Market Talk: Sharpen

Digital Pencils Poor Q4 2023 Data

We take the temperature of Hungary’s tax and accountancy market. What are the changes for 2024, what should change in the future, what is coming down the line that businesses should be preparing for now, and what are the workforce concerns?

Inflation

Chocks Away?

13

3

writer, handicrafts

in

a “small city”

25

Overshadows

‘This is Budapest’

fees, but

“great

destination” and an “easy sell.” Ryanair’s greatest challenge is the delays to delivery of

9 Tax and Accounting SPECIAL REPORT INSIDE THIS ISSUE SPECIAL REPORT SOCIALITE NEWS SPECIAL REPORT YOUR INDISPENSABLE EVERYDAY COMPANION FOR BUDAPEST BUSINESS NEWS AND VIEWS SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM VOL. 32. NUMBER 5 | MARCH 8 – MARCH 21, 2024 HUF 2,100 | EUR 5 | USD 6 | GBP 4 C M Y CM MY CY ai1709106091210_Főoldali banner.pdf 1 2024.02.28. 8:41:31

The unexpected base rate cut of 100 basis points in late February undermined support for the forint. There is hope of a return to some growth this year, even if results in the final quarter of 2023 disappointed.

Turkish

artisan and instructor Jale Elhadef on Life

Hungary’s capital,

compared to Istanbul.

Your

Michael O’Leary worries nationalizing Budapest Airport would result in higher landing

says the city is a

tourist

Boeing aircraft, he insists.

/

Photo by Alexandros Michailidis

Shutterstock.com

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES:

Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center

1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu The

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

THE EDITOR SAYS

DEATH, TAXES, AND MILITARY ALLIANCES

They say there’s not much more certain in life than death and taxes, though a Swedish cynic might have wanted to add Hungary blocking accession to NATO to that list in the past couple of years.

It has been difficult to determine what the calculus for Hungary has been since Sweden, faced with Russia’s war in Ukraine, turned its back on long-held neutrality to seek the comfort of a NATO security blanket. On the face of it, Hungary’s oft-repeated promise not to be the last to ratify, only to be proven to be just that, ought to have been embarrassing. But as one enormously experienced business leader put it to me (in different circumstances) just before Christmas, that is to make the mistake of applying rationality to the argument.

Let’s put one excuse to bed: Hungary’s leadership frequently said it supported Sweden’s bid, but, it added, Hungary’s lawmakers are sovereign, felt insulted by Swedish comments about the quality of Hungarian democracy, and they would need to be appeased. Yet, a motion to accept Sweden’s bid wasn’t even put on the parliamentary agenda until Turkey, the only other holdout, seemed to surprise everyone by suddenly dropping its veto. Fidesz, and specifically Viktor Orbán, has such an iron grip on his MPs that if he told them to argue black is white, it would surprise no one if they did so. Also, if not liking the things others say about you is to be the test for gaining your approval, Hungary seems unlikely to ever agree to anything ever again. That said, it is precisely the argument the country has deployed on another NATO-related matter, with Minister of Foreign Affairs and Trade Péter Szijjártó insisting the government cannot support Dutch Prime Minister Mark Rutte’s bid to head up the military alliance.

“We certainly can’t support the election of a man to the position of NATO’s secretary general, who previously wanted to force Hungary on its knees,” Reuters quoted Szijjártó as saying,

a reference to statements made by Rutte during the many arguments between Hungary and the EU over rule-of-law concerns. Orbán has never given the impression of worrying too much about what the rest of the world thinks of him (with the possible exceptions of Donald Trump and Vladimir Putin). Still, he presumably wanted to get something in return for agreeing to Sweden joining NATO. In the aftermath of Turkey’s approval, Sweden’s PM visited Budapest, did not speak to parliament, but did agree to an arms deal with Orbán, which will, among other things, boost Hungary’s fleet of Gripen fighters by four aircraft. And then parliament voted its approval. Perhaps that was the calculus all along.

This issue of the Budapest Business Journal also deals with another of life’s certainties: taxes (and accountants). Our Market Talk survey shows that many players feel the introduction of eVAT will likely be hugely impactful. It is a reminder that, like the National Bank of Hungary and green finance, the digitization of the tax environment is an area where Hungary is carving out a pioneering role. It’s not new to the game, either. You can chase its development back to the (admittedly not flawless) introduction of shop tills connected directly to Hungary’s National Tax and Customs Administration. Not that Hungary’s system is perfect; far from it. Asked what changes they would like to see, our panel suggested an end to special taxes, closer alignment with IFRS, closer following of trends like cybercurrencies, and, unsurprisingly, less administration and over-regulation and fewer bureaucratic burdens. I wouldn’t hold my breath on that last one. People have been asking for that since the Dual Monarchy and probably before.

Robin Marshall Editor-in-chief

THEN & NOW

In the black-and-white picture from the Fortepan public archive, opera singer Mihály Székely (center) sings Sarastro’s aria from Mozart’s opera “Magic Flute” in the Hungarian State Television’s studio in 1963. In the color photo from state news agency MTI, András Batta, executive director of the House of Music Hungary, speaks before the opening performance of Concerto Budapest’s Mozart Day at the Liszt Academy on March 3, 2024. The festival, now in its seventh year, features four concerts for adults and one for children, with performances by clarinetist Wenzel Fuchs, horn player Stefan Dohr, wind soloists from the Berlin Philharmonic Orchestra,

2 | 1 News www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US ONLINE: WWW.BBJ.HU

IMPRESSUM

BBJ-PARTNERS

pianist Gergely Bogányi and Norwegian violinist-conductor Arvid Engegard.

*****

Photo by Zoltán Balogh / MTI

Photo by Zoltán Szalay / Fortepan

1News

Poor Q4 2023 Data Overshadows January’s Headline Inflation News

The unexpected base rate cut of 100 basis points in late February undermined support for the forint.

Change in GDP in Hungary, 2010-2023

Annual economic growth rate

At 3 p.m. on a Tuesday, Mammut Shopping Center in Buda has a fair sprinkling of visitors. If the linguistic clues were removed, the mall could pass for one of its Western European peers. Certainly Nick Shaishmelashvili, a teacher of English, on holiday from Tbilisi, Georgia, felt so.

“It’s very modern, very Western, yeah,” he told the Budapest Business Journal in a random encounter, only to add: “But it depends what you are comparing it to. When I was in Spain, there was a big difference. If you look at the streets, you can feel it. The ones here are like, Eastern, and Spain is more West.”

Indeed, had the Georgian ventured towards the back of the first floor of the Mammut I building, he might also have tempered his judgment on the mall. Your correspondent counted some 10 units closed or empty on this floor, clear symbols of the faltering Hungarian economy over the past 18 months, even if this evidence was well camouflaged behind colorful advertisements.

There is, however, hope of a return to some growth this year, even if results in the final quarter of 2023 disappointed. Unadjusted output for the quarter was unchanged, although it edged up by 0.5% when seasonally and calendar adjusted, the Central Statistical Office stated in its final reading, released on March 5.

This end-year weakness meant the economy for the full year contracted by

0.9%,

or 0.7% when adjusted, compared to 2022.

“Agriculture saved the day, again,” OTP Bank Securities headlined its flash report the next day, further warning, “Domestic sectors may have hit bottom, but stagnation in Q4 and gloomy export outlook suggest that growth could be modest in 2024.”

Indeed, such was the impact of the agricultural sector, which expanded by almost 82% last year (following a drought-hit year in 2022) that its growth contribution was 2.5 percentage points to the final result.

Worse Than Expected

“Hence, the non-farm GDP contracted by 2.6% year-on-year in Q4, after shrinking by 4.1% in Q3 (and declining by 3.2% in 2023 as a whole). This 2.6% contraction was even worse than our -2% expectation [….] meaning that the growth structure was even worse than we had forecast,” OTP analysts lamented.

In particular, industry (down 6.4%) and construction (down 7.4%) played a significant role in the fourth-quarter data.

The downbeat GPD report somewhat obscured one item of what, at least initially, appeared as good news: the National Bank of Hungary (MNB) Monetary Council’s decision to cut the base rate by 100 basis points to 9% on Feb. 27.

Following four consecutive monthly cuts of 75 basis points, the decision came as some surprise, especially after what analysts described as the “hawkish tone” of the council’s January press conference.

However, the rate-setters felt emboldened by January’s headline inflation news, which saw CPI fall to 3.8%, the first time in

months

34 months that this indicator was within the MNB’s inflation target band of 3% +/- 1%.

Yet, given the many economic uncertainties, the likely one-off larger cut failed to please the markets and the forint began to slip in the wake of the

announcement, falling to HUF 396.80 to the euro at one point on March 4, a 12-month low, before recovering to around HUF 394 as this paper went to press.

The poor fourth-quarter GDP news has dampened analysts’ hopes for the year, in contrast to the government’s current projections of 4% growth.

Harsh Reality Check

In an assessment entitled “Walking on thin ice,” written before the detailed fourth-quarter data was announced, the ING Bank team, headed by Péter Virovácz, wrote: “The economic recovery got a harsh reality check as GDP stagnated in 4Q23. [….] Against this backdrop, we lower our full-year GDP forecast from 3.1% to 2.1%, mainly due to a much less positive carry-over effect.”

Moreover, although the report acknowledges the surprise inflation numbers for January, it points out that it was primarily due to the base effect (CPI peaked at 25.7% in January 2023) and warns of an expected increase in inflation later this year.

“We will be closely monitoring the repricing of services, as we expect strong repricing in March and April on the back of price increases by telecoms, banks, and insurance providers,” ING said.

And, while headline inflation in the immediate future is likely to remain below the upper limit of the central bank’s tolerance band, “from May, we see a slight reflation driven by base effects. In this context, another round of reflation will emerge towards the end of the year, hence our call for year-end inflation in the range of 5.5-6%,” it argues.

As a result, the ING team sees the base rate falling to

6.5%

at the June rate-setting meeting but then sticking at this level, with year-end inflation in the range of 5.5-6%.

However, the owners of Mammut and other malls can take heart, as ING has good news for the retail sector.

“Consumers will receive a significant income boost from retail bond coupon payments throughout the first quarter (approximately 2% of GDP), which, if not reinvested, will support consumer spending, while consumer confidence is trending higher,” the ING analysts predict.

OECD Cautiously Optimistic on Hungary, but Outlook ‘Subject to Significant Risks’

Economic output in Hungary is projected to hit 2.4% this year, compared to 2023, but the outlook remains “subject to significant risks,” the OECD warns in its latest report on Hungary, released shortly before this edition of the BBJ went to press.

In its report, the Paris-based organization details a long list of concerns regarding Hungary and its economic policies, which, it argues, hamper economic development.

“Beyond uncertainty related to inflation and energy prices, rising business failures may cause an increase in non-performing loans, which would further reduce credit distribution and weigh on economic activity,” it states.

Furthermore, while any “incomplete or late delivery” of European Union

funds that are currently subject to the implementation of rule-of-law reforms in Hungary constitute “another key risk for investor confidence, the cost of capital and the exchange rate,” in addition to the direct negative impact this loss will have on investment and public finances.

Among the many factors the survey urges policymakers to address, it turns the spotlight on poor productivity growth (although this has seen improvements since 2016) and the need to focus on more inclusive growth, that is, to reduce inequalities of opportunities between men and women and between income groups.

“Social transfers keep income inequalities and poverty low. However, those in the

upper-income quintile receive a larger share of social transfers than those in the lower-income quintile,” the OECD points out. It advocates better targeting of social transfers to achieve the same redistribution but in a “more cost-effective way.”

It also blames the education system for failing to assist those from a poor socio-economic background to develop their economic potential, noting that “on average, it takes seven generations for children in the lowest income decile to reach an average income level.”

In short, if you are born into a lowincome family, your chances of making even an average income in Hungary are extremely remote.

34

www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

• macroscope

EDDY

KESTER

Quarterly change in GDP; volume index, same period of the previous year = 100 (seasonally and calendar adjusted and balanced data) Source:

DVM Group and Greenfield Development Launch Industrial JV Real Estate Matters

DVM group and Greenfield Development have launched an industrial sector joint venture under the name DVM-Greenfield to combine the construction experience of the former and the industrial contracting experience of the latter, according to the JV.

Doubtless reflecting the attractiveness of the industrial real estate sector and the increasing complexity of development and tenant demands, the new company will work closely with Limelog, a manufacturing and logistics firm, to provide its clients with integrated services.

Since its launch, DVM-Greenfield has already undertaken more than 70,000 sqm of general contracting and project management work. The participants have been keen to emphasize that the partnership does not represent a merger; DVM group, Greenfield Development, and Limelog will continue to operate independently.

“Due to the coronavirus pandemic, the stability of supply chains had to be reinforced, and in parallel, the growth of online commerce has led to a significant

A biweekly look at real estate issues in Hungary and the region

boost in the domestic and regional industrial real estate market in recent years,” comments Dávid Huszlicska, director of DVM-Greenfield.

“To ensure production security, European companies are increasingly bringing their own and their suppliers’ manufacturing facilities closer to their local markets, further increasing demand for quality warehouses and production halls. This interest is only intensified by the emergence of Asian manufacturing and assembly plants in the country, which also represents a huge opportunity for expansion,” Huszlicska adds.

Positive Trends

In reaction to these positive industrial market trends, Greenfield Development was launched in 2022 to provide general contracting and consultancy services to the industrial real estate sector. The founders of the company are Gábor Móró (also the owner of Limelog, which has its own fleet of transport vehicles and a prefabricated concrete element factory), Dániel Szélesi (who formerly held management positions at leading industrial park developer and operator CTP) and Huszlicska.

Since its foundation, Greenfield has developed a close professional relationship with DVM, which provides integrated building services in Hungary.

On behalf of the group, Tibor Massányi has joined DVM-Greenfield’s management team as the JV’s managing director.

“Synergies enable us to deliver industrial real estate projects quickly, efficiently, tailor-made and to the highest professional standards,” Massányi says.

“In addition to general construction, we are able to guide our clients through the entire process, from the selection of the ideal site, through to conceptual design and construction, to commissioning,” he explains.

“We are available to our clients in all areas of the investment process, whether it is the development of a feasibility study or leasing issues,” Massányi concludes.

Booming Market

The industrial market has been booming, with leading regional industrial park developers and operators and Hungarian firms active in Hungary. Although the stock is still relatively small here compared to the more significant Central European industrial markets, a regional logistics and light industrial market has emerged, as elsewhere in CEE.

As of the turn of the year, there were around five million-plus square meters of modern logistics and light industrial space in Hungary, with 3.5 million sqm in the Greater Budapest area and 1.6 million sqm in provincial countryside centers.

According to consultancy Colliers, vacancy stands at 8.6% in Greater Budapest and 5.7% in the countryside. The industrial pipeline for Hungary currently stands at 460,000 sqm, of which

43%

is preleased. The most significant projects are a 118,000 sqm warehouse at CTPark Sziget, the 56,000 sqm Weerts Vecsés and a 45,000 sqm facility at HelloPark Maglód - Budapest Airport.

DVM-Greenfield clients include Biggeorge Property with the realization of the 8,200 sqm West Gate H building and Panattoni Hungary with the 15,000 sqm ZF chassis manufacturing plant and warehouse in Debrecen (222 km east of Budapest by road).

“To ensure production security, European companies are increasingly bringing their own and their suppliers’ manufacturing facilities closer to their local markets, further increasing demand for quality warehouses and production halls. This interest is only intensified by the emergence of Asian manufacturing and assembly plants in the country, which also represents a huge opportunity for expansion.”

Elsewhere, the 22,800 sqm manufacturing unit of Jiecang Linear Motion in Kaposvár (187 km southwest of the capital) and the 26,000 sqm manufacturing unit of Evoring Precision Manufacturing in Jászfényszaru (65 km east) will be supported by complete project management, including the preparation of the design, the management of the construction permit, the general contractor tender, technical control and the financial monitoring.

4 | 1 News www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

GARY J. MORRELL

Industrial Pipeline TOTAL 460,000 sqm PRELEASED 43% Largest Projects sqm CTPark Sziget 118,000 Weerts Vecsés 56,000 HelloPark Maglód - Budapest Airport 45,000

Hungarian

The 15,000 sqm DVM-Greenfield project for Panattoni is under construction in Debrecen.

Hungary Finally Allows Sweden in From the Cold Roundup Crisis

Feb. 24 marked the second anniversary of Russia’s invasion of Ukraine. Hungary had blocked European Union member states from issuing a joint statement to mark the occasion. Although the reasons for the veto were not immediately clear, a diplomat “in a position of authority” told Bloomberg News that the Hungarian government found the language of the statement excessively forceful.

of the conflict, held near the Russian embassy in central Budapest on Feb. 24.

“We are here today to stand with the courageous Ukrainian people and send the message to the world that although we may have a worthless government, we are not a worthless nation,” Karácsony said. “Budapest knows what it is like when Russian tanks roll along its streets. Budapest knows how hard it is to stand up for freedom.”

Consequently, the presidents of the European Commission, Council and Parliament issued their own statement on Feb. 23, alongside a separate statement issued by the Hungarian government addressing the conflict.

In his own separate statement, Budapest Mayor Gergely Karácsony expressed solidarity with the Ukrainian cause and shame over the government’s perceived lack of support at a demonstration marking the anniversary

Meanwhile, the Hungarian Parliament finally ratified Sweden’s accession to NATO during the opening of its spring session on Feb. 26. The Promulgation of the Protocol to the North Atlantic Treaty on the Accession of the Kingdom of Sweden, as the bill is formally titled received 188

votes

for and six votes against, with no abstentions.

Following Russia’s invasion of Ukraine, Sweden broke with its longheld precedent of neutrality and

applied to join NATO, alongside Finland, on May 18, 2022. While the latter’s bid had been approved much earlier, NATO member states Hungary and Turkey had been reluctant to accept Sweden in a process that requires unanimity. Although Hungary had repeatedly assured Sweden it would not be the last to approve the Nordic country’s bid, it failed to honor this when Turkey’s parliament ratified Sweden’s accession to NATO in January.

Fidesz Boycott

Thereafter, opposition members of Parliament called an extraordinary meeting to ratify Sweden’s NATO bid on Feb. 5, but lawmakers from the ruling Fidesz party boycotted the session, insisting that Swedish Prime Minister Ulf Kristersson must visit Budapest before they would grant approval.

At the invitation of Prime Minister Viktor Orbán, Kristersson ultimately came to Budapest on Feb. 23, during which Hungary and Sweden signed an arms deal, as part of which, Sweden will provide Hungary with an additional four Gripen fighter jets, bringing its fleet to 18 aircraft.

The countries also extended a contract on logistics services for military systems and broadened it to include training. Under another agreement, Saab and Hungary’s Defense Research Institute will open a center of excellence focusing on artificial intelligence.

Following the ratification by Parliament, Deputy Parliamentary Speaker Sándor Lezsák signed off on the ratification of Sweden’s NATO accession and forwarded the legislation to the president’s office for promulgation, according to voting records on parliament’s website accessed on March

2.

Hungary’s newly elected President Tamás Sulyok, who MPs voted in on the same day the NATO bill was passed, subsequently signed the legislation on March 5, the first day of his term. The remaining formalities, such as depositing accession documentation in Washington, will likely be concluded swiftly, allowing Sweden to become the 32nd member of the alliance.

“It is tremendously important, and hopefully, we will now become members, and it will not be a matter of weeks but a matter of days,” Swedish Defense Minister Pal Jonson said at a press conference in Stockholm. “It will be good for Sweden, and it will be good for NATO. It will be good for stability in the entire Euro-Atlantic area that Sweden can become a full-fledged member of NATO.”

1 News | 5 www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024 BUDAPEST HYDROGEN SUMMIT JOIN THE REGION’S LEADING HYDROGEN CONFERENCE APRIL 10 2024 HOTEL MARRIOTT BUDAPEST REGISTER NOW 3RD

NICHOLAS PONGRATZ

Ukraine

ADVERTISEMENT

Sweden’s Ambassador to Hungary Diana Madunic (front right) watches on at the plenary session of the National Assembly on Feb. 26 when parliament gave its consent to Sweden’s accession to NATO. Photo by Szilárd Koszticsák / MTI.

Digital Patient Journey Management System Enters its Next Phase Health Matters

Based on feedback from professionals and patients, the development of the digital patient journey management system Dr. BetMen, (a mosaic word from beteg or “patient” and menedzsment , “management”), which is linked to Hungary’s e-health system, EESzT, has entered the next stage.

The innovative web application, the first version of which was donated to the Hungarian state by the Hungarian Foundation for the Development of Personalized Healthcare (Szefa), founded by Roche Hungary, is set to be improved with the involvement of other hospitals and extended to cover more types of diseases.

The Ministry of the Interior, the National General Directorate of Hospitals (Okfő), the five hospitals concerned, and Szefa have signed cooperation agreements to facilitate the joint development of Dr. BetMen.

The web application will provide users (GPs, specialists, care managers and patients) with a treatment plan, appointment booking system and consultation facilities, making the patient journey from primary care to specialist treatments, follow-up care and analysis of therapies more predictable and traceable.

The Dr.BetMen digital patient pathway management system will offer an integrated solution that follows the patient through the entire patient pathway: enabling prevention, facilitating early admission, shortening and optimizing the efficiency of each treatment pathway and making it assessable from multiple perspectives.

Roche Hungary developed the first version of Dr.BetMen

in collaboration with Bács-Kiskun County Hospital to provide a protocolrich and personalized treatment, rehabilitation and follow-up phases of the oncology patient journey.

“One of the big advantages of the digital patient journey management system is that it helps to identify good practices in care: those that lead to better outcomes can be used to update existing procedures,” said Zsolt Horváth, chief oncologist at BácsKiskun County Hospital, who has been involved in the project since its launch.

Significant Advantage

The specialist sees the ability to integrate patient satisfaction into the care system as a significant advantage. At the same time, it also allows for quality assurance considerations and the introduction of performance measurement.

According to Horváth, the digital management system could play a vital role in the future of patient care in Hungary because it could reduce administrative time, improve the relationship between patient and healthcare provider, make medical work and human resource management more predictable, and make the allocation of professional resources more dynamic.

At the end of the original development period, the first official version of

A monthly look at health issues in Hungary and the region

following the technical and technological validation and agreement with EESzT. The cooperation agreements now concluded will create opportunities for the further development of the system, involving new institutions and fresh areas of expertise. In cooperation with the Korányi National Institute of Pulmonology, the focus will be on supporting early detection and diagnosis of lung diseases.

State Secretary for Health Péter Takács considers care management along patient pathways the basis of modern, sustainable healthcare systems and says that user-friendly digital support for patients and healthcare workers in planning and monitoring patient journeys is one of the most innovative areas of today.

“A care management service package based on such patient journeys can be effectively integrated into the EESzT, which provides a network and a basis as well as innovative functionalities, connecting healthcare actors with a very high level of security,” the state secretary adds.

Digital Development

Regarding e-health development, Hungary currently stands out in the European field, Takács says, and he insists that the sector’s leadership remains committed to the digital development of the Hungarian healthcare sector and the introduction of new, forward-looking solutions.

Dr.BetMen was delivered by Szefa to the Hungarian State and the Hungarian Federal Office for the Management of the EESzT in December 2021.

“One of the big advantages of the digital patient journey management system is that it helps to identify good practices in care: those that lead to better outcomes can be used to update existing procedures.”

“With this donation, we committed to continue the development of the most suitable solution for the users together with our partners,” said Zsolt Molnár-Gallatz, president of the Szefa Foundation. He considers the great strength of the web application to be that users are involved in the development process and the elaboration of the operating model.

All the functional packages developed in this spirit will be handed over to the Hungarian state free of charge,

The renewal of healthcare, putting it on a sustainable footing and creating an efficient, quality-oriented, patientcentered system that supports prevention are among the government’s key objectives, Takács says.

“The digital health strategy goes hand-in-hand with the professional strategy of the health sector and supports the user-friendly implementation of national and EU-level professional objectives,” adds Magdolna Kádár, head of the Health Development Policy Department of the State Secretariat for Health of the Ministry of Interior.

As one of the plug-in service packages of the EESzT, Dr. BetMen offers a development process based on actual needs, with the involvement of users.

“In the digital development of healthcare, it is of paramount importance not to create duplicate systems, so Dr. BetMen will be integrated with the sectoral systems and tools that provide citizen EESzT access and digital appointment booking,” she notes.

“The integrated solution will significantly increase the quality and quantity of structured data that can be linked to patient journeys, supporting the development of datadriven healthcare and further raising the quality of patient care,” she noted.

6 | 1 News www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

BENCE GAÁL

Representatives of the cooperation institutions that have agreed to develop the Dr. BetMen digital patient journey management system further.

A School, Home and Joyful Refuge for Displaced Ukrainian Children

A small, dedicated team of educators helps relieve the difficulties of Ukrainian children in maintaining their schooling and lives in Budapest.

On a grey February afternoon, Oksana Bohdanova, aged 11, is awaiting the start of an English class in a modest flat in Budapest’s Józsefváros district

On a wall above are paintings and drawings, one showing buildings engulfed in flames, another a dark grey ship, a large letter “Z” on the side, sinking beneath the waves.

Yet another image is a map of Ukraine, dotted with hearts across the country. One is drawn over Kharkiv, Ukraine’s second city. It is in the far northeast of the country, a mere 40 km from the frontier with Russia. It is Oksana’s former home.

This is Ukrainian Space, an association founded soon after the fullscale Russian invasion of its western neighbor, where a small team of dedicated staff help kids like Oksana keep up with their education in their mother tongue. But it’s more than just an alternative, auxiliary, voluntary school.

“We believe it’s really a home for the kids and the parents who let them come here. We study together here, we try and give them psychological assistance, and also they teach us a lot,” says Hanna Danylenko, a co-founder of the association and teacher of math and biology.

She is one of three staff and four visiting educators who teach subjects from Ukrainian language and literature to geography, history, English and Hungarian to about 40 students. Some, such as Oksana, attend daily in addition to her regular morning school. Others come for one class a week.

With just two classrooms, the kids have to study with a mix of ages, ranging from preschool (aged four to six) through juniors (seven to 10) to seniors (10-14).

“Quite often, it is hard to teach children simultaneously from different forms, but, in our case, the younger kids often listen to what is being said to their elders, and they can sometimes grasp, maybe, some complicated

things [in advance]. And older kids are revising what they were taught two or three years ago, and this also helps,” says Danylenko.

War and COVID

Indeed, because of the war and COVID restrictions, many kids have not had “normal” classes for four years, so older children, in particular, can benefit from revisiting earlier parts of the curriculum.

Whether revising or pioneering new knowledge, the dedication and sheer doggedness of many pupils, some of whom may be in classes for up to nine or 10 hours a day, has amazed the staff.

“I’m astonished because they like to study. They all come from their respective Hungarian or online Ukrainian schools, with home assignments. Their motivation is that they don’t understand what they were told at the morning school, but they want to understand it,” she says. Moreover, the kids,

in many cases, exhibit a maturity and responsibility beyond their years.

“They realize that if they start to lag behind the curriculum, their parents will have to pay for tuition, while here they get this knowledge free of charge. Some of their parents are “over-educated” here in Hungary, a teacher may be washing dishes in a restaurant or a professional engineer doing some [simple] assembly work because they don’t speak Hungarian,” Danylenko says. “They don’t want to be a future burden on their parents,” she adds.

Like Oksana, Kateryna Yuhas, aged 14, attends Ukrainian Space daily, usually for three classes. Asked what she studies, her reply is simple: “Whatever I am taught! I study everything they teach here.”

Originally from Uzgohrod, western Ukraine, she switches to English for a few words to express why she works so hard. “I feel happy when I’m here,” then reverting to Ukrainian

Keeping Ukrainian Space Solvent

Like any operation, even those run on a shoestring, Ukrainian Space needs support. The association relies on a small band of private donors and, at different times or for specific projects, has gained assistance from Bálint Ház, the Jewish Community Center in Budapest, and the Calvinist (Református ) Church of Hungary. But the staunchest support has come from the Saint Margaret of Scotland Anglican Episcopal Church in Budapest.

“[Church] Councilor Gordon Cross brought his hope and plan to council to assist arriving Ukrainian families and their children with afterschool activities in their native language, help with Hungarian and other Western European languages, assistance with schoolwork, and counseling support where needed,” the Rev. Frank Hegedus, the chaplain of St. Margaret’s tells the Budapest Business Journal

for the complicated parts: “I love being with people with whom I can speak, the kids and the teachers as well. All the people around me here.”

But what about the scars of war and the need for psychological treatment? That is no longer so necessary, Danylenko says.

“It used to be quite an issue at the beginning. Now, what most of the kids need is just getting adapted to the Hungarian environment. The kids are more optimistic; they are able to see good things and to feel happy where adults still cannot think there is anything to be happy about.”

Coping Mechanism

Oksana seems to be a case in point.

During the first year of the conflict in Kharkiv, she survived a Russian attack hiding, with her parents, in the inside corridor of a high-rise block when a missile struck the neighborhood, destroying a shopping mall. Was she afraid? The question seems almost fatuous.

“A little bit. It was very loud. But more than that, I wanted to drink tea,” she recalls.

But, Danylenko admits, there are surely problems lurking deeper in many of those in her charge, as some might infer from the artwork on the wall.

“One of our girls learned, some two months ago, that her grandfather had been killed in the Zaporizhzhia region. He was taken to a jail by Russian soldiers because he openly showed his dissent with the new administration, and later shot. He was 76. We have quite a few such stories,” she says.

The effects of such traumas will likely take some time to work through, assuming they ever do. At least for now, Oksana appears to be the embodiment of stoicism.

“I come to the school because it’s Ukrainian Space here in Budapest. It’s a sort of shelter, a home, and people around who understand me, because the Hungarians don’t understand me at all,” she says.

As to whether the workload from two schools is too much, she responds breezily, “I still have days off, Saturday and Sunday, every week.”

Hearing this, from across the room, Kateryna, seemingly not wanting to be outdone in the diligence rankings, chips in: “I have three schools, and I don’t complain.”

The church council swung into action and was also instrumental in bringing Ukrainian Space’s needs to the United Society Partners in the Gospel (USPG), a United Kingdom-based charitable organization, which has since been able to offer significant additional funding.

“Ukrainian Space also assists parents in navigating life in Hungary. The center and its staff have become good friends of Saint Margaret’s, and we continue to offer help and support as we can,” says Hegedus.

1 News | 7 www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

KESTER EDDY

Teacher and Ukrainian refugee Anna Buzadzhy (back row, far right) with Kateryna Yuhas beside her. Oksana Bohdanova is in the center of the front row, holding a younger girl. Photo by Kester Eddy.

Geopolitics, Economics, AI and Quantum Computing: HBLF Financial Summit

The Hungarian Business Leaders Forum organized its 24th Financial Summit, “Games People Play: Geopolitics, Global Economic Challenges, Artificial Intelligence, Quantum Computing,” on Feb. 16 at K&H Bank’s Headquarters in Budapest.

leaders, ambassadors, and international specialists. The speakers provided valuable insights into the challenges and opportunities the ever-evolving global landscape presents.

The conference shed light on conflicting economic and policy interests that are increasingly prevalent today. As technology and the widespread use of artificial intelligence continue to shape daily lives, the economy, and physical security, it is crucial to interpret global political events and changes within the European Union and overseas.

To help navigate this complex landscape, the conference brought together a lineup of ministers, economists, C-suiters, business

András Bácsfalvi, the HBLF board member responsible for the financial summit, opened the event, followed by Attila Gombás, board member and K&H Deputy CEO. Minister of National Economy Márton Nagy, a keynote speaker, urged the launch of a program to support the purchase of electric cars at the European Union level and shared details about the ongoing global economic changes regarding the automotive industry along with its possible impacts and consequences.

In the panel discussion titled “Global Politics Through the Lenses of Ambassadors,” former Permanent Representative to the UN Ambassador André Erdős (vice president of the Hungarian UN Association), German Ambassador Julia Gross, and Andrew

Davidson, Chargé d’Affaires of the British Embassy in Budapest, shared their thoughts. Borbála Czakó, the former Hungarian Ambassador to London and honorary president of HBLF, moderated the roundtable.

The program continued with the “Economy, Security and Artificial Intelligence” panel, moderated by EY partner András Bácsfalvi, with the participation of Ádám Balog, president of Rheinmetall, Éva Hegedüs, president and CEO of Gránit Bank, György Jaksity, founder of Concorde Securities Zrt., and Ferenc Vágujhelyi, president of the National Tax and Customs Administration.

AI and Productivity

Paolo Sironi, IBM’s global research leader in banking and financial markets, shared the results of research into artificial intelligence and productivity by the IBM Institute for Business Value

during a presentation called “Transparency in the Age of AI.”

The Asia panel (also moderated by Bácsfalvi) featured Dávid Németh, a senior analyst at K&H Bank, Botond Feledy, a lawyer and foreign policy expert with the Center for EuroAtlantic Integration and Democracy, Hungarian Investment Promotion Agency CEO István Joó (also a Government Commissioner for Investment Promotion and the Implementation of Priority Largescale Investments), and Marcell TataiSzabó, BDO Hungary’s FDI partner.

Minister of Defense Kristóf Szalay-Bobrovniczky was another keynote speaker and covered the development of the Hungarian armed forces, the Russo-Ukrainian war, and the conflict in the Gaza Strip.

Following a two-decade-long tradition, the 24th HBLF Financial Summit was an exceptional platform for knowledge, networking, and collaboration. Attendees had the opportunity to engage with industry leaders and explore innovative solutions to address the pressing economic and geopolitical issues of our time.

The event finished with the thoughts of István Stumpf, university professor, former constitutional judge, and chancellor minister.

The Hungarian Business Leaders Forum is a non-profit organization founded on the personal initiative of the United Kingdom’s King Charles III when he was still Prince of Wales in 1992. It is dedicated to promoting diversity, inclusion, and responsible business practices that benefit business and society to achieve social, economic, and environmentally sustainable development in Hungary. With a strong focus on collaboration and knowledge sharing, the HBLF brings together influential leaders from various sectors to address critical challenges and positively impact the future of the Hungarian business sphere.

8 | 1 News www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

BBJ STAFF

Paolo Sironi is IBM’s global research leader in banking and financial markets.

(From left) Moderator András Bácsfalvi, Dávid Németh (K&H Bank), Botond Feledy (Center for Euro-Atlantic Integration and Democracy), István Joó (Hipa), and Marcell Tatai-Szabó (BDO Hungary).

Minister of Defense Kristóf Szalay-Bobrovniczky spoke about the development of the Hungarian armed forces, the Russo-Ukrainian war, and the conflict in the Gaza Strip.

(From left) Moderator Borbála Czakó, HBLF honorary president, German Ambassador Julia Gross, British Chargé d’Affaires Andrew Davidson and André Erdős, vice president of the Hungarian UN Association.

2 Business

Michael O’Leary: ‘Boeing Delays Remain our Greatest Challenge’

Ryanair boss has bemoaned an aircraft delivery bottleneck but defends Boeing’s safety record, even as he fears a state-owned Budapest airport operator would raise fees.

Ryanair would like to launch yet more new air links to Hungary, but production troubles at Boeing plants in the United States mean the low-cost carrier cannot obtain aircraft fast enough, CEO Michael O’Leary has said.

In Budapest on Feb. 20 to announce six confirmed new routes and other schedule enhancements for the summer timetable (as outlined in our previous issue), O’Leary was quizzed regarding the paucity of flights to countries like Switzerland, France and Germany from the Hungarian capital.

“We have no plans to go to Switzerland. It’s outrageously expensive, and they don’t particularly want Ryanair flying there. They want to protect Swissair from competition,” he replied.

As for Germany, commercial aviation there is struggling “because the government is raising taxes and the airports are raising fees, which is why this morning the German airports’ association released January traffic figures that said traffic in Germany is

77%

of what it was in January 2019,” he argued. More optimistically, he predicted the country would “see the error of its ways in the next year or two, begin to reduce airport fees, and then you will see more connections.”

But O’Leary stressed Budapest has a “great name,” represents “a great tourist destination,” and is “a very easy sell,” which deserved more connections, including France and “certainly” should be better linked to Spain and northern destinations such as Poland and the Baltics.

However, the slow delivery of new Boeing 737 aircraft from the United States is hampering expansion.

Aircraft Constraints

“One of the challenges we have this summer [is that] we are constrained by aircraft. We had hoped to get 57 aircraft from Boeing by June, but we'll be lucky if we get 45-50,” he said.

Mention of the U.S. aerospace company elicited questions from journalists aware of troubles with the latest Boeing 737 iterations in recent years. (These include two crashes in 2018-19, which saw the entire Boeing MAX fleet grounded for some 20 months, and the loss of a door plug on an Alaska Airlines flight this January. That incident involved no loss of life, and the aircraft landed safely.)

Did Ryanair have safety concerns given that both major airlines serving Budapest (Ryanair and Wizz Air) have planes that “fall out

of the sky, or are just falling apart,” one belligerent journalist demanded?

“Look, neither Boeing nor Airbus have planes falling out of the sky. These are the safest aircraft that have ever been made!” O’Leary retorted.

“The A320 and 737 have flown more flight hours than any other aircraft ever. We completed almost 1.1

million flights last year on 737s across Europe, so planes are not falling out of the sky, and I have no concerns about the safety of those aircraft the way we operate them,” he said.

Airbus has had problems with the engines on the A320, and Boeing has had quality control problems at both their Wichita and Seattle manufacturing plants, O’Leary admitted. To alleviate these issues, Ryanair has nearly 30 engineers seconded to both locations to inspect the production quality from start to finish.

Ryanair: What’s new for Budapest?

Ryanair will fly to six new destinations from March 31, the start of the summer schedule. Leading the pack is Milan Malpensa, with six flights per week, followed by Tirana, the capital of Albania, with three weekly flights.

Trieste (northern Italy), Frankfurt Hahn, Faro (southern Portugal) and

“We should not have to invest that kind of money in overseeing Boeing’s quality, but Boeing’s quality, not unlike Airbus on the engine side, has been problematic since they re-started production postCOVID,” O’Leary said, emphasizing in response to a Budapest Business Journal question that the inspectors concerned were professional engineers (and not technicians) and full-time employees of the airline.

O’Leary Complaints

No Ryanair press conference in Budapest would be complete without the man from County Cork sniping against “high-cost” competitor Wizz Air and, in particular, criticism of the Hungarian government for introducing its environmental tax on short-haul aviation traffic.

“The government, seeing the success of traffic here in Hungary, has introduced this bogus enviro tax, and they’re now going to purchase back the airport with a bunch of French monopolists, which is not a good recipe for the future growth of Budapest,” he complained. “But we’re here now, and we’re not going to retreat backwards.”

Ignoring the fact that it is difficult to retreat forwards, one journalist asked if the expected nationalization of Budapest Airport would result in higher landing fees.

“I expect if the state takes over Budapest Airport, particularly in partnership with the French company Vinci, [.…] the charges at Budapest airport will rise. You will have an even higher cost environment here in Hungary; you’ll have a highercharge, monopoly airport that is not committed to growth,” he concluded.

Vinci, headquartered in France, operates more than

70 airports worldwide, including some, such as London Gatwick and Belfast International, served by Ryanair.

The BBJ requested a response from Vinci on O’Leary’s criticism but did not receive an answer by our deadline.

Editorial update: Ryanair announced on March 1 that it now expects to receive only 40 new aircraft from Boeing by the end of June and, as a result, would be reducing the frequency of flights on some routes this summer. However, these cuts would not affect any of the new routes or enhancements already announced for services to and from Budapest, a spokesperson confirmed to the BBJ

the Greek island of Skiathos will each see two flights per week.

In addition, several current routes will see additional flights, notably Copenhagen and Rome (each with three extra weekly flights) and Birmingham, United Kingdom, with one extra.

The Belfast route, introduced last year with two weekly flights and allowing Hungarians to spend

time in what O’Leary optimistically described as the “sun-get-away destination” in Northern Ireland, is “doing fine,” according to a Ryanair spokesperson. Still, there are no plans to enhance the current service levels.

As a result of the new schedules this summer, Ryanair expects to be the number one airline in Budapest in 2024, with some five million passengers, up 22% from 4.1 million last year.

www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

EDDY

KESTER

Ryanair CEO Michael O’Leary promotes the number of flights from Budapest in front of Gellért Hill.

Cutting-edge Medical Chemistry Research Thriving at Szeged University

A pair of towering 91-meter cathedral spires stand at one end of Szeged’s Dóm tér, a 12,000 sqm quadrangle with cobblestone paving, walled in by three four-storied expansive brick buildings that are home to various university faculties and laboratories. The space resembles Saint Mark’s Square in Venice and is the most emblematic feature of the city and its university, which is top-ranked in Hungary.

been to organize our research portfolio around big questions, big challenges,” says Martinek.

OVI collaborates with other faculties and institutions in Szeged, such as the Biological Research Center (BRC), where Karikó worked in the early 1980s.

On the first floor of the structure facing the spires and the Votive Church and Cathedral of Our Lady of Hungary is the former office of Dr. Albert SzentGyörgyi, the late Nobel laureate biochemist after whom the university’s medical school is named.

The office’s current occupant is the winner of last year’s Nobel Prize in Physiology or Medicine, Dr. Katalin Karikó, who completed her studies here and currently serves as a research professor. Dr. Tamás Martinek, who heads the Institute of Medical Chemistry, or OVI, which was run by Szent-Györgyi from 1930 until 1945, works next door.

“So, this is a bit of a positive pressure on us, the legacy of two Nobel laureates,” says the jocular Martinek. “But we try to live up to the standards they set.”

OVI consists of several independent research groups and well-staffed core facilities that provide specialized support for the researchers. Present strengths include work on overcoming bacterial resistance, antibody delivery into cells, protein-to-protein interactions and the discovery of new cancer therapeutics.

The support facilities include nuclear magnetic resonance, mass spectrometry, the study of proteins, and computational and other services, enabling the research teams to investigate a range of molecules, including metabolites and proteins and their modifications and interactions.

“My approach since coming into this department in 2018 has

“There’s a strong group in the BRC, across the river [Tisza], working on antimicrobial resistance, led by Dr. Csaba Pál,” Martinek says.

Around five million people die from drug-resistant microbial infections each year, according to the World Health Organization.

Big Question

“Pál was among the first to state that antimicrobial peptides are really important tools fighting against antimicrobial resistance. And we started a collaboration with his group. And the big question is how antimicrobial peptides get useful in this fight.”

Peptides, like proteins, are made of amino acids, generally composed of short chains of them. Proteins are longer molecules made up of multiple peptide subunits. Synthesizing peptides has been an OVI specialty for many years and a specific interest of Martinek, particularly “foldamers,” artificial molecules that replicate the ability of proteins, nucleic acids, and polysaccharides to fold into well-defined conformations.

Through their research, the groups at OVI and BRC have discovered that certain disease-causing bacteria manage to evade the effect of antibiotics by slowing down their metabolisms and essentially “playing dead.”

“We realized that these antimicrobial peptides change the electrophysiology of the bacterial membrane. You just add peptides, and you measure increased voltage,” he says. “And that kick-starts the bacteria back to life.”

rival processes and holds much promise for macromolecular cancer therapy.

Entrapment of an antibody by a cell’s internal sorting compartments, known as endosomes, poses a significant challenge.

“This is what we are now working on. I won’t spoil the story, but we found something. It’s really interesting. We are figuring out how to initiate the escape from the endosomes before the degradation.”

Targeting Cancer

Treating cancer is the aim of another research group within OVI, headed by Dr. Gabriel Fenteany, a Harvard Ph.D. in biochemistry. Fenteany set up his group in 2021 and is currently focused on pharmacological approaches to unraveling and therapeutically modulating cellular pathways involved in cancer.

“We are looking at a number of dynamic protein-to-protein interactions that regulate cell growth, movement, and invasion, with roles in cancer progression and metastasis,” Fenteany explains.

Suddenly awake, the bacteria should again be vulnerable to the lethal effects of antibiotics, which the Martinek and Pal groups reported in 2021.

Another focus of Martinek’s research involves testing macromolecular agents, especially recombinant antibodies that penetrate cells to produce “intracellular” effects, as is the case with the mechanism of the mRNA-based therapy developed by Karikó. These differ from extracellular antibody agents whose actions occur outside the cell membrane.

Historically, most macromolecular therapies have been extracellular in the way they act, says Martinek. The big challenge is figuring out how to get the antibodies through the cell membrane. The cell membrane is inherently impermeable to protein molecules. Martinek and his group take advantage of a “back door” in a process called lipid raft-mediated endocytosis to gain entry for bespoke antibodies that specifically target the diseaserelated proteins within the cell without affecting other intracellular processes.

“We developed a method to trigger this lipid raft-mediated endocytosis, to route the antibody to the lipid raft-mediated pathway, and we patented it,” he says. He adds that this process of cell membrane penetration is far more efficient than

Lately, the team has been investigating the interactions between proteins involved in tumor growth and metastasis (when cancer spreads from one part of the body to another), including what is known as a Raf kinase inhibitor protein, or RKIP. This protein regulates the activity of several other proteins involved in cancer metastasis.

“One project involves protein-to-protein interactions with central players that control cancer growth and metastasis. Some of these interactions stimulate […] cancer cell proliferation, migration and invasion,” the researcher says.

“Other protein interactions are inhibitory, which means that one protein limits the activity of another that promotes these disease-related processes. Therefore, if we discover compounds that block cancer-promoting interactions or stabilize cancerinhibiting interactions, we may have potential drug leads,” Fenteany notes.

Given the potential of the group’s research on proteins like RKIP, Fenteany foresees involvement with a pharmaceutical company “once we find drug-like molecules that stabilize cancer-suppressing protein interactions or block cancer-promoting interactions.”

Fenteany’s group employs an interdisciplinary approach, combining pharmacological, biochemical and cellular methods to dissect the complex web of cellular signaling pathways. This approach allows for a deeper understanding of cellular dynamics and facilitates novel therapeutic targeting.

“I like this field. I already worked on it during my bachelor’s at home in Tunisia, and it was profoundly interesting for me,” said Sawssen Bouali, a Ph.D. student in the Fenteany Group. The importance of fighting cancer appeals to her. So, too, does the breadth of medical chemistry.

International students have become critical components in OVI’s research capacity and that of the university as a whole, says Martinek. A combination of human capital needs and funding have coupled with the availability of motivated students from countries such as India, Pakistan, Egypt, Tunisia, Syria and elsewhere.

10 | 2 Business www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

JACOB DOYLE

Ph.D. student Sawssen Bouali checks a sample under a microscope, watched over by Prof Gabriel Fenteany. In the background is Master’s student Csanád Vidéki.

Tamás Martinek, the head of OVI.

Rippl-Rónai Work, Unseen for Decades, Featured at Art and Antique Fair

A masterpiece by József Rippl-Rónai (1867-1927), unseen for almost 80 years, was the centerpiece of this year’s sixth Art and Antique Budapest exhibition and fair, which ran at the Bálna from Feb. 29March 3. This event, highly anticipated by art enthusiasts and collectors alike, unveiled a rare piece of Hungarian postimpressionism that has been hidden away in a private collection for decades, as reported by state news agency MTI.

of HUF 300 million, remains in private hands, with ongoing negotiations for its sale being handled by the gallery.

Record Sale

“St. Paul’s Farewell” was painted around the same time as another of RipplRónai’s masterpieces, “The Garden of the Castle of Geszt,” which achieved a record sale at a Judith Virág Gallery auction in December 2022.

“With this amount, the painting has ascended to second place on the list of Hungarian auction records, trailing only behind Csontváry’s ‘Mysterious Island,’” Kelen told MTI, pointing to the painting’s monumental value and significance.

The work, “St. Paul’s Farewell,” was painted by Rippl-Rónai in 1912 and showcases the zenith of his artistic journey. The artist is celebrated as the most distinguished Hungarian exponent of post-impressionism. His masterpiece was presented at the Judit Virág Gallery stand, offering the public a glimpse into his unique artistic vision.

“The painting has lain dormant for decades as a treasured piece of a private collection. It was first exhibited in Kaposvár in 1912, and the last time [in public] in December 1947, at the commemorative exhibition of the Ministry of Religion and Public Education in the capital,” explained Anna Kelen, an art historian with the Judit Virág Gallery, highlighting the painting’s historical and cultural significance.

Kelen emphasized the rarity of such large crowd scenes in Rippl-Rónai’s oeuvre, underscoring the uniqueness of “St. Paul’s Farewell.” The period, known as the artist’s “corn era,” gave birth to a style distinctly his own, winning him international acclaim and making his works highly sought after. This particular painting, with an estimated market value

The annual Art and Antique Budapest exhibition and fair boasted representation from 40 galleries, presenting thousands of artworks, ranging from paintings, sculptures, and jewelry to unique carpets, furniture, and antique books, allowing

visitors to immerse themselves in a world of artistic wonder and historical depth.

“This year, we have a fantastic selection of classical and contemporary material,” announced Ádám Tausz, the event’s main organizer. He highlighted an online charity auction, where items donated by the exhibiting galleries were up for bidding on the Axioart platform until the evening of Sunday, March 2. The proceeds from this auction were dedicated to supporting the Opera House Ballet Students’ Charitable Foundation, fostering a bridge between art and philanthropy. Now in its sixth iteration, the Art and Antique exhibition and fair was first held in 1994. Tausz noted that several of today’s exhibitors, including Erdész Gallery, MissionArt Gallery, Nemes Gallery, Nudelman Numismatica, and Virág Judit Gallery, have been participating since the event’s inception 30 years ago, a testament to its enduring appeal and significance in the art world.

1955 Masterpiece

Highlighting the fusion of classical and contemporary art, the fair featured

notable works such as Judit Reigl’s “Black Explosion,” a 1955 masterpiece that represents a pivotal moment in Reigl’s career, shown at the Kálmán Makláry Fine Arts Gallery stand. This piece, along with a 1971 painting by Hantai Simon presented by Initio Arts & Design, valued at approximately HUF 100 million and recently discovered in a French private collection after more than 50 years, underscores the fair’s role as a premier platform for encountering the crème de la crème of Hungarian art.

This year’s fair was also distinguished by its display of a 12-person dinner set adorned with the Kossuth family coat of arms, showcased at the Nudelman Numismatica stand. This exquisite

230-piece

silver

dinner set once belonged to Ferenc Kossuth, son of the Hungarian 184849 revolutionary Lajos Kossuth and a minister of trade from 1906-1910. Preserved in an original four-drawer deer skin-covered wooden box, it is valued at HUF 16.5 million.

In addition to these highlights, the fair also featured “Storm at the Horse Race” by Gyula Batthyány, brought by the Nemes Gallery. This painting, hidden for almost a century, represents one of the most significant pieces of Batthyány’s oeuvre and ties contemporary art to Art Deco influences. It previously belonged to an American oil magnate, who acquired it directly from the artist, adding a layer of international intrigue and history to its story.

This year’s Art and Antique Budapest exhibition not only serves as a showcase for the unseen masterpieces of Rippl-Rónai and other celebrated Hungarian artists but also as a cultural event that bridges the gap between the past and present, offering visitors an unparalleled journey through the realms of art and history.

The Bálna became a hub for art lovers and collectors during the fair. Its fusion of classical and contemporary art and the inclusion of unique historical items ensures the exhibition remains a highlight of the cultural calendar, inviting enthusiasts to explore, discover, and appreciate Hungary’s rich artistic heritage and contemporary creativity.

2 Business | 11 www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

GERGELY HERPAI

The Rippl-Rónai masterpiece, “St. Paul’s Farewell.”

Exhibitors and organizers at the press conference launching the sixth Art and Antique Budapest exhibition and fair.

Expat CEO of the Year 2024 Shortlist Announced

The official shortlist of nominees for the Budapest Business Journal ’s Expat CEO of the Year Award 2024 has been announced.

BBJ STAFF

Revealed first to members of the BBJ’s Boardroom Meeting at the Matild Palace on Feb. 22, the shortlist are the candidates from which the 10th annual Expat CEO of the Year will be chosen and awarded at an invitation-only Black Tie gala in the Corinthia Hotel Budapest’s Grand Ballroom on Saturday, March 23.

In alphabetical order by surname, they are: Raffaella Claudia Bondi of Roche Hungary; Chresten Bruun of Lego; and Arne Klehn of the Budapest Marriott Hotel & Marriott Executive Apartments.

Raffaella Claudia Bondi is general manager of Roche Hungary and

a board member of the Innovatív Gyógyszergyártók Egyesülete (Association of Innovative Pharmaceutical Manufacturers or AIPM). An Italian national, she was appointed to Budapest in August 2021, having arrived from Basel, Switzerland. The pharma company has two sites in Budapest and employs more than 2,000 workers, 200-plus of whom work in critical areas and functions for Roche.

Chresten Bruun is general manager of the Lego factory at Nyíregyháza and senior vice president at the Lego Group. A Danish citizen, he has been based in Hungary since June 2021,

initially as SVP for EMEA molding and Duplo, but since May 2023 as SVP for EMEA manufacturing, covering the Danish, Hungarian and Czech Republic markets. On September 28, 2023, the Lego Group announced a HUF 50 billion expansion to its 15-year-old factory in Nyíregyháza, creating additional production capacity to continue to meet strong demand. In 2008, Bruun was part of the “Discovery” group that toured CEE and chose Hungary for its factory site.

Arne Klehn is the multi-property general manager of the Budapest Marriott Hotel & Millenium Court

‘Innovation, Inspiration, Interaction and Integration’ at Corvinus Gellért Campus

After three years of architectural design, development and construction, the newly unveiled Gellért Campus of Corvinus University was officially inaugurated with the symbolic handover of the campus keys created in the new building’s innovative Makerspace classroom.

Executive Apartments and the Marriott Worldwide Business Councils guidance chair for Europe. Born in Germany, he moved to Budapest in May 2018 and has been at the center of local and expat hospitality and networks ever since. During his time here, the hotel has undergone a EUR 10.5 million renovation program. Interior refurbishments continue, the latest examples being the iconic Liz and Chain Sky Lounge in January and February 2024 and a EUR 1.4 mln project at the in-house laundry.

The title of Expat CEO of the Year is given to the business leader who has done the most for the country’s development and international recognition through his or her professionalism and outstanding achievements in the past 12 months. The award is now a tradition dating back a decade; it has been granted annually since 2015.

A professional awards committee chose the shortlist. The same jury will select the eventual winner in the minutes before the gala starts on March 23.

For more information about the award, including the names of the jury members, previous Expat CEO of the Year winners and for reports from the earlier galas, see our dedicated website: expatceogala.com.

and kitchen appliances available for students. The housing capabilities of the building center around hosting both Hungarian and international students; there are also six fully furnished apartments for professors.

The campus can accommodate 680 students across almost 14,000 sqm within the building, with classrooms, countless shared spaces, an extensive library and multiple fully equipped sports centers.

Apart from providing a stateof-the-art facility for students’ education and dormitory needs, the architectural concept of the building also focuses on sustainability and environmental awareness.

Constructed and operated according to Leed “Gold” certification sustainability criteria, the building has an “AA+” energy efficiency certification thanks to the solar panels and geothermal heat pumps installed across the campus.

“The Gellért Campus aims to show how a 21st-century university of economics and social sciences works. The building is a symbol of the future and of connections. It is a quality facility that is the home of the four ‘Is:’ innovation, inspiration, interaction and integration. These are the key factors that make this place special,” Lajos Szabó, rector of Corvinus University of Budapest, told the audience at the opening ceremony on Feb. 22.

Throughout the campus, much emphasis has been placed on communal areas and open spaces, aiming to invoke connections between students.

“The building itself is just stone, iron and glass. This building is defined by the spirit with which you, the students, fill it,” explained Minister of Culture and Innovation János Csák as he addressed students.

“It is this spirit, this soul, that will determine the future of the university. We have an identity not only as individuals, not only as Hungarians;

we also have an identity through the institutions where we study and work. Good institutions are those where some kind of identity is formed. It is a pleasure to see that this bond can now be created in world-class conditions at Corvinus,” Csak added. Corvinus is his alma mater

Student and Staff Accommodation

The dormitory can house up to 180 students in a mix of two- and threebed rooms, with a shared dining space

A biodiverse, 1.1-hectare park surrounds the campus with low irrigation requirements to save water. Less than a quarter of the park area is covered in paved surfaces.

Three-quarters of the HUF 17 billion investment was provided by European Union and Hungarian government funding, with the Maecenas Universitatis Corvini Foundation, which maintains the university, providing the remainder. Construction began in November 2020, with more than 3,000 people working on the project until its inauguration.

12 | 2 Business www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

LUCA ALBERT

From left: Raffaella Claudia Bondi, Chresten Bruun, and Arne Klehn

Corvinus University rector Lajos Szabó at the official opening of the Gellért Campus.

3 Special Report

Taxes, accountants

Tax and Accountancy Market Talk: Sharpen Your Digital Pencils

The Budapest Business Journal takes the temperature of Hungary’s tax and accountancy market with some of the country’s leading players. What are the significant changes for 2024, what would they like to see in the future, what is coming down the line that businesses should begin preparing for now, and what are the workforce concerns?

András Szalai: I would mention two major changes: 1) In line with the EU GloBE Directive 2022/2523, Hungary implemented the Global Minimum Tax regime. The interpretation and application of the new law will be challenging both for the companies involved and for professionals. 2) As a next step towards digitalization, eVAT was implemented from the start of this year as an optional solution besides traditional manual tax returns.

BBJ: What are the biggest tax changes for 2024?

Károly Radnai: 2024 will once again significantly transform the Hungarian tax system. The eVAT system started

at the beginning of the year, the detailed domestic rules of the global minimum tax came into force, the introduction of the compulsory recollection system further complicates the regulation of domestic waste management, and importers already have to provide data under CBam (carbon border adjustment mechanism).

It is also important that, as of Jan. 1, Hungary does not have a valid double taxation treaty with the United States. Péter Hajnal: Several small changes affect the state budget, but I would mention introducing the global minimum tax and the tax amnesty after reported shares.

Helga Kiss: One of the most significant changes affects fiduciary trusts’ personal income tax liability. Instead of the so-called input taxation in force until 2023, the tax changes introduce output taxation. In practice, from 2024, the taxation point shifts from the revaluation of assets to the current market value when the private individual beneficiary receives revenue. For the PIT liability calculation, the dividend rules are applied if the asset transfer is carried out within five years and the asset value has increased due to the revaluation.

Continued on page 14 ›››

www.bbj.hu Budapest Business Journal | March 8 – March 21, 2024

ADVERTISEMENT

STAFF

BBJ

Millions of HUF are at Stake if you Don’t Know Your Tax Options

The final phase of the 2023 financial statements has started. Businesses with a regular fiscal year (Jan. 1-Dec. 31) have until May 31, 2024, to prepare their accounts and declare their corporation tax on their 2023 profits.

“Our experience shows that one out of two companies does not take advantage of the tax base reduction and tax reliefs to which they are legally entitled, and this can create a serious financial, competitive disadvantage in today’s economic environment,” warns Csaba Szabó, accounting and tax director of ICT Európa Finance Zrt.

Corporate tax relief is based on three pillars: tax deferral, tax base reduction, and tax incentives.

The best-known example of tax deferral is allocating a development reserve. This method involves setting aside funds for anticipated development projects or investments. Typically, these funds must be used within a designated timeframe, with exceptions in certain circumstances. Failure to utilize the development reserve within the specified period may result in the repayment of previously deferred corporation tax, along with penalties. Some companies facing liquidity issues opt to delay the payment of corporation tax by utilizing this method.

Hungary’s range of tax base reduction options and tax incentives is extensive. They are mostly linked to small- to large-scale investments but also include R&D tax deductions, the possibility of sponsoring team sports, and regional and other incentives for SMEs. The significant difference

is that while tax deferral options defer tax, and tax is paid over time, tax relief and specific tax base reduction options save actual tax revenue.

Development Tax Credit

In recent years, in addition to the SME investment loan interest rate relief, development tax relief has also become available in the SME sector, offering significant savings if a business has major investment plans.

What is a development tax credit?

It’s a tax relief available for businesses to claim against their corporate tax, with a maximum benefit of 80% of the corporate tax amount in a given year. This tax credit can be claimed for up to 13 tax years following the year in which the investment is put into service or, alternatively, in the tax year when the investment is put into service, along with the subsequent 12 tax years. The maximum claim period extends up to 16 tax years after the submission of the declaration or application. Additionally, there are stipulations regarding the minimum investment amount and limits on tax relief and aid intensity as a percentage of the investment’s value.

Tax relief for energy improvements has also become available in recent years, providing potential savings for businesses. It’s important to note that incentives such as the company car tax credit also apply to company vehicles.

Szabó highlights that ICT Európa Finance’s tax due diligence on more than 100 companies in recent years has revealed a significant trend: nearly every second company examined has overlooked substantial tax benefits, amounting to millions of forints.

On average, our audits have uncovered HUF 2.6 mln of overpaid taxes that could have been avoided if these deductions had been utilized. In today’s challenging economic climate, neglecting available tax deductions can result in a considerable liquidity disadvantage for businesses. Therefore, seeking guidance from an experienced tax advisor before finalizing the corporate tax return is strongly advised.

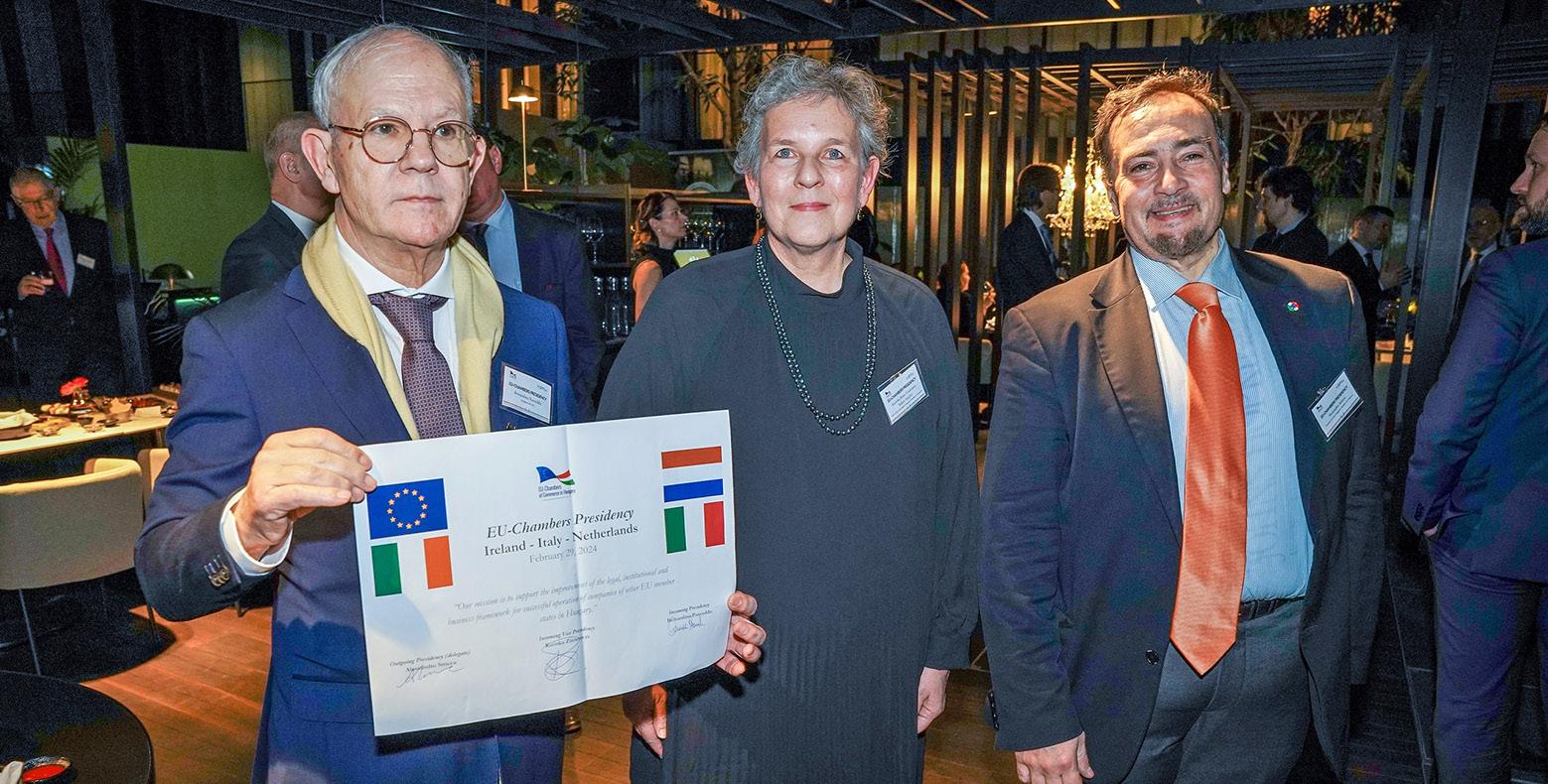

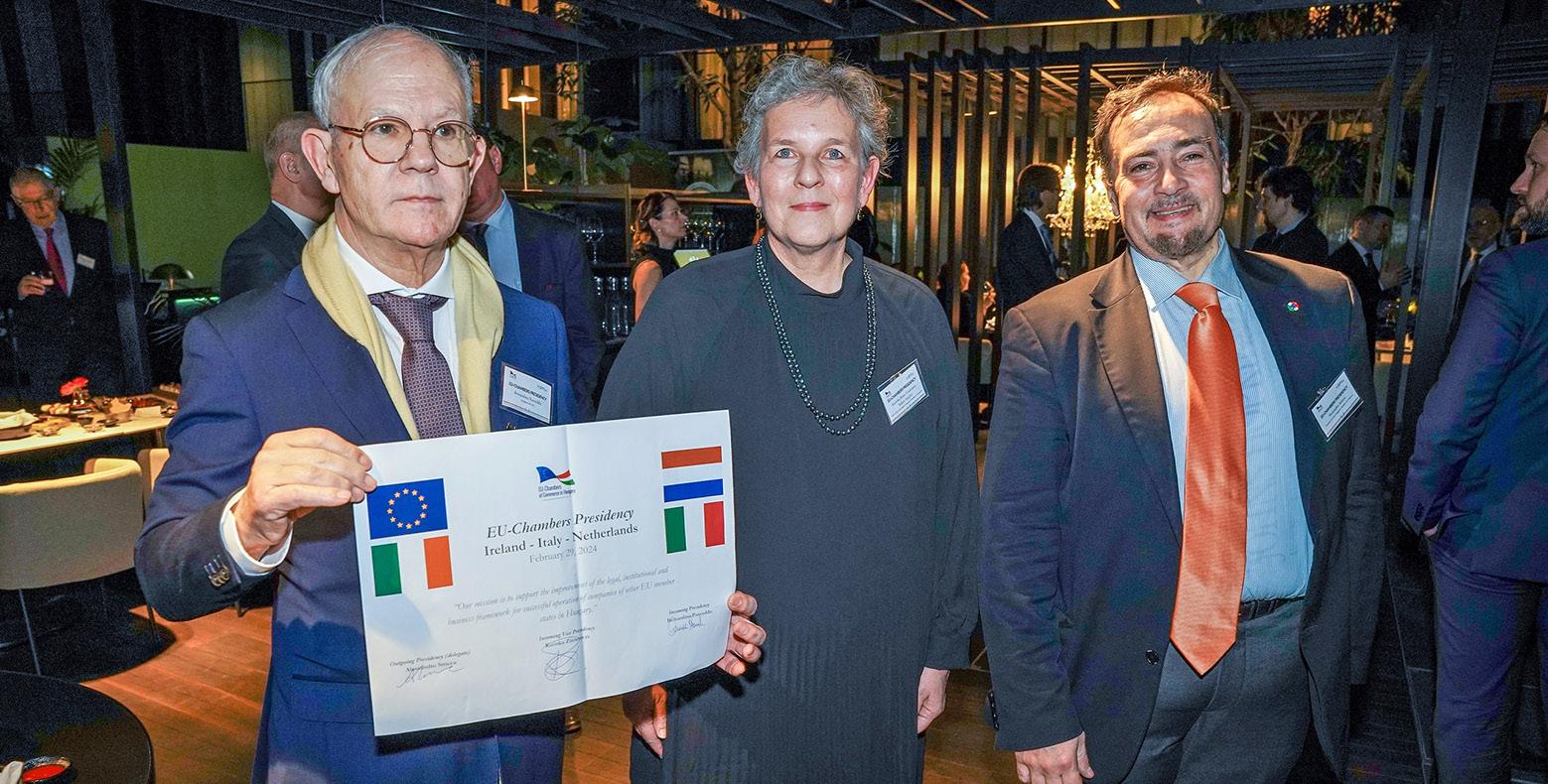

www.icteuropa.hu