SPECIAL REPORT INSIDE THIS ISSUE

One of the main drivers of GDP growth is internal consumption, or, more simply put, shopping. The more consumers spend, the happier companies are. Sadly, Hungarian growth outlooks for this year do not look very good, although there are some brighter spots out there. 17

An American expat businessman says Hungary is missing out on a golden opportunity to develop an industry of the future built on its natural strengths. 14

The Széchenyi Bath has been voted among the best in Europe by the British newspaper website Mirror.co.uk. That accolade transported David Holzer back to the first time he encountered the famous old building, on New Year’s Eve, 2014. 21

The National Bank of Hungary (MNB) left its key rate unchanged at the first rate-setting meeting of 2023, in line with analysts’ expectations. The decision signals that the MNB will continue its tight monetary policy. 3

Six months into his tenure as CEO of the Hungarian Investment Promotion Agency, István Joó discusses a record-breaking year in 2022, key industries and countries for FDI, the strength of Hungarian investments, and the 2023 project pipeline. 4

Ryanair boss Michael O’Leary announced his lowcost carrier will link the Hungarian capital to Northern Ireland from March, along with ambitious expansion plans everywhere in Europe, and hopes that Hungary will scrap its special airport tax. 10

Ryanair Reveals new Route to Belfast, Hints at More Links

Making a Lonely Case for Hungary’s Natural Strengths

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Christian Keszthelyi, Gary J. Morrell, Nicholas Pongratz, Robert Smyth.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

We had snow last week, which has proved a rarity this season. Enough fell for us to take the kids for a walk and for them to build a Snow Thing in the back garden. (It would have been stretching credulity to call it a Snow Man, and their description of Snow Demon seemed a little morbid.) But despite that brief Winter Wonderland, it feels like there is a sense of change in the air.

Perhaps it has been the unusually mild winter and the palpable lifting of the gloom and doom about sourcing gas and oil. Then again, maybe it is just that Michael O’Leary, of Ryanair fame, has been in town. He is a man blessed with the gift of the gab, though, as he revealed to our reporter after his press conference, in what may be a Budapest Business Journal exclusive, he has never kissed the Blarney Stone.

Be that as it may, O’Leary has never knowingly missed an opportunity to talk up his airline, talk down his rivals, and talk about whatever message he feels needs pushing. This latter point seemed to be why he was in town, for he had precious little tangible news to reveal in his conference beyond the launch of a new flight connecting Budapest and Belfast. No, this was more about what might be.

Say what you like about O’Leary, and there are plenty who do; he is not afraid of a fight. So it was last fall when we had him squaring off with various Hungarian ministers in a bout of name-calling. He was irked by what was then called an excess-profits tax and is now known as an eco-tax. They were angered by the language he used to express his displeasure. (Even now, he could not resist a sideways swipe at a “ludicrous” levy.)

To be honest, the interface between politics and business hadn’t been so much fun since Sándor Csányi, of OTP fame. The then Minister in charge of the Prime Minister’s Office, János Lázár, had a public falling out around the time the government was restricting nicotine product sales to a new system of national tobacco shops, the so-called trafiks. It is a crude paraphrase, but the core of the argument seemed to involve calling into question the ability to organize a party in a brewery.

But I digress. Ryanair is challenging the rebranded ecotax in the Hungarian Supreme Court and seems confident this “manifestly unfair” ruling will be overturned. That said, companies are always seemingly confident, right up to the point they don’t win. The real issue, though, is that a noticeably more conciliatory (or, at least, less aggressive) O’Leary was holding out the prospect of much more than a twice-a-week flight to Belfast.

“It all depends on the eco-taxes. If the eco-taxes get scrapped, there would be a significant announcement of new routes, and we would base more aircraft here. This is a market that we do want to grow, and we’d like to grow rapidly,” he said.

We will have to wait and see. Equally, this may be a false spring. We have not yet reached February, and even by the Hungarian meteorological system, winter isn’t over until March 1 (in “old money,” the spring equinox is not until March 20). There’s plenty of time for winter to blast back with a bite. And quite possibly the Hungarian courts.

Robin Marshall Editor-in-chiefThe National Bank of Hungary (MNB) left its key rate unchanged at the first rate-setting meeting of 2023 on January 24, which was in line with analysts’ expectations. The decision signals that the MNB will continue its tight monetary policy.

ZSÓFIA CZIFRAIt is necessary to maintain the strict monetary policy in the long-term, which ensures the anchoring of inflation expectations and the ability to achieve the inflation target in a sustainable manner, the Monetary Council of the MNB reasoned in its first interest rate decision of the year, when it kept the central bank base rate at the 13% level.

The last time the council raised the key rate was in September 2022. The board did not modify either side of the interest corridor, and the decision met analysts’ expectations.

The primary goal of the MNB is to achieve and maintain price stability, the bank said in its statement. It supports the maintenance of financial stability and the government’s economic policy, as well as its goals related to environmental sustainability, without jeopardizing the central bank’s primary goal, it wrote.

Listing the factors that continue to contribute to substantial uncertainty, the MNB mentioned that the global economy had started to slow down recently, gross domestic product had declined in many countries, the ongoing Russo-Ukrainian war, the European energy crisis, and the generally rising interest rate environment. Although raw material and energy prices have decreased significantly in recent months, they are still at high levels compared to previous years.

While the base rate remained at its previous level, a significant change was announced at the meeting. The MNB will continue to increase the required reserve ratio: from the beginning of April, it will raise its level to 10%

from the previous 5%, and from the beginning of February, it will launch discount bond auctions on a weekly basis.

Changes in Average Earnings in Hungary, 2003-2022 (January-November)

Net monthly average earnings of full-time employees (excluding public works employees), HUF/month

expected to be lowered first, and only after that can we expect the base rate to be reduced, he said.

According to him, the January data will be of outstanding importance in the development of inflation in 2023,

as the revaluations at the beginning of the year will affect the exchange rates for the whole year.

According to Magyar Bankholding’s head analyst

The goal is to ensure that the interest conditions determined through the one-day deposit rate are enforced as effectively as possible, MNB deputy governor Barnabás Virág said.

He pointed out that the effects of disinflation will intensify in the coming months, the background of which, in addition to base effects, is lower raw material prices and electricity and gas consumption.

He noted that a turnaround is also emerging in the development of food costs; prices have already started to decrease in the grain market, but similar processes are expected in other sub-markets. In addition, from the domestic side, the narrowing of retail trade also acts as a “disciplining force” on pricing, he added.

He reminded that the central bank and the economic competition authority GVH cooperate closely in breaking down price increases above costs. He recalled that inflation reached 24.5%

in December; the two percentage point increase compared to November was caused by the removal of the fuel price cap, the effect of which extends into January as well, he underlined.

The slowdown in economic growth continued, as there was a decline

in two consecutive quarters [editor’s note: the fourth quarter GDP data will be published in February], but at the same time, there is a good chance that the indicator will remain in the positive range for the whole of 2023, Virág said.

The MNB continues to pay particular attention to the external and internal risk factors defined earlier, he stated. He added that the “horror” of the energy crisis has decreased, but at the same time, the end of the RussoUkrainian war is not yet in sight, and the largest central banks are still tightening for the time being.

According to Magyar Bankholding’s head analyst Gergely Suppan, inflation may turn around from the beginning of the year due to increasingly strong base effects, to which the recent sharp drop in energy prices may even pose a downside risk.

Suppan expects the base interest rate to be reduced from the middle of 2023, which may be more significant in the last quarter as the rate of inflation decreases, so that it may drop to 9% by the end of 2023.

An easing of monetary conditions is not expected in the first quarter. It will come only after a substantial slowdown in inflation, commented Gábor Regős of Makronóm Institute. Even then, the one-day deposit rate is

Gergely Suppan, inflation may turn around from the beginning of the year due to increasingly strong base effects, to which the recent sharp drop in energy prices may even pose a downside risk. He expects the base interest rate to be reduced from the middle of 2023, which may be more significant in the last quarter as the rate of inflation decreases, so that it may drop to 9% by the end of 2023.

According to Regős, there is no big surprise in the commentary on the interest rate decision; it suggests the maintenance of the current monetary conditions. At the same time, the analyst said that the central bank’s press release lists factors that are optimistic about inflation and that influence it in a favorable direction.

Numbers to Watch in the Coming Weeks

December retail trade data will be published on February 6, and the Central Statistical Office will release the December industrial output figures on February 7. The much-awaited January inflation data will be out on February 10.

Six months into his tenure as CEO of the Hungarian Investment Promotion Agency, the Budapest Business Journal had its first sitdown interview with István Joó. We discussed the specifics of another record-breaking year in 2022, the critical industries and countries for FDI, the strength of Hungarian investments, and the project pipeline for 2023.

BBJ: In most years, HIPA either breaks its record for investments in terms of value or is very close to it. What was the story in 2022?

István Joó: It was a successful year for HIPA because we reached new records in 2022. The investment volume amounted to EUR 6.5 billion, a new all-time high in the history of Hungarian investment promotion. And with those investments, the companies committed themselves to creating 15,000 new jobs on top of retaining 42,000. As a reminder, in 2021, the investment value was EUR 5.3 bln. So we are talking about a year-on-year increase of some 23%. We were able to close 92 deals in 2022.

BBJ: Are those 92 projects both investment and reinvestment?

IJ: It was both, and HIPA contributed mainly with non-refundable cash. We have a wide range of services we can offer to companies; identifying the necessary land, potential sites for the investment, and handling all kinds of company issues: HR-related, taxation,

cooperation with universities and higher education. We have a bunch of services that we can offer to companies.

BBJ: Which countries were the leading foreign investors?

IJ: First of all, I’d like to mention the success of the “Opening to the East” strategy of the government, which was launched back in 2012. In 2022, 48% of our investments came from Eastern countries, 42% came from the West, and Hungarian companies made 10%. HIPA deals not only with foreign investors but also helps the expansion of Hungarian companies in the country.

Our largest investor, based on volume, was South Korea. Germany was the second, and Hungary third. And this was followed by Switzerland, France and

Japan. I’d also like to mention China here because it is a vital partner for Hungary. Last year, we announced the most significant greenfield investment in Hungary’s economic history, CATL’s more than EUR 7.3 bln investment in Debrecen [230 km east of Budapest by road]. But, since physical works are just about to start in the first or second quarter, this number will be reflected in the 2023 data.

Germany is always a key investor in Hungary. Mercedes-Benz announced an expansion in Kecskemét [93 km southeast of the capital], Audi has announced some developments in Győr [119 km northwest], and BMW decided to further expand its Debrecen factory, which is now under construction. This is encouraging

news from Germany, let me name Thyssenkrupp, Kostal, Diehl, Bürkle, and Infineon, which are important partners for Hungary.

Hungarian companies were successful not just because they implemented the third-biggest investment volume in the country in 2022. They were also third based on the number of new jobs created and second in terms of the number of new projects.

BBJ: Is that a relatively new trend, the level of input from Hungarian companies?

IJ: Based on investment volume data from the previous nine years, Hungary ranked between seven and two, and typically made at least the top five over the last few years. One should not forget that HIPA deals not just with foreigners but also with Hungarians. Sometimes I need to draw the attention of Hungarian companies to the fact that they are also entitled to our services.

BBJ Automotive, especially EVs, and business services have long been dominant. Is this still the case? Are there new areas emerging?

IJ: The picture doesn’t differ from previous years because most investments took place in the electronics sector, especially battery productionrelated projects. That was followed by the automotive and food industries. These were the top three categories, but pharmaceutical and logistics-related investments are also substantial. And the business services sector and BSCs continue to thrive. More than 70,000 people are employed at such centers, and in 2022, nearly 2,500 new jobs were created for highly skilled workers in the country, taking into account all the BSC, ICT and R&D projects.

BBJ: Are any areas beginning to bubble up that look interesting for the future?

IJ: Well, generally speaking, we were happy to see the increasing number of R&D-related projects in the automotive industry, in healthcare, and also in the food industry. That is very promising because we aim to attract high valueadded investment to the country. Before 2019, our top priority was job creation quantity. Now we have shifted towards quality. Jobs with high added value are crucial for the success of the country.

And R&D-related activities are booming.

BBJ: When we talk to businesses, the concern we hear a lot is finding available appropriate workforce. Hungary has the good challenge of having near full employment. In terms of finding reserves of labor, how does that challenge develop?

IJ: As you mentioned, it is a positive challenge for the country. It is true that the labor market is very tight. In November last year, the unemployment rate was 3.8%, which is very low compared to other EU member states. But we shouldn’t forget that the unemployment rate is still higher in some regions of the country. Especially in the northern and southern areas of Hungary, we still have relatively significant reserves from which companies can benefit. Moreover,

to inspire our youngsters to participate in the labor market, we exempted them from paying personal income tax from January 1 last year, which seems to have been a very successful step by the government. In 2021, we eased the participation of third-country workers in our labor market. We have a list of 15 countries from where registered recruiting companies are able to bring the necessary labor force on a fast track. Our primary objective is to help Hungarian people to have a livelihood in the country. But still, third-country workers are an option for companies. The government also launched a new program last year when the war broke out to help Ukrainian refugees who would like to work in Hungary find a job. We support companies with a cash subsidy if they hire a Ukrainian refugee. And so, this is another alternative.

BBJ: Talking of Ukraine, have you seen investors pulling out or expressing concern about investing in Hungary because of the war next door?

IJ: Foreign investors’ trust in the country and the Hungarian economy seems to be unbroken. That’s why we were able to reach another investment record in 2022. I believe they really value, first of all, the political stability in the country. Also, the lowest tax rates in Europe. We have one of the most competitive investment environments in Hungary, which is very important from the investors’ point of view. We don’t feel any adverse

effects so far. And the government does everything in its power to counter the negative effects of the economic impact of the war. Our main purpose is to avoid recession and to be a local exemption from the European recession. For this, successful investments are critical. That’s why HIPA is boosting its activities. We have the necessary financial resources to provide cash subsidies for foreign investors, for new investments or reinvestments.

Certainly, all kinds of companies, from small to large, face challenges in terms of energy prices. That’s why the Hungarian government decided to launch the so-called Factory Rescue program to subsidize the energy efficiency and energy generation-related investments of large companies. We have further launched a program for small- and medium-sized enterprises to support their operational costs. We have also reviewed a state subsidy scheme under which companies are currently able to apply for funding when building a new factory, and up to 25% of the renewable energy-related costs are eligible. We would like to push this number up, hopefully from February.

BBJ: What are your expectations for 2023? Does the project pipeline look good? Do you think you will be able to better the 2022 record, or at least get close to it?

IJ: I am confident we can make it happen, considering that the

“We were happy to see the increasing number of R&D-related projects in the automotive industry, in healthcare, and also in the food industry. That is very promising because we aim to attract high valueadded investment to the country. Before 2019, our top priority was job creation quantity. Now we have shifted towards quality. Jobs with high added value are crucial for the success of the country.”

CATL investment is reflected in 2023’s numbers; in addition, the project pipeline is very promising. I am optimistic that, in the coming months, we will be able to announce some significant investments again. Our priority is to attract high added-value investments into

the country. We welcome investors regardless of their origin, whether from East or West.

BBJ: Is there anything else to add?

IJ: Last year, 90% of the projects targeted the countryside and 10% Budapest, which shows our commitment to the countryside and its economic development.

BBJ: And it helps with the tight labor market if you can convince investors that they should go to the south or the north.

IJ: Yes, but, of course, competition is fierce in the region too, and it takes a lot of effort to secure each and every investment project.

BBJ: Finally, it’s six months since you moved into the CEO’s role. How’s that been?

IJ: I’m thrilled to lead an organization of such strategic importance because the objective is clear for me and the whole agency, and our activities are vital for the success of the economy. Nowadays, Europe is facing economic challenges. So, our task is critical. At HIPA, we have highly skilled people with significant experience in investment promotion; we have the full support of the government, the foreign ministry, and Minister [Péter] Szijjártó. We have a clear mandate to help Hungary thrive; we have to be the best investment promotion agency in the region.

sanctions against Moscow, alleging they have done more damage to EU economies than to Russia’s. Earlier this month, the government announced the results of a National Consultation it had earlier launched, asking the population if they agreed with Brussel’s sanctions.

Following an intensive advertisement campaign on behalf of the government declaring that these sanctions were destroying the economy, roughly

of Hungarians who responded said they disagreed with them. (However, only around 1.389 million people, from a population of a little under 9.7 million, participated in the survey, representing around one in seven Hungarians.)

Hungary’s foreign minister said the country opposes the delivery of Western weapons to Ukraine because it could “lead to the prolongation or potential escalation” of the war.

met with haulers’ associations in Záhony (300 km northeast of Budapest) on January 24

Indeed, Szijjártó also warned that Hungary would oppose any sanctions the EU proposed against Russia that could adversely affect the operations of Hungary’s sole nuclear power plant, whose four reactors produce roughly half of Hungary’s electricity production, and is dependent on Russia for its fuel rod supply.

Szijjártó began by clarifying that, while his government is not in favor of the EU sending funding for weapons to Ukraine, it would not block a proposed EUR 500 million in assistance to its beleaguered neighbor. He dismissed media reports that emerged last week that Hungary intended to veto funds earmarked under the bloc’s European Peace Facility as “lies.”

The Veszprém-Balaton 2023 European Capital of Culture program was launched in Veszprém (110 km southeast of Budapest) on January 21, according to origo.hu. The program, backed by a budget of HUF 74 billion, including HUF 72 bln in central government support, involves more than 3,000 events, Aliz Markovits, who heads project company Veszprém-Balaton 2023, said. The project aims to make Veszprém, together with the region, a “new cultural hub of Europe.” The European Union designates European Capitals of Culture each year to highlight the diversity of cultures in Europe and celebrate the cultural aspects Europeans share. The other cities sharing the designation in 2023 are Elefsina, Greece, and Timisoara, Romania. Becoming a European Capital

“Instead of dead-end sanctions and hundreds of millions of euros in arms shipments, the EU should focus on peace-building in Ukraine,” he added. So far, Hungary has refused to provide Ukraine with weapons or allow their transfer across its border with Ukraine.

However, authorities have made progress regarding the shipment of other cargo across the border between the two countries. Hungarian and Ukrainian customs and border authority officials

of Culture can raise a city’s international profile, boost tourism, and generate significant local investments. Pécs (195 km southwest of Budapest) was a European Capital of Culture in 2010.

Magyar Posta issued a special block of stamps for the first anniversary of the House of Hungarian Music on January 23, writes profitline.hu. The stamp features an interior detail and the exterior facade of the institution’s building, while the commemorative envelope shows a top view of the House of Hungarian Music. Magyar Posta said it is producing 50,000 copies of the perforated stamp block with black serial numbers and 4,000 copies of the cut version with red serial numbers. The stamp was designed by graphic artist György Kara, based on the artistic photos of György Palkó, and produced by ANY Security Press. The special issue can be purchased at Filaposta, some post offices, and via Magyar Posta’s website.

to discuss accelerating throughput, according to Hungary’s National Tax and Customs Authority (NAV).

At the meeting, both countries’ authorities underscored their commitment to further improving throughput capacity at border crossings while acknowledging that the goal could only be achieved through mutual cooperation.

In Brussels, Szijjártó recalled that Budapest has consistently opposed

More than 100,000 visitors were curious about the exhibitions of the Ferenc Móra Museum and its exhibition spaces last year, according to profitline.hu. The museum, based in Szeged (175 km southeast of Budapest), said it had an outstandingly successful year. The most popular show was the Cowboy-Indian exhibition, which drew 40,000 visitors. The public collection attracted most visitors during the summer and fall “Night of the Museum” programs and in the days between Christmas and New Year.

The National Bank of Hungary (MNB) has issued commemorative coins with a face value of HUF 15,000 in silver and HUF 3,000 in non-ferrous metal, marking the 200th anniversary of the writing of the poem that forms the basis of Hungary’s national anthem,

“We will never accept a single decision that would even slightly limit HungarianRussian nuclear cooperation,” Szijjártó said. “It would put the security of our national energy supply at risk, and nobody should expect that from us.”

Hungary’s foreign minister also called on Ukraine’s government to respect the rights of the Hungarian ethnic minority in the western Ukrainian region of Transcarpathia. According to Szijjártó, ethnic Hungarians there had recently been victims of “concentrated attacks” by local authorities.

the central bank said in a release on its website. This year’s MNB commemorative coin issue program started with commemorative coins designed by the sculptor Tamás E. Soltra. A total of 5,000 pieces of the silver version and 6,000 pieces of the non-ferrous metal version will be made. The obverse of the commemorative coins shows a halflength portrait of Ferenc Kölcsey, the poem’s author, stepping forward from the divided background.

An exhibition of the work of El Greco (1541–1614) at Budapest’s Museum of Fine Arts has attracted more than 100,000 visitors since it opened late in October, according to state news agency MTI. The show of more than 50 of the artist’s works, including items on loan from the Prado, the Louvre, the National Gallery in London, and the National Gallery of Art in Washington DC, runs until February 19.

Minister of Foreign Affairs and Trade Péter Szijjártó encapsulated the latest developments for Hungary regarding Russia’s invasion of Ukraine in statements he made during a meeting of the European Union’s Foreign Affairs Council in Brussels on January 23.Destruction at Kherson International Airport in Chornobaivka, Kherson Oblast in Ukraine on November 20, 2022. Hungary’s foreign minister Péter Szijjártó has continued to push the Hungarian line that the EU should abandon sanctions against Russia and arms shipments for Ukraine and “focus on peace-building” instead. Photo by Jose HERNANDEZ Camera 51 / Shutterstock.com

“The war in Ukraine has affected the economic situation of all countries from the CEE region, ESG moves from ‘nice to have’ to a market standard in all RE market segments, and increasing construction, operation, and transportation costs translate into increasing costs in all real estate sectors. These are some of the key findings in Highlights 2022: CEE-6 Real Estate Market,” the consultancy says in its outline.

Last year saw a slowdown in investment volumes compared to previous years, owing to the elevated financing costs, availability of fewer products and general market uncertainty.

“Investors from the Czech Republic, Hungary, Romania and Slovakia, in particular, proved that local market knowledge and presence are the keys to success. Approximately 35% of the investment volume came from CEEbased investors,” Colliers says.

“Asset price corrections compared to the level before the war generate appealing market opportunities for investors. Further inflows of capital from Romania, the Baltic States, the Czech Republic and Hungary are expected,” it continues

There were two particularly significant transactions in Hungary in 2022. The first of these was the acquisition by Groupama Gan REIM, on behalf of SCPI

Affinités Pierre, of the 20,000 sqm Green Court Office for EUR 77 million from CODIC Hungary and Pesti Házak. The other was the purchase by Hungary’s Adventum of the Tesco portfolio in Hungary and the Czech Republic for EUR 219 million.

Concerning the supply of assets, Colliers has traced 200,000 sqm of speculative office assets delivered during 2022. Further, a noted delivery was the long-awaited MOL Campus building. The new MOL headquarters provides Budapest with its first skyscraper at 147 meters tall in South Buda’s riverside BudaPart development, which is seeing the creation of an entire neighborhood of retail, office and housing units.

In comparison, only 77,000 sqm was delivered in the Prague office market, the third-lowest volume over the last 10 years. This is despite gross take-up reaching 500,000 sqm, making it one of the most successful years for the market. 2022 saw the lowest level of supply in most CEE office markets, although demand is again reaching pre-COVID levels, with hybrid working as the norm.

In Poland, the volume of office delivery in eight of its regional cities exceeded that of the capital Warsaw for the first time.

In the hotel market, the deteriorating operating environment could cause a number of underperforming hotel projects to become insolvent,

providing opportunities for investors and private equity firms to buy them at a favorable discount.

A noted success for incoming investment into Hungary is the signing last year of an agreement between the municipality of Debrecen and Contemporary Amperex Technology Co., Limited (CATL), a Chinese global leader in lithium-ion battery development and manufacturing.

The most extensive greenfield development yet in Hungary will see the building of what is described as the largest battery factory in Europe, with the new manufacturing facility to be delivered on a 220-hectare site in the south of the city.

The volume of investment into the project is put at EUR 7 billion, and 9,000 people will be employed at the factory. That is a significant number under any circumstances, but especially so in Hungary, where the labor markets are tight, and the recent government priority has been attracting high added-value jobs, placing quality over quantity.

Production is planned to start in 2025 with Mercedes Benz and BMW, both of which have their own plants in Hungary,

intending to use the batteries in their products. BMW’s factory, which is under construction and, when operating fully, will produce 150,000 electric vehicles a year in a EUR 1 billion investment, is also located in Debrecen.

The year 2022 saw an increasing trend for the prominence of domestic Central and Eastern European capital across investment transactions in the region and a downturn in investment activity, according to Colliers in its latest CEE regional report.

“Investors from the Czech Republic, Hungary, Romania and Slovakia, in particular, proved that local market knowledge and presence are the keys to success. Approximately 35% of the investment volume came from CEE-based investors. Asset price corrections compared to the level before the war generate appealing market opportunities for investors. Further inflows of capital from Romania, the Baltic States, the Czech Republic and Hungary are expected.”The 20,000 sqm Green Court Office, bought by Groupama Gan REIM, on behalf of SCPI Affinités Pierre, for EUR 77 million from CODIC Hungary and Pesti Házak.

Rita Hruska has been appointed marketing director of Pernod Ricard Hungary, coming to the Hungarian subsidiary of one of the world’s leading alcohol producers from her position as brand manager of Dreher’s international brands.

At Pernod Ricard, she will be responsible for marketing global brands such as Absolute Vodka, Beefeater, Jameson, Ballentine’s, and Chivas Regal.

“It is a huge honor to work with such globally renowned and iconic brands as those in Pernod Ricard’s prestigious and comprehensive brand portfolio,” said Hruska. “I will use all my experience to make these brands even better known and more successful in the domestic alcohol market.”

Hruska graduated from the International Business School with a degree in Marketing Economics and started her professional career at British American Tobacco. After a twoyear management training program, she focused on innovative marketing solutions, built premium brands, and launched several successful products.

Firm (LKT), was promoted to partner as of January 1, 2023.

Specializing in litigation and arbitration and also active in the Corporate and M&A Group, Fazakas joined LKT in September 2010 as a trainee lawyer straight from university.

He was promoted to head the Dispute Resolution team in 2020 when the Litigation and Dispute Resolution Group was enlarged and restructured.

Fazakas is an acknowledged lawyer before the Hungarian and international courts and arbitration tribunals and is highly ranked by international rating agencies. He is a qualified ICC Arbitrator, organizer and judge of the annual Budapest Willem C. Vis PreMoot (International Commercial Arbitration Moot), and trainer of new litigation waves.

most prominent startup accelerators in the Central and Eastern European region. She notes that WeAreOpen’s thought leadership can have a serious social impact locally, adding that real change begins at the microcommunities level. Still, the creation of the foundations of openness within WeAreOpen’s business community can ignite positive change in broader society, she says.

Sásdi is the CEO of Publicis Groupe Hungary and co-head of Publicis Le Pont, which unites the Czech, Polish, and Hungarian expert centers of Publicis. Since January, she has held the position of WeAreOpen’s board chairperson in addition to her current roles.

According to a press release sent to the Budapest Business Journal, her commitment is both value- and business-based: as the leader of the country’s most significant creative and media market player, she believes that diversity and inclusion are the basic conditions for outstanding business operations.

Berea has extensive experience in top-ranked law firms, both international and local. She has been a member of the Romanian Union of Lawyers and the Romanian Bar Association since 2004 and has an online MBA Essentials certificate from the London School of Economics.

Gábor Kovács, BLS-CEE’s co-founding managing partner, commented: “Having a strong team in Bucharest unlocks the potential for offering integrated business law solutions to clients for Hungary and Romania.”

BLS-CEE’s Budapest team has also grown: Chen Chen has joined forces with the firm to develop business law solutions tailored to the needs of Chinese investors in the region.

In 2009, she joined Zwack Unicum, where she initially managed the Johnnie Walker brand and then the flagship Unicum brand team, as well as representing international brands such as Moët & Chandon, Hennessy, Evian, Baileys, and Captain Morgan.

From 2019, she worked at Dreher, where her main task was to strengthen the international super-premium brand portfolio (Pilsner Urquell, Peroni, Asahi), positively shaping consumer perceptions, increasing the company’s super-premium share of the domestic beer market.

Balázs Fazakas, head of the Litigation and Dispute Resolution Group at Lakatos, Köves & Partners Law

“Balázs has been instrumental in leading the dispute resolution practice at LKT with tireless dedication in the last few years,” commented LKT managing partner Péter Lakatos. “Péter Köves and I believe that Balázs as a partner will further develop LKT’s rightly recognized and well-known dispute resolution practice. He is a very talented litigation and arbitration lawyer with outstanding expertise.”

Commenting on his promotion, Fazakas said, “Being promoted to partner at LKT is an honor for me and an important milestone in my professional career. I’m grateful to have had the chance to learn and work with such internationally recognized, outstanding litigation lawyers.”

Hungary’s market-leading diversity, equity, and inclusion organization, WeAreOpen, has been expanded with two new leaders. Nóra Várady became CEO, while Helga Sásdi was named the new chairperson of the board of directors.

Várady transferred to WeAreOpen from CEU InnovationsLab, one of the

In addition, Márton Beck, communication strategist and founding member of the MindMiners Collective, has joined WeAreOpen as a strategic adviser.

“In today’s world, the basic expectation of workplaces is that employees are judged based on their performance regardless of skin color, religion, gender identity or sexual orientation; that is, to operate in an open manner. With the arrival of Helga, Nóra, and Marci, I think that the relationship between WeAreOpen and the domestic corporate sector will rise to a new level,” said Péter Árvai, founder of WeAreOpen and honorary chairman of the board.

Romanian law-qualified lawyer Iulia Berea (Stoianof) and her team based in Bucharest have joined BLSCEE. A Romanian law-qualified lawyer, she is highly specialized in corporate, M&A, labor, data protection, consumer protection, and environmental practices.

Chen is a collaborating partner of BLS-CEE with extensive knowledge in managing legal matters concerning the European operation of the subsidiaries of Chinese Enterprises. She is specialized in corporate M&A, construction, real estate, dispute resolution, and arbitration and is fluent in English, Hungarian, and Chinese.

“Fleeing Big Law and sharing her time between Hungary and Switzerland, Chen was seeking a legal community that enables her to thrive and take her professional career to the next level. We are very proud that she chose us,” Kovács commented.

This requires the redevelopment of the building in accordance with thirdparty sustainability accreditation to attract tenants to the Class “A” office market strata and high-end retail and to comply with environmental regulations regarding emissions and energy usage.

“I see EU taxonomy adaptation on the European market as one of the major sustainability achievements of 2022,” says Zsombor Barta, president of the Hungarian Green Building Council (HuGBC).

“Although many local real estate stakeholders might not yet realize the importance of this, in the midterm and on a larger scale, this is a very important framework towards a more sustainable future and aligned with the ambitious 2050 zero carbon targets as well,” he adds. Barta points out that financial institutions now need to report on their portfolio’s EU taxonomy ratio, and projects which comply with the Taxonomy criteria are eligible for financial incentives. He argues that this will have an enormous

“We do not take any shortcuts when it comes to carefully repositioning such a prestigious building in the heart of Budapest,” comments Jake Lodge, principal of Avison Young Hungary, which is responsible for the renovation project. “In order to provide our future tenants with a combination of modernity and historic tradition, we did not shy away from hand-picking materials and selecting specialized architects while targeting a Breeam ‘Excellent’ certification to ensure the asset’s long-term attractiveness in the local market.”

The architects for the project are Bord Studio. Realiscon advised on and completed the Breeam assessment and also performed the project management.

impact on real estate stakeholders and push the entire sector toward a more energy-efficient and sustainable future.

Budapest Airport (BUD), the operator of Ferenc Liszt International, has added 83 electric vehicle charging stations resulting in 102 additional charging points at the airport.

“E-mobility is a key pillar of Budapest Airport’s sustainability strategy, which is why the airport operator has placed emphasis on expanding its electric vehicle fleet and build an electric charger network. In 2022, Budapest Airport applied for the EU CEF 2 Transport – Alternative Fuel Infrastructure Facility funding program with its Net Zero Airport project, and a grant for

“Renovating a heritage building has had many challenges, including undoing numerous changes inflicted on the building over the years, removing entire floor slabs, and replacing the building’s mechanics with efficient modern systems, thereby transforming Krausz Palota into a commercially viable and premium commercial property fit for modern businesses,” Lodge says.

Discussing the difficulties of redeveloping historic buildings, particularly one that has undergone several function changes, into sustainable offices as opposed to greenfield projects, he explains that the process can be very demanding and throw up many surprises, like unexpected supporting beams that were not on the historical plans.

the installation of 83 charging stations and 102 charging points was recently signed,” BUD said.

Dealerships belonging to the BMW group sold 550 purely electric models in Hungary in 2022, of which 460 were BMWs and the remaining 90 Minis. Sales of EVs thus increased by 119% compared to 2021, making BMW the most popular electric car manufacturer among premier brands, according to the automaker. The company is building a factory that will produce 150,000 electric cars a year in Debrecen (231 km east of Budapest by road) in a EUR 1 billion investment.

Green and efficient buildings are in focus, becoming much more than

Lodge says you only really get to know about these skeletons in the cupboard once you have pressed the button on the refurbishment and demolition works; therefore, a great degree of innovative thinking is required to solve these issues.

“There are very few opportunities (if any) to develop greenfield modern office buildings in the CBD [Central Business District]. Locations within UNESCO world heritage sites, especially on the famous Andrássy út, need to fully embrace the underlying architecture and heritage of these classic buildings. It would be a travesty to knock down these majestic buildings in the sole interest of generic office buildings in order to maximize buildable sqm,” he adds.

a simple check mark that companies and investors include in their reports to shareholders, says Colliers in its “10 Predictions for the CEE-6” report. This is because efficiency can yield actual (and quite significant) financial benefits. Consequently, Colliers consultants expect to see a greater differentiation in the rent/value of a building based on how green/efficient it is for all countries in the CEE-6 group. This should apply to all real estate sectors, but particularly to offices and industrial. “ESG moves from ‘nice to have’ to a market standard in all RE [real estate] markets,” says Colliers. In Bucharest, the 28,000 sqm America House has become the first project in the Romanian capital to be awarded Breeam “Outstanding In-use” certification after EUR 10 million was spent on the development with the certification process undertaken by BuildGreen.

The modernization of the Krausz Palota at Andrássy út 12 is nearing completion. The listed building was acquired in 2019 by the investment manager AEW on behalf of its clients and is part of a trend for investors and developers purchasing such classic architecture in the historical center of Budapest and renovating for use as top-end offices and street-front retail complexes.GARY J. MORRELL

Ryanair boss Michael O’Leary announced his low-cost carrier will link the Hungarian capital to Northern Ireland from March, along with ambitious expansion plans everywhere in Europe, and hopes that Hungary will scrap its special airport tax.

But aside from excitedly talking up his company’s numbers, some seemingly contradictory statements, and typical O’Learyesque disparaging of rival carriers, he presided over what may have been one of the most newsless news conferences ever held in Budapest on Tuesday, January 24.

But, ever the show host, O’Leary began brightly and steadfastly maintained his stance to the end.

“The good news this morning is that this will be our largest summer schedule [in Hungary], and we have one new route to announce, linking Budapest with the exciting city of Belfast, in [Northern] Ireland. So those of you looking for a sun getaway destination can sample the delights of Belfast this summer,” he quipped, in defiance of the facts.

(According to website weather and climate sites, “sunspot” Belfast has 1,302 hours of sunshine per year, while Budapest has 1,890, some 45% more.)

The CEO was also a little unsure regarding the number of weekly flights to the province, initially claiming “three or four” before, being pressed for accuracy, he asked an aide. “Two,” the assistant clarified.

O’Leary then launched into his regular spiel about Ryanair as Europe’s largest, greenest and cheapest airline, which is aiming to add 51 new planes this year to its fleet, and its recovery post-pandemic.

“We’re operating this winter at

of our pre-COVID capacity. That is a record across Europe; most of the legacy airlines are operating at about 70% of pre-COVID capacity,” he said.

Turning to Budapest, he insisted the Hungarian market was proving most resilient, achieving monthly load factors in the last quarter of 2022 of 92-94%.

With eight aircraft based at Budapest Ferenc Liszt International Airport (unchanged from last year), Ryanair expects to carry four million passengers to and from the Hungarian capital over the next 12 months, “making us the number one airline in Budapest [...] We have about 10% more flights than Wizz Air, and [will] have a 32% market share, with Wizz Air down to 29%,” he forecast.

Listing the prominent risks to the recovery, he noted potential “adverse news flow from Ukraine,” COVID, and concerns over inflation eating into disposable incomes. However, he stressed that, thus far, “we haven’t seen any evidence of that.”

Notably, unlike his press conference in Budapest last September, while critical, he was far less discourteous to the Hungarian government over the special tax slapped onto airline passengers from July last year.

Asked to clarify the current situation, O’Leary responded: “As you know, the government have changed the format of that tax from this ludicrous excessprofits tax, which was levied on handling agents, which, of course, was never

going to be levied on handling agents. It’s now an eco[logical] tax, although we continue to think it is manifestly unfair.”

He then read an email from his legal team, which is fighting to have the tax rescinded via Hungary’s Constitutional Court.

“We had a hearing in the Hungarian Constitutional Court yesterday [… which] we believe went well. The judgment is expected in the first half of

[…], and we trust that the Court will make the right decision and overturn this anticonsumer, anti-competitive and nonenvironmental tax. And then my lawyer says: ‘And don’t say anything else!’”

Asked if his carrier planned any further new routes from Budapest, O’Leary initially cited his current mantra: “It all depends on the eco-taxes. If the eco-taxes get scrapped, there would be a significant announcement of new routes, and we would base more aircraft here. This is a market that we do want to grow, and we’d like to grow rapidly.”

Declaring Budapest as “a city with cultural vibrancy” and one of the

“great city-break destinations across Europe, all year round.” Its potential is “just being strangled by this silly ecotax that raises so little money for the government,” he added.

“We have Ireland pretty well covered now we’re linking Budapest to Dublin and Belfast; that’s more or less all you need. But there are lots of more routes we’d like to link to Budapest,” he said, citing Italy, Scandinavia, Spain and Portugal as being of particular interest.

Asked by the Budapest Business Journal about the passengers likely to use the new Belfast flights, O’Leary said he expected a good flow of inbound visitors coming to Budapest for a city break.

“It’s a new destination for Belfast. The city has a lot of flights to the U.K. and European sun spots, Spain, Portugal and Italy, but it doesn’t have these kinds of interesting European cities.”

“It’s a new destination for Belfast. The city has a lot of flights to the U.K. and European sun spots, Spain, Portugal and Italy, but it doesn’t have these kinds of interesting European cities.”

There would be Hungarians living and working in Ireland and their equivalents resident in Hungary. At the same time, “there are probably a few crazy Hungarians who want to go to Belfast for a weekend. There’s [the] Titanic, pubs, […] there used to be a war on up there about 20 years

ago, [and] you can do interesting taxi drives around the [former troubled areas]. We don’t know who’ll fly there, but we’re pretty sure with our prices, we’ll be able to fill our [planes],” he said.

The new link was welcomed, if with certain reservations, by Thomas Sneddon, a professional translator, originally from Northern Ireland and now living near Budapest.

He told the BBJ: “Yes, there was already talk of it when I was home at Christmas, but we didn’t know how many flights there would be. Twice a week is fine, but it’s a pain that all the return flights to Belfast are at 6:30 in the morning.”

Regardless of the bleary eyes and hangovers likely to be encountered by some segments of the passenger market, Ryanair usually does its homework when launching new routes.

However, given the paucity of hard news offered in the 42-minute press conference, the BBJ asked O’Leary afterward how frequently he took the trip to county Cork to kiss the Blarney Stone, a limestone rock in Ireland which traditionally gives the kisser an enhanced level of eloquence.

The former accountant retorted: “I’ve never been there, and I come from Cork. I’ve been talking shite now for 40 years, all my career, so I don’t need to go there!”

The milder-thanusual winter has so far had a positive impact on gas prices, bringing relief to the whole European economy, including Hungary, but this does not mean the end of the economic crisis triggered by the Russo-Ukrainian war, Equilor analysts warn.

According to Equilor Investment’s annual outlook, the Hungarian economy is likely to show low growth of 0.5% this year; annual inflation could reach 18%. At the same time, the forint could return to a slightly weaker path after strengthening and stabilizing in recent weeks, and the euro return to around HUF 415. At the same time, energy price developments will remain a key determinant of inflation rates, which economies fall into recession, and how quickly they recover.

For all that 2023 might see a calmer economy than last year, the first and second halves could differ significantly. One of the critical questions remains the gas price evolution, which is a crucial determinant of inflation, especially

for European economies. In addition to the warm winter, subdued energy demand from industrial consumers has helped to keep reservoirs at levels well above the five-year average, contributing to the TTF-listed gas price falling from a peak of close to

to close to EUR 50.

According to Equilor, unless there is a drastic change in the weather, we could turn to the new filling season without any supply problems. Another critical question is which economies could sink into recession this year and how quickly they will recover. Equilor believes H1 will see hardship and recession in most European economies, including Hungary, while H2 could see growth resume.

Europe could avoid recession in 2023 thanks to the mild winter, but rising financing costs and energy shortages could lead to a restructuring of the economy, with entire industries transformed.

Equilor expects GDP growth of around half a percent this year in Hungary. Domestic consumption may fall due to the general rise in prices, many

corporate investments could be postponed due to higher financing costs, public investment may be cut back, and the uncertainty surrounding EU funding has not been resolved.

Inflation is likely to be around 18% this year due to imported inflation and the stickiness of the price-wage spiral but could ease to about 7% in 2024, according to senior analyst Lajos Török. Further restraint in government spending and a reduction in the import ratio will be essential to halt the rise in the current account and budget deficits.

Labor shortages are growing in several sectors and occupations, leading to a dynamic upward trend in average wages, but the unemployment rate is expected to remain below

for a sustained period.

The tightening policies of the major central banks could reach their interest rate peak in the second quarter and remain in place throughout the year, adversely affecting capital market movements, the analysts note.

The National Bank of Hungary (MNB) completed its cycle of base rate hikes at the end of September, but the intense weakening of the forint led it to continue monetary tightening through unconventional means. Since then, the benchmark rate has been the overnight deposit rate, which remains unchanged at 18%.

The MNB has set six key conditions for the start of the rate cut, which has not been fully met so far. Török says he does not expect a rate cut until the second quarter at the earliest, although it may come before inflation peaks.

He adds that it is worth keeping an eye on credit rating agencies, as downgrades are expected. The first scheduled rating review came from Fitch Ratings on January

and while Hungary’s “BBB” sovereign rating was affirmed, the outlook was changed to “negative” from “stable.”

At the end of January, S&P Global Ratings is expected to warn of existing risks but hold off on downgrading due to new deadlines for European Union funds. If a full agreement with the EU is not reached in March, a downgrade (to BBB-, which is still investment grade) could be expected at the following review in July.

At the moment, the forint is being squeezed by opposite influences. Among the risks, the January ratings, continued conflicts with the European Union, disagreements between the MNB and the government, and the fragility of favorable international investor sentiment are all worth highlighting.

The forint could be supported by high-interest rates, a possible further weakening of the dollar, and any positive news on EU funding. Overall, though, the Hungarian currency could be on a slightly weakening path in the second half of the year, and the euro could return to the previously seen high of 415 HUF/EUR.

In terms of investments, this year could be a good time to build longterm portfolios, according to Equilor. Last year’s bear market has improved equity pricing, and a significant yield rise has opened up the space for bond investments again.

According to senior analyst Lajos Török, it is worth building a long-term portfolio this year, with the HUF and EUR versions of the premium Hungarian government bond and the newly issued dollar-denominated Hungarian government bond being important building blocks.

Higher risk takers could consider value stocks in developed markets, and Indian and Chinese equity markets could also perform relatively well in the period ahead. In China, the squeeze on the corporate sector may ease following the relaxation of the zero-COVID policy. Restoring stability in the property market has fueled a rally in Chinese technology stocks in recent weeks.

India could overtake China as the world’s most populous country and attract increasing attention from investors. The country’s economy could expand by 6.1% this year, and inflation could fall to 5.1%, making it the globe’s fifth-largest economy.

India could benefit from cheap Russian energy supplies, and a more pro-Western leadership compared to China could also encourage foreign investment and factory relocations. A favorable age profile could also help the Indian economy to perform relatively well over the next decade.

Since June 2022, Andrea Kővágó-Laky has been managing director of Ford in Hungary and the Czech Republic. The Budapest Business Journal sat down with her to better understand the regional market and how she sees it developing.

MARSHALL

MARSHALL

BBJ: How do you view the current state of the market in the two countries, and how do you see their future development?

Andrea Kővágó-Laky: In some ways, they are similar; smaller countries with a similar number of inhabitants, around 10 million. If you look at the key economic indicators, unfortunately, both are in a challenging situation in terms of inflation at the top of the league table, and the base rate is also higher than the European average. But in the automotive sector, there are differences. If you look at motorization, Czech is much ahead of Hungary. Regarding the number of passenger vehicles per 1,000 inhabitants, in the Czech Republic, we have 573, and the European average is 560. When it comes to Hungary, we are much below the European average with 401 units. Czech is number eight in the ranking, and Hungary is 23rd. If you look at the automotive market size, Czech last year was at 219,000 units, and Hungary at 135,000, including passenger and commercial vehicles. So, it’s clear that the Czech potential is significantly higher, 61% above Hungary’s.

The strategy was different in the two markets. In Hungary last year, we were the number three brand. And we are traditionally strong in the commercial vehicle area, where we were number one last year. That’s a long story for us; we have been leading that segment for more than 10 years. And we were number one within the fleet segment; our overall share was roughly 10%. When it comes to commercial vehicles, basically every fourth unit sold in Hungary last

year was a Ford. We are very proud of that. Looking at commercial vehicle sales penetration into total sales, it’s very interesting. In the 28 years I’ve worked for this company, there wasn’t a year when we sold more commercial vehicles than passenger cars. But that happened last year in Hungary: 7,462 commercial vehicles and 6,133 passenger vehicles.

In the Czech Republic, though the potential is high, we are constantly focusing on finding the right balance between volume and profit. For the time being, we have a lower share at around 4.4%, and we were only number seven in the market. So, when it comes to that country, our future strategy is growth, while in Hungary, we have to focus on finding the balance between market share and profitability. 2022 was a very challenging year for any importer in Hungary because of the forint devaluation.

BBJ: What steps is Ford taking in switching to a non-fossil-fueled future?

AK-L: Ford is deeply committed in terms of sustainability. It’s critical for us to be a responsible company, and it’s a key focus to speed up electrification, which is a challenge not only for Ford, but also for other manufacturers. What we do for our part is heavily invest in new products. We are planning to introduce three new fully electric passenger vehicles by 2024. The debut of the first volume model, a mediumsized crossover, will be this year, and we are planning to introduce four new fully electric commercial vehicles by 2024. So, seven new EVs by 2024. We have established a dedicated business unit called Model e, responsible for successfully launching these vehicles. We are not only thinking about great products; we also know we need a transformation on the experience side. Electrification is undoubtedly one of

the key trends, but I think another one is connectivity. Here, we want to be creative and provide new solutions to our customers. The key objective is to scale electric vehicle production now, meaning we would like to sell more than 600,000 electric vehicles within the region by 2026.

There is an additional thing I would like to highlight concerning our region. In Hungary, I have to say that the pace of electrification is slow. If we look at last year’s figures, roughly 4% of vehicles were fully electric, so it’s a minimal amount. If I add the hybrid and the plug-in hybrids, we are in better shape because that accounts for 20% of the overall market. We see some movement there, but we will definitely need support from governments: to make these vehicles more affordable and to put in place a charging network in Hungary and the Czech Republic to help take away “range anxiety” from customers. These are areas where, with a little support, I think we could speed up the spread of electrification and make our life more sustainable. If you think about Norway, where 80% of the vehicles are already EVs, this all happened very fast. And it’s because the support programs were there from the government.

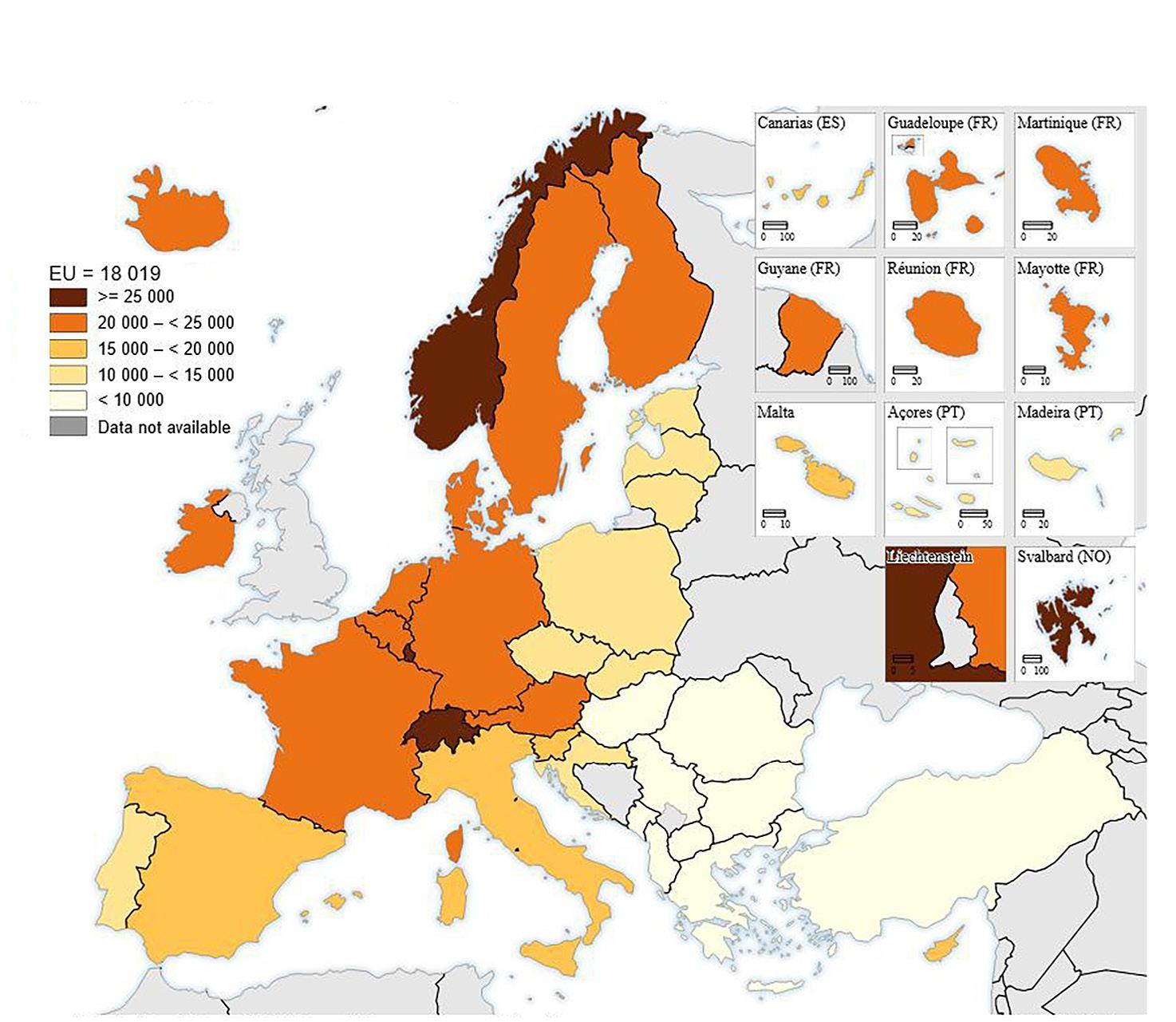

BBJ: Regarding the charging infrastructure, where do Hungary and the Czech Republic compare with the rest of Europe?

AK-L: It’s always a good question; ‘What comes first?’ Do we need the charging network in place to speed up sales? Or should we first increase sales and then develop the charging, as that creates a business case to invest? I think the manufacturers are doing our part. I would really encourage the government to do theirs as well. It’s hard to find exact figures on the number of charging stations, but for superfast chargers per 100 km of road, the EU average is around five. And if you look at where we are in Hungary, it is very much at the end of the rankings, with four charging stations. The U.K. has 19. It, the Netherlands and Germany might distort the averages with their high figures, but the key for me is that we are very much at the other end of the ranking. Czech is in a little better shape; it’s at the European average.

BBJ: Is there anything specific you want the Hungarian government to do?

AK-L: I read a survey from Ernst and Young, which was done last year: 50% of the customers they asked said they would change their vehicle to a hybrid or an EV at their next purchase. This is great because what you need is a demand market. And it seems that more customers are conscious about a sustainable future. Where we need support is although EV prices are coming down, the technology is still expensive. Any help from the government could really move the needle here to generate more sales. Of course, the other

thing is the charging infrastructure. Although the range of EVs is getting longer, many customers are just not buying because of this “range anxiety.” We could take this away or reduce it if we had a denser charging station infrastructure.

BBJ: Are you optimistic that there is an understanding that these challenges need to be overcome?

AK-L: I am. In terms of future models, the range is getting longer. The technology is developing, and the cost is coming down, so EVs will become more affordable for ordinary customers. Not immediately. It’s not a quick change, but with these tendencies plus a developing infrastructure, I think it will improve over time. In terms of the legislation, there is already an endpoint. By 2035, we have to become fully electrified and carbon neutral. There is no choice;

we have to get there. And the sooner we take the first steps, in terms of speeding up in this area, the easier it will be. To leave the targets to the last minute would make it very challenging. So, we are doing our part and, yeah, it would be nice if the government could also support us. I always try to highlight best practices: in Norway, the support was there, and the speed of EV sales was really fast.

BBJ: One of Ford’s most storied brands, Mustang, has made its electric debut. Does that help boost sales or at least raise awareness?

AK-L: Absolutely. I think it was a super important step to have done that with one of our most iconic passenger vehicles, the Mustang. And we also did it with the F-150 Lightning truck. It was crucial to demonstrate that this can be done with passenger vehicles, commercial

vehicles, and trucks, even on such iconic models. We wanted to be the first movers, so I think it was a good decision by the company.

BBJ: In 2014, when you were managing director “just” of Hungary, you were the Manager of the Year of the Hungarian Association of Executives. Do you view part of what you do as being a role model for other women?

AK-L: Those were very different times. The market was growing, and the economic conditions were excellent. I had an experienced team, a strong dealer body, we had leadership within the market and so on. That enabled me to focus on much more than the business. I was raised with a spirit to help others and was very much focused on CSR activities. I regularly attended or was a conference keynote speaker and belonged to many female clubs.

The Manager of the Year award helped me become more visible and be a role model. I’m proud I was the first female to receive this award in Hungary.

I would love to continue these efforts at a certain level, and I’m still trying to support them. But given I’m responsible for two countries at this stage, I just don’t have the time. What I am doing regularly is mentoring; I had two mentees last year within the company and one from outside. That’s ongoing. We have an initiative globally called Women of Ford and are doing a lot to support our colleagues in becoming leaders, even if they are women and mothers. We kicked off a leadership course in Hungary for female colleagues and are also working to create an infrastructure that can support women to progress in their careers, for example, during summertime when, for mothers with small kids, it’s a challenge to sort out the 10-week vacation.

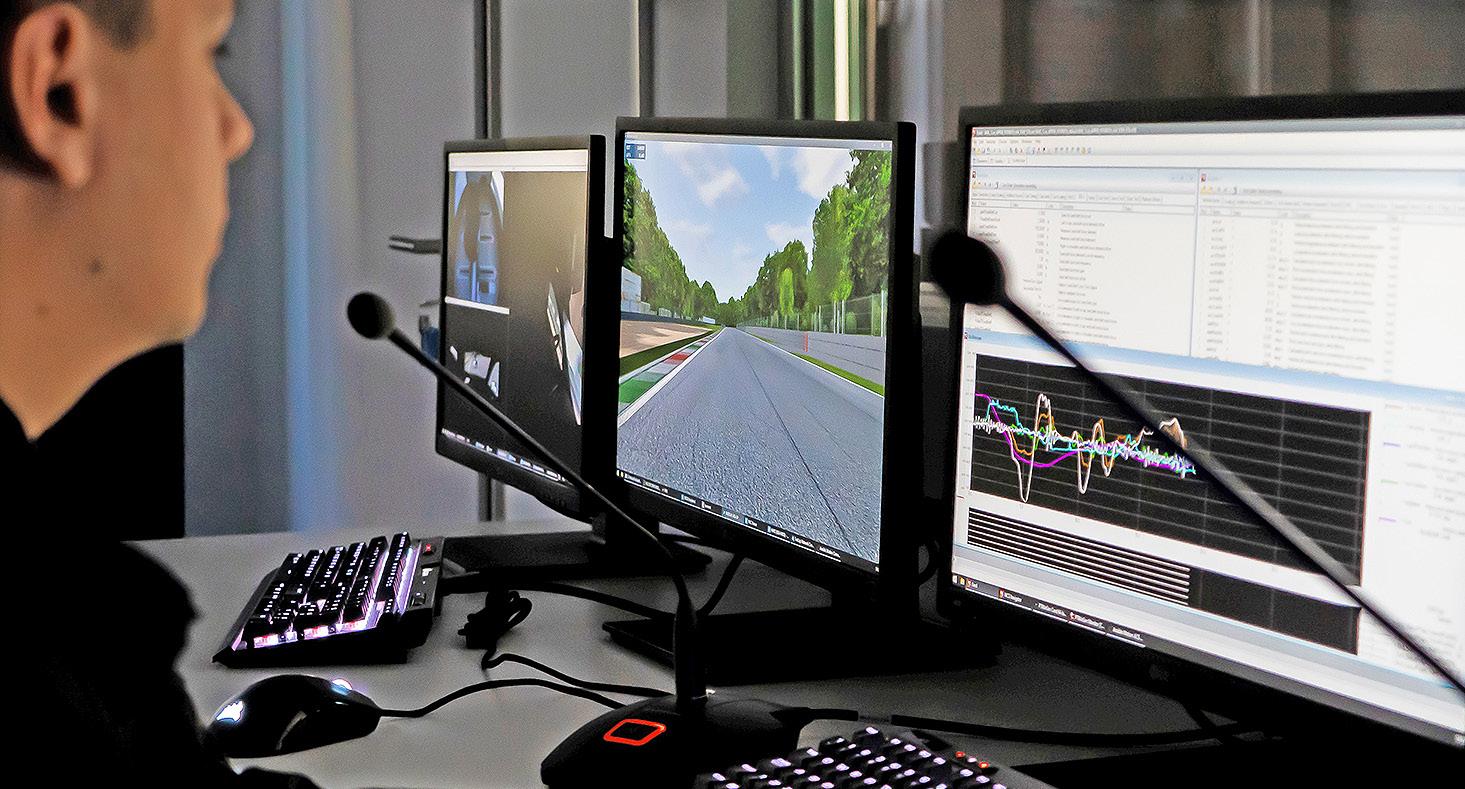

Hungary’s Bay Zoltán Research Center says it is now offering open access to one of the world’s most advanced “driver-in-the-loop” (DIL) simulators. Ansible Motion’s award-winning S3 series simulator is now available at the everexpanding ZalaZone automotive R&D park.

BENCE GAÁL

BENCE GAÁL

The machine will benefit the research center’s growing number of research projects. But it will also be available for external engineers and companies working on autonomous driving, human factors, driver assistance, vehicle dynamics, so-called vehicle-to-everything (V2X) projects, and electrification technologies.

The high-fidelity DIL simulator laboratory is of a level that has previously been the sole preserve of vehicle manufacturers and the largest Tier 1 suppliers. It will enable vehicle modeling, scenario generation, and environment simulation for passenger cars, commercial vehicles, and motorsport applications, with options for customers to have bespoke cabins for a fully immersive experience.

The simulator will further enhance the role of both the research center and ZalaZone, already key contributors to Hungary’s automotive industry, which makes up some one-fifth of the country’s exports. Thanks to its

location and relative proximity to the Austria, Slovenian, and Croatian borders, ZalaZone says it offers a convenient venue that includes a world-class proving ground that is attracting many European automotive manufacturers and suppliers.

“The automotive industry is advancing rapidly towards a digital transformation, having full systems designed and validated in simulated environments,” says site manager Márk Lelkes. “To promote digital twin development and complement our existing experience at Bay Zoltán, we invested in this highly sophisticated DIL simulator. For both our current and future requirements and the stringent demands of our customers, Ansible Motion’s Delta series S3 simulator was the perfect match.”

Launched in 2022, Ansible Motion says the Delta series S3 is the most sophisticated, high-performance, dynamic motion driving simulator for both road and motorsport applications. The appeal of a fully integrated virtual environment that provides everything needed to engage real people convincingly with the automotive product development process

has led multiple OEMs, Tier 1s, and research organizations to acquire these simulators, making it Ansible Motion’s most successful product to date.

“Bay Zoltán Research Center is a gateway to virtual product development, and it brings versatility and performance to key sectors of the automotive

industry,” says Kia Cammaerts, technical director and founder of Ansible Motion.

“Staffed by a knowledgeable and experienced team, Bay Zoltán’s facility delivers flexible, turnkey access to world-leading simulation tools that are drawing interest from Europe and beyond. It’s a privilege to be involved with this truly world-class center for automotive development.”

The Delta series S3 simulator features an open and modular architecture that is software agnostic, allowing it to operate seamlessly with virtually every automotive software package a customer would need. Examples include Hexagon VTD (for environment and traffic scenarios), Cosworth Pi Toolbox (for telemetry and data analysis), AVL VSM (vehicle modeling), and AVL Model.Connect (model integration and co-simulation).

Project partner AVL provided vital engineering services and software stacks that directly support use cases ranging from advanced driver-assistance systems and autonomous developments to highperformance vehicle dynamics and chassis development work. Projects from these fields have already been tested at the facility, which is now operational.

An American expat businessman says Hungary is missing out on a golden opportunity to develop an industry of the future (and a future-proof industry) built on its natural strengths.

ROBIN MARSHALLEric Sievers is the investments director at ClonBio Group Ltd., the Irish familyowned holding company that is the parent of Pannonia Bio Zrt., which operates Europe’s largest biorefinery at Dunaföldvár.

Pannonia Bio was a principal sponsor at the Budapest Climate Summit at the end of 2022. Is there a perceived need to talk publicly about the story of the business and what it does? I wonder.

“We’re just talking to the strengths that Hungary has. And we are finding ways to bring those to regional and global markets,” says Sievers.

He says the business “is not in any way” connected to the idea of producing in Hungary for Hungarian consumption. “The size of our operations is disproportionate to the size of the Hungarian market. There’s no argument that the Hungarian market itself is important; it’s [just] not important for our business,” the investment director explains.

“We could, and we did for years, not sell anything in Hungary. We are an EU asset; we only exist in Hungary because of what is supposed to be the common market.”

In that sense, he says Pannonia Bio is similar to the car manufacturers and EV battery plants that have become mainstays of the Hungarian economy.

“Where we’re different is there’s no argument that the particular climate or people or natural resources of Hungary lead to the conclusion that this is where batteries or cars should be produced. That came about only because of a result of history, which is that Hungary for decades had extremely talented, productive workers whose salaries didn’t need to be very high. But according to the very development of that logic, that should go away. And it has gone away.”

Sievers argues that critical thinkers in Hungary should ask themselves why cars and batteries are so essential to the country’s future. Going forward,

he believes issues like the price of energy will be much more important for those industries than labor costs.

“If you turn to our industry, which, in the big picture, is an agricultural processing industry, our argument for why we have a competitive advantage in Hungary, and why Hungary has a competitive advantage in the EU markets, is because Hungary has very productive farmland,” Sievers says.

“It [Hungary] produces a lot of stuff; it can produce a lot more stuff. Converting those raw agricultural products into food, feed, biomaterials, energy, and other things is something that Hungary can do so much better than Finland, or the Netherlands, or Germany. This is the competitive advantage of Hungary.”

“It produces a lot of stuff; it can produce a lot more stuff. Converting those raw agricultural products into food, feed, biomaterials, energy, and other things is something that Hungary can do so much better than Finland, or the Netherlands, or Germany. This is the competitive advantage of Hungary.”

Sievers contends that Hungary’s economic policies don’t reflect the country’s competitive advantage.

“It’s not in solar power production; it’s not in assembling cars. We would have expected a lot more industry in Hungary to develop along the lines of what we’re doing. And already Hungary is the superpower in, for example, ethanol. It produces much more ethanol per capita than any other country in Europe. In fact, it’s the third largest producer per capita in the world behind only the United States and Brazil.”

It is, in other words, one of the very few areas in the world where Hungary can say it is undisputedly a global leader.

While Sievers accepts that “it’s good for our business that we’re the people who figured this out,” he is puzzled that others, apparently, have not.

“Hungry no longer has a large pool of unemployed skilled workers just to be had for the taking. Going forward the next 10 years or 20 years and 30 years, what will make the Hungarian economy competitive at the EU level and ensure that people have an increasing standard of living?” he asks. That said, he does acknowledge that the knowledge economy is a strength.

“Budapest, in some ways, is a better place than Madrid; the average 20-year-old here actually speaks English better than the average 20-year-old in Madrid. The pure knowledge economy, service sector stuff, Hungary can do. But 50 kilometers outside of Budapest or 300 kilometers outside of Budapest,

what will people be doing that’s relevant to the EU economy or the global economy?”

Sievers argues that Hungarian society and business should have a much better understanding of how Fit for 55 impacts the country and how that can connect to a discussion about what Hungary’s inherent strengths are, its comparative advantage.

He claims that the only area where something close to that has happened in Hungary is around solar.

“We invest in solar; we have 43 solar plants. And they’re great investments. But an individual investment isn’t the same as a sectoral focus. Hungary can’t argue that it’s a uniquely good place to produce solar power.” He thinks it is “remarkable” there isn’t a more nuanced conversation going on.

He makes the analogy that it is like a parent asking their kids what they want to do. When they say they want to be a fashion model, the response is, “Great, go be a fashion model,” instead of asking them what they think they are actually good at.

“That’s bizarre. We’re here because Hungary is the best place in the EU to produce ethanol. It’s the most costcompetitive place. We know why we’re here. And we were correct.”

Editor’s note: This article is taken from a wide-ranging interview conducted with Eric Sievers at Pannonia Bio’s headquarters. Much of the ground we covered concerned energy issues. That much larger section of the discussion will be included in our Forthcoming Top 50 Executives in the Energy Sector publication, due out at the end of February.

fiscal and monetary policies have been fueling inflation, but Hungary is not in a financial crisis in the classical sense, though imbalances must be addressed for the sake of stability and sustainable economic development, according to György Surányi, professor of finance at Corvinus University, and a former governor of the National Bank of Hungary.