Annual FRIDAY, MARCH 8, 2024 8:00 AM - 5:00 PM | Conference 5:00 PM - 6:00 PM | Networking @ABQFOUNDATION

the Marketing & Development Department at Albuquerque Community Foundation, we extend a warm welcome to you to the 5th Annual New Mexico Estate Planning Conference. It is with great pleasure that we gather to celebrate and explore the crucial work of professional advisors in our community, the principles of values-aligned philanthropy, and the indispensable role philanthropy plays in shaping the future of our city.

In the landscape of estate planning, professional advisors stand as beacons of wisdom and guidance, navigating individuals and families through the intricate journey of securing their legacies. The 5th Annual Conference provides a unique platform to delve into the latest developments, share insights, and foster collaboration among the brilliant minds dedicated to this noble pursuit. Your presence at this event underscores your commitment to excellence in the field and your dedication to ensuring the prosperity of our community.

Values-aligned philanthropy lies at the heart of our collective mission. As we come together to explore innovative approaches and best practices, we acknowledge the profound impact that strategic and purposeful giving can have on the well-being of our society. By aligning our values with our philanthropic endeavors, we pave the way for transformative change and sustainable community development.

Albuquerque Community Foundation is honored to play a role in advancing values-aligned philanthropy in our city. As a cornerstone institution, we strive to be a catalyst for positive change by connecting donors with meaningful causes, fostering collaboration, and supporting initiatives that address the evolving needs of our community. Your participation in this conference reinforces the collaborative spirit that defines Albuquerque Community Foundation and highlights the significance of our shared commitment to building a stronger, more resilient community.

As we embark on the 5th Annual New Mexico Estate Planning Conference, let us seize this opportunity to learn from each other, inspire innovation, and strengthen the ties that bind us in our collective pursuit of a brighter future for Albuquerque. Thank you for being an integral part of this momentous event, and we look forward to the valuable insights and connections that will undoubtedly emerge from our time together.

Denise Nava Wyrick Development Director

Denise Nava Wyrick Development Director

Sam Bicknell-Hernandez Marketing & Development Associate

Sam Bicknell-Hernandez Marketing & Development Associate

THANK YOU SPONSORS

THANK YOU

TITLE SPONSOR

BOARD OF TRUSTEES

Chair-Elect Dekker/Perich/Sabatini

Treasurer

Secretary

Sanjay Engineer FBT Architects

Katie Esquibel Sandia National Laboratories

CliftonLarsonAllen LLP

Monique Fragua Indian Pueblo Cultural Center

Jason Galloway UNM Health Sciences Center

Rebecca Harrington Community Member

Dr. Abinash Achrekar UNM Health Sciences Center

Paul Mondragón Bank of America New Mexico

Arellana Barela Levenson Community Member

Bob Bowmania Productions

Singleton Schreiber

Tom Daulton Independent Venture Capital & Private Equity Professional

Michelle Dearholt Nusenda Credit Union

Junior League of Albuquerque

AGENDA

There will be a 5-minute break between each session

8:10 AM

9:15 AM

10:20 AM

José Viramontes, Chair, ACF Board of Trustees MediaDesk

Brad Justice & Darci Severson Justice Financial Sophisticated Financial Planning Strategies

Cristy Carbón-Gaul

Representing LGBTQ+ Clients 11:20 AM 11:30 AM Lunch 12:20 PM

Designing Trusts to be the Beneficiary of Retirement Benefits

NM-NEW

1:25 PM

Ethical Issues with a Guardianship

2:30 PM

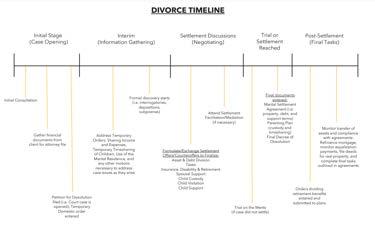

The Good, the Bad, and the Uglier: What you and your clients need to know about divorce and estate planning

The Law Office of Cristy J. Carbón-Gaul

Ken Leach Roybal-Mack & Cordova, P.C.

Beverly Bendickson & Natalie Donnelly NM-NEW & CNM Ingenuity, Inc.

Nell Graham Sale Pregenzer, Baysinger, Wideman & Sale, PC

Why work with community foundations?

3:35 PM Modifying Irrevocable Trusts

Jennifer deGraauw Terry & deGraauw, P.C.

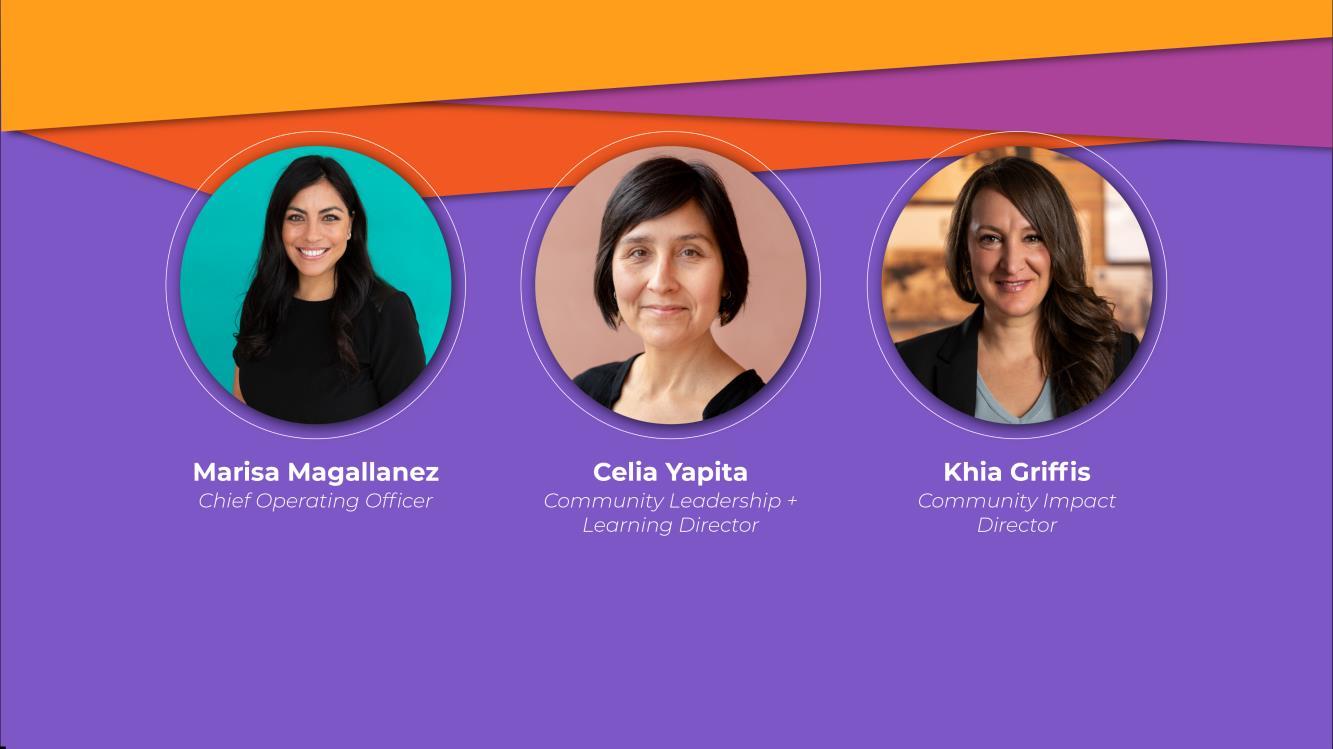

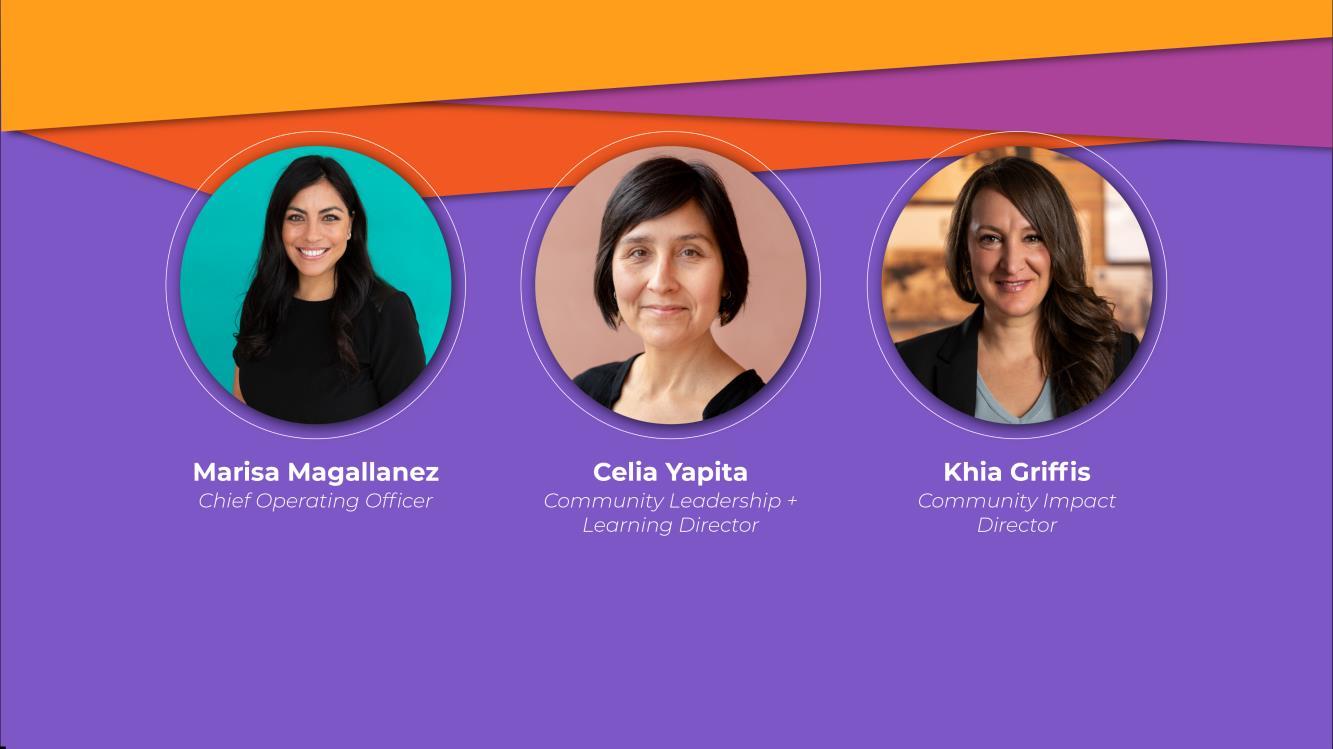

Khia Griffis, Marisa Magallanez, & Celia Yapita Albuquerque Community Foundation

4:35 PM Closing Remarks

Vanessa Kaczmarek Modrall Sperling

Marisa Magallanez, COO

Albuquerque Community Foundation

Boxing Bear Brewery 8420 Firestone Lane NE 87113

TIME )S(REKAEPS CIPOT

8:00 AM Opening Remarks

5:00 PM Networking

Plan on dying.

frenchfunerals.com

Plan your funeral ahead of time and take the burden off your loved ones.

FACULTY BIOGRAPHIES

CELIA joined the Albuquerque Community Foundation team in the spring of 2023. Celia is of the Aymara people of Bolivia through her father and was raised by her mother in Gainesville, Florida. After going to college in the northeast and law school in the west, Celia found her home in the vibrant community of Albuquerque in 2004.

Her legal work in Florida, California and New Mexico included support of survivors of domestic violence, as well as advocacy for senior citizens and youth in special education. In Albuquerque, Celia worked at Catholic Charities for 11+ years, directly serving immigrants and refugees, and in her last couple of years there, supporting all programming as the Chief Program Officer. In fall 2021, Celia became the first Director of Diversity, Equity and Inclusion at United Way of North Central New Mexico. Throughout her career, Celia has centered clear communication in her collaborations: Aruskipt’asipxañanakasakipuniraskispawa – Sea lo que fuere, estamos obligados a comunicarnos – In all situations, we must communicate with each other.

Celia is part of a blended family, with three teenagers at home. She enjoys reading both fiction and nonfiction, dancing for exercise and fun, listening to podcasts, hikes with her husband, and relaxing with her two senior chihuahuas. Her joy comes from being with her kids, challenging herself through deep learning from the wisdom of those with lived experience, and learning how to embrace rest as a value in life.

As a native New Mexican, MARISA has been working in the nonprofit sector for over 18 years, establishing her career at the National Institute of Flamenco, and starting at the Foundation in 2019 as Advancement Manager. During her time at the Foundation, Marisa has led and managed the largest federal government contract the Foundation has seen in 42 years, led the development of the Foundation’s first strategic plan in 15 years, along with the update of the organization’s mission, vision and values, and increased work in diversity, equity and inclusion of the overall organization.

In July 2023, Marisa was promoted to Chief Operating Officer. Marisa is the first woman of color in executive leadership at Albuquerque Community Foundation, and the first person to hold the title of COO and responsibilities, in the history of the organization.

Marisa holds an MBA with a focus in Policy and Planning from the University of New Mexico. In her free time, she enjoys horseback riding, hot yoga, and spending time with her dog.

Community Leadership & Learning Director

Albuquerque Community Foundation

Celia Yapita

Marisa Magallanez

Community Leadership & Learning Director

Albuquerque Community Foundation

Celia Yapita

Marisa Magallanez

KHIA joined the Albuquerque Community Foundation team in June 2019 after completing her graduate internship at Con Alma Health Foundation, where she was drawn to the world of grantmaking. Khia earned her Bachelor of Arts in Psychology from UNM and her Master of Social Work from NMHU.

Philanthropy & strategic grantmaking at Albuquerque Community Foundation have been a welcome application of her passion for improving the lives of others. Khia was born and raised in New Mexico and currently resides in Corrales, while also spending time in the East Mountains with family. In her free time, Khia enjoys playing soccer and running in the Bosque with her dog Buffy.

KENNETH C. LEACH completed his education through the University of New Mexico with his B.A. in History in 1972, and his JD in Law in 1975. He was then admitted to the bar by the New Mexico and U.S. District Court in 1975. He is a Fellow of the American College of Trust and Estate Counsel (ACTEC), and has been listed on Martindale-Hubbell’s Bar Register of Preeminent Lawyers. He is a member of the University of New Mexico Law School Alumni Association, the Albuquerque Bar Association, the New Mexico Estate Planning Council and Southern New Mexico Estate Council, and a past Trustee on the Board of Trustees of the Albuquerque Community Foundation. Kenneth previously served on the New Mexico Board of Legal Specialization, An Agency of the Supreme Court of New Mexico Estate Planning, Trusts & Probate Law Specialty Committee. He is presently serving on the San Juan College Foundation Board and served as President from 2019-2022. Mr. Leach served on the University of New Mexico Foundation Board (from 1995-2003), and as the Chairman of the Gift Acceptance Committee for the UNM Foundation. Kenneth has been listed in the prestigious “The Best Lawyers in America” publication in the Trust & Estates section for 26 consecutive years (1996-2022). He was the Community Foundation of Southern New Mexico advisor for the year of 2013, and he received the Excellence in Charitable Gift Planning Award for 2006 by the Albuquerque Community Foundation.

Community Impact Director

Albuquerque Community Foundation

Khia Griffis Attorney Roybal-Mack & Cordova, P.C.

Kenneth C. Leach

Community Impact Director

Albuquerque Community Foundation

Khia Griffis Attorney Roybal-Mack & Cordova, P.C.

Kenneth C. Leach

JENNIFER DEGRAAUW is an attorney who has practiced Family Law for over sixteen years in the state of New Mexico. Her practice includes divorce, complex property division, business valuations, asset tracing, child custody, and support.

While Jennifer has extensive trial and litigation experience, she is also a skilled negotiator and trained Collaborative Law practitioner. She is a Past-President of the New Mexico Collaborative Practice Group, and was appointed by the Supreme Court of New Mexico to serve on the New Mexico Domestic Relations Rules Committee. During her time on the committee, she helped author various Domestic Relations rules, including drafting the New Mexico Collaborative Law Act. Jennifer has also served as a board member of the Albuquerque Bar Association and State Family Law Section board.

Jennifer was named a “Top Three Family Law Attorney” by the Albuquerque Journal from 2018 to present, was deemed a SuperLawyers “Rising Star” in 2017 and has received the SuperLawyers distinction from 2019 to present. She earned the Best Lawyers distinction for Family Law in 2020 and was named “Attorney of Year” in 2022 for Family Law Mediation and Collaborative Divorce and “Lawyer of the Year” in 2023 for Family Law in Albuquerque.

Counsel and Attorney

NELL GRAHAM SALE is Of Counsel with the law firm of Pregenzer, Baysinger, Wideman & Sale, PC. While actively practicing law, she was licensed in New Mexico, Delaware, Pennsylvania, U. S. Tax Court and the U. S. Supreme Court. She is a Certified Elder Law Attorney, a member of the American College of Trust and Estate Counsel, and is an emerita member of the Special Needs Alliance. Nell is celebrating over 10 years of having her AV Preeminent® rating from LexisNexis Martindale-Hubbell. She has been repeatedly selected for inclusion by her peers in Best Lawyer in America®, Super Lawyers and was included in the 26th Edition of Best Lawyers in America for her work in Elder Law and Trusts and Estates in 2020. In 2019 Nell was chosen for Who’s Who among American Lawyers. In 2017, Nell chaired a successful capital campaign for Paws and Stripes and she is also one of the founders of the New Mexico Planned Giving Roundtable.

Owner & Partner Attorney

Terry & deGraauw, P.C.

Jennifer deGraauw

Of

Pregenzer, Baysinger, Wideman & Sale, P.C.

Nell Graham Sale

Owner & Partner Attorney

Terry & deGraauw, P.C.

Jennifer deGraauw

Of

Pregenzer, Baysinger, Wideman & Sale, P.C.

Nell Graham Sale

Director of Planning and Investment Operations

Justice Financial

DARCI was born and raised in Albuquerque, New Mexico. She served 11 years in the Air Force and was a Pilot and Commander. She went to undergraduate school and earned a Bachelor of Science in Engineering while serving in the US Air Force. After graduating, she went to pilot training and flew as an Instructor Pilot teaching young officers how to fly and later as a Fighter Pilot. After separating from the Air Force, Darci worked in Product Management for large companies in the meat and protein industry like Tyson Foods.

In 2023 she joined Justice Financial as the Financial Planning Analyst. Her background as an Air Force Commander, which includes responsibilities of leading, managing and improving her unit, reflect greatly in the progress she is making in her position at Justice Financial. Darci has an MBA and has her New Mexico Life & Health Insurance license.

Outside of work, Darci enjoys spending time in the mountains, practicing yoga and great food. She also enjoys relaxing with a cup of tea and a book or movie.

Attorney at Law

CRISTY J. CARBÓN-GAUL grew up primarily in Omaha, Nebraska but considers herself a New Mexican, living in Albuquerque most of her adult life. Her and her husband, Daniel Gaul, moved to New Mexico in 1997. They have two children, two dogs, three cats, and 23 chickens.

She is a lawyer licensed by the New Mexico State Bar since 1997, earning her law degree from Creighton University School of Law, graduating cum laude. Her undergraduate degree, a B.S. in Business Administration with a concentration in accounting is from Trinity University in San Antonio, Texas.

The Law Office of Cristy J. Carbón-Gaul

Cristy J. Carbόn-Gaul has practiced estate planning, guardianship and conservatorship and probate law in New Mexico for over 25 years. She is also the Probate Judge for Bernalillo County.

Darci Severson

Cristy Carbón-Gaul

Darci Severson

Cristy Carbón-Gaul

The Advisors’ Trust Company® Zia Trust, Inc. Our Team is Ready to Help Trust Administration Estate Settlement Special Needs Trusts Medicaid Payback Other Fiduciary Services Old fashioned “face-to-face” service - we’re accessible Personal and attentive client engagement Experienced Trust Officers and Support Team We work alongside your clients’ investment advisor 505.881.3338 ziatrust.com 6301 Indian School Road, Suite 800, Albuquerque, NM 87110

Born and raised in Orange County, California, BRAD graduated from Brigham Young University with a double major in Business Administration and Portuguese in 2004. Immediately after college Brad was recruited by GE Consumer Finance to move to Albuquerque, New Mexico.

In May 2006, Brad transitioned into financial services and joined Northwestern Mutual. He achieved prestigious company milestones and excelled in multiple leadership roles. The Justice Financial team was recognized in 2022 by Forbes Magazine as one of the best Wealth Advisors in the state of New Mexico.

Today Brad focuses primarily on working with clients in the retirement income space and professionals. He holds securities registrations in Series 6, 7, 26, and 63 in addition to the following designations: CERTIFIED FINANCIAL PLANNER™(CFP®), Masters of Finance Services (MSFS), Retirement Income Certified Professional (RICP), Certified Life Underwriter (CLU), Chartered Financial Consultant (ChFC), Certified Advisor of Senior Living (CASL) and Wealth Management Certified Professional (WMCP).

Brad is married to Lisa, and they have four wonderful children, one dog, and 18 box turtles that live in their backyard. They love playing lots of board games, swimming, traveling, regular visits to Disney, and anything that involves family. He loves a good hamburger, fries, and a Dr. Pepper.

VANESSA C. KACZMAREK is a shareholder in the Transactions Department at Modrall Sperling. Her practice is focused on estate planning, trust administration and probate, tax matters, private foundations and nonprofits, and closely-held businesses. Vanessa’s clients include individuals, families, businesses, and tax-exempt organizations in Santa Fe and Albuquerque, New Mexico. Before joining Modrall Sperling in 2013, Vanessa was an associate in the Tax Department at the New York offices of Clifford Chance US LLP.

Wealth Management Advisor

Justice Financial

Brad Justice

Shareholder

Modrall Sperling

Vanessa Kaczmarek

Wealth Management Advisor

Justice Financial

Brad Justice

Shareholder

Modrall Sperling

Vanessa Kaczmarek

Trusts and Estates Taxation Real Estate Native American Law Litigation Labor, Employment and Benefits Energy, Environment and Natural Resources Corporate, Business and Finance Bankruptcy and Creditors’ Rights We Know New Mexico® Albuquerque modrall.com Santa Fe

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp. Investment products: Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value The Bull Symbol and Merrill are registered trademarks of Bank of America Corporation. CDFA® and Certified Divorce Financial Analyst® are trademarks of The Institute for Divorce Financial Analysts™.CFP Board owns the marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the U.S. © 2024 Bank of America Corporation. All rights reserved. MAP6400902 | MLWM-243-AD | 470945PM-0323 | 02/2024 When you’re ready to make a difference, we’re ready to help Merrill is proud to support Albuquerque Community Foundation’s 2024 NM Estate Planning Conference. Kim M Helm, CDFA®, CFP®, CPFA™ Vice President Wealth Management Advisor 505.884.9880 kim_maguire@ml.com Merrill Lynch Wealth Management 2125 LOUISIANA BLVD SUITE 200 ALBUQUERQUE, NM 87110 http://fa.ml.com/kim_maguire

SESSION

SESSION 1 8:10 AM

Sophisticated Financial Planning Strategies

Brad Justice, Wealth Management Advisor & Darci Severson, Director of Planning and Investment Operations Justice Financial

An overview of advanced planning strategies to increase client wealth.

▶ Leveraging whole life insurance and annuities with investments to strengthen your overall portfolio

▶ IRA withdrawal strategies to optimize tax planning – QCDs, QLACs

▶ And more!

SESSION 2 9:15 AM

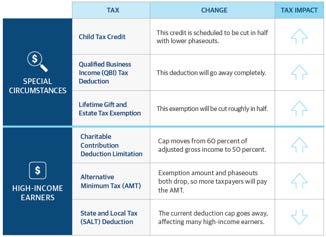

▶ Tax Cuts & Jobs Act Sunset and SECURE Act 2.0 highlights for financial planning

Representing LGBTQ+ Clients

Cristy Carbón-Gaul, Attorney at Law

The Law Office of Cristy J. Carbón-Gaul

Cristy has represented the LGBTQ+ community for over 20 years. In this presentation, we will discuss issue spotting that is particular to the LGBTQ+ community, including addressing the children of these relationships, in order to provide the protections needed in their estate plans. We will also discuss legal terms and terms of art that are used in preparing estate plans for individuals, couples and throuples in the LGBTQ+ community.

Roybal-Mack & Cordova, P.C.

Designing Trusts to be the Beneficiary of Retirement Benefits

In this presentation, Ken Leach will cover the process of designing a trust to be the beneficiary of IRA, 401k and other retirement benefits under the Secure Act and the proposed regulations.

GRANT WRITING

EVENT COORDINATION

OPERATIONS + PROGRAM SUPPORT

HIGHPOINT NONPROFIT SERVICES

@GMAIL

LOGISTICS DESIGN

SOCIAL MEDIA

FURTHER YOUR IMPACT

MARKETING + OUTREACH

N O N PROF I T S ERVI C E S HIG H P O INT

SERVICE S F ORMISSION-BASED ORGANIZATIONS

NICHE

SESSION 4 12:20 PM

Ethical Issues with a Guardianship

Nell Graham Sale, Of Counsel and Attorney Pregenzer, Baysinger, Wideman & Sale, P.C.

SESSION 5 1:25 PM

A grandmother in Albuquerque establishes a kinship guardianship for her grandson who is somewhat adventurous. His adventures lead to grandmother being sued by a victim of grandson.

Jennifer deGraauw, Owner & Partner Attorney Terry & deGraauw, P.C.

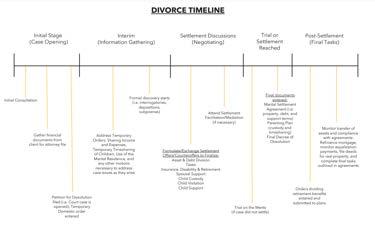

The Good, the Bad, and the Uglier: What you and your clients need to know about divorce and estate planning

SESSION 6 2:30 PM

In this presentation, Jennifer deGraauw bridges the gap between family law and estate planning issues and provides useful information on how to help your estate planning clients when they tell you they are going through a divorce. From exploring the various types of divorce processes to understanding the overlap between estate planning and the divorce process, you’ll walk away with a better understanding of how to support your clients when they need you most.

Why work with community foundations?

Khia Griffis, Community Impact Director; Marisa Magallanez, Chief Operating Officer; Celia Yapita, Community Leadership & Learning Director Albuquerque Community Foundation

SESSION 7 3:35 PM

Modifying Irrevocable Trusts

Vanessa Kaczmarek, Shareholder Modrall Sperling

Leadership from the Albuquerque Community Foundation will discuss the positive impact community foundations have on the areas they serve, and how the foundation’s local relationships in the community provide meaningful value for investors and donors. They will cover the Foundation’s recent updates to the mission, vision, and values and why these updates are important. They will discuss trust-based and values-aligned philanthropy and cover why these changes facilitate more equitable distribution of resources throughout the community.

There are many reasons why an irrevocable trust may need to be modified; for example, to correct mistakes, achieve tax benefits, adapt to changing laws, and reduce administrative costs. Fortunately, there are a variety of methods for modifying, and even terminating, irrevocable trusts. This presentation will provide an overview of some common approaches to modifying irrevocable trusts as well as a few important factors to consider when choosing which method to use.

@ABQFOUNDATION in Denise Nava Clarissa Earl Kelsey Martin Sam Bicknell-Hernandez Marketing& DevelopmentDirector MarketingManager denise@abqcf.org clarissa@abqcf.org kelsey@abqcf.org sam@abqcf.org DevelopmentManager Marketing& DevelopmentAssociate Let’s Connect! 624 Tijeras Ave. NW, Albuquerque NM 87102 abqcf.org | 505.883.6240

We are looking for community members interested in reviewing scholarship applications and participating in our scholarship recipient selection committee.

If you are interested or would like more details about the process, please reach out to Dominic Garcia, Senior Grants Associate at dominic@abqcf.org

2024

COMMITTEES

SCHOLARSHIP

GRANT PANELS

Prior to signing up, please review these guidelines, requirements and expectations:

$75 stipend is provided for your time. Meals will be provided.

In-person attendance is required at the Foundation’s office on the day of the panel.

Panelists commit to attending, or watching the recording of, a panel orientation prior to participation. Orientations will be held on February 28th from 12pm1pm and April 5th from 12pm-1pm.

Panelists agree to read and score, and provide feedback where applicable, to all applications submitted in the field-of-interest they sign up for. The average number of applications is 35, and the time it takes to read each application varies greatly, from 30 minutes to 1 hour.

Panelists should sign up for a field-of-interest in which they have some level of expertise/experience, and no conflict of interest.

2024

SESSION 1 8:10 AM

Sophisticated Financial Planning Strategies

Brad Justice

Wealth Management Advisor

Justice Financial

Sophisticated Financial Planning Strategies

March 8, 2024

Agenda

• Strengthen portfolios through both offense and defense

• IRA withdrawal strategies to optimize tax planning – QCDs, QLACs

• Tax Cuts & Jobs Act Sunset & SECURE 2.0 highlights for financial planning

• More!

1

Brad Justice, CFP®, MSFS, CLU®, ChFC®, RICP®, WMCP® Wealth Management Advisor

2

Darci Severson Director of Planning & Investment Operations

2

1

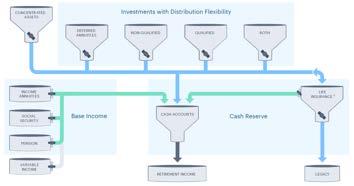

Two Types of Financial Planning Issues

• Offensive

• Investments (portfolio, real estate, business)

• Retirement accounts

• Portfolio allocation

• Defensive

• Emergency Funds

• Insurance

• Retirement risks

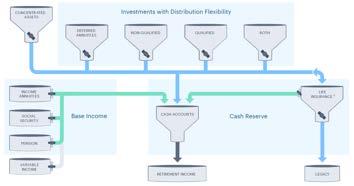

Having Choices in Retirement Really Matters

2

3

4

1The primary purpose for life insurance is to provide a death benefit. Using accumulated value to supplement your retirement ncome may reduce death benefits and may affect other aspects of your plan.

4

3

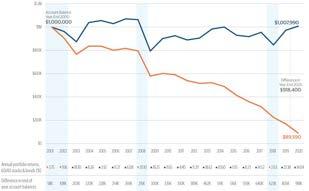

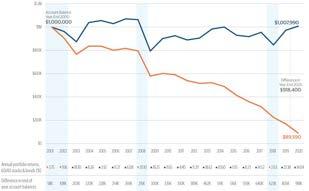

Minimizing Withdrawals During Down Markets –2001-2020

3 5

in Down

Minimizing Withdrawals

Markets Makes a Difference

Hypothetical analysis for educational purposes only. Not a recommendation of any specific investment or investment strategy. No investment strategy can guarantee a profit or protect against loss. Past performance is not a guarantee of future results. IRA distributions may be subject to ordinary income tax and may be subject to a 10% IRS early withdrawal penalty if taken before age 591/2. Stocks are represented by the S&P 500 Index, which is an unmanaged group of securities considered to be representative of the U.S. stock market in general. Bonds are represented by the Barclays U.S. Aggregate Bond index, which is an unmanaged, broad-based flagship benchmark that measures the investment-grade, U.S.- denominated, fixed-rate taxable bond market. An investment cannot be made directly in an index. Systematic distributions increased at 2.1% per year based on annualized calculation of inflation rates provided by the Bureau of Labor Statistics. These numbers do not reflect fees and charges associated with an actual investment. Assumes the account owner has readily available source of cash to draw on in years following a down market in both scenarios. Analysis does not account for potential opportunity cost of holding uninvested cash. Difference net of cash used after down-market years is $660,657.These scenarios are also illustrated in detail in tables on following pages, “Down Market Systematic Distribution Details” and “Down Market Strategic Distribution Details,” using the same data and assumptions. 6 Tax & Financial Strategies to Maximize Your Charitable Giving • Highly appreciated stocks • IRAs • Donor-advised funds • Private foundations, community foundations • Permanent Life Insurance • Split interest charitable giving • Tax bunching This publication is not intended as legal or tax advice. Northwestern Mutual and its Financial Representatives do not give le gal or tax advice. Taxpayers should seek advice based on their particular circumstances from an independent tax advisor. Tax and other planning developments after the original date of publication may affect these discussi ons 5 6

IRA Tax & Financial Strategies

• Roth conversions in the years after retirement and before RMDs

• Qualified Charitable Distributions (QCDs) – after age 70.5

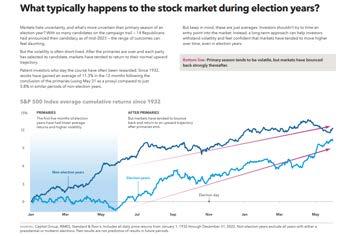

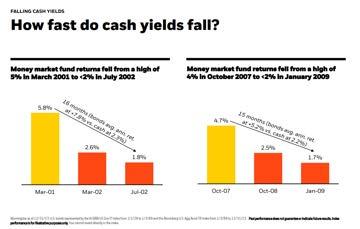

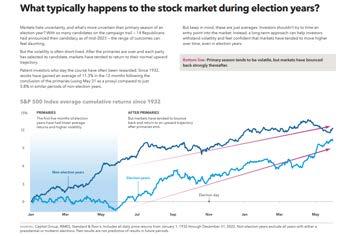

Current Topics

• Election year volatility

• Interest rates

• Tax Cuts & Jobs Act sunset

• Secure 2.0

4

7

This publication is not intended as legal or tax advice. Northwestern Mutual and its Financial Representatives do not give le gal or tax advice. Taxpayers should seek advice based on their particular circumstances from an independent tax advisor. Tax and other planning developments after the original date of publication may affect these discussi ons 8

7 8

5 9 10 9 10

6 11 This is not intended as legal or tax advice. This information was compiled by The Northwestern Mutual Life Insurance Company. It is intended for the information and education of Northwestern Mutual’s financial representatives, their customers, and the legal and tax advisors of those customers. It must not be used as a basis for legal or tax advice, and is not intended to be used and cannot be used to avoid any penalties that may be imposed on a taxpayer. Northwestern Mutual and its financial representatives do not give lega or tax advice. Taxpayers should seek advice regarding their particular circumstances from an independent legal, accounting, or tax advisor. Tax and other planning developments after the original date of publication may affect these discussions.

12 This is not intended as legal or tax advice. This information was compiled by The Northwestern Mutual Life Insurance Company. It is intended for the information and education of Northwestern Mutual’s financial representatives, their customers, and the legal and tax advisors of those customers. It must not be used as a basis for legal or tax advice, and is not intended to be used and cannot be used to avoid any penalties that may be imposed on a taxpayer. Northwestern Mutual and its financial representatives do not give lega or tax advice. Taxpayers should seek advice regarding their particular circumstances from an independent legal, accounting, or tax advisor. Tax and other planning developments after the original date of publication may affect these discussions.

11 12

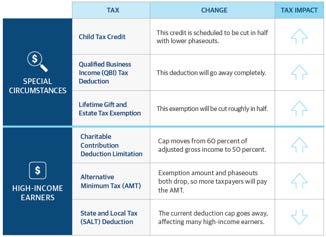

TCJA Sunset

TCJA Sunset

•

•

•

• Changes

•

7

SECURE Act 2.0

13

Over 90 provisions

Increased catch up contributions

Increased Roth options

RMD

to

ages

flexibility

access 14 Contact Information Brad Justice & Darci Severson https://justicefinancial.nm.com 505-872-7848 13 14

Increased

in retirement plan

Disclosures

Brad Justice & Darci Severson use Justice Financial as a marketing name for doing business as representatives of Northwestern Mutual. Justice Financial is not a registered investment adviser, broker-dealer, insurance agency or federal savings bank. Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM) and its subsidiaries, Northwestern Mutual Investment Services, LLC (NMIS) (Investment Brokerage Services), a registered investment adviser, brokerdealer, and member of FINRA and SIPC; and Northwestern Mutual Wealth Management Company® (NMWMC) (Investment Advisory Services), a federal savings bank. NM and its subsidiaries are in Milwaukee, WI. Brad Justice & Darci Severson are Insurance Agents of NM, Brad Justice & Darci Severson are Registered Representatives of NMIS, Brad Justice & Darci Severson are Advisors of NMWMC.

Northwestern Mutual Private Client Group is a select group of Northwestern Mutual advisors and representatives. Northwestern Mutual Private Client Group is not a registered investment adviser, broker-dealer, insurance agency, federal savings bank or other legal entity. Not all Northwestern Mutual representatives are advisors. Only those representatives with “Advisor” in their title or who otherwise disclose their status as an advisor of Northwestern Mutual Wealth Management Company (NMWMC) are credentialed as NMWMC representatives to provide advisory services.

8 15

This publicationis not intended as legal or tax advice. Northwestern Mutual and its Financial Representatives do not give legal or tax advice. Taxpayers should seek advice based on their particular circumstances from an independent tax advisor. Tax and other planning developments after the original date of publication may affect these discussions. 15

Representing LGBTQ+ Clients

at Law The Law Office of Cristy J. Carbón-Gaul

AM

Attorney

SESSION 2 9:15

Representing LGBTQ+ Clients

Gay Marriage

On June 26, 2015, the U.S. Supreme Court ruled that same-sex couples had the right to marry. The narrow, 5-4 decision did away with same-sex marriage bans in 14 states.

Thirty-five states ban same-sex marriage in their constitutions, state law, or both, according to the National Conference of State Legislatures and Stateline research. All were invalidated in 2015 by the Obergefell v. Hodges ruling. But should the now-moreconservative U.S. Supreme Court overturn the right to same-sex marriages, those state laws and constitutional amendments would kick in.

3/5/2024 1

1 2

Respect for Marriage Act

The Respect for MarriageAct guarantees federal recognition of any marriage between two individuals if the union was valid in the state where it was performed. It also requires states to accept the legitimacy of a valid marriage performed elsewhere and protects interracial marriages.

Issue Spotting When Representing the GBTQ+ Community

If a couple, are they married or domestic partners?

How long have they been married? (separate versus community property)

Do they have children?

How has their family reacted to them coming out?

3/5/2024 2

3 4

Wills versus Revocable Trust

DOES ONE PROVIDE MORE PROTECTION THAN ANOTHER?

Children

Bio parents

Adopted children

Surrogacy

Step-Parents

3/5/2024 3

5 6

45-2-120. Child conceived by assisted reproduction other than child born to gestational carrier.

45-2-117. No distinction based on marital status.

Except as otherwise provided in Section 45-2114, 45-2-119, 45-2-120 or 45-2-121 NMSA 1978, a parent-child relationship exists between a child and the child's genetic parents, regardless of the parents' marital status.

3/5/2024 4

7 8

Domestic Partners

Gay or Straight- need documents

Estate Planning is essential

Cons of Domestic Partnership

Cannot file joint return

Cannot receive social security from domestic partner (although joint children can if minors)

Complications of asset distribution at death if no estate plan

3/5/2024 5

9 10

Registration of Domestic Partners

– Recognition by the State

California

Washington DC

Maine

Nevada

Oregon

Washington

Wisconsin

Hawaii has “reciprocal partnership”

Why Register

It is for Benefits

If you move from that Statedo you cancel the registration

What is the impact on estate planning and probate

3/5/2024 6

11 12

Common Law Marriage

New Mexico does not have Common Law Marriage

Colorado, Iowa, Kansas, Montana, New Hampshire, Oklahoma, Rhode Island, South Carolina, Texas, Utah, and DC

New Mexico will recognize a common law marriage when transferred from another state.

Benefits of a Surviving Spouse

Some benefits are lost if a surviving spouse remarries

Military benefits

Pensions

Continued medical insurance

As an estate planner, making sure the couple knows how these assets work so couple understands their financial position upon the death of one of them

3/5/2024 7

13 14

Domestic Partnership Agreements

House ownership

Household expenses

Break-Up

Death

Tangible Personal Property

Contemplation of Marriage

Social Security of Deceased Spouse (12 months)

Health Insurance

Separate versus Community Propertyremember how this transfers if no will

PreNuptial Agreement

Still Need an Estate Plan

3/5/2024 8

15 16

Cremation

Domestic Partners can authorize cremation

24-12A-2. No written instructions; priority of others to decide disposition.

A. Except as provided in Subsection B of this section, if a decedent has left no written instructions regarding the disposition of the decedent's remains, the following persons in the order listed shall determine the means of disposition, not to be limited to cremation, of the remains of the decedent:

(1) the surviving spouse;

(2) a majority of the surviving adult children of the decedent;

(3) the surviving parents of the decedent;

(4) a majority of the surviving siblings of the decedent;

(5) an adult who has exhibited special care and concern for the decedent, who is aware of the decedent's views and desires regarding the disposition of the decedent's body and who is willing and able to make a decision about the disposition of the decedent's body; or

(6) the adult person of the next degree of kinship in the order named by New Mexico law to inherit the estate of the decedent.

B. If a decedent left no written instructions regarding the disposition of the decedent's remains, died while serving in any branch of the United States armed forces, the United States reserve forces or the national guard and completed a United States department of defense record of emergency data form or its successor form, the person authorized by the decedent to determine the means of disposition on a United States department of defense record of emergency data form shall determine the means of disposition, not to be limited to cremation.

3/5/2024 9

17 18

Terms

Non-Binary

Gender identity refers to how someone conceptualizes their gender. This identity is distinguishable from a person’s sexual orientation and sex assigned at birth.

Someone who is non-binary does not identify as exclusively male or female. They may identify as both, neither, or some combination of the two. For example, someone who identifies as non-binary may feel more masculine on some days and more feminine on other days. Their gender expression, the way they present themselves (including clothing choices), may fluctuate – or they may choose to dress more androgynously

3/5/2024 10

Gay Lesbian

19 20

Transgender

A transgender person (often abbreviated to trans person) is someone whose gender identity or gender expression does not correspond with their sex assigned at birth

Cisgender

Cis, short for cisgender (pronounced sis-gender, or just sis), is a term that means whatever gender you are now is the same as what was presumed for you at birth. This simply means that when a parent or doctor called you a boy or a girl when you were born, they got it right.

3/5/2024 11

21 22

Asexual

Asexuality is the lack of sexual attraction to others, or low or absent interest in or desire for sexual activity. It may be considered a sexual orientation or the lack thereof.

Gender versus Sexual Orientation

Gender identity is each person's internal and individual experience of gender. It is a person's sense of being a woman, a man, both, neither, or anywhere along the gender spectrum. A person's gender identity may be the same as or different from their birth-assigned sex.

Sexual orientation is about who you’re attracted to and who you feel drawn to romantically, emotionally, and sexually. It’s different than gender identity. Gender identity isn’t about who you’re attracted to, but about who you ARE male, female, genderqueer, etc.

3/5/2024 12

23 24

Dead Name

the birth name of a transgender person who has changed their name as part of their gender transition.

If there is not a legal name change, you need to use the birth name in document

Name Changes

Court Proceeding to legally change name

Law has change recently regarding publication of a name change – for safety of Petitioner (i.e. domestic violence and Trans Individuals)

Legal name change needed to use new name in legal documents like estate planning documents, passports, driver’s license

3/5/2024 13

25 26

He,Him, His

She, Her, Hers

They, Them, Theirs

IT can be offensive or harassing to guess at someone’s pronouns and refer to them using those pronouns if that is not how that person wants to be known. Or, worse, actively choosing to ignore the pronouns someone has stated that they go by could imply the oppressive notion that intersex, transgender, nonbinary, and gender nonconforming people do not or should not exist.

Professional Ethics

16-804.Misconduct.

It is professionalmisconductfor a lawyer to:

A. violate or attemptto violate the Rules of ProfessionalConduct,knowingly assistor induceanother to do so or do so through the acts of another;

B. commit a criminalact that reflects adversely on the lawyer’s honesty, trustworthinessor fitnessas a lawyer in other respects;

C. engage in conductinvolvingdishonesty, fraud, deceitor misrepresentation;

D. engage in conductthat is prejudicialto the administrationof justice;

E. stateor imply an abilityto influenceimproperlya government agency or official or to achieveresults by means that violate the Rules of Professional Conductor other law; or

F. knowingly assista judge or judicialofficer in conductthat is a violation of applicablerules of judicialconductor other law.

G. engagein conduct that the lawyerknows or reasonablyshould know is harassmentor discrimination on the basisof race, sex, religion,national origin,ethnicity,disability,age, sexual orientation,genderidentity,or maritalstatus in conduct relatedto the practiceof law.This paragraph does not limitthe abilityof a lawyerto accept, decline,or withdrawfrom a representation in accordancewith Rule 16-116NMRA. This paragraph does not preclude legitimateadvice or advocacy consistent with these rules.

[As amendedby Supreme Court Order No. 08-8300-029,effective November 3, 2008;as amendedby SupremeCourt Order No. 198300-012,effective December 1, 2019.]

3/5/2024 14

Pronouns

27 28

Cristy J. Carbón-Gaul

The Law Office of Cristy J. Carbón-Gaul Pronouns: she, her, hers https://www.mypronouns.org/what-and-why

Maiiling address: 10515 4th St., NW Albuquerque, New Mexico 87114

Hand deliveries/ Client Meetings: 10143 4th St., NW Albuquerque, New Mexico 87114

505.899.5696 cristy@carbon-gaul.com carbon-gaul.com

3/5/2024 15

29

SESSION 3 10:20 AM

Designing Trusts to be the Beneficiary of Retirement Benefits

Roybal-Mack & Cordova, P.C.

Designing Trusts for Retirement Benefits Under the Secure Act

By Kenneth C. Leach Roybal Mack and Cordova, PC

SECURE ACT and the “Stretch IRA”

• Background; Prior to SECURE “stretch IRA” Income taxes could be deferred for decades after death of client with a “life expectancy payout” of the IRAto the client’s children or grandchildren.

• The SECURE Act. Signed into law December 20, 2019, SECURE has radically changed the estate planning landscape for clients’retirement benefits. Except for a few types of beneficiaries, the life expectancy payout is gone and replaced by a maximum 10-year post-death payout period for most retirement benefits.

• Also, the rules under SECURE got much more complicated than before while the benefit of complying with the new rules became less.

• Death before or after RBD matters more than ever.

3/5/2024 1

1 2

Instead of Simpler Rules – More Complexity

• Though the SECUREAct itself appeared to reduce the differences between the RMD rules for “death before the RBD” and “death after the RBD,” the IRS proposed regulations have increased that difference

• Example 1, the EDB of a participant who dies before his RBD can elect to use the 10-year rule instead of the life expectancy payout.

• The EDB of a participant who dies after his RBD can’t elect the 10year rule

• Example 2:ADB subject to the 10-year rule who dies before his RBD does not have to take any annual RMDs in years 1-9, just a 100% distribution in Year10; but must take annual RMDs in years 1-9 if dies after his RBD.

Categories of Beneficiaries Under the SECURE ACT

•3 categories of beneficiaries under SECUREAct:

1. Beneficiary who is not a designated beneficiary (estate, a charity, or a trust that does not qualify as a see-through trust) (“non-DB”)

2. Designated beneficiary (individual(s) or see-through trust with individuals)

3. Eligible designated beneficiary: This is a subgroup of 5 types of designated beneficiaries who are eligible for the life expectancy payout.

• Surviving Spouse. § 401(a)(9)(E)(ii)(I).The surviving spouse can still use the life expectancy payout.

• Minor child of the participant. § 401(a)(9)(E)(ii)(II).

3/5/2024 2

3 4

Categories of Beneficiaries Under the SECURE ACT

• Disabled beneficiary (within the meaning of § 72(m)(7))

• Chronically ill individual. (within the meaning of § 7702B(c)(2)

• Less than 10 years younger beneficiary

The Proposed Regulations

• On February 23, 2022, the Treasury issued proposed regulations regarding required distributions from IRAs and certain other retirement plans

• See https://www.federalregister.gov/documents/2022/02/24/202202522/required-minimum-distributions. The 275-page Notice contains proposed changes to the Treasury regulations dealing with required minimum distributions (RMDs) from defined contribution plans, primarily to deal with changes made in the Tax Code by SECURE,

3/5/2024 3

5 6

The Proposed Regulations

•The proposed regulations provide definitions for some of SECURE’s important terms, including “reaches majority” and other elements of the “eligible designated beneficiary” category.

•Proposed Regs also adopt and define some alreadywidely-used terminology, including “see through trust,” “conduit trust,” and “accumulation trust,” for the first time

Drafting Considerations for Trust as beneficiary of IRA

• What’s different when drafting a trust to be the beneficiary of IRA or other retirement plans?

1. No “stepped up basis” at death

2. Distributions from these accounts (except a Roth) will be income-taxable to the recipient at ordinary income rates.

3. Spreading out distributions over a longer period of time rather than a shorter one may allow a lower overall income tax burden, A drafter needs to know what distribution period will apply to the client’s IRAs and the extent to which such period can be extended by drafting the trust in accordance with the “See-Through Trust” rules.

3/5/2024 4

7 8

Income Tax Considerations in leaving IRA to a Trust

• Distribution of traditional IRAwill be taxed at trust income tax rates except to the extent the distributions are, in the same year received and passed out to the trust beneficiary in a manner qualifying for the “DNI deduction.”

• The income taxes on the distributions will likely be much lower if they are passed out to the beneficiary instead of retained in the trust, due to the fact that a trust hits the top bracket (37% in 2024) at just $15,200 of taxable income vs. $609,350 for a single individual taxpayer.

• If the trustee has discretion whether and when to make distributions, the trustee can distribute when trustee judges that beneficiary will make good use of the money or not distribute (and let the benefits be taxed at the higher trust tax rate) at times when it appears the beneficiary may not make good use of the funds.

Income Tax Considerations (Continued)

• Roth IRA: There is no income tax on Roth IRA distributions; but the longer the funds can be kept inside the account growing tax free, the more the tax free growth!

• Under the SECURE ACT for most beneficiaries the account must be distributed within ten (10) years (year containing the 10th anniversary of client’s death)

3/5/2024 5

9 10

New RMD Rules

• Is death before or after the RBD? Step one in determining RMDs to the beneficiary of an inherited retirement account is determining whether the participant died before or after his or her RBD. YOU CANNOT DETERMINE POST-DEATH RMDS FOR ANY BENEFICIARY UNTILYOU KNOW WHETHER THE PARTICIPANT DIED BEFORE OR ON/AFTER THE RBD

• Generally, the RBD for 2024 isApril 1 of the year after the year the client turns age 73.

New RMD Rules – Exceptions to RBD Rules

• For a qualified retirement plan (i.e. 401(k) plan) the RBD is the same as for a traditional IRA if the participant owns more than 5% of the employer (“5% owner”). For a non-5%-owner, it isApril 1 following the later of the year the employee retires from the employer that sponsors the plan or the year the employee attains age 73

• Roth IRAs: Roth IRAs have no RMDs during the account owner’s life so death is always before the RBD regardless of age.

3/5/2024 6

11 12

Designated beneficiary (DB) vs. Non-DB

• The Code mandates different RMDs for the beneficiary who inherits a retirement account based on whether the beneficiary is or is not a “designated beneficiary.” The Code defines “designated beneficiary” (DB) as “any individual designated as a beneficiary by the employee.” § 401(a)(9)(E)(I).

• The Proposed Regulations define DB as “an individual who is a beneficiary designated under the plan.” Prop. Reg. § 1.401(a)(9)-4(a)(1)

DB vs Non-DB Continued

• The Proposed Regulations provide, for each type of beneficiary, in effect, an annual distributions track plus a final payout year.

• When the final payout year arrives, it overrides any life expectancy payout then in progress. See Prop. Reg. § 1.401(a)(9)-5(e) therefore regardless of what the schedule of annual payments is, the payouts must be completed and end in a certain year 100% distribution is required in that final year.

• For EDBs generally, the final payment year is the tenth calendar year following the calendar year of the EDB’s death; in other words the final payment year generally does not apply to the EDB himself, it applies to the successor beneficiary of the EDB. Prop. Reg. § 1.401(a)(9)- 5(e)(3).

3/5/2024 7

13 14

DB vs Non-DB (Continued)

• Because the Proposed Regulations’interpretation that RMDs were still required during the 10-year period was a surprise the IRS has issued a Notice that it will NOT enforce the 25% excise tax (IRC § 4974) against the successor beneficiary of an EDB for the years 2021 and 2022 (relative to EDBs who died in 2020 or 2021. However, for an EDB who is an EDB solely because he or she is the child of the employee who had not reached majority (“minor child-EDB”), it is the tenth calendar year following the year the beneficiary reaches majority, i.e., the calendar year of his/her 31st birthday. Prop. Reg. § 1.401(a)(9)-5(e)(4).As applied, it means the calendar year that contains the 10th anniversary of the earlier of the minor’s death or the minor’s 31st birthday.

Life Expectancy pay out

• The annual RMD is determined by dividing the prior year-end account balance by the remaining life expectancy of the designated beneficiary. Annual RMDs are smaller for young beneficiaries and get larger over the years as the beneficiary’s life expectancy (formerly called the divisor, now called theApplicable Denominator) gets smaller.

• Prior to SECURE the life expectancy payout method was utilized in estate planning by making a client’s retirement benefits payable to a young designated beneficiary. SECURE took away that option for most clients, but the life expectancy payout method still exists for the 5 categories of “EDBs”

• IRS updated its tables for determining life expectancy for RMD purposes (effective for 2022 and later years)

3/5/2024 8

15 16

No change in rules for Non-DBs

RMDs for a Non-DB is unchanged by SECURE and unchanged by the Proposed Regulations and as a review are as follows:

• 5-year rule If the participant dies before RBD, the 5-year rule applies. Generally, all benefits must be distributed by the end of the year that contains the fifth anniversary of the participant’s date of death. No payments are required before the final payout year. In the final year, 100% of the account becomes the RMD.

• Ghost life expectancy. If the participant dies on or after RBD, the Non-DB must take annual distributions over what would have been the participant’s life expectancy if the participant hadn’t died. In the RMD literature , this is often referred to as the “ghost life expectancy.” As in all cases of participant’s death after the RBD, the beneficiary must also take the distribution for the year of death if the participant had not taken RBD prior to death.

RMDs for Designated Beneficiary (DB)

• ADB is subject to the 10-year rule regardless of whether the participant died before or after the RBD. § 401(a)(9)(H)(i).

• The “10-year rule,” created by SECURE, was modeled on the 5-year rule. It applies to a Designated Beneficiary (DB) who is not an Eligible Designated Beneficiary (EDB).

• Here is how the 10-year rule works:

i. 10-Year Rule - requires no distributions prior to the 10th year. Prop. Reg. § 54.4974-1(c): “(3) 10-year rule. Distributions satisfy this paragraph (c)(3) if the employee’s entire interest is distributed by the end of the calendar year that includes the tenth anniversary of the date of the employee’s death; and

ii. is not connected to any life expectancy payout

iii. HOWEVER, according to the Proposed Regulations the “At LeastAs Rapidly Rule” (theALAR Rule) requires annual life-expectancy payments within the 10-year rule period where Participant dies after his or her RBD!

3/5/2024 9

17 18

At Least As Rapidly Rule

• Biggest Surprise under the Proposed Regulations! If the participant dies after RBD, the Proposed Regulations state that annual RMDs must continue to be made after the participant’s death even though the 10-year rule also applies. How can this be? While the IRS agrees there are no distributions required under the 10year rule until the 10th year, in enacting the SECUREAct, Congress did not repeal § 401(a)(9)(B)(i), so § 401(a)(9)(B)(i) is still in force and applicable and still must be complied with even when the 10-year rule also applies!

• § 401(a)(9)(B)(i) provides that when Participant dies after RBD, distributions must continue to be made (to the beneficiary) “at least as rapidly” as before the participant’s death.

• This was a huge surprise to practitioners, beneficiaries and plan administrators, so the IRS issued Notice 2022-53 stating the 25% excise tax (§ 4974) will not be enforced against any designated beneficiary who: (1) inherited from a participant who died in 2020 or 2021 after the RBD and (2) is subject to the 10-year rule, with respect to RMDs required in 2021 or 2022.

At Least As Rapidly Rule (cont)

• the proposed regulation require a DB to take annual RMDs, based on the DB’s life expectancy, beginning the year after the year of the participant’s death.

• This continues each year until the year that contains the 10th anniversary of the participant’s death, at which time the 10-year rule takes over and requires 100% distribution of the account. Prop. Reg. § 1.401(a)(9)-5(d)(1)(i) (last sentence), -5(e)(1), (2).

• Greater of Rule. “(ii) Employee with designated beneficiary. If the employee has a designated beneficiary as of the date determined under §1.401(a)(9)-4(c) the applicable denominator is the greater of (A) The designated beneficiary’s remaining life expectancy; and (B) The employee’s remaining life expectancy.”

• Under the “greater of” rule, if the DB or EDB is younger than the decedent, the minimum annual distribution under theALAR rule will be determined using the beneficiary’s life expectancy with 100% distribution under the 10 year rule.

3/5/2024 10

19 20

RMD rules for Eligible Designated Beneficiaries (EDBs)

• Only an “eligible designated beneficiary” (EDB) is entitled to the “life expectancy payout exception” of § 401(a)(9)(B)(iii)

• Generally, RMDs to an EDB are calculated using the life expectancy payout, just as was done for all designated beneficiaries prior to SECURE

• Annual RMDs commence the year after the year of the participant’s death) by dividing the prior year end account balance by the factor (on IRS tables) for the beneficiary’s age on his/her birthday in that year after the death and repeating the process annually, reducing the divisor by one each year until the factor drops to one or below.

• If the EDB dies before his or her life expectancy has run out, the successor beneficiary will continue to take RMDs on the same schedule the EDB was using (same rule as before SECURE);but now under SECURE, the successorbeneficiary must withdraw 100% of the account in the year that contains the 10th anniversary of the EDB’s death even if the “life expectancy payout period” for the EDB under the tables has not run out.

RMD Rules for EDB when Participant dies before RBD

• 10-year rule may apply to EDB – SECUREAct itself states that the life expectancy payout “shall apply only in the case of an eligible designated beneficiary.”

• If the participant dies before his or her RBD, under the proposed regulations, the life expectancy payout is not the EDB’s only option. When participant dies before his or her RBD, the 10-year rule could apply to the EDB instead of the life expectancy payout if any of the following applies:

• the applicable plan document requires it, or

• the participant directs in the beneficiary designation form that the 10-year rule will apply (and such direction is permitted by the plan), or

• the EDB elects it (and such election is permitted by the plan). Prop. Reg. § 1.401(a)(9)-3(c)(5)(iii).

3/5/2024 11

21 22

RMD Rules for EDB when Participant dies after Participant RBD

• If the participant dies after his or her RBD, theApplicable Denominator for determining annual RMDs to an EDB is the longer of the EDB’s life expectancy or the participant’s life expectancy (the “longer of” rule). Prop. Reg. § 1.401(a)(9)2(a)(4). This is a carryover from pre-SECURE treatment of all DBs. See Reg. § 1.401(a)(9)-5(d)(1)(ii).

• Three (3) limitations for life expectancy payouts (“outer limits” applicable to EDB payouts).

i. 10 years after death of EDB. SECUREAct limits how long a life expectancy payout can continue after the death of the EDB. Prior to SECURE, the designated beneficiary’s successor beneficiary would step into the shoes of the deceased DB and simply keep taking RMDs over the remaining life expectancy of the DB until it was reduced to one year or less; but now there is a cap on how long that payout can continue: 100% of the account must be distributed no later than the year that contains the 10th anniversary of the death of the EDB. § 401(a)(9)(H)(iii); Prop. Reg.§ 1.401(a)(9)-5(e)(3).

ii. EDB’s life expectancy: The second limit is the final year of the EDB’s life

RMD Rules for EDBs (continued)

ii. EDB’s life expectancy: The second limit is the final year of the EDB’s life expectancy, which is a hard cap on distributions (100% must be distributed by the end of that year).

iii. For Minor-child EDB, 10 years after age-21 birthday (or earlier death). SECURE further provides that in the case of a minor child of the participant, EDB status ends upon reaching majority, so the payout must end in the year that contains the 10th anniversary of the earlier of such child’s death or the year in which he such child reaches majority. § 401(a)(9)(E)(iii).

3/5/2024 12

23 24

RMD Rules for EDBs - Limitations

• Comment: Some EDBs now worse off than before SECURE

• Purpose of SECURE was to retain existing life expectancy payout rules for “eligible designated beneficiaries and shorten the payout period for other designated beneficiaries and for the “successor beneficiaries” of the EDBs. EDBs were to be the protected class for whom the pre-SECURE rules are preserved (or, in the case of disabled and chronically ill beneficiaries, even made more favorable). But with the “shorter of” rule of Prop. Reg. § 1.401(a)(9)-5(e)(5), the IRS is making things decidedly WORSE for elderly EDBs. Under the existing regulations (pre-SECURE) the distribution period for the designated beneficiary of an employee who died after his or her RBD is...” Reg. § 1.401(a)(9)-5, A5(a)(1). “the longer of (i) The remaining life expectancy of the employee’s designated beneficiary...; and (ii) The remaining life expectancy of the employee

• The proposed regulations adopt a “shorter of” rule for the existing “longer of” rule for (effectively) all EDBs who are older than the participant, if the participant died on or after his or her RBD.

Elderly EDBs Worse off Under Proposed Regulations

• Example: The designated beneficiary of Ken’s IRAis his mother Janice who is 22 years older than Ken.

• If Ken dies at age 72 (before his RBD), therefore, Janice inherits at age 94, Janice's life expectancy is only 4.3 years; but as an EDB (No more than10 years younger EDB. Janice can elect the 10-year rule and so withdraw the IRAgradually over that period of time. However, if Ken dies after his RBD and Janice is now 95 with a life expectancy of 4.0 years. and no more option to elect the 10year rule, Ken would have been better advised to leave the IRAto his own estate (non-DB), which would at least get the benefit of his “ghost life expectancy” (about 16 years at age 73). That would produce better results for Janice, who is the sole beneficiary of his estate!

3/5/2024 13

25 26

Rules and Limitation applicable to each of 5 types of EDBs

- #1 Surviving Spouse

1. The participant’s surviving spouse is an EDB and is therefore eligible for life expectancy payout. The special rules for determining when payouts to the surviving spouse must commence, how such payments are computed, and what happens if the surviving spouse dies before being required to start taking such distributions appear not to have been changed by SECURE or the Proposed Regulations except RMDs commence at age 73 instead of age 70 and ½.

• The general rule is that a beneficiary who is required to take life-expectancybased RMDs must commence such RMDs the year after the year of the participant’s death, there is a special rule for the surviving spouse. If the participant died before the year in which he or she would have turned age 73, the spouse is not required to commence distributions until the later of the year after the year of death of the participant or the year in which the participant would have attained age 73 [age 70½ if the deceased participant was born before July 1, 1949]. § 401(a)(9)(B)(iv); Prop. Reg. § 1.401(a)(9)-3(d).

#1 -Surviving Spouse as EDB

• Unlike other EDBs, the surviving spouse’s life expectancy is recalculated annually. the surviving spouse (while living) will not be required to withdraw 100% of the inherited account until attaining the age of 120, when the life expectancy finally drops to one year or less. Thus, unlike other EDBs, as a practical matter the Surviving Spouse cannot outlive his or her own life expectancy.

• At death of surviving spouse, life expectancy is “frozen” at that point, and thereafter reduced by one each year for purposes of calculating RMDs to the successor beneficiary.

• Spouse may do a spousal rollover or an election to treat the participant’s IRA as the surviving spouse’s IRA.

3/5/2024 14

27 28

#2 Minor Child of Participant as an EDB

• RMDs based on life expectancy continue until the child “reaches majority.” The account must be fully distributed 10 years after that point (or 10 years after the child dies, if death occurs before reaching majority). § 401(a)(9)(E)(ii)(II), (E)(iii)

• Age of majority is 21 years old.

• the entire account payable to a minor child-EDB must be distributed by the end of the year that contains the minor’s 31st birthday (or date of death, if death occurred before age 21). Prop. Reg. § 1.401(a)(9)5(e)(1), (3), (4).

#2 continued –

Trusts for Minor Children of Participant

• Amajor uncertainty for planners after enactment of SECURE has been the options for structuring a trust for minor children: How can such beneficiaries be provided with the protections of a trust (needed due to their youth) while minimizing the negative tax impacts of a trust?

• Planning problems:

• Atrust could be drafted as a conduit trust; but the conduit trust concept did not work well with large IRAs (annual distributions too large to be absorbed by expenditures on minor’s behalf).

• Pre-SECUREAct, it was unclear whether a “pot trust” for multiple children could qualify as a conduit trust. It now clearly does under the Proposed Regulations Prop. Reg. § 1.401(a)(9)-4(1)(ii)(A)).

3/5/2024 15

29 30

Problems with trusts for minor child of participant (continued)

• There was also a problem with “accumulation trusts” for minor children: Typically, the trust would hold funds until the minor reached a certain age But then the trust had to specify who would receive what was left in the trust if the minor died before reaching that age...and if this contingent remainder beneficiary were older than the minor, the remainder beneficiary’s life expectancy, not the child’s, would be the payout period.

• If the remainder beneficiary were a charity, the trust would flunk the RMD trust rules altogether because it had a countable non-individual beneficiary.

• The Proposed Regulations provide an easy way to eliminate this problem just specify that the minor will receive his or her share outright by age 31. Any beneficiary who will take the share only if the child dies BEFORE age 31 is disregarded in applying the RMD rules to the trust, if the child is a first tier beneficiary Prop. Reg. § 1.401(a)(9)- 4(f)(3)(ii)(B).

Improvements for minor child trusts under the Proposed Regs

• The following new rules in the Proposed Regulations substantially improve accumulation trusts for minor children of the participant:

• Age 21 is the age of majority

• Any minor child EDB qualifies for “EDB” treatment in computing annual RMDs for the trust.

• Life expectancy payout based on oldest DB (not oldest minor child) If the retirement account is left to a trust of whichANY countable beneficiary is a minor child EDB, that trust will receive “eligible designated beneficiary” treatment, and will use a life expectancy payout (not be subject to the 10-year rule) because the employee is deemed to have an EDB: “If any of the employee’s designated beneficiaries is an eligible designated beneficiary because the beneficiary is the [minor child of the employee]...then the employee is treated as having an eligible designated beneficiary even if the employee has other designated beneficiaries who are not eligible designated beneficiaries.” Prop. Reg. § 1.401(a)(9)- 4(e)(2).

3/5/2024 16

31 32

Proposed Regs Improvements (continued)

• the 10-years-after-reaching-majority limit is based on the trust’s oldest minor child EDB, even if he or she is not the oldest countable beneficiary of the trust

• the “age 31-disregard” rule

#3 Disabled or Chronically Ill EDB

• Here is how you establish the designated beneficiary is disabled (§ 401(a)(9)(E)(ii)(III)) or chronically ill (§ 401(a)(9)(E)(ii)(IV)).

i. the beneficiary must meet the definition of “disabled” or “chronically ill”. In either case the status must exist as of the date of the participant’s death.A beneficiary who does not become disabled or chronically ill until some later time is not disabled or chronically ill for EDB purposes

ii. Applicable Multi-Beneficiary Trusts facilitate trust planning for disabled/chronically ill beneficiaries SECURE granted special rules to facilitate EDB status and lifetime payout to what it calls “Applicable Multi-Beneficiary Trusts.” § 401(a)(9)(H)(iv), (v). The apparent purpose of these these special rules is to facilitate creating a “supplemental needs trust” (SNT) for a disabled or chronically ill (D/CI) beneficiary while still qualifying for the life expectancy payout granted to such beneficiary as an EDB.

3/5/2024 17

33 34

AMBTs (continued)

• What is aApplicable Multi-Beneficiary Trust (“AMBT”) SecureAct defines it as “For purposes of this subparagraph, the term ‘applicable multibeneficiary trust’means a trust (I) which has more than one beneficiary, (II) all of the beneficiaries of which are treated as designated beneficiaries for purposes of determining the distribution period pursuant to this paragraph, and (III) at least one of the beneficiaries of which is an eligible designated beneficiary described in subclause (III) [disabled] or (IV) [chronically ill] of subparagraph (E)(ii).” § 401(a)(9)(H)(v). ...and the Proposed Regulations’definition: “An applicable multi-beneficiary trust is a See through trust with more than one beneficiary and with respect to which-(i)All of the trust beneficiaries are designated beneficiaries; and (ii)At least one of the trust beneficiaries is an eligible designated beneficiary who is disabled (as defined in paragraph (e)(1)(iii) of this section) or chronically ill (as defined in paragraph (e)(1)(iv) of this section).” Prop Reg. § 1.401(a)(9)-4(g)(1).

Type 1 and Type 2 AMBTs

• The proposed regulations define two types ofAMBTs.

i. “Type I” is anAMBT that “is to be divided immediately upon the death of the employee into separate trusts for each beneficiary.”

ii. Type II AMBT is anAMBT the terms of which “identify one or more individuals” who are disabled or chronically ill and who are “entitled to benefits during their lifetime,” [sic] provided that “no individual (other than...[an individual so identified]) has any right to the employee’s interest in the plan until the death of all of the eligible designated beneficiaries described in...[(A), i.e., the D/CI individual(s) “identified” as receiving benefits during “their lifetime”].”

3/5/2024 18

35 36

Why is Type 1 AMBT important?

• Type IAMBTs were recognized as See Through Trusts to exempt suchAMBT from the effects of Reg. § 1.401(a)(9)-4, A-5(c), which disallows “separate accounts” treatment (for purposes of determining the applicable distribution period) for subtrusts created out of a single trust named as beneficiary of the retirement account, even if the creation of such subtrusts is mandated at the employees’ death under the terms of the trust.

• Under The 2002 regulations, such subtrusts can be recognized as separate beneficiaries only if they are designated directly as beneficiaries in the beneficiary designation form. If the single (“funding”) trust qualifies as anAMBT, the Applicable Denominator is determined separately for each of the subtrusts.

Type 1 AMBTs (continued)

• Note that each subtrust so created has its payout period determined as if it were a separate trust, not just the subtrust that has one or more D/CI beneficiaries. § 401(a)(9)(H)(iv); Prop. Reg. § 1.401(a)(9)-8(a)(1)(iii)(B). In other words a Type IAMBT is exempt from Reg. § 1.401(a)(9)-4,A-5(c).

3/5/2024 19

37 38

Why Do We Care about Type 2 AMBTs?

• By providing that anAMBT that has no beneficiary other than the Disabled/Chronically Ill beneficiary “has any right to the employee’s interest in the plan” as long as a Disabled/Chronically Ill beneficiary is living, the Code allows a trust to accumulate plan distributions received during the lifetime of the beneficiaries and without the trust being a conduit trust it can still use the life expectancy payout applicable to the disabled EDB, even though there are other trust beneficiaries who are not EDBs.

Not more than 10 years younger EDBs

• To qualify as an EDB, the individual must meet two requirements.

i. Beneficiary does not fit into any of the other EDB categories (e.g., he/she is not the participant’s spouse).

ii. Beneficiary must be either older than the participant; or the same age as the participant; or younger but not more than 10 years younger than the participant.

Note: The proposed regulations define this category of EDB based on the actual dates of the parties’birth, not the year of birth: “Prop. Reg. § 1.401(a)(9)-4(e)(6)

3/5/2024 20

39 40

Not More than 10 years younger EDBs (cont)

• Participant dies before RBD. In general, this category of EDB will have RMDs determined based on the life expectancy of the EDB. If the participant died before RBD, theApplicable Denominator will be the EDB’s remaining life expectancy, with RMDs starting the year after the participant’s death. Prop. Reg. § 1.401(a)(9)-3(c)(4), § 1.401(a)(9)-5(d)(2). The Outer Limit Year for this situation is the year that contains the 10th anniversary of the EDB’s death. Prop. Reg. § 1.401(a)(9)-5(e)(3). Therefore, the final year of RMDs will be the final year of the EDB’s life expectancy, or the year that contains the 10th anniversary of the EDB’s death, whichevercomes first

Not More Than Ten Years Younger EDB (cont)

• Participant dies on or after RBD. Applicable Denominator for the beneficiary is the “greater of” the beneficiary’s life expectancy or the participant’s life expectancy. Prop. Reg. § 1.401(a)(9)5(d)(ii). If the beneficiary was older than the participant, the participant’s (longer) life expectancy is used to determine annual RMDs to this EDB. This is usually called the “longer of” or “greater of” (the two life expectancies) rule.

• However, here comes the surprise in the Proposed Regulations: For the Outer Limit Year, a “shorter of” rule (brand new in the Proposed Regulations) kicks in: If the EDB was older than the participant, 100% of the account must be distributed no later than the final year of the EDB’s life expectancy! The “shorter of” (or “lesser of”) rule! Prop. Reg. § 1.401(a)(9)-5(e)(5). This “shorter of” rule is a new creation. Under existing regulations, the distribution period for a designated beneficiary in cases of participant’s death after the RBD was the longer of the beneficiary’s or the participant’s life expectancy! See Reg. § 1.401(a)(9)-5,A-5(a)(1). This “shorter of” rule almost exclusively affects the Not More Than Ten years Younger EDB!

3/5/2024 21

41 42

Effect of “Shorter Of” Rule

• It does not affect the surviving spouse, even if he or she is older than the participant, because a surviving spouse has an escape hatch and can rollover the account and avoid the rule.

• It would apply to a conduit trust for the surviving spouse, if the surviving spouse is older than the decedent and he or she died after his or her RBD, but since the surviving spouse’s life expectancy is recalculated annually it does not run out until age 120.

• It cannot affect a Minor Child-EDB, since the participant’s minor child cannot be older than the participant. It does not apply to trusts for minor-child-EDBs or to AMBTs because both those types of trusts are specifically exempted from this rule; Thus, the only types of beneficiaries actually subject to this rule are Not More Than Ten Years Younger EDBs who are older than the participant, and Disabled/Chronically Ill beneficiaries who are older than the participantAND who are named directly as beneficiary (rather than benefitting through anAMBT named as beneficiary).

See Through Trust, Conduit Trust and Accumulation Trust

• For the first time, we have definitions of terms that have been in common use for years:

• See Through Trust defined: ASee-through Trust is a trust that is “designated as the beneficiary of an employee under a plan” and which meets the requirements of Prop. Reg. § 1.401(a)(9)-4(f)(2). The effect of a See-through Trust is that certain beneficiaries are treated as having been designated as beneficiaries of the employee. Having a See-through Trust is the first step in order to have the beneficiaries of the trust be treated as designated beneficiaries; but does not guarantee that the trust will qualify for any life expectancy payout or even the 10-yearrule.

3/5/2024 22

43 44

See Through Trust (Cont)

• ATRUST MAY QUALIFYAS ASEE THROUGH TRUSTAND STILLNOT HAVE THE TRUST BENEFICIARIES QUALIFY AS “DESIGNATED BENEFICIARIES.

• ALSO NOTE: Even though the trust beneficiaries are deemed to be the beneficiaries of the retirement plan, the trust is considered the “payee” for purposes of the 25% excise tax for failure to make an RMD or under distribute (§ 4974), so the trustee will be responsible for paying that tax. Prop. Reg. § 1.401(a)(9)-8(a)(1)(iii). “The determination of which beneficiaries of a see-through trust are treated as having been designated as beneficiaries of the employee...depends on whether the see-through trust is a conduit trust or an accumulation trust.” Prop. Reg. § 1.401(a)(9)-4(f)(ii).

Conduit Trust

• AConduit Trust is a See-through Trust that provides, with respect to the deceased participant’s interest in the retirement plan account, that “all distributions [from such retirement account] will, upon receipt by the trustee, be paid directly to, or for the benefit of, specified beneficiaries.” Prop. Reg. § 1.401(a)(9)-4(f)(1)(ii)(A). For the first time, the IRS has recognized that a conduit trust can be for more than one designated beneficiary.

3/5/2024 23

45 46

Accumulation Trust

• AnAccumulation Trust is “any See-through Trust that is not a conduit trust.” Prop. Reg. § 1.401(a)(9)-4(f)(1)(ii)(B

• The payout period for RMDs after the participant’s death depends on the identity of the beneficiary of the account (i.e. payout period different for an EDB, DB, Non-DB etc.).Atrust has multiple potential beneficiaries current beneficiaries, remainder beneficiaries, contingent remainder beneficiaries, etc. To determine theApplicable Denominator (i.e., the payout period under the minimum distribution rules) for a trust named as beneficiary of a retirement account, you need to know which of those trust beneficiaries “count” as beneficiaries and which can be disregarded

Accumulation Trust and “Mere Potential Beneficiaries”