SSCs Mature Into GBSs as They Provide Higher Added-Value Functions

As shared services centers have graduated to business services centers and now, increasingly, to global business services centers, the industry’s evolution has seen Hungary maintain its role as an essential player at the regional level. 14

Helping Drive Success of the Office Market

Whether you call them SSCs, BSCs, or GBCs, and what they do business process outsourcing or being a center of excellence, there is no doubt this alphabet soup of a sector has had a profound impact on the office market. 15

Penny for Your Thoughts

El Greco Show: Unexpectedly Transformative

Walking up the steps to the entrance of the Museum of Fine Arts to visit the El Greco exhibition, David Holzer realizes he has seen more world-class public displays of work by great artists in Budapest than anywhere else. 21

NEWS

Record-breaking Fall, but not in a Good Way

The inflation rate is above 20% for the first time in 25 years, and there was negative GDP growth on a monthly basis in the third quarter for the first time since the spring of 2020. 3

The Budapest Business Journal talks with Penny Hungary CEO Florian Jens Naegele about the 2022 business year, today’s “genuinely challenging period,” charity plans for Christmas and 2023 investments. 8

BUSINESS

In his first interview with the BBJ since taking over at the Hungarian Investment Promotion Agency, CEO István Joó talks about policy continuity, efforts to support businesses in the face of the energy crisis, and to make the Hungarian economy crisis-proof. 9

HIPA Boss Vows to be There Come ‘Rain or Shine’

SOCIALITE

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BBJ.HU VOL. 30. NUMBER 21 NOVEMBER 18 – DECEMBER 1, 2022 HUF 1,850 | EUR 5 | USD 6 | GBP 4 SSCs & BSCs SPECIAL REPORT INSIDE THIS ISSUE

BUSINESS

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, David Holzer, Christian Keszthelyi, Gary J. Morrell, Nicholas Pongratz, Gergely Sebestyén, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress.

THE EDITOR SAYS

SSCS EVOLVE ALONGSIDE HUNGARY’S ECONOMY

No one should doubt the importance of the shared service center to the Hungarian economy. In its way, the evolution of the sector (how its name has changed, even the battle to get potential employees to understand what it does) is a metaphor for the development of Hungary’s own economy.

There was a time when it was all about cost. SSCs began to appear here because multinationals realized it was cheaper to employ someone to answer a simple question or perform a basic function in Budapest than in most Western European capitals. Those same multinationals had to be careful about how excited they were to announce 50 jobs in Budapest because it usually meant 50 jobs had been axed back home.

They came to Budapest because its bright lights have always been a giant magnet, drawing talent to it. That answers a riddle I struggled with when I first came here. Hungarians, traditionally, have not scored well in terms of the foreign languages they speak, yet the managers of the SSCs I spoke with unfailingly said one of the attractions of Budapest was the availability of young graduates with good language skills. The young are generally better than the old regarding languages, and Budapest could effectively recruit from across the country.

But just as Hungary has purposefully moved away from a “Made in Hungary” mentality to “Invented in Hungary,” what the government calls a paradigm shift from manufacturing jobs to value-added roles, so those services centers have morphed from a workbench setting to something intellectually more challenging.

It started with myth-busting. Sector players realized they had to convince people that an SSC was not synonymous with a call center. They started reaching

out to ever younger year groups at school to explain what they did and what they could offer. They were even prepared to band together to evangelize: think of AmCham Hungary and its BSS Hungary Working Group. BSS, standing for the business services sector, became part of the evolution, too, the new name aiming to reflect a fresh reality but also cement a different reputation.

The government has been a willing partner in this, realizing the SSCs, BSCs, Global Business Centers, and Centers of Excellence offer it the possibility of reversing the brain drain by demonstrating that exciting career opportunities and reasonable pay levels can be found here, just as easily as abroad. And with good universities scattered around the country, there are inducements it can offer to set up a center in Debrecen or Szeged, for example, and spread those roles across the regions.

Those multinationals who have been here the longest talk of earning the trust of home boards, of proving they have the talents and skills and disciplines to do more varied work here, to run end-to-end processes, to trouble-shoot, to handle research and design, of creating a virtuous circle where the better they perform, the more complex the roles they can attract. There is a balance point here. I am told that Hungary still offers a cost advantage, but the whole concept of convergence, of the country inching towards parity with the EU average, must eventually bring that into question. Then it will be a case of who can do the best job. Then Hungary, which has always prided itself on its brain power, will genuinely be standing on its own feet.

Robin Marshall Editor-in-chief

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

THEN & NOW

2 | 1 News www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The

Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

Reproduction or use without permission of editorial or graphic content in any

Budapest

VISIT US ONLINE: WWW.BBJ.HU

IMPRESSUM

BBJ-PARTNERS

In the color photo from state news agency MTI, surgeons operate on a person using the DaVinci Xi surgery robot at the University of Pécs, purchased through the European Commission’s Recovery and Resilience Facility. The black and white image from the Fortepan public archive shows an operation at Szent János Kórház (St. James Hospital) in Budapest in 1947.

Photo by MTI / Tamás Vasvári

Photo by Fortepan / Horváth Miklós dr

macroscope

A Record-breaking Fall, but not in a Good Way

Changes in GDP in Hungary, 2010-2022 (Q3) Rate

Gloomy Outlook

in the Region

The ever-deteriorating geopolitical and financial conditions have set back the growth momentum of Central and Eastern Europe, according to a recent analysis by S&P Global. According to the international credit rating agency, a substantial slowdown in economic growth is already visible in addition to persistently high inflation, worsening people’s purchasing power.

ZSÓFIA CZIFRA

Based on raw data, the performance of the Hungarian economy grew by 4% in the third quarter compared to the same period of the previous year, while the seasonally and calendar-adjusted figure was 4.1%.

The latest statistics from the Central Statistical Office (KSH) also reveal that, compared to the previous quarter and based on seasonally and calendar-adjusted data, the performance of the economy contracted by 0.4%. In other words, output went into the red again on a quarterly basis for the first time since spring 2020.

Nearly all sectors contributed to the growth, but the industry and services sector played a big part in the expansion, while the agricultural sector restrained growth.

In the first three quarters of 2022, the performance of the economy exceeded the same period of the previous year by 6.1%, according to both raw and seasonally and calendar-adjusted and balanced data.

Decline Likely to Continue

According to Gábor Regős of Makronóm Institute, the third quarter data was less favorable than expected. He pointed out that if the performance of the economy continues to decline in the next quarter, the Hungarian economy will have met the definition of a technical recession.

Numbers to Watch in the Coming Weeks

The Central Statistical Office will reveal the October state of the labor market on November 25. Third-quarter investment data will be published on November 28, and the second estimate of third-quarter GDP data will be posted on December 1.

Quarterly

The Hungarian growth data is less favorable than the EU average on a quarterly basis but more favorable on an annual basis, as the European Union achieved an expansion of 0.2% on a quarterly basis and 2.4% on an annual basis, the analyst said.

“According to our expectations, the performance of the economy will continue to decline in the fourth quarter, and the recovery can only start next year,” Regős said. However, there are several conditions for this: the curbing of inflation, a reduction in energy prices, the strengthening of the forint exchange rate, the

receiving of EU funds, and the maintenance of purchasing power.

“Based on our estimate, economic growth in 2022 could be around 4.8%,” Regős warned.

Technical Recession Ahead?

A technical recession seems inevitable, as a further contraction is expected in the next two quarters due to falling real wages as a result of soaring inflation, an increase in household energy prices above average consumption, performance reductions due to the multiplying energy costs of businesses, municipalities and state institutions, as well as sharply rising interest rates, according to Magyar Bankholding’s senior analyst Gergely Suppan.

He stated that due to the much weaker-than-expected performance, Magyar Bankholding would reduce its growth expectations for this year from 5.3% to less than 5%; however, it will leave its growth expectation of 0.4% unchanged for next year.

Following shocking September data, October’s inflation data was also bad news. For the first time in 25 years, Hungarian inflation rose above 20% in September and further strengthened to 21.1% in October. Core inflation rose from 20.7% to 22.3%.

According to S&P, the average GDP growth of the six countries in the region (Bulgaria, Czech Republic, Hungary, Poland, Romania and Slovakia) will fall from this year’s 4% to 1.4% in 2023 and then accelerate to 3.1% in 2024.

For Hungary specifically, the rating agency’s base scenario is that the economy will slow from this year’s 4.9% growth to 1.8 % next year, and growth will pick up again to 2.8% in 2024.

On the other hand, the more pessimistic scenario outlines an economic decline of -2.6% in 2023 in parallel with a similar trend in the region.

As for its inflation outlook, S&P economists point out that price increases in the region may be broader and more prolonged than previously expected. In Hungary’s case, they add that the weakening of the forint exacerbates this. Since the beginning of the year, the Hungarian currency is 20% weaker against the dollar and almost 10% down against the euro.

In one year, food prices rose by 40%, including eggs by 87.9%, bread by 81.4%, and dairy products by more than 75% from the October 2021 prices. In an effort to curb inflation, the government announced price caps on further food products, namely potatoes and fresh eggs.

Inflation accelerated above expectations, Suppan commented on the data. The rising price pressure is reflected in the fact that core inflation jumped sharply to 22.3%, he said. In light of fresh data, Magyar Bankholding raised its previous inflation forecast both for this year and next. For 2022, he says inflation may rise to close to 23% by the end of the year, but from the beginning of next year, due to base effects, he expects inflation to decrease.

The inflation rate is above 20% for the first time in 25 years, and there was negative GDP growth on a monthly basis in the third quarter for the first time since the spring of 2020.

www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022 1News

•

of annual economic growth

“According to our expectations, the performance of the economy will continue to decline in the fourth quarter, and the recovery can only start next year. Based on our estimate, economic growth in 2022 could be around 4.8%.” change in GDP in Hungary, 2010-2022 (Q3)

Seasonally-andcalendar-adjusteddata Source:

AutoWallis’s new Partnership, Acquisition Boosts 2023 Business Outlook

Automotive Matters

AutoWallis has agreed to purchase the fleet management division of Nelson Group, which the former says is critical to its strategy and margin generation capabilities. The Hungarian stock exchange-listed company believes the acquisition is a “milestone” on its journey to expanding mobility services and expects it to result in important synergies.

The acquisition of the fleet management division of the more than 30-year-old Nelson Group is the latest in a number of deals AutoWallis has undertaken in recent years to support the expansion of its retail and wholesale activities. It will give the auto importer and retailer a 2-2.5% stake in the Hungarian fleet management market, making it one of the 10 largest players in the vertical.

“AutoWallis is financing the acquisition from its own funds and will not use external financing or treasury shares,” according to a press statement issued by the company.

“The purchase is taking place with beneficial pricing conditions, which ensures a short-term (within two years) return on the goodwill paid in addition to the equity of the purchased companies.

In

2021,

Nelson’s fleet management division achieved revenues of HUF 4.2 billion with an EBITDA of HUF 2.4 million and a pre-tax profit of HUF 230 mln,” the statement continues.

AutoWallis CEO Gábor Ormosy tagged the acquisition as a significant step in the company’s services portfolio expansion, supporting earlier acquisitions that have strengthened the company’s retailer and wholesale divisions.

Building on Nelson’s current market share and organically increasing it, the AutoWallis Group says it will be able to offer clients of its retail and services business (which plans to sell almost 10,000 vehicles in 2025) another vertical that will generate significant profits. The CEO expects the rapid integration of the fleet management business due to Nelson’s advanced corporate culture and management system.

Outperforming Expectations

Announcing the acquisition, Ormosy said that the group’s growth had outperformed expectations, which may trigger an upward review of previously published targets, as it had not previously included any revenues or profits from fleet management activities.

The deal is pending Hungarian Competition Authority approval and is expected to be finalized in the first quarter of

2023.

The key employees and executives from the Nelson division are expected to join the AutoWallis Employee Share Ownership Program, providing them with a long-term incentive to implement the AutoWallis Group’s strategy.

Meanwhile, the AutoWallis Group has also announced it is entering into strategic cooperation with listed power company Alteo. In a deal focussing on the coordination of e-mobility-related services between the two businesses, customers will be able to buy electric vehicles, charging equipment, and related services from Opel dealers, paired with solar panel systems and energy storage solutions starting in 2023.

The partnership is a new stage in the two companies’ collaboration launched last year to support the spread of green mobility in Hungary. Under this new

partnership involving the professional backing of Alteo’s e-mobility division Alte-GO, solar panel and energy storage systems will be sold in the Hungarian Opel brand dealerships represented by the AutoWallis Group in four countries: Bosnia and Herzegovina, Croatia and Slovenia, in addition to Hungary.

Additionally, Hungary-based Opel showrooms will also offer the installation of EV chargers, the development of an electrical grid, and an energy management system to ensure the efficient use of available electrical capacity, tailored to the needs of private and corporate customers.

AutoWallis says it is committed to sustainable operations while transitioning to greener solutions, according to Gábor Székely, the firm’s investor relations and ESG director.

The combined market share of electric vehicles in the European Union and the United Kingdom reached 19% in 2021, up from 11% in the previous year, Székely said. Last year, 15,510 vehicles with green license plates, which means they have some sort of electric drive, were registered in Hungary.

Growing Share

That growth continued into this year, with more than 17,000 such vehicles registered in the first 10 months of 2022. Székely noted that the AutoWallis Group sold 1,084 electric and hybrid autos in 2021.

“The price for publicly charging EVs will soon rival that of fossil fuels while charging at home and at company sites will continue to provide better conditions, lower prices, and increased comfort,” said Dénes Novotny, head of Alteo’s e-mobility division. He added that Alteo-GO and AutoWallis would provide a one-stop shop solution to ensure that by the time Opel models are delivered to the dealership, the infrastructure for cost-effective EV

ownership is already in place at the customer’s home or business premises.

“Although this is an important step in our cooperation, we are not done yet. In 2023, solar panel systems and energy storage solutions will be added to the charging of electric Opel vehicles. Car dealerships are the ideal location for showcasing these solutions and providing customers, who will be able to purchase entire decentralized packages when buying a vehicle, with explanations,” Novotny added.

Next year, the partner companies plan to sell at least 100

chargers via Opel dealerships under the agreement. That will boost the number of customers opting for solar panels and energy storage systems to complement their chargers.

In unrelated news, on Friday, November 4, it was announced AutoWallis had bought five million of its own shares in over-thecounter trading to finance subsequent acquisitions and ensure the number of shares required for the Employee Share Ownership Program. The company bought the 1.14% stake in shares trading at HUF 91.33.

In October, the AutoWallis Group announced it had seen double-digit growth in all its business lines in the first nine months of 2022, and in several areas, the sales figures are already higher than last year. The group, which is present in 14 countries of the region, says it has become permanently independent from domestic and international trends.

Its vehicle sales increased by 27.1% in the first three quarters, and the number of service hours increased similarly. The car rental area jumped even more: the number of rental events increased by 64, while the number of rental days increased by 31%.

4 | 1 News www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

less than 24 hours, the AutoWallis Group announced an acquisition (and hence entrance to a new market) and a sustainable energy solutions partnership. The former

to help

the

growth

electro-mobility

CHRISTIAN KESZTHELYI

In

is expected

support

group’s future

plans, while it hopes the latter will drive the spread of

in the country.

A monthly look at automotive issues in Hungary and the region

Photo by petrmalinak / Shutterstock.com

Hungary Against Joint EU Loan for Ukraine

Last month, the European Commission proposed a support package for Ukraine of up to EUR 18 billion for the whole of 2023, with monthly payments averaging EUR 1.5 bln. The EC said Ukrainian authorities and the International Monetary Fund (IMF) estimated that Ukraine needs roughly EUR 3 bln-4 bln a month to keep the state operating. This includes necessities like paying public wages and pensions and maintaining essential public services, such as hospitals, schools, and housing for relocated people.

To secure the funds for the loans, the Commission proposed borrowing on capital markets using a diversified funding strategy. Varga said the EU’s executive body is asking member states for a mandate to pursue this line of credit but also wants them to pay around EUR 630 million in related interest.

While Hungary is prepared to participate in preparing this sum, Varga said it does

not support doing so on credit. He intimated that Hungary has a “bad experience” with joint EU loans since the country had still not seen any support from credit the EU utilized during the coronavirus crisis. Varga added that Hungary’s support for Ukraine included more than HUF 31 bln in funding and taking in one million-plus war refugees.

Minister of Foreign Affairs and Trade Péter Szijjártó similarly expressed his disagreement with the joint borrowing proposition at a meeting of foreign ministers of the Central European Initiative (CEI) in Sofia on November 7.

“We are ready to continue providing financial support based on a bilateral agreement between Ukraine and Hungary,” Szijjártó said, “but we will certainly not support any kind of joint European Union borrowing in this area.” He added that Hungary had been providing support for Ukraine, which had gone to healthcare, education, cultural institutions, and churches, even before the war.

‘Misconstrued’ Position

Shortly thereafter, Szijjártó felt the need to defend Hungary’s stance against various accusations. First, Szijjártó said that German Minister of Foreign Affairs Annalena Baerbock had “misconstrued” Hungary’s

Roundup Crisis

position on the EC’s joint borrowing initiative. He said that Germany’s foreign minister implied that Hungary was somehow utilizing this position as a negotiation tactic.

“Rejecting another joint European Union loan is not a tactical matter on our part, but a matter of principle,” Szijjártó explained.

Later, during a meeting of EU foreign ministers in Brussels on November 14, Szijjártó dismissed accusations that Hungary’s government had “adopted the Russian narrative” in its opposition to EU proposals.

“That is outrageous and must be rejected in the strongest terms,” Szijjártó declared. Stating that the government is “uninterested” in what the Russians or EU politicians think about their perspective, Szijjártó explained it was “interested in one thing, looking at every issue through the lens of our national interests.”

To this end, Szijjártó has said that the global energy crisis triggered by the war in Ukraine, and subsequent sanctions against Russia, required prioritizing domestic energy security. Consequently, Szijjártó wrote on his Facebook page on November 10 that the expansion of the Paks nuclear power plant is both a national strategic and national security interest for Hungary.

“Hungary is, to put it mildly, not rich in mineral resources, so in our case, nuclear energy will be able to ensure our independence,” he concluded.

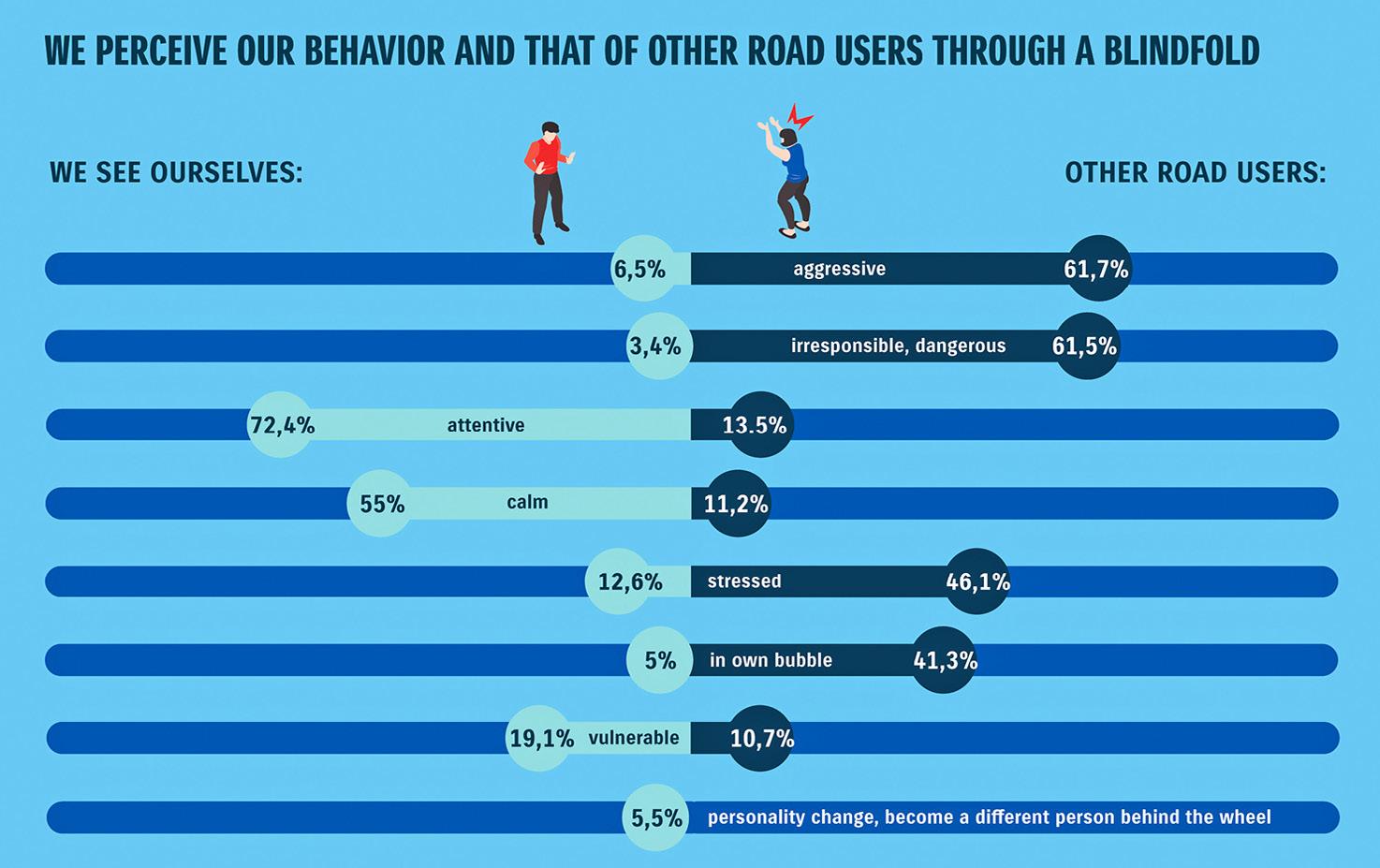

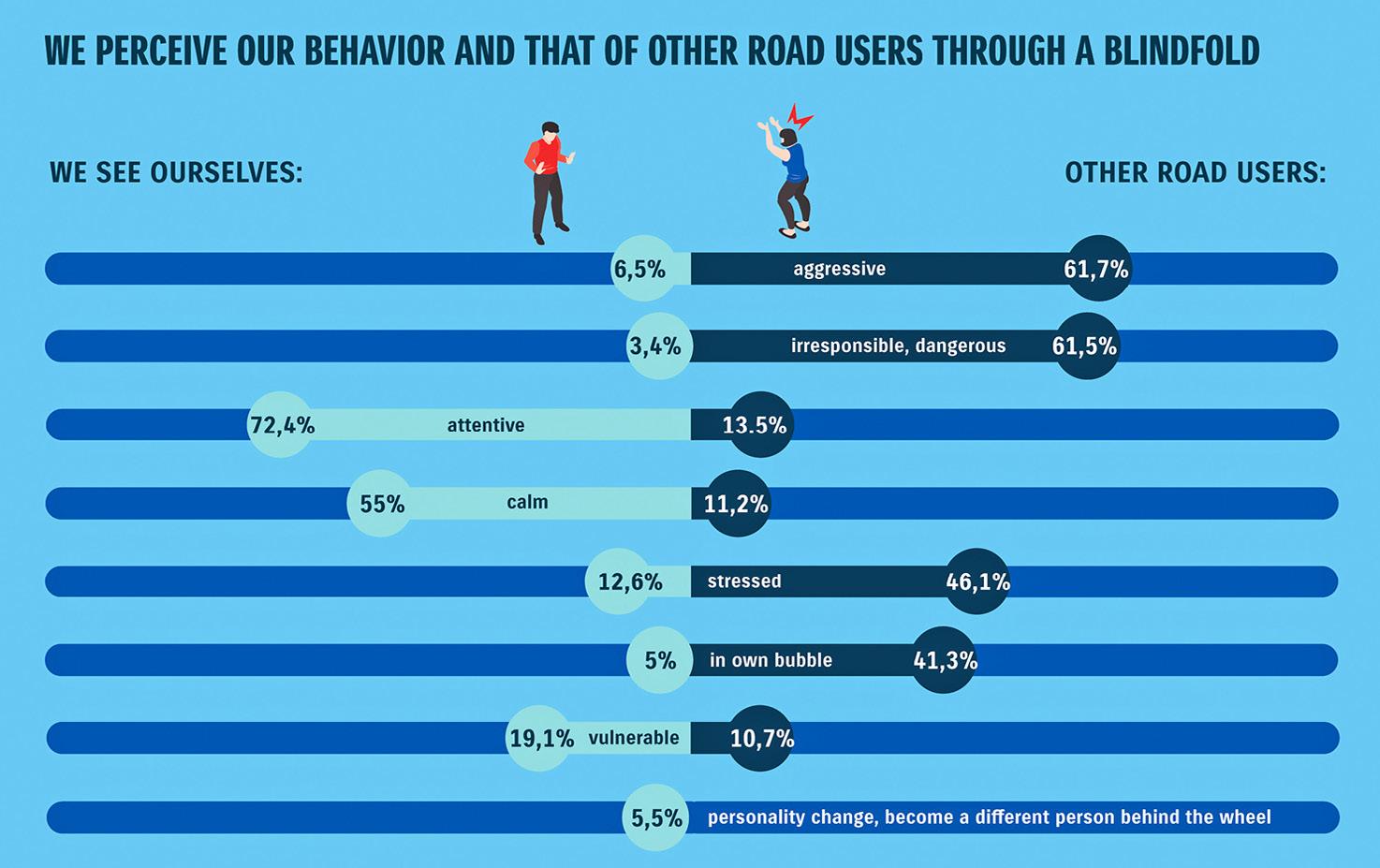

Magyar Suzuki: Courteous Traffic Rules to Make Roads Safer

We can be tense, inattentive, impatient, or aggressive in the car, and many people use the roads as a racetrack; a change is required at the social level to ensure safe road use. Through its “Together on the Roads” campaign, Magyar Suzuki, supported by opinion leaders and experts, has created a courteous Highway Code that could be used to make traffic safer.

Many factors affect the safety of road users, one of which is their mental state. The pandemic, the Russo-Ukrainian war, and the current economic situation also influence mental well-being. People are more tense, irritable, and inattentive as active participants in traffic every day.

Based on online research conducted together with Ipsos in 2021 and again in August this year on the driving behavior of a representative survey of 525 Hungarians aged between 18 and 65 with a driver’s license, Magyar Suzuki felt that a change in social behavior is necessary to ensure that everybody is safe on the roads.

Nearly 75% of the participants in the research had violated traffic rules, while almost 60% said they saw daily accidents on public roads. According to those who answered, the leading causes of accidents are non-compliance with the rules, inattention and violent behavior. The research also revealed that even the calmest people become frustrated, inattentive, or fearful in a stressed traffic

situation. In such cases, they swear, honk their horns, deliberately shorten the safety gap, undertake, or even jump out of the car to engage in heated verbal exchanges.

What could be a solution so that everyone could feel safe on the roads, whether they travel on foot, on two wheels or four? With some courtesy, kindness, patience, and politeness, most respondents would experience traffic situations more comfortably.

“With the involvement of opinion leaders and transport-related experts, we launched an educational and awareness-raising campaign entitled ‘Together on the Roads.’ We believe safe transport is our shared responsibility,” says Zsuzsanna Bonnár-Csonka, head of communications at Magyar Suzuki.

Influencer Suggestions

“We asked influencers to suggest what could help change the transport culture. From those ideas, we chose

the Courteous Traffic Rules proposal of Nóra Semjén (an actress and creator of the Anyakivan blog) and created the 14 points that complete the Highway Code. These affect human emotions and also take into account other participants in traffic,” she explained.

Responding to the 14 points, traffic psychologist Dávid Zerkovitz says that decisiveness does not preclude being courteous at the same time in a traffic situation. Driving technique trainer László Csörgő believes that the most important thing is to look at ourselves and see

if we are doing everything we expect from others while behind the wheel instead of looking at how they behave.

“There are three important behavioral factors in traffic: Patience, understanding, and time. Let’s give ourselves time to get around and understand the others,” he says.

According to András Rusznák, a judicial traffic expert, conflicts could often be avoided with some attention or courtesy. He thinks what is missing most for drivers is assessing all the sources of danger in every situation and seeing the consequences of their actions.

1 News | 5 www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

PRESENTED CONTENT

NICHOLAS PONGRATZ

Hungary will continue to support Ukraine financially, but disagrees with the European Union’s initiative of joint borrowing to do so, Minister of Finance Mihály Varga said following a meeting of EU finance ministers in Brussels on November 8.

Ukraine

In the photo released by the Prime Minister’s Press Office, Prime Minister Viktor Orbán (left) chairs a government meeting in the office in the Carmelite Monastery on November 16. Next to him are State Secretary for Public Administration of the Prime Minister’s Government Office Gábor Bordás, and Parliamentary State Secretary of the Ministry of Defense Tamás Vargha. The latest developments of the Russo-Ukrainian war were assessed in detail at the government meeting, after a missile strike in Poland, and the shut down of the Friendship oil pipeline due to a power outage caused by another missile attack. Photo by Zoltán Fischer/Prime Minister’s Press Office/MTI.

NEWS Do you know someone on the move? Send information to news@bbj.hu

Sales Director

Named at Dreher

Csaba Szilágyi took over as Dreher’s sales director this summer, joining from Jacobs Douwe Egberts’ headquarters in Amsterdam.

Szilágyi holds a degree in economics from the University of Miskolc.

He started his professional career at Procter&Gamble in 2002. As a sales representative in the northeastern region of Hungary, he was responsible for selling P&G products to retail stores and became a nationwide manager in 2006. Finally, from 2009, he managed the sales team accountable for the largest chains in the company.

In 2010, he joined Jacobs Douwe Egberts, where he initially managed the national sales team and the teams responsible for sales in the national retail chains. He transformed contractual terms with crucial sales partners during this assignment. He was responsible for the continuous development of the company’s sales team and the creation of more efficient retail operations.

From 2015, he managed all of JDE’s domestic sales, and in 2020 he was given an international assignment with global responsibility for clients such as Lidl, Aldi, Kaufland, EMD, and Metro.

“As soon as the opportunity arose to continue my career with one of the biggest companies with a long history in Hungary, I immediately realized that I could easily identify with Dreher’s business policy, values, and traditions. It is an exciting and honoring task to be involved in shaping the future of such a company with such a long history,” says Szilágyi.

Danubius Hotels Appoints Group Director of Development

Andrea Róna became the group director of development at Danubius Hotels this summer. She will be responsible for domestic and European brand hotels belonging to the group.

Róna will control the strategic and operational coordination of the Danubius Hotels’ expansion and development, the acquisition of the operation of additional hotels, and identifying new areas for growth.

She has more than 15 years of experience in hotel management and development, followed by eight years at one of the largest real estate development companies in the Central

and Eastern European region. She was responsible for the market introduction and opening of several domestic hotels, as well as the operation and development of sports halls and sports centers in Hungary.

“We are confident that, with Andrea’s experience, we will be able to use this knowledge in the next phase of our expansion. Our aim is to continue expanding as a hotel operator in the domestic and European market,” says Balázs Kovács, Danubius Hotels CEO.

“After two years of difficulties, tourism is recovering. Although the environment around us is still unpredictable, this excellent team has proven that it can achieve fantastic results under less-thanideal circumstances. And our owners, trusting in the expertise of Danubius, are committed to the expansion of the hotel chain and plan for the long term,” he adds.

Danubius Hotel has completed several investment projects this year that were delayed by the COVID-19 pandemic. These included the completion of the entire renovation of the Radisson Blu Béke Hotel, the refurbishment of 44 rooms at Danubius Hotel Astoria, and the opening of the White Raven skybar & lounge.

Time to Care: Express Medical Assistance at Doktor24 Multiklinika

The Budapest Business Journal speaks with Balázs Sárosi, head of Doktor24 Express, the urgent care unit of the leading local private healthcare provider Doktor24. Sárosi and his professional team of doctors offer instant medical care to walk-in patients at the company’s state-of-the-art Doktor24 Multiklinika in District XI, Budapest.

BBJ: Who should turn to Doktor24 Express?

Balázs Sárosi: We give families peace of mind by offering easy and quick access to professional urgent medical care without long waiting times. We primarily treat walk-in clients with acute health issues, but we are also prepared to assist people who are simply not sure what kind of specialist they should see for a particular problem. Our Western European-trained, Englishspeaking team of ER doctors examine, test, diagnose, and treat clients on the spot. If needed, we can also give direct referrals to 50-plus in-house consultants and specialists within Multiklinika for secondary care. We intend to serve

families, so we also treat kids over the age of one, and we can also refer them to Doktor24’s strong team of pediatric specialists. Our clinic is open beyond regular business hours, from Monday to Friday between 10 a.m. and 8 p.m. Clients can secure a parking spot in our underground car park by phone, and we can also assist those with limited mobility to access our premises from the parking area. Our English-speaking doctors boast decades of experience in ER patient care from Western Europe and maintain a comprehensive knowledge of the U.K.’s NHS protocols.

BBJ: What kinds of injuries and illnesses do you treat at the clinic?

BS: We treat a long list of non-lifethreatening medical issues from fever, colds, coughs, minor burns, urinary

problems, allergic symptoms, slight head injuries, strains, sprains, and more. In other words, we cover typical sports injuries, domestic accidents, common illnesses, and conditions that require medical attention but do not require hospitalization. The “we treat” and “we do not treat” lists are available on our website, along with our fair and transparent pricing. Our clients cannot

Dentons Appoints Europe Corporate, M&A

Group Co-heads

Global law firm Dentons has appointed Rob Irving and Kuif Klein Wassink as co-heads of the Europe corporate and M&A practice group.

Irving is an M&A and private equity partner with more than 30 years of experience leading landmark transactions throughout Central and Southeastern Europe. Based in Budapest, he was previously the co-head of Dentons’ private equity sector group at both the global and European levels.

“Over the last five years, Dentons has made significant investments into strengthening the depth, breadth, and sector focus of our corporate and M&A practice. Our focus will now be to fully leverage our practice across Europe and around to world to deliver high-quality, commercially focused advice to support our clients on their major M&A transactions,” Irving said.

Klein Wassink is a partner in Dentons’ corporate and M&A and private equity groups in Amsterdam. He was previously co-head of the Europe Private Equity sector group.

anticipate when they will need to come to us, so no appointments are necessary to visit Doktor24 Express. We guarantee medical attention within 15 minutes from arrival, and a full cycle of treatment is completed within four hours.

If the client’s condition requires emergency care in a specialized facility, we will do our best to stabilize their condition and call an ambulance or refer them to the local emergency care department.

BBJ: What kind of care do you provide on-site?

BS: Clients are treated in their order of arrival, in line with ER triage protocols. Primary care includes triage classification, medication to relieve pain or fever, a preliminary medical examination, and, if necessary, an ECG and targeted emergency ultrasound to make a full assessment. On-site lab tests are also available to rule out certain diseases and conditions such as thromboembolism, myocardial infarction, or severe organ failures. We have a whole arsenal of diagnostic equipment at hand at Multiklinika, with ultrasound, X-ray, and additional laboratory tests. We treat sports and domestic injuries with state-of-the-art bracing and gait support. If necessary, we can administer intravenous infusion treatments and obturation, offer wound management and wound closure (in the vast majority of cases with sutureless closure) and remove foreign bodies.

6 | 1 News www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

WHO’S

Csaba Szilágyi

Andrea Róna

Rob Irving

PRESENTED CONTENT

BENCE GAÁL

Balázs Sárosi

Wing Hands Over 2 Industrial Halls

The prolific Hungarian and regional developer Wing has completed the first two halls at its East Gate PRO Business Park. The construction of A1 and B1 halls, which have a total area of nearly 20,000 sqm, comes in response to the success of East Gate Business Park and Login Business Park, both owned by Wing, as well as growing industrial market demand, according to Wing.

East Gate PRO is in the town of Fót (24 km northeast of Budapest), at the junction of the M0 and M3 motorways, and a few minutes from Megyeri híd

(bridge). The project specifications meet Breeam’s “Very Good” rating criteria; the high-quality heat insulation provides a minimum indoor temperature of 16°C.

“Eco-friendly, easy-to-clean building materials with no harmful components were used in the construction, and a special focus was put on energy-efficient solutions,” Wing said. “Technical specifications include an ESFR [Early Suppression, Fast Response] sprinkler system, smart meters, and a large car park with a license plate recognition access system and electric car chargers,” the developer explained.

The contractor of the development project was Weinberg ’93 Építő, with financing provided by UniCredit Bank.

Some 75% of East Gate PRO’s available space was leased on completion,

reflecting the high industrial market demand. Construction of the next phase of the business park has already started, with digging and foundation work for buildings A2 and B2 underway. The expected completion date is summer 2023, according to Wing.

Major Player

The developer and investor is a key industrial player in the northern part of the Greater Budapest area. It has now delivered 230,000 sqm of completed industrial halls, with an additional 60,000 sqm of development potential in East Gate, East Gate Pro, and Login Business Parks. Its industrial property portfolio of nearly 300,000 sqm has an almost 100% occupancy rate with a development

potential of a further 200,000 sqm. The group now provides customized and modern halls to significant companies, including Philip Morris, Phoenix Pharma, and Wizz Air, and provides fulfillment services for Webshippy.

The boom in the Hungarian industrial market is continuing. The total modern industrial stock had reached close to 4.5 million sqm at the end of the third quarter, according to the Budapest Research Forum, consisting of CBRE, Colliers, Cushman & Wakefield, Eston International, JLL, and Robertson Hungary.

Total stock in the Greater Budapest area has surpassed three million sqm, while 1.4 million sqm is located in the rest of Hungary. In the third quarter, speculative industrial stock in Greater Budapest expanded by eight buildings with a total of

145,000 sqm;

in the same period, a total of 33,000 sqm of space was delivered in the rest of the country. In Greater Budapest, CTP has handed over 32,000 sqm at CTParkVecsés, while elsewhere, 13,000 sqm was delivered at InPark Gyula (225 km southeast of the capital).

The vacancy rate in the third quarter stood at close to 5% in Greater Budapest and 4.3% in the countryside. Take-up in Greater Budapest, excluding renewals, stood at 170,000 sqm, two and a half times higher than in the same period of 2021. New leases dominated demand with a 72% share.

1 News | 7 www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022 EACH AGENCY INDEPENDENTLY OWNED AND OPERATED. Franchisee: T-SOLUZIONI ZRT. H-1054 Budapest, Szabadság tér 7. +36-30-591-7998 YOUR COMMERCIAL REAL ESTATE EXPERT

GARY J. MORRELL

ADVERTISEMENT

East Gate industrial park, by Wing.

Business

Rebranding at Full Pace, Penny Wants to Expand Further

The Budapest Business Journal talks with Penny Hungary CEO Florian Jens Naegele about the past business year, today’s challenges, and its plans for Christmas and 2023.

BBJ: What have been the highlights of 2022?

Florian Naegele: First of all, I would like to highlight our largescale retail premises renovation and modernization project. Under our rebranding process that began in 2020, the entire network of 228 stores will be renewed and modernized to the new standards by the end of this year. Our customers will enjoy a modern and high-level shopping experience. Of course, we are not only renewing our stores; their number has also increased. We just opened our newest unit in Hajdúsámson (240 km east of Budapest, relatively close to the border with Romania) this month. Moreover, we have extended our product range by 25%, and our focus on bio and “freefrom” customers has also improved (in line with industry trends).

In addition, we will soon officially take over our renewed logistics center in Karcag (168 km east of the capital), which has been extended by around 40,000 sqm. This project began in 2019 and is very important for us because it will nearly double the storage capacity of the distribution center and allow us to supply more stores from there. With this step alone, our delivery trucks will reduce our Co2 emissions by almost 220,000 kg annually. Thus, the center’s operation has become more sustainable, costeffective, and environmentally friendly; meanwhile, we are creating around 100 new jobs in the area.

Another highlight of the year is that we have expanded our express home delivery service. Since this summer, more than three million Hungarian

customers have enjoyed the benefits of online shopping at Penny on various e-commerce platforms such as Foodpanda and Roksh.

BBJ? What investments do you plan for next year? How is the renovation and rebranding/brand-building project going?

FN: One of our primary goals is to complete our rebranding and store modernization process. We spent a total of EUR 87 million on renovating our stores last year and this, and we will spend another EUR 35 mln in 2023. We are very proud that we will realize this significant rebranding and repositioning project in just two and a half years.

Furthermore, we are constantly working on the development of our product range. The selection of our own-brand products is also getting wider, including “Penny Ready” convenience products. Based on the feedback from our customers, we also know that healthy nutrition is becoming more important to them.

As a result, we have significantly expanded the range of healthconscious, gluten-free, lactose-free, sugar-controlled, organic, and vegan products, which can be found on our store shelves. In addition to expanding our fruit and vegetable selection, we also take more second-class fruit and vegetable crops from producers.

With the so-called “Girbe-gurba” product line, our customers can get vegetables and fruits that are not perfect in appearance but still excellent in quality and at a more favorable price.

Since sustainability and the conscious use of energy also play an essential role at Penny, we are gradually increasing the number of solar panels, and we use only LED lighting in our stores, warehouses, and headquarters. We are also installing heat-retaining glass doors on the refrigerators in the stores, a move that is resulting in up to 40% savings on cooling energy.

In addition to finishing the transformation of our aforementioned logistics center in Karcag, we are working on expansions and improvements in our center in Alsónémedi and also planning to open additional stores.

BBJ: How many stores do you have in Hungary? What are the plans to increase this? How many stores could Hungary eventually support?

FN: Our store in Hajdúsámson takes us to 228 in Hungary. Our expansion department is constantly working to increase this number. Many factors hinder our efforts, although we are willing to invest more than EUR 50 mln in the following years only into expansion, which would create hundreds of new jobs. Within our company group,

our domestic developments in this area are considered lagging, as Penny International increased its expansion by about 5% in the recent period. Ideally, we would catch up with the international trend by opening 8-10 new Hungarian stores per year, but unfortunately, we do not currently have the opportunity to do so. Yet we are confident that with time, we will be able to offer quality products with an excellent price-value ratio to even more Hungarian settlements.

BBJ: Post-COVID and possibly on the brink of recession, how is the economy evolving, and how is this changing the market approach of Penny?

FN: We are now living in a genuinely challenging period. The effects of COVID-19 are no longer so strong; now, it is more the war in the neighborhood, the increase of energy prices, the price cap on food products, the raw material crisis, and the extra profits tax that are putting not only Penny but the entire sector in a difficult situation. In addition, the long-term maintenance of the aforementioned economic measures strongly calls into question their impact on society and the economy. Within these circumstances, one of our most significant advantages is that we source our product range from local and international resources. Actually, nearly two-thirds of our goods are from domestic producers. On the other hand, our parent company REWE Group is present in 21 countries in Europe. In the current economic situation, it is imperative that we have a stable, international corporate background in all respects; thus, we can provide our wide range of products to our customers even if supply difficulties arise.

BBJ: Christmas is just around the corner, and Penny always runs charity programs at this time of year. What do you have planned for 2022?

FN: We are currently organizing a charity campaign for the Együtt a Daganatos Gyermekekért Alapítvány [Together for Children with Cancer Foundation], with which we would like to reach a donation amount of HUF 10 mln. Our goal is to purchase a car suitable for transporting sick children for the foundation. We have had a longstanding cooperation with the foundation for 15 years, and we are proud that, together with our customers, we have supported the organization’s work with almost HUF 100 mln.

One of the most critical elements of our company’s corporate policy is the support of employees, and professional organizations have recognized our efforts on numerous occasions. For example, the German-Hungarian Chamber of Industry and Commerce recently recognized our responsible employer practice for the third time with the “Reliable Employer” award. We are well aware that rising energy prices impose extra financial burdens on everyone, which may bring even more challenges as Christmas approaches. That is why we decided to help our employees with a subsidy package total of nearly EUR 2.5 mln paid in three phases until the first quarter of 2023.

www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

2

ROBIN MARSHALL

PRESENTED CONTENT

Florian Jens Naegele, CEO of Penny Hungary.

HIPA Boss Vows to be There for Business Come ‘Rain or Shine’

In his first interview with the Budapest Business Journal since taking over at the Hungarian Investment Promotion Agency, CEO István Joó talks about policy continuity, efforts to support businesses in the face of the energy crisis, and to make the Hungarian economy crisis-proof.

BBJ: Congratulations on taking on the role of HIPA CEO. Is it what you expected? What has surprised you most?

István Joó: I was very much honored to be invited by Minister [Péter] Szijjártó to take up the CEO job as HIPA is the most crucial satellite institution in the field of Hungarian foreign trade relations. It also meant enormous prestige that Prime Minister Viktor Orbán tasked me to be Government Commissioner for investment promotion and implementation of large FDI projects. The latter position is crucial to see through the infrastructure-related investments of industrial parks all over the country. I must add, though, that I have never been interested in positions, but I am instead inspired by duties, which, when carried out successfully, will benefit the whole country.

BBJ: Business loves continuity and stability. Have the priorities at HIPA changed in any way since you took over?

IJ: The economy is in permanent need of investments to counter the impact of a looming recession. The government

and HIPA have done their homework to fuel growth by launching the HUF 150 billion Factory Rescue Program, which is managed by HIPA and supports energy efficiency and energy production investments by large companies with non-refundable funds. The coordinating role of HIPA, the soft investment promotion methods, and the one-stop-shop service model are all game-changing factors that are gaining significance in terms of competitiveness during a crisis, thanks to the new government structure.

BBJ: As part of the government’s response to the coronavirus pandemic, HIPA took over management of the COVID-specific subsidies. Will it play a similar role in response to the energy crisis?

IJ: Indeed, the subsidy to improve competitiveness was very popular among businesses, and the scheme helped save jobs and start new projects during the pandemic. The energy crisis poses yet another challenge that we must tackle head-on. In particular, companies with energy-intensive activities are under extreme pressure. The above-mentioned Factory Rescue Program is bound to ease the situation by providing a maximum of EUR 15 million each for large companies in production and processing to carry out investments to improve energy efficiency and build renewable energy generation capacities. There was enormous interest, given that 168 companies registered for incentives worth HUF 200 bln. An additional 214 companies started the registration process but could not complete it

as the fund’s threshold was reached within 20 minutes; however, they will have the opportunity to participate in a subsequent registration. The applications submitted successfully thus far account for investments worth HUF 500 bln, showcasing the sheer volume of future projects.

BBJ: Talking about COVID, do you expect some form of restrictions to return this winter/spring should another wave arrive, or have we found other ways to manage now?

IJ: To the best of our current knowledge, no COVID-related restrictions are expected to take place.

BBJ: Do you think the energy crisis could eventually be more damaging to businesses than COVID? Is it a concern you hear expressed from potential investors?

IJ: We are talking about two different issues here, and due to the alternate nature of the two crises, other solutions are needed to address them. HIPA and the government work hard to assist businesses to prevail in these difficult times. As a result, Hungary strives to be the local exception amid the global recession that makes its economy crisis-proof.

BBJ: We have seen a lot of investments recently connected to batteries for EVs, and we know this has been a trend in Hungary for a while. Do you expect this to continue? Are there more deals in the pipeline?

IJ: There are talks in progress in this regard, as interest from market players in the EV segment is unbroken. In fact,

since 2016, 43 related deals worth EUR 7.9 bln were closed by HIPA, the bulk of them with South Korean companies. Our objective is to ensure that the entire EV ecosystem is represented in the country. It is a very pleasant development that not only battery manufacturers and suppliers have invested in Hungary but also battery recycling businesses, which showcases that different stakeholders of the EV production cycle have found a home here.

In addition, a series of large deals in other sectors are also underway, so we are pleased to have a strong pipeline not only in the EV segment.

BBJ: What other business sectors are you particularly excited by in terms of developing trends?

IJ: Medical technology is among the rapidly developing sectors. Take the example of the American Becton Dickinson, which plans to spend onefifth of its USD 210 mln development budget earmarked for the upcoming five years at its plant in Tatabánya. In addition, no gloom over recession can stop the BSC sector from thriving, providing a modern work environment for more than 70,000 highly skilled people. ICT is growing fast, too, by relying on top-notch local talent. U.S.based HTEC is setting up software development hubs to hire over 600 engineers, while Nokia’s EUR 6.8 mln 5G research-related investment will also help keep Hungary in the driver’s seat of innovation.

BBJ: You have now been in post for several months. If there was something you could change about the Hungarian economy to make it more attractive to foreign investors, what would it be?

IJ: We offer one of the most business-friendly economic environments in Europe, and to maintain our competitive edge, it is vital to keep the current low corporate tax rate. The government is committed to achieving this goal. HIPA’s job is to attract investments with the biggest value-added possible.

On the other hand, the country has reached its limits in terms of labor in many segments. However, there are still untapped reserves in certain regions, and we need to work on directing investments there. It is also crucial to urge businesses settled in Hungary to bring their R&D activities here, which is the precondition for creating quality jobs. There have been several such projects lately.

To name but one, Bosch’s new R&D center in Zalaegerszeg will welcome 200 engineers to work on autonomous driving and 5G technology.

BBJ: Is there anything else you would like to add?

IJ: HIPA remains at the disposal of its business partners and will continue to serve them by providing a one-stopshop service model and presenting their needs to different government decision-makers. Rain or shine, we will always be there for them.

2 Business | 9 www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

PRESENTED CONTENT

ROBIN MARSHALL

István Joó, CEO of HIPA.

Fighting Inflation on Black Friday, Whenever it Falls

In recent times, Black Friday has become the biggest sales event, generating the highest revenues of the year. In the weeks beforehand, retailers and market research companies have traditionally published their forecasts for growth and likely popular products. But this season, the whole phenomenon has become markedly less predictable.

BALÁZS BARABÁS

Inflation, recession, and skyrocketing utility bills mean it is almost impossible to predict Black Friday spending accurately. Any statement and its polar opposite might equally well be true. Some will not buy anything because prices are too high, while others are making purchases now to avoid even higher prices later. According to analysts, inflation will likely peak at the end of the year, during Christmas.

Retailers are struggling hard to separate themselves from the competition. Most scheduled their Black Friday promotion for November

25,

the “official” date, as it is the Friday after Thanksgiving. Others are going a week early, on November 18,

and some have extended the sale from one day to a week or even two. Retail chain Euronics stretched Black Friday from November 14 to 20 and made its forecasts based on the sales figures of the previous two years. In both 2020 and 2021, the most popular items sold were small home appliances (mostly coffee machines), followed by beauty products. This year, Euronics expects the same categories to lead the sales, along with growth in IT accessories and mobile phones. The football world cup is expected to drive sales of 55” or wider TV sets. However, those counting on huge discounts will probably be disappointed, as the maximum will be around 20%. And even discounted products will still be more expensive than this time a year ago due to inflation of more than 20% and the depreciation of the forint, which is now 10% weaker compared to November 2021.

Smaller Discounts

Dezső Dévavári, the business unit director at price comparison site olcsobbat.hu, says customers should expect discounts of 10-20%, or even below 10%, figures that a few years ago would have been ridiculed.

Family Solvency Drops

A survey conducted in October by Intrum and GKI shows that the solvency of Hungarian families has dropped by 71% year on year. Solvency, an indicator calculated from prices, salaries, and consumer debts, reached a decade-low figure in Q3 2022 of 12.6 points, a 64% drop compared to the previous quarter. More and more families are feeling the impact of high energy prices and inflation and have started to save what money they can. This indicates the possibility of lower domestic consumption and increases the potential for a recession next year. By way of comparison, during the most severe COVID lockdown, the solvency index dropped no lower than 18.9 points.

Retail store chain MediaMarkt conducted a pre-Black Friday survey, which indicated that 20% of the respondents say they are likely to buy energy-saving appliances that will reduce their expenses in the long term. Many are also planning to invest in IT products necessary for remote work. Some

16% plan

to buy a laptop, desktop, or IT peripherals on Black Friday.

MediaMarkt also expects high sales of kitchen appliances, smartphones, TV sets, and tech gadgets for Christmas presents, like smartwatches, bracelets, wireless earphones and headphones, soundbars and “party” loudspeakers.

Retailer eMAG offers the opportunity for an interesting comparison, given that it operates both in Romania and Hungary, and it has already had the Black Friday promotion in the former, on November 11, while in Hungary, it is scheduled for today, November 18.

According to eMAG’s final figures, Romanians spent as never before on Black Friday, RON 644 million (HUF 52.8 billion) in total, compared to RON 609 mln last year. The average amount

spent per client was RON 1,170 (HUF 96,000), compared to RON 1,083 in 2021. As for the product categories with the highest sales, the list is directly linked to the products with the most inflated prices in the last 12 months:

Product category No. sold

Drinks, groceries and pet shop 380,000

Toys and kids products 364,000

Perfumes, personal care and cosmetics 276,000

Furniture and home products 204,000 Small and large home appliances 165,000

Smartphones, tablets, gadgets, TVs, and laptops ranked much lower, as did fashion.

Hungarian Preferences

The preferences in Hungary differ, at least according to a survey conducted by eMAG. Those who indicated their intention to participate in the Black Friday promotion said they would mostly buy clothing (28.8%), a 10% increase compared to last year.

An even more significant increase is expected in the food segment (drinks and food); this year, 12.7% of the respondents will make purchases in this category, compared to just 1.2% last year. As for technology products, most respondents (25%) said they would buy small home appliances, refrigerators, TVs and washing machines. Since most clients buy Christmas presents on Black Friday, it is no surprise that toys will sell well, too, eMAG says.

However, Hungarians seem much more restrained with spending. While in Romania, the average per client was the equivalent of

HUF 96,000

on Black Friday, almost half of the Hungarian respondents plan to spend between HUF 15,000 and 60,000, and only 17% between HUF 60,000 and 100,000.

Market research company GKID (formerly GKI Digital) also surveyed Hungarian consumers and found that this Christmas, the most popular products will be innovative home appliances (air fryers, robot vacuum cleaners, beauty products) and mediumcategory smartphones. Also, many will buy clothing and cosmetics for Christmas presents. Following the international trends, the fashion segment is expected to grow significantly in Hungary, GKID says.

Balázs Várkonyi, chairman of the eMAG board of directors, confirmed at a press conference that the company expects the highest sales in energy-saving appliances and smart accessories aimed at reducing energy bills on Black Friday. Besides that, eMAG says it is experiencing a shift in consumer preferences. Until recently, buyers focused mainly on tech products, but now they turn more towards fashion, Várkonyi said.

10 | 2 Business www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

ADVERTISEMENT

PwC: Employees Want Financial Security and Stability

Although base salary remains the most critical factor, growing insecurity has changed job preferences: career prospects and overtime pay have overtaken flexible working hours and a predictable work schedule in job seekers’ list of priorities, PwC Hungary says.

The Big Four consultancy compiled an annual survey of the job preferences of employees in Hungary for the sixth time this year, quizzing nearly 25,000 respondents. It has also announced its Most Attractive Employer awards.

PwC Hungary asked high school students over 16 (grades 11-12), higher education students, and employees what they look for in a job, their expectations of employers, and the employer brands they find most attractive in Hungary. Although data collection is ongoing, the awards were given based on responses received between September 12 and October 31, 2022.

In an uncertain geopolitical and economic environment, PwC found key employee preferences have changed significantly compared to previous years. Financial security has become more important than work-life balance or meeting social needs.

In line with this, items related to wellbeing have declined compared to the year before, PwC says. Although the possibility to work from home and human factors such as good relations with colleagues and superiors remain essential, a secure and stable workplace is now more important.

Examining the responses of school pupils and university students, they perceive their work and career as a lesser part of their identity and the employer-employee relationship as more transactional. Base salary remains the highest preference, followed by overtime and career opportunities. They are less keen to work from home, demonstrating a need to separate work from their personal life.

“For younger workers, employers should pay particular attention to developing workplace relationships and employee engagement, failing which the transactional approach can easily be detrimental to retention,” explains Márta Reguly, head of PwC’s HR consulting team.

“The results also show that young workers have much lower expectations of the ratio of home office. This could be due to fatigue induced by online learning in higher education or that they prefer

on-the-job training in person,” she adds. This year’s survey also asked employees about new topics, such as a four-day workweek. While the idea itself is popular, and there are ongoing experiments to introduce it in Hungary, the survey shows that it is not a high priority for employees when considered along with other compensation elements. One reason for this may be that in the current economic climate, it is considered less of a realistic option, PwC says.

Volatile World

The study showed that environmental factors and the so-called VUCA (Volatile, Uncertain, Complex, Ambiguous) world have a stressful effect on employees that may have lessened their flexibility, openness, and social expectations.

According to Reguly, bosses should pay increased attention to supporting employees

during this period to lay the foundations for the company’s resumed growth in a more favorable economic environment.

“Employees look to their employers for the stability and security they lack in their daily lives. This comes at a time when the economic environment presents companies with significant challenges. It is important for company leaders to address these needs in their communication, maintaining transparency and informing employees about the company’s situation and possibilities,” the PwC PR specialist warns.

“In addition to employee expectations, it is also crucial to pay attention to futureproofing the company through leadership development, maintaining flexibility, and the capacity to innovate. These values can give companies a significant competitive advantage once the crisis is over, depending on how much they retain in these years,” says Reguly.

Magyarország

Digitalization of the Hungarian Tax System Progressing Unhindered

In the past decade or so, the Hungarian tax system has undergone a massive change. A critical aspect of this is the quick digitalization of the system, which has fundamentally transformed the process of filing tax returns and undertaking tax audits.

contributed to whitening the Hungarian economy to a considerable degree.

A few years ago, we reached the point in Hungary where practically all tax returns must or could be filed electronically instead of on paper. It is considered a significant achievement, even internationally, that, based on the data available, the Hungarian tax authority now prepares a draft personal income tax return for everyone, which the taxpayer only has to accept or supplement as needed. If the digitalization trend is not broken, the tax return filing process is expected to be transformed radically in respect of all tax types within 10 years.

Developments aimed at connecting the various economic IT systems, such as EKÁER (the Electronic Goods Control System for Road Transport), online cash registers, or online billing data services, all represented significant steps in the process of digitalization. They also

The tax authority can now obtain information from sources other than just tax returns, which significantly improves the efficiency of tax audits. It is important to note that, in terms of services, these pieces of information enable the tax authority to prepare draft tax returns on behalf of taxpayers.

The transformation of the tax return filing and data collection process has fundamentally transformed tax audit methods. The established practice used to be that staff from the tax authority would primarily visit high-performing taxpayers for audit purposes, where the ratio of the investment in work to the tax shortfall expected to be uncovered was considered acceptable. These days, there are far fewer largescale operations of this kind and far more so-called targeted audits. This is because the tax authority primarily

works from online data, so that action can be taken much sooner in the case of discrepancies or suspected tax fraud.

Vast Data Resources

Thanks to digitalization and IT developments, there is a vast data resource at NAV’s disposal. This massive sea of data contains inherent exciting correlations from the aspect of tax audits, which can be uncovered through tried and tested technologies. It is possible, for example, to perform the timeconsuming analytical work of humans

using self-learning, self-developing algorithms, which further enhances the efficiency and speed of tax audits.

The Hungarian tax authority relies on the analysis of this wealth of assets to an increasing degree. An Artificial Intelligence Group has been set up within the organization, and one of its main tasks is identifying tax irregularities.

The bill preparing the upcoming implementation of e-receipts formed part of the fall tax law package submitted mid-October. According to the official information received, paper-free receipt issuance will mean less administration, more straightforward usage, and reduced costs for entrepreneurs. Although the detailed rules are not yet known, the implementation of e-receipts may be another important milestone in the digitalization of the Hungarian tax system.

The launching of the e-VAT system will be of similar significance. The essence of the globally unique development is that the tax authority could compile companies’ VAT returns based on the available data. Originally planned for 2021, the launch has been postponed a few times, most recently in November last year. Although the precise date of implementation is not yet known, NAV has again recently requested the opinion of users on the plan to connect bookkeeping programs and e-VAT tax returns.

2 Business | 11 www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

PRESENTED CONTENT

KÁROLY RADNAI

Károly Radnai, managing partner of Andersen Adótanácsadó Zrt.

BBJ STAFF

•

•

•

PwC’s Most Attractive Employer 2022 Awards were given in 10 industry listings and one overall category based on responses received from participants.

Overall Winner: Audi Hungaria; CATEGORY

WINNERS:

Automotive Manufacturers: Audi Hungaria

Energy and Public Utilities: MOL

•

•

•

•

•

•

•

•

Financial Service Providers: OTP Bank

FMCG: Coca-Cola

Manufacturing: Bosch Group

Pharma: Richter Gedeon

Retail: Lidl Magyarország

Shared Services Centers: BP Hungary

Technology: Microsoft Magyarország

Telecommunications and Media: Magyar Telekom

PwC’s Most Attractive Employer 2022 Award winners

The Cure for High Prices is… High Prices

Prices are essential economic signals, notes our corporate finance columnist Les Nemethy. High prices, whether for energy, foodstuffs, or whatever, are signs to the world to a) supply more, b) find a substitute, or c) conserve. And so, high energy and food markets today should eventually result in lower prices.

In today’s column, we first examine how this principle might apply to energy, then foodstuffs, and then discuss the impact on inflation.

A dramatic increase in gas prices, especially in Europe, has resulted in a glut and temporarily negative wholesale gas prices. There are more liquified natural gas (LNG) ships waiting to unload in Europe than available terminals. Storage tanks are pretty well full. All this is testimony to the enormous ability of economies to adapt when market forces are allowed to work.

And yet, in the short- to medium-term, I am not optimistic about the world’s ability to solve the energy crisis, nor about the prospect of lower energy prices due to interference with markets. Some examples of market interference are discussed below:

1. In parallel to an energy crisis, we are witnessing the unfolding of a climate crisis. While the move away from carbon-bearing fuels is a laudable objective, the execution of the transition has been catastrophically managed, as will be described more fully below.

2. Despite high prices, oil and gas companies have curtailed capital expenditures and drilling, choosing to distribute cash to shareholders. Why invest when there is so much interference from environmentalists, politicians, and even activistappointed board members? Case in point: U.S. President Joe Biden excoriates oil companies for not producing more and almost on the same day calls for “no drilling!” Oil and gas companies are legitimately

concerned that they may end up with stranded assets, oil and gas that will not be sold, just stuck in the ground.

3. The United States is drawing down its strategic oil reserves. While the politically desirable objective of dampening prices is achieved, this also diminishes the price signal to conserve and increase supply. Various price caps and subsidies on oil and gas in the EU and elsewhere similarly muddle market signals.

4. Governments have taken many nuclear reactors off-stream (in Japan due to Fukushima, in Germany due to green pressure, and in France due to maintenance neglect), which once again puts pressure on energy markets.

My prognosis is that energy prices will remain high for at least four or five years, even if there is a recession, because hydrocarbon-based energy still accounts for 84% of the global energy supply; alternatives appear incapable of taking up the slack sufficiently quickly and are constrained by the availability of critical minerals.

The Corporate Finance Column

Bringing on board new energy sources is capital intensive, whether hydrocarbon drilling, nuclear or alternative energy (building solar parks, establishing new mines, etc.) Recent increases in interest rates and cost of capital must be passed

through to incentivize promoters to bring new capacity onstream. As energy prices are always determined at the margin, this will serve to increase the cost of all energy.

My prognosis is that energy prices will remain high for at least four or five years, even if there is a recession, because hydrocarbon-based energy still accounts for

84%

of the global energy supply; alternatives appear incapable of taking up the slack sufficiently quickly and are constrained by the availability of critical minerals (such as copper, aluminum, and battery metals). Bringing new gas, oil, or nuclear projects on stream is capital-intensive and takes at least four or five years.

Energy and Food

One of the highest input costs of food is energy. Higher energy prices predestine the world to higher food prices. There are also other factors. For example, the fertilizer supply has been disrupted in the world because:

• Russia and Ukraine, two of the largest fertilizer exporters, have curtailed exports.

• Ammonium-based nitrogen, made with natural gas, has been curtailed by shutdowns due to volatility and uncertainty of gas supply.

As of the date of this article in midNovember 2022, financial markets are breathing a collective sigh of relief at a recently announced lower-than-forecast inflation rate. This trend may be shortlived. Energy and food are two of the most significant components of inflation.

There are also lag effects: neither energy nor food price increases have been fully passed through to consumers.

• Many European countries are only now passing through higher gas prices to consumers.

• Farmers have been using up fertilizer inventories. It will be in spring

that they must decide whether to pay higher fertilizer prices (which must inevitably be passed through to consumers) or to reduce fertilizer usage, resulting in poorer yields and ultimately being equally inflationary.

Other persistent sources of inflation are:

• Prices in the service sector and labor markets remain stubbornly high, and the ratio of job openings to people seeking work remains very high.

• Rents remain high.

• Globalization (which has a deflationary effect) is swinging to de-globalization (inflationary).

• Demographic trends are leading to a labor shortage (an inflationary effect).

• Inflationary expectations often take on a life of their own.

I would argue there is no way we are likely to approach 2% inflation in the coming years unless central banks hike interest rates enough to induce not just a recession but a full depression. Assuming they will not be prepared to pay this high political price, brace for greater than 5% inflation.

12 | 2 Business www.bbj.hu Budapest Business Journal | November 18 – December 1, 2022

2023

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

One of the highest input costs of food is energy. Energy and food are two of the most significant components of inflation. Photo by Daniele Mezzadri / Shutterstock.com

Website: www.cultus.hu • Email: info@cultuscipo.hu • Phone: +36 30 989 5557 Luxury shoes and elegant interiors at 3 Párizsi Street. Great selection and discounts in our shop, with a 10% discount on our full-price shoes. CULTUS IS THE SHOP WHERE CLASSIC ELEGANCE AND CONTEMPORARY LINES GO HAND IN HAND. Helyszín: Kozmo Hotel Suites & Spa Divattervező (női ruhák): Viktória Varga

3 Special Report

SSCs & BSCs

SSCs Mature Into GBSs as They Provide Higher Added-value Functions

collar workers, with relatively high salaries and high paid taxes,” confirms Balázs Horváth, associate partner of KPMG Hungary. “Hungary remains an attractive investment location with a lower cost yet stable operations and good talent base,” he adds, acknowledging that competition for well-qualified talent is tight in Hungarian and global markets.

Eszter Lukács, GBS director at Deloitte Hungary, told the BBJ that they have identified three key trends driving the evolution of SSCs to GBCs: digitalization, a focus on sustainability, and data’s increasing importance for businesses. As a result of these trends, expectations toward the centers have changed, Lukács says, which has resulted in these centers transforming their operating model.

New Direction

KESZTHELYI