Human Resources

March Inflation Shows Mixed Picture

The rise in core inflation suggests strong second-round inflationary effects, according to analysts. They also believe the government’s 15% inflation forecast for the year is increasingly unrealistic. 3

Reaping Benefits of a Systematic Approach

Korea has been making headlines in Hungary for bringing significant FDI into the country. Hipa says it is the result of a well-crafted strategy. 12

Dalí in Bp: Limitless or Uninspired?

With at least 150 exhibits, “Dalí the Limitless” claims to be the most comprehensive exhibition of his work in Hungary to date. 38

Making Three Into One

Kitti Dobi, chief HR officer at Magyar Bankholding, describes the challenge of combining three banks, and three corporate cultures, into one in the biggest merger in recent history ahead of the launch of MBH Bank. 15

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM HUF 2,100 | EUR 5 | USD 6 | GBP 4 VOL. 31. NUMBER 8 | APRIL 21 – MAY 4, 2023

SPECIAL REPORT INSIDE THIS ISSUE NEWS SOCIALITE ai168120105012_WorkForce_hirdetes_v4.pdf 2 2023. 04. 11. 10:17 FOCUS SPECIAL REPORT

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

What

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017

BUSINESS MEDIA SERVICES LLC with

THE UNEXPECTED CORRELATION OF SIZE, VOLUME, GRAIN AND DOGS

I think something instructive may have come into closer focus in the standoff between the European Union and Hungary over Ukrainian grain, and it concerns the not-insignificant issues of respect and power.

VISIT US ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

Years ago, Viktor Orbán said a small country has to be a loud country if it wants to have its opinions heard. I’m extrapolating as well as paraphrasing here, but bear with me when I say this point of view may well explain the Hungarian Prime Minister’s willingness to pick a fight. If a country the size of Hungary was to simply roll over to have its belly tickled every time the EU walked past, it would get nowhere, he might have argued. There is an undeniable logic to that line of thinking. But at the risk of stretching this canine analogy to breaking point, it is much easier to tolerate a friendly dog than an aggressive one. You can circle back to respect at this point, but what does the dog that snarls at you actually win if you decide you aren’t going to feed it? I think I really should move on from that metaphor at this point. Remember Orbán’s words about size and volume? Hungary and Poland had a natural ally when the United Kingdom was still a member of the European Union, a country that was inclined to Euroskeptisim, wasn’t afraid to say so, and, as the fourth or fifth biggest economy in the world at the time, had to be listened to. With Britain having Brexited, Hungary and Poland must lead the EU Awkward Squad. While they have not been lone voices in complaining about what is, in effect, the unintended dumping of Ukrainian grain on their markets, they have been among the loudest. And with good reason: street protests by farmers in Poland have already resulted in one agriculture minister being removed from office. When Poland and Hungary, countries that agree on just about everything except the prosecution of the war in Ukraine, banned imports, having decided they had had enough of the EU batting back their requests to look again at the grain issue, the initial

response from the European Commission appeared almost angry. Bloomberg News cited the commission spokeswoman for trade and agriculture, Miriam Garcia Ferrer, as saying on Sunday, April 16: “It’s important to underline that trade policy is of EU exclusive competence and, therefore, unilateral actions are not acceptable. In such challenging times, it is crucial to coordinate and align all decisions within the EU.”

Fast-forward 24 hours, and Slovakia (not exactly a big country, but indicative of a growing trend) has joined Hungary and Poland in announcing a ban on Ukrainian grain imports, and the commission has markedly softened its rhetoric. “We are working now on a second package of measures where we would continue supporting these countries that are being affected by the inputs from Ukraine,” a commission spokesperson said during the EU executive’s daily press conference on April 17.

Perhaps the timing of these events is coincidental. Perhaps not. Either way, it does seem striking. It is worth recalling that the measures which led to Ukraine’s grain swamping neighboring markets at lower prices came from a desire to ensure the grain got out of the war-torn country, raised some cash for it, and, most importantly, was shipped to those in absolute need of it, not least in Africa. That the countries around Ukraine all experienced problems and wanted the EU to look again, not at global shipments but at the effect in domestic markets, seems to have been ignored for a long time. If Poland and Hungary were not the top dogs (sorry, it seems I cannot help myself) of the Awkward Squad, would their concerns have been heard sooner? Perhaps not, but it is worth thinking about. Then again, perhaps the EC could have considered earlier that Hungary, Poland, and all those neighbors of Ukraine had a point worth listening to.

Robin Marshall Editor-in-chief

THEN & NOW

2 | 1 News www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

all rights reserved.

We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

IMPRESSUM BBJ-PARTNERS THE EDITOR SAYS

On the right, a community space is shown at the inauguration of the new workers’ dormitory of Videoton Holding Zrt. in Székesfehérvár (65 km southwest of Budapest by road) on April 18, 2023. The photo on the left, from the Fortepan public archive, shows an earlier workers’ dormitory, this time belonging to the Mecsek Ore Mining Company in Uránváros, a western district of the city of Pécs (212 km southwest), in 1962.

Photo by MTI / Vasvári Tamás

Photo by Fortepan / Lechner Nonprofit Kft. Dokumentációs Központ

March Figures Hint Inflation may be Slow to Go

The March data showed a mixed picture overall: the further slowdown of the “headline” index is favorable, but the rise in core inflation suggests strong secondround inflationary effects, according to analysts. The government’s 15% inflation forecast for the entire year is now increasingly unrealistic, according to some market experts.

Prices went up by 25.2% in March compared to the same month of the previous year, of which the rise in food products was the most significant: a price rise of 42.6% was recorded in the third month of the year, according to the latest inflation figures published by the Central Statistical Office (KSH). In one month, consumer prices increased by 0.8% on average.

Although the annual inflation rate slowed to 25.2% from 25.4 in February, the pace of the decrease was below expectations, as analysts had forecast 24.8%, according to Gábor Regős, the head economist at the economic think-tank Makronóm Intézet.

Food products are responsible for 49% of the total deterioration, Regős said. It also pushed up the monthly price increase;

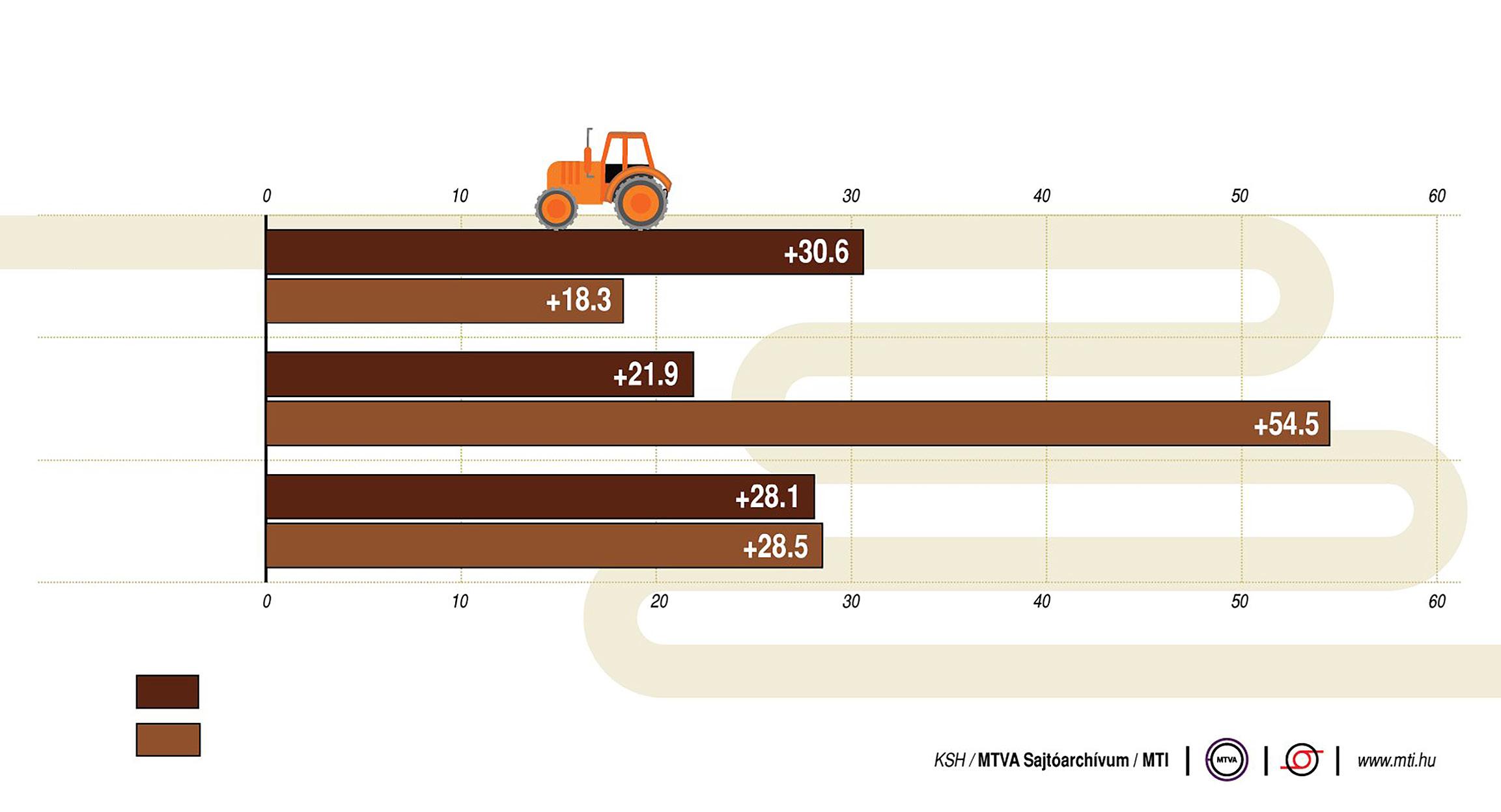

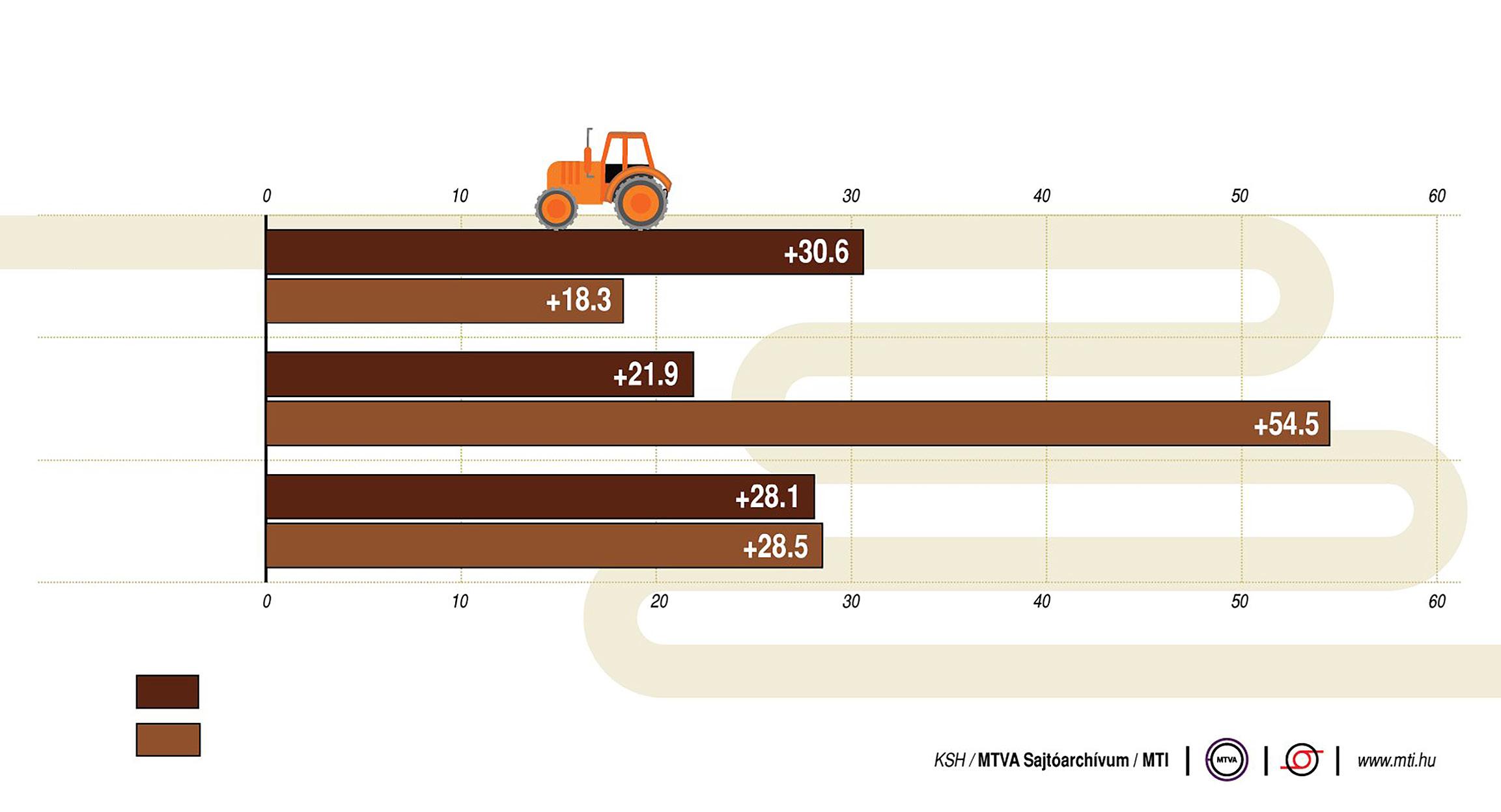

Development of Agricultural Prices in Hungary, 2022-2023

compared to February, food prices rose by an average of 1.5%, although the price increase slowed from 43.3% to

42.6%

on an annual basis.

Price reductions announced by the retail chains had not been able to moderate inflation effectively for the time being, although the prices of several product groups had decreased on a monthly basis, Regős pointed out.

At the same time, the price of vehicle fuels had a positive effect on monthly inflation: it decreased by 2.6% in one month, thereby curbing monetary deterioration by 0.2 percentage points, Regős reckoned.

Hair’s Breadth Reduction

According to Erste Bank’s head analyst Orsolya Nyeste, the data showing a reduction by a hair’s breadth had corresponded to her expectations. The annual core inflation index stood at 25.7%, higher than expected, and rose from 25.2% in February, clearly showing still strong second-round inflationary effects. The structure of inflation more or less corresponded to expectations, she said.

“We continue to believe that food price increases, which are more restrained than last year, will be able to support the disinflation expected for this year; however, the current data suggests that the rate of price increases will slow down at a much slower pace than previously thought,” Nyeste said.

“As for the outlook, we expect inflation to decline somewhat faster from the second quarter, but the annual index is expected to remain above 20%

until July. In the second half of the year, due to the increasingly stronger base effect, the annual growth rate of prices may slow down more rapidly,” she concluded.

Inflation had again caused an unpleasant surprise, according to ING Bank analyst Péter Virovácz. Although the leading inflation indicator was lower in March than it had been in February, with some exaggeration, the decrease was within the statistical margin of error. After a decline of only 0.2 percentage points, the annual inflation index stood at 25.2% in March.

“This can hardly be labeled as a significant change in inflationary processes,” Virovácz pointed out.

Food Price Shock

Compared to the market consensus and ING’s forecast, the figure was higher, he noted. Four groups are responsible for the surprise: food, alcoholic beverages, clothing, and services. The most significant surprise was caused by processed foods and services, he said. The former was a shock because, in recent weeks, the press has been full of food price reductions and marketing promotions of supermarket chains. Despite that, the monthly increase in

food prices was 1.5% in March, compared to 1.7% in February, meaning there was hardly any visible change, he added.

“In January, we said that the composition of the main inflation indicator had taken a rather bad direction, and although February brought a slight change, it seems that the trends are more towards the unfavorable tendencies of January,” Virovácz explained.

“At the moment, it is essential items outside the core inflation basket that are characterized by frequent price changes that drag the inflation down, while more permanent inflationary processes are strengthening. This is also indicated by the fact that core inflation accelerated both on a monthly and annual basis. Based on this, the statement that we have seen the peak of inflation is less confident. In core inflation, it seems that this earlier statement did not hold its ground after all,” he warned.

Looking at the processes in the first quarter, the government’s 15% inflation

forecast is increasingly unrealistic, according to Virovácz. For the whole year, ING still expects average inflation of around 19%, significantly higher than last year’s 14.5%.

“We still believe that there is a chance that the rate of price increase will drop below 10% by the end of the year. At the same time, the danger of a persistently high inflationary environment has not been eliminated,” he concluded.

www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023 1News • macroscope

ZSÓFIA CZIFRA

Comparing January-February Prices Plant and horticultural products Live animals and animal products Altogether January-February 2022 January-February 2023 Source:

Hungary’s Cordia Completes Renovation of Listed Building in Birmingham Real Estate Matters

The leading Hungarian residential developer, Cordia, the residential arm of the Futureal Group, has completed the renovation of The Bank. A heritage building, it is located in the Jewellery Quarter of Birmingham in the West Midlands area of the United Kingdom.

Cordia formed a joint venture with the Birmingham-based Blackswan for the project. In a demonstration of growing ambitions, Hungarian developers and investors are increasingly undertaking projects in other parts of Central and Western Europe. Cordia is one of the largest residential developers in Central Europe with a presence in the mid-and mid-to-high segments of the for-sale residential market in Hungary, Poland, Romania and the United Kingdom. It is also undertaking pilot projects in Spain.

“The Bank is an important project in Cordia’s local subsidiary, Cordia Blackswan’s urban regeneration

ADVERTISEMENT

vision for Great Hampton Street. The developer has restored the former Lloyds TSB Bank landmark building, offering seven high-quality commercial spaces for mixed uses, including office and retail. The Bank is located next to Cordia’s other local residential project, The Gothic, the first phase of which was delivered last autumn,” said Cordia Blackswan in a press statement. Cordia Blackswan is also working on the neighboring site with the development of the 148-apartment The Lamp Works, where 97%

of the demolished assets were reused. With sustainability at the forefront of the design, the developer has improved The Bank’s energy performance rating from “D” to “B.” This is while retaining and repairing a large portion of the

building’s original and lost features to the standing and quality of design prior to its 1980s reconfiguration works, including the buff terracotta façade and large span sash windows, which contain Gothic, Renaissance and Dutch gable motifs, Cordia Blackswan added.

Authentic Features

“Reaching completion on The Bank signifies the start of Cordia Blackswan’s commercial offering and reinforces our overall vision for Great Hampton Street. From the banking hall to the Cordia Blackswan office, each space within The Bank has been finished to the highest standard, with authentic features restored throughout; that’s

A biweekly look at real estate issues in Hungary and the region

what makes the building such a unique place to work,” says András Kárpáti, deputy CEO at Cordia Blackswan.

“TheBank is an important project in Cordia’s local subsidiary, Cordia Blackswan’s urban regeneration vision for Great Hampton Street. The developer has restored the former Lloyds TSB Bank landmark building, offering seven highquality commercial spaces for mixed uses, including office and retail.”

The JV currently has 11 active developments across the United Kingdom’s West Midlands area, nine of which are located in and around Great Hampton Street.

“Urban regeneration is at the forefront of Cordia Group’s mission, with many large-scale projects delivered or in the pipeline including one that is described as one of Central Europe’s largest regeneration projects, Corvin Quarter. Another Budapest project is the soon-tobe-launched Marina City on a 10 hectare brownfield site on the bank of the Danube in District XIII, close to Váci út,” comments Cordia.

Back in the United Kingdom, Cordia Blackswan has a pipeline comprising more than 1,800 homes, as well as 360,000 square feet (about 33,445 sqm) for commercial use across the West Midlands. It is actively looking for new sites across the region.

4 | 1 News www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

GARY J. MORRELL

The Bank, a heritage building in Birmingham in the United Kingdom.

‘Unusual’ Billboards and Grain Disputes Roundup Crisis Ukraine

Billboards urging the withdrawal of Russian troops from Ukraine have appeared across Hungary over the past few weeks, according to a report from telex. hu. The posters draw parallels between the 1956 Hungarian Revolution and the current situation in Ukraine, bearing an inscription from Hungary’s uprising:

According to the text on the poster, “There can be peace in Ukraine when the Russian occupying army withdraws.” The campaign was commissioned by the Facebook group Nyugati Pályán and was supported by the U.S. Embassy in Budapest.

Prime Minister Viktor Orbán called the campaign “unusual,” adding that Hungarians “don’t need to be reminded of their own history [….] and certainly don’t need to be convinced to pay attention to their security [.…] especially with regard to Russia,” in an interview with Kossuth Rádió on April 14. During an earlier press conference on April 12,

ADVERTISEMENT

Orbán’s chief of staff Gergely Gulyás said the “pro-war” billboard campaign would not change Hungary’s position on peace being “in the common good.”

While the campaign is unlikely to affect domestic policy, other efforts by the United States to put pressure on Hungary regarding its relationship with Russia seemed to have had an effect. U.S. Ambassador to Hungary David Pressman announced the sanctioning of the Budapest-based International Investment Bank and several of its executives, including the IIB’s Hungarian vice president Imre Laszlóczki, because of their ties to Russia, at a press conference on April 12.

“The presence of this opaque Kremlin platform in the heart of Hungary threatens the security and sovereignty

of the Hungarian people, their European neighbors, and their NATO Allies,” Pressman explained.

The following day, Hungary’s Ministry of Economic Development announced that the country would withdraw from the IIB and recall its delegates from the Russian-based lender, which had moved its headquarters from Moscow to the Hungarian capital in 2019.

Untenable Operations

While acknowledging the “important development role” it had played in the CEE region, the announcement said that the sanctions had made the continuing operation of the bank untenable. Although previous members Bulgaria, the Czech Republic, Romania and Slovakia had ended their participation in the IIB after the start of the war in Ukraine, Hungary had continued to

maintain a 25.27% stake in the IIB, the second-largest share after Russia, which at the time controlled 45.44%.

Meanwhile, Hungary has also been able to influence external policy based on actions of its own. For weeks, countries bordering Ukraine have complained that European Union support given to the war-ravaged nation’s farmers was effectively undercutting their domestic markets. With the EU seemingly turning a deaf ear, Hungary and Poland took matters into their own hands last weekend, announcing temporary bans of agricultural products from Ukraine.

According to Bloomberg News, the initial reaction from the European Union was to slam the move, saying “unilateral actions” were unacceptable and a potential breach of the bloc’s trade policy. “It’s important to underline that trade policy is of EU exclusive competence and, therefore, unilateral actions are not acceptable,” Miriam Garcia Ferrer, European Commission spokeswoman for trade and agriculture, was quoted as saying on April

16.

But the EU position appeared to soften after Slovakia joined Hungary and Poland in announcing its own ban, according to euroactiv.com

“We are working now on a second package of measures where we would continue supporting these countries that are being affected by the inputs from Ukraine,” a commission spokesperson said during the EU executive’s daily press conference on April 17. A EUR 56 million package to help Poland, Bulgaria, and Romania had been agreed upon at the end of March and funded through a financial envelope of EUR 450 mln per year included in the agricultural reserve fund of the EU’s farming subsidies program. As the second package is “still under discussion,” the commission declined to add further details on the amount, timing, or allocation criteria.

THE ART OF LAJOS GULÁCSY

1 News | 5 www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023 Gulácsy Lajos: Varázslat, 1906–1907 © Magyar Nemzeti Galéria, Budapest 7 April – 27 August 2023 HUNGARIAN NATIONAL GALLERY

en.mng.hu

NICHOLAS PONGRATZ

“Russians, go home!”

Specialists of

the National Food Chain Safety Office (Nébih) take samples from a corn shipment from Ukraine at the Záhony road border crossing late in the evening of April 17, 2023. The route of all grain shipments arriving from Ukraine to Hungary by road and rail is checked, and only transit traffic vehicles are allowed to pass through the country, State Secretary for Food Industry and Trade Policy Márton Nobilis of the Ministry of Agriculture said on the spot. Minister of Agriculture István Nagy announced on April 15 that, like Poland, Hungary would temporarily ban the import of grain and oilseeds originating from or coming from Ukraine, as well as several other agricultural products.

Photo by Zsolt Czeglédi / MTI.

Director of Corporate Affairs and Communication at Heineken Hungária

Eszter Varga-Nagy became the new director of corporate affairs and Communication at Heineken Hungária on March 1.

“Years in the FMCG sector has already taught me that change can work for us, so I am doing my utmost to make our common goals, especially our sustainability priorities, a reality,” Varga-Nagy notes.

The communications specialist has been responsible for the corporate relations and communications, brand reputation and public relations of Heineken Hungária since March 1.

Southeast Asian Tax Specialist Joins Andersen Hungary

Having worked for 10 years in Cambodia, Myanmar and Singapore for various consulting firms, including VDB Loi, Andersen’s collaborating partner in the region, Ngwe Lin Myat Chit joined Andersen Hungary in January 2023.

Opening up to Far East markets has emerged as a new strategic element of Andersen’s medium-term plans, the company says. Its goal is to approach those Asian businesses and large corporations with operating investments, sites, manufacturing capacities, or subsidiaries in Hungary or which are laying the groundwork for such. The signing of an experienced Southeast Asian tax specialist was a fundamental step in this process.

Hungary but also for other Central European countries by collaborating with Andersen firms in the region as well as other Andersen collaborating firms in Asia.

Director of F&B at Matild Palace

Matild Palace has added another top executive to its management team with the appointment of Burak Cecen as the luxury hotel’s new director of food & beverages.

“I would like to be the person who helps broaden the local taste in both food and cocktails. I would like to use ingredients from all over the world, offering the city and the community an interesting alternative. This is my vision,” Cecen said.

GM Named at Four Seasons Hotel Gresham Palace

The Four Seasons Hotel Gresham Palace Budapest has named Thibaut Drege as general manager. He has nearly two decades of experience in the hospitality industry, the hotel tells the Budapest Business Journal

Drege joined Four Seasons in 2018 as Hotel manager at Four Seasons Hotel George V, Paris.

“From the first day of my career, I always told myself, the day Four Seasons will call me, I’d stop whatever I’d been doing and join this amazing company,” Drege says.

After five successful years in Paris, he now takes the helm at Four Seasons Hotel Gresham Palace Budapest.

“I feel honored and proud, having the opportunity to be the general manager of one of the most beautiful hotels on the planet,” he adds.

Over the course of her career, the communications specialist spent more than a decade at Ikea, where she gained extensive experience in internal, external, and corporate communications. From 2013, she was responsible for leading the Hungarian PR team and later the entire Hungarian communications team, additionally contributing to regional strategic planning in the Czech Republic, Hungary, and Slovakia.

Prior to her time at Ikea, she was the internal communications manager at Tesco Hungary and gained experience in public administration at both local and national levels.

Most recently, she worked as a communications manager at The Coca-Cola Company.

“A brand like Heineken can only be successful if it takes its consumers’ opinions and feedback into consideration as its primary point of alignment,” Varga-Nagy says.

“It is a great pleasure and also a responsibility to join this team, which represents both national and multicultural values. I am proud to be a member of a company that is also responsible for the communications of the Soproni brand, the product of one of the oldest breweries in Hungary,” she says.

The recently hired expert has an extensive background in direct and indirect taxes, particularly in corporate tax structuring, cross-border tax planning, tax optimization of commercial contracts, tax due diligence, tax compliance, and tax dispute matters for a wide range of industries.

In her new role, she is responsible for Asian-focused business developments not only for

The professional will be responsible for the operation of the Spago Budapest by Wolfgang Puck restaurant, Matild Café & Cabaret, and The Duchess rooftop bar, in close cooperation with the Wolfgang Puck Fine Dining Group.

Cecen started his career at Swissotel The Bosphorus Istanbul. He has worked in prestigious hotels worldwide, including in Chicago, Mecca, Sydney, and Osaka, where he managed the operations of several restaurants, bars, and venues.

Before his recent appointment, he was based at Park Hyatt in Shanghai, where he was responsible not only for the luxury hotel but also for the luxury catering of the city.

According to Matild Palace, Cecen wanted to continue his career path in Europe, hence his arrival in Budapest. The venue’s F&B director aims to make Matild Palace the city’s reference point and create an experience for guests that is not just about dining by inviting internationally renowned professionals and using highquality ingredients not only from the local area but from around the world.

The new general manager’s leadership philosophy is inspired by the passion of craftsmen and fine artisans, who put all their heart into their work and creations and never stop striving for excellence. This passion translates for him into an admiration for great food and cooking, considering gastronomy an authentic way of caring for people.

Four Seasons Hotel George V maintained its unique position under his leadership, being the only hotel in Europe housing five Michelin stars within three restaurants.

6 | 1 News www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Eszter Varga-Nagy

Ngwe Lin Myat Chit

Burak Cecen

Thibaut Drege

in Brief News

How Will the Global Minimum Tax Change Role of CFOs?

Gergely Czoboly Senior Manager, Tax and Legal Services

PwC Hungary

4iG Selling Digi Mobile Infrastructure Network

Listed ICT company 4iG on April 13 said that Digi, wholly owned by its subsidiary Antenna Hungaria, intends to sell its mobile network infrastructure assets “in the near future,” according to an announcement on the website of the Budapest Stock Exchange. Digi will seek a buyer for “certain elements of the mobile network infrastructure and the radio frequency usage rights exercised in the context of mobile telecommunications services, based on the opinion of the decision preparation forums,” 4iG said. It added that, given the specific nature of the transaction, it is announcing the planned sale before a board decision on the matter is taken or a firm contract on the transaction is signed. 4iG acquired Digi for EUR 625 million early in 2022. According to public records, Digi had material assets of HUF 53.7 billion at the end of last year. In Unrelated 4iG news, Gellért Jászai, the chairman of listed IT company 4iG, was elected to the board of trustees of the foundation that runs the University of Szeged on April 14, the school said on its website. Jászai noted that 4iG’s experts and its base in Szeged have cooperated with the university for years. Jászai replaces Minister of Energy Csaba Lantos, who resigned from the board of trustees with effect from February 15.

Mercedes-Benz Hungary CEO Awarded Hungarian Order of Merit

Minister of Foreign Affairs and Trade

Péter Szijjártó awarded Christian Wolff, the chief executive of Mercedes-Benz Manufacturing Hungary, with the Hungarian Order of Merit during a visit to the German-owned car maker’s plant in Kecskemét (95 km southeast of Budapest) on April 13, according to origo.hu. Wolff was recognized for his work to promote the advancement of Hungary’s automotive industry, the Ministry of Foreign Affairs and Trade said. In a speech at the plant, Szijjártó said Mercedes-Benz is a “flagship” of the EV industry in Europe and is helping turn Hungary into an industry hub. He also acknowledged

the company for its “pioneering role” in Hungary’s vocational education system. He noted that Mercedes-Benz is doubling its production area at the base in Kecskemét and will soon start production of new electric models.

BMW Group Plant Debrecen Launches 3-year Vocational Program

BMW Group Plant Debrecen (225 km east of Budapest) will launch a threeyear dual vocational training program in September, plant officials announced on April 17. Some 100 10th-grade students from local technical schools have been selected to participate in the program. Botond Barabás, the factory’s training head, said the selection process was no easy task, as the pool of qualified applicants was far bigger at the three schools. The 100 will start their training in four areas (vehicle mechatronics, mechatronics, electronics, and IT systems and applications operation) in September and will be offered positions at the automaker’s plant in Debrecen when they finish in three years, Barabás added.

MNB, Finance Ministry Heads Meet

Minister of Finance Mihály Varga and National Bank of Hungary (MNB) governor György Matolcsy discussed the current economic situation and the “most important tasks of economic policy” at a meeting on April 13, the central bank and the Ministry of Finance said in a joint statement, according to state news agency MTI. The MNB and the ministry acknowledged the successful management of the coronavirus crisis thanks to cooperation between economic policy and branches of the economy. They said further close collaboration between fiscal and monetary policy is of “key importance” in resolving the crisis resulting from the war in Ukraine and sanctions. “Working together contributes to bringing down inflation, reducing interest rates, cutting the [fiscal] deficit and state debt, and returning to balanced growth,” they said. The parties agreed to continue consultations in person regularly.

Gergely Czoboly, senior manager at PwC Hungary and one of Hungary’s most experienced global minimum tax experts, explains how the new international framework may affect businesses and change the roles of CFOs.

Last year, 137 countries agreed to introduce a 15% global minimum tax (GMT) in line with the OECD’s model rules. Broadly, the regulations will require any multinational group of companies with a consolidated revenue of EUR 750 million to pay income tax of at least 15% effective rate (ETR) in any jurisdiction they operate in.

According to the OECD’s proposal, the effective tax rate will not be calculated based on countries’ existing tax laws but on a new set of internationally agreed principles. If a multinational group’s entities in a jurisdiction fall below the 15% threshold, then the group will be charged a so-called top-up tax to make up for the difference. This is irrespective of whether the jurisdiction where the low-taxed entities of the group operate adopted the new rules or not. Due to the cross-border charging provisions of the new regulations, it will be enough for any multinational group to work in just one jurisdiction where these rules have been adopted to fall into scope with its global operations.

After a long-lasting saga, the European Union became one of the first movers and adopted a Council directive to ensure the timely and uniform application of the rules within the block. All member states, including Hungary, will need to transpose the new regulations into their domestic legislation this year for them to become effective from January 1, 2024. With that, a new era will begin for countries and companies.

Tax policymakers must embrace the change and adapt to the new reality, and companies will be compelled to reassess their tax strategies. For example, when planning new investments, companies will need not only to consider applicable tax credits under domestic law but will also have to examine whether the GMT rules will allow them to keep the benefits of such tax credits.

These developments will undoubtedly bring the biggest change for CFOs, whose responsibilities will most likely

expand due to the introduction of the global minimum tax. Although it may seem that the new levy will only affect those companies whose effective tax rate is below 15%, practical experience shows that the administrative tasks will equally impact companies with higher tax rates; without completing the entire complex set of calculations, how would one be able to prove that no top-up tax is due?

The OECD is working on proposals to simplify calculations and hence compliance burden for those reasonably expected to be above the 15% threshold. Still, there is reasonable doubt whether these simplifications will be material enough to reduce complexity and workload.

Two of the biggest challenges are that the new rules do not build on the local statutory financial statements of the entities but on the unconsolidated financial data produced according to the generally accepted accounting principles (GAAP) used to prepare the consolidated financial statements of the group. The calculations also rely on complex deferred tax accounting-based adjustments to deal with the issue of temporary GAAP to tax differences affecting the ETR. This can easily mean data that is currently nonexistent or not easily accessible will be required to perform calculations and to be able to fulfill compliance requirements.

Thus, CFOs must become familiar with more than one financial accounting standard, focus on differences between consolidated and standalone financial data, control currently underrated deferred tax calculation exercises, coordinate between different subsidiaries to extract the necessary data and follow the constantly evolving international framework of the GMT.

Why is it important to deal with GMT regulations before 2024?

On the one hand, preparing the organization to collect necessary but not yet available data and a new entity-level balance sheet under a foreign financial accounting standard are time-consuming. On the other hand, it may make a difference to how companies enter the new era; there are transitional rules which can preserve certain tax benefits (such as credits and losses) or worsen the overall impact of the new regulations if transactions have been performed in the transitional period without regard to the upcoming changes. And we are already in the transitional period (since December 2021.)

1 News | 7 www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023 NOTE: ALL ARTICLES MARKED INSIDE VIEW ARE PAID PROMOTIONAL CONTENT FOR WHICH THE BUDAPEST BUSINESS JOURNAL DOES NOT TAKE RESPONSIBILITY INSIDE VIEW

2 Business

Szijjártó: Keeping Hungary a

Meeting Point

of Western and Eastern FDI is key to Growth

Hungary wishes to keep its doors open to investors regardless of origin as only steady foreign direct investment inflow can pave the way to sustainable development, Minister of Foreign Affairs and Trade Péter Szijjártó told members of the American Chamber of Commerce (AmCham) in Hungary.

LEVENTE HÖRÖMPÖLI-TÓTH

Attendees of the business forum at the InterContinental Budapest Hotel on April 3 were first given a summary of the economic consequences of the war between Ukraine and Russia. The minister pointed out that, although it is a regional conflict, the price was being paid by the entire continent in the form of inflation, surging energy prices and commodity shortages.

Most of all, European competitiveness suffers. In Europe, natural gas costs seven times more than in the United States, and electricity is three times higher than in China. According to the minister, sanctions continue to strain the European economy but have failed to force Russia to cease its aggression and have not prevented the financing of the war, he insisted.

Intensifying weapons deliveries, a race Szijjártó said was initiated by America, does not help end the conflict. Hungary has been advocating peace

from the outset, not least because many ethnic Hungarians in Ukraine have died in the war. The minister insisted that Hungary belongs to the majority of countries in the world that don’t provide military support to Ukraine, but added that he worries continued war will lead to a globe divided into blocs.

“History taught us that when there was a conflict between East and West, we always lost. Therefore, instead of creating blocs, we urge for connectivity and mutual respect,” Szijjártó said. He added that, unfortunately, he sees signs of “decoupling” globally, with attempts to cut economic ties between the EU and China.

“If this happens, this would be a knock-out,” he said, referring to the bilateral trade volume of EUR 875 billion between the two geopolitical superpowers.

Whatever may come geopolitically, the automotive transition is inevitable and provides a massive opportunity for Hungary. As the minister highlighted, European OEMs drew up great business plans for handling the jump to electrification

but didn’t factor in that the top 10 battery manufacturers are Chinese and Korean companies.

East Meets West

This is where Hungary comes into the picture. The country has never discriminated against investors, the only precondition being the requirement to respect local regulations. Many Western investors have been asking the government to lay the groundwork for greater Eastern capital influx to shorten supply chains, the minister noted. “We wish to remain the meeting point for Western and Eastern investors because that is the key for long-term growth and our protection against all uncertainties,” Szijjártó said, noting that Hungary is making itself an essential element of the electrification of the automotive industry.

The country is the fourth largest battery producer in the world, three of the seven biggest battery manufacturers are present here, and Hungary is the only country outside of Germany and China where the top three premium German automakers (Audi, BMW, and Mercedes) have a manufacturing presence.

In 20 of the last 25 months, batteries were Hungary’s top export item, contributing to last year’s all-time export record of EUR 142 bln. Batteryrelated economic activities also helped exceed the HUF 10 trillion threshold for the first time in automotive and electronics in 2022, the minister said

The government has a clear strategy built on four pillars to keep the economy on a growth track. Firstly, it will continue to support export activities by all means, whether economic, political or financial. In addition, it is necessary to help Hungarian companies invest abroad. Many local exporting businesses have reached a glass ceiling, and without setting up shop across the border, won’t be able to accelerate their export volumes.

Secondly, the government will mobilize all its assets to increase FDI attractiveness, as it is a significant factor for economic development. Up to 1,700 U.S. companies employing some 107,000 people operate in the country, 14 of which have a strategic partnership agreement with the government. Bilateral trade hit

www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

Minister of Foreign Affairs and Trade Péter Szijjártó addresses AmCham members.

a record high last year, and in the past eight years, 103 U.S.-related deals have been incentivized, with another eight new FDI projects in the pipeline.

‘Keep Relationship Alive’

“We count on American businesses to keep this close relationship alive given the current political relations,” Szijjártó noted for the third pillar, in reference to the fact that Hungary’s conservative government tends to have better relations with Republican administrations.

He listed energy security as the fourth leg of Hungary’s long-term economic strategy. Hungary won’t give up any existing reliable sources, and diversification means adding additional energy sources. That includes 100 million cubic meters per year of natural gas from Azerbaijan, starting at the end of 2023; under a long-term contract, that will rise to two billion cubic meters.

Ongoing talks with southeastern countries could make more Azeri gas and LNG from Greece and Turkey accessible to the CEE region. The expanded nuclear power plant in Paks is scheduled to be in operation by 2030 or 2031, providing ultimate energy security for the economy.

“We are living a nuclear renaissance, led by France,” Szijjártó noted.

Many AmCham members had been concerned by the termination of the double taxation treaty between Hungary and the United States. The minister said that Hungary had given up its veto of the global minimum tax, which was the reason cited for the termination; therefore, the Hungarian Government sees no obstacle to beginning negotiations on a new treaty. However, the minister argued this would only happen under a Republican administration.

Regarding labor shortages, Szijjártó stressed the importance of maintaining the FDI inflow, as new jobs are needed to secure existing ones. There is a clear methodology under what conditions guest workers can be employed while ensuring that all Hungarians have a job. Domestic mobility must be further encouraged by housing and commuting incentives, but long-term growth is ultimately connected to maintaining foreign capital influx.

AmCham President Zoltán Szabó said the chamber appreciated the minister’s openness to consultations with businesses.

Regarding the U.S-Hungarian Double Taxation Treaty, AmCham is currently working to assess the short- and longterm impacts of the treaty’s cancellation and to facilitate dialogue between decision-makers. However, the chamber is concerned that negotiating a new treaty could take years. A newly formed task force of the AmCham Tax Committee is dedicated to clarifying emerging questions and uncertainties and finding possible solutions from the business side to the challenges that arise from the cancellation.

2 Business | 9 www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

“History taught us that when there was a conflict between East and West, we always lost. Therefore, instead of creating blocs, we urge for connectivity and mutual respect.”

Prior to the business forum, Minister of Foreign Affairs and Trade Péter Szijjártó met privately with members of the AmCham leadership team.

Minister of Foreign Affairs and Trade Péter Szijjártó and AmCham President Zoltán Szabó conduct a Q&A session.

Budapest Airport Among 1st to be Awarded Well Accreditation

Budapest Ferenc

Liszt International Airport has achieved the international Well Health and Safety Rating, confirming that the operator is taking all steps necessary to ensure the welfare of staff and passengers. During the rating process, independent experts examined five areas at the passenger terminals (cleanliness, emergency preparedness, health, air and water quality, and stakeholder involvement). Previously, only airports in Canada and the United Kingdom had achieved this rating.

“In recent years, the pandemic has also highlighted the importance of the quality of our built environment in safeguarding our health, which is why Budapest Airport [BUD] has reviewed and further developed its processes for a safe passenger experience with a focus on health protection and emergency preparedness,” the airport operator explains.

“This means the airport operator is taking all measures to prepare for the rapid and effective management of any emergency, be it a pandemic or any other experience that could potentially threaten the safety of aviation and passengers,” BUD says.

“To examine these processes and to demonstrate its crisis resilience from as many aspects as possible, Budapest Airport applied for the rigorous accreditation process required for the international Well Health and Safety accreditation,” the operator ads.

The rating is designed to support business owners and operators in

Green Matters

A monthly look at environmental issues in Hungary and the region

protecting health. Awarding the Well Health and Safety seal is a sign of a company’s commitment to the health and well-being of staff and visitors to its building. The process is typically targeted by office operators but is spreading to other commercial real estate sectors, such as industrial/logistics. BUD is one of the first airport operators to have submitted itself to the rating process.

“The airport terminals are a special area from a health and safety perspective, with more than 50,000 passengers passing through every single day and with staff on duty 24 hours a day. Operating a busy facility like this, which accommodates people from many different places, requires a lot of attention and expertise, and in many cases special equipment,” comments Lászlo Eiszrich, chief technical officer at BUD.

“During the rating process, we had to meet strict criteria; in addition to the cleanliness of the terminals, air and water quality, the experts also examined the crisis resilience of Budapest Airport’s strategy in the event of a possible emergency,” he adds.

Sustainability Accreditation Becoming the Norm in Industrial Sector

Hungary’s industrial park developers and operators are increasingly developing sustainability-accredited projects in reaction to changing tenant demands and environmental regulations. CTP is now committed to developing Breeam-

accredited buildings throughout its Central European logistics portfolio. HelloParks, part of the Futureal Group, is developing according to the New Construction category of Breeam to achieve an “Outstanding” rating and comply with EU Taxonomy requirements in its industrial halls in Hungary. Panattoni is looking to add energy-efficient solutions to its products, such as solar panels, electric vehicle charging facilities, and heat pump systems. It aims for Breeam “Excellent” New Construction accreditation as a standard for its products in Hungary. Prologis is developing its parks to at least Breeam “Very Good” standards. Belgium’s VGP says it is committed to becoming carbon neutral by 2025. It is also seeking Breeam/DGNB certification and green power generation across its European portfolio, including six parks in Budapest and provincial hubs across Hungary. In addition to sustainable energy, VGP wants all its parks equipped with EV charging facilities and access to public transport.

New Study Maps Evolving ESG Regulations

The Urban land institute (ULI), European Association for Investors in NonListed Real Estate Vehicles (Inrev), and Principles for Responsible Investment (PRI) have undertaken what they describe as a ground-breaking study that maps out the evolving landscape for ESG regulation. “There is no one-sizefits-all reporting standards, and this is not expected to change in the short-

to medium-term, as ESG is so broad and complex it will continue to evolve as social knowledge grows and social norms become more widely accepted,” says the report. It aims to help real estate navigate the growing myriad of ESG regulations and reporting standards.

István Nagy to Attend AIM for Climate Summit

Hungarian Minister for Agriculture

István Nagy is to attend the two-day AIM (Agriculture Innovation Mission) for Climate Summit in Washington DC in May. The U.S./UAE-led event is supported by 47 countries, including Hungary, and 275 NGOs. John Kerry, U.S. Special Presidential Envoy for Climate, and former U.S. Vice President and climate change activist Al Gore will also attend. The summit “aims to raise ambitions, build collaborations and share knowledge on climate-smart agriculture and food systems innovation in the lead-up to COP28.”

NAP Acquires 3 Solar Parks

The listed Hungarian solar energy company NAP Nyrt. has purchased three solar parks with a combined capacity of 2.5 MW, according to an announcement on the Budapest Stock Exchange website. NAP already has 70 solar parks in its portfolio with a total capacity of 36 MW. The company aims to expand this to 100 MW by the year’s end.

10 | 2 Business www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

GARY J. MORRELL

Bail-ins: Are Your Bank Deposits Less Safe Than Your Tax Dollars?

Most readers of this column will have heard of bailouts (in other words, the use of government money to stabilize banks and other financial institutions); in this column, Les Nemethy and Leo Rioufrays discuss the much less wellknown bail-ins, where depositors’ and bondholders’ funds are used to stabilize banks.

During the 2008 Great Financial Crisis, regulators had no legislative authority for bail-ins. Hence, in 2009, many countries began quietly passing legislation to authorize them. Bail-ins are an additional method for bank resolution in the regulator’s toolkit, allowing the use of creditor funds to keep banks operational, arguably reducing systemic risk but potentially increasing the threat to bank depositors and creditors.

The purpose of this article is to familiarize those not familiar with bail-ins and discuss possible implications. We will first provide a broad summary of the legislation passed over the past 10-15 years in two significant jurisdictions; then talk about the pros and cons of bail-ins; provide a few examples; and speculate on possible implications for investors’ portfolios.

Post 2008, both the United States and the European Union quietly introduced legislation enabling bail-ins:

• In the States, the Dodd-Frank Act (2010) contains a provision called the “Orderly Liquidation Authority,” which permits the Federal Deposit Insurance Corporation (FDIC) to use creditor funds to resolve a financial institution by converting them to equity.

Finance Matters

• The EU introduced the Bank Recovery and Resolution Directive (BRRD) in 2014, which sets out a range of tools regulators can use to resolve failing institutions, including bail-ins. Creditors can be required to take losses, either through converting debt into equity or writing down claims, designed to ensure that creditors rather than taxpayers bear resolution costs. From a regulator’s perspective, the major advantages of bail-ins are creating a more streamlined process, avoiding the need for a messy bankruptcy while limiting the use of government (in other words, taxpayers’) funds, and avoiding the moral hazard of bail-outs.

Banking is essentially a confidence trick. Banks take in short-term deposits and provide long-term loans, meaning a sudden wave of withdrawals will cause problems. The success or failure of bail-ins may ultimately depend on how they affect confidence.

The biggest downside of bailins is that they may augment contagion. The mere possibility of bail-ins may accelerate the process of withdrawing deposits or selling bonds. Bail-ins, once implemented, oblige creditors and depositors to write off all or part of their investments, possibly triggering a domino effect. Bail-ins may increase risks associated with lending to or investing in financial institutions,

and hence increasing the cost of capital. There have also been concerns about the transparency of bail-ins. Banking is essentially a confidence trick. Banks take in short-term deposits and provide long-term loans, meaning a sudden wave of withdrawals will cause problems. The success or failure of bail-ins may ultimately depend on how they affect confidence. Here are a few examples.

Cyprus (2013)

According to the IMF, bailing out the two largest banks in Cyprus would have cost 50% of the GDP, as Cyprus had an enormous financial sector. Hence a bail-in was implemented, which involved the conversion of a portion of depositors’ balances into bank shares and the closure of one of the country’s largest bank, Cyprus Popular Bank. The bail-in caused panic among depositors, leading to a bank run and the imposition of capital controls. This bail-in was criticized as disproportionately affecting smaller depositors and potentially undermining confidence in the European banking sector.

Greece (2015)

Four Greek banks were bailed-in. Banks’ liabilities were converted into equity. Depositors and bondholders bore the losses. There was considerably less contagion here than in Cyprus, in part given the lesser size of Greek banks in relation to the overall economy.

Spain (2017)

The BRRD was applied in the case of Banco Populare, a medium-sized bank. In addition to EUR 1.3 billion of equity being wiped out, EUR 1.97 bln of Tier 1 capital and EUR 716 million of Tier 2 capital were wiped out, after which Banco Santander stepped in to buy the bank for a symbolic euro.

Impact on Investors’ Portfolios

Legislation can convert your bank deposits to equity or give them a haircut, literally with the stroke of a pen. You may also think your funds are safe up to the USD 250,000 limit in the United States or EUR 100,000 limit in Europe. But, bear in mind that the FDIC insurance fund, which provides the American guarantee, has just USD 130 billion collateral, far less than 1% of deposits in U.S. commercial banks, not even talking about derivatives in the banking system.

The reluctance of U.S. regulators to use bail-ins during the recent wave of bank failures is probably owing to a fear of contagion effects. However, should bank failures become particularly large or systemic, regulators may have no choice but to use bail-ins on a massive scale.

What can be done? You may wish to a), at a minimum, examine the financial health of the financial institution in which you deposit funds; b) diversify deposits across multiple institutions, perhaps even in multiple jurisdictions; and c) you may consider holding some of your wealth in liquid physical assets outside the financial system, such as gold.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

2 Business | 11 www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

A biweekly look at financial issues in Hungary and the region

Photo by FrankHH / Shutterstock.com

3 Country Focus

South Korea

Reaping the Benefits of a Systematic Approach

South Korea has been making headlines in Hungary year after year for bringing significant investment into the country. A roundup by the Hungarian Investment Promotion Agency reveals that it is the result of a wellcrafted strategy that is paying off handsomely.

If you need to name a country that has dominated the most recent chapters of Hungary’s foreign investment promotion history, a top choice would be the Republic of Korea. Having the 10th largest economy in the world and the fourth largest in Asia, South Korea has clocked up FDI worth USD 6.8 billion in Hungary, an equivalent of 6.7% of the FDI stock.

The investment appetite of Korean companies has been enormous since 2018, in particular. That year the country was catapulted to second place in terms of investment volume, but in 2019, 2021, and 2022, it finished on the top step of the podium each year. It invested EUR 2.8 billion last year alone, whilst every fourth new workplace and every 10th project could be linked to them. No wonder, either, that in the recent past, Korean investors such as SK On, Samsung SDI, and Toray Industries raked in numerous recognitions at HIPA’s Investors of the Year Awards. W-Scope’s

EUR 720 million separator plant project earned the company the “Newcomer Investor of the Year” title in 2022.

As Hipa CEO István Joó explains, South Korean investments have always been welcomed as they represent the highest technological standard and are making a significant contribution to the rapid cyber age transformation of the Hungarian economy.

“The activity of Korean investors is best showcased by the fact that a total of 49 related HIPA-guided deals have been closed over the nine years between 2014-2022,” he says. “These projects account for a total investment volume of EUR 9.8 bln and nearly 15,000 new jobs for the Hungarian economy.”

Systematic Approach

Attracting Korean capital is part of the systematic approach of Hungarian foreign trade policy that strives to harness the power of two prevailing global trends. For one, tectonic shifts in the worldwide FDI landscape led to a growing significance of Eastern investments. On the other hand, e-mobility is a major driving force behind many recent investment decisions. Since Asian stakeholders rule that market, clinching their deals helps the Hungarian economy kill two birds with one stone.

A glance at the sectoral structure of Korean investments reveals that the bulk of projects are connected with e-mobility. Perhaps more importantly, from a Hungarian perspective, these market players cover different parts of the value chain, thus making the local EV ecosystem more diverse.

“The activity of Korean investors is best showcased by the fact that a total of 49 related HIPA-guided deals have been closed over the nine years between 20142022. These projects account for a total investment volume of EUR 9.8 bln and nearly 15,000 new jobs for the Hungarian economy.”

W-Scope’s aforementioned separator film manufacturing business is just one example. EcoPro will produce cathode material in a EUR 728 mln project, while Nice LMS plans to make battery cases by pouring EUR 14.4 mln

into its local operation. CK EM Solution has recently inaugurated a facility to produce heat sink glue. The latter is an investment of EUR 10.42 mln in two stages to manufacture enough material for 200,000 EV batteries per year.

And these are just endeavors on a smaller scale. Battery manufacturers Samsung SDI and SK On have continued to invest even more heavily. SK On alone has so far announced investments in Hungary worth close to EUR 3 bln, not least

www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

BBJ STAFF

BILATERAL TRADE (EXPORT+IMPORT ) 6,8 (up 36.8% y-o-y) EXPORT 0,7 (up 12.1% y-o-y) IMPORT 6,1 (up 40.2% y-o-y)

Hungarian-South-Korean Economic Relations 2022 (in bln USD)

Source: HIPA, KOTRA

PRESENTED CONTENT

Newcomer Investor of the Year 2022 W-Scope invests EUR 720 mln in a separator film plant.

NO. OF BUSINESSES 260+ NO. OF EMPLOYED 20,000+ SHARE OF TOTAL FDI STOCK 6.7%

thanks to its 30 GWh battery factory to be set up in Iváncsa (50 km south of Budapest by road).

Trade is also booming between the two nations. South Korea is Hungary’s 13th most important partner. Bilateral trade volume grew by a whopping 37% year-on-year in 2022, hitting USD 6.8 bln. Exports expanded mainly due to sales of public road vehicles and inorganic chemicals, whereas imports ballooned because of a spike in buying chemical materials and products. The dynamics show no signs of decline, with bilateral trade up 90% in January of this year.

Efficient Collaboration

The embrace is tightening, not least thanks to a cooperation agreement between the Korean Trade Investment Promotion Agency (KOTRA) and Hipa that aims to institutionalize and make more efficient the existing collaboration. The investment promotion and trade development pact signed by Hungary and South Korea in October 2022 serves the same purpose.

Although it is among the Korean companies with the largest revenues and staff in Hungary, Hanon Systems is not necessarily a household name here. A leading thermal and energy management solution provider for automotive, Hanon Systems celebrated the 30th anniversary of its plant in Székesfehérvár (64 km southwest of the capital) in 2021.

According to a company statement, Hungary’s highly skilled workforce and close proximity to Europe’s value chain means the country continues to offer great strategic potential. And the Korean corporation walks the walk.

Since 2018,

it has announced investments worth EUR 171 mln that concerned its sites in Székesfehérvár, Rétság (65 km north of Budapest) and Pécs, including setting up a brand new factory in that latter location.

Hanon Systems is apparently here to stay because, as its statement

continues, it has “a solid and growing global footprint to support our diverse customer base and with locations close to customer sites.” Its Hungarian operations mean it “can continue building trust to win new and retain existing business and delivering value as a long-term supplier partner.”

HIPA counts on more Korean investments to come. “We look forward to this year with optimism, too, as Hipa currently has 14 projects of South Korean relevance in the pipeline,” Joó says. He adds that Korea is bound to play a crucial role in helping the Hungarian economy avoid recession.

HIPA-guided South-Korean projects (2014-2022)

NUMBER OF DEALS CLOSED 49

TOTAL INVESTMENT VOLUME

EUR 9.8 BLN

Transfer Pricing Documentation: Immediate Action Proposed

The May roll-out of data reporting on related party transactions to the Hungarian National Tax and Customs Administration (NAV) may cause severe problems for Hungarian companies. Short preparation times, IT problems, and unclarified regulatory issues could hinder the timely submission of transfer pricing documentation.

The regulation on recording related party transactions affects around 20,000 companies in Hungary. Significant changes have been made in this area as of this year, as transaction-level data on transfer pricing must now be reported in the corporate tax return by May 31.

Most Important Changes

Under the previous rules, the transfer pricing documentation also had to be prepared by the deadline for tax returns, but it did not need to be submitted, and its existence did not have to be verified by May 31. According to the changes that entered into force on August 26, 2022, the submission of the documentation will still not be mandatory. However, affected companies will still have to provide the details of their transactions with related parties (for example,

their parent company or subsidiaries within a group), together with their corporate tax return. Such reporting must include the type of transaction, the activity code, the consideration, the related parties’ data, and the method of establishing the transfer price. The data must be submitted to the tax authority in a predefined structure for easier processing.

Preparation Time too Short

The goal of the new regulation is justifiable from the perspective of the authorities and financial control, but there are several problems with it. One is the lack of gradual implementation, since companies will find it difficult from an IT point of view to collect the data required for reporting on time from their own systems.

The decree on the detailed rules of the concept was published on December 28, giving those involved only four or five months to prepare at best, which is extremely

short. There is no testing or grace period, and failing to provide the data can lead to immediate sanctions from NAV. Moreover, resulting from the mid-year amendment, the default penalty has also been significantly increased compared to its previous level and can now be levied individually per record (essentially per transaction).

Different Deadlines Abroad

It could also be a serious problem for international groups that the transfer price and the adjustment of the tax base are not just the decision of the Hungarian party.

NUMBER OF NEW JOBS almost 15,000

Usually, it is a consensual arrangement, which also requires the agreement of the related foreign party of the company concerned. However, the deadline abroad for preparing accounts and records is typically not May 31, so transfer pricing decisions are made later. This means that, according to the new Hungarian rules, the Hungarian party must decide on the market price to apply without any assurance that the foreign members of the group (whether the parent or sister company) will agree. Consequently, the transfer pricing data submitted on May 31 will, most likely, be inaccurate, and the companies will have to correct them later. Adding to these difficulties, those involved also have to expect that the external advisory capacity for compiling the transfer pricing documentation will likely be insufficient.

NAV’s ‘Wonder Weapon’ Going Live

The tax authority will have a very accurate means of control through the structured collection of transfer pricing data, providing them with up-to-date information on the pricing, profitability and profits of the players in the given industry. This will enable cross-checking, detecting anomalies, and improving risk analysis, making a significant overall contribution to more effective control activity.

3 Focus | 13 www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

SÁNDOR HEGEDÜS

Sándor Hegedüs, Director of Andersen Adótanácsadó Zrt.

CONTENT

The South-Korean Investor Community in Hungary

PRESENTED

Source: HIPA, KOTRA Source: HIPA, KOTRA

4Special Report

Human Resources

Morgan Stanley Helping Women, Ethnic Minorities Attract Funds for Growth

The head of Morgan Stanley’s Budapest office, Norbert Fogarasi, speaks with the Budapest Business Journal about the aims of the financial services firm’s accelerator program investing in and supporting startups led by women and those from ethnic minorities. Both are cohorts that find it increasingly challenging to attract capital injections to grow their fledgling businesses.

Morgan Stanley is doubling the number of participants in its Inclusive Ventures Lab (MSIVL) in Europe, the Middle East, and Africa as the firm seeks to accelerate the growth of startups led by women and those from ethnic minorities. The MSIVL accelerator program invests in and works closely with early-stage businesses to drive their growth.

In 2023, MSIVL aims to select 10 startups from across EMEA to participate in a bespoke five-month program. Hungary, with its established base of diverse entrepreneurs running emerging high-growth companies, is being specifically targeted this year as a source of applications for the accelerator program.

Morgan Stanley launched the Inclusive Ventures Lab in 2017 to address the systemic disadvantages faced by ethnic minority and female business founders, particularly in access to capital and funding. Research showed that, in 2020, female-founded companies in Central and Eastern Europe

received only 1% of venture capital investments, while 5% went to those with a mix of male and female founders and 94%

to all-male teams. In Hungary, the proportion of self-employed women in science, engineering, and information and communication technology is the lowest in the EU at less than 13%.

“We recognize that securing funding is vital for early-stage companies to grow. We also recognize that, for far too long, women and ethnically diverse company founders have particularly suffered from not being able to access capital and networks for their businesses,” Norbert Fogarasi, the head of Morgan Stanley’s Budapest office, tells the BBJ. “That is why we founded the Morgan Stanley Inclusive Ventures Lab.”

The program aims to address these disparities via Morgan Stanley’s equity investments and support for the growth and development needs of startups through an intensive fivemonth program. It provides a unique opportunity for an emerging company to take its development to the next level.

Bespoke Curriculum

Each participating startup is given equity capital of GBP 250,000 (about USD 309,000), a bespoke curriculum involving problem-solving experts and mentors both inside and outside the firm, and the opportunity to showcase their business at the end of the course to a network of invited professional investors and venture capitalists.

“The Lab’s financial inclusion goals align with one of Morgan Stanley’s core values: Commit to diversity and inclusion. This means we value individual and cultural differences as a defining strength and champion an environment where all employees feel a sense of belonging and are heard, seen and respected. We expect our people to challenge behavior counter to our culture of inclusion, helping us to attract, develop and retain talent that reflects the full diversity of society,” Fogarasi says.

Morgan Stanley’s Budapest office has also committed to promoting diversity, particularly in the fields of science, technology, engineering, and mathematics (STEM). The Hungarian business is dedicated to increasing the representation of women in all areas within the firm and, more broadly, in STEM fields across the industry.

“We are proud of the fact that the number of women involved in IT at Morgan Stanley’s Budapest office continues to grow rapidly. The firm’s long-term goal is to inspire high school girls and draw their attention to careers closely related to STEM,” Fogarasi explains.

“One of the firm’s key initiatives in this quest is Smartiz, a mathematics and coding-focused education program for female high school students, organized in partnership with the Association of Women in Science. We also support initiatives such as the annual Girls’ Day and Girls Who Code events,” he adds.

Multicultural Diversity

In addition to its focus on promoting gender diversity in STEM fields, Morgan Stanley is also committed

to fostering multicultural diversity. The Budapest office’s staff comprises a strong community of colleagues from a variety of ethnic backgrounds, Morgan Stanley says.

“We have also been involved with numerous initiatives in support of the underprivileged Roma minority in Hungary. These include mentoring talented Roma students, providing grants to our charity partners focusing on Roma integration and, at times, using our skills and physical strength to help build local infrastructure together with local Roma communities, for example, in partnership with the BAGázs organization,” Fogarasi said.

In the last five years, the MSIVL program, the curriculum of which is delivered in English, has seen 69 companies from the United States and EMEA partaking by raising more than USD 150 million in additional funding.

Morgan Stanley’s local arm has been operating in the Hungarian capital for the past 16 years. During this period, it has established itself as one of the leading centers for technology and analytics within the global investment bank, employing more than 3,000 people.

“We know first-hand that, right across Hungary, there are determined and inspirational people with great business ideas. We believe the MSIVL is a proven, unrivaled opportunity to overcome the barriers faced by many of our most promising entrepreneurs, to participate as part of a truly international cohort of like-minded people, and ultimately transform the growth prospects for their businesses,” Fogarasi said back in mid-February when the latest iteration of the MSIVL program was announced.

www.bbj.hu Budapest Business Journal | April 21 – May 4, 2023

BBJ STAFF

Morgan Stanley’s office in the Hungarian capital.

Norbert Fogarasi, the head of Morgan Stanley’s Budapest office.

Tackling the HR Challenges of the Biggest Bank Merger in Recent Hungarian History

Integrating the corporate cultures of different entities for a merger is always an interesting business challenge.

The Budapest Business Journal talks with Kitti Dobi, the chief HR officer at Magyar Bankholding, who has been faced with tackling a three-way tie-up ahead of the launch of MBH Bank.

BBJ: The launch of MBH Bank, born via a merger of MKB Bank, Takarékbank, and Budapest Bank, is just days away. What are the most significant challenges in integrating the corporate culture of three different organizations?

Kitti Dobi: In Hungary, even in Europe, this transformation is a rarity. This is not only a legal, IT, or marketing challenge but also an enormous, coordinated effort of more than two years in organisational development, transformation, and leadership. It is, if not “mission impossible”, a challenge unprecedented in the last 20-30 years. The size of our organisation adds a particular complexity to shaping the corporate culture, as the merger involves the cultures of three different banks. One of the biggest challenges that we face is how we can stay necessarily structured while at the same time also customerfocused, digitally agile and flexible. Our vision of the new corporate culture embraces a pioneer role in digitalisation based on collaboration and cooperation. We are committed to delivering bestin-class solutions, so we strive to bring in new talents to the existing ones with the right competencies from a diverse range of backgrounds. In this ecosystem, we are creating a new bank with a new organisation based on a new corporate culture. In doing so, we must pay special attention to be able to react quickly, to be one step ahead of market needs.

BBJ: Which HR and corporate culture elements will you retain from the structures of the three banks?

KD: The former Budapest Bank had an extensive network of branches and a large customer base and was also a dominant player in the micro and SME sector. Takarékbank has a different profile, with one of the largest branch networks in the country, was a market leader in the agricultural segment, and has a significant presence

in the micro and SME segment. MKB Bank, with a strong financial market track record, has a solid corporate client base.

The transformation will preserve the best practices and most valuable organizational aspects of the banks. The extensive physical reach provided by the largest branch network, and the in-depth knowledge of customers, built on decades of market presence, are very important. We are building on a very sound foundation while banking and the banking ecosystem are changing, and we are part of it. We can now rethink what banking is, rethinking the rules of the game. MBH Bank can, over time, be noticeably different in how it treats customers and how it can think about customers in a broader way than traditional day-to-day banking.

BBJ: In total, how many employees will the new bank have? Will an expansion of the headcount be on the cards after the merger?

KD: One of the most significant assets of the three member banks is our staff, who have a big responsibility in this transition. It is through their work that business results are achieved, and it is they who serve customers to the highest possible standards. That’s

why our focus is on creating an excellent customer and employee experience (and, with it, business performance) rather than on specific headcount targets.

We want to become the most efficient player in the market. It is a priority to work with the best professionals in all areas while eliminating any duplication in the merger. Our flexible teams and working methods are also motivating factors among experts. It is no coincidence that our group has recently become an increasingly attractive employer in the labor market. The fact that we have a “good story,” a new bank, and a new organization to which all colleagues can contribute is a factor and is attractive to both potential talent and existing colleagues. We support them with complex and future-proof talent attraction, retention and development programs.

BBJ: MBH Bank is launching a unique career program with solutions tailored to different age groups. What are the key parts of the program in the case of each age group?

KD: With the new lifecycle program, we want to support employees at all stages of their careers, according to their needs. The principle is that all colleagues are