Nagy Advocates for Public

in Corporate

for Economic Development Márton Nagy argues that addressing the current energy crisis requires public intervention in the corporate sector at an event organized by the American Chamber of Commerce in Hungary.

FOCUS

A Unique Bond Forged by Investors

shape are business relations between Germany and Hungary

Hungarian Investment Promotion Agency

a detailed

Jopp

Eastern Beat”

to them

their

Top of the

Tammy Nagy-Stellini, managing director of Hays Hungary, talks exclusively about the recruitment agency’s 15 years in the country, coming top of listings for the sector in the

of Lists attracting talents, staying competitive in an uncertain economic climate, and the need for businesses to be adaptable.

Ends Rate Hike

but Deploys Other

National Bank

most extended

Hungary

months

for the capital markets

MNB

Cycle

Tools Anna

established “The

in 2020 to feature stories of expat artists living, working and creating in Budapest. She talks

about

work, inspiration and plans for the future. 20 ‘The Eastern Beat’ and Budapest’s Art Scene Turbulent

are ahead

and the Hungarian economy, according to Equilor Investment, which an agreement on EU funds may help ease. A bear market could stay with us for a long time, the consultancy says. 6 The

of

(MNB) has decided to end its

rate hiking cycle but warns that strict monetary conditions will remain in force. 3 ‘Winter is Coming:’ Economy Faces Tough, Uncertain Period NEWS SOCIALITE

Listings HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BBJ.HU VOL. 30. NUMBER 18 OCTOBER 7 – OCTOBER 20, 2022 HUF 1,850 | EUR 5 | USD 6 | GBP 4 BUSINESS Energy SPECIAL REPORT INSIDE THIS ISSUE BUSINESS Minister

14

Intervention

Sector

COUNTRY

What

in nowadays? The

offers

picture of the current conditions. 11

Book

7

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia

Czifra, Kester Eddy, Bence Gaál, David Holzer, Christian Keszthelyi, Renáta Kónya, Gary J. Morrell, Nicholas Pongratz, Gergely Sebestyén, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

:

NEWS

Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center

1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

ENERGY REALITIES NIPPING AT THE NOSE

Energy is the new black, the thing everyone wants, only cheaper. It is also the only thing about which anyone wants to talk. Well, that might be somewhat of an exaggeration, but it is undoubtedly at top of mind for business leaders. It was not by accident that this was the subject of our latest CEO Breakfast Briefing with our friends at the GermanHungarian Chamber of Industry and Commerce.

Unless you are a CEO or a finance director signing off on eye-watering energy bills, budgeting for next year, or trying to negotiate new deals, the realities of the coming winter may well, until now, have been largely theoretical. But as the nights draw in and the temperatures drop, the practicalities are starting to bite, like frost nipping at your nose.

rural buildings will close from November until February 28, 2023. According to international news wire AP, the 111-year-old, 1,800-seat Erkel Theater in Budapest, one of the three performance spaces used by the Hungarian State Opera, will also close its doors in November.

The Budapest Business Journal, HU ISSN 1216-7304,

For a start, those realities are beginning to seep into our daily news feeds. The fall school break, which would have been due in the last week of October, has been axed, with the Christmas holiday instead extended to run from December 22 to January 8, 2023. That period will extend to all state-run organizations. The compulsory holidays will, doubtless, irk those forced to take them, but at least it negates the debate about who has to stay home to look after the kids!

The National Bank of Hungary has similarly said it would lower the thermostats at its buildings to 18ºC (64ºF) during the winter, reduce hot water usage, and cut back on outdoor lighting. That 18ºC threshold will be a familiar one across government and local authority buildings this fall and winter, meaning the Christmas novelty sweater could well become an everyday office necessity until spring.

Some institutions are going even further: The Hungarian National Museum has announced that all but four of its

The scramble for diversified energy supplies has prompted Minister of Technology and Industry László Palkovics to vow that Hungary will eliminate Russian gas imports by 2050 through a large-scale electrification drive, following a review of Hungary’s energy strategy in early 2023. If that 2050 dateline does not exactly seem overly ambitious (by law, that is also the year Hungary should become climate-neutral), it does indicate the depth of Hungary’s reliance on Moscow for gas, although that is not unique in this region.

It also hints at something climate activists may wish to keep an eye on: in the short-term, it seems inevitable those that have coal – Poland, Germany, and to a much lesser extent, Hungary – will try to fill immediate energy gaps with what is at hand. But it might also drive a much more rapid expansion of renewable sources. The vital question will be where the balance falls between those two ends of the seesaw.

In the meantime, the less lofty among us must do what we can. At Chez Marshall, there is a grim determination not to switch the boiler on, though the fireplace has been lit and the kids have been told to put on extra layers. I’ll leave you with words shamelessly stolen from “Game of Thrones” for one of our headlines in this issue: “Winter is Coming.”

Robin Marshall Editor-in-chief

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

more information visit

2 | 1 News www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

AND PRESS RELEASES

is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US ONLINE: WWW.BBJ.HU

For

budapestbusinessjournal.com IMPRESSUM BBJ-PARTNERS THE EDITOR SAYS

The color photo from state news agency MTI shows maintenance works on the single runway at Debrecen Airport, which has been closed for a week to repair damage caused by heavy military and humanitarian use due to the war in Ukraine. In the black and white image from the Fortepan public archive, Italian-made Fiat Cr.32 biplane fighters with Austrian ensigns celebrate the opening ceremony of the Budaörs Airport in 1937.

THEN & NOW

Central Bank Ends Rate Hike Cycle but Deploys Other Tools

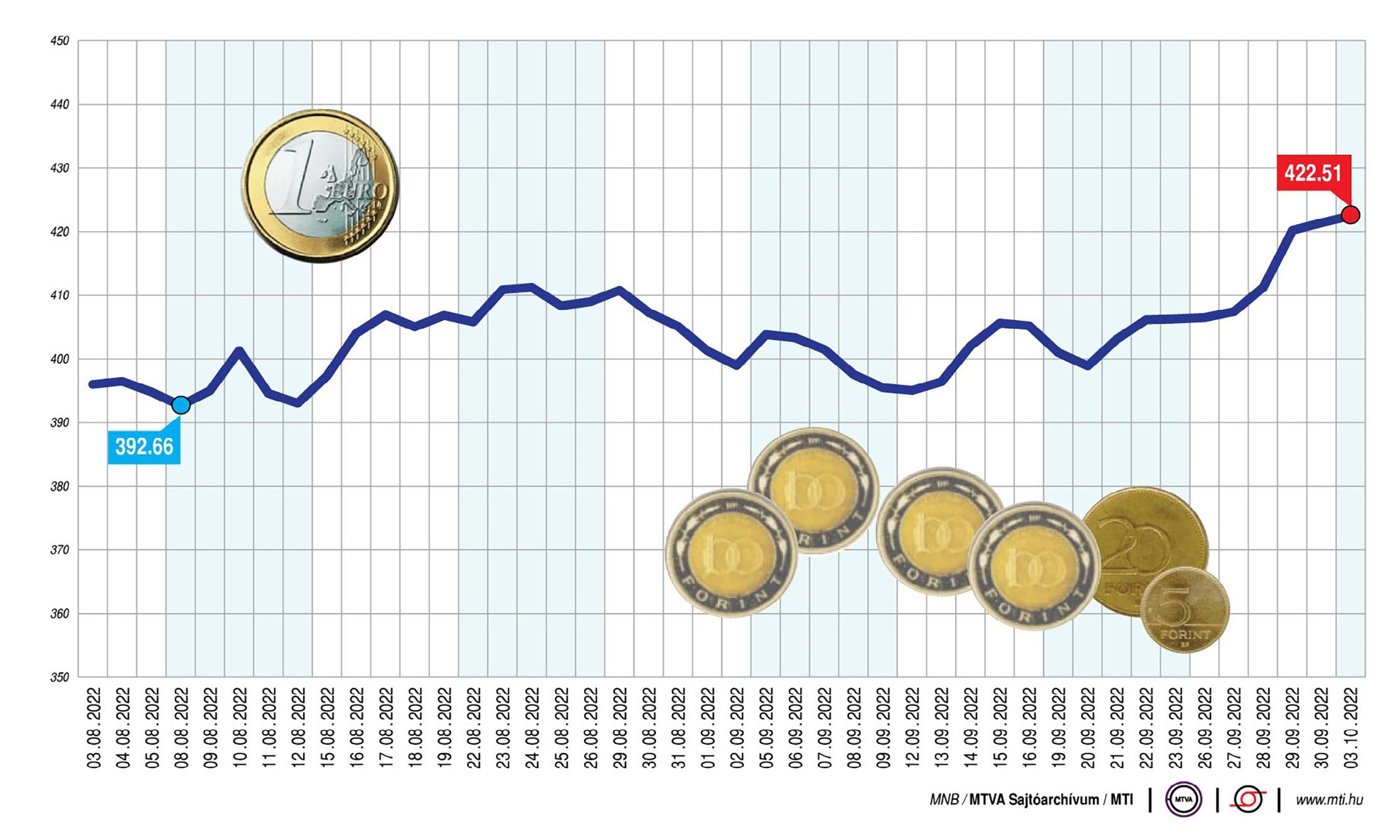

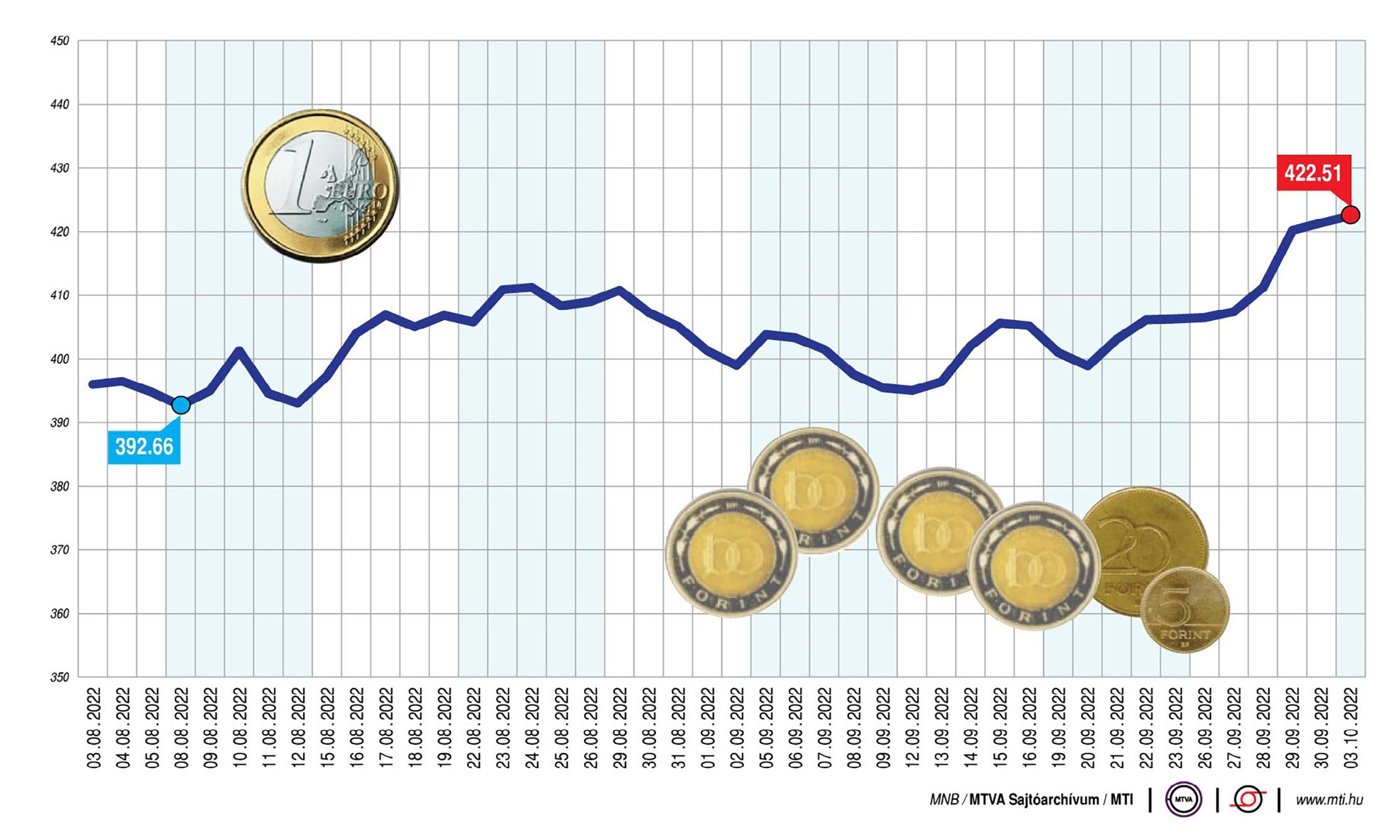

Forint/Euro Exchange Rate, Aug. 3-Oct. 3, 2022

The official euro exchange rate of the National Bank of Hungary; exchange rate for 1 unit, in forints

In a rather unexpected move, the central bank’s Monetary Council brought the cycle to a conclusion at its latest rate-setting meeting on September 27. The council raised the key rate by 125 basis points to 13% and, right after the decision, MNB Governor György Matolcsy announced the end of the tightening cycle.

In doing so, the MNB closed its most prolonged rate-hiking period in 30 years. As it was the first in the region to start such hikes, it has become the first to end them, despite the central bank expecting inflation to accelerate further.

“We are not going any further because there is no point in going higher than a double-digit base rate, and there is also favorable data coming from the global inflationary environment,” Matolcsy said at a press conference following the rate decision.

Analysts unanimously described the

125-basis

point

hike as surprising, and opinions on winding up the rate hiking cycle vary.

Gergely Suppan, senior analyst at Magyar Bankholding, drew attention to the fact that the strict monetary conditions will remain even after the interest rate hikes are stopped. He noted that the forint has recently reached historic lows against the euro, despite the pace and severity of interest rate hikes in the recent period showing a “commitment” against inflation that is almost unique in the world.

Exchange Rate Drivers

Suppan said that the exchange rate of the Hungarian currency is not primarily driven by the interest rate but rather by the changes in gas prices (which significantly worsens growth prospects), the strengthening of the dollar, global risk aversion, and the uncertainties of the EU embargo and payment disputes.

He reminded that the central bank had also decided on liquidity-restricting measures at the last interest rate meeting, which supports the fact that there is no longer a need to raise interest rates significantly, even though inflation may still rise considerably for the remainder of the year, Suppan said.

The analyst noted that, due to the conflict in Ukraine, the sanctions against Russia, and the very low level of Russian gas deliveries to Europe, the rise in European energy prices had continued substantially, making the easing of shortterm inflationary pressure still unlikely.

Moreover, a significant rise in inflation is expected due to the extension of utility cuts above average consumption, energy prices expected to continue rising at current levels, continued repricing in some product areas, and a sharp rise in company costs, Suppan wrote.

Dániel Molnár, an analyst at the Makronóm Institute, believes that the end of the interest rate hike cycle was “not necessarily expedient in the current uncertain economic environment” and that the MNB should continue raising interest rates until the peak of inflation is visible, which could occur by the end of this year at the earliest.

Energy prices continue to show significant volatility, which affects the prices of all products. Normalization cannot be expected until the end of the Russo-Ukrainian war and the lifting of sanctions. If that does not happen,

the situation will result in permanently high energy prices and thus inflationary pressure, as well as a worsening of the balance of payments, Molnár warned.

He believes the continuation of interest rate increases is also necessary because it supports the exchange rate of the forint, which in turn has an impact on inflation through the prices of imported products.

‘Unorthodox’ Return

Péter Kiss, investment director of Amundi Alapkezelő Zrt., explained that the MNB is returning to the use of its former “unorthodox” monetary policy tools and will primarily try to influence short-term interest rates by managing interbank liquidity, but he says it is questionable how foreign investors will evaluate this.

This will be especially difficult to explain when, according to the central bank’s forecast, inflation may rise until the end of the year, and it may not fall back to the target range until 2024, Kiss noted.

He accepted that the central bank had successfully carried out this liquidity policy in the past in a low-interest rate environment. However, it is questionable how successful the old-new approach would be with high and still rising inflation in the short term. That is especially so when the leading developed market central banks are about to get rid of non-conventional instruments

and are obliged to increase interest rates in the fight against inflation, Kiss said. In the meantime, the MNB has raised its inflationary forecast in its September Inflation Report. According to this, domestic inflation will continue to rise in the fall months, and this year it may average between

13.5–14.5%

overall.

Inflation will decrease slowly in the first half of 2023 and then more significantly from the middle of the year. The consumer price index may be in the range of 11.5–14% in 2023 and will return to the central bank tolerance band in the first half of 2024, at between 2.5–4%, the MNB says.

Numbers to Watch in the Coming Weeks

The Central Statistical Office (KSH) was due to release its first estimates for August’s industrial output yesterday (October 6), with the August performance of the retail sector also due to be published on the same day. The September consumer price index will be out on October 11. August construction sector data will be posted on October 14.

The National Bank of Hungary (MNB) has decided to end its most extended rate hiking cycle but says strict monetary conditions will remain.

ZSÓFIA CZIFRA www.bbj.hu Budapest Business Journal | October 7 – October 20, 20221News • macroscope

Source:

Orbán Warns That ‘Sanction Surcharge’ may be Baked-in

RoundupCrisis Ukraine

Gulyás said a similar break would also be ordered at government administrative institutions during the same period, resulting in “significant” energy savings.

Máté Kocsis, the leader of the parliamentary group of Fidesz, requested the government conduct the public survey so that Hungarians could express their opinions on the matter, which he said would make them the first in Europe to be able to do so.

In a weekly interview with Kossuth Rádió on September 30, Orbán warned that the “sanctions surcharge” Europeans are currently paying on energy could be “built-in” to the economy if European Union policies concerning punitive measures against Russia remain in place.

“If we don’t protest, if we don’t get Brussels to change the sanctions policy […] the sanctions surcharge will become a fact of life for the coming 5-10 years,” the PM warned. Orbán said that the National Consultation on Brussels’ sanctions policy would give Hungarians an opportunity to establish a consensus.

“We need to voice our opinions because if the sanctions policy is not changed, the sanctions surcharge that we’re paying today, which is a temporary thing, will be built into the economy and will remain with us for the long term,” he said.

As a consequence of the higher energy prices, Hungarians are consciously preparing for this year’s heating season, according to research from IKEA. While households said they would keep the temperature in their homes higher than the 18ºC (64ºF) recommended by the government, the survey revealed that most, some 47.7%, would turn down the heating in rooms when they are not in use.

MNB Turning Down the Dial

As a public institution, the management of the National Bank of Hungary (MNB) said it would lower thermostats at its buildings to 18ºC during the winter, in addition to reducing hot water usage and cutting back on outdoor lighting in an effort to

save energy, the central bank said in a release on its website on September 28.

To further save on energy costs, the government announced that Hungarian students’ that there would be no fall break this year, but the winter holiday would be extended from December 22 to January 8, the Prime Minister’s chief of staff Gergely Gulyás said at a weekly press briefing on September 29.

Yet, as Russia’s Gazprom has severed ties with every other European country, Hungarian energy company MVM said it had reached an agreement with the energy giant on October 3 to make deferred payments for gas over the winter, which it said would increase its financial room for maneuver.

Hungary signed a 15-year deal with Russia last year, before the invasion of Ukraine, to receive 4.5 billion cubic meters of gas per year via Bulgaria and Serbia, according to Minister of Technology and Industry László Palkovics. The minister told an energy conference organized by portfolio.hu on October 4 that Hungary was aiming to eliminate Russian gas imports by 2050 through a large-scale electrification drive, following a review of Hungary’s energy strategy in the first quarter of 2023.

On the same day, the European Commission provided Hungary with EUR 21.1 million in support to help cover the country’s costs in providing for refugees from Ukraine, according to the Ministry of the Interior. The ministry said that related services and supplies for the more than 900,000 Ukrainian refugees who have arrived in Hungary have amounted to roughly HUF 28 billion, or EUR 66 mln.

TriGranit Hands Over 1st Phase of Millennium Gardens

TriGranit has completed the first phase of its Millenium Gardens office project overlooking the Danube on the Pest bank of the river. The office development is the final phase of a 25-year mixeduse office, cultural, entertainment, and retail project on a brownfield site in District XI.

The latest office complex at the site is being developed by TriGranit and funded by Revetas Capital, with OTP Bank and the European Bank for Reconstruction and Development providing finance. The 21,600 sqm north tower is more than 90% let with the local unit of Henkel, the Germany-based maker of Adhesive Technologies, Beauty Care, and Laundry and Home Care products, already occupying space in the building.

Tom Lisiecki, CEO of TriGranit, emphasized what he regards as the outstanding achievement of completing and leasing an office project developed during the COVID pandemic.

“It is always a pleasure to open a new office building, but Millennium Gardens

is unparalleled for us, as the building is the final element of Millennium City Center. The opening of Millennium Gardens, especially in these turbulent times, is an outstanding accomplishment from the TriGranit team,” Lisiecki said.

“I would like to thank Revetas Capital, [the] pan-European real estate investment advisor, for their trust and support. As the next step, we are working intensively to continue phase two of Millennium Gardens,” he added at the official handover reception.

Millennium Gardens is the opening phase of Revetas Capital’s ESG and

neutrality strategy. Steps were taken to reduce emissions and energy use during construction and source environmentally

friendly materials. All activities on the building site, including CO2 emissions, were closely monitored. According to the company, the building was planned in accordance with Breeam “Excellent” and Access4You “Gold” accreditations.

Roof Garden

The Budapest-based Finta Studios designed the complex, which has a green garden on the ninth floor and a roof terrace, both of which can serve as alternative workspaces and meeting points. A 300-seat restaurant with a terrace on the ground floor will serve employees from the building as well as nearby offices and the National Theater.

The Millennium City Center follows the concept of a “city within a city,” containing cultural institutions, offices, residential buildings, green areas, and a 1.5 km-

long promenade surrounding the buildings. The location provides several public transport and road links, deemed essential for any successful office complex.

Such large office deliveries as Millenium Gardens have been rare in recent months. Despite a strong office pipeline, developers are cautious about undertaking new projects in the current challenging economic and political environment.

“Development activity remains strong in Budapest despite elevated inflation pressures and the weak forint,” comments Orsolya Hegedűs, partner and head of research and advisory at Cushman & Wakefield Hungary.

“While some developments are delayed until the third quarter, the new pipeline in the second half of 2022 is estimated to exceed 240,000 sqm, 49% of which is already pre-let. New supply in 2022 is likely to break a record set in 2009,” she adds.

4 | 1 News www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

NICHOLAS

PONGRATZ

The cabinet of Prime Minister Viktor Orbán approved an initiative on September 28 from governing FideszKDNP MPs to organize a National Consultation on the sanctions imposed on Russia by the West, which the PM blames for “sky-high” energy prices.

2040 carbon

GARY J. MORRELL

Millennium Gardens by TriGranit.

Prime Minister Gergely Gulyás announces the extended Christmas break at Hungarian schools, universities, and state offices at the Government Info press conference in the Prime Minister’s Office building on September 29. Photo by Zoltán Balogh / MTI.

Speeding Automotive Sector Lifts Industrial Output but Future ‘Uncertain’

The automotive sector, Hungary’s leading manufacturing segment, has shown accelerated growth recently, boosting the headline industrial figure. While the improved performance is a welcome sign, and national economic trends may fuel future growth, the outlook remains uncertain.

the sector, an essential driver of the Hungarian economy, was up by 2.9% y.o.y. only, slowly continuing the gradual rebound from the halfa-year fall before January 2022.

Automotive Matters

Following its year-start rebound, Hungary’s automotive sector has sped up, performing 16.6% year-on-year growth in July, according to Central Statistical Office (KSH) data published in mid-September. The increase was a marked improvement on June’s when

China’s NIO Building Battery Swap Station

China-based automotive business NIO has started building a HUF 5.5 billion battery swap station plant in Biatorbágy, on the outskirts of Budapest, with a HUF 1.7 bln Hungarian state support. Once finished, the investment is seen to create hundreds of jobs, according to State Secretary Tamás Menczer of the Ministry of Foreign Affairs and Trade. The Hungarian station will be one of the 4,000 by 2025 to operate globally, of which 1,000 will be based external to China.

Three-strong Automotive Consortium Invests HUF 1.5 bln

A consortium of three Hungarybased automotive firms has

In July, the automotive sector accounted for 24% of the overall manufacturing output, a slight increase from June’s 23%, the latest KSH data confirms. The automotive industry has been challenged by the semiconductor shortage, a foundational component in modern car manufacturing, and supply chain problems.

In the first half of the year, total automotive industry output grew by 4.9% compared to the same period a year earlier.

completed HUF 1.5 billion of investments, which received HUF 772 million in European Union and state grant. The investment has been carried out by a consortium of Csaba Metál, Csaba Tool and Droidx. Consortium leader Csaba Metál, one of Hungary’s biggest aluminum foundries, bought an Industry 4.0-compliant enterprise management system and supported its business partners with consulting services via the investment. Csaba Tool, an instrument and tool manufacturer, invested HUF 471 mln in installing a 10-tonne overhead crane, allowing the company to make 10-12-tonne tools; purchased tool design software; and expanded its production area by 500 sqm. Droidx, a manufacturing technology maker, expanded its production area by 840

The statistical office confirmed that year-on-year headline industrial output increased 4% in July, accelerating from 1.5% y.o.y. in the preceding month. The output climbed 6.6%, adjusted for the number of workdays.

Larger Growth

In January-June, the headline industrial output indicator grew by 5.1%. The figure was lifted by growth in the most significant branches of the sector. Automotive and the computer, electronics and optical equipment segment both increased to a “larger degree,” the KSH said, while the food, drinks and tobacco segment increased to a “smaller degree.” Output in most of the other segments fell.

The overall growth in industrial output performed above expectation, and positive trends may be in store in the upcoming months. Magyar Bankholding chief analyst Gergely Suppan told Hungarian stateowned news agency MTI that the growth pace could accelerate due to a low base period and easing semiconductor shortage. However, he also acknowledged that risks of the war in Ukraine, lingering supply chain issues, and snowballing energy prices may harm future output. Despite that, though, he added that industrial stock order is elevated, and new capacities are in the pipeline.

In July, the automotive sector accounted for 24% of the overall manufacturing output, a slight increase from June’s 23%, the latest KSH data confirms. The automotive industry has been challenged by the semiconductor shortage, a foundational component in modern car manufacturing, and supply chain problems.

Data suggests that companies are getting better at managing supply chain issues, ING Bank senior analyst Péter Virovácz told MTI. Nevertheless, he cautioned that the outlook remains “extraordinarily uncertain” as high order volume may mean little if supply chain problems resurface or high energy prices force rationalization.

sqm and bought a tool-making center that can turn out XXL parts and tools via an investment of HUF 867 mln.

Continental Opens R&D Expansion in Budapest

Continental Automotive Hungary has opened its expanded Application Development Center at its Budapest research and development base. The new addition is part of a HUF 4.2 billion investment, which received a HUF 1 bln Hungarian state grant, to expand its research and development centers in Budapest and Veszprém (115 km southwest of the capital). Continental’s R&D centers in Hungary are planning to make several hundred new hires in the coming years, Balázs Loránd,

the head of the driving support and automated driving solutions division in Hungary, said during the inauguration. Continental employs more than 8,000 people in the country.

Rába Loses HUF 252 mln in H1

Hungarian automotive component manufacturer Rába booked a HUF 252 million loss in the first half of the year as inflation squeezed margins and financial losses weighed. Rába’s revenue was up 27% at HUF 30 billion; however, direct sales costs grew 31% to HUF 24.7 bln and other operating expenses were up 52% to HUF 4.6 bln. A financial loss of more than HUF 900 mln bit into the bottom line, Hungarian state news agency MTI said.

1 News | 5www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

CHRISTIAN

KESZTHELYI

A monthly look at automotive issues in Hungary and the region

Photo by Jasen Wright / Shutterstock.com

Business

‘Winter is Coming:’ Economy Faces Tough and Uncertain Period, Equilor Warns

Turbulent months are

ahead for the capital markets and the Hungarian economy, according to Equilor Investment, something an agreement on EU funds may help ease. The rapid and broad-based economic recovery following the coronavirus outbreak was primarily interrupted by the Russo-Ukrainian war and the ensuing energy crisis. All this also means that a bear market could stay with us for a long time, the consultancy says.

The development of the Hungarian economy and the forint exchange rate will be significantly influenced by the debate on the disbursement of EU funds, any resulting agreement, and, ultimately, the amount of funds disbursed.

Erratic energy prices, galloping inflation, slowing investment, the region’s highest base interest rate, a rising wage-price spiral, and an expected slowdown in domestic consumption are just some of the factors that make the outlook gloomy.

The euro could enter the new year at around its current level to the forint. Still, it is unlikely to strengthen next year, with the rate reaching the 420 level to the forint, according to Equilor. Its analysts expect GDP growth of 5% this year and stagnation next year, while inflation could reach 13.5% this year and

15%

next, they warn.

The Hungarian and European economies are facing their most uncertain winter in a decade, Equilor says. Economic indicators could be affected by average winter temperatures and, thus, the use of gas reserves. Still, in the longer term, the outcome of the RussoUkrainian war and the resulting energy crisis could be a vital issue, according to the company’s most recent analysis.

In total, EUR 7.5 billion in funding has been suspended from operational programs. As a baseline scenario, Equilor expects that Hungary will receive the bulk of the pending amount, some 80%, but that the contested items of the 2021-2027 operational programs will not be paid. If this materializes, Equilor expects that after this year’s 5% GDP growth, next year could see stagnation, while in 2024, GDP growth could still be subdued at 2.5%.

Domestic inflation started to rise in fall 2021, boosted by fiscal easing and, on the demand side, the personal income tax rebate. The rise in world energy prices, which also started last fall, has intensified significantly following Russia’s invasion of Ukraine.

Inflation Expectations

The revision of the overheads cut will be reflected in the CPI from September and could reach 20% annually in the fourth quarter. Equilor expects annual average inflation to be around 13.5% this year, rising to 15% next year and only returning to single digits (7%) in 2024.

However, Lajos Török, a senior analyst at Equilor, thinks that the outlook has many uncertainties. He explained that the main trends could be determined primarily by the evolution of world energy prices, but there are also several risks.

In his view, it cannot be ruled out that residential overheads will have to be adjusted again from January 1, leading to a further increase in inflation from the first quarter. In addition, the system of price caps, extended until the end of the year, should be phased out soon, which could lead to a

1-2%

increase in inflation, depending on current market prices.

Like the central banks of developed countries, the National Bank of Hungary (MNB) is fighting against the build-up of inflation expectations and their persistence at high levels: it has been raising the base rate in significant steps, but this can only have a partial effect due to the various subsidized loans and the interest rate freeze.

Despite having the highest base rate in the region, the forint has been in a tailspin against the euro since the outbreak of the war and has also drifted away from the region’s other currencies. This is partially explained by the relative fragility of the Hungarian economy, and partly by the withholding of EU funds, Török noted.

In addition to the interest rate hike, the MNB took other monetary tightening measures at the end of August, including an increase in the reserve requirement ratio for the banking system, a regular auction of central bank discount bonds, and the introduction of a long maturity deposit facility. The pace of the increase in the central bank base rate is expected to moderate from 100 basis points over the rest of the year.

In the absence of a shock weakening of the forint, regular base rate hikes could be completed this year, with ad hoc interventions in the first quarter. After peaking at around 15%, the policy rate could gradually decline to about 10% by the end of next year, in line with developments in global conditions, Equilor believes.

Risk Premium

In addition to accelerating inflation, Hungarian government bond prices have also been weighed down by a significant increase in the country’s risk premium. Although Standard & Poors affirmed Hungary’s debt rating in August, the outlook was downgraded to negative because of a deteriorating balance sheet and short-term country risks. With real interest rates still in negative territory, the incentive for higher interest rate hikes to increase savings and leverage is limited.

The Hungarian economy is facing several challenges. Although the debtto-GDP ratio is not exceptional by European standards, the highest yield levels in the region could put the budget under pressure in the medium term.

In addition to the fiscal deficit, the current account deficit is also high, which could be addressed by further reducing government expenditure and lowering the import ratio. In the summer, the government opted for fiscal adjustment: special sectoral taxes were increased and extended, government spending cuts were announced, utility subsidies were linked to consumption ceilings, and preferential taxation for small businesses was abolished.

With uncertainties remaining around the increase in debt refinancing and the receipt of EU Recovery Fund resources, and with tax revenues rising with inflation, the budget deficit would have been around 4.9%. It could increase to

6.1%

due to extra gas purchases, according to Equilor’s forecast.

The domestic labor market has recovered quickly from the crisis caused by the coronavirus epidemic, with the unemployment rate falling steadily to below 4% last fall. Severe labor shortages in many sectors and specializations are causing average wages to rise dynamically. The pace of wage growth is expected to accelerate towards the end of the year as companies try to offset the rising costs of inflation for their workers by raising wages.

The resulting price-wage spiral is already visible, but inflation remains primarily driven by external factors for the time being. High energy prices in Europe are likely to lead to a structural reorganization of the economy, with closures and shutdowns, especially in energy-intensive and cost-sensitive companies, which could temporarily increase unemployment by 1-2% in the coming quarters. Still, Equilor expects unemployment to remain low in the coming years, with high inflation compared to the past decade, and with moderate fluctuations due to structural changes.

on energy matters, see

For more

our Special Report on pages 12-19. www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

GERGELY HERPAI 2

From left: Bálint Szécsényi, CEO; Lajos Török, senior analyst, and Szilárd Buró, head of financial innovation.

Hays Hungary: a Talented Team's 15-year Rise to the Top

In August, Hays celebrated 15 years in Hungary. The Budapest Business Journal spoke with managing director Tammy Nagy-Stellini about coming top among recruitment agencies in the Book of Lists, candidate attraction, staying competitive in an uncertain economic climate, and the adaptability of businesses.

BBJ: Congratulations on Hays Hungary coming top among Recruitment agencies in the Book of Lists for the first time this year. To what do you attribute this success?

Tammy Nagy-Stellini: Thank you. A business is about its people, and I have a very talented and dedicated team. All the hard work we have been putting in has got us to the top. We have been here for 15 years and have grown the business by building long-term partnerships with clients and candidates. We also continue to offer new services. Fifteen years ago, we were just five people working in permanent recruitment. Now we also offer contracting, temporary staffing, RPO [recruitment process outsourcing], salary benchmarking, employer branding, and various consultancy services. We have kept pace with what the market needed.

BBJ: We have inflation (and thus pressure on wages), near full employment, and an energy crisis simultaneously, plus COVID still lurking and the possibility of a new wave arriving this winter. Is this the most challenging environment you have ever known in which to do business?

TN-S: These are indeed “interesting times.” Looking back over the past 15 years, the expansion of Hays Hungary has been accelerating continuously. And we are still growing today. Almost every month, we achieve record-breaking results; however, due to the uncertainty felt within the market, even more emphasis is being put on observing the market dynamics shaping our clients’ hiring plans. Most clients continue to hire, although some are waiting to see what will happen. We continue to prepare, to plan ahead so we can act early and be there for our candidates and clients. In the upcoming months, we’ll see if the recession will happen at the beginning of next year and to what extent it impacts us.

BBJ: What are your expectations for this year and next? How will Hays hold on to its number one position?

TN-S: Up to this autumn, hiring has not slowed down in any industry we operate in. Looking to 2023, we are curious to see how the market changes. We’ll continue keeping our standards in terms of service quality and continue to develop our strategic partnerships with our candidates and clients. And, of course, putting our people and the team itself in focus.

BBJ: What are the most significant trends shaping the recruitment market?

TN-S: With inflation affecting salaries, it seems some can adapt more quickly than others, but there is only so far you can continually offer higher wages. According to our latest Hays Market Trends study, many organizations have already increased salaries throughout the year and are now looking to plan their next steps for the beginning of 2023.

In today’s market, it is imperative to retain staff by being close to your people. You certainly want to keep the best talent within your organization, given the labor scarcity in almost all sectors. Employer branding has gained a much more critical role. Companies need to stand out and differentiate themselves from the

competition. Employers must become attractive to passive candidates and engage job seekers by offering flexible working solutions and a competitive benefits package.

Contracting as a form of employment is becoming more widespread. The flexibility offered by contracting is much appreciated both by clients and freelancers. Some of our clients, mainly in technology, already have a staff population of 70% employees vs. 30% contractors. And at the end of the project, it can be decided to extend, part ways, or employ the contractor permanently. There is also a growing demand for temporary staff to take on specific projects. This form of employment gives companies flexibility and allows them to outsource all related administrative duties.

Companies are increasingly nearshoring positions to Eastern Europe, especially in technology and business services. Their HR teams are seeking alternative ways to support hiring plans and looking for strategic recruitment partners that offer both expertise and consulting. As a result, clients ever more outsource their recruitment.

Lastly, an interesting new trend is that technology candidates would prefer getting their salary in euros or another stable currency. However, Hungarian

labor law doesn’t allow wages to be set or paid in anything other than Hungarian forints. We also see more one-off signing bonuses for new hires. In the engineering sector, some companies are even building flats in the countryside for employees, rather than renting accommodation, thereby offering more possibilities for relocation.

BBJ: We have heard from HR managers who say if they find a talented candidate, they will offer them a job first and then work out the role.

TN-S: Absolutely. With so much competition for talent, you need to act fast. Employers have recognized the need to reduce the number of interviews, to make the hiring process quicker and secure the best talent as quickly as possible.

BBJ: What could the government do to make business easier for your sector?

TN-S: Further governmental measures to attract candidates, where there is a skills scarcity on the market, could make the employment process quicker for jobseekers from outside the EU and, therefore, generate more available workforce in Hungary.

BBJ: What is your advice to businesses to ensure they get the best talents?

TN-S: Employer branding is vital to get onto the radar of candidates and stand out among competitors. According to our latest Salary Guide study, we’ve seen that, beyond offering a competitive compensation package, employers also need to provide a healthy work-life balance, flexible working solutions, and professional development opportunities to attract the best talent. Also, it is key for a company to take care of its employees since this is portrayed on the market and is part of building a strong employer brand.

You need to be up to date with what is happening in the market to ensure your strategy is aligned. That is why salary benchmarking and HR consultancy is so important.

BBJ: What would be your advice to those children who started secondary school or university this September? Where they have the choice, what should they be studying?

TN-S: Study what you really love. At a conference about five years ago, a colleague from Hays asked a futurist the best foreign language for children to learn. The futurist said, “Coding!” Tech is obviously a good area to go into if you are interested in that; I do believe the demand for tech skills will remain.

According to a recent study, 65% of children entering primary school today will ultimately end up working in entirely new jobs that do not yet exist. You must develop the ability to adapt to change, new technologies, and new markets.

To university students, I would say you need to get into the mindset of being a life-long learner. Never stop being curious. Whatever you are studying, be interested in other areas, take part-time jobs, and ask questions. Be inquisitive.

2 Business | 7www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

BBJ STAFF PRESENTED CONTENT

Tammy Nagy-Stellini

AutoWallis Group Heading in Fresh Directions: Austria and Online Sales

The AutoWallis Group is opening up to online sales and Western Europe markets, with a significant acquisition and business development in each direction. The announcements align with the strategy announced last year by the auto retailer and importer, which is listed on the Hungarian stock exchange and aims to increase its turnover to more than HUF 400 billion by 2025.

Gábor Ormosy, CEO of AutoWallis Group, said that the two latest transactions are significant in a changing and turbulent economic environment in which AutoWallis intends to continue to move forward at a dynamic pace, building on its capital strength and more than

30 years

of experience and “crisis-proof strategy.”

He recalled that the group announced its new strategy last year, which expects the company, listed in the Premium category of the Budapest Stock Exchange, to show explosive growth until 2025.

share in the first six months than last year,” Ormosy said. He did not rule out raising the target figures outlined above but noted that the ongoing and significant changes in macroeconomic conditions made it prudent to keep them at the same level for the time being. The management is working on further developments and acquisitions, the CEO added.

The acquisition by AutoWallis’ wholesale operation of the exclusive rights to import SsangYong vehicles in Austria means the group will now be present in

15

countries.

Speaking at a press conference on September 21, AutoWallis said it would enter the Austrian market with its SsangYong car wholesale business. It also has plans to acquire Net Mobilitás Zrt., operator of the JóAutók.hu and Autó-Licit.hu portals. It

The acquisition of the exclusive import rights of SsangYong in Austria could be a decisive new direction in terms of diversification, the company argued. At the same time, the purchase of Net Mobilitás Zrt. is a first step towards the expansion of online sales. The moves follow the earlier announced acquisition of Renault Hungária by AutoWallis Group and a JV partner.

Ormosy says it expects to become the leading auto retail and mobility provider in the Central and Eastern European region by the decade’s end. The group’s revenue could double last year to more than HUF 400 billion, while EBITDA could rise above HUF 14 bln. The projected growth is driven by the transactions completed or announced by the company so far, organic growth and planned further acquisitions, the CEO said.

Record Results

“As you know, the company reported record half-year results in August, already generating more earnings per

While this further strengthens its already-dominant CEE position by taking it into a developed market for the first time, it is described as a pilot project.

The group has been the exclusive importer of SsangYong since 2012 in Hungary (where it has also retailed the brand since the spring of this year), followed by Romania, the Czech Republic, Slovakia and, from 2023, Austria.

Andrew Prest, head of wholesale at AutoWallis Group, said the move is an excellent complement to the strategy to organically through acquisitions, making the brands it already represents available in more and more countries.

He stressed that the current business development would allow AutoWallis to test its well-known and highly successful import brand at low risk in the market to the west of its strategic territory of Central and Eastern Europe.

Significant Demand

It perceives significant demand for its value-for-money offering in a niche market segment and believes this will strengthen its visibility and position, increase its revenues and operational efficiency through synergies between group members, and support shareholder value growth. Prest said sales are expected to reach the fivedigit mark in 2023.

The acquisition of Net Mobilitás Zrt., on the other hand, brings with it the JóAutók.hu and Autó-Licit.hu portals. These aggregate verified used car advertisements from qualified sellers and are leading players in the Hungarian market. Launched in

2017,

JóAutók.hu is the second largest player in the market. It supports traditional used car sales as well as new and showroom car sales, where sellers are typically car dealerships, but individuals can also advertise on the site.

Founded in 2006, Autó-Licit.hu is a car auction portal where contracted fleet operators (multinational companies, banks, leasing companies, public companies, fleet managers, rental car companies, etc.) and a small number of private individuals offer their cars for sale.

The buyer side is open to registered national and foreign dealers and employees of contracted fleet managers.

Commenting on the transaction, Ormosy said that the move is intended to support ongoing development projects, taking advantage of synergies within the group.

It was also a vital step in responding to the needs of the changing distribution model, where online sales channels are becoming increasingly important. AutoWallis will acquire Net Mobilitás Zrt. from WAM Immobilia Ingatlanhasznosító és Üzemeltető Zrt. via a share swap transaction. The transaction is expected to close by the end of the year.

8 | 2 Business www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022 20 October 2022 Hotel Marriott Budapest, Hungar y BOOK YOUR SE AT ADVERTISEMENT

GERGELY HERPAI

From left, Andrew John Prest (head of wholesale) and Gábor Székely (investor relations) of AutoWallis Group at the announcement of two new acquisitions.

Is the World Heading Towards a ‘Polycrisis?’

finance columnist Les Nemethy takes

of a

and how individual countries are placed to cope.

According to historian Adam Tooze, we are currently potentially facing a “polycrisis:” several smaller to mediumsized crises in the world that have the potential to combine and reinforce each other. Think of many small and medium-sized fires combining to form one magnificent conflagration.

Historian Niall Ferguson talks of a crisis shaping up in the 2020s that could be significantly worse than the 1970s.

Debt is always associated with fragility. Whereas during the 1970s crisis, global debt was hovering around 100% of global GDP, today it is in the range of 350%.

For a long time, the U.S. Federal Reserve was in denial about inflation, then labeled it as “transitory.”

Quantitative tightening and interest rate hikes were postponed to the point where the genie was already out of the bottle by the time the Fed and European Central Bank started raising interest rates.

Over the past months, the Fed has pushed through several 75 basis point increases (and the ECB a few relatively minor increases), but it has proven too little, too late, to stop inflation.

The taming of inflation typically requires positive real interest rates.

Even after many interest rate hikes, real interest rates in the United States remain in the range of negative 4-5%,

and in Europe, 8 to 10% as of the beginning of October 2022. Because of significantly higher debt levels, the pain inflicted by raising interest rates is, by definition, much higher than in the late 1970s. Something will break.

Another driver is that climate change has been pushing an agenda of substituting green energy for fossil fuels.

The planning for this was done poorly, particularly in Europe. Even if we look beyond the colossal error of reliance on Russian hydrocarbons, fossil fuels were phased out faster than green fuels could be brought on stream, particularly with respect to satisfying base load capacity.

The nuclear industry, a carbon-free source of such capacity, was virtually shut down in Germany and curtailed in other European countries.

In the 1970s, the world enjoyed a number of favorable tailwinds, including good demographics and rising productivity; globalization was just beginning. These factors now constitute headwinds. Most of the world faces a demographic cliff, and globalization is stalling or reversing, resulting in diminishing efficiency and productivity.

SPACE

The Corporate Finance Column

liquidity. Much of emerging market sovereign and corporate debt is denominated in U.S. dollars, and with the appreciation of the dollar, is becoming increasingly difficult to service. Turkey and Argentina are approaching hyperinflation. Sri Lanka and Pakistan are basket cases. Russia, Iran and Venezuela all face sanctions.

The above drivers were in place even pre-COVID and the war in Ukraine, although both have served to accelerate and aggravate matters.

Is the World Ready?

So, how is the world poised to face down this polycrisis? China is losing its locomotive effect on the world economy due to an imploding real estate sector (which accounted for almost one-quarter of GDP), aggravated by the demographic cliff China is now facing. COVID lockdowns further diminish GDP growth and create supply chain havoc. The government’s insistence on recentralizing power to the Communist Party is also likely to dampen growth.

Continental Europe faces multiple challenges, the cessation of Russian gas supplies perhaps being the greatest. Meanwhile, Italy’s newly-elected rightwing government could well bring havoc to debt markets in Europe and put stress on the European banking system: at least half a dozen major European banks see share prices collapsing and have price-to-book ratios of less than

40%.

The bankruptcy of a globally systemically important bank (G-SIB) such as CSFB is not inconceivable. Emerging markets worldwide are in tough shape due to higher U.S. interest rates and global crises sucking up

The United Kingdom is in crisis due to markets reacting poorly to giant tax cuts announced by the relatively new Liz Truss government (a controversial cut for the highest earners was dropped in an embarrassing u-turn on October 3). The Bank of England had to suddenly reverse gear from quantitative tightening to quantitative easing in a quest to re-establish stability, likely accelerating inflation.

The United States seems to be the only real economic locomotive of the world today; its job market remains surprisingly strong. Even the U.S. economy is decelerating, thanks to ever-higher interest rates. Yet inflation in America remains robust at over 8%, meaning that the Fed will likely continue increasing interest rates until something breaks. And then the world’s last economic locomotive will lose traction.

Might that be the moment that triggers a “polycrisis?” Think again of various fires coalescing. Might it be the emergence of a new strain of COVID? Or the bankruptcy of a G-SIB creating a Lehman moment? The trigger or spark is almost irrelevant. We know there is a huge amount of combustible material around.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

2 Business | 9www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022 EACH AGENCY INDEPENDENTLY OWNED AND OPERATED. Franchisee: T-SOLUZIONI ZRT. H-1054 Budapest, Szabadság tér 7. +36-30-591-7998

FOR YOUR BUSINESS

Corporate

a high-level view of the

potential

drivers

“polycrisis”

ADVERTISEMENT

Photo by thodonal88

/ Shutterstock.com

3 Country Focus

Germany

Clouded Prospects, Improving Business Environment?

With the fall update of the business sentiment survey of the German-Hungarian Chamber of Industry and Commerce (DUIHK) due to start on October 4, the Budapest Business Journal asked Dirk Wölfer, the chamber’s head of communications, to review the findings from earlier this year.

sharply. Nonetheless, a slight majority still expected improved results this year; even regarding employment and investments plans, the balance of sentiments was still slightly positive.

This is an important signal to Hungary, given the strong presence of German companies in the country.

the Chamber warned. Although it provides no comfort, it is noteworthy that these labor market tensions are not specifically Hungarian problems, but affect many countries in the region.

key risk these days is surging energy and raw material prices – three out of four companies named this among the most important threats – thus outpacing even the labour shortage which ranked “only” third. In the light of latest developments, it does not surprise that the exchange rate volatility is of rising concern to the managers. As a result, two thirds of them would now vote in favour of introducing the Euro in Hungary –a jump by about 10 percentage points from last year. However, the finance minister dampened such hopes when asked: “Good economic policy can be made both with and without the euro”, he said.

An interesting detail of the survey was that disruptions of international supply and value-chains which emerged since the outbreak of the corona pandemic could even generate a chance for Hungary. Many companies are looking or may look out for new suppliers in order make their supplier network more divers and resilient to shocks. When asked in which regions they would search for new partners, clearly the Central and Eastern European EU member states were named as preferred target area.

The business sentiment of German companies in Hungary are suffering from the negative impacts of the war in Ukraine and disruptions in international supply chains, according to the latest corporate survey of DUIHK members.

Given the outstanding role German businesses play in the Hungarian economy, Hungarian Minister of Finance Mihály Varga attended the official presentation of the survey results in the early summer and commented on the findings.

The annual sentiment survey, first launched back in 1994, not only features data on business expectations and investment plans, but also looks into the assessment of the regulatory framework, labor market trends and risk factors for the companies’ business outlook.

Compared to 2021, German companies saw their business situation and that of the economy as a whole in a better shape, but the outlook for the upcoming 12 months had dropped

According to DUIHK president András Sávos, there are about 2,700 such firms operating in Hungary, employing more than 220,000 people and contributing nearly one sixth of the gross value added in the private economy.

Finance minister Mihály Varga noted that German-Hungarian economic relations have proved “crisis-resilient,” adding that their quality has been raised successively in recent years. These ties are ever more characterized by cooperation in areas such as research and development, innovation and higher education and vocational training, in addition to production, Varga said.

The DUIHK survey again certified that tight labor markets remain a crucial issue for companies: two out of three managers are unhappy with the situation. This, on the other side, adds to existing wage pressures. This year, companies expect labour costs to rise by 10% on average – the highest forecast ever measured in the survey. But given rampant inflation and the fact that previous forecasts used to underestimate reality, the final rise in wages could be even higher,

With regards to the quality of the general business environment , the new poll saw some further improvements, thus extending positive trends of recent years. The finance minister - who has just taken up this post for the fifth time - was probably particularly pleased to see that the assessment of the tax system has continued to improve, satisfaction in Hungary exceeds the average of the Central and Eastern European region. Similarly, to the state quality of public infrastructure, conditions for research and development received better ratings than in many other countries of the region. In contrast, the surveyed companies in Hungary are clearly dissatisfied with the transparency of public procurement, and with the containment of corruptions: more than half of the respondents had negative opinions which is even poorer than the regional average.

Impacts of global developments

Current crises in Europe and in the global economy have a severe impact on open economies such as Hungary or Germany. According to the poll, the

This could even give an additional impetus to further investments of German companies in Hungary. Commenting on the fact that 88% of the survey respondents stated they would again choose Hungary as an investment location, the finance minister said: “We are working on getting to 100%.”

Talking about the current challenges facing Hungary’s economic policy, Varga named inflation and the resulting rise in interest rates and yields, which makes financing more expensive not only for the state but also for companies. Hungary must therefore pursue a stable and disciplined fiscal policy, Varga said, forecasting that the budget deficit should fall to 4.9% of GDP this year and to 3.5% in in 2023, while economic growth could reach around 4% in 2022.

full survey results can be downloaded from the Chambers website in Hungarian or German: https://www.ahkungarn.hu/ konjunktur

www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

BBJ STAFF

The

DUIHK president András Sávos and finance minister Mihály Varga. Photo by Nóra Halász / DUIHK.

A Unique Bond Forged by Uninterrupted Investor Activity

When France sneezes, the rest of Europe catches a cold, Austrian Chancellor Metternich said in the 19th century, referring to how French political developments impacted other European nations back in the day.

In Hungary today, the phrase might be used in the context of relations with Germany to highlight to what great degree Hungarian growth depends on whether or not Germany booms. What shape are business relations between the two countries in nowadays? The Hungarian Investment Promotion Agency offers a detailed picture of the current conditions based on its data and case studies.

If you want an overall impression of Hungary’s current investment landscape, just take a look at HIPA’s press event calendar. It provides a snapshot of projects through corporate announcements and, hence, reflects current investment trends. Roughly two-thirds of the items in early fall 2022 feature the events of Germanowned companies; the ratio was pretty similar earlier in the spring. An accident it is not; it’s part of a clear pattern.

Being the largest investor nation in Hungary, Germany accounts for around 21% of the total FDI stock, with more than 2,700 German-owned businesses employing

225,000 people in the country, according to the Hungarian Central Statistical Office (KSH). They include giants like Bosch or Thyssenkrupp and more traditional family-owned, Mittelstand SME ventures such as OBO Bettermann or Kostal. And they tend to show an equal level of activity; in fact, all those mentioned above have made different project-related announcements this year.

The German presence in the automotive sector is particularly strong; Hungary is the only country in the world apart from China that can pride herself in hosting production sites for all three of the most significant German OEMs, namely Audi, BMW and Mercedes-Benz.

three job creators and were responsible for the highest number of HIPA-guided deals, with the exception of 2014.

This high level of activity is coupled with the ability to adapt to changing circumstances. The global supply chain disruption is the latest issue that demands such flexibility. A worldwide shortage of semiconductor components particularly impacts automakers like Mercedes-Benz. The OEM is confident the situation can be handled, although a prognosis about when the supply bottleneck would be cleared is not possible as yet.

EQB, the first fully electric car manufactured in Hungary at Mercedes-Benz’ Kecskemét plant, October 2021.

Like their fellow German investors in other industries, these three behemoths are here to stay, as showcased by a solid reinvestment pattern. Mercedes-Benz, for example, recently announced a more than EUR 1 billion investment as yet another sign of its long-term commitment.

The focus will be on further flexibilization of production lines, digitization and sustainability.

In fact, Hungary’s first all-electric production vehicle was produced at the Kecskemét factory site, which plays an ever-bigger role in the global production network by integrating new models into series production.

Among other things, a new assembly and body-in-white (the pre-painting stage of the assembled auto frame) line are being built to pave the way for producing a new model of the allelectric MB.EA platform from 2025 on.

However, German investors are active in many other sectors beyond automotive. Between 2014 and the first half of this year, HIPA guided 171 companies from Germany, generating investments worth EUR 7.86 bln and creating 32,000 jobs.

Trail Blazer

One such was a project by Krones, a global market leader in the manufacture of fully integrated packaging and bottling line systems, which decided to settle in Hungary in 2017. It chose Debrecen for its location, a decision that is a welcome piece of local history for the city, as it was the first significant multinational company to make the move. It marked the start of a new industrial era, and Krones was the very first business to move into the Southern Industrial Park, recalls the managing director of Krones Hungary Kft., Zoltán Kocsis.

For Krones, the factory was its first in Europe outside of Germany. Since then, Debrecen has become something of a regional FDI hotspot, and Krones’ EUR 49 million investment has clearly paid off.

“Our expectations became a reality: we have already overshot the previously planned headcount, signed strategic

agreements with vocational training centers and the universities of Debrecen and Miskolc,” Kocsis says. “Now Krones Hungary is not only the second pillar of European production for Krones AG, but we found a home here.”

The company is looking forward and looks likely to follow the example of the majority of fellow foreign investors guided by HIPA to go for reinvestment.

“That’s no secret that our current 40,000productionsqm

area is only half of our whole plot, so we have room for more capacities here,” Kocsis notes. “We have a proven track record of ramping up a greenfield production plant.”

This optimism is based on skilled employees, a crisis-proof product, and a service package that contributes to every second bottled drink in Europe and every fourth globally. The Hungarian unit is an essential piece of the puzzle as it aims to fulfill ever-increasing European demand.

Chart Toppers

German investors in Hungary typically top the charts in every major category. Between 2014 and 2021, they consistently ranked among the top

“We are going to intensify our coordination on production planning with our direct suppliers as well as with the semiconductor suppliers in order to make the system more robust in the future,” a statement from Mercedes-Benz Manufacturing Hungary Kft. says.

“Together with our suppliers, we work to secure capacity and further develop the technology to enable new generations and availabilities. This includes more concrete agreements on supply quantities, extended planning cycles, as well as the development of a safety stock at various points of the supply chain and multiple supply sources.”

For Krones Hungary, the shortening of global supply chains could open new horizons.

“We have already built a young and agile team of more than 35 engineers to provide a strong basis for the relocation of further engineering and design functions to Hungary, but there are multiple scenarios discussed,” Kocsis explains.

All in all, despite past, current and possible future turbulence in the economy, the managing director is full of optimism. He believes that the future of Krones in Debrecen is bright, a stance shared by fellow German investors who have repeatedly placed their trust in the local economy regardless of the economic outlook.

German-Hungarian Bilateral Trade (2021) +11.3% y.o.y.

Hungarian exports to Germany (2021) EUR 31.8 bln, +8.6% y.o.y.

German imports to Hungary (2021) EUR 27.9 bln, +14.5% y.o.y.

Volume of HIPA Supported German Investments (2014-2022 H1) EUR 7.86 bln

German FDI stock in Hungary (2020) EUR 17.5 bln

3 Focus | 11www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

BBJ STAFF

PRESENTED CONTENT

4Special Report

Energy

The Way Ahead for Green Energy in Hungary

The cost of energy is perhaps the single biggest concern for households and businesses today. Electricity prices have risen multiple times in the first half of this year. Gas prices have increased by more than 10 times compared to the pre-pandemic cost, according to the European Commission.

will work on updating its electric grid to allow more solar facilities to connect.

Steiner also noted that while domestic gas production currently covers approximately

15%

of Hungary’s consumption, there is work in progress to increase this ratio to about 20%. Notably, while domestic production can make a more significant contribution, it cannot cover all of Hungary’s needs.

facilitating funding support for ailing utility companies struggling to pay for supplies on the market.

Steiner talked positively about these first four ideas, but the fifth proposal, which would set a price cap on Russian gas, was not received well by the state secretary.

president of the DUIHK, said that while his company does have some energyrelated problems, it is lucky as it has a long-term electricity contract in place.

He also emphasized the importance of investing in sustainability projects. Knorr-Bremse started such a program some two decades ago, but it was in the last five-to-seven years that the company started making significant investments in sustainable energy. Sávos added that the firm had decided to accelerate the program while also considering in which areas they could make savings.

“In terms of security of supply, we have progressed quite well. It’s better to have some gas with high prices than to have none. […] We have to speed up our endeavor to decrease energy dependence on Russia.”

The latest event in the CEO Breakfast Briefing, organized by the GermanHungarian Chamber of Industry and Commerce (DUIHK) in partnership with the Budapest Business Journal, discussed “The Future of Energy” and featured a panel consisting of Attila Steiner, State Secretary for Energy and Climate Policy at the Ministry of Technology and Industry; Viktor Sverla, head of group strategy at MOL Group; Ákos Hegedűs, CEO of Linde Gáz, and DUIHK president András Sávos.

After a short introduction by Barbara Zollmann, the CEO of DUIHK, State Secretary Steiner took the stage, outlining to the audience the government’s plans to alleviate the adverse effects of the energy crisis.

“In terms of security of supply, we have progressed quite well. It’s better to have some gas with high prices than to have none,” he noted.

He added that Hungary is wellpositioned in transitioning to sustainable energy sources but pointed out, “We have to speed up our endeavor to decrease energy dependence on Russia.” This means that Hungary

In terms of support to businesses, the state secretary argued that measures should be tailor-made for specific sectors, and help should be provided to SMEs looking to make themselves more energy efficient.

In the long term, Hungary aims to complete a EUR 16 billion investment plan in alternative energy by 2030, Steiner explained. That includes some 31 sub-projects and would cover the bulk of the country’s climate-neutrality goals.

European Proposals

After the state secretary’s presentation, a panel discussion followed, moderated by BBJ editor-in-chief Robin Marshall. In response to a question from him, Steiner said that there are currently five potential proposals from the European Commission to tackle the energy crisis.

Announced by the European Commission in mid-September, the proposals include mandatory measures to reduce electricity demand during peak hours, a cap on the high revenues some companies are making by generating electricity from lower-cost sources than gas, a solidarity tax on fossil fuel companies making big profits with the funds sent to help ease the pain for consumers and businesses, and

He said that an EU-wide price cap on gas imports might be detrimental to Central Europe, as it cannot cope with cuts in delivery if Russia decides not to supply more (or any) gas at the prices set by the European Union.

MOL’s Viktor Sverla concurred with this argument saying, “As an economist, I cannot imagine how a thing like that could work,” referring to the commission’s proposed price cap.

Addressing the current energy situation in Hungary, Sverla told the audience that MOL is doing its best in Hungary, trying to supply filling stations, even if the fuel situation is not the same as Hungarians have gotten used to in the past

20-30

years.

Regarding windfall taxes, he noted that while companies are not happy about them, they still have to be “reasonable” in order to help those in need. In the case of the introduction of an EU-wide windfall tax, he pointed out that the general framework would have to be harmonized with national plans; otherwise, companies in countries such as Hungary, where a tax on extra profits is already in place, would be at a disadvantage on the international market.

Long-term Contract

András Sávos, vice president and head of digitalization and process optimization at Knorr-Bremse, in addition to being

He also warned that the more significant threat was not to the multinationals but to the local SMEs who form the value chain and are less likely to have embarked on long-term projects and more likely to struggle with rising costs.

Ákos Hegedűs explained how hydrogen could be a vital alternative form of energy in the future, noting how interest in the alternative energy source is reflected in the fact that he had some

2,000

hydrogen-related business meetings in the last two years.

However, regarding the current crisis, he admitted, “It is not the solution. Although it can help in the decarbonization process, it also requires investments.”

He argued that the recent appearance in Hungary of two hydrogen-fueled personal autos is little more than a “dog and pony” show but noted that the gas as a fuel source for buses and trains could be a significant factor in a greener future.

Held at the Anantara New York Palace Hotel on Wednesday, September 28, the CEO Breakfast Briefing started with greetings by New York Palace general manager Tamás Fazekas. Apart from providing the venue, the hotel also offered participants an exquisite range of breakfast foods, pastries, and coffee.

www.bbj.hu Budapest Business Journal | October 7 – October 20, 2022

BENCE GAÁL

From left: Robin Marshall, Attila Steiner, András Sávos, Viktor Sverla and ÁkosHegedűs.

in BriefNews

MVM Reaches Agreement With Gazprom

Hungarian energy company MVM said on October 3 that it had reached an agreement with Russia’s Gazprom on making deferred payments for gas for the winter, according to napi.hu [Daily]. MVM also said it decided to tap some 800 million cubic meters of “cushion gas” in a storage facility in Hajdúszoboszló (205 km east of Budapest) and weigh its replacement with carbon dioxide in the interest of achieving emissions reduction targets. MVM noted that the market value of the cushion gas in Hajdúszoboszló is around EUR 1.5 billion. “To mitigate the impact of the increase in market prices, MVM Group and Gazprom have agreed deferred payments for the forthcoming winter period,” MVM said in a statement quoted by international news wire Reuters. “The temporary inclusion of the deferred payment option in the contract increases MVM Group’s room for maneuver in financing and its liquidity position,” it added. Meanwhile, it was revealed that MVM booked a consolidated first-half loss of HUF 81.1 billion as costs climbed at a faster clip than revenue. According to an earnings report posted on the website of the Budapest Stock Exchange, sales revenue increased 124% to HUF 2.429 trillion. Operating costs jumped 151% to HUF 2.596 tln. Gas sales came to HUF 1.375 tln, up from HUF 638.8 bln in the base period. Electricity sales rose to HUF 825.1 bln from HUF 288.5 bln.

MOL COO Appointed INA Chairman

Péter Ratatics, the COO of Hungarian oil and gas company MOL’s domestic business, has been appointed chairman of Croatian energy company INA, which MOL manages, novekedes.hu [Growth] reported on September 29. Ratatics replaces Sándor Fasimon, who resigned earlier in September amid revelations of fraudulent gas trade deals that took place under his watch “despite no involvement in any of the wrongful practices that surfaced around INA.” MOL’s other two delegates to INA’s board also resigned. Late in August, Croatian authorities took five people into custody, including the

head of INA’s gas trade business, Damir Skugor, suspected of defrauding INA of more than HRK 1 billion through gas deals on international markets.

Production of Paks Reactor Vessels Begins

Production of the reactor vessels for new blocks at Hungary’s Paks nuclear power plant has started in Russia, Minister of Foreign Affairs and Trade Péter Szijjártó said in a post on Facebook. All permits have been issued for the 330-tonne, more than 11-meterhigh reactor vessels, Szijjártó said. Hungary’s National Atomic Energy Office (OAH) issued the implementation license to expand the Paks nuclear power plant in August. The target date for putting the two new blocks online is 2030. Meanwhile, the second September delivery of fuel rods from Russia has arrived at the Paks nuclear power plant, Minister of Foreign Affairs and Trade Péter Szijjártó said in a video message posted on Facebook early on September 28. “We’ve been able to complete both September deliveries of fuel rods,” Szijjártó said. Since the start of the war in Ukraine, the fuel rods have been delivered to Hungary by air. Paks power plant, Hungary’s only commercial source of nuclear energy, accounts for about half of electricity generation in Hungary.

Solar Power Set to Reach 8GW by 2025

Hungary’s solar power capacity could reach 8GW by 2025 and 12GW by 2028, Minister of Technology and Industry László Palkovics said at a conference in Siófok (110 km southeast of Budapest) on September 27, according to state news agency MTI. Addressing the 52nd International Gas Conference, Palkovics said Hungary’s solar capacity has increased “faster than planned.”

The issue now is how to upgrade the network to put that solar energy to use, he added. He acknowledged “debates within the government” over wind energy, adding that one advantage of wind is that it requires less space than solar. A single turbine can generate 4MW of electricity, while six hectares of solar panels are necessary to match that volume, he explained.

Electricity Storage, Regulation Play key Role in Development of Renewables and Energy Independence

Dr. Róbert Szuchy Managing Partner

BSLAW BUDAPEST Bocsák & Szuchy Ügyvédi Társulás