Banking

Good Numbers but Hungarian Banking System Under Pressure

Government interventions, the urgency to digitize and the need to comply with new regulations: the local banking sector is under a lot of pressure. Yet, the numbers still look rosy. 14

R34DY: Building Blocks for Core Banking Systems

The company’s name reminds you of a robot from Star Wars, and it has been pronounced in the wildest possible ways. But R34DY draws banking experts’ attention for something much more remarkable: its expertise in core banking systems, pushing a long overdue paradigm shift to the fore. 18

SOCIALITE

Hungarian Art & Business: 1 Year On

Growing its collection of significant Hungarian artists, acquiring work by heavyweight international names, and being visited by a growing number of art lovers, Hungarian Art & Business (HAB) goes from strength to strength. 21

Empowering Women in Business

AmCham Hungary

China in Hungary: Growth in the Books

According to Chinese tradition, the Year of the Dragon promises prosperity. This positivity also seems to apply to investment relations between Hungary and China, which are thriving more than ever. Insights from the Hungarian Investment Promotion Agency shed light on the specifics. 12

CEO Írisz Lippay-Nagy and U.S. Ambassador David Pressman have signed the “Empower Her” initiative, an international movement promoting women-led entrepreneurship, into force in Hungary. 9

Disinflation Continues, but not for Long

Inflation slowed further in February, remaining in the central bank’s 2-4% target band. However, analysts warn that the generally favorable inflation picture cannot be maintained in the long term. 3

FOCUS YOUR INDISPENSABLE EVERYDAY COMPANION FOR BUDAPEST BUSINESS NEWS AND VIEWS SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM

NEWS BUSINESS

VOL. 32. NUMBER 6 | MARCH 22 – APRIL 7, 2024 HUF 2,100 | EUR 5 | USD 6 | GBP 4

SPECIAL REPORT INSIDE THIS ISSUE

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES:

Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center

1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu The

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

THE EDITOR SAYS

BATTING FOR COMMUNITY, DIVERSITY AND HUNGARY

Depending on when you read this, we are either preparing to name our 10th Expat CEO of the Year Award winner or have just done so: the Black-tie gala event will be held at its usual venue of the Corinthia Hotel Budapest on an unusual day, for us, a Saturday. We will also present the Community Award for the second time to a business leader demonstrating social commitment, diversity and ethical leadership. It seems impossible that we will be making the award for the 10th time, and yet, as I have had the privilege of hosting each event, I know it to be a fact. When we launched the title, presented for the first time in 2015, we wanted to underscore that the best expat bosses add real value to Hungary’s economy.

The most successful expat CEOs are also ambassadors, both for their home country here and, perhaps more importantly, for Hungary when they sit down at the boardroom table back in their headquarters, wherever that may be. If you want a good way of measuring how business-friendly a country is, look for the standout FDI projects it can attract. Think of the BYD factory under construction in Szeged or the CATL plant going up in Debrecen, not a hundred miles from the BMW site, which is due to see EVs rolling off the production line in 2025. Those are here in no small measure due to the work of the Hungarian Investment Promotion Agency, and you can read more about that in the context of Chinese companies on page 12.

But another measure of success is reinvestment. Having decided to invest once, more than satisfied with the quality of the workforce and happy with the level of government and municipal support, you might think it is easier to reinvest. But it is a competitive world out

there. I have spoken with countless CEOs who talk of having to convince the board to invest again (and a few who have had to accept they will have to wait a while before they can get more money). Hipa, again, has a role to play here, but the opening batter for Hungary is always the local CEO. Think of Mercedes: its first factory at Kecskemét was, at the time, a record-breaking greenfield investment for Hungary and a rare piece of good news for the country in the aftermath of the 200708 financial crisis. The first cars rolled off the production line in 2012, three years before our first gala. The groundbreaking ceremony was in 2009. A crucial role in convincing the Daimler board in Stuttgart to continue to invest in Hungary was played by the expat CEOs who worked here. And the same is true for pretty much every other multinational with a Hungarian interest. We always hoped the Expat CEO would demonstrate diversity over time. Not including the 2024 results (because I genuinely do not know who the winner will be at the time of writing), six men and three women (the first in 2019) have won the award. There have been three Germans (one of whom is half-Brazilian) and one each from the Czech Republic, the Netherlands, Finland, Italy, Spain and the United Kingdom. One woman and two men are on this year’s shortlist, representing Denmark, Germany, and Italy. That’s not a bad mix. Congratulations to all our past winners and all three candidates this year. Any one of them would be a deserving winner.

Robin Marshall Editor-in-chief

THEN & NOW

The black-and-white photograph, shot from the steps of the Hungarian National Museum and taken from the Fortepan public archive, shows a scene from the 1952 March 15 celebrations at Budapest’s Museum Garden. The national holiday marks the anniversary of the outbreak of Hungary’s 1848-1849 Revolution and War of Independence against Habsburg rule. The color photo from state news agency MTI captures a moment from the performance on the steps in front of the National Museum during this year’s celebrations.

2 | 1 News www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US ONLINE: WWW.BBJ.HU

IMPRESSUM

BBJ-PARTNERS

Photo by Magyar Rendőr / Fortepan

Photo by Szilárd Koszticsák / MTI

1News

Disinflation Continues, but not for Long

Inflation slowed further in February, remaining in the central bank’s 2-4% target band. However, analysts warn that the generally favorable inflation picture cannot be maintained in the long term.

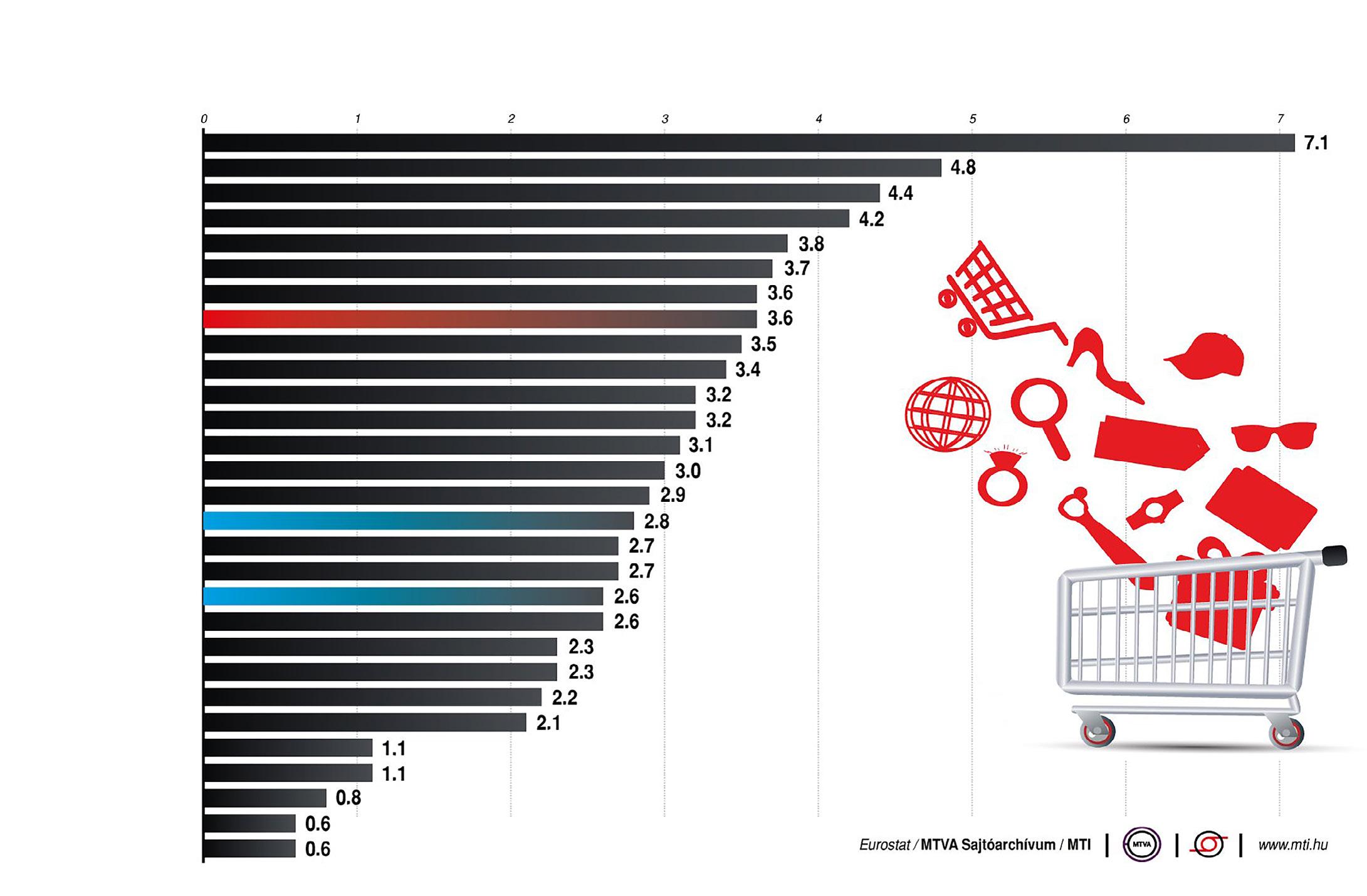

Inflation in EU Member States (February 2024)

12-month change in consumer prices, February 2023-February 2024

Inflation in Hungary continued its downward trend, standing at 3.7% in February. Compared to the same month last year, a price increase of 2.2% was recorded for food, according to the latest report released by the Central Statistical Office (KSH). Electricity, gas and other fuels became 9% cheaper, service prices went up by 10%, while alcoholic beverages and tobacco prices rose by 5.3% on a year-on-year basis.

From the previous month, prices were up by 0.7% on average. Food became 0.2% more expensive on average, while electricity, gas and other fuels became 0.6% more expensive. In the latter group, motor fuels were 6.7% more expensive.

Analysts were surprised by the betterthan-expected February inflation data, but many are warning of the possibility of reflation due to the repricing of services.

According to ING senior analyst Péter Virovácz, February saw a slowdown in the previously extremely fast disinflation, as the consumer price index rose by only 0.1 of a percentage point to 3.7%, compared to January. Although this was close to ING Bank’s preliminary expectations (3.9-4%) and to the consensus of

3.9-4%

on an annual basis in the market, the data can be evaluated as a small positive surprise.

In his outlook, Virovácz emphasizes that the monthly exchange rate will probably be slightly weaker in the next period, and the annual consumer price index will be around 3.3-3.5%.

He points out that the inflation in the cost of services may still be the most significant driving force, and the rise in fuel prices may further strengthen the monthly repricing. However,

Romania

Croatia

Estonia

Austria

Slovakia

Poland

Belgium

Hungary

Bulgaria

Slovenia

France Luxemburg

Greece

Malta

Spain

EU

Germany

The Netherlands Euro zone

Swedish Ireland

Portugal

Czech Republic

Cyprus

Lithuania

Finland

Italy

Denmark

Latvia

the generally favorable inflation picture cannot be maintained long-term, and ING still expects two rounds of reflation.

Downside Risk

According to Virovácz, the first round is expected in May, with the second in October. As a result, ING’s inflation forecast for December 2024 is in the range of 5.56% and currently closer to the top end of the range. For the second half of the year, however, the analyst sees downside risks in the inflation outlook due to the weakness of economic performance, the easing of labor market tightness, and the slight improvement in consumer confidence.

The better-than-forecast CPI data creates a complicated situation for the Hungarian National Bank (MNB); if it persists with 100 basis point interest rate cuts, support for the forint exchange rate may weaken.

According to Péter Kiss, investment director of Amundi Fund Management, the lower-than-expected February inflation data will strengthen the MNB in continuing to cut interest rates. However, the phasing out of the base effects and a euro-forint exchange rate of nearly 400 might complicate the situation.

Kiss says the interest rate cuts may continue at a rate between 75 and 100 basis points, with a mid-year inflation target of 6-7%.

The stability of the capital markets and the European Central Bank’s statements

Source:

referring to an interest rate cut favor the larger 100 basis points cut. However, by the middle of the year, due to the continuously decreasing domestic interest rate and the stagnation of the European base rate, Kiss believes support for the exchange rate may weaken.

Orsolya Nyeste, Erste’s chief analyst, emphasized that the core inflation rate had slowed, which is a positive surprise. Food prices rose slightly, and with the decrease in fuel prices contributed to the reduction in the inflation rate. The cost of clothing fell while services rose in price.

“We continue to expect the current rapid disinflation to peter out in the spring. In the coming months, the annual reference rate should be between 4-5.5%,” says Nyeste.

Budget Consolidation

According to her, the expected improvement in internal demand and the strong need for some kind of budget consolidation may cause additional inflation risks in the second half of the year. Erste Bank expects the inflation rate will stabilize consistently within the MNB’s tolerance limit only in 2025.

According to the Ministry of National Economy, however, the government has already won the battle against inflation. As Minister of National Economy Márton Nagy wrote in a press release, the significant decrease

in inflation is due to the targeted and effective measures of the government.

The minister said the introduction of the online price monitoring system and mandatory promotions supported the continuous moderation of inflation. He emphasized that real wages have been rising since September and that the minimum wage and guaranteed minimum wage increases in December, as well as the teacher wage increase and the general wage dynamics, may further strengthen this trend.

In light of persistently low inflation and reasonable wage offers, a real wage increase of 5-6% is expected in

2024,

according to the minister. Having successfully suppressed inflation, the government is now focusing on the main challenge of 2024, restoring economic growth. For this, it is necessary to increase the mobilization of domestic labor reserves further, encourage a high investment rate, and restore household consumption by strengthening consumer confidence and removing caution, Nagy claims.

Indeed, the minister recently admitted at a conference that this year’s 4% growth target is unrealistic. This was the first acknowledgment by the Minister of National Economy that the original macroeconomic target of the 2024 budget is no longer tenable.

www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

• macroscope

ZSÓFIA CZIFRA

Hungarian Investment Markets Awaiting Price Correction

The conventional wisdom is that there will not be a recovery in the Hungary investment market until at least next year as a re-pricing process needs to be gone through, writes Budapest Business Journal real estate editor Gary J. Morrell.

Hungarian asset owners need to re-access pricing to become an attractive investment destination again. Essentially, real estate investment trends in Central Europe are 12 months behind Western Europe, and there is a further time lag between Hungary and the remainder of the established Central European markets, according to Mike Edwards, head of capital markets at Cushman & Wakefield Hungary.

A bounce back in Western European markets by the end of this year would make a recovery in Hungarian investment possible next year.

“There is a need to be more realistic in pricing in relation to Western Europe,” Edwards said at the second Cushman & Wakefield Hungary Market Outlook Breakfast at the Café Gerbeaud, attended by around 80 Hungarian and international property professionals.

Cushman & Wakefield traced EUR 630 million in investments for Hungary in 2023, representing a 43% fall in year-onyear activity. The consultancy recorded about

EUR 5 bln

in investment volume across the region (Hungary plus Bulgaria, the Czech Republic, Poland, Romania,

Real Estate Matters

A biweekly look at real estate issues in Hungary and the region

and Slovakia), representing a 55% fall in year-on-year activity. The investment volume for Hungary represents 11% of this total. Poland and the Czech Republic are the leading Central and Eastern European destinations.

According to the consultancy, 65% of transactions in Hungary were undertaken by domestic investors, marginally up from 2022, when domestic capital accounted for 63% of investment activity. Traditionally, the country has always had a high proportion of local players. It is a trend that may be spreading.

Significant Shift

“In 2023, Central Europe’s commercial real estate market saw a significant shift in the source of capital, with a marked increase in local investment share

amidst a decrease in Western capital inflow. This transition reflects a broader trend of regional investors playing a more pivotal role in sustaining market liquidity and driving investments,” comments Cushman & Wakefield.

Yields for Hungary are put at 6% for prime office, 6.75% for prime industrial and 7% for prime high retail and shopping centers. The market anticipates further yield adjustments.

The retail sector currently has the most positive indicators, with retail sales improving in addition to rental growth, particularly outside of the capital. Some 35

new brands have entered Hungary since 2019. This includes Primark, due to open its first store in Hungary. The country has the lowest density of shopping center space in CEE, and no major shopping centers are in the pipeline.

There are significant opportunities in the industrial sector, with stock well below the CEE average and strong take-up. Vacancy stands at a comparatively low 8% despite the unprecedented supply over the past five years. The market has also moved from being almost entirely Budapest-centric to more countrywide, as in other Central European markets. From a supply perspective, development trends have moved from a speculative to a built-to-suit basis.

Take-up in the office market is still down on pre-pandemic levels with a significant drop in requirements for large corporations,

2023.

“In 2023, Central Europe’s commercial real estate market saw a significant shift in the source of capital, with a marked increase in local investment share amidst a decrease in Western capital inflow. This transition reflects a broader trend of regional investors playing a more pivotal role in sustaining market liquidity and driving investments.”

although 90% of relocations of 1,000plus sqm are to new buildings. With ESG issues and quality having come to the fore, there is now a clear distinction between newer and older buildings. Vacancy stands at 13%. Several office projects are available for investors if a price can be agreed.

Ilya Nikitin from Morgan Stanley argued that a clear pricing distinction between Hungary and Western Europe needs to be established for the country to attract international investors. Edwards estimates investment volume for Hungary in 2024 to EUR 500 mln-750 mln mark.

4 | 1 News www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

The H2Office development was a significant investment deal in the Budapest market in

Ukraine

U.S., Hungary Exchange Barbs Over ‘Difficult’ Relationship Roundup Crisis

Prime Minister Viktor Orbán met with former U.S. President Donald Trump in Florida on March 8. Afterward, Orbán told TV news channel

M1 that if Trump were reelected, he would end the war in Ukraine by depriving the country of support from the United States.

“He will not give a penny into the Ukraine-Russia war, and therefore, the war will end as it is obvious that Ukraine on its own cannot stand on its feet,” Orbán said. “If the Americans do not give money and weapons, and also the Europeans, then this war will be over,” he continued, “and if the Americans do not give money, the Europeans are unable to finance this war on their own, and then the war will end.”

Orbán has been a longtime supporter of Trump, who is once again the presumptive Republican nominee for this November’s U.S. presidential election. The Hungarian PM broke with precedent in meeting with Trump and not the sitting head of state, President Joe Biden, with whom the Hungarian PM has a much frostier relationship.

Asked whether he was concerned about Orbán meeting with Trump, Biden replied, “If I’m not, you should be.” At a campaign event, Biden said to his supporters of Trump: “You know who he’s meeting with today down in Mar-a-Lago? Orbán of Hungary, who stated flatly he doesn’t think democracy works, he’s looking for a dictatorship,” Biden said, adding, “I see a future where we defend democracy, not diminish it.”

Ambassador Summoned

In response, Minister of Foreign Affairs and Trade Péter Szijjártó said that he had summoned U.S. Ambassador David Pressman to his ministry to answer for the comments made by the President.

Szijjártó said the ambassador was asked to provide the quote Biden had referred to regarding Orbán’s disbelief in democracy.

“Obviously, no such statement was made, so no substantive response of any kind was forthcoming,” Szijjártó added. “We’re not obliged to tolerate such lies from anyone, even if that person is the President of the United States.”

The American position that Hungary was “building a dictatorship” was making bilateral relations “extremely difficult,” the foreign minister said, adding that questioning the democratic choice of Hungarian voters is an “insult.”

At a U.S. Embassy event on March 14, marking the 25th anniversary of Hungary joining NATO, Pressman said that despite being a longtime friend and ally, Hungary has been doing things that undermine trust and friendship, raising concerns among NATO allies that, he said, “cannot be ignored.”

Such concerns include a government “that labels and treats the United States an ‘adversary’ while making policy choices that increasingly isolate it from friends and allies,” Pressman said.

‘Cannot Understand’

The United States “cannot ignore the speaker of Hungary’s National Assembly claiming that [Russian President Vladimir] Putin’s war in Ukraine is in fact ‘led by the United States,’” Pressman added. “We cannot understand or accept that the prime minister identifies the United States as the ‘main adversary’ of [….] Hungary.”

The ambassador also noted that Hungary’s expanding relationship with Russia raised “legitimate security concerns.”

In addition to celebrating the 25th anniversary of its accession to NATO on March 14, Hungary commemorated the start of its 1848-49

Revolution and War of Independence against Austrian Habsburg rule on March 15. In a busy international calendar, Russia held its presidential election between March 15-17.

At a rally in Budapest on March 16, Yulia Navalnaya, the widow of Russian opposition leader Alexei Navalny, who recently died under suspicious circumstances in prison, issued a statement against Vladimir Putin.

“He will not give a penny into the Ukraine-Russia war, and therefore, the war will end as it is obvious that Ukraine on its own cannot stand on its feet. If the Americans do not give money and weapons, and also the Europeans, then this war will be over.”

“In every speech I make, I emphasize one thing: Putin is not Russia. Russia is not Putin. And Hungary is not Orbán either. This is what you prove here today. Democratic and free Hungary has allies, tens of millions of my fellow citizens who also want to live in a democratic and free Russia.”

Putin subsequently won a fifth term as President of Russia in an election widely considered neither free nor fair. The presidential term is now six years, and under the current system, Putin could stand for one more term, meaning he could be in power until 2036.

1 News | 5 www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

NICHOLAS PONGRATZ

In this photo released by the Prime Minister’s Press Office, Viktor Orbán (left) and former U.S. President Donald Trump talk before their sit-down meeting at Trump’s residence in Mar-a-Lago, Florida, on March 8. Photo by Zoltán Fischer / MTI / Prime Minister’s Press Office.

Hungarians Unhappy With Salaries, Saving Wherever They Can

As in most HR Matters columns, we start this month with the GKI Economic Sentiment Index, composed of two elements: business confidence and consumer confidence. In the most recent report at the time of writing, released on Feb. 26, GKI notes that Hungary’s industry and construction sectors saw a “noticeable negative change,” although there was a better situation in trade and services.

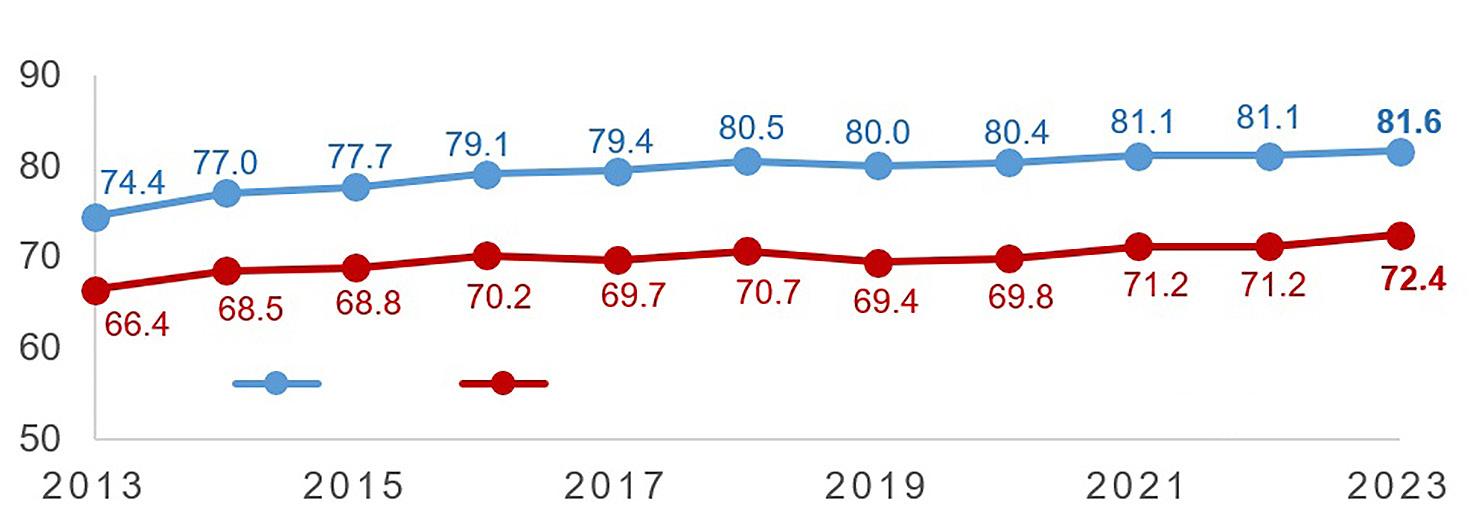

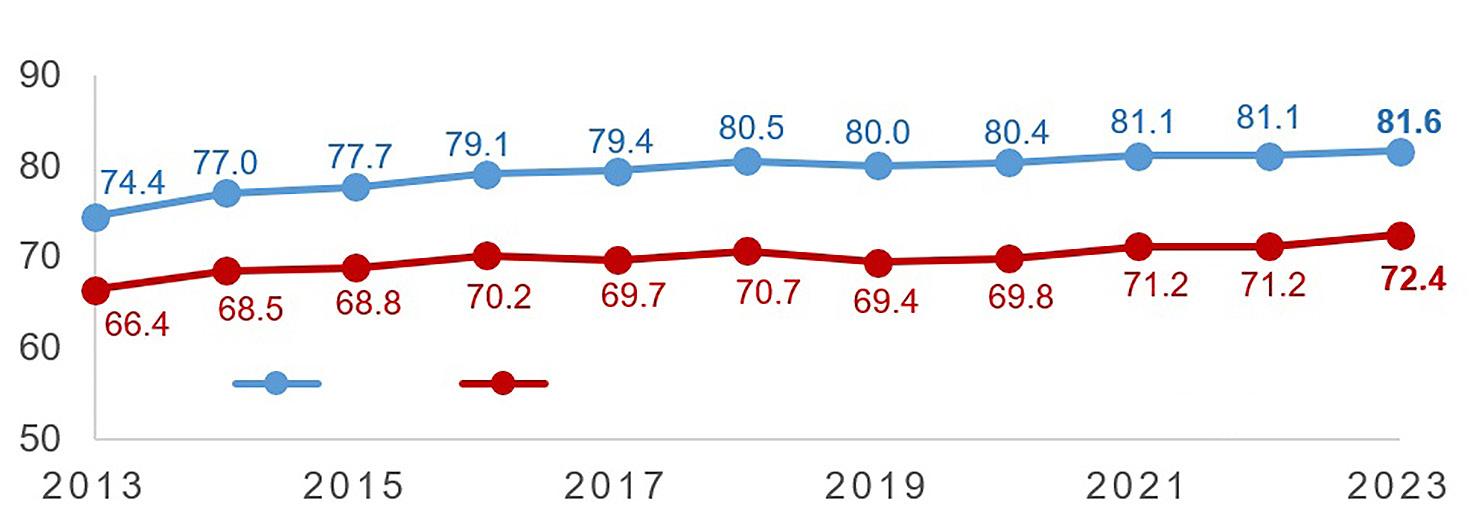

Activity Rate on the Labor Market by Sexes

HR Matters

A monthly look at human resource issues in Hungary and the region

part-time or expanding the number of jobs that can be done from home office.”

As for the difference in revenues between men and women, this is partly explained by the fact that women are overrepresented in jobs that pay poorly, like caretaking, sales, and education. It is also more common for women to temporarily pause their careers to deal with family-related activities, such as caregiving. Regarding job seekers, about 23% of women registering with Trenkwalder are from the

41-50

the situation in the labor market before 2020, when any job seeker could easily find a job, will not return any time soon.

According to the respondents, 59% say finding a job fitting their skills is more challenging than last year. In 2023, this rate was 53%. As for how high a salary raise would make them more satisfied in their current jobs, 49% would not expect more than 20%, and only 29% would hope a raise higher than that but below 30%.

Hope vs. Expectation

The good news for job seekers and employees is that the employment intentions of companies did not change significantly compared to the previous month. Consumers, however, were not motivated: after a rise in January, household expectations “deteriorated significantly” last month. Respondents saw the economic outlook for the country over the next 12 months as much less positive compared to January, GKI says.

This is reflected in a survey conducted in early February by staffing company Trenkwalder, showing that more than half, 54%, of respondents expect their financial situation to deteriorate compared to last year. This is similar to 2023, meaning that the employees do not yet perceive any improvement in macroeconomic figures.

Half are unsatisfied with their current salary level, and almost two-thirds, some 63%, are considering leaving their jobs if a better opportunity arises. On the other hand, the survey shows that the employees are aware that

So much for their wishes, but what do the employees realistically expect? According to a survey by Hays Hungary, 43% of employees expect raises between 5-10%. Based on the responses provided by 2,600 employees and employers, tensions remain in the labor market. The number of jobseekers is higher than in previous years, but their skills are insufficient, and salary expectations are too high.

“Reaching a higher rate of female activity can be done by hiring part-time or expanding the number of jobs that can be done from home office.”

Despite that, the majority of the companies say they do not need or do not want to hire foreign workers. Counterintuitively, they do not want to spend too much on retaining the existing labor force either. Most employers are willing to raise salaries between 5-10%

this year. This should cover inflation this year, forecasted between 4 and 6%. However, the majority of employees would like to see a raise between 10-20%, and a quarter of them, even higher.

A somewhat more optimistic image is projected by staffing company Manpower, which published its forecast for Q2 2024. Almost one-third, 31%

of companies plan to expand their staff, 43% would keep their headcount unchanged, and 22% are eying layoffs in Hungary.

Primarily, it is the larger companies of 5,000 or more employees that would reduce their staff, especially in the automotive and logistics sectors. IT, real estate and financial services companies are more likely to hire.

Women seem to be gaining more traction on the market. In 2023, 72.4% of active-age women were present in the labor market, the highest rate yet registered. The bad news is that their average gross salary was HUF 524,000, 15% less than men at HUF 620,000. Meanwhile, in the last 10 years, the number of jobless women has shrunk from 200,000 to 94,000.

Societal Differences

The difference between women and men regarding the employment rate is 9-10%, which in part can be attributed to social characteristics. Women are more likely to stay at home with children for several years and either retire before the age of 65 or only ever work as a housewife.

Trenkwalder sales manager József Nógrádi says, “Reaching a higher rate of female activity can be done by hiring

age group, the company says.

Finally, a word about how employees handle their finances, both men and women. According to a survey conducted in Europe by Intrum, inflation and high interest rates are making planning expenses and saving money more challenging. There are generational differences: Gen Z has problems paying utility bills and tracking monthly costs, while Baby Boomers are more likely to handle these tasks efficiently.

In all, respondents were most pessimistic about their ability to pay utility bills in Greece (20%), the United Kingdom (16%) and Hungary (15%). About two-thirds of Hungarians (68%) are trying to reduce their expenses by shopping in discount stores and choosing cheaper branded products, Intrum says.

Editor’s note: For more on women in the workforce, see “Economic Empowerment for Women: Increasing Equality in Hungary” on page nine.

Mental Health

Deteriorating Among the Young

Workers in their early 20s are more likely to be absent from work due to illness than workers in their early 40s, according to research from the U.K.-based independent think-tank the Resolution Foundation. In the past, the opposite was the case. According to the findings, the mental health of young people is getting worse, which can hinder their education, meaning they can only find lower-paying jobs or become unemployed. The survey showed that in 2023, 5% of young people were inactive due to their health. In 202122, 34% of 18 to 24-year-olds reported suffering from a mental disorder and experiencing symptoms of depression, anxiety or bipolar disorder. In 2000, this rate was only 24%.

6 | 1 News www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

BALÁZS BARABÁS

%

Men Women Source: Central Statistical Office, Trenkwalder

Mercedes-Benz Manufacturing Hungary CEO Introduced

Jens Bühler became director and CEO of Mercedes-Benz Manufacturing Hungary in Kecskemét this January.

Bühler, who has held various management positions at the company for 21 years, is responsible for the ongoing expansion of the plant and the integration of future models of the Mercedes-Benz Modular Architecture and MercedesBenz Electric Architecture Midsize platforms into production.

After studying mechanical engineering, Bühler joined the company in 2003 as a production processes and materials technology specialist at Mercedes-Benz’ Sindelfingen plant. After various roles in process design, he took over the management of production planning for the GLC and E-Class at the Beijing Benz Automotive Company plant in Beijing in 2014 and played a significant role in the construction of the plant’s expansion. Later, he was responsible for the design of the Kecskemét plant expansion project and, from 2018, for developing the strategic direction and management model of Mercedes-Benz operations.

In 2021, he became the global factory planning area leader at Mercedes-Benz. In this position, he played a major role in transforming Mercedes-Benz cars’ production planning functions and laid down the design guidelines for Mercedes-Benz AG’s future factories.

“It is a great honor to be appointed as director at the head of a factory I was previously responsible for expanding. Thanks to the ongoing expansion, Kecskemét will become one of the world’s most important

Mercedes-Benz plants. The coming years will bring exciting challenges with the introduction of future ‘Made in Kecskemét’ models, and I am counting on the great team at Kecskemét to help me achieve this,” said Bühler.

Bühler took over the management of Mercedes-Benz Manufacturing Hungary from Christian Wolff, who managed the plant for eight years.

Bence Barta Named Partner at Andersen

Bence Barta , the former director of Andersen Adótanácsadó Zrt.’s indirect taxation business, was appointed a partner at the company from Jan. 1.

Barta has gained nearly one and a half decades of experience in the field of taxation and tax consultancy. During his career, he has primarily focused on indirect taxation, particularly VAT and environmental product charging, but he also has a proven professional reputation in customs consultancy. Over the past year, he has also covered Extended Producer Responsibility and Carbon Border Adjustment Mechanism, which are at the intersection of taxation and ESG and has successfully helped Andersen build its competence.

He joined the company as a senior manager in February 2020 and was promoted to director of the indirect taxation business in January 2021. Under his management, sales revenue tripled, and Andersen Adótanácsadó Zrt. ’s above-average market growth in recent years is partly thanks to this.

The prestigious international tax magazine International Tax Review has recognized this performance in recent years. In addition to the “Tax Advisor of the Year in Hungary” award, the company won ITR’s “VAT Advisor of the Year in Hungary” title in 2022 and 2023. Two years

ago, the organization recognized Barta’s outstanding professional work by nominating him as one of seven European tax advisers for the Indirect Tax Rising Star title.

In addition to his merits, Károly Radnai, Andersen’s managing partner, attributes Barta’s promotion to his human qualities.

“He has the entrepreneurial spirit that is indispensable to the management of a rapidly growing company. With his innovative approach, he has developed several new and tax-efficient operating solutions for our customers in recent years. His competence and commitment have made him a true role model for his colleagues,” says the expert.

Tibor Tatár Made Deputy CEO at Wing

Tibor Tatár took over as the head of the Hungarian residential and office development business of Wing, one of the leading real estate development and investment groups in the Central European real estate market, on Jan. 10.

In this specially created position, he is responsible for implementing Wing’s Hungarian residential and office development strategy, managing the business, and preparing, executing, and supervising projects in these areas.

Tatár has worked in real estate for more than 30 years and has unique experience in implementing and managing developments and investments in Hungary, using his own capital and with the involvement of external capital partners. He was CEO of Futureal Development for almost 20 years, where he played a significant role in the domestic and regional growth of the group. Before that, he worked for five years as head of KPMG Property Services in international real estate advisory and was managing partner of TND Real Estate Advisory and Financial

Consulting, where he provided property and privatization advisory services.

He completed his studies at the Faculty of Architecture of the Budapest University of Technology in 1990. Later he completed a twoyear postgraduate course at the Budapest University of Economics and Business Administration, and in 1999 he obtained a Master’s degree in Real Estate at the Nottingham Trent University. He is a member of RICS, a U.K.-based real estate professionals association.

With his arrival, Wing’s management team gains a recognized professional with decades of experience who will play a key role in boosting the group’s domestic residential and office development. Tatár will be supported by Gábor Angel, deputy CEO of Wing Offices, and János Martin, deputy CEO of Wing and director of residential development at Living.

International Partner Appointed at Mazars

International audit and advisory firm Mazars announced that Dávid Szegő, the head of its outsourcing business, has been named an international partner effective from the end of 2023 in recognition of his many years of professional service.

Before joining Mazars in 2018, Szegő acted as accounting and reporting manager at Sony. At Mazars, he first worked as the deputy head of the company’s outsourcing division before taking over its leadership in June 2021.

Under his leadership, Mazars says the company’s outsourcing space has grown significantly in efficiency, scale, professionalism, and profitability. As an international partner, he will focus on developing the business’ professionals and maintaining close client relationships while applying innovative solutions and streamlining processes.

1 News | 7 www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

Jens Bühler

Bence Barta

Tibor Tatár

Dávid Szegő

2 Business

OECD on Hungary and Productivity: Impediments Must be Removed

The latest OECD survey delves into Hungarian productivity issues, including barriers to new market entrants, excessive regulation of professions and corruption.

Contrary to the impression created by the never-ending supply of upbeat government press releases on economic development, labor productivity in Hungary is not in good shape.

Indeed, after peaking at some 61% of the average productivity of the G7 just before the Great Financial Crisis in 2008, it then fell on average by 0.2% percentage points per annum to bottom out at around 51% in 2016, according to the latest OECD survey of Hungary, published on March 5.

Granted, since then, it has climbed back to close to 65% in 2022, but as the survey notes, despite growing at an annual average of just 3% since 2016, “labor productivity growth remains lower than before the GFC.”

The upshot of the intervening years is that, as of 2022, Hungary is the poorest performer in Central Europe in productivity, lagging Slovakia, the regional leader, by some eight percentage points.

As the OECD stresses in its introduction to the subject: “Labor productivity growth is the key to sustaining living standards. This is particularly important in the context of an aging population. Hungary’s working-age population is set to decline from 60% to just above 50% of the total population between 2020 and 2070 […]. This will weigh on GDP per capita unless productivity can be increased to compensate for this trend.”

In other words, Hungary must address productivity growth as a high priority, but how? The survey’s authors admit several hopeful developments, notably Hungary’s ability to attract foreign direct investment.

Automotive Transition

“The entry of new firms on a market facilitates the diffusion of innovations and can be an important source of future growth,” the authors argue. In particular, the influx of investment related to electric mobility will contribute to the transition of this sector to green technologies.

“Nevertheless, it is still too early to assess to what extent they will increase domestic value added and productivity in the long term,” the OECD cautions. The ultimate benefit to the economy will depend on the ability of domestic SMEs to contribute to the new value chains.

But aside from such potentially bright spots as electric mobility and auto manufacturing in general, the survey warns that business entry rates in Hungary are lower than in other OECD countries in

almost all economic sectors, particularly in telecommunication and IT services.

Worse still, in most sectors, these lower-than-average entry rates are compounded by lower-than-average survival rates of new entrants in the first five years after their arrival.

True, the survey notes that administrative burdens relating to start-ups are low by OECD standards, with one-stop shops informing businesses about their license and permit issues, thereby cutting costs and establishment times. However, in some sectors, excessive regulation creates barriers to competition and market entry.

“The number of regulated professions in Hungary is the highest in any European country. For example, stringent regulations affect competition in legal professions such as lawyers and notaries, as well as water and road transport,” the survey stresses.

Indeed, it identifies more than 400 regulated professions in Hungary, twice the average within the European Union and four times more than Lithuania and Estonia, the EU’s least regulated countries.

The Absence of Pressure

The implication is that, protected by these barriers, incumbent operators in Hungary are under little pressure to innovate and reduce prices or improve competitiveness, to the detriment of long-term economic development.

By way of an example, the survey cites the case of the household retail electricity market in Hungary, where both the “strong presence of state-owned enterprises” along with current regulations and the uncertain regulatory environment “tend to hinder the entry of competitors.”

Moreover, the regulated prices (while politically useful for the government) “discourage competitors from entering the market as their return on investment would be insufficient” to justify their investment while simultaneously preventing new entrants from winning customers from incumbents by offering lower prices, the survey argues.

Not for the first time in its surveys on Hungary, the OECD recommends replacing blanket price caps on energy with targeted cash transfers to vulnerable households, arguing this would both increase the attractiveness of the Hungarian retail electricity market for new investors, contribute to efficiency gains and reduce the cost of targeted cash transfers for the government.

These barriers to entry inhibiting new market entrants contribute to another metric where Hungary performs poorly, namely the dominance of sectors by a small number of players. Indeed, when market dominance was measured on a scale of one (worst) to seven (best) at the World Economic Forum in 2019, Hungary scored just over three. This was significantly below the OECD’s average of 4.4, making Hungary the worst performer among the 38 countries assessed. (Chile headed the list, with a score of 5.8, followed by Japan on 5.6.)

As the OECD concludes: “The low entry and survival rates of new businesses are likely related to the dominant position of a few firms in Hungary. This, in turn, limits competitive pressure on incumbent firms and probably contributes to the fact that both innovation activities and businessfinanced research and development are low compared to other EU and OECD countries.”

Behind the Initials

G7: The Group of Seven consists of seven significant economies (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, plus the European Union) working as an informal forum of heads of state and government. It was formerly known as the G8 until the expulsion of Russia in 2014 following its annexation of Crimea.

OECD: The Organization for Economic Cooperation and Development is an intergovernmental organization consisting of 38 members that works, in its own words, “to build better policies for better lives.” Hungary, together with the Czech Republic, joined the OECD in 1996. In February 2023, the OECD formally recognized Ukraine as a prospective member, committing to an initial accession dialogue designed to increase its adherence to OECD standards and participation in OECD bodies. Accession discussions were opened with Bulgaria, Croatia, and Romania (alongside Argentina, Brazil and Peru) in January 2022.

www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

KESTER EDDY

Average Productivity Growth Central and Eastern Europe* 0 50 100 150 200 250 300 350 400 L T U E S T G R C S W E D E U I S L B E L D N K E S P N L D I T A L V A N O R A U T CH E O E C D Europe R O U I R L H R V F I N G B R P R T F R A S V N S V K P O L C Z E HU N Number of Regulated Professions in European Countries, 2021 30 35 40 45 50 55 60 65 70 75 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Czechia Poland Slovak Republic Hungary Note: Panel A: Information refers to laws and regulation in force on 1 January 2018. Source: Panel A: OECD - 2018 PMR database; Panel B: European Commission – Regulated Profession database. Note: Labour productivity is defined as value added divided by total hours worked by employees and self-employed workers. Due to the lack of industry-level PPPs, labour productivity convergence across countries can only be meaningfully assessed at the total economy level. Source: OECD Database on Productivity Statistics.

1999–2008 2008–2016 2016–2022 G7 1.7% 0.9% 1.0% Czech Republic 4.2% 1.0% 1.4% Poland 3.6% 2.9% 3.6% Slovak Republic 4.8% 1.9% 2.5% Hungary 4.6% -0.2% 3.0% Source: OECD Database on Productivity Statistics *Total Economy, G7 = 100, constant prices and PPPs

Labor Productivity Central and Eastern Europe

Economic Empowerment for Women: Increasing Equality in Hungary

Initiatives and research programs across Europe are highlighting both issues of gender disparities within the workplace and the benefits that come from inclusivity and equality between genders in economic settings. Hungary has risen among the ranks for decreasing inequality in aspects such as the wage gap disparity and funding of women-led startups, a familiar story across Central and Eastern Europe.

Apart from initiatives promoting gender equality and empowerment for women in the workplace, research on these topics is crucial to show that such efforts can make a difference.

In recent years, an increasing number of initiatives working towards the economic equality of women have been founded across Europe, with one of the most recent movements in the country being AmCham Hungary’s “Empower Her” initiative, dedicated to promoting women-led entrepreneurship and equality within international trade.

The initiative is a joint effort between the U.S. Department of Commerce’s Commercial Service, the American Chamber of Commerce to the European Union (AmCham EU), and AmChams in Europe (ACE). It was introduced to the country, signed and put into motion by AmCham Hungary in March 2023, with continuous efforts for equality within the workplace.

The movement’s long-term goals include working towards gender equality in international trade, urging American and European companies to diversify their workplace, and supporting women-owned businesses with the necessary tools and services. The initiative also hopes to increase female entrepreneurs’ awareness of trade, investment, and export-related services.

In honor of the 35th anniversary of the foundation of AmCham Hungary this year, the organization hopes to collect 35 additional institutional signatures on the Empower Her declaration by the end of 2024.

PwC’s 2024 Women in Work Index delved into the gender pay gap issue across OECD countries, ranking various nations based on five indicators: the country’s gender pay gap, women’s labor market participation rate, the difference between men’s and women’s labor market participation rates, women’s unemployment rate and the full-time employment of women.

Hungary Improves

Luxembourg was placed first in the index, followed by Iceland and, intriguingly, Slovenia. The index highlighted the improvement of Hungary’s ranking, as the country rose one place in 2022 (the year for which the latest information is available) into the top 15 from 16th place in 2021.

Hungary’s score rose by three, from 68.1 to 71.1, due to factors such as the labor market participation of women rising by 1.2

percentage points to 72.4%, and the domestic gender wage gap decreasing from 17.3 to 16.1%.

“While this is still a long way from gender equality, improving indicators suggest that corporate efforts to achieve this are beginning to show results,” says Márta Reguly, head of PwC Hungary’s HR consulting team responsible for collecting the domestic results.

region and more developed parts of Europe. Spearheaded by EIT Health, Europe’s leading network of healthcare innovators, the initiative recognizes the specific challenges faced by health and life science startups in CEE.

The consortium’s partners represent business acceleration service providers and investor networks from Hungary, Poland, Slovakia, and Slovenia, as well as innovation hubs from Belgium and the Netherlands.

Huge Funding Disparity

According to the organization, only one percent of Central Eastern Europe startup funds go towards companies founded by women, with more than 94% of funding distributed amongst companies led solely by men. Despite that disconnect, its data shows that increased funding of women-led startups would be economically beneficial.

The “Funding in the CEE Region” report highlights that companies founded by women generate almost twice as much revenue per euro of funding received at

96%

than those established by men.

“Diverse teams have been shown to be more innovative and effective, leading to better business outcomes. Therefore, addressing gender diversity is not only a matter of fairness but also a strategic imperative for fostering a vibrant, innovative healthcare ecosystem,” explains Magda Krakowiak, EIT Health director of business creation.

“Examples [of efforts] include company programs that support women’s career development or practices regarding the reintegration of mothers with young children and flexible forms of employment,” Reguly adds.

Issues of gender wage gaps and lack of labor participation by women are usually the most often referred to examples of gender inequality within an economic system. However, women also face disparities in many other work areas, such as entrepreneurship and team-leading opportunities.

Recent research published Healthy Investment Central Eastern Europe (HiCEE) sheds light on these pressing issues regarding gender inequality throughout Europe. Many health disparities stem from social determinants including gender disparities. Increasing diversity in the corporate world and beyond can facilitate collaboration between stakeholder groups and lead to better access to resources, and a better healthcare ecosystem

The organization aims to narrow the investment gap between the

Research on the disparity between genders within the workplace is just as relevant in Hungary as they are in much of Europe. According to the Hungarian Startup Report 2022, only a quarter of domestic startup companies have at least one female founder. The report also highlights a significant gender imbalance in access to financing from venture capital and angel investors.

“I see many more brilliant women than female founders, and it’s bad. This way, we lose the innovative power of many talented women. We should change it for our own sake,” says Péter Csillag, president of the Hungarian Business Angel Network.

The good news in the wake of International Women’s Day on March 8 is that there are an increasing number of programs within Hungary promoting the recognition and equality of women, not only within the workplace but in education, research and leadership opportunities in various fields. The next challenge is making sure women know about them and are able to make use of them.

Visa Relaunches’ She’s Next’ in Hungary

Visa is relaunching its international “She’s Next” program in Hungary to support the development of women-led SMEs. Building on the success of last year’s program, female entrepreneurs will again be able to apply for five grants of HUF 2 million each. Winners will also receive business

development mentoring for a year to help them grow. Applications can be submitted by April 30 using a simple form. Hungarian women entrepreneurs are most likely to seek knowledge-transfer support in the areas of marketing (44%), finance (30%), and digitalization (26%), Visa says.

2 Business | 9 www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

LUCA ALBERT

AmCham Hungary CEO Írisz Lippay-Nagy signs the “Empower Her” initiative, alongside U.S. Ambassador David Pressman. Photo courtesy of U.S. Embassy.

‘Money Week’ Celebrates 10 Years of Educating Kids

For the 10th time, the Pénz7 (Money7) Finance and Entrepreneurship Week was organized nationwide from March 4-8 to raise awareness of the importance of developing financial literacy, entrepreneurship and business skills among primary and secondary school students.

BBJ STAFF

More than 200,000 students from 1,250 schools nationwide participated in Pénz7 2024 through 15,000 lessons given by 650 volunteer tutors.

The 10th edition of the thematic week also attracted experts from associations representing the insurance sector, including the Hungarian Association

of Insurance Consultants (MBTSz), founded only this January, which delivered “Financial Life Lessons” in three educational institutions.

Under a strategic agreement between the Pénziránytű Foundation, the co-organizer of the week, and the Association of Hungarian Insurance Consultants will coordinate awareness-raising activities and work together implementing financial awareness campaigns.

The experts of the MBTSz have transformed unconventional lessons for primary and secondary school students

News Company

Kermann IT Solutions Cleared for NATO Deliveries

The Ministry of Defense has cleared Hungary’s Kermann IT Solutions for NATO deliveries, the company, listed on the Budapest Stock Exchange’s Xtend platform for SMEs, said in an announcement on the bourse’s website on March 18. The firm was cleared after a vetting process by the ministry. The measure allows Kermann to participate in NATO tenders at the “not certified” and “limited certification” levels. Its status will be reviewed every year.

Gundel Targets 20% Revenue Rise

The operator of the Gundel Restaurant, a culinary landmark in the capital, will target a 20% revenue rise this year, managing director Jenő Magyary told state news agency MTI. Last year, the restaurant’s turnover reached

HUF 1.5 billion, Magyary said. The establishment’s profit margin was 8-10%, he added. He said the restaurant welcomed almost 57,000 guests in 2023 and expects to serve 70,000-75,000 this year.

Audi Revenue up 8% Last Year

The revenue of the local unit of German automaker Audi rose 8% to EUR 9.102 billion last year, Audi Hungaria said in a press release on March 19. The aftertax profit of the unit edged up 3% to EUR 354 million. Capex reached EUR 343 mln as the company invested in series production of the new Premium Platform Electric drives and the EA888 R4 Otto drives. Since its establishment in 1993, Audi has plowed EUR 12.5 bln into its operations in Hungary. Audi Hungaria chairman Michael Breme said economic challenges had had “a major impact” on the 2023 business year but added that the company had

Among other things, they discussed the details of savings, borrowing and interest calculation, and the importance of insurance as students become actively involved in finance at an ever earlier age.

“As an economist and a financial professional, I believe it is important to raise young people’s financial awareness, and I focused on this during my presentation,” said Koppány.

“The Pénz7 event clearly proved that any opportunity we dedicate to educating young people finds fertile ground,” added Martonosi. “For me, it is of the utmost importance that in the information society, when this age group is exposed to an incredible amount of impulses, one should not only be a ‘money user,’ but a fully conscious money manager.”

Edina Szojka was also impressed with her students. “I gave a presentation to sixth and eighth graders, and I was surprised to see how knowledgeable and professional the younger age group is about finance,” she said.

into instructive financial life lessons. One of the volunteers was economist and monetary expert Péter Koppány, who gave a combined lesson to students of the Ferenc Nádasi Gymnasium and College of the Hungarian University of Dance Arts.

Edit Martonosi, chair of the MBTSz committee for customer education, lectured to students of the Szent István Ciszterci Gimnázium in Székesfehérvár. Edina Szojka, chair of the MBTSz committee for training and certification, taught students of the Mátyás Hunyadi Elementary School in Budapest.

continued to be a “particularly important player” in the Hungarian economy. Audi Hungaria will start production of the Cupra Terramar model this year and continue preparing for the next generation of its MEBeco electric drives.

AutoWallis Secures Exclusive Farizon Rights in 8 Countries

Hungary’s AutoWallis has secured exclusive distribution rights in eight countries in the region for the Farizon brand of commercial vehicles manufactured by China’s Geely, the listed auto retailer announced on the website of the Budapest Stock Exchange on March 14. AutoWallis will distribute the vehicles in Austria, the Czech Republic, Croatia, Poland, Romania, Slovakia, and Slovenia, in addition to Hungary. Geely launched the Farizon brand in 2016 and has expanded sales to South America, the Middle East and Southeast Asia. The vehicles are being rolled out in Europe in 2024. AutoWallis will start distribution in H2 2024, beginning with the V6E and SuperVan models. AutoWallis CEO Gábor Ormosy noted that his company had been among the first to conclude partnerships with Chinese brands such as BYD and MG.

“I feel it is my personal mission to be involved in this and to pass on my knowledge about insurance to young people and young adults.”

Another longstanding guest lecturer is Minister of Finance Mihály Varga, who was presented with the Financial Support Volunteer Award at the opening event of the Pénz7 week at the Supervisory Conference Center of the Hungarian National Bank on March 5.

Editor’s Note: For plenty more banking and financing news, see our Special Report, pages 8-20.

MOL Boosting Share of Low-carbon Capex

Hungary’s MOL will raise its share of spending on low-carbon investments to 30-40% of total capex in 2025-2030, according to an update of the oil and gas company’s strategy for diversifying away from fossil fuels published on the website of the Budapest Stock Exchange. “MOL is committed to continue working towards climate neutrality along a smart transition path, also keeping an eye on energy supply security and economic competitiveness, besides sustainability,” the company said after its board approved the update of the “Shape Tomorrow” strategy. The firm aims to leverage the cash generation of its upstream business to fund its group-level transformation, targeting average daily production of upwards of 90,000 barrels of oil equivalent with unit direct production cost of USD 6-8/boe in 2025-2030. The main focus of the upstream business in the region will be to optimize production and infrastructure while enhancing hydrocarbon recovery to contribute to supply security.

10 | 2 Business www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

Minister of Finance Mihály Varga Mihály holds a lesson on financial awareness during the Pénz7 week at the Sándor Kőrösi Csoma Bilingual Baptist High School in Budapest on March 5. Photo by Attila Kovács / MTI.

Good Hungarian Representation at Mipim 2024

Against a background of a challenging economic and geopolitical environment, more than 20,000 real estate and investment professionals from 90 countries attended the 32nd edition of Mipim at thePalais des Festival in Cannes.

GARY J. MORRELL

“The global urban festival brings investors, political leaders and the real estate community together to facilitate relationships and find solutions to the challenges facing the built environment,” said Reed Midem, the organizer of the annual four-day event. In general, market sentiment was less bright than the sunny spring weather on the Côte d’Azur last week.

“With a growing number of stands and pavilions (340) taking more space (19,500 sqm), Mipim demonstrated that there are still a significant number of opportunities amid geopolitical, environmental and socio-economic uncertainty,” Reed Midem added.

As one of the leading international meeting points for developers and city and regional representatives, Mipim was attended by

70%

of the top asset managers who manage more than EUR 4 trillion of assets, according to Reed Midem.

The debates and private discussions over a glass of wine at Mipim reflect the themes and concerns prevalent in the real estate markets at a given time. In the EU in 2024, these are, essentially, when will the investment markets make a come-back and how do the real estate industries face the challenge of the need for sustainable and EU Taxonomy-

compliant features throughout the real estate cycle from financing to planning to construction to letting to property management and, finally, to an exit strategy.

Views over when there will be an upturn in the investment markets in CEE differ, as analysts have a range of opinions on when the recovery will begin, from the beginning of this year to at least two years. An upturn in activity in Western Europe would be followed by Poland, the Czech Republic and then Hungary.

According to CBRE figures, Central and Eastern European investment volumes fell by 49% year-on-year for 2023. Around EUR 6.7 billion was invested in CEE, with Hungary taking EUR 440 million of that.

When to Return

Investors are waiting for the right time to return to the CEE markets, with the industrial sector potentially the most favored destination. The office markets could take longer, with a return in two years, according to Norbert Schőmer, country director at Atenor Hungary.

This country, along with the Czech Republic, has the cushion of a strong presence of domestic funds, which are lacking in Poland, albeit it is considered the number one CEE investment destination for international investors.

“Tenants, landlords and investors in all CEE countries are increasingly focusing on the quality of buildings. The gap between older/outdated and modern/efficient buildings is becoming increasingly wider in terms of a multitude of factors, from rents to attractiveness for tenants and occupancy rates to capital values,” said Colliers of the impact of ESG on the industry.

“In turn, we view this as a decisive factor in pushing for more retrofitting of older buildings which may become viable. Timing-wise, these changes are coming at a bad time, as the green push is coming in a difficult

context for the market, given how high interest rates are. Furthermore, we need to acknowledge how relevant the green characteristics are on the financing side, as banks need to take into account not just the value of the building itself, but how efficient and future-proof it is,” added the consultancy, which had a strong presence at Mipim.

“We need to acknowledge how relevant the green characteristics are on the financing side, as banks need to take into account not just the value of the building itself, but how efficient and future-proof it is.”

Mike Edwards, head of capital markets at Cushman & Wakefield Hungary, sees a possible turnaround in Western European investment markets in the second half of this year, with a recovery in Poland early next year and Hungary to follow that.

Hungary and several leading Polish cities had a strong presence with promotional stands, reflecting the perceived need for companies, cities, regions and country promotion agencies to promote their home markets and investment opportunities to international developers, investors and lenders.

Prime Location

The 80 sqm Hungary stand had a prime location with a terrace overlooking the harbor and the old city of Cannes. Several panel discussions moderated by Gábor Borbély, head of research

for CEE and Hungary at CBRE, discussed the investment markets in Hungary and the region.

Among other things, these reflected the view that the industrial market is seen as a “driving force” in attracting FDI across Hungary. Notable developers promoting themselves at the stand were HelloParks, Infogroup and Wing Industrial. The latter also had a presence at the Poland stand through its ownership of the Polish developer Echo Investment and its promotion of the Towarowa 22 project in central Warsaw in partnership with AFI Europe.

A further feature of the Hungary stand was the promotion of secondary Hungarian cities such as Debrecen (some

222 km

east of Budapest by road), Kaposvár (187 km southwest) and Békéscsaba (211 km southeast), which have been particularly successful in attracting industrial inward investment.

“The aim of Békéscsaba is to promote industrial parks and target industrial developers with the sale of industrial space, with whom we have had business meetings,” said Tamás Varga, deputy mayor of the town. Potential clients include suppliers to BMW.

Wing, IGParks, HelloParks, the Belgium-based developer Atenor, and Gránit Asset Management sponsored the stand. CBRE was a content provider, and the Hungarian Investment Promotion Agency participated in the organization. The three provincial cities were also sponsors. The organizers aim to continue to promote Hungary with a similar stand at Expo Real in Munich from Oct. 7-9.

Mipim will return to the Palais des Festivals from March 11-14 in 2025, when participants look forward to improving markets.

2 Business | 11 www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

The Hungary stand had a great location and drew plenty of visitors. Photo by Expo Group event management.

3 Country Focus

China

Chinese Investments in Hungary: Growth Written in the Books and the Stars

According to Chinese tradition, the Year of the Dragon promises prosperity. This positivity also seems to apply to investment relations between Hungary and China, which are thriving more than ever. Insights from the Hungarian Investment Promotion Agency shed light on the specifics.

Three trillion Hungarian forints: that’s the revenue of the local battery manufacturing ecosystem hit in 2023, according to the Hungarian Battery Association. This is up 50% year-on-year and is equivalent to 4% of Hungary’s exports. The sector has been catapulted up to the secondlargest manufacturing segment.

Hungary has enormous expectations for the battery industry, which is expected to help growth rebound to the 3-4% range this year. And Chinese stakeholders will assume a crucial role in the process. In 2023 alone, three related mega projects were announced by EVE Power, Sunwoda and Huayou Cobalt. Needless to say, battery-focused endeavors go hand-in-hand with EV-related projects, and remarkable activity was also detected on that front.

The crown jewel of Hipa’s project catalog in that department is the BYD deal. The Chinese behemoth, which became the leading manufacturer of both plug-in hybrid and electric-only vehicles in 2023,

will invest billions of euros in setting up its first European EV plant in Szeged (175 km south of Budapest by road).

Hungary is no uncharted territory for BYD. It already operates an electric bus factory and a battery assembly plant and manufactures electronics parts in Komárom, Fót and Páty, respectively. Nevertheless, the newly announced investment takes the country’s strategic importance to a new level.

“The idea is to replicate the success of Hungarian automotive so that an equally

thriving ecosystem is created in the EV segment from suppliers to research and development,” Hipa CEO István Joó says. Chinese companies are doing their part to make it happen. Just to name two recent projects, Evoring Kft., a Shuanghuan Driveline company, will invest EUR 104.4 million to make shafts and gear for EVs, while PEX Automotive’s new plant, worth EUR 15 mln will make EV parts, among other things.

Anniversary Celebrations

The Hungarian Government’s Eastern Opening policy fuels the abovementioned investor activity. Relations between the two countries have never been closer than this year, which marks the 75th anniversary of the establishment of diplomatic relations.

Last year, two high-level diplomatic encounters occurred (one in each

country), and Hipa’s top management consulted with several critical would-be investors in China earlier this year.

As Joó highlights, an attractive business environment, the strength of the automotive ecosystem and the dedicated support of the Hungarian Government and Hipa boost the country’s reputation with Eastern stakeholders as an excellent investment location.

That mutual trust resulted in EUR 8.5 billion in investment volume, 33 projects and the creation of well over 13,000 jobs

by Chinese investors in the past five years alone, a total that does not include the above-mentioned mega projects.

China not only became the largest national investor last year for the second time after 2020, but it also broke the record for the biggest capital pledge (EUR 7.6 bln) a country has made in Hungary in any given year to date. This volume represented nearly two-thirds of the 2023 total; overall, China ranks eighth in terms of its share of the total FDI stock. The country is Hungary’s ninth most important trade partner, accounting for 4% of the total foreign trade volume.

Hungary received the second most capital investments in the CEE region under the One Belt, One Road Initiative, which aims to expand China’s global economic footprint.

“The trust that Chinese investors place in our economy is unbroken, and no change is in sight in that regard,” the Hipa CEO notes. “We continue our business talks about potential new projects, and the prospect of such eventual partnerships drove Hipa to meet with several automotive stakeholders in China in January, which went very well.”

BorsodChem Leads the Way

There are more than 400 Chinese companies in Hungary that employ around 20,000 staff, the largest of which is by far BorsodChem, with revenues of nearly HUF 1.2 trillion. It is now owned by Wanhua Chemical Group, a leading global supplier of innovative chemical products.

With Hipa’s support, it has been conducting its most intensive investment period since 2019. The development program, which amounts to close to EUR 1 bln, focuses on production capacity increases, upstream integration, and securing utility supply and industrial infrastructure.

“In 2023, these projects reached an important milestone when a new industrial site and new production plants with cutting-edge safety technology, environmental protection and the best available technical standards were handed over and put in operation,” a company statement shared with Hipa explains.

“As a result of these investments, the company expanded its headcount through the past five years by more than

300 people, reaching a total employment of 3,200,” the statement adds.

Celebrating the 75th anniversary of its operations, BorsodChem plays a pivotal role in the group’s corporate strategy as it will “become the most competitive polyurethane manufacturing base in Europe.” It “serves as Wanhua’s operational headquarters on the continent, encompassing investments, logistics and financing functions.”

BorsodChem’s example showcases that Chinese investor commitment is not restricted to the automotive sector and that a Hungarian presence can be prioritized in global operations. All signs point in the same direction as far as general Chinese investor sentiment is concerned.

On top of that, the Year of the Wood Dragon began on Feb. 10. In Chinese tradition, it symbolizes power, nobility, honor, luck, and success. According to one Chinese horoscope website, it “marks the beginning of a new 12-year cycle, which will bring opportunities for growth and change.” Hence, 2024 is forecast to bring lots of opportunities, as told by experts and, apparently, the stars alike.

www.bbj.hu Budapest Business Journal | March 22 – April 7, 2024

STAFF

BBJ

HIPA-guided Chinese Investments 2019-2023 Investment volume HUF 8.447 bln Projects 33 New jobs 13,208 PRESENTED CONTENT

BYD Szeged Promises Ecosystem Development and a Significant Economic Boost for the Area

The Szeged factory plans announced just before Christmas by Chinese electric automaker Build Your Dream include an ambitious timeline for production to start, as well as proposals for the longterm economic benefits for Hungary and the infrastructural development planned around the factory’s location.

When it came to the final decision for BYD’s new factory site, the choice was between Hungary and Germany, with the EV company finally settling on Hungary after 224 rounds of negotiations with the Hungarian Investment Promotion Agency, according to About Hungary, the official blog of the Cabinet Office of the Prime Minister.

The decision was announced in December 2023, when BYD ended speculation that had been circulating for some time by publicly naming Szeged (175 km southeast of Budapest by road) as its newest location for the production and assembly of fully electric and hybrid vehicles.

The European publication specializing in the electric transport industry, Electrive, shared the reasoning behind the company’s ultimate decision to buy land in Szeged.

“BYD already has a strong presence in Hungary, having established a hightech eBus production facility in Komárom [93 km northwest of the capital] since 2016. This has led to BYD’s further investment in Hungary, prompting the announcement in December

2023

that it would construct an electric car manufacturing plant in Szeged, bringing a new wave of technological innovation to Europe.”

“The city of Szeged and BYD both believe in the same values: knowledge, sustainability, and environmental protection,” said Mayor of Szeged László Botka, when he first announced the plans for the factory in his university city.

Since the announcement of the new factory, development of the building has been steadily progressing; BYD signed the preliminary land agreement on Jan. 31, agreeing to purchase nearly 300 hectares of land. The factory itself is already under construction.

“The investment is worth billions of euros and will create thousands of new jobs,” emphasized Minister of Foreign Affairs Péter Szijjártó during the signing of the preliminary land allocation contract at his ministry.

Infrastructure Dividend

According to Minister of the Prime Minister’s Office Gergely Gulyás, “The government will spend HUF 47 billion-48 bln (EUR 122 million-125 mln) on infrastructure development” around the factory site.

Szijjártó added, “The Hungarian Government will, of course, provide financial support for [the investment], the extent of which will be finalized during negotiations with the European Commission.”

The Hungarian unit of the electric vehicle company has been registered with a share capital of

HUF 192 bln,

twice the city’s annual budget. The yearly group-level revenue of BYD is nearly three times as much as Hungary’s annual GDP, according to Hungary Today.

The company has announced plans to start production within the next three years, with the goal that the first autos will roll off the assembly line in late 2025. More detailed production plans have not been shared to date.

Apart from the direct manufacturing and sales of electric and hybrid vehicles, the BYD investment also highlights a promising outlook for the Hungarian economy.

During the first Hungarian customer delivery ceremony for BYD EVs on Feb. 23, Szijjártó promised that “BYD’s investment in Szeged would be a longterm guarantee for keeping Hungary’s economy on the path of growth.”

He added, “Chinese companies had brought the most foreign direct investment to Hungary in 2020 and again in 2023.”

Electrifying FDI

With the investment in the BYD factory, Hungary expects a significant increase in FDI, up to double the current amount, by the end of the decade, according to Bloomberg.

“The jump in Hungary’s FDI stock by 2030 from the current level of

EUR 100 bln

will be mainly in EV and battery investments,” explained Minister of Economic Development Márton Nagy in Shanghai, China, last November.

BYD has promised that the Szeged manufacturing plant will “create

thousands of local jobs,” and not just in the factory itself. In a press release after the announcement was first made, BYD vowed it “would use [its] expertise in integrated vertical supply chains to create a local green ecosystem.”

Plans regarding this commitment have already been put into motion. The city and BYD plan to invest in developing the Homokhátság settlements in southern central Hungary.

“We are working to make every resident of Szeged and Homokhátság a winner of BYD’s major investment.”

“We are working to make every resident of Szeged and Homokhátság a winner of BYD’s major investment,” wrote Béla Mihálffy, an MP for the governing Fidesz-KDNP (Christian Democratic People’s Party), on his Facebook page.

Szeged City Hall and the Hungarian Government are collaborating on a regional development package for Homokhátság. Mihálffy declared that the package “will include, in addition to infrastructural developments, educational and training institutional developments, transport developments and agricultural and water management developments.”

Szijjártó highlighted another positive effect of BYD establishing its newest factory location in Hungary.