMBER FDIC

Designing the Best Vehicles to Own and Manage Real Estate Ken Leach Attorney Kenneth C. Leach & Associates SESSION 1 8:25 AM

Presented By Kenneth C. Leach & Associates, P.C.

THE BEST VEHICLES TO OWN AND MANAGE REAL ESTATE?

DESIGNING

1 2

How do we determine best entity to hold real estate?

•Tax efficiency –income tax and transfer tax benefits

•Asset Protection for the owner of the entity and the real estate

•Minimizes administrative fees and complexity

Traditional Business Entities

•For years, the three main business entities utilized to hold and manage real estate were the general partnership, limited partnership and corporations (C and S)

3 4

Advent of LLCs

•first limited liability company legislation in the state of Wyoming was enacted in 1977

•Revenue Ruling 88-76, 1988-2 C.B. 360 which categorized a Wyoming LLC as a partnership for federal income tax purposes

Advent of LLCs (cont)

•New Mexico enacted LLC statutes in 1993. (See §§ 5319-1 through 53-19-74 NMSA)

5 6

General Partnerships

•Many are unintentionally in GPs

•All that is required is an express or implied intent that a business venture be established, an agreement for joint control and proprietorship, a contribution of property or services and a sharing of profits

Advantages of a general partnership

•No entity level income taxation (flow through entity

•entity level debt (i.e., mortgage on the real estate) increases the basis of the partnership interest owned by the partner.

7 8

Advantages of GP (cont)

•Special Allocations

•IRC Section 754 election to step up basis at death

•Generally, tax free contributions and distributions

Disadvantages of GP

•Joint and several and unlimited liability

•Apparent Authority of all partners to bind partnership

•Withdrawal of partner can result in no partnership for tax purposes and under state law

•Prior to 2018, 50% or more of interests in a partnership sold or exchanged within twelve (12) months, terminated partnership for federal income tax purposes

9 10

Disadvantages of GP

•Appreciated undeveloped real estate

•IF developed and sold off –ordinary income treatment (See IRC § 1221).

•If the client sells to a related entity partnership, IRC § 707(b) treats the gain as ordinary income

•If instead the property is sold to an S Corporation, the initial gain can be treated as capital gain because S Corporations have no statutory restriction like IRC § 707(b)

Limited Partnership

11 12

•One or more general partners who are liable for partnership debts and actions; but the limited partners are not.

Advantages of LP

•Generally, only the general partner is liable for partnership obligations. However, limited partners can become liable if they participate in control of the business.

•If the general partner is a corporation or an LLC, then no individual will be liable for the obligations of the limited partnership.

Advantages of LP (cont)

•Limitedpartnersarenotagentsofthe limitedpartnershipandtherefore cannotenterintoobligationswhichbind thelimitedpartnership.

•FamilyLimitedPartnerships–transfer taxadvantages

•ChargingOrderonlyremedyof creditorofalimitedpartner

13 14

Advantages of LP (cont)

•Some states administrative fees and taxes are less than for an LLC

Disadvantages of LP

•Complexity of having to have a corporate GP as well as a limited partnership.

•If LP exercises too much control can be treated as a GP with attendant vicarious liability

15 16

C Corporation

•It would be a rare occasion where a planner would want to place real estate in a C Corporation.

•limited liability protection for its shareholders

•Double taxation (particularly from the sale of the real estate)

•losses such as deprecation do not flow through to the shareholder

S Corporations

•AnSCorporationisaregularcorporation (oranLLC)electingScorporationstatus)

-Thecorporationmaynothavemorethan 100shareholders,althoughspousesandfamily membersaretreatedas1shareholderfor purposesofthisrule.

- Scorporationmayonlyhaveindividuals,an estate(butonlyforalimitedtime),certaintypesof trustsasashareholder.

17 18

S Corp (cont)

-Non-residentaliensmaynotbeshareholders.

-Thecorporationmayhaveonly1classofstock (althoughitcanhavevotingandnon-voting shares).

-AsinglememberLLCmayownstockinanS Corporation;butmustbeadisregardedentity forincometaxpurposesandsinglemember mustbeaqualifiedScorporationshareholder.

S Corp (cont)

- Important: Thiscanbeatrapfortheunwary becauseifthesinglememberLLCacquiresa secondmember,theLLCwouldnolongerbe aneligibleSCorporationshareholder.

-TheelectiontobeaScorporationmustbe madebythe15th dayofthethirdmonthofthe currentyearofformation.

19 20

S Corp (cont)

-IfSCorpelectionis“blown”becauseof failuretomeetanyoftheserequirements,the corporationwillbetreatedasaCcorporation withalloftheproblemsforCCorporationsthat ownrealestate.

-OneoftheprincipaladvantagesofanS CorporationvsanLLCisthatcurrentlyS corporationdistributionsarenotsubjecttoSocial SecurityandMedicaretaxes.

Principal advantage of S Corp

• Instead of paying wages, an S Corporation distribution is used, limiting the Social Security, Medicare and other employment taxes.

21 22

Limited

Liability Company (LLC)

• Preferred Entity for real estate.

•pass through of profits and losses to the members

•members may control the without the risk of losing their limited liability (compared to LP)

•Flexibility -can elect to be treated as a C Corporation, S Corporation, a partnership (as long as the LLC as at least 2 members) or a single member LLC which is a disregarded entity for federal income tax purposes

•facilitates like kind exchanges of real estate

•lack of complex rules (compared to S Corp)

Advantages LLC

•LLCs are flexible in their management as an LLC may be member-managed or manager-managed.

•A transferee of a membership interest only becomes an economic interest owner with a right to a share of the profits and losses; but with no right to vote or to have any say so or control as to how the LLC is managed.

23 24

Advantages LLC (cont)

•With the possible exception of single member LLCs, the courts have generally refused to pierce the “LLC veil” and allow the creditor go after the LLC member for LLC liabilities.

•Parent LLC places each real estate project into a separate LLC so that each project has it own LLC shield from liability and the parent LLC provides an LLC veil that protects the individual investor/owner or trust

•Charging order -may not be exclusive remedy

Single Member LLC

•Unless elect otherwise –disregarded entity for income tax purposes

•a single member LLC has the same “LLC shield” from liability as multi-member LLCs

•Revenue Proceeding 2002-69 –H and W in community property state are a single member

•Operating Agreement is important!!

25 26

Single Member LLC –1031 Exchange

•Single member LLC –disregarded entity, the owner is treated as the owner of the real estate owned by the LLC

•PLR 9807013, an exchange of single member memberships which own qualifying real estate will qualify as an exchange of real estate for the purposes of the tax free exchange provisions of IRC § 1031 without being treated as a transfer of real estate for state law purposes.

•By not having to deed the real estate out of the LLC; but only transferring the LLC, it continues to be protected by the LLC shield against liabilities.

•TIN is social security number of single member

Membership Interest as Personal Property

•Members Interest is intangible personal property

•Client dies owning a single member LLC owning real estate in another state

•Intangible personal property may be probated in the state of residence so may be unnecessary to do an ancillary probate in the state where the real estate is actually located.

27 28

Trusts

• A revocable living trust provides no asset protection.

•This is because the person establishing the trust retains the right to revoke the trust and return all of the assets back to the Trustor at any time. § 46A-5-505A(1) NMSA 1978.

•If the trust was revocable at the time of the death of the Trustor, the trust assets are subject to the claims of creditors of the Trustor. § 46A-5505A(3) NMSA 1978.

Third Party Settled Trust

•What if we transfer real estate or an LLC owning real estate to a third party settled trust established for the benefit of another person (i.e., spouse, children and other lineal descendants) that is irrevocable and unamendable.If properly drafted this type of trust would provide asset protection, management and potentially income and estate tax benefits

29 30

Non-tax advantages of leaving property in trust for children and other family members

•Protection from Divorce

•Creditor Protection.

•Same level of protection whether or not the beneficiary is the trustee or a third party is the trustee.

•See 46A-5-504E NMSA

•Exceptions:

1.Child support and spousal support –46A-5503 NMSA.

2.Judgment creditor providing services for protection of beneficiary’s interest in the trust.

3.A claim of the state of NM or United States to extent a NM statute or federal law so provides.

Individual Income Tax Provisions -Rates

• Individual income tax rate structure replaced with 10%, 12%, 22%, 24%, 32%, 35%, and 37% tax brackets

• For 2023, top rate of 37% starts at $578,125 for single individuals and heads of household, $693,750 for married individuals filing joint returns.

• For 2022, top rate of 37% commences for estates and trusts at $14,450 in income.

• All rates are indexed for inflation.

31 32

Consider planning that will not be included in estates of children

Estate tax benefits. If clients leave their estate outright to children by gift or bequest, property may be subjected to federal estate tax upon death of children. Trusts for children could be structured so that:

1. Child receives income.

2. Child receives principal under a HEMS standard.

3. Child can be the trustee of the trust and can direct investment of trust assets for income or principal growth as your child may decide is in child’s best interest.

4. Child is granted a limited power of appointment so child can at death appoint and direct the trust assets to anyone chosen by child except to that child, the estate of that child, the creditors of that child or the creditors of his or her estate. The class of beneficiaries to whom child can appoint property of the trust can be more limited if desired.

Consider providing for trusts that will not be included in estates of children

•None of the powers listed above either alone or cumulatively will cause the assets of a trust established for the benefit of a child to be included in his or her estate for federal estate tax purposes.

•The limited power of appointment will allow the child to appoint the property outright or in trust to descendants.

33 34

What about Step Up in Basis?

•If an irrevocable trust for a beneficiary is not included in the estate of the beneficiary at death, then the assets in the trust will not receive a basis step up for income tax purposes

• If the basic estate tax exemption remains high, the assets of the trust could be included in the estate of the beneficiary without negative estate tax ramifications

Formula General Power of Appointment

•Using formula general power of appointment (“GPOA”), the trust can be designed for a clients’ descendants in a manner that will cause the value of the assets in such trusts to be included in their respective gross estates just up to the point beyond which estate tax would be incurred

35 36

What is a GPOA?

•IRC §2041(b)(1) defines a GPOA as a power which is exercisable in favor of the decedent, the estate of the decedent, the creditors of the decedent or the creditors of the estate of the decedent.

•Property subject to a GPOA, whether or not exercised, will be deemed to have been acquired from the decedent and will, therefore, qualify for the step-up in basis. Treas. Reg. §§1.1014-2(a)(4), (b)(2).

Consider including trusts for children that will not be subject to GST tax

•The estate, gift and GST tax exemption of $12,920,000 in 2023 will allow clients to set up trusts for their children that will be GST exempt and can place up to $12,920,000 ($25,840,000 for married couples) in these trusts which will then be insulated from estate tax and the GST tax.

•This should be considered before the increased exemptions sunset on December 31, 2025 (or sooner if your clients believe the sunset will be accelerated!).

37 38

Do we make irrevocable trusts grantor trusts?

•A grantor trust is a trust for income tax purposes that the grantor has retained one or more powers under IRC §§ 671 through 679.

Why a grantor trust?

•When an irrevocable trust is established someone is going to have to pay the income tax on income received by the trust which is either:

–The Grantor

–The Trust

–Or the beneficiaries.

39 40

Grantor Trust

(Reason #1)

•Grantor is making a gift tax free and gift tax exemption free gift of the amount of the income tax to the beneficiary.

Grantor Trust

Reason #2

•Installment sales may be made income tax free between the grantor and a trust that is a grantor trust for income tax purposes. Rev Rul 85-13

41 42

Grantor Trust Reason #3

•If the trust is a grantor trust and the terms and provisions of the trust need to be modified, you can distribute the assets or decant into another grantor trust with no income tax consequences.

Designing the Grantor Trust

•Grantor trust status needs to be able to be toggled on or off.

–Toggle off by grantor releasing power that makes the trust a grantor trust.

–Toggle on by giving a trust protector or independent trustee the power to re-grant the power that makes the trust a grantor trust.

•Trustee may be given a power in the discretion of the trustee to reimburse the grantor for income taxes paid.

43 44

Spousal Limited Access Trusts (SLAT)

•Many clients are not comfortable making large gifts into trusts for children and other descendants because:

– Do not know how much will need for the rest of their life;

– Turn children into “trust babies” and disincentivize children from reaching potential.

– Fear of nature or extent of future changes in future tax legislation.

Recommendation: Gift LLC interests at a discount during lifetime

•Gifting minority interests to children or to trusts for children at a discount allows leverage of the annual exclusion and lifetime gift tax exemption using a Wandry formula gift.

•In the 2012 Tax court case of Wandry v Commissioner, TC Memo 2012-88, the taxpayers gifted membership units in a family LLC to their children and grandchildren. The Tax Court approved an adjustment formula clause triggered by post-audit revaluation under which units are reallocated so that value of number of units to each donee equaled the gift tax exclusion dollar amount specified in transfer documents A Wandry type formula gift should be used to prevent gift tax from being incurred when the valuation of the family entity could be adjusted on audit by the IRS.

45 46

Recommendation: Gift LLC interests at a discount during lifetime

•Gifts of interests in LLC or other business assets can be used to create minority interests in assets of client at death.

• Example: 2% gift to children, could create a 49% interest in each spouse.

Thank you for your time and attention!

47 48

Kenneth

C. Leach, Attorney kleach@kcleachlaw.com

Marilyn A. Marsh, Paralegal mmarsh@kcleachlaw.com

Susan A. McEntee, Paralegal smcentee@kcleachlaw.com

Donna R. Sowers, Paralegal dsowers@kcleachlaw.com

LAW OFFICES OF KENNETH C. LEACH & ASSOCIATES, P.C. A PROFESSIONAL CORPORATION

www.kcleachlaw.com

Michelle Martinez, Paralegal mmartinez@kcleachlaw.com

Jessica M. Quezada, Legal Secretary jquezada@kcleachlaw.com

Stephanie M. Montoya, Legal Secretary smontoya@kcleachlaw.com

DESIGNING THE BEST VEHICLES TO OWN AND MANAGE REAL ESTATE?

PRESENTED BY

KENNETH C. LEACH of the

Law Offices

of Kenneth C. Leach & Associates, P.C.

When considering entities which can hold and manage real estate, there are a proliferation of business entity choices, including corporations, LLCs, general partnerships, limited partnerships limited liability partnerships and trusts. Most clients want an entity that lets them have their cake and eat it to. Client are looking for an entity which protects the real estate and the owner of the real estate from liability, provides the optimal tax advantages and provides the least amount of administrative fees and complexity. In this presentation, wewill explore theadvantages and disadvantage of different entities as the owner and manager of real estate as there is no one size fits all with regard to the appropriate entity in given situations.

I. Background on historical use of business entities in owning real estate

For years, the three main business entities utilized to hold and manage real estate were the general partnership, limited partnership, C corporation and S Corporation. C corporations were typically not preferred because C corporations are subject to double taxation, the real estate when and if sold would be subject to taxation and distributions to the shareholders would be taxed again as dividends when the net proceeds of the sale or other income from the real estate were distributed to the shareholders. As a result, business planners preferred to use entities that were classified as partnerships for federal income tax purposes as the profits and losses of an entity classified as a partnership would flow through to the partners and there is no tax at the entity level. General partnerships were widely used to own real estate; but general partnership do not insulate the general partners from liability for claims against the partnership and partnership debts. Because of the desire for limited liability protection, business planners advised real estate owners to establish limited partnerships. However, to protect the general partner in a limited partnership arrangement, a corporation was usually formed to be the general partner which made for a more cumbersome and complex arrangement.

Because of the use of corporations and partnerships to hold and manage real estate not being fully satisfactory. the first limited liability company legislation in the state of Wyoming was enacted in 1977. However. limited liability companies (“LLC”) were not widely in use until 1988

when the Internal Revenue Service issued Revenue Ruling 88-76, 1988-2 C.B. 360 which categorized a Wyoming LLC as a partnership for federal income tax purposes. Revenue Ruling 88-76 caused a flurry of states to adopt LLC statutes, including New Mexico in 1993. (See §§ 5319-1 through 53-19-74 which sets forth New Mexico’s LLC statutory scheme). A LLC is a noncorporate business entity that provides its members with limited liability and allows its members to participate actively in the management of the entity. Because it is a non-corporate form of entity, it avoids double taxation and permits the pass-through of income and losses to the members for federal income tax purposes. Unlike general partners, the members of an LLC have limited liability like a shareholder in a corporation. Unlike a limited partnership, there is no restriction on the members level of control. An LLC can be “member-managed” or “manager managed” which givesanLLCflexibilityinmanagementwithouthavingtohaveapersonwhohasgeneralunlimited liability like a general partner in a limited partnership.

Through the desire of business clients to obtain limited liabilityand tax pass through status, the limited liability partnership was born (“LLP”). An LLP is fundamentally simply a type of general partnership modified by statute to eliminate the traditional liability consequences of general partnership status.

Against the background of the historical use of business entities to hold and manage real estate, this presentation will be discussing the pros and cons of the most widely used entities to own and manage real estate.

I. Choices of business entities to own and manage real estate

Once a client determines that he or she desires to own real estate, the choice of the type of entity to use to own and manage real estate is one of the more important decisions that a client will need to make. Usually clients will want liability protection, a single level of tax so that deductions like property, taxes, losses and depreciation will flow through to the client so the client can take these deductions on the client’s individual income tax return. The advantages and disadvantages of the various choice of entities are examined in the materials that follow.

A. General Partnerships. It should be noted that many persons are in general partnershipwithoutevenknowingitasapartnershipcanbeformedunintentionallyforbothfederal tax and state law purposes. All that is required is an express or implied intent that a business venturebeestablished,anagreementforjointcontrolandproprietorship,acontributionofproperty or services and a sharing of profits. Therefore, real estate owned by clients as joint tenants or tenants in common can end up being treated as general partnerships for both state law and income tax purposes. This could result in joint and several liability for all the owners of the real estate. The advantages and disadvantages of a general partnership are set forth below:

1. Advantages of a general partnership

(a) Partnerships are not subject to income taxation at the entity level. Income and losses flow through to the partners.

2

(b) IRC § 752 provides partnerships with a major advantage. An entity taxed as a partnership which includes an LLC taxed as a partnership is the only business entity that permits entity level debt (i.e., mortgage on the real estate) to increase the basis of the partnership interest owned by the partner. Loss deductions are typically limited to the basis of the partner in that partner’s ownership interest. The higher the basis the greater the loss deductions permitted. There is no provision like IRC § 752 for S Corporations and therefore debt incurred by an S Corporation will not increase the basis of an S Corporation shareholder in the shareholder’s ownership of the corporation.

(c) Although the rule are complex and are beyond the scope of this presentation, if IRS regulations are carefully followed, it is possible to make special allocations (i.e., a 20% partner may be allocated 80% of the depreciation deductions arising from ownership of a particular parcel of real estate). Special allocations are not available to S Corporations where all profits and losses are allocated proportionately in accordance with the stock ownership in the corporation.

(d) If a partner dies, an IRC § 754 election can be made to step up the both the inside and outside income tax basis of the partnership interest of the deceased partner. IRC 754 elections are not available to S corporations. The IRC § 754 election must be made by the partnership not by the individual partner.

(e) Contributions of property to a partnership by a partner are typically tax free under IRC § 721 and the partner’s basis in the partnership interest is increase by the basis of the contributed property under IRC § 722. Usually, no gain or loss is recognized when the partnership distributes money or property to the partners under IRC § 731(a). A partner’s basis in his or her partnership interest is reduced under IRC § 705 by the amount of money and the partnership’s basis in property distributed to that partner. Money (including marketable securities) distributed to a partner that exceeds his or her basis in his or her partnership interest results in the recognition of gain to the extent it exceeds basis. Contributions to an S Corporation or C Corporation are only tax free if the contributor meets the 80% control test of IRC § 351. Typically gain is recognized by a C Corporation or S Corporation when the corporation makes a distribution of appreciated property.

1. Disadvantages of a general partnership

(a) All the partners are jointly and severally liable for the obligations of the partnership. Since a general partnership can be formed without any filing or intention to form a partnership, the determination that an arrangement between 2 or more persons is a general partnership can result in a catastrophic vicarious liability.

(b) Partnersin ageneral partnership have“apparent authority” todoany act within the usual course of business of the partnership, even if actual authority has not been given to that partner.

3

(c) In a two-person general partnership , the withdrawal of one partner terminates the partnership for both state law and federal income tax purposes. If, the entity was instead a two member LLC, the withdrawal of one member would terminate the status of the LLC as a partnership for income tax purposes but would have no effect on the LLC as an entity for purposes of state law.

(d) Prior to 2018, if 50% or more of interests in a partnership were sold or exchanged within twelve (12) months, the partnership terminated for federal income tax purposes. The Tax Cuts and Jobs Act (hereinafter referred to as the “2017 Act”) repealed this rule.

(e) If a client owns appreciated real property for several years that would qualify as a capital asset for capital gains purposes; but would like to subdivide and develop the property to sell it off in lots, lots held in the ordinary course of business would not qualify for capital gains treatment and all of the gain would therefore be taxed as ordinary income. (See IRC § 1221). How does your client lock in his or her existing gain at capital gain rates? If the clients sellsto a general partnership thatisa relatedentity,IRC §707(b) treatsthe gain as ordinary income if the seller and the partnership are related (seller owns directly or indirectly, including via family members) more than 50% of the partnership. If instead the property is sold to an S Corporation, the initial gain can be treated as capital gain because S Corporations have no statutory restriction like IRC § 707(b).

B. Limited Partnerships.

1. Advantages of a limited partnership. A limited partnership is a partnership so it has all the same advantages listed as advantages for general partnership.

(a) Generally, only the general partner is liable for partnership obligations. However, limited partners can become liable if they participate in control of the business. If the general partner is a corporation or an LLC, then no individual will be liable for the obligations of the limited partnership.

(b) Limited partners are not agents of the limited partnership and therefore cannot enter into obligations which bind the limited partnership.

(c) A family limited partnership (“FLP”) has transfer tax (estate, gift and GST tax) advantages. Appreciated assets are placed in a FLP and the limited partnership interests are gifted to the lower generation (children, grandchildren, etc.) at a discount for lack of control and minority interest.

(d) A creditor of a limited partner generally may not execute against or foreclose the limited partnership interest of a limited partner as generally, the creditor may only obtain a charging order. There is an argument that if because of the charging order income from the partnership can only be paid to the creditor, the creditor may be liable for the income tax on the distributions. See Rev Rul 77-137, 1977-1 C.B. 178. Even if foreclosure of the limited partnership interest were permitted, it would only give the creditor the rights of a transferee of

4

partnership interest and the creditor can not become an actual partner. This essentially means that the creditor is only going to have rights to distributions, if and when any are actually made by the partnership.

(e) In some states, notably Texas and California, the tax and ongoing fee burdens for a limited partnership are less than for a LLC.

2. Disadvantages of a limited partnership

(a) The necessity of having to have both a corporation to own the general partnership interest and the limited partnership entity itself causes complexity that may makeitinappropriateforclientswhowillnotbeabletokeeptherelationshipbetweenthecorporate general partner and the role of the limited partners straight.

B. C Corporations. It would be a rare occasion where a planner would want to place real estate in a C Corporation. While the corporation has limited liability protection for its shareholders, the problem of getting distributions (particularly from the sale of the real estate) without double taxation and the fact that losses such as deprecation do not flow through to the shareholder generally makes it a poor choice to hold real estate from a tax perspective. Where you have a client who is a shareholder in an old C corporation that holds real estate, there are some ways to minimize the double taxation of selling the real estate and having it taxed to the C Corporation and taxed again when distributed out to the shareholders.

1. Distribute the income out as salary to the shareholder/employee. The corporation would receive a deduction for payment of salary; but be careful that the shareholder/employee can actually justify services performed for the payment of salary.

2. If the shareholder/employee is inthe37% bracket,instead of paying salaries consider paying out dividends which would only be taxed at 15%. In this scenario, the income tax savings of the shareholder receiving the dividends at 15% may outweigh the benefit of the corporation obtaining a deduction if the distribution was to be salary.

C. S Corporations. An S Corporation is a regular corporation (or an LLC electing S corporation status). An S election (Form 2553) is filed with the Internal Revenue Service electing S corporation status. This changes its status for income tax purposes; but has no effect on its status as a corporation under state law. The biggest problem with S Corporations is the rules for eligibility and to maintain eligibility are picayune and unforgiving when violated. To qualify as an S Corporation, the corporation or LLC electing to be taxed as an S corporation must meet the following requirements:

1. The corporation may not have more than 100 shareholders, although spouses and family members are treated as 1 shareholder for purposes of this rule.

2. The corporation may only have individuals, an estate (but only for a limited time), certain types of trusts as a shareholder.

5

3. Non-resident aliens may not be shareholders.

4. The corporation may have only 1 class of stock (although it can have voting and non-voting shares). Debt can be re-classified as equity and you can end up with a second class of stock. Shareholder notes representing amounts loaned to the S Corporation could be reclassified as a second class of stock if certain parameters are not met. A single member LLC may own stock in an S Corporation; but must be a disregarded entity for income tax purposes and then the single member must be a qualified S corporation shareholder. Important: This can be a trap for the unwary because if the single member LLC acquires a second member, the LLC would no longer be an eligible S Corporation shareholder.

5. The election to be a S corporation must be made by the 15th day of the third month of the current year of formation.

6. If an S Corporation election is “blown” because of failure to meet any of these requirements, the corporation will be treated as a C corporation with all of the problems for C Corporations that own real estate.

7. One of the principal advantages of an S Corporation vs an LLC is that currently S corporation distributions are not subject to Social Security and Medicare taxes that would be payable if a general partnership or LLC were the business entity used. Therefore, if instead of paying wages, an S Corporation distribution is used, it is possible to limit the Social Security, Medicare and other employment taxes.

C. Limited Liability Company (“LLC”). In most cases the preferred entity to own and manage real estate will be a LLC. A LLC combines limited liability with pass through of profits and losses to the members and unlike a limited partnership interest, the members may control the LLC without the risk of losing their limited liability. The LLC is also flexible as it can elect for federal income tax purposes to be a C Corporation, S Corporation, a partnership (as long as the LLC as at least 2 members) or a single member LLC which is a disregarded entity for federal income tax purposes. LLCs are generally the entity of choice for the operation of most businesses for the reasons stated above; but are especially the preferable entity of choice for owning and managing real estate because of their use in making like kind exchanges of real estate, their flexibility and lack of complex rules.

1. Advantages of LLCs.

(a) In general, an LLC will have the same advantages of a general partnership as discussed in these materials under Advantages of General Partnerships.

(b) LLCs are flexible in their management as an LLC may be membermanaged or manager-managed.

6

(c) A transferee of a membership interest only becomes an economic interest owner with a right to a share of the profits and losses; but with no right to vote or to have any say so or control as to how the LLC is managed.

(d) With the possible exception of singlemember LLCs, the courts have generally refused to pierce the “LLC veil” and allow the creditor go after the LLC member for LLC liabilities. For example, a parent LLC which is involved in the business of real estate typically places each real estate project into a separate LLC so that each project has it own LLC shield from liability and the parent LLC provides an LLC veil that protects the individual investor/owner.

(e) The second important protection is the extent to which a creditor of the LLC can go after the LLC assets for the debt of the member. In general, a creditor is only entitled to a “charging order” and is able to access the assets of the LLC. See § 53-19-35 NMSA 1978 which states “On application to a court by any judgment creditor of a member, the court may charge the interest of the member with payment of the unsatisfied amount of the judgment . . “ (emphasis added). This provision limits the creditor’s remedy to having only the rights of an “assignee” which means if distributions are made, the creditor would be entitled to the share that would have been otherwise distributed to the member subject to the judgment. Unfortunately, unlike some states (notably Nevada), the New Mexico statute does not state that a charging order is the exclusive remedy of a creditor which leaves open the argument that the judgment creditor shouldhavethesamerights astothejudgmentdebtormembershipinterestasthejudgmentcreditor may have to go after any other asset of the judgment debtor.

(f) Single-Member LLCs. The ability to have a single member LLC greatly enhances the choice of options for business entities for real estate. Unless an LLC with a single member elects otherwise, the default provision is that a single member LLC is a disregarded entity for income tax purposes. A single-member LCC can also elect to be taxed as a C or S Corporation for federal income tax purposes.

For the purposes of state law, a single member LLC is treated as an entity separate and apart from its owner. The owner has no direct ownership in the assets of the single member LLC. Most importantly, a single member LLC has the same “LLC shield” from liability as discussed above for multi-member LLCs. Having said this, there are courts who have been more willing to pierce the LLC veil when the LLC is a single member LLC. It therefore becomes more important than ever to make sure the owner operates a single member LLC as an entity separate and apart from the owner.

(i) It is important to note that in Revenue Proceeding 2002-69, the IRS ruled that in a community property state, a LLC owned wholly by a husband and wife as community property may elect to be treated as a disregarded entity or a partnership for income tax purposes.

(ii) In the experience of this author, I have seen many single member LLCs formed with only Articles of Organization and no operating agreement is prepared..

7

In the opinion of the author, having an operating agreement is just as important for single member LLCs as multi-member LLCs as it will show the formalities necessary to bolster an argument that the “LLC veil” should not be pierced as it shows operation of the LLC is being conducted as a business entity separate and apart from the single member. An operating agreement is also essentially an “owner’s manual” for how the LLC is to be operated, is essential in dealing with a lender if the LLC needs to borrow money to acquire the real estate or make improvements and the loan is to be secured by a mortgage on the real estate. Lenders will expect to see provisions in an operating agreement authorizing the LLC to obtain loans, setting forth who is authorized to obtain loans on behalf of the LLC and who can execute the necessary paperwork. It is also essential to protect the property in case the owner/member dies, becomes bankrupt or incompetent.

g. Since single member LLCs can be disregarded entities for federal income tax purposes and for federal income tax purposes, the owner is treated as the owner of the real estate owned by the LLC, the IRS ruled in a private letter ruling (PLR 9807013, an exchange of single member memberships which own qualifying real estate will qualify as an exchange of realestateforthepurposesofthetaxfreeexchangeprovisionsofIRC §1031 withoutbeingtreated as a transfer of real estate for state law purposes. By not having to deed the real estate out of the LLC; but only transferring the LLC, it continues to be protected by the LLC shield against liabilities.

h. Except for single member LLCs that have employees, the Tax ID number for the LLC is the social security number of the owner if the LLC is a single member LLC. See Reg. § 301.6109-1(h)(2)(i) and Reg. § 301.7701-2©(2)(i).

i. An interest in a single member LLC is intangible personal property so when a client dies owning a single member LLC owning real estate in another state, intangible personal property may be probated in the state of residence of the decedent so it may not be necessary to do an ancillary probate in the state where the real estate is actually located to transfer it to the heirs of the decedent single member.

C. Trusts. A revocable living trust provides no asset protection. It is no different for income tax purposes or liability purposes than if the individual owns the real estate in his or her ownname. This is because the personestablishingthe trust (theTrustor, Settlor or Grantor) retains the right to revoke the trust and return all of the assets back to the Trustor at any time. § 46A-5505A(1) NMSA 1978. If the trust was revocable at the time of the death of the Trustor, the trust assets are subject to the claims of creditors of the Trustor. § 46A-5-505A(3) NMSA 1978. However, a third party settled trust established for the benefit of another person (i.e., spouse, children and other lineal descendants)that is irrevocable and unamendable does provide both asset protection, management and potentially estate tax benefits. This can be one by making transfers to an irrevocable trust during life or by assets passing into an irrevocable trust at death via a will or a revocable living trust that becomes irrevocable at death.

1. Income considerationsunder the 2017Act. The 2017Act signedinto law by President Trump changed the income tax rates for individuals and trusts as follows:

8

• The individual income tax rate structure replaced was with 10%, 12%, 22%, 24%, 32%, 35%, and 37% tax brackets.

• For the 2022 tax year, the top rate of 37% starts at $539,900 for single individuals and heads of household, $647,850 for married individuals filing joint returns.

• Top rate of 37% commences for estates and trusts at $13,450 for 2022.

• All rates are indexed for inflation.

• If passed, these rates would most certainly increase under the various Biden administration and progressive proposals.

(a) Because real estate produces deductions for real estate taxes, depreciation etc. it is important that the income and deductions pass through to the beneficiaries. Also, if the trust is a complex trust for income tax purposes, any income that is not distributed out annually will be income taxed to the trust at the higher income tax rates for estates and trusts However, if the trust is designed as a simple trust for income tax purposes (i.e., provide that the income shall be distributed to the beneficiaries no less often than annually) so the income is income taxed to the beneficiaries at their much lower tax rates, we are losing the asset protection of a third party settled trust as to the distributed income. For that reason, the trust should be designed as a “grantor trust” for federal income tax purposes by making sure that one or more of the provisions under IRC §§ 672 through 679 are invoked so that for income tax purposes the income and deductions flow through and are taxed to the grantor instead of to the trust or the beneficiaries. Because the trust is a grantor trust for federal income tax purposes, the income and deductions would flow through to the grantor even if distributions are made to beneficiaries. However, the grantor is not a beneficiary nor does the grantor of the trust hold any rights or powers that would bring the trust assets into the estate of the grantor at death for federal estate tax purposes under IRC §§ 2036 or 2038.

(b) Designing the third party irrevocable trust. The irrevocable trust would work in tandem with an LLC owing the real estate. Instead of making a gift to or leaving the LLC membership interest to children at death outright or only in trust for children and other descendants until they reach a certain age, the establishment of lifetime irrevocable trusts for children and other descendants at death or by gifting during life should be considered. The irrevocable trust could be designed as follows:

(i) Estate tax benefits. Subject to the discussion on generation skipping tax below, clients should be encouraged to consider whether transferring property to children outright is in their best interest, as anything transferred to a child outright may ultimately be subjected to estate tax at that child’s subsequent death. Depending on future legislation or whether the increased estate tax exemption sunsets at the end of 2025, clients’ estates may again be subject to a substantial estate tax at death. If clients transfer assets outright to their children by gift or bequest, assuming that the children still have the property received by their parents upon their subsequent death, that property could be subjected to federal estate tax in the children’s

9

estates. Clients should consider transferring assets to children in a trust structured so that each child has substantial use of the property during his or her lifetime; but the trust property will not be subjected to federal estate tax upon the child’s subsequent death. Trusts for children can be structured so that a child has use of assets in the trust remarkably close to absolute ownership; but not powers which would result in the trust assets being included in his or her estate for federal estate tax purposes at his or her death except to the extent it is desirable for assets to be included in the child’s estate to obtain a step up in income tax basis.

Example – a trust for a child or other descendant could be structured so the assets of the trust are not included in the child’s estate; with the child having any or all of the following powers without negative estate tax ramifications:

- A child would be entitled to all of the income from the trust during his or her lifetime. Caveat: For asset protection, it may be more desirable to design the trust so that distribution of the income is discretionary by an Independent Trustee.

- The trustee (who could be the child – see below) would have the right to invade the principal of the trust for the health, education, support and maintenance of the child. However, see caveat above.

- Once a child is old and mature enough, the child could become the trustee of the trust established for his or her benefit. As trustee, the child can direct investment of trust assets for income or principal growth and have the trust buy assets which the child as beneficiary can use personally.

- The child could be granted a limited power of appointment exercisable in the child’s will under which he or she can at death appoint and direct the trust assets to anyone the child chooses except to that child, the estate of that child, the creditors of that child or the creditors of his or her estate. Typically, clients choose to limit the class of beneficiaries to whom the child can appoint property of the trust to a smaller class of beneficiaries (i.e., descendants of the child or the clients).

- None of the powers listed above either alone or cumulatively will cause the assets ofthe trust established forthe benefitofa childto beincluded in his or her estate for federal estate tax purposes. The limited power of appointment will allow each child to appoint the property outright or continue the assets in trust for the client’s descendants or the child’s children or other beneficiaries as a child may so desire.

(ii) Generation Skipping Tax ("GST"). The generation skipping transfer tax (hereinafter “GST”) imposes a tax for each generation which is by-passed or "skipped" byatransferofwealth,evenifnomemberoftheskippedgenerationhaduseorenjoyment

10

of the property transferred. The GST tax was specifically designed by Congress to remedy the common tax avoidance technique where an individual gives property, either during life or after death to a generation lower than the child of the transferor (i.e., grandchildren or below), thus avoiding gift and estate tax being paid with respect to the intervening generation (the child’s generation). The legislative philosophy supporting the GST tax is a belief that a transfer tax (estate or gift tax) should be imposed at each generation below the transferor, not just at the generations which receive or otherwise enjoy the transferred property.

This legislative philosophy has been implementedbytaxingskipped generations at the highest estate tax rate (40% for transfers made in 2022). Unfortunately, because of the breadth of the legislation, the GST tax is often incurred even when there is no intention to skip a generation. For example, if a grandparent leaves property in trust for a child until a certain age, date or for life, and the child dies or another event triggering distribution occurs before final distribution to the child then if at the death of the child the property is distributed to grandchildren, this is a "taxable termination" for GST tax purposes and the value of the property going to the grandchildren is GST taxed at the highest estate tax rate of 40%

For 2022, each individual has an exemption from GST tax of $12,060,000. This means that if each of a married couple chooses to do so, together they may transfer up to $24,120,000 total to persons of a generation level of grandchildren or below without incurringGSTtax ItisimportanttorememberthattheGSTexemptionisthesameastheapplicable exclusion amount for estate tax purposes and like the applicable exclusion amount is indexed for inflation. So, as the applicable exclusion amount changes due to the index, the GST tax exemption amount will change identically.

Through the use of both GST exemptions, for a married couple in 2022, up to $24,120,,000 in assets are exempt from GST tax for property distributed to children in a trust as described under Estate Tax benefits above without incurring an estate tax in a child’s estates or a GST tax at the death of a child should the assets of the trust be distributed to a person two (2) or more generations below the generation of the married couple.

(iii) Asset Protection

There are also non-tax advantages to leaving property in trust for children instead of outright. First, it will protect the property in the event of the divorce of a child. Secondly, property in the trust will be protected from most creditors of the beneficiary-children. If the real estate is held by an LLC and the LLC is owned by the trust, it will enhance the protection of the beneficiary under the LLC because generally, the trust cannot be accessed for the debts of a beneficiary and therefore the LLC membership interest held by the LLC cannot be accessed by a creditor even with a charging order. Under the New Mexico Uniform Trust Code, property placed in an irrevocable trust for a beneficiary will have the same level of asset protection whether or not the beneficiary is the trustee or a third party is the trustee. See § 46A-5-504E NMSA 1978 The only exceptions are as follows:

• Child support and spousal support – § 46A-5-503 NMSA

• Judgment creditor providing services for protection of beneficiary’s interest in the trust.

11

• A claim of the state of NM or United States to extent a NM statute or federal law so provides.

D. Restructuring ownership of business entities. Ownership of

interests in

LLCs

or other business entities which own real estate could be restructured by making some gifts to children or other family members. Properly done, gifts of minority interests in LLCs or other business entities should be entitled to discounts for lack of marketability and minority interests ranging from 35% to 45%. This allows a client, in effect, to leverage his or her $16,000 annual gift tax exclusion and yet maintain control of the asset because gifting could be done in such a way so the client remains the owner of the majority interest in each entity. If this planning is undertaken, it will be necessary to engage a qualified business appraiser experienced in valuing businesses to establish these discounts. There is an annual exclusion from gift tax of $16,000 per year per donee. This is indexed for inflation. This means each spouse can give $16,000 per year to children or any other person without incurring gift tax or using up the lifetime applicable exclusion amount. In addition to annual exclusion gifts, clients should consider using part of their $12,060,000 lifetime gift and estate tax exclusion transfer business interests to children (preferably in trust – the benefits of a gift in trust were explained previously). This would have two positive tax effects: (i) Assuming a discount of 35%, by using some lifetime exclusion, the business interests may be removed from the estate for transfer tax purposes on a discounted basis plus any future appreciation that occurs after the date of the gift on the gifted property and (ii) the remaining business interests retained by the clients will likewise be entitled to an estate tax discount at death. The major drawback to making gifts of corporate stock, LLC or other business entity interests during life is the cost of a good business appraisal to value these interests which will need to be obtained. Gifts made to a lifetime QTIP marital trust would further fractionalize ownership of LLC and other business interests and would assure that neither spouse of a married couple would be deemed to own a majority interest at the death of the surviving spouse.

12

Integrating Portfolio and Insurance Planning Brad Justice Wealth Management Advisor Justice Financial SESSION 2 9:35 AM

Two Types of Financial Planning Issues

• Defensive

• Offensive

March 3, 2023 Integrating Portfolio and Insurance Planning 2

Brad Justice,CFP®, MSFS, CLU®, ChFC®, RICP®, WMCP® Wealth Management Advisor

1 2

Defensive Planning Issues

• Emergency Funds

• Insurance

• Health

• Life

• Disability

• Asset and Liability

• Retirement risks

Offensive Planning Issues

• Investments (portfolio, real estate, business)

• Retirement accounts

• Portfolio allocation

3

4

3 4

Ongoing Planning Issues

• Tax planning

• Estate planning

Life Insurance

• Two types:

• Term

• Permanent

• Cashflow management 6

5

5 6

8

Uses of Life Insurance

• Death benefit

• Living benefit

• Business continuity

• Non‐qualified deferred compensation

• Estate planning

• Estate equalization

• Special needs

• Estate tax planning

Disability Insurance

• Group

• Individual

• Business

• Buyout

• Key person

• Disability overhead

7

7 8

Retirement Planning

• Qualified plans

• Non‐qualified plans

• Social Security

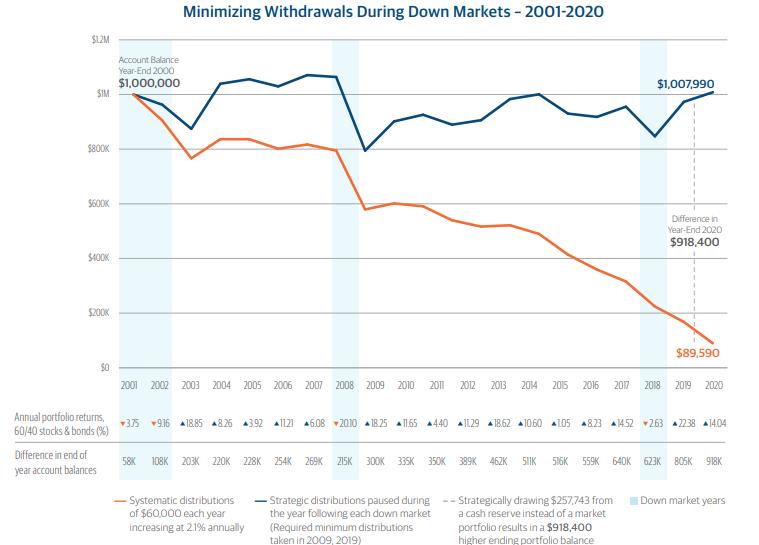

• Annuities

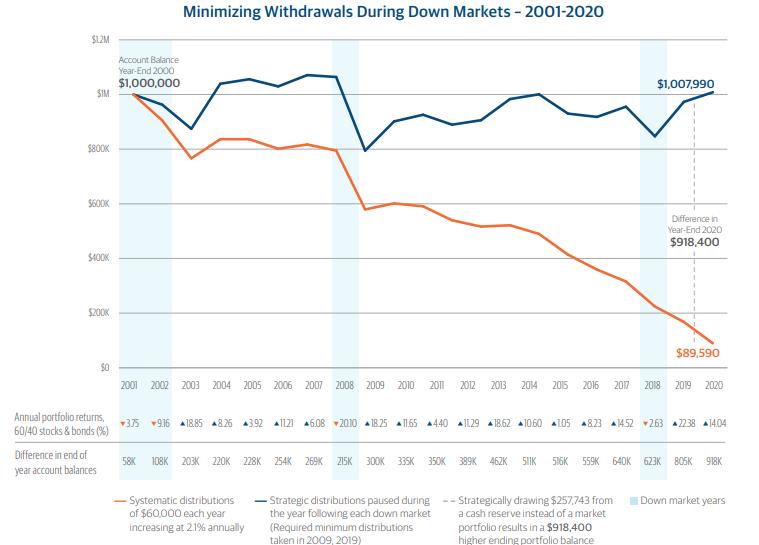

Retirement Risks

• Declining health

• Inflation

• Sequence of returns, market volatility

• Longevity

9

10

9 10

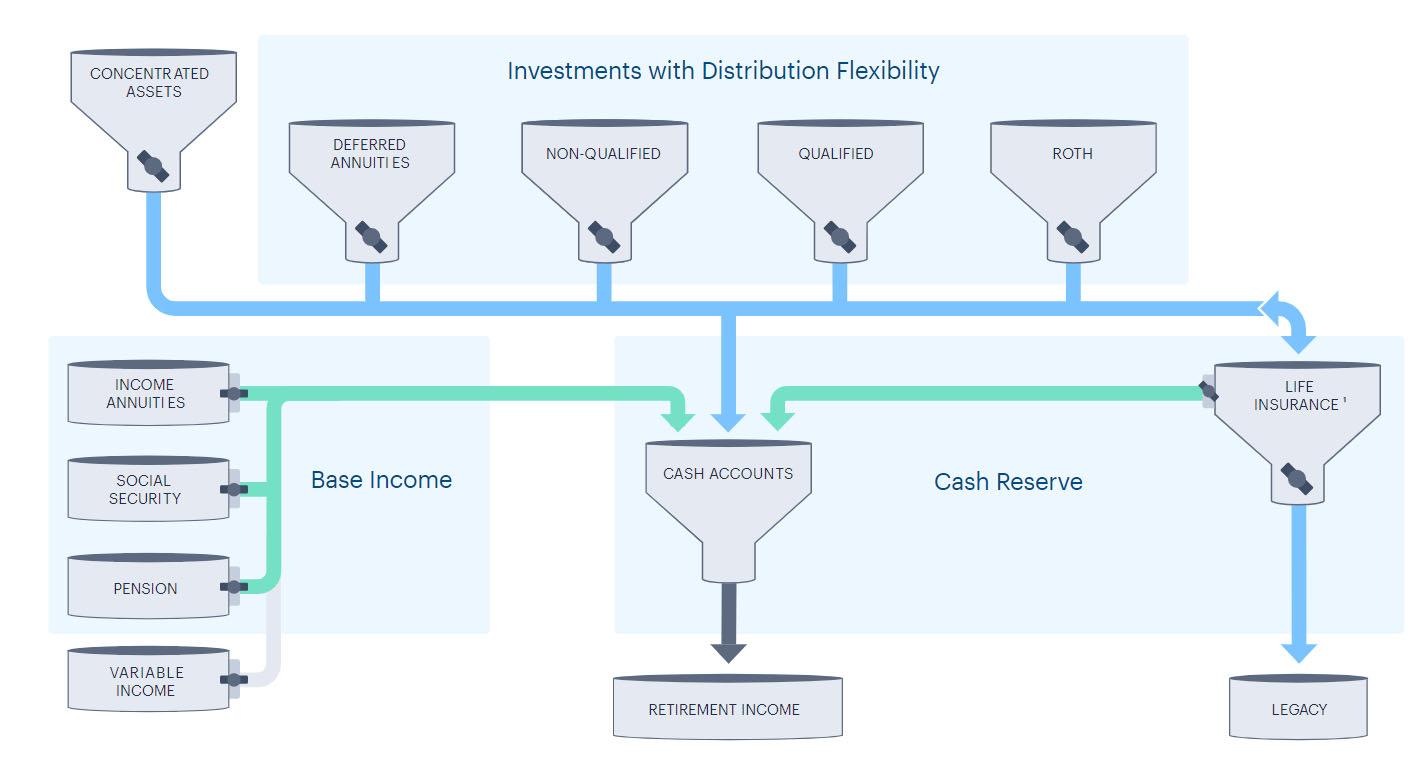

Integrating Portfolio and Insurance Planning

• Impact of emergency funds or cash value life insurance

• Health events and longevity

Integrating Portfolio and Insurance Planning

• Retirement Income Options

• Systematic withdrawals

• Bucket strategy

• Flooring strategy

• Impact of behavioral finance

11

12

11 12

13 14 13 14

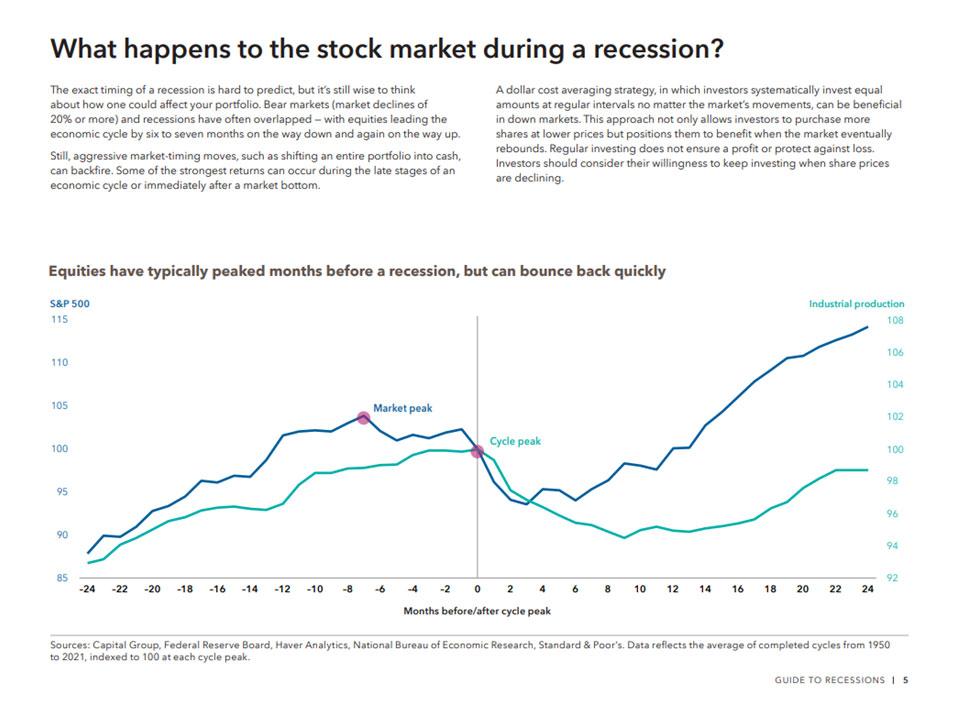

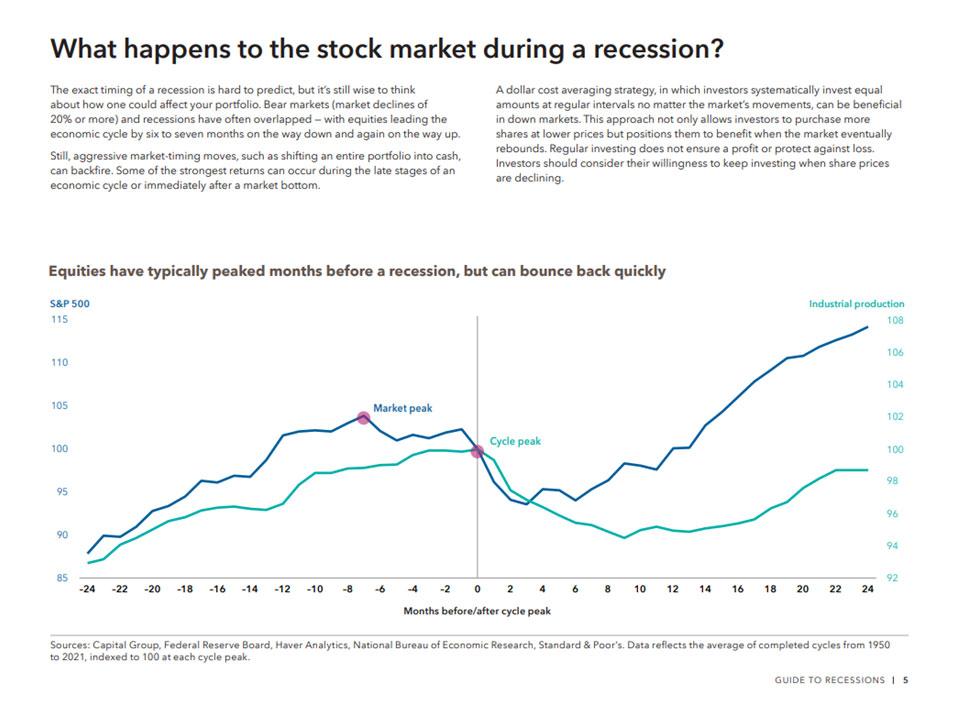

Current Events: Recessionary Market Cycle

15

US stock market is a leading indicator

US economy is a lagging indicator 16

‐to‐recessions.html 15 16

•

•

https://www.capitalgroup.com/advisor/insights/articles/guide

Current Events: Increasing Interest Rates

• Audit money market / savings account interest rates

SECURE Act 2.0

• Over 90 provisions

• Increased catch up contributions

• Increased Roth options

• Changes to RMD ages

• Increased flexibility in retirement plan access

17

18

17 18

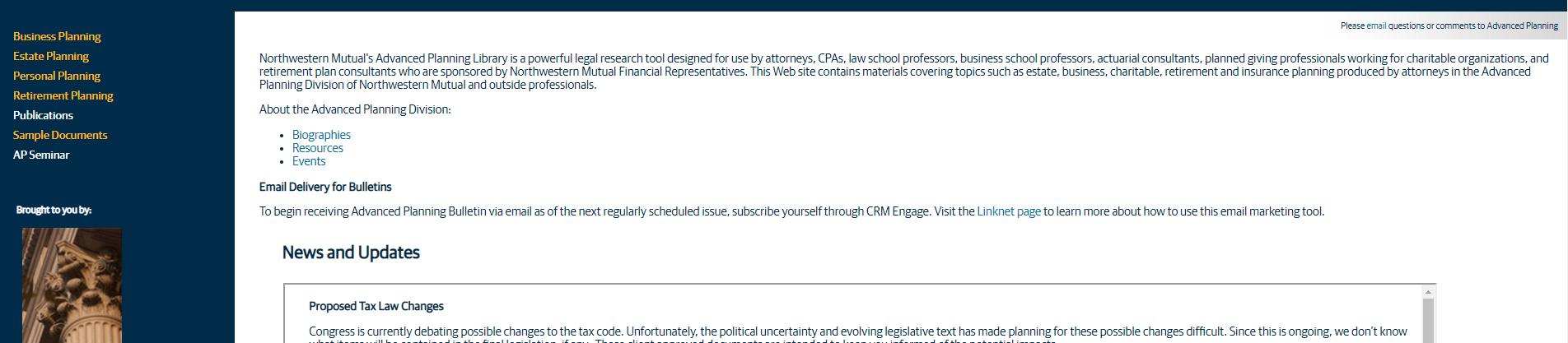

19 Advanced Planning Library 20 Advanced Planning Library Sample Documents 19 20

21 Advanced Planning Library Access Email: justicefinancial@nm.com (full name, phone number, email address) 22 Contact Information Brad Justice https://justicefinancial.nm.com 21 22

SESSION

Planning for the LGBTQ+ Community Cristy Carbón-Gaul Attorney The Law Office of Cristy J. Carbón-Gaul

Estate

3 (virtual) 10:45 AM

Cristy J. Carbón-Gaul

The Law Office of Cristy J. Carbón-Gaul

Pronouns: she, her, hers

REPRESENTING LGBTQIA+ CLIENTS

CREATING AN INCLUSIVE ENVIRONMENT

• Maybe Signage and useintentional advertising. Create a welcoming environment using a "safe zone sticker" or through generally LGBTQ-affirming comments, which can communicate that this is a safe space.

• Do not make assumptions regarding sexual orientation or gender identity.Instead of assuming what pronoun your client uses, create space where they feel confident and safe disclosing that to you.

• Include a check box for genderon all client forms.

• Include your gender pronouns on your business card.

• Avoid using heteronormative andcisnormativelanguage duringconversations. For example, when you would normally use wordssuch as “boyfriend/girlfriend” or “husband/wife,” try using the word“partner,” "significant other,” and “spouse”.

1 2

TERMS

• Lesbian

• Gay

• Bisexual

TRANSGENDER

A transgender person (often abbreviated to trans person) is someone whose gender identity or gender expression does not correspond with their sex assigned at birth.

3 4

QUEER/QUESTIONING (ONE'S SEXUAL OR GENDER IDENTITY)

An adjective used by some people whose sexual orientation is not exclusively heterosexual or straight. This umbrella term includes people who have nonbinary, gender-fluid, or gender nonconforming identities. Once considered a pejorative term, queer has been reclaimed by some LGBTQIA+ people to describe themselves; however, it is not a universally accepted term even within the LGBTQIA+ community.