Szijjártó: Nuclear Power Could Mean More Energy Security for Hungary

The construction of additional nuclear power units at Paks is on schedule and on course to make Hungary more competitive while protecting the environment, Minister of Foreign Affairs Péter Szijjártó insists. 16

Is Cabinet Mulling Action on Fuel Costs to Boost Growth?

Could the government be mulling another intervention to limit fuel prices in a short-term bid to boost growth, consumption and the value added tax take? 17

‘Unity and Cooperation’

Smile, You’re in Hungary Now!

If you see rather more people on the streets of Budapest beaming from ear to ear today (Friday, Oct. 6) than usual, today is World Smile Day, dreamed up by the man who created the internationally recognized bright yellow smiley face, and Hungary is one of the countries grinning for good. 25

Retail Trade Likely to Drop Further

Businesses value stability, transparency, and a level playing field. German investments in Hungary have been a success story for decades, says Ambassador Julia Gross, one she wants to build on, despite some challenges. 10

Hungary’s retail sector is still in decline, with the August data weaker than expected. Analysts thought domestic consumption would pick up from the previous month, but instead, it contracted further. This is not likely to change until real wages start to increase. 3

AutoWallis Balancing Growth and Chinese Competitors

Public investor day reveals that, despite “robust growth” for AutoWallis, the industry cannot ignore the advance of Chinese competitors on the Hungarian and regional automotive markets. 7

SOCIALITE

NEWS

HUNGARY’S PRACTICAL BUSINESS BI-WEEKLY SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM

Energy SPECIAL REPORT INSIDE THIS ISSUE

BUSINESS

VOL. 31. NUMBER 18 | OCTOBER 6 – OCTOBER 19, 2023 HUF 2,100 | EUR 5 | USD 6 | GBP 4 FOCUS

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center 1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in

BREAKING THE HUNGARIAN NOBEL GLASS CEILING

VISIT US ONLINE: WWW.BBJ.HU

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

The British have a saying: you wait around at a bus stop for hours, and then three buses turn up simultaneously. I have no empirical evidence for how reliable a measure this really is when it comes to omnibus transportation, but its use has been expanded to cover just about anything you find yourself waiting for. Like Nobel prizes. The official Hungarian tally for Nobel laureates, as recognized by the Hungarian Academy of Sciences, had stood at 13 since 2004, when Avram Hershko (born Ferenc Herskó in Karcag, 168 km east of Budapest by road, in 1937) won for chemistry. Just two years earlier, in 2002, another laureate of Jewish descent, Imre Kertész, the author of “Fateless,” had become the first Hungarian to win the literature prize. They were at the head of a remarkable lineage that goes back to the first Hungarian winner in 1905, Philipp Lenard (Philipp Eduard Anton von Lenard, to his friends), who won the physics prize for his work on cathode rays. Lenard is an interesting case study of how messy Hungarian history can be and also demonstrates how hard it can be to pinpoint which winners come from where. He is listed as a German physicist by britannica. com, for example, and was born in 1862 in what was then Pressburg (Pozsony to Hungarians), Hungary but is today Bratislava, Slovakia. I have no idea if the Czechoslovaks claimed him as one of their own back in the day, or if the Slovaks do today. You could imagine that they might, but no winners are listed on the Wikipedia national breakdown. Lenard is also a case study of how what is viewed as acceptable changes with time. His was clearly a brilliant mind, but he was not a brilliant human. Britannica says of him: “An ardent

supporter of Nazism, Lenard publicly denounced ‘Jewish’ science, including Albert Einstein’s theory of relativity.” Anyway, back to those buses. After a wait of 19 years without a Hungarian Nobel laureate, this week we got two: Katalin Karikó (a graduate of Szeged University) for medicine and Ferenc Krausz (whose alma mater is the Budapest University of Technology and Economics) for physics. Meaning no disrespect to Krausz (and glossing over the fact that I have absolutely no idea what his work on attosecond pulses of light for the study of electron dynamics in matter means in the grand scheme of things), let us take a moment to celebrate Karikó. The work she and co-winner Drew Weissman, an American immunologist, did on mRNA led directly to the BioNTech/ Pfizer and Moderna vaccines against COVID-19. That will instantly make her a hero to countless millions worldwide and a villain to a tiny number of conspiracy theorists and anti-vaxxers. Never mind that, or that she apparently felt stifled in pursuing research in Hungary and moved to America to stretch her ambitions and brain. Let us just glory in the fact that she has shattered the glass ceiling for female Hungarian Nobel prize winners. She is also the latest in a list of 62 women to have won 63 prizes, stretching back to Marie Curie, who won in 1903 (physics), and then again in 1911 (chemistry). Here’s to many more female laureates, globally, of course, but also specifically in Hungary. It would be nice if a few of them felt encouraged and able to do their work here, to boot.

Robin Marshall Editor-in-chief

NOW

In the color photo from state news agency MTI, Captain Bence Gieszer (second from left, wearing the beret), of the Ludovika University of Public Service (NKE) Faculty of Military Science and Military Officer Training, talks with third-year military officer candidates on a Leopard 2A4HU tank, which was presented to NKE for educational purposes on Oct. 3.

In the black and white picture from the Fortepan public archive, dating from 1944, a Panzerkampfwagen VI B, also known as the “King Tiger” tank, stands guard in front of the Fisherman’s Bastion in Budapest.

2 | 1 News www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved.

What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential.

IMPRESSUM BBJ-PARTNERS

THEN &

THE EDITOR SAYS

Photo by Máthé Zoltán MTI

Photo by Album076 / Fortepan

1News

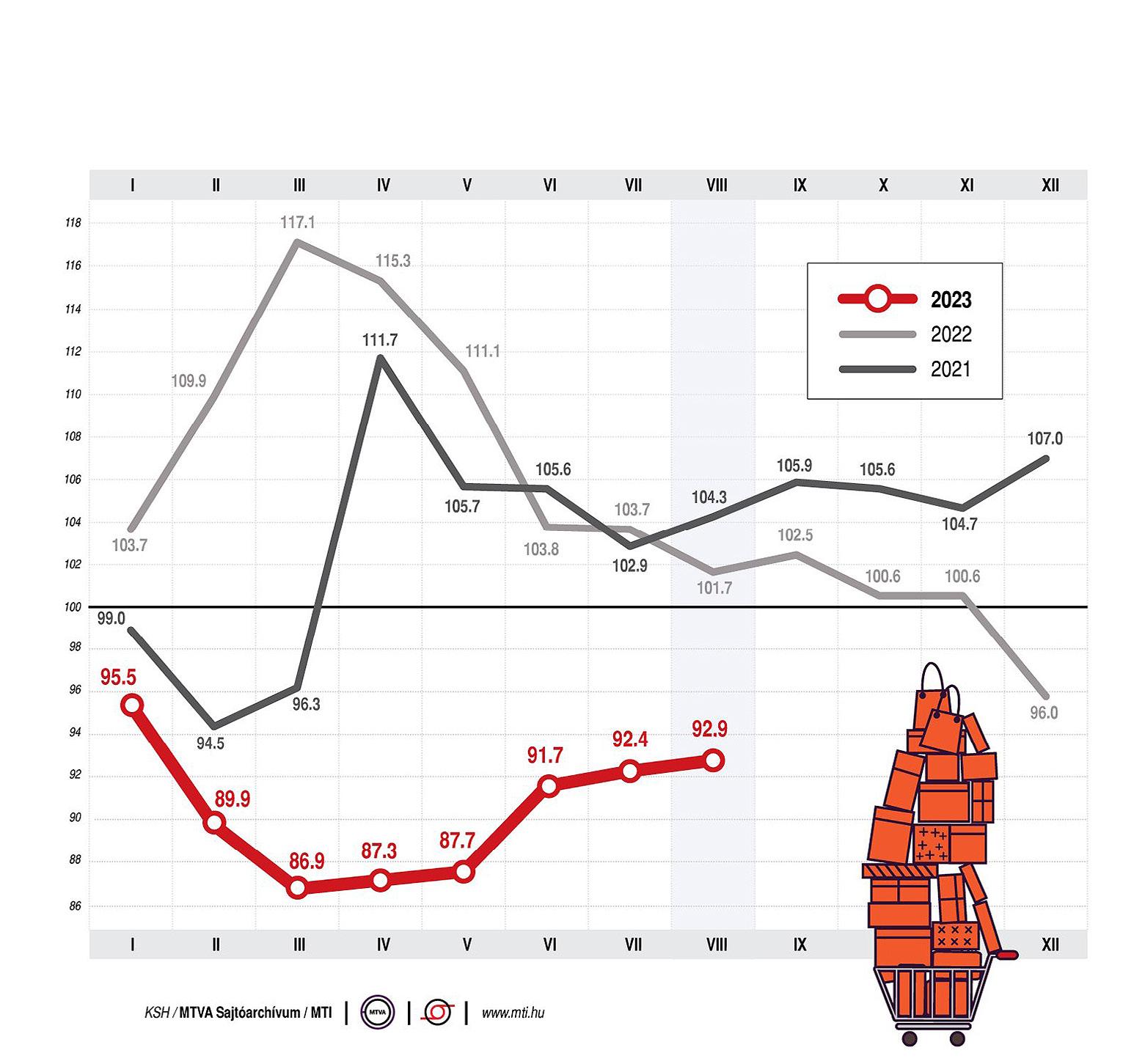

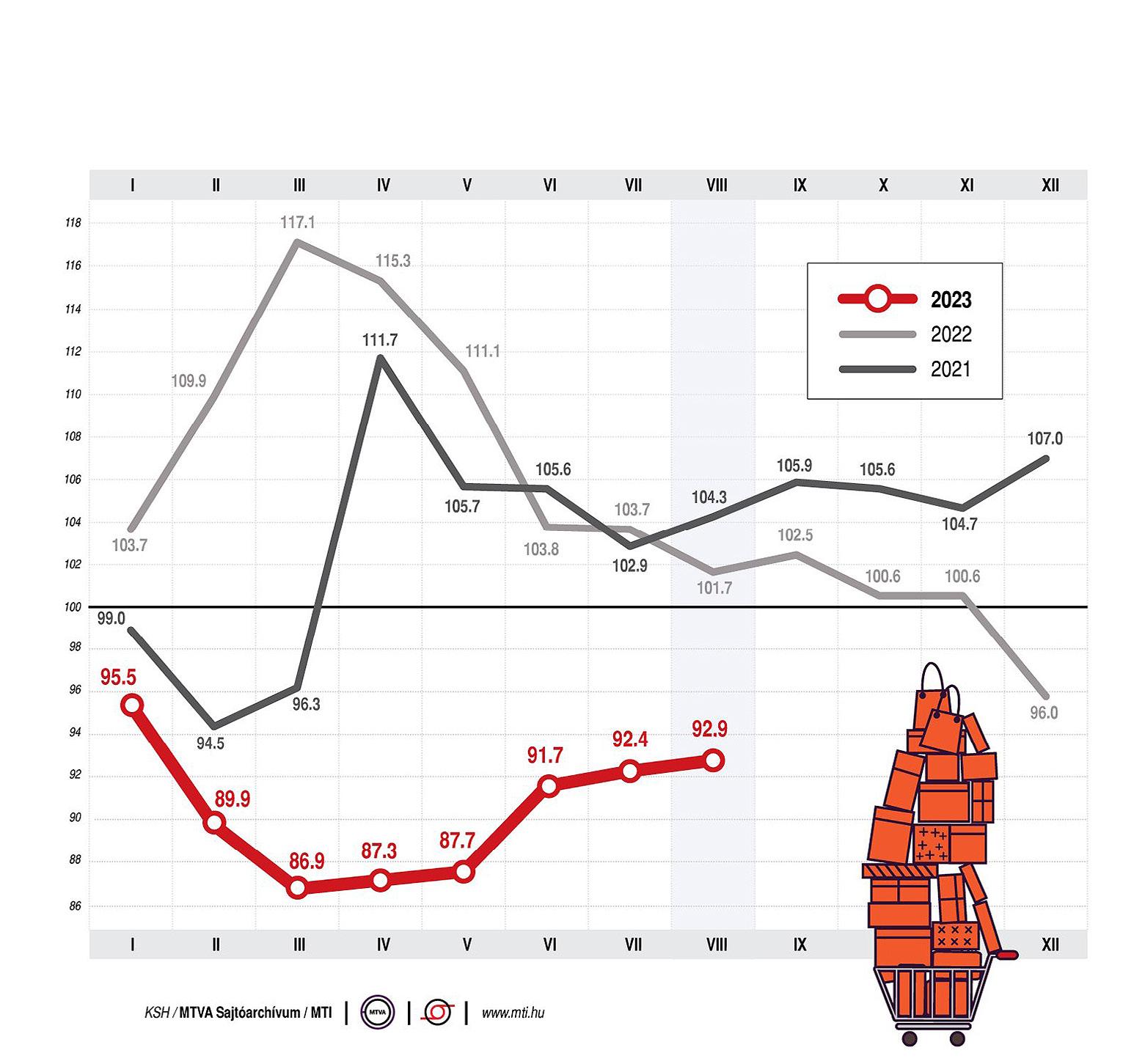

Retail Trade Seems Likely to Drop Further

Hungary’s retail sector is still in decline, with the August data proving to be even weaker than expected. With the gradual slowdown of the inflation rate, analysts thought domestic consumption would pick up from the previous month, but instead, it contracted further. This is not likely to change until real wages start to increase.

ZSÓFIA CZIFRA

The volume of retail trade declined by 7%, according to raw data, and by 7.1% when adjusted for calendar effects in August.

Sales revenue rose by 7.8% to HUF 1,594 trillion due to high inflation. Compared to the previous month, retail turnover decreased by 0.5%. In the first eight months, the volume of retail trade decreased by 9.6%, according to the fresh data released by the Central Statistical Office (KSH) on Oct. 4.

The volume of sales decreased by 4% in specialized and non-specialized food retailing year-on-year in August.

The volume decreased by 4.2% in non-specialized food and beverages stores (accounting for 75% of food retailing) and 3.4% in specialized food, beverage and tobacco stores.

The turnover of non-food retailing decreased by a total of 5.2% in volume in August compared to the same period of last year. Sales volumes rose by 4.8% in pharmaceutical, medical goods and cosmetics shops. In comparison, sales volumes decreased by 1% in second-hand goods shops, by 6% in books, computer

Volume of Retail Trade in Hungary

(August 2021-2023)

Calendar-adjusted volume index of retail trade (same period of previous year = 100)

High Base

The high base was mainly due to the fuel price cap, which significantly increased demand: while the KSH measured a 17.9% increase in the base period, this August, it fell by 18.1%. Due to the incorporation of high prices into the base and the reduction in prices of some products, the decline in the volume of food was smaller than before but still significant at 4%, Regős points out.

In the case of retail sales, on an annual basis, there will definitely be a decline in the coming months: real earnings will only start to increase from September, which will be visible for the first time in the October retail sales data.

Source:

equipment and other specialized stores, by 7.8% in textiles, clothing and footwear shops, by 11% in non-specialized shops dealing in manufactured goods and by

15%

in furniture and electrical goods stores.

The volume of mail order and internet retailing, accounting for 7.3% of all retail sales and involving a wide range of goods, was essentially unchanged. The sales volume in automotive fuel stations was 18.1% down compared to the same month last year. Sales in motor vehicles and motor vehicle parts and accessories stores not belonging to retail data were essentially unchanged.

According to Gergely Suppan, head analyst at MBH Bank Nyrt., the significant drop in retail sales in the spring months, in addition to the high base caused by the personal income tax refund and last year’s six-month gun money payments, is caused by the exceptionally high (albeit decreasing) inflation and the significant increase in household energy prices for households with higher than average consumption.

Lagging Effects

The decline in the turnover of food stores is still substantial but is getting milder. More conscious

and cautious purchases are reflected by the fact that sales growth in retail stores lags behind wage dynamics and that volume declines lag behind the decline in real wages.

That suggests that households are increasing their savings, as evidenced by household financial accounts or spending on other services, says Suppan. He believes one-off base effects also helped cause the notable drop in retail sales.

As for the near future, he notes that, for the rest of the year, due to the everlower base, the rate of decline in the retail sector may gradually ease and that it has already passed the low point.

“Due to easing inflation and the expected turnaround in real wages in September, we can already expect a pick-up in the coming months,” he says. “The decrease on a monthly basis is what caused the negative surprise since we could have expected an increase here with the gradual slowdown of inflation,” Makronóm Institute’s head economist Gábor Regős argues.

“The year-on-year decline is not a surprise, as it resulted from the high base and the 2% drop in real earnings in July, as households spend their July wages in August.”

The turnover of non-food stores fell by 5.2%. At the same time, the postponement of non-essential, higher-value purchases is still typical: a double-digit volume decrease was measured in the case of industrial goods and furniture and technical goods. Growth was achieved only in the case of pharmacies, where the increase in volume amounted to

4.8%,

meaning that Hungarian households have money for the most necessary things. The decrease in the volume of retail trade significantly exceeds the EU average, where the rate of decline was 1.2% in July.

In the case of retail sales, on an annual basis, there will definitely be a decline in the coming months: real earnings will only start to increase from September, which will be visible for the first time in the October retail sales data.

At the same time, due to the high base caused by the fuel price cap, the volume of retail trade can only show annual growth at the end of the year or at the beginning of next year, according to Regős.

“On the other hand, on a monthly basis, we can hope for the livening of consumption since this is also a condition for a recession of only a few tenths of a percentage point to occur in the Hungarian economy this year. This now has perhaps much less of an income-related barrier than of consumer sentiment,” he adds.

www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

• macroscope

ConvergenCE Officially Opens the Academia Office Center

The 12,500 sqm Academia office center redevelopment on the Pest embankment of the Danube in central District V has officially opened. Europa

Capital purchased the 12,500 sqm building, then called Akadémia, in partnership with ConvergenCE as asset manager, inJanuary 2022.

The partnership has since undertaken an extensive renovation of the historic building, bringing the complex to the standard required for Breeam, Well, Acccess4You and WiredScore accreditation (the latter being a first for the technology certificate in Hungary). Certification is ongoing.

The office interiors and common areas have been redeveloped to meet current tenant demands. ConvergenCE has emphasized the novelty value of the project’s sustainable and ESG-compliant space in a central business district location.

A notable development option in the Budapest office market is for the redevelopment and renovation of existing quality buildings, particularly in the CBD, where there is a scarcity of building plots, but there are listed buildings needing renovation. Despite this, the CBD sub-market has the lowest amount of office space under construction in Greater Budapest due to the difficulties of developing office projects.

Convergence and Europe Capital have been working together since

2005

with notable office developments such as the Eiffel Square, Kálvin Square, and B52 redevelopments. All these projects have successfully attracted buyers.

Real Estate Matters

A biweekly look at real estate issues in Hungary and the region

“ESG requirements are mainly tenant-lead; therefore, we designed our Academia project based on those principles in collaboration with BuildExt, an innovative Hungarian architectural company,” Zeley explains.

“In the CBD, there are very few developments and no newly built projects at all. To comply with sustainability initiatives, we do not build new buildings from the ground but focus on valueadded developments of existing buildings that require refurbishment,” he says.

Zeley said although the building is now complete, a few operations are still ongoing, and certifications are in progress.

The Akadémia building was bought for the Europa Capital value-add Europa Fund V1, with project financing provided by Erste Bank. The building was originally constructed between 1861-63.

“With our investor partners, we buy under-positioned buildings in great locations, which we renovate and refurbish with state-of-theart technology and services, then reposition and re-let,” says Csaba Zeley, managing director of ConvergenCE.

Highest Ratings

“We pay great attention to ensuring that all our properties have the highest environmental ratings. Obtaining certification is not just regulatory compliance, but also a cost-saving, value-added aspect, a crucial factor in sales and leasing,” he insists.

EC, Hungary and Ukraine all Maneuver on Funding, Accession

The European Commission is reportedly preparing to release EUR 13 billion in frozen funds to Hungary to solicit further support for Ukraine, both in securing continued funding during the war and in launching talks for the country’s accession to the EU.

In December, EU member states are scheduled to decide whether to allow Ukraine to begin accession negotiations, which would require unanimous agreement from all 27 countries. Prime Minister Viktor Orbán told Kossuth Rádió as recently as Sep. 29 that “very

difficult questions” still needed to be answered before the EU could even start membership talks, such as the issue of Ukraine’s treatment of its ethnic Hungarian minority population.

The bloc also hopes to bolster its financial support for Ukraine, which is expected to run out by December, with an additional EUR 50 bln. Hungary has suggested that halving that amount to EUR 25 bln would be sufficient for Ukraine at this stage, with an additional EUR 25 bln coming after an evaluation halfway through the 2024-2027 disbursement period.

To facilitate Hungary’s cooperation in both these endeavors, senior EU officials told the Financial Times that it was preparing to unlock EUR 13 bln of funding that has been withheld over rule-of-law and corruption concerns. “

“I can’t imagine Hungary agreeing without there first being a solution to the blocked funds,” said one EU official. A second confirmed a connection between

“I am proud to announce that Academia will soon become the first non-new construction Well ‘Platinum’ building in Hungary. Breeam certification is underway, and we are on the verge of obtaining the ‘BB’ energy certificate, a level even new office buildings in Budapest rarely achieve,” Zeley says. Academia is a rare completion in a market with a low pipeline currently. CBRE estimates the total office completions in the Budapest office market to be

180,000 sqm by year-end. For 2024, it estimates 114,000 sqm of delivery, two-thirds already preleased. In the following year, 2025, just 67,000 sqm of space is expected to be delivered.

CBRE has also identified 15 projects where construction has not started, but planning is at an advanced stage. These have a combined volume of 311,000 sqm and could be completed by 2027.

Roundup Crisis

releasing funds to Hungary and EU plans requiring unanimity, namely in the enlargement and budget talks, while a third confirmed the EUR 13 bln figure.

December Freeze

In December last year, the EU froze EUR 22 bln in cohesion funds, intended to narrow the investment gap and improve the infrastructure of less developed member states, allotted to Hungary, having determined that the Orbán’s government was failing to comply with regulations protecting human rights and the rule of law.

Following the report from the Financial Times, Minister of Regional Development Tibor Navracsics told journalists that he believed Hungary would reach an agreement with the EC to access the country’s EU funding by the end of the year. He said the latest press report “underpinned an optimism” he had held during the negotiations for the financing

over the past year and a half. According to Navracsics, the government had not received official communication about the situation. He added that it had become a “tradition” to learn of the EC’s position from the press.

However, in yet another twist, European Commission VP Vera Jourova categorically rejected the press reports an agreement was in the pipeline. At a press conference in Strasbourg on Oct. 3, she said the suggestion was “baseless speculation.”

Meanwhile, Ukraine’s National Agency on Corruption Prevention (NACP) removed OTP Bank from its list of “war sponsors,” according to the agency’s press service.

“During the discussions that lasted for the last few days 24/7 with the participation of the EU External Action Service, OTP Bank made a number of commitments regarding its future plans for the Russian market,” the press release stated.

4 | 1 News www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

GARY J. MORRELL

Ukraine

NICHOLS PONGRATZ

The official opening of the Academia office. This space was previously part of the Raiffeisen Bank HQ and branch.

Workers Look to Keep Existing Jobs Amid Gloomy Fall News HR Matters

A monthly look at human resource issues in Hungary and the region

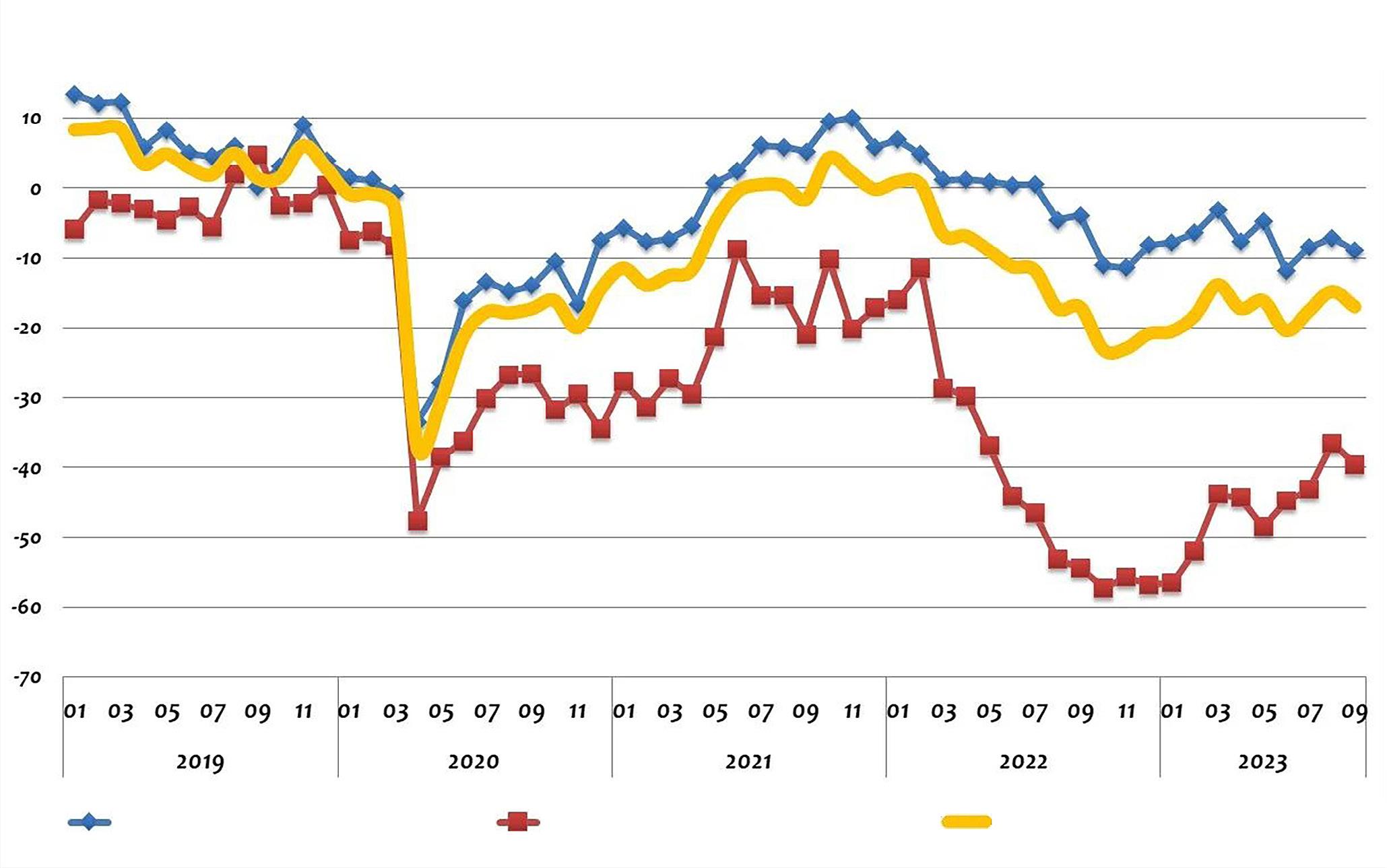

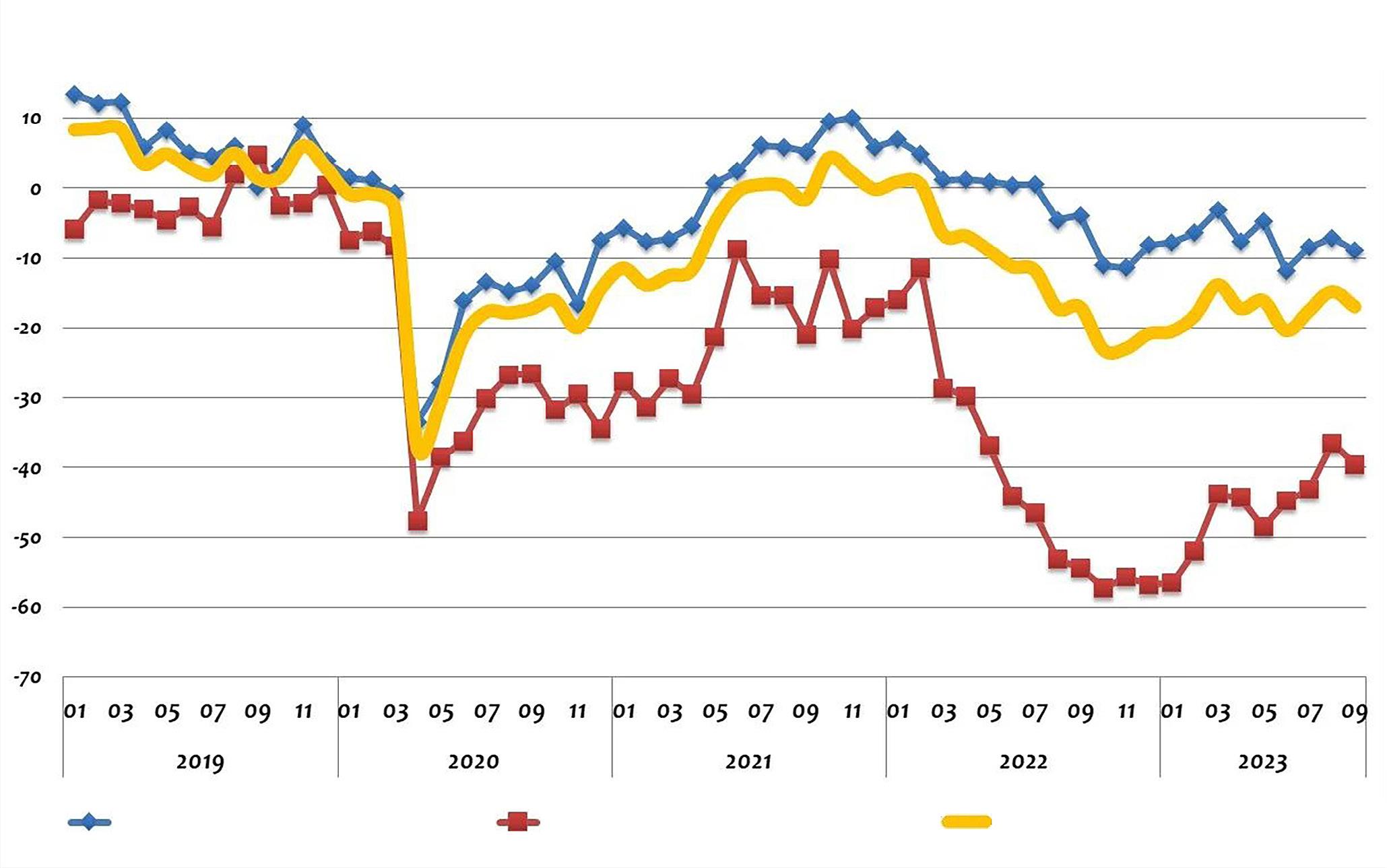

GKI Economic Sentiment Index and its Elements, 2019-2023

Moody’s praised “the availability of skilled workers, one of the highest wage-adjusted labor productivities among EU countries, a solid infrastructure, one of the lowest corporate income tax rates among EU countries and its integration into European manufacturing production networks.”

Among other positive factors, Hungary is coping with a “moderately high” debt burden, while the “economic strength is expected to remain robust in light of significant investments.” Moody’s expected Hungary to “ultimately receive most EU funds in a noisy, step-by-step process so that the impact from a delayed flow of EU funds on economic growth and public finances will be limited.”

The big question is how GDP growth will develop, and here, Moody’s expects stagnation this year, with expansion to resume next year at 3%,

driven by a recovery of the domestic economy and exports. Private consumption will benefit from real wage growth turning positive as consumer price inflation decelerates. So, there is much good news in Moody’s rationale and, more importantly, positive outlooks for the future. The present, however, remains grim.

On the same day Moody’s rating news was released, Hungary’s Central Statistical Office (KSH) published the Q2 figures, reaffirming the preliminary data of a decrease in GDP growth of 2.3%, the worst since 2020.

Industrial output fell by 5.7%, construction output by 6%. Farm output saved the figures from an even worse performance, as agriculture grew by 67.9% in annual terms due to favorable weather conditions this spring. Commerce registered a 12.6% shrinkage, tourism and hospitality were down 2.9%, and logistics by 6.2%.

10-month Cycle

Household consumption decreased by 1.6%. According to other KSH statistics, the real wage decrease has been continuous for 10 months in Hungary. Analysts estimate that internal consumption will not start growing in the next two quarters.

This is sustained by the solvency index (IFI) report released in early August by Intrum and GKI. The index summarizes the financial security of households in a single figure, factoring in income, the volume of loan debt, the value of savings, as well as the cost of living.

Compared to the first quarter, the IFI slightly improved in Q2, to 11.06 points from 6.51. However, it is still well behind compared to Q2 2022, when it stood at 35.33 points. Growth is hindered by inflation and stagnating wages, the report says.

If so, what caused the IFI growth from Q1 to Q2 this year? Judit Üveges, sales director at Intrum, says that the load debt component of IFI is the explanation. Households stopped taking out loans and concentrated

instead on repaying existing ones. So, they are not spending more; on the contrary, consumption fell by 2.5% in

Q1,

and more is expected this year as families dip into their savings. Moreover, it seems that some have already depleted these, given that new loans are mainly directed to finance daily expenses, Üveges explains.

Other data confirms these findings. A survey conducted by workforce placement firm Trenkwalder indicates that among employees working at private companies, almost half (48%) are unsatisfied with their salaries and two-thirds (62%) feel their financial situation is worsening. Meanwhile, employers seem unable to address the dissatisfaction: only 28% of respondents said their company had raised their salary during the current year to compensate for inflation.

Trendkwalder also inquired how much higher salary would be required for employees to leave their current jobs. Two-thirds would do so for 30% more. But this is an unlikely situation, as demand for workers dropped this year, significantly limiting employee bargaining opportunities. Hence, the high rate (73%) of those who prioritize keeping their job rather than focusing on a salary raise.

Rollercoaster Confidence

A growing number of employees (53%) also feel that this year it is harder to find a job matching their profession, up from 45% last year. Other outlooks are not better, either.

In August, the GKI consumer confidence index reached a 16-month peak. “Both the assessment of own

financial position over the past 12 months and expectations for the next 12 months improved substantially. The perception of money that can be spent on high-value consumer goods also became more favorable,” GKI said at the time.

One month later, the party was over. In September, the index fell by three points. “Households assessed their own financial situation in the past 12 months as worsening compared to the previous month and had a similar view for the next 12 months. Households’ perception of their ability to spend money on high-value consumer goods over the next 12 months also deteriorated slightly,” GKI wrote.

In a separate analysis released on Sep. 21, GKI made forecasts for the economic environment this year and next. For 2023, GKI expects real earnings to fall by

1.5-2%,

but by the end of this year, they could grow substantially in the private sector.

Next year, however, three “major dilemmas” will shape the labor market: the treatment of the 2023 real earnings decline, the credibility of the government’s 2024 inflation forecast, and the acceptability to workers of a modest real earnings increase on average across the economy that does not threaten to restart the wage-price spiral.

“If the government were to advocate 6% in wage negotiations, it is possible that the minimum wage increase would be close to 10%, even in the face of employer opposition,” GKI estimates. If everything goes well, including economic productivity, real income and consumption could grow by around 2%, according to the GKI forecast.

1 News | 5 www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

BALÁZS BARABÁS

At the start of last month, the Hungarian government received some news that was probably accompanied by a great sigh of relief: Moody’s Investors Service affirmed the “Baa2” rating for Hungary, maintaining a “stable” outlook on Sep. 1.

Business confidence index

Consumer confidence index GKI economic sentiment index

The goal of the transformation is to include a representative of the next generation of lawyers in the management of the office, while Szabó wished to focus on professional work and client service and step back from management duties. Accordingly, as a member whose name is in the company’s name, he will continue representing clients as an active lawyer.

Szabó has almost 40 years’ experience in corporate and commercial law in Hungary and internationally. He specializes in commercial contracts, property purchases and developments, corporate restructuring, and the acquisition of company shares. He co-founded SZKT Andersen, which has been operating since 1996.

Dominek joined the law firm in September 2010 and has been a partner since December 2015. His main areas of expertise include competition law, consumer law, and M&A advisory. Several professional awards have acknowledged his work.

Managing Partner Appointed at Andersen Legal

Balázs Dominek joined Szabó, Kelemen & Partners Andersen Attorneys’ (SZKT Andersen) fourmember management team as managing partner at the beginning of June. Tamás Szabó, former managing partner of SZKT Andersen, will continue his work as senior partner.

SZKT Andersen has four managing partners: László András Kelemen, Domonkos Kiss, Péter Vincze, and Dominek.

Andor Nagy Joins Dentons Budapest

Dentons has announced the addition of Andor Nagy to its public law and regulatory practice in Budapest.

“We are thrilled to welcome Andor Nagy to the Dentons family,” shares Gábor Király, managing partner at Dentons Budapest.

“Andor’s strong legal background and unwavering dedication to public service and diplomacy will not only strengthen our team but also elevate our capabilities in meeting our clients’ diverse needs,” he adds.

According to Dentons, Nagy “brings a wealth of experience in public administration and diplomacy and, in his new role, will advise clients on projects related to public law and government relations.”

Before joining Dentons, Nagy served ambassador postings for Hungary in Vienna and Tel Aviv. His past service also includes stints as head of staff of the Prime Minister and later as a Member of Parliament.

Nagy has received the Staufer Medaille from the Prime Minister of Baden-Württemberg, amongst other prestigious accolades.

His long-standing association with the István Bibó College, dating back to 1983, reflects his commitment to the education and development of future leaders, Dentons notes.

Nagy is chairman of the MBH Bank supervisory board and holds leadership roles in the National Council for Sustainable Development and the Environmental Protection Committee.

Procter & Gamble Appoints Senior VP for Central Europe

Uluc Ayik took up on Sep. 1 the position of senior vice president for Procter & Gamble’s Central European Region, responsible for business operations in 10 countries, including Hungary, as well as the Baltic States, Croatia, the Czech Republic, Poland, Slovakia, Slovenia, and Ukraine.

“I am honored to take over the leadership of P&G’s Central Europe organization. I look forward to working with P&G’s talented and dedicated people, innovating to deliver the best possible service to the region’s 120 million consumers, and creating value with our partners. Central Europe, with its size and huge growth potential, plays a key role in P&G’s European and global business, and I see it as an important goal to continue to serve our communities and act as a driver of economic growth,” Ayik said.

marketing, sales, and general management positions, including local and regional management.

Earlier, he was responsible for the business operations of several of P&G’s core categories in Turkey and beyond. Before assuming responsibility for Central Europe, he served as senior VP of textile care in India, the Middle East, and Africa, serving consumers in more than 70 countries. Ayik is married and has two sons.

Energy Lawyer Joins RVD Partners

Márk Köles, an expert with 12 years of experience in energy law, has joined RVD Partners, the law firm.

A graduate of the University of Debrecen, Köles later obtained a postgraduate degree in energy law at the University of Pécs. He is an expert in the district heating sector. Throughout his career, he has been involved in price regulation and licensing, including preparing legislation, managing administrative procedures, and in respective litigations.

In 2011, he joined the predecessor of the Hungarian Energy and Public Utility Regulatory Authority (Mekh), becoming a unit head and then deputy head of department.

Szabó will support the managing partners in his new role as senior partner, and they will continue to rely on his expertise and decades of experience in this new role, the law firm tells the Budapest Business Journal

He also acted as chief of staff for the Fidesz-Hungarian Civic Party and was a Political State Secretary of the Prime Minister’s Office during the government’s formation in 1998. In recognition of his contributions to various civic and political roles,

The senior VP graduated in business management and administration from Bosphorus University in Istanbul and joined P&G Turkey in 1996. He worked in various

RVD Partners, a Budapestbased boutique law firm, was founded in 2021 by senior lawyers Levente Rövid, Zoltán Gyönyörű, and Gábor Rozsnyai, who have decades of combined experience gained at international and domestic law firms.

The firm is focused on business law, although it can provide legal assistance in the jurisdictions of almost 20 European countries through its membership in the Cyrus Ross European Group of Law Firms.

6 | 1 News www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Tamás Szabó

Balázs Dominek

Andor Nagy. Photo by István Filep/MTI

Uluc Ayik

Márk Köles

2 Business

AutoWallis Navigates Global Shifts in Balancing Growth and Chinese Competitors

The AutoWallis Group’s public investor day revealed that, despite promising data and “robust growth,” the industry cannot ignore the advance of Chinese competitors. The event featured numerous presentations and roundtable discussions that painted a clear picture of the outlook for the Hungarian and regional automotive markets.

Máté Tóth István, deputy CEO of the Budapest Stock Exchange Zrt., noted: “The capital market maturity of the Hungarian corporate sector doesn’t even match the current level of economic development. It’s commendable for a corporate group to engage in the capital market.”

He also stressed the importance of promoting dialogue between investors and issuers and the high relevance of environmental, social and governance issues.

“Sustainability is now present in every segment of the financial and capital markets. There may be downsides, but ESG compliance is here to stay,” he said.

In his presentation, Gábor Ormosy, CEO of AutoWallis Nyrt., summarized the key events of the past year.

“We secured distribution rights for brands such as Renault, Dacia and Alpine, made significant progress online, acquired the fleet management business of Nelson and became the operator of the car-sharing platform Share Now Hungary,” he noted.

While there are overarching macroeconomic concerns about the Hungarian economy, Ormosy pointed out that AutoWallis had achieved “robust” results in the first half of 2023, with

25,634 vehicles sold (a 66.7% growth compared to the first half of 2022), revenues of HUF 194 billion (up 48%), a share price of HUF 16.9 (up 85%), and EBITDA of HUF 10.4 bln (up 50%).

“It is important to note that more than half of our revenues are generated internationally,” Ormosy added.

Challenges Ahead

Commenting on industry trends, he mentioned challenges such as the chip shortage, the EU’s decision to phase out combustion engines by 2035, lobbying in Germany in favor of synthetic fuels, and research into hydrogen fuel cells by some manufacturers.

“The aim is not to let the market become one-dimensional with the emergence of environmentally friendly vehicles. The technology race between powertrains is still up in the air,” Ormosy said.

A clear indicator of the challenge faced by the European car industry was on display at the IAA (Internationale Automobil-Ausstellung or International Mobility Show) in Munich, where almost half of the exhibitors were Asian.

“This year, there will be twice as many Chinese brands as two years ago,” said Ormosy.

AutoWallis’ capital market goals have progressed as outlined during the IPO, with key milestones achieved over the past five years, emphasized Gábor Székely, director of investor relations and ESG.

“In the last five years, our company has joined the BUX and BUMIX [Budapest Stock Exchange] indexes, moved up to the BÉT Premium category and carried out one of the largest public share offerings of the decade. Today, we have more than 4,000 shareholders,” said Székely.

Going forward, AutoWallis will focus on obtaining an ESG rating and preparing for green financing. There are plans to issue foreign currency and/ or convertible bonds and to broaden analyst coverage, possibly including international firms.

“We will continue our share buy-back initiative in line with the needs of our employee share ownership program,” said Székely.

China: Both Ally and Rival

The significant push by Chinese manufacturers cannot be overlooked. In 2022, China exported 3.2 million cars, of which 522,000 went to the EU, and the Asian giant is also building up European manufacturing capacity.

“Before 2021, China exported less than one million cars. In 2022, it surpassed three million, overtaking world leader Japan,” said Ormosy. In the first half of this year, it has already reached 1.78 million, of which 534,000 are electric (an increase of 160%). The total could reach four million by the end of the year, he suggested.

He described the Chinese as both competitors and potential partners, even considering a UBS Group forecast that suggests, “The global market share of traditional carmakers could fall from 81%

to 58% by 2030,” he says.

Retail models are evolving. Manufacturers are moving away from distributor sales models towards agency concepts. Despite the importance of digital, Ormosy insisted, “Physical car showrooms remain essential. Customers want to see first-hand the color of the car and how it suits them.”

Consumer habits are also changing, especially among young people and urban commuters, who are increasingly turning to car-sharing services.

“Last year, 44% of cars sold in the EU were electric or hybrid-electric. In Hungary, this share exceeded 5% for the first time. But these numbers are still tiny in the grand scheme of things. Especially in Central and Eastern Europe, the average age of the car fleet remains high at over 14 years and is increasing,” Ormosy pointed out.

Eying Foreign Investment

Despite securing a capital inflow of HUF 21 bln last year and a yield of more than 20% on AutoWallis shares, finding funding in the Hungarian market remains challenging. Attila Vágó, chief analyst at Concorde Értékpapír Zrt., expressed his concern.

“Despite the earnings, there’s an obvious liquidity problem. This underlines the need for foreign investors.”

Sustainability was a focus of the roundtable discussion. Székely, whose responsibility it is, described ESG commitments and developments as “fascinating. [….] However, specifics on expectations remain nebulous, and predicting consumer preferences becomes challenging in a world where young people are giving up meat for environmental reasons,” he added.

Ormosy revealed that the AuztoWallis portfolio now includes 22 brands.

“Some of our acquisition processes took longer than two years, and negotiations with Chinese partners are still ongoing,” he revealed.

The discussion also covered dividend payments. Small investors pointed to a 30% real lag in share value due to inflation and drew contrasts with the 2021 interest level. Management, however, emphasized its preference for allocating cash flow to further development rather than dividend payouts.

One highlight of the roundtable came when the moderator asked the AutoWallis management whether they could imagine arriving at the Investor Day in a year’s time in a Chinese car.

“I can imagine arriving here in a Chinese car,” replied Ormosy. When asked when the 23rd brand would be added, the CEO replied, “I’ll be happy [if it is] by Christmas!”

www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

GERGELY HERPAI

Roundtable discussion at the AutoWallis Investors’ Day event on Sep. 20.

Navigating Change and Innovation: Doherty’s Journey From Birmingham to Hungary

Twenty-five years after his family business manufacturing electric motor shafts moved from the U.K.’s Birmingham to Orosháza, a city of just under 29,000 people in Hungary’s southeast, Englishman Jim Doherty faces a mixed bag of challenges and opportunities.

An evolving economic environment has dramatically increased the cost of living for his 150-strong workforce. Annual inflation soaring in Hungary from under 5% in 2020 to more than 25% at the start of this year forced him to balance wage increases against the price of his product to customers.

Meanwhile, the ever-changing demand for motor shafts with new precision and cleanliness specifications from customers has kept his engineering team on their toes.

Doherty proudly toured us around his factory, a strikingly clean, well-ventilated, modern facility housed in a repurposed and expanded former supermarket building.

The factory floor is lined with advanced CNC machines the size of small pickup trucks that speedily transform four-meter lengths of stainless steel rods into the shafts for electric motors of various sizes, ranging from tiny ones used in hand-held power tools to much larger ones used in the booster motors of “mild hybrid” motorcars.

Diameters of shafts from 32mm down to 6mm

are produced, with precision to within six micrometers, roughly a tenth the thickness of a human hair, according to the company.

Rising labor costs, however, along with the need for new technology to meet the changing specifications and increasing quantities demanded by customers, are pressing both the company and the man who owns and leads it to adapt.

To the untrained observer, his factory appears highly automated, staffed not by manual laborers but by highly skilled technicians who monitor and

tune the machines as they work their magic, spinning out a gleaming new motor shaft every few seconds. Even so, new automated processes are in the pipeline to increase overall efficiency.

“There is technology available that will give us one to two year’s payback, and we need to accelerate our investment,” Doherty says.

The upgrade will, of course, come with costs, around EUR 1 million, but won’t mean a reduction in workforce.

Perfect Scenario

“If you’re growing, you don’t have to lose jobs to automation. You have a natural attrition rate, and the perfect scenario would be that you could grow with the headcount already in place,” the owner says.

Demand for electric motor shafts is high and getting stronger, Doherty emphasizes, thanks mainly to the global trend toward more electrification and e-mobility, whether in electric cars, power tools or new “smart” homes and businesses with automated window features, climate control systems, adjustable lighting, and security devices; just to name a few.

Much of this demand is essentially local, coming from European device manufacturers that have set up shop in Central Europe, putting Doherty at the center of several supply chains. He estimates that his factory will produce around nine million shafts for its customers in 2023.

The move from Birmingham to Orosháza in

1997

was precipitated by Siemens’ expansion of its manufacturing operations in nearby Slovakia throughout the 1990s, Doherty explains.

“Exporting shafts from Birmingham to Slovakia was too big a trip. ‘It’s just not going to work,’ they said, informing us that we needed to be in the region here in Central Europe,” he says.

“A lot of great customers along the way have supported us in terms of getting our quality standards up; General Motors were amazing in the beginning,” he said.

“If you’re to supply the automotive industry, you need to have certain accreditations, which they helped us achieve in the United Kingdom, and then six months later, when we said we’re moving to Hungary, they came over to help us get the accreditation here.”

As the years rolled on, more international manufacturers opened factories in Hungary and began placing orders with Doherty, including Bosch. The German company opened the first of its two plants in 2001 and the second in 2003, making products such as automotive parts, electric power tools, and eBike systems.

Doherty also supplies the Hungarian divisions of a pair of other international firms: an American automotive and e-mobility manufacturer and a Japanese differential manufacturer.

He explained that his customers broadly fall into three types: some who wanted Doherty Hungary’s long-term strategic development support, some who were dissatisfied with their current suppliers, and some who were moving their business from the Far East to Europe because of transportation and environmental issues.

Adding Value

While honoring his customers’ place in the driver’s seat keeps Doherty Kft. in business, there are times when he has to pause and assess what and when his firm can reliably deliver. Such moments remind Doherty of his value as CEO.

“It’s a fine line because you need to be listening to your customers, and you need to be driven by them, but you also need to consider your own capacities and limitations. By reminding yourself and other stakeholders, including customers, that delivering the highest possible quality on a realistic schedule is what’s best for everyone, you can avoid disappointments. It’s important to avoid promising the impossible,” he says.

Developing a mastery of “the art of the possible” is more important than ever, as it has become necessary to match wage rises necessitated by local inflation with increased revenue.

For a time, Jim Doherty tried living in Britain with his family while running the Orosháza factory by remote control.

“Managing things by spreadsheet or Teams meetings isn’t the way to go for us,” he said. “You’ve really got to be here, spend time with your team onsite to make the most of the opportunities.”

Pointing to a network of black tubing running from the floor up to and along the high ceiling, he described how his maintenance leader proposed siphoning off the surplus heat generated by the factory compressors to keep the factory floor warm in winter.

“He came to me with the idea, and I told him to go for it.” Other moves, such as extended breaks for staff during heatwaves and allowing the grasslands surrounding the plant to return to a natural ecosystem, can be credited to the owner being present and plugged in.

It’s been over 100 years since his greatgrandfather started a bicycle parts business in Digbeth, outside Birmingham, and 90

since

the founding of W. H. Doherty and Co. Ltd., the Birmingham company that later became Doherty Hungary Kft. in Orosháza.

Having survived challenges, including the COVID pandemic that cut output in half, the production team is back to working three shifts on the 4,500 sqm factory floor. Despite new challenges, Doherty reckons his firm is in the right place at the right time.

“Hungary is a good place to do business, and you are geographically right in the middle of the supply chain action,” he said. “Which is good, because it’s convenient for us to send product to our European customers in a short span of time. And that’s what my customers want: a fast and efficient response and delivery.”

8 | 2 Business www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

JACOB DOYLE

Jim Doherty says the business cannot be managed remotely but works best with his presence.

Bankers Show Their Heart in Backing Blood Donor Week

For the fourth year in a row, the partnership between the Hungarian Banking Association and the wider Hungarian banking community has been solidified through the Bank Blood Donor Week initiative. This year, the Hungarian National Bank (MNB) has added significant further weight to the event by collaborating with the Good Bank program.

In its official announcement, the Hungarian Banking Association emphasized that this year’s Bank Blood Donor Week has been extended to run for two full weeks, from Monday, Oct. 2 to Friday, Oct. 13. This extension shows its dedication and commitment to the cause, the association says.

During this period, blood donation sessions will be organized at 12 locations in Budapest, with two more in rural areas.

The Good Bank initiative has been at the forefront of this blood drive. Now in its fourth year, it has seen active participation from bank employees ranging from clerks to senior executives, demonstrating their commitment to community health. Their donations are critical to ensuring the continued availability of blood products, often urgently needed for medical procedures.

Hundreds of units of blood have been successfully collected over the years. These have been processed into thousands of vital blood products that play a critical role in patient recovery.

As a testament to the importance of the initiative, the MNB has not only endorsed it but is now actively involved.

This involvement extends to the highest levels of the bank. Nor is it limited to the banking sector. Key figures from various government ministries have also pledged their support. One example is Minister of Agriculture István Nagy, who is no stranger to the cause, being a regular blood donor. Nagy attended this year’s inaugural event, where he thanked each participating donor.

The critical nature of blood donation cannot be overstated. Hungary has an urgent need for 500,000 units of blood annually. This is primarily to ensure a reliable and safe supply is always available for medical use. It is estimated that half a million altruistic voluntary blood donors are needed to meet this demand.

Make a Difference

“The commitment of approximately 1,600-1,800 blood donors on a daily basis is paramount to maintaining the reliability of our blood supply,” Nagy explained. “As a regular donor, I earnestly invite everyone to take up this mantle and make a tangible difference. By donating, you become an integral part of a larger community, a community that has the power to create positive change, to do real good, and most importantly, to save precious lives,” he added.

In the same vein (no pun intended), Csaba Kandrács, deputy governor of MNB responsible for financial supervision and consumer protection, highlighted the central bank’s contributions even before it joined the program.

“Last year alone, our dedicated employees at Magyar Nemzeti Bank were responsible for donating nearly 1,000 units of blood. This was achieved in eight different sessions. To put this into perspective, these donations were

instrumental in saving around 3,000 lives,” he said. He went on to explain the broader implications of these actions.

“The consistent and active involvement of Hungarian commercial banks in the announcement and subsequent organization of Blood Donation Week under the banner of Good Bank is a clear testimony,” Kandrács said.

“The commitment of approximately 1,6001,800 blood donors on a daily basis is paramount to maintaining the reliability of our blood supply. As a regular donor, I earnestly invite everyone to take up this mantle and make a tangible difference. By donating, you become an integral part of a larger community […] that has the power to create positive change, to do real good, and most importantly, to save precious lives.”

“It shows that these institutions are not just about business; they have a heart. They understand their role in society and go beyond just donating blood. Their commitment extends to investing both financial resources and time in various social responsibility programs. This includes not only blood donation but also other avenues such as educational initiatives, customer awareness, and various consumer protection programs.”

Another deputy governor, Barnabas Virág, responsible for monetary policy and financial stability at the MNB, took a moment to underscore the essence of societal unity.

“Acts of selflessness, epitomized by blood donations, are fundamental to our social fabric. More than that, they are shining beacons illuminating the path of mutual responsibility,” he said.

Ambitious Goal

The deputy director general of the National Blood Service, Sándor Nagy, expressed his optimism that this event would not only achieve its goals (the aim is to set a donation record this year) but also set a precedent for other sectors to emulate.

Jelasity Radovan, president of the Banking Association (and CEO of Erste Bank Hungary), added: “Our goal this year is ambitious. We want to reach an all-time high in blood donors during Bank Donor Week.”

Beyond Budapest, the initiative’s reach will extend to a couple of countryside regions. The National Blood Service, in cooperation with the Hungarian Red Cross, has taken on the task of overseeing the logistical and professional aspects of the entire program.

In Nyíregyháza and Békéscsaba, bank employees and the general public have the opportunity to donate blood at specially established centers.

The coronavirus epidemic had a silver lining to its dark cloud. The association says it brought members of the banking industry together in a common cause. This unity gave birth to the Good Bank initiative, a CSR program designed by the banking community. The Bank Blood Donor Week stands out as a keystone event within this framework. Recognizing the need to extend its reach, this year’s program has been expanded to a fortnight, with a particular focus on reaching more remote parts of the country this year.

2 Business | 9 www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

GERGELY HERPAI

Group photo marking the start of the 2023 Bank Blood Donor Week. Minister of Agriculture István Nagy is in the front row, fifth from right, with Jelasity Radovan, president of the Banking Association, at his left shoulder. 2023 Expat CEO of the Year Veronika Spanarova, of Citi, at third from right. Photo by Gyula Bartos.

3 Country Focus

Germany

German Business Presence in Hungary a Success Story we ‘Want to Continue,’ Says Ambassador

The 50th anniversary of diplomatic relations between Hungary and the Federal Republic of Germany will be marked on Dec. 21. The Budapest Business Journal asked German Ambassador Julia Gross to give us her overview of the state of bilateral relations between the countries.

BBJ: How important is the Hungarian market for German businesses?

Julia Gross: Economic relations between Hungary and Germany are traditionally very intense. Today, 3,000 companies with German ownership employ about 250,000 Hungarians. Germany is Hungary’s most important trading partner as a customer and supplier, accounting for approximately 27% of trade volume. In 2021 alone, German companies invested or reinvested around EUR 900 million in Hungary, the largest share in overall FDI. German companies not only create jobs and contribute to Hungary’s export balance, but they also invest in training and research. They feel that, overall, Hungary provides a positive business environment, and the interest of German investors in the Hungarian market remains at a high level. In recent years, however, German companies in some sectors have begun to feel that the Hungarian business environment has become less predictable and

welcoming. Businesses and investors worldwide value stability, transparency, and a level playing field when doing business. The presence of German firms in Hungary has been a success story for decades, and we want this to continue.

BBJ: What are the most significant sectors for Hungarian exports to and imports from Germany? How has this changed over the years?

JG: The most important sectors for Hungarian exports to Germany include automotive products, machinery, electrical equipment, and pharmaceuticals. Hungary, with the help of German companies, has built up a strong automotive industry, with many German automakers and suppliers having large production facilities in the country. This has led to a significant export of automotive parts and components to Germany. Measured in terms of value-added, vehicle manufacturing is the most important sector within

German investments in Hungary (with an approximately 28% share), followed by the rest of manufacturing (about 25%), trade (17%), and the information/communication sector (13%). In 2022, Germany exported goods worth approximately EUR 32.2 billion to Hungary. The value of German imports from Hungary in the same period was around EUR 33.8 bln. During the last 26 years, the exports of Hungary to Germany have increased from EUR 3.5 bln in 1995. These are very impressive figures.

BBJ: What are the most interesting new business fields developing in bilateral trade between the two countries?

JG: In recent years, several interesting new business fields have been developing in bilateral trade between Germany and Hungary. Both Germany and Hungary are focusing on transitioning to renewable energy sources. This has led to collaborations

and investments in areas such as solar energy, wind power, and bioenergy. German companies with expertise in renewable energy technologies have partnered with Hungarian counterparts to develop sustainable energy projects.

Another flagship project is the test track for autonomous driving in Zalaegerszeg. The ZalaZone Technology Park is used to develop and test autonomous vehicles but also connects technologies such as the 5G mobile network standard or AI for vehicle sensors. Bosch, among others, will be working there on the mobility of the future. Continental is building a development center for AI in Budapest and Audi as well.

Hungary aims to strengthen further its reputation for research and innovation. With more than 500 university partnerships between German and Hungarian universities, there is ample space and a wellestablished network for cooperation.

www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

ROBIN MARSHALL

German Ambassador Julia Gross

The digital transformation has opened up new opportunities for collaboration in IT services. German companies are partnering with Hungarian IT firms to develop innovative software solutions, digital platforms, and infrastructure projects. This includes cybersecurity, data analytics, cloud computing, and e-commerce.

BBJ: What are the most significant challenges facing German businesses in Hungary?

JG: Some of the current challenges are not confined to Hungary but also impact German businesses here. Given the long-term geopolitical challenges, inflationary pressures are expected to remain an issue in the coming years. Pressure on supply chains continues to be an issue as well.

But there are other factors more specific to Hungary: The shortage of skilled labor has become one of the biggest challenges for German companies in Hungary, and in that context, investors also point to the necessity to invest more in education, especially in languages and STEM subjects. In some sectors, investors face short-term measures and changes like special taxes or businesstargeted regulations. All foreign investors need predictability and transparency to thrive, to contribute to Hungary’s economy, and to deliver to the Hungarian consumer.

BBJ: Although the historical links between Germany and Hungary are strong, especially around the fall of the Iron Curtain and German reunification, it is no secret that political relations have not been as good as trade relations for several years. What are the greatest areas of concern for Germany, and do you see any changes on these fronts?

“The value of German imports from Hungary [in 2022] was around EUR 33.8 bln. During the last 26 years, the exports of Hungary to Germany have increased from EUR 3.5 bln in 1995. These are very impressive figures.”

JG: Germany and Hungary are friends and partners, both bilaterally and as members of the EU and NATO. We have strong ties in many areas: trade, business, culture, and people-to-people contacts. We continue to cooperate well in many areas. But it is fair to say that disagreements at the European level and within NATO cannot but impact bilateral relations. Some of these political discussions directly concern the

functioning of the EU’s single market and thus also affect trade relations and the business environment in Hungary. Dialogue at the European and bilateral levels is ongoing, and we continue to work to resolve the differences. We are convinced that for both our countries, unity and cooperation within the European Union and NATO are guarantors and safeguards for the future of a resilient and prosperous Europe.

BBJ: Business and diplomacy are the bread and butter for any modern ambassador, but culture is also essential. How are cultural relations, and how much time do you dedicate to this sphere?

JG: Cultural relations constitute one of the main pillars of German foreign policy: if business and diplomacy are the bread and butter, then culture might be called the ham in the sandwich. The cultural relationship between Germany and Hungary is especially rich and multifaceted. Over the years, there have been numerous exchanges and influences between the two countries in fields such as music, literature, art, and science. There are three German Schools Abroad in Hungary, German-speaking Andrássy University in Budapest, the Goethe Institute, and the German Academic Exchange Service, to name but a few. German is, after English, by far the most popular language to study in Hungary. The Hungarian-German minority, with

World Championships Ensure Packed Launch for Radisson Hotel BudaPart

The management behind the new Radisson Hotel in BudaPart interviewed 300 candidates to find a “World Championship” team. General Manager Carien Veldman takes the Budapest Business Journal through the uniquely exciting experience of opening a new hotel.

BBJ: Why was BudaPart chosen as the location of the newly opened Radisson Hotel Budapest BudaPart?

Carien Veldman: The award-winning BudaPart district was the ideal location for a Radisson hotel, somewhere we can enable guests to find harmony in

their hotel experience with relaxing spaces, thoughtfully considered details and unexpected delights. Cozy and natural areas are crucial elements for our brand, and you can see this in the many wooden details throughout the hotel and the large plants incorporated into the interior design. This is complemented by Kopaszigát, close by, which offers a relaxing space to go for a run outdoors or just to enjoy the view.

BBJ: What occupancy do you expect for Q4 2023 and Q1 2024?

CV: We opened more than two months ago, in the middle of August, just in time to accommodate groups for the World Athletics Championships, and business during this period has exceeded our expectations for travelers from around the world. For August, 80% of guests that stayed with us came specifically for this sports event and chose our hotel

its strong involvement in the education sector, is a strong voice and partner in our cultural relations. The large number of Hungarian students in Germany and German students in Hungary and the extensive alumni network also contribute to our ties in culture and education.

“Dialogue at the European and bilateral levels is ongoing, and we continue to work to resolve the differences. We are convinced that for both our countries, unity and cooperation within the European Union and NATO are guarantors and safeguards for the future of a resilient and prosperous Europe.”

In return, Hungary has also made its mark on German culture. Hungarian composers like Franz Liszt and Béla Bartók, writers like Pétöfi and Konrad, artists like Moholy-Nagy, and scientists like [Nobel winner] Katalin Karikó have had a profound influence on German music, literature, art, and science.

due to the excellent location. Significant international events like these are a perfect opportunity to showcase our area and, of course, our hotel.

BBJ: What is a hotel opening like from a professional point of view? Was there a unique concept tailor-made for this market?

CV: Work started in 2021, and I joined the project in late 2022 to begin planning for the operational phase. It is exciting to purchase what goes into a hotel; everything from mattresses and pillows to conference tables down to the last teaspoon has to be selected, ordered and installed in the correct area of the hotel. Think of it as a massive house with 198 bedrooms and an amazing kitchen! The equipment list had more than 1,300 different items.

Why select Shanghai Kitchen for your primary F&B offering?

CV: As the hotel is in the BudaPart and Kopaszi-gát area, where there are already several dining options within walking distance, we wanted to offer something interesting and appealing to local residents as well ashotel guests. We did not want to be just another hotel restaurant offering the standard hotel fare. Shanghai Kitchen does very elegant cuisine inspired by the flavors of Shanghai, although it still does a killer filet mignon for those who prefer something more traditional. The concept also lends itself beautifully to vegetarian and vegan dishes, catering to many different dietary requirements.

3 Focus | 11 www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

PRESENTED CONTENT

Photos

Carien Veldman

by Balint Alovits

in Brief News Germany Focus

Production Halted at Audi Hungaria’s Győr Plant

Production at Audi Hungaria’s plant in Győr (120 km northwest of Budapest) stopped on Sep. 27 because of an IT malfunction that affected Volkswagen group members across Europe, the Ministry of Economic Development said on its website on Sep. 29. Audi informed the government that the problem was quickly resolved, and production in Győr restarted at 9 a.m. on Sep. 28. The production outage was “insignificant” and will be made up in the coming days, the automaker told the government.

Bosch Investing HUF 18 bln in its Miskolc Base

German-owned Bosch Energy and Body Systems will invest HUF 18 billion at its base in Miskolc (180 km northeast of Budapest), Minister of Foreign Affairs and Trade Péter Szijjártó said on Sep. 11, according to origo.hu. Bosch Energy and Body Systems will spend HUF 4.5 bln to expand its electric drive development and testing activities and HUF 13.5 bln to boost the capacity of several product

Thyssenkrupp Plans 8,200 sqm HUF 23 bln Expansion at Jászfényszaru Factory

types, Szijjártó said. The government is supporting the investments, which will create 170 jobs, with HUF 3 bln, he added. Bosch employs around 20,000 people in Hungary.

Defense Minister Visits KMW Plant in Munich

Minister of Defense Kristof SzalayBobrovniczky has visited the Munich plant of German defense industry company KMW, according to a video on his Facebook page. Hungary ordered 44 latest generation Leopard 2A7 tanks from KMW (in December 2018), SzalayBobrovniczky noted in the video message. He said work was underway with the KMW plant’s management on organizing supplementary services, simulations and maintenance.

Lidl Hungary Increasing Wages Once Again

German-owned discount retailer Lidl Hungary has decided on another wage increase, the market-leading retail chain announced, according to business daily Világgazdaság [Global Economy].

Germany’s Thyssenkrupp plans a HUF 23 billion expansion at its camshaft and steering system plant in Jászfényszaru (60 km northeast of Budapest), Minister of Foreign Affairs and Trade Péter Szijjártó said on Oct. 2. The investment will give Thyssenkrupp the capacity to turn out two million rotor shafts for electric vehicles a year, Szijjártó said. The state is supporting the project, which will create 110 jobs, with HUF 4.6 bln, he added. Hungary competed against “very many” countries for the investment, Szijjártó said, adding that Thyssenkrupp”s choice clearly showed German companies” continued confidence in Hungary and the local investment environment. “Ties between the Hungarian government and

From September, the wages of store and warehouse workers were increased by an additional 10%. Over the course of nine months at the company, basic wages for manual workers have increased by 21-43%. This is the second wage increase decision at Lidl Hungary, the first being implemented at the beginning of the year.

15 Siemens Locomotives Added to MÁV Fleet

Some 15 Siemens locomotives will be added to the fleet of Hungarian State Railways (MÁV), according to profitline.hu. The vehicles made by the German multinational technology conglomerate will be in service from the second half of October on the domestic InterCity and EuroCity lines to Vienna. With the expansion of the locomotive fleet, train traffic will become more predictable, MÁV-Start, the company’s passenger division, saidd on its website on Sep. 28. According to MÁV, 15 used ES64 U2 V7 twocurrent high-performance locomotives in “excellent technical condition” are being rented to better serve the constantly growing passenger traffic.

German companies that invest in the country are based on mutual respect,” he said. Szijjártó acknowledged the work of Marc de Bastos Eckstein, Thyssenkrupp”s executive in Hungary, with a state award. In a separate statement, Thyssenkrupp said the production palette at its engine components plant in Jaszfenyszaru would be expanded with rotor shafts for EVs. Construction of an 8,200 sqm expansion at the plant is expected to finish in Q1 2024, and production is set to start in Q3 2024. Recruitment for the new capacity has already started. Rotor shafts produced at the plant will mainly go to premium German car makers. Since 2015, Thyssenkrupp has invested more than HUF 150 bln in Hungary.

Szijjártó: German Automotive Presence in Hungary Drew Asian Investment

Minister of Foreign Affairs and Trade Péter Szijjártó, addressing the IAA Mobility conference in Munich recently, said Hungary had benefited from a “strong cooperation” between Chinese and German automotive industry companies, according to origo.hu. Szijjártó told automotive industry leaders at the trade event that Hungary had based its strategy on being “equally attractive” to German OEMs and their Chinese suppliers. The country is now a “meeting point” for investments from the West and the East, he added. Three of the big German premium car makers already have or will have a manufacturing presence in Hungary, while five of the top 10 global battery manufacturers have committed to building plants in the country, among them China’s Catl, Sunwoda and Eve Energy, and South Korea’s SK Innovation and Samsung SDI, he noted. “What brought these big Chinese companies to Hungary? I have to tell you, mostly the German OEMs,” Szijjártó said.

12 | 3 Focus www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

ADVERTISEMENT

3 R D E D I T I O N O F T H E H U N G A R I A N B A T T E R Y D A Y H O T E L M A R R I O T T B U D A P E S T T h e l e a d i n g b a t t e r y c o n f e r e n c e o f C e n t r a l & E a s t e r n E u r o p e 2 6 O C T O B E R , 2 0 2 3

Photo by Cineberg / Shutterstock.com

Emphasizing Group Efforts to fly to a Greener Future

Those jobs are spread across the Infopark in Budapest, at Vecsés, and in Szeged in two distinct companies. Perhaps counter-intuitively, they have nothing to do with the automotive industry, although transportation is front and center. Vecsés is a somewhat disingenuous clue: it is home to the Ferenc Liszt International Airport, whose official address is given as Budapest’s District XVIII. The group is Lufthansa, and the two companies are Lufthansa Systems Hungária Kft. and Lufthansa Technik Budapest Kft.

Lufthansa is best known as the national flag carrier for Germany. However, the group comprises further airlines and companies, including Austrian Airlines, Brussels Airlines, Swiss, regional airlines CityLine and Air Dolomiti, and low-cost carriers Eurowings and Discover Airlines (Lufthansa prefers the term “holiday airlines”). It is a sizeable operation by any standards, and the two local managers are working to make its full scope better known in Hungary.

“The Lufthansa Group offers Hungary frequent links through its main airlines with its hubs in Germany, Switzerland, Belgium and Austria, as well as offering additional destinations in Germany with Eurowings. I think we belong

to the three biggest airline groups at the airport,” says Lufthansa Technik Budapest Kft. CEO Thoralf Wagner. The two Hungarian companies follow the group model where nonflight services are also offered to the industry on a market price basis. Lufthansa Technik Budapest Kft. (LTB), part of Lufthansa Technik AG (LHT), provides maintenance, repair, and overhaul services for narrowbody aircraft. The core activity of Lufthansa Systems Hungária (LSYH) is the development, testing and operation of aviation industry applications, although it also offers IT solutions to clients in other industrial branches.

independently, and the majority of the orders come from outside the Lufthansa Group,” Wagner explains.

Strong market presence

The same is true for LSYH, says its managing director, Stephan Neumann. “Whilst providing substantial IT services to Lufthansa Group customers, most of the businesses we serve are nonLufthansa Group airlines, and in some cases, even fierce competitors of the group. We serve more than 350 airlines worldwide, showing great interest in our products and solutions.”

LTB has around 400 people on staff, all based at the airport. “We are really the guys with the oily hands,” Wagner jokes. Neumann is responsible for more than 750 IT professionals at LSYH in Hungary. The majority are based in Budapest’s Infopark, with about 75 in Szeged. Coincidently, both managers moved to Hungary in 2021. They are in regular contact, even if their day-to-day roles are in different fields.

“Lufthansa Systems GmbH, the LSY headquarters in Germany, holds the customer contracts. Lufthansa Systems Hungária Kft. is a 100% subsidiary of Lufthansa Systems GmbH, and together they are one substantial part of the big IT ‘tribe’ of Lufthansa Group,” Neumann says.

The Szeged operation opened just before COVID struck and exists, in part, to give LSYH access to another talent pool beyond Budapest.

“We are super happy with the quality of work. Where we are super unhappy is that we cannot get enough people, but that’s not driven by Hungary at all; it is the same everywhere. […] We take people directly from high school, so we need them to have a good basic STEM education; that’s super important for us. The output of the state system for aircraft technicians is minimal. So, we rely completely on our internal training school, taking them from scratch.”

Size Matters

LSY is still in a growth phase in Hungary, having doubled its headcount in the past couple of years, although Neumann suspects that might begin to plateau in the next year or so. Lufthansa Technik Group is also growing constantly and has to, Wagner adds.

“Our model is a market relationship. We bid on Lufthansa Group tenders as well as tenders from other airlines, even if they are competitors of the group airlines. We can act fully

“We had good connections to the local university; some of our key people were studying there, and it is pretty strong in data engineering and data science,” the LSYH head says. “While data was an initial focus, the employment net has since widened. We found a lot of great people in Szeged with various competencies,” he adds.

The maintenance, repair and overhaul market is growing, and the Lufthansa Technik Group, as a market leader, must expand to maintain and, ideally, increase market share. That is important when negotiating with significant partners like the aircraft,

Continued on page 14

3 Focus | 13 www.bbj.hu Budapest Business Journal | October 6 – October 19, 2023

Many of the jobs created in Hungary by German investors are value-added; it is one of the reasons the government is so happy to encourage further investment from its most significant Western partner. One quintessential German group has more than 1,000 employees across the country, all in highly skilled positions.

ROBIN MARSHALL

Thoralf Wagner

›››

engine and component manufacturers or airline groups. This is one area where size really does matter because consolidation is ongoing.

For both managers, finding staff is an issue. “We are super happy with the quality of work. Where we are super unhappy is that we cannot get enough people, but that’s not driven by Hungary at all; it is the same everywhere,” says Wagner. In response, LTB has significantly increased the intake of its training school at Budapest Airport.

“We take people directly from high school, so we need them to have a good basic STEM education; that’s super important for us. The output of the state system for aircraft technicians is minimal. So, we rely completely on our internal training school, taking them from scratch.”

Every six months, LTB takes on 25-30 trainees. The latest intake began this September. Wagner says the education level required falls somewhere between the vocational and university paths. Once a car mechanic has qualified, that is pretty much it, he says by way of comparison. To become a fully licensed airline engineer, able to work on even the most sophisticated aircraft systems, can take six years. The benefit lies in the compensation levels if and when you get that far.

ADVERTISEMENT