Magyar Multis

Country Border Poses High Hurdle for Would-be Champions

Exploring and conquering new markets is an obvious means of growth and development for companies; in Hungary, it is also a crucial aspect of the national economy. 14

Graboplast: Making Flooring in Hungary, Selling to the World

László Ivan, CEO of flooring manufacturer Graboplast Zrt., talks about how the company is focusing on maintaining growth, its current projects, sustainability efforts, and future aspirations. 17

Megamerger is Only the Start

SOCIALITE

World’s first Permanent Capa Exhibition Opens

In June of this year, the world’s first permanent exhibition of the legendary war photographer’s work opened in the new exhibition space at the Robert Capa Center just off Király utca in Budapest. 20

Analysts Warn of Slight Recession on the Horizon

The Monetary Council of the National Bank of Hungary has kept the key interest rate at 13%, which is not expected to change any time soon. Meanwhile, some analysts already see worsening outlooks for Hungary’s economy. 3

Péter Balogh, MD of MBH Bank’s large corporate lending and special finance, talks about the expansion plans, rebranding process, and ESG commitments of Hungary’s second-largest lender. 15

Surányi: Losses at MNB Down to ‘Indefensible’ Policies

According to a study released in June, the National Bank of Hungary is set to post losses of up to HUF 2.4 trillion (EUR 6.4 billion) this year. That is equivalent to 2.5% of GDP or half the cost of the Paks II nuclear power station project, weekly HVG wrote last month. 8

NEWS

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM

SPECIAL REPORT INSIDE THIS ISSUE

HUF 2,100 | EUR 5 | USD 6 | GBP 4 VOL. 31. NUMBER 15 | JULY 28 – SEPTEMBER 7, 2023 SPECIAL REPORT

BUSINESS

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in

AN IDEA WITH WINGS TO FLY?

The theme of our Special Report in this issue is that relative rarity, the Magyar Multinational. If the government gets its way, they won’t be so out of the ordinary in the future. The rationale is that if foreign multinationals based here ship their profits home, then Hungarian companies ought to do exactly the same from beyond the borders.

Relatively late in the day, on deadline eve, in fact, we stumbled upon a story that may yet have legs, not to mention wings. You will have had to have been here for some time to remember Hungary’s official national carrier because Malév Hungarian Airlines, for that was its name, went bust early in 2012. Malév was, at times, a multinational. It was also privatized and renationalized. At one point, it was 99% owned by AirBridge Zrt., which had links to Russian money, and the Abramovich brothers Alexander and Boris (nothing to do with the former owner of Chelsea FC in the United Kingdom). Undoubtedly, many working for multinationals in Hungary would have flown with Malév. I certainly did when I first came here. It seems there are plans to bring the brand, and possibly the airline, back.

so much crash on takeoff as fail to taxi down the runway. If establishing a business is hard, making that business an airline just adds to the layers of complexity. Will it fly? Time will tell.

This is our last print issue before we take our annual August break. If you are a relatively new reader of the Budapest Business Journal, please don’t be alarmed. We have done this every year since we launched in 1992. Our first fall issue on September 8, with a Special Report dedicated to Green Business, is already in the planning stages, and our publication schedule is mapped out all the way to December 15 and our Christmas and New Year break.

But if you aren’t embarking on whatever the modern equivalent of the Grand Tour is this August, we will still have plenty of reading material to offer you. Our website, budapestbusinessjournal.com, will continue to be updated daily, and our Hungary A.M., Energy Today and Regional Today newsletters will go out early each working day morning.

VISIT US ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

For now, it’s all pretty low-key. We found out almost by accident, researching a completely different story. There seems to have been little or no coverage in the Hungarian media, though I stand to be corrected on that; what we can say about the story we have laid out on page 13. We are planning on doing much more. But before any Malév superfans out there get too carried away, I would remind you of the fate of Sólyom Hungarian Airways, which didn’t

However and wherever you choose to spend your summer holidays, we hope you get a chance to rest and relax and recharge your batteries, ready for the mad dash toward Christmas and those end-ofyear budgetary planning meetings! And perhaps we will all have a chance to reconnect at one of our BBJ Business Mixers. Until then, have a great time.

Robin Marshall Editor-in-chief

THEN & NOW

2 | 1 News www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved.

Stand For: The

Business Journal aspires to be the most

newspaper in

We believe that

should work on

of

shareholders. We believe that

most important

a government can make to

is improving the business and investment climate so that its citizens may realize

full potential.

What We

Budapest

trusted

Hungary.

managers

behalf

their

among the

contributions

society

their

IMPRESSUM BBJ-PARTNERS THE EDITOR SAYS

**********

In the color picture from state news agency MTI, a newly restored bus from the Ikarus 200 series is displayed in the Diesel Hall of the Northern Vehicle Garage in Kőbánya on July 26, 2023. The coach belongs to the Museum of Transportation. In the black-and-white photo from the Fortepan public archive, an Ikarus 211 is parked at what was then called Ferihegy Airport, but today is the Ferenc Liszt International Airport.

Photo by Zoltán Máthé / MTI

Photo by Magyar Rendőr / Fortepan

Analysts Warn of Slight Recession on the Horizon

The Monetary Council has kept the key interest rate at 13%, which is not expected to change any time soon. Meanwhile, some analysts already see worsening outlooks for Hungary’s economy.

The current level of the key interest rate in Hungary is sufficient for addressing inflationary risks, therefore modifying it is not on the agenda, National Bank of Hungary deputy governor Barnabás Virág told a press conference on July 25, following the rate-setters meeting of the Monetary Council of the National Bank of Hungary (MNB).

For the time being, it would be too early to signal anything in this regard before September. He added that it is still necessary to maintain strict monetary conditions to achieve price stability.

At its meeting on Tuesday, the council did not change the base interest rate of 13%, but it did further narrow the interest corridor, the upper edge of which will decrease by 100

basis points from 18.5% to 17.5%. The lower end of the range remains at 12.5%.

Virág pointed out that, in line with the central bank’s expectations, the deflation rate will continue to accelerate, and the indicator will be “perceptibly” below 10% by the end of the year. The goal is for disinflation to continue in 2024, with the projected numbers to be included in September’s Inflation Report.

The favorable risk environment enables the MNB to continue the normalization of the interest rate environment at the previous pace, the deputy governor emphasized. The rate of disinflation continues to accelerate and is being felt more widely; prices have decreased in about one-third of the entire consumer basket on a monthly basis, Virág pointed out, indicating that this trend will continue in the coming months. He opined that with the rapid decrease in inflation, the retrospective real interest rates may become positive already in the fall.

Convergence the Focus

The overnight rapid tender rate and the gradual convergence of the base rate remain the focus of the monetary policy, Virág says. The deputy governor described the domestic financial market situation as stable but warned that the volatile international macroeconomic and market environment still requires a cautious approach.

Among the internal factors, the balance of the current account continued to improve, while inflation and core inflation are expected to decrease further, according to Virág.

“There are fluctuations in the mood of international investors, and the RussianUkrainian war also causes constant uncertainty. According to our current knowledge, the rate hike paths of the major central banks are coming to an end,” he said.

Something has moved in the Hungarian economy going into the third quarter, according to Virág. While he emphasized that we were still “below the line,” there are signs of a turnaround, so that growth could be seen in the second half of the year.

“An important pillar of economic growth will be the repeated increase in real wages, as this statistic may return to the positive range again in the coming months,” he said.

While this all sounds relatively upbeat, some analysts have, in the meantime, started to paint a darker picture of the Hungarian economy.

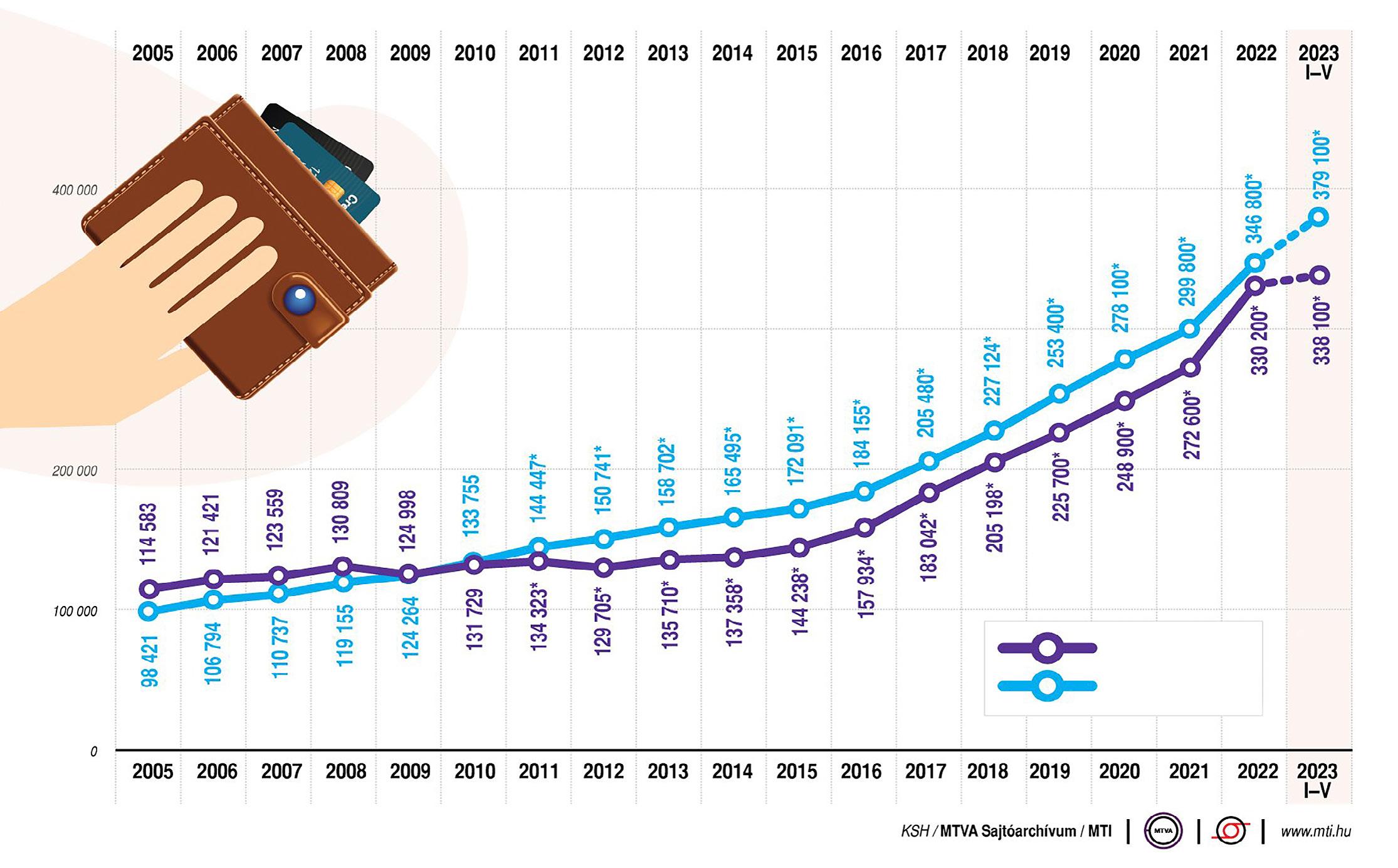

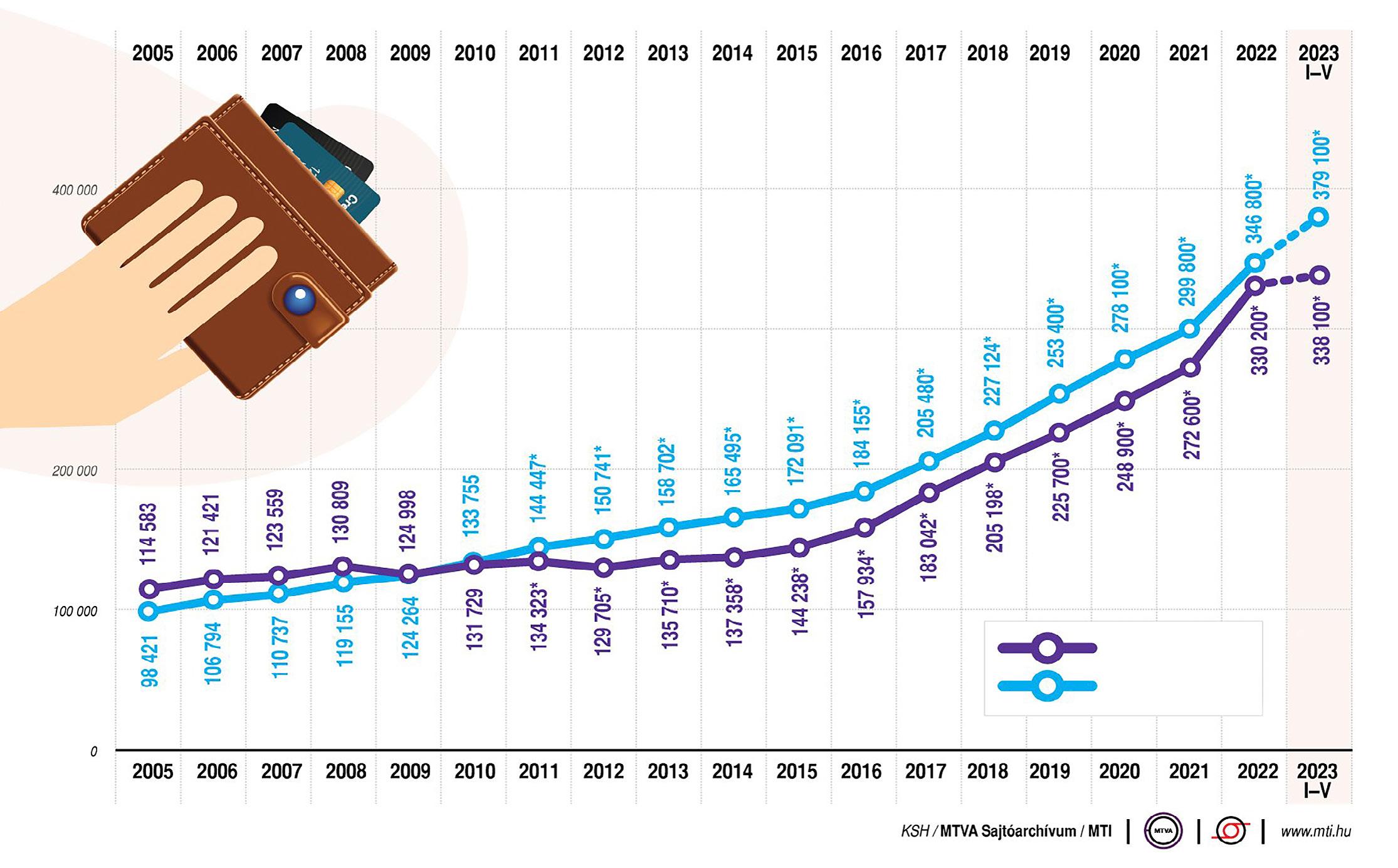

Change in Average Earnings in Hungary

2003-2023 (January-May)

Average monthly net earnings of full-time employees (excluding those on fostered public work schemes), HUF/month

For one, BNP Paribas released its revised forecast for the country, in which it emphasized the soft domestic demand.

Negative Growth

The report recalls that the Hungarian economy posted negative growth in the last three quarters. Real GDP fell by 0.3% on a quarterly basis in the first quarter, following -0.6% in Q4 2022 and -0.8% in Q3 2022. Domestic demand is losing momentum and is mainly responsible for this. Household consumption and destocking contributed negatively to GDP growth. By contrast, analysts at the bank write that net exports improved in Q1 but were insufficient to offset the weakening domestic demand.

They also mention that this year, Hungary may underperform compared to its neighbors in Central and Eastern Europe. Inflation, which is much higher in the region, will still impact negatively on growth, as wages have been rising more slowly than consumer prices since August 2022.

Furthermore, the level of interest rates is not favorable to demand for new loans. Besides, fiscal policy will provide relatively weak economic support, given consolidation efforts introduced since the summer of 2022. The authorities’ target is to reduce the budget deficit to 3.9% of GDP in 2023 and then to 2.9% in 2024, although, at first glance, this seems optimistic, particularly for 2023.

As a result of the above, prospects for an improvement in economic activity are weak in the short term. High-frequency indicators, such as industrial production, retail sales and the significant purchase intentions of households for the current and future period, have deteriorated in recent months. Production fell by

3.6%

on a yearly basis in April, after reaching -2.9% and -1% in previous months. The drop in retail sales was more pronounced (-12% year-on-year in April, -12.7% in March and -8.4% in February). Notably, industrial production and retail sales fell below their pre-COVID level in April.

The analysts also mention that Hungary has by far the highest inflation rate among countries in the European Union. In May, it stood at 21.5% y.o.y. compared with an average of 10-15% in the region.

In light of the above, BNP Paribas expects an economic decline of 0.2% rather than the 1.5% growth expected by the Hungarian government. According to analysts in France, there is a chance of a 3.1% GDP expansion in 2024, while the cabinet hopes for 4%.

Morgan Stanley also expects a GDP contraction, noting that the Hungarian economy is expected to show weak GDP growth in the second quarter of 2023, as both domestic and external demand will remain subdued.

www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023 1News • macroscope

ZSÓFIA CZIFRA

* Without discounts

Public sector Private sector Source:

Quiet Year in Real Estate Investment Market Expected Real Estate Matters

A quiet summer and a subdued year are predicted for the investment market by commentators, reflecting the cautious waitand-see strategy being adopted by investors toward Hungary and, indeed, the broader CEE region and Europe as a whole. This reflects the unstable geo-political environment and the resulting economic and financial uncertainty.

GARY J. MORRELL

“We are seeing a sharp downturn in activity and a longer period of ‘price discovery’ during which the expectations of sellers and buyers are not matching,” comments Benjamin Perez-Ellischewitz, principal at Avison Young Hungary.

“I don’t think we will witness a serious improvement in volume traded before the end of the year. We are going through a market correction in CEE and Hungary. Some deals are in discussions at a different price point than earlier, but the transactions are taking longer to materialize, and the attrition-stroke-failure rate is much higher than before due to the difficulty with regard to ‘price’ and the lack of debt finance,” he adds.

In this situation, vendors and investors are exercising caution in anticipation of more predictable yields and pricing levels. Earlier in summer, Colliers put prime Budapest office

yields at 5.75%, industrial at 6% and shopping centers at 6.5%. Office and shopping center yields are expected to move out, with industrial remaining constant. This provides a yield differential of around 100 basis points compared to Prague, where prime office yields stand at 5%, industrial at 4.75% and shopping centers at 5.75%.

Perez-Ellischewitz estimates that the market has already digested a move out of yields by 100

basis points on the prime segment and 200-300 basis points on anything less core.

“We have seen a significant price change with the outward shift of yields; in some cases, it is more drastic than in others, but, generally

speaking, the current market bodes well for opportunistic investors. This is a good time to buy, but not the best year to sell,” comments Máté Galambos, director of leasing at Atenor Hungary. The developer has office projects that are possibly available to investors.

“The fact that new foreign capital keeps showing up on our market is promising. I envisage multiple significant office transactions this year. Office yields are moving in the range of 6.5-8.5%, depending on the location, age, and technical features of the building,” he says.

Billion-euro Market?

Kevin Turpin, head of CEE at Colliers, estimates the CEE investment total for 2023 to be in the range of EUR 7 billion-10 bln. Hungary is expected to be between EUR 750 million-1 bln.

“Everybody is nervous as there are no deals. We expect a quiet summer and possibly a turn in the market in the fourth quarter of the year or the first quarter of 2024. A total investment of up to EUR 1 bln for the year would be a [plausable] figure,” comments Gábor Borbély, director of research and business development at CBRE Hungary. That pause provides opportunities for investment consultants to take an extended break and consider investment strategies for when the markets do pick up.

“Everybody is nervous as there are no deals. We expect a quiet summer and possibly a turn in the market in the fourth quarter of the year or the first quarter of 2024. A total investment of up to EUR 1 bln for the year would be a [plausable] figure.”

Perez-Ellischewitz considers that, realistically, the total volume in the Hungarian investment market will remain below EUR 400 mln if arm’s length transactions are accounted for.

“The major problems facing the investment market are, firstly, a lack of debt finance from senior banks and a lack of debt on the alternative debt market, and, secondly, the difficulty of pricing the risk in this period of uncertainty and deteriorating fundamentals,” he says.

Despite the dominance of domestic capital, he expects more transactions involving international money to materialize towards the end of the year and early 2024.

4 | 1 News www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

Estimated Q1 CEE Office Yield Prague 5.25% Warsaw 5.25% Bratislava 5.85% Budapest 6% Bucharest 6.75% Source:

A biweekly look at real estate issues in Hungary and the region

Colliers

The Green Court Office complex in Budapest. It was acquired by Groupama Gan REIM on behalf of French investor SCPI Affinités Pierre from Belgian developer Codic Hungary and its partners Picton Group and Pesti Házak for EUR 77.1 mln in late November 2022. It was one of the most recent significant office deals in Hungary.

Nagy and Zelensky Argue Over ‘Unacceptable’ Timing of Agri Ban Roundup Crisis Ukraine

Ukrainian President Volodymyr

Zelensky urged the European Union to follow through on lifting restrictions that have been placed on the import of certain agricultural products from Ukraine, which are set to expire on September 15, during his nightly address on July 24.

The European Commission introduced the ban on importing wheat, maize, rapeseed and sunflower seed from Ukraine on May 2, after unilateral restrictions had been imposed by neighboring member states, notably Hungary and Poland, in the weeks prior. Originally set to expire on June 5, the limits were then extended until September 15.

“Any [further] extension of the restrictions would be absolutely unacceptable and frankly anti-European,” Zelensky said. “We are in touch with all stakeholders to find a solution that suits everyone,” the president added in a message on Telegram after a meeting with government officials.

However, Hungarian Minister of Agriculture István Nagy called the September 15

expiration date for a ban on imports of Ukrainian grain to neighboring countries in the EU “unacceptable” at a meeting with his peers from Poland, Bulgaria, Romania and Slovakia in Warsaw on July 19.

Nagy said he and his peers insist that the EU extend the ban on the import of these agricultural products until at least December 31, adding that if it did not, Hungary “will use all means available to protect Hungarian farmers.”

For his part, Polish Prime Minister Mateusz Morawiecki has already indicated that Poland would refuse

to open its borders to Ukrainian grain even after the current expiration date of restrictions on September 15.

Continued Cooperation

Nagy added that the sides had signed an agreement “signaling that Hungary, Poland, Bulgaria, Romania and Slovakia will continue to cooperate on the matter of Ukrainian grain.” These countries neighboring Ukraine had initially introduced their own bans after an exemption from customs duties and quotas for Ukrainian grain, intended to expedite deliveries to countries in the Middle East and Africa and referred to as “Solidarity Lanes,” which caused a surplus in their domestic markets.

In a message on his Facebook page on July 25, reiterating the request that Brussels extend the ban until the end of the year, Nagy also referred to the importance of improving the operation of these so-called “Solidarity Lanes” and restoring their original purpose. Explaining that the cost of land transport was very high, Nagy said the EU should provide progressive financial support for transport costs that take into account the transport distance.

“This makes it possible to transport Ukrainian grain by land to European ports and from there on to where it is really needed. Otherwise, a situation could easily arise where products from Ukraine remain in Europe, crops produced in Europe become unsellable, and developing countries acquire their needs from Russia.”

“This makes it possible to transport Ukrainian grain by land to European ports and from there on to where it is really needed,” Nagy said. “Otherwise, a situation could easily arise where products from Ukraine remain in Europe,

crops produced in Europe become unsellable, and developing countries acquire their needs from Russia,” the Hungarian minister concluded.

Meanwhile, the ratification of Sweden’s bid to join the North Atlantic Treaty Organization (NATO), which had been agreed to by holdouts Hungary and Turkey at the NATO Summit in Vilnius, Lithuania, earlier this month, will likely take place in the fall.

Zsolt Németh, chairman of the Foreign Affairs Committee of Hungary’s Parliament, told Inforádió on July 13

that an extraordinary parliament session would not be required to approve the decision, which would instead be discussed when parliament reconvened for its regular autumn session in mid-September.

Additionally, Turkey’s Parliament decided on July 15 to keep the country’s foreign affairs committee on standby, thus enabling it to carry out work during the summer recess, which lasts until October 1, and speed up its own ratification process of Sweden’s membership in NATO.

1 News | 5 www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

NICHOLAS PONGRATZ

In this file photo from July 7, Minister of Agriculture István Nagy (left) speaks with Tamás Iván, president of the Association of Hungarian Entrepreneurs in Slovakia, at a forum called “Treasures of the Hungarian Countryside” in the Martos Free University, now in Slovakia, but once Upper Hungary. Nagy has since vowed to use “any means necessary” to protect Hungary’s farmers. Photo by Csaba Krizsan / MTI.

New CEO to Lead Penny Hungary

A new head took over as the CEO of Penny Hungary on July 1. Mathias Mentrop was previously the chief operating officer of the Penny network in the Czech Republic. He replaced Florian Jens Naegele, who has moved to Prague as CEO of the operation there. Jens Krieger, the previous boss of Penny Czech Republic, is continuing his career with the parent Rewe Group in Germany.

Hungarian business. We couldn’t be in a better position, and I feel privileged to be able to take our company forward from here,” Mentrop added.

When Naegele took over Penny in Hungary, the discount chain had an FMCG market share of 8.1%, 215 stores, and around 3,800 employees. That has since grown to 229 stores, nearly 5,000 employees, and a market share of almost 10.7% in Hungary.

AutoWallis Strengthens Ranks With Group HR Director

corporate governance, business ethics, and transparency working groups. The next major milestone in his career was at Transparency International, where he undertook the development of private sector and public procurement programs. After several years of successful research, he was asked to join the organization’s headquarters in Berlin, where he was responsible for the technical management of the legal aid service, which operates in 120 countries.

WTS Klient, Finacont to Merge

The owners of two leading Hungarian entities in the local accounting and tax advisory market, WTS Klient Business Advisory Ltd. and Finacont Ltd., will merge their activities and staff into one company under joint management.

The relevant legal documents were signed in June; the final seal of approval will be put on the agreement later this summer once the necessary licenses have been received.

Mentrop joined Rewe Group in 2012 as sales director for Penny Bulgaria, with more than 10 years of retail experience. From 2015, he was the sales director of Penny in the Czech Republic, and from 2018, he was its COO, where his primary responsibilities included sales, construction, and retail chain expansion.

Naegele became CEO of the Hungarian business in 2018 after five years as regional director of Penny Bavaria.

“Running a Hungarian business was one of the biggest opportunities of my career. We had a great team of experts and worked hard to shape Penny in the right direction,” said Naegele.

“I am confident that Penny is on track to further increase its market share in Hungary. We improved the customer experience and choice while offering more opportunities for our Hungarian suppliers,” he added.

Since June, a group HR director has been managing the human resource activities of AutoWallis Group. The new position was filled by Aranka Erdélyi, who has extensive experience in the automotive industry; her tasks will include supporting AutoWallis’s organization development, providing strategic support to the CEO in organizational issues, keeping the group’s HR strategy up to date, regional organization development, succession planning, and recruitment.

On his return to Budapest, he continued in a family business: he took over the management of Fruccola restaurants. It also developed a network of automated restaurants, using a unique mobile app to serve food in several office buildings. Sadly, this project could not survive in the face of the spread of home office that became established during the coronavirus epidemic.

WTS Klient and Finacont, established in 1998 and 2002, respectively, have grown organically over the past 20 years to number among Hungary’s leading providers of complex business advisory services. The merger of the two companies will make the entity, continuing as WTS Klient, one of the largest players on the market, according to a press release sent to the Budapest Business Journal

Initially set up as an accounting firm in 1998, Klient established its tax consulting division in 2004. It joined WTS Global, a leading global tax and financial advisory network, in 2013. According to 2022 figures, WTS Klient has a staff of 130 and generates annual sales revenue of more than HUF 2 billion.

Mentrop said, “Mr. Naegele leaves behind a Hungarian business built on strong foundations, and I look forward to continuing the work where he and his team left off. I worked for almost eight years at Penny in the Czech Republic, which belongs to the largest of the Penny networks. I gained a lot of experience in the field of improvement and expansion of our stores, and I would like to use this experience in the development of the

The creation of the position became necessary because the number of staff employed by AutoWallis Group’s subsidiaries, now present in 15 countries in the region, has seen substantial growth due to the acquisitions of recent years and is now nearing 1,000 employees.

Erdélyi arrived at AutoWallis from a multinational environment: She worked as the HR manager of Caterpillar Hungary Zrt. since 2021. Before that, she spent 10 years (2011-2020) as the regional HR manager for Central and Eastern Europe and Ukraine at Nissan Sales CEE Kft. She has also worked in HR in retail and the financial sector.

She obtained her marketing degree from Szent István University in 2000, after which she completed the Human Resources Management training program run by Budapest Corvinus University in 2011.

Wolt Announces New Business Unit in Hungary

Wolt has announced the launch of its new business unit Wolt Drive in Hungary, appointing Péter Tausz as its head.

Tausz holds a law degree from the University of Szeged and worked at the American Chamber of Commerce in Hungary, where he coordinated the

Tausz’ mission is to bring the Wolt and Doordash product, which is present in almost every country in the world, to a broader audience in Hungary as quickly as possible. Wolt Drive offers delivery within one hour for webshops and retailers. Online merchants who integrate Wolt Drive as a delivery option can deliver the products ordered to their customers in the shortest possible time with the help of Wolt courier partners.

“I am a great believer in the success of Wolt Drive, mostly because we have an incredibly professional team to work with, one of the largest fleets in the country, one of the most innovative and customer-friendly logistics systems in the world, and one of the best customer service teams,” says Tausz. “And with market demand constantly growing in line with international trends, we have a huge opportunity on our hands,” he adds.

Wolt regional managing director Ákos Tajta says, “Wolt, which has been present in Hungary for five years now, has grown tremendously in all directions since its launch: not only has the number of active courier partners increased from a few dozen to more than 7,000, our service area has expanded significantly, and by the end of this year we will be present in almost 60 additional municipalities in addition to Budapest.”

He continued, “The types of services we offer have also changed. Wolt is now far from being just a food delivery company; the launch of Wolt Drive in Hungary is an integral part of this development. I am confident that, under Péter’s leadership, this business will be at the forefront of Wolt’s operations in the same way as many of our other areas.”

Also founded by Hungarian individuals in 2002, by 2022, Finacont’s sales revenue was close to HUF 1.7 bln, and the number of employees exceeded 140.

“We are delighted that the merger of WTS Klient and Finacont will strengthen our market position, and together we can intensify our efforts to consolidate the accounting and tax advisory market and tackle the inevitable technological developments,” said Zoltán Lambert, managing partner of WTS Klient.

“The almost identical philosophy of the two companies ensures we can continue to enjoy the trust of both our clients and our employees and continue to provide premium services in the future,” Lambert said.

György Pintér, the managing partner of Finacont, commented, “During the negotiations over the past few months, we have made sure that by combining our resources, we can take another major step towards our basic goal of creating a dominant accounting services company in the Hungarian market, providing extensive and integrated quality services to our clients. Taking into account the organic development in 2023, the merger will call to life a company with nearly 300 employees and sales revenue in excess of HUF 4.5 bln.”

6 | 1 News www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Mathias Mentrop

Florian Jens Naegele

Aranka Erdélyi

Péter Tausz

György Pintér (left) and Zoltán Lambert

Photo by Valter Berecz.

Orbán: Gov’t Aims to Double GDP by 2030

The government’s goal is to double the size of Hungary’s GDP from HUF 80 trillion to HUF 160 tln by 2030, Prime Minister Viktor Orbán said in a speech delivered at the Bálványos Summer University in Băile Tușnad, Romania, on July 22, according to state news agency MTI.

Orbán noted that Hungary’s GDP had tripled from HUF 27 tln in the 13 years since his party, Fidesz, had returned to power. Hungary’s level of development

Varga: Inflation in Single Digits This Year

Hungary’s annual inflation will slow to 7-8% by December from 20.1% in June, helping the economy rebound, Minister of Finance Mihály Varga told international news wire Reuters, adding that no further measures were needed to contain the budget deficit for now. Prime Minister Viktor Orbán’s government is struggling with the highest inflation in the European Union, a cost-of-living squeeze that has eroded household purchasing power and slammed the brakes on consumption. In the interview, Varga said curbing inflation was also crucial to containing the deficit, which has seen energy subsidies, pension and debt service costs surge, widening the cash-flow-based gap to about 85% of the target by the end of June. “By December for sure, but if we are lucky, inflation will be below 10% already in November. I can say that inflation will be around 7-8% by December,” Varga said.

Justice Minister Tells EC Hungary has ‘Fully Delivered’ on Commitments

Minister of Justice Judit Varga has written a letter to European Commissioner for Justice Didier Reynders informing him that Hungary has “fully delivered” on commitments related to judicial milestones. Varga said in a post on Facebook that Hungary had adopted a package of legislation on the judiciary in May, and those pledges had been “implemented in practice.” She called on Brussels to pay the EU

in Brief News

He added that the government is seeking to reduce Hungary’s degree of energy dependency from 28% to zero by 2030 with the expansion of the Paks nuclear power plant along with solar power investments and network upgrades.

Orbán acknowledged the impact of the war in Ukraine on Hungary’s path of economic development but augured a turnaround “around July 2024,” with “significant” GDP growth, “strong” lending and a return to a path of development “well over” the EU average.

While real wages fell in H1, they are set to rise for the full year as inflation falls, Orbán said. Lending rates will “normalize and return to an acceptable level” by Q2 2024 “at the earliest,” he added.

funds to which Hungarians “are entitled.” Payouts of Hungary’s EU funding have been suspended pending the implementation of remedial measures earlier defined in “super milestones.”

Number of Police Recruits Falling

This year, only 470 young people applied to the two-year technical schools for police officers, down from more than 3,000 a few years ago, according to hrportal.hu. Roughly 1,000 began the other route into the force, the 10-month patrol training period. Far fewer people will complete that, as some change their minds or do not meet the eligibility criteria, so only about 800 police officers graduate from secondary schools every year. Many of these young people are laid off or resign due to heavy workloads or low wages. According to the data, 779 people graduated from technical school and patrol training in 2021 and 732 in 2022.

Hungary Drifting Closer to Leaving EU, Says Former Central Banker

Hungary has drifted closer to a scenario of potentially leaving the European Union, a former National Bank of Hungary governor has warned, according to Bloomberg News. András Simor, who helped steer Hungary through the financial crisis when it required an International Monetary Fund-led bailout, said an exit from the bloc is not the most likely scenario, but “it is a possible one. Its probability, if it was 10% last year, has now risen to 20-30%,” he told ATV television on July 23. “I’m afraid that Hungary’s

stood at 78% of the European Union average in 2022, up from 66% in 2010, and the government aims to raise that ratio to 85-90% by 2030, the PM said.

government will maneuver the country into a situation where an exit from the European Union becomes a real alternative,” said Simor, a fierce critic of Prime Minister Viktor Orbán.

Gov’t Allocates HUF 112.2 bln for Debrecen Development

The central government has allocated HUF 112.2 billion for developments in Debrecen (225 km east of Budapest), Hungary’s second-largest city, Mayor László Papp said on July 20, according to telex.hu. Much of the resources will be used for transport developments, including constructing a logistics base, complete with a tax and customs office, to serve lorry traffic generated by the BMW plant under construction in the city, Papp said. He added that the government decision would allow several projects shelved for fiscal reasons last fall to move forward. Papp noted that Debrecen was earlier allocated HUF 175.5 bln in central government monies for waterworks and railway developments.

Hungary 4th Largest Exporter of Game in EU

Hungary is the fourth-largest exporter of game meat in the European Union, after Poland, Germany and Spain, according to a publication compiled by the National Agriculture Chamber (NAK), writes novekedes.hu [Growth]. According to the publication, around 3,800 tonnes of game is processed in Hungary each year, and close to 90% of that is exported, mainly to Germany and Italy. Some 46 Hungarian companies trade in game.

Hungary Takes Delivery of 2 Airbus Helicopters

The Hungarian Defense Forces took delivery of the first two of 16 new Airbus H225M helicopters in Szolnok (105 km southeast of Budapest) on July 24, according to novekedes.hu [Growth]. The aircraft, configured as troop transport helicopters, arrived from the Airbus Helicopters plant in Marignane, France.

The helicopters were officially handed over at Szolnok Airbase by Bruno Even, CEO of Airbus Helicopters. The firm inaugurated a parts plant in Hungary a year ago.

1 News | 7 www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

Minister of Defence Kristóf Szalay-Bobrovniczky delivers a speech at the ceremonial handover of the first two Airbus H225M helicopters to the Hungarian Defence Forces at the József Kiss 86th Helicopter Brigade in Szolnok, Hungary.

BBJ STAFF

Photo by János Mészáros / MTI.

Image by David Carillet /Shutterstock.com

Business

György Surányi: Huge Losses at MNB are down to ‘Indefensible’ Policies

According to a study released in June, the National Bank of Hungary (MNB) is set to post losses of up to HUF 2 trillion-2.4 tln (EUR 5.3 billion-6.4 bln) this year. That is the equivalent of 2.5% of GDP or half the cost of the Paks II nuclear power station project, weekly HVG wrote last month.

György Surányi, former MNB governor (1990-91 and 1995-2001), former chairman of CIB Bank and CEE regional head of Intesa Sanpaolo, and now professor of finance at Corvinus University, deemed “at least two-thirds of these central bank losses” to be the result of “mismanaged,” “indefensible” and “crazy” economic and monetary policies when speaking to foreign journalists on July 19.

Perhaps surprisingly to the non-expert, Surányi initially stressed that loss or profit at a central bank does not indicate a mismanaged or well-run institution.

“I have several examples of central banks making losses; however, the monetary policy was [...] excellent,” he said, pointing to the West German Bundesbank in the

1960-70s

and, more recently, the Czech National Bank.

The Bundesbank, for example, facing massive inflows of U.S. dollars, was forced to sell Deutschmarks to avoid abrupt (and damaging) appreciation of the national currency.

“When the Bundesbank was buying up tremendous amounts of dollars, […] it created tremendous losses because the value of the assets, namely the dollar, was depreciating, whereas the liabilities, in German marks, were increasing,” he said. However, the Bundesbank earned praise for maintaining price stability.

Currency Appreciation

The Czech central bank has acted similarly in recent years, selling koruna to buy euros to manage the appreciation of its currency, sometimes incurring “massive” losses. However, apart from the last 18 months, where there has been a takeoff of inflation everywhere, the Czech Republic has maintained price stability for the past 15 years, Surányi stressed. “So that’s why losses in themselves do not [judge] monetary policy positively or negatively.”

So, what about Hungary?

“The situation here is a bit different. It is different because the root causes of these losses, I mean at least twothirds of these losses, are attached to the mismanaged macroeconomic policies,” he intoned.

In an otherwise complex nutshell, Surányi argues that Hungary pumped far too much money into the economy, for longer than was justified and often to the wrong players, in the name of stimulating growth while “unprofessionally” ignoring the risks to the forint exchange rate of rising inflation (see separate box).

When world energy prices suddenly rose last year, the market confidence in Hungary’s fragile state evaporated, and the forint plunged to HUF 430 and more to the euro, propelling the country to the top of the European inflation league.

In particular, Surányi points to the “Lending for Growth” and later “Bonds for Growth” schemes as fundamental elements of the problem. Interestingly, with the credit supply dwindling in the early 2010s, he was initially an advocate of lending.

‘Absolutely Acceptable’

“In the post-financial crisis period from 2009 to 2015, the credit stock in Hungary was contracting each and every year. Under these conditions, it was absolutely acceptable for the central bank to facilitate credit growth; therefore, I myself also welcomed its implementation,” he said. However, the MNB put this facility on the table at a fixed zero interest rate for 10 years.

“It’s an unprecedented, open, unhedged interest rate position within the central bank balance sheet, which means, the higher the inflation, the higher the transfers towards the borrowers, and the higher the central bank losses,” he said.

Thus, this policy turned to bite the providers once inflation started to accelerate last year, and the MNB was forced to move the base rate up to 18%

to defend the forint.

“Professionally, it was a dramatic mistake not to provide this facility on a floating basis,” Surányi argues. He says the introduction of the growth bond facility in 2019 was even less justified: the economy was already growing at more than 5%, and credit growth was up to 17% per annum. Citing an article in the economic weekly HVG, Surányi said, “Roughly 60% of this facility was directed towards the cronies of the government.”

Politicians, Central Bankers: Ignore the Exchange Rate at Your Peril

In the fall of 2016, with the pound sterling under pressure as a result of the Brexit vote, David Willets, an economist formerly with the U.K. Treasury, wrote in the Financial Times: “Governments that start with no commitment to the value of [their] currency often end up caring when it keeps falling.”

It seems no one at József Nádor tér or in Bank utca read that particular FT. If they did, they ignored it.

As György Surányi scathingly notes: “The fall of the currency last year, primarily in the second half of last year, was the consequence of a coordinated, foolish exchange rate policy of the government and central bank. For years, they declared publicly that they didn’t care about the exchange rate of the forint. In the case of a small, open economy, one should not say such a sentence.”

The former MNB governor admits that if a central bank adopts an inflation-targeting system, there can be no direct, explicit exchange rate target, “but to say that we don’t care about the exchange rate is crazy.”

As a result of the high fiscal deficits, poor targeting of subsidies, and a policy of having a weak forint, when world energy prices surged last year, the forint went into free fall.

“So, then they [the government and central bank team] were frightened. They understood that this was an incredibly dangerous game, what they were doing with the currency. That’s why […] the central bank was explicitly forced to increase the reference rate by 500 basis points, from 13% to 18%” to (successfully) stabilize the currency, he argues.

But with the central bank offering short-term interest rates of 18%, commercial banks, awash with deposits on which they pay little or no interest, can make huge profits at no risk.

Since a large proportion of government and central bank largesse from 2013 onwards went to “government cronies” who in turn, rather than spend on high productive investments, put much of the cash into bank deposits, there is “at least HUF 11,000 billion in excess liquidity

deposited by the commercial banks with the central bank, on which the commercial banks are makingwindfall profits,” Surányi says.

Part of this windfall profit is taken through the HUF 250 billion sectoral “excess profit tax” imposed on the banks by the government, but, he argues, this still leaves the recipients of all this funding as the ultimate winners, and the ordinary taxpayer as the ultimate losers in this exercise.

Even as this issue of the BBJ paper went to press, the matter seemed far from clear to those in charge. While both Minister of Finance Mihály Varga and the MNB now vociferously advocate the importance of a stable exchange rate, Minister of Economic Development (and former MNB deputy governor) Márton Nagy appeared committed to his earlier views, saying: “Every public reference to the exchange rate level by economic policymakers is extremely harmful,” as it should be left to the market to determine the exchange rate.

KESTER EDDY www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023 2

György Surányi, former MNB governor, former chairman of CIB Bank, and now professor of finance at Corvinus University.

Europe’s Worrisome Declining Relative Competitiveness

Finance Matters

A monthly look at financial issues in Hungary and the region

2023 EU Competitiveness Rankings

an economy’s productivity level, wealth creation, job creation, capture and return of investment, economic growth and social welfare.”

What Stats?

Many stats are often used to describe competitiveness; here are some of the most popular.

competitiveness among European countries. See the chart below, noting that lower scores mean higher competitiveness.

Explaining the Decline

This article breaks down the subject of Europe’s declining relative competitiveness into four areas:

1) how to define competitiveness?

2) what statistics might be used, and what do they actually show?

3) what might explain this decline? and, finally,

4) what is the prognosis for the future, and how might this decline be reversed?

Defining Competitiveness

There is no standard definition of competitiveness. In researching this article, I came across quite a few. The one I liked best was, “Competitiveness, at regional and/or country level, is based on the ability to compete in the global market. It can be understood as a set of institutions, policies and factors embedded in networks of innovation and entrepreneurship, able to determine

The Global Competitiveness Score (GCI), as calculated by the World Economic Forum, declined from 70.9 in 2011 to 66.8 in 2020.

GDP growth over a more extended period is an indication of competitiveness. According to the World Bank, GDP growth from 2011-2020 was as follows: • Eurozone: 0.8%, • US: 2.1%, • China: 6.6%

The Global Innovation Index (GII) overall ranking for Europe decreased from 58.9 in 2010 to 54.7 in 2021 (although Switzerland, Sweden and Germany scored well).

Startup activity: In 2020, there was USD 149.2 billion investment into U.S. startups, USD 67.9 bln in China, and only USD 42.8 bln in Europe. Europe significantly lags in the number of unicorns (startups that reach a market capitalization of more than USD 1 bln).

It is interesting to note that there are some fairly broad variations of

The reason perhaps most often given for declining European competitiveness is the decreasing participation of Europe in global value chains (GVCs). This seems to be mainly at the expense of China’s increase. Furthermore, China’s vertical integration seems to be diminishing Europe’s ability to export into China. In many areas, such as automobiles, China has moved from merely supplying inputs to a fully finished product.

Here’s one amazing statistic: the number of graduates in STEM (science, technology, engineering and mathematics) subjects in China equals those in Europe, the United States and Japan combined.

A 2023 document by the European Commission comes to some pretty serious conclusions.

“Since the mid-1990s, the average productivity growth in the EU has been weaker than in other major economies, leading to an increasing gap in productivity levels. Demographic change adds further strains. Analyses show that the EU is also not at par with other parts of the world in some transversal technologies, trailing in all three dimensions of innovation, production and adoption and losing out on the latest technological developments that enable future growth.”

Future Prognosis

The same document by the EC is optimistic that Europe’s relative competitiveness may begin to improve after 2030. Is this well-founded? The factors listed in the previous paragraph are hard to reverse, and the report is thin on specifics. Moreover, much of its strategy relies on deeper European integration (deepening and broadening the Single Market, creating a unified capital market, and so on). This may well happen, but it is a politically fraught exercise.

Meanwhile, we continue to read about examples where China eats European

market share for breakfast. PwC, for example, recently forecast that due to China’s advances in electric vehicles and the increasing market share of EVs, Europe may become a net importer of cars by 2025.

It is true that the purchasing power of the European market is vast and that Europe has an excellent competition policy. In my opinion, these are necessary but insufficient conditions for competitiveness. There are both topdown and bottom-up requirements to improve competitiveness.

The top-down element involves the EU and governments enabling education, capital markets, legislative framework, and so on.

The bottom-up element involves entrepreneurs creating winning innovation-based strategies accompanied by superb productivity gains and execution, a kind of industry-by-industry trench warfare to claw back market share. I do not see adequate discussion of the latter in the EC’s document; hence, I cannot share the commission’s optimism about a post-2030 renaissance of competitiveness. (Meanwhile, Europe could lose its car industry by 2025.)

Unfortunately, if Europe’s relative competitiveness with China improves over the decade, it is likelier this would be due to a slowing of or implosion by China (see my earlier article “Are we now Seeing Peak Russia and Peak China?” in the November 7, 2022 issue), than a dramatic improvement in European competitiveness.

Les Nemethy is CEO of EuroPhoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www. businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

2 Business | 9 www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

Gross Domestic Product growth (hence wealth creation and improved living standards) is impossible without competitiveness. That makes the European track record on competitiveness a genuine cause for concern, warns Finance Matters columnist Les Nemethy.

Image by Photon photo / Shutterstock.com

Challenger Yettel Says it is ‘Bolder and Braver’ Than Competitors

In his first interview with the Hungarian media, Nemanja Zilovic, chief commercial officer of Yettel Hungary, talks with the Budapest Business Journal about the local market experience, trends, market opportunities, and sustainable trading.

BBJ: What market opportunities do you see for Yettel Hungary?

BBJ: You came to Hungary from Yettel Serbia. How have you found the local market? Are there any obvious differences beyond language?

Nemanja Zilovic: Yettel in Serbia is the market-leading telecommunications company focused on maintaining that position, supporting steady overall market growth. In Hungary, Yettel is a challenger with room to grow its market share. To do this, we can be bolder and braver and challenge the whole market with our services and customer-centric approach. Customers in all markets have similar needs, but they do have significantly different habits and relationships with our industry. Consequently, I have taken it upon myself to learn as much as possible about Hungary’s people, culture, customs, and language.

Wizz

opportunity would like to participate in it commercially and/or increase their role in the sector. There is a kind of consolidation going on in the market, and presumably, it is not over yet. The strengthening, expansion and broadening of the range of services of 4iG has no significant impact on our strategy since we have been living with a very similar competitor for many years on the domestic market. We will continue to focus on solutions based on mobile technology in the future and distinguish ourselves in these.

BBJ: What are Yettel Hungary’s ESG targets? Will you hit them?

NZ: We are the only telecommunications service provider in Hungary that focuses on mobile technology and offer mobile and home services based on it at a higher quality than many wired internet solutions. Our largescale network modernization project is already bringing 5G to many customers and significantly increasing the capacity of 4G, which has national coverage of more than 99%. On the frequency that provides the real benefits of 5G (3600+ MHz), Yettel has the largest contiguous block in Hungary, which offers our customers exceptional access speeds. Based on this network, we were able to launch Yettel TV recently and a home internet solution challenging established players in that domain. Additionally, the whole industry’s future is in the

digitalization of products and channels, and I expect Yettel to lead the way in Hungary in digital transformation.

BBJ: What are the market trends? Do you expect any further acquisitions or consolidation?

NZ: The mobile traffic measured on Yettel’s network is growing by roughly 30% every year. People’s hunger for data is, therefore, constantly increasing; I don’t think this will change in the near future. Telecommunications is a robust and crisis-resistant industry, and I think it is natural that anyone who has the

NZ: Yettel’s ESG strategy is based on four pillars, within which we have formulated a total of 18 goals, from the benefits from the development of 5G networks to digital education and transparent operation. All of these are in different phases, but I can tell you that we are on schedule in all of them. Currently, the environment is the most noticeable to the outside world, including the collection of used devices. Left lying in drawers, they can be dangerous on the one hand, and on the other hand, by reusing or recycling them, we can do a lot for a sustainable mobile ecosystem. We have undertaken to collect at least 20 tonnes of used phones in the years ahead. From market research, we see that the awareness of the Hungarian population can still be improved in this area, so we recently launched a serious educational campaign and, of course, a commercial campaign offering a discount for the return of an old phone; it has only been running for a few weeks, and so far, we see the initiative as an absolute success.

Air Takes Cabin Crew Training ‘to the Next Level’

Students who complete the six-week flight attendant training program at Wizz Air will receive a certificate that will help them find work at any airline operating in any EU state, the company says.

have completed its training.

“We are delighted that we can now directly award our airline cabin crew trainees with their well-deserved certificates. In Hungary, Wizz Air is the first airline that can cover the entire training process, from instruction, through examination, to documentation,” says Zsuzsa Trubek, communications manager of Wizz Air.

“It is an honor for us, and we are confident that our training will become even more popular,” she adds.

Low-cost carrier Wizz Air, whose first flight was in May 2004, has all but become the national flag carrier since the Malév Hungarian Airlines went bankrupt in February 2012.

It has now announced that it is entitled to issue flight attendant basic training certificates in Hungary to students who

That makes Wizz Air the first airline in the country whose training organization can issue this type of international document on behalf of the Hungarian Aviation Authority (MLH). The airline assures participants, “Those who complete the training at Wizz Air will be able to work in all EU member states with their certificate.”

Since 2021, roughly 1,500 people have completed the six-week flight attendant training each year at Wizz Air’s training center in Hungary. While women have traditionally taken the majority of flight attendant roles across the industry, Wizz says the proportion of men among its participants has increased recently: they currently make up approximately 35% of the students.

Essential Requirements

Those who complete their training with Wizz Air and would like to continue their career with the airline must meet a few

essential basic requirements. Apart from obvious criteria such as participants needing to be at least 18 years

of age, with a high school diploma and a clean background check, others are more specific to the role.

Participants must display a friendly and customer-oriented personality, speak and write English fluently, have no tattoos or piercings on parts of the body that are visible when wearing a uniform, must be able to swim, and must have an arm reach of at least 210 cm (6 ft. 10 inches)

when standing on tiptoe. The airline also warns that those who wear glasses or contact lenses with a prescription above +4 or below -4 are “unlikely to pass the mandatory medical examination.”

According to a statement shared with the Budapest Business Journal by Wizz Air, “Flight attendants with Wizz Air are guaranteed a competitive salary, a favorable monthly schedule and many professional development opportunities, including becoming an instructor or brand ambassador, or joining the company’s ‘Cabin Crew to Captain’ program, which offers the chance to realize their dreams as a pilot.”

Other perks include “ongoing and guaranteed” flight tickets and discounts for private use, as well as for family and friends, and a promise that there are no layovers, meaning there is an “opportunity to lead a normal life in your home town.” For those interested in learning more, Wizz Air will host its the next recruitment days in Budapest on August 4 and 23 at 9 a.m. at the Hilton Garden Inn Budapest, Lázár u. 11-13.

For more business detail on Wizz Air, see “Wizz Air Faces Challenging Post-COVID Ascent” on page 19.

10 | 2 Business www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

ROBIN MARSHALL

LUCA ALBERT

Yettel Hungary CCO Nemanja Zilovic.

Denso Gears up to Tackle Shift to Electrification Head-on

Automotive Matters

Denso is one of the more than 200 Japanese firms that operate in Hungary, and also happens to be the world’s thirdlargest automotive supplier with a presence in 35 countries. The company set up shop in Székesfehérvár (a city 100 km west of Budapest by road) back in 1997 and has been continuously investing ever since. For 2014-2024 alone, some EUR 220 million has been earmarked for that purpose.

The latest waves of investment focus on one particular factor, namely preparations to meet rising customer demand for electrification. Denso already has three decades of expertise in the segment, but it wasn’t until recently that things came to a head, and a strategic shift from internal combustion engines (ICEs) became a necessity.

The Hungarian factory is the company’s exclusive producer of power transmission items in Europe and one of the largest under-one-roof manufacturing cells within the group. Among its customers, leading OEMs such as Audi, GM, Toyota, VW Group and Volvo are served from Székesfehérvár by more than 4,700 staff.

Denso’s latest announcement in midJune concerned installing three new production lines worth EUR 64.4 mln to manufacture inverters for electric and plug-in hybrid electric vehicles. Hungary already ranks 14th in terms of inverter exports; that position is set to improve as a result of this project.

“Ever since Denso Manufacturing Hungary was set up, we have been striving to establish a product portfolio that allows us to remain competitive. The current paradigm shift in automotive has a huge impact on the industry, so we have been consciously monitoring market opportunities by applying a strategic approach,” the company says.

Fierce Competition

Vice president Attila Szincsák stressed the importance of making the operation future-proof.

“We are witnessing the largest technology change in a century, and this investment

is a response to this tech challenge,” he notes. “Another key aspect is to continue to maintain jobs and remain a reliable cooperative partner of the city of Székesfehérvár as well as take part in Hungary’s development.”

A diversified product portfolio is critical to making that happen, as it has allowed Denso’s Hungarian site to be a stable manufacturing hub, and that promises further investments.

Denso’s FDI activity showcases the government’s overall economic strategy, which aims to turn Hungary into a powerhouse of electrification. According to Minister of Foreign Affairs and Trade Péter Szijjártó, adapting to the automotive transition is essential to maintaining growth. A fierce race is on since everybody is aware that those countries that can attract electric automotive investments will be strong in the future and remain on a growth path.

The rapid development of the industry bears witness to the fact that the country has a positive appeal in this regard: production value grew by a factor of 3.5 in the past 12 years and hit a record level of HUF 12 trillion, with some 90% of products exported. Growth is significantly attributed to battery-related projects. To put their significance into perspective, it must be noted that although Hungary ranks

only 95th in the world in terms of population size, it is fourth when it comes to battery manufacturing; upon completion of ongoing developments, it should advance to second place.

Reskilling is Vital

The transition also means jobs will be affected. Many fear that major layoffs could take place since manufacturing EVs requires fewer components than vehicles powered by an ICE. However, an analysis by Boston Consulting

Group (BCG) found that although 930,000 auto manufacturing and supplier jobs will disappear in Europe by 2030 with the introduction of EVs, another 895,000 new jobs will be added.

So, the transition to electrification will be “a net job wash,” BCG says. Denso’s example gives a clear indication that there is room for positivity: its recently announced investment, scheduled to be completed by the end of 2024, will create up to 55 jobs.

What is absolutely certain is that planning has become more critical than ever, and part of that process is to equip staff with the skills required to perform tasks that change due to electrification. Denso places considerable emphasis on knowledge transfer within the organization so that employees can master knowledge that enables them to implement further developments and elevate manufacturing to the next level.

Reskilling is vital, and Denso says it is up for the challenge. It remains to be seen to what extent other market players follow suit, for a total of 158,000 people are employed in the automotive sector.

Denso, for its part, has done its homework and looks forward to entering a new electrified era, as evidenced by a company statement it put out, according to which it “awaits the upcoming challenges in automotive well-prepared, and it has also set up the base for eventual further expansion.”

2 Business | 11 www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

BBJ STAFF

The automotive sector in Hungary is being forced to adapt to the paradigm shift of electrification. Japanese-owned Denso offers an excellent example of how to do it.

A monthly look at automotive issues in Hungary and the region

Photo

by T. Schneider / Shutterstock.com

“Ever since Denso Manufacturing Hungary was set up, we have been striving to establish a product portfolio that allows us to remain competitive. The current paradigm shift in automotive has a huge impact on the industry, so we have been consciously monitoring market opportunities by applying a strategic approach,”

‘More Aggressive’ AlphaTauri Welcomes

‘Extraordinary’ Sponsor Orlen

Japanese F1 driver Yuki

Tsunoda and Scuderia

AlphaTauri

team boss Franz Tost shared their thoughts regarding racing at the highest level, the importance of sponsors, and the departure of Nyck de Vries at an exclusive press conference ahead of the Hungarian Grand Prix.

The 38th Hungarian Grand Prix of Formula 1 was held at the Hungaroring in Mogyoród (just 24 km northeast of Budapest by road) on July 23. As preparations for the race were well underway to accommodate the thousands of fans arriving for the spectacle, the Budapest Business Journal had the opportunity to meet up with the representatives of the racing team and sponsor Orlen S.A. at one of the latter’s refueling stations on the outskirts of Gödöllő, a few kilometers from the track.

The multinational oil refiner and petrol retailer headquartered in Płock, Poland, joined AlphaTauri’s roster of sponsors this year. Accordingly, the team’s cars now have an upgraded livery with red joining its traditional navy blue and white colors.

Tsunoda jokingly noted that the change in livery suits the team as red is a striking color, which makes the car look “more aggressive” and immediately recognizable in the rearview mirror.

“To have such a partner like Orlen is extraordinary. It is very important for

every team, and we have a very, very close collaboration with Orlen,” the Austrian Tost said. He added that he was also impressed with the refueling station, which served as the event venue.

Asked why the oil company had chosen AlphaTauri, the junior Red Bull team, to sponsor, Jaroslaw Szeliga, managing director of Orlen Hungary, was full of praise for the Scuderia.

“One of the reasons is that it is a really dynamic team with recognized drivers, and we were looking for a long-term partnership. It is one of the best teams in the world,” Szeliga said. He added that fans of the sport would not only encounter the Orlen logo on the car but “everywhere,” and not only at the Hungaroring, as the company is also present in several marketing materials.

Return of Ricciardo

AlphaTauri arrived at the Hungaroring after a shakeup in its pilot lineup, with star driver Australian Daniel Ricciardo sacked by McLaren at the end of the last season but picked up as a reserve driver by Red Bull, taking the second car from Nyck de Vries.

“I had an enjoyable time over the past 10 races with Nyck. I learned from him, and we also had a good time away from the track. He had plenty of experience in other categories and gave the team good feedback based on his knowledge. He had the pace, and, as a friend, I enjoyed my time with him,” Tsunoda remarked. Tost also weighed in, noting that while the recently dropped Dutchman had a lot of experience in racing

series like Formula E, there are several tracks on the calendar where he had no prior knowledge compared to Ricciardo, a veteran driver with eight Grand Prix wins to his name.

“Believe me, it was a very, very difficult decision because Nyck is a fantastic person with whom I have a very good relationship. He is also an excellent driver,” the team principal noted.

Tsunoda was also asked about the Hungarian track and recalled it had a landmark role in his career.

“Actually, this is the first track I drove on after I came to Europe. I was racing in Japan until I was like 17-18 years old. I was never coming to Europe to do racing. This track was the first time I drove on a European track, and I was still with the Honda Junior program.”

Despite Tsunoda’s fond memories of Hungaroring, AlphaTauri has been

Post-race Post Script

AlphaTauri’s race weekend at the Hungaroring ultimately did not yield any points, but there was plenty of action from the green lights. Daniel Ricciardo, who started 13th after a good qualifying performance on Saturday, was hit from behind at the start by Zhou Guanyu in an Alfa Romeo, which left the Australian at the back

underperforming compared to its expectations and came to Hungary last in the Constructor’s Standings.

Performance Counts

“First of all, we have a lot of new upgrades coming. Also, here in Budapest, we will have something new on the car, and then there’s another upgrade coming for Singapore. But I want to see it on the performance in the lap time because this is the only thing which is valid, which counts,” Tost said.

He added that while he is not satisfied with the results so far this season, the arrival of Ricciardo could give the team a push forward in terms of race performance and setting up the car.

Regarding areas for improvement, Tsunoda reflected on his iconic radio messages, which border on shouting, and are loved by viewers but less so by his race engineer.

“Actually, this [the Hungaroring] is the first track I drove on after I came to Europe. I wasracing in Japan until I was like 17-18 years old. I was never coming to Europe to do racing. This track was the first time Idrove on a European track, and I was still with the Honda Junior program.”

“Sometimes, I get too frustrated and click the radio button too fast and become like a monster on the radio. I’m just trying to stick to what I have to do, obviously help the team from the development side and give good feedback as much as possible, specific feedback, which is really important for the future as well.”

The Japanese driver also dismissed speculation about his future, telling the audience he is more focused on what’s happening now.

“AlphaTauri will change a lot next year as well, we’ll see how it goes, but for now, I’m pretty happy with the performance, happy with the team, how they are operating. Everyone is facing in the same direction; we are struggling a lot now, but at the same time, everybody wants to improve,” he said.

of the field, but he had managed to claw his way back to 13th by the end. Yuki Tsunoda finished two places behind Ricciardo, despite having good race pace, due to a slow pit stop. Speaking after the race, chief engineer Claudio Balestri said, “We’ll focus on the next race [in Belgium this weekend], where we believe we’ll be in the position to fight for points.”

12 | 2 Business www.bbj.hu Budapest Business Journal | July 28 – September 7, 2023

BENCE GAÁL

Team principal Franz Tost (left) and F1 driver Yuki Tsunoda pose with the Scuderia AlphaTauri AT04 at the Orlen filling station near Gödöllő. Photo by Bence Gaál.

Could Malév Return to the Skies?

News Company

Gedeon Richter Acquiring Giskit MD

Looking to double-check the date when Malév collapsed, we noticed a Wikipedia link to an official website, unusual for a business declared bankrupt in February 2012. That led us to what appears to be a holding page (see photo) and another link for inquiries.

Through that, we contacted Mikhail Biryukov, who describes himself as “responsible for general questions regarding the restoration of Malev [sic] activities.” He confirmed that the project has been ongoing since June 2022 and said the site will start working on September 5, 2023.

The initial plan seems to be to organize the sale of air tickets and “tours that will popularize holidays in Hungary” through the website, but that appears to be only a starting point.

“In 2024, if everything goes well and our investors support us, we will begin the

Liberty Steel Pays HUF 20 bln for Dunaferr Assets

Global steel and mining business

Liberty Steel paid about HUF 20 billion for the assets of troubled Hungarian steel maker ISD Dunaferr Zrt., State Secretary Gergely Fábián of the Ministry of Economic Development told business daily Vilaggazdasag [Global Economy]. Fábián called the sale “a remarkable success.” According to the website oilprice.com, Liberty Steel originally submitted its bid on July 7, beating out India’s Vulcan Steel, Ukraine’s Metinvest B.V., Swissbased Trasteel Trading, and local company Trinec Property. Fábián told Vilaggazdasag that Liberty Steel’s Czech unit had delivered coal to Dunaferr in December, allowing the company to restart one of its blast furnaces, and a contractor agreement had paved the way for the successful sale. Dunaferr’s assets have been transferred to two separate companies: one for upstream and the other for downstream. Liberty Steel’s takeover requires approval from the European Union, but until the transaction is cleared, the contractor arrangement can continue, Fábián said. He added that the sale of the assets was “a milestone” but that the company still required “significant restructuring.”

procedure for obtaining a license to operate regular flights,” Biryukov told the BBJ

He describes a team of 12 people, some of whom previously worked at Malév. “At the moment, our team is dealing with legal issues related to the revival of the Malev brand and the resumption of the activities of a new legal entity. [….] At the moment, I cannot tell you more information due to the preparation of the project for launch and the resolution of legal issues.

He also welcomed the opinion of our readers on the project. Let us know your thoughts, and we will pass them on.

The deal was not universally welcomed, however. According to Bloomberg News, Ukraine’s Metinvest has accused the Hungarian government of selling the steel plant to Sanjeev Gupta, the Indian-born British businessman who heads Liberty Steel, for less than a third of its value. Metinvest, which says it was excluded from the bidding process for the bankrupt Dunaferr, alleged in a statement on July 20 that the auction had not been transparent and called on the EU to investigate. “It looks like the Hungarian government originally designed the tender as a mechanism to legitimize the transfer of the plant at a non-market value to a specific buyer,” Metinvest claimed. The government has covered wages at Dunaferr for six months after a court ordered its liquidation late last year.

FinTech Sector Grows to 175 Companies

Hungary’s FinTech sector has grown to about 175 companies, according to a report published by the National Bank of Hungary on its website on July 24. Microbusinesses accounted for 55% of the companies, according to the report. About 85% were focused on B2B activities. The combined annual turnover of Hungarian FinTech climbed over HUF 220 billion in 2021.

Malév Zrt. was the national flag carrier for Hungary from 1946 until it went out of business on February 14, 2012. Since then, low-cost carrier Wizz Air, founded in 2003, has been the only Hungarian airline. There was an attempt to launch a private company called Sólyom Hungarian Airways in 2013. However, although a liveried aircraft was delivered with some ceremony to Budapest that year, the airline’s short story involved bankruptcy, sale, and suicide, and it never became operational.

The headcount at local companies in the sector was more than 8,000 in 2022. A little more than 4,000 people employed in the industry worked in data analysis and business intelligence.

AutoWallis Vehicle Sales Rise 67%

Listed car seller AutoWallis's vehicle sales rose 67% to 25,634 in the first half from the same period a year earlier, according to a preliminary report released on the website of the Budapest Stock Exchange on July 17. Turnover of the wholesale division climbed 92% to 20,500 autos. In the retail segment, new car sales increased 10% to 4,178, while used auto sales edged up 2% to 956. Growth was supported by AutoWallis's acquisition, together with Portuguese peer Gruppo Salvador Caetano, of Renault Hungaria last year, adding 5,998 units to vehicle sales. However, even without the purchase, sales of the wholesale division still rose 36%, supported by a 64% increase in sales of SsangYong vehicles. CEO Gábor Ormosy said the company would "continue to focus on its expansion abroad, in a region where growth prospects on the car market are favorable." He added that the wholesale division would continue to drive sales growth while services supported the expansion of the retail business.