SPECIAL REPORT INSIDE THIS ISSUE

Market Talk: Real Estate Market Learning to Embrace Sustainability Green Business

Analysts agree that commercial real estate projects are becoming more sustainable and efficient, notably in the office and industrial sectors. To what extent this is due to market demand, financial pressure, or regulatory influences remains to be seen.

Inflation Keeps Breaking Records, Still Far From Peak

Consumer prices in Hungary are rising at a nearly unprecedented pace, and, according to analysts, there is no turning point visible on the foreseeable horizon.

In August, the consumer price index in Hungary accelerated to 15.6%, up from 13.7% in July, breaking another 24-year record.

Developing Along New Lines

A challenging time to do business is prompting a different approach in real estate, says Mátyás Gereben of CPI Hungary, where it provides “not only physical space but energy solutions, sustainability solutions, community solutions.”

Offices that combine classic luxury with modern technology to ensure a professional work environment and an outstanding visitor experience.

BUSINESS HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BBJ.HU VOL. 30. NUMBER 17 SEPTEMBER 23 – OCTOBER 6, 2022 HUF 1,850 | EUR 5 | USD 6 | GBP 4

13

3

9

www.academiaoffices.hu NEWS

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, David Holzer, Christian Keszthelyi, Renáta Kónya, Gary J. Morrell, Nicholas Pongratz, Gergely Sebestyén, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES:

Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

ONLINE: WWW.BBJ.HU

ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

THE EDITOR SAYS

KEEP BEING CURIOUS

If you will forgive me the indulgence, it has been an unsettling couple of weeks. The death of Queen Elizabeth II affected me much more than I thought it would.

Though I accept the concept of a constitutional monarchy is absurd for a liberal democracy, it is what the British have, and I see no great need to change it. Apart from anything else, it gives us a point of continuity that stretches back to William the Conqueror, which is quite something when you stop to think about it.

Hers was a life of service. Whether you are a monarchist or not, whether you are British or not, you cannot but admire a woman who proved more resolute and committed, dare I say it, than the vast majority of the politicians and statesmen and women she has seen come and go: 15 British prime ministers, 14 U.S. presidents (13 of whom she met); five freely elected Hungarian PMs.

Continuity proved to be one of the watchwords of the period of national morning that followed the death of the late queen. In my mind, she was, despite her diminutive stature, the Long Queen, the only British monarch in my 55 years on this earth, one stable point in an ever-changing world. She seemed at once frail and indestructible, and I felt much the same about my mother, 92, and my dog, a rescued German ShepherdHusky cross who is at least 15, quite possibly older.

But that’s the rub. The Long Queen is dead. My mother is unwell in hospital, and my dog is increasingly unsteady on her feet. The undeniable fact of the Long Queen’s mortality can only point to theirs. Queen Elizabeth’s death is unsettling even if there is solace in her own words: “Grief is the price we pay for love.”

But that is not the only factor behind my disturbed state of mind. Assuming you read this on our publication day and all has gone well, I will be back in the United Kingdom. I will, of course, visit my mother, though she may well not recognize me, but that is not the only reason for me being there. I will accompany my eldest daughter to help her move into her university accommodation.

It is, for her, a grand moment, the start of the next great adventure in her life; she worked incredibly hard for it and deserves all her success. But for her mother and I, it is also the end of something. My wife, given that special mother-daughter bond, will have her moment at the airport on Thursday; mine will be on the train on the way back from London on Saturday evening.

It is inevitable and natural. Parents across this country have already gone through the same as their children take up courses in hometown universities or further afield. It is a passing of the baton to a bright young generation. But still, it hurts. Only now do I know something of what my parents must have felt when I moved to Hungary all those years ago.

I was talking with a recruitment agency head last week and wondered what her advice would be to the cohort starting university this month. “Keep being curious,” she said. And not just now, get into the habit of continuous learning, she added.

As a journalist, I cannot help but like that. So, to my brave, clever and beautiful daughter Lili (she takes after her mother on all counts), and to all those starting their university studies across this country and abroad, I salute you, wish you well, and urge you to “Keep being curious.”

Robin Marshall Editor-in-chief

THEN & NOW

Historical and contemporary trams lined up in Budapest on September 17 to celebrate European Mobility Week, as captured in this photo from the state news agency MTI. In the black and white image from the Fortepan public archive, trams pass by Budapest’s Western Railway Station (Nyugati pályaudvar) sometime between 1890 and 1900.

Photo by MTI / Noémi Bruzák

Photo by Fortepan

Budapest Főváros Levéltára

Klösz György fényképei

2 | 1 News www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US

IMPRESSUM BBJ-PARTNERS

/

/

macroscope

Inflation Keeps Breaking Records, But Still Seems Far From its Peak

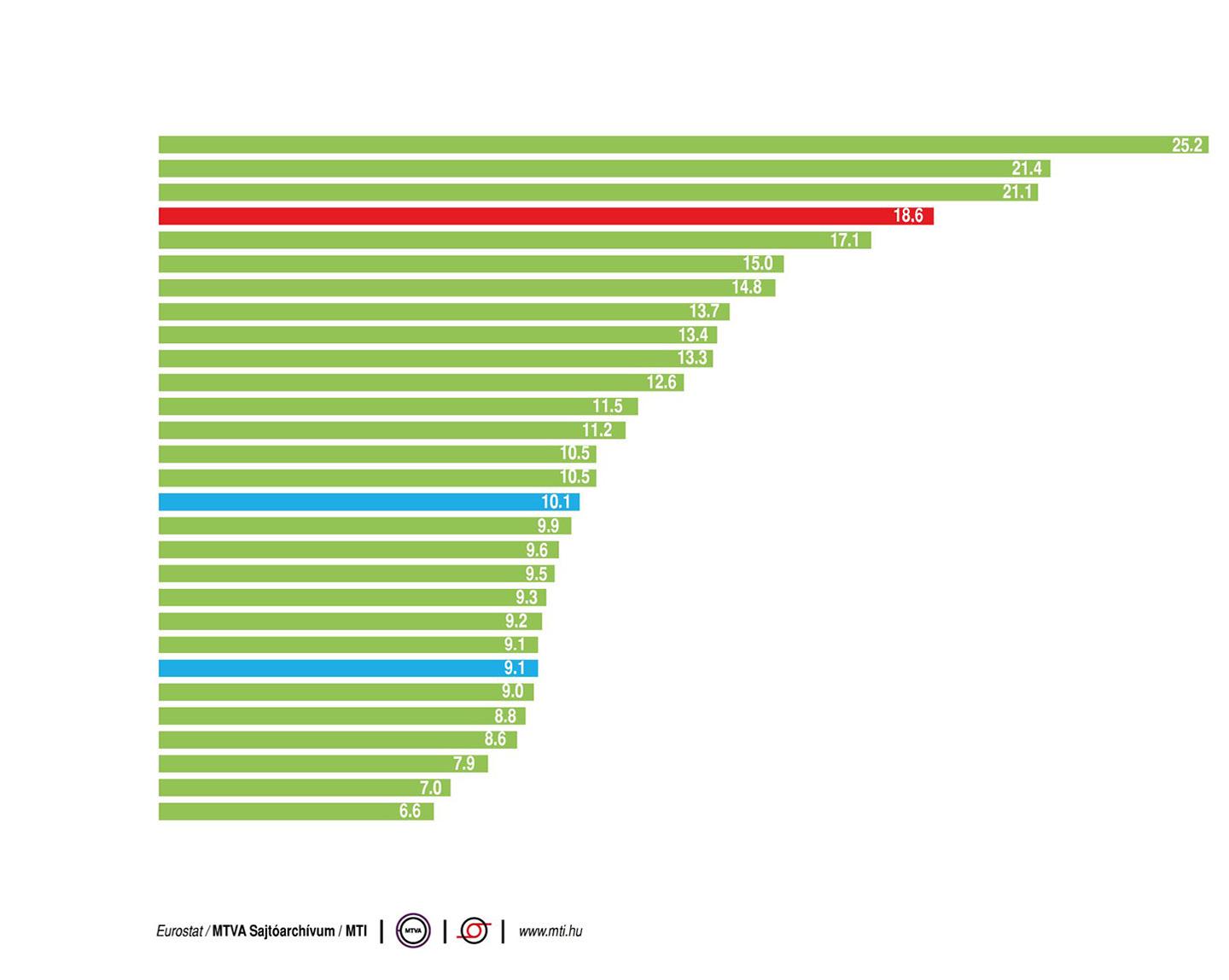

Inflation in EU Member States (August 2022) 12-month change in consumer prices

durables. The smallest average price increase of 2.1% was found in household energy; the increase in official energy prices above the average consumption will appear in the September data.

In August, inflation in the Eurozone accelerated from 8.9% to 9.1%; a peak cannot be observed here either, although the monthly rate in several countries was negative. There is a significant difference between individual countries: while Estonian inflation already exceeds 25%, French inflation is only 6.5%, Regős pointed out.

Hungarian inflation is expected to increase further in the coming months due to the weak forint exchange rate, record-high energy prices on the world market, poor harvests, and changes in official energy prices above average consumption, the analyst said.

The rate of inflation climbed above 10% in the European Union, with Hungary among those countries way above the EU average. In August, the consumer price index in Hungary accelerated to 15.6%, up from 13.7% in July, breaking another 24-year record.

The rising price pressure is reflected in the fact that core inflation jumped sharply to 19%, far exceeding expectations. The surprise was caused by the higher-than-expected increase in food prices and other consumer goods and services.

Due to inflation that is much higher than expected, the substantial weakening of the forint, the public health product tax, and the increase in the excise tax on tobacco products and alcoholic beverages, continued repricing due to the sharp increase of raw materials and energy costs in many product lines, and the partial lifting of the freeze on household energy prices, Takarékbank is raising average inflation expectations for this year and next to 13.4% and 11.9%, said head analyst Gergely Suppan.

He added that inflation could be increased by another four or five percentage points if the price restrictions on certain foods and fuels were abolished entirely, which could have resulted in average inflation of 14.3% this year and 14% next year. Suppan added that the abolition of price restrictions could also lead to a faster decrease in inflation, albeit from a much higher level, once the price of the affected products fell.

(Subsequent to him making those comments, the government has announced the prolongation of price caps until the beginning of next year.)

Permanent Inflation?

It was necessary to start the interest rate hike cycle due to the high inflation that, increasingly, seems to be permanent. In addition, the secondary effects of raw material and energy prices also represent an upward risk, together with the exploding demand after the reopening, with which supplies struggled to keep pace, Suppan said. Wages are also expected to jump significantly due to the labor shortage; all this leads to an increase in inflation expectations, meaning the National Bank of Hungary will continue the interest rate hike cycle.

Surging gas and electricity prices appear in many sectors and almost all industrial processes, from bakery goods and catering to fertilizers for food production, to the chemical industry, metal processing, and construction material production, also causing significant price increases.

In the coming months, due to repricing, tax increases, and the partial removal of the freeze on household energy prices, inflation will continue to rise significantly, which could reach 22% without the price-limiting measures and would exceed 25% without the freeze on household energy

prices below average consumption. The maintenance of price restrictions preceded a significant price shock, the analyst noted.

Although inflation in August accelerated to 15.6% from 13.7% in the previous month, it developed more favorably than the market consensus had predicted, commented Századvég analyst Gábor Regős.

The monthly inflation actually decreased from 2.3% in July to 1.8% in August, which is still a significant value, but, considering the tax increases in August, it was not a surprise, he said.

Factors at Play

At the same time, the lower value in August means that the effect of the tax increases was already partly visible in the July data. In addition, the high level of inflation, as in the previous months, is primarily caused by soaring energy prices, but the weak forint exchange rate, the disruption of supply chains due to the war, and, increasingly, the very poor harvest due to the drought also play a role.

Compared to the previous month, inflation accelerated for all product groups. The currency deterioration is the biggest concern in the case of foodstuffs, where prices rose by an average of 30.9% year-on-year after a 27% increase in the previous month.

The second most significant growth, 14.8%, was measured for consumer

In the coming months, due to repricing, tax increases, and the partial removal of the freeze on household energy prices, inflation will continue to rise significantly, which could reach 22% without the price-limiting measures and would exceed 25% without the freeze on household energy prices below average consumption.

The stabilization of the energy market and the strengthening of the forint are necessary for inflationary processes to become more favorable. Accordingly, the central bank must further tighten monetary policy, meaning the base interest rate may continue to rise in September, Regős concluded.

Numbers to Watch in the Coming Weeks

The Central Statistical Office will release the August data for Hungary’s industrial production on October 6. On the same day, August retail trade figures will be published. In the meantime, the Monetary Council of the National Bank of Hungary will hold its next rate-setting meeting on September 27.

Consumer prices in Hungary are rising at a nearly unprecedented pace, and, according to analysts, there is no turning point visible on the immediate horizon.

ZSÓFIA CZIFRA

www.bbj.hu Budapest Business Journal | September 23 – October 6, 20221News •

Estonia Latvia Lithuania Hungary Czech Rep. Bulgaria Poland The Netherlands Slovakia Romania Croatia Slovenia Greece Spain Belgium EU average Denmark Cyprus Sweden Portugal Austria Italy Euro area average Ireland Germany Luxembourg Finland Malta France

Source:

Szijjártó Calls Russian gas cap ’Absurd’, Wants Focus on Peace

government support for the regulated gas and electricity prices amounted to a monthly HUF 150,000 per household.

Crisis

Assembly not as some kind of narrative contest but to achieve peace.”

According to a survey by Századvég Foundation, some 86% of Hungarians would prefer Ukraine and Russia to sit down for talks to end the war instead of imposing sanctions on Russia. Some 50% of respondents said the sanctions currently in force against Russia were “over the top,” another 25% saw them as “adequate,” with no need for further measures, while 20% considered sanctions not stringent enough.

“This is not a prediction; this is a statement of fact,” Orbán said in the post on September 10. “There will be gas and enough electricity in Hungary.”

Consequently, Hungary’s government decided to mandate a 25% reduction in gas consumption at state institutions, barring hospitals and nursing homes, and state-owned companies, the PM’s chief of staff Gergely Gulyás said, according to state news agency MTI.

He added that the government could maintain the regulated utilities price system for households, up to average consumption, calling on consumers to keep their gas and electricity use “within reason.” Gulyás added that

After a meeting of European Union energy ministers in Brussels on September 9, Minister of Foreign Affairs and Trade Péter Szijjártó said the European Commission’s proposal to put a price cap on Russian gas delivered to Europe was “absurd.”

He added that the proposed cap would raise prices and put Hungary’s energy supply at risk, emphasizing that gas accounts for 40% of the country’s energy consumption. He said that nine member states were opposed to or had expressed reservations concerning the gas price cap at the meeting. Szijjártó added that Hungary has enough gas in reserves to cover 38% of consumption, well above the 22% average ratio for the EU.

Make Peace the Priority

Later, at the United Nations General Assembly (UNGA) in New York, Szijjártó said peace should be the main topic of discussion, according to a video message posted on Facebook on September 20. Szijjártó said fellow EU foreign ministers had earlier discussed how to change the global perspective that the impact of sanctions is more significant than the effect of the war itself.

“I think this is a waste of time, and we finally have to focus on peace,” he said. “We have to use the UN General

ITR Names Andersen Tax Firm of the Year in Hungary Again

According to the prestigious International Tax Review, Andersen was again the best performing Hungarian tax advisor this year. For the second year in a row, the firm has earned the highest professional accolade of the year, while also collecting the Indirect Tax Firm of the Year award.

Founded in 1989, the International Tax Review (ITR), one of the world’s leading tax journals, has awarded Europe’s best tax advisory service companies for the 18th time. A jury of ITR’s editors and experts ranked the candidates’ performances in several categories based on the volume and complexity of the tasks they had completed during the period, the innovative nature of their implementation, and feedback from clients.

To win the ITR EMEA Tax Award 2022 / Hungary Tax Firm of the Year title, Andersen beat off competition from Deloitte, DLA Piper, Ernst & Young, and WTS.

This year, ITR judged Hungarian tax advisory firms in the top “Tax Firm of the Year” category and three others: transfer pricing, indirect taxation, and tax litigation. Andersen ranked among the best in all of them, a feat only matched by Deloitte. In Hungary, the jury also awarded the title of Hungary Indirect Tax Firm of the Year to the firm to Andersen.

ITR ranked the overall performance of Andersen’s offices in the top five in the field of indirect taxation (mainly VAT) at the European level. This demonstrates that Andersen’s Hungarian VAT advisory department is backed by a powerful

international network that can offer clients the best solutions to crossborder VAT problems.

Rising Star

The ITR also recognized the outstanding work of Bence Barta, head of the firm’s VAT service line, by making him one of the seven European tax advisers nominated for the Indirect Tax Rising Star title in 2022. This is a considerable achievement, not least because this was the only category in which a

Incidentally, the proportion of Hungarians who believe the attack to be an act of Russian aggression has increased to 63% in August, from a dip of 56% in April, according to research by the Publicus Institute.

After an informal meeting of EU finance ministers in Prague on September 9, Minister of Finance Mihály Varga said Hungary would support European Union financial assistance for Ukraine.

At the meeting on Friday, the ministers committed to transferring a further EUR 5 billion in so-called macro-financial assistance (MFA) loans as the second part of an exceptional MFA package of up to EUR 9 bln endorsed by the European Council early in the year, according to a statement from the Ministry of Finance.

Hungarian tax advisor was nominated at all out of the 76 candidates.

According to Károly Radnai, managing partner of Andersen in Hungary, the brand’s performance and success in Hungary are reflected not only in the business results of the past period but also in the number of nominations and professional awards it has received.

“Winning the most prestigious international award in the tax profession last year was not just a one-off flash in the pan. By being named the best Hungarian tax advisory firm by ITR for two consecutive years, we have proven that we are able to maintain this high level of professionalism in our work. In all segments of the tax advisory work, in all areas of expertise, we are a serious competitor to the biggest players, as the Indirect Tax Firm of the Year award confirms,” said Radnai.

Andersen in Hungary is the fifth largest player in the Hungarian consulting market. The Budapestbased tax advisory and law firm currently employs nearly 100 people. In 2021, it increased its revenues by 20%, well above the average annual growth target of 14-15% set by the company’s management. Andersen is catching up with the Big Four advisory firms faster than expected.

Further information: info@hu.Andersen.com +36 703 174 146

Although countries across Europe face energy supply crunches as the temperature drops with the changing season, Prime Minister Viktor Orbán said that Hungary “won’t have a shortage of energy,” according to his Facebook page.

NICHOLAS PONGRATZ

Photo by Alexandros Michailidis / Shutterstock.com

4 | 1 News www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

Roundup

Ukraine PRESENTED CONTENT

GARY J. MORRELL

The Maglód and Fót developments in the Greater Budapest area, which opened earlier this year, are the first industrial buildings in Hungary to achieve Breeam “Excellent” certification in the New Construction category.

A HelloParks megapark in Páty (20 km west of central Budapest) is also being developed. The company, established almost two years ago, plans to deliver two further projects this year. As a result, the total gross leasable area offered by the HelloParks portfolio will increase to 160,000 sqm by the end of the year, representing a total investment of EUR 190 million.

In January, the first 46,000 sqm building of HelloParks Maglód (MG1) received its occupancy permit, followed by the handover of the first

46,000 sqm phase of HelloParks Fót (FT1) in June. This latter hall reached maximum

occupancy less than two months after its handover.

The facilities are operated by a sustainable, smart building management system and Internet of Things technology solutions. The first building at the Maglód megapark has been occupied by FoxPost, Bútor1, Quehenberger, Karzol-Trans, and Esdwork, while the tenants at Fót include HTNS, Expert, K&V, and Seojin Auto Hungary.

The new halls have achieved very high sustainability standards in terms of technology, ergonomic design, environmental impact, and energy management, as well as operation and management of the entire development process, according to HelloParks.

The buildings provide smart ready lights in common areas, expandable solar panels on the rooftops, electric car chargers in the parking lots, and energy-efficient mechanical systems in the buildings.

Tenant App

Tenants can manage their energy consumption via the HelloParks mobile app. This means they can monitor their utility consumption and adjust heating, ventilation, and lighting settings from anywhere. They can also create time schedules and check whether all lights are turned off.

“There is still a strong market demand for environmentally friendly, energyefficient and smart industrial and warehouse centers, which is confirmed by the significant demand for HelloParks Maglód and HelloParks Fót,” says Rudolf Nemes, CEO of HelloParks.

“Our projects are being developed at full capacity; that enables our megaparks to meet a wider range of needs and requirements. The upcoming phases, which will be handed over

this year, are also going to be groundbreaking in the industry,” he adds.

Preparations are underway for the second 45,000 sqm hall (MG3) at Maglód, and it is expected to be ready for occupation in the last quarter of 2022. With the new facility, HelloParks is already aiming to achieve an “Outstanding” Breeam New Construction rating, which is achieved by less than

3%

of buildings worldwide.

Construction work on the next 26,000 sqm hall at Fót (FT6), also aiming for that “Outstanding” certification, started in April on the 76-hectare site. The building reached structural completion at the beginning of July, and the first tenants will be able to move in at the end of the year.

At the same time, the final phase of earthworks, soil stabilization, and bedding preparation is currently underway at the first HelloParks Páty building; structural works will start soon. The initial hall on the more than 100 hectares of land will be 58,000 sqm. It is the beginning of what will eventually be 400,000 sqm of total gross leasable area.

Across HelloParks’ three current locations, it is working on the development of more than 900,000 sqm of warehouse and industrial space on a total of 222 hectares. The combined investment value of the ongoing projects is close to EUR 200 mln.

HelloParks warehouse.

1 News | 5www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

The first two warehouses developed by the industrial developer HelloParks, part of the Futureal Group, are now 100% occupied after just a few months, according to the developer. First HelloParks Industrial Halls Fully Occupied ADVERTISEMENT

EACH AGENCY INDEPENDENTLY OWNED AND OPERATED. Franchisee: T-SOLUZIONI ZRT., H-1054 Budapest, Szabadság tér 7. +36-30-591-7998 SPACE FOR YOUR BUSINESS

in BriefNews

Government Extends Food, Fuel Price Caps

Hungary’s government has decided to extend price caps on staple foods and motor fuel, Gergely Gulyás, the head of the Prime Minister’s Office, said at a press briefing during a cabinet meeting break on September 17, according to a report by news agency MTI.

The government rolled back prices for a number of staples, including pork, cooking oil, and flour, to mid-October levels from February 1 in an effort to dampen inflation.

The government has also capped prices at the pump at HUF 480/liter for both gasoline and diesel since November 15, 2021.

Vehicles with foreign number plates were earlier excluded from the measure, and from late July, corporate vehicles registered in Hungary also became ineligible.

The food and fuel price caps, which were set to expire on October 1, will be extended until the end of 2022, Minister of Economic Development Márton Nagy told the press briefing. He added that a freeze on mortgage rates would be extended by another six months until the end of June 2023.

Nagy said he had also supported the extension of the price caps, even though he continued to consider them “abnormal market intervention,” albeit under “abnormal market circumstances.” He added that the National

Bank of Hungary (MNB) augurs a continued rise in CPI in the coming months, with inflation expected to decline only in 2023.

Gulyás said the extension of the price caps is justified by the “extraordinary situation” for which there is “no realistic chance” of improvement as long as sanctions against Russia, which have driven up energy prices, remain in place.

He added that Hungarian households will continue to pay regulated prices for gas and electricity, up to average consumption levels, saving them HUF 150,000-180,000 a month.

Majority of Companies Experienced Financial Difficulties in July

Some 44% of company managers did not find it challenging to meet their company’s financial obligations. In comparison, 56% experienced various difficulties and are less optimistic about the next half-year, the Economic and Entrepreneurial Research Institute (GVI) of the Hungarian Chamber of Commerce and Industry announced, according to hrportal.hu.

In July 2022, GVI asked 350 domestic businesses employing at least 20 people about their financial situation, including their ability to fulfill their financial obligations, their financial difficulties, and the level of their reserves.

U.S. Ambassador Presents Credentials to President Novák

U.S. Ambassador to Hungary David Pressman presented his Letter of Credence to President of Hungary Katalin Novák at the Sándor Palace in Budapest on September 14. The Ambassador was accompanied by his partner Daniel Basila, their children, and Acting Deputy Chief of Mission Derek Westfall.

During their discussion in the Blue Salon, Pressman expressed to Novák the significance of the long-standing relationship between the United States and Hungary, particularly as European and global security is under attack as a result of Russia’s unprovoked war against Ukraine. Pressman noted their productive conversation, saying the two discussed the need to strengthen the U.S.-Hungary relationship.

“In these complicated times, with a land war in Europe, it is more important than ever for our two countries to be united in opposing Russian aggression and working

According to the survey, the most significant economic problem for most businesses in the months leading up to July 2022 was the exchange rate loss, the payment of raw materials, and the payment of energy carriers.

Growth and Market Expansion at Sixt: Flexibility and Quick Reaction are Key

together to advance regional and international security on the basis of fundamental transatlantic values,” he said.

After departing the Sándor Palace, Pressman traveled to Heroes’ Square, where he laid a wreath at the Monument of Hungarian Heroes. After laying the wreath, the ambassador noted the significance of honoring the bravery and loyalty of Hungarians, long-time allies, and friends of the United States and its people.

The GVI research showed that company managers judged the level of financial reserves for the first half of 2022 to be more favorable in retrospect than what is likely for the next half of the year.

Of course, car rental costs can be calculated in the same way as for an operating lease, but car rental is a much more flexible solution for companies, as the vehicle can be returned to the rental company at any time, and the type of vehicle can be changed without any restrictions. The current inflation crisis also means that flexible rental solutions are more predictable, transparent, and convenient for our rental customers than fixed four- or five-year leasing solutions, which represent a significant commitment for companies.

Why Sixt?

Company Fleet Delayed? Sixt Offers Solution

The difficulties in the new auto market are also reflected in company car purchases. In many cases, employees entitled to use a company car must wait much longer than usual, sometimes even up to a year. This has prompted Sixt to adapt as quickly as possible to the changing environment and to develop a service that helps all companies waiting for a car.

For companies that want to maintain their own fleet despite the difficulties indicated above, Sixt offers flexible rental options until the arrival of new cars,

whether a temporary rental of one or two vehicles or a fleet of significantly more cars.

This type of rental arrangement is not new to Sixt: a significant part of the rental fleet has been booked by corporate partners for shorter or longer periods in the past. In the current situation, we see an increasing demand for rental cars due to the difficulties in car production and the ongoing delays.

We also intended to target the corporate segment, so we launched a website for business partners in June.

On www.sixtbusiness.hu, one can find more information about our business rental schemes, Sixt’s fleet available

at any given time, photos, videos, trim level lists, and a lot of helpful information to enable prospective rental customers to choose the best vehicle for them.

Car Rental vs. Leasing

Car rental is a highly flexible service: you can get into the car of your choice straight away and use it both at home and abroad. If the rental customer’s needs or living situation change, they can switch to another model at any time, be it a car, a van, or even a light commercial vehicle. The rental period is adapted to the customer’s individual needs, and the car user pays the rental fee accordingly.

We offer nearly 40 different models in more than 30 categories in our fleet, most of which have high trim levels and were acquired in 2022. We are proud that we could respond quickly and flexibly to difficult circumstances, thanks to which we won the Business Excellence Award in the Mobility Service category last year.

This flexibility and customer focus are also reflected in our corporate rental offers, which is why we look forward to becoming a mobility partner for more and more companies. We aim to ensure that once people have tried this type of long-term car rental, they will realize the potential and stop thinking about fixed, leased fleets only.

Before the pandemic, the dominant source of our income was generated by foreign leisure and business visitors. The customer portfolio also included domestic corporate customers with long- and short-term car rental schemes, but their importance has increased recently, and not only due to the pandemic-related restrictions.

Rita Szolnoki, Head of B2B Business Unit, Sixt Hungary.

Photo by Office of the President

6 | 1 News www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

PROMOTION

PwC Hungary Picks Tourism Advisory Team Head

PwC Hungary has announced the appointment of Bálint Rippert as the head of its tourism advisory team, effective from August 1.

The expert previously worked at the Hungarian Tourism Agency, which he joined in 2016. There, he was involved in several key projects, such as developing the National Tourism Development Strategy 2030. He also contributed to developing and implementing the National Tourism Data Supply Center. Earlier in his career, he gained project management experience in public administration and e-learning development.

PwC says that the new tourism advisory team leader’s main objective is to promote the market entry and successful operation of Hungarian tourism service providers and tourist attractions and to build

based in Budapest and report to Kim Ruymbeke, president of the Eastern Europe Region at UPS.

has recently made several significant investments in its healthcare business in the country, offering faster delivery times and greater flexibility to its customers in existing and new healthcare markets.

In addition, the company has renewed and expanded its UPS Premier service portfolio to deliver time-sensitive, highvalue items in Hungary and says it now offers three levels of flexibility to meet customers’ needs in different industries.

Fresh Director of Sales at Matild Palace

Viktória Berényi took over as the director of sales of Matild Palace in August, the establishment told the Budapest Business Journal

The new manager will be responsible for parcel operations in logistics markets that are among the fastest-growing in Europe. She is tasked with ensuring that the growing demand for e-commerce is met and that the countries under her leadership are better connected to other key export markets, both in Europe and worldwide.

“Throughout my professional life, I have accepted many challenges in different positions, both inside and outside my workplace. I have worked hard to remain ‘constructively dissatisfied’ and never believe that I have achieved perfection in anything,”

Constantinescu says.

To achieve the sales goals of the hotel, Berényi supervises and coordinates the sales team’s work daily while also ensuring training. As director of sales, she plays a crucial role in the preparation and implementation of strategies for the development of the company, Matild Palace says.

Fluent in English, Berényi previously gained extensive experience as the sales and events director of Corinthia Hotel Budapest and later held the position of business development director of Mistery Hotel Budapest.

further strengthen its market position among both foreign and domestic guests,” the hotel management said.

Gresham Palace Names Hotel Manager

Four Seasons Hotel Gresham Palace Budapest has announced that Federico Giovine has been named the new hotel manager.

effective partnerships within the sector. Rippert said he considers it important for PwC Hungary’s tourism advisory team to become a regional player and support tourism development in Hungary and other European countries in international projects.

UPS Appoints Regional Director

UPS has appointed Daniela Constantinescu as the country director for its subsidiaries in Hungary, Greece, Romania, and Slovenia (HUGRROSI region). Constantinescu will be

“I look forward to working to help businesses in these countries to exploit the opportunities of international trade better. Our smart, global logistics network means easier access to global markets and sustainable business growth, especially for small- and medium-sized enterprises,” she adds.

The director has more than 20 years of experience in finance and accounting. She started working for UPS in 2007 as head of finance and accounting for the company’s Romanian subsidiary and later held several other management positions. She was also previously responsible for the company’s financial operations in Hungary for one and a half years.

Hungary and the region play a significant role in UPS’s intensive global growth strategy. The company

“As a dedicated employee and based on her successes so far, the appointment of Viktória Berényi will greatly contribute to the achievement of the objectives of Matild Palace. We believe that by leading our sales team, she will contribute to Matild Palace continuing to maintain and

Giovine started his career in 2005 as a phone operator at Four Seasons Hotel Buenos Aires. Most recently, he held the position of senior director of rooms at Four Seasons Resorts at Jumeriah Beach and Dubai Financial Center.

“I’m honored to be appointed as hotel manager of Gresham Palace, and I can’t wait to discover the city. Every destination and every property has its own unique history and traditions; I’m looking forward to learning about the Gresham Palace and its team and supporting them in continuing a successful journey,” Giovine said.

“Four Seasons provides the right environment for growth. What we are, and what differentiates us, is our culture, our people. It is the real asset we have. If we are able to create a true sense of belonging in our teams, raising the bar is a lot more feasible, fun, and exciting,” he adds.

Born in Buenos Aires, Giovine speaks Spanish, Portuguese, English, and French. He holds a bachelor’s degree in international relations and political sciences from UBA Universidad de Buenos Aires.

Yves Giacometti remains the Gresham’s general manager and a regional vice president.

Bálint Rippert

Daniela Constantinescu

Viktória Berényi

Federico Giovine

Bálint Rippert

Daniela Constantinescu

Viktória Berényi

Federico Giovine

1 News | 7www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

MEET THE EXCLUSIVE BR HPOBOESTAURANT INARISARK WITH SECTION ROOMS FOR BUSINESS MEETINGS PRIVATE PARKING OPEN EVERY DAY 1022Budapest,Marczibányitér6-7. @bobobudapest +36 70 77 22 665 @boborestaurant_bp Bobo_Meet_252x77mm Monday, September 19, 2022 7:59:20 PM Composite 150 lpiADVERTISEMENT WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Ryanair’s O’Leary: Hungarians Suffer From ‘Idiotic’ Excessive-profits Tax

Michael O’Leary was at his clowning best for the first minute of his Budapest press conference on September 13, grimacing, gesticulating, and waving a placard for the cameras. But his message was deadly serious: “Scrap ‘excess-profits’ tax on loss-making airlines.”

KESTER EDDY

KESTER EDDY

“I’m sorry that today we don’t have good news,” the Ryanair chief executive said after his PR antics were over.

The Dublin-based low-cost carrier had planned to launch its “biggest ever” winter schedule from the Hungarian capital this winter, with 10 new destinations and another aircraft at Budapest airport.

“Sadly, however, those plans have now fallen at the altar of the Hungarian government’s decision to impose a ludicrous and idiotic “excess-profits” tax on an airline sector which is reporting record losses,” O’Leary lamented.

Instead, Ryanair would be reducing the destinations served from Budapest from 53 to 45 from October 1 while reducing the frequencies on another seven. (See box for more on this.)

He said that the carrier’s passenger numbers using Budapest are set to fall to a “little below four million” this year against the 4.5 million expected earlier and 5 million in 2023.

The “excess-profits” tax referred to by O’Leary is the government-imposed charges on airport handling companies, effective from July 1, of HUF 3,900 for passengers traveling to European destinations and HUF 9,750 for those heading outside the continent. O’Leary said these had “inevitably” been passed on to the airlines.

The Irish CEO stressed that Ryanair “respected the right” of the Hungarian government to impose an “excess-profits” tax on sectors, such as oil and gas, “which are making excess profits.”

However, “what we don’t understand is how you can levy an excess-profit tax on the airline sector, which has been reporting record losses over the last two

years because of air travel being shut down by COVID-19 and the impact of Putin’s invasion of Ukraine,” he argued.

As a result of the restrictions, Ryanair had reported losses for those two consecutive years, an unprecedented performance in the last 30 years of the budget carrier’s existence.

As an upshot of the new levies, Ryanair, in turn, had “no choice” but to increase ticket prices, including those who had already booked flights to and

from Budapest before the taxes were announced in early June. (The carrier promised to refund the earlier fare in full if passengers opted not to pay the increase. Ryanair said earlier that only 3% of passengers had opted for the refund.)

This latter move had created another “minor dispute” with the Hungarian authorities, resulting in the Consumer Protection Authority issuing a fine of HUF 300 million on the carrier. Ryanair has appealed the fine, even though O’Leary is confident it will lose in Hungary. He pledged to take the case to the European court if necessary.

“We have politely pointed out to the Hungarian government that under EU regulations, the airlines are free to price our services as we see fit, and since we’re making record losses, we cannot afford to pay an excess-profit tax,” he said, adding that this would hit “Hungarians, Hungarian families and Hungarian tourism” most of all.

The additional aircraft originally planned to be based in Budapest would instead be located in a neighboring country.

“Hungary, as a result [of the new tax], has become a much more expensive destination this winter. At a time when neighboring countries like Austria, Slovenia, Slovakia and Romania, are cutting costs to try to recover their preCOVID tourism traffic, Hungary is going the other way and making itself more expensive,” O’Leary claimed.

While Ryanair had hedged its fuel prices up to next spring, he said fares would have to rise “by about EUR 5” next year to cover increased kerosene prices into 2023-24.

On the positive side, the carrier did not intend to close its base in Budapest, having “worked too hard to open it,” though the company would reconsider its plans next spring and could not rule out more cutbacks, he warned.

Ryanair Routes Affected Serving Budapest

Eight canceled routes: Bordeaux, Bournemouth, Cologne, Krakow, Kaunas, Lappeenranta, Riga, and Turin. Six routes at reduced frequencies: Amman, Bristol, Prague, Pisa, Sofia, and Warsaw. Michael O’Leary stated seven routes would be

affected in his press conference, but in an email to the BBJ , Ryanair only listed six. When asked to clarify, Ryanair failed to answer. Some Hungarian media outlets listed Tel Aviv as the seventh route affected.

Michael O’Leary on Ryanair’s PR, Tax policy, Brexit and Politicians

After the main press conference, the BudapestBusinessJournal sat down with the former Irish accountant, who sometimes can’t resist a little hyperbole.

BBJ: Didn’t you launch an ‘Always Getting Better’ program some time ago?

Michael O’Leary: That was a long time ago!

BBJ: But you’re not getting better now in the eyes of the Hungarian public.

MO: What?! People are selling their firstborn child to be able to get on a Ryanair aircraft in Budapest airport. They’re desperately trying to get off expensive Wizz and EasyJet flights.

BBJ: But what about the Hungarian government [and its budget deficit]?

MO: If you really want to levy an excess profit tax, levy it on an industry that is making excess profits.

BBJ: What have been the main effects of Brexit? Has it reduced demand for flights between Central Europe and the United Kingdom?

MO: Brexit has been very damaging to the U.K. economy generally. I think, generally, non-British people in the U.K., the Irish, Romanians and Poles, felt less welcome. But there has also been a dramatic recovery in the economies of Poland and Romania. Lots of people left the U.K. as a combination of Brexit and COVID, went back home, and have now got jobs at home where

essentially you have full employment, and they don’t want to go back to the U.K.

The U.K. economy is really struggling for labor in retail, hospitality, agriculture. It is going to do very badly for the next year or two, not so much because of Brexit [per se], the British were free to choose to leave the EU, but they should have left with a free trade deal with the Union.

It was Johnson and the other idiots who he appointed to his cabinet, and they insisted on the hardest possible post-Brexit deal, which has been very damaging to the U.K. economy. And it will continue to be damaging until Liz Truss or whoever comes after works out that you can have Brexit, but at least let’s have the greatest amount of freedom of movement of labor and capital between

the U.K. and the European Union. That’s the only way to deliver Brexit. Leave the EU if you want, but for [expletive]’s sake, negotiate a proper free trade deal which allows people to move freely between the U.K. and the EU.

BBJ: Do you have a politicians’ idiot ranking? MO: [Laughs.] Top of the tree would be [expletive] Johnson and anybody in the ERG [the pro-Brexit European Research Group] voting for a hard Brexit. The Hungarian company would come a close second. No, actually, third now, because the Dutch government will have leapfrogged them with their EUR 30 environmental tax from January 1. Look, most politicians are idiots; you have to be an idiot to be a politician in the first place.

Michael O'Leary, CEO of Ryanair, makes a point ahead of his Budapest press conference.

www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

2 Business

Multiple Challenges Changing the way Real Estate Market Operates

For anyone who wasn’t also working during the energy crisis of the 1970s, this must be the most challenging time to do business, regardless of the sector. That is certainly the case for real estate, and is prompting a different approach, says Mátyás Gereben, country manager of CPI Hungary.

“What we are trying to figure out is whether there an option to have a proportion of this energy product, let’s assume 60-70%, coming from resources where you can determine at least a price range, or a close estimation, or, hopefully, a direct price.”

Energy Resources

“We’re not focusing only on asset management, we’re not focusing only on a physical portfolio strategy. We’re focusing on how we will be able to sustain operations at a company that is in contact with 1,000-plus tenants and providing not only physical space but energy solutions, sustainability solutions, community solutions,” he explains.

“We’re not [just] providing physical space; we’re providing services related to how companies can maximize their know-how and their profit based on combining all these elements in their business.”

There is a multitude of challenges out there, from simply keeping tenants happy to finding construction staff, costing office fit out, and building a sustainable and ESG-compliant business. We cover all in a wideranging interview, but energy is perhaps the most pressing concern.

“What is clear is that energy as a product does not exist anymore, or at least not now on the Europe market,” Gereben says. “You cannot buy fixedprice energy to have a longer-term vision. Or, let’s put it another way, to budget.”

Those concerns are driving a different approach, one that probably would not have been considered even just a few years ago.

Options being considered range from CPI having its own energy-producing resources (whether that’s solar panels on roofs or power plants within the portfolio) to a long-term relationship with alternative energy producers, as well as possibilities connected to the national grid itself, though Gereben describes that as “an evershrinking bottleneck.”

“Right now, we are in the process of creating business cases for how we’re able to put together this combination to make sure that we could become a secure energy provider, in the sense that we become a landlord where the energy-providing element is an executive option, and not a vulnerable element of the operation,” he says.

Get that right, and, presumably, it would give CPI a market advantage, I suggest. “I assume so because then you give your partners the possibility to plan ahead, to understand, and this gives certainty and security, which is probably the most needed factor in today’s business,” Gereben replies.

Energy isn’t the only headwind out there, of course. Hungary enjoys near full employment, which is another way of saying the labor market is extraordinarily tight and sourcing workforce a bottleneck across skillsets and sectors.

Changes introduced over the summer to the simplified taxation system Kata have raised fears about people leaving

the labor market or going black if companies cannot afford to take them on the payroll. Those that can take them on such freelancers may need to raise prices to cover this more expensive option. Does Gereben fear an impact in the construction sector?

“Indirectly, for sure, there is an impact. At the end of our supply chains are individuals who use this taxation. In the already difficult construction market, this will not ease the price concerns we’ve been having for a long time,” he explains.

But there is also a direct effect, which affects the critical negotiation area with new tenants. Where the focus was on rental fees or service charges, today, it is on the fit-out cost.

“Until now, we provided a turnkey solution. Today, if we were to do so, there would be no profit on that piece of office area in the five-year period for which we are signing the contract,” Gereben explains.

The result is that who provides what proportion of the fit-out fees has become “a much more difficult element of the negotiation. And this is influenced by the change of Kata, because many of the subcontractors will set the prices based on the change of the taxation system, and it will not help ease this burden,” Gereben points out.

Sustainable Pioneer

The country manager says CPI has long seen itself as a pioneer in sustainable, ESG-compliant buildings. It works to the BREEAM standard rather than LEED as the former is more European in outlook, but rather than going for WELL accreditation, he prefers to concentrate on the company’s ESG rating.

“If I say we have an ESG strategy and a strong sustainability framework, I

believe that today, it is a bigger tool in your hand and worth more than a standardized rating in any category. The goals laid down in direct action plans must be achieved jointly with our tenants and individuals,” says Gereben.

What goals does CPI’s ESG framework set out?

“It states that we want to reduce greenhouse gas production by 30% and water intensity by 10% by 2030. The group has also set a target to switch to 100% renewable energy purchases by 2024 and pays close attention to selective waste collection. Overall, we have recently aligned our targets and strategy to Paris Agreement goals,” he says.

“The sustainability framework states many other important and achievable goals, like new building materials, and whenever we’re doing fit-out, we should aim for reusable elements,” he adds.

“We have very particular goals and plan, country by country, the actual actions: what do we have to do to add to this goal, what kind of actions will be taken, who’s responsible, and what are the deadlines? There’s a very big Excel sheet behind it, and believe me, we are putting in a load of effort,” he says with a laugh.

Sustainability brings us back to the energy crisis. Does Gereben believe it will drive companies to double down on finding green alternatives or, as in the case of Germany and Poland, prompt a possible return to coal? “Both” is Gereben’s immediate answer, but overall, he says he is optimistic about his industry on two grounds.

“One is that it’s actually happening because we’re all forced to confront that. Sustainability is not a ‘nice to have’ item any longer. The mindset is changing, which is very welcome. CPI has always tried to be a trendsetter in its vision of how to be future-proof or futureconsiderate. So, yes, there is that positive change. We can always speed it up more, and that’s what we must work on.”

Gereben adds that his optimism is also built on the fact that CPI itself is growing.

“As a result of the purchase of 76.8% of Immofinanz shares, CPI Property Group became a European leader in the commercial real estate market. Its portfolio is now valued at EUR 20.9 billion. And apart from all these concerns, I work for an organization that believes in real estate and the future functionality of real estate. And I love that and share that. So, from this aspect, I am super positive.”

ROBIN MARSHALL

“We’re not [just] providing physical space; we’re providing services related to how companies can maximize their know-how and their profit based on combining all these elements in their business.”

Mátyás Gereben, country manager of CPI Hungary.

2 Business | 9www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

PRESENTED CONTENT

Dawn of a New Era: More Expensive Energy and Wages?

Psychologists say that the human brain suffers from dozens of different biases, perhaps one of the most important being “recency bias.” We tend to project the past into the future. Assuming the hypothesis in the title of this article is correct, we likely face a very different future, says corporate finance columnist Les Nemethy.

I see, this period of high cost of energy and wages as being a phase; maybe five years, maybe ten. As the saying goes, the cure for high prices is… high prices. High prices will encourage energy innovation and substitution, robotics, etc., that will, over time, shift the supply of these production factors. But brace yourselves for a few tough years before we get there.

So, let’s look at the evidence behind higher costs for energy and wages, and then we will revert back to some implications for the future.

Over the past year or two, we have already seen a huge increase in energy prices. There has been a tendency to pin this on the Russo-Ukrainian war, but the trend was under way even before that, and in my opinion, would continue even if peace were to break out in Ukraine tomorrow. The Ukraine war did, however, accentuate the trend.

Let me summarize three non-war related reasons for increasing energy prices.

Spending: There has been a dramatic diminution in capital expenditure (e.g. drilling) for oil and gas companies, caused by societal expectations that we need to progress in a “greener” direction. Politicians and philanthropic organizations, for better or worse, have put huge pressure on industry, resulting in the cancellation or rollback

of pipelines, drilling, etc. Oil and gas companies also risk being left with “stranded” assets if the switch to alternative energies were to be successful, which increases the risk of new capital expenditures.

Decision-making: Mistaken government policies (such as the shuttering of nuclear reactors in a number of countries) and poor planning (assuming alternative energy could supply adequate base load) have been a part of the problem. The U.S. Government has been haranguing European leaders for many years about the risk of dependency on Russian hydrocarbons. The Europeans turned a deaf ear.

Time Lags: The transition to alternative energies is taking longer, and is much more expensive, than most policymakers assumed. We do not have enough minerals (copper, nickel, cadmium, etc.) to switch the auto industry to all electric vehicles in the coming decade or two.

Grossly oversimplifying, we have fallen between two stools. Don’t let the temporary and minor fall in oil prices fool you. While I am sympathetic to environmental considerations, we have neglected tried and proven fossil fuel supplies while under-estimating the cost and time needed to transition to alternative fuels. Once again, the good news is that this may only be a temporary (five-10) year phenomenon, provided that the policy errors are reversed, and proper planning is undertaken.

There is a vast demographic trend afoot in virtually all the world except part of Africa: the number of (highly productive) baby boomers leaving the labor market exceeds the number

The Corporate Finance Column

of (relatively inexperienced and less productive) young workers coming into the market by a very wide margin. At a time when the objective is “re-shoring” (bringing the production of at least

U.S. sovereign debt is more than 10 times what it was in the late 1970s (about USD 30 trillion today, compared to USD 2 trillion back then), meaning that even a fraction of the interest rate levels achieved by 1980 would be enough to trigger a wave of defaults for sovereigns, corporates and individuals.

strategic products home) we are likely to see demand for labor increase while supply decreases, causing wages to rise. (This theme is explored further in my last two columns on the subject of demographic trends.)

High energy and labor factor costs feed into all areas of the economy. Take, for example, agriculture, which requires large amounts of both factors. High energy costs have also caused radical rises in fertilizer prices, giving farmers the choice of eliminating or reducing fertilizers (and likely reducing yields), or charging higher fertilizer costs through to the consumer. Both are highly inflationary. To a greater or

lesser degree, energy and labor costs have a similar ripple effect in just about every sector of the economy.

Today central banks are raising interest rates with a view to preventing the type of prolonged high inflation that existed in the 1970s. The difference today, depending on the country, is that there are many multiples of the level of debt compared to the 1970s. For example, U.S. sovereign debt is more than 10 times what it was in the late 1970s (about USD 30 trillion today, compared to USD 2 trillion back then), meaning that even a fraction of the interest rate levels achieved by 1980 would be enough to trigger a wave of defaults for sovereigns, corporates and individuals.

Recession or depression is likely to occur much sooner than inflation can be tamed. Something will break, and then we may well have both high inflation and recession, at which time the Fed will have little choice but to bring on the most expansionary monetary regime since World War II.

Inflation is never an accident. It is always the result of monetary and fiscal policies; unfortunately many of them were poor decisions, taken in the past. Central banks are increasingly caught between a rock and hard place.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

Photo by xalien / Shutterstock.com

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

Photo by xalien / Shutterstock.com

10 | 2 Business www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

Kempi Corvinus at 30: ‘Belonging There, not Being There’

The general manager of the Kempinski Hotel Corvinus Budapest, Stephan Interthal, talks exclusively to the Budapest Business Journal about its 30th anniversary, ‘footprints in our history,’ the COVID recovery, and using Hungarian art for marketing.

BBJ: How will you be marking the anniversary?

Stephan Interthal: The actual anniversary is September 11; this is the official opening of the hotel in 1992. We’ll mark this with the employees and their spouses at a brunch in Etyek at the Sonkamester [Restaurant]. As always, some will have to work, and we have morning and evening shifts, but I think we will have approximately 150 people coming. We have done many other activities, starting from April 5, which was the 125th anniversary of Kempinski. Our 30th anniversary celebrations will continue until the end of the year. On September 29, we are inviting our partners who have accompanied us from the beginning to an official party. Earlier that same day, my owners will be giving lunch for those employees who have been here for 30 years: we have 10. And we’re going to invite people from the former board and supervisory board, the construction, our lawyers, all those who left a footprint in our history.

BBJ: Having 10 staff who have been with you the whole time seems quite impressive.

SI: To retain these employees for so many years is really a commitment from both sides. It is the difference between being there or belonging there; we have a great sense of belonging from the employees, management, and owners.

BBJ: Is this “belonging” the secret of your enduring success?

SI: I was GM for seven years, from 19972004. And 10-and-a-half years later, the owners asked me to come back. The owners are very much aware that one part of the success of a hotel is continuous good management and ownership and having young employees mixed with senior employees. This is not something you can explain plainly, like mathematics. Besides the quality ratings and the scores we are getting, the nicest compliment is that people say this hotel has something that makes them ‘feel good.’ This makes me proud. We have

a good atmosphere and spirit among the staff, which automatically relates to the customers. We care, especially during the last two and a half years, we care big time, and eventually, it pays off. This is, I think, one of our strengths.

BBJ: How important is employee branding?

SI: I worked for 30 years for the company in different countries. We have a very good name in the employee market. This comes both from the brand and from the longterm HR policy of our hotel, how we have built relations and dealt with our employees over many years. I think the success of our rehiring and rebound and having been so successful in bringing people back is not only due to the brand but a local issue too.

BBJ: How has the hospitality market changed in Budapest over the past 30 years?

SI: When I came here in 1997, I didn’t know what to expect. We were the clear market leader in a small, introverted hotel market. That started expanding from 2001-2003. The bigger surprise was returning almost 11 years later, discovering a city that had developed so much for the better. It was utterly different regarding shopping facilities, high-end brands, restaurants, bars, etc. But I always felt this strong connection with Budapest. I cannot tell you why, but it happened immediately we arrived. And the time from 1997-2004 was also good. We had a good life here.

BBJ: Has the hospitality scene recovered from COVID?

SI: It’s not over yet, but I believe that those who are serious and who have a strategy and a concept, and, yes, who probably have

a little financial backbone, will survive. The whole utility gas and electricity issue is beyond our control. When these increases go from a couple of EUR 100,000 to, in our case, over EUR 1 million, you cannot pass this on to your customers. You have to digest it and understand that this is just a period Europe has to go through. Until then, we must work around the problem.

“I am convinced that the future ahead of us in this city is bright. We just had a threehour meeting this morning; we have to submit our budget for next year: we expect 2023 to be a good year.”

much volume as before, but the costs would still be there. To position the hotel, we changed our pricing and sales strategy. It was clear that there would be no Chinese market for some time. We didn’t know then that there would be no Russian market, but we knew that the American market would be much less in volume. So, we repositioned.

Our rate today is higher than in 2019, with lower occupancy. But we accept the occupancy because we know there is still a market for us big enough to be sustainable. I am convinced that the future ahead of us in this city is bright. We just had a three-hour meeting this morning; we have to submit our budget for next year: we expect 2023 to be a good year.

BBJ: Kempinski Budapest has an extensive art collection. How did this come about?

BBJ: Has the pandemic and subsequent crises altered your marketing at all?

SI: We are not yet back to 2019 figures. Eventually, we will be back there, but my goal is not ultimately to achieve this as fast as possible. You must have a strategy for how to get out of this dilemma. One part that was very important during Corona was that we kept a certain number of key employees on the payroll because I knew I had to retain these people. This included all the senior managers and those getting a higher salary. If I let them go, I would never see them again.

Secondly, during Corona, we did many repairs, cleaned the hotel, renovated, and had many meetings about the rebound. What would the market expect, and what could we expect from the market? We knew one thing: there would not be as

SI: For us, it’s a privilege, and it started from the beginning; this was a commitment to Hungary, to Budapest, that we will always support Hungarian art. We have an annual budget given to us by the owners. Some years ago, we started two partnerships: one with Ar2Day Gallery, which is organizing our exhibitions on the Promenade, and another with the Kogart Art Foundation. It gave us professional assistance in curating our Corvinus Art Collection, consisting of more than 1,000 pieces of art.

As the next step, we selected 50 pieces and started an exhibition called “Gems of Corvinus.” Our second exhibition was in 2018; we went to the Hungarian Embassy in Berlin, opposite the Hotel Adlon Kempinski. We had a three-month show there, to the opening of which our chairman came because he was so proud about using art as a communication and marketing tool. Not many have done this. We are really proud of our Corvinus Art Collection.

ROBIN MARSHALL

Stephan Interthal

2 Business | 11www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

PRESENTED CONTENT

Bosch Innovation Campus: Automotive Technology Development Center Inaugurated

GERGELY HERPAI

The campus, construction of which started in 2018, is an extension of the Budapest Development Center campus. The HUF 70 billion investment will further strengthen Hungary’s role in international innovation and industrial cooperation, as well as in global automotive development.

The inauguration of the world-class facility in Budapest was attended by Prime Minister Viktor Orbán, chairman of the management board of Robert Bosch GmbH Stefan Hartung, and István Szászi, head of the Bosch Group in Hungary and the Adriatic Region.

“For 136 years, the Bosch name has been synonymous with cuttingedge technology. The Bosch Budapest Innovation Campus demonstrates that Hungary, with its many talented and skilled engineers, is playing an

increasingly important role in our global development and manufacturing network, creating technologies under the slogan ‘Designed for Life,’” Hartung said.

“In recent years, the Budapest Development Center has become one of Bosch’s flagships and an innovation leader in the international automotive industry.”

The Budapest Development Center is an increasingly important location for Bosch’s global development activities and one of Europe’s biggest in terms of staff numbers. Today, around

3,000

specialists

(programmers, electrical engineers, mechanical engineers and physicists) are working to shape trends, including the future of mobility, on Gyömrői út.

The Bosch Budapest Innovation Campus will be home to 1,800 nextgeneration workplaces, 14,000 square

meters of instrumented research and test laboratories, a unique outdoor test track and a high-tech giant test hall, all of which will serve the company’s wideranging technological developments.

“The new Bosch Budapest Innovation Campus plays a key role in developing our electromobility and automated driving solutions. The creation of the new campus was justified by the dynamic domestic growth and nextgeneration development projects of the Bosch Group,” said Szászi.

Unique Facilities

An essential part of the new campus is the 10,000-square-meter instrumented test track with unique facilities. Here, ultrasonic, radar- and camera-based driver assistance systems for future vehicles can be measured and fine-tuned under controlled conditions on various road surfaces and in different situations.

The enclosed test track has fuel and electric charging stations; a track lighting system has been installed to simulate twilight and night-time lighting conditions.

The development and testing of future passenger and commercial vehicles will occur using large scale yet precision measuring chambers. One of the special features of the Bosch Budapest Innovation Campus is a test hall that can accommodate several trucks simultaneously. Aerospace technology will ensure exact measurements for the fine sensors of the vehicles while completely filtering out ambient vibrations.

In Hungary, Bosch says it relies on the active involvement of industry and academia.

“The new campus also symbolizes a new approach, which my fellow leaders and I are committed to. We need to go beyond the walls and create a multistakeholder ecosystem with startups, universities, academic institutions,

small- and medium-sized enterprises and government to be truly innovative,” Szászi explained.

In addition to joining the Hungarian Startup University Program (HSUP), the Bosch Group in Hungary is also actively deepening a startup mindset in-house, he said.

In the new complex, particular emphasis will be placed on sustainability and energy-efficient operation, which will be achieved through, among other things, excellent thermal insulation, building management solutions adapted to the environmental impact, automated lighting and shading systems, and heat recovery ventilation.

Renewable energy sources are used for the operation of the campus, with only certified green energy purchased, highefficiency heat pump systems as the primary cooling and heating solution, complemented in the future by solar PV systems. The heat generated by the R&D site’s test systems will be reused for heating and hot water.

No Shortages

Welcoming the development, Prime Minister Orbán vowed there would be no energy shortages in Hungary, and no need to shut down factories.

“It is indeed a minor miracle that such a research and development center could be created,” the PM said. He saluted the Hungarian researchers, engineers and teachers, whose achievements have made it possible to expand the company’s research and development center.

“I have never experimented with natural sciences because of a lack of skills, but there is innovation in politics too,” Orbán said. The prime minister said that a Christian Democratic government is necessarily innovative and that Hungary’s government welcomes any technology that can move the country forward to its benefit.

He argued that Europe is running out of energy and that what we have must be brought in from elsewhere.

“What comes here is expensive, and we have to fight the fundamentalist greens and the bureaucrats to use different energy sources,” he added.

Bosch says the innovation campus is a vision of the workplace of the future, providing an inspiring and creative working environment. The design of the different functions aligns with the company’s new way of working concept.

Considering the latest HR trends and employee feedback, the architectural design emphasized creating community spaces that facilitate creative thinking and inspiration, the company says. In addition to the essential functions, the main building will also include a 500-seat auditorium equipped with state-of-the-art conference technology, which will host professional, business and artistic events.

Meeting rooms are equipped with stateof-the-art technology for professional online meetings. Work and relexation are catered for with a roof garden community space. The campus buildings are surrounded by a green park with walkways, ponds and resting islands.

Leading supplier of automotive technologies and services Bosch has inaugurated its Budapest Innovation Campus, a

sqm complex that will be the site of future automotive developments.

12 | 2 Business www.bbj.hu Budapest Business Journal | September 23 – October 6, 2022

90,000

Green Business 3 Special Report

Market Talk: Real Estate Market Learning to Embrace Sustainability

the case of green certifications, the energy use of properties will be measured and compared with others directly, creating further accountability and transparency. Unfortunately (or fortunately?), the sudden increase in energy prices increased awareness of energy efficiency much quicker; thus, developers and property managers will not be able to omit this in the future.

Zsolt Jakab Portfolio Manager Diófa Asset Management

There is no one primary system that would tick all areas of sustainability. Therefore, defining what goals and actions we would like to prove through a third-party system is vital. (There

Sustainability accreditations in office developments are no longer “nice to have.”

Developers must think ahead and aim to obtain one from the early stages of design, on the one hand, for the end users’ benefit, but also for improved chances of achieving greater success in the investment market. Will these certifications spread over to other types of assets too? Very likely; in fact, accreditations are now becoming common in newly developed industrial and logistics centers and hotels. Some experts even say that new blocks of residential developments are also adapting to the trend. Certifying your asset is also an efficient way to assess a building’s

commercial real estate business still has a long way to go to be a truly “green business,” based on the current understanding of green and sustainability targets.

Csaba Zeley Managing Director ConvergenCE

Our world is currently facing the many challenges of climate change. To minimize the environmental impact, GTC carries out its business in a manner that supplements the implementation of the 17 Sustainable Development Goals as defined by the United Nations for 2015-2030. We are committed to continuing our engagement in developing environmentally friendly solutions. The real estate development industry is responsible for 38% of the world’s CO2 emissions; hence, measures to minimize the environmental impact of buildings are essential, making reducing CO2 one of our main objectives. At GTC, we are aware that ever more investors are paying attention to sustainable businesses,

is a different scheme, for example, for life cycle assessments, zero carbon strategies, and so on.) Whether we like these international schemes or not, they play a significant role in international benchmarking in transparent assessments and classifications. Currently, there is no way around these assessments.

Zsombor Barta

President Hungarian Green Building Council

impact on the environment and can help owners find ways to improve. At the end of the day, working, staying and living in buildings that hold sustainability accreditation makes people feel like their built environment is environmentally conscious, and that is a good feeling.

Máté Galambos Leasing Manager Atenor Hungary

I think that the sustainability accreditation process is detailed and time-consuming enough. The reality is that the market drives improvements much more than accreditation. For this reason, in the near future, we will see much more of a focus on building operating efficiency and economy. This will affect all sectors. From an architectural perspective, I expect BIM [building information modeling] to become the market norm as part of a circular process of designing, building, operating, and designing. I think the

Green certification systems, such as Leed and Breeam, have been around since the early 1990s. It took a long time for it to play a vital part in the commercial realty business, something that players now take for granted. During these 30-plus years, the standards constantly evolved and were refined to cope with technological innovation, as well as regulatory and end-user needs and targets. The European Union, with its sustainability goals for 2030/2050, had already paved the direction for the continent,