Real Estate Development

Opportunities Exist, But Market Becoming More Cautious

With economic and geopolitical uncertainties barriers to development in office, retail and hotel, future development patterns look uncertain. Even in the industrial sector, rising construction and energy costs can be a brake. Investors are adopting a waitand-see approach to the markets.

Industrial Sector Continues to Boom

The industrial and logistics sector boom continues unabated, as demand remains high, vacancy stands at a record low, e-commerce expands and provincial hubs finally emerge.

The Hotel GM and the Dragon Boat World Champs

As he goes about his high-powered work, making sure everything at Budapest’s luxurious Anantara New York Palace Budapest Hotel runs smoothly, you’d never know that Tamás Fazekas is also a World Champion.

The BusinessPolicy Back Channel

Hungary to Face High Inflation Well into 2023

The inflation rate broke a nearly 26-year record in September, reaching 20.1%. Analysts expect high prices will remain a factor for the majority of next year as well.

Sopron Surprises as it Emerges From Burgenland’s Shadow

As a wine region and a city, Sopron literally sticks out from the Hungarian pack, jutting out into Austria’s Burgenland. Long in the shadow of its neighbor, it is finally making wines that are at least a match for it in terms of quality.

33

35

3

NEWS SOCIALITE

HUNGARY’S

PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BBJ.HU VOL. 30. NUMBER 19 OCTOBER 21 – NOVEMBER 6, 2022 HUF 1,850 | EUR 5 | USD 6 | GBP 4

SPECIAL REPORT INSIDE THIS ISSUE BUSINESS

10

AmCham Hungary president Zoltán Szabó and CEO Írisz Lippai-Nagy discuss what the chamber is doing to help members in a challenging economic environment and its relations with the Hungarian government and the U.S. Embassy.

6

SOCIALITE

24

Photo by Lázár Todoroff / AmCham

IMPRESSUM

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia

Czifra, Kester Eddy, Bence Gaál, David Holzer, Christian Keszthelyi, Renáta Kónya, Gary J. Morrell, Nicholas Pongratz, Gergely Sebestyén, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES:

Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

THE EDITOR SAYS

THE ETERNAL OPTIMISM OF THE BRICKS AND MORTAR MERCHANT

Real estate developers are, pretty much universally, a positive bunch of people. They have all the enthusiasm of the natural salesperson, unsurprising since their job is to sell you an idea or an asset, depending on where you meet them on a project timeline. That’s not to say they are relentlessly upbeat. I have, on several occasions, enjoyed hearing a group of them exchanging complaints about who has gazumped whom for a particular plot, or the lack of transparency in the planning process, or how today’s problems are nothing compared to doing business in the republics of the former Yugoslavia in the Nineties and Noughties. But that aside, they are a “glass half full” species.

especially in the industrial and logistics sector. But that doesn’t mean there aren’t a few dark clouds gathering. The ongoing pipeline continues, but new projects are increasingly on hold. That makes sense when finance is getting more expensive; why build today when it will be cheaper tomorrow? But as our Macroscope report on page three makes clear, if inflation continues in the high double digits well into 2023, when exactly will tomorrow come? The war in Ukraine has had a direct impact on the supply chain for raw and finished materials. It may also have some effect in scaring off the more risk-averse investors, although looking at Hungarian fundamentals (not to mention a map) ought to provide comfort.

BBJ-PARTNERS

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

I was struck, during the pandemic, by how relaxed they were about the whole “death of the office” line of reasoning. One regional developer produced studies which, it argues, prove that most people prefer to be in an office. As one of my more cynical colleagues puts it, “Well, they would say that, wouldn’t they!” But I have spoken to enough CEOs to know that there are probably three times as many keen to get staff back in the office as there are those ready to embrace the flexibility that remote working offers. The divide largely depends on their field of business and just how tight the labor market is for the skillsets they need. IT firms are generally much happier to embrace a “work anywhere” mentality, not least because so many of their staff demand precisely that. And while almost everyone seems prepared to consider variations on the hybrid theme (albeit with plenty of arguments about where the office vs. home split should fall), I have read some isolated views from America which condemned hybrid as “the worst of all possible worlds” and called for one or the other, but not both.

As the Special Report in today’s issue on Real Estate Development makes clear, the market is pretty healthy,

Energy is the big concern for everyone. It makes sustainability and energy efficiency ever more important for developers in terms of the costs of running a building, attracting tenants, or finding investors to buy. But I wonder if there might not be a more immediate concern. Our daily newsletter Hungary A.M. carried a story on Wednesday, October 19, about a city center hotel that has announced it will take no bookings over the winter period because of the cost of energy. We know of several cultural institutions that have taken similar steps. If those same costs make it more attractive for an employee to commute to the office and let work pay for the heating (an argument I have heard from at least one developer), might there not also be businesses who think the same, but in reverse?

These are, as everyone keeps telling me, interesting times. I don’t believe any of the developers I speak to regularly are about to give up their membership of the positivity club, but there might at least be a nanosecond’s pause for thought come renewal time.

Robin Marshall Editor-in-chief

THEN & NOW

2 | 1 News www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

VISIT US ONLINE: WWW.BBJ.HU

István Szepsy of Hungarian winery Szepsy Pincészet Úrágya, which has a vineyard in Mád (220 km northeast of Budapest in the Tokaj wine region), has been named a member of the Golden Vines Hall of Fame at the II Golden Vines Awards in Firenze. His winery was also named the best in Europe. The black and white image from the Fortepan public archive shows gentlemen enjoying a glass of wine in the cellar of the Agrária Szőlőtelepítő Corp. in Ecséd (74 km northeast of the capital) in 1933.

Photo by MTI / Zsolt Szigetváry

Photo by Fortepan / Lászlóné Szöllősi

• macroscope

Hungary to Face High Inflation Well into 2023

The inflation rate broke a nearly 26-year record in September, reaching 20.1%. Analysts expect high prices will remain a factor for the majority of next year as well.

ZSÓFIA CZIFRA

Climbing slightly above expectations, Hungary’s September data also saw a 20.7% core inflation. The acceleration was mainly attributed to suddenly jumping overhead costs and rising food prices.

In one month, consumer prices increased by 4.1% on average. Compared to September 2021, a price rise of 35.2% was recorded for food, within which the highest price increase was for bread (76.2%).

Due to the changes in the regulations on household utility prices effective from August 1, the cost of electricity, gas and other fuels went up by 62.1%

on a yearly basis.

In a monthly comparison, consumer prices increased by 4.1% on average. Food became 3.5% more expensive. The cost of electricity, gas and other fuels went up by 59.2% due to the rise of natural and manufactured gas as well as electricity prices.

Raised Projections

“After the September data, we will most likely have to revise our forecast for peak inflation, which anyway projects a peak in December with inflation of 20.8%”, commented Péter Kiss, Amundi’s investment director.

According to him, an essential question for the next period is how the data will affect monetary policy. The central bank has somewhat tied its own hands by announcing the end of the interest rate hike cycle, although it has continued to tighten through other tools, as it said it would.

One positive factor in the data is that despite the weak forint, consumer durables did not exert more significant pressure; indeed, a year-on-year decrease was already observable, Kiss noted. He believes inflation of around 20% could be maintained in the coming months and expects a substantial decrease only from the second quarter

Inflation in EU Member States (September 2022) 12-month change in consumer prices

of next year. Of course, this is only valid if the price stops are maintained, he added.

ING Bank analyst Péter Virovácz pointed out that the weakening of the forint significantly affects the price of imported products, which can put further upward pressure on inflation. In addition, an increasing proportion of companies are faced with higher energy bills, which may trigger new rounds of repricing. This can drive up the price of industrial products and services. In light of the September data, this year’s average annual inflation may reach 14%, and next year, the average may be even higher, at around 15%, Virovácz war.

According to Bankholding analyst Gergely Suppan, inflation, which will continue to rise in the coming months, could reach 24-25% without the price restrictions. However, the measures introduced in the case of certain foodstuffs have largely been passed on to other products, he noted. Inflation may rise slightly above 21% by the end of the year, but from the beginning of 2023, he expects inflation to decrease due to base effects.

The outlook for inflation is still not favorable, and according to Erste Bank calculations, the annual rate of price increase may remain above 20% even into the second quarter of 2023, said analyst János Nagy. He does not expect

to see a single-digit inflation rate again until next September at the earliest, although there is significant uncertainty in this, he warns.

High Rate to Remain

In its latest forecast, the International Monetary Fund also warned that the inflation rate might linger at a higher level in Hungary for some time.

After 5.7% economic growth in 2022, activity may slow down significantly next year, and the IMF now expects only 1.8% growth. However, the forecasts of the latest World Economic Outlook (WEO) publication are still higher than the figures in the National Bank of Hungary’s recently published inflation report. The central bank expects economic growth of 3-4% this year and 0.5-1.5% in 2023; compared to this, the IMF forecast is rather optimistic.

According to the IMF, there will be hardly any decrease regarding the annual average inflation next year; after this year’s 13.9% figure, the price increase may still be at 13.3%

in 2023. Incidentally, this also falls within the relatively wide range estimated by the MNB.

Energy prices are 40-50% directly responsible for the current generally high inflation and 30% indirectly, Prime Minister Viktor Orbán recently claimed. That means the inflation is clearly the result of the failed sanctions policy, he emphasized.

Had Hungary not been able to exempt itself from the oil and gas sanctions, inflation would be even higher, and there would not be enough energy, he claimed. According to him, the government, fortunately, has experience in how to fight inflation from when it first returned to power in 2010.

“I asked the governor of the central bank and instructed the finance minister that by the end of next year, this inflation should at least be halved to single digits,” Orbán said.

Numbers to Watch in the Coming Weeks

The Central Statistical Office (KSH) will publish August earnings data on October 24. A few days later, the KSH will release the September labor market figures.

www.bbj.hu Budapest Business Journal | October 21 – November 6, 20221News

Estonia Lithuania Latvia Hungary Czech Rep. The Netherlands Poland Bulgaria Slovakia Romania Croatia Greece Belgium Denmark Austria Germany EU average Slovenia Sweden Euro area Portugal Italy Cyprus Spain Luxembourg Ireland Finland Malta France

Source:

Baker McKenzie Strengthens Employment Law Practice

Baker McKenzie Budapest has promoted Nóra Óváry-Papp, who joined the employment team in Budapest in 2019, to counsel. As a lead attorney, ÓváryPapp advises the firm’s clients on various employment matters, from immigration to collective labor law and employment protection. She has extensive experience advising domestic and multinational companies on employment matters, including traditional issues, management terminations, and other critical employment services, such as business transfer transactions and restructuring.

Óváry-Papp graduated from the faculty of law of Eötvös Loránd University in Budapest. Previously, she worked in law firms with international clientele, advising on several domestic and cross-border corporate, banking, and finance transactions, in addition to employment law matters. She also gained significant experience in data protection matters.

Head of Audit Services at EY Hungary

Nóra Óváry-Papp

Zsolt Kónya became EY Hungary’s head of audit services this summer. With nearly 20 years’ professional experience, he started his career at EY, where he built up the financial advisory business within the accounting practice in 2017, drawing on his extensive experience in the industry and the knowledge base available within the consultancy.

Óváry-Papp also has experience in whistleblowing matters, assisting clients in training, conducting employee interviews, drafting questionnaires, advising on employer decisions, and developing and reviewing workplace protocols. She also has extensive practical experience in atypical employment nationally and internationally.

PRESENTED CONTENT

As head of audit services, he will develop an operating model that allows staff to develop faster and support the firm’s clients more effectively.

“With Zsolt, a leader who has already proven his ability to take the business to new heights takes the helm,” said Botond Rencz, country managing partner for EY and CSE central cluster and Hungary tax leader.

“His expertise and experience will ensure that we continue to serve our clients, whether they are successful domestic companies, entrepreneurs or multinationals, to the highest possible standards,” he added.

Kónya commented, “Our profession is undergoing a major transformation. I see it as my personal mission to ensure the long-term success of the business, which is based on the satisfaction of our clients and employees.”

Kónya’s predecessor, Zsuzsanna Bartha, will remain at EY and focus on the capital markets, looking to develop the consultancy’s client base further.

AutoWallis Appoints ESG Director, Consultant

In preparation for the company obtaining ESG certification, AutoWallis Group has appointed Gábor Székely as ESG director and selected Deloitte as a consultant. Székely retains his position as director of investor relations.

Deloitte will help AutoWallis by preparing its ESG report and assisting in working out the measures necessary for obtaining an ESG certification as quickly as possible. Present in 14

#FeelGoodDoGood Bonfire Party to Support Children, Refugees

As in previous years, the party, which also celebrates XpatLoop’s 22nd anniversary, will support Hungarian children’s charities. A food bank supporting Ukrainian refugees has been added to the beneficiaries this year.

BBJ STAFF

XpatLoop is using the social media hashtag #FeelGoodDoGood to promote the fundraiser, which, it says, “unites good-hearted guests from the international community in Hungary.” Once again, FirstMed is the principal sponsor.

Entertainment includes live pop, soul and funky tunes by Fruzsi & Badman, a light show by ElmoStix, the traditional virtual bonfire and fireworks display by Special Effects International, wine blind tasting, roulette and blackjack tables for fun (not money), plus pop, rock, and & dance hits from DJ Woods.

Regular Master of Ceremonies Hans Peterson will guide proceedings all evening, including hosting a Live Auction and announcing the winners of the Silent Auction.

All auction proceeds go to support three local charities: The Magic Lamp Wish Granting Foundation (Csodalámpa), which helps three18-year-old children suffering lifethreatening illnesses; the Young People in Need (Rászoruló Fiatalok) NonProfit , which focuses on solutions to emotional abuse of Hungarian children up to the age of 18; and The Autistic Art Foundation (Autistic Art Alapítvány), which conducts research to help spread autism awareness, housing facilities and care for people with autism.

Food Bank Support

There will also be a raffle, for which tickets will cost HUF 2,000 each, with all proceeds going to the Food Bank for Refugees-Budapest, which supports displaced Ukrainians in Hungary, feeding around 130 people per week and providing them with groceries and hygiene items.

The wide-ranging international buffet selection will include tastes from British, Chinese, Italian, Indian, Lebanese, and Mexican cuisine, not to mention savory snacks, grilled food, pizza, salads, artisanal donuts, and a birthday cake. Drinks include craft beers, Jell-O Shots, wine, single malt whisky and pálinka tasting, a Unicum Cocktail Bar sponsored by Zwack, plus a range of soft drinks and water

Guests will receive a free day pass to the Fitness & Health Club by Marriott Budapest worth HUF 4,500 and a HUF 50,000 Voucher for Dr. Rose Private Hospital as welcome and farewell gifts, respectively.

countries in the region, AutoWallis says it is looking to ensure that sustainability-related factors are suitably validated to the correct extent in all areas of its operations.

A priority is to recycle as much of its waste resulting from operations as possible, to make the group’s day-today operations more energy efficient, to increase the use of renewable energy sources, and to favor environmentally responsible suppliers. In addition, the group wishes to increase its social commitments and meet the targets specified in the ESG framework as part of corporate governance.

AutoWallis is the first company listed in the Premium Category of the Budapest Stock Exchange to develop a Green Finance Framework, based on which it successfully issued green bonds. Székely explained that obtaining ESG certification, planned for no later than 2024, has several positive aspects besides the obvious environmental and social advantages. It would, for example, allow investment funds that target businesses committed to sustainability to purchase the company’s shares.

Confirmed VIP guests include Dutch Ambassador Désirée Bonis, Irish Ambassador Ronan Gargan, British Deputy Head of Mission Andrew Davidson, and Duncan Graham, chairman of the British Chamber of Commerce in Hungary.

“As a Brit and as ambassador, I am proud that XpatLoop.com has held celebrations for Bonfire Night for over a decade,” said U.K. Ambassador Paul Fox last year. He cannot attend this year as he will be in London. “Not only have they been some of the best parties in town, but also events that have raised incredible amounts of funds for a number of worthy causes,” the ambassador added.

Tickets bought ahead of the evening are HUF 15,000 per person (guests must be 18-plus), with a gala table for 10 people costing HUF 150,000. A limited number of on-the-spot tickets will be priced at HUF 20,000. There is also a “Philanthropist Ticket” for HUF 30,000 for those who want to make a more significant donation to charity.

The evening runs from 6 p.m. to 1 a.m., with the dress code being smart-casual, although guests are welcome to dress up for the occasion if they wish.

4 | 1 News www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

XpatLoop publisher and Bonfire Night organizer Stephen Linfit (right) with British Ambassador Paul Fox, pictured at the 2021 event.

Visit the xpatloop.com website to learn more about the fundraiser and register for tickets. The Budapest Business Journal is a media sponsor of the Bonfire Night Celebration.

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Zsolt Kónya

Gábor Székely

Hungary Raises Questions Over Further Support

RoundupCrisis Ukraine

Orbán emphasized peace was the ultimate solution to these issues.

However, Minister of Foreign Affairs and Trade Péter Szijjártó said that while Hungary had agreed to this round of funding, with a contribution of EUR 10 mln, he could not guarantee that this would be the case next time, adding that the fund now totaled at EUR 3 billion.

Hungary’s foreign minister also exercised what he called a “constructive abstention” toward an initiative that would establish a Military Assistance Mission to train Ukrainian soldiers, saying that other member states are free to participate and contribute, but Hungary would not.

“We do not think that anything leading to an escalation is a good idea,” Szijjártó explained.

During the UN General Assembly in New York in September, Szijjártó had met with Russian Foreign Minister Sergei Lavrov, despite an explicit request from the EU not to conduct bilateral

PRESENTED CONTENT

negotiations with the country. Although he received flak from opposition politicians and international observers, Szijjártó defended his decision in a post on Facebook on October 9.

He said the talks had directly contributed to Hungary concluding an agreement with Gazprom to reroute gas shipments to Hungary through the TurkStream pipeline and that continued dialogue was necessary to achieve peace.

At a summit of European Union leaders in Prague, which concluded on October 7, Prime Minister Viktor Orbán also expressed a reluctance to continue with the bloc’s current policies and emphasized the necessity of seeking peace. The PM insisted that the sanctions against Russia must be changed.

Bleeding Out

“Russia has not been brought to its knees at all while European economies are bleeding out,” he claimed. Adding that sanctions were to blame for “sky-high” energy

prices that are “practically impossible to pay,” Orbán acknowledged that “all of the important Hungarian national goals” had been achieved during the meeting; Hungary managed to negotiate exemptions from the sanctions affecting crude and gas deliveries as well as nuclear energy.

However, stressing the need to work towards “a cease-fire and negotiations,”

Yet, despite the rhetoric, Hungary remains committed to supporting Ukraine. At a meeting with the vice president of the International Finance Corporation, a World Bank group member, on October 16, Minister of Finance Mihály Varga declared backing for making more World Bank resources available to Ukraine and neighboring countries affected by the war.

Varga noted that Hungary’s financial support for Ukraine amounted to HUF 28 bln, in addition to the country taking in nearly one million refugees.

Ukraine has been providing support to the Hungarian economy as well.

According to State Secretary Zsolt Feldman of the Ministry of Agriculture, Hungarian feed and manufacturing companies have been buying maize from Ukraine amid a local shortage caused by the summer drought.

While Feldman acknowledged that the rail cargo volume of grain brought from Ukraine to Hungary had averaged 120,000 tonnes in recent months, the Association of Hungarian Logistics Service Centers added that the import of Ukrainian grain has also had a beneficial effect on domestic rail traffic, offsetting the decrease in international traffic caused by more expensive traction energy.

There’s no Good tax Advice Without Industry Knowledge

According to an assessment by the International Tax Review magazine, Andersen Adótanácsadó Zrt. was again the best-performing Hungarian tax advisor this year. Besides the highest professional accolade, the firm has also collected the “Hungary Indirect Tax of the Year 2022” title. We spoke with Bence Barta, the head of Andersen’s indirect tax business, about the awards.

BBJ STAFF

BBJ STAFF

BBJ: To what extent were these awards a surprise? What factors paved the way to you winning the VAT Advisor of the Year title in Hungary?

Bence Barta: In light of our results and the feedback from our clients, we secretly hoped that the ITR would acknowledge our work again this year, but we couldn’t be sure since competition is fierce in the advisory market.

We’ve consciously emphasized this area in recent years and have significantly expanded our team of experts and our range of services. Besides this, we continually monitor the legal practice of the European Court of Justice and Hungarian courts so that we can provide our clients with best-in-class services.

It’s a critical success factor that Andersen’s international network has solid competencies in indirect taxation,

which helps us tremendously. It is not by accident that ITR has ranked the overall performance of Andersen’s offices in the top five for this category at the European level.

BBJ: Apart from these, what other qualities characterize the firm’s indirect tax advisory services?

BB: I’d highlight client focus and maximum satisfaction of client needs because, in this respect, we probably make even greater efforts than our competitors. It’s manifested in how, first and foremost, we develop practical solutions for our clients and support them during their implementation.

We represent a new approach and, in many cases, implement creative and novel ideas, for which a thorough understanding of case law is indispensable. Additionally, we also spearhead the preparation of clients for legislative changes.

BBJ: How much do you need to know about your client or the industry to complete an assignment?

BB: In the past, it was enough to know the tax laws well; today, clients need much more complex advice, so we don’t just need to understand them thoroughly but also the economic environment in which they operate. You can’t give relevant tax advice without up-to-date and in-depth industry knowledge.

Let’s take, for example, the energy sector, from which we receive a lot of assignments. It is a very strictly regulated market that has its particular operational logic. Without being familiar with it, it’s simply impossible to solve our clients’ problems; we can’t expect them to teach us everything we need to know prior to fulfilling the engagement.

BBJ: What indicators describe the work of Andersen’s indirect tax business?

BB: The most important indicator is perhaps the rise in revenues. In both 2020 and 2021, we doubled our revenues from our business compared to the previous years. By the end of August this year, we’d surpassed last year’s level by 60%. We’ve also expanded our team of experts significantly over three years to maintain this growth rate, essentially doubling its size.

The quality of our work is also evident from the increasing complexity and volume of the tasks we receive. We receive plenty of positive feedback and more engagements based on the recommendations of our existing clients. Our strongest references are in the energy, automotive, pharmaceutical, logistics and finance sectors.

BBJ: How long can this growth rate be maintained?

BB: Naturally, it depends greatly on the economic environment and the performance of the Hungarian economy. It is encouraging that we’ve managed to multiply our profits in recent years, despite the negative effects of the pandemic. Another reason I consider the prospects of Andersen’s indirect tax business to be good is that we have an extensive and diversified client portfolio.

1 News | 5www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

NICHOLAS PONGRATZ

Hungary supported the funding of a further EUR 500 million by European Union member states to support Ukraine’s Armed Forces through the European Peace Facility (EPF) at a meeting of EU foreign ministers in Luxembourg on October 17.

Bence Barta

In this photo released by the Prime Minister’s Press Office, Prime Minister Viktor Orbán (right), former Colombian President Andres Pastrana (center), the president of the Christian Democratic International organization of conservative parties, and former Slovenian Prime Minister Janez Jansa, vice president of the CDI (left) before a working dinner at the Carmelite monastery on October 17, 2022. Strategies and opportunities for cooperation available to right-wing, Christian, and conservative parties in the current situation created by the Russo-Ukrainian war were discussed. Photo by Zoltán Fischer / MTI / Prime Minister’s Press Office

Business

AmCham: Serving as a Channel Between Businesses and Policymakers

The leadership team at the top of the American Chamber of Commerce in Hungary, president Zoltán Szabó and CEO Írisz LippaiNagy, sit down with the Budapest Business Journal to discuss what they are doing to help members in a challenging economic environment and relations with the Hungarian government and U.S. Embassy.

ROBIN MARSHALL

ROBIN MARSHALL

BBJ: Former U.S. Ambassador to Hungary Donald M. Blinken recently died aged 96. What are your memories of him from his time here?

Írisz Lippai-Nagy: Unfortunately, we did not get to meet him personally, but as an honorary member of our chamber, his legacy is cherished within the AmCham community.

Zoltán Szabó: Ambassador Blinken was a true friend and supporter of our country at a pivotal time. He firmly supported Hungary’s integration into the West and championed our membership in NATO and the EU. We are forever grateful for that and offer our deepest sympathies to his family in this difficult time.

BBJ: The latest diplomat to hold the role, Ambassador David Pressman, was sworn into office in August. You recently met him. What are your expectations of the relationship, and where do you hope to work together?

IL-N: We had a great first meeting: Ambassador Pressman is a highly accomplished, open-minded, and dedicated professional who came to Hungary to build bridges at an incredibly challenging time. It was clear from the start that he was genuinely excited to be here, curious to learn about our country, and eager to work with stakeholders from both sides of the aisle. He wants to make a difference.

ZSZ: He is a business-oriented man and was keen to learn about the challenges businesses face and how the embassy can offer its support. Hopefully, we can arrange an event with him in the forthcoming months where he can address the wider membership. We are excited to work with him and his team.

BBJ: The key issues affecting Europe and Hungary are the energy crisis for businesses and the cost of living for households. What definitive steps is AmCham taking in working with the government and others to help?

ZSZ: As always, AmCham serves as a channel between businesses and policymakers. We offer a platform for our members to share their concerns and proposals, and we take these issues to the relevant representatives of the government to find solutions to the best of our abilities.

IL-N: Just to give one example, a concerned member reached out to us because their contract with their gas provider was up, and with no new supplier or offer on the cards, they simply could not guarantee continuing operations in the coming months. We contacted Márton Nagy, Minister for Economic Development, and his team about this following his presentation about the impact of the energy crisis and the government’s measures at our business forum. They were quick to help, and the matter was sorted out within a few days.

BBJ: The other major geopolitical issue is the war in Ukraine, where AmCham’s scope for influence is perhaps less obvious. What has the chamber been doing?

ZSZ: During the initial phase of the invasion, we were in contact with our members to find out how they were impacted by the war: the main concerns besides the safety of the people and the escalating humanitarian crisis were supply chain issues, lack of raw materials, energy supplies, employment of third-country nationals, and the total uncertainty, of course. Unfortunately, many of these concerns have become a reality, we are now trying to avoid a recession, and the war rages on still. We have also brought in various experts to brief the membership about the state and economic impact of the war.

IL-N: We consulted with AmChams in the region and across Europe to exchange best practices, learn about the developing situation, and the measures governments and business organizations are taking to help. The AmCham network has also supported AmCham Ukraine directly with donations. We helped one of their colleagues move to Hungary and supported them with accommodation. Most importantly, we delivered food and supplies to the refugees arriving at Nyugati Railway Station.

ZSZ: We were incredibly humbled by the actions of our members, who immediately stepped up in a time of need. They supported the Ukrainian people and refugees coming to Hungary with donations of food, medicine, clothes, hygiene products, shelter, free devices, and other services. Many have provided aid to colleagues in Ukrainian offices, offering transportation, relocating them to Hungary or other countries, providing accommodation, legal services, advanced wages, you name it.

BBJ: Inflation, supply chain issues, and the ever-tighter Hungarian jobs market also need addressing, with the latter a particular area of focus for AmCham in the recent past. How is the chamber reacting to these pressures?

IL-N: Within our committees and working groups, AmCham members can discuss their experiences and exchange best practices on these issues. We also share these experiences and insights with the government wherever we can. We will undoubtedly focus heavily on these topics at the Business Meets Government Summit, our flagship event with HIPA, on October 24.

ZSZ: We have also recently surveyed our members to learn how they are dealing with the unexpected inflation rates, the historically low Hungarian forint exchange rates, and how they compensate employees. A significant portion (39%) of the survey participants have already provided some form of compensation for the unexpected inflation rate and one-third are still considering the option. Large and medium-sized companies are more able to compensate their employees, but that also varies from sector to sector.

BBJ: There was palpable shock among AmCham members on July 8 when the U.S. Treasury Department announced it was terminating the double taxation treaty concluded with Hungary in 1979. What has AmCham done since, and what is the view of the membership now?

ZSZ: With inflation and crippling energy prices, this topic has taken a backseat, but it is important for us to keep it on the agenda. The United States is one of our most prominent investors and trading partners; we cannot stress how important it is to have a tax treaty with jointly developed tax mechanisms for stability, predictability, and our ability to attract capital. Hungary could be the only EU and OECD country without a tax agreement with the USA.

IL-N: When the decision was announced, we held an extraordinary tax committee meeting with tax, legal, and finance directors across the membership to discuss the effects of this decision, find out which companies are most impacted, and formulate our response. We sent a letter to the government, urging them to find a solution with their American counterparts to avoid irreversible reputational damage and further harm to our competitiveness. We received a response, but unfortunately, no progress has been made yet. We seem to be at an impasse, but AmCham is prepared to work with policymakers in any way we can to achieve a breakthrough.

www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

2

Írisz Lippai-Nagy and Zoltán Szabó. Photo by Lázár Todoroff / AmCham.

Company

Buyout Offer for Waberer’s Cleared

A buyout offer for listed Hungarian hauler Waberer’s International has been cleared, the company announced in a release on the website of the Budapest Stock Exchange. MHB Optimum and High Yield are offering HUF 2,336 per share, the statutory minimum, in the buyout, which runs from October 19 until November 18. MHB Optimum will acquire twothirds of the shares offered and High Yield one-third. BDPST Equity, a unit of the real estate management company BDPST Group, earlier agreed to acquire MHB Optimum. High Yield is owned by György Waberer, who built up Waberer’s over more than two decades. The buyout offer was initially announced in July but suspended in September pending approval by the National Bank of Hungary (MNB) of the takeover of Waberer’s insurance unit Wáberer Hungária Biztosító.

Gov’t Signs Strategic Agreement with Alstom

Hungary’s government signed a strategic cooperation agreement with French rolling stock manufacturer

Alstom on October 14, the Ministry of Foreign Affairs and Trade said, according to autopro.hu. Alstom is committed to increasing its capacity in Hungary and creating new jobs, Minister of Foreign Affairs and Trade Péter Szijjártó said at the signing ceremony. He added that cooperation with Alstom could be further enhanced in hydrogen, noting that the company has built the world’s first hydrogenpowered train. Alstom employs 650 people at a plant in Mátranovák (115 km northeast of Budapest).

Continental Expands Software Development in Szeged

German automotive industry company

Continental is adding driver assistance and automated driving software development activities in Szeged (170 km southeast of Budapest), Continental Hungary country director Róbert Keszte said at an event at the University of Szeged on October 13. Keszte said

Continental had decided to expand the activities of the software development base in Szeged in light of the quality of the local university instruction and the

Japan’s Toyo Ink Inaugurates HUF 7 bln Plant in Újhartyán

Japan’s Toyo Ink inaugurated a HUF 7 billion battery parts factory in Újhartyán (45 km southeast of Budapest) on October 18, according to napi.hu [Daily]. The plant will turn out conductive carbon nanotube dispersions for lithium-ion battery cathodes developed for electric vehicles. The dispersions will be delivered to South Korean-owned SK On, which supplies EV batteries to significant automotive industry manufacturers such as Volkswagen Group. The state awarded Toyo Ink HUF 700 million for the investment, which has created 45 jobs, State Secretary Tamás Menczer of the Ministry of Foreign Affairs and Trade said at the ceremony. Katsumi Kitagawa, chairman of Toyo Ink SC Holdings, said the group had made investments to strengthen its capacity to produce advanced

battery materials with the aim of turning the activity into a core business that can generate JPY 20 bln (HUF 56.3 bln) a year.

existing community of professionals based in the city. He noted that

Continental had operated a plant in Szeged for decades. Balázs Lóránd, who heads Continental Autonomous Mobility Hungary, said a team of 40 software engineers in Szeged would be tasked with preparing data for AI-based

From left: Ono Josiharu, managing director of Toyo Ink Kft.; Hideki Okaicsi, president of Toyocolor; Kitagawa Kacumi, president of Toyo Ink SC Holdings; State Secretary Tamás Menczer; Junko Szató, Deputy Head of Mission of the Embassy of Japan; the local Fidesz MP Tibor Pogácsás, and Mayor József Schulz. Photo by Tibor Illyés / MTI.

developments. Continental signed a strategic cooperation agreement, extending to instruction and research, with the university at the event.

Continental employs more than 8,000 people at six manufacturing bases, a tire sales center, and its development centers in Hungary.

2 Business | 7www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

'TIS THE SEASON WITH THE BUDAPEST MARRIOTT HOTEL T O B E J O L L Y Feel the magic of the festive season treasuring the most wonderful time of the year Indulge in a delectable dining experience and pamper your loved ones with our Christmas and New Year inspired takeaways specially crafted to suit these matchless occasions. More information: www.dnbbudapest.com | +36 20 444 6169 ADVERTISEMENT News

The U.K. Gilts Crisis: A Harbinger of Things to Come?

In 1994, James Carville, an advisor to U.S. President Bill Clinton, stated he’d like to be reincarnated as the bond market because “you can intimidate everybody.”

The U.K. gilts crisis has intimidated with a vengeance.

US bond return

U.S. Stock vs. Bond Returns (1920-2022)

stock return

As Former U.S. Treasury Head Larry Summers famously recently stated: the “U.K. is behaving a bit like an emerging market turning itself into a submerging market.” In 18 months, 30 year Government Bond (gilt) yields have

quadrupled, with most of the acceleration happening over the past six months:

You might argue that the United Kingdom is a particular case. Brexit caused a loss of trade markets, accelerated London’s decline as a

financial center, destroyed investment and confidence, and took the country to the edge of a precipice. Liz Truss’ weeksold government pushed it over the edge with a very ill-advised budget.

An optimist might say this is a “oneoff” crisis with little chance of occurring elsewhere. In this article, I will first talk about recent global developments and then provide a brief analysis of why, in my opinion, the U.K. gilts crisis may be a harbinger of things to come.

Some of the recent messages coming from major national and international institutions have shown both inconsistency and a rapid deterioration in outlook.

Oct. 7. The European Central Bank warns of a “potential wave of default on banks.”

Oct. 11. The International Monetary Fund says there is an “increased risk of rapid, disorderly repricing in financial markets […] exacerbated by existing vulnerabilities and a lack of liquidity.”

Oct. 11. The IMF says, “In a severe economic downturn, up to 29% of emerging market banks would be undercapitalized.”

Oct. 11. U.S. Secretary of the Treasury Janet Yellen seems confident: “I’m not seeing anything in markets that causes me to be concerned.”

8 | 2 Business www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022 E ACH AGENCY INDEPENDENTLY OWNED AND OPER ATED Franchisee: T SOLUZIONI ZRT , H 105 4 Budapest , Szabadság tér 7. +36-30-591-7998

Corporate Finance columnist Les Nemethy looks at what this might indicate.

ADVERTISEMENT

US

Source: Bloomberg, Lombard Odier

You might argue that the United Kingdom is a particular case. Brexit caused a loss of trade markets, accelerated London’s decline as a financial center, destroyed investment and confidence, and took the country to the edge of a precipice. Liz Truss’ weeks-old government pushed it over the edge with a very ill-advised budget.

Oct. 12. One day later, Secretary Yellen appears to have spotted something after all. “I’m concerned about the loss of adequate liquidity in Treasuries.”

It is remarkable that Yellen would make such a strongly optimistic statement on the same day as the IMF issues a very negative picture, only to flip-flop the next day. That goes to credibility.

Perfect Storm Building

The upcoming perfect storm that is brewing stems from the confluence of many inter-related factors:

PRESENTED CONTENT

1. record global debt levels;

2. stubbornly high global inflation;

3. supply side constraints (particularly in the area of energy, compounded by serious policy errors);

4. profound macro shocks (COVID-19, the war in Ukraine);

5. the steepest rate hike over any four months in the history of the Fed (against the background of weakening economic performance), and

6. the simultaneously dismal performance of both equity and bond markets.

The world has, in the past, had to deal with a few of these at a time, but never with all at once. Despite global markets being increasingly integrated, there is no evidence of coordination between the central banks. Because of high inflation and tight job markets, the U.S. Fed may continue tightening, at least a few hundred more basis points.

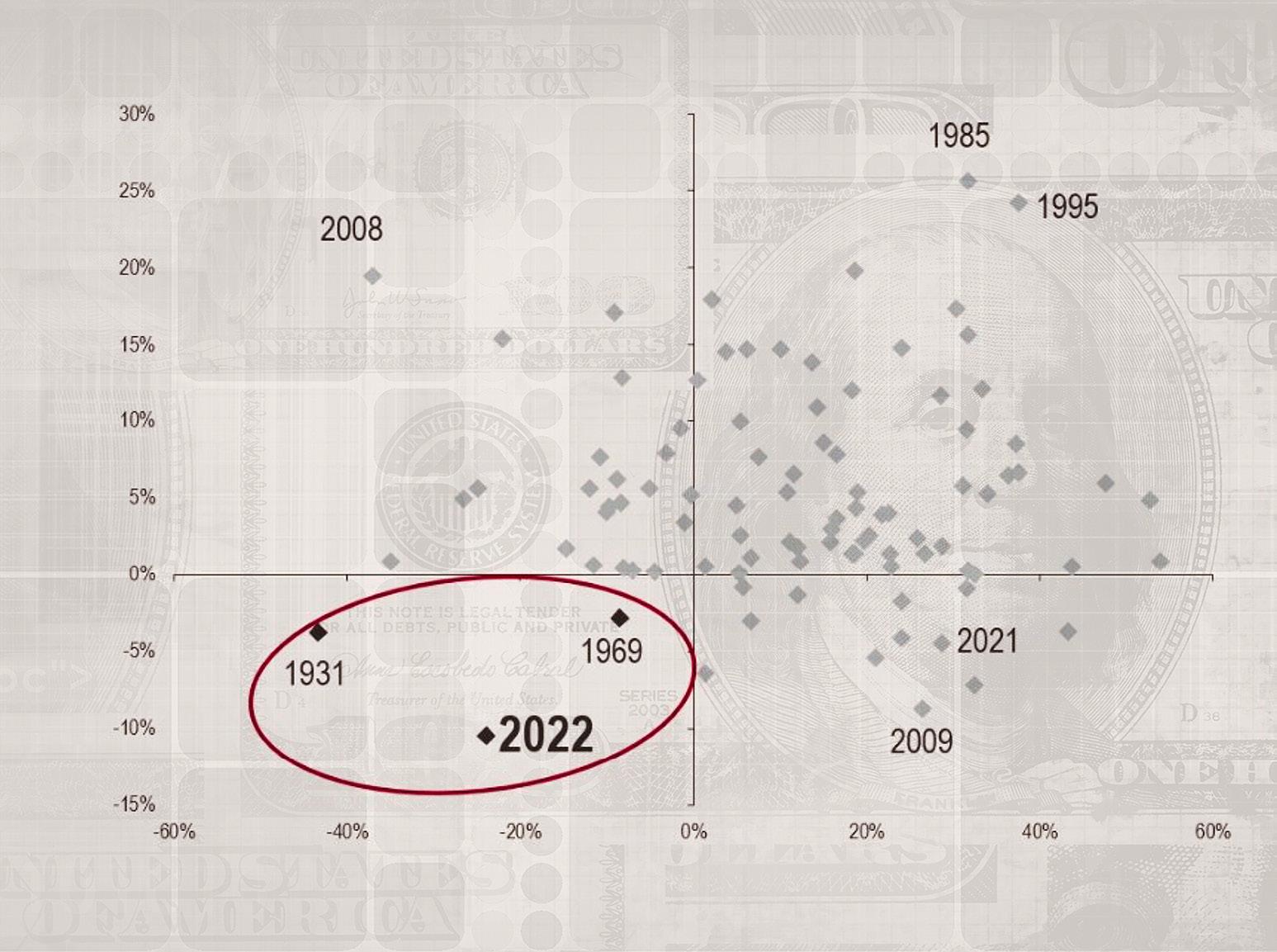

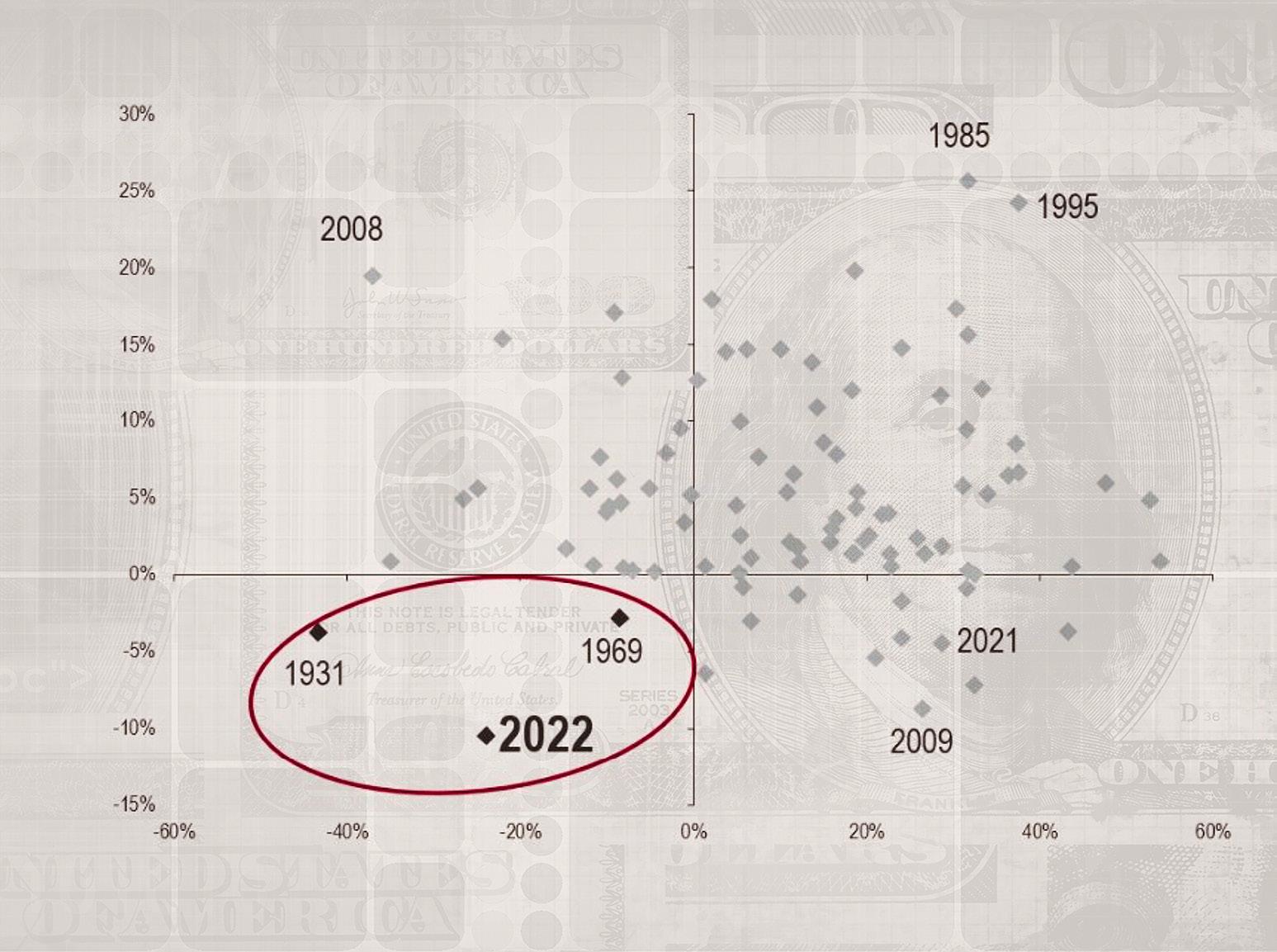

The following chart shows that since the Great Depression, there have been only three years, including 2022 yearto-date, where both equities and bonds had negative returns:

Furthermore, the first three quarters of 2022 have given the worst performance of any comparable period for bonds, as well as for a 60/40 portfolio of equity and bonds, in the past century; worse, even, than during the Great Depression.

The Corporate Finance Column

Saving Pensions

Now, to come back full circle to the U.K. gilts crisis: the main reason the Bank of England had to suddenly change gear from Quantitative Tightening (QT) to Quantitative Easing (QE) was to save the U.K. pension industry, which risked being completely wiped out by the sudden spike in yields.

Pension funds must make fixed payments on so-called defined benefit pensions. Given the low-yield environment since 2008, they have shifted into ever-riskier investments to generate sufficient yield to service payments.

Given the recent quadrupling of yields, bond prices have come tumbling down. Not only do lower bond prices make it more difficult for pension funds to make payments, which goes to solvency, but they must also maintain regulatory liquidity ratios, which forces sudden liquidation of assets, driving bond prices further down and creating a vicious circle.

Hence, the Bank of England suddenly needed to reverse from QT to QE to prevent an entire generation of pensioners from being wiped out financially.

Yettel Hackathon Seeks to Uplift Talent Solutions-seeking Talents

Yettel, one of Hungary’s biggest telecommunication service providers, is launching the “Hack it Your Way” hackathon to encourage developers and coders to realize tech solutions for the most pressing issues in business.

CHRISTIAN KESZTHELYI

The 24-hour competition seeks ideas in three main areas and will reward the best projects with an accumulated HUF 5 million in prize money. Mohamed ElSayad, chief commercial officer at Yettel Hungary, walks the Budapest Business Journal through the details of the hackathon.

“Since we launched Yettel, a key area of focus for us has been the idea of balance; we exist to ensure that people have balance in their lives. Why? Because when you do things your way, you can reconnect with your real self, reaching the flow state and coming up with the best creations you can have. We believe that is how you reach balance,” ElSayad says.

This philosophy is at the core of Yettel’s latest hackathon. Entrants receive some guidelines, but the telco wants to stand apart from such competitions and has decided to allow applicants a marked degree of freedom.

The hackathon focuses on three essential standalone issues that need solutions, although the trio is, nevertheless, interconnected in the grand scheme of things. “Hack it Your Way” aims to encourage solutions for reducing household expenses through the use of smart devices; promote more efficient operations for small- and medium-sized enterprises; and rethink urban transport in an environmentally friendly and more energy-efficient way.

But how can Yettel ensure it recruits the most brilliant brains in the Hungarian labor market to find solutions via its hackathon?

Bringing Solutions to Life

“We hope to become facilitators by supporting the best ideas with some funding to ensure that they can bring useful solutions to life and a platform where they can meet businesses who need the talent,” ElSayad explains.

These issues are not unique to Britain. The largest pension industry in the world is in the United States (USD34 trillion), which is experiencing similar, albeit for the time being less drastic, liquidity issues to the United Kingdom.

Yields are expected to continue to surge, which would drive bonds and equities lower, potentially creating a U.K.-type scenario. Could the pension industry become the Achilles heel of the U.S. economy, similar to mortgagebacked securities in 2008-2009?

Allowing pensioners to become financially wiped out is something no government can politically afford.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

The competition aims to help developers, coders, and thinkers reach target audiences and meet business people in the hopes of either developing their pet projects or finding synergies for future collaboration.

“We want to uplift new talent, give them a stage in the framework of this hackathon, give empowerment to their views, and set them on a journey delivering useful solutions for humanity. The monetary prize here is a ‘thank you’ for the effort entrants put into their project,” ElSayad says.

The 24-hour coding marathon will end with a review and assessment of the solutions and the announcement of the winners in the three categories. On the last evening of the event, essential stakeholders are invited to come together and meet the brilliant minds of the hackathon during a B2B event.

Yettel’s hackathon is timely. Like other labor markets in the European Union, the Hungarian labor market suffers from a shortage of specialized talent. Furthermore, the limited talent pool usually ends up in large firms, which means smaller companies can rarely hire such professionals.

“I believe it is essential to ensure a constant flow of education for people to get specialized professionals. Our hackathon also aims to shed light on the best professionals in the country to encourage young minds through their successes to follow suit once they realize the attractiveness and rewarding nature of this career,” ElSayad concludes.

2 Business | 9www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

Mohamed ElSayad

3 Special Report

Real Estate Development

Opportunities Exist, But Market Becoming More Cautious

With economic, financial, and geopolitical uncertainties acting as barriers to development and demand in office, retail and hotel, future development patterns look uncertain. Although the industrial sector is booming, here, too, rising construction and energy costs are acting as a brake. Further, investors are adopting a wait-and-see approach to the markets. The Budapest Business Journal asked several leading developers and consultants to give us their take on Hungary’s real estate market.

GARY J. MORRELL

The office leasing process has undoubtedly slowed down. With regard to size, there has been little to no change when it comes to more significant leases; indeed, it is often more straightforward to negotiate larger transactions such as the 16,200 sqm E.On deal. More urgent transactions can take two to three months to negotiate, and the longest deal I have been involved in took almost two years. The average size of transactions in our buildings is about 1,500-2,000 sqm. Tenant specifications include more open space, more collaborative space, focus rooms and private spaces.

The office market has slowed down and many new developments will not be initiated, although those that have already started are ongoing. Given the right opportunity and a good development plot, we would consider launching a new development project. With the increase in costs, we need to procure materials and conclude

more future-proof; in my opinion, it is the older generation stock that will suffer in the current climate.

Máté Galambos Director of leasing Atenor Hungary

The figures in the office market are inflated due to several owner-occupied developments being completed and

to cities such as Miskolc, Debrecen, Székesfehérvár and Kecskemét.

Retail is limited to developments where it forms part of a wider mixeduse project or smaller regional retail complexes with a significant hypermarket component. Shopping mall development is essentially limited to the refurbishment of existing centers.

Gábor Borbély Director of research and business development CBRE Hungary

Most probably, both demand and, subsequently, supply in the market will decline in the following months. Developers will only undertake new projects where cash flow projections confirm the long-term profitability of the planned development. I expect that, in the short term, many planned projects will fall short financially, and they are going to be postponed or suspended. The development process is facing several problems: the war with Russia dragging on in neighboring Ukraine, soaring construction and utility costs,

Developers and asset holders inevitably should turn to their actual portfolio and try to make the best of it. Redevelopment can be an excellent answer to the current challenges. For example, Horizon Development has just started redeveloping the former Henkel HQ building. By the end of the first quarter of 2023, it will open as Villányi Gardens offering flexible, quality and reasonably priced office spaces in an already popular and up-and-coming Buda location.

Tamás Ádány Business development director

Horizon Development

With regard to an exit strategy for developers, investors are exercising caution when it comes to Hungary due

the fit-out provisions well in advance and therefore, close cooperation with tenants is of the essence. Concerning demand, sustainable projects are

projects slipping forward; therefore, delivery will be around the 200,000 sqm mark. The level will fall in 2023 and 2024. In general, developers are not undertaking new projects due to the uncertainty caused by the war in Ukraine and the energy crisis. Finance is also hard to access, as banks act cautiously even for projects with a solid business plan. Therefore, there is a wait-and-see attitude until possibly next spring, when the conditions may change. There are opportunities for small niche projects and quality refurbishments.

There is a big catch-up ongoing in the industrial market, with around 400,000 sqm of space due to be delivered in the Budapest area. The pre-lease ratio is high, but there are bottlenecks in the construction process, for example, the availability of materials. Development has also spread to the countryside,

high inflation, the quick devaluation of the forint to the euro and U.S. dollar, and the fear of a recession and an economic downturn. It is not looking good now.

to concerns over inflation, the falling value of the forint, the prospect of rising interest rates, and the war in Ukraine. Deals are on-hold in the office and industrial sectors, and, at the same time, investors are adopting a cautious waitand-see approach.

Developments, in general, now take two to three years to get off the ground to produce assets that provide investment opportunities. There is interest from investors in logistics, and in development land from logistics developers. For hotel developers, now is a good time to purchase standing assets for value-add investment.

Major domestic investors and developers such as Adventum, Futureal, and Wing have been looking abroad due to the limited possibilities in Hungary and the greater choice elsewhere. Concerning financing, banks are changing their lending conditions, making it more difficult for buyers to obtain finance, even for a standing asset.

Péter Takács

Partner Newmark VLK Hungary

Péter Takács

Partner Newmark VLK Hungary

www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

Máté Galambos

Gábor Borbély

Péter Takács

Tamás Ádány

ZenGarden, in Harmony With the Environment

Using the latest technology can save a lot of energy, and there is no question anymore that any type of energy development is an excellent long-term investment. The combination of environmentally conscious thinking with innovative interior design solutions can thus provide not only favorable financial conditions but also unique working environments.

ZenGarden Office Building’s EUR 2.5 million investment is focused on meeting these needs. Today, it is hard to find an energy investment that does not generate a return in a few years. Upgrading heating, modernizing HVAC systems, and replacing lighting are the cornerstones of energy efficiency. In addition, the energy used to heat, cool and light buildings accounts for 28% of the world’s total carbon emissions, so whatever your approach, environmental and sustainability considerations are a first-round requirement from the drawing board.

Excellent Rating for ConvergenCE Office Buildings

Among the properties acquired and repositioned by ConvergenCE, and refurbished with stateof-the-art technologies, CityZen and Kálvin Square Office Building have both received Breem Excellent certification this year, while ZenGarden has previously achieved the most significant environmental accreditation. The recent improvements to the building, which benefits from

an excellent location in Buda, have included several green solutions. ZenGarden has been given modern awnings and sun-reflecting glass facades on the outside. The interior features an energyefficient four-pipe fan-coil heating and cooling system, low-energy LED lighting and a new computerized building management system.

Focus on Harmony, Body and Soul

The design phase, which focuses on ideal work environments as well as physical and mental refreshment, also included the modern use of internal open spaces. The unique atmosphere of the rock garden and the fire-resistant, water-permeable and maintenance-free artificial grass does not require energy-intensive maintenance. Those who like to play petanque in one-on-one, two-on-two, or even threeon-three settings can pass their lunch break with a game and a little exercise in the garden. A great way to build community, this French ball game has become a popular form of recreation among employees.

Those who prefer a sportier lifestyle can also use their own or rented bikes. There is a cycle path leading to the office building, a MOL Bubi parking facility in front of the ZenGarden, and a secure bike storage area inside the building for safe and convenient use of bicycles. On warmer days, cyclists do not need to feel uncomfortable during

zengardenirodahaz.hu zengardenirodahaz.hu

the day either, as the changing rooms and showers can make their working days more comfortable.

The building offers services on nine levels; the four lifts make it easy and time-saving to get from the parking facilities to the top floors that offer panoramic views of Parliament. The garage level provides 170 parking spaces and an intelligent building management system for tenants and their guests, with particular attention paid to electric car users.

Perfect Location, Surroundings to Suit all Needs World Mental Health Day has been celebrated on October 10 since 1992, so it’s not without reason that many people call October the month of mental and spiritual health. Taking care of emotions, well-being and inner harmony daily has become a responsibility not only for individuals but also communities and service providers. A physically and mentally invigorated person can do more creative and better-quality work. Designing the interior of office buildings, optimizing their features for users, and making them peoplefriendly is, therefore, an important task.

In addition to excellent transport links, Margaret Island, Millenáris Park, and Mechwart Liget are all within easy reach. Those who want to do sports outdoors or just walk, move and relax can quickly get to some of Budapest’s most beautiful green areas on foot. The Mammut shopping center and several

renowned restaurants and cafés are also nearby, but everyday necessities such as grocery stores, the post office, and other service providers are also within a short walking distance. There are a number of exercise studios, yoga centers, and gyms in the surrounding streets, so recharging before or after work can be done easily. The harmonization of an excellent location with the quality of ZenGarden’s services makes this office building unique.

“The Energy Efficiency Obligation Scheme (EEO) is helping to save energy on the corporate and residential side, but we are committed to using our own resources to support green processes and environmental protection,” summarizes Dóra Papp-Vas, leasing director at ConvergenCE.

“We attach great importance to supporting the energy efficiency plans prolonged by the government this summer or the Budapest municipality’s efforts to protect the climate and the environment. That’s why we furnish our office buildings with the latest equipment and technologies. Building trust with our partners and developing a reliable, long-term relationship is of paramount importance to us, and providing the best services is essential to this. It is especially gratifying when the best rating systems recognize our efforts and work,” Papp-Vas adds.

Developments Delivered Amid Rising Market Concerns

Although there are substantial pipelines in the office, logistics, and even the hotel markets in Hungary, questions remain about demand, the ability to source finance, the construction process, rising energy and labor costs, and the availability of an exit with a sale to an investor.

GARY J. MORRELL

GARY J. MORRELL

The first phase of the Millennium Gardens office development by TriGranit has been handed over. It will constitute the final section of the mixed-use Millennium City project.

The various real estate sectors are being impacted by these issues to different degrees. All are also facing the challenges of the broader economic environment, including sentiment about

Portfolio

Hungary as an investment destination due to the war in Ukraine, inflation, and the falling value of the forint.

There are several ongoing phased developments in the Budapest office

market by established market players that are attracting substantial preleases, albeit the letting process is more prolonged, according to developers.

Atenor has concluded a 16,000 sqm prelease with E-On for the first phase of BakerStreet, due to be completed in the first quarter of 2024.

A further 24,000 sqm phase of the project is due for completion late that same year. TriGranit has completed the 21,600 sqm first phase of the Millennium Gardens, with the project already more than 90% let, it says.

However, no new projects have been announced by the relatively small pool of international and local developers operating in Hungary, reflecting concerns over demand, the ability to conclude substantial preleases, and to source debt finance on favorable terms if needed.

The boom in industrial and logistics continues unabated, both in the Greater Budapest area and provincial hubs; the sector is an undoubted winner in the post-pandemic environment.

The first two warehouses developed by the industrial developer, HelloParks (established a couple of years ago and

Development Responds to New Market Requirements

Leading real estate development and management company Horizon Development has been synonymous with premium commercial and luxury residential properties, mainly in the downtown areas of the Hungarian capital, districts V and XIII. In 2022 – branching out both geographically and with regards to its target audience – the company simultaneously launched two neighboring projects in Budapest’s district XI, ParkSide O ces and Villányi Gardens.

When asked about the reasons why Horizon Development’s market o er has been broadened within the o ce segment, Gabriella Sasvári Managing Partner and Development Director responded: “Our business model during the past 16 years was certainly more unidirectional, but 2020–2022 has given us the opportunity to reflect on how we can respond to various tenant needs that di er in size and fit-out requirements, and other contractual parameters.

Our ongoing ParkSide O ces project was architecturally conceptualized around the values of greenery, community, and flexibility, and will o er an inclusive, healthy, and enjoyable work environment for companies searching for a new, ESG-compliant, certified sustainable, pet-friendly o ce building from 2025.

The 5+2 story property will feature 20,000 sqm leasable o ce and retail space, 260 underground parking spaces, as well as 35% greenery. The landscaped area by the building with its outdoor gym (open to the public); the front yard with its water features and contemporary pieces of art; the protected private gardens with smart furniture; and the vegetated roof terraces with community gardens will all contribute to tenants’ wellbeing, creativity, and loyalty, and attract new generations of young talent.

Completely rejuvenated and technically upgraded by Q1 2023, 2,500 sqm Villányi Gardens is a GF+5 floor flexible o ce park both in terms of space allocation and rental conditions. Consisting of 3 building units, a cozy interior garden with lounge furniture, and 75 surface parking spaces, Villányi Gardens welcomes tenants who seek adaptability, high e ciency, and a great price-for-value ratio.

Both o ce buildings benefit from the green environment and the wide service range of district XI, with Lake Feneketlen, Móricz Zsigmond Circle, Kosztolányi Dezső Square and Allee Mall in their close vicinity.”

12 | 3 Special Report www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022

A Diversified

Horizon

ParkSide O ces

Villányi Gardens

horizondevelopment.hu

ADVERTISEMENT

part of the Futureal Group), are now 100% occupied after a period of a few months, according to the developer.

As a result, the company says that the total gross leasable area offered by the HelloParks portfolio will increase to 160,000 sqm by the end of the year.

Hotel Pipeline

A substantial hotel pipeline has been traced in Budapest by consultants, although there needs to be an element of caution here as several are on hold with no definite completion dates. However, hotel projects are being delivered with operators in place.

One such is the upper mid-scale, 123-room A52 Hotel Octogon in the historical center of Budapest, developed by CD Hungary and operated by the Continental Group. The luxury 71-room Radisson Collection Basilica has been completed and is due to open in a few months, opposite the tourist landmark of St. Stephen’s Basilica.

Futureal officially opened the 55,000 sqm Etele Plaza shopping center a year ago after a frequently postponed development process. It was the first Budapest mall delivery in several years, and no new centers are planned.

The retail sector faces the dual threat of e-commerce and concerns over the cost of living (and therefore spending power), a common theme across Central Europe, where few shopping centers have delivered in recent years.

Redevelopment is currently the central element for retail in Budapest as owners look to reposition their assets by updating the design and tenant mix. Multi Corporation has completed the

EUR 18 mln

refurbishment of the Allee mall, and developer-owners Wing and CPI have undertaken substantial redevelopments of their own respective retail assets.

Asset owners in the office sector now have to provide more highly specified, efficient and sustainable products offering flexibility in the provision of space to attract tenants and cater to staff needs in terms of amenities, location and transportation.

“PM [property management] and FM [facility management] came into focus during and post-COVID,” comments Tamás Ádány, business development director at Horizon Development.

“Now, the record high energy prices put even more emphasis on proper PM and FM. Service charges and the quality of management are going to (or already have) become important factors in tenant decisions,” he adds.

Sustainability accreditation to the Breeam and Leed systems and increasingly the interior and staff health-oriented Well are the norm for a commercially successful development or standing asset in the office market that adheres to increasingly stringent sustainability regulations.

“On the one hand, regulations are stricter; on the other hand, and more importantly, tenants, investors, and

banks (virtually everybody) puts sustainability on the top shelf. There is no future for non-sustainable new developments,” adds Ádány.

Energy Focus

Concerning the international energy crisis, energy efficiency accounts for 30% of the total points of Leed, and 20% of Breeam, according to Edina Hornok, head of the sustainability consultancy at the DVM group.

Such expectations are now extended to the industrial, hotel and retail sectors. In industrial, for example, a major concern of tenants is energy usage. HelloParks is developing the phased 354,000 sqm HelloParks Páty megapark close to Budapest.

The first “Big Box type hall” is being developed on

58,000 sqm in accordance with the sustainability requirements for “Outstanding” certification in Breeam’s “New Construction” category, says Rudolf Nemes, CEO of HelloParks.

At the end of the development cycle, building owners and developers need to adopt a longer-term sustainable strategy to have the option of an exit strategy with a sale to an investor.

“On the one hand, regulations are stricter; on the other hand, and more importantly, tenants, investors, and banks (virtually everybody) puts sustainability on the top shelf. There is no future for non-sustainable new developments.”

“Investors need to think of their future exit; outdated assets are and will be more difficult to dispose of; therefore, the market is definitely shifting towards a more sustainable mindset,” comments Máté Galambos, leasing manager at Atenor Hungary. The company follows a policy of developing phased office projects and selling individual assets on to investors once completed and leased.

ESG and EU taxonomy reports are now expected to be part of the information pack by some investors when presented with an acquisition opportunity, says Benjamin Perez-Ellischewitz, principal at Avison Young Hungary.

In the current uncertain economic and financial environment, investors and vendors are adopting a wait-andsee attitude to investment, and the total volume for the year is not expected to be above EUR 1 billion.

The future is clear; developers will need to offer ever more well-conceived and sustainable products to gain finance, let and sell a property.

Energy Cost Hikes to Have Significant Impact on Tenancies, Affect Landlords and Tenants

payment obligation is typically set as the actual (i.e., 2022) amount of the rent and ser-vice charge advance.

To mitigate the landlord’s risks and costs, the advance payments can be increased now by mutual agreement if the tenant is willing to do so.

For landlords that have not done so, it is advisable to include a clause in all future leases stating that they can unilaterally increase the service charge advance payment in the event of a significant change in any circumstances.

(iii) Prepaid Energy Consumption

Landlord’s Perspective

For landlords, the increase in energy costs could have a direct impact in three areas: (i) temporarily vacant premises (including premises not yet let), (ii) common areas, and (iii) leased premises where the tenant has no direct contract with the utility service provider; hence the invoices are prepaid by the landlord.

(i) Vacant Premises

Since the costs of vacant premises remain payable by the landlord, it is in the landlord’s interest to keep vacancy rates low and the duration of any vacancy as short as possible, as this reduces the property’s economic viability for the landlord.

(ii) Common Areas

The energy costs incurred in common areas, along with the costs of other services relat-ing to those areas (reception services, etc.), are typically charged by the landlord to the tenants at the end of the year in question.

To minimize the prefinancing of these costs by the landlord, an estimated advance pay-ment for service charges is collected from the tenant. The advance payment is set by the landlord at the beginning of each year and remains the same throughout the year.

In the absence of an express provision in the lease, the landlord cannot change the ad-vance payment during the year. This means that landlords now have significant prefinancing requirements due to the current drastic change in the actual costs versus the ad-vance payments estimated and set for 2022. The risk of settling these prefinanced amounts at the beginning of 2023 will also increase since the collateral for the tenant’s

If the landlord and not the tenant has a direct contract with the utility providers, the land-lord will pay the incoming bills and pass them on to the tenant. Due to the increased en-ergy costs, the time for settling these prepayments by the landlord will be decreased, or the landlord will require advance payments for such energy bills.

An indirect consequence of rising service charges is landlords will have to invest in mak-ing their properties more energy efficient to remain competitive; otherwise, tenants may seek alternative properties with lower service charges.

Tenant’s Perspective

As a direct result of the increase in energy costs, tenants’ costs will increase significantly: rents, service charges and collateral will go up. The service charges in specific properties may even exceed the rent.

All rents are likely to rise at the beginning of 2023 since leases typically contain an index-ation clause allowing the landlord to increase the rent each year based on the actual change in the consumer price index.

Based on standard provisions in leases, the collateral (security deposit or bank guaran-tees) provided earlier by the tenants will also need to be adjusted at the beginning of 2023 since the collateral is tied to the level of applicable rent and service charges.

In these circumstances, tenants will rationalize and save costs where possible: they will review whether they can take less space (where possible, even using a combination of office-based and remote working). In such cases, the vacated space may be sublet if the lease allows this or if the landlord explicitly agrees.

3 Special Report | 13www.bbj.hu Budapest Business Journal | October 21 – November 6, 2022 NOTE: ALL ARTICLES MARKED INSIDE VIEW ARE PAID PROMOTIONAL CONTENT

FOR WHICH THE BUDAPEST BUSINESS JOURNAL DOES NOT TAKE RESPONSIBILITY

INSIDE

VIEW

The drastic and rapid increase in energy costs will significantly impact tenancies, affect-ing landlords and tenants.

Noerr and Partners Law Firm

dr. Zoltán Nádasdy Managing partner

www.noerr.com

Record may Fall, but Restrained Activity Prevails in the Office Market

Few office developments are expected to be undertaken in the near future as supply and demand in the Budapest office market is expected to fall. However, there is a robust immediate pipeline as developers have carried on with existing projects, despite geopolitical and economic concerns and rising development and energy costs.

GARY J. MORRELL

GARY J. MORRELL

Developers express confidence that tenants can be found and preleases concluded, although, with hybrid work practices now the norm, tenants could require smaller spaces. Even so, the office market could record an annual record supply.

A STRONG

Green & accessibility

– BREEAM

& Access4You certified buildings

Green Finance Framework

created consistently with the guidelines of “Green Bond Principles”