Legal Market Talk: ESG is on the Rise

Some of Hungary’s leading legal minds give us their take on the country’s evolving market, including significant growth areas (with ESG to the fore), the level of business-friendly legislation, and the law-making process itself. 17

Central Bank Remains Cautious and Patient

It’s been a year since the MNB started its current rate-cutting cycle, lowering the base rate from 18%. Now it seems the trend might slow markedly, as the central bank is “in no rush.” 3

Hungarian Snappers in the United States

“Hungarian Photographers in America (1914-1989)” at the Museum of Fine Arts features the work of more than 30 pioneers. 37

Taking the Long View

AmCham has released the 2024-25 edition of its 'Cooperation for a More Competitive and Sustainable Hungary.' Írisz Lippai-Nagy and Zoltán Szabó say it addresses factors vital for the long-term development of the economy and offers insights for strategic planning and decision-making. 13

Happy anniversary, DLA Piper Hungary! 35 years of local expertise with 20 years of global impact

Legal Services SPECIAL REPORT INSIDE THIS ISSUE YOUR INDISPENSABLE EVERYDAY COMPANION FOR BUDAPEST BUSINESS NEWS AND VIEWS SINCE 1992 | WWW.BUDAPESTBUSINESSJOURNAL.COM VOL. 32. NUMBER 11 | MAY 31 – JUNE 13, 2024 HUF 2,100 | EUR 5 | USD 6 | GBP 4

SOCIALITE BUSINESS NEWS SPECIAL REPORT

EDITOR-IN-CHIEF: Robin Marshall

EDITORIAL CONTRIBUTORS: Luca Albert, Balázs Barabás, Zsófia Czifra, Kester Eddy, Bence Gaál, Gergely Herpai, David Holzer, Gary J. Morrell, Nicholas Pongratz, Gergő Rácz.

LISTS: BBJ Research (research@bbj.hu)

NEWS AND PRESS RELEASES: Should be submitted in English to news@bbj.hu

LAYOUT: Zsolt Pataki

PUBLISHER: Business Publishing Services Kft.

CEO: Tamás Botka

ADVERTISING: AMS Services Kft.

CEO: Balázs Román

SALES: sales@bbj.hu

CIRCULATION AND SUBSCRIPTIONS: circulation@bbj.hu

Address: Madách Trade Center

1075 Budapest, Madách Imre út 13-14, Building B, 7th floor. Telephone +36 (1) 398-0344, Fax +36 (1) 398-0345, www.bbj.hu

THE EDITOR SAYS

IN PRAISE OF OPEN INNOVATION

If, as the cliché has it, no man is an island, it is equally valid that no man is all-knowing, which is why we generally hold omniscience is the sole reserve of Godlike beings, if all. Or, as the American business theorist Henry Chesbrough rather more eloquently said, “No one has a monopoly on knowledge the way that, say, IBM had in the 1960s in computing, or that Bell Labs had through the 1970s in communications. When useful knowledge exists in companies of all sizes and also in universities, non-profits and individual minds, it makes sense to orient your innovation efforts to accessing, building upon and integrating that external knowledge into useful products and services.”

BBJ-PARTNERS

Why Support the BBJ?

• Independence. The BBJ’s journalism is dedicated to reporting fact, not politics, and isn’t reliant on advertising from the government of the day, whoever that might be.

• Community Building. Whether it is the Budapest Business Journal itself, the Expat CEO award, the Expat CEO gala, the Top Expat CEOs in Hungary publication, or the new Expat CEO Boardroom meeting, we are serious about doing our part to bind this community together.

• Value Creation. We have a nearly 30-year history of supporting the development of diversity and sustainability in Hungary’s economy. The fact that we have been a trusted business voice for so long, indeed we were the first English-language publication when we launched back on November 9, 1992, itself has value.

• Crisis Management. We have all lived through a once-in-a-century pandemic. But we also face an existential threat through climate change and operate in a period where disruptive technologies offer threats and opportunities. Now, more than ever, factual business reporting is vital to good decision-making.

For more information visit budapestbusinessjournal.com

Chesbrough lives by what he says. He coined the phrase “open innovation.” He is the educational director of the Garwood Center for Corporate Innovation at Berkeley Haas. In a nutshell, he argues that you do better by looking outside your organization, even by sharing your IP. Think open source software rather than proprietary coding.

I have long felt that this isn’t a concept that governments are naturally prone to embrace. They generally seem more keen on telling citizens what to do rather than assuming others might have something valid to contribute. Even Winston Churchill is supposed to have said, “The best argument against Democracy is a five-minute conversation with the average voter.” There’s something oddly pleasing about the curmudgeonliness of that quote, but sadly, it probably isn’t true. The International Churchill Society lists it in its “Finest Hour” section among “A Concise List of Attributed Churchill Quotes which Winston Never Uttered.” Ah, well.

But I digress. Like many other political parties, Fidesz has rarely given the impression of wanting, needing, or seeking outside help. But look around at the companies that comprise the membership of the various international chambers of commerce. Think of the quality of CEOs they can bring together. Indeed, simply scroll through the roll call of all those nominated for Budapest Business Journal’s annual Expat CEO Award. With all these brilliant business minds on tap, why wouldn’t you go to the well and drink deep?

As featured on our cover page, the American Chamber of Commerce in Hungary (other chambers are available) has recently published the 2024-25 edition of its “Cooperation for a More Competitive and Sustainable Hungary,” its annual recommendation package of steps to be taken to help improve the economy. These are serious suggestions to put Hungary in a better place. I’m not suggesting for a moment that AmCham complains it is not listened to. I am very much saying that I hope its advice is welcomed, read, internalized, and acted upon. Elsewhere in this paper, you’ll find our annual Legal Services Market Talk. It’s a deep dive that I will leave you to enjoy at your leisure. Still, one emerging thread is a suggestion that new laws should be given a longer lead time and that more comprehensive consultations should be made, especially among those affected by the changes or who may have relevant experience. That doesn’t sound like a particularly radical idea, now, does it?

Robin Marshall Editor-in-chief

THEN & NOW

In the black-and-white photograph from the Fortepan public archive, the first Hungarian cosmonaut, Bertalan Farkas, is seen waving to the crowd during a visit to his hometown of Gyulaháza (278 km northeast of Budapest by road) in 1980, the same year he went to space via the then-Soviet space program. In the color photograph, taken on May 28, 2024, Tibor Kapu, picked to embark on a mission to the ISS, receives a plaque from Orsolya Ferencz, Ministerial Commissioner for Space Research and Péter Sztáray, Minister of State for Security Policy and Energy Security at the press conference announcing the Hunor Hungarian Astronaut Program selection. For more on this, see page 8.

2 | 1 News www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

The Budapest Business Journal, HU ISSN 1216-7304, is published bi-weekly on Friday, registration No. 0109069462. It is distributed by HungaroPress. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. ©2017 BUSINESS MEDIA SERVICES LLC with all rights reserved. What We Stand For: The Budapest Business Journal aspires to be the most trusted newspaper in Hungary. We believe that managers should work on behalf of their shareholders. We believe that among the most important contributions a government can make to society is improving the business and investment climate so that its citizens may realize their full potential. VISIT US ONLINE: WWW.BBJ.HU

IMPRESSUM

Photo by Béla Szalay / Fortepan

Photo by Róbert Hegedüs / MTI

1News •

macroscope

Central Bank Remains Cautious and Patient

It’s been a year since the central bank started its current rate-cutting cycle, lowering the base rate from 18%. Now, it seems the trend might enter a serious slow-down, as its deputy governor noted that the MNB is “in no rush.”

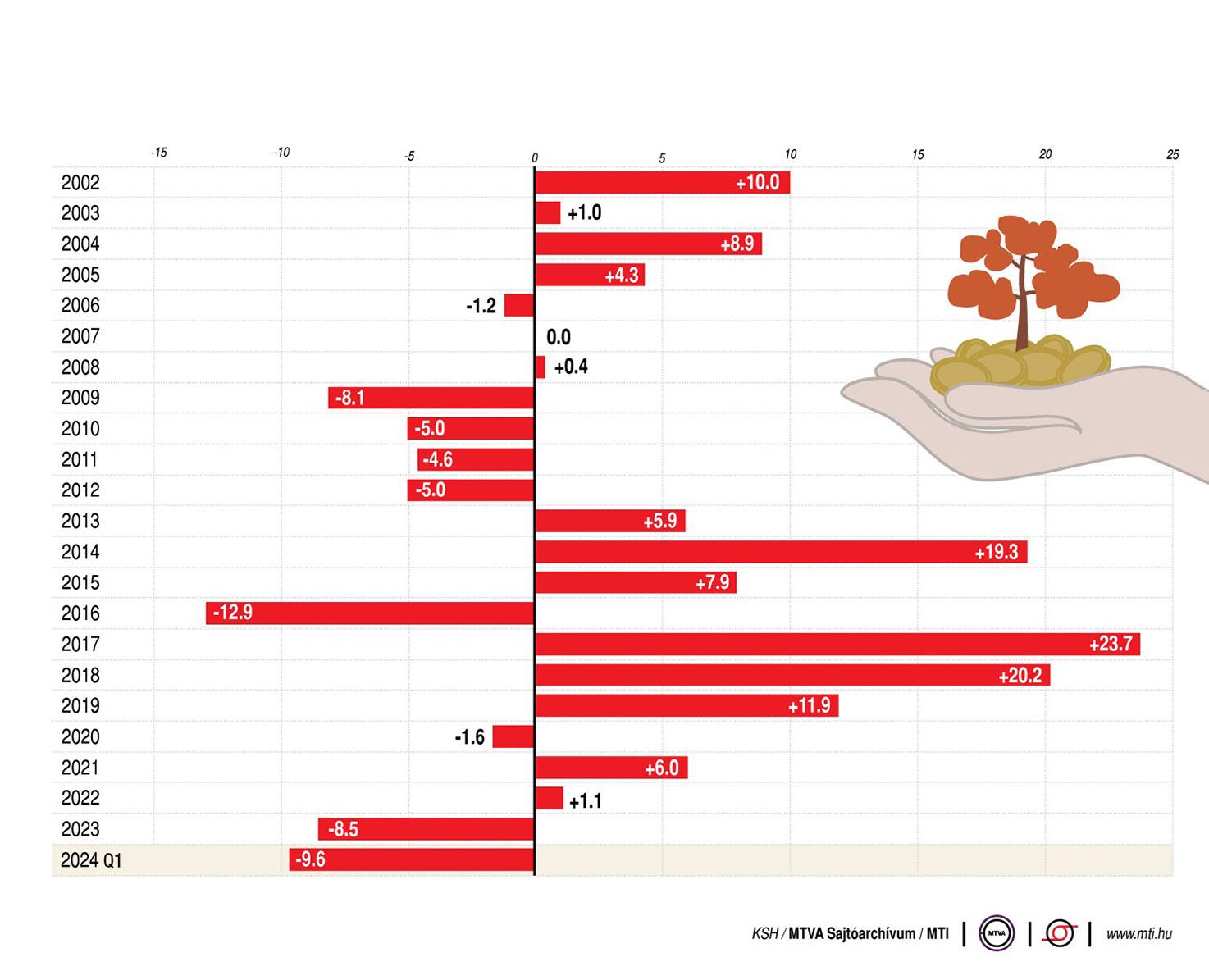

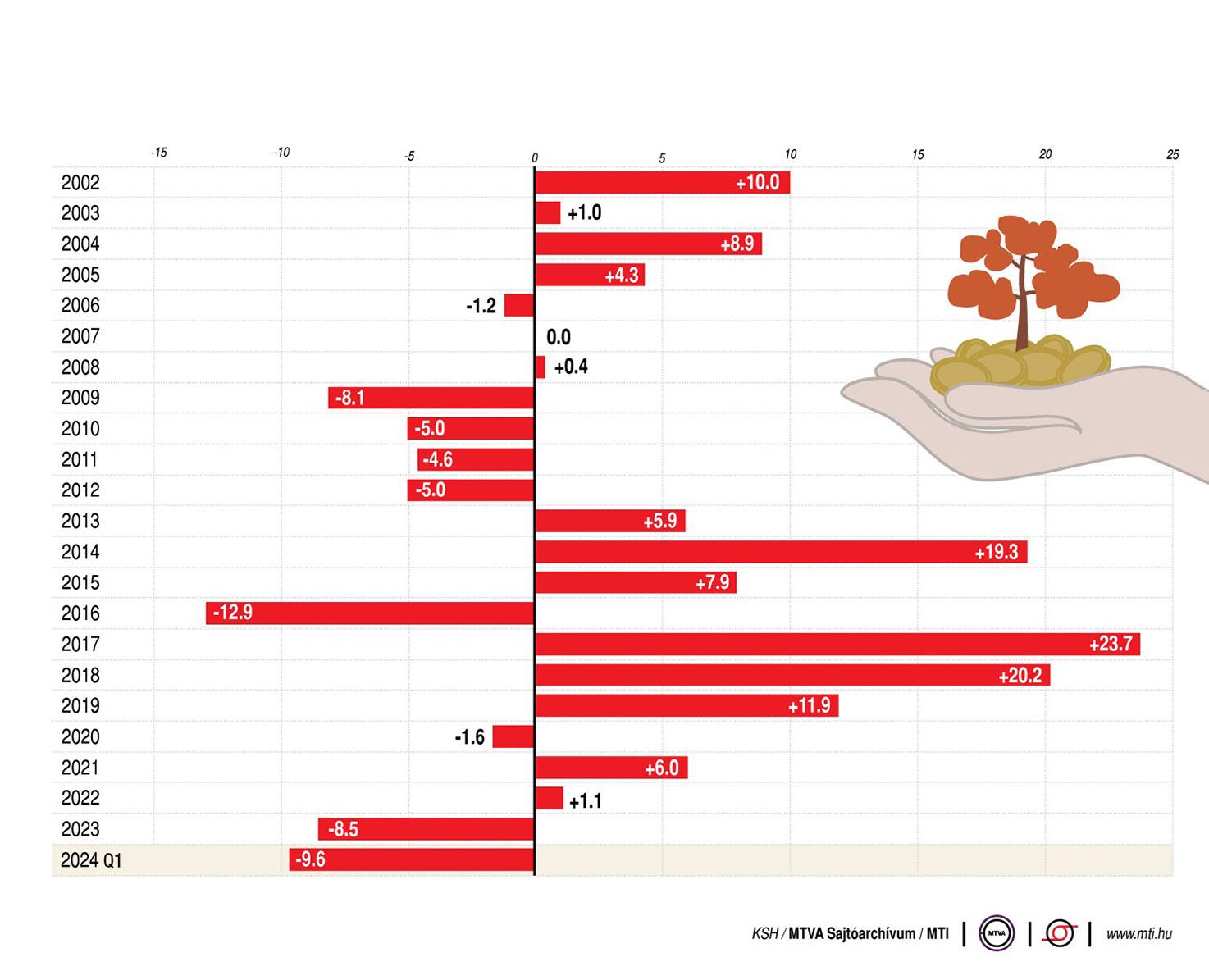

Investment in Hungary’s National Economy (2002-Q1 2024)

Source:

The Monetary Council of the National Bank of Hungary (MNB) cut its base interest rate by 50 basis points to 7.25% on May 21. In addition, it lowered the overnight deposit interest rate by 50 basis points to 6.25% and reduced the O/N secured loan interest rate to 8.25%.

At the press conference following the decision, MNB deputy governor Barnabás Virág spoke very cautiously about the second semester, emphasizing that “we are in no rush,” meaning that the second half of the year is expected to bring much smaller relaxation measures.

By the end of next month, the base interest rate will be 6.75-7% (that is, a cut of between 25 and 50 basis points may come in June), but Virág did not want to make any reference to the likely interest rate at the end of the year. He noted that the MNB will address this issue once the June inflation report has been published.

The cautious and patient easing of monetary conditions in Hungary continued in May; the size of the move was similar to that of April, ING Bank analysts noted in commenting on the move. Besides the base rate, the central bank maintained the symmetry of the interest rate corridor with 50 bp cuts at both ends.

“Given that market expectations of the upcoming decision were virtually unanimous this time around, the actual outcome did not contain any surprises.

The Monetary Council decided to recycle the messages from the previous rate-setting meeting. The ‘rinse and repeat’ process implies a hawkish stance across the board,” they wrote.

New Emphasis

While the press release and the background discussion following the decision did not contain any unexpected, eye-opening messages, ING analysts found two new elements of emphasis in the communication.

The first relates to the Federal Reserve’s monetary policy. Previously, the central bank focused on the timing of the expected easing cycle, but now the message is more about the expected divergence between the Fed and European Central Bank policy, which may lead to a persistently higher U.S. interest rate environment and possibly increased volatility in emerging markets, ING says.

“With this kind of change, the Monetary Council has made itself independent of the decisions of the Fed and the ECB while acknowledging that possible money market instability created by this divergence could cause headaches in the future,” they noted.

The second focus was on local (and global) services inflation and the risks to the inflation outlook, according to ING Bank. It notes that, while these issues had been highlighted in previous months, the Monetary Council put more emphasis on the sticky nature

of services inflation and the bad habit of backward-looking repricing patterns that limit the disinflation process.

Moreover, this pricing decision goes against the central bank’s desire to anchor inflation expectations at a lower level. The latest survey showed that the decline in inflation expectations has come to a halt, and it remains high at around 8%,

according to the MNB’s calculations, twice the upper limit of the inflation target tolerance band).

“All in all, the focus on services inflation risks and the divergence of key monetary policymakers now serve as risks that warrant the MNB remain on the side of caution and patience,” ING analysts assume.

‘Neutral’ Communication

“In our opinion, the press conference following the decision can be said to have had a neutral tone; the guidelines indicated in April have not changed substantially,” Márta Balog-Béki, senior macroeconomic analyst at MBH Bank, said in a press release. She believes that the central bank can reduce interest rates by another 50 basis points in June, and then in the second half of the year, it will only ease interest conditions to a minimal extent.

“Thus, we expect a basic interest rate of 6.25% by the end of the year. In the following months, the annual rate of inflation will gradually increase

again, and geopolitical tensions and the volatility of international investor sentiment also justify a prudent and cautious monetary policy.

In addition, market expectations regarding the Fed’s key rate also limit the MNB’s room for maneuver.

The markets are pricing in two interest rate cuts overseas, but compared to the Fed, a significant interest rate premium may be necessary in Hungary,” Balog-Béki opined.

Equilor analysts explained the elements the MNB will monitor in the coming period. Among international factors, disinflation is strong, but at the same time, inflation in services remains high. Geopolitical conflicts could increase energy market volatility and cause disruptions in global value chains.

“The Monetary Council has made itself independent of the decisions of the Fed and the ECB while acknowledging that possible money market instability created by this divergence could cause headaches in the future.”

The willingness to take international risks has improved, but, at the same time, the expected divergence between the monetary policy of the ECB and the Fed may result in an increase in volatility in emerging markets through the global interest rate environment.

Among the domestic processes, deputy governor Virág highlighted that, since the beginning of the year, inflation has been within the central bank’s 2-4% tolerance band, but domestic service inflation is also high, and the central bank will pay special attention to this in the coming months, Equilor thinks.

The improvement in the country’s risk perception was based on the revival of economic growth, the high current account surplus, and the historically high foreign exchange reserves. In the next period, the MNB will likely continue to focus on inflation, the international monetary policy environment, country risk assessment, and financial market stability, Equilor wrote.

www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

ZSÓFIA CZIFRA

EU and Hungarian Tensions Grow Over Ukraine Aid Roundup Crisis

Hungary will continue to maintain its current position of advocating for peace while avoiding any escalation of the war despite “enormous pressure,” Minister of Foreign Affairs and Trade Péter Szijjártó told reporters after meeting his European Union peers in Brussels on May 27.

Szijjártó made the comments after blocking the provision of an additional EUR 6.5 billion in support for Ukraine, comprising EUR 1.5 bln from the European Peace Facility for arms deliveries to Ukraine and a further EUR 5 bln from the Ukraine Assistance Fund. The move drew audible complaints from his colleagues.

Acknowledging the tense atmosphere at the meeting, Szijjártó said, “There is no reason to shout at us; we are on the side of peace.” While Budapest continually leans on its appeal for peace in blocking support for Ukraine, diplomats told international news wire Reuters that Hungary’s stance is often in line with Russia’s interests.

Indeed, Szijjártó noted that Hungary would not back another round of sanctions against Russia, arguing that it went against Hungary’s economic interests and could threaten the country’s steady supply of energy.

Hungary’s persistent obstruction of support for Ukraine and its reluctance to distance itself from Russia has become a running theme at meetings of Western allies, raising tensions that boiled over at the latest gathering.

“We always have [issues] with Hungary,” Estonian Foreign Minister Margus Tsahkna told German press

Ukraine

Vigorous Warrior 24, the world’s largest multi-national military medical exercise, took place in Hungary from April 28 to May 9. In the photo, a “wounded” man is transported to the Hungarian Defense Forces Role2 field hospital at the Bakonykút training area on May 7. The NATO drill involved 33 nations, deploying medical units and field hospitals, but also involved in planning and analysis. Vigorous Warrior is held every two years and will next be staged in Estonia in 2026. However, while happy to host the exercise, PM Viktor Orbán says he will not agree to any changes to NATO’s founding treaty.

agency DPA. According to Lithuanian Minister of Foreign Affairs Gabrielius Landsbergis, roughly 41% of resolutions by the EU on Ukraine have been blocked by Hungary. Before the meeting, he called out Hungary for effectively neutralizing any efficacy on the part of the European Union toward resolving the conflict.

Systemic Approach

“Almost all of our discussions and needed solutions and decisions by the EU are being blocked by just one country,” Landsbergis told reporters upon arriving at the meeting. “We have to start seeing this as a systematic approach towards any efforts by the EU to have any meaningful role in foreign affairs.”

The EU’s top diplomat, Josep Borrell, asserted that the bloc could not let its military support for Ukraine become dependent on “other decisions which have nothing to do with the specific issue,” suggesting that Hungary could be effectively using its veto as leverage to gain concessions from the EU over its own funding dispute of its own.

Since 2022, the EU has been withholding tens of billions of euros slated for Hungary in the 2021-27 budget cycle over concerns of democratic backsliding by the government of Prime Minister Viktor Orbán, who has been in power since 2010.

After continually insisting that he would withhold his approval for further

funding for Ukraine at an EU summit last year, Orbán changed his tune on Dec. 14-15 when the EU decided to release more than EUR 10 bln to Hungary on Dec. 13.

“I’m ready to make a financial deal on financial issues,” Orbán told the Mandiner weekly podcast the same day. Although he ultimately blocked the funding, he tacitly allowed the EU to start membership negotiations with Ukraine by leaving the room when the vote was taken.

Overstepping?

While EU officials accuse Hungary of impropriety, the Hungarian premier believes that the North Atlantic Treaty Organization is overstepping its bounds with a recent proposal. At a two-day meeting of NATO foreign ministers on April 3-4, General Secretary Jens Stoltenberg proposed a EUR 100 bln five-year package of military aid to Ukraine, which would involve assuming control over some of the coordination work of the Ramstein Group, a U.S.led ad-hoc coalition providing military equipment for Ukraine.

During an interview with Kossuth Rádió on May 24,

Orbán said that Hungary adhered to the founding treaty of NATO as a defense alliance, emphasizing that there is no mention of the organization performing military actions outside of NATO territory.

Orbán reiterated that Hungary does not wish to contribute arms or financing to the conflict. During the same interview, he also said that fears of an attack on NATO by Russia were unfounded, given the difficulty it has been experiencing in Ukraine.

“I do not consider it logical that Russia, which cannot even defeat Ukraine, would all of a sudden come and swallow the Western world whole,” said Orbán. “The chances of this are extremely slim.”

“The Russian military is fighting a serious and difficult war with the Ukrainians,” Orbán said. “If the Russians were strong enough to wrestle down the Ukrainians in one go, they would have done so already.” He also pointed out its relative weakness compared to the Western alliance.

“I do not consider it logical that Russia, which cannot even defeat Ukraine, would all of a sudden come and swallow the Western world whole,” said Orbán. “The chances of this are extremely slim.”

4 | 1 News www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

NICHOLAS PONGRATZ

Photo by Tamás Vasvári / MTI

Atenor Receives BakerStreet Occupancy Permit

The first 16,600 sqm phase of BakerStreet has successfully obtained its occupancy permit. The project, in South Buda, has been leased to E.ON Hungária Zrt., with the tenants scheduled to move in this June, according to the developer, Atenor.

projects could be delayed given the current market climate.

Office vacancy in Hungary has risen to 13.8%, according to Cushman & Wakefield. The pipeline for 2024 is 178,000 sqm, although

Atenor purchased the 5,700 sqm brownfield BakerStreet plot in 2019. After the demolition of the ex-bakery for which it is named, the construction of the office

Real Estate Matters

A biweekly look at real estate issues in Hungary and the region

building, with eight levels, terraces, a ground-floor restaurant, four floors of underground parking and an internal garden, started in 2021.

Simultaneously with the commencement of the construction works, Atenor signed an agreement to purchase an adjacent 8,300 sqm plot on Hengermalom út, on which the 24,500 sqm second phase of the project will be developed. Both phases are ESG-compliant, EU Taxonomyaligned, and have Breeam “Excellent” and Access4You “Gold” certifications, according to Atenor.

“The fact that BakerStreet I is 100% occupied before its handover obviously proves that there is still serious demand for modern, highly technical and aesthetic workspaces,” said Norbert Schőmer, the country director of Atenor Hungary.

Challenges in Creating the Right Work Environment

Employees demand more freedom and flexibility from the companies that employ them but also want more “experiences” in the office. This poses a double challenge for professionals involved in creating and maintaining the right working environment and for HR departments.

A new approach is needed to ensure employees do not feel compelled to work and perform at their best in the office. That was the conclusion of a joint meeting of the Workplace Environment and Facilities Management and HR committees of the American

Chamber of Commerce in Hungary, which reviewed the latest trends, best practices and solutions related to office use.

“Location is key, the office should be easily accessible, and its design should be tailored to the needs of the people working there, providing the right conditions for efficient working,” Valter Kalaus, managing partner of Newark VLK, told the AmCham event.

“Today, it is also a natural expectation that you should not have to travel long distances to reach services such as restaurants, cafés and shopping

Liget Center Vitrum Structurally Complete

Liget Center Vitrum by Wing will be handed over in its shell and core stage this fall. Vitrum is a near-zero energy building that will offer 2,200 sqm of office space over six floors. The boutique office development is located opposite the Városliget (City Park) and features a combination of Hungarian modernist art and architecture, according to the developer.

“With the completion of the Liget Center Vitrum building, the development of the Liget Center office complex has reached yet another milestone,” says Gábor Angel, deputy CEO of Wing responsible for offices.

“This is a truly unique development, including both

the construction of a completely new office building and the renovation of two office buildings listed as historic monuments. In line with our objectives, we have paid particular attention to aesthetics, quality and sustainability: Liget Center Vitrum is a nearly-zero energy building with extensive vertical green spaces. The building offers state-of-the-art technical features for tenants looking for exclusive office space downtown or even a suitable location for their entire headquarters,” Angel adds.

Liget Center Vitrum was designed by Tiba Architects Studio, while the general construction is being carried out by Workup.

facilities during a break or after work. Proximity to a gym or beauty or barber shop can be an added advantage,” he added.

Following his presentation, Kalaus answered questions from participants. The exchange clearly demonstrated that meeting the requirements for an ideal office is a complex task that needs to be tackled jointly by managers and HR staff if they want to ensure that employees see going in to a central office as an experience rather than a constraint and to avoid offices sitting empty. This is the most expensive solution from every point of view.

Sky bar Opens at Budapest Stadium Hotel

The panoramic Cloud IX sky bar of the Ibis & Tribe Budapest Stadium Hotel, developed by Wing, was inaugurated at a ceremonial event; the hotel now offers its guests a full range of services after its soft opening, according to the operator.

As part of Wing’s mixeduse Liberty development in District IX, the co-branded hotel occupies the top floors adjacent to office space. The Budapest Stadium Hotel has 332 rooms that are equally shared between the two brands, with the threestar Ibis offering complementing the four-star Tribe brand.

“As one of the leading real estate firms in Hungary and the region, we are committed to projects that represent high architectural quality and create long-term value. The Liberty reflects our ambition to create a dual-branded hotel with a wide range of services and an outstanding guest experience as part of an internationally acclaimed mixed-use development,” says Noah Steinberg, chairman and CEO of Wing.

OTP Bank has financed liberty, although the energyefficient, green property also received public funding through the Real Estate Fund sub-program of the Gábor Baross Capital Program. As a co-investor, the Hungarian Development Bank (MFB) also provided funds.

1 News | 5 www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

GARY J. MORRELL

The Liget Center Vitrum office development by Wing.

Hungarians Gear up for European and Local Elections on June 9

Hungarians and citizens of EU member countries resident in Hungary go to the ballot box next month amid a level of excitement usually reserved for parliamentary elections.

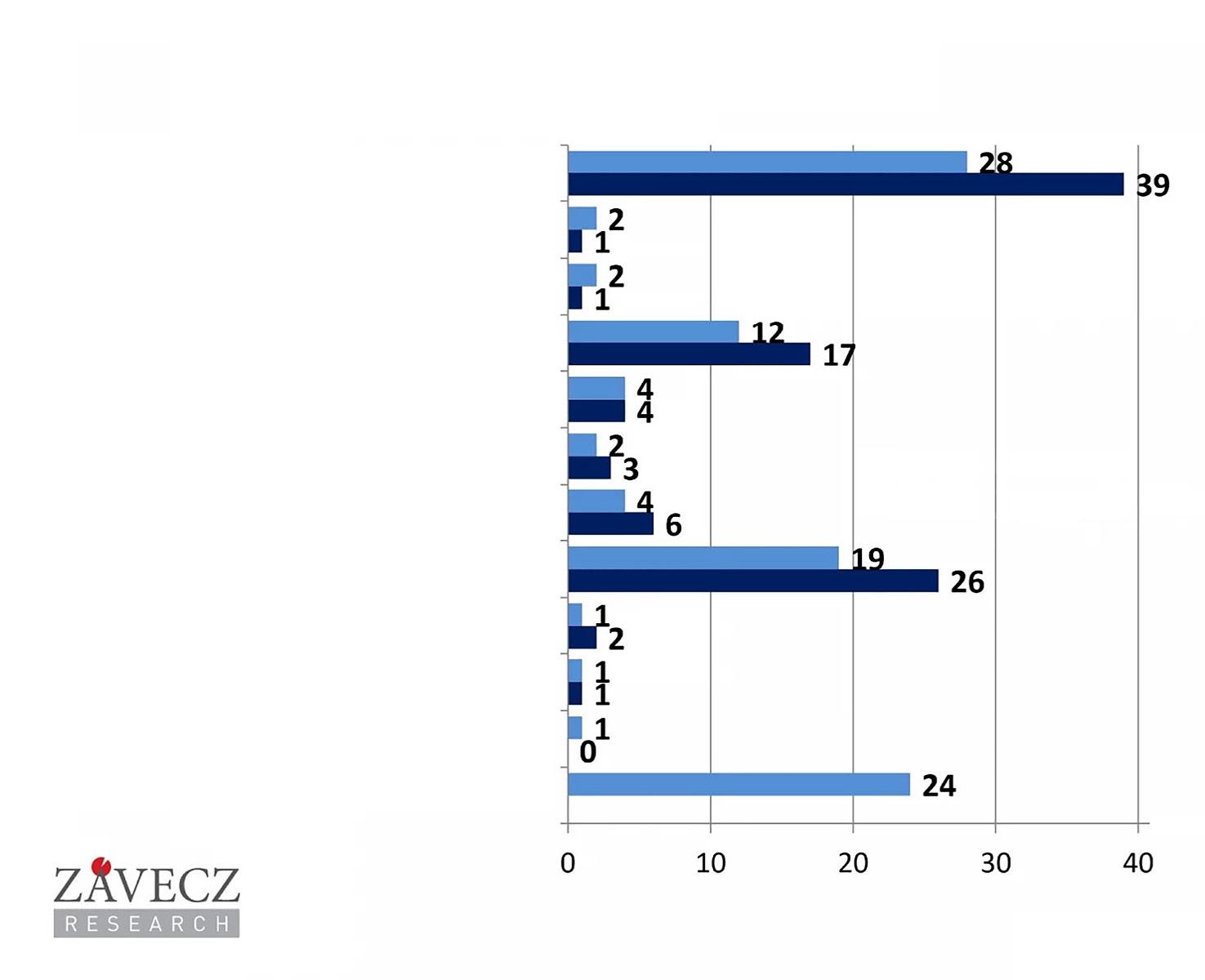

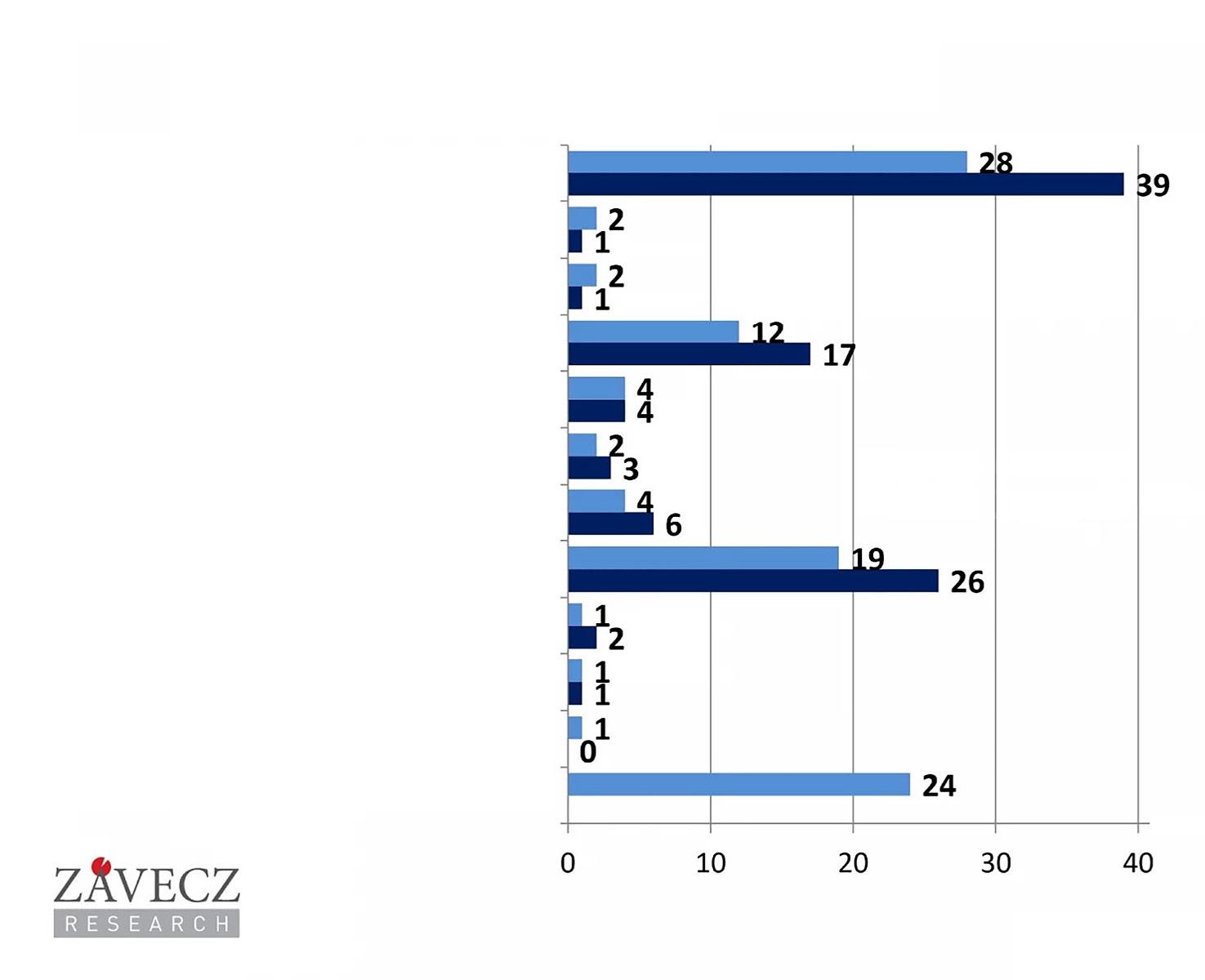

Popular Support of EP Party Lists (%)

Fidesz-KDNP's list, led by Tamás Deutsch

Jobbik's list, led by Péter Róna

LMP's list, led by Péter Ungár

DK-MSZP-Párbeszéd's list, led by Klára Dobrev

Momentum's list, led by Anna Donáth

MKKP's list, led by Marietta Le

Mi Hazánk's list, led by László Toroczkai

TISZA Party's list, led by Péter Magyar

MMN's list, led by Péter Márki-Zay

2RK's list, led by Gábor Vona

Other lists

No preference

When the history books on contemporary Hungarian politics are written, there will surely be one entire chapter on 2024 focusing on the meteoric rise of Péter Magyar and the previously almost unknown Tisza (Respect and Freedom) Party, of which he is vice-president.

Magyar, then aged 42, burst onto the Hungarian political stage in February after his ex-wife, Minister of Justice Judit Varga, resigned in the wake of the “pedophile clemency” scandal, which also ended the term of former President Katalin Novak.

In the subsequent four months, Magyar, who until that point had seemingly been a loyal, high-flying Fidesz-functionary with no public political profile, has transformed Hungarian politics.

Through a string of Facebook posts alleging government corruption, interviews with internet influencers, and non-stop campaigning around the country, Magyar has propelled Tisza (with himself heading the party’s EP list

Voting-age

of candidates) into the country’s second most popular political grouping.

According to a survey in early May by Závecz Research, a respected Hungarian pollster, Magyar and Tisza had the support of

26%

of those committed in the EP elections, trailing only Fidesz, with its EP list headed by founding-party stalwart Tamás Deutsch, on 39%.

This rapid growth in support for Magyar is a “symptom of the deep crisis in Hungarian politics, as it not only reflects disappointment with the Orbán regime but also a complete disillusionment with the established opposition,” political scientist András Bíró-Nagy, director of Hungarian think-tank Policy Solutions, told the Budapest Business Journal

Swept Past

Indeed, en route to these political heights, Magyar has swept past the Democratic Coalition-led opposition grouping, headed by the DK’s Klára Dobrev (with 17% of decided voters) and also pushed the radical right Our Homeland down to 6%, perilously close to the 5% threshold needed for entry into the European Parliament. Somewhat counterintuitively, Magyar, who early in his campaign declared himself to be largely in tune with the Fidesz nationalistright philosophy (except for the corruption he alleges to have witnessed), has found the majority of his active supporters originate mainly from the liberal-left opposition camp. According to Závecz, this is particularly true for Momentum, the Two-Tailed Dog Party, and a grouping of minor and micro right-wing parties.

If the Závecz poll becomes a reality on June 9, it will likely result in Fidesz winning 10-11 MEP seats (down from 13 in the outgoing parliament), Tisza with four or five (all new), the DK-led alliance with four (against five previously), and Our Homeland with one.

Ágoston Mráz, founder and CEO of Nézőpont Institute, a rightleaning think-tank, predicts Fidesz support will achieve 45-47% of the vote (and 11 seats), with Tisza at around 5-7 seats. Going against most other pollsters, which put the jokecum-protest Two-Tailed Dog Party below the threshold vote, Mráz’ has them on 8%, potentially set to win two seats. In contrast, he sees the leftist Democratic Coalition alliance garnering “a maximum” of 15%

of the vote and winning just two MEP seats.

But both analysts agree that Momentum, with two MEPs in the outgoing parliament, and Jobbik, with one, are set to lose all representation.

Crucially, both pollsters have Fidesz still winning roughly 50% of the 21-strong Hungarian allocation

Incumbent Karácsony Favorite in Budapest City Mayor Race

After four and a half years at the helm in the Hungarian capital, Gergely Karácsony appears set to keep his position as Mayor of Budapest despite a formidable competitor in the person of Dávid Vitézy (an independent backed by LMP) and massive campaign support for the Fidesz candidate Alexandra Szentkirályi.

A study by pollster Publicus published on May 21 put Karácsony, a Párbeszéd (Dialogue)-Green member supported by the united opposition in 2019, with a morethan-comfortable lead of 46% voter support. This was twice that of

nearest rival Vitézy, at 23%, with Szentkirályi at 19%.

The Our Homeland candidate, András Grundtner, brought up the rear with just 3%, while 9% of respondents were undecided. However, from the start of this contest, speculation has been rife that Szentkirályi, who would inevitably face a tough battle in the liberal capital, would likely pull out of the race, leaving the contest open for Vitézy as a quasi-Fidesz combatant for the mayor’s position. (Vitézy served as head of the Budapest Transport Company (BKK) under Fidesz Mayor István Tarlós and, for

a short period, was a state secretary under a Fidesz minister in 2018.)

However, speaking to foreign journalists in late April, Vitézy denied being any kind of Fidesz “mole” or any collusion between himself and Szentkirályi. Stressing his track record as an expert in urban planning and transport, he said his program is based on “social housing and housing for public employees in the national education, health and police systems,” adding that there “has been no investment at all in the rental market or in public housing” in either the current or previous mayoral terms.

6 | 1 News www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

KESTER EDDY

© European Union 2022 –Source: EP

Photo by:

CC-BY-4.0:

Photo by: MTI/Zsolt Szigetváry

population Committed voters certain to pick a party list

Tamás Deutsch

Dávid Vitézy

Who can Vote for What?

EU Elections

The elections on June 9 consist of two entirely separate contests. First, eligible Hungarian citizens and resident EU citizens who have registered their intention of voting with their home country may vote in the European Parliamentary election for the 21 MEPs representing Hungary.

Voters can choose from parties that field “party lists” of candidates (see box). However, if the latest opinion polls prove accurate, only a handful of parties (or party alliances) will garner

of MEPs, a position that would be the envy of many EU governing parties.

However, for the Fidesz party leadership, such have been their expectations since 2010 that any voter support below 45% of the total would be viewed as a poor result, says Policy Solutions’ Bíró-Nagy.

Lacking Direct Power

Equally, whatever the Tisza success in the EP elections, it will have no direct

more than the 5% threshold of total votes cast needed to qualify for seats in Brussels.

Municipal Elections

Eligible Hungarians, legally resident EU citizens and U.K. citizens with residency in Hungary before Brexit may also vote in municipal elections to elect mayors and local councilors. The main focus of these elections is the race for the mayor of Budapest, one of the highest-profile public offices outside parliament and the presidency. (See separate box for details of candidates.) Budapest residents will also cast ballots for their district mayor and local ward councilors.

meaning in exerting power at home: Tisza has no presence in the Hungarian Parliament, where Fidesz still controls a constitutional majority in excess of 67% of MP votes.

In essence, Magyar can speak all he wants about improving the Hungarian education and health systems (two of his campaign promises) if he succeeds in winning a seat in Brussels, but it will make

little real difference to legislation tabled and passed in Budapest.

Nonetheless, Fidesz takes the EP elections very seriously, one reason being that the more powerful its cohort in Brussels is, the more attractive it is to right-wing “family groups” in the new cycle. After leaving the center-right European Peoples Party some years ago, Orbán has realized his influence has declined in the European Parliament and will, therefore, be actively seeking a haven in another grouping.

The governing party also senses danger from the growth of any new political threat and has launched a massive campaign to discredit Magyar, labeling him variously as a wife beater, a left-wing puppet of financier philanthropist George Soros (a favorite Fidesz hate figure) and a warmonger.

For Orbán, the choice is simple: a Fidesz vote guarantees peace; any vote otherwise is for war.

These campaigns have successfully kept core Fidesz voters within the fold and further encouraged opposition voters to jump into the Tisza camp in the hope that this newcomer can effect change, notably the defeat of Fidesz in the 2026 parliamentary elections.

However, at Magyar’s current level of support, any such victory remains a distant goal. Nonetheless, politicians and political scientists of all persuasions will be studying the results of the contests held on June 9 for pointers as to the possible future trajectories of politics in Hungary.

Parties Registered for the European Parliamentary Elections

The following parties or party alliances will compete for Hungary’s 21 seats in the European Parliamentary election via the list system. In the local elections, many of the parties listed here form alliances on a case-by-case basis to win mayoral seats or municipal wards.

Fidesz-Christian Democratic Peoples’ Party (Fidesz-KDNP) Officially, the government is a coalition of the right-wing Fidesz and KDNP. In practice, even government-side politicians privately admit that the KDNP is merely a satellite grouping, subservient to the parent.

Hence, in most cases, most articles refer to the “Fidesz” government of Prime Minister Viktor Orbán. Under his leadership, Fidesz has dominated both domestic and EP elections since 2010. In 2019, it won 13 MEP seats (including one for the KDNP) in Brussels.

Tisza, the Respect and Freedom Party (Tisztelet és Szabadság Párt or Tisza)

Although founded in 2021, this tiny, virtually unknown party has shot into the limelight after being adopted by former Fidesz insider Péter Magyar to allow him to fight in this year’s EP elections. Vehemently denouncing Fidesz and its oligarchs for corruption, Magyar has seen support for Tisza leap to around 13-17% of the total electorate and some 26% of committed voters.

Democratic Coalition (Demokratikus Koalíció or DK)

A social democratic party created out of the Socialist Party by former Prime

Minister Ferenc Gyurcsány. Currently holds four MEP seats in Brussels, including Klára Dobrev, Gyurcány’s wife, who heads the DK-led alliance list in this June’s elections.

Hungarian Socialist Party (Magyar Szocialista Párt or MSzP)

A social democratic party formed from the former communist party in 1989. Now a shadow of its former self, the MSzP won a single seat in the 2019 EP elections as part of the opposition alliance.

Dialogue-Greens

(Párbeszéd-A Zöldek Pártja)

A left-leaning green party that formed out of LMP (Politics can be Different) in 2013. Commonly referred to as just Dialogue. The above three opposition parties are fighting the EP elections as a single coalition alliance.

Our Homeland Movement (Mi Hazánk Mozgalom)

Our Homeland is a far-right, nationalist party composed principally of former Jobbik members opposed to that party’s swing to the center in 2018. Our Homeland failed to win any EP seats in 2019 but secured six in the 2022 Hungarian parliamentary election. Current opinion polls put the party on the cusp of the 5% threshold needed to win an MEP seat.

The Hungarian Two-Tailed Dog Party (Magyar Kétfarkú Kutya Párt or MKKP)

MKKP, commonly referred to as “the Dogs,” is a spoof party, parodying

the traditional party groupings, founded by student artists in 2006, though not officially registered as a party until 2014. Its party promises include free beer and eternal life. While it has won several municipal seats in local elections, it is yet to win seats in either the national parliament or in Brussels.

The following parties have seen support in most polls fall away with the growth of Tisza, meaning none is likely to win any EP seats.

LMP-Green Party of Hungary (LMP-Magyarország Zöld Pártja)

Founded in 2009 as the liberal alternative Lehet Más a Politika, or Politics can be Different, the party has had a tumultuous history, including a split with Dialogue (see above). LMP is cooperating in some seats with other parties in the municipal elections, but its decision to nominate former Fidesz state secretary for transport David Vitezy for Mayor of Budapest has led many opposition figures to denounce the party as a stooge for Fidesz.

Momentum Movement (Momentum Mozgalom)

Founded in 2017 as a liberal grouping and usually referred to merely as Momentum, the party won two MEP seats in the 2019 elections. However, recent opinion polls indicate the party will not achieve the 5% threshold in the EP election. However, Momentum

is cooperating on a local level with other opposition parties in many of the municipal elections.

Jobbik-Conservatives (Jobbik-Konzervatívok)

Commonly known simply as Jobbik, the party has transformed itself over the past decade from a radical rightwing grouping to claim the centerright ground. In 2022, it won eight seats in the domestic parliament as part of a six-party opposition coalition and a single seat in the 2019 EP elections. However, this time, it is fighting the EU elections alone and is unlikely to win any seats despite its list being headed by Péter Róna, an experienced economistlegal professor at Oxford University.

Solution Movement

(Megoldás Mozgalom or Memo)

Founded in 2021 by wealthy entrepreneur György Gattyán, Memo has a minimal voter base and is highly unlikely to win any EP seats this year.

Everybody’s Hungary People’s Party (Mindenki Magyarországa Néppárt or MMM)

Led by Péter Márki-Zay, the opposition alliance’s nominee for prime minister in the 2022 general election. His star has waned in the two years since then.

Second Reform Era Party (Második Reformkor Párt, abbreviated to 2RK.)

Led by former Jobbik president Gábor Vona, 2RK barely registers in most opinion polls

1 News | 7 www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

Péter Magyar

by csikiphoto / Shutterstock.com

Photo

in Brief News

Bulgarian Cultural, Educational Center

Unveiled in Hungary

After two years of construction, a Bulgarian Cultural and Educational Center was officially opened in Hungary on May 25 by Bulgaria’s President Rumen Radev and his Hungarian counterpart Tamás Sulyok. Radev was in Hungary on a two-day state visit. According to the Bulgarian News Agency BTA, the building houses a bilingual kindergarten, a Bulgarian school, the Bulgarian Cultural, Documentation and Information Center, a research institute, a Bulgarian Theater (Malko Teatro),

a gallery, and the Administration of the Bulgarian Republican Self-Government. It is next to the Bulgarian Orthodox Church. The construction of the building, which is heated by geothermal energy, was supported by the Hungarian Government and the Bulgarian State.

More Early School Leavers Than EU Average

The share of those aged 18-24 leaving education and training early in Hungary was 11.6% in 2023, above the 9.5% average in the European Union, according to data from the EU’s statistical agency Eurostat. The lowest

Hungary Selects Astronaut, Backup for ISS Mission

Minister of Foreign Affairs and Trade Péter Szijjártó announced on May 27 the selection of a Hungarian astronaut and a backup for participation in a research mission on the International Space Station, according to origo.hu.

Tibor Kapu, a 32-year-old mechanical engineer with a background in battery development in the automotive industry, is the number one pick to become the next Hungarian astronaut, Szijjártó said. The backup for the mission is 35-year-old electrical engineer Gyula Cserényi.

share of early school leavers was recorded in Croatia at 2%, and the share was highest in Romania at 16.6%. The EU has set a target of reducing the rate to 9% by 2030. Compared with Hungary’s Visegrád Four peers, the share of early school leavers last year was 6.4% in the Czech Republic and Slovakia and 3.7% in Poland. In Hungary, the rate has edged down from 11.9% in 2013.

Hungary Focusing on ‘Farmer-friendly Agricultural Policy’

Hungary will focus on the need for a “farmer-friendly agricultural policy” that addresses competitiveness, crisis management, sustainability and the knowledge-based economy when it takes over the revolving presidency of the Council of the European Union in the second half of the year, Minister of Agriculture István Nagy said after a meeting of his EU peers in Brussels on May 27. According to agroinform. hu, Nagy said the EU wasn’t protecting European farmers and called for action on the dumping of Ukrainian farm products on local markets. He added that European farmers couldn’t be made a “scapegoat” for climate change and urged support for adopting environmentally friendly technologies.

HUF 23 bln Tender Supports Vocational Training for Disadvantaged

Vocational training centers will be able to tap a HUF 23 billion tender to promote training for disadvantaged people and create flexible learning paths, State Secretary for Innovation, Higher Education, Vocational Training and Adult Education Balázs Hankó said, according to profitline.hu. Speaking at a press conference held at the Tatabánya Vocational Training Center (64 km northwest of Budapest by road), Hankó said that the vocational training must simultaneously ensure the acquisition of traditional trades in the three-year school system and represent the trades necessary for high-tech production during the five-year technical school training. “The application of high-tech production technologies is important for Hungary, which is why we need specialists in the technical, engineering, industrial and chemical fields,” he added.

over the weekend of May 20-21. The government supports the survival of protected native and endangered livestock breeds, including the Kisbér half-breed, Minister of Agriculture István Nagy said at the ceremony.

Hungary, Japan Sign Agreement on Nuclear Cooperation

Hungary and Japan have signed an agreement on nuclear energy cooperation, including the joint development of small modular reactors, Minister of Foreign Affairs and Trade Péter Szijjártó said in Tokyo on May 21, according to a post on his Facebook page. Hungary and Japan will assign an increasing role to nuclear energy and expand capacities, the minister said after his talks with the Japanese ministers for foreign affairs, economy, and infrastructure. He said the two countries would work together to extend the life of their existing nuclear power plant blocks, for which preparations are already underway at the Paks nuclear power plant.

3 mln Using EgészségAblak

Some three million Hungarians now use the state's EgészségAblak healthcare mobile application, State Secretary Bence Rétvári said at a conference organized by business news portal Figyelő on May 28. Initially launched as a digital COVID immunity certificate, the mobile app was renamed "Health Window" in Hungarian and expanded with a range of functions, including access to users' test results and other medical documents. The rollout of a function that allows scheduling of appointments for outpatient procedures will start on July 1, Rétvári said. Around 2.5 million people log into the app monthly, downloading nine million documents.

Hungary Proposing EU-wide Incentive Program for EV Purchases

The two men were among four Hungarian to Orbit (Hunor) program candidates. Hungary will send an astronaut to the International Space Station, with the cooperation of U.S.based Axiom Space, for a 30-day research mission at the end of 2024 or early in 2025.

Cosmonaut Bertalan Farkas was the first Hungarian in space on a nearly eight-day mission in the summer of 1980. Hungarianborn American software engineer Charles Simonyi traveled into orbit twice as a space tourist in 2007 and 2009.

Puskás Arena to Host 2026 Champions League Final

The Puskás Arena in Budapest, home to the Hungarian national soccer team, will host the 2026 Champions League final, European soccer governing body UEFA said in a press release on May 22 after its executive committee met in Dublin.

Hungarian Royal Stud Farm Inaugurates

HUF 850 mln

Stable

The Hungarian Royal Stud Farm of Kisbér (90 km west of Budapest) inaugurated a HUF 850 million stable completed with government funding

To speed up the transition to electric vehicles, the Hungarian Government will propose and present to European Union member states in July an EU-wide incentive program for purchases, which will cover both new and used vehicles, Minister of National Economy Márton Nagy said in a release on his ministry’s website. A strong and competitive European automobile industry is in Hungary’s interest. The minister said it is, therefore, necessary to increase performance and accelerate the shift towards EVs in Europe. Protectionism and punitive tariffs are foolish and are a step against cooperation and the free market economy, he added. Nagy was speaking at the signing of a memorandum of understanding on research cooperation between the European unit of Chinese EV maker NIO, Széchenyi István University and the Hungarian Mobility Development Agency, which operates under the school’s aegis.

8 | 1 News www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

Hungarian astronaut in training Tibor Kapu

Photo by MTI / Ministry of Foreign Affairs and Trade

Biggeorge Adds 2 Directors

With the addition of János Gárdai in April and Ildikó Rézműves in May, Biggeorge Property Plc. has expanded its top management with two new directors responsible for asset management and communications, according to a press release sent to the Budapest Business Journal

János Gárdai also serves on the board of directors. The company says the organizational transformation is driven by ambitious expansion goals and the objective of optimizing current operations.

With 25 years of experience in the real estate sector, Gárdai comes from the position of COO of GTC S. A., a Warsaw Stock Exchangelisted company. There, he was singlehandedly responsible for managing an international real estate portfolio totaling EUR 2.5 billion, 44 projects spanning six countries, 800,000 sqm of floor space, and the overall management of an operation with 150 employees.

In addition to leasing, asset, property, and project management, he was also responsible for property development and ESG compliance.

Before that, as finance, development, and managing director and Hungarian partner of White Star Real Estate (AIG/ Lincoln), he managed the 60-person Budapest office for nearly two and a half decades and oversaw the areas of real estate development, property and asset management, business development, bank financing, acquisitions and divestment transactions; as well as the planning, permitting, construction management and leasing processes.

Before the acquisition of White Star Real Estate, he managed an investment

portfolio of EUR 400 million and the implementation of several major domestic real estate development projects.

Ildikó Rézműves brings nearly 20 years of international real estate experience to Biggeorge Property. In 2011, she joined the Hungarian real estate development team of Swedish Skanska, listed on the Stockholm Stock Exchange, where she oversaw the communication of sustainable Budapest office projects while also playing an essential role in building the company’s global brand.

From 2014 to 2023, as communications and marketing director at DVM group/ Horizon Development, she was responsible for the branding, leasing and sales/ divestment support of both companies and their real estate development projects on a strategic and operational level, as well as for national and international press coverages, professional events and award-winning tenders.

In addition to Horizon Development’s own developments, she managed the communication of numerous design, project and construction management (building and fit-out) mandates. She also delivered premium marketing services for the Hungarian portfolios of international real estate funds for several years.

In her position as communications director at Realis Development between 2023 and 2024, she engaged in creating the corporate image of the newly established Hungarian property development company and the preparation of commercial real estate projects.

Commenting on the appointments, Tibor Nagygyörgy, Biggeorge’s founder and CEO, welcomed the newcomers.

“Biggeorge Property and its subsidiaries have reached a milestone in their corporate evolution, where we wanted to further strengthen our excellent team by attracting the best

professionals in the market. I am delighted to welcome Dr. Ildikó Rézműves and János Gárdai to our top management, who will work with the existing teams and contribute to the success of Biggeorge Property not only with their remarkable international professional backgrounds but also with their outstanding human qualities.”

Marriott Hungary MultiProperty GM Named

Angela Saliba has been appointed the new multi-property general manager of the Budapest Marriott Hotel and Millennium Court, Marriott Executive Apartments.

Saliba started her career, which now spans 30 years, in Malta, honing her skills in various positions before making significant contributions to the pre-opening team of the Westin Dragonara Resort in 1997.

During her tenure at the Westin in Malta, she assumed pivotal roles, including executive housekeeper and director of Six Sigma. She also served as a board member for Malta’s Tourism Authority.

In June 2007, she assumed leadership of the Le Meridien St. Julians Hotel & Spa, helping establish it as one of Malta’s premier spa hotels. Her achievements led to her appointment as complex hotel manager for the acclaimed luxury resort of Costa Navarino in Greece in 2011, overseeing The Westin Costa Navarino and The Romanos, a Luxury Collection Resort.

In October 2013, Saliba spearheaded the Sheraton Krakow in Poland. Under her guidance, the hotel completed a guestroom renovation project that led to the hotel receiving the Sheraton Grand designation in 2016, becoming the first Sheraton hotel in Poland to achieve this status. In 2017, she was recognized as Marriott GM of the Year for Europe, Core Brands.

As of 2019, she led the Sheraton Grand Warsaw, where she was

responsible for successfully repositioning the property after renovating guestrooms and public spaces. Additionally, Saliba was actively involved in leading the Poland, Czech, Slovak and Baltics Marriott Business Council, comprising 29 managed and franchised hotels. In this role, she championed the Marriott culture amongst all hotels while supporting joint initiatives around company culture, sustainability, and talent development.

CEO Change at Metro Hungary

As of April 1, Vladimir Gnjidić was appointed CEO of Metro Hungary, replacing Thierry Guillon-Verne, who became CEO of Metro Austria in February. Gnjidic joined the retailer in November 2011 at Metro Croatia, gaining experience as the board member responsible for offer management, followed by a commercial director role. In 2019, he moved to Makro Czech Republic, holding various board positions within the commercial area, most recently having responsibility for sales and operations.

Metro Hungary’s five-member board of directors now includes two international executives: Marijana Racic took over the duties of chief finance officer as of March 1, moving from Metro Serbia, where she held the same role. The board of Metro Hungary also includes Beáta Kápolna, director of procurement; Helga Kaszás, director of people and culture; and Péter TóthKorom, director of sales and operations.

With the arrival of the new executive managers, Metro Hungary is entering the next implementation phase of its wholesale strategy. Store transformations focusing on gaining efficiency will soon be successfully completed, Metro says. Building on these fundamentals, the company will focus on further acceleration in meeting the needs of professional customers using the strength of its multi-channel services.

Editor’s note: For Legal Services Who’s News, check out page 28.

1 News | 9 www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

WHO’S NEWS Do you know someone on the move? Send information to news@bbj.hu

János Gárdai and Ildikó Rézműves

Angela Saliba

Vladimir Gnjidić

2 Business

Waberer’s Reports Record Revenue but Declining Profits in Q1

Waberer’s has released its firstquarter earnings, highlighting record revenue in the first three months of the year. Despite this, profitability notably declined, with the international transport and freight forwarding segment reporting a loss at the EBIT level.

at the beginning of the year. Additionally, retail also performed weakly on both international and Hungarian levels. Significant increases in road tolls in several countries relevant to transportation also contributed to the EBIT decline.

GERGELY HERPAI

In its first quarterly report of the year, Waberer’s detailed a significant increase in revenue but faced a nearly 90% decline in taxed earnings. The company’s management insisted that the quarterly performance was in line with expectations, and no adjustments to the annual forecast are planned.

Waberer’s latest numbers show that revenue rose by 11.3% in the first quarter to EUR 196.7 million compared to the same period in 2023, setting a new quarterly record for the company. However, EBIT fell significantly, with a 24.1% decrease compared to the same quarter last year. While the contract logistics and insurance segment saw an improved performance, the international transport and freight forwarding segment’s EUR 2 mln loss

significantly worsened the results. The decline in EBIT can partly be attributed to decreased industrial production volumes in key markets such as Germany, Italy, and Hungary

However, the company expects significant improvements in the international transport and freight forwarding segment in the second half of the year, which could positively influence the group’s results.

“The Waberer’s Group has been through a significant quarter in terms of strategy execution. We closed acquisitions aligned with our defined growth directions [PSP Group and MDI], started developing a new logistics center in Debrecen, and are in the final stages of constructing our warehouse in Ecser,” commented Zsolt Barna, president and CEO of Waberer’s.

“We initiated an ESO [Employee Stock Ownership] program; thus, the company group’s upper and middle management became directly interested in the stock price changes. Based on approval at the general meeting, our company will pay a dividend of HUF 120 per share, 20% higher than last year, and now three analysts (Concorde, Equilor, MBH) are also following Waberer’s stock, thus providing credible and independent information to current and potential investors,” he added.

Big Drop

Waberer’s net quarterly result was EUR 1.1 mln, representing a decrease of EUR 9.3 mln, or 89.5%. The decline was blamed on the lower EBIT and the

in the RCL and insurance segments could not offset the EUR 2.4 mln EBITDA fall in the ITS segment.

Core Activity

A similar situation is apparent at the EBIT level; RCL improved 14.8% to EUR 4.6 mln. The core activity maintained its profitability despite stagnant domestic consumer demand. The acquisition of the Serbian MD International was closed at the end of the quarter, and its results will appear in the group figures from Q2 on.

The EBIT result was minus EUR 2 mln, a y.o.y. weakening of EUR 3.8 mln. At the beginning of the first quarter of 2024, Waberer’s closed the acquisition of the rail logistics firm PSP Group. The proportionate EBIT consolidation of the ownership stake (51%) improved the segment’s EBIT performance by EUR 0.3 mln.

The insurance segment’s EBIT increased by EUR 0.5 mln, reaching EUR 5.9 mln with an EBIT margin of 25.8%. This is primarily due to high investment results, and the insurance client portfolio also grew by 15% over the past year. This is expected to expand further thanks to recent strategic sales agreements that have been concluded.

The company’s consolidated revenue is expected to approach

EUR 800 mln

this year, compared to EUR 711 mln in 2023. EBIT is expected to exceed EUR 40 mln, similar to last year.

unrealized non-cash foreign exchange effects resulting from the weakening of the forint against the euro, which resulted in a EUR 3.9 mln decrease compared to the first quarter of 2023.

Additionally, there was higher latent tax and lower interest income available on a lower cash balance due to investments and acquisitions, which together resulted in a EUR 2.7 mln decrease.

Q1 revenues in the contract logistics segment (RCL) increased by 16.9% to EUR 58.5 mln, transport and freight forwarding rose by 6.4% to EUR 118.4 mln, and the insurance sector was up by 21.4% to EUR 23 mln, year-on-year.

The revenue growth in the RCL line was due to the impact of price increases and the effect of new projects that started at the end of last year and the beginning of

2024,

affecting transportation, warehousing, and manufacturing support logistics activities.

The growth in transport and freight forwarding was attributed to the expansion of subcontracted services, representing a lower business risk, while revenue from own fleet transportation activities did not change. Revenue in the insurance segment, calculated in forints, increased by 21.3% and is primarily due to the growth of the contractual portfolio.

The company group’s EBITDA reached EUR 22.1 mln in Q1, a decrease of EUR 1.5 mln, or 6.4%. The growth

Szabolcs Tóth, Waberer’s deputy CEO for economics and strategy, stated that profitability is likely to remain lower compared to the base period in the second quarter, but growth is expected in Q3 and Q4. He said that the drastic increases in road tolls (which burdened the ITS segment in the first quarter) could be incorporated into annual contracts later; additionally, European industrial production and Hungarian consumption may stabilize in the second half of the year.

“While Waberer’s has been through a volatile period characterized by market pressure, I am pleased to report that this was followed by a very active negotiation period. In the last quarter of last year and the first months of this year, Waberer’s participated in tenders that closed in March-April, and the company group performed well. We can ensure in terms of price and volumes for the second half of the year that our international segment will again generate results. In the segments with higher added value, which play a key role in our strategy, we achieved further victories,” said Tóth. He also mentioned that operations can begin in the new Ecser warehouse complex this summer, so the impact on results will be visible from August to September. Preparation for a Debrecen warehouse development is also underway, with the site next to the BMW factory paid for in the first quarter. The warehouse could be handed over in the second half of next year, Tóth said.

www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

HCEMM: Making an Aging Society Work

Technological developments over the past two centuries have fundamentally transformed our relationship to health, disease and death. It is imperative that we integrate these changes as we plan for the future if we are to keep healthcare sustainable and effective.

DR. CHRISTOPH W. SENSEN

middle-income countries. The average of 25 extra years of life that science has won us is a mind-boggling increase. The trend is not stopping, either; since 2000, life expectancy has risen five years, mostly fueled by greater numbers of people living into more advanced ages.

Learn, we Must

For much of recorded history, life expectancy at birth hovered around 30 years. It would be tempting to compare that number to the modern global life expectancy of 72 years, but it is also quite deceiving. Historically, infant mortality had a profound impact on life expectancy since a significant number of children, nearly half of all live births, did not survive to adulthood.

In recent times, medical discoveries and inventions have slashed infant mortality rates to a tenth of their former value globally and by yet another order of magnitude in developed countries specifically. Modern infant mortality has little impact on life expectancy.

Looking at early adulthood rather than birth (how many years one has to live after having navigated the perils of childhood) is much more informative, and its perspective is not any less impressive. From classical Rome to medieval Europe, life expectancy at 25

seems to have been around 25 years. In other words, someone who survived into adulthood could look forward to a total lifespan of around 50 years, give or take, of course.

That is a number we can put next to current life expectancy values, which are 72 globally and 75 years in upper-

There is a catch, though. Living longer and being in good health longer are not necessarily connected. In the same time life expectancy took to rise five years, healthy life expectancy, the span of time we spend mostly free of disease, rose by only one, mainly because we are still learning to tackle age-related disease. There should be no surprise there: in terms of disease burden, these only took the lead in the late 1990s. But learn, we must: age-related disease puts an enormous strain on society.

When the first comprehensive social security program was launched in 1883 in Germany, there were roughly 10 working-age people for every elderly person, and the retirement age (initially 70, later 65 years) was well above the approximately

years

an adult was expected to reach. Back then, people would consider themselves lucky if they survived until retirement. Today, they plan the things they will do after they retire, and with every passing year, Europe inches closer to each elderly person having only three working-age adults to rely on.

With the average lifespan moving farther ahead of healthy life expectancy, there comes an increase in per capita medical expenditure, which has,

for the past few decades, increased by an average of more than USD 4,500 in the EU (at 2017 prices).

Clearly, the combined effect of these trends is highly problematic: experts of the Stanford Institute for Economics Policy Research have predicted that a 10% percent increase in the fraction of the population aged 60 or older will decrease per capita GDP by 5.7%.

Until recently, it looked like a head-on collision of economy and the realities of human biology was inevitable. Fortunately, our understanding of aging has gradually transformed in the past few decades, and it appears that molecular biology has the potential to offer a muchneeded helping hand.

Leaps of Progress

In some of the most prevalent agerelated diseases, leaps of progress have been made: since the 1970s, the overall five-year cancer survival rate has increased from 49% to 68%, with several impressive success stories. A salient example would be Melanoma, where the five-year survival rate of metastatic disease (accounting for both regional and distant metastases) has increased tenfold since the 1970s to around 50%. But this is only the beginning.

Increasingly, medical research investigates aging as a complex medical issue underlying several superficially unrelated conditions such as cardiovascular disease, cancer or dementia. Institutes such as the Hungarian Centre of Excellence for Molecular Medicine (HCEMM) have been established to do away with the practice

of handling these conditions as isolated problems and address them as the interconnected phenomena they are.

In Hungary, HCEMM has become a prominent player. Its development is part of a global trend; the yearly number of publications concerning age-related diseases increased about twofold between

1980

and 2000 but fivefold between 2000 and 2020.

Since new drug development is proverbially slow, it might seem like the fruits of this research are still years in the future, but that avenue is only one part of the effort. Since existing therapies are often very effective if age-related disease is diagnosed early and accurately, developing and refining diagnostic approaches is just as important as finding new therapies and is more readily commercialized.

Of course, society only profits from medical developments that are actually available for use, prompting a need for institutions that shepherd new inventions towards application, uniting cross-disciplinary basic research, support for clinical trials and a focus on bench-to-bedside tech transfer.

WHAT IS HCEMM?

The Hungarian Centre of Excellence for Molecular Medicine (HCEMM) is a distributed Institute whose scientists develop advanced diagnostics and treatment options to support healthy aging. Currently, the HCEMM Program is funded by an H2020 Teaming Grant, where Semmelweis University, the University of Szeged and the Biological Research Centre in Szeged cooperate with their advanced partner EMBL (with headquarters in Heidelberg) and a Thematic Excellence award, as well as a National Laboratory award, from the Hungarian Government. The various activities are coordinated by HCEMM Kft., with headquarters in Szeged. HCEMM works at the interface of academic and industrial research on topics related to translational medicine. The goal is to improve the quality of life for an aging Hungarian population while at the same time lowering the cost of healthcare provision through novel applications in molecular medicine.

The author is the director general and CEO of HCEMM Kft.

2 Business | 11 www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

60

PRESENTED CONTENT

Dr. Christoph W. Sensen

7% of Companies Worldwide Involved in Greenwashing

With the recognition of environmental crimes growing globally, Corvinus University’s researchers have looked at how prevalent greenwashing is among businesses. According to the research, it has already occurred in 7% of the studied companies.

“Misleading green corporate communication should be punished more; this would make sense not only from a legal point of view but also from an economic one,” commented Edina Berlinger, a professor at Corvinus University, researcher at the University of Luxembourg, and expert in sustainable finance.

“It [greenwashing] is tempting for companies, as it is easier and cheaper to communicate green than to innovate and act green, while the market rewards companies that look green,” she added.

She was speaking at a Hungarian Economic Association event, “Is it Really Green? Fresh Research on Greenwashing,” held in May, which focused on a specific case of environmental abuse.

Berlinger began by pointing out that there is currently no generally accepted legal definition for greenwashing, which makes it more challenging to fight. Typically, it is taken to mean a company that uses communication to create the false impression that its activities or products are green when they are not.

This harms consumers, investors and, ultimately, society as a whole. The more significant the difference between what a company actually does and what it says it does, the more it can be called greenwashing.

Berlinger presented her joint research with co-authors Zsolt Bihary, Barbara Dömötör, Judit Lilla Keresztúri, Ágnes Lublóy, Martin Márkus and Gábor Neszveda. In one of their studies, more than 1,200 companies from 23 developed countries were examined between 2008 and 2020.

The team found that, overall, 7% of firms have already been involved in greenwashing at least once. This ratio rises to 40% in the energy

sector, 28% among utilities and 10% in energy-intensive industries such as chemicals and construction materials.

Plenty of Attention

According to the researchers, the energy sector is so prominent because it is easier to find out if its players are polluting the environment; the companies are bigger and tend to have capital-heavy projects that require more investments, raising the level of scrutiny.

Another study highlights that companies that are larger, have higher profits and returns on their assets, fewer independent directors on their boards, less liquid trading in their shares and operate in a country where consumers are less environmentally conscious are more prone to greenwashing. However, the practice can be counteracted if a business has a robust internal control system, so monitoring plays a significant role. Why are companies even tempted to greenwash? Berlinger mentioned various motivations: because the regulations allow it, because it can help generate extra profits, and self-deception: “I’m only doing what everyone else is doing.”

In all cases, the cost of greenwashing communication is markedly lower than that of genuine

should a company present itself as greener than the reality, the penalty for causing damage should be heavier. Likewise, if we want to promote green investments, we should not only offer discounts to firms that launch environmentally beneficial projects but also proportionately increase the penalties if the promised greening is not achieved.

The ESG phenomenon can also be used for greenwashing, Berlinger warned. A good example is the case of Credit Suisse, where a series of scandals followed one another, but the bank tried to justify its actions to shareholders in its ESG reports.

“False green corporate communications should be punished more; this would make sense not only from a legal point of view but also from an economic one. Greenwashing is tempting for companies, as it is easier and cheaper to communicate green than to innovate and act green, while the market rewards companies that look green.”

green innovation. According to the professor, AI will be increasingly important in identifying cases.

The researcher says environmental crimes are the fourth most common globally. Worse, it is growing by 5-7% per year and trails only drug, arms, and human trafficking.

In 2024, a new EU directive was adopted. The related sanctions include significant maximum penalties: 10 years in prison, fines of 5% of turnover or EUR 40 million. Aggravating circumstances include death or severe injury due to an incident, misleading company documents, recurring pollution events, or a company profiting from environmental crimes.

The expert reminded the audience of the British Petrol (BP) oil spill in the Gulf of Mexico in 2010 and said that the company had been able to reduce a significant loss of revenue caused by a consumer boycott by using what she called greenwashing advertising.

The Polluter Pays

In Berlinger’s opinion, from both a legal and an administrative point of view, it would be logical that

Muddying the waters even more, because the methodologies used to assess ESG reports differ significantly, it has happened that the same bank has received both the highest ESG rating from one international organization and the riskiest rating from another.

While, according to research, a one standard deviation better ESG rating typically reduces the severity of damage caused by a company by 50-60%, there is some backlash against ESG overseas. Several bills have been introduced in different, mainly Republican-controlled, U.S. states that have sought to prohibit asset managers from using ESG criteria when investing taxpayer or state money.

Berlinger also explained how a spectrum of green, greenwashing, “brownwashing” (acting green but not communicating it) and so-called “honest brown” (causing environmental damage but not denying it) companies can coexist. This situation arises due to unequal knowledge between investors and companies, leading to adverse selection and moral hazard.

Adverse selection occurs because investors offering green loans at preferential rates often don’t know how committed the company is to its green project or how effective it will be. Moral hazard refers to the uncertainty about whether the company will actually use the loan for the intended green project, whether it will achieve positive environmental impacts, or if it will misuse the loan and falsely label it as an environmental investment.

12 | 2 Business www.bbj.hu Budapest Business Journal | May 31 – June 13, 2024

BENCE GAÁL

Edina Berlinger, a professor at Corvinus University, researcher at the University of Luxembourg, and expert in sustainable finance.

AmCham Offers Strategic View on Improving Hungary’s Competitiveness

The American Chamber of Commerce in Hungary has just released its latest recommendation package of suggested reforms in government economic policy. AmCham President Zoltán Szabó and CEO Írisz LippaiNagy lift the curtain to give Budapest Business Journal readers a greater understanding of the preparation, intent and reception of the “Cooperation for a More Competitive and Sustainable Hungary.”

BBJ: You make suggestions in four crucial areas: General Business and Investment Environment; Taxation and Competitiveness; Human Capital; and Smart Growth. What are your critical findings? What are the changes that need to be implemented?

ZSz: Regarding the General Business and Investment Environment, we find that due to heavy international competition, it is imperative for Hungary to develop its investment and industrial strategies with a regional perspective. Our chamber has consistently emphasized that maintaining Hungary’s long-term competitiveness requires a significant increase in productivity and a shift in economic policy from the quantitative to the qualitative. These changes can only be realized with a firm government intent and effective measures. Without urgent intervention, we risk falling behind our regional competitors in attracting and securing capital investments, possibly even in the medium term.

We also underline the need to simplify and stabilize the current regulatory and tax system. There are currently 61 different taxes, contributions, and special taxes, while 91% of the central budget’s tax revenue is generated by only seven tax types. Reducing the number of taxes is, therefore, indispensable. It is also an EU commitment we should comply with, and it could also lead to a more attractive investment environment. Quasi-retroactive legislation that is common in the imposition of special taxes is also identified as a country risk.

in the system’s digital infrastructure are also crucial to make processes more efficient and create a more welcoming environment for further research and investment.

The available human capital fundamentally determines the country’s future competitiveness; it is, therefore, critical that the two areas that are fundamental components of economic performance, education and healthcare, are given adequate strategic weight in stakeholders’ visions for Hungary’s future.

ZSz: Lastly, in the Smart Growth section, we focus on the key questions of innovation and sustainability. A vital element of the innovation ecosystem is the collaborative framework between companies and universities, which should be elaborated and enhanced. We address digitalization, as the development of a modern data economy has significant economic and R&D&I potential, which is essential to strengthening our position on the regional and global landscape. Additionally, we stress that a gradual green transition of the economy, and industry in particular, is necessary, although it is only possible if these changes do not impose a disproportionate burden on society and do not undermine the competitiveness of EU businesses.